BAKERY & DELI INNOVATION

How grocers can reinvent these key departments

CULTURE OF CLEAN

Deploy the right strategies for sparkling stores

READ THE SIGNS

Expert advises on impactful solutions

BAKERY & DELI INNOVATION

How grocers can reinvent these key departments

CULTURE OF CLEAN

Deploy the right strategies for sparkling stores

READ THE SIGNS

Expert advises on impactful solutions

The Diablo from Southern CaseArts leaves competitors’ frozen cases in the dust. Designed for maximum packout, customer engagement and energy-efficiency, the Diablo highlights every package in the case for added sales. Brilliant LED lighting, and optional anti-fog doors set the stage for a winning performance every time. These adjustable-shelf cases are available in multiple lengths with one to five doors, as remote or self-contained units. Easy lift-off panels make pit stops for maintenance and cleaning lighting-quick. Visit southerncasearts.com now and learn how our complete line of cases can blow the doors off your frozen department sales.

MANAGER Jackie Batson 224-632-8183 jbatson@ensembleiq.com

MARKETING MANAGER Krista-Alana Travis ktravis@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

contact@progressivegrocer.com

IN-STORE EXPERIENCE, THE ROI OF TECH, AND NATURAL FOODS ARE TOP OF MIND.

he past few weeks have seen some of the biggest trade shows in the grocery industry making waves when it comes to understanding trends in brick-and-mortar and e-commerce grocery.

The NGA Show, in Las Vegas, attracted a record crowd of 3,600 attendees in March, and one session in particular unveiled some unexpected trends in grocery. Kathy Risch, SVP, shopper insights and thought leadership at Acosta Group, delivered an impressive presentation on shopper preferences, barriers and experiences in the area of food retail technologies. Topics ranged from technological ownership by generation, to online grocery shopper behaviors, to in-store tech adoption.

Some of the most interesting takeaways:

More than one-third of shoppers order groceries online at least weekly.

Half of online grocery shoppers pick up their orders at the store, although delivery is used by many, especially busy Millennials.

Gen Z (ages 18-26) is shopping more in-store than online.

Speaking about Gen Z’s surprising shopping habits, Risch said: “It’s really just that they don’t have the frequent need to be running to or getting online and ordering as much, so they’re doing a lot of in-store shopping. They really do love to shop in-store. I think that some of the hypothesis was that, ‘The younger you are, the more you’ll shop online.’ But the reality is that as these Gen Zs are entering adulthood, they really do love to shop in-store.”

At The NGA Show’s Tech Summit, electronic shelf labels (ESLs), which have been around forever, are increasingly winning over retailers looking for solutions to labor shortages and real-time price optimization.

Chad Cameron, VP of IT for Associated Food Stores, asserted that the ROI for ESLs is finally here.

“We wanted to find a solution that could be implemented regardless of current infrastructure, with the same kind of use case or success for any retailer,” Cameron said. “We went with a group that has standard equipment inside, and so all we really needed was one port for the internet. And whether you have a low ceiling or high ceiling, or you’re a 5,000-item location or a 35,000-item location, it’s been seamless. Our very first implementation was around 40,000 tags, and it just works.”

Cameron took part in a session with other retailers who spoke of the customer experience, labor savings and energy efficiency benefits as well.

“It’s one of the few technologies out there that benefit the large retailer and small retailer,” Cameron added, “and really, this just scales by your size. If you’re a small retailer, your investment’s going to be lower, but the effects and the benefits are still there. It really has been a great addition for us. Fantastic.”

At Natural Foods Expo West, in Anaheim, Calif., more than 67,000 attendees hit the “Super Bowl of food” to get a glimpse of the innovation coming to shelves this year. The show took place amid an economic landscape in which natural foods have been facing the headwinds of inflation and consumers trading away from premium products to more mainstream choices — or so we thought.

Some of the biggest trade shows in the grocery industry are making waves when it comes to understanding trends in brickand-mortar and e-commerce grocery.

Kathryn Peters, head of industry relations at SPINS, told the Expo West audience that natural products are actually outpacing sales of all other products, growing 4.7% to more than $302 billion in 2023.

“And organics are outpacing non-organics across the store as well, both in dollars and units,” Peters continued. “Organics are growing everywhere, and it’s because shoppers trust organic. In fact, if you look at sentiments since 2019, organic and non-GMO have the strongest consumer mindset and comfort and trust. And we particularly see not only are all shoppers starting to trust and look for organics, the younger shoppers, as we’re going to hear a lot more about, really trust this seal. … [as part of this] macro trend of consumers focusing on health and planet.”

Gina Acosta Editor-In-Chief gacosta@ensembleiq.com

Gina Acosta Editor-In-Chief gacosta@ensembleiq.com

National Caribbean-American Heritage Month

National Dairy Month

National Iced Tea Month

National Papaya Month

National Fresh Fruit and Vegetables Month

National Pollinators Month

2

National Rocky Road Day. As far as we’re concerned, the rockier, the better.

9

National Kids Day. Teach youngsters how to prepare their own healthy afterschool snacks.

3

National Egg Day. This versatile nutritional powerhouse is also extremely low in carbs.

4

Shopping Cart Day. Make sure yours are all in good working order.

5

National Gingerbread Day

6

7

1

National Olive Day

8

10

Eat Flexitarian Day. Have your retail dietitian guide customers to make the best choices as they embark on this style of eating.

11

Say Hi Day. Remind associates that the best way to engage with customers is with a simple greeting.

Who says this sweet treat should be eaten only during the winter holidays?

12

National Jerky Day. Create a craveable wall of meat snacks to lure hungry shoppers.

Visually Impaired People Day. Welcome blind and low-vision shoppers to your store(s) with the appropriate adaptive devices.

13

World Softball Day. Support your store’s team with customized gear.

World Caring Day. In your interactions with associates and customers, do your part to make this world a little kinder.

23

National Hydration Day. Keep front end bins well stocked with water bottles and other thirst-quenching beverages that shoppers can grab and go as they check out.

30

Social Media Day

24

Upcycling Day. Offer tips on how customers can make use of packaging after they’ve consumed the contents, as well as pointing out all of upcycled food items you carry.

25

Goat Cheese Day. Highlight this popular offering in your deli section’s cheese case.

26

National Parchment Day — parchment paper, that is. Instruct shoppers to have it on hand when they bake at home.

27

National Bingo Day. Invite customers to play this always popular game, with the winner receiving free groceries.

14 Flag Day International Bath Day

National Rosé Day. Post online a list of food pairing suggestions with this popular type of wine.

15

National Dog Dad Day. Show guys the many cute toys they can purchase from the pet care aisle to enhance playtime with their best fourlegged friends.

22

National HVAC Tech Day. Now is the time to pay tribute to the installation and repair folks who keep your store sections at the optimal temperatures.

28

Paul Bunyan Day. In honor of this legend, offer a flapjack-eating contest for employees and shoppers alike.

29

National Waffle Iron Day. Crossmerchandise mixes, fixings and fruit for a leisurely homemade brunch.

Which cohort is spending, on average, the most per trip on prepared foods

Butter, margarine and oils are used in nearly every U.S. household for cooking, baking and more. With rising prices, some consumers are trading down, but not trading out of the category. Value continues to be found in all segments, leading to growth in the category as a whole.

Given the enduring interest in at-home food preparation, consumers anticipate an increase in their use of butter, margarine and oils. This necessitates brands to stay competitive within their individual segments. Meeting consumer expectations in each segment will be vital in providing value to consumers.

Consumers have established perceptions and beliefs with regard to cooking fats, making successful innovation a challenge. Emphasizing simplicity and ease of use will go further in meeting consumer needs. Brands that lean into the strongest purchase drivers of individual segments and their unique benefits have the greatest growth potential.

Butter and olive oil are the leaders in cooking fat consumption. They’re widely accessible, and consumers are comfortable with their usage across occasions. Growth is sustained, but interest in innovation is low. Ultimately, consumers are content with the category, indicating that attributes like value and quality will drive choice.

Gen Z and Millennial consumers tend to be less loyal to one cooking fat and find value in diversity. With less cooking experience, these consumers have less determined opinions on individual cooking fat segments. Their interest in personalization through health and sustainability attributes expands usage to divergent segments.

Purchase drivers vary among cooking fats, indicating that consumers recognize worth across segments. Products aren’t viewed as substitutions for each other; swapping between them is low. Balancing versatility for a single fat with a need for options is tricky, and ultimately depends on household needs.

