10 minute read

The Phoenix housing market stabilizes 46

THE PHOENIX HOUSING MARKET STABILIZES AS SELLERS YANK LISTINGS NATIONWIDE

Peggie Simmons

Markets all over the country are in chaos. Buyers have been locked in their homes, and sellers are not listing for fear of selling during an economic crisis. While that is true for most areas, one market remains standing, defying all odds. The housing market in Phoenix appears to stay afloat; however, many real estate professionals say that the pandemic has brought change to the Phoenix market needed. While the Metro Phoenix market is healthy, that doesn’t mean that the economic downturn in the country will leave it unscathed.

In the past few weeks listing have climbed 20%, which is a clear indication that the homeowners are struggling financially and are hoping to get out of their mortgages or short-term rental owners who do not have customers and are looking to sell. The number of homes for sale is still 32% below the same time last year according to an Arizona Housing expert Tina Tamboer of the Cromford Report. Nonetheless, most experts agree that for the coming months, the Phoenix housing market, like most others, will hunker down.

RE-SETTING THE MARKET

In overall, however, the market itself is looking to be doing what it was needed to do, and most real estate experts say that the Phoenix market is in a state of reset. Before the pandemic hit, there were just 10,000 homes available for sale in the Phoenix market, with only a few houses in the market, that meant that most buyers were kept out of reach. Remember the Phoenix market has about 7 million people, and having just 10,000 properties for sale, was a meager number. Since the coronavirus hit, the number of homes has jumped to more than 14,000 available units of purchase.

This just shows that the market is headed in the right direction since a stable housing market should at least have 20,000 to 25,000 units available which is good news for the buyers. This just shows how serious the seller is, after all, who would want to sell their home during a pandemic?

Over the years, we have seen the median home prices rise rapidly, in April 2018, the median home price for homes in and around the Phoenix market area was $255,000. In 2019, it jumped to just over $267,500, and in March 2020, it was just under $299,400.

What will happen is that, with more units available for sale in the market, the home prices will stabilize. And while it is still a seller’s market, we shouldn’t be worried about that.

What’s truly interesting with the Phoenix housing market is that even though there are more houses for sale in the market, homes are being shown through virtual tours instead of open-house tours.

