CatMan Do

Reach across aisles to boost center store Page 62

s i 2

Truth and Consequences Exploring the ramifications of deli failures Page 80

r e t t e b

e-Shop Around

Choose the best online model for your company Page 129

! 1 n a th

Page 30

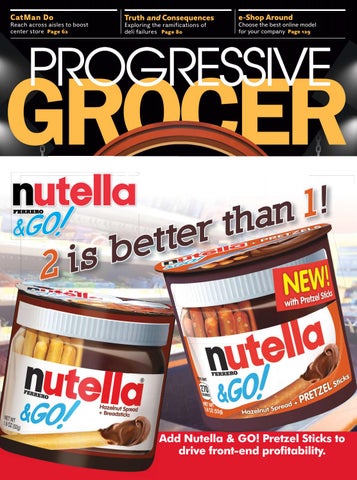

Add Nutella & GO! Pretzel Sticks to drive front-end profitability. April 2015 • Volume 94 Number 4 $10 • www.progressivegrocer.com

Nutella & GO! is ranked 2nd among top front-end SKU’s*

12cnt front end tray*

Nutella & GO! Pretzel is projected to be a Top 10 front-end item* Nutella & GO! Pretzel is the only snack offering Nutella 's delicious hazelnut spread with dip-able pretzel sticks ®

12cnt front end tray* *Also available in 24cnt front-end display

Order Nutella & GO! Pretzel Sticks today to continue driving high revenue and profit on the front-end! *Source: IRI Total US MULO, Latest 52 WE 4/20/14

© 2015 Ferrero. All rights reserved.

CatMan Do

Reach across aisles to boost center store Page 62

Truth and Consequences Exploring the ramifications of deli failures Page 80

e-Shop Around

Choose the best online model for your company Page 129

Page 30

April 2015 • Volume 94 Number 4 $10 • www.progressivegrocer.com

BREWED THE HARD WAY,

TO WORK HARD FOR YOU. The King of Beers is an asset on Grocery Store shelves. In fact, Budweiser accounts for over $1.5 billion in annual sales, meaning one case of Budweiser is sold from large-format stores every second. It’s a brand with so much stopping power that 54% of shoppers can recall seeing Budweiser on display.* Contact your local distributor to get your Brewed The Hard Way signage today.

* Sources: iri total convenience and drug, last 52 weeks IRI MULO, last 52 weeks ©2015 Anheuser-Busch, Budweiser® Beer, St. Louis, MO

#1 Hard Discount Grocery Designed for Independent Retailers Save-A-Lot has been developed with the independent retailer in mind. Contact us to learn why leading independent grocery and convenience store retailers have chosen Save-A-Lot as part of their expansion plans. Minimum $200,000 fnancial incentive. Comprehensive support including training, operations and marketing. Dedicated distribution of fresh meat, produce and exclusive private label brands.

To learn everything you need to know about opening Save-A-Lot food stores visit save-a-lot.com/own or call 314.592.9446

CO

L

ACTUAL SIZE

NV

O EB EN L IEN EAB V T 12 A OZ MIRCROW

W

profit from our innovation As organic goes mainstream, Blount enables you to expand your organic offerings with an exciting variety of our delicious innovative side dishes. Hand crafted in small batches, our products are available in convenient 12 or 16 oz retail bowls. Elevate your customer’s dining experience and your stores profits.

With Blount, you get more because we do more. To learn more about our artisan-crafted organic sides, call 800.274.2526 or visit blountfinefoods.com/buildsales Visit us at the IDDBA Georgia World Congress Center • June 6-9 • Atlanta Booth# 1901

Arugula Salad with Pear Nectar Vinaigrette

©2015 Goya Foods, Inc.

Your shoppers find this and other great recipes at goya.com

The ChefsBest® Excellence Award is awarded to brands that surpass quality standards established by independent professional chefs.

April 2015

features

Volume 94, Issue 4

cover story

88

PrePared food PaCkaging

62

To Protect and Serve Retailers collaborate with suppliers on innovative packaging for prepared foods.

Category ManageMent

Delivery Solutions Reaching across aisles to satisfy shopper need states is the way to boost center store.

92

ProduCe

Pack and Play Today’s packaged produce delivers it all: convenience, sustainability, personality and fun.

grocery

70

CondiMents

Hot Stuff Sauces with a spicy kick enliven supermarket displays and customers’ palates.

frozen & refrigerated

30

98

Progressive groCer ’s 82 annual rePort of the groCery industry nd

Aisles of Opportunity

Grocers are bullish on 2015, but new specters are bringing on sleepless nights for retailers.

fresh food

ProduCe Category sPotlight

Masters of Melons Flavor-packed varieties, strategically merchandised, are key to this category’s success.

106

guest PersPeCtives

80 Progressive groCer ’s deli insights

Facing Deli Consequences Training is key to reducing prepared food product issues, out-of-stocks.

A Call for an Organic Checkoff Grocers can combat out-ofstocks by supporting a boost in organic farming.

115

74 Baked goods

A Slice of the Action Savvy promotions and a keen eye on consumer needs position frozen cakes and pies as an attractive alternative to home baking.

2015 annual Meat ConferenCe

Lessons in Meat Marketing Annual conference looks at branding, natural products, foodservice and how to enhance the shopper experience.

April 2015 | progressivegrocer.com |

7

nonfoods 120 HealtH Beauty & Wellness

570 Lake Cook Rd, Suite 310, Deerfield, IL 60015 224 632-8200 • www.progressivegrocer.com

Advances in Care Retailers can tap new technology for personal disease management to attract diabetes patients.

vP, Brand Director 201-855-7621

EDITorIAL Editorial Director Joan Driggs 224-632-8211 jdriggs@stagnitomail.com Chief Content Editor Meg Major 724-453-3545 mmajor@stagnitomail.com Editor-in-Chief James Dudlicek 224-632-8238 jdudlicek@stagnitomail.com Managing Editor Bridget Goldschmidt 201-855-7603 bgoldschmidt@stagnitomail.com Technology Editor John karolefski 440-582-1889 jkarolefski@stagnitomail.com Senior Editor katie Martin 224-632-8172 kmartin@stagnitomail.com Senior Editor Anna wolfe 207-773-1154 awolfe@stagnitomail.com Digital Editor kyle Shamorian 224-632-8252 kshamorian@stagnitomail.com Art Director Bill Antkowiak bantkowiak@stagnitomail.com Contributing Editors Bob Ingram, Jenny McTaggart, Barbara Sax, Jennifer Strailey and Christina Veiders

126

Batteries and FlasHligHts

Storm Cells In times of emergency, consumers look to grocery retailers for batteries and fashlights.

technology 129 e-CommerCe

Getting Started Now What’s the best type of service for online grocery?

134

guest PersPeCtives

The Perception Gap Here’s how grocers can use data more efectively.

138

logistiCs

The Digital Link Beyond serving consumers’ needs, up-and-coming technology can help streamline the supply chain for a new era of retailing.

equipment & design

142

sHoPPing Carts

Pushing Into Tomorrow Te ‘shopping cart of the future’ has attracted a wide array of concepts.

8

| Progressive Grocer | April 2015

ADvErTISING SALES & BuSINESS Midwest Marketing Manager John huff 224-632-8174 jhuff@stagnitomail.com western regional Sales Manager Elizabeth Cherry 310-546-3815 echerry@stagnitomail.com Eastern Marketing Manager Maggie kaeppel 630-364-2150 • Mobile: 708-565-5350 mkaeppel@stagnitomail.com Northeast Marketing Manager Mike Shaw 201-855-7631 • Mobile: 201-281-9100 mshaw@stagnitomail.com Marketing Manager Janet Blaney (AZ, CO, ID, MD, MN, MT, NM, NV, OH, TX, UT, WY) jblaney@stagnitomail.com 630-364-1601 Account Executive/ Classified Advertising Terry kanganis 201-855-7615 • Fax: 201-855-7373 tkanganis@stagnitomail.com Advertising/Production Manager Jackie Batson 224-632-8183 • Fax: 888-316-7987 jbatson@stagnitomail.com Classified Production Manager Mary Beth Medley 856-809-0050 marybeth@marybethmedley.com MArkETING & ProMoTIoN Director of Market research Debra Chanil 201-855-7605 dchanil@stagnitomail.com Audience Development Manager Shelly Patton 215-301-0593 spatton@stagnitomail.com List rental The Information refinery 800-529-9020 Brian Clotworthy reprints and Licensing wright’s Media 877-652-5295 sales@wrightsmedia.com Subscriber Services/Single-copy Purchases 978-671-0449 or email at Stagnito@e-circ.net