Convenience, quality and adaptability should be at the core of cooking fats. Brands that stress practicality for simpler meal prep will engage consumers more successfully than by offering novel flavors and formats. Supplying easy recipe inspiration and timesaving hacks with cooking fats has the potential to create meaningful value.

Cooking fat is a diverse category in use and perception. Rather than trying to be everything to everyone, growth is most achievable by leaning into the unique factors of a particular segment and product. For butter, this may be indulgence, while for olive oil, this may be nutrition, as it has a health halo that other fats don’t.

With high food prices and tighter budgets, stressing value in cooking fats is more important than ever. Lowering costs may not be an option, but emphasizing ease of use and providing various application ideas will help alleviate consumers’ concerns about price while simultaneously encouraging greater usage.

b . T ’ w

Q: W ? H w ?

: The Nicky brand was an innovation born from experience as part of the Sofidel Group; providing consumers and businesses with sustainable and hygienic paper products for over 55 years. Nicky has already become a trusted brand in numerous markets, including the UK, Spain, Ireland, and Italy. Today, Sofidel America continues expanding and meeting the needs of its partners, and ultimately consumers, by taking key learnings from global markets and translating those into the US Nicky expansion.

Nicky is the first US-produced household paper brand to provide a full product assortment wrapped with plasticfree packaging — reducing the impact of plastics on the environment. The line includes paper towels, bath tissue, facial tissues, dinner napkins, and our new innovative Super Shine household towel — designed to demonstrate how innovation can improve the consumer experience.

Super Shine is a unique 3-ply paper household towel made with super-sized sheets. They are ideal for cleaning all surfaces with extra thickness and strength for scrubbing, plus, Super Shine is lint-free so your shiny surfaces like mirrors, stainless steel, or glass are left streak-free.

Q: W b ?

: Research from McKinsey and NielsenIQ shows that 78% of US consumers care about sustainability and back it up with their wallets. A greener assortment translates to actual spending behavior, and with Nicky — grocery retailers don’t have to choose between sustainability or growth.

What’s more, Nicky believes that consumers should not have to choose between price, quality, or sustainability — they should be able to have all three. Carrying a brand like Nicky helps consumers create a more sustainable future without being too hard or expensive to accomplish. When you combine this with Sofidel’s passion for the planet, you have a triple win: A win for the consumer, a win for the retailer, and a win for the planet.

Q: W b ?

: Nicky is made with super soft and high absorbency FSC® certified virgin fiber, so the consumer gets a product that works. Prioritizing the use of FSC® certified virgin fiber as a raw material means that the paper used in the production of Nicky is from sustainably managed forests that follow strict management principles to ensure a quality sustainable product. In short, quality paper products do not mean there’s a need for deforestation.

Q: H w w w b ? W ?

: At Sofidel we consider the consumer, category, and the planet before launching a new brand. We look for gaps in consumer needs, or opportunities to improve the consumer experience. Our brands, like Nicky, should be highperformance so that less product needs to be used.

In addition to quality, Sofidel manufactures products in a way that removes anything unnecessary from the entire production cycle, resulting in less CO2, less plastic, and less water waste. Each innovation is deeply rooted in Sofidel’s Clean Living purpose: For everyday needs (the product), for a healthier planet (the environment), and for integrity and respect (the people).

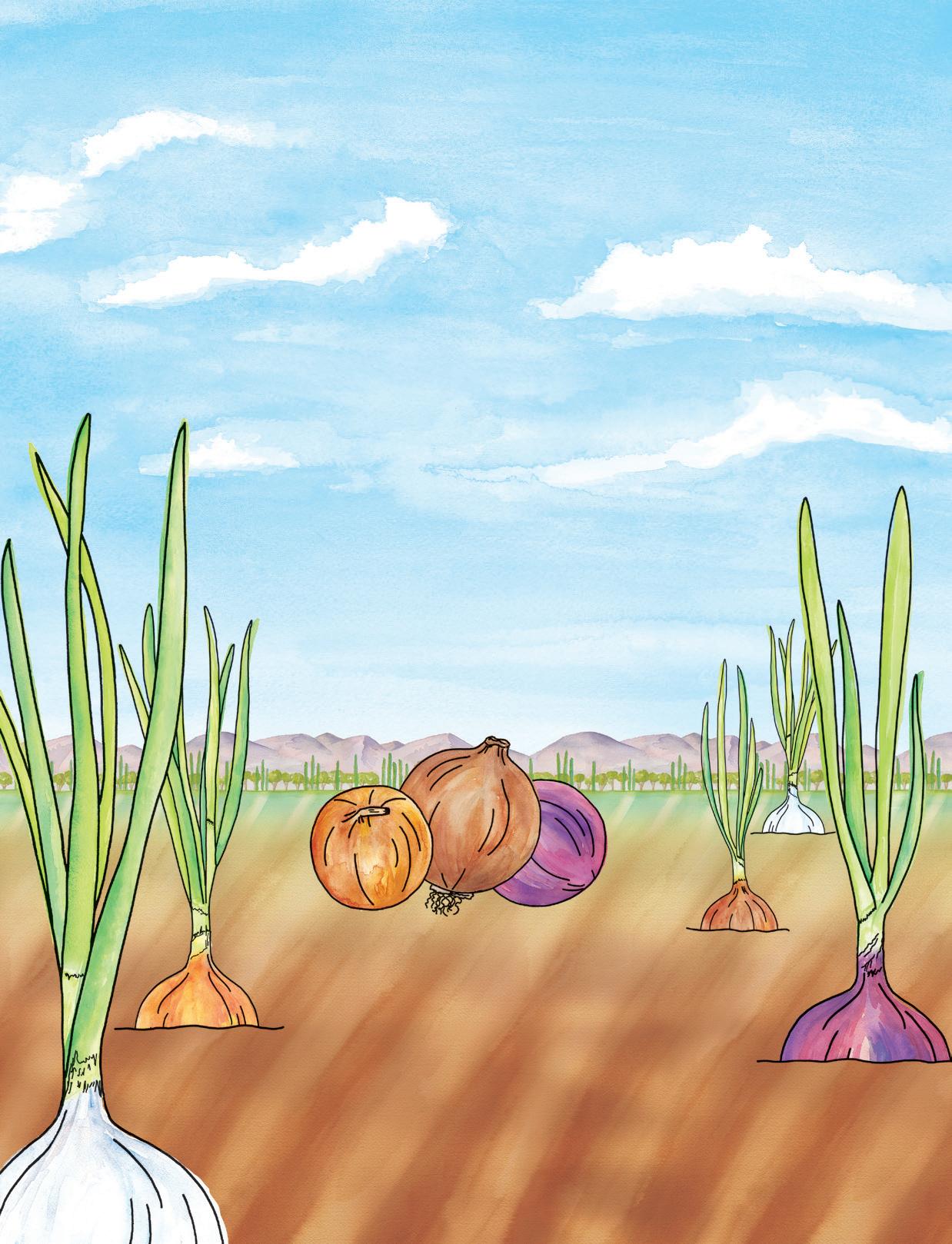

CONTINUED FOCUS ON INNOVATION IN THIS AREA CAN HELP RETAILERS CAPITALIZE ON EMERGING HEALTH TRENDS.

ore than half of consumers say that private brands are very or extremely important in determining where they shop, according to FMI — The Food Industry Association’s “Power of Private Brands 2023” report. With record-breaking private-brand sales outperforming national brands in 2022 and 2023, shoppers have increased private-brand purchases in the past year and say that they’ll keep buying them even if grocery prices decline.

As customers increasingly seek value beyond price, retailers should be expanding private-brand assortments that highlight elevated health, nutrition and sustainability attributes while also delivering on quality, convenience and experience.

The “Numerator Visions ’24 Consumer Trends” annual report predicts that private brands will continue to grow and play an important role in how retailers attract and maintain loyal customers. The report urges leaders to be proactive in addressing the increased consumer focus on improving health and wellness that is universal, transcending income levels, generations and ethnicities.

Continued focus on healthier private-brand innovation can help retailers capitalize on two emerging health trends influencing consumer purchase decisions: food as medicine (FAM) and GLP-1 weight-loss drugs. Both offer a unique opportunity for retailers to increase awareness (marketing) and sales (profitability) of healthier private-brand products.

Consumers are demanding more from their food, viewing it as medicine, and are increasingly aware of how food can increase the risk of diet-related illness and how nutrients in food can also optimize health. According to the latest FMI report on “Food Industry Contributions to Health and Well-Being,” supermarkets are a logical hub for the FAM movement, as they can offer a multifaceted approach that includes product curation, nutrition education, health care partnerships and digital innovation.