HOUSING DATA TRENDS

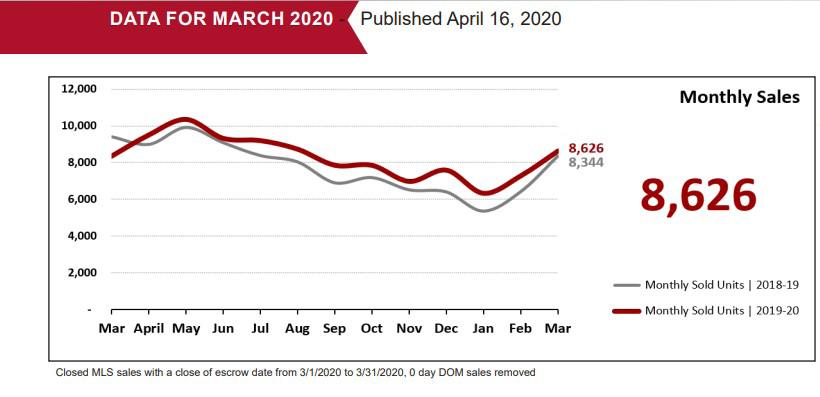

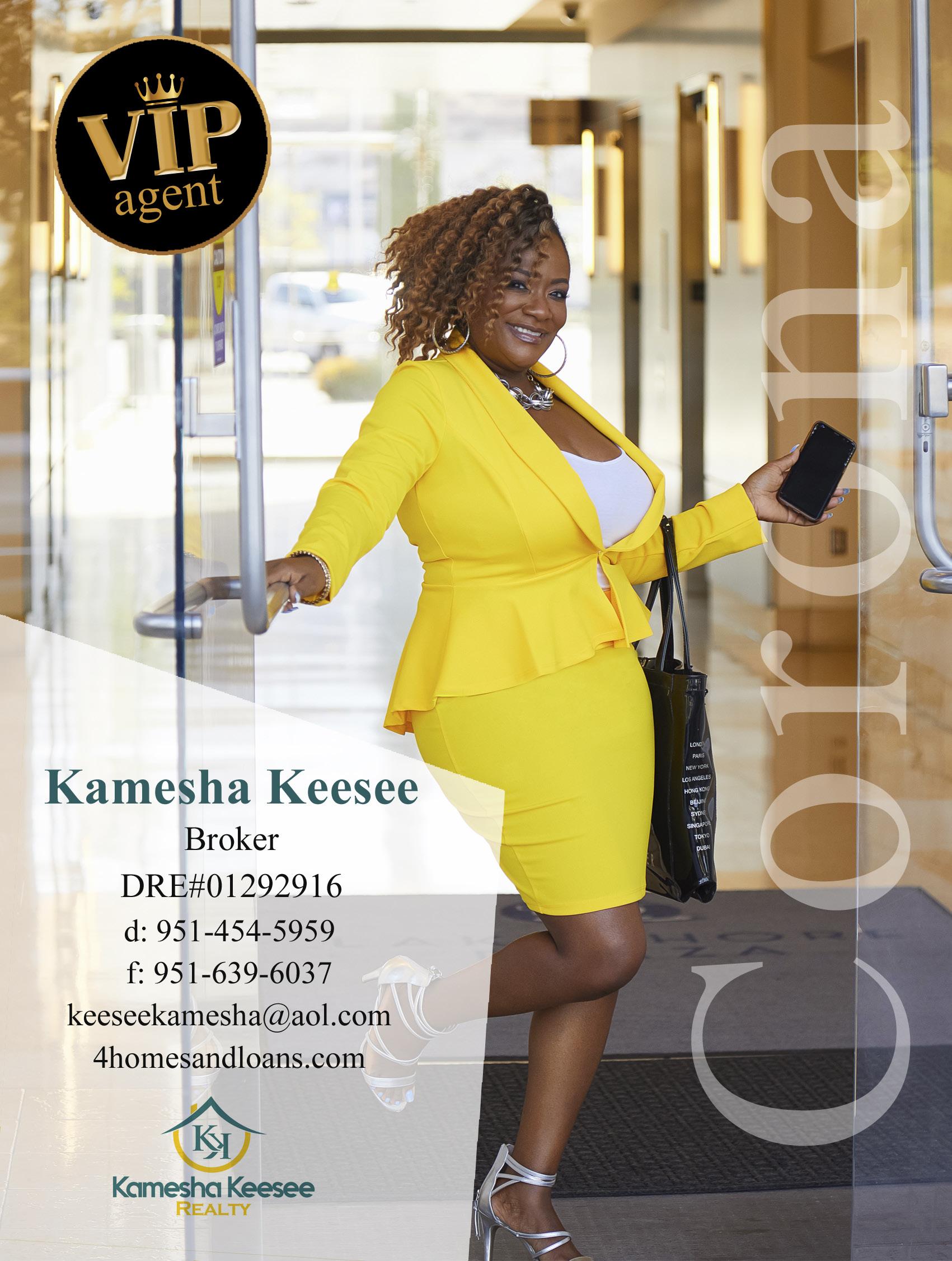

MONTHLY SALES

The latest preliminary report from the Arizona Regional Multiple Listing Service shows that sales are up 18.5% month over month and 3.4 Y-o-Y.

