EGON VON GREYERZ

Discusses the profoundly simple solution to fiat

STEFAN KREMETH

Looks at stagflation and world markets

ADRIAN DAY

Delivers his expert analysis on gold

JOSEPHINE GEORGE

On profitability and banking in St Helena

EGON VON GREYERZ

Discusses the profoundly simple solution to fiat

STEFAN KREMETH

Looks at stagflation and world markets

ADRIAN DAY

Delivers his expert analysis on gold

JOSEPHINE GEORGE

On profitability and banking in St Helena

Jinhee Wilde provides her leading insight into HNW and investment immigration solutions for affluent clients

Tourist

opens the door to virtual payment transactions when visiting the remote island of St Helenaa unique destination with limited International Card Payment Services.

EDITOR-IN-CHIEF

John Marshall

HEAD OF PRODUCTION

Peter Green

EDITORIAL

Thomas Hughes, Rachel Smith, Oliver Taylor, Shannon Berkley, Vincenzo Morello, Cheryl Jones

ART DIRECTION & DESIGN Stormcues Limited

BUSINESS DEVELOPMENT

Steve Williams, David Warmann, Jack Moore, David Goldwin, Mike Walsh

COMMERCIAL DIRECTOR

Luke Francis

PHOTOGRAPHY

James Drake, Sarah Dean, Rick Thompson

Executive Global Magazine is published by: Stormcues Limited 405 Kings Road Chelsea London SW10 0BB

Tel: +44(0)207 993 4782

www.executive-global.com

ADVERTISING

advertising@executive-global.com

EDITORIAL

editorial@executive-global.com

The information in this publication has been obtained from sources the proprietors believe to be correct, however no legal liability can be accepted for any errors. No part of this magazine may be reproduced without the consent of the publisher. Executive Global is registered trademark ® of Stormcues Limited. Copyright © 2023 Stormcues Limited. All Rights Reserved.

IBCs in Montserrat 40

Shannon Berkley explores the sparsely populated Caribbean British Overseas Territory.

Business in Puerto Rico 42

Rachel Smith reports on the island located in the Northeast of the Caribbean Sea.

The Norwegian mixed economy 44

Balanced capitalism and a prosperous welfare state. Thomas Hughes explores the dichotomy.

Digital IDs and

46

Shannon Berkley explains why Digital IDs and CBDCs combined are a misuse of technology.

The Bitcoin wars 48

Oliver Taylor explores the differences between Bitcoin Core and Bitcoin Satoshi Vision.

Improvements in auto technology 50

Cars today have features that were previously only science fiction. Thomas Hughes reports.

Sustainable aviation fuel 52

Rachel Smith reports on how aircraft owners could explore biofuels for greener travel.

Aircraft registration in Malta 54 Malta has set an example of growth in the aviation industry. Oliver Taylor tells us why.

World class hospitality 56

Oliver Taylor reviews why Qatar Airways has become one of the most sought after airlines.

Is small beautiful? 58

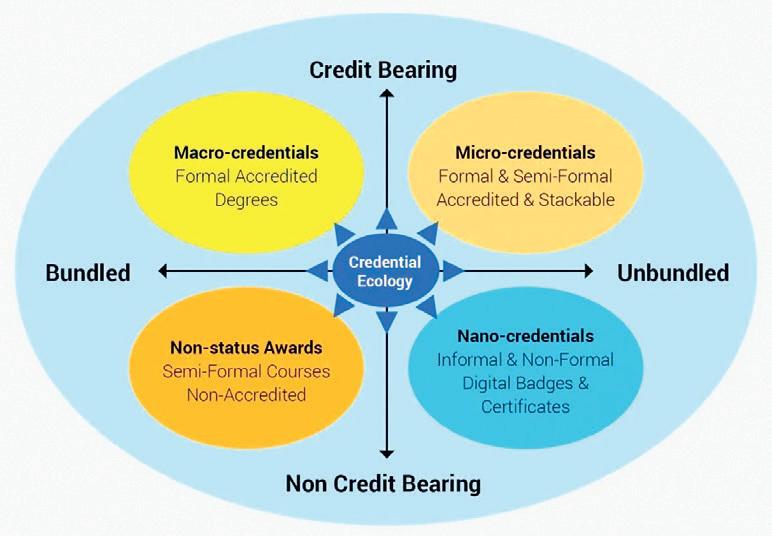

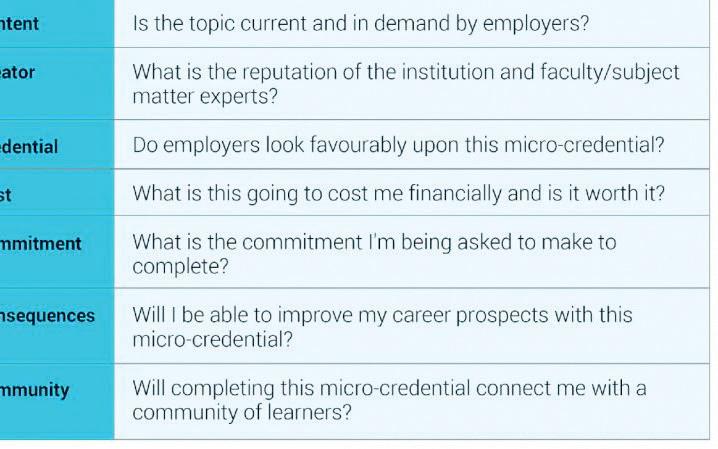

Dr. Keith Pond explores how micro-credentials can open higher education to global society.

Profitability and business strategy 60

Oliver Taylor takes a look at the key concerns for businesses in today’s economic landscape.

An international outlook 62

Andrew Main Wilson, CEO, AMBA, discusses the continued demand for MBA programmes.

Exploring Saint Helena

Cheryl Jones reports on tourism, luxury travel and life in the British Overseas territory.

64

Don’t wait to buy real estate 66

Oliver Taylor discusses the multiple advantages that make property the best asset class.

Luxury shopping in Monte Carlo 68

The elegant Monte Carlo is synonymous with luxury living. Shannon Berkley reports.

Helping buyers and sellers 70 Century 21 Harvey Properties have hands-on experience and proven performance.

Chateau Margaux

72

Rachel Smith, looks at why a Chateau Margaux estate wine can be a potent investment.

The Cayman Islands Aircraft Registry is the registry of choice for many owners and management companies with corporate aircraft ranging from Cessna Citation, Gulfstream, Embracer, Airbus and Boeing Business Jets. Standards are rigid and specifications exact to qualify, but this has led to the register being highly respected and recognized throughout the aviation industry internationally. The Civil Aviation Authority of the Cayman Islands (CAACI) is the statutory body responsible for aviation regulatory oversight throughout the Cayman Islands and for aircraft registered in the Cayman Islands. The CAACI works in close partnership with a specialized group of legal firms and Cayman Islands Government authorities to ensure that clients have the most comprehensive counsel on every avenue of law, custom law, tax and insurance.

1. The Cayman Islands provides a safe, stable and ‘friendly flag’ jurisdiction for registration of aircraft and boasts a highly developed legal system and a respected system for perfecting security over aircraft

2. As a leading international financial centre, the Cayman Islands is a tax neutral environment within which a highly developed legal system based on English common law flourishes, affording certainty and confidence to both owners and financiers of aircraft.

3. The CAACI, as the statutory authority responsible for safety regulatory oversight throughout the Cayman Islands and for aircraft registered in the Cayman Islands wherever they operate. The CAACI provide technical experts in the Flight Operations and Airworthiness departments and will dispatch inspectors/surveyors from these disciplines to review aircraft based globally.

4. The CAACI is available 24/7 through a bespoke electronic data management system: VP-C Online to electronically manage all aircraft registration applications, certificates and authorisations making it easier for the clients to access pertinent aircraft information and manage applications regardless of their location and time zone.

5. The CAACI procedures are not complicated and. It is however the CAACI’s responsiveness, willingness to assist and provide technical expertise which have afforded it the excellent reputation it enjoys internationally today

6. Operators of Cayman Islands-registered aircraft are exempt from certain TSA Waiver Authorization requirements. This allows greater flexibility to operators who wish to operate flights within the US or over US airspace on short notice

7. The CAACI mortgage registration procedures are straightforward yet afford financiers with certainty of security, making the Cayman Islands the jurisdiction of choice for many financiers.

8. The Cayman Maritime & Aviation City offers an exceptional opportunity for businesses in the aviation sector to leverage the outstanding features of the Cayman Islands business environment, particularly where a physical presence is required, for example in obtaining an AOC, operating offshore the Cayman Islands.

9. The Cayman Maritime & Aviation City provides companies seeking to obtain a Cayman Islands AOC with an efficient solution for setting up a principal place of business in the Cayman Islands.