Further, the FMI report shares key insights on how brands are reformulating products to respond to consumer health-and-wellness trends, including the reduction of sugar, salt and portions, while adding beneficial ingredients to support health. With 7% of the U.S. population estimated to be on GLP-1 weight-loss drugs by 2035, the private-brand innovation and reformulation cited in the report are opportunities for retailers to help customers to manage weight loss and improve

Future privatebrand innovation will focus on improving the nutritional quality of food products and the promotion of innately healthy whole foods. the promotion of

diabetes outcomes with and without taking GLP-1 agonist drugs.

Traditional private-brand innovation has focused on the removal of negatives (i.e., “free-from” artificial fl avors/preservatives/ sweeteners/hormones/GMOs) and increasing the affordability and accessability of organics. Future innovation will focus on improving the nutritional quality of food products and the promotion of innately healthy whole foods that are the cornerstone of FAM initiatives (fruits, vegetables, nuts/seeds, beans/legumes, seafood).

The next generation of healthier private brands will help consumers battle the health conditions that are having the biggest impact on our health care system today — obesity, heart disease and cognitive disorders. Consumers need help increasing their intake of nutrients that support health: dietary fiber, omega-3 fats, (sustainable) protein, pre/probiotics and functional ingredients.

As well as leveraging the latest food, health and diet trend data to inform private-brand strategy, enlisting registered dietitian nutritionists (RDNs) adds credibility and builds trust with shoppers. RDNs can help design evidence-based consumer health promotion strategies that use new technology to influence shoppers along the path to purchase.

Barbara Ruhs, MS, RDN, is the owner of MarketRD.com, a marketing agency that provides nutrition and health strategy to food brands. A former retail dietitian (RD), she launched and directed an annual supermarket RD symposium for eight years. Connect @BarbRuhsRD on Instagram and LinkedIn.

Chief merchant Latriece Watkins and other execs detail the mega-retailer’s strategy to attract even more shoppers.

By Gina AcostaHere’s two things we know are true:

First, Walmart sells more groceries in physical stores than any other retailer in the United States. Second, Walmart sells more groceries online than any other retailer in the United States.

With those facts in mind, where could the company’s seemingly bulletproof value proposition for grocery possibly evolve next?

Walmart’s chief merchant and EVP, Latriece Watkins, knows the answer.

“The Walmart grocery value proposition — like everything we do — is rooted in our purpose, which is to help people save money and live better,” says Watkins. “To deliver that purpose, we have a customer value proposition based on having a quality assortment that we offer customers at everyday low prices. We combine those with our unique ability to provide customers a truly omni shopping experience in one of our more than 4,600 stores, on Walmart.com or both.”

According to Watkins, the company plans to continue to leverage its momentum in grocery “by working to understand customers’ evolving needs and innovating. This includes bringing innovation to our assortment in terms of quality and convenience, but also elevating the customer experience through technology.”

Walmart EVP and chief merchant Latriece Watkins hit the stage at the CES show in January to discuss all the ways that the retailer is innovating in grocery merchandising and fulfillment. The company's fourth-quarter earnings report, posted in February, showed mid-singledigit comp growth in grocery, resulting in strong market share gains in consumables.

What that innovation will look like becomes increasingly clear through talking with Watkins, as well as from comments made by other Walmart executives at the annual Consumer Electronics Show (CES) and National Retail Federation (NRF) trade shows earlier this year.

Assortment Quality and Convenience

Walmart U.S., which operated 4,717 stores and had annual sales of $420 billion in 2023, reported more than $247 billion in grocery sales last year, making it the No. 1 U.S. food retailer by a wide margin. The retailer’s fourth-quarter report, released in February, beat estimates and showed mid-single-digit comp growth in grocery, resulting in strong share gains (it already holds 25% of market share in U.S. grocery) in consumables, especially among higher-income households. Walmart’s customer value prop in grocery is just getting stronger with a growing cohort of value-seeking households, and the volatile macro environment is a big tailwind for the retailer. Watkins, who was elevated to chief merchant last year after decades of service with the company, notes that

Walmart is winning at grocery because its assortment strategy is focused on quality and convenience.

AI, generative AI and AR innovations will supercharge the retailer’s grocery strategy further.

At Walmart, the concept of adaptive retail is rooted in a clear focus on people.

the retailer is winning at grocery because its as sortment strategy is focused on quality and con venience. Walmart’s assortment is curated with the goal of providing customers with quality products at an unexpected value, she adds. The retailer is also constantly improving and expand ing its grocery assortment to satisfy consumer demand for national-brand and private-brand products with more flavor, variety and natural ingredients.

“We also think about lifestyle, so we build our assortment to enable customers to personalize their choices,” says Watkins. “This might include healthy options like gluten-free or plant-based products. … We want to be locally relevant, so we tailor assortment to the community. This might mean culturally specific baked goods, spices or other ingredients that uniquely reflect a community.”

Talking about the state of the (frugal) shopper, Watkins observes that the U.S. consumer continues to be stressed and is being careful when it comes to spend.

“It’s an interesting situation right now,” she admits. “On the one hand, the economy is doing really well, unemployment is low, and wages are growing. But our customers are telling us they’re feeling financially stretched. They’re concerned about inflation. We know this is true in grocery, because inflation has had a big impact on food prices over the past few years. Even though that’s easing a bit, customers are paying very close attention to how they spend. They’re making careful choices aimed at maximizing savings and value. We like to say we’re taking inflation out of the equation for our customers.”

During the holiday season, Walmart offered a Thanksgiving meal for a price lower than last year, effectively removing inflation on a holiday meal for eight to 10 people. According to Watkins, Walmart is doing it again for Easter this year.

But, believe it or not, value isn’t everything to today’s shopper, Watkins asserts.

“Customers definitely want convenience,” she says, adding that because convenience is a priority, the retailer is doubling down on stocking meal solutions that offer busy families healthy, flavorful and easy-to-prepare options.

There’s yet another angle to Walmart’s focus on convenience for grocery shoppers.

“We enable that convenience with an omni shopping experience — giving customers the ability to shop however, wherever and whenever they want to,” notes Watkins, “and we’re continually giving them more and more options

“The Walmart grocery value proposition — like everything we do — is rooted in our purpose, which is to help people save money and live better. To deliver that purpose, we have a customer value proposition based on having a quality assortment that we offer customers at everyday low prices. We combine those with our unique ability to provide customers a truly omni shopping experience — in one of our more than 4,600 stores, on Walmart.com or both.”

—Latriece Watkins, EVP/Chief Merchandising Officer, Walmart

by expanding delivery with early-morning options starting at 6 a.m., late-night up to 10 p.m., or express delivery in three hours or less.”

Since 2000, when Walmart first created walmart. com and samsclub.com, the company’s e-commerce capabilities have exploded. In its most recent fiscal quarter, the retailer topped $100 billion in e-comm sales for the first time as large numbers of shoppers used curbside pickup and placed grocery delivery orders. The company’s digital strategy has focused on improving customer-facing initiatives in stores and clubs and creating a seamless omni experience for customers. As such, the company has allocated more capital to supply chain, omni initiatives, technology and store remodels, and less to new store and club openings. This investment includes the creation of a Walmart Global Tech division, which employs more than 28,000 associates globally and includes businesses such as Walmart Luminate, GoLocal and Walmart Data Ventures.

Today, Walmart U.S. has more than 4,600 pickup locations and more than 3,900 same-day delivery locations (plus 34 e-commerce fulfillment centers). Its Walmart+ membership offering provides enhanced omnichannel benefits, including unlimited free shipping on eligible items with no order minimum, unlimited delivery from a store, fuel discounts, access to the Paramount+ streaming service, and mobile scan and go for a streamlined in-store shopping experience.

Since Walmart has heavily invested in omnichannel and e-commerce innovation, Watkins explains how AI, generative AI and AR innovations will supercharge the retailer’s grocery strategy further.

“We’re enhancing the digital shopping experience by using technology to create greater personalization and remove friction,” she says. “One great example of how we’re doing this is the AI-powered Walmart Shopping Assistant we’re currently testing that will bring a new level of simplicity and accuracy to the digital search experience for customers.” Gen AI search capabilities can work in cases where customers are shopping for an occasion versus shopping for items, she adds.

At CES, held in Las Vegas this past January,

We exist to make a better world by making meat right –better food, better care for our animals, better communities, and a better planet.

Proudly Carbon Neutral

Raised with NO Antibiotics

Humanely Raised

Walmart CEO Doug McMillon discussed how Walmart’s Shopping Assistant tool might support a customer looking to host a Super Bowl party.

