• Machine and service at no cost

• Stores start making money on DAY 1

• Frazil is the #1 slush program across the U.S.

SCAN TO GET A MACHINE IN YOUR STORE AT NO COST

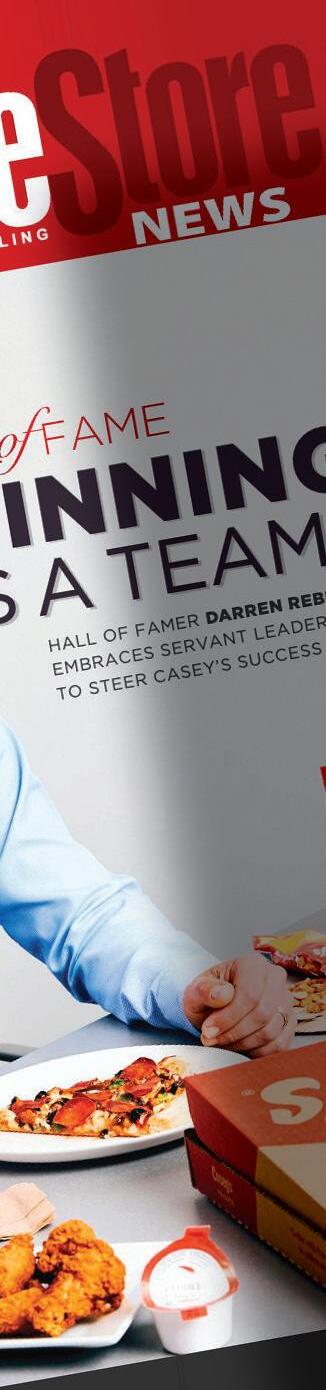

FOOD-FORWARD CONVENIENCE RETAILERS ARE IN A POSITION TO STRIKE WITH THE RIGHT OFFERING

Ensure that retail remains the most trusted place to responsibly sell tobacco products.

Did you know the average number of FDA compliance checks per month are approaching pre-COVID-19 levels?

In 2023, as of 9/30/23, the FDA conducted 9,381 compliance checks per month, which was an uptick from previous years.*

*Source: FDA CTP Violation Rate analysis was completed using publicly available raw data posted online at fda.gov. Calculations of Total Compliance Checks and Violation Rates were computed by AGDC based on Decision Data published. Inspections data FFY 2019 - 2023 FDA COMPLIANCE CHECKS Per Month (Avg.)

Age Validation Technology (AVT)

Modernize and simplify the ID check process with AVT, helping to reduce the likelihood of selling tobacco products to underage individuals

Improve ID check rates at a store and individual employee level, with We Card™ Training, available for Free via AGDC

State and Federal Law

Summaries and additional resources via the We Card™ resource center

Reinforce your sales associates’ understanding of ID check requirements and policies with Mystery Shop incentives

Customers need a compelling reason — or reasons — to turn right into your parking lot instead of turning left into your competitor’s lot

“IS IT WORTH IT?” I find myself asking this question more these days when considering purchases, as the total cost of my weekly grocery bill keeps ticking up and no one seems to be able to definitively answer what the impact of the tariff situation will be.

I know I’m not alone in being more price-conscious these days. According to the 2025 Convenience Store News Realities of the Aisle Study, which surveyed 1,500 consumers who shop a c-store at least once a month, roughly six in 10 shoppers say the most important factor that defines “a positive shopping experience” for them is the price of products.

While worth is most associated with price, value is a much broader concept — and more subjective. Value tends to be the sum of several qualities that each customer considers important. Price can certainly be in the mix, but so can convenience, quality, uniqueness and joy.

Our cover story this issue (see page 24) highlights the importance of convenience store retailers finetuning their value proposition, which is essentially their “it factor.” What compelling reason or reasons do you give customers to choose your store over your competitors?

EDITORIAL EXCELLENCE AWARDS (2016-2025)

2021 Jesse H. Neal National Business Journalism Award

Finalist, Best Infographics, June 2021

2018 Jesse H. Neal National Business Journalism Award

Finalist, Best Editorial Use of Data, June 2017

2023 American Society of Business Press Editors, National Azbee Awards

Silver, Data Journalism, January/April/June 2022

2023 American Society of Business Press Editors, Upper Midwest Regional Azbee Awards Gold, Data Journalism, January/April/June 2022

Bronze, Diversity, Equity and Inclusion, March 2022

2016 American Society of Business Press Editors, National Azbee Awards Gold, Best How-To Article, March 2015

Bronze, Best Original Research, June 2015

2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015

2020 Trade Association Business Publications

Intl. Tabbie Awards

Honorable Mention, Best Single Issue, September 2019

2016 Trade Association Business Publications

Intl. Tabbie Awards Silver, Front Cover Illustration, June 2015

This is especially crucial when it comes to foodservice sales. Consumers today are looking to save on food, so convenience retailers focused on high-quality fresh food at affordable prices are in a position to capitalize, but they face intense competition from other c-stores, quick-service restaurants, fast-casual outlets and even the home kitchen.

To measure the success of their value proposition, many retailers engage directly with their customers for feedback. 7-Eleven Inc. has something called the Brainfreeze Collective, which includes more than 250,000 engaged members who regularly share ideas, opinions and experiences related to their visits to 7-Eleven, Speedway and Stripes stores. The insights gathered from this community have a direct impact on business decisions.

