2 minute read

Interest Rates

Mortgage interest rates have been a driving force in the housing market in 2022. The year started with near record low rates for a 30-year fixed rate mortgage, which averaged 3.22% nationally at the start of the year.1 At the same time, inflation was on the rise globally and home prices were rising rapidly as low borrowing costs enticed buyers and contributed to stiff competition for a limited inventory of homes. To reign in inflation, the Federal Reserve began raising its benchmark interest rates in the spring, a factor leading to an increase in mortgage rates. The Fed’s goal in raising interest rates was to cool demand and slow price increases, an effect that has been felt in the housing market more than in most sectors of the economy.

Mortgage interest rates more than doubled over the course of 2022, the largest single-year increase since the early 1980s. By June, the average rate for a 30-year fixed-rate mortgage exceeded 5.25%, which proved to be a sensitivity threshold above which buyer demand dampened, leading to declines in home sales beginning in late summer. The average interest rate for a 30-year fixed-rate mortgage reached a 20-year high of 7.08% in November, which most economists

Metro Atlanta 2022 Monthly Pending and Closed Sales vs. Interest Rates

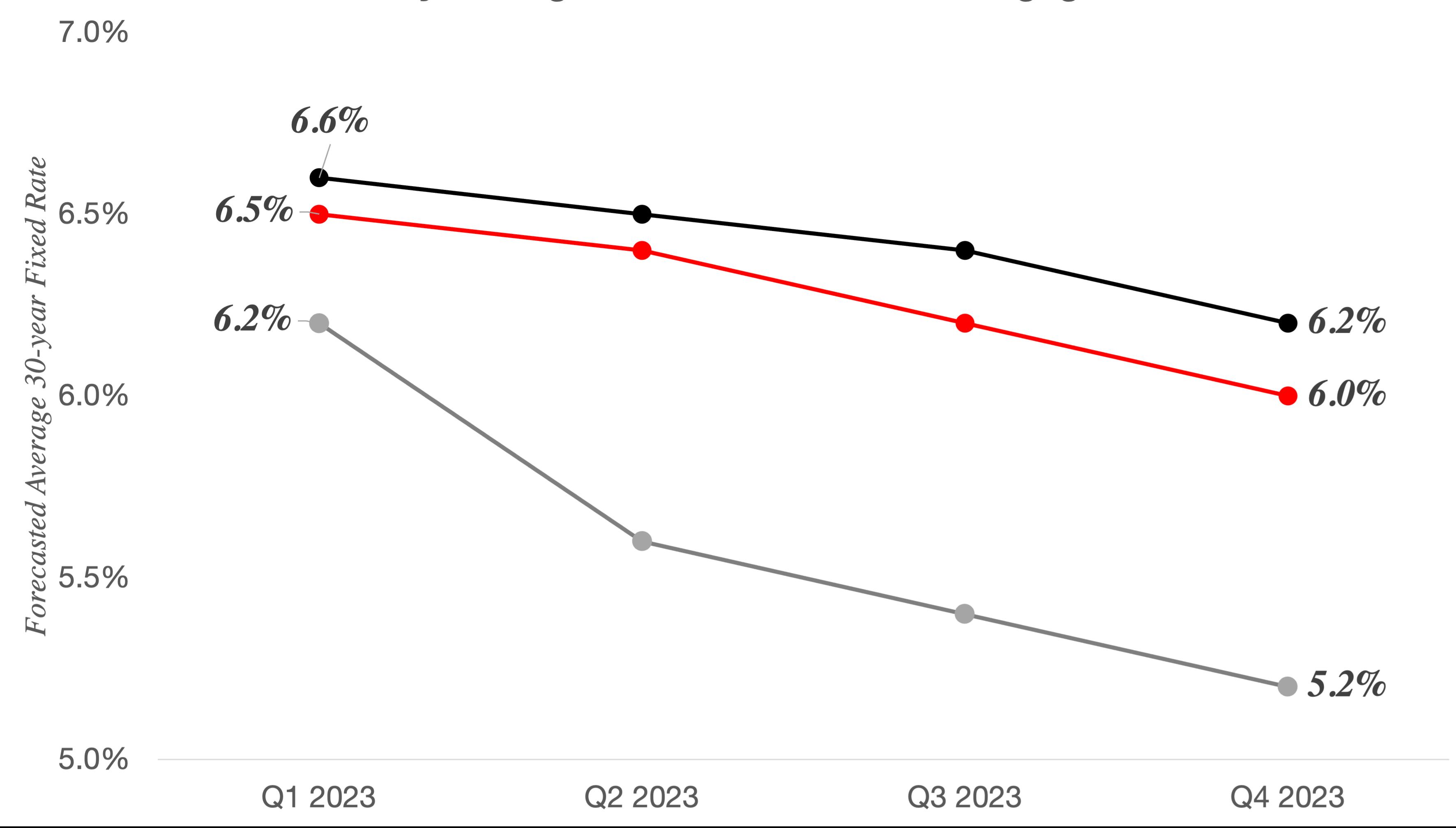

Most economists believe mortgage interest rates for this cycle peaked in November 2022 and will stabilize in 2023, ranging from about 6.5% to 5.5%.

believe to be the peak rate for this cycle. It declined to 6.42% by the end of the year,2 returning to a level typical in the early 2000s, but still above levels that are likely needed to bring significantly more buyers into the market.

What’s Next for Interest Rates?

The Federal Reserve has stated its intent to continue restricting monetary policy until it believes inflation is under control. This means that although mortgage interest rates are expected to decline slightly in 2023, they are not likely to return to the 3% range in the next couple of years. The Federal Reserve has not yet made a clear statement about their policy for rates in 2023. Most economists are forecasting that inflation and mortgage interest rates already peaked for this cycle in late 2022.

Forecasts for mortgage interest rates next year vary,3, 4, 5 typically stabilizing near current levels (6% to 6.5%) in the first half of 2023, with a slight decline in the latter half of the year. Buyers interested in making a purchase over the next year will need to adjust to mortgage rates staying within the 5.5% to 6.5% range.

2023 Quarterly Average 30-Year Fixed Rate Mortgage Forecasts

30-year Fixed Rate Mortgage Interest Rate Forecasts

Market Trend: Rate Buydowns

In the new construction market, some homebuilders have begun to work around the prevailing interest rates by offering incentives like rate buydowns to attract buyers who are sitting on the sidelines waiting for rates to drop. In certain cases, individual homeowners have offered similar rate buydown incentives as well.

Rate buydowns allow a seller to pay an upfront fee to reduce the buyer’s interest rate by a set amount for a set period of time, before returning to a fixed rate. The most common types are 2/1 buydowns—which reduce the interest rate by 2% in the first year and by 1% in the second year—and 3/1 buydowns, which reduce the interest rate by 3% in the first year, 2% in the second year, and 1% in the third year. With these temporary buydowns, buyers typically hope that interest rates will decline in the next few years, at which point they can refinance their loans at a lower rate, generally for a fee. For a permanent reduction, the seller may pay discount points to reduce the interest rate over the life of the loan, at a higher cost.

For more information about these trending tools, check with your mortgage provider for available programs and terms.

Types of Rate Buydowns

2/1 Buydown

The mortgage interest rate is reduced by 2% in the first year and by 1% in the second year

3/1 Buydown

The mortgage interest rate is reduced by 3% in the first year, 2% in the second year, and 1% in the third year

Discount Points

Fee paid to permanently reduce a fixed interest rate