“Instead of searching for chips, then dip, then drinks, paper plates or napkins, a customer might say, ‘Show me everything I need to host a Super Bowl party,’” he said. “That search will then generate suggestions for a range of food and general merchandise options for the customer to consider. It might also include items they hadn’t thought of. Once they place the order, they can decide if they want to pick it up or have it delivered.”

Speaking of grocery delivery, Walmart is expanding its InHome program, which delivers orders straight to a shopper’s kitchen, garage or doorstep. Tips are included, and no delivery fees or item markups are included. InHome will now feature replenishment, an AI-powered offering that aims to automatically order groceries when the customer needs them, and deliver them, too.

“It’s a feature we’re building using AI to get a personalized replenishment algorithm,” said Whitney Pegden, VP and GM, Walmart InHome, at CES. “It learns the customer’s purchase patterns to determine the perfect cadence to restock their essentials. So, the long list of things you purchase frequently, whether it’s the ones you need every week, or the things you need every 17 days, they’ll be there the moment you open the fridge or pantry. And you don’t have to lift a finger.”

Pegden made sure to emphasize that the new Walmart service isn’t a subscription (like Amazon’s Subscribe & Save program, for instance).

“For example, I know in my house, we consume a lot of yogurt, waffles, milk, some other things, but how much? And what exactly are those other things? Our replenishment service solves that. It’s personalized and adjusts based on your changing needs. Not only are we going to get you what you need, we’re going to get it to you when you need it, and even where you need it, right to your refrigerator,” she said.

The service even allows for vacations.

“You can adjust for that if, say, you know you’ll be away for vacation, and you don’t want more milk showing up,” observed Pegden. “That’s all in your control. Bottom line, the entire shopping experience is automated, from filling the basket to delivery to your refrigerator, whether that’s in your kitchen or your garage.”

At CES, McMillon described business leaders as standing at a fork in the road, with two paths ahead.

“One path is to completely prioritize technology, to maximize what’s possible without considering the people implications,” he said, as the words “technology,” “people-led” and “tech-powered” flashed on a giant Walmart-blue screen behind him.

“Then there’s the other path,” he continued. “It’s more nuanced. It’s one where the benefits of technology are pursued, but people are considered along the way. This is by our heads

and our hearts. The underlying principle is that we should use technology to serve people, and not the other way around. This path enables people to do things in more efficient and enjoyable ways.”

He asserted: “We’re choosing the second path.”

It was the first time that McMillon so eloquently made clear that Walmart intends to continue founder Sam Walton’s servant leadership legacy of “people first,” even in the face of relentless transformation — and competition — in the industry.

“Sam challenged us to design our business to make a bigger, more positive difference in our world,” said McMillon. “That’s what inspires us to solve problems and address our own imperfections. Making a real difference for so many families is what gets us up, and fires us up, every morning. … We love what technology can do, but we’re building it in a way that creates better careers at the same time it creates the best customer experiences, and a stronger business.”

To tell the Walmart future story, McMillon used the opportunity of his keynote address — a first for the retailer at CES — to serve up the best and brightest minds from his executive leadership team. Of the company’s execs at the show, it was Suresh Kumar, EVP/global chief technology officer and chief development officer, who stole the show by introducing the retailer’s new mantra of “adaptive retail.”

“While omnichannel retail has been around for decades, this new type of retail — adaptive retail — takes it a step further,” observed Kumar. “It’s retail that is not only e-commerce or in-store, but a single, unified retail experience that seamlessly blends the best aspects of all channels. And for Walmart, adaptive retail is rooted in a clear focus on people.”

Walmart Global Tech SVP/COO Anshu Bhardwaj, who is scheduled to keynote Progressive Grocer’s GroceryTech event in Dallas this June, explained it as

The grocery retail landscape is undergoing an unprecedented shift and the stakes are higher than ever. How will you harness emerging technologies like Generative AI and progressive grocery retail strategies to enable intelligent and resilient operations, merge physical and digital realms seamlessly and foster an environment where memorable experiences win the hearts and minds of your customers at every touchpoint?

Cognizant is the vanguard of grocery retail transformation, sitting at the intersection of deep industry expertise and technology foresight to help you see around the next big corner. With solutions that span the entire grocery retail value chain, we position and propel brands to win in the next digital grocery retail era.

a bet on hyper-personalization.

“There’s a couple of buckets of retailers,” said Bhardwaj. “Some are still on the omnichannel journey, so they’re continuing to focus on the basics of omnichannel — buy online, pick up in store — making sure the customers know they have that option. I think these retailers will continue down that path. Then there’s another bucket, which is slightly ahead and continuing to invest in hyper-personalization. For us, we are turning into an adaptive retailer. … Omnichannel was bringing e-comm and brick and mortar together, right? Adaptive is: There’s so many other ways to shop, there’s so many other ways to discover.”

According to Bhardwaj, Walmart will continue adapting rapidly to what the customer needs.

“For example, we are adding drones,” she said. “Drone delivery is going to be available to millions of people in Dallas, and 75% of the products we have in a supercenter can be delivered through drones, which is massive.”

In January Walmart placed a big bet on drones by expanding drone delivery across the DFW metro, marking the first time that a U.S. retailer has offered drone delivery to this many households in a single market. The deliveries will be powered by on-demand drone delivery providers Wing and Zipline. Both are approved by the FAA to fly their drones without a dedicated observer.

Drone delivery gives customers a faster delivery option, getting items to them in 30 minutes or less, and some deliveries can happen in as fast as 10 minutes. Popular Walmart orders via drone include rotisserie chicken and cold medicine.

“On the search side, generative search, we are offering text to shop, social shopping with friends,” added Bhardwaj. “So, whatever suits a consumer at a point in time, we will adapt to his or her needs and become a concierge. … I think where most retailers will be focused is going to be on the customer side, but some of the more savvy ones will want to start pivoting to associates, too. For us, that’s a big area of investment over the last five years, because if associates can’t shop the shelves, you won’t have sales in the store.”

At the top of Walmart’s 10-K is its value proposition: We are a people-led, technology-powered omnichannel retailer dedicated to help people around the world save money and live better.

Bhardwaj isn’t kidding about the company’s investment in its more than 1.6 million associates in the United States and more than 2 million across the globe.

At CES, EVP/Chief People Officer Donna Morris talked about the retailer’s new tools for U.S. and Canada campus-based associates.

“Walmart is people-led and tech-powered, and we know that the best way to help our people reach their full potential is to

provide the same intuitive, consumer-grade experience we’ve built for our customers and members,” said Morris. My Assistant, created in-house by Walmart’s Global Tech team, will enable associates to interact with the tool in their native language. From speeding up the drafting process, to serving as a creative partner, to summarizing large documents, My Assistant is poised to change how associates work and solve problems. That’s not the only new tool for Walmart employees, however.

“As customer expectations have changed, we’ve also accelerated the digital journey for our associates and built an app called Me@Walmart,” noted Morris. “This app gives our associates the ability to manage their schedules, gain new skills that can assist them in moving across roles in the company, and even make changes to personal benefits such as their 401(k) or stock purchase plan.”

As the company becomes more tech-powered, it will continue to evolve to support associate growth while also meeting the needs of customers, according to Morris.

“At the end of the day, we want people to grow and to thrive,” she added, “and we want everyone to know that they belong at Walmart. We are people-led and we are tech-powered, but it will always be our people that make the difference.”

Echoing her remarks, McMillon characterized Walmart’s future journey as really just a simple story about people.

“Today, we focus a lot on the technology that’s powering adaptive retail, and we described the future of shopping,” he said, “but remember that this is a story about people who are learning and adapting to make that future real. We all have a choice to choose a future that puts people first. If we keep doing that, we can help people around the world live a better life. That’s what we want. That’s the world we want to help create.”

Progressive Grocer singles out 10 food retailers that are excelling at eco-friendly actions and messaging. By PG Staff

Sustainability is a growing concern. According to Mike Johnston, managing director of data products at international research tech firm Glow, citing recent research from his company: “While 83% of shoppers deem it important for retailers to act sustainably, only 31% currently cite sustainability as a significant influence on their retailer choice. However, this gap will narrow, with 45% of shoppers expecting sustainability to have a greater impact on their choice of retailers in the next 12 months, and only 15% anticipating a decline.” Given that so many consumers have the planet’s health on their minds, it makes sense that most forward-looking grocery retailers do, too.

