THE TOP

The Top 150 Hardware and Building Supply Dealers are leading the way with innovation and excellence.

JULY/AUGUST 2023 Volume 49 No. 7

THE LEADERBOARD ISSUE

• • Aug. 2 – 3 in Dallas, TX INDEPENDENTS CONFERENCE O Sign up online at YourNHPA.org/conference

• ! • O • • O • x • T • 2 0 23 NHPAYOUNG R E TAILEROFTHE YEA R • 27THANNUAL A W ARDS PROGRAM Young R ail r Y ar of NHPATOP G U NS AWARDS Top Guns • • • • • THE INDUSTRY ' S BEST RETAILERS • • • • • J f f f G f f f G x f , , Aug. 1 – 3 in Dallas, TX ORGILL COMPANION EVENT YourNHPA.org/conference, or talk to your Orgill rep. We’ll see you in Dallas!

27

28 Windows and doors. Masonite’s CFO shares market insights in the door category.

30 Six keys to converting online shoppers.

4 July/August 2023 HARDWARE + BUILDING SUPPLY DEALER HBSDealer.com Hardware + Building Supply Dealer (ISSN 2376-5852) is published monthly, except for July/August and November/December, which are double issues, by EnsembleIQ, 8550 W. Bryn Mawr Ave., Suite 200, Chicago, IL 60631. Subscription rate in the United States: $110 one year; $200 two year; $14 single issue copy; Canada and Mexico: $130 one year; $235 two year; $16 single issue copy; Foreign: $150 one year; $285 two year; $16 single issue copy; in all other countries (air mail only). Digital Subscription: $75 one year; $140 two year. Periodical postage paid at Chicago, IL., and additional mailing offices. POSTMASTER: Please send address changes to HBSD, Circulation Fulfillment Director, 8550 W. Bryn Mawr Ave., Suite 200, Chicago, IL 60631. Copyright © 2023 by EnsembleIQ. All rights reserved. 07/08.23 COVER STORY The Industry Leaderboard Meet the rst Fifty, from Home Depot to LaValley/ Middleton Building Supply. Plus: Dealers re ect on 2022 and prepare for the challenges of 2023. FROM THE EDITOR 8 Who you calling ‘grumpy?” A response to a Silicon Valley disrupter. NEWS & ANALYSIS 10 Meet the ProDealers of the Year. 12 Mead Lumber rebrands with a new logo and website. 14 Ace Builds in Kansas City. 14 Fast Five highlights from Chicago INDEPENDENT PROFILE 15 Parks Building Solutions looks to perfect the process. 18

VALUE REPORT

TRUE

to the

26 Rising

challenge of staf ng at Johnson True Value.

ground.

CEO Chris Kempa helps break

PRODUCTS

TECHNOLOGY

WOMEN PROFILE SERIES

IN EVERY ISSUE 12 News Map 14 Product Knowledge 33 People in the News 34 Quikrete Industry Dashboard 30 15

TOP

32 Secrets to longevity from Idaho’s ‘Tin Lady’ Leila Crockett.

We already have a PIM. But we get hundreds of requests weekly from customers for our product data. OnePDX has this figured out.”

The One Spot Where Business Meets

LBMX Supply Cloud has revolutionized supply chain relationships. It unites suppliers and distributors for a simpler procurement-to-payment process. With 30+ integrations to the world's largest systems, it's your secret ingredient to effortless trading.

Gone are the days of one-time integrations, unsecure emailed PDFs, and data entry errors. Accurate product information, seamless EDI connection, easy commerce, electronic payments, and insightful analytics - they're all centralized in LBMX Supply Cloud.

Trade Smarter. Order Easier. Send Accurately. Pay Simply.

Join the Supply Cloud network today and connect the way you want.

gosupplycloud.com OneEDI OnePay OneAnalytics OnePDX OnePIM

“

Here's What's Online

See more and share more when you follow us on Linkedin.

Garage video: BuildRight deck screw

A very special 22nd episode edition of Ken’s New Jersey Garage demonstrates the BuildRight Deck Screw from Midwest Fastener. Check it out in our video library at HBSDealer.com/video. And Follow us on Youtube @HBSDealer

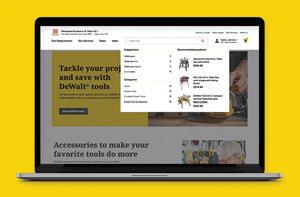

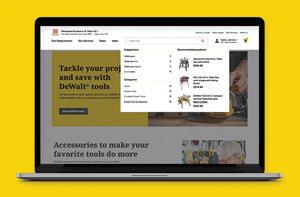

Inside an E-commerce initiative

HBSDealer.com traveled to Fort Wayne to meet the leaders behind Do it Best’s ambitious e-commerce effort. Watch the interview with Allison Flatjord, Brianna Wells and Corbin Prows, and read more about the initiative at HBSDealer.com

The 2023 Industry Leaderboard is online

The fi rst 50 leaders of the hardware and building supply industry are spelled out on pages 20 and 22. For the full list of one through 150, visit the online Leaderboard Report, sponsored by Epicor, at HBSDealer.com/report

When you connect with us, you connect with the industry @HBSDealer

6 July/August 2023 HARDWARE + BUILDING SUPPLY DEALER HBSDealer.com

From the Editor

Who you calling ‘grumpy?’

From the Editor doesn’t like to pick ghts with Silicon Valley titans. But when the honor of the innovative and customer-centric leaders of the hardware and building supply industry is at stake, editorials most slant appropriately.

Inferno, on the contrary has created an environment that has generated $47 billion in new business in the last three years alone.

Secondly, and more importantly, in a letter to potential contractor customers, Forte describes his business this way: “We are not the building materials supplier from the 1980s with the grumpy guy behind the counter.”

550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 www.HBSDealer.com

BRAND MANAGEMENT

SENIOR VICE PRESIDENT John Kenlon (516) 650-2064 jkenlon@ensembleiq.com

EDITORIAL EDITOR-IN-CHIEF Ken Clark kclark@ensembleiq.com

LBM EDITOR Andy Carlo acarlo@ensembleiq.com

HARDWARE EDITOR Tim Burke tburke@ensembleiq.com

ADVERTISING SALES & BUSINESS

ASSOCIATE PUBLISHER Amy Platter Grant MIDWEST & SOUTHERN STATES (773) 294-8598 agrant@ensembleiq.com

REGIONAL MANAGER Greg Cole

NORTHEAST & GREAT LAKES STATES (317) 775-2206 gcole@ensembleiq.com

A recent article that appeared in HBSDealer about BuildClub, which describes itself as “like Amazon Prime for Building Materials,” compels me to push back on this Palo Alto, California-based newcomer.

It’s founder, Stephen Forte, seems sincerely energetic and enthusiastic about his growing business, which delivers—in a matter of hours—various hardware and building products to homeowners and contractors.

I am compelled to object, however, with some heat, to a couple of his suggestions.

First, here’s how Forte in a promotional video describes the DIY home improvement sector:

“Home improvements have always meant braving that special hell otherwise known as a big box store on Saturday morning before trying to get those materials home.”

(The video cuts away to images of a Home Depot and cars awkwardly burdened with building materials.)

Ladies and gentlemen, Home Depot doesn’t need me to defend it against this extreme exaggeration.

But as the editor of the magazine founded as “National Home Center News,” I feel compelled to simply mention that Home Depot, in contrast to the notion that it creates an environment fit for inclusion in Dante’s

I ask respectfully, sir, where today is this so-called grumpy guy behind the counter?

He’s not at Hancock Lumber, where CEO Kevin Hancock infuses native-American enlightenment while he promotes a shared leadership approach throughout the company. [In a recent article, Hancock told HBSDealer: “Our industry is lled with incredible companies that provide authentic and sustained value to their employees, industry, and community.”]

He’s not at Drexel Building Supply, where the mission is “Supply. Happiness” and the happy employees use titles such as defensive coordinator and quarterback instead of COO and salesman, respectively.

And he’s not at Hilltop Lumber or Kodiak Building Partners, our 2023 prodealers of the year.

Gentle readers, your attention please to our Industry Leaderboard that begins on page 20 and continues online at HBSDealer.com/report.

You’ll nd a lot of innovative and customer-centric businesses on the list. And you won’t nd many grumpy old guys behind the counter.

Agree? Let us know.

