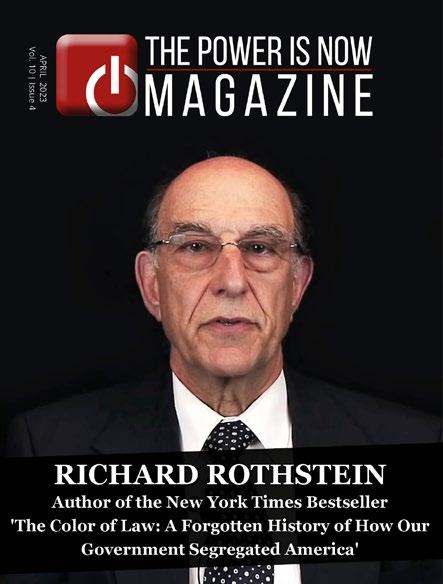

the power is now magazine VOL 11 | JUNE 2023 Jeffrey P. Frieden CEO / Co-Founder of F&F Capital Group Co-Founder of Auction.com/Ten-X

Eric Lawrence Frazier, MBA Publisher

Office: (800) 401-8994 Ext. 703

Direct: (714) 361-2105 eric.frazier@thepowerisnow.com www.thepowerisnow.com

EDITORIAL TEAM

Sheila Gilmore Editor in Chief (800) 401-8994 ext. 711 sheila.gilmore@thepowerisnow.com

Daniels George Managing Editor (800) 401-8994 ext. 712 daniels.george@thepowerisnow.com

Goldy Ponce Arratia

Graphic Artist and Design Manager goldy.ponce@thepowerisnow.com

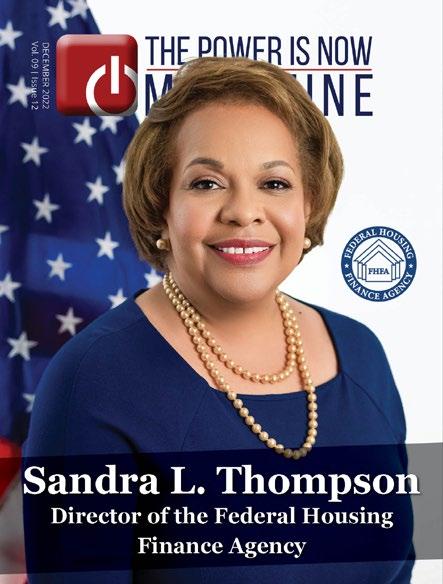

CENTRAL EDITION Vol. 09 | Issue 11 the power is now magazine

CONTRIBUTORS

Power Is Now Research Team HAVE YOU READ OUR PAST ISSUES YET? CLICK HERE TO READ US ONLINE!

The

HEADQUARTERS

The Power Is Now Media Inc. 3739 6th Street Riverside, CA 92501

Ph: (800) 401-8994 | Fax: (800) 401-8994

info@thepowerisnow.com

www.thepowerisnow.com

IMPORTANT STATEMENT OF COPYRIGHT:

The PIN Magazine™ is owned and published electronically by The Power Is Now Media, Inc. Copywrite 2022 The Power Is Now Media Inc. All rights reserved.

“The PIN Magazine” and distinctive logo are trademarks owned by The Power Is Now Media, Inc.

“ThePINMagazine.com”, is a trademark of The Power Is Now Media, Inc.

“Magazine.thepowerisnow.com”, is a trademark of The Power Is Now Media, Inc.

No part of this electronic magazine or website may be reproduced without the written consent of The Power Is Now Media, Inc.

Requests for permission should be directed to: info@thepowerisnow.com

Find The Power Is Now TV on for more details go to www.thepowerisnow.com 2nd AND 4th FRIDAYS OF THE MONTH 3:00 PM TO 4:00 PM PST

the power is now magazine

CONTENTS JUNE 2023

and Bank of America Reports

REAL ESTATE NEWS

Pg. 14. Real Estate Investing Amid Economic Downturn: Evaluating Opportunities in the 2023 Housing Market

COMMERCIAL NEWS

Pg. 18. The Ripple Effects of Rising Interest rates on NNN retail Properties

ENVIRONMENTAL NEWS

Pg. 22. Green Living: Embracing Sustainable Homes for a Greener Future inion: It’s 2022, can technology replace the human touch?

LIFESTLE AND LIVING

Pg. 25. Exquisite Enclaves: Discovering the Epitome of Luxury Real Estate

TPIN DESIGNS

Pg. 28. Creating Irresistible Spaces: Expert Home Staging and Design Tips to Attract Buyers

MORTGAGE NEWS

Pg. 8. Consumer Debt Surpasses $17 Trillion Amidst Declining Mortgage Demand: Unveiling the Implications

ECONOMIC NEWS

Pg. 10.The Changing Landscape of US

Consumer Behavior: Insights from Deloitte

TECHNOLOGY NEWS

Pg. 34. Revolutionizing Real Estate: Exploring Cutting-Edge Digital Tools for Buyers, Sellers, and Investors

FROM OUR VIP AGENTS:

Pg. 42. Strategies for Summer Home Buying in Florida, by Adriana Montes

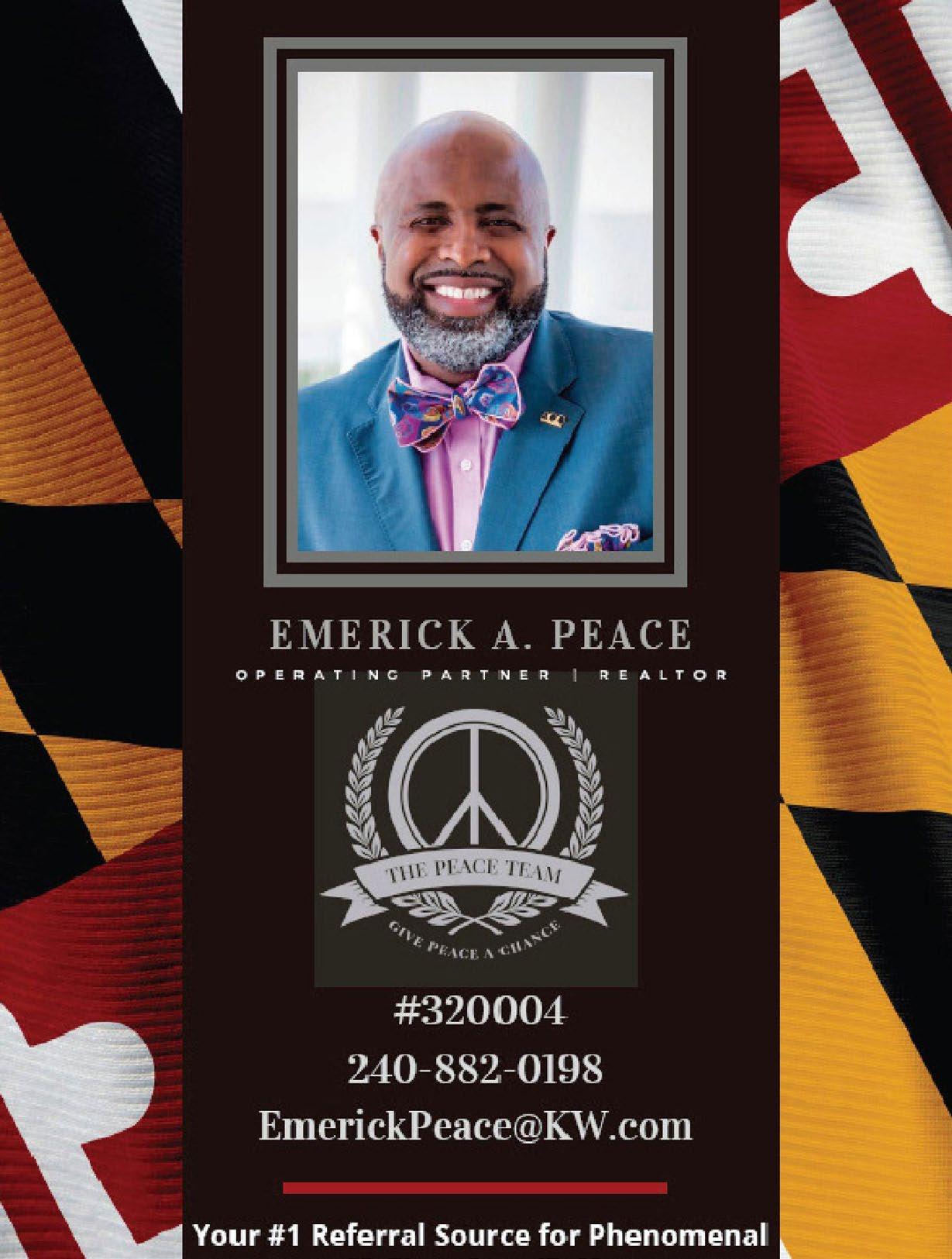

Pg. 48. Maryland’s Vacation Homes: A Guide to Making the Perfect Investment Move!. by Emerick Peace.

Pg. 58. Minnesota Real estate maket: A comprehensive overview of the current state of the real estate market in the USA, including data on housing prices, inventory levels, mortgage rates, and forecasts for the upcoming months.

by Francine Marsolek

Pg. 62. Proven Methods for Demonstrating Income When Applying for a Mortgage, by Heith

Mohler

Pg. 66. Unlock Your Dream Home in Menifee, California: The Power of a REALTOR® by Your Side by Monica Hill

Pg. 72. Master the Art of Real Estate Flipping in New Haven, Connecticut: Insider Tips and Tricks for Success, by Steven Rivkin

Pg. 80. The Key Differences Between PreQualification and Pre-Approval for Denver

Homebuyers by Walter Huff

Pg. 88. The Credit Boosting Power: How Monthly Mortgage Payments Enhance Your Credit Profile in Scottsdale, Arizona by Yvonne

McFadden

Pg. 94. Insights into the Palm Desert Real Estate Market: Analyzing Housing Prices,

Inventory, Mortgage Rates, and Future

Outlook Brandy Nelson

Pg. 100. Essential Tasks to Complete on Your Summer Home Buying Checklist, by DaShunda Morris.

Pg. 110. Irresistible Home Features for Young Buyers in Los Angeles: A Top 6 List, by Dolores Golden:.