A clearly stated value proposition is a must for every convenience retailer and should be the lens through which business decisions are made. When consumers consider visiting your c-store and ask themselves “is it worth it?” you want the answer to be a resounding yes.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

2024 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, May 2024

Honorable Mention, Business to Business, Magazine Section, October 2024

2023 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, September 2022

Business to Business, Retail, Single Article, March 2023

2022 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, March 2022

Winner, Business to Business, Food & Beverage, Series of Articles, October 2021

Honorable Mention, Business to Business, Retail, Single Article, September 2021

2020 Eddie Award, Folio: magazine

Business to Business, Retail, Series of Articles, September 2019

2018 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Website

Business to Business, Retail, Full Issue, October 2017

Business to Business, Editorial Use of Data, June 2017

2017 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single/Series of Articles, May 2017

Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016

2016 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, October 2015

Business to Business, Retail, Single/Series of Articles, August 2015

EDITORIAL ADVISORY BOARD

Laura Aufleger OnCue Express

Richard Cashion Curby’s Express Market

Billy Colemire Majors Management

Robert Falciani ExtraMile Convenience Stores

Jim Hachtel Core-Mark

Chris Hartman Rutter’s

Jonathan Polonsky Plaid Pantries Inc.

Greg Scriver Kwik Trip Inc.

Roy Strasburger StrasGlobal

THE CONVENIENCE STORE INDUSTRY has always been about adapting to consumer needs and today, those needs are shifting rapidly across generational lines. As operators navigate the evolving preferences of baby boomers, Gen Xers, millennials and Gen Zers, it is clear that one-size-fits-all can’t work. Understanding the unique priorities of each generation is key to driving growth, especially foodservice growth.

Kevin Farley, a former executive at GSP Retail and W. Capra, and currently an independent c-store consultant, says “it’s fascinating how food consumption varies across generations.” Kevin moderated a panel on this topic at the 2025 Convenience Store News Convenience Foodservice Exchange event in Denver this month. He noted that while baby boomers prioritize quality and tradition, younger generations seek convenience, value and unique food experiences.

Understanding the unique priorities of each generation is key to driving growth, especially foodservice growth.

For boomers, c-stores often struggle to provide the “from-scratch” or full-meal experiences they prefer. Additionally, their resistance to rapid technological advancements can pose challenges in engagement. However, boomers’ spending power is significant and c-stores that offer high-quality, freshly prepared options will find a loyal customer base within this group.

Millennials and Gen Z, on the other hand, are driving the growth of c-store food sales. Their emphasis on speed and diverse food options makes them frequent visitors. Digital engagement is critical for these consumers — they expect mobile ordering, loyalty programs and an active social media presence. And they don’t have baby boomers’ preconceptions about the quality of gas station food. Furthermore, these younger consumers are highly receptive to new food trends, making innovative menu options a key differentiator for c-stores looking to capture their business.

Beyond foodservice, the shift in consumer demographics is reshaping multiple facets of the convenience retailing business, particularly in:

Marketing: Social media engagement, personalized promotions via mobile apps and influencer partnerships are driving consumer interactions. However, these efforts must be seamlessly integrated with the in-store experience, ensuring consistency from digital touchpoints to physical locations.

Employee Management: As foodservice operations become more complex, employee training must evolve. Staff must be well-versed in food preparation, technology-driven ordering systems and superior customer service. Additionally, fostering a positive work environment is crucial for attracting and retaining talent in a competitive job market.

Product Mix: The demand for healthier snacks, functional beverages and meal solutions is rising. While traditional convenience store staples remain important, expanding options to include mocktails, adaptogenic drinks and global flavors can attract younger consumers seeking variety and wellness-focused products.

While catering to millennials and Gen Z is essential for growth, c-store operators cannot afford to neglect baby boomers and Gen Xers. The key lies in balance — leveraging digital innovation to engage younger consumers while maintaining high-quality offerings that appeal to older generations. By strategically adapting to these generational shifts, c-stores can position themselves as go-to destinations for foodservice across all age groups.

For comments, please contact Don Longo, Editorial Director Emeritus, at dlongo@ensembleiq.com.

COVER STORY

24 Rethinking your Value Proposition

Food-forward convenience retailers are in a position to strike with the right offering.

TOP 100

50 A Familiar Landscape, for Now

Despite a relatively quiet year for deals, a mega-merger looms with the potential to alter store counts, the competitive landscape and consumer perception.

E DITOR’S NOTE

4 What Is Your Value Proposition?

Customers need a compelling reason — or reasons — to turn right into your parking lot instead of turning left into your competitor’s lot.

VIEWPOINT

6 It’s a Question of Balance

Convenience stores must navigate generational shifts to grow foodservice sales.

12 CSNews Online

19 New Products

SMALL OPERATOR

20 The Local Advantage

Cliff’s Local Market prioritizes made-to-order foodservice and community partnerships.

THE BUSINESS CASE FOR D&I

70 Opening Doors

Imperial Trading runs an internship program for historically black colleges and universities.

INSIDE THE CONSUMER MIND

90 Tightening Their Wallets

Today’s c-store shoppers are price conscious and concerned about their financial situation.

From crispy, crave-worthy chips to rich, flavor-packed cookies, GOYA® Snacks deliver the bold taste consumers love and the quality retailers trust. With decades of brand loyalty and growing demand across generations, GOYA® brings authentic Latin flavor to every aisle. Discover the snack lineup that keeps customers coming back.

FOODSERVICE STUDY

32 Cooking Up Competitive Strength

Food-forward convenience retailers are taking steps to overcome challenges and enhance their appeal as dining destinations.

TOBACCO

40 Infusing Technology Into Tobacco Selling

Pricing, personalization and buydown management are just a few of the areas that can benefit.