DESIGN/PRODUCTION/MARKETING

SENIOR CREATIVE DIRECTOR Colette Magliaro cmagliaro@ensembleiq.com

ART DIRECTOR Bill Antkowiak bantkowiak@ensembleiq.com

PRODUCTION MANAGER Patricia Wisser pwisser@ensembleiq.com

MARKETING MANAGER Kathryn Abrahamsen kabrahamsen@ensembleiq.com

SUBSCRIPTION SERVICES LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@HBSDealer.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF OPERATING OFFICER Derek Estey

CHIEF PEOPLE OFFICER Ann Jadown

CHIEF STRATEGY OFFICER Joe Territo

EDITORIAL ADVISORY BOARD

Levi Smith, CEO, Franklin Building Supply

Steve Sallah, CEO, LBM Advantage

Christi Powell, Women & Minority Business Enterprise Market Manager, 84 Lumber

Neal DeLowery, Store Projects and Merchandise Manager, Aubuchon Co.

Brad McDaniel, Owner, McDaniel’s Do it Center

Joe Kallen, CEO, Busy Beaver Building Centers

Tom Cost, Owner, Killingworth True Value

Permissions: No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or information storage and retrieval system, without permission in writing from the publisher.

connect with us

8 July/August 2023 HARDWARE + BUILDING SUPPLY DEALER

Ken Clark Editor-in-Chief

The HBSDealer Top Women in Hardware & Building Supply program honors women making outstanding contributions to their companies and their communities. Join us at the Sheraton Grand Chicago Riverwalk, November 15th - 16th 2023 to celebrate the honorees! Visit www.hbsdtopwomen.com for more information. EMPOWERING INDUSTRY TRAILBLAZERS Thank You to Our Current 2023 Sponsors

Real Estate Agent

Million Dollar Listing

Resilience Expert, Author

Consultant, Ask Dr.

Talia McKinney

Bravo's

Dr.

Deb Gilboa

and

G

Vice President

Alisha Gray Purchasing Manager, Home Products, Orgill Ecommerce, Do

Allison Flatjord

of

it Best

Lyndze Baldwin

Inside

Sales Specialist, Boise Cascade

INTRODUCING THE LATEST SPEAKERS TO JOIN OUR EVENT

Jordan Paeth Director of Field Operations, Franklin Building Supply

Meet the ProDealers of the Year

NLBMDA AND HBSDEALER RECOGNIZE ELITE PERFORMANCE.

For Kodiak Building Partners, it all started in 2011 as an idea to invest in a steel fabricator with loads of potential just outside of Denver.

For Hilltop Lumber the road to success began in 1988, when the Minnesota company launched with five employees and three trucks in the city of Glenwood.

Today, Kodiak and Hilltop earned recognition as the ProDealer of the Year and the Independent ProDealer of the Year, respectively. The award is presented by the editors of HBSDealer in concert with the National Lumber and Building Material Dealers Association, and they recognize high-performance

lumberyards with a commitment to best practices and the best values of the lumber and building material industry.

Kodiak Building Partners has grown to well over 100 locations in 25 states.

More openings,

closings and acquisitions

The HBSDealer News map above illustrates the location of acquisitions, openings and closings in the hardware, home center, lumberyard and building supply sectors. The chart is updated regularly from press announcements, external media reports and original reporting.

Recent updates to the map include plans for a new Westlake Ace Hardware in the Kansas City metro area, this one in Olathe, Kansas. There’s also a closing in Enfield Connecticut for one of the stores of Carr Hardware, which continues to operate six stores in New England.

Dallas-based Nation’s Best Holdings acquired two more Texas locations, which will continue to operate as B & S Hardware & Lumber in Pittsburg and Gilmer. Visit the interactive version of the map at HBSDealer.com/map

“We founded Kodiak with a vision to create a culture that empowers local leaders to succeed in the communities they serve,” said Kodiak CEO Steve Swinney. “So this award is fi tting recognition for our continued focus on empowering our operators in a locally led organization that honors the legacy of the great independent operators who built our industry.”

Hilltop currently operates four locations in western Minnesota , including a dazzling Idea House show room in Alexandria.

“Our purpose—to help plan, supply and deliver dreams—along with our core values have always been at the forefront of everything we do and the main reason for our success,” said Brian Klimek, Hilltop Lumber owner and general manager, described his team as “incredibly honored” for the recognition.

The prodealers will accept their awards in a ceremony held during the Oct 4-6 ProDealer Industry Summit in Kansas City, hosted jointly by HBSDealer and the NLBMDA. Find out more at Prodealer.com

10 July/August 2023 HARDWARE + BUILDING SUPPLY DEALER HBSDealer.com News + Analysis

The Kodiak Building Partners portfolio includes the crew of Barnsco, specialists in concrete supplies and rebar in Texas and Michigan (shown here.)

Hilltop Lumber of Minnesota is the 2023 Independent ProDealer of the Year.

Name change: International edition

IN CANADA, A FINAL PASSING OF THE TORCH.

RONA Inc., one of Canada’s largest home improvement retailers and the former Lowe’s Canada, announced that it will begin converting the banners of its stores.

Lowe’s Canada stores will be transitioned to the Rona banner, which has served Canadian home improvement customers since 1939.

The conversions will start at the end of July 2023 and will take place over several months, the Boucherville, Quebec-based retailer said.

In February, RONA announced that it had “re-established itself” as an independent industry player following its

acquisition from Lowe’s by private equity firm Sycamore Partners.

Valued at $400 million, the deal put an end to Lowe’s international retail ventures.

Sign of the future: All Lowe’s stores in Canada will eventually be converted to the new banner.

The first 10 Lowe’s stores to be converted are all located in Ontario. All Lowe’s stores that will be converted, will bear the new RONA+ banner. Eventually, all Lowe’s stores will be converted to the new banner, RONA said.

Brand change: Domestic edition

MEAD LUMBER MAKES A MODERN ADJUSTMENT.

Mead Lumber launched a rebranding initiative that includes new logo and new website and new web address (Meadlumber.com).

“Our team has been working tirelessly to develop a fresh look for our brand that better represents the quality, reliability, and innovation that our customers have come to expect from us,” said Dave Anderson, CEO of Mead Lumber.

The diverse prodealer with 52 operating locations across nine states, said some

STAT OF THE MONTH

keep their name but will follow the new logo and design scheme.

Mead Lumber, the 2019 HBSDealer Pro-

Dealer of the Year, has 52 operating locations in Colorado, Kansas, Iowa, Missouri, Montana, Nebraska, Oklahoma, South Dakota, and Wyoming, including five truss and wall panel manufacturing plants and a countertop manufacturing facility.

The company also operates Mead Lumber Farm and Ranch, offering products for livestock pens to pole barns.

Number of new stores The Home Depot plans to open in the next five years. That figure was shared during the 2023 investor and analyst conference in June. At the end of the first quarter, the Atlanta-based giant operated 2,324 stores.

12 July/August 2023

+

HBSDealer.com News + Analysis

HARDWARE

BUILDING SUPPLY DEALER

Eighty

LET’S GET GROWING

G

Do it Best provides me the guidance and insights to set my business apart from the competition.

Experienced Do it Best member-owners gave first-time member-owner Steve Bennett a wealth of industry knowledge.

tr y

We connected first-time member-owner Steve Bennett with a network of successful LBM member-owners to help him start out strong. Join a company that’s committed to taking your business as far as you can dream it.

Read how Pilot Lumber Company’s success story started with a supportive community at doitbestonline.com/PilotLumber.

Ace builds in Kansas City

Ace Hardware Corporation has announced plans to open a new retail support center (RSC) located in Kansas City, Missouri.

Product Knowledge

Product: Ultimas lawnmowing shoes

Made by: Valley City, Ohiobased Cub Cadet, a brand of Stanley Black & Decker

Knowledge: That’s right. It’s a shoe to wear when mowing the lawn. The limited-edition shoe features a water-resistant upper, grass-stain proof exterior, a laceless design and an LED light-up tongue. A step-out heel frame is built-in for easy dismount.

Fun Fact A: The shoe was designed by the same footwear insider who was in charge of the Adidas Yeezy Innovation Lab.

Fun Fact B: The back heel support resembles a rear bar on the Cub Cadet Ultima Series zero-turn lawn mower.

The new facility, spanning approximately 1.5 million square feet, is projected to be fully operational in 2025, and is expected to provide employment opportunities to over 350 people, reported Ace. Encompassing more than 1.5 million square feet of floor space, it will be almost twice the size of the average Ace RSC and will be the first facility in the new KCI 29 Logistics Park, assembled by Hunt Midwest.