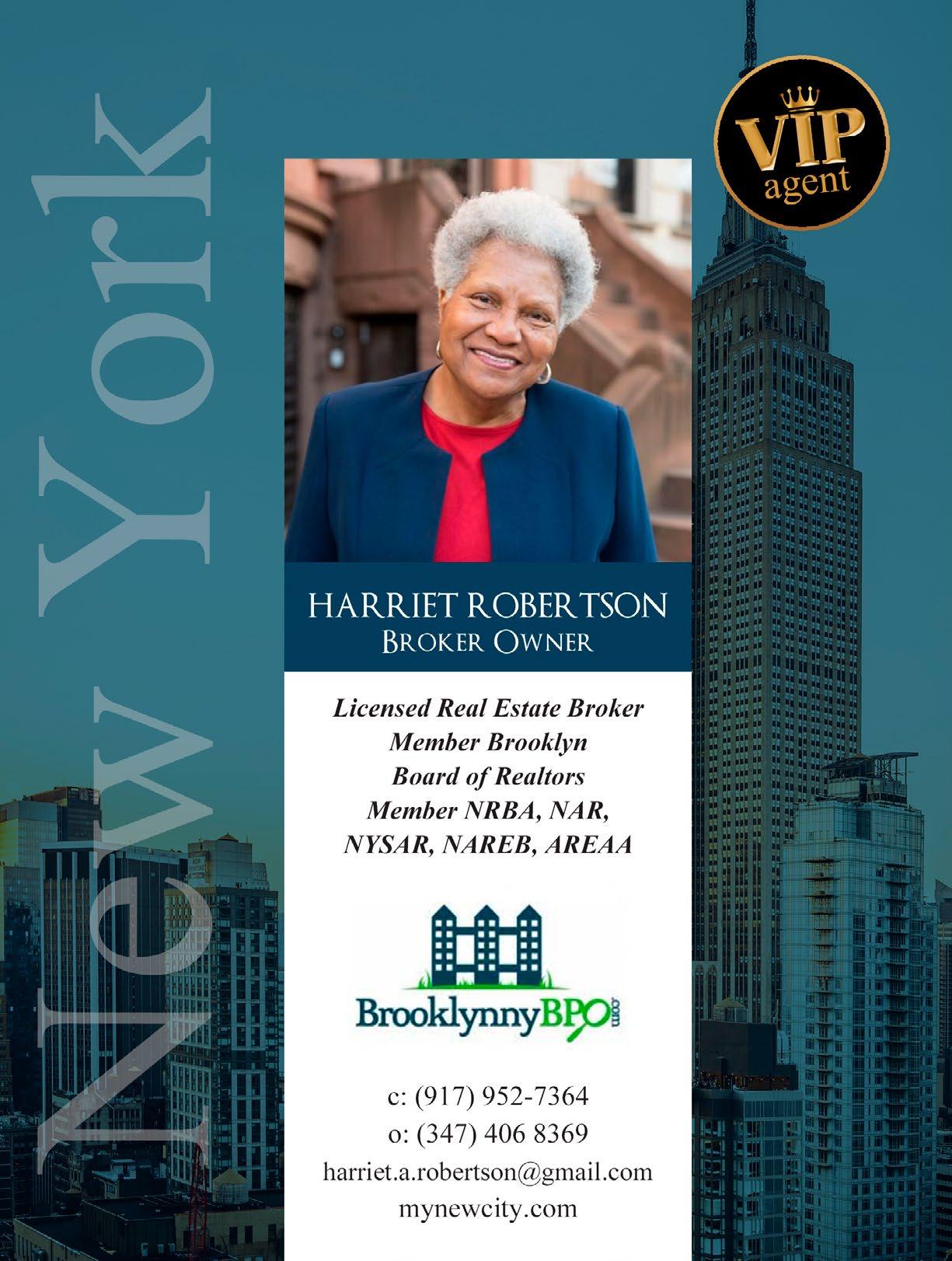

Pg. 116. Acquiring a Home in Brooklyn, New York: No-Money Buying Strategies

By Harriet Robertson

Pg.120. cheap Homes in Riverside, California: Evaluating Their Value and Benefits By Ruby Frazier

Pg. 125. Mastering the Homebuying Process in Los Angeles: 6 Essential Tips for Success

By Success Money

Pg. 134. Jeffrey P. Frieden

CEO / Co-Founder of F&F Capital Group

Co-Founder of Auction.com/Ten-X

Pg. 144. Empowering Herstory: Celebrating Women’s Achievements and the Founding of NOW

Welcome to the June issue of Power Is Now Magazine, a month that holds special significance for homeownership, the birth of NOW, and the celebration of Father’s Day. As we delve into the world of real estate, we are excited to feature an influential figure who is shaping the industry: David C. Benson, the President of Fannie Mae.

Fannie Mae has played a pivotal role in the real estate landscape, and we are eager to explore how their efforts continue to impact buyers, sellers, and investors across the United States. With David C. Benson’s insights, we aim to gain a deeper understanding of Fannie Mae’s vision and their contributions to the evolving dynamics of the real estate market.

This issue is packed with valuable information tailored to meet the needs of our diverse readership. Whether you are a prospective buyer, a seasoned seller, or a savvy investor, our team has curated a collection of articles, features, and expert advice to guide you on your real estate journey.

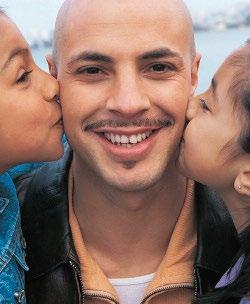

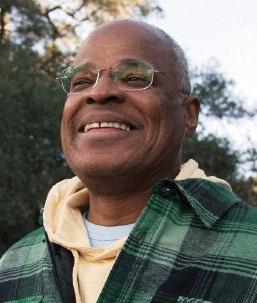

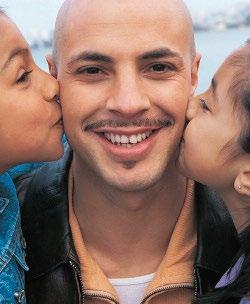

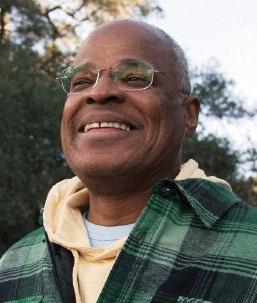

Additionally, as we celebrate Father’s Day this month, we will also take a moment to acknowledge the significant role that fathers play in shaping our lives and communities. We’ll explore how homeownership intersects with fatherhood, reflecting on the joys, challenges, and the legacy we create for future generations.

As always, I, Eric Lawrence Frazier, along with our dedicated team of writers and contributors, strive to bring you the most relevant and up-to-date information in the real estate industry. Our mission is to empower you with knowledge and insights that will help you make informed decisions and unlock the full potential of your real estate endeavors.

Thank you for your continued support and for being a part of the Power Is Now community. We hope you enjoy this issue and find inspiration to make your homeownership dreams a reality.

Best regards,

Eric Lawrence Frazier Editor, Power Is Now Magazine

June 2023 FROM

JUNE 2023 thepowerisnowmeida

THE EDITOR

BACK TO CONTENTS

Consumer Debt Surpasses $17 Trillion Amidst Declining Mortgage Demand: Unveiling the Implications

Consumer debt in the United States has reached an unprecedented milestone, surpassing a staggering $17 trillion, despite a noticeable decline in mortgage demand. This unsettling development, revealed in a CNBC article, underscores the complex financial landscape that individuals and households find themselves navigating. As consumer debt continues to rise, it becomes crucial to explore the implications of this trend and understand the factors driving the increase, shedding light on the potential risks and challenges it poses for individuals, the economy, and the lending industry.

In recent years, the expansion of consumer debt has been a cause for concern, and the CNBC article exposes the severity of the issue. Despite the housing market experiencing a decline in mortgage demand, other forms of consumer debt, such as credit card debt, student loans, and auto loans, have surged. This divergence suggests that consumers are increasingly

relying on non-mortgage borrowing to meet their financial needs and maintain their desired lifestyles.

The rise in consumer debt can be attributed to several factors. Low interest rates, which have made borrowing more accessible and affordable, have played a significant role. Additionally, the ease of obtaining credit and the proliferation of online lending platforms have contributed to the accumulation of debt. Consumer spending patterns and the desire to maintain a certain standard of living, even in the face of economic uncertainties, have also fueled the growth of debt.

However, the increasing burden of consumer debt raises concerns about financial stability and long-term economic consequences. High debt levels limit individuals’ ability to save, invest, and build wealth, potentially hindering economic growth. Furthermore, a significant portion of consumer debt comprises high-interest

MORTGAGE

JUNE 2023 thepowerisnowmeida

SECTION

loans, which can become unmanageable and lead to financial distress if not carefully

CONCLUSION:

managed.

The implications of escalating consumer debt extend beyond individuals and households. Lenders and financial institutions face increased risks as the debt burden grows, impacting their loan portfolios and overall stability. Moreover, the broader economy may experience a slowdown if consumers become constrained by debt payments, leading to reduced spending and decreased economic activity.

To address the challenges posed by escalating consumer debt, financial literacy and responsible borrowing practices become crucial. Educating individuals on managing debt, budgeting effectively, and making informed financial decisions can help mitigate

the risks associated with high debt levels. Implementing regulations and safeguards to prevent predatory lending and encourage responsible lending practices is also essential.

Alternative financial solutions, such as debt consolidation programs and refinancing options, can provide individuals with opportunities to manage their debt effectively and reduce interest payments. Moreover, promoting a culture of financial wellness and encouraging savings can contribute to debt reduction and long-term financial stability.

The CNBC article sheds light on the alarming milestone of consumer debt surpassing $17 trillion, despite a decline in mortgage demand. This development highlights the pressing need to address the implications and risks associated with rising consumer debt. By fostering financial literacy, promoting responsible lending practices, and offering viable debt management solutions, individuals, lenders, and policymakers can navigate the challenges posed by escalating consumer debt, striving towards a more sustainable and financially resilient future.

Sources https://www.cnbc.com/2023/05/15/consumer-debt-passes-17-trillion-for-the-first-time-despite-slide-inmortgage-demand.html

BACK TO CONTENTS

`

photo from freepik

JUNE 2023 thepowerisnowmeida

The Changing Landscape of US Consumer Behavior: Insights from Deloitte and Bank of America Reports

The landscape of consumer behavior in the United States is constantly evolving, influenced by various factors such as economic conditions, technological advancements, and shifting societal norms. Two recent reports, namely “State of the US consumer: April 2023” by Deloitte and “Consumer Checkpoint” by Bank of America, shed light on the current state of the US consumer and provide valuable insights into the changing dynamics of consumer behavior. By analyzing the findings of these reports, we can gain a deeper understanding of the trends shaping the consumer landscape, uncover emerging patterns, and explore the implications for businesses and the overall economy. In this article, we will delve into the key takeaways from these reports, highlighting noteworthy trends and discussing their significance in the context of the evolving US consumer behavior. From spending habits and financial priorities to the impact of technology and changing demographics, we will examine the factors influencing consumer decision-making and provide valuable insights for businesses and individuals navigating the ever-changing consumer landscape.