CANDY

46 Sweetening Candy Category Sales

Innovation in the nonchocolate segment is a bright spot for c-stores.

8550 W. Bryn Mawr Ave., Ste. 225, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

SENIOR VICE PRESIDENT/GROUP PUBLISHER, CONVENIENCE NORTH AMERICA Sandra Parente sparente@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

SENIOR ACCOUNT EXECUTIVE Griffin Randall - (404) 702-6931 - grandall@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (917) 634-7471 - tkanganis@ensembleiq.com

DESIGN/PRODUCTION/MARKETING

ART DIRECTOR Cristian Bejarano Rojas crojas@ensembleiq.com

PRODUCTION DIRECTOR Pat Wisser pwisser@ensembleiq.com

MARKETING MANAGER Jakob Wodnicki jwodnicki@ensembleiq.com

MARKETING COORDINATOR Mateo Rosas mrosas@ensembleiq.com

SUBSCRIPTION SERVICES LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER

CHIEF FINANCIAL OFFICER

CHIEF PEOPLE OFFICER

CHIEF OPERATING OFFICER

Jane Volland

66 Cashing In on Retail

Media Networks

Convenience retailers can create their own or join an aggregated network to generate revenue.

On April 16, Wawa Inc. marked its 61st anniversary in the convenience retail space, as well as the company’s expansion into its 10th state. A grand opening celebration took place at the new Wawa store in Liberty Township, Ohio.

The convenience and fuel retailer now accepts the 10-4 by WEX mobile app, which offers independent truckers and small trucking companies in the U.S. fuel discounts typically reserved for larger trucking enterprises. The app is accepted at more than 60% of Circle K’s locations that offer high-flow diesel.

The company will continue to develop the nationally recognized program to deliver future enhancements and value following the purchase from PDI Technologies and Excentus Corp. PDI will remain the platform’s technology and service provider.

Members of Casey’s Rewards who purchased any large pizza on April 15 received a pizza refund in the form a free large, one-topping pizza credited to their rewards account. The Pizza Refund could be redeemed anytime during the 21 days after Tax Day.

5

The retailer added four new-to-industry stores in Belen, Las Cruces and Chaparral, N.M., and Ardmore, Okla. The locations are part of Yesway’s initiative to expand its banners, and mark the company’s 81st new store or major rebuild in the past three and a half years.

VP Discusses

Groundbreaking Travel Plaza

Onvo’s new Pottsville, Pa., travel plaza marks several milestones for the chain. Not only is it the retailer’s largest location to date at 9,961 square feet, but it also introduces Onvo’s first madeto-order food program and its first dog park. Convenience Store News recently caught up with Harman Aulakh, vice president of marketing for the Scranton, Pa.-based company, to discuss how this site came to fruition and what’s ahead for the retailer.

In March, the retailer announced that founder and longtime CEO Greg Parker was transitioning to the role of executive chairman after 50 years at Parker’s helm. Brandon Hofmann, who joined the retailer as a third-shift cashier at the age of 19 and worked his way up through a variety of leadership roles at Parker’s Kitchen — most recently, serving as president — has now assumed the company’s top executive role. The outgoing CEO and incoming CEO spoke with Convenience Store News about the leadership transition and what’s next for Parker’s Kitchen.

For more exclusive stories, visit the Special Features section of CSNews.com.

The Oreo brand is growing in 2025 thanks to the addition of four new flavor innovations that join the portfolio as permanent additions. Oreo Irish Creme Thins feature the brand’s original thin cookies filled with Irish Creme-flavored creme. Oreo Minis Peanut Butter, a new take on its classic Minis, feature bite-sized chocolate cookies filled with smooth peanut butter creme. Golden Oreo Cakesters, back after more than a decade, feature creme filling sandwiched between two soft-baked golden snack cakes. Rounding out the new offerings, Oreo Loaded cookies feature the brand’s classic chocolate cookie with Mega Stuf level creme that’s filled with bits of actual Oreo pieces.