10. The CAACI offers an innovative solution to lessors and financiers requiring a reputable register to facilitate the temporary registration of aircraft that are transitioning between leases or have been repossessed. The CAACI will facilitate the temporary registration of an aircraft on the Aircraft Register until the lessor or financier is ready to move to the next phase of the process, be that remarketing of the aircraft, sale, storage or otherwise.

What the world needs now are representative political leaders committed to relieving diplomatic tensions- true statesmen of the calibre of Abraham Lincoln, George Washington, Thomas Jefferson, or JFK- with a focus on negotiations, not nukes because it is ultimately diplomatic solutions that are the only way forward in resolving international conflicts.

The world today is teetering on the edge of a financial abyss, with central banks printing money as if there’s no tomorrow and governments drowning in an everdeepening sea of debt. This dire economic situation is the result of irresponsible monetary policies and yet, instead of seeking solutions, central banks and governments have chosen to fan the flames of war and use it as a tool of distraction from the abysmal economic conditions they have created. We must recognise that now more than ever, diplomacy should take precedence over hawkish unilateralism if we are to recover from this crisis.

Since the dawn of time, human beings have sought to alter the political landscape in order to gain power and authority. Regime change has been attempted countless times, and it seems that each cycle breeds a new era of instability. The media in particular, which should function in its role as the fourth estate, has failed to provide a stabilising influence on relations between superpowers, instead riling up all sides for further confrontation at every turn, doing nothing to avert or assuage tensions. There can be no benefit to gaining all of the wealth in the world if nations fail to prevent thermonuclear war.

As tensions mount, it is crucial to contemplate the staggering devastation that could unfold if a real war were to break out. With the United States boasting 10,002 nuclear weapons, Russia stocking 23,232, and China now armed with over 2 million nukes, the consequences of deploying tanks, boats, jets, missiles and other weapons to foreign countries could prove disastrous if things spiral out of control.

Major General Smedley D. Butler stated: “War is a racket. It always has been. It is possibly the oldest, easily the most profitable, surely the most vicious. It is the only one international

in scope. It is the only one in which the profits are reckoned in dollars and the losses in lives.” To safeguard the future of our children and grandchildren, diplomatic negotiations must be prioritised over every option

Humanity cannot handle another cataclysmic war. As Thomas Jefferson poignantly put it, “the two enemies of the people are criminals and government, so let us tie the second down with the chains of the Constitution so the second will not become the legalised version of the first.” Now in 2023 instead of central banks using the printing press to bring us into a golden age with Tesla technologies, subsidised housing grants, free energy, or grants for small business, they are financing military escapades abroad while the national population struggles to make ends meet, put gas in the tank, pay for energy or buy food. We must protect our constitutional rights and values, while our political leaders should serve their constituents by doing all they can to bring peace to every corner of our world. When it comes to war, cui bono? Executives must ponder who truly benefits from the profitability in this instance. Defence contractors? Politicians? Or perhaps the central banks, which serve as one of the main facilitators of war, which is financed through a system of deficit spending and monetisation. Edwin Starr sang it best in his 1970 Motown hit: “War! Huh, yeah! What is it good for? Absolutely nothin’!” EG

John Marshall Editor-in-Chief, Executive Global

“This is the ROLEX within the guitar arena...”

Five luxury apartments at the centre of the Belair district from 57 to 300 sq.m.

Elegance. Exclusivity. Belair

For inspection, please call A. John Price

Web www.PattersonPriceLand.com

Email ajohnprice100@gmail.com

Tapeta Farm is a truly magnificent private setting with rolling hills, vistas, and horse training improvements, which are second to none. A true horseman will appreciate what two-time Breeders’ Cup winning trainer Michael Dickinson has meticulously designed, constructed, and maintained here at Tapeta.

The 196 acre estate is designed as a training mecca with six different training surfaces, including: ‘‘Summer’’, which is best utilised at that time when most other turf surfaces are harder; ‘‘Main Tapeta’’, 7 furlongs with its long uphill gallop; ‘‘Tapeta Round’’, a 4 furlong warmup track on Tapeta surface; ‘’Boomers Hill Turf’’, 5 1/2 furlongs uphill gallop for conditioning; ‘‘Noah’s Arc’’, good even with 2 inches of rain; and ‘‘Normal’’, which is best utilised under normal conditions. Also included is a modern 40 stall barn and a separate facility called

the Tapeta Performance Center featuring a vibrating platform, salt room, cold-water spa and an eight horse Eurociser. Adjacent to the Performance Center is a swimming pond (with central dock) and extensive paddocks of varying sizes.

There are numerous trails, both wooded and fields, throughout the property for allowing the horse to relax and unwind. Tapeta is also accented by a beautiful 4,500 sq.ft. updated English Manor House situated on a hill overlooking the upper waters of the Chesapeake Bay.

North East, Maryland allows for access to numerous racetracks that one will not find anywhere else in the United States.

Exclusively Offered at $5,995,0000

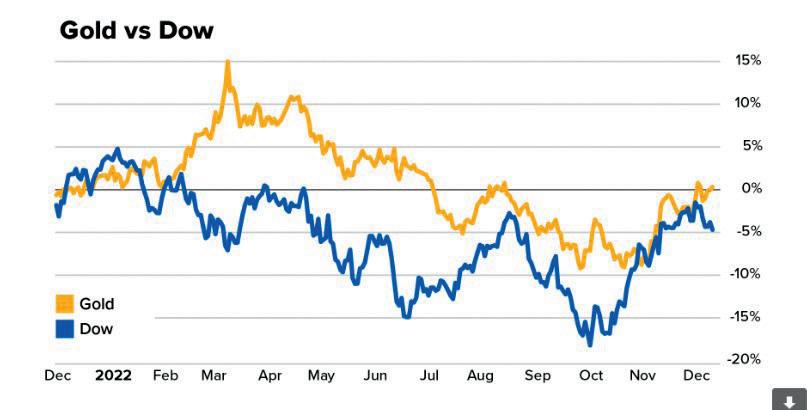

Gold investors always want more! Last year saw sharply higher inflation around the world, a war in Europe, with stocks and other assets down: a perfect trifecta for gold.

Article By Adrian Day CEO, ADRIAN DAY ASSET MANAGEMENT

Instead gold was down for much of the year. Why did we not see the sharp move in gold that many predicted? The metal’s performance left many gold investors disappointed and frustrated for most of the year.

There are misconceptions here. Most importantly, the gold price does not necessarily

move higher with inflation. In fact, its correlation with rising prices is rather weak. For one reason, where prices are going up, the market fears central bank tightening action to stop inflation, and that is negative for gold. Gold may go up in nominal dollars at the onset of an inflation period, but in real terms and relative to other assets, gold does not shine in inflations.

This was demonstrated clearly in Prof. Roy Jastram’s pathbreaking book, The Golden Constant. In a study of annual prices going back to the 13th century, Jastram demonstrated that gold performed better in deflationary periods than inflations

As for wars and geopolitical events, the impact on gold tends to be short lived. Often, indeed, gold moves up during the gathering storm, as a

crisis develops, and often peaks at or very shortly after the feared event. This was seen clearly with the Russian invasion of Ukraine last year, when gold peaked within a weak of the tanks rolling in. Gold often goes up when stocks are weak, but it’s a little more complex than that. In fact, it goes down almost as often, and there is very little correlation at all. Generally, three things determine whether gold goes down with stocks: had gold and gold stocks appreciated in the period before the decline– if so, they are more likely to go down with the broad market; are the gold stocks expensive–if so, they are more likely to go down; and what type of market decline–in a sharp sudden decline, think 1987, gold and gold stocks will fall as all assets are sold. Similarly, in a liquidity driven decline, gold will fall in a search for liquidity.

Apart from the above, there were two main reasons why gold did not move sharply higher last year, in US dollar terms at least. The relentless strength in the U.S. dollar was a very strong headwind. And rising rates and QT around the world leading to asset deflation.

Gold, as we know, performed quite well when priced in most currencies. Brits counting in pounds saw it up almost 12% for the year.

Even in U.S. dollar terms, at the end of the year, gold was essentially flat, holding up well in the face of a dollar that was up over 8%. It performed its job, therefore, in holding its own. In a period of general asset deflation, simply not losing made it a winner.

If gold is not correlated with current inflation, if geopolitical events have only a short-term impact; and if gold may or may not move up when stocks fall, what does move gold? These are the two key determinants of gold’s performance over more than a very short period: the currency and interest rates

The gold price in dollars has a clearly inverse relationship with the dollar. This is not surprising, since gold is money. As a bull market gathers strength, then we can see gold move up in terms of all currencies even if the dollar is relatively strong.