In today’s uncertain economic landscape, the Deloitte report “State of the US consumer: April 2023” and Bank of America’s “Consumer Checkpoint” highlight a notable shift in consumer priorities, with financial resilience taking center stage. As the reports indicate, consumers are increasingly focusing on building financial security and creating robust savings buffers to protect themselves from economic uncertainties.

The aftermath of the COVID-19 pandemic has left a lasting impact on consumer behavior. Heightened awareness of the fragility of the economy and the potential for job losses has instilled a sense of caution and prudence in consumers. They are proactively reassessing their financial situations and redirecting their priorities to reduce debt burdens and bolster savings.

Deloitte’s report reveals that a significant number of consumers are actively working towards increasing their savings and establishing emergency funds. This newfound emphasis on financial security stems from a desire to be better prepared for any unforeseen circumstances that may arise.

Bank of America’s “Consumer Checkpoint” report reinforces this trend, illustrating that consumers

1. SHIFTING CONSUMER PRIORITIES: FINANCIAL RESILIENCE TAKES CENTER STAGE

ECONOMICS NEWS PHOTO FROM 123RF JUNE 2023 thepowerisnowmeida

are adjusting their spending habits and exercising greater restraint. It suggests that individuals are consciously opting for responsible financial behaviors, such as reducing discretionary spending and adopting frugal practices.

The reports attribute this shift in consumer priorities to the lingering impact of the 2008 financial crisis and the recent pandemic-induced economic downturn. These events have left a lasting impression on individuals, emphasizing the need for financial preparedness and resilience.

By prioritizing financial security and savings, consumers aim to mitigate the potential impact of job losses, economic downturns, and unexpected expenses. This cautious approach indicates a desire to create a safety net that provides peace of mind and ensures a degree of stability in an uncertain economic climate.

The implications of this shift in consumer behavior are significant for businesses across various sectors. Understanding the changing priorities of consumers is crucial for companies to adapt their strategies and meet the evolving needs and expectations of their customer base. Moreover, it highlights the importance of financial institutions and advisors in providing guidance and support to consumers as they navigate these uncertain times.

The Deloitte and Bank of America reports indicate a notable shift in consumer priorities towards financial resilience. As individuals seek to build financial security and establish robust savings, businesses must be responsive and adaptive to these changing consumer needs. By recognizing and addressing these shifting priorities, companies can foster trust, provide relevant solutions, and navigate the evolving consumer landscape successfully.

2. DIGITAL TRANSFORMATION: ACCELERATING ADOPTION AND ITS INFLUENCE ON CONSUMER BEHAVIOR

The digital transformation has significantly reshaped the way consumers interact with businesses and make purchasing decisions. According to the “State of the US consumer: April 2023” report by Deloitte and the “Consumer Checkpoint” report by Bank of America, the adoption of digital technologies has accelerated and continues to influence consumer behavior in various ways.

One prominent impact of digitalization is the rise of e-commerce and online shopping. The reports highlight the increasing preference for convenient and seamless online shopping experiences. Consumers now have access to a vast array of products and services at their fingertips, enabling them to compare prices, read reviews, and make purchases from the comfort of their homes. This shift has propelled the growth of online retailers and forced traditional brick-and-mortar stores to adapt their strategies to remain competitive.

Moreover, the reports underscore the importance of technology in shaping consumer expectations. With the widespread use of smartphones and the

internet, consumers have become accustomed to instant gratification and personalized experiences. They expect businesses to provide user-friendly websites, mobile apps, and responsive customer service across multiple digital channels. Companies that can meet these demands by offering seamless digital experiences are more likely to attract and retain customers.

The influence of technology on consumer behavior is not limited to online shopping. The reports also highlight the increasing adoption of contactless payment methods, such as mobile wallets and payment apps. Consumers value the convenience and speed of these payment options, especially in the context of the ongoing COVID-19 pandemic, which has emphasized the importance of touchless interactions.

BACK TO CONTENTS

JUNE 2023 thepowerisnowmeida

Furthermore, digitalization has empowered consumers to voice their opinions and experiences through social media and online reviews. Consumers now have the ability to share their feedback, both positive and negative, with a wide audience. This has significant implications for businesses, as reputation management and maintaining positive online presence have become critical for success.

Overall, the reports indicate that digital transformation has not only influenced how consumers engage with businesses but also shaped their expectations. To thrive in this digital era, companies need to prioritize technology integration, provide seamless digital experiences, and actively engage with customers across multiple digital touchpoints. By embracing digitalization,

businesses can stay relevant, build customer loyalty, and capitalize on the evolving consumer behavior trends.

3. SUSTAINABLE CONSUMERISM: THE RISE OF ETHICAL AND ENVIRONMENTALLY CONSCIOUS CHOICES

The Deloitte and Bank of America reports both indicate a significant rise in sustainable consumerism, with consumers increasingly prioritizing ethical and environmentally conscious choices in their purchasing decisions. This shift is driven by growing awareness of environmental issues, social responsibility, and a desire to align personal values with consumption patterns.

generations, are actively seeking out sustainable and ethically produced products. They are more likely to support companies that demonstrate a commitment to sustainability and social causes. The report suggests that this trend reflects a broader cultural shift towards conscious consumerism, where individuals are mindful of the environmental and social impact of their choices.

Bank of America’s “Consumer Checkpoint” report also highlights the increasing importance of sustainability in consumer behavior. It notes that consumers are willing to pay a premium for sustainable and environmentally friendly products, indicating a strong demand for businesses to incorporate sustainable practices into their operations.

The rise of sustainable consumerism presents both challenges and opportunities for businesses. Companies that prioritize sustainability and transparent supply chains are well-positioned to attract and retain customers. By offering eco-friendly products, reducing waste, and implementing environmentally conscious practices, businesses can align with consumer values and gain a competitive edge.

According to the Deloitte report, a significant portion of consumers, particularly younger

Moreover, the reports highlight the influence of technology and social media in driving sustainable consumerism. Digital platforms provide consumers with easy access to information about a company’s sustainability practices, allowing them to make informed choices.

PHOTOS FROM 123RF

JUNE 2023 thepowerisnowmeida

Social media platforms have become powerful tools for raising awareness about environmental issues and advocating for sustainable practices, leading to increased scrutiny of brands’ sustainability credentials.

To respond to the growing demand for sustainability, businesses need to integrate sustainable practices throughout their value chains. This includes responsible sourcing of raw materials, reducing carbon emissions, and prioritizing recycling and waste reduction. Transparent communication about these efforts is essential to building trust and credibility with consumers.

The Deloitte and Bank of America reports confirm the rising prominence of sustainable consumerism in the US market. Consumers are actively seeking out ethically produced and environmentally friendly products, supporting businesses that demonstrate a commitment to sustainability. This trend presents opportunities for businesses to differentiate themselves by embracing sustainable practices and meeting the increasing demand for environmentally conscious choices. By aligning their values with consumer preferences, companies can not only drive growth but also contribute to a more sustainable future.

In conclusion, the reports from Deloitte and Bank of America underscore the significant rise of sustainable consumerism in the United States. Consumers are increasingly prioritizing

ethical and environmentally conscious choices, driven by a heightened awareness of environmental issues and a desire to align their values with their consumption habits. This shift has profound implications for businesses, as companies that embrace sustainability and transparent practices stand to gain a competitive advantage in meeting the demands of this growing market.

The findings highlight the importance of integrating sustainable practices throughout the value chain. From responsible sourcing and reducing carbon emissions to prioritizing recycling and waste reduction, businesses can demonstrate their commitment to sustainability and appeal to the conscious consumer. Furthermore, leveraging technology and social media platforms can help companies communicate their sustainability efforts and engage with a broader audience.

As sustainable consumerism continues to gain momentum, it presents opportunities for innovation, growth, and positive environmental impact. Businesses that proactively adapt to this trend can not only drive financial success but also contribute to a more sustainable future by encouraging responsible consumption and production.

In the broader context, the rise of sustainable consumerism reflects a broader cultural shift towards conscious decision-making. It signals a growing awareness of the impact of individual choices on the environment and society. This shift is encouraging, as it demonstrates a collective commitment to creating a more sustainable and equitable world.

In conclusion, businesses that recognize and respond to the rise of sustainable consumerism have the opportunity to not only thrive in the market but also contribute to a more sustainable and socially responsible future. By aligning their practices with consumer values, they can foster positive change and drive meaningful impact in the pursuit of a more sustainable society.

BACK TO CONTENTS

JUNE 2023 thepowerisnowmeida

REAL ESTATE INVESTING AMID ECONOMIC DOWNTURN: EVALUATING OPPORTUNITIES IN THE 2023 HOUSING MARKET

The housing market of 2023 presents a unique landscape for potential real estate investors, as economic uncertainties loom and the majority of Americans remain hesitant to venture into property investments during an economic downturn. According to a recent article from Yahoo Finance, a staggering 90% of Americans have refrained from investing in real estate amidst the prevailing economic challenges. As the market experiences fluctuations and uncertainties, the question arises: Should you consider real estate investment in the face of an economic downturn? This article delves into the factors influencing the housing market in 2023 and explores the opportunities and considerations for those contemplating real estate investments during these uncertain times. By examining the latest market trends and expert insights, we aim to provide valuable perspectives to help individuals make informed decisions about investing in real estate amidst an economic downturn.

REAL ESTATE NEWS JUNE 2023 thepowerisnowmeida

THE CURRENT STATE OF THE HOUSING MARKET: UNDERSTANDING ECONOMIC DOWNTURN IMPACTS

The housing market in 2023 is navigating through the challenges posed by an economic downturn, leading to a cautious approach among potential real estate investors. With 90% of Americans refraining from investing in real estate during this period, it is crucial to understand the factors driving this hesitancy.

Economic downturns can have a significant impact on the housing market. Uncertainty surrounding job security, income stability, and overall financial well-being often leads individuals to adopt a more conservative stance. Concerns about declining property values, potential difficulties in selling properties, and the ability to secure financing contribute to the hesitancy observed in the market.

Moreover, external factors such as changing interest rates, tightening lending standards, and market volatility further influence the decisionmaking process. As individuals prioritize financial security and stability during uncertain times, real estate investment may be perceived as a riskier proposition.