Employee owned, success oriented

The latest “Fast Five” interview from HBSDealer features insights from Xan (Sean) Flink, CEO, and one of the employee-owners of northside Chicago-based Clark-Devon Hardware.

In the interview, Flink describes the business decision to form an ESOP and other insight.

On the business

“The way this business has been run, for a long time, the [previous owners] gave us a lot of leeway, and a lot of encouragement, to try new ideas, so I think we’ve been operating as partial owners for a long time, so I think the continuation of that culture is what we’re going to do.”

On sales trends: “We’ve seen a lot of lawn and garden activity. We’ve also gotten right into the swing of the moving season. Property management is a big part of our business so it’s been really great, really positive.”

On the ESOP move: “An employee ownership plan is a good avenue to take if you’re looking for an exit strategy that will maintain the culture and the legacy of your store. You’ve got to have a strong management team in place and you’ve got to have a strong group of employees to make it work, but if you’re in that situation, it’s a great way to go.”

See the “Fast Five with Xan (Sean) Flink” interview at HBSDealer.com/video

14 July/August 2023 HARDWARE + BUILDING

HBSDealer.com News + Analysis

SUPPLY DEALER

Ace’s Wilton, New York, distribution center.

Xan (Sean) Flink, CEO and one of the employee owners of Chicago-based Clark-Devon Hardware.

Parks Building Solutions looks to perfect the process

THE NORTH CAROLINA PRODEALER CONTINUES TO MAKE IMPROVEMENTS WHILE STRIVING TO ASSIST BUILDER CUSTOMERS.

By Andy Carlo

With two locations in Fayetteville and Raleigh, North Carolina, Parks Building Solutions services a large portion of the state while focusing on a 100-mile radius around the two cties.

According to Parks President John Quast, the company maintains a progressive strategy in servicing home builders.

“Parks Building Solutions was established several years ago when our strategy was to focus on builders and creating solutions for them during the building process,” Quast told HBSDealer. “We deliver 90% of what we sell, we provide help to our clients through the design process, we professionally install many of the components of the house and we focus on saving our clients time to get newly built homes on the market and sold as quickly as possible.”

“We pride ourselves on customer service and doing everything possible to save our clients time in the building process,” says Quast, who joined Parks in February 2023. Quast’s background was primarily working in manufacturing and distribution for consumer/DIY products.

The company president says Parks has taken considerable steps to improve services over the past two years. Parks has expanded its trucking eet, set higher inventory levels while buying ahead, and hired more inside and outside team members who know the industry and customer base.

Recently, Parks has made two major investments. The rst is an upgrade at its Fayetteville location, which includes the resurfacing of nearly its entire yard with new concrete. The second major investment is a 70,000-squarefoot warehouse, custom builder showroom, and of ce space in Raleigh. This new location is expected to open in September.

Improved technology and more operational tools are also part of Parks’ planned future investments.

“We utilize an LBM-speci c ERP system that incorporates multiple additional technologies to get goods out the door correctly, purposely, and timely,” Quast explains. “However, we are

About Parks

The business model at Parks Building Solutions is a full-service, one-stop shop for home builder and contractor customers.

Most of Parks’ builders in Fayetteville and the surrounding areas are spec home builders, while in Raleigh its primary builder clients are luxury and custom home builders. Overall, home builders represent 75% of the company’s business with multifamily builders accounting for 15% and remodelers and commercial accounts making up the balance.

The prodealer and its 135 associates offer installed services for most of the products it sells while maintaining sales experts and designers in building materials, cabinetry and countertops, appliances, flooring and tile, interior trim, door and hardware, exterior doors and windows, roofing, siding, and drywall.

touching the surface of our needs and over the next year there will be multiple investments with the purpose of improving operational services while reducing the cost to serve through better ef ciency.”

Like many dealers, the labor shortage is a challenge that Parks has faced including searching for truck drivers, material handlers, warehouse personnel, and forklift drivers. “There is an evident labor shortage, and Parks is working around the problem through expanded bene ts, real-time bonuses based on performance, and improved work environments,” Quast says.

In the end, all of Parks’ changes and improvements are designed to

help its customers.

“Time and great service is money in the bank to our clients and we continually strive to perfect this process by nding new ways to improve service, bringing in new team members with expert experience in our industry, and adding to our install program,” Quast says.

HBSDealer.com July/August 2023 15 Independent Profile

With diverse offerings, Parks is known as a one-stop shop and building solutions provider.

John Quast, president, Parks Building Solutions

THE TOP

NOTES FROM THE LEADERBOARD

Dealers re ect on 2022 and improvements made to meet challenges in 2023.

By Andy Carlo

By Andy Carlo

18 July/August 2023 HARDWARE + BUILDING SUPPLY DEALER HBSDealer.com

COVER

THE LEADERBOARD ISSUE

FEATURE

Lumber prices sat in the penthouse at the start of 2022 before taking a gradual, slow ride down to the ground floor at year’s end.

And in 2023, lumber and commodity prices have been a source of frustration for some of the industry’s biggest players. During their first quarter 2023 conference calls, the CEOs of The Home Depot, Lowe’s, and Builders FirstSource all reported lower sales numbers and pointed to commodity prices as, perhaps, the biggest setback in revenue for the period.

But while lumber and wood product prices are down as much as 16% with softwood lumber prices lagging more than 40% from a year ago, housing suddenly has legs after a slow start in 2023. A lack of existing inventory has pushed buyers back toward new single-family home purchases despite high price tags, inflation, and lofty mortgage rates.

Housing starts in May increased 12.2% to a seasonally adjusted annual rate of 763,000, the U.S. Census Bureau and the Department of Housing and Urban Development reported. The latest figure is also 20% above the May 2022 estimate of 636,000.

Bob Dietz, chief economist of the National Association of Home Builders (NAHB) said the most recent forecast calls for 860,000 single-family starts and 500,000 multifamily starts in 2023. But the NAHB is also projecting new home sales will hit 670,000 this year.

In Syracuse, N.Y., Erie Materials saw 2022 sales rise 11% to more than $298 million.

“In 2022 we were able to win orders by just having the product in stock,” Chris Neumann, president of Erie Materials told HBSDealer. “We have always kept robust inventories on all products and this strategy was never more successful than in 2022.”

This year the company is celebrating its 50th

Sales in $millions

NAICS 4441

Building material and supplies dealers

anniversary and has expanded to nine locations with 350 associates since its founding in 1973. Location number 10 is scheduled to open in upstate Poughkeepsie, N.Y. in 2024. But a celebration may also come with much more work on the front lines.

“As supply lines have begun to stabilize, we are back to competing more on price,” Neumann told HBSDealer. “Inventory positions, while still important, are not giving us the same advantage. We are back to ‘Sales 101,’ making more purposeful sales calls, showing the value that Erie Materials brings to our customers as well as strengthening our relationships with customers and vendors.”

In the next state over, 84 Lumber based in Eighty Four, Pennsylvania, has continued to put up big sales gains over the past several years. In 2022, sales increased 11% to nearly $8.8 billion. It was less than 3 years ago, when 84 Lumber hit a milestone of $4 billion in sales for the first time.

“We’ve always operated with the belief that we can only control what we can control,” says Maggie Hardy, CEO and owner of 84 Lumber. “When look-

Continued on page 24

NAICS 44413

Hardware stores

Source: U.S. Census Bureau

The massive sales surge of 2020 has been followed consecutive year of gains for hardware and building supply dealers. For hardware stores, those gains are continuing in 2023—up 6.3 percent through the first four months of the year.

However, NAICS 4441 sales, weighed by commodity deflation are down 3.6 percent in the first third of the 2023 compared to the same four months of 2022.

HBSDealer.com HARDWARE + BUILDING SUPPLY DEALER July/August 2023 19

Year 2022 2021 2020 2019 2018 Sales: 445,758 417,055 367,144 326,298 321,901 YOY % gain: 6.9% 13.6% 12.5% 1.4% 5.4%

Year 2022 2021 2020 2019 2018 Sales: 38,317 35,833 34,516 28,635 27,382 YOY % gain: 6.9% 3.8% 20.5% 4.6% 5.8%

After three massive years, Home Depot is about to go after an even larger slice of the pro market.

Lowe's is back in the U.S.A. exclusively, after selling off its Canadian holdings.