EvEnts • MEdia • REsEaRch • infoRMation uNITED STATES MArkETS Convenience • Grocery/Drug/Mass Store Brands • Specialty Gourmet Multicultural • Green

departments 10 EDITor’S NoTE: BANNEr YEAr 14 PG PuLSE 16 IN-STorE EvENTS CALENDAr: JuNE 2015 20 NIELSEN’S ShELf SToPPErS/SPoTLIGhT: frozEN AND rEfrIGErATED PrEPArED fooDS/ frozEN AND rEfrIGErATED GrAvIES AND SAuCES 22 MINTEL GLoBAL NEw ProDuCTS: SALTY SNACkS, MEAT SNACkS AND PoPCorN 24 NEw horIzoNS: ‘IT’S TIME’ for A NEw workPLACE 28 ALL’S wELLNESS: EArTh DAY EvErY DAY 146 whAT’S NExT: EDITorS’ PICkS for INNovATIvE ProDuCTS 150 ThE SuPPLIEr SIDE 154 ThE LAST worD: ANTICIPATIoN

Jeff friedman jfriedman@stagnitomail.com

CANADIAN MArkETS • Convenience • Pharmacy • Foodservice

President & CEo harry Stagnito Chief Information officer kollin Stagnito SvP, Partner Ned Bardic Chief Brand officer korry Stagnito vP & Cfo kyle Stagnito vP/Custom Media Division Pierce hollingsworth 224-632-8229 phollingsworth@stagnitomail.com Production Manager Anngail Norris human resources Manager Sandy Berndt Corporate Marketing Director Bruce hendrickson 224-632-8214 bhendrickson@stagnitomail.com Promotion Director robert kuwada 201-855-7616 rkuwada@stagnitomail.com vP/Events John failla 201-855-7634 jfailla@stagnitomail.com Director of Digital Media John Callanan 203-295-7058 jcallanan@stagnitomail.com Audience Development Director Cindy Cardinal

Drive traffic and sales with innovative and exciting items from Pillsbury®.

Shoppers know they can celebrate any occasion with Pillsbury. With the bright colors and unique flavors your shoppers look forward to each season, we’re making the bake aisle a destination for inspiration all year long.

Innovation brought to you by The J.M. Smucker Company family of brands. ©/® The J.M. Smucker Company. Pillsbury, the Barrelhead logo and the Doughboy character are trademarks of The Pillsbury Company, LLC, used under license.

editor’s note by Jim Dudlicek

Banner Year

G Marketing meals, not ingredients — solutions, not products — is what’s going to keep the traditional grocer relevant and thriving.

10

rocery retailers tell Progressive Grocer they’re upbeat about their prospects for a successful 2015, and apparently the folks who supply the food they sell are happy about the year ahead as well. Despite an underwhelming performance in 2014, the near-term prospects for the U.S. food and beverage industry are encouraging, according to a new report from Chicago-based BMO Economics. “Although margins and proftability fell short of lofty expectations in 2014, stronger demand growth, falling livestock prices and still-low crop costs should help producers make up lost ground,” says Aaron Goertzen, an economist for BMO Capital Markets. Te outlook for demand is relatively upbeat, with real consumer spending expected to grow 3.3 percent in 2015 as employment continues to expand and, eventually, as wage growth shifts into higher gear. “Te profle of consumer spending growth is becoming more balanced, with less focus on durable goods such as autos and faster growth in nondurables such as food,” Goertzen notes. “Lower pork and dairy prices should also create some wiggle room in household food budgets later this year, which should provide a lift to volume demand across most segments.” He adds, “Looking ahead, a more moderate pace of global growth should help to limit upward pressure on commodity prices and help keep costs better contained.” Tis analysis mirrors what grocery retailers told us in responses to the exclusive survey underpinning our 82nd Annual Report of the Grocery Industry, which begins on page 30. On a 100-point scale, retailers score their confdence in 2015 at just above 72, six points higher than their 20/20 hindsight rating for 2014, which a year ago they gave a 71.8. Nearly half of our respondents express signifcantly more optimism for 2015, up from the 39 percent who said they felt that way last year about 2014. Among “issues keeping you up at night,” grocers put data security in frst place, up from ffth after a year of widely publicized breaches hitting Super-

| Progressive Grocer | Ahead of What’s Next | April 2015

valu, Target and other retailers. Meanwhile, a perpetually competitive retail climate, continued channel blurring and the advancement of e-commerce have made grocers more mindful of exclusive products, customization and in-store services geared toward a rewarding shopper experience that can’t be had by clicking and dragging. To prove their relevance to younger demographics that were raised on mobile technology but are foodsavvy and hungry for authentic experiences, traditional grocers are enhancing their historic competencies with digital components designed to bring speed, convenience and uniqueness to a mature channel, as if to say, “Sure, you can buy diapers online, but do you really want Amazon picking out your steak?” A mouse click can whisk ancient grains to your doorstep, but a grocery store wellness expert who knows your name and face can explain why they’re good for you, over kale smoothies at the market’s cozy café. Meat remains the top sales driver for grocers, while center store dropped to eighth, replaced at No. 2 by private label, which has hopscotched its way up our ranking. Center store’s ills might well be cured by better cross-merchandising across multiple aisles, including the fresh perimeter, as our category management report suggests, starting on page 60. Marketing meals, not ingredients — solutions, not products — is what’s going to keep the traditional grocer relevant and thriving as Millennials start bringing their kids along on shopping trips. Grocers not already thinking this way may already be in big trouble. Have your own thoughts about this? Don’t wait until our 83rd annual report — reach out to us anytime. PG Jim Dudlicek Editor-in-Chief jdudlicek@stagnitomail.com Twitter @jimdudlicek

INNOVATION IS EVERY DAY.

Consumer-led innovation delivering the

INCREMENTAL CATEGORY GROWTH you’re looking for. Another way we’re committed to creating shared success every day. SUCCESS IS AN EVERYDAY THING.

hersheys.com

Join us at the NCA Sweets & Snacks Expo, Booth 1505.

Š General Mills

Driving Growth with New Products that meet Evolving Food Trends

DELIVERING INNOVATION ACROSS THE STORE

What’s trending on Progressivegrocer.com …

Supermarkets Excel at Experience Ratings

A tip of the cap to Publix, Aldi and H-E-B, each of which earned top scores on the 2015 Temkin Experience Ratings, an annual ranking of large organizations based upon the quality of the customer experience. Also lauded from the grocery industry in the online consumer poll were Trader Joe’s and Hannaford, which cracked the list’s top 12. “Customer experience drives loyalty, so it’s a growing area of focus for most businesses,” notes Bruce Temkin, managing partner of Temkin Group, the Waban, Mass., research and consulting firm that conducts the annual ratings program based on the feedback of 10,000 U.S. consumers, who this year were asked to rate recent interactions and overall experiences with 293 companies in 20 industries across three dimensions: success, effort and emotion.

Millennials Driving Meal Prep

Meal preparation takes center stage among top evolving trends in U.S. consumers’ eating habits, according to Jacksonville, Fla.-based Acosta Sales & Marketing, whose recent survey finds that nine in 10 shoppers prefer eating at home, driven by a desire for comfort (61 percent), cost (60 percent) and convenience (59 percent). Rather than cooking from scratch, however, Americans are turning to readyto-eat and take-and-bake solutions, including “hybrid homemade meals” such as a grocery store rotisserie chicken with a salad-in-a-bag and homemade potatoes. Some 46 percent say they prepared meals at home over the past year — 48 percent when considering only the Millennial generation — which also reports eating prepared foods from grocery stores at home at a much higher rate than total U.S. diners (27 percent versus 16 percent, respectively). —Acosta Sales & Marketing’s The Evolution of Eating Survey

Making Things Personal American consumers want a more personalized retail experience but are divided on retailers’ tactics and the types of personal information they feel comfortable disclosing, according to Accenture. Nearly 60 percent of consumers want real-time promotions and offers, yet only 20 percent want retailers to know their current location

7.4%

The rise in the Hispanic population’s spending power over the past 10 years —Nielsen

14

and only 14 percent want to share their browsing history. The Dublin, Irelandbased firm’s research also found that while many consumers are willing to share some personal details with retailers, nearly all (90 percent) of the respondents say that if the option

were available, they would limit access to certain types of personal data and would stop retailers from selling their information to third parties. In addition, 88 percent would prefer to determine how the data can be used, and 84 percent want to review and correct information. —Accenture Personalization Survey

$12 Minimum Wage Yields Maximum Support Based on results of PG’s recent online poll asking readers to weigh in with thoughts on the minimum wage following Walmart’s move to increase its hourly wage rate to $10, it seems clear that more front-line associates responded than industry executives. To wit: While 40 percent of the total votes were tallied across an hourly rate range between $8 to $11, with $8 6% 23 percent voting to keep the present hourly rate intact, $9 9 the 37 percent favoring a $12 minimum wage doesn’t square with the industry’s well-established $10 19 position that a minimum wage increase $11 6 would create significant challenges for $12 37 many grocers. At left is how the votes It doesn’t need to stacked up as we went to press. be increased 23

| Progressive Grocer | Ahead of What’s Next | April 2015

FAMILIES IN NEED ARE ASKING FOR MILK Milk is one of the most requested items at Feeding America® food banks nationwide. But donations fall far short of the need. That means many of the 16 million children who struggle with hunger every day miss out on milk’s high-quality protein and other essential nutrients. It’s a big problem.