The following pages contain details of 10 exemplary supermarket companies’ wide-ranging sustainability efforts, encompassing such areas as store design and landscaping, packaging, product sourcing, food waste, refrigeration, fleet mileage, and more. The operators range in size from chains

that are part of sprawling multinational businesses with thousands of locations across various countries to a regional cooperative grocer with just 15 locations to a pure-play e-grocer with no brick-andmortar stores at all, but they all share an unwavering commitment to advancing policies designed to help save the earth, as well as to effectively publicizing their environmental, social and governance (ESG) efforts and achievements. Glow’s Johnston puts it succinctly: “After all, if shoppers aren’t aware of a retailer’s positive impact on people and the planet, how can they choose it over the competition?”

Read on to find out more about the outstanding sustainability moves of Ahold Delhaize USA, ALDI USA, Giant Eagle, Meijer, PCC Community Markets, SpartanNash, Thrive Market, Tops Markets LLC, Wegmans Food Markets and Whole Foods Market.

Hussmann is proud to offer our Transcritical CO₂ Rack as an integral piece of our Evolve Technologies portfolio.

As your trusted partner, we’re ready to help you meet regulatory standards and reach Low Global Warming Potential goals while optimizing retail conditions for your shoppers.

S u T k S M k I u u w C u - u w ’ u

SMI w P G w k

PG: bu W ’ u

SMI: FI 61 j ’ 30 2 36 - F 3

W - - 60 I ’ j —

30 j

S x 10

PG: W bu

SMI: F k u w u u F

SMI: I O ’ q

W — 0 M C ’

PG: W bu w u

PG: T u bu w b

C

SMI: — 80 DWS S ’ I — 8 U q

WILD L SK

PG: W k b

SMI: B C ’ S“ ” S 8 x S q ( 2 ) q (48 ) w u b “ w k ”

bu w k S

C w u

w u 6

b w S k

k u b w u b k

T k S M k I u ( SMI)

u u F : www k / /

Ahold Delhaize USA, known for its distinct local brands in this country, is part of a multinational retail conglomerate long dedicated to sustainability. As revealed in its annual report for 2023, parent company Ahold Delhaize made significant progress in this area across its companies, further re ducing GHG emissions in its own operations by 35% compared with its 2018 baseline, lowering food waste per food sales by 37% com pared with its 2016 baseline, and reducing virgin plastic in own-brand primary packaging by 10% compared with its 2021 baseline.

Core Green Building Certification for its Cony Street store, in Augusta, Maine; Giant Food’s work with Divert to process more than 30.8 million pounds of wasted food in the first year of their collaboration, mitigating almost 1,400 metric tons of greenhouse-gas emissions; and The Giant Co.’s annual Healing the Planet grant program, which donates hundreds of thousands of dollars to projects addressing food waste prevention, reduction and recovery across the chain’s market area of Pennsylvania, Maryland, West Virginia and Virginia.

The company also expanded the report’s environmental, social and governance (ESG) section with additional details, among them a new overview of the UN Sustainable Development Goals and how it’s working to help fulfill them, and it also related its efforts to comply with the Corporate Sustainability Reporting Directive. Its aim to have climate targets in

ALDI USA started 2024 with a heartfelt letter to customers from CEO Jason Hart, who highlighted steps that the discount grocer is taking to increase sustainability without increasing prices for shoppers — no small feat at a time of such rapid expansion for the organization. Hart summarized key accomplishments in this area, such as the elimination of plastic shopping bags from all of its stores, a move that saves nearly 9 million pounds of plastic from circulation each year.

Hart also explained recent investments in sustainability features and technologies, like the use of more eco-efficient refrigerants and refrigeration systems. “We are proud of what we’ve accomplished together so far, and we thank you for doing your part to help protect the planet and support the causes that matter most to our communities,” he wrote. “There is

line with the 1.5º C scenario hasn’t changed, but it did update its scope 3 targets in alignment with the latest communication of the Science Based Targets initiative. Thanks to its ESG efforts, Ahold Delhaize has received an AAA rating from MSCI, indicating the company’s status as an industry leader in managing financially relevant ESG risks and opportunities.

As for the actions of individual U.S. brands, these include Hannaford’s pursuit of the Living Building Challenge

more work to be done, and we look forward to sharing our progress on this journey.”

Shoppers can check out that progress by browsing ALDI’s most recent sustainability report, which details other intended and completed steps in a greener direction. The report is divided into different areas of sustainability, including measures to lessen the company’s carbon footprint, reduce packaging, slash food waste and enhance responsible sourcing.

Recognizing the importance of tak-

Additionally, Marc Stolzman was recently named Ahold Delhaize USA’s chief sustainability officer, shortly after Alex Holt took on that role at the parent company, where she succeeded Jan Ernst de Groot. Stolzman oversees all aspects of health and sustainability for the U.S. businesses, including strategy and goal setting, in accordance with Ahold Delhaize’s global sustainability ambitions and commitments, in addition to all U.S. regulatory, compliance and financial reporting.

ing incremental steps that have a larger effect, ALDI seizes a variety of opportunities to do things in eco-friendlier ways. For instance, the retailer switched from printed to electronic shelf labels, saving both paper and labor. The company also leverages partnerships for the greater good, from its participation in the U.S. Plastics Pact to collaboration with suppliers to reduce food and packaging waste. Seeking to close the proverbial loop, ALDI also engages and encourages shoppers to recycle at home by adding the How2Recycle logo to packages and sharing messages on its various platforms.

As the retailer expands its physical footprint while being mindful of its environmental footprint, ALDI has a literal built-in advantage, too. Its smaller-format stores are inherently efficient from a square footage perspective, and its comparatively smaller assortment offers both price and sustainability benefits. Less, in this case, is definitely more.

In keeping with its ongoing commitment to a greener environment, Giant Eagle has continued setting new goals and creating forward-thinking programs to address everything from pollinator health to seafood sustainability.

According to Friends of the Earth’s 2023 “Bee-Friendly Retailer Scorecard,” a report tracking what the biggest U.S. retailers are doing to address toxic pesticides used in their supply chains that affect bees and other biodiversity, Giant Eagle increased its score from a B to B+ for its recent efforts, receiving the organization’s highest score. To date, Giant Eagle is the only major U.S. food retailer to set a measurable goal for pesticide reduction, with a policy aimed at eliminating the use of nitroguanidine neonicotinoids.

On the seafood side, Giant Eagle took part in the Global Seafood Alliance’s (GSA) second annual consumer campaign to celebrate October as National Seafood Month, which was focused on increasing consumer awareness of GSA’s Best Aquaculture Practices certification and driving sales of responsibly produced and sourced seafood. This was only to be expected for a company ranked among the top 10 major U.S. grocery retailers for socially responsible sourcing in the second edition of Greenpeace’s “High Cost of Cheap Tuna” report, published in February 2023.

In an impressive own-brand move, the grocer recently relaunched the Nature’s Basket private brand and, in doing so, focused on offering products that are responsibly sourced and offer high-quality ingredients. Giant Eagle teamed up with sustainable food-rating company HowGood to evaluate the environmental and social impact of each item in the Nature’s Basket line and to

provide a comprehensive sustainability rating for its customers to consider. Products that achieve HowGood Ratings of Good, Great and Best have an overall environmental and social sustain-

Just like its stores include a wide range of products that reflect its superstore roots, Meijer’s longstanding sustainability road has multiple lanes. The employee-owned retailer continues to make investments — and strides — in its diverse goals to improve the health of the planet.

Those efforts include in-store and online initiatives and, sometimes, the in-between area of outdoor spaces. From testing a parking lot pavement made with recycled plastic shopping bags to installing eco-friendlier landscaping, the retailer eyes many areas of its properties. Last fall, Meijer teamed with the EVgo Inc. network to add more fast-charging stations at select stores; so far, EVgo has deployed 24 charging stalls at Meijer locations across Michigan and Ohio.

Meijer also continues to conserve and optimize resources within the proverbial store box. Refrigerants are one area of continuous improvement, as the retailer was recognized by the Environmental Protection Agency’s GreenChill Program for having the lowest corporate-wide refrigeration emissions rate out of all its partners in 2023. According to Meijer Chief Administrative Officer Vik Srinivasan, the retailer has made “significant progress” toward its goal of reducing absolute carbon emissions by 50% by next year, due in part to its

Pacific Northwest cooperative grocer PCC Community Markets earned the Living Building Challenge (LBC) Petal Certification last year for its Downtown and Kirkland, Wash., stores. The certification is established and awarded by the International Living Future Institute (ILFI) for meeting the world’s most rigorous

ability impact better than more than 70%, 85% and 95% of food products assessed by HowGood, respectively. About 70% of Nature’s Basket items have earned a

focus on refrigeration management.