By acknowledging the prevailing economic downturn impacts on the housing market, investors can gain a better understanding of the challenges and opportunities that lie ahead. Through careful analysis and consideration, individuals can navigate the complexities of the market and make informed decisions regarding real estate investments during this time.

benefits to consider.

One key advantage is the possibility of acquiring properties at lower prices. Economic downturns often result in a softening of the housing market, leading to reduced property valuations. This creates opportunities for investors to purchase properties at more favorable prices, potentially maximizing longterm returns when the market rebounds.

Additionally, an economic downturn can increase rental demand. Financial uncertainties may prompt individuals to opt for rental housing instead of committing to homeownership. Real estate investors can capitalize on this trend by acquiring properties to meet the rising demand for rental accommodations, potentially generating stable and reliable income streams.

However, it is crucial for investors to conduct thorough market research and due diligence before making investment decisions. Assessing the specific market conditions, evaluating rental potential, and understanding the local economic factors are essential for mitigating risks and maximizing returns.

Moreover, seeking professional advice and leveraging the expertise of real estate professionals can provide valuable insights and guidance throughout the investment process. Expert advice can help investors identify potential opportunities, analyze market trends, and make informed decisions that align with their investment goals and risk tolerance.

EVALUATING THE POTENTIAL BENEFITS OF REAL ESTATE INVESTMENT IN AN ECONOMIC DOWNTURN

Real estate investment during an economic downturn can present unique opportunities for savvy investors. While the majority of Americans may be hesitant to venture into real estate during challenging economic times, there are potential

While real estate investment during an economic downturn carries inherent risks, carefully evaluating the potential benefits and adopting a strategic approach can position investors for long-term success. By staying informed, conducting thorough research, and considering market dynamics, individuals can navigate the challenges and leverage the opportunities that arise in the real estate market during an economic downturn.

BACK TO CONTENTS

JUNE 2023 thepowerisnowmeida

CONSIDERATIONS AND STRATEGIES FOR REAL ESTATE INVESTMENT DURING AN ECONOMIC DOWNTURN

When contemplating real estate investment during an economic downturn, several considerations and strategies can help investors navigate the uncertainties and mitigate risks. Here are some key points to keep in mind:

1.THOROUGH MARKET RESEARCH:

Conduct extensive research to understand the local market dynamics and trends. Analyze factors such as job growth, rental demand, and property prices to identify areas with potential investment opportunities.

2.RISK MANAGEMENT:

Assess the potential risks associated with investing in real estate during an economic downturn. Consider factors such as vacancy rates, liquidity, and potential changes in property values. Diversifying your portfolio across different property types and locations can help spread risk.

3.FINANCIAL

STABILITY:

Ensure your own financial stability and readiness before investing. Have a clear understanding of your budget, financing options, and the ability to weather any potential downturn in the real estate market.

4.PROFESSIONAL GUIDANCE:

Seek advice from real estate professionals, such as agents, brokers, or investment advisors, who have experience navigating economic downturns. Their expertise can provide valuable insights and help identify promising investment opportunities.

5.LONG-TERM PERSPECTIVE:

Real estate investment is typically a long-term commitment. Consider the long-term potential

PHOTOS FROM 123RF JUNE 2023 thepowerisnowmeida

of the property and focus on building a sustainable portfolio that can withstand market fluctuations.

6.CASH FLOW ANALYSIS:

Evaluate the income potential and cash flow generated by the property. A wellperforming rental property can provide a steady income stream, even during economic downturns.

7.PROPERTY CONDITION:

Assess the condition of the property and factor in potential maintenance and renovation costs. A thorough inspection can help identify any issues that may affect the property’s value or rental income.

By considering these aspects and adopting a cautious and strategic approach, investors can position themselves for success in real estate investment during an economic downturn. While challenges exist, opportunities can arise for those who carefully evaluate the market, manage risks, and plan for the long term.

CONCLUSION

Navigating the housing market during an economic downturn requires careful consideration and strategic planning. While it is true that 90% of Americans currently refrain from investing in real estate amidst economic

uncertainties, there are opportunities for those who approach it with caution and thorough research.

By understanding the current state of the housing market and the factors influencing investor hesitancy, individuals can make informed decisions about real estate investment during an economic downturn. The potential benefits, such as lower property prices and increased rental demand, can be attractive for investors seeking long-term gains.

However, it is crucial to consider various factors and implement strategies to mitigate risks. Thorough market research, risk management, financial stability, and seeking professional guidance are essential elements of a successful investment approach. A long-term perspective and cash flow analysis help ensure sustainable investment outcomes, while considering the property condition aids in making sound investment choices. While challenges exist, real estate investment during an economic downturn can present unique opportunities for those who approach it strategically. By leveraging market insights, adopting a prudent approach, and remaining adaptable,

individuals can position themselves to thrive in the ever-evolving landscape of real estate investment.

Ultimately, the decision to invest in real estate during an economic downturn should be based on careful evaluation of personal circumstances, risk tolerance, and market conditions. With the right strategies and a wellinformed approach, individuals can navigate the housing market of 2023 and potentially capitalize on the opportunities presented by an economic downturn.

BACK TO CONTENTS

JUNE 2023 thepowerisnowmeida

THE RIPPLE EFFECTS OF RISING INTEREST RATES ON NNN RETAIL PROPERTIES

As interest rates experience an upward trajectory, the impact on NNN (Triple Net) retail properties becomes increasingly significant. NNN properties, known for their long-term lease agreements and stable income streams, face unique challenges in an environment of rising interest rates. This article delves into the effects of higher interest rates on NNN retail properties, exploring the implications for property investors, tenants, and the broader commercial real estate market. By understanding these dynamics, stakeholders can make informed decisions to navigate the evolving landscape of NNN retail properties.

UNDERSTANDING THE RELATIONSHIP BETWEEN INTEREST RATES AND NNN RETAIL PROPERTIES

Interest rates play a crucial role in shaping the performance and dynamics of NNN retail properties. These properties, known for their long-term leases

and stable income streams, are influenced by changes in interest rates in several ways.

One primary effect of rising interest rates is the impact on property valuations. As interest rates increase, the required rate of return for investors also rises. This often leads to higher capitalization rates (cap rates), which are used to estimate property values based on net operating income. With higher cap rates, the value of NNN retail properties may decrease, affecting both property owners and potential investors.

Moreover, rising interest rates can also affect the cost of borrowing for property investors. As borrowing costs increase, it becomes more expensive to finance property acquisitions or refinance existing loans. This can potentially limit investors’ purchasing power and affect their ability to expand their NNN property portfolios.

Another aspect to consider is

the impact of rising interest rates on investor sentiment. Higher interest rates can introduce greater uncertainty and perceived risk in the market, which might lead some investors to be more cautious or conservative in their investment decisions. This shift in investor sentiment can impact demand and pricing for NNN retail properties.

Additionally, the relationship between interest rates and NNN retail properties extends to lease terms and negotiations. When interest rates rise, tenants may face increased

COMERCIAL NEWS PHOTOS FROM 123RF

JUNE 2023 thepowerisnowmeida

occupancy costs due to higher borrowing costs for property owners. This can influence lease negotiations, with tenants seeking more favorable terms or rent adjustments to account for the changing financial landscape. Landlords, on the other hand, may need to carefully assess the impact of rising interest rates on tenant stability and the potential for increased vacancies.

Understanding the relationship between interest rates and NNN retail properties is essential for property owners, investors, and tenants alike. Monitoring interest rate trends, assessing the impact on property valuations, and adapting lease strategies to account for changing financial conditions can help stakeholders navigate the complexities of the market and make informed decisions.

In the next sections of this article, we will delve deeper into the specific impacts of rising interest rates on property valuations, tenant negotiations, and investor strategies in the context of NNN retail properties. By gaining a comprehensive understanding of these dynamics, stakeholders can proactively respond to market shifts and position themselves for success in the evolving interest rate environment.

IMPACT ON PROPERTY VALUATIONS: EVALUATING THE EFFECT OF RISING INTEREST RATES

Rising interest rates have a direct impact on the valuation of NNN retail properties. As interest rates increase, the required rate of return for investors also rises, leading to higher capitalization rates (cap rates). Higher cap rates result in a decrease in property valuations.

Property valuations are typically determined based on the net operating income (NOI) generated by the property. With rising interest rates, the increased cost of borrowing affects the NOI and, subsequently, the property’s value. Investors often assess the income potential of NNN retail properties based on a formula that incorporates cap rates. Therefore, as cap rates increase due to rising interest rates, the estimated value of the property declines.

The impact of rising interest rates on property valuations can have implications for both property owners and potential investors. Owners may experience a decrease in the market value of their properties, potentially impacting their equity position or ability to refinance. Investors, on the other hand, need to carefully evaluate the potential risks and returns associated with NNN retail properties in a rising interest rate environment.

It is essential for property owners and investors to monitor interest rate trends and understand

BACK TO CONTENTS

JUNE 2023 thepowerisnowmeida

how changes in interest rates can affect property valuations. By staying informed and adapting strategies accordingly, stakeholders can navigate the evolving market conditions and make informed decisions regarding NNN retail property investments.

TENANT NEGOTIATIONS AND LEASE TERMS IN A RISING INTEREST RATE ENVIRONMENT

In a rising interest rate environment, tenant negotiations and lease terms for NNN retail properties can be influenced by several factors. As interest rates increase, property owners may face higher borrowing costs, which can potentially impact tenants.

Tenants may experience increased occupancy costs due to landlords’ higher financing expenses. This can prompt tenants to seek more favorable lease terms or rent adjustments to mitigate the impact of rising interest rates. Landlords, on the other hand, need to assess the potential implications of rising interest rates on tenant stability and the overall market demand for their properties.

ability to provide competitive lease terms while maintaining profitability. Tenants, in turn, should assess their own financial capabilities and seek lease agreements that align with their evolving cost structures.

Effective communication and collaboration between landlords and tenants become vital during such negotiations. Exploring options such as lease structuring, rent adjustments, or incentives can help mitigate the impact of rising interest rates for both parties. Flexibility and transparency in lease negotiations are key to reaching mutually beneficial agreements in a changing interest rate landscape.

By understanding the implications of rising interest rates on lease terms and tenant negotiations, stakeholders can navigate the evolving market conditions for NNN retail properties. Open dialogue, proactive strategies, and a willingness to adapt can contribute to maintaining healthy landlord-tenant relationships and supporting the long-term viability of NNN retail investments.

their strategies to effectively navigate the impact of rising interest rates. Here are key considerations to help investors make informed decisions:

1.Portfolio Diversification:

Investors can mitigate the risks associated with rising interest rates by diversifying their NNN retail property portfolios. Spreading investments across different sectors, locations, and lease terms can help reduce exposure to any single property or market fluctuations.