The Great American Milk Drive® is the answer.

LIFT YOUR SALES BY DOING GOOD

© 2015 America’s Milk Companies.®

Invigorate your milk sales without discounting

Drive foot traffic and new customers to your stores

Strengthen your community presence

MELISSA MALCOLM, MILKPEP Let’s discuss how to put The Great American Milk Drive to work in your stores. Mention this ad during our conversation and I’ll donate a gallon in your name for your time and interest.

1-800-945-MILK

mmalcolm@milkpep.org

June 2015 is... National Dairy Month National Candy Month National Iced Tea Month National Soul Food Month National Country Cooking Month

S

M

1

Say Something Nice Day. Let your staff know you appreciate their efforts.

T

W

T

F

S

2

3

4

5

6

9

10

11

12

13

17

18

19

20

National Rocky Road Day. Sample different brands of rocky road ice cream.

National Egg Day

Hug Your Cat Day. Put up a display of cat food and accessories.

National Doughnut Day. Make sure the bakery is ready and offer doughnut samples to shoppers.

National Yo-Yo Day. Hold a contest for the best Walk the Dog or Around the World.

World Milk Day

7

IDDBA’s DairyDeli-Bake Expo begins in Atlanta and continues through the 9th.

8

Make sure your barbecue products are well stocked — Father’s Day and the first day of summer are coming.

National Chocolate Ice Cream Day

14

Flag Day. Decorate the store in red, white and blue.

21

Father’s Day

15

National Lobster Day

22

National Chocolate Éclair Day National Onion Ring Day

It’s also the First Day of Summer.

28 2

Summer Fancy Food Show begins in New York and continues through the 30th. Finalize a sale on summer items in honor of the nation’s birthday next month.

16

29

National Waffle Iron Day

National StrawberryRhubarb Pie Day

National Iced Tea Day

National German Chocolate Cake Day

FMI Connect begins in Chicago and continues through the 11th.

16

National Fudge Day Fresh Veggies Day

23

Public Service Day. Work with your team to find a couple of community projects.

National Apple Strudel Day

Conversely, it’s also Eat Your Vegetables Day.

To celebrate International Picnic Day, build a big display of picnic baskets, recyclable cutlery, plates and glasses, napkins, and food storage containers.

24

25

National Cherry Tart Day

National Pralines Day

National Pink Day. Use your Facebook page to ask shoppers to wear something pink.

Global Beatles Day. Play music in store by the Fab Four.

National Peanut Butter Cookie Day. Schedule cooking demos to show how easy it is to make this treat at home.

National Flip-Flop Day

Kitchen Klutzes of America Day. Display items to help the clumsy — like sponges, cleaning aids, adhesive bandages, mops and brooms.

National Vanilla Milkshake Day

National Martini Day. Take an online poll: shaken or stirred?

26

National Chocolate Pudding Day

27

To celebrate National Sunglasses Day, ask all staff to wear their shades.

National Catfish Day

30

Social Media Day. Tweet your shoppers to find special deals on your Facebook page and fun ideas on your Pinterest page.

National Almond Buttercrunch Day

| Progressive Grocer | Ahead of What’s Next | April 2015

E-mail your calendar submissions to

awolfe@stagnitomail.com

Trion Cooler Merchandising ®

AMT Adjustable Merchandising Tray ™

Org ga aniz Chaos, Increase Sales Organize Designed for yogurts; dips; spreads; puddings, gelatins and snacks; ice cream and sherbet; instant soup cups; microwave single-serves; food-to-go offerings, tubs, bottles and other difficult to organize products. ■

Small AMT adjusts from 2 11/16" to 3 5/16" wide for 4-6 ounce yogurt cups and similar small products.

■

Medium AMT adjusts from 3 5/16" to 3 15/16" wide for 5-6 ounce greek yogurt cups and mid-range offerings.

■

Large AMT adjusts from 4" to 4 5/8" wide for tub, pint, 11/2 pint, ice cream and large containers.

■

Width adjusts in 1/8" increments and locks in place. Two breakaways allow easy adjustment in the field from standard 22" length to 20" and 18."

■

Built-in manual feed allows trouble-free forwarding and facing of products for increased sales and profits.

■

Trays lift out for rear restocking and proper rotation.

■

Durable, easy-clean plastic construction for long-life, even under heavy use and in harsh environments.

■

Optional plain-paper label, sign and flag holder provides a protected home for product and price information and improves promotional opportunities. Proudly Made in the U.S.A.

Built-in Manual Feed Optional Label/Flag Holder

Adjustable Width Breakaway Lengths

Built-in Handles Built-in Ventilation

Paddle Extenders Sidewall Extenders

Part of the Trion® Shelf Works® System of Cooler and Storewide Merchandising Solutions.

©2014 Trion Industries, Inc. 297 Laird Street, Wilkes-Barre, PA 18702-6997 Phone 570-824-1000 l Fax 570-823-4080 Toll-Free In U.S.A. 800-444-4665 www.TrionOnline.com Patents and patents pending. Note: Product photography is a simulation of a retail environment and is not meant to imply endorsement by or for any brand or manufacturer.

Trion WonderBar ®

®

Pouch Hook

™

Pouch Merchandising Simplified T Trust the hook-makers at Trion to invent creative solutions sspecifically for the new wave of pouch packaging and merchandising. Field-tested and already in retail use, m Trion’s new Pouch Hook is ready to back your expansion Tr into this exciting new venue of product promotion. in ■

Standard and Gravity-Feed configurations available to keep items forwarded and automatically faced.

■

Proprietary gate keeps product from being jostled off rear. o

■

FFlip-front Label Holder swings up for easy access and product removal. a

■

LLoads from rear, or easily dismounts to insure fast restocking, product rotation and reduced shrinkage. re

■

Saddle mounts on a Universal Bar design allowing Sa tool-free installation on all thick- and thin-walled to gondola and cooler uprights. go

■

Stocked in 4 lengths compatible with all standard St shelf sizes allowing mixed use in display. sh

■

Custom sizes and short-run configurations possible. Cu

Proudly Made in the U.S.A.

Proprietary Rear Gate

Insures Product Rotation

Easy Vending Front

Gravity-Feed Available

Part of the Trion® WonderBar® Family of Tray and Bar Merchandising Solutions.

©2014 Trion Industries, Inc. 297 Laird Street, Wilkes-Barre, PA 18702-6997 Phone 570-824-1000 l Fax 570-823-4080 Toll-Free In U.S.A. 800-444-4665 www.TrionOnline.com Note: Product photography is a simulation of a retail environment and is not meant to imply endorsement by or for any brand or manufacturer.

Front End

Market Intelligence By The Numbers GROCERY’S TOP 10

Shelf Stoppers

Frozen/Refrigerated Prepared Foods Largest Sales Increases in Supermarkets by The Nielsen Co. (52 Weeks Ending Jan. 17, 2015)

Sales % Change Dollars (Millions) 2015 2014 Entrées-Mexican (One-food-Frozen) $621.9 5.0% 1.9% Entrées-Meat (One-food-Frozen) 641.3 4.2 7.5 Sauces and Gravies-Frozen/Refrigerated 308.1 3.5 3.0 Entrées-Remaining (Two-food-Frozen) 13.3 3.5 -14.5 Soup-Frozen/Refrigerated 224.1 3.1 5.5 Entrées-Remaining (One-food-Frozen) 487.4 2.5 -0.2 Corn Dogs-Frozen/Refrigerated 200.0 0.7 -2.7 Pot Pies-Frozen 317.7 0.1 4.8 Entrées-Poultry (One-food-Frozen) 1,898.9 0.0 1.9 Pasta-Plain-Frozen 192.6 -0.4 0.0 Total Category

$8,108.1

-1.5%

% Change 2015 3.6% 2.1 2.9 -7.8 2.0 -0.3 -0.4 -1.5 -1.7 -1.8

Units 2014 1.2% 6.8 0.8 -15.1 2.2 0.0 -1.6 0.5 0.0 -1.1

-3.3%

-2.1%

-1.2%

NielseN’s Spotlight Consumption Index: Frozen/Refrigerated Gravies and Sauces LIFESTYLE Behavior Stage

Cosmopolitan Affluent Comfortable Struggling Centers Suburban Country Urban Spreads Cores

Modest Working Towns

Plain Rural Living

Total

indicative perhaps of higher disposable incomes and a greater interest in culinary experimentation, residents of affluent suburban spreads use more frozen and refrigerated sauces and gravies than other lifestyles, across all behavior stages. Particularly enthusiastic consumers in this category are younger and older bustling families, who no doubt appreciate the products’ convenience, and empty nesters, many of whom are using their newly freed-up spare time to whip up interesting meals.