The relationship with interest rates is a little more complex, but not much. In a period of rising real rates when the market expects rates to continue to move up and inflation to be beaten, gold will be weak. But rates, even real rates, can be high and moving up, and gold can still appreciate. This happens if rates, though high, are not above the rate of inflation, and if the market does not expect rates to continue to move up.

We can see this distinction clearly in the 1970s. Federal Reserve Chairman Arthur Burns, widely viewed today as a weak chairman, was repeatedly raising rates, but always lagging inflation and the markets had little confidence in his ability to kill inflation. When Paul Volker came in, however, even though inflation was far higher than under Burns, rates started moving above the rate of inflation and the market believed that Volker would continue until the job was done, regardless of the short term cost to the economy. He was fortunate in having a president, Reagan, who supported him.

Today, interest rates are still well below the prevailing rate of inflation, even after the decline we have seen in the last couple of months. This is true in the U.K. and Europe as much as the U.S. The market, the gold market at least, is increasingly of the view that the Fed will not see the job through, and certainly not without a serious recession that might induce the Fed to reverse course. A pause before the job is done would be extremely positive for gold. That is why gold moved up in the last few of months, even as inflation was coming down.

Investors are beginning to realise that the Fed will not achieve 2% maximum inflation, and certainly not without a recession. Monetary policy works with long and variable lags. The most interest rate

Looking at the last seven recessions in the U.S. back to 1973, gold rose in all but one of those recessions (and in 2001, it declined by less than half a percent). Gold stocks outperformed the broad market in a majority of all recent recessions, since 1990. If we look at gold and gold stocks during and in the six-month period after recessions, we find positive performance in all but two of those periods; the first being the sharp Volcker recession of 1981 which came after a period of extraordinary performance for gold stocks; and the second, the short recession of 1990, which coincided with the onset of a period of heavy central bank selling. If, however, we see a stagflation, with persistent inflation and a sluggish or even declining economy, then we can expect gold and gold stocks to shine.

This scenario of persistently high inflation and a sluggish economy is the famous stagflation, such as the US experienced in the second half of the 1970s. It is a very favourable economic environment for gold and gold stocks.

We are also seeing a strong boost in central bank buying, the result of the weaponisation of the dollar and the global banking system by the U.S. Suffice to say now that this is going to be a long-term trend and clearly very bullish for the metal.

Lastly, let’s look at the gold stocks: they remain very undervalued, despite a strong rally since mid September, that saw the index (XAU) up over 50% at one point.

sensitive sectors, such as housing and autos, feel it first. Other sectors come later. Retail sales for example held up very well throughout 2022, leading many to point to them as support for the argument that the economy remained robust. But if prices are up, retail sales should be up equally if consumers are maintaining their consumption. More significantly however, is this: while retail sales were holding steady, savings were eroding and later credit card balances appreciating rapidly; now, we have started to see card write-offs shoot up, to 20-year records. If people are buying, but are doing so from savings and on credit card debt, then that obviously cannot continue for very long. Consumers, particularly at the lower 50% of income, are tapped out.

Some investors are concerned that a recession will be bad for gold and gold stocks. Not necessarily!

· They have lagged bullion for a decade now after moving more-or-less in tandem for decades (the stocks multiplying the metal’s moves, up or down, by three or four times)

· Gold stocks are undervalued on an historical basis, trading below average valuations, and by many metrics, such as price to free cash flow, at close to the lows.

· Gold stocks are undervalued relative to the broad market, an unusual circumstance.

These under-valuations come at a time when the gold sector is in a strong shape, in aggregate net cash positive, with strong margins (not withstanding rising costs), and a powerful outlook for the metal. That the stocks should be so inexpensive in such a positive environment is a compelling buying opportunity. EG

For further information, please visit: www.AdrianDayAssetManagement.com

TODAY, INTEREST RATES ARE STILL WELL BELOW THE PREVAILING RATE OF INFLATION, EVEN AFTER THE DECLINE WE HAVE SEEN IN THE LAST COUPLE OF MONTHS.

Heading into 2023, the macros look anything but pretty.

The core themes, percolating over time but now becoming both unsustainable and undeniable, are simple: Debt, war, inflation and currency destruction. The evidence is literally all around us as trust in political and central bank leadership heads steadily south.

This is true despite a comical Nobel Prize awarded to Bernanke and desperate attempts by government-aligned media outlets and data agencies to misreport everything from CPI inflation to the very definition of a recession.

Having reached a 40-year high of 9.1% in June of 2022, US CPI inflation fell to 6.4% by January of 2023, prompting an almost galvanic euphoria in the so-called “war against inflation.”

As we see it, nothing could be further from the truth and the inflation war, as well as data, is anything but over or honest.

In fact, the entire inflation narrative is so riddled with mis-information, dis-information and omitted information that it is nearly impossible for the average citizen to know what or who to believe despite the fact that everyone can “feel” inflation whenever they open their wallet or purse.

For now, of course, the official narrative coming out of DC is a comical mixture of false blame and fudged data interspersed with a pathological failure of leadership accountability—hence the declining trust.

Rising CPI has been blamed, of course, on Covid and a bad guy in Russia.

As energy and food prices reached double-digit price increases in 2022 (coming down temporarily now), the pundits and politicos pointed toward petri dishes and Putin to escape culpability.

Furthermore, the Bureau of Labor Statistics (BLS), which reports CPI inflation, uses a

magical scale which comically ignores the proper weightings of food, energy and housing. If the BLS used the same scale to measure inflation during the Volcker era, actual inflation today would be above 15%, not 6.4%.

Furthermore, even if one were to believe in the 6.4% figure, it is nothing worth celebrating and is anything but close to the Fed’s 2% target inflation rate. In fact, even this bogus 6.4% CPI print effectively makes any bond (from corporate to sovereign) a negative-yielding asset in real, inflation adjusted terms.

Negative yielding bonds, by definition, are defaulting bonds. Just saying…

But none of these distracting but genuine issues really touch the heart of the inflation matter, which all boils down to mouse-click money creation and the criminal negligence of US and global central bankers post 2008.

Macro economics and micro market forces are admittedly complex and highly interwoven forces which require more than a single article to unpack and explain. Nevertheless, and despite this complexity, the core of the inflation matter is in fact quite simple: When nations print or mouseclick trillions of dollars, yen, euros or pounds to monetise their debts, the end result is inherently and unavoidably, well: Inflationary

In the US, for example, the M2 money supply has tripled, and is up 40% from 2000. This, ladies and gentlemen, is not a good thing

Throughout the 20th century, the evidence is unequivocal that: 1) such increases in the money supply are always inflationary and 2) price inflation always and eventually (even after years of lagging) catches up with money supply inflation. As we see it then, price inflation, even when mis and under-reported by 50%, will continue to catch up with money supply inflation, which means we

are anything but close to “beating inflation.”

Or stated more simply, we are not even close to peak inflation, no matter how fictionally it is reported to us out of D.C.

Those faithful to Powell or unwilling to look deeper into the hard math, will, of course, argue otherwise.

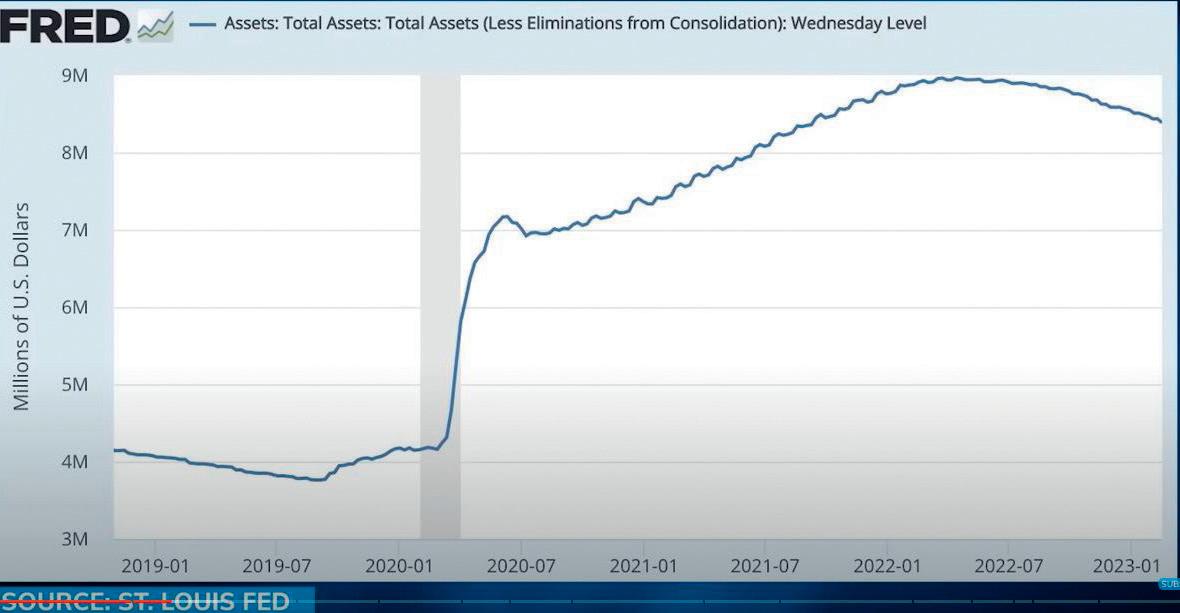

The headlines, for example, are giddy with positive spin, reminding the world that: 1) US CPI inflation is coming down, 2) that the M2 money supply between March and December of 2022 fell by over $500B, and 3) that Powell’s valiant QT and rate hiking policies to combat inflation are confirmed by a brave Fed balance sheet reduction from $8.9B to $8.6B in 2022.