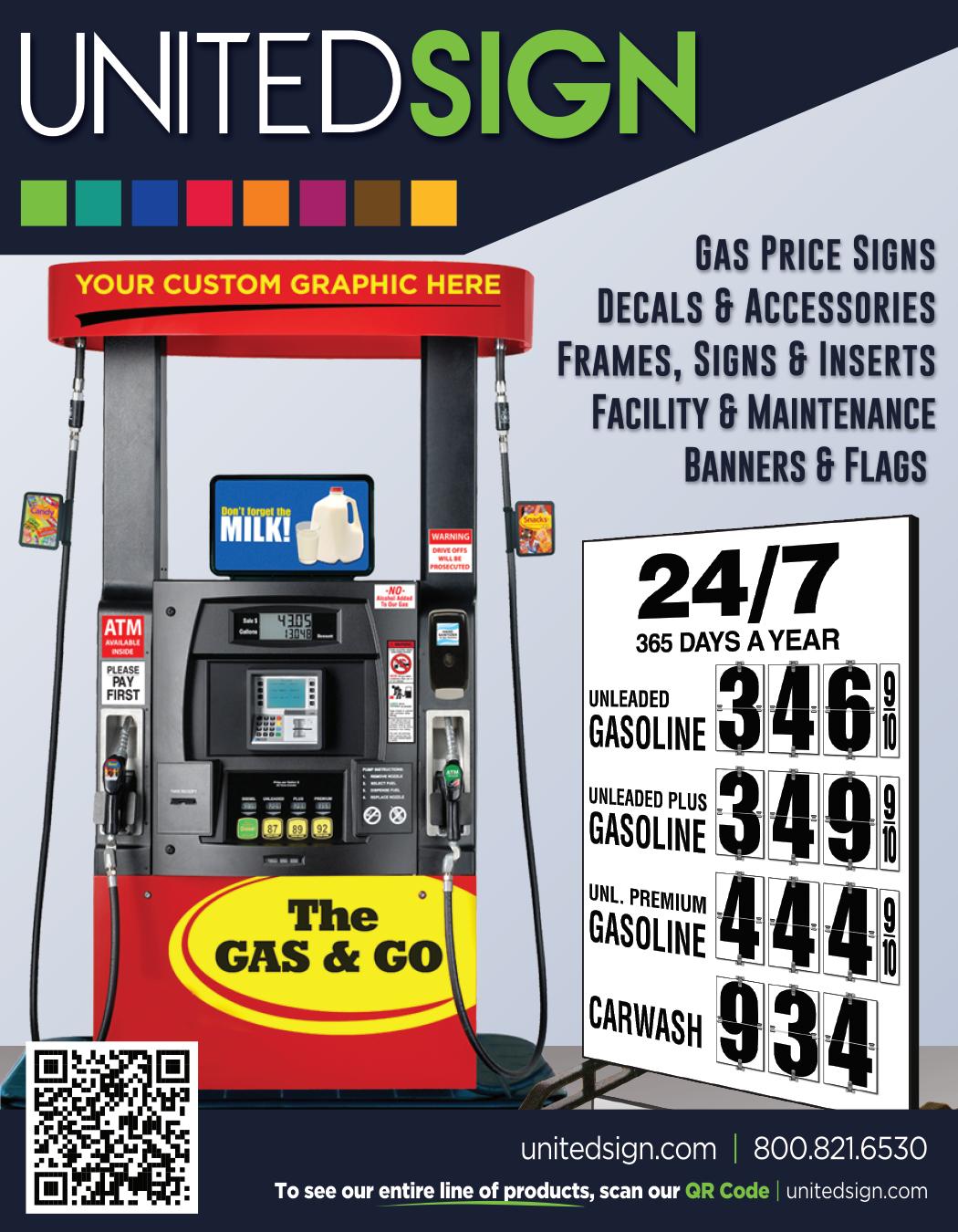

Trusted across the U.S., OWL Services is the premier provider of fueling system sales, installation, program management and service. Peace of mind to fuel your business

With 40+ offices and distribution centers and more than 1,750+ field service professionals, OWL provides full turnkey petroleum and EV charging services to keep your business moving 24/7/365

The OWL team specializes in every aspect of petroleum construction and installation. We make it easy to build and maintain reliable EV charging solutions with

Expert Team

Efficient Service

24/7 Support

Reliable Coverage

Full-service design, installation and maintenance

Partnerships with all major charging station brands

Proven 97% uptime across all projects

Our team is QIR certified and offers complete support from deployment to protection.

POS systems, card readers and fuel dispenser communications

EMV technology for fraud detection

Secure network infrastructure and system integration

The leadership change comes as the company is experiencing shareholder dissent

A CHANGE IN LEADERSHIP is coming to Parkland Corp. after President and CEO Bob Espey announced that he is stepping down after 15 years of leading the company.

This news comes on the heels of Calgary, Alberta-based Parkland launching a strategic review process that includes analysis and evaluation of the company’s business strategies and optimization opportunities, as well as consideration of value maximization alternatives that are in the best interests of all shareholders. Those alternatives include, but are not limited to, asset divestments, acquisitions, transformative business combinations and a sale of the company.

Espey will stay on until Parkland’s board of directors appoints a new CEO, the completion of the company’s strategic review or until Dec. 31, whichever comes first.

“On behalf of the board, I would like to thank Bob for his vision and leadership over the last 15 years as president and CEO,” said Michael Jennings, Parkland’s executive chair. “Bob has led Parkland through a period of exponential growth, transforming the company from a small regional fuel retailer into one of Canada’s leading fuel and convenience retailers with international operations in 26 countries. We thank him for his unwavering commitment and dedication.”

Espey’s departure accompanies a period of dissent among some of the company’s investors. Earlier this year, Parkland’s largest shareholder Simpson Oil Ltd. won a

court ruling freeing it from voting and standstill restrictions required by a 2019 governance agreement. On April 7, Simpson sent a letter to all Parkland shareholders announcing its intention to nominate nine new board members to replace incumbent directors. Simpson accused Espey of having an “undisciplined M&A [merger and acquisition] strategy, poor integrations and runaway spending.” Parkland countered by calling Simpson’s nomination slate an attempt to seize full control of the company without paying a control premium.

Parkland’s board of directors has already formed a CEO search committee comprising independent directors who will oversee an extensive executive search process to select a qualified candidate to replace Espey.

“Serving as Parkland’s CEO has been the opportunity of a lifetime. I want to thank the entire Parkland team — past and present — for their incredible dedication and drive. I am proud of what we have built together,” Espey said at the time of his announcement in April.

“Over the past few months, it became clear that stepping down and announcing my departure may help bring resolution to the situation with Simpson Oil Ltd. and benefit all shareholders. I remain deeply committed to Parkland and will support a smooth transition to new leadership.”

— Chomps 34%

1.63M

Gen Z and millennial consumers represent roughly 34% of protein snack consumers.

In 2024, 1.63 million U.S. middle and high school students used e-cigarettes.

— The U.S. Food and Drug Administration

Maverik — Adventure’s First Stop cut the ribbon on two stores in Kansas, marking the chain’s entrance into its 21st state of operation. The retailer also recently celebrated the completion of 40 Kum & Go rebrands in Oklahoma.