CROSS-MERCh Candidates

wITh ChILDREN: startup Families

105

169

77

67

81

103

103

small-scale Families

124

158

107

83

89

72

106

Younger Bustling Families

104

183

102

76

118

79

109

Older Bustling Families

159

177

161

65

129

89

136

Young Transitionals

57

130

66

89

90

37

77

independent singles

72

94

92

61

62

36

67

senior singles

48

81

60

92

46

49

59

established Couples

127

167

120

124

111

76

119

empty-nest Couples

133

194

125

96

112

84

126

senior Couples

125

134

129

63

99

72

105

Total

100

152

110

81

91

68

100

HHs with young children only <6 small HHs with older children 6+ large HHs with Children (6+), HOH <40 large HHs with children (6+), HOH 40+

NO ChILDREN: Any size HHs, no children, <35 1-person HHs, no children, 35-64 1-person HHs, no children, 65+ 2+-person HHs, no children, 35-54 2+-person HHs, no children, 55-64 2+-person HHs, no children, 65+

Very High Consumption (150+)

20

High Consumption (120-149)

Average Consumption=100

| Progressive Grocer | Ahead of What’s Next | April 2015

• Wine • Photographic

Supplies • Baby Needs • Yogurt • Skin Care Preparations • Disposable Diapers and Training Pants • Baby Food • Fresh Produce More ONLINE Dig up actionable e research and additional al intelligence at Progressivegrocer.com

A Taste of Sweet Excitement comes to Store Shelves!

— Introducing — ZingTM Zero Calorie Stevia Sweetener

- packets & easy-spoon jar -

and

ZingTM Baking Blend Stevia & Cane Sugar - easy-pour canister -

Real ingredients. Perfect sweetness.

The Zing™ sweetener brand was created with the discriminating Millennial demographic in mind – the younger shopper searching for products with authentic ingredients and a pure sweet taste they can believe in. For this target of youthful, well-informed consumers seeking a delicious sugar substitute made with real ingredients, Zing™ is a victory, a true reason to get excited.

ZingTM Zero Calorie Stevia Sweetener Made with only real ingredients of stevia leaf extract and dextrose. Zero calories per serving. Delicious sweetness. 1 packet or 1/4 tsp. Zing™ Stevia Sweetener = sweetness in 2 tsp. of sugar. 40-count box of single-serve packets & 9.5 oz. easy-spoon jar. Learn more at zingstevia.com.

ZingTM Baking Blend Stevia & pure cane sugar blend. 5 calories per serving. Bakes and browns like sugar for delicious, golden-brown cakes and cookies. 1 canister sweetens like 2.5 lbs. of sugar. 20 oz. canister with an easy pour spout for quick measuring and a snap-closed lid.

Mintel Global New Products Database Category Insights

Salty Snacks, Meat Snacks and Popcorn

For more information, visit www.mintel.com or call 800-932-0400.

Market Overview The United States is the standout market in the North American salty snack, meat snack and popcorn category, with a predicted average value growth of 5.3 percent over the next five years. Canada also offers promising average value growth of 3.1 percent during the same period, despite lower per capita consumption. key iSSueS Introducing protein to food and drink has become a major focus of innovation, due to its links to increased satiety and muscle retention. Recent new product development activity has shown that the protein trend has migrated into the salty snack category, with manufacturers fortifying their innovations with protein or by prominently marketing natural protein content on-pack. For instance, a number of brands have launched salty snacks based on vegetables and grains to achieve high-protein claims. The past 12 months have also seen how brands have been launching skinny snacks onto the market. No/low/reduced fat has been one of the main areas of innovation in North America, accounting for 14 percent of the total new product launches in the past year.

What Does it Mean?

22

High-protein snacks have huge potential in North America if brands can successfully convey the health benefits of eating protein throughout the day rather than on specific occasions.

knowledgeable about nutrition. Vegetable-based protein snacks are currently enjoying a boom, but innovations like egg-white chips suggest that there will be more variety in the future.

Protein source will become a distinguishing feature as consumers become even more

The growing interest in skinny products suggests that more brands should be looking to enter

| Progressive Grocer | Ahead of Whatâ&#x20AC;&#x2122;s Next | April 2015

the no-/low-/reduced-fat and no-/ low-/reduced-calorie segment. Convenient on-the-go formats that allow consumers to experience guilt-free indulgence should also emphasize recommended portion sizes to offer consumers control over their calorie intake.

so happy together ÂŽ

More bundled beverage choices can help drive proft to your deli promotions. From snacks to complete meal solutions, The Coca-Cola Company has a perfect beverage for every meal combination you serve. Go to CokeSolutions.com/retail for more insights.

Š 2015 The Coca-Cola Company

Nonfoods

Category

Today’s leadership model isn’t working for everyone, which means it’s not working at all.

NEW

Horizons

By Joan Toth

‘It’s Time’ for a New Workplace Women’s leadership has stalled — we’ve launched a movement to change that.

corporate culture and workforce policies to create a better workplace for everyone.

F

ourteen years ago, a handful of determined leaders launched the Network of Executive Women at the FMI Midwinter Executive Conference. At this year’s FMI Midwinter, we launched a new network with a bold vision — a workplace with no limits — and an urgent message: “It’s Time.” It’s not that “old NEW” wasn’t successful — far from it. Since 2001, NEW has grown into one of the industry’s largest and most infuential organizations. We’ve put women’s leadership on the agenda, we’ve changed hearts and minds, and we’ve helped thousands of women advance. But we haven’t “moved the needle.” In recent years, the share of women corporate ofcers has barely budged. Women represent almost half of the retail industry’s total workforce but fewer than one in fve corporate ofcers and one in 20 CEOs. Te reason for this is simple: We’ve been focusing on the wrong thing. We need to change our

24

| Progressive Grocer | Ahead of What’s Next | April 2015

Joining the Movement This message was delivered loud and clear at FMI Midwinter. More than 100 senior industry leaders gave up part of a sunny Sunday afternoon in Miami Beach to hear me; Amy Hahn, of Ahold USA; and Lisa Walsh, of PepsiCo, present a call to action on women’s leadership and workplace change. More than half of those present committed to our It’s Time movement. Our industry’s top executives know that women leaders are critical to their organizations, and they’re committed to take action. But this is no easy lift. Tere are strong cultural and business headwinds against women’s leadership and workplace change. But we must create a more fexible, collaborative, inclusive and authentic workplace if we’re to connect with our increasingly diverse consumers and workforce. Today’s leadership model isn’t working for everyone, which means it’s not working at all. Our manifesto, presented by Walsh, NEW’s marketing chair, calls for “a new leadership culture — less rigid and more fexible, less conformist and more diverse, less impersonal and more authentic.” We need a workplace culture that values the unique contributions of everyone — male and female, young and old, black and white, Latino and Asian, native-born and immigrant, gay and straight. Tis new workplace will make our industry a destination for women and a model to attract Millennials, who are the largest generation in our history — 80 million strong — and 43 percent nonwhite.

What Needs to be Done NEW has developed a researchbased action agenda that zeroes in on the top priorities needed to advance women leaders and transform the workplace:

sustainable — organizations must have targets in place that advance women.

Change the culture and the way we look at women, who are often viewed as either “too nice” or “too bossy.” Change the organization to eliminate the countless subtle barriers to advancement, including lack of role models, sponsors and access to senior leadership, and career paths and policies that favor men. Engage men and treat them as partners instead of problems to be fxed. Engage senior leadership. At PepsiCo, which has taken a strong stand on women in the workplace, 31 percent of U.S.-based executives are women. Achieve critical mass. To achieve the benefts of women’s leadership — and make these gains

Hahn closed our movement launch with a retailer’s perspective. “At Ahold USA, we make three promises every day,” she said. “First, be a better place to shop. Second, be a better place to work. And third, be a better neighbor everywhere we do business. Women’s leadership provides the talent, new ideas and customer connections we need to deliver on these promises.” To enlist in the It’s Time movement, visit newonline.org/itstime. PG Joan Toth is president and CEO of the Network of Executive Women, Retail and Consumer Goods, a learning and leadership community with 9,000 members, 750 companies, 100 corporate partners and 20 regional groups in the United States and Canada. For more information, visit newonline.org.

Spring i here! Get Your Sale Blooming with …

NEW! U-LINK CURVE TM

U-LinkTM Curve

360o Merchandising

180o Merchandising

Booth 623

Vancouver Convention Centre ● Vancouver, BC

WWW.FORTEPRODUCTSOLUTIONS.COM

CALL 816.741.3000 April 2015 | progressivegrocer.com |

25

Consuming a plant-based diet may cut one’s greenhouse gas emissions in half.

All’s Wellness By Molly McBride

Earth Day Every Day Alternative proteins, local products and waste reduction can impact health of consumers and the planet.