Unfortunately, such “good news” when placed into something called “context” is in fact openly, well, pathetic

First, to boast of a $500B decline in M2 ignores its $14T increase in the preceding years. The mismatch is appalling and amounts to far too little, far too late. Additionally, bragging about a $300B

(2%+) reduction in the Fed’s 2022 balance sheet is simply laughable when measured against its $8 trillion climb from $800B in 2007 to $8.9T in early 2022.

In short, bragging about a few hundred billion in tightening while ignoring the eight trillion of easing is an open insult to the collective intelligence of those actually doing the real math of the Fed’s policies. It’s

also worth noting that the measly 2% reduction of the Fed’s balance sheet in 2022 resulted in the worst nominal return for US stocks and bonds since 1871.

If Powell continues to tighten at a rate of $90B per month, what we saw in 2022 will be far worse in 2023 as credit and equity markets sink in tandem, leaving investors with almost no place to hide. Thus, if you think Powell’s “war on inflation” is both winning and sustainable, we would openly beg to differ

In fact, we see macro conditions and inflationary forces getting worse, much worse in the year(s) ahead. Why? Simple.

As indicated above, debt is a core theme of the current and coming macro disaster. It makes discussions on interest rates, markets and inflation easier to clarify and predict, as debt is predictable throughout history.

In short, debt destroys economies and markets—slowly and then all at once. Keeping things painfully simple, just consider the painful reality of a US public (i.e., government) debt of $31+T and $19T in cumulative deficits since 2001. Already, the US is looking to add nearly $1T to that deficit in Q1 of 2023 alone, meaning we could see at least another $3T to $4T added to that deficit pyre in 2023.

Given these hard facts, who or what is going to pay for those debts in a declining and debtsoaked nation of anaemic GDP and declining tax receipts? The answer, despite a currently hawkish Fed, is painfully and historically obvious: More fake money and an eventual rise rather than fall in inflationary and mouse-clicked M2.

Meanwhile, of course, Powell is continuing with rate hikes and QT into a debt crisis. We think he will stick to his doomed (Volcker-wannabe) course of raising the Fed Funds Rate to well above 5% into 2023. But eventually, the destruction these rate hikes will have on the bond and then stock markets will become too painful.

Far more importantly, the destruction such a hawkish policy will have on Uncle Sam’s IOUs (i.e., the US Treasury market) will be devastating Given the trillions is USD-denominated debts held globally, the rising USD on the back of rising US rates will force more selling of USTs globally, which will add insult to the US’s debt injury.

Even Janet Yellen, the former Fed-Chair turned Treasury Secretary (imagine that…) is openly confessing the need for more “liquidity” to support an increasingly unloved and distrusted US sovereign bond market. Eventually a choice between evils will be forced upon the Fed and the markets.

In simple terms, Powell’s strong USD and rising rate policy will backfire. At some point, the Fed in particular and the US government in general will have to make the hard choice of seeing its Treasury market die or its currency market inflate. Throughout history, the choice was always made in favour of inflation (viz. currency debasement) and we think this time will be no different.

The only way to save (i.e., monetize) the UST market is to debase (i.e., inflate) the currency via more mouse-click money creation and hence a steady rise, rather than temporary and minor decline, in the M2 money supply.

This move will be inflationary by definition, and not even the dis-inflationary forces of an engineered recession or a bogus CPI figure will be enough to prevent the real inflation which investors will feel in the continued decline of their currency’s purchasing power.

Gold, of course, is a monetary metal. Its duration is infinite and its supply nearly finite. It was not created by an anonymous code writer and it can’t be mouse-clicked at a local central bank.

Instead, central bankers, especially in the east, are buying more physical gold, not BTC or USTs. There’s a reason. The world is changing, currencies are dying and gold’s role is rising. Throughout history, gold has held its purchasing power as every fiat currency from ancient Rome to DC has failed Investors hoping paper gold held in trusts, ETFs or even in IRA’s will save them need to understand that those instruments are backed by leverage not actual metals and that the only safe and historically confirmed way to own gold is physical gold stored in the safest vaults and most trusted jurisdictions.

We’ve known this for decades, and so have our clients in over 80 countries. Yes, the world and macros are complex, but the solution to openly dying paper currencies is in fact profoundly simple EG

For further information, please visit: www.goldswitzerland.com

IN FACT, EVEN THIS BOGUS 6.4% CPI PRINT EFFECTIVELY MAKES ANY BOND (FROM CORPORATE TO SOVEREIGN) A NEGATIVE-YIELDING ASSET IN REAL, INFLATION ADJUSTED TERMS.with Josephine George MANAGING DIRECTOR, BANK OF ST. HELENA LTD SAINTHELENABANK.COM

Our dedicated interview with JOSEPHINE GEORGE, Managing Director at Bank of St. Helena Ltd, documents the activity behind the governmentowned bank based in the British Overseas Territory of Saint Helena, Ascension and Tristan da Cunha. Executive Global discuss lending, personal and commercial banking with the head of the pre-eminent institution located on the island in the middle of the South Atlantic Ocean.

EG What are some of the factors that make the banking sector in St. Helena more resilient when compared with other major international banking jurisdictions?

JG Shaped by isolation, expensive internet connectivity and a small customer base, the Bank’s resilience has been established through commitment and responsibility to our valued customers. Whilst profitability is essential for sustained growth and development, customer satisfaction is often prioritised over increased profitability. Endeavouring to keep abreast with local and international environments and adapting appropriately to change has also supported resilience. Although unable to provide many banking products and services that are readily available elsewhere, the Bank’s strength lies in its ability to be creative and innovative in providing bespoke alternatives.

EG How significant of a role would you say that the bank’s favourable low interest rates for personal and commercial lending, play in contributing to positive economic growth and GDP?

JG The Bank plays a significant role as an enabler for economic growth providing lending products and services with interest rates applied to reflect the desire to encourage growth, whilst considering associated risks. Over time the Bank has supported increasing numbers of new and established businesses, provided support during the COVID pandemic and beyond, and continuing to review products supporting home building and ensuring finance availability for other initiatives.

EG And as an experienced banker, what innovations in fintech do you see on the horizon that excite you the most?

JG The world of fintech is fast moving with many of the innovations supporting the conscious consumerism framework of ESG. I am excited about the future role of fintech for Bank of St Helena and its customers, which will enable enhanced access to electronic banking, support environmental initiatives and the island’s goal of becoming a cashless society.

EG Having gained the prestigious chartered banker designation (MCBI), what additional impact has this coveted qualification had in enhancing operational efficiency and the overall customer experience at Bank of St. Helena?

JG Gaining the qualification and the designation of Chartered Banker (MCBI) has validated my professional skills and experience gained. It has also provided further credibility for Bank of St Helena as an organisation of highly qualified professionals with detailed knowledge of modern banking management and ethical and professional requirements.

EG With over a decade of experience, what would you say is the secret to profitability in banking?

JG For us, sustained profitability has been derived from placing our customers at the heart of our business. This includes a robust strategic plan that is followed closely, building and maintaining relationships with the shareholder, various stakeholders and attracting and retaining staff with the skills and experience who share our

common values of integrity, engaging, delivering, improving and being commercially minded.

EG Tell us about St. Helena Pay and some of the technologies implemented to improve banking and online payments for St. Helenians?

JG St Helena Pay is a complete bespoke closed loop system developed to ensure our customers have access to a digital payment environment. This bespoke system was necessary due to the challenges faced in acquiring an issuing licence for branded payment cards such as Mastercard and Visa. St Helena Pay is supported by the Bank’s local debit card and online banking which has transformed banking for our customers. The latest addition supported by St Helena Pay is the Tourist Card - a prepaid cash card aimed at supporting short-term visitors to St Helena and Ascension Island. The Bank’s commitment to improved financial outcomes and opportunities has also been recognised through the Award gained for Best Bank for Financial Inclusion 2023 from the World Commerce Review.