NEW INVENTORY AND TOTAL INVENTORY

New inventory is up+21.3% monthover-month while the year-over-year comparison increased by +0.9%. On the other hand, Total inventory has a monthover-month increase of +17.1% while yearover-year reflects a decrease of -21.3%. nature to feel that way, but one thing you should never do is to give up. Over the years, we have seen several ups and downs in the real estate in Arizona, but what’s happening right now is somewhat unique. If you want to stay ahead with what’s happening in the Phoenix housing market, get in touch with Peggie Simmons. Peggie Simmons is no ordinary realtor; she has 34 years’ experience as a real estate agent and broker in Tempe, Arizona, and currently serves as the Founder and CEO of Realty Marketing Group specializing in relocation, new homes sales, traditional homes, marketing & sales, short sale negotiations, foreclosures, luxury rentals, investments among many others.

Despite doing her business in Arizona, she also has been a resident of the state since 1983, which makes her your ideal choice and your go-to real estate agent. Go ahead and take advantage of the situation right now while it still lasts. To learn more about Peggie, go to https:// thepowerisnow.com/vipagentsservices/ peggie-simmons-arizona/ and find out more.

Sources

https://armls.com/docs/2020-MARCHSTATwith-commentary.pdf https://www.azfamily.com/news/ continuing_coverage/coronavirus_ coverage/covid-19-could-helpstabilize-phoenix-area-home-prices/ article_7d8b4110-7dc8-11ea-a1bb8f765812690b.html https://www.usatoday.com/story/money/ real-estate/catherine-reagor/2020/04/05/ dont-expect-metro-phoenix-housingmarket-crash-due-covid-19-sayexperts/5114064002/

THE FORECLOSURE MARKETS REACHES RECORD LOWS

Kamesha Keesee

Foreclosure is the legal process through which a lender takes control of a property, evicts the homeowner, and sells the home after the homeowner is unable to make full payment of the principal and the interest payments on their mortgage as stipulated in the mortgage contract. The foreclosure process mainly derives its legality from the mortgage or the deed of trust contract, which gives the lender the right to use the property as security or collateral in the event that the buyer fails to uphold his or her repayment obligation.

According to a report by ATTOM Data Solution, there were a total of 48,004 U.S. properties with foreclosure filings- default notices, scheduled auctions, or bank repossession, which represents the lowest number of total foreclosure filings recorded since 2005.

“Foreclosure activity across the United States hit new lows in February, yet another marker of the nation’s long housing boom,” said Todd Teta, chief product officer with ATTOM Data Solutions. “However, as with just about anything connected to the housing market right now, the foreclosure situation is now totally in flux because of the everevolving coronavirus pandemic. Many lenders have suspended foreclosure proceedings, so the numbers will most likely continue to drop in the coming months. But after that, we may see an uptick in foreclosures as a result of dramatic economic impacts, such as more homeowners losing their jobs and falling behind on mortgage payments. ”

CoreLogic also reported that countrywide, 3.7% of all the U.S. mortgages were delinquent- at least 30 days past due, and this includes the foreclosures. Looking at these statistics, you will notice that there is a slight decline from December 2018 and the lowest in a month in almost 20 years.

Foreclosure Completion Numbers Continue Annual Decline Lenders repossessed 10,469 U.S. properties through completed foreclosures (REOs) in February 2020, up by 1 percent compared to January 2020 and down 8 percent from last year. This shows a second consecutive annual decline in completed foreclosures.

The states that showed an annual decrease in REO in February 2020 included; Florida (down 47 percent); New Jersey (down 37 percent); New York (down 18 percent); Texas (down 16 percent), and Maryland (down 13 percent). The major MSAs with a population of over 200,000 that saw the greatest number of REOs

included; Chicago, IL (614 REOs); Riverside, CA (529 REOs); New York, NY (446 REOs); Los Angeles, CA (368 REOs); and Philadelphia, PA (328 REOs).

ATTOM additionally reported the highest foreclosure rates in New Jersey, Illinois, and Delaware noting that on a nationwide scale, one in every 2,841 housing units had a foreclosure filing in February 2020. In New Jersey, one in every 1,457 housing units had a foreclosure filing. In Illinois, one in every 1,507 housing units had a foreclosure filing, and in Delaware, one in every 1,628 housing units had a foreclosure filing. In South Carolina, one in every 1,688 housing units had a foreclosure filing, and lastly, in Maryland, one in every 1,713 housing units had a foreclosure filing.