S

pring is upon us, and with it comes sunny weather, fowers in bloom and more fresh produce. Earth Day is April 22, and what better way to revisit how we treat our planet than looking at food, one of the greatest resources we use? How many consumers equate the way they eat to their carbon footprint? A recent study published in Climatic Change, encompassing 55,504 participants from the EPIC-Oxford cohort, addressed this concept. It found that the kilograms of carbon dioxide equivalents per day (kgCO2e/ day) was 7.19 for high meat-eaters, 5.63 for medium meat-eaters, 4.67 for low meat-eaters, 3.81 for vegetarians (no meat, poultry or fsh) and 2.89 for vegans (no animal products). Tese numbers suggest that consumers could decrease their environmental impact as fewer animal products are consumed, and that consuming a plant-based diet may cut one’s greenhouse gas emissions in half. Plant-centric diets are many times lower in total calories, saturated fat, cholesterol and sodium, while higher in fber and antioxidants. Alternatives on the shelf like soy and almond milks, legume-based proteins, mock meats, and dairy-free desserts, alongside plenty of fresh, canned and frozen fruits and vegetables, can present opportunities for supermarket customers to enjoy wholesome as well as innovative products. As dietitians, we realize that consumers have many diferent diets and preferences; however, some simple swaps for plant-based fare can be an environmental and health-conscious advantage.

28

| Progressive Grocer | Ahead of What’s Next | April 2015

Discovering Local At Kroger, our Discover Local campaign focuses on locally grown products, with an emphasis on great quality. Te less time food is on road, rail, water or air equates not only to a greener approach, but also a cost savings that can be passed on to the customer. Current numbers from the Environmental Protection Agency indicate that 13 percent of all global greenhouse emissions are from transportation and 14 percent are from agriculture. Retailers can be leaders in limiting the distance from farm to table, to control the amount of energy expended in putting brands on the shelf. Other ways to honor Mother Earth this month include adhering to the four Rs: reduce, reuse, recycle and repurpose. Customers continue to strive to use less and do more with less, in eforts to save money, decrease clutter and contribute to sustainability eforts. Capitalize on this time to talk to your packaging department, category managers or CPG manufacturers to brainstorm ways that can decrease packaging waste and make your products even more appealing. Te sustainability movement involves much more than what’s happening outside the walls of your stores. Take a harder look at plant-based oferings, waste, packaging, sourcing, geography and even seasonality to engage and retain customer interest and support resources for generations to come. PG Molly McBride, RD, LD, is a corporate dietitian for The Kroger Co., based in Cincinnati.

Still getting heartburn flare-ups? It’s time for a new routine.*

Try Nexium® 24HR—the latest choice in frequent heartburn protection—and get Nexium Level Protection.™ *Get tips on how to improve your heartburn routine at Nexium24hr.com/routine

Nexium24hr.com/guarantee Use as directed.

© 2015 Pfizer Inc.

30

| Progressive Grocer | Ahead of Whatâ&#x20AC;&#x2122;s Next | April 2015

82nd AnnuAl RepoRt

of the GRoceRy IndustRy

Aisles of opportunity

Grocers are bullish on 2015, but new specters are bringing on sleepless nights for retailers. Analysis by Jim Dudlicek, Bridget Goldschmidt and Meg Major / Research by Debra Chanil

G

rocery retailers’ confdence in ana rosy retail climate, up from 30 percent this year. other year of success continues to It’s obvious that current economic conditions inch upward from the valleys of the are buoying retailers’ spirits. Te Kroger Co. past decade, and their optimism for recently celebrated its 45th consecutive quarter the retailing climate has reached of same-store sales growth. Describing 2014 as new heights, exclusive research from “an outstanding year by all measures,” Rodney Progressive Grocer reveals. McMullen, chairman and CEO of the CincinnatiMeanwhile, as the manner in based grocery giant, said at Kroger’s March earnwhich business is transacted continues to evolve, ings call that the company “captured more share new issues are keeping grocers up at night. of the massive food market [and] delivered on On a scale of 0 (awful) to 100 our commitments and invested to grow (sensational), retailers surveyed by PG our business. … [O]ur core operating Grocers Are just topped 72, up nearly six points performance without fuel shows that our siGnificAntly from their score for 2014. A year ago, associates are improving our relationship however, retailers’ forecast for the com- more optimistic with customers in ways that grow loyalty About the ing year was 71.8, indicating that 2014 and generate strong shareholder returns.” didn’t pan out quite as expected. However, Ken Odeluga, senior market retAil climAte Still, sentiments are most defnitely compAred with analyst for London-based City Index, trending up, and have come a long way that future trends in the market A yeAr AGo, with warns from the score of 58.4 reported in 2009. may prevent Kroger from delivering the Overall, grocers are signifcantly more neArly hAlf of staggering numbers that it did in Q4. respondents optimistic about the retail climate com“With the shares having gained pared with a year ago, with nearly half of sAyinG they’re more than 64 percent over the last 12 respondents saying they’re sweet on 2015; sweet on 2015. months, and a 52 percent rise in 2013, that’s up from about 39 percent a year the bar is getting higher for continued ago. Just more than a ffth express less strong sentiment,” Odeluga said in Prooptimism (versus 28 percent a year ago) and just shy gressivegrocer.com’s report on Kroger’s last earnof 30 percent declare they envision no change. ings call. “Te point is, a number of forces are As is typical, chain operators are the most confcoalescing that are expected to press on Kroger’s dent, with nearly two-thirds expressing optimism for ‘batting’ average over the next few quarters, retailing this year, up from about 52 percent a year largely from fuel-related to headwinds.” Continued on page 34 ago. About 44 percent of independent operators see April 2015 | progressivegrocer.com |

31

82nd ANNUAL RePORT

of the GROceRy INDUSTRy

methodology Progressive Grocerâ&#x20AC;&#x2122;s 82nd Annual Report of the Grocery Industry is based primarily on an exclusive survey conducted among headquarters executives and store managers at 135 supermarket chains, independents, wholesalers and distributors across the United States. Sixty percent of the respondents classify themselves as independent retailers, and about 18 percent are selfdistributing chains; about 12 percent are wholesalers, and 7 percent are distributors.

Of the total respondents, more than half represent organizations with one to 10 stores, and about a third have 100 or more stores, while about 15 percent are from operations with between 11 and 99 units. Regionally, about 31 percent of respondents are from the Midwest, about a quarter are from the West, just less than a quarter are from the Northeast, and about 21 percent are from the South. Additional store count and sales data are provided by Nielsen TDLinx, which maintains a national database of supermarket and other retail format locations.

type of orgaNizatioN

Number of SupermarketS operated

perceNt of reSpoNdeNtS

perceNt of reSpoNdeNtS

Independent (Use a wholesaler) Chain (Self-distributor) Wholesaler/Wholesaler-owned Store Distributor Other type

1-10 11-99 100 or More Average Number of Stores: 770

51.2%

34.1%

60.3% 17.6%

14.5% 14.7% 0.8%

primary reSpoNSibility/job area

President/C-level Buyer/Merchandiser/Category Management Retail/Store Operations Sales/Advertising/Marketing Store Manager Distributor/Broker Other 19.2%

6.9%

regioN Midwest West Northeast South

21.4% 31.3%

13.1%

3.8%

22.9% 17.7%

41.5% 1.5%

3.1%

Source: Progressive Grocer Market Research, 2015

32

| Progressive Grocer | Ahead of Whatâ&#x20AC;&#x2122;s Next | April 2015

24.4%

All-day choices. All-day growth. Take a fresh look at our new lineup. Everyone is seeing Special K® differently. For shoppers, it’s satisfaction without sacrifice around the clock. For you, it’s a renewed focus on growth. With bold, new flavors and packaging, Special K® nourishes your shoppers and your center store growth. See more at centerstoregrowth.com.

®, ™, © 2015 Kellogg NA Co.

82nd AnnuAl RepoRt

of the GRoceRy InduStRy Continued from page 31

Kroger is likely “mindful of the impact lower crude oil prices, and consequently cheaper wholesale fuel, will have on customer perception,” Odeluga added. “I think essentially, Kroger is saying it will soon need to reduce prices to closer to the average forecourt rate for its biggest rivals.” Te recent drop in gasoline prices has left more money in consumers’ pockets to spend at retail, including grocery. Tat being said, consumer optimism about the economy in early March had fallen to its lowest level since August 2014, according to new survey results released by NACS, the Association for Convenience & Fuel Retailing. At the time of the report, gas prices had increased 29 cents per gallon versus the previous month as refneries began the transition to producing the more expensive summer-blend fuel required in many U.S. markets. Meanwhile, leaders of the newly combined Albertsons Safeway have expressed high hopes for an improved and invigorated shopping experience as the merger partners become a single entity in 2015. “We plan to be the favorite local supermarket in every How was 2014? How are community we serve,” said Robert Edwards, president/ prospects for 2015? CEO of the 2,230-store Rated on a scale of 0-100, where enterprise. “We will do this 0=awful, 100=sensational by knowing, listening to and delighting our customers; providing the right products Total at a compelling value; and 2015 (forecast) 72.2 delivering a superior shop2014 66.3 ping experience.” Market optimism also 2013 67.7 bodes well for the benef2012 63.6 ciaries of the 168 stores cast 2011 65.6 of as a condition of the merger, most signifcantly 2010 59.4 Bellingham, Wash.-based 2009 58.4 Haggen, which, by exponential expansion of its banner 2008 67.1 throughout several states, has 2007 70.9 the potential of becoming 2006 66.9 the next great regional West Coast grocery chain. 2005 65.2 Independents, too, have Source: Progressive Grocer reason to be excited as they Market Research, 2015 vie for the loyalty of consumers looking for new, better and more personalized shopping experiences. Companies like Minneapolis-based wholesale distributor Supervalu Inc. are feeling bullish about the future of the independent grocer. Says Brian Audette, SVP of Supervalu’s corporate independent business, “We’re really focused on keeping our customers relevant.”