THE LEADERBOARD ISSUE

2023 Top 150 Industry Leaderboard

from Canada is complete. And the company is “solely focused on the transformation of our U.S. business,” says CEO Marvin Ellison.

replaced Dave Flitman as chief executive in late 2022. But the strategy remains the same: “Outperform today. Transform tomorrow.” Stock price is soaring.

The Eau Claire, Wisconsin-based company founded by John Menard Jr., now 83 years old, operates more than 300 super-sized home centers in 15 states.

Group (re ected here) accounted for 57 percent of total company revenues. Opened 72 new paint stores in 2022, and also hired 1,400 management trainees.

Numbers re ect residential showroom, residential trade and residential digital commerce sales in U.S and Canada. FERG moved from London to the New York Stock Exchange.

with a new headquarters address in Atlanta, the LBM giant operates a network of more than 400 locations across the county.

The company said goodbye to founder Joe Hardy, who died at the age of 100. President Maggie Hardy plans signi cant investments in new stores and existing markets in 2023.

green eld locations within its Building Products Division in 2022. Also: Proud sponsor of college football’s SRS Distribution Las Vegas Bowl through 2025.

an “Ambition 2025”. Strategic plan, the company points to digital capability and private label (Tri-Built) as competitive differentiators.

Private label and low prices are the one—two punch of this expanding retail business, home or Hercules, Chicago Electric and Pittsburgh, to name a few.

Unit number describes “in-market selling locations,” including

onsite locations spanning 25 countries. E-commerce sales surpassed $1 billion in October.

Gypsum Management & Supply says it is maintaining or growing share in each of its core product categories. Wallboard accounts for 40 percent of sales.

its goal of opening 32 warehouse stores in scal 2022. Opened its 200th store (in Metairie, Louisiana) in May 2023.

Recently named HBSDealer and NLBMDA ProDealer of the Year. In November, created a new position: VP of continuous improvement.

Ohio-based company opened its 14th component manufacturing plant — and its rst in South Carolina. The 120,000 sq. ft. facility serves the coastal Carolinas.

California-based company (the of cial jersey patch partner of the Los Angeles Angels) made a big acquisition in April: New York’s MarJam Supply and its 32 locations.

Insulation-focused company points to a strong backlog of single and multi-family homes that still need to be insulated.

In 2022, longtime CEO Brian McCoy retired, making way for the fourth generation and his daughter Meagan McCoy Jones to take the reins.

In addition to. the Lansing Delivery App and Lansing Green Financing; there’s the Lansing Positive Impact Podcast, hosted by Hunter Lansing, president and CEO.

Growth based on three pillars: Deep assortment of tools, a fully functioning parts and service department, and store associates with real-world expertise.

Across 13 states, the company’s diverse footprint ranges in size from small lumberyards to warehouse stores measuring in excess of 140,000 sq. ft.

In June of 2023, the company formerly known as Lumber Liquidators rejected an unsolicited takeover bid from Cabinets To Go.

THERE’S MORE ONLINE For the full list of the Top 150, including additional data, visit HBSDealer.com/report.

20 July/August 2023 HARDWARE + BUILDING SUPPLY DEALER HBSDealer.com COVER FEATURE 1 The Home Depot Atlanta, Ga. 157,403,000,000 4.1 2,322 Created $47 billion in

business

2019.

pro

2 Lowe’s Mooresville, N.C. 97,059,000,000 0.8 1,738 The

3 Builders FirstSource Dallas, Texas 22,726,418,000 14.2 570 Dave

4 ABC Supply Beloit, Wisc. 18,500,000,000 25.0 902 L&W Supply,

5 Tractor Supply Brentwood, Tenn. 14,204,717,000 11.6 2,333 In 2022,

63

6 Menards* Eau Claire, Wisc. 13,400,000,000 2.4 350

new

since

Now, the company is getting serious about the $200 billion “complex-project” segment of the

market.

exit

Rush

a division of ABC, acquired Feldman Lumber, Rosen Materials and Wallboard Supply from US LBM Holdings in a deal announced early 2023.

the Brentwood, Tennessee-based farm and ranch giant opened

new stores and relaunched its Neighbor’s Club loyalty program.

7 Sherwin-Williams Cleveland, Ohio 12,661,000,000 13.4 4,931 Americas

8 Ferguson Newport News, Va. 12,170,000,000 21.4 1,679

9 US LBM Holdings Atlanta, Ga. 11,476,000,000 24.5 487 Now

10 84 Lumber Eighty Four, Pa. 8,754,338,000 10.8 310

11 SRS Distribution* McKinney, Texas 8,717,000,000 61.4 690 Opened

12 Beacon Building Products Herndon, Va. 8,429,700,000 26.9 480 Following

13 Harbor Freight Tools* Calabasas, Calif. 7,700,000,000 28.3 1,350

14 Fastenal Winnona, Minn. 6,980,000,000 16.1 3,306

1,623

15 GMS Tucker, Ga. 4,580,500,000 -1.2 382

20

16 Floor & Decor Holdings Atlanta, Ga. 4,264,500,000 24 197

17 Kodiak Building Partners Denver, Colo. 3,208,500,000 28.3 131

Achieved

18 Carter Lumber Kent, Ohio 3,100,000,000 19.2 245

19 Foundation Building Materials* Tustin, Calif. 2,940,000,000 10.9 245

20 Service Partners (TopBuild) Daytona Beach, Fla. 2,061,800,000 62.1 162

21 McCoy’s Building Supply San Marcos, Texas 1,689,200,000 18.7 88

22 Lansing Building Products Richmond, Va. 1,561,000,000 17.7 112

23 Northern Tool + Equipment Burnsville, Minn. 1,550,000,000 -3.1 125

24 Sutherland Lumber* Kansas City, Mo. 1,450,000,000 1.4 63

25 LL Flooring Richmond, Va. 1,110,700,000 -3.6 442

Rank Company Location of Headquarters 2022 Full Year Sales Percent Change 2022 Units (EOY) Highlights

BROUGHT TO YOU BY * Estimates included in data.

Ti berline® UHDZ ™ is r new pre i l in te s in le

GAF has reengineered and relaunched Timberline® UHD — Ultra High Definition — Shingles as Timberline® UHDZ ™ Shingles. With our patent-pending Dual Shadow Line and new 30-year StainGuard Plus PRO™1 limited warranty against blue-green algae discoloration, they go beyond any GAF shingle offered to date. And with just 3 bundles per square, you can stock more than before. Visit

We protect what matters most ª

©2023 GAF • RESUHDADD-0223

1 30-year StainGuard Plus PRO™ Algae Protection Limited Warranty against blue-green algae discoloration is available only on products sold in packages bearing the StainGuard Plus PRO™ logo. See GAF Shingle & Accessory Limited Warranty for complete coverage and restrictions, and qualifying products.

G bey n r

r st ers 1

y

2023 Top 150 Industry Leaderboard

of an effort to create consistency across its business units.

Network Retail Group, owned by Orgill, acquired Germantown Hardware near its of ces. Also recently acquired stores in Minnesota, Arkansas and Mississippi.

in cost-effective and just-in-time shipments to projects such as multi-family housing, assisted

In June of 2022, acquired Brock’s Building Materials of Rochester, New Hampshire, lifting Hammond’s employee count to nearly 900.

A Midwestern success story for owners Robert and Donna Plummer. Sold its R.P. Home & Harvest farm and ranch brand to Runnings.

Showrooms are emphasized. The average store measures approximately 20,000 square feet, with a majority of the square footage devoted vignettes of bathrooms, kitchens and other rooms.

Closely tied to Do it Best, the hardware and lumber dealer co-op, recent acquisitions include B & S Hardware & Lumber in Texas, and Patrick Building Supply in North Carolina.

Company is at the center of a push to make Boise, Idaho, a hub and incubator of lumber industry innovation and start ups.

Late 2021 acquisition of Winnipesaukee Lumber in Wolfeboro, New Hampshire, followed on the heels of an acquisition of Lapointe Lumber of Maine.

Late November acquisition of D & M Truss Co. of Pensacola, Florida, expanded the business into the Florida Panhandle, within easy reach of Mississippi and Alabama.

In East Greenbush, New York, an upgraded 25,500 sq. ft. store on a 12-acre site features a larger showroom and a pick-up warehouse: a response to market demand.

In May of 2022, Guy C. Lee purchased the 100-year-old E.W. Godwin’s Sons Lumber Co., of Wilmington, North Carolina.