The metro areas with a population greater than 1 million with the worst foreclosure rates in February included Riverside, CA, Chicago, IL, Philadelphia, PA, Cleveland, OH, and Baltimore, MD.

In February 2020, lenders started the foreclosure process on about 27,000 U.S. properties, which is up by 3 percent compared to January and down 9 percent from the same time in 2019. This is the 13th consecutive month showing an annual decline. The states that showed a double-digit increase in the foreclosure start from January included; Nevada (up 63 percent); Oregon (up 49 percent); Washington (up 47 percent); Texas (up 28 percent); and Michigan (up 20 percent).

This data has been provided by ATTOM Data Solution. To learn more, visit; https:// www.attomdata.com/news/markettrends/foreclosures/attom-data-solutionsfebruary-2020-u-s-foreclosure-marketreport/

If you’d like to understand more about the data given or learn more about real estate markets, especially the Inland Empire real estate, get in touch with Kamesha Keesee of the Kamesha Keesee Realty. Mrs. Keesee epitomizes hard work, resilience, compassion, and creative service delivery in every detail of your real estate transaction, from the start to the closing.

Kamesha’s journey in real estate business began when she was 15 years old, where she was employed as a teller at Security

Pacific Bank. Being energetic and as curious as she was, she quickly adapted to the changing employment environment and became a personal loan officer. This would be a remarkable point in her life as it was the first contact with the real estate industry. Even though her early career in real estate was not by choice, but by somewhat an accident, it would turn out to be the best turn of even for her. To learn more about Kamesha and her work, go to; https://thepowerisnow.com/ vipagentsservices/kamesha-keesee/.

Kamesha Keesee

President and CEO Kamesha Keesee Realty.

Sources

https://www.investopedia.com/terms/f/ foreclosure.asp https://www.attomdata.com/news/market-trends/ foreclosures/attom-data-solutions-february2020-u-s-foreclosure-market-report/

HOMEOWNERS ARE LIKELY TO MAKE DURING THIS CRISIS

THE COMMON REFINANCING MISTAKES

Mortgage rates have never been this low. And again, the coronavirus pandemic is sending our economy in a tailspin, which has trapped so many people into believing that this is the right time to refinance their properties. This is a very risky move and one mistake that could cost these buyers tons of money in the long run. Therefore, if you think that this is the right time to refinance, do it with caution, but not before you read this article. Do not assume that a federal rate of 0% means 0% mortgage rate! David C. Trubey

In the wake of the coronavirus pandemic, the Federal Reserve had to drop the federal funds rate to about 0% and 0.25% to stimulate the economy. The number one mistake that most people made is assuming that the drop in federal funds rate meant that the mortgage rates would fall into the same range too. But that’s not the case.

Remember that the Federal Reserve interest rate, the prime rate, and the lender rate are all different rates. The federal funds rate is set by the Feds and is the rate that the bank pays to borrow

from each other. This will not any interfere with the mortgage rates, at least not directly; however, it does have a trickle-down effect.

You have to understand that the mortgage interest rates are affected by many variables, and that includes where you live, your borrower’s profile among so many others. The prime borrower with a good credit score and debt-toincome ratio will get the cheapest rate. If you aren’t an ideal borrower, your rate will be higher.

You must have noted that in the past few weeks, the interest rates have been fluctuating. This might go on for a few more weeks before finally leveling out. Therefore, as a prospective buyer looking to refinance, do not do it with unrealistic expectations.

Having New Credit Accounts and Running up Debt With what’s happening with the economy, certainly, most people are likely to fall in debt. Making a major purchase on credit or even applying for new credit could lead to delays in the approval process, and in the worst case, you could even be rejected for a mortgage refinance loan.