EG What future prospects do you see long term for St. Helena as a financial centre?

JG St Helena has many wonderful attributes making it attractive as a potential financial centre in the long-term, if managed correctly. In addition to the location and life-style, being English speaking and having a currency at parity with the Great British Pound (GBP), could prove to be attractive to potential investors. EG

For further information, please visit: https://sainthelenabank.com/

For us, sustained profitability has been derived from placing our customers at the heart of our business.

When most sane voices are pointing to the obviously disastrous consequences of current central bank behaviour around the world, what do you think it means that these banks are also hoovering up the world’s gold? Asks Shannon Berkley.

Alongside countries like Russia and China, central banks bought more gold in the first nine months of 2022 than they have since 1967.

There are a few possible explanations, but to whatever extent they’re true, you can at least be sure that central bank behaviour has never and will never factor in your wellbeing, merely your consent. Put differently, there’s a slim chance that central banks’ buying gold will ultimately extrapolate into benefits for the man in the street.

Central bank gold purchases in 2022 were the highest in over fifty years. The highest, in fact, since the gold standard was abolished. Rather than scalp for a quick trade or look for something to quickly trickle down, investors would do better to emulate the behaviour. If central banks want gold, you can be sure it will be a medium of exchange, control, or simply wealth as we currently understand it, in the near future.

The reasons central banks have embarked upon the biggest gold buying spree in half a century could centre on simple economics. What goes up, must come down, and asset prices are no exception. Gold is the hedge, the stabiliser, the answer — at least for them, and at least in part. Central banks are also simply both leading and emulating those who fear inflation’s already gob-smacking effect on local lives. Gold is the historic safe haven, after all.

Central banks’ buying of gold is less ominous than reassuring, at least over the near term. If anything, it’s a signal for retail investors to do the same.

Perhaps it was the recent disclosure by the CCP of China’s official gold reserves that has sparked others’ panic. Looking at American Foreign Policy (it’s hawkish and bereft of morality), emblematic as it is of spots in Europe and elsewhere where minions toe the US’ line, many central banks will have been spurred to play catch-up after China rubbed its opulent reserves ($2 trillion in 2022) in their faces.

The fact that an entire page could be filled with alarming yet plausible reasons for the precious metal buy-up, is indicative of just how badly central banks have done in building strong and prosperous nations, for their part. Sovereign nations are also inclined to want a repatriation of their gold, realising (as everyone now does) that governments aren’t as solvent as their image suggests.

It might be that central bank economists have been reading some monetary history, internalising the outcome of monetisation for Ancient Rome and Ancient Greece. For Zimbabwe, once the breadbasket of Africa. For Hungary. Modern day Venezuela.

In spite of insisting they’d develop some sort of financial ninja techniques to avoid the eventual dark fate that everyone has been warning of, central banks’ gold buying could be indicative of a tacit admission and a sober return to fiscal discipline. A very long shot indeed, for the crowd that has mastered the unpanicked destruction of economies of late.

Perhaps the fact that Russia has been buying gold hand over fist for the past few years, and is now only accepting roubles and gold in payment for its oil, for example, has made the house mad. Could Zimbabwe’s recent return to a gold standard have outed the truth of just how fundamental, gritty, painful, and soul-sapping hyperinflation can be?

Is Zimbabwe educating central banks, or blowing their cover?

It could be that Warren Buffett’s wise father Howard is finally to be markedly vindicated, as he was the one who said “human freedom rests on gold redeemable money.” Of course, central banks aren’t engaged in a quest to restore the freedom of the citizenry, quite the opposite — CBDCs are designed to unashamedly enslave people — but in order to keep the wheels on right now, perhaps they need to display some genuine legitimacy. Looking ahead, fiat currencies will need the gold asset backing to restore confidence in currency (and maintain docility in men).

It’s as likely that the longer term goal is to permanently remove the freedom associated with “gold redeemable money,” and the first step towards

that is to start hoarding gold. Eliminate its currency potential, while pretending that it’s all being put away for the citizenry, of course. As Lynette Zang of ITM recently pointed to, by way of explanation for much of what is happening in global markets right now, when corrupt interests “know that bankruptcy is near,” their motto becomes “steal as much as you can while you still can.”

Let’s not forget that these are the same people who have brutalised notable economies for decades, making huge, wilful mistakes, while also perpetually and illegitimately appearing as the saviours in crises they’ve created — the same people who completely screwed up the repo market. They’re now possibly scrabbling for a veneer of normality to hide the repercussions of their failures, and gold fits the bill. This is not merely opinion, because Fed chairman Jerome Powell has been issuing some remarkably ambiguous and/or completely weird statements recently, allowing the mainstream press to latch onto snippets of implied hope, while sane economists leave the same briefing shaking their heads.

It’s a bait-and-switch when it comes to the Fed right now, with nonsense given out by serious guys in suits that the press johnnies attempt to wring joy out of, while more competent analysts watch

Again, while the hawks in Washington have not yet even begun to consider the end of the petrodollar and the US dollar’s hegemony as world reserve, its dethroning has already happened.

By all visible technical criteria, the dollar has been told to stand up and move to one side of the throne. Other currencies are vying for pole position, and gold is intrinsic to this internecine war in the palace. Scholars are pointing to the remarkable similarities between declining ancient empires and life in America today. Small wonder the ancient remedies are finding currency.

Of course, central banks have to go back to a gold standard to prevent economic chaos. That too is a valid (if somewhat curt) statement, looking at the global economy through the legacy lens. But with CBDCs having left the wings and now heading for centre stage, you can be sure that if today’s vested interests are forced into what might appear to be an about-turn on a gold standard, they’re going to make damn sure the benefits come their way

What does that mean for investors, exactly? Still, regardless of central banks’ motivation, investors everywhere should be getting into gold. A combination of geopolitical and economic factors are currently shaking the global economy. An overarching globalist agenda that is ultimately meaningless and irrelevant at best, or downright repugnant and extremely fascist at worst, is being spouted by the WEF and UN, and it’s diluting domestic cohesion everywhere.

Social instability, global monetisation, and the ever germinating-and-then-popping asset bubbles are making for a bad impact on global economic health. Admittedly, it’s always a similar recipe, but we’ve run out of some things now, and this time the added ingredients might make something dramatically different without the tempering of what we’ve lost.

Gold’s current valuation, the visible wisdom of other nations that have clearly learned from economic history, as well as the contingent of wealthy institutional clients (family offices, sovereign wealth funds, and private banks) that have yet to allocate a significant percentage of their ample funds to buying gold, all contribute to upward pressure on the gold price. This means that investors should seriously consider including this asset in their portfolios. If the world’s central banks added over 80 tonnes of gold in 2022, perhaps wise investors should too?

the banks mask, attempt to delay, or outright lie about the very real stinkpot we are already floating in. Against the backdrop of global debt monetisation (aka looming or at least potential hyperinflation), rising interest rates, and asset price bubbles; do central banks know something we don’t?

The BRICS nations are expanding their membership, the southern hemisphere is talking gold-backed, strong trade, and good neighbours.

If you hope soon to mint gold coins in your basement, you’re a primitivist, or at least a wannabe pirate, and also likely missing the real value of physically holding gold in trying times, even times of economic oblivion. Gold brings stability in the moment of crisis and value when the world returns to normal.

With an almost supernatural pedigree spanning countless centuries, if gold is not the salve for looming financial implosion, nothing else can be. EG

STILL, REGARDLESS OF CENTRAL BANKS’ MOTIVATION, INVESTORS EVERYWHERE SHOULD BE GETTING INTO GOLD.Photo: Medicimage Education / Alamy Stock Photo

I vowed to be more accessible to our clients because they deserve VIP treatment.Jinhee Wilde CEO and Founder, WA Law Group, LLC

Our special interview on The EB-5 Expert with JINHEE WILDE, CEO and Founder of WA Law Group, LLC, profiles the boutique immigration law firm helping EB-5 investors, corporations and private clients across the U.S. and around the world. Executive Global sit down with the pre-eminent attorney representing clients in matters of EB-5 investment and employment immigration, citizenship, naturalization and non-immigrant work visas.

EG You have an exceptional record in I-526 and I-829 petitions with only three Requests for Evidence (RFE) on Source of Funds (SOF) from USCIS. Why does your experience make your firm the perfect choice for foreign executives wanting to relocate their business to the U.S?

JW EB-5 cases combine both business (investment) and immigration documents in a single submission. I-526 and I-829 case files are usually thousands of pages long with document stacks 9-12 inches high, so providing a short summary of the case to guide the USCIS officer is key, and analogous to the executive summary of a long business plan. On the business side, it is essential to understand what the project is trying to do and how the investor’s funds could play a role in it, and then translating that vision with skill and finesse for USCIS. WA Law Group, under my leadership, has been very successful in doing this, with a track record of 100% approvals thus far.