2.Risk Assessment and Due Diligence:

Thoroughly assessing the financial health of tenants and conducting comprehensive due diligence on properties become even more critical in a rising interest rate environment. Investors should carefully evaluate tenant stability, lease terms, and potential risks to ensure their investments remain resilient.

3.Lease Structuring

Negotiating lease terms in a rising interest rate environment requires careful consideration from both landlords and tenants. It is crucial for landlords to evaluate the financial impact of rising interest rates on their

INVESTOR STRATEGIES: ADAPTING TO RISING INTEREST RATES IN NNN RETAIL PROPERTY INVESTMENTS

Investors in NNN retail properties need to adapt

: Investors may consider exploring lease structuring options that provide more flexibility in rent adjustments or lease renewals to accommodate changing market conditions and interest rates. This can help protect investment returns and align lease terms with potential shifts in tenant affordability.

4.Monitoring Interest Rate Trends:

JUNE 2023 thepowerisnowmeida

Staying informed about interest rate trends and their potential impact on NNN retail property investments is crucial. Regularly monitoring market indicators, economic forecasts, and central bank announcements can help investors make proactive decisions and adjust their strategies accordingly.

5.Long-Term Investment Approach:

NNN retail properties are often considered long-term investments due to their stable income streams and lease terms. Taking a patient and disciplined approach, focusing on cash flow stability, and considering the potential impact of rising interest rates over the long term can contribute to successful investment outcomes.

CONCLUSION

The rise in interest rates has significant implications for NNN retail property investments. Understanding the relationship between interest rates and property valuations, navigating tenant negotiations, and adapting investment strategies are essential in a changing market environment.

As interest rates increase, property valuations may decline due to higher capitalization rates. Investors need to carefully evaluate the risks and potential returns associated with NNN retail properties. Tenant negotiations become crucial, with landlords and tenants seeking mutually beneficial lease terms that account for the impact of rising interest rates.

Investors should consider diversification, conduct thorough due diligence, explore lease structuring options, monitor interest rate trends, and maintain a long-term perspective in their investment approach. By staying informed, adapting strategies, and fostering open communication with tenants, investors can navigate the challenges and maximize the potential of NNN retail property investments.

While rising interest rates introduce complexities, they also present opportunities for savvy investors. By aligning strategies with changing market conditions and maintaining a proactive stance, investors can position themselves for long-term success in the dynamic landscape of NNN retail property investments.

BACK TO CONTENTS

JUNE 2023 thepowerisnowmeida

Green Living: Embracing Sustainable Homes for a Greener Future

In a world where environmental concerns are at the forefront of our collective consciousness, there is a growing interest among homeowners to minimize their impact on the planet. Sustainable and green homes have emerged as a compelling solution, combining eco-friendly features, energy-efficient technologies, and sustainable design practices to create residences that not only minimize environmental harm but also provide a healthier and more efficient living space. In this article, we will explore the fascinating world of environmentally-friendly real estate options, showcasing innovative and inspiring examples of sustainable homes that appeal to buyers who are committed to reducing their carbon footprint and embracing a more sustainable lifestyle. From passive solar design and renewable energy systems to green building materials and water conservation strategies, join us as we delve into the exciting realm of sustainable living and discover how these homes can pave the way towards a greener future.

RISING DEMAND FOR SUSTAINABLE HOMES

As environmental awareness continues to grow, there has been a significant increase in the demand for sustainable homes. Homebuyers are increasingly seeking environmentally-friendly real estate options that align with their values and aim to minimize their ecological footprint. This shift in consumer preferences is driven by a desire to contribute to a greener future and enjoy the numerous benefits associated with sustainable living

ECO-FRIENDLY FEATURES AND TECHNOLOGIES

Sustainable homes incorporate a range of eco-friendly features and technologies that contribute to energy efficiency and environmental conservation. These may include solar panels for renewable energy generation, energy-efficient appliances and lighting, advanced insulation for improved thermal performance, and rainwater harvesting systems for water conservation. By integrating such

.

ENVIRONMENTAL NEWS

JUNE 2023 thepowerisnowmeida

PHOTOS FROM 123RF

features, homeowners can significantly reduce their energy consumption and lower their carbon emissions.

SUSTAINABLE DESIGN PRACTICES

Sustainable design practices play a crucial role in creating homes that are not only aesthetically pleasing but also environmentally responsible. Architects and designers embrace principles such as passive solar design, which maximizes natural light and heat while minimizing energy usage. They also prioritize the use of sustainable and locally-sourced materials, employ efficient spatial planning to optimize resource utilization, and incorporate natural ventilation systems for improved air quality. These design practices ensure that sustainable homes seamlessly blend with their surroundings and promote a healthy and eco-conscious living environment.

BENEFITS OF SUSTAINABLE HOMES

Living in a sustainable home offers numerous benefits to homeowners. Financially, sustainable

features and technologies help reduce energy bills and operating costs in the long run, leading to substantial savings over time. Health benefits include improved indoor air quality, reduced exposure to toxins commonly found in conventional homes, and enhanced comfort due to efficient insulation and ventilation. Moreover, sustainable homes contribute to environmental conservation by conserving resources, minimizing waste, and reducing carbon emissions, making a positive impact on the planet.

CERTIFICATION AND RECOGNITION

Green building certifications, such as LEED (Leadership in Energy and Environmental Design) or ENERGY STAR, provide recognition and assurance that a home meets certain sustainability standards. These certifications act as valuable indicators for buyers, signaling that a property has undergone rigorous evaluation and adheres to specific environmentally-friendly criteria. They instill confidence in potential buyers, making it easier for them to identify and

JUNE 2023 thepowerisnowmeida

choose sustainable homes that align with their values and sustainability goals.

FINANCING AND INCENTIVES

To encourage the adoption of sustainable homes, various financing options and incentives are available to potential buyers. Financial institutions offer green mortgages or loans with favorable terms to support the purchase of energy-efficient properties. Additionally, government programs and incentives, such as tax credits or grants, may be available to homeowners who invest in sustainable features and technologies. These financial mechanisms help make sustainable homes more affordable and accessible, promoting widespread adoption and contributing to a greener real estate market.

By focusing on these aspects, buyers can gain a better understanding of the advantages and considerations associated with sustainable homes, allowing them to make informed decisions that align with their environmental values and aspirations.

CONCLUSION

In conclusion, the rising demand for sustainable homes reflects a growing commitment among homebuyers to minimize their environmental footprint and embrace a greener future.

By incorporating eco-friendly features and technologies, sustainable homes offer tangible benefits such as reduced energy consumption, lower operating costs, improved indoor air quality, and enhanced comfort. The integration of sustainable design practices ensures that these homes harmonize with their surroundings while promoting resource efficiency and environmental conservation.

Green building certifications serve as important indicators of a home’s sustainability credentials, providing assurance and recognition for ecoconscious buyers. Furthermore, financing options and incentives make sustainable homes more accessible and affordable, facilitating their widespread adoption and contributing to a greener real estate industry.

Embracing sustainable homes not only aligns with personal values but also delivers longterm financial savings and promotes healthier living environments. By choosing sustainable homes, individuals can actively contribute to the preservation of our planet’s resources and mitigate climate change.

As the demand for sustainable homes continues to rise, it is essential for real estate developers, architects, and policymakers to prioritize sustainable practices and promote the availability of eco-friendly options. Together, we can foster

JUNE 2023 thepowerisnowmeida

Exquisite Enclaves: Discovering the Epitome of Luxury Real Estate

In the world of real estate, there exists a realm of unparalleled opulence, where grandeur meets exclusivity. This article takes you on a captivating journey into the realm of luxury real estate, where extraordinary properties, exclusive neighborhoods, and lavish amenities cater to the discerning tastes of affluent buyers and investors.

Prepare to immerse yourself in a world of refined elegance and sophistication as we explore the epitome of luxury living. From stunning mansions nestled in prestigious locations to high-rise penthouses with breathtaking skyline views, we unveil the remarkable properties that redefine the meaning of luxury.

Beyond the properties themselves, we delve into the exclusive neighborhoods that epitomize luxury living. These enclaves boast immaculate landscapes, privacy, and an unparalleled sense of prestige. Whether it’s waterfront estates, gated communities, or prestigious urban neighborhoods, we uncover the most soughtafter locations that captivate the world’s elite.

Moreover, we delve into the lavish amenities that accompany these luxury properties, from state-of-the-art spas and fitness centers to private theaters and wine cellars. Experience the ultimate in comfort, convenience, and indulgence as we reveal the exceptional features that make these properties truly extraordinary.

Whether you are an affluent buyer seeking the

perfect luxury residence, an investor looking for prime real estate opportunities, or simply an enthusiast of exceptional properties, join us on this voyage through the world of luxury real estate. Prepare to be inspired, enchanted, and transported to a realm where luxury knows no bounds.

EXPLORING THE WORLD OF EXQUISITE ENCLAVES

In this fast-paced and ever-evolving world, luxury real estate has emerged as a symbol of prestige and sophistication. Exquisite enclaves represent the pinnacle of opulence, where architecture, design, and location harmoniously blend to create an unparalleled living experience. Embark on a journey with us as we delve into the realm of exquisite enclaves and discover the epitome of luxury real estate.

UNVEILING THE EPITOME OF LUXURY: FEATURES OF EXQUISITE REAL ESTATE

Exquisite real estate is characterized by a myriad of features that elevate it to a level beyond ordinary residential properties. Architectural brilliance takes center stage, with meticulously crafted designs that seamlessly integrate with their surroundings. From contemporary masterpieces with sleek lines and expansive glass walls to timeless estates showcasing classical elegance, these properties boast extraordinary craftsmanship.

BACK TO CONTENTS

PHOTOS FROM 123RF

LIFESTYLE AND LIVING JUNE 2023 thepowerisnowmeida

a future where sustainable living becomes the norm, creating a positive impact on both individuals and the environment. By embracing the green home movement, we can build a more sustainable and resilient world for generations to come.

The location of exquisite enclaves is another crucial factor that sets them apart. Nestled in prestigious neighborhoods or nestled within stunning natural landscapes, these properties offer breathtaking views and provide a sense of exclusivity and privacy. Whether it’s a beachfront villa, a mountainside retreat, or an urban penthouse, the location of these enclaves enhances their allure and value.

Luxury amenities and cutting-edge technology define the interior spaces of these residences. State-of-the-art home automation systems, private home theaters, wine cellars, and spalike wellness areas cater to every conceivable desire. Impeccably designed kitchens, lavish master suites, and sprawling entertainment areas further exemplify the attention to detail and sophistication found within exquisite enclaves.