Parker’s Kitchen opened new locations in Evans and Richmond Hill, Ga., as well as in Beaufort and Moncks Corner, S.C. The convenience stores serve up Southern-style, made-from-scratch Parker’s Kitchen food for breakfast, lunch and dinner.

Pilot Travel Centers has begun the development of a new travel center at Empire Industrial Park in Eagle Pass, Texas. This development was made possible through a land purchase from Empire Industrial Park LLC.

About one in four consumers (39%) eat breakfast before 8 a.m.

— Circana 39%

Love’s Travel Stops expanded its portfolio with new locations in New Iberia, La., and St. Clairsville, Ohio. Both feature a Love’s Fresh Kitchen, dog park and self-checkout options. The two travel stops add 184 truck parking spaces to the company’s network.

Royal Farms welcomed customers to a new store in Lexington Park, Md. This location features 24/7 service, 16 fuel dispensers offering E-free fuel and fresh, made-to-order food, including Royal Farms’ signature World-Famous Chicken.

Walmart Inc. has big plans for its convenience services in 2025. The retailer — which currently operates more than 400 gas and c-stores nationwide — is poised to open or remodel more than 45 fuel stations across the United States this year.

•

Stinker Stores is selling 13 convenience stores in Colorado as part of portfolio optimization efforts. The retailer signed a listing agreement with Corner Realty LLC to sell the fee property sites.

Forward Corp., a fifth-generation family-owned business, is celebrating its 100th anniversary this year. The fuel retailer is gearing up for a yearlong series of events designed to give back to the communities it serves.

EG America relaunched the SmartRewards program. Working with Par Technologies, the reimagined platform is expected to increase customer engagement by 275% this year.

Maverik — Adventure’s First Stop enhanced the mobile experience for its Adventure Club rewards members. A redesigned app boasts a more intuitive interface, an upgraded map feature and the addition of Nitro Mobile Pay.

Patron Points Inc. celebrated the one-year anniversary of its formi universal mobile app. Launched in January 2024, the app is the first instant savings digital platform for the convenience channel, according to the company.

Following W. Capra’s acquisition of Impact 21, the combined entity unveiled a new company logo to reflect the joint companies doing business under the W. Capra name.

The Hershey Co. is expanding its better-for-you portfolio with the acquisition of LesserEvil, a growing, cross-category snack brand. Following the acquisition, which is expected to close later this year, Hershey will increase its share in popcorn, puffed snacks, snack bars and overall savory snacks.

Sunoco LP is bringing an in-car payment option to its North American network. The SheevaConnect platform will be available to thousands of drivers at Sunoco stations this summer.

7-Eleven Inc. is teaming up with AriZona Beverages to bring Southland Reserve, an exclusive private label drink line, to the retailer’s network. It pays tribute to 7-Eleven’s origin story as the world’s first c-store founded in 1927 as Southland Ice Co.

bp is rolling out its epic goods private label brand, which includes more than 50 unique products, exclusively across its retail brands: ampm, Thorntons and TravelCenters of America. The company introduced the product line in 2024.

Mondelēz International is partnering with Club International de Fútbol Miami as the professional soccer club’s official snacking partner. Mondelēz brands will use partnership assets such as player appearances, tickets and resources to support local businesses.

Jenny Lee Sammiches, manufactured by 5 Generation Bakers, has landed a spot on the menus of numerous college campus convenience stores and dining facilities. Locations include the University of Michigan, Michigan State and Franklin College.

National Retail Solutions announced a new integration with Google. Independent retailers can automatically showcase their in-store products to local customers searching on Google Search, Google Maps and the Shopping tab.

Red Bull Zero is a no-sugar option crafted with monk fruit extract and other sweeteners for a unique taste that is distinct from Red Bull Sugarfree. Packaged in a sleek 8.4-ounce can, the sweet and tart energy drink blends notes of tutti frutti with the taste of pineapple and vanilla, according to the brand. One can of Red Bull Zero contains 80 milligrams of caffeine, comparable to the caffeine content in a home-brewed cup of coffee. The beverage is available nationwide. RED BULL • SANTA MONICA, CALIF. • REDBULL.COM

The Ritz brand is tapping into consumer trends with its latest flavor innovation: a layered experience that combines a rich, creamy cheese flavor with a bold, spicy kick. Ritz Bits Spicy Queso Cracker Sandwiches marks the first new Ritz flavor in nearly a decade. The product is available in 3-ounce snack-sized bags at convenience stores and 8.8-ounce boxes at major food retailers. Spicy Queso follows the successful launch of Ritz Toasted Chips’ Sweet Habanero flavor earlier this year, the brand noted.

MONDELĒZ INTERNATIONAL INC. • EAST HANOVER, N.J. • SNACKWORKS.COM/BRANDS/RITZ

As demand for gluten-free offerings grows, Tyson Foodservice brings to market Gluten Free Fully Cooked Breaded Chicken Tenderloins. The product is designed to replicate the taste and texture customers expect from traditional breaded chicken tenderloins, but without the top nine food allergens, including gluten. The fully cooked tenderloins can help operators reduce back-of-house labor and ensure consistent quality and food safety, according to the company.

TYSON FOODSERVICE • SPRINGDALE, ARK. • TYSONFOODSERVICE.COM

Lay’s All Dressed U.S. snackers can now enjoy the best Lay’s flavors — Sour Cream & Onion, Salt & Vinegar and Barbeque — in one bite with Lay’s All Dressed. The chips come in a 2.5-ounce bag for a suggested retail price of $2.69 and a 7.75ounce bag for $4.99. This is already one of the most beloved varieties in Canada and after years of fan requests, Lay’s brings it stateside for the first time in its classic potato chip format. Previously, Ruffles All Dressed was offered in the United States for a limited time in 2021 and 2024, while Lay’s Kettle Cooked Ruffles All Dressed was available as part of the brand’s Flavor Swap Program in 2023.