EG What are the greatest challenges you’ve faced as immigration counsel for Case Farms and as advisor on the EB-3 Other (EW) Program? How do these differ from the challenges pertaining to investment-based EB-5 Immigration?

JW Employment-based immigration under the EB-3 Other (EW) program requires a U.S.based employer to prove that they do not have enough U.S. workers to fully staff their needs before they can sponsor foreign workers to supplement their hires. This process goes through three different government agencies—Labor Dept., USCIS, and State Dept.--and they all focus on

making sure that no U.S. employees are displaced and that a foreign worker is eligible and passes background/security checks. EB-5 immigration is completely different in that there is no U.S. employer sponsoring the foreign applicant. Instead, the program is designed to receive investments from foreign investors into a U.S. entity/project that will create 10+ full-time, permanent jobs for U.S. workers. The greatest challenge to being an immigration counsel is to explain to our clients what their specific immigration path would require in terms of documentation and presentation to government officials. This often necessitates following or understanding not just the letter of the law (regulation) but also the spirit or intent behind a statute, regulation or policy. We explain the minutia of these requirements to our clients to help them understand the years-long process and alleviate their anxiety.

EG Being a tenured attorney for over three decades and having been an immigrant yourself, how has your experience working in the higher echelons of the legal profession deepened your insight into the U.S. immigration system?

JW The biggest issue for many immigrants is the extremely long and arduous process of U.S. immigration. Having been an immigrant myself whose family went through many sleepless nights worrying what could happen to us and also seeing the other side of the process where the attorneys were too busy to communicate with their clients, I vowed to be more accessible to our clients because they deserve VIP treatment.

Seoul, Korea

ALMA MATER

Loyola University Chicago School of Law

EXPERIENCE

2009-Present Founder and CEO, WA Law Group, LLC.

2005 Managing Partner, Teras & Wilde, PLLC.

2004 Partner, Johnson & Yang, PLLC.

2001 Commissioner, Washington Suburban Sanitary Commission.

1989 Inspector General Designee and Special Counsel, United States Department of Agriculture.

1985 Assistant Counsel, City of Chicago.

EG Who are some of the most successful investors you have advised, and what does profitability mean to you?

JW The most successful EB-5 investors are the ones who had their conditional green card approved (I-526 immigrant petition approved and DS-260 immigrant visa issued), had their application for removal of condition (I-829) approved, and had their full investment funds returned. We have many investors who went through all three steps successfully and even had their U.S. citizenship approved.

As in any business, profitability is important to us. But unlike many other law firms that focus on billable hours and bill for every minute that the firm’s staff communicates with the clients, our firm spends as much time as needed in responding to emails and speaking with them on the phone answering their questions and updating them. So, profitability is less important than making our clients feel comfortable and assured of their immigration process and progress.

EG As an award-winning firm, you have consistently ranked as a top immigration lawyer. How critical to your success as a firm, is quality customer service?

JW The legal field is still very much a man’s world, where being invited to play golf with senior partners gives you greater insider status than putting in long hours at the office. Immigration law is replete with women lawyers, but they tend to be solo-practitioners and not partners at large law firms. I would like to see more women partners mentor their associate attorneys, like many male partners do. My partner, Sunwook “Sunny” An, was an associate attorney right out of law school, whom I groomed and made my partner after 10 years. She will inherit the firm as the Managing Partner after I retire in few years.

EG As an EB-5 Investment Immigration specialist, how does it feel to be a big part of America’s success story, helping U.S. employers and positively contributing to GNP?

» PRODUCTIVITY

Taking time to answer clients is not a waste.

» STRATEGY

Don’t cut corners; do it right the first time.

» PROFITABILITY

Don’t chase dollars; build reputation.

JW The quality of customer service is the key to our clients’ satisfaction and the main driver of our awards. All of our clients state that our less than 24 hours response time to their communications and the accessibility of the top lawyers (partners) of the firm is the best. The fact that they do not get nickeled and dimed for every call or email they send is also a great relief as they feel free to ask questions about their case status and their immigrant status.

EG Tell us more about the Jinhee Wilde Scholarship that you established to assist the next generation of aspiring lawyers?

JW I recently established a scholarship endowment at my alma mater, The University of Chicago, for the Jinhee Wilde, Esq. and Dr. David Wilde Odyssey Scholarship Fund. These scholarships are designed to give back to the community and encourage young men and women to follow their dreams.

EG Having worked as a partner for several prominent law firms in Washington D.C., what do you feel can be done to encourage more women to enter this field of law?

JW The work we do as business immigration lawyers is critical to helping U.S. employers maintain an adequate workforce through immigration. Employment-based immigration is a win-win-win scenario where employers get workers for jobs they cannot fill with U.S. workers alone, the foreign workers get immigration benefits, and the U.S. government is supplied with legal immigrants who will contribute to the economy and our tax base. EB-5 investments, on the other hand, actually put foreign capital into a U.S. region where there is higher than average unemployment or into rural areas to create more regional jobs – at least 10 permanent jobs must be created per investor immigrant. I cannot think of any government program on a per capita basis, including corporate tax cuts, that adds more to the U.S. economy than employment-based immigration – our government gets many more economic benefits from this than what it spends.

EG As a successful attorney and entrepreneur, who are some of the people that personally inspire you in business and why?

JW I do not have any particular person who inspired me as an attorney or entrepreneur. However, I admire women leaders who would mentor and groom associates or younger people who work for them rather than those who would roll-up the ladder up behind them after they made it to the top. In fact, I have seen many women leaders who treated female associates/staff tougher as if to say, “I had it difficult so you should also and get toughened up.” As I said earlier, the legal

Recently, this client obtained her citizenship and told me that she did not know where she would be if I did not rescue her case from her previous lawyer.

During more than 3 decades of her legal career, Ms. Wilde has had a diverse and unique background, as corporate lawyer facilitating multi-million dollar, multi-national transactions, as a government prosecutor/attorney before changing her focus to business and investment immigration law.

» First Asian American woman to be Commissioner of Washington Suburban Sanitary Commission.

» First Asian American designated as Inspector General of U.S. Dept. of Agriculture.

» First Head of Korea practice at Arent Fox, Kintner, Plotkin & Kahn.

» Who’s Who in American Law 2022 –Executive Spotlight.

» Top 100 Immigration Lawyer by Top 100 Magazine

» Top 25 EB-5 lawyer by EB-5 Magazine.

fly a plane after having had flown as a passenger. The case was mismanaged from the beginning where this lawyer took six months to file the I-526 petition instead of one month that we usually take, which caused the client’s optional practical training (OPT) to expire and causing her to lose her job at PricewaterhouseCoopers. Things became worse when this client’s removal of condition application (I-829) received a Notice of Intent to Deny (NOID) and this lawyer gave up on the case as she did not know how to overcome this negative decision. I took over the case to successfully overcome this NOID and got the client’s case approved, thereby saving her from losing another job- this time at Deloitte, and from losing her permanent residency. Recently, this client obtained her citizenship and told me that she did not know where she would be if I did not rescue her case from her previous lawyer

EG How has your experience starting as prosecutor for the city of Chicago, Special Counsel at the United States Department of Agriculture, and then as corporate lawyer, being shaped your outlook?

profession is still very much a man’s world, and many young male lawyers were groomed by male senior partners, whereas very few women partners do that for young female associates. I wanted to change that.

EG Having been an immigration lawyer for 20+ years with a high approval record across hundreds of cases, what is the most notable case that you are most proud of today?

JW Every case approval is very precious to us as we have changed their lives and allowed them to take a step in achieving their American dreams. The cases that make me most proud are those whose cases were messed up by other lawyers that I take over to successfully win them. Although I have many of these, the one EB-5 case that stands out is the one case where another lawyer who attempted and failed to do a case properly for the daughter of one of my clients by herself after only watching me do the mother’s case. This is like me attempting to

JW The immigration law practice is an administrative practice where the case is adjudicated by government officials, not necessarily by a lawyer or judge. My 10+ years as a government lawyer gives me insight into how government officials think and how they review a case, emphasising how it meets the public good that was intended when the law was legislated or regulated. My corporate legal experience negotiating multi-million dollar contracts allows me to review and understand complex projects and the financial documents that comprise EB-5 investment immigration cases. These collective experiences give me a unique set of skills to prepare winning immigration cases, so that we enjoy a nearly 100% approval track record in all types of immigration cases, not just EB-5.

EG You have a Juris Doctorate from the Chicago School of Law at Loyola University. How did your education and training prepare you to succeed at the forefront of U.S. investment immigration today?