Hardware company changed its identity

22 July/August 2023 HARDWARE + BUILDING SUPPLY DEALER HBSDealer.com 26 Parr Lumber Hillsboro, Ore. 1,045,000,000 5.5 45 The Oregonian recognized Parr with a Top Workplaces 2022 designation. Further evidence of the strong culture: CEO Mike Howell began as a Parr driver. 27 Contractor’s Warehouse Rosevillle, Calif. 870,100,000 3.0 14 Formerly HD Supply Home Improvement Solutions, this California retailer builds its business on a no-frills, low-price, huge-inventory model. 28 Ganahl Lumber Co. Anaheim, Calif. 782,000,000 17.3 12 Ganahl Lumber has 950 employees across 11 locations in California and is the oldest lumberyard and hardware supply store in the state. 29 Riverhead Building Supply Calverton, N.Y. 673,000,000 21.3 20 High-end customer focused prodealer entered Massachusetts in the summer of 2021, expanding footprint from New York, Connecticut and Rhode Island. 30 Westlake Ace Hardware Lenexa, Kan. 611,500,000 1.3 155 Rapidly growing retailer, owned by Ace Hardware Corp., added stores recently in Raleigh and Charlotte, North Carolina; and Santa Rosa and Placentia, California. 31 Mead Lumber Columbus, Neb. 606,700,000 31.2 55 Diverse hardware and building supply dealer unveiled a new brand logo as part

32 CNRG Collierville, Tenn. 579,400,000 9.5 144 Central

33 Shelter Products Portland, Ore. 566,100,000 29.5 5 Specializes

hotels/motels,

student housing. 34 Sunpro Corp. Saint George, Utah 559,100,000 23.4 15 Formerly

35 Idaho Pacific Lumber Boise, Idaho 557,500,000 62.6 1 Employee-owned

in

Eastern Massachusetts. 36 Mill Creek Lumber & Supply Tulsa, Okla. 502,100,000 38.8 29 Serving Kansas

37 Hammond Lumber Belgrade, Maine 437,000,000 20.4 22

38 R.P. Lumber Edwardsville, Ill. 435,000,000 11.5 84

living,

and

known as Sunroc Building Materials, Sunpro changed its brand name across its Utah and Idaho locations in 2019

company doing business as IdaPac was founded in 1979 and is involved

building projects as far away as

and Oklahoma, prodealer took home recognition in 2022 as both Top Work Places and Veteran Employer Champion.

39 The Tile Shop Plymouth, Minn. 394,702,000 6.5 142

40 Nation’s Best Dallas, Texas 376,197,830 89.8 46

41 Franklin Building Supply Boise, Idaho 374,800,000 1.0 17

42 Hancock Lumber Co. Casco, Maine 349,000,000 18.5 12

43 Tibbetts Lumber St. Petersburg, Fla. 339,600,000 39.8 8

44 Curtis Lumber Ballston Spa, N.Y. 325,700,000 12.0 23

45 Guy C. Lee Building Materials Smith eld, N.C. 315,000,000 24.0 9

46 Aubuchon Company Westminster, Mass. 307,000,000 4.7 110

to Aubuchon Company in early 2022, better re ecting its multi-brand strategy and desire to grow. 47 Stine Sulphur, La. 299,400,000 -6.4 11 Jeremy Stine, was director of marketing for the lumberyard and home center company when he was elected to the Louisiana State Senate. 48 Erie Materials Syracuse, N.Y. 298,100,000 10.9 10 Founded in 1973, the company’s 50th Anniversary was celebrated by thousands of contractors and dozens of manufacturers. 49 Reliable Wholesale Lumber Huntington Beach, Calif. 288,000,000 -7.1 2 Family owned business embraces high-tech tools for customers, including Hyphen Solutions Supply Pro. 50 LaValley/Middleton Building Supply Newport, N.H. 287,300,000 27.4 15 Company’s operations also include an off-site construction modular home division and an Eastern White Pine sawmill. COVER

Rank Company Location of Headquarters 2022 Full Year Sales Percent Change 2022 Units (EOY) Highlights

THERE’S MORE ONLINE For the full list of the Top 150, including additional data, visit HBSDealer.com/report. BROUGHT TO YOU BY * Estimates included in data.

FEATURE

THE LEADERBOARD ISSUE

A PROUD HISTORY OF ALWAYS HAVING YOUR BACK .

On day one we started with just a truck and a commitment to be the best. When the YellaWood® brand says you can trust us to deliver, those aren’t empty words; they’re actually proven words. And words we take seriously. Which is why we’ve been striving to give our very best every day for over five decades now. We can say with confidence that the Yella Tag can deliver like no other because it’s been shown to do just that. See all the other ways the YellaWood® brand has your back. Visit yellawood.com/for-dealers

YellaWood® brand pressure treated products are treated with preservatives (the “Preservatives”) and preservative methods, and technologies of unrelated third parties. For details regarding the Preservatives, methods, and technologies used by Great Southern Wood Preserving, Incorporated, see www.yellawood.com/preservative or write us at P.O. Box 610, Abbeville, AL 36310. Ask dealer for warranty details. For warranty or for important handling and other information concerning our products including the appropriate Safety Data Sheet (SDS), please visit us at www.yellawood.com/warranties or write us at P.O. Box 610, Abbeville, AL 36310. YellaWood and the yellow tag are federally registered trademarks of Great Southern Wood Preserving, Incorporated. All other marks are trademarks of their respective owners and are used with their permission.

THE LEADERBOARD ISSUE

ing at 2022 vs 2023, there are outside forces we can’t control such as lumber and panel indexes, housing starts, etc. We can control how we operate our stores, take care of our associates and our customers.”

Hardy says 2023 is about putting in hard work to develop new customers while gaining greater market share through the opening of new stores and panel plants. At the same time, the company is giving its employees the right tools to take care of its customers.

“We implemented several key technologies focused on better serving our customers,” Hardy said. “We have enhanced the integration between our operational systems at stores with the ordering systems of our customers.”

For its growing installed sales division, 84 Lumber has implemented a completely new platform to manage its end-to-end process with mobile on-the-job site technology for real-time updates of project status and task completion. In its components division, the company has moved several solutions that manage design and production to the cloud.

“Additionally, we implemented a new secure payment platform in all of our locations, which allows customers to pay securely and with new features such as tap to pay and Apple Pay,” Hardy noted. “What we do in 2023 will pay off in future years.”

According to Steve Swinney, CEO of Kodiak Building Partners in Highlands Ranch, Colorado, the biggest challenge the company faced in 2022 was having enough labor and materials to meet demand.

“In 2023, it’s managing expense levels while retaining your people to be ready for renewed growth that is coming in later 2023 and beyond,” Swinney says.

ABOUT THE LIST

“In the past year alone, TAL’s significant growth presented its own set of opportunities and challenges,” says TAL Holdings CEO Jason Blair, who joined the company in January 2022. “We expanded our market presence and diversified our offerings, enabling us to remain resilient in the face of falling commodity prices. Yet, the increased scale also presented us with challenges in integrating new entities and cultures into the larger TAL organization, increasing the complexity of our operations.”

The 2023 Top 150 Industry Leaderboard tracks hardware and building supply dealers by sales.

To be included, the majority of a company’s sales must be in the home improvement or building supply space.

Information is gathered from several sources: corporate statements, original research and published reports. HBSDealer also relies on estimates, which are noted in the listings by an asterisk.

Swinney also said that Kodiak, with more than 110 locations in 25 states, is preparing for “beyond” with investments in technology. While the automation equipment has been brought on board for various aspects of the business, the dealer has implemented A.I. and new tech for back-office support, dispatch, and delivery, along with new warehouse tools.

Vancouver, Washington-based TAL Holdings has been extremely active in 2022 and 2023. The lumber, building supplies, and hardware dealer acquired seven companies since the start of 2022, including two moves this year.

When new housing demand began to slow, Blair said it gave the company an opportunity to streamline operations while focusing on efficiencies that will support future growth plans.

“This is an opportunity for us to show our adaptability and commitment to our customers.” said Blair. “And while it hasn’t been easy, we’re confident we have the right approach and team to keep moving forward.”

At TAL, the dealer is always looking for ways to improve our services and customer experiences.

“We have made significant enhancements and investments in technology, with an emphasis on BisTrack by Epicor,” Blair notes. “This will help enhance our ability to efficiently manage business processes, inventory, and customer service. The technology allows us to provide real-time data and streamline operations across all our divisions, enabling us to offer added value to our customers.”