RETAIL CLIMATE

Compared with a year ago, are you more optimistic or less optimistic about the retailing climate for supermarkets? More optimistic

| Progressive Grocer | Ahead of What’s Next | April 2015

No change

TOTAL 49.6% 29.8%

20.6%

THE BOTTOM LINE

34

Less optimistic

CHAIN 63.6%

22.8%

13.6%

INDEPENDENT 30.4%

44.3%

25.3% Source: Progressive Grocer Market Research, 2015

What are the big issues keeping you up at night? Current Data Protection/Security

64.3%

Rank 1

Tossing and Price Increases 59.5 2 Turning Tere was a notable Benefits (Minimum Wage, Affordable Care Act, etc.) 56.3 3 change in priorities Food Safety 37.3 4 among grocers who Labor (Recruitment, Retention, Diversity, Training) 35.7 5 responded to our question, “What are the Keeping up With Advancements in Technology 33.3 6 big issues keeping you Increasing Overhead Costs (Energy, Infrastructure, Maintenance, etc.) 28.6 7 up at night?” Topping the list: Sustainability 20.6 8 data protection and Genetically Modified Organisms (GMO) 12.7 9 security, noted by Feeding the Hungry 11.1 10 more than 64 percent of respondents. Competitive Threats 6.3 11 A year ago, data Animal Welfare 2.4 12 security ranked ffth. Since then, retailSource: Progressive Grocer Market Research, 2015 ers of all kinds have been rocked by data breaches of varying severity, from the double hit at Supervalu last summer to the lingering efects of the Target breach that resulted in an executive housecleaning. “In 2014, we saw more attention paid to cyberScore: 100=increase; 50=no change; 0=decrease risks, namely because of Target’s late-2013 attack,” observes Tracy Kitten, executive editor of the Princeton, Current Rank N.J.-based Information Security Media Group. “Media attention, coupled with the congressional hearings Wage Costs 90.9 1 that occurred throughout the year to review merchant Benefit Costs 85.5 2 security, undoubtedly are to thank for bumping cybersecurity concerns to the top of the list among grocers. Competition 84.8 3 While we actually saw a furry of breaches throughout Technology Spending 82.8 4 2013 targeting merchants across the board, including Retail Prices 78.2 5 grocers like Schnucks, none of these breaches got a ton of public attention until Target.” Capital Expenditures 66.4 6 Kitten asserts that retailers’ cybersecurity is Percent Net Profit 65.1 7 subpar. “I think more attention has been paid to Percent Gross Margin 60.0 8 PCI compliance in the last year and a half,” she tells PG, “but we are still a long way out from havEnergy/Fuel Costs 56.3 9 ing EMV [chips] fully implemented at the POS, Employee Turnover 54.4 10 and most grocers are not particularly innovative, Source: Progressive Grocer Market Research, 2015 relative to other merchants, when it comes to payments security. I doubt grocers will adopt EMV at a rate that exceeds other retailers.” Further, most merchants across the board have not historically made big investments in behavioral analytics to monitor transaction activity, Kitten notes. “Grocers and all retailers have an obligation to protect their customers’ cardholder data and personal information,” Kitten says. “If consumers do not feel that their information is safe, they will stop shopping with that merchant, so data security has

Last Year

Rank

28.8%

5

25.8

7

59.5

1

16.0

8

47.9

3

28.2

6

45.4

4

12.9

9

3.7

10

1.8

11

53.4

2

1.8

11

expected 2015 change in coMpany operational Factors Last Year

Rank

83.3

2

84.3

1

79.6

3

75.8

5

74.8

6

57.5

7

51.9

9

46.9

10

77.4

4

51.6

9

Continued on page 38 April 2015 | progressivegrocer.com |

35

82nd AnnuAL RePORT

of the GROCeRy InDusTRy

10 Ideas to support revenue Growth In 2015 By Tara Oberg Tara Oberg, a senior associate at data-driven consultancy Seurat Group, gives her top 10 list of strategies that supermarkets can use to drive revenue in the coming year:

foodservice sales as shoppers seek more quality, time-saving options. Invest space and resources in both meeting shoppers’ need for a convenient dinner to take home and driving impulse hot-meal purchases.

1.Build loyalty through trust. The continued rise of natural and specialty grocers displays the value in creating a loyal shopper base by offering products and brands that buyers can be confident about, both in terms of safety and quality. These retailers are creating proprietary rating systems that consumers trust to guide them.

7. Cautiously approach shoppers’ “deal only” purchase behavior. Given declining revenue and margins in CPG retail since 2007, retailers have placed a huge emphasis on managing pricing and promotion. More than one-third of packaged food and household products are now sold on discount, meaning that today’s shoppers are trained to purchase on “deal only.” Today’s retailers should proceed with care, but shift focus of CRM and merchandising toward value instead of price.

2. Look to frame-breaking channels for inspiration. Retailers across channels have begun to look toward smaller, more entrepreneurial channels to stay informed on the latest innovation, macro-trends and consumer preferences. Within the pet industry, Petsmart and Petco continuously learn from mom-and-pop pet stores and local/regional chains that are more in touch with their pet owner communities, and more in tune with requests and preferences. 3. Do more to understand your customers. Shopper segmentations are a common way of understanding the subsets of shoppers. However, this work becomes most actionable when retailers can prioritize high-value segments and understand the moment and message necessary to trigger a purchase. This process drastically improves efficiency and simplifies marketing, ensuring it’s not just a game of trial and error. 4. Turn double-digit e-commerce growth into triple digit. Despite slower adoption of e-commerce for certain grocery categories, online purchase remains an avenue for revenue growth for most retailers. Success in this area comes from being consumer-led and understanding how to connect the array of touchpoints, from navigational behaviors and purchase drivers to delivery options (home delivery, curbside pickup). 5. Partner to most effectively use your data. Collaborative planning is invaluable, and there are often huge benefits for retailers sharing granular purchase behavior data (at the household level, beyond reports) with go-to partners that have experience working with them. This kind of data has been used to create new insights and actions that double the rate of category growth in a market.

8. Offer shoppers price and value instead of just the lowest price. In the face of a challenging environment to raise prices, retailers can increase revenue by taking a more holistic approach to the total price-value equation and refuting the notion that pricing up or taking product out are the only levers available. Understanding the relationship between the desired benefits of a product or service and the price paid will allow retailers to better assess which items to carry and how to communicate a value message in-store. 9. Leverage private label to win. Another way to appeal to value-seeking shoppers is through a more strategic private label offering. Many retailers have created both value and premium private label lines to differentiate themselves. Success comes from fully understanding shoppers’ price and product needs and developing store-brand products to best meet them. 10. Appeal to growing customer cohorts by understanding their perception of value. The staggering growth and buying power of Millennials have already made CPG retailers and manufacturers take notice. Winning with this shopper group depends on retailers’ ability to appeal to their value equation. Millennials are less interested in specific brand names, but more interested in what brands stand for, and are more likely to pay more for natural or organic products. A retailer that can offer the right mix of private label products and premium, branded ones will appeal more to this cohort.

6. Be part of shoppers’ dinner consideration set. “Dinner tonight” is a growing source of wallet that leading retailers are capturing through prepared meals. In fact, the growth of in-store and takeout dining options is outpacing that of

36

| Progressive Grocer | Ahead of What’s Next | April 2015

Tara Oberg, a senior associate at the Norwalk, Conn.-based Seurat Group, has domestic and international experience that includes category leadership, brand and channel strategy, and organizational design work.

mcgladrey.com/retail

82nd AnnuAl RepoRt

of the GRoceRy InduStRy

Supermarket SaleS by Format Number of Stores

Continued from page 35 Percent of Total

Sales ($ Millions)

Percent of Total

$638,338

100.0%

Total Supermarkets ($2 million or more)

37,716

100.0%

Supermarket-Conventional

26,487

70.2

414,794

65.0

Supercenter (Grocery and Mass Merch.)*

4,150

11.0

159,824

25.0

Supermarket-Limited Assortment

3,242

8.6

16,106

2.5

Supermarket-Natural/Gourmet Foods

3,144

8.3

38,372

6.0

Warehouse Grocery

523

1.4

4,367

0.7

Military Commissary

170

0.5

4,876

0.8

152,120

n/a

$412,703

n/a

Gas Station/Kiosk

22,303

n/a

n/a

n/a

Superette

13,070

n/a

19,974

n/a

1,320

n/a

136,339

n/a

674

n/a

4,067

n/a

Other Food Retail Formats Conventional Convenience**

Conventional Club Military Convenience Store

a huge and direct impact on customer satisfaction and sales.” Also higher on the list: price increases, at second place, noted by nearly 60 percent of survey respondents and up from seventh a year ago. Benefts, such as minimum wage and the Afordable Care Act, ranked third this year after leading the list in 2014. Competitive threats, No. 2 last year, plunged to 11th place — an interesting development, especially amid growing challenges from alternative channels like drug, dollar and digital.