JW Law school provides the foundations of law and legal procedure. It teaches you how to identify the issues of a case, do research, and present an argument. However, the greater part of learning how to practice as an attorney comes from on-thejob training. The nuances of immigration law are not usually taught in law school, so the best way to become an expert practitioner is to take the time to prepare cases in a detailed way that makes it easy for the USCIS officer to understand and approve the case. EG

For further information, please visit: www.WALawUSA.com

Gold’s historic 2,300% leap in the 1970s from $35 to $850 per ounce occurred right after President Nixon took the US off the gold standard.

Article By Jon Forrest Little FOUNDER & PUBLISHER, THE PICKAXE

Moreover, in the early 2000s, gold tripled in value – soaring from under $300 per ounce in 2000 to $1,000 by 2008. This 3x move was part of the commodity super cycle. Today is a better set up and here is why. Market volatility is rising. Despite the phoney reporting that inflation is coming down, inflation is at its highest level in 40 years. Lies like ‘the M2 is contracting’ are monstrous-style falsehoods with disturbing intensity. The more false the statement, the more enthusiastic the lie.

M2 is a cherry-picked stat showing cash circulating plus money in bank accounts and money markets. The reason M2 is shrinking is that people are withdrawing their savings en masse to make ends meet. So stating that M2 is shrinking to demonstrate you are fighting inflation is pure insanity. M2 is shrinking because people’s real wages have decreased for 21 consecutive months (a new record).

People are pulling out money to buy food and pay overheads. These are for the people lucky enough to have savings. Another way of saying this is that bank deposits are negative.

1. Market instability will continue in 2023

2. Inflation will increase in 2023 for many reasons, such as past QE and supply chain disasters.

3. The Fed, US Treasury, Executive branch and Congress will do their normal debate dance about raising the debt ceiling or closing down the government.

The Fed is lying when they say they are fighting inflation by raising rates.

If the Fed really wanted to fight inflation they could increase the reserve requirement for banks. Banks do not hold cash reserves that match your deposits (within the fractional reserve banking scheme.) So if you deposit $100,000 dollars, the bank does not have to keep ANY OF THAT UNDER YOUR NAME. Your deposit, by law, is just a loan to the bank. And if they fail, they are either bailed out by the public or “bailed in” by law. A “bail-in” means they keep your deposit, and you lose your money. They will give you a paper certificate symbolising worthless shares of the very bank that went bankrupt.

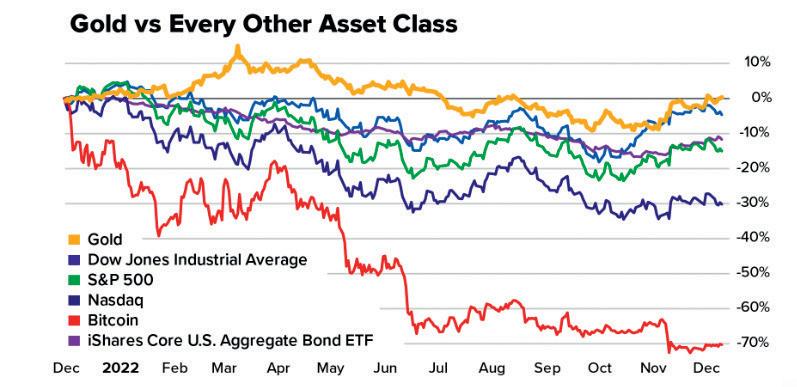

The following chart shows what gold did against the S&P 500, Dow, and Nasdaq in 2022.

Now look at gold against standard asset classes together in one chart.

Let’s discuss why gold will continue to do well in 2023. Gold is the barometer for how people feel overall about monetary policy. If the market believed the economy was healthy and that monetary policy made sense, gold would drop like a rock

So we have these things happening:

1. Market volatility.

2. Raging inflation (40 year high)

3. Systemic risk (based on debt, derivatives, equities, and the way banks are allowed to function)

4. The distorted bond market.

5. Safe havens like real estate are no longer safe havens.

6. Geopolitical instability (greatest since WW2)

Too many conventional gold and so-called silver experts keep harping on the same thing when it comes to silver and gold. They talk way too much about what the Fed is going to do. They talk way

too much about existing stockpiles relative to future demand. They talk too much about cup and handles, Fibonacci analysis, and other technical analyses.

Why such distrust? Because of the increasing lies by the government, The Fed and the legacy media. Small snapshot of government lies.

1. We are not in a recession.

2. The economy is healthy.

3. Inflation is Putin’s fault.

4. There is no energy shortage.

5. The inflation reduction act will reduce inflation.

6. The American economy has never been stronger.

7. We can phase out fossil fuels.

8. There is a virus that came from bats.

9. There is a vaccine that is good for everyone.

10. Raising rates will cool inflation.

11. The war in Ukraine was Putin’s fault.

12. We need a $1.75 trillion Omnibus spending bill.

13. We need members of Congress to buy and sell stocks after they receive classified briefings.

14. It’s OK to release the Strategic Petroleum Reserves.

15. It’s OK to have the children of Pelosi, Biden, and Kerry broker national security-sensitive energy deals with foreign governments.

Even the stupidest things like hearing that the government wants to ban gas stoves makes no sense. My thinking is, of course the government wants to ban gas stoves, all the easier to turn off the grid. This is about centralisation, whereas having your own

gas (whether it’s your car or stove) is decentralised, yielding more freedom. Note the pattern here?

Gold is rising because there is a lack of trust in the health of the US dollar at home. This domestic lack of confidence stems from the reasons I mentioned above.

It’s a matter of trust. Metals people know that the US dollar has lost 98% of its purchasing power over the past several decades but the emotion of trust is just as significant. The structure of the fiat financial system has destroyed the middle class. The oligarchy has siphoned wealth through inflation and taxation. Manipulated interest rates and money printing have grown the wealth gap. And it’s bound to get worse. At this point, I’d like to point out that the term mentioned above, “oligarchy,” is only partially true.

We’re suffering through a lethal mix of oligarchy and plutocracy, but we mostly have a kleptocracy. Kleptocracy differs from plutocracy (ruled by the richest) and oligarchy (headed by a small elite). In a kleptocracy, corrupt politicians enrich themselves secretly outside the rule of law through kickbacks, bribes, and special favours, or they simply direct state funds to themselves and their associates.

Those closest to the money printer were the primary beneficiaries. The US printed $6.4 TRILLION, and in 2021 billionaires saw their wealth increase by $5.1 TRILLION. The ruling class benefited from the money printing. Meanwhile, the middle class had their businesses closed, and their living cost doubled, destroying savings; The Fed stepped in and said they would champion “The fight against inflation” (which they created & benefitted from).

Now let’s discuss what has happened internationally.

The US has enjoyed dominating the global monetary system. It’s often presented to the public like it’s the natural order of things, such as the law of gravity, or just believed it’s a given, like oxygen will always be there to breathe. This assumptionbased narrative leads people to think that the rest of the World is alright with the US being the global reserve currency or this is just the de facto World state of affairs.

Nothing is further from the truth.

The US must be vigilant to maintain US dollar hegemony. The playbook looks like this:

1. The US can print the dollar to oblivion while other countries are forced to hold it.

2. Other countries hold something that the owner can devalue at any time.

3. The US can print up its dollars and buy real things of value with it. The US receives tangible items in exchange for paper.

4. The US can confiscate other countries’ currencies because of our military advantage. That is what just happened in Russia.

5. The US can also block other countries from using the global financial system (SWIFT) Naturally, hundreds of countries are trying

to exit this type of system. The de-dollarization process is well underway. BRICS has unfurled their Russian Ruble pegged to gold. This system was designed by Russian economist Sergey Glazyev. Sergey Glazyev and his eastern and southern partners are seizing this unique chance to “jump off” the sinking ship of the dollar-centric debt economy. Sergey Glazyev, is a Russian economist and architect of the gold-pegged ruble. Why was he the first person the US sanctioned in 2014?

The Fed is intentionally destroying the US and the World’s economies as an excuse to ‘come to the rescue’ with their CBDC.

The Fed knows they created inflation and that they can’t raise rates to fight it. We don’t have the funds to service the debt. Therefore, it is simple logic to understand they are intentionally destroying the economy

WHY IS THE FED WRECKING THINGS INTENTIONALLY? BECAUSE THIS WILL GIVE CAUSE TO ‘COME TO THE RESCUE’ WITH THEIR CENTRAL BANK DIGITAL CURRENCY.

Why is The Fed wrecking things intentionally? Because this will give cause to ‘come to the rescue’ with their Central Bank Digital Currency. The CBDC is also called The Fed Dollar. You can look it up here under President Biden’s Executive order #14067

Here are some disturbing features of the CBDC

• GPS technology.

• Facial recognition.

• Instantaneous credits and debits.

• Fully Programmable, so it can be turned off.

• A social credit merit system.

