3 minute read

Inventory

Is supply beginning to exceed demand?

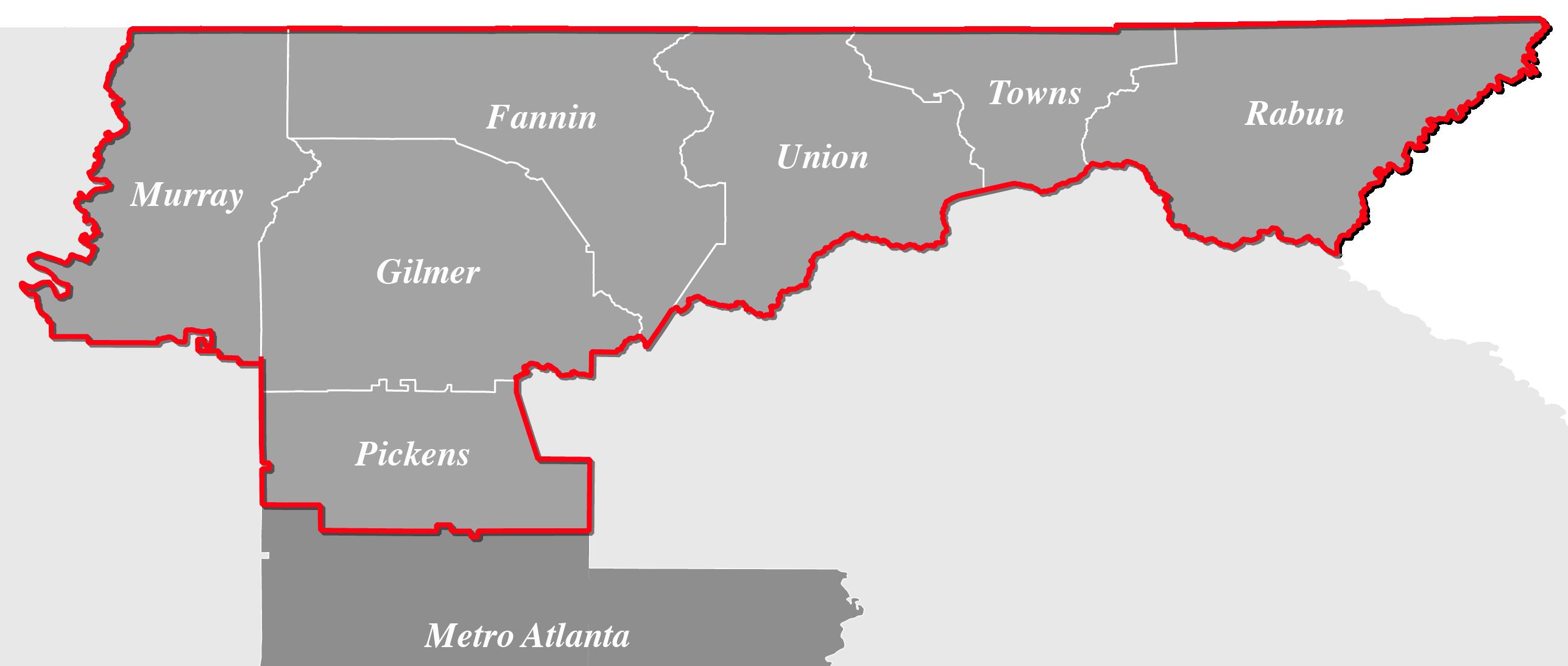

Demand continues to outpace supply in Atlanta. In January 2022, home inventory was at a record low of 1 month of supply. Although it has risen significantly since then, there was still only a 2.1-month supply of homes for sale by year end.6 summer, buyer demand declined, but so did new listings, with current homeowners hesitant to give up their low interest rates. Atlanta reached a peak of 2.3 months of supply in October and dropped back to just 2 months in December, following a typical seasonal slowdown in the winter.

