13 minute read

Does Exness Broker Work in Malaysia?

Exness is a well-established and globally recognized forex broker that provides access to the forex market for traders around the world. Known for its user-friendly platform, competitive spreads, and range of account options, Exness has attracted a large number of traders. However, for those in Malaysia, a common question arises: Does Exness operate in Malaysia?

Given Malaysia's growing interest in forex trading and its increasingly sophisticated financial market, it's important for Malaysian traders to understand if Exness is a viable and legal option for them. This article explores whether Exness works in Malaysia, examining its regulatory status, available services, and any specific requirements for traders based in Malaysia. Whether you're a beginner or an experienced trader, understanding these details is essential before choosing Exness as your broker.

Exness Overview

Exness is a well-known and highly regarded global forex and CFD broker, founded in 2008. Since its inception, Exness has gained a strong reputation for providing a reliable and transparent trading experience to clients across the globe. The broker is renowned for offering a wide variety of financial instruments, competitive trading conditions, and user-friendly platforms, making it a popular choice for traders at all experience levels. With a focus on safety and regulation, Exness has expanded rapidly and now serves millions of customers from various countries, providing access to the forex, commodities, indices, and cryptocurrency markets.

One of the key strengths of Exness is its regulatory compliance. The broker is licensed by several highly respected financial authorities, such as the Financial Conduct Authority (FCA) in the UK, Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. These regulations ensure that Exness adheres to strict standards of financial conduct, offering traders a high level of protection for their funds. By complying with these regulatory bodies, Exness instills trust among traders, ensuring that their trading experience is both secure and transparent.

Regulation and Legal Considerations in Malaysia

When it comes to trading forex in Malaysia, understanding the country’s regulatory environment and legal considerations is crucial for traders. Forex brokers must operate within the legal framework set by the Malaysian government and its financial authorities to ensure transparency, fairness, and security for traders. These regulations are designed to protect investors and maintain the integrity of the financial markets in Malaysia.

Securities Commission Malaysia (SC)

The primary regulatory body overseeing financial markets in Malaysia is the Securities Commission Malaysia (SC). The SC is responsible for ensuring that the country's financial markets are fair, efficient, and transparent. It regulates various financial activities, including the operation of forex brokers, securities trading, and investment management.

Bank Negara Malaysia (BNM)

Bank Negara Malaysia (BNM), the central bank of Malaysia, plays a key role in regulating and overseeing the broader financial landscape, including currency exchange activities. BNM regulates the foreign exchange market in Malaysia and establishes policies related to the movement of funds, cross-border transactions, and capital controls.

Legal Restrictions on Forex Trading

Although forex trading is not illegal in Malaysia, there are some restrictions and regulations that traders should be aware of. The Malaysian government has made it clear that online forex trading is subject to certain guidelines to ensure that it is not used for illicit activities like money laundering or fraud.

How Exness Fits into the Regulatory Landscape in Malaysia

As for brokers like Exness, they are typically regulated by international financial authorities such as CySEC (Cyprus Securities and Exchange Commission) and FCA (Financial Conduct Authority, UK). Exness has earned a reputation for operating within the legal and regulatory frameworks of several countries, ensuring that its operations are transparent and compliant with financial regulations.

Start Trading: Open Exness Account or Visit Website

Is Exness Available for Malaysian Traders?

Yes, Exness is available for Malaysian traders, and it provides access to a wide range of financial markets, including forex, commodities, indices, and cryptocurrencies. Exness has gained a global reputation for its user-friendly trading platform, competitive spreads, and excellent customer service. The broker offers a secure and regulated environment for traders worldwide, including those in Malaysia.

1. Opening an Account with Exness in Malaysia

Malaysian traders can easily open an account with Exness by registering on the broker’s official website. The account opening process is straightforward, and traders are required to provide some personal information along with identity verification documents as part of the Know Your Customer (KYC) process. Exness typically requests a proof of identity (such as a passport or national ID) and a proof of address (like a utility bill or bank statement) to ensure the account is opened in compliance with international regulations.

2. Local Payment Methods

One of the key factors that make Exness an attractive broker for Malaysian traders is the availability of local payment methods for deposits and withdrawals. Exness supports popular local payment solutions such as bank transfers, credit/debit cards, e-wallets like Skrill, Neteller, and local bank payment options like FPX.