Just recently all US flights were grounded because of a computer glitch. Meanwhile globalists are telling everyone to “beware of more cyber attacks.” Remember, there is no such thing as a coincidence. Like a switch, all our funds can be turned off. This is why you need real money like gold and silver. Not the Fed Digital Dollar! EG

For further information, please visit: www.ThePickaxe.xyz

For this article, we were asked to elaborate on our view on the impact of rising interest rates on real estate investments. After a general introduction to current topics, we will outline what we consider critical factors for this popular asset class in the newly changed interest rate environment.

Article by Stefan Kremeth CO-FOUNDER & CEO, INCREMENTUM AG

Article by Stefan Kremeth CO-FOUNDER & CEO, INCREMENTUM AG

One year ago, when the war in Ukraine broke loose, energy prices soared, and financial markets crumbled. Interest rates went up and are still increasing. Stagflation was one of the keywords used excessively by the media and even by economists. Stagflation is a business cycle characterised by slow growth, high unemployment, and inflation. For economic policymakers, this combination is challenging to manage, as any attempt to correct one of the factors may aggravate another. However, one year later stagflation is still nowhere to be seen and as often, things develop differently than predicted by the masses; the term “stagflation” was sent back to sleep, at least for the time being and seems to have disappeared from the media altogether. Instead, today’s buzzword is “soft landing”.

We will see in what direction economies went in twelve or twenty-four months. However, we can learn from the old “Austrians” that societies and economies with constantly unbalanced budgets and accompanying market interventions inevitably lead to a consistent misallocation of resources. Over time, the loss of purchasing power due to a lack of budgetary discipline is significant and during the last twelve months, global economies suffered heavily from this effect. At times inflationary pressure can be pushed back on the timeline, but eventually, an outbreak is unavoidable. Therefore an investment strategy tailored to one’s needs and which helps to diversify inflation makes enormous sense.

Balanced and cash-flow-producing strategies have proven resistant and shown impressive inflation diversification potential. Furthermore, those who can afford to invest in real estate and physical precious metals and want to add them to their portfolio can expect an additional diversification effect, maybe leading to lower volatility but not necessarily any better long-term performance.

OF THE DAY Volatility always seems to be an issue, and as inconvenient as it may seem for investors, volatility nevertheless represents an intrinsic part of investing, and any investor should know that. We usually tell our private clients that volatility is a price to pay for any consistent long-term performance. Now, many people would like to see a fully insured society with its economy in total equilibrium, which on top of everything- is tailored to the needs, fears, etc., of each individual. But unfortunately, this is not realistic. Just as we cannot always expect perfect solutions from science, we cannot expect our society, the state, monetary policy, individual politicians, fellow human beings, doctors, teachers, gurus, family members, friends, and acquaintances to always have the adequate and tailor-made solution ready to address the problems of each individual. How should that be possible? Economic cycles come and go, economic crises come and go, political cycles come and go, and political crises come and go. This

may seem unreasonable, out of date, exhausting and at times unfair, but it is nevertheless constantly the case that all sorts of crises affect our daily interactions. Societies and their financial markets are pretty complex systems, and complex systems are unfortunately not always fair or in balance.

SOCIETIES AND THEIR FINANCIAL MARKETS ARE PRETTY COMPLEX SYSTEMS, AND COMPLEX SYSTEMS ARE UNFORTUNATELY NOT ALWAYS FAIR OR IN BALANCE.Photo: REUTERS / Alamy Stock Photo Article by Dr. Christian Schärer PORTFOLIO MANAGER, INCREMENTUM AG

Even the best political system, economic theory, and investment approach have their limits and cannot answer all the questions, identify all the unknowns (hence the name) and take into account the complexities and interdependencies of politics, the macroeconomic environment, central bank policies and scientific innovation, to name but a few. Against this backdrop and for purely common sense reasons, it seems arbitrary to us to focus on one asset class, or even worseone single asset.

Karl Popper pointed out more than 80 years ago that science can never produce absolute truths but rather approaches the truth in constant processes (also thanks to trial and error), i.e. every theory is only considered ‘good’ until it can be replaced by a new, better and tested one. Now we all know that theories often leave out certain aspects; the developers of such theories deliberately limit themselves to core topics and usually do not claim to be all-encompassing. So when investing, we should keep that in mind and not expect the

impossible from any investment or other theory.

After this introduction, let us focus on the main topic of this article- real estate and the impact of higher interest rates, opportunities and threats to this asset class.

Over the last few decades, real estate investments have enjoyed immense popularity against low or negative interest rates and steady economic growth. Prices knew only one direction - up. However, the newly changed interest rate landscape has also left its mark on the real estate market. The days of continuously rising valuations are over, at least for now. Moderation is the order of the day

Our thoughts relate to the market for investment property. For owner-occupied residential real estate, some arguments are less relevant because not only economic factors play a role in respective purchase decisions. Rising interest rates influence the performance of investment property in three ways. Firstly, raised financing costs and declining

relative attractiveness due to higher yields on alternative investments (bonds) harm price levels.

In addition, the discount rate is the most critical factor influencing the valuation of an existing real estate portfolio. Real estate companies and pension funds use the discount rate to determine the present value of their portfolios. This rate is usually derived using models and is conceptually based on a riskfree interest rate (yield on long-term government bonds). In addition, the general real estate risk and property-specific surcharges are considered when determining the discount rate. Steadily falling discount rates have been the main driver of rising valuations in recent years. Accordingly, real estate portfolios have appreciated significantly. For example, the largest Swiss real estate company, “SPS”, has recognised more than CHF 1 billion as income from revaluations since 2017. Therefore, the need for adjustment due to this newly changed interest rate landscape will likely not be insignificant. However, due to the inertia and longterm nature of the real estate market, the impact of these adjustments will probably only become apparent over the coming years. From an investor’s perspective therefore, there is no reason to rush into investing in existing real estate portfolios.

For real estate to become more attractive again from an investor’s perspective, property yields must rise (significantly). This means that property prices must fall and/or rents must rise. Rents for space in commercial properties are determined by supply and demand. Here, both the economic environment and structural factors impact pricing. Because of current trends in the labour market (home office) and retail trade (online shopping vs stationary retail), high-quality offers in central locations will likely remain in demand. On the other hand, properties in geographically peripheral regions and properties of inferior quality will become significantly less attractive. As a result, the market will become increasingly differentiated again in the future.

Regarding investment strategy, the time for “buying and holding” is also over in the real estate market. An active strategy that focuses on quality and valuations seems more promising. It is essential to monitor current trends on the demand side. Structural changes are occurring due to demographics (immigration and urbanisation), the labour market (home office) and shopping habits (online vs stationary retail). This structural change is likely to accelerate further.

Nevertheless, selected real estate investments are to remain interesting. This is because they may offer a diversification contribution and deliver significant cash flows based on a reasonable valuation. This opens up exciting investment opportunities in the medium and long term for disciplined investors with experience who can handle investments in non-liquid asset classes. EG

For further information, please visit: www.incrementum.li

STRONG AND COMPASSIONATE ADVOCATES FOR IMMIGRANT AND NON-IMMIGRANT VISA MATTERS

WA LAW GROUP is a boutique immigration law firm focusing on investment and employment immigration. WA LAW GROUP offers comprehensive immigration law services with emphasis on investment and employment immigration. From green cards to the process of citizenship, our attorneys and professionals guide you through often confusing and changing immigration law and policies. We help EB-5 investors, corporations and individual clients from around the world and across the United States.

• Employment-Based Immigration

• EB-5 Investment Immigration

• O-1, H1B, L-1, TN, E-2

• Citizenship and Naturalization

• Consular Processing

Entrust your U.S. investment immigration process to WA Law Group, LLC. You deserve VIP treatment from a law firm also.

> 100% Approval track record in 15 years.

> Awarded Top 100 immigration lawyer and Top 25 EB-5 lawyer in the U.S.

> Voted Best 10 immigration law firm for client service.

> Prompt and courteous responses to your inquiries within 24 hours.

> Personal attention from top partners of the law firm.

The island of Jersey is officially known as the Bailiwick of Jersey, and is a selfgoverning Crown Dependency. Located off the northwestern coast of France, it is the largest of the Channel Islands at around 120km². The surrounding (uninhabited) islands such as Les Dirouilles, Les Minquiers, Les Pierres de Lecq, and Les Écréhous form part of Jersey too, reports Oliver Taylor.

Jersey was once part of the Duchy of Normandy, and Norman dukes became kings of England circa 1066. After Normandy was lost to France by the English kings during the 13th century, the ducal title was surrendered to France. Jersey, however, today a country of just over 100,000 people, maintained its loyalty to the English Crown, although it was never incorporated into the Kingdom of England and today still remains officially outside of the UK