At the start of 2022, the very limited number of available homes in Atlanta could not match pandemic era buyer demand in a time with low mortgage rates and an increased focus on life at home. This inventory shortage contributed to competitive conditions that heavily favored sellers and led to bidding wars, rapidly rising home prices, and ultrafast timelines, with most homes selling in less than a week.

Home inventory is measured as “months of inventory,” a term that describes how long it would likely take for all the actively listed homes to sell, if no new homes were listed, based on the recent pace of home sales. A 6-month supply is considered a balanced market, with fewer months of inventory favoring sellers and more favoring buyers.

Supply ticked up heading into the spring market as more homes were listed, a normal seasonal trend. As mortgage interest rates rose over the Metro Atlanta 2022 Monthly Home Inventory

Despite lower demand, the Atlanta market remains at less than half of the supply that would be considered a balanced market (6 months of inventory), with select submarkets approaching a balanced market. Assuming interest rates peaked in November and demand bottomed out at that time, months of supply in spring and summer 2023 are not expected to go above 3 months.

Much of the increase in home inventory in late 2022 can be attributed to homes taking longer to sell than they did early in the year, rather than a major increase in the number of homes buyers can choose from. After lightning fast sales in early 2022, the time it takes to sell the average home also increased in the second half of the year, a return to normal seasonality after an unusually hot market in 2020 and 2021. By December, the median days on market rose to 23 days in the Greater Atlanta Area, still a week faster than in December 2019, a typical year when the median days on market was 30 days.7

Buyers feel like they have more to choose from when new listings that fit their criteria are added. New listings in Metro Atlanta declined every month from June to December, slightly outpacing the normal seasonal trend of fewer new listings in the second half of the year. The number of new listings in December 2022 was the lowest of any month in a decade. Just 3,849 new listings were added, about a third of the new listings added in June 2022 and 29% lower than the average of Decembers in 2017 to 2021.8 Fewer homeowners are choosing to sell, discouraged by higher interest rates and limited inventory. As of November 2022, 99% of U.S. homeowners with mortgages had rates below 6%,9 which disincentivizes them from selling their current home to buy another at a higher rate, leading to stagnation in home inventory and limited choices for buyers.

In January 2023, the number of new listings went up for the first time since June 2022, with 45% more new listings than December. Although new listings were still below average for January, this uptick is a sign that sellers who have been waiting are beginning to get off the fence.

Will there be an influx of foreclosed homes like in the Great Recession?

Current homeowners often have a significant amount of equity in their homes due to recent price appreciation. Combined with a strong labor market and less risky loan underwriting in recent years, this means they are not likely to be forced into a sale for financial reasons, as was the case for some homeowners during the Great Recession. Several indicators show current homeowners in a strong financial position with a low likelihood of a wave of foreclosures:

• The foreclosure rate today is at a historical low of 0.6% nationally.10

• Significant price appreciation in past two years has given homeowners stronger equity positions in their investments. In the third quarter of 2022, the average U.S. loan-tovalue (LTV) ratio was 43.6%, significantly lower than the average 71.3% LTV heading into the great recession in Q1 2010.11

• Nationally, distressed property sales made up just 2% of all sales in November 2022, well below the 30% mark seen during the Great Recession.12

• Mortgage delinquency is also low at 3.6%, compared to 10.1% during the Great Recession.13

• The national unemployment rate is at 3.4%, the lowest in 53 years14

Are there more new construction homes on the way?

New homes are under construction, but not enough to meet demand. As of January 2023, the Atlanta market had an annual housing deficit of 62,000 units,15 with just 13,000 new homes expected to be constructed over the next 12 months.16 As builders begin to pull back on new starts due to economic conditions, we may see even fewer of these homes actually completed this year, furthering the deficit. This low level of inventory is one of the factors that has shielded Atlanta from the kind of significant price reductions that some buyers may have expected to coincide with a significant increase in mortgage interest rates.