With 32 locations in Washington, Oregon, Idaho, and Montana, TAL also continues improving communication with the right suite of tools. “Having clear and direct communication channels will help us work seamlessly as a team and provide a better customer and vendor experience,” Blair says.

And like many companies on this year’s leaderboard, TAL is not satisfied with business as usual.

“Our focus is not merely on overcoming immediate challenges, but on setting the foundation for long-term success,” Blair says. “We believe in the potential of our team and our ability to adapt to changing circumstances while always upholding our core values.”

24 HBSDealer.com COVER FEATURE

Commodity price volatility, especially with lumber, continues to impact prodealers on the list, including 84 Lumber.

In the Pacific Northwest, TAL Holdings has acquired seven companies since the beginning of 2022.

For Sponsorship Opportunities, please reach out to: Amy Grant, Associate Publisher | agrant@ensembleiq.com | 773-294-8598 OCTOBER 4-6, 2023 KANSAS CITY MARRIOTT DOWNTOWN REGISTRATION IS OPEN Please visit www.prodealer.com for more information. Thank You to Our Current 2023 Sponsors Chris Beard Director, Building Products Research, John Burns Real Estate Consulting Joseph Gruber Executive VP and Director of Research Federal Reserve Bank of Kansas City Matthew Saunders Vice President, Building Products, John Burns Real Estate Consulting Kylie Holland Executive Vice President Curtis Lumber Company Timothy Papandreou Founder & CEO, Emerging Transport Advisors Virginia Lewis Vice President Tart Lumber Sunny Bowman President and Owner Dakota County Lumber Steve Swinney CEO & Co-Founder Kodiak Building Partners, Inc. Anthony DiPrizio Inside Sales Representative Ricci Lumber Tom Ford Vice President of Supply Chain & IT Spahn & Rose Lumber Co. L.T. Gibson President, Chief Operating Officer and Founder U.S. LBM MEET OUR CURRENT SPEAKERS

Rising to the challenge of staffing

A MIDWEST TRUE VALUE STORE OWNER TELLS ITLIKE IT IS — FROM THE FRONT LINES OF STAFFING. BY TIM BURKE.

Doug Johnson is the owner of Johnson True Value Hardware, in Mt. Pulaski, Illinois, a town of 1,500 with a colorful history in the heart of the golden Midwest farmlands in central Illinois. Abraham Lincoln himself regularly practiced law at the local courthouse, which is available for tours.

Here is where Johnson purchased the former Farmers Hardware in 1996. “I had been behind the scenes in the auto dealership business for years after college and the entrepreneurial spirit got me looking to start my own business,” he said.

The trajectory was slow but steady and in 2021 he moved to a new location in town, “and went from 4,000 square feet to 12,000 square feet — and business has been great,” he said.

Now we know about Doug, his business roots, and the

town; but what does the overall staffing picture look like for his hardware store?

“We are a small closely knit group,” he explained. “Like many small businesses, as owner and manager, I wear many hats — but depend on everyone to share in as many hats and responsibilities as possible.”

He has two assistant managers, and five parttime customer care team members. “We have had our share of student employees over the years. Last year’s crop of kids moved on and I waited until this spring to find replacements. With winter and uncertain economic times looming I tried to wait as long as possible to hire new employees,” said the owner.

This spring kicked off above expectations, he said, so he recently brought on two high school age part-timers as trainees for the summer. He hopes they will continue into the next school year.

“The team is a good cross-section of our community and customer base,” he said. “All of the employees are locals, varying in age from 17-84 years old, evenly split into men and women including the new hires.”

Illinois instituted a big minimum wage act effective in 2020, he pointed out. It increased to $10 for

26 July/August 2023 HARDWARE + BUILDING SUPPLY DEALER HBSDealer.com True Value Report

The staff at Johnson True Value. From left: Doug Johnson, owner and manager; Abby Jones, customer care; Rene Hubal, assistant manager; and Andy Volle, assistant manager.

all workers and goes up $1 per year until 2025 leveling off at $15 per hour. “Adding additional entry level staff is difficult to justify due to the immediate high cost,” he said.

Although some of the employees were above minimum wage, everyone received an automatic raise every January, said the owner.

“Payroll, payroll taxes, and workers comp insurance have all increased proportionally so my employment costs have essentially risen 30% since 2019, with another bump coming in January 2024, and January 2025,” said Johnson.

Most of the employees are now earning the minimum of $13.00 per hour and the more senior staff are a couple dollars higher, he explained. Additionally lead staff are earning a weekend hours bonus of $1 per hour.

“I still print paychecks weekly using our in-house accounting software,” he said. “I would definitely consider direct deposit if we had a larger staff, but I have been doing paychecks the same for all these years I almost can do it in my sleep. The software does all the work, so it’s not a big deal.”

The technology-driven world we live in today can bring about changes in staffing, but in degrees.

“We are still pretty low-tech, so not a lot of impact there. Two Point of Sale terminals using RockSolid Classic software

True Value is a sponsor of Project Green Freedom, the first net-zero Habitat for Humanity (HfH) community in Illinois. CEO Chris Kempa (left) and John Vanderpool, SVP True Value Manufacturing, help break ground on this three-year project with Chicagoland Habitat for Humanity and Fox Valley Habitat For Humanity. The community will consist of 30 single-family net-zero homes equipped with a combination of renewable, electric, and natural gas technologies, said Fox Valley Habitat For Humanity. True Value said it is donating its low VOC, asthma-and-allergy certified EasyCare paint to support this green effort.

“Building community is very important to me personally, and True Value and our stores serve local communities in that way every day,” said True Value CEO Chris Kempa. “I am thrilled True Value can support Habitat for Humanity and these deserving families through Project Green Freedom and help make these sustainable houses a home.”

When it comes to staffing-up, a local hardware store can be an inviting job to potential hires.

“I find that word of mouth is a good way to find suitable applicants,” said Johnson. “Current employee referrals have worked out well for us. Being a small town where everyone knows everyone else, you kind of have an idea of who the applicants are from the get go. I have not advertised for new employees in many years.

“Thankfully with most of my staff having been on board for many years, we have not had a lot of turnover. Half of my employees have over 10 years or more of seniority. I try to hire for the long term, avoiding temp or summer help. The learning curve is too steep to start over after only a few months or even a year,” he said.

From the front lines of hiring, Johnson said: “Hiring today is one of the more challenging and important tasks I face as owner and store manager. Today’s worker is as demanding as the customer we serve. A careful balance is difficult to achieve. Trying to balance payroll costs and at the same time provide the right level of customer care and also provide a good work environment is getting more difficult.”

The owner added, “regulations and increased overhead costs will drive a lot of small businesses like ours out of the market. The Amazons and Walmarts of the world take a huge toll on the smaller competitors too.”

Johnson said: “We are fortunate to be in a rural setting with lots of loyal customers and what I like to think are friends of our locally owned and operated hardware business.”

HBSDealer.com HARDWARE + BUILDING SUPPLY DEALER July/August 2023 27

Two staff members at Johnson True Value: Karen Hummel, customer care, and Kellen Wilham, customer care.

Claire Coogan, customer care, and Dave Hansen, customer care, two team members employed at Johnson True Value.

Open for business

MASONITE’S CFO SHARES MARKET INSIGHTS FOR DOOR CATEGORY

By Andy Carlo

By Andy Carlo

Not even counting the company’s NYSE ticker symbol (DOOR), Tampa, Florida-based Masonite is one of the biggest names in interior and exterior door designs. The manufacturer of doors and door systems for the new construction and repair, renovation, and remodeling (RRR) sectors last year saw sales increase 11 percent to $2.9 billion. HBSDealer discussed market conditions with Masonite Executive Vice President and Chief Financial Officer Russ Tiejema, who has served in that executive position with the company since 2015. Here’s what the CFO had to say.

Q: What is Masonite’s current feel for the new residential construction and remodeling markets and moving forward into 2024?

A: We came into 2023 planning for a weaker U.S. housing market, with new housing starts potentially down 20% and remodeling activity to be lower by a high-single digit percentage. Through the first quarter, end markets are performing broadly in line with that outlook.

While it’s still too soon to predict, we are cautiously optimistic that by 2024 housing demand will begin to recover. New housing starts improved sequentially each month in the first quarter, and a limited inventory of existing homes for sale could support additional remodeling.

Q: What has Masonite done to combat a slowdown in residential construction?