THE LIFESTYLE BENEFITS OF EXQUISITE ENCLAVES

Living in an exquisite enclave extends beyond the physical attributes of the property. It offers a lifestyle that embodies refined living, unparalleled comfort, and exclusivity. Residents of these enclaves enjoy a range of amenities tailored to their desires and leisure pursuits.

Exclusive clubhouses, private pools, fitness centers, and sports facilities provide opportunities for relaxation and recreation within

the confines of the enclave itself. Lush gardens, walking trails, and outdoor entertainment spaces create an oasis of tranquility where residents can unwind and connect with nature.

The sense of community and security within exquisite enclaves fosters a unique social environment. Like-minded individuals and families form tight-knit bonds, sharing common interests and experiences. The presence of private security and controlled access ensures peace of mind and allows residents to enjoy their surroundings with confidence.

Moreover, the prime locations of these enclaves offer proximity to cultural attractions, fine dining establishments, high-end shopping districts, and other amenities. Residents have convenient access to the best that the city or region has to offer, enhancing their overall quality of life and providing opportunities for entertainment and leisure activities.

In conclusion, the world of exquisite enclaves epitomizes luxury real estate, blending extraordinary architecture, breathtaking locations, and a host of exceptional amenities. By choosing to reside in these enclaves, individuals embrace a lifestyle that embraces opulence, exclusivity, and an unparalleled living experience.

JUNE 2023 thepowerisnowmeida

BACK TO CONTENTS Purchase Price of Home: $350,000 First Mortgage Loan: $339,500 Down Payment and Closing Cost Assistance from GSFA*: $23,765 Total Assistance Program Highlights • No first-time homebuyer requirement • 620 FICO’s score minimum • Down Payment and Closing Cost Assistance Available Toll Free: (855) 740-8422 E-mail: info@gsfahome.org Website: gsfahome.org *Advertisement contains general program information, is not an offer for extension of credit nor a commitment to lend and is subject to change without notice. Example based on 97% Conventional First Mortgage Loan combined with 7% in down payment and clossing cost assistance. For complete program guidelines, loan applications, interest rates and annual percentage rates (APRs) contact a GSFA Participating Lender. Golden State Finance Authority (GSFA) is a duly constituted public entity and agency. Copyright © 2021. Your PATHWAY to HOME OWNERSHIP DOWN PAYMENT ASSISTANCE NOW AVAILABLE! You may be able to purchase your dream home with little-to-no money out of pocket! CALL TODAY TO LEARN MORE

Creating Irresistible Spaces: Expert Home Staging and Design Tips to Attract Buyers

When it comes to selling a property, first impressions are everything. In a competitive real estate market, the art of home staging and design can significantly impact a buyer’s perception and ultimately influence their purchasing decision. This article is your guide to mastering the art of creating captivating spaces that entice and engage potential buyers. From enhancing curb appeal to optimizing interior layouts and incorporating the latest design trends, we will provide you with expert advice and practical tips to transform your property into an irresistible haven. Whether you’re a homeowner looking to sell or a real estate professional seeking to elevate your listings, join us on this journey as we unlock the secrets to attracting buyers and maximizing the

potential of every space. Get ready to unleash the power of home staging and design and make your property stand out in the crowded real estate market.

THE POWER OF CURB APPEAL: TRANSFORMING THE EXTERIOR

The exterior of a property is the first thing potential buyers see, and it sets the tone for their overall impression. Enhancing the curb appeal can make a significant difference in attracting buyers and generating interest. Here are some key aspects to focus on when transforming the exterior:

TPIN DESIGNS PHOTOS FROM 123RF JUNE 2023 thepowerisnowmeida

ENHANCING THE ENTRANCE AND FRONT YARD:

The entrance should be welcoming and inviting. Consider painting the front door with a fresh coat of paint that complements the overall color scheme of the house. Adding potted plants or flower arrangements near the entrance can bring life and vibrancy to the space. Pay attention to the condition of the walkway and ensure it is clean and well-maintained.

FRESHENING UP THE EXTERIOR WITH PAINT AND LANDSCAPING:

A well-maintained exterior can instantly elevate the appeal of a property. Consider repainting the exterior walls if needed, opting for neutral and timeless colors that appeal to a wide range of buyers. Landscaping plays a crucial role as well. Trim overgrown shrubs, mow the lawn, and plant seasonal flowers to add color and charm.

UPDATING LIGHTING FIXTURES AND DOOR HARDWARE:

Upgrading lighting fixtures and door hardware can give the exterior a modern and polished look. Replace outdated light fixtures with contemporary options that complement the architectural style of the property. Similarly, updating door hardware such as doorknobs and hinges can make a noticeable difference in the overall aesthetics.

Remember, the goal is to create an exterior that immediately captures attention and entices potential buyers to explore further. By investing

some time and effort into enhancing curb appeal, you can make a lasting first impression and set the stage for a positive experience inside the property.

MAXIMIZING INTERIOR SPACE: EFFECTIVE LAYOUT AND ORGANIZATION

When it comes to selling a property, buyers are often looking for homes that offer ample space and a sense of openness. By focusing on effective layout and organization, you can maximize the interior space of your property and create an environment that appeals to potential buyers. Here are some key strategies to consider:

DECLUTTERING AND DEPERSONALIZING:

The first step in optimizing interior space is to declutter and depersonalize your home. Remove any unnecessary items, such as excess furniture, personal belongings, and knick-knacks. This not only creates a cleaner and more spacious look but also allows potential buyers to envision themselves living in the space.

FURNITURE ARRANGEMENT FOR FLOW AND FUNCTIONALITY:

Take a critical look at your furniture arrangement and consider the flow of each room. Arrange furniture in a way that maximizes open pathways and creates a natural traffic flow. Remove any furniture pieces that obstruct movement or make the room feel cramped. Rearranging furniture can create a more inviting and spacious feel,

BACK TO CONTENTS

JUNE 2023 thepowerisnowmeida

showcasing the full potential of the space.

CREATING THE ILLUSION OF SPACE:

Even if you have limited square footage, there are techniques to create the illusion of space. Consider using light and neutral colors on the walls and ceilings, as they reflect natural light and make the room feel brighter and more expansive. Mirrors strategically placed can also give the illusion of larger rooms by reflecting light and creating depth.

STRATEGIC DESIGN CHOICES:

Pay attention to design choices that can enhance the perception of space. Opt for furniture with legs that expose the floor, as it creates a sense of openness. Choose streamlined and multifunctional furniture pieces that serve a purpose while taking up less visual space. Utilize vertical storage options like shelving units to free up floor space and keep the room tidy.

Remember, the goal is to make the interior space feel open, airy, and inviting to potential buyers. By decluttering, optimizing furniture arrangement, creating the illusion of space, and making strategic design choices, you can transform your property into a visually appealing and spacious environment that captures the interest of buyers.

ON-TREND DESIGN ELEMENTS: INCORPORATING POPULAR STYLES

When it comes to attracting buyers, staying up-to-date with current design trends can make a significant difference in the appeal of your staged property. Incorporating popular styles not only showcases your property as modern and stylish but also helps potential buyers envision themselves living in the space. Here are some key points to consider when incorporating ontrend design elements:

JUNE 2023 thepowerisnowmeida

EXPLORING CURRENT DESIGN TRENDS AND THEIR APPEAL TO BUYERS

Take some time to research and understand the latest design trends that are capturing the interest of buyers in the real estate market. Pay attention to popular interior design magazines, online platforms, and social media to gain insights into what styles are in vogue. Trends such as minimalist aesthetics, Scandinavian-inspired designs, or mid-century modern elements may be sought after by potential buyers. By understanding these trends, you can selectively incorporate elements that align with your property’s aesthetic and appeal to a wide range of buyers.

ADDING FRESH AND MODERN TOUCHES WITHOUT BREAKING THE BUDGET

Updating your property to reflect current design trends doesn’t have to be an expensive endeavor. Simple changes can go a long way in creating a fresh and modern look. Consider cost-effective updates such as painting walls with trendy colors, replacing outdated fixtures, or upgrading cabinet hardware. Introducing stylish throw pillows, area rugs, or decorative accents can also inject a sense of contemporary style into the space without straining your budget.

USING COLOR SCHEMES, TEXTURES, AND ACCESSORIES TO CREATE VISUAL INTEREST

Color schemes play a vital role in setting the tone and atmosphere of a space. Opt for neutral base colors, such as shades of white, gray, or beige, to create a versatile backdrop that appeals to a wide range of buyers. Add pops of color through accessories like artwork, cushions, or curtains to create visual interest and a sense of personality.

wallpapers, to add depth and dimension to the space. Textures can create a tactile experience and elevate the overall visual appeal.

Lastly, carefully select accessories that complement the style you’re aiming for. Pay attention to trends in furniture shapes, lighting fixtures, and decorative pieces. Introduce elements such as geometric patterns, organic materials, or statement pieces to create a cohesive and stylish look that resonates with buyers.

By incorporating on-trend design elements, you can captivate potential buyers and position your property as a desirable and contemporary living space. Remember to strike a balance between incorporating popular styles and maintaining a timeless appeal, ensuring that your design choices stand the test of time and appeal to a wide range of buyers.

THE POWER OF STAGING: CREATING A LIFESTYLE EXPERIENCE

When it comes to selling a property, staging can make all the difference in capturing the hearts and minds of potential buyers. Staging is the art of creating a lifestyle experience within the property, allowing buyers to envision themselves living in the space. Here are some key strategies to harness the power of staging:

Showcasing the potential of each room through staging is essential. Consider the function of each space and furnish it accordingly. For example, transform an empty room into a home office by adding a desk, chair, and some tasteful decor. By showing buyers the possibilities, you help them connect emotionally with the space.

Don’t overlook the importance of textures when incorporating on-trend design elements. Experiment with different textures, such as natural fibers, metallic accents, or textured

BACK TO CONTENTS

JUNE 2023 thepowerisnowmeida

Highlighting key features and focal points can significantly impact a buyer’s perception of a property. Draw attention to architectural elements, such as fireplaces or unique built-in shelving, by arranging furniture and accessories to accentuate these features. A well-placed piece of artwork can also serve as a focal point, adding visual interest and a sense of sophistication.

Using art, lighting, and decor to create a welcoming atmosphere is vital in staging a property. Hang art that complements the style of the home and adds personality without overwhelming the space. Proper lighting can make a room feel warm and inviting, so ensure that each area is well-lit with a combination of natural and artificial lighting. Thoughtfully selected decor items, such as fresh flowers, stylish throw pillows, or tasteful table settings, can evoke a sense of comfort and luxury.