FRITO-LAY NORTH AMERICA INC. • PLANO, TEXAS • LAYS.COM

AutoBrite introduces a prefabricated ModBrite Car Wash System, with a small footprint that allows convenience store operators to keep their old car wash structures or install the pre-fab structure within just weeks. C-stores can have a technologically advanced, automated, express mini-tunnel car wash with a conveyor belt system that is optimized for profitability in a fraction of the time as most other modern car wash options, the company noted. Standard features include stainless steel construction and an advanced dual 30-inch conveyor belt system that delivers benefits such as four times the output of traditional in-bay automatic systems, in footprints as small as 35 feet.

AUTOBRITE • SAN ANTONIO • AUTOBRITECO.COM

Cliff’s Local Market prioritizes made-to-order foodservice and community partnerships

By Renée M. Covino

WHEN A SMALL CHAIN wanted to recommit to the communities it served in a new way, it made “local” its middle name, literally.

Cliff’s Local Market emerged in 2017 after being a part of the Nice N Easy Grocery Shoppes franchise program for many years.

“Our franchisor was acquired by a local entity and we saw similar consolidation across the industry,” recalled Mike Clifford, vice president of Cliff’s Local Market. “The ‘local’ part of our brand name is exactly how we sought to distinguish ourselves. We prioritize local partnerships, selling local products, and investing in and giving back to our local communities. This helps us stand out and craft our own identity while competing with larger chains.”

Cliff’s currently owns and operates 22 convenience stores, many of which have been recent knock-down and rebuild projects to

expand and strengthen the chain’s dedication to the local neighborhoods it serves in Central New York.

“Given our size and locale, we focus on our adaptive and flexible abilities to provide an elevated customer experience,” said Jeff Carpenter, director of education and training at parent company Clifford Fuel Co., which has roots stretching back three generations to 1961. “With all the consolidation that has been prevalent in the industry, we are proud to have all that comes with the ‘local advantage’ in serving our customers.”

With most stores hovering around 4,500 square feet, Cliff’s new sites were designed to include a labor-intensive, fully made-to-order (MTO) foodservice program.

“Even in our early days, foodservice played a prominent role, but as we’ve expanded and remodeled stores, it has become a core focus,” explained Derek Thurston, director of foodservice for the chain, which is now known for offering high-quality, fresh and convenient options such as made-to-order sandwiches, hot breakfast items, pizza and house-made ciabatta sandwiches. With a wide selection of freshly baked breads, proteins, cheeses and vegetables, patrons can customize their orders to their liking.

“Our deli lines are customer facing, which allows them to see our fresh product offering, but also to be involved in the experience of their food being made. A little extra lettuce? Sure. Too many tomatoes? No problem,” noted Carpenter.

Added Thurston: “Our MTO staff takes pride in offering exceptional service and it’s not uncommon for customers to compliment them for the quality of the product and the experience.”

Cliff’s also caters to those customers who are in a rush, but still crave fresh, ready-to-go options. For them, grab-and-go coolers are stocked with freshly made salads, wraps, sandwiches, fruit cups, yogurt parfaits and protein bowls. During peak times, warmers hold breakfast sandwiches, burgers, chicken sandwiches and soups.

The local angle has enhanced the foodservice experience at Cliff’s. “We’ve really raised the bar by introducing quarterly, limited-time offers (LTOs) and fostering local partnerships,” Thurston said. “For example, we partnered with Utica Coffee, a respected local brewer, to offer their coffee in our stores. This partnership aligns with our values of community connection and sets us apart from competitors.”

While Cliff’s foodservice program was created to appeal to a wide range of customers, the chain is focused on increasing visits from female shoppers. To do this, the retailer is partnering with the American Heart Association’s Go Red for Women luncheons.

“This gives us the opportunity to showcase our heart-healthy options to a group of successful women entrepreneurs. We’ll distribute coupons at the event to encourage future visits,” Thurston said. In addition, Cliff’s is working on targeted marketing campaigns that expand awareness of its food offerings.

“Looking ahead, we’re focused on further streamlining the customer experience and exploring new ways to enhance both the in-store and online ordering process.”

— Derek Thurston, Cliff’s Local Market

Streamlining the customer experience is a priority for the retailer as well. When customers walk into a Cliff’s Local Market, they’re immediately greeted by the open-air case stocked with fresh, made-in-house items. Just next to it, right near the registers, pizza warmers offer hot, freshly made slices to encourage impulse sales. Then, the heart of the store features the large MTO area where customers can engage with staff to create their perfect sandwich. In this area, three large digital menuboards showcase LTOs with professional food photography and motion to capture attention.

“The layout is designed for smooth customer flow from ordering to checkout, creating a seamless experience with minimal friction,” Thurston told Convenience Store News.

To this end, Cliff’s also offers online ordering and is proud of the progress it’s recently achieved with the program. “Our existing foodservice program has provided a great foundation from which to build customer engagement, and we intend to lean in further on this newer offering,” said Carpenter. “The dichotomy of our online vs. in-store experience allows us to capture customers who enjoy the customized personal engagement, as well as those who prefer the ‘don’t talk to me deliveries’ with a ‘leave on porch, don’t ring bell’ request. Pickup works very similarly.”