Reducing food waste and packaging waste are other important sustainability categories for the Midwest grocery business. A few months ago, Meijer revealed that it was the first retailer nationwide to carry mini carrots packaged by Bolthouse Farms in compostable bags. The retailer is also working on making its store-brand packaging 100% recyclable, reusable or compostable.

Meanwhile, Meijer has diverted more than 10 million pounds of potential food waste through the Flashfood app. All stores currently offer the food waste reduction program that allows customers to buy items nearing their sell-by dates at up to 50% off the normal price. Meijer was the first U.S. retailer to hit that milestone.

As a testament to its commitment, Meijer held a sustainability summit last fall. The virtual event enabled suppliers to showcase their environmentally conscious products, bringing its efforts full circle back to store aisles.

green building standards. These two locations join PCC’s Ballard, West Seattle and Bellevue stores in receiving this esteemed recognition.

“The certifications for Downtown and Kirkland are significant milestones in the co-op’s practice of regenerative operations and advance the health and well-being of the people and communities we serve,” said PCC Director of Store Design Lori Ross at the time.

In designing and building its stores, PCC worked to reduce the environmental impact of human movement by providing resources for staff and shoppers who are walking, biking or taking public transit to the stores. For example, each location features bike racks, and PCC helped secure 10 EV parking stalls at the Downtown location and created the capacity for four EV parking stalls at the Kirkland PCC store.

The grocer also reviewed hundreds of building materials and pieces of equipment to confirm that all materials used in constructing the Downtown and Kirkland stores were LBC compliant. The company adhered to specifications for types of timber and sourced Red List-free interior materials for drywall, concrete finishes and paints.

In addition, PCC recently expanded its Growing for Good program into central Washington. Growing for Good supports the stream of fresh produce from small farms in the Puget Sound region to local hunger relief agencies. Since it began in 2020, it has grown to include 16 farms, along with 21 community-based hunger relief agencies.

Online retailer Thrive Market is on a mission to build the world’s first climate-positive grocery store, and the company boasts the certifications to prove it. The e-grocer is currently Climate Neutral Certified through measuring, reducing and compensating for 100% of the carbon emissions generated from making and delivering its products.

Thrive Market has a plan to reach its goal of carbon negativity (also known as climate positivity) by 2025, and it will work toward science-aligned reduction targets by optimizing shipment loads and increasing its investments in regenerative

Late last year, food solutions company SpartanNash shared an in-depth look at its 2022 advancements in sustainability initiatives, environmental health and more, as well as revealing its 2025 environmental, social and governance (ESG) goals, which are aligned to the core capabilities of people, operational excellence and insights that drive solutions.

On the environmental side, SpartanNash reduced fleet mileage by 12% in 2022, decreased distribution center facility ozone-depleting emissions by 59%, and began converting distribution center lighting, which led to a 6% decrease in electricity use. The company also diverted more than 4.2 million pounds of food from landfills.

Moving forward, SpartanNash will publish its ESG report on a biennial basis, with its next comprehensive report set to be released in 2025 and covering its progress in 2023 and 2024. By 2025, the company intends to use 100% renewable energy and also plans to complete two large projects focused on converting from freon to ammonia or carbon dioxide in its distribution centers.

Additionally, through its partnership with app-based marketplace Flash-

agriculture. The company will also continue to employ ground-only shipping and support reforestation projects.

Additionally, each Thrive Market warehouse is TRUE Certified for Zero Waste, meaning that the company recycles or repurposes at least 90% of the materials that enter its facilities. To

food, SpartanNash revealed last year that it had saved 1 million pounds of food waste while also helping families save $1.9 million on their grocery bills. The two companies have worked together for several years, starting with a pilot program at SpartanNash’s Family Fare and Martin’s Super Markets banners in Indiana and Michigan in 2020, and expanding to include 44 stores operated by Family Fare and SpartanNash-owned VG’s Grocery in Iowa, Michigan and Nebraska.

SpartanNash’s other eco-friendly initiatives include such wide-ranging efforts as a partnership with sustainability solutions organization Ecodrive to plant 20,000 mangrove trees in Kenya to mark Earth Day last year. Mangroves capture and store millions of pounds of carbon dioxide in their lifetime; they also create a habitat for hundreds of organisms and protect shorelines from erosion and storm surges. For every 100 trees planted, one full workday was created for a villager in need.

maintain that certification, the company must continue to meet its 90% diversion requirement every year.

Plastic neutrality is another sustainability initiative that Thrive Market is working toward. In 2022, it reduced plastic shipping materials by 70%, and the plastic used in the packaging for its owned brands and shipping for all member orders is Plastic Neutral Certified through a partnership with rePurpose Global, which recovers as much plastic from nature as Thrive Market’s materials create. The online grocer has plans to continue cutting plastic usage wherever possible and to maintain its certification with rePurpose Global.

Corrugated boxes make the world go ‘round in a truly circular motion. The industry’s long-standing commitment to sustainability adds up to an incredible 50% per unit reduction in the greenhouse gas emissions for an average corrugated box from 2006 – 2020, and we’re still improving. Boxes transport everything with the right combination of new, fresh fibers and recycled fibers to maximize reuse and enable circularity. New fibers come from renewable, sustainably managed trees that take carbon dioxide out of the atmosphere – tackling a major threat to our climate. And, more than 90% of corrugated boxes are successfully recycled.

If you’re thinking circular, you’re thinking corrugated.

Learn more about the renewability, recyclability and responsibility of boxes at: https://www.fibrebox.org/life-cycle-assessments.

Northeast grocer Tops Markets’ sustainability efforts continue to pave the way for a greener future. In 2023 alone, its stores recycled more than 503 tons of organic scraps, which include unusable produce, floral, bakery cull and unsaleable produce. Tops can divert food from landfills by partnering with companies like Organix Recycling. The grocer also partners with farmers who use these scraps for feed.

The company’s recycling efforts don’t stop there. Its Used Cooking Oil Program has recycled 102-plus tons of used

cooking oil and repurposed it into other products such as biofuels that reduce the world’s carbon footprint.

Last year, Tops began transitioning to BioFlex bags instead of traditional plastic bags for its potatoes, becoming the first retail chain to adopt this technology. BioFlex increases the natural microbial activity in modern landfills and contributes 19 times more energy than that of regular plastic. The FDA-compliant, 100% recyclable packaging biodegrades in landfills and converts into renewable methane gas.

Shoppers walking into Wegmans Food Markets’ flagship store in Rochester, N.Y., can expect to see the retailer’s commitments to sustainability front and center, right past the entrance doors and next to the shopping carts. There, the retailer has several large automated receptacles available for the recycling of plastic, glass, cans, cardboard and mixed recyclables.

Once the recycling is done, shoppers can grab a cart and roll into the main part of the store, where a sign over the produce department declares “PROUD: Reducing our food mile emissions,” a testament to the retailer’s pledge to source food as locally as possible. That’s one of Wegmans’ sustainability pillars: More Responsible Sourcing. To reduce its carbon footprint, Wegmans is focused on sourcing from farms and suppliers near stores to minimize food miles, employing compressed natural gas and electric vehicles to decrease diesel usage, and prioritizing energy efficiency across operations.

Wegmans’ other pillars include More

Then there’s Tops’ Fresh Recovery Program, which has been expanded at 130 store locations across New York state. The initiative tackles food waste head-on by focusing on rescuing and repurposing fresh produce and perishable items that would otherwise go to waste. Tops has operated a similar program for decades, partnering with local food banks, food pantries and community organizations to ensure that surplus food is redirected

to those in need. By redistributing these items, the program not only combats hunger, but also reduces the environmental footprint associated with food waste. More than 310-plus tons of food was repurposed last year.

In addition, Tops has been renovating its Northeast stores for the past year with sustainability in mind. To that end, various New York and Pennsylvania locations have been renovated with such features as energy-efficient equipment and LED lighting, solar-powered efficiencies, and EV-charging stations.

Sustainable Growing, More Waste Reduction and More Sustainable Packaging. The company operates an organic farm and orchard in Canandaigua, N.Y., where it leverages regenerative farming practices and crop rotation to grow the most flavorful produce. Its zero-waste initiatives include donating excess food to area food banks and farms, a commitment to composting, and exploring new recycling programs for materials such as waxed cardboard. Finally, Wegmans is focused on reducing plastic packaging and using packaging made from renewable or

recycled material.