Remember, the goal of staging is to create an emotional connection between the buyer and the property. By carefully curating the space, highlighting its best features, and creating a welcoming ambiance, you can inspire potential buyers to envision themselves living a desirable lifestyle in the home.

CONCLUSION

Mastering the art of home staging and design is a powerful tool in attracting buyers and maximizing the appeal of a property. By implementing the tips and strategies mentioned in this article, you can transform your property into an irresistible space that captures the attention of potential buyers from the moment they step foot inside.

Whether it’s enhancing curb appeal, optimizing interior spaces, incorporating popular design trends, or utilizing the power of staging, each element plays a crucial role in creating an inviting and aspirational environment. Remember, the ultimate goal is to help buyers imagine themselves living in the space, making an emotional connection, and ultimately influencing their purchasing decision.

So, take the time to invest in home staging and design. With careful planning, attention to detail, and a touch of creativity, you can transform your property into a standout gem in the competitive real estate market. Let your staging efforts speak volumes, and watch as potential buyers fall in love with the irresistible spaces you’ve created.

JUNE 2023 thepowerisnowmeida

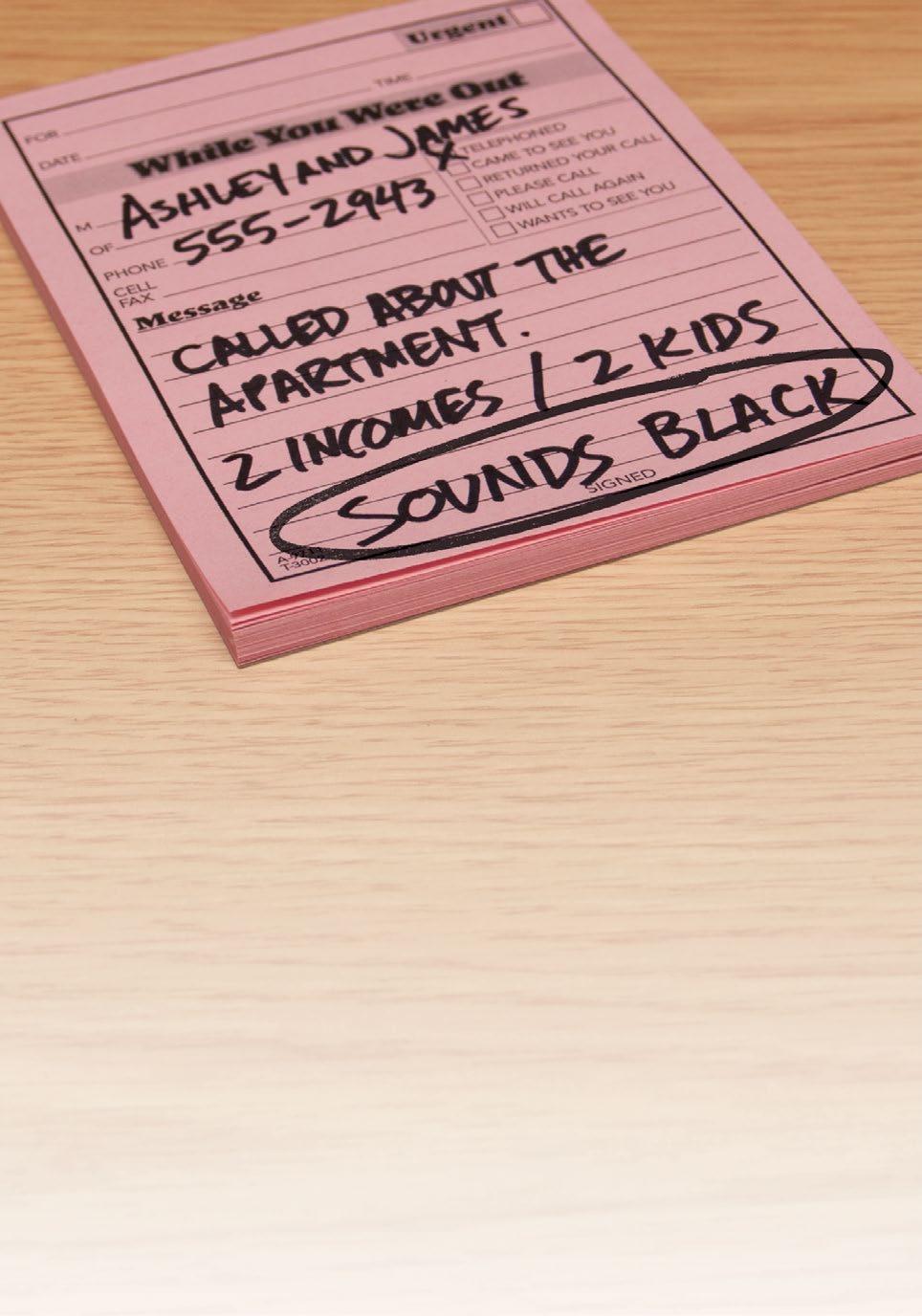

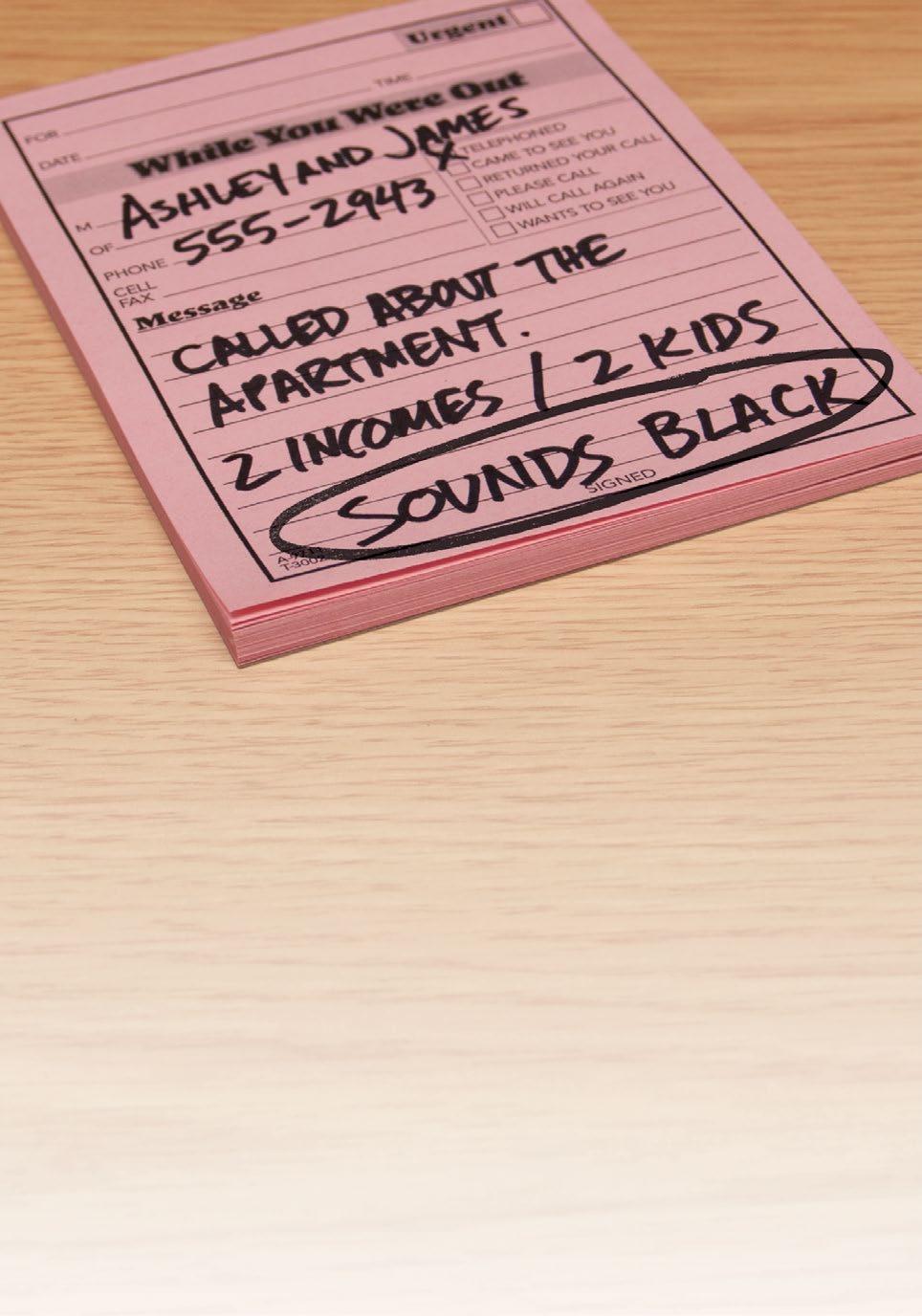

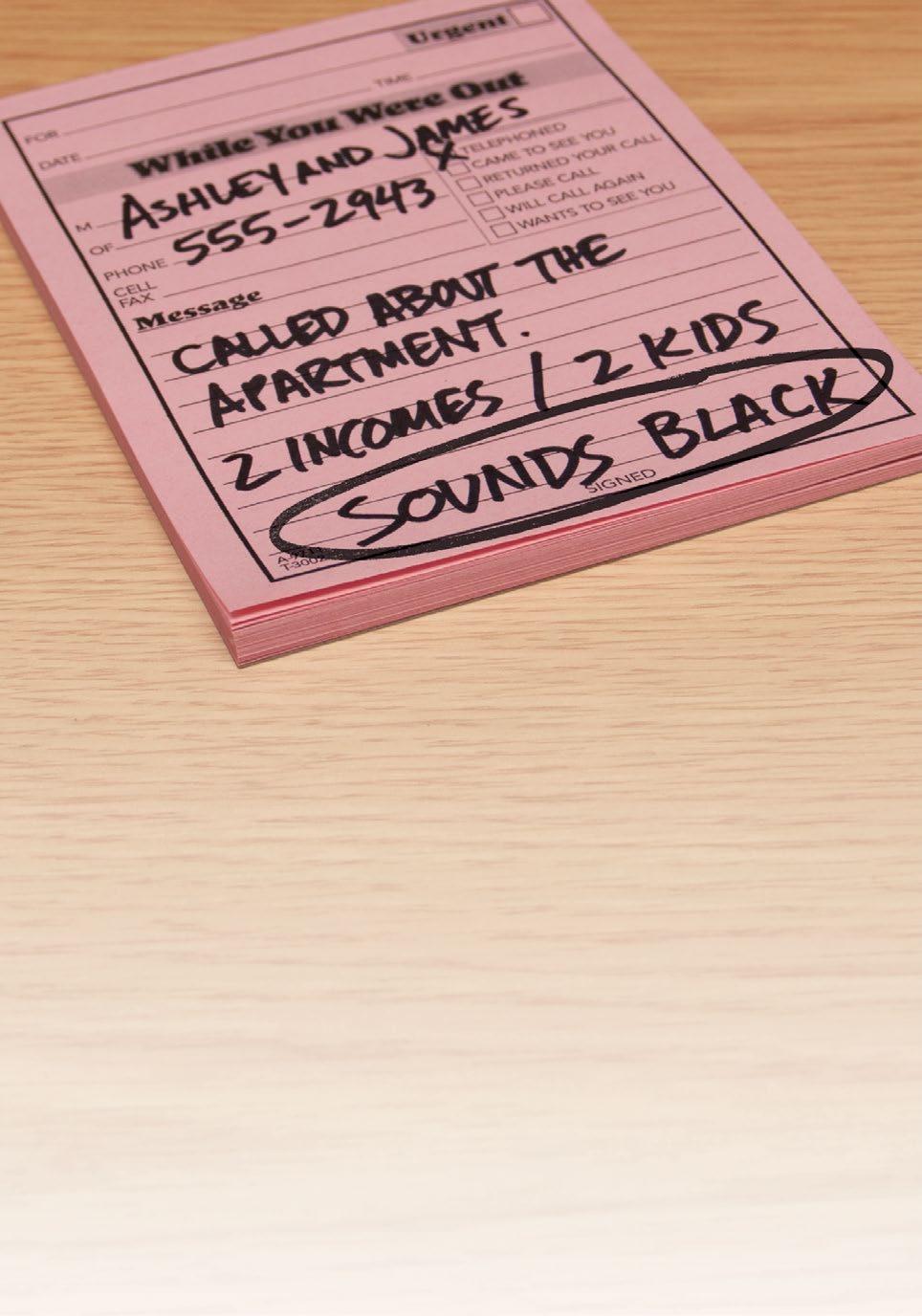

THE FLOOD TURNED OUR LIVES UPSIDE DOWN. WHEN WE TRIED TO RENT A NEW PLACE TO LIVE, WE KEPT GETTING TURNED DOWN. When the flood came, we had to run from our home. Fortunately, we found temporary shelter. But as we started looking for a place to live, we ran into housing discrimination, which isn’t just unfair – it’s illegal. If you feel that a landlord or broker has denied you the sale, rental or financing of a home based on your race, color, religion, sex, national origin, disability or because you have children, report it to HUD or your local fair housing center. Go to hud.gov/fairhousing or call 1-800-669-9777 Federal Relay Service 1-800-877-8339 FAIR HOUSING: THE LAW IS ON YOUR SIDE. A public service message from the U.S. Department of Housing and Urban Development in cooperation with the National Fair Housing Alliance. The federal Fair Housing Act prohibits discrimination because of race, color, religion, national origin, sex, familial status or disability. JUNE 2023 thepowerisnowmeida

Revolutionizing Real Estate: Exploring Cutting-Edge Digital Tools for Buyers, Sellers, and Investors

In today’s fast-paced world, technology has become an indispensable part of the real estate industry. From advanced property search apps to immersive virtual tours and sophisticated investment analysis software, digital tools have transformed the way we navigate the world of buying, selling, and investing in real estate. In this article, we will dive into the innovative tools, apps, and platforms that are reshaping the landscape of real estate, empowering individuals to make informed decisions, save time, and enhance their overall

real estate endeavors. Whether you’re a buyer seeking the perfect dream home, a seller looking for effective marketing strategies, or an investor seeking profitable opportunities, join us as we explore the forefront of real estate technology.

ENHANCED PROPERTY SEARCH: DISCOVERING HOMES WITH ADVANCED SEARCH APPS

In the digital age, finding the perfect property has become

TECHNOLOGY

NEWS

JUNE 2023 thepowerisnowmeida

easier than ever, thanks to innovative search apps that offer advanced features and functionalities. These apps empower buyers, sellers, and investors with comprehensive tools to streamline the property search process and make informed decisions.

With enhanced property search apps, users can now specify their desired criteria with precision. From location and price range to specific amenities and property types, these apps allow users to customize their search based on their unique preferences.

Moreover, advanced search apps often incorporate intelligent algorithms and machine learning capabilities, which learn from user behavior and preferences over time. This means that the more users interact with the app, the more personalized and accurate their search results become. This level of customization saves time and effort by presenting only the most relevant listings.

In addition to basic search features, many apps also provide interactive maps, allowing users to explore properties in their desired areas visually. Users can view properties in satellite or street view, assess neighborhood amenities, and even evaluate the proximity to schools, transportation, and other points of interest. These interactive maps provide valuable context and help users make more

informed decisions about their potential investment.

Another exciting feature offered by some advanced property search apps is the ability to set up alerts. Users can create customized alerts based on their criteria, such as price range or specific neighborhoods. Whenever a new property that matches their preferences enters the market, users receive instant notifications, ensuring they stay ahead of the competition.

With their advanced search capabilities, interactive maps, and personalized alerts, these apps provide a powerful toolset for finding the perfect property efficiently and effectively. Whether you’re a first-time homebuyer, a seasoned investor, or a seller looking to maximize exposure, leveraging these digital tools can greatly enhance your real estate endeavors.

IMMERSIVE VIRTUAL TOURS: STEP INSIDE PROPERTIES FROM ANYWHERE

Gone are the days when potential buyers had to physically visit numerous properties to get a feel for their layout and ambiance. Thanks to innovative digital tools, such as immersive virtual tours, individuals can now step inside properties from anywhere in the world.

Virtual tours utilize advanced 3D imaging and interactive technology to provide a realistic and immersive experience. With just a few clicks, buyers can explore every corner of a property, from the comfort of their own homes. They can navigate through rooms, zoom in on details, and even get a sense of the property’s dimensions.