The chain has added online order pickup racks to all its locations to improve convenience for customers in a hurry. “Looking ahead, we’re focused on further streamlining the customer experience and exploring new ways to enhance both the in-store and online ordering process,” Thurston added.

Cliff’s is looking at other technology advancements, but treading cautiously as there are a lot of factors to consider, including team member impact, according to Carpenter.

“Being a smaller retailer, it can be challenging to tie together different pieces of necessary technology to create a seamless customer experience and not overwhelm your support/store teams with all the technological pieces,” he said. “It is important for us not to rush into solutions and ensure they’re a good fit for all parties — especially our customers. It’s also worth noting that you have to be extremely conscious of how today’s decisions can affect future initiatives.” CSN

By Angela Hanson

WITH ECONOMIC UNCERTAINTY SPIKING and fears of a looming recession, it is no surprise that consumers are looking to save on food. Convenience retailers focused on high-quality fresh food at affordable prices are in a position to capitalize, but they face intense competition.

What’s more, it is no longer enough to offer the best price. To win out over other c-stores, quick-service restaurants (QSRs), fast-casual outlets, or even the home kitchen, food-forward convenience retailers must revisit their overall value proposition to ensure they are giving consumers a reason to choose them, again and again.

“Good value is a mix of price, quality, convenience and overall satisfaction from the purchase. It’s not always about getting the cheapest option, but rather the one that meets or exceeds your needs and expectations for the cost,” said Ryan Blevins, director of food and beverage innovation at Weigel’s, describing the Powell, Tenn.-based chain’s approach to crafting its own value proposition. “Sometimes, value is subjective. If the purchase brings joy, convenience and it tastes great, it may be of greater value than something that saves you a little money.”

For all convenience stores, a vital component of a well-planned value proposition is right there in the name of the channel. It’s not just what customers want, but when and how they want it.

“Availability is extremely important. You need to have all offers available during expected hours of operation,” said Dave Grimes, vice president of foodservice at Martin and Bayley Inc., operator of Carmi, Ill.-based Huck’s Market. “We look at volume

by item by store to ensure we have all products available at each location that offers that product.”

Consistency is another pillar of the value proposition, and one that can only be built over time. Consumers are more likely to return to a foodservice operator they trust to serve something they enjoy the same way every time than they are to take a chance on a competitor of unknown quality. Consistent execution requires investment in consistent training. At Huck’s, this includes written procedures, how-to videos and QR codes that link to a guide for any product it offers.

Adding delivery to the value proposition through multiple third-party operators is also increasingly feasible thanks to delivery aggregators and other moves to streamline digital ordering, which have made it easier for c-stores to extend the reach of their menu without overwhelming their timestrapped kitchen employees.

“We have found e-commerce platforms to be very helpful, as many consumers want fast and easy transactions that come to their door,” Grimes said, pointing to Grubhub, DoorDash and Uber Eats as reliable partners, along with online ordering for its Godfather’s Pizza offering.

Tim Powell, a principal at research and consulting firm Foodservice IP, headquartered in Chicago, advises c-store operators to think of value in terms of “price-and.”

“Beyond price point, this commonly includes quality. Consumers might also factor in a broader range of things that are more individually important to them like the ease of the overall experience (speed, service and

accuracy), portion size, uniqueness, the ability to find options that meet their dietary considerations, etc.,” he explained. “So, even as absolute price points have become something consumers are paying more attention to in the current environment, value can be relative. And what can be considered a good value from a pricing standpoint might vary.”

Tiered menus and barbell pricing can be beneficial by providing a range of options and different price points, giving customers the opportunity to trade up or down depending on the attributes they consider to be most important, Powell added.

As consumers take stock of their dining habits these days and reconsider the best options for their priorities, c-store operators must be prepared to make a case for why they are the better

option than the local QSR, fast-casual outlet or cooking at home.

Ensuring their prepared food and beverage offerings are of similar or better quality is a baseline requirement. Beyond that, retailers should emphasize what they offer that others don’t.

“C-stores win on immediate gratification — no drive-thru wait, no tipping,” said Powell. “C-stores must emphasize convenience and immediate availability as their edge.”

He advises c-store operators to shift their framing from cost to savings in both time and effort, and

recommends highlighting “skip the wait” or “grab-and-go without compromise.”

Convenience retailers can also give their foodservice offerings a better competitive angle by emphasizing how nonfoodservice items such as fuel, packaged beverages, snacks and other everyday essentials can be purchased during a single trip, increasing the efficiency of time spent away from home. Operators should lean into this with bundles that offer a prepared food item with an in-demand product from another category.

“Our stores offer a one-stop experience, allowing customers to quickly grab a satisfying, fresh-made meal along with their everyday essentials — all in a single visit,” said Blevins.

While meals eaten at home will usually win in a financial comparison, c-stores can offer superior value in other ways. “While cooking at home may save money, it often requires more time and effort. We offer hot and cold meals that provide the same comfort and satisfaction of a home-cooked meal without the prep or cleanup,” Blevins added. “For busy consumers, this time-saving convenience is a key value proposition.”

Grimes, though, pointed out that c-stores can sometimes compete with the savings of meals at home. He cited the “extremely aggressive single-day promotions” that Huck’s runs to create loyalty engagement and endearment and drive visit frequency. In addition, he agreed that the intangible benefits of c-stores can be extremely impactful.

“We also sell them time. The customer can be in and out quickly,” he said. “I can sell you 20 minutes of sleep every morning!”

Honing a Competitive Advantage

Developing a value proposition also means developing distinctiveness despite the fact

that the most popular items on a c-store menu are also some of the most commonly available.