Also, while industry standards exist for responsibly sourcing seafood, Wegmans holds itself to an even higher standard across the areas of sourcing, freshness and traceability. Its seafood comes from facilities that are certified to the standards of the Global Food Safety Initiative (GFSI), the Global Dialogue on Seafood Traceability (GDST), the Global Sustainable Seafood Initiative (GSSI) and the Sustainable Supply Chain Initiative (SSCI).

Few retailers have sustainability woven into their DNA like Whole Foods Market. The company’s stated purpose, printed on signage visible by customers in every store, is to nourish people and the planet.

Whole Foods has been long an industry leader in offering shoppers an eco-friendly, responsibly farmed, animal welfare-rated and sustainably sourced grocery shopping experience. The company was the first U.S. grocer to ban plastic grocery bags at checkout in 2008 and plastic straws in 2019. In 2007, it became the first and only food retailer in North America to introduce 100% post-consumer recycled-content paper bags. It has eliminated all Styrofoam (polystyrene) meat packaging trays in North American stores. And it has replaced all hard-plastic rotisserie chicken containers with bags that use approximately 70% less plastic.

Last year at Progressive Grocer’s

Grocery Impact conference, Whole Foods CEO Jason Buechel discussed the collective role that grocers play in our global food system and the company’s belief that food can and should be a force for good. Buechel urged industry leaders to consider responsible sourcing and climate-smart practices, including regenerative agriculture, as solutions to repair the gaps in the food system.

“Climate-smart agriculture has the capacity to reverse and heal our environment and our soil,” he said at the conference. “To tackle this challenge, Whole Foods Market is working with

suppliers, scientists, experts and other committed organizations to learn how we can utilize organic and regenerative agriculture to evolve the growing, harvesting, and producing of crops for food and other products.”

Also in 2023, Buechel unveiled Growing with Purpose, Whole Foods’ 10-year vision to lead the company into the future, focused on enhancing the store experience, investing in team member growth and expanding the company’s reach to serve customers in new ways.

THE BAKERY AND DELI SECTIONS OF SUPERMARKETS ARE RIPE FOR INNOVATION.

By Barbara Saxhe in-store bakery remains a powerful supermarket destination. A recent study from Arlington, Va.-based FMI – The Food Industry Association has revealed that more than half of shoppers (53%) say that in-store bakery items are fresher and taste better than those in the commercial bakery aisle. A full 95% of shoppers eat a bakery item at least occasionally, and 63% eat a bakery item on a weekly basis.

Nearly two-thirds of shoppers (72%) say that they buy indulgent treats (such as doughnuts, cakes, cookies and pies) at the same store where they purchase their groceries. Futher, a majority of these purchases are impulse buys.

“Consumers want to focus their daily diet on the best-tasting products, leading to a shift from center store packaged goods to in-store bakery items that are fresher and more indulgent,” says Brant Cash, managing director at New York-based global

Artisanal breads are gaining appeal in the in-store bakery, along with international flavors and healthier options.

Tech solutions can help elevate grocery stores’ bakery business. Pizza programs and specialty cheeses can drive sales in the deli department.

investment bank Harris Williams. “The confluence of these consumer themes bodes well for the premium baked goods sector.”

Supermarket retailers clearly have an opportunity to maximize their bakery departments. FMI’s research shows that shoppers want variety from their in-store bakery, including more cultural/ethnic options and a greater number of indulgent items, and they want these offerings to be fresh.

Supermarkets are raising their game in the bakery department with improved products and expanded variety. Research from Arnhem, Netherlands-based Innova Market Insights reveals that consumers are increasingly seeking unique bread experiences and view artisanal breads as an affordable everyday indulgence. This trend is fueling the popularity of traditional and artisanal varieties, and as a result, baguettes, ciabatta and naan bread are now widely available in supermarkets.

Lakeland, Fla.-based Publix Super Markets recently debuted Italian-inspired Tutto Pugliese bread, made exclusively from durum wheat semolina flour and certified sourdough flour,

which are typically used to make pasta. The grocer’s bakers trained for months to produce the loaf, which has a higher hydration than other breads produced in the bakery and requires extra handling. Each loaf is shaped by hand, made daily and sold in paper bags.

For its part, The Kroger Co. recently revamped a number of its private label bakery offerings, includ -

•

ing its Private Selection Signature Buttercream Cakes, Private Selection Cinnamon Rolls, Private Selection Cinnamon Crumb Cake, Fresh Baked Chocolate Chip Cookies and Private Selection Croissants. The Cincinnati-based retailer also added a Private Selection French Baguette to its lineup.

Adding new twists on old favorites creates novel flavor experiences that entice customers. “A churro doughnut isn’t that much different than a sugar cinnamon doughnut, but they can be from different cultural experiences,” notes Sarah Hickey, senior director of insights and market research for Jackson, Mich.-based Dawn Foods North America.

From mochi desserts infl uenced by Japan to Middle Eastern baklava, international fl avors can provide new inspiration to traditional desserts. FMI research shows that two-thirds of shoppers want to see cultural or ethnic bakery items in-store, and more than half (58%) are already fi nding these products in grocery store bakery departments.

“Food retailers have an opportunity to expand the assortment of cultural and ethnic bakery items they offer and to consider seasonal options,” observes Rick Stein, FMI’s VP of fresh foods. “This could also be paired with weekly themed meals — Taco Tuesday with tortilla options, or Italian Thursday with an artisanal Italian loaf. This offers both meal ideation and convenience for shoppers and enhances the value of their shopping experience.”

Meanwhile, Hickey urges retailers to think about layering in flavors like matcha or savory tahini to give nostalgic favorites

“A churro doughnut isn’t that much di erent than a sugar cinnamon doughnut, but they can be from di erent cultural experiences.”

—Sarah Hickey, Dawn Foods North America

an ingredient upgrade, or infusing pastries with unexpected fruit options.

New fl avors are particularly important for seasonal products, which play a big role in driving incremental sales. A recent report from Dawn Foods notes that “operators can also expand beyond traditional seasons and holidays to celebrate quirky mini-holidays like ‘National Lemonade Day’ or ‘National Donut Day.’ Decorated baked goods, like a Pink Lemonade Old Fashioned Donut, are an easy way to participate in these single-day activations.”

Consumers are also health conscious when it comes to bakery items. FMI’s 2023 “Power of In-Store Bakery” study revealed that two-thirds of shoppers paid attention to at least one nutrition-related claim when purchasing functional bakery items, with whole grains and fi ber topping the list of callouts. Yet, while 54% of shoppers noticed calorie callouts at times in their instore bakeries, only 21% of shoppers were infl uenced by them when making their bakery selections.

In addition, about one-third (33%) said that health, nutrition and better-for-you choices have a lot of impact on their choices of indulgent bakery items or desserts. “Consumers want to indulge themselves, but they are also more demanding in terms of product quality and their own health and wellness, driving greater emphasis on clean-label bakery products,” says Harris Williams’ Cash.

“Food retailers have the opportunity to highlight ingredients and functional bakery items by calling attention to whole grain, minimally processed ingredients, allergen-free and other attributes,” notes Stein. “One way to do this is to leverage MyPlate resources, which help make the Dietary Guidelines for Americans

Texas Pete® offers a wide range of sizes, heat levels, and flavors for all your supermarket deli needs. From packet to gallon, Original Hot Sauce to ¡Sabor! by Texas Pete® Mexican-Style Hot Sauce and CHA! by Texas Pete® Sriracha Sauce, you’ve got the versatility and variety you need to keep customers happy and fresh flavors at the forefront.

Proudly Passed Down: Family-Operated Since 1929.

®

Learn More at TexasPeteFoodservice.com. To get started, email Dan today at SalesStaff@garnerfoods.com.

easy to understand. MyPlate recommends that at least half of the grains we eat should be whole grains, which is an easy message for shoppers to understand and can be called out instore and online at the point of purchase.”

FMI’s research indicates that retailers can also win with shoppers by calling out products made with “real” ingredients, without artifi cial fl avors and coloring, and by offering smaller portion sizes, lower-calorie alternatives, or other nutrient content claims such as reduced sugar or reduced fat.

According to industry experts, tapping into tech solutions can help elevate the bakery business. “There are many ways — most of them easy to adopt — for bakeries to leverage technology to help them create relationships with customers as well as improve their daily operations,” says Cathy Wisloski, manager of insights and customer experience at Dawn Foods. “One

ELEVATED OFFERINGS OF THIS TYPE IN THE DELI DEPARTMENT CAN HELP ATTRACT SHOPPERS IN SEARCH OF PREMIUM DAIRY PRODUCTS. By Bridget

Another way to lure customers to the in-store deli is by offering an enticing selection of premium cheeses. According to research released in March by Chicago-based Circana and 210 Analytics, in San Antonio, specialty cheese remains an area of strength in the deli, whereas pre-sliced and service cheese declined in February. The market researchers reported specialty cheese segment dollar sales of $6.2 billion for the latest 52 weeks ending Feb. 25, up 2.8% from the year-ago period, while pounds purchased were up 1.4% from last year.