3. Regulation and Trustworthiness

Although Exness is not regulated by Malaysia’s Securities Commission Malaysia (SC), it is a well-regulated international broker. Exness operates under the supervision of CySEC (Cyprus Securities and Exchange Commission), FCA (Financial Conduct Authority in the UK), and other regulatory bodies in multiple regions.

4. Language and Customer Support

Exness provides multilingual support, making it easier for Malaysian traders to communicate with the support team in their native language. The broker’s customer service is available 24/7, offering assistance via live chat, email, and phone support. This is particularly valuable for Malaysian traders who may need help with account setup, deposits, withdrawals, or any other inquiries.

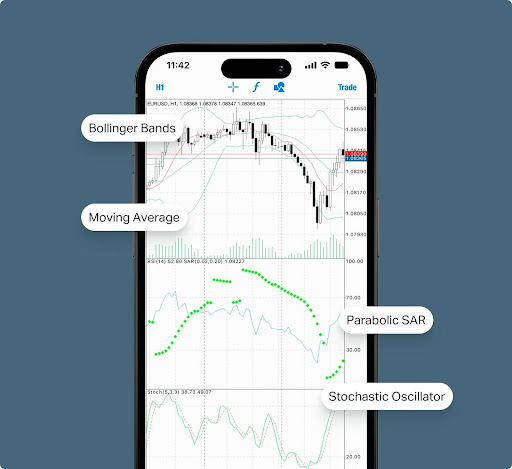

5. Access to Advanced Trading Tools

Exness provides access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are among the most popular and widely used trading platforms globally. These platforms offer advanced charting tools, automated trading features (like Expert Advisors), and a wide range of technical analysis indicators. Malaysian traders can easily download these platforms on their desktops or use the mobile apps for trading on the go.

6. Leverage and Trading Conditions

Exness offers high leverage options, which are especially appealing to traders looking to maximize their positions with smaller capital. Depending on the account type, Malaysian traders can access leverage of up to 1:2000, allowing for more flexibility in their trading strategies. However, it’s important to note that high leverage can increase both potential profits and risks, so traders should use it with caution.

Start Trading: Open Exness Account or Visit Website

Exness Features for Malaysian Traders

Exness offers a variety of features that make it an appealing choice for Malaysian traders looking to engage in forex trading. From user-friendly platforms and local payment methods to high leverage options and comprehensive educational resources, Exness ensures that traders from Malaysia can access a seamless and secure trading experience. Below are some of the key features that cater specifically to Malaysian traders:

Localized Payment Methods

One of the most convenient features for Malaysian traders is the availability of local payment methods. Exness supports several local deposit and withdrawal options, including bank transfers, credit/debit cards, and e-wallets such as Skrill and Neteller. Additionally, Exness offers FPX (Financial Process Exchange), a popular payment gateway in Malaysia that allows for fast and secure deposits from local banks. This makes it easier for Malaysian traders to fund their accounts and access their profits with minimal delays, avoiding international transaction fees and complications.

Regulated and Secure Trading Environment

Exness is a well-regulated broker, licensed by reputable financial authorities like the Cyprus Securities and Exchange Commission (CySEC), Financial Conduct Authority (FCA) in the UK, and Financial Sector Conduct Authority (FSCA) in South Africa. Although it is not directly regulated by Malaysia’s Securities Commission, Exness adheres to stringent regulatory standards that ensure the safety of client funds and transparency in its operations.

High Leverage Options

Exness offers some of the highest leverage options in the industry, with leverage ratios of up to 1:2000 for certain account types. This high leverage allows Malaysian traders to control larger positions with a relatively small initial investment, amplifying potential profits. However, it’s important to note that high leverage also increases the risk of significant losses, so traders should use leverage cautiously and practice sound risk management strategies.

Low Spreads and Zero Commission Accounts

Exness is known for offering tight spreads, starting from as low as 0.0 pips on major currency pairs, particularly with their Zero Accounts. For Malaysian traders, this means they can execute trades at a lower cost, which is especially beneficial for those who trade frequently or use strategies that require quick, small profits.

No Minimum Deposit Requirements for Some Accounts

Exness is an excellent choice for Malaysian traders, especially beginners, due to its low minimum deposit requirements. For certain account types, such as the Standard Cent account, traders can start with as little as $1. This makes it accessible for traders with limited capital to begin their trading journey. The flexibility to start with a low deposit ensures that even traders with small budgets can test the platform, learn the basics of forex trading, and build their skills without committing large amounts of capital upfront.