*Supermarket-type items only **Excluding gas Source: Nielsen TDLinx; Progressive Grocer Market Research, 2015

Supermarket SaleS by SaleS range Number of Stores

Percent of Total

Sales ($ millions)

Percent of Total

Supermarkets ($2 million or more)

37,716

Chains (11 or more stores)

30,925

100.0%

$638,338

100.0%

82.0%

$602,708

94.4%

$2,000,000 to $4,000,000

2,980

7.9

9,265

1.5

$4,000,000 to $8,000,000

6,858

18.2

39,604

6.2

$8,000,000 to $12,000,000

3,442

9.1

35,998

5.6

$12,000,000 to $20,000,000

4,833

12.8

79,087

12.4

$20,000,000 to $30,000,000

6,118

16.2

151,379

23.7

$30,000,000 to $40,000,000

3,217

8.5

111,580

17.5

$40,000,000 to $50,000,000

2,077

5.5

92,048

14.4

$50,000,000+

1,400

3.7

83,747

13.1

Independents (10 or fewer stores)

6,791

18.0%

35,630

$2,000,000 to $4,000,000

2,222

5.9

6,756

$4,000,000 to $8,000,000

5.6% 1.1

4,015

10.6

21,751

3.4

$8,000,000 to $12,000,000

366

1.0

3,695

0.6

$12,000,000 to $20,000,000

148

0.4

2,252

0.4

$20,000,000 to $30,000,000

33

0.09

802

0.1

$30,000,000 to $40,000,000

3

0.01

105

0.0

$40,000,000 to $50,000,000

1

0.00

46

0.0

$50,000,000+

3

0.01

225

0.0

Source: Nielsen TDLinx; Progressive Grocer Market Research, 2015

38

| Progressive Grocer | Ahead of What’s Next | April 2015

Supermarket Sales by Store Format Total supermarket sales topped $638 billion in 2014, up from $620 billion a year ago. Tat’s an increase of about 2.9 percent, the same as PG reported last year, indicating a fattening trend that follows the 3.1 percent growth in 2012. Tat fatness bears out when looking at store numbers by format. No surprise that conventional supermarkets dominate the marketplace, with 70 percent of all stores (down 1 percentage point from a year ago). Supercenters increased their share by just three-tenths of a percentage point, while natural/gourmet format stores account for more than 8 percent of stores, up about four-tenths of a point, with that growth driven in part by the rapid expansion of upand-coming chains such as Sprouts and Fresh Tyme. In share of sales, conventional supermarkets maintain a frm 65 percent

82nd AnnuAl RepoRt

of the GRoceRy InduStRy

AverAge Per-Store SuPermArket PerformAnce meASureS 2014

2013

2012

Sales Volume ($ Millions)

$16.92

$16.56

$16.26

Selling Area (Square Feet)

33,300

33,250

33,100

10.5

10.2

9.9

$325,478

$318,462

$312,758

Number of Checkouts Average Weekly Sales Dollars per Store Dollars per Square Feet Dollars per Checkout

9.77

9.58

9.45

30,998

31,222

31,592

Source: Nielsen TDLinx; Progressive Grocer Market Research, 2015

hold on total sales, supercenters take a quarter, and natural/gourmet enjoy 6 percent, up almost a full point since last year.

Supermarket Sales by Store Count Dollar sales growth outpaced unit growth among chains with 11 or more stores, as well as among

independents, with percentages holding steady year over year. Larger chains added just 147 new stores in the past year, an increase of less than 0.5 percent on a total approaching 31,000 units, or 82 percent of all stores. Tose stores accounted for nearly $603 billion in sales, or more than 94 percent of all supermarket sales, consistent with their share a year ago. Independent operators added 110 stores in the past year, an increase of 1.6 percent from a year ago. Indies’ sales contribution rose nearly 2.7 percent since last year, for a total of $35.6 billion, or a 5.6 percent overall share, unchanged from a year ago.

Store Performance Measures Investments in people, space and service continue to reap positive results. Sales volume is up more than 2 percent and selling area is up slightly over a year ago, as is the number of checkouts. Likewise, dollars per store are up about 2 percent overall in the past year.

GREEN RETAILING SUSTAINABILITY EVENT FOCUS ON

AT THE ONLY CROSS CHANNEL RETAIL INDUSTRY

June 29–July 1, 2015

Rosemont Hilton Hotel • Rosemont, IL An invitation-only event that brings suppliers and retailers of all channels together to discuss innovation and the future of sustainability and green retailing. Now in its fourth year, this year’s summit ofers excellent networking and learning for top executives with four featured keynotes, boardroom briefings and one-on-one meetings. Great sessions and speakers on the agenda: • Responsible Retailing at Ahold, Jihad Rizkallah from Ahold • Selling and Financing Energy Eficiency Programs Internally in a Challenging Environment, Gary Levitan from Hudson Bay • Success with the Better Building Challenge, Department of Energy Panel • Strengthen Your Sustainability Programs by Leveraging Partnerships with the EPA, Environmental Protection Agency Panel Retailers: For more information or to request an invitation, contact John Failla, at jfailla@stagnitomail.com or at 914-574-5709. Suppliers: To become a sustainability partner or summit sponsor, contact Jory Cener, at jcener@stagnitomail.com or at 201-855-7617.

40

| Progressive Grocer | Ahead of What’s Next | April 2015

Our All Natural Gelato and All Natural Ice Cream are made with a few simple ingredients: fresh cream, pure sugar, rich cocoa, fresh fruit, and real vanilla. It may sound simple, but at Turkey Hill, we know that real ingredients get real results. N E W ! A L L NAT U R A L G E L ATO

A L L NAT U R A L I C E C R E A M NEW F L AVO R S

B u t t e r Pe c a n Chocolate Chip Chocolate Chocolate Chip C h o c o l a t e Pe a n u t B u t t e r H o m e m a d e Va n i l l a Va n i l l a Fu d g e

Belgian Style Chocolate Butter Almond & Chocolate Mint Chocolate Chip S a l t e d C a ra m e l Va n i l l a B e a n Va n i l l a B e a n a n d C h o c o l a t e

Chocolate Chocolate Chip C h o c o l a t e Pe a n u t B u t t e r Coffee Chip Hazelnut Mint Chocolate Chip Pe a c h M a n g o

P u re l y Va n i l l a S e a S a l t e d C a ra m e l

Contact Colin Wright at Turkey Hill Dairy, 800.873.2479 | Email: colin.wright@turkeyhill.com 2601 River Road, Conestoga, PA 17516 | turkeyhill.com

82nd AnnuAl RepoRt

of the GRoceRy InduStRy

Enhancing thE in-storE ExpEriEncE

Evolving store concepts, amenities, marketing strategies and modes of communication shape how grocers keep shoppers coming back. Perpetually challenged by a cutthroat competitive climate, notoriously thin proft margins, and demanding — and often dichotomous — patrons, the grocery business can be brutal, which speaks directly to the need for grocers to concentrate heavily on enhancing the in-store experience to stand apart from both traditional and upstart competitors. To that end, signature products, private label and store-within-a-store specialty departments are deemed the top three most productive tactics to augment the in-store experience among retail executives respond-

Enhancing thE in-storE ExpEriEncE: MErchandising/Brand EnhancEMEnt

Percent of respondents rating each strategy as extremely or very important Signature Products

64.5 62.7

Private Label

61.5

Store-within-store Specialty Depts. Cross-merchandising

57.8

Prepared Foods

57.4

Locally Sourced Products

55.8

BOGOs

34.5

In-store Pharmacies

28.8

Free WiFI

22.2

Cooking/Meal Prep Stations

22.1

Source: Progressive Grocer Market Research, 2015

iMportancE of stratEgiEs: consuMEr MarkEting/advErtising

Percent of respondents rating each strategy as extremely or very important 58.1

In-store Signage/Digital Media 45.2

Digital Marketing

42.1

Newspaper Inserts

37.1

Newspaper Ads (ROP) Mobile Marketing

34.5 31.0

Direct Mail (Circulars, etc.) Radio Advertising TV Advertising Custom Magazines

12.1 9.5 5.3

Source: Progressive Grocer Market Research, 2015

42

| Progressive Grocer | Ahead of What’s Next | April 2015

ing to PG’s 2015 Annual Report of the Grocery Industry survey. While signature products and private label are often considered one and the same in the supermarket world, the latter, for purposes of this study, refers to exclusive products housed primarily in the fresh departments, such as gourmet desserts from the in-store bakery, store-made entrées from the fresh meat department, specialty cheese products, bundled meal deals, everyday-value bouquets in foral, and oven-ready regional seafood specialties. Meanwhile, today’s increasingly sophisticated supermarket private label products are all about differentiation, quality and the overall value proposition, and only partially about price. Retailers have invested countless internal resources and millions of dollars annually into perfecting their vast and diverse private brands across the entire store to provide customers meaningful value while shining a spotlight on items that “can only be had here.” Consequently, private label prominence has forever solidifed its place in the hearts of both retailers and consumers alike, and will remain a critical and compelling component of building the in-store experience for years to come. Conversely, as we glance back 30 years — give or take a few — a retailer’s life was certainly far easier, regardless of the channel. Food stores sold food, drug stores sold medicines and sundries, and fastfeeders sold meals. Beginning in the late 1980s and revving up in earnest by the mid-1990s, however, retailers of all stripes began to realize that they could successfully sell many products beyond the Continued on page 46