A: We’re fortunate to have a very experienced team at Masonite that has

28 July/August 2023 HARDWARE + BUILDING SUPPLY DEALER HBSDealer.com Products

Glass double doors from Masonite help bring the outside world inside the home.

proven it can adapt to quickly evolving market conditions while executing our long-term growth strategy.

We’ve remained focused on adjusting prices to stay ahead of inflation and promoting a higher-value mix of products that deliver better performance for homeowners and capture more revenue for both Masonite and our distribution channel partners.

Meanwhile, we’re also carefully managing our expenses and optimizing our manufacturing capacity to match demand.

Q: Is one market stronger than the other for Masonite: new single-family homes vs. remodeling/repair?

A: Our business in the North American residential housing market is fairly evenly balanced between new construction, including both single-family and multi-family homes, and the repair-renovate-remodel sector. This diversification has enabled us to better weather the volatility that sometimes occurs in the new housing sector.

Q: How does Masonite perceive the current remodeling and repair market?

A: Estimates vary, but experts broadly agree that new construction in the U.S. has lagged behind the need for new housing stock for several years. This has created a situation where existing homes are aging further and, in turn, could benefit from remodeling.

For these reasons, we see both the new construction and renovation markets as having good demand potential in the years ahead, irrespective of near-term demand fluctuations we may experience due to inflation and higher interest rates.

More news in windows and doors:

Simonton Windows & Door s introduced PLUS4 Low-E Glass — its newest energy-efficient glass option. Highly durable and sustainable, PLUS4 Low-E Glass is built to prioritize the overall well-being of homeowners, and especially those in colder climates. Matt Gibson, marketing Director, U.S. Windows for Cornerstone Building Brands, said: “Our cutting-edge glass option introduces advanced technology that efficiently redirects heat indoors, resulting in enhanced warmth and overall comfort.” Simonton.com

MI Windows and Doors

V3000 Series Multi-Slide

Patio Door, Model 1618 from the MITER Brands family of window and door products can light up a room. Opening up to 18 feet wide and available in heights up to 8 feet, the V3000 Series 1618 multi-slide patio door is built to blend interior and exterior spaces. Miwindows.com

Temp Windows created what it calls the first temporary window and door system the window-and-door install. The key benefit: builders won’t have to postpone interior

HBSDealer.com 29

"We see both the new construction and renovation markets as having good demand potential in the years ahead, irrespective of near-term demand fluctuations we may experience due to inflation and higher interest rates."

—Russ Tiejema, Masonite

Six keys to conversion

RESEARCH SMILES ON BIGGER BASKETS AND FASTER CHECKOUTS.

Astudy from Shopify and Boston Consulting Group (BCG), “Leading Online Shoppers to the Finish Line,” points to the keys to converting online shoppers into buyers.

The study is based on analysis of more than 220,000 e-commerce sites and more than 1 billion data points, the researchers say, and it highlights six key areas of online conversion optimization that retailers can directly influence: 1

Traffic sources. Analysis from Shopify and BCG indicates that organic channels such as word-of-

Go from constantly wasting money on dead stock to freeing up $100,000 in tied-up, unsold inventory.

mouth or social media recommendations are more effective than paid channels in overall conversion rate, particularly for smaller retailers. 2

Basket building. Carts that contain more than five to 10 items tend to yield higher conversion, according to the study. The conversion rate can increase by as much as 63% when a customer who initially puts just one or two units in the cart continues to shop and ends up with more than 10 items. 3

Checkout Experience. Automatically filling known or easily predictable information (such as

10 hours per week shaved off payroll

$2,000 saved in paper costs annually

$100,000 savings in inventory

Exotic Woods switched to Spruce, ECI’s end-to-end management solution for lumber and building suppliers, realizing how their clunky software held them back. Now with Spruce, they have streamlined their document management system, saving signifi cant time and money.

30 July/August 2023 HARDWARE + BUILDING SUPPLY DEALER HBSDealer.com Technology

LEARN MORE AT ECI SOLUTIONS.COM/SPRUCE

a shipping address or credit card information) can increase the conversion rate. According to the study's research, 99% of stores enable autofill when it is available. In addition, to prevent customers from leaving mid-checkout, the retailer can move them directly from the product detail page to the checkout flow, increasing the number of checkouts that get started by upward of 18%.

option can increase both traffic and sales for e-commerce sites with higher revenues and average order values. Data suggests that this option boosts traffic for sites whose average order value exceeds $50, while sites with $1 million or more in revenue are likely to see spending increases.

program. Although customization has less impact on the smallest e-commerce sites, it produces a notable lift in lower funnel conversion for stores with revenues of $10 million or more.

6

Payments. The analysis found that in North America, the use of accelerated digital payment methods such as Meta Pay, Amazon Pay, PayPal, Shop Pay, Apple Pay, and Google Pay can increase lower funnel conversion rates. The study found that offering these six methods, rather than a checkout experience that lacks any accelerated digital payment method, can increase lower funnel conversion rates by more than 50%.

4

Similarly, a buy now, pay later (BNPL)

5

Customization. Websites with front-end customization—such as a simplified user experience, obvious gateways to specific products, and an uncluttered product page—tend to achieve higher conversion rates than those with back-end customization only, according to study results.

The study also found that loyalty incentives are the most effective customizations across sites of all sizes. The analysis indicated that stores with average order values below $200 can see a lift of 4% to 6% on their conversion rate by implementing a loyalty

Performance. Counting from the moment the checkout experience begins, the conversion rate increases significantly if customers can complete the full checkout process in less than 90 seconds. If the process takes longer, the lower funnel conversion rate may decrease by around 47% on average.

"Conversion is at the heart of commerce and is the center of everything we do at Shopify," said Harley Finkelstein, president of Shopify. "The study reveals drivers like an optimized checkout experience, the use of accelerated payment methods, and selection of relevant customizations have a dramatic impact on conversion."

HBSDealer.com HARDWARE + BUILDING SUPPLY DEALER July/August 2023 31

Simplify. Get Paladin. Think of the things you can do with Paladin Point of Sale. Call 800.725.2346or visitpaladinpointofsale.com to learn more and get ready to tell your employees you’re going fishin’.

Top ProfileWomenSeries

SECRETS TO LONGEVITY FROM IDAHO’S TIN LADY LEILA CROCKETT HAS HAD FIVE DECADES OF FUN IN THE BUSINESS

Leila Crockett and her husband bought out his father in the early 1970s after rebuilding from a fire that destroyed their Idaho hardware and building supply business. And she’s been doing her thing at Best Built Builders Supply in Grangeville, Idaho, ever since.

“In 1972 my husband asked me to come in and help with various things, but I had a baby so was taking some time off, when he begged me to come to work full time. I mainly did the bookkeeping responsibilities,” she said.

But as a gregarious people person, she eventually found herself facing customers. “I did more with sales and I became the expert in selling metal roofing,” she said. “They all call me the ‘Tin Lady.’ It wasn’t easy gaining the trust of them since I was a woman.”

But she gained it. And she still works with the contractors to this day.

From across five decades at her business, Crockett shared with HBSDealer some of her favorite customer interactions.

“A long time ago when women wore dresses and nice shoes to work, a contractor called and ordered from me a skid of rebar,” she said. “We didn’t have any and it was before cell phones so I went to the jobsite to tell him that it would be there first thing in the morning dropped off by our supplier.

“As I walked through the mud up to my knees. He came screaming and cussing toward me telling me he needed it first thing. I got right back in his face and yelled back at him.

“He stopped and looked at me and asked if he was being a jerk and I replied, ‘Yes and you are really good at it.’

“When I got back to the store there were flowers for me from my favorite jerk and we became fast friends.”

About Best Built Builders Supply

Founded in 1928 in Orofino

Locations in Orofino, Kamiah, Grangeville and Lewiston

Joined the TAL Holdings family in April 2022

Everyone in town knows Leila is an animal lover.

“We have a contest at Christmas where you bring your dog in to sign up for our doggy stocking full of treats and toys, so we can give them a treat and hug them,” she said.

“We draw out one big dog and one small dog as winners. Then we send at least one dollar for each dog that came in to the local Humane Society. We write a thank you letter to each dog for supporting their less fortunate kin,” said Crockett.

The five-decade worker said that one day the employees in the warehouse called her on the intercom yelling for her to get back there — and fast.

“I asked why, and they said Mr. Brown, an old farmer, brought his favorite Billy Goat in to see me and he was pooping all over their yard. I did not get employee of the month that day,” she laughed.