Start Trading: Open Exness Account or Visit Website

Advantages of Trading with Exness in Malaysia

Exness offers a variety of features that make it an appealing choice for Malaysian traders looking to engage in forex trading. With a reputation for being reliable, transparent, and secure, Exness provides an excellent platform for both beginner and experienced traders. Here are some of the key advantages of trading with Exness in Malaysia:

1. Localized Payment Methods

One of the biggest advantages of trading with Exness for Malaysian traders is the availability of local payment methods. Exness supports FPX (Financial Process Exchange), which is a local payment gateway widely used in Malaysia. This allows traders to deposit and withdraw funds from their Exness account directly through local Malaysian banks, ensuring that payments are processed quickly and without high fees. Additionally, Exness supports other global payment methods like Skrill, Neteller, bank transfers, and credit/debit cards, making it easy for traders to fund their accounts and access their profits.

2. High Leverage Options

Exness provides some of the highest leverage options in the forex industry, with leverage up to 1:2000 available for certain account types. This is especially beneficial for Malaysian traders who may have limited capital but want to amplify their trading potential. With high leverage, traders can control larger positions with smaller amounts of initial investment, allowing them to maximize opportunities in the market.

3. Competitive Spreads and Zero Commission Accounts

Exness offers competitive spreads, with some accounts offering spreads starting from 0.0 pips on major currency pairs. This is particularly attractive to Malaysian traders who want to minimize trading costs. Additionally, Exness provides Zero Accounts, which allow traders to access the tightest spreads possible with no commission fees on trades, making it a cost-effective option for those who trade frequently or prefer low-cost trading conditions.

4. Regulated and Secure Trading Environment

Exness is regulated by several major financial authorities, including the Financial Conduct Authority (FCA) in the UK, Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. While Exness is not directly regulated by Malaysia’s Securities Commission, its adherence to stringent international regulatory standards provides Malaysian traders with a safe and secure trading environment.

5. Advanced Trading Platforms

Exness offers access to two of the most popular and advanced trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are known for their powerful charting tools, technical indicators, and automated trading features, including Expert Advisors (EAs) for algorithmic trading. Both platforms are available for desktop, mobile, and web trading, allowing Malaysian traders to trade from any device at any time.

Conclusion

Exness is fully available to Malaysian traders, providing them with a secure, reliable, and well-regulated trading platform to access global financial markets. While Exness is not directly regulated by Securities Commission Malaysia (SC), it operates under the supervision of highly respected international regulatory bodies like CySEC and the FCA, ensuring a transparent and secure trading environment.

With features such as local payment methods, high leverage options, competitive spreads, and access to advanced trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), Exness offers a comprehensive and flexible trading experience tailored to both beginners and experienced traders. Moreover, the broker’s commitment to educational resources, 24/7 customer support, and low minimum deposit requirements makes it a great choice for Malaysian traders seeking to build their trading skills and grow their investments.

FAQs

Is Exness available for Malaysian traders?

Yes, Exness is available to Malaysian traders. While Exness is not regulated by Malaysia’s Securities Commission, it is regulated by other international authorities like CySEC and the FCA, providing a secure trading environment.

Can Malaysian traders use local payment methods with Exness?

Yes, Exness supports local payment methods for Malaysian traders, including FPX (Financial Process Exchange) for direct bank transfers, as well as Skrill, Neteller, and credit/debit cards for easy deposits and withdrawals.

What trading platforms does Exness offer to Malaysian traders?

Exness provides access to the highly popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are available for desktop, mobile, and web trading. These platforms offer advanced charting tools, automated trading options, and a user-friendly interface.

Is Exness regulated in Malaysia?

Exness is not directly regulated by Malaysia's Securities Commission (SC), but it is regulated by reputable global authorities like CySEC, FCA, and FSCA, ensuring a high level of security and compliance with international standards.

What are the minimum deposit requirements for Malaysian traders?

Exness offers a low minimum deposit requirement, with some account types allowing traders to start with as little as $1. This is ideal for new traders who want to get started with minimal financial risk.

What leverage options does Exness provide for Malaysian traders?

Exness offers high leverage of up to 1:2000 for certain account types, allowing Malaysian traders to control larger positions with smaller amounts of capital. However, it's important to use leverage carefully, as it can magnify both profits and losses.

Does Exness offer customer support in Malaysia?

Yes, Exness provides multilingual customer support, including support in Malaysia and English, ensuring that Malaysian traders can easily communicate with the support team whenever needed, 24/7.