Jay Leno Entertainer

Martha Stewart Founder, Martha Stewart Living Omnimedia

Walter Robb Co-CEO, Whole Foods Market

Phil Lempert the Supermarket Guru

Harold Lloyd Founder, Harold Lloyd Presents

Youngme Moon Author and Professor, Harvard Business School

Arianna Huffington Co-founder & Editor-in-Chief The Huffington Post

Shaquille O’Neal NBA All-Star and Sports Analyst for TNT and NBATV

• Learn from renowned food safety speakers • Improve delis with IDDBA Food Safety research • Engage in Listeria food safety training in the new Show & Sell Theater • Get credentialed in a free ServSafe® Certification Class

New Initiative!

Protect your customer’s well-being and strengthen your food safety culture with IDDBA’s new Safe Food Matters!

Go to iddba.org/safefoodmatters for more information.

The Evolution Continues

Hands-On Expo & Learning Opportunities

Grow with 8,500 other dairy, deli, bakery and foodservice professionals while you surround yourself with changing demographics and buying behaviors, increased emphasis on natural, and new convenient formats. See what it takes to increase store visits and have your products embraced by multi-generational buyers using digital strategies and omni-channel marketing. World-class presentations will expose you to many leaders and insightful business people and marketers in our industry.

Experience our jam-packed show floor with more than 1,800 booths filled with new products, services and new ideas that will move your business. Don’t miss our eye-opening New Product Showcase or our 10,000 sq. ft. Show & Sell Center. You’ll have plenty of networking opportunities while exploring the latest merchandising and new products – all in a retail setting that integrates actionable take-aways.

608.310.5000 • www.iddba.org

Anti-fog Lids Keep Food Fresh & Appealing • Crystal clear lids • No lid condensation • Food looks fresh and just made • Sustainable solutions • Leak resistant seal • Variety of shapes and sizes • Hinged packages with tear-away lids • Separate bowls and lids • Post-Consumer recycled content • Recyclable

Let’s Make This Perfectly Clear

anchorpac.com

All products are BPA-free and eligible for recycling ©2015 Anchor Packaging, Inc - St. Louis, Missouri

82nd AnnuAl RepoRt

of the GRoceRy InduStRy

importancE of stratEgiEs: consumEr EngagEmEnt

Percent of respondents rating each strategy as extremely or very important Customer Relationship Marketing

69.8

Social Media

49.1

Loyalty Incentive Programs

47.4 24.1

Online Surveys Comment Cards

21.6 19.8

Blogs Toll-free Hotlines

12.9

Source: Progressive Grocer Market Research, 2015

Enhancing thE in-storE ExpEriEncE: customEr intEraction

Percent of respondents rating each strategy as extremely or very important Community Involvement

71.2 65.8

Seasonal Special Events Sampling, Demos

52.7 27.9

Wellness Events/Health Screenings Healthy-eating Store Tours

18.0

Cooking Classes

18.0

Source: Progressive Grocer Market Research, 2015

Enhancing thE in-storE ExpEriEncE: in-storE sErvicEs

Percent of respondents rating each strategy as extremely or very important On-site Butchers

60.4 34.5

Seafood Specialists

26.1

Service-based Kiosks

23.4

Informational Kiosks

20.0

Children’s/Student Programs

17.1

Wellness Experts/Registered Dietitians Event Planners

12.6

Certified Chefs

10.0

Cheesemongers

10.0

Source: Progressive Grocer Market Research, 2015

Continued from page 42

edges of their traditional boundaries. Grocery stores began adding pharmacies with complete HBC sections and morphed quickly into compelling combo food/drug formats. Drug stores followed suit by making signifcant forays into food, a cause which was vigorously furthered by spunky regional Bentonville, Ark.-based retailer Wal-Mart Stores Inc.,

46

| Progressive Grocer | Ahead of What’s Next | April 2015

which started selling a full line of groceries and high-volume fresh commodities in some stores. Te common denominator for migratory channelblurring can be explained by a simple answer: store size. Over the period between 1960 and 2000, the square footage of the average store grew relentlessly; the latest year’s prototype foor plan always seemed to be a few thousand feet larger than the prior year, which provided retailers with an incrementally larger platform to test and experiment with new departments housing more products in bigger cases, and with it, bigger ROI needs and expectations. But much has been learned from yesteryear’s “bigger is best” store confgurations, which brings us back to the present day of retailing, when more compact footprints are becoming the preferred choice for many retailers’ new store confgurations. Regardless of the size of the box, store-within-a-store departments have been among the most infuential tactics for progressive grocers to amp up the in-store experience with full-on specialty departments, be it beauty and wellness, kitchenware, pet food/pet care, or free-from products. To that end, the key to the most successful retailers’ store-within-a-store concepts is to capitalize on categories that drive frequent visits and concurrently surprise and delight their most important shoppers, which in turn enables them to capitalize on those visits with countless other items found throughout the rest of the store. Other elements cited as being highly infuential in enhancing the in-store experience among this year’s retailer panelists include cross-merchandising (57.8 percent), which slid nearly 10 points from last year; prepared foods (57.4 percent), which held steady from the year-ago report; locally sourced products (55.8 percent), which are expected to continue to gain prominence; time-tested BOGOs (34.5 percent); in-store pharmacies (28.8 percent); free WiFi (22.2 percent); and cooking/ meal prep stations (22 percent).

In-store Services In the current food retailing war, supermarkets are clearly in the crosshairs of many formidable contenders. For that reason, grocers are pulling out all the tools in the shed to help them shine in a sea of sameness, with strategies to help impart an experience, rather than just another place to pick up products that can be sold anywhere. To that end, many grocery leaders are accelerating ongoing eforts to enhance relevancy, diferentiation and tailor-made community appeal with specialty services and resident expertise that are available for the asking. In addition to personalized, professional advice and guidance from pharmacists, in-store nutritionists, dietitians,

WANT BETTER SELL-THROUGH? USE BETTER BAIT. Find your supplier tod

t Buy.louisi n se food.com

82nd AnnuAl RepoRt

of the GRoCeRy InDuStRy wellness experts and even aestheticians available to consult with shoppers on how to live with a new diagnosis such as diabetes, high blood pressure or celiac disease, many retailers are also seeing success with kids’ cooking and nutrition classes, wellness and nutrition sessions, oral care screenings, and smoking cessation seminars — all of which are usually free or inexpensive. However, the most critical in-store service cited by this year’s Annual Report of the Grocery Industry panelists is that of on-site butchers or resident meat department experts, viewed by 60 percent as the most rewarding component of an excellent in-store experience. Pacing butchers in the second seed is having seafood experts, which is also considered to yield a rewarding ROI for building bonds with consumers among 34 percent of respondents, followed next by service-based and informational kiosks.

Benefits of MoBile Devices/sMartphones Total Facebook

48.3%

e-Coupons

46.6

Digital Circulars

45.7

Interactive Websites

31.9

Price Comparison Apps

28.4

Personalized Discounts

27.6

Shopping List Apps

27.6

Personal Shopping Assistance

24.1

Delivery of Online Orders

23.3

Paper Circulars

22.4

POS Loyalty Cards

19.8

Order Online/In-store Pickup

18.1

Meal Planner Apps

15.5

Direct Mail

13.8

In-store Digitial Media

12.9

Shopping History

12.1

11.2

QR Codes

9.5

YouTube

6.0

5.2

In-store Video Marketing

5.2

Geo-fencing

3.4

Other

1.7

Source: Progressive Grocer Market Research, 2015

48

| Progressive Grocer | Ahead of What’s Next | April 2015

GraDe of coMpany’s strateGy for connectinG with consuMers Total A: We have a fully integrated strategy using in-store, online and digital channels (omnichannel).

12.9%

B: We’ve got a strategy that we’re executing.

32.8

C: We’re just getting started.

37.1

D: We’re barely there.

12.9

F: What’s omnichannel?

4.3

Source: Progressive Grocer Market Research, 2015