Things have changed dramatically from her entry into the business five decade ago. When she started, accounting records were kept on ledger cards. Checks were written on the typewriter. And payroll was performed by hand with the help of a calculator.

And then there’s the products. “They used copper pipe and soldered it together. Now they use plastic and SharkBite fittings,” she said. Kitchen appliances are another area of revolution. “It seems they have an appliance to do everything now.”

The only way to last 50 years in this industry, she said, is to like people and like what you do, and we have a great crew.

“For a long time, I was the only girl working in the store with all those men,” she said. “I learned that most men don’t like to squabble like females do,” said Crockett. “They would all bend over backwards to help me and to make sure I wasn’t carrying something too heavy. They all used to call me mom, now they all call me ‘Grandma.’”

Whether it’s ‘Tin Lady,’ or ‘Grandma,’ Crockett says she doesn’t really have plans for the future.

Leila said, “I am thankful for the opportunity to keep coming here and hopefully making people laugh.”

32 July/August 2023 HARDWARE + BUILDING SUPPLY DEALER HBSDealer.com

With manager Ian Stemrich, Leila Crockett displays a 50th anniversary plaque from a vendor.

People In The News

Lowe’s Companies announced that it has appointed Quonta (Que) Vance as executive vice president, pro and home services. Vance most recently served as Lowe’s senior vice president, transportation and final mile. Lowe’s new pro EVP has more than 25 years of retail experience and leadership roles with store operations, merchandising, and supply chain across Lowe’s, Home Depot, and Target.

Ernst & Young named US LBM President and CEO L.T. Gibson as its Entrepreneur of the Year 2023 Southeast Award winner. The candidates were evaluated based on their demonstration of building long-term value through entrepreneurial spirit, purpose, growth, and impact, among other core contributions and attributes. The National Award winners including the Entrepreneur Of The Year National Overall Award winner will be announced in November.

Ace Hardware elected member director David W. Cripe to a first term on the company’s board of directors. Cripe is vice president of Whitmore Investments, Inc., a 13-store Ace Hardware chain located in Wilmington, Illinois, and the surrounding communities. Whitmore Hardware was established in 1896. He has worked for Whitmore Ace Hardware since 2002 and has been an owner since 2013.

Jeld-Wen, the manufacturer of windows, interior and exterior doors, and wall systems, appointed Wendy Livingston as executive vice president and chief human resources officer (CHRO). Livingston replaces Tim Craven, who previously announced his plan to leave the company in July. She joins Jeld-Wen from Spreetail, a multinational e-commerce company, where she served as the chief people officer.

Hampton Lumber & Family Forests named Randy Schillinger as its new CEO. Schillinger brings more than 25 years of experience in the Pacific Northwest wood product industry. He began his career at Weyerhaeuser in 1998 where he provided strategic planning and analysis before moving to their Trus Joist Engineered Wood Products (EWP) division, where he worked on sales and operations planning and manufacturing. Schillinger takes over following the retirement of Steve Zika, who has served as CEO at Hampton since 2003.

BlueLinx Holdings announced that Tricia Kinney has been appointed general counsel and corporate secretary, effective July 31. Kinney will report to BlueLinx President and CEO Shyam Reddy. Kinney most recently served as the chief legal and compliance officer of ServiceMaster Brands. Previously, she served in various senior-level roles at Kimberly-Clark Corporation.

Kreg Tool Company reported that Donovan Fuhs has been promoted to vice president of information technology. Previously, Fuhs served as IT applications manager at Kreg. Fuhs has more than 20 years of experience in the IT field. In his new role, he will lead the information technology team providing strategic direction and oversight for the design and implementation of Kreg’s information systems and digital solutions.

LMC announced that it has appointed Jacques Vauclain as its new vice president of finance. Vuclain held several key positions at Vanguard, the investment advisory firm, including overseeing the finance function for the company’s European operation, leading financial planning, and analysis initiatives, and contributing to strategic decision-making. Prior to Vanguard, he spent a decade at Campbell Soup Company.

ABC Supply’s new location in Gilroy, California, situated in Santa Clara County, is being managed by Alexandrea Dionne. Since joining ABC Supply in 2021, Dionne has worked in inside sales in the company’s Santa Rosa, California, location and completed the Branch Management Training Program. Dionne has also mentored and coached associates in the West Region.

Hardlines Distribution Alliance promoted Trent Kauffman to director of merchandising. Previously a merchandise manager, Kauffman brings with him numerous years of experience in the industry. Prior to joining HDA, Kauffman earned a psychology degree at the University of Oregon before beginning his career at Jerry’s Home Improvement. In 2012, he joined True Value as a product merchant where he managed purchasing programs with over 160 vendors.

McCoy’s Building Supply promoted Brandon Bishop to vice president of merchandising. Bishop has spent 15 years at McCoy’s including five years working at the company’s Stephenville location. He served at headquarters as a forest products buyer before moving into management roles in the commodities department. Most recently, he served as director of merchandising-commodities.

Belco Forest Products, the Shelton, Washington-based manufacturer of treated exterior trim and fascia products, announced that Baxter Reimer has been promoted to director of sales. Reimer is responsible for overseeing national sales and sales strategy, as well as managing the Belco sales team. In 2017, Reimer began working with Belco as the Pacific Northwest Market development manager.

HBSDealer.com HARDWARE + BUILDING SUPPLY DEALER July/August 2023 33

Vance

Fuhs

Vauclain

Kauffman

Bishop

Gibson

Reimer

Cripe

Schillinger

Livingston

Kinney

Dionne

Residential Construction/Sales

Monthly Retail Sales, not adjusted

13 months of housing starts and existing-home sales home centers and pro dealers (NAICS 444) and hardware stores (NAICS 44413) NAICS 444 (sales in $ billions)

NAICS 44413 (sales in $ billions)

HBSDealer Stock Roundup

the percent-change performance of stocks based on Jul. 6 prices

Consumer Watch

BECN (BEACON); BLDR (BUILDERS FIRSTSOURCE); BMCH (BMC STOCK HOLDINGS); MAS (MASCO CORP.); HD (HOME DEPOT); LOW (LOWE’S); SHW (SHERWIN-WILLIAMS); SWK (STANLEY); TSCO (TRACTOR SUPPLY); WY (WEYERHAEUSER); DJIA (DOW JONES INDUSTRIAL AVERAGE)

SOURCES: LABOR DEPARTMENT, THE CONFERENCE BOARD, AAA

34 July/August 2023 HARDWARE + BUILDING SUPPLY DEALER HBSDealer.com 50 40 30 20 10 0 3.06

Consumer confidence indexed to a value of 100 in 1985 Unemployment rate for the entire United States

prices

per gallon (regular) Current Prior month Prior year Total starts (in thousands, SAAR) May: 1,631,000 140 60 80 100 120 June $5.00 $2.00 $3.00 $4.00 Jul. 6

Gas

average price

starts (in thousands, SAAR)

Single-family

May: 997,000

SOURCE: MONTHLY RETAIL TRADE REPORT FROM

U.S. CENSUS BUREAU 20.0 0.0 2.0 10.0 4.0 6.0 8.0 12.0 14.0 16.0 18.0 June MARCH APRIL MAY FEBRUARY MARCH APRIL 4 3 2 1 0 2022 2023 2022 2023 SOURCE: COMMERCE DEPARTMENT M J J A S O N D J F M A M 1800 1700 1600 1500 1400 1300 1200 1100 1000 900 Existing-home sales (in millions, SAAR) May: 4,300,000 SOURCE: NATIONAL ASSOCIATION OF REALTORS 7 6.5 6 5.5 5 4.5 4 3.5 M J J A S O N D J F M A M MONTHLY CHANGE ANNUAL CHANGE 0 5 10 15 20 150 120 90 60 30 0 -30 SOURCE: COMMERCE DEPARTMENT M J J A S O N D J F M A M 1400 1300 1200 1100 1000 900 800 700 600 $3.53 109.7 3.6% 51.5 42.2 50.6 44.8 3.29 43.5 46.5 2.48 3.27 2.65 3.41 WY BECN BLDR MAS HD LOW SHW SWK TSCO DJI

THE

POWERED BY SEPT 25-27, 2023 SEATTLE, WA REGISTER TODAY! valuechaintechevent.com EVOLVING YOUR SUPPLY CHAIN INTO A VALUE CHAIN The time to transform supply chains into strategic, value-driven ecosystems is now. ARE YOU READY ?

By Andy Carlo

By Andy Carlo

By Andy Carlo

By Andy Carlo