To succeed, retailers need to offer customers what they want, but do so in a way that differentiates themselves. For instance, retailers can’t offer value if consumers view pizza and chicken strips as fully interchangeable regardless of the purchase location.

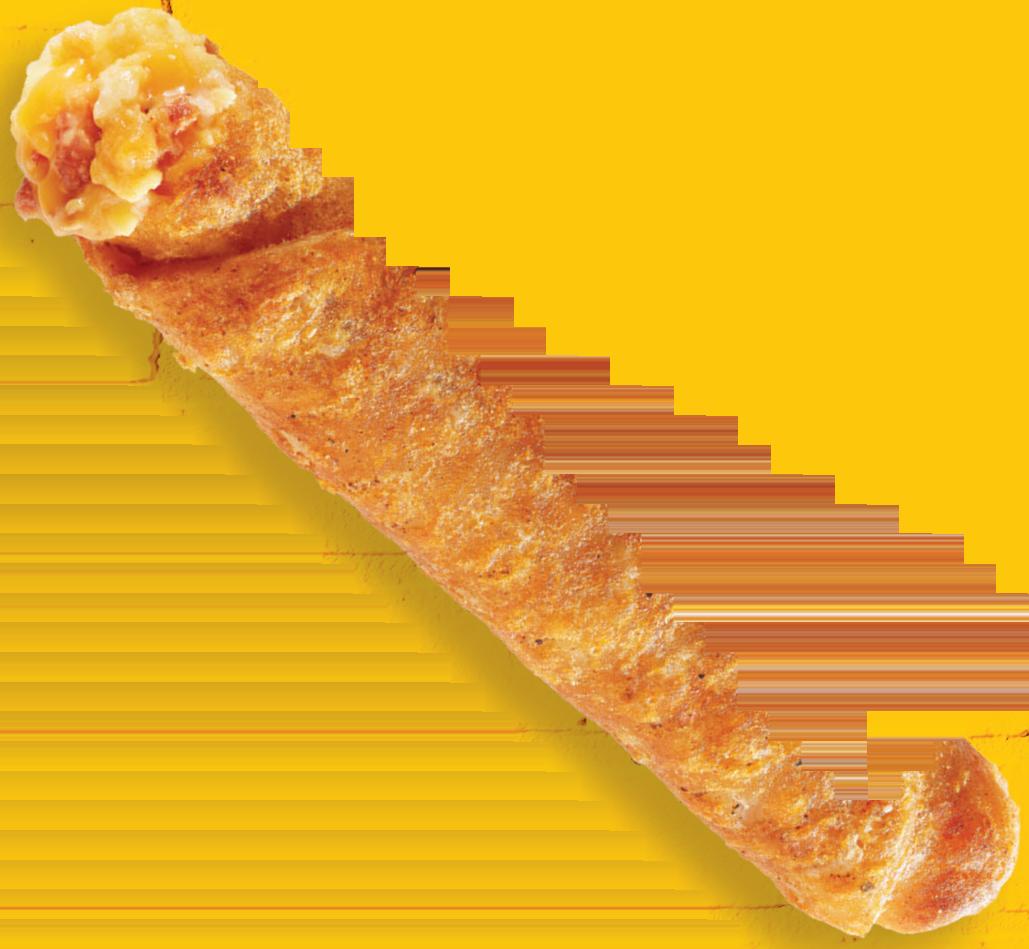

“We recognize that while core menu favorites remain consistently popular, differentiation is essential to staying relevant in a competitive market,” said Blevins. “Our approach focuses on elevating familiar favorites, such as chicken and pizza, while continuously introducing innovative, craveable options that set us apart.”

Examples include Weigel’s Hot Honey Big Pig limited-time offer (LTO), which reimagines a classic breakfast favorite by incorporating premium ingredients to enhance both flavor profile and visual appeal. The chain also partnered with a renowned hot sauce company to develop exclusive sauce flavors using “speed-scratch” recipes.

Meanwhile, Huck’s highlights the quality of its breading, which is a vital yet often under-recognized part of chicken menu items. An upcoming campaign will highlight the fact that Huck’s hand-breads its chicken and fresh-cracks its eggs daily. “We have our own proprietary chicken breading,” said Grimes. “It will always be unique because it is ours.”

Likewise, Powell advocates for maintaining consistency in the core menu while using seasonal, limited-run flavors to differentiate from competitors’ menus and drive purchases. He pointed to Royal Farms as a good example of a smaller c-store chain that balances standard, best-selling chicken piece meals with seasonal specialty chicken tenders.

“Limited-time options encourage impulse buys,” he said. “Behavioral cues like ‘only available this month’ increase perceived exclusivity. Lessons from past economic downturns show that consumers gravitate toward comfort foods in uncertain times. C-stores should emphasize nostalgic favorites while adding subtle innovations to keep offerings fresh.”

Weigel’s focuses on elevating familiar favorites, while continuously introducing craveable options that set it apart.

“Even as absolute price points have become something consumers are paying more attention to in the current environment, value can be relative.”

— Tim Powell, Foodservice IP

These efforts need to be ongoing, not a one-and-done cultivation process.

“Our competitive advantage is our ability to bring exclusive proprietary items to our customers. We work with our broad network of 16 commissaries and 16 bakeries across the U.S. to develop and deliver new, high-quality menu items daily. We partner closely with each to adapt our offerings to reflect seasonality and shifting customer preferences,” said Brandon Brown, senior vice president of fresh foods at Irving, Texas-based 7-Eleven Inc.

“For example, in the past year, we have worked with our partners to develop and introduce new LTO items like Mangonada donuts with Tajin, [the] Old Bay