Recently released products in this space include Belle Chevre’s Greek Kiss, described by the Elkmont, Ala.-based company as “an exquisite 4-ounce fresh chèvre disc artfully enveloped in tender, brined grape leaves, infusing the tangy goat cheese with subtle notes of lemon and sea salt. Upon unveiling, the creamy-colored goat cheese beautifully contrasts with the muted-green grape leaf, creating an eye-catching addition to any cheese board. Each package is vacuum sealed to ensure optimal freshness, featuring a captivating label that artfully depicts an embrace reminiscent of Greek sculpture.” The product was sampled at the Winter Fancy Food Show this past January in Las Vegas.

Also at the Winter Fancy Food show were selections from Northern California brands Laura Chenel and Marin French Cheese Co.

“Our latest creation, Pear, Sauvi-

Goldschmidt

gnon and Herb, is a moment of pure excitement for us,” said Durae Hardy, brand manager at Sonoma, Calif.-based Laura Chenel, in January. “This exceptional goat cheese encapsulates the unwavering commitment of our cheesemaking team’s ability to infuse genuine craftsmanship into a delightful, innovative flavor. Beyond being quite delicious, this log is not just a cheese, but an experience — a journey through flavors that are inspired by the beautiful place we call home.” Available in stores this spring, the Wine Country-inspired

product offers 4 ounces of fresh, creamy cheese complemented with sweet and earthy ripe pears and the aroma of a bright Sauvignon Blanc, and then finished with a burst of fresh rosemary.

For its part, Marin introduced Petite Garlic & Pepper, the latest addition to the brand’s lineup of Petite Classic 4-ounce brie-style cheeses, at the show. The offering is a rich and buttery triple crème brie enhanced with garlic and cracked pepper for an aromatic and savory taste of decadence. The company suggests folding it into baked or scalloped potatoes, or serving it as part of a grazing board.

According to Bonnie Kaufman, associate brand manager at Petaluma, Calif.-based Marin, earlier this year: “This cheese was inspired by the French Gaperon, a fresh cheese that’s traditionally made in the Auvergne region [of France]. We couldn’t think of a better way to add to our line than crafting a Petite that’s inspired by a beloved French cheese, but tweaked to fit our production process and infused with a distinct Northern California vibe.”

Among imported cheeses, Truly Grass Fed, a premium brand of sustainably produced dairy products from Ireland, showcased its Natural Maker’s Blend Cheddar Cheese at Natural Products Expo West, in Anaheim, Calif., last month. Featuring notes of parmesan, the aged cheddar cheese offers the classic flavors typical of an Irish cheddar. Noted Conor O’Donovan, general manager at Kilkenny-based Truly Grass Fed, in March, “We’re … excited to continue growing our dairy portfolio with the Maker’s Blend — an ideal creamy, buttery pairing for full-bodied wines, charcuterie boards or snacking.”

Our dairy herds are raised on family-owned farms*

Our dairy herds are raised on a diet of 95% grass and grass-based forage*

Our dairy is grass fed verified by the Bord Bia Grass Fed Standard

To discover more: irishfoo danddrink.com/irish-dairy

of the biggest areas of growth was in food delivery, and this can have positive implications for bakeries in 2024 if embraced and executed correctly.”

Since many baked goods, such as cookies and brownies, travel very well through delivery channels, Wisloski suggests that supermarkets can take a cue from restaurants that are capturing impulse sales of baked goods with “add to order” reminders on their platforms.

Harnessing technology to enable kiosk ordering is another way that supermarket retailers can do more with fewer staffers. FMI research shows that nearly half (49%) of shoppers prefer ordering specialty bakery items using technology at the in-store bakery, and 47% would use technology to design and order specialty bakery items.

“Shoppers are enticed by the convenience of utilizing technology for in-store bakery purchases,” adds Stein. “Food retailers can work to ensure a seamless ordering experience that offers similar detailed options — i.e., added decorations, fl avor options, etc. — while meeting the shopper’s needs.”

Over in the deli department, pizza is becoming a powerhouse for retailers as they add variety to win a wide range of consumers to the category and to the foodservice/deli department overall.

Heather Stammler, product manager of fully topped pizza and

“Consumer demand for indulgent and authentic varieties of pizza is very high, especially among Gen Z and Millennial demographics.”

—Heather Stammler, Rich Products

flatbread at Buffalo, N.Y.-based Rich Products, describes pizza as a “standout in grocery over the past two years.”

FMI’s 2023 “Power of Foodservice at Retail” report indicates that 84% of shoppers are most likely to purchase pizza/Italian fare from their grocery store deli departments, and more than half (55%) of shoppers are highly interested in featured days, including Pizza Friday.

“Pizza in the foodservice at retail department is a great way to introduce shoppers to your foodservice offerings and entice them to try more,” affirms Stein. “It also plays to shoppers’ need for convenience and value.”

New flavors are one way to generate excitement in the category. Research from Chicago-based Technomic reveals that more than 70% of pizza operators are experimenting more with globally inspired pizzas and pizza ingredients than they were two years ago.

“Consumer demand for indulgent and authentic varieties of pizza is very high, especially among Gen Z and Millennial demographics, so retailers providing choices like Neapolitan, Sicilian, thin-crust, deep-dish and gluten-free are catering to customers’ unique tastes and driving them to the deli for a fresh pizza experience,” adds Stammler.

At Dom’s Kitchen & Market location in Chicago’s Lincoln Park neighborhood, customers can choose from a variety of Bonci Roman-style pizzas, including Potato & Mozzarella, Ricotta Zucchini, Sopressata, Spicy Eggplant, Sun Dried Tomato Arugula, and Mushroom Rosa. Slices are cut with scissors in rectangular pieces and weighed by the pound.

“Retailers who offer unique options in this category will see incremental sales opportunities,” says Stammler. “There is also demand for more single-serve handheld pizza options to take and bake at home.”

HOW CAN GROCERS CREATE A “CULTURE OF CLEAN” WITHIN THEIR STORES THAT PROMOTES EASE FOR ASSOCIATES, AS WELL AS CUSTOMER LOYALTY?

By Emily Crowen-store cleaning can be a relatively sticky subject for grocers of all shapes and sizes, because, while everyone knows how important it is, it tends to slip down the priority list. Many grocers are also of the mindset that they’re OK being mediocre when it comes to store cleanliness.

“We would say you should not be OK just being OK,” asserts Allen Randolph, VP of business development at Hamilton, Ohio-based Kaivac. Randolph recognizes that cleaning is often thought of as a necessary evil in the food retail industry, and also that many grocers realize that their systems are broken, but they simply don’t know how to fix the problem.

Randolph and his colleague Mike Perazzo, EVP of sales at Kaivac, are working to change the conversation around cleaning in an effort to help create clean, fresh and safe environments for grocery shoppers and employees alike.

Perazzo says that Kaivac is trying to help grocers create a “culture of clean” within their businesses because the company knows firsthand that food retail is an extremely competitive space.

“Creating those first impressions and those lasting impressions to build your customer loyalty all revolves around the experience that you have with that brand,” he explains. “No matter what, cleaning is going to play a role in that.”

Randolph notes that store cleanliness ties directly to revenue and profit, pointing to the fact that cleaning stores correctly from the start can lead to more than 30% less cost and labor than doing it the wrong way. While creating a true culture of clean from the top down can be a struggle, Perazzo believes grocers have

Coolers are the second-largest investment that retailers make beyond the physical structure of their building, and having clean, well-kept coolers can be a major point of differentiation for grocers.

the right intent when it comes to cleaning their stores, but they need to work toward tying their vision to the correct execution.

“That’s why you can’t solve the problem unless you think about the problem differently,” Randolph says. “How do you communicate and execute change management at scale? If you don’t have any people, you’ve got to find a different way to do it that doesn’t require people. You’ve got to use technology.”

Beyond simply enacting new hardware and cleaning solutions, Perazzo and Randolph also stress the importance of properly and thoroughly training employees to do the work necessary to keep stores truly clean. “Training has to be at the forefront of everything you’re doing,” Perazzo emphasizes, “and that training needs to be created and brought down into the reality of the environment.”