These virtual tours offer a level of convenience and efficiency that was previously unimaginable. Prospective buyers no longer have to spend time and money traveling to multiple locations, especially if they are considering properties in different cities or countries. They can simply access virtual tours through dedicated platforms or real estate websites, giving them the freedom to explore properties at their own pace and in their preferred order.

Furthermore, virtual tours benefit not only buyers but also sellers and real estate agents. Sellers can showcase their properties to a broader audience and attract potential buyers who might not have otherwise considered visiting in person. This increased exposure can lead to faster sales and higher chances of finding the right buyer. Real estate agents can leverage virtual tours as a powerful marketing tool, offering clients an immersive and engaging experience that sets their listings apart from the

BACK TO CONTENTS

JUNE 2023 thepowerisnowmeida

competition.

Additionally, virtual tours have become particularly valuable in times of restricted mobility or global events that limit physical interactions, such as the COVID-19 pandemic. They provide a safe and socially distanced alternative for property viewings, allowing the real estate industry to continue operating smoothly even during challenging times.

Overall, immersive virtual tours have revolutionized the way buyers explore and evaluate properties. They offer convenience, timesaving benefits, and an enhanced understanding of a property’s layout and features. As technology continues to advance, we can expect virtual tours to become even more immersive and interactive, providing an increasingly realistic experience that bridges the gap between physical and virtual property exploration.

STREAMLINED TRANSACTIONS: DIGITAL PLATFORMS FOR BUYERS AND SELLERS

In the ever-evolving world of real estate, digital platforms have emerged as gamechangers, revolutionizing the way buyers and sellers engage in transactions. These platforms offer a range of features and tools that streamline the process, making it more efficient and convenient for all parties involved.

One of the primary advantages of digital platforms is the ability to centralize and manage all transaction-related activities in one place. Buyers can browse listings, schedule viewings, and submit offers directly through these platforms, eliminating the need for lengthy paperwork and multiple communication channels. Similarly, sellers can list their properties, review offers, and communicate with potential buyers effortlessly.

These platforms also integrate secure payment gateways, ensuring smooth and secure financial transactions. Buyers can make secure online payments, while sellers can receive funds directly into their designated accounts, reducing the risks associated with traditional payment methods.

Additionally, digital platforms often provide features that facilitate seamless collaboration between buyers, sellers, and their respective agents. Realtime messaging systems enable quick and efficient communication, allowing parties to address queries, negotiate terms, and provide updates instantly. This level of transparency and accessibility fosters trust and accelerates the decision-making process.

Furthermore, these platforms often offer tools for document management, allowing parties to digitally sign contracts and share important files without

JUNE 2023 thepowerisnowmeida

the hassle of physical paperwork. This not only saves time but also reduces the chances of misplaced or lost documents, ensuring a smooth and organized transaction experience.

Moreover, many digital platforms provide access to additional resources such as property history, market trends, and neighborhood insights. Buyers can leverage this information to make informed decisions, while sellers can gain valuable market intelligence to set competitive prices and attract potential buyers.

As the real estate industry continues to embrace digital transformation, these platforms are continuously evolving and incorporating innovative features. From AI-powered chatbots that provide instant customer support to augmented reality tools that enable virtual staging, the possibilities are expanding.

Digital platforms have revolutionized real estate transactions by offering streamlined processes, secure payments, efficient collaboration, and access to valuable resources. Whether you’re a buyer or a seller, embracing these digital tools can significantly enhance your real estate endeavors, saving time, reducing stress, and ultimately leading to successful and satisfying transactions.

DATA-DRIVEN INVESTMENT ANALYSIS: UNLEASHING THE POWER OF REAL ESTATE SOFTWARE

In today’s dynamic real estate market, making informed investment decisions is crucial for both seasoned investors and newcomers alike. Fortunately, the advent of advanced real estate software has revolutionized the way investment analysis is conducted, empowering individuals with data-driven insights and strategic advantages. Let’s delve into the world of digital tools that are transforming the landscape of real estate investing.

One of the key benefits of real estate software is its ability to provide comprehensive market data and analytics. These tools aggregate and analyze vast amounts of information, including property values, rental rates, historical trends, and demographic data. By leveraging this wealth of data, investors can gain a deeper understanding of market conditions, identify lucrative investment opportunities, and evaluate the potential risks associated with a particular property or location.

Sophisticated investment analysis software goes beyond basic data and offers robust features such as financial modeling, cash flow projections, and investment performance metrics. These tools allow users to assess the financial viability of an investment by factoring in variables such as acquisition costs, operating expenses, financing terms, and projected returns. With the ability to run scenario analyses and perform sensitivity testing, investors can make more accurate forecasts and optimize their investment strategies.