OFFSHORE IN SEYCHELLES - UNLOCKING

OFFSHORE IN SEYCHELLES - UNLOCKING

Overview of Seychelles as an offshore destination- Seychelles has emerged as the best offshore destination for international businesses. It offers a favorable tax regime with zero corporate tax on offshore profits. Setting up an offshore in Seychelles is a seamless process, with minimal reporting and accounting requirements. It offers attractive asset protection measures, global accessibility and a robust banking system that ensures a secure and flexible environment for businesses to thrive and expand internationally.

• Favorable tax regime with zero corporate tax on offshore profits

• Strict confidentiality laws

• Minimal reporting and accounting requirements

• No requirement for a local director or shareholder

• Asset protection benefits

• Access to global markets and international clientele

• The stable and secure banking system

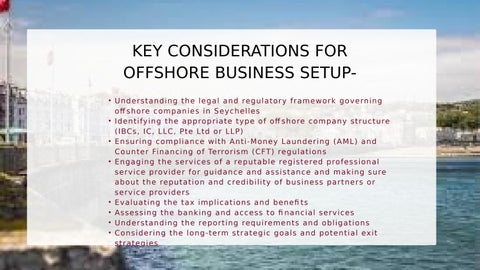

• Understanding the legal and regulatory framework governing offshore companies in Seychelles

• Identifying the appropriate type of offshore company structure (IBCs, IC, LLC, Pte Ltd or LLP)

• Ensuring compliance with Anti-Money Laundering (AML) and Counter Financing of Terrorism (CFT) regulations

• Engaging the services of a reputable registered professional service provider for guidance and assistance and making sure about the reputation and credibility of business partners or service providers

• Evaluating the tax implications and benefits

• Assessing the banking and access to financial services

• Understanding the reporting requirements and obligations

• Considering the long-term strategic goals and potential exit strategies

•

• No capital gains tax

• Exemption from import and export duties

Strong confidentiality laws protect shareholders' and directors' information

No public disclosure of beneficial owners

Nominee directors and shareholders available for additional privacy

Presentation and Sharing

Protection against creditors and legal claims

Inheritance management benefits

• The stable and secure anking system

• Wide range of financial services available

• Currency options and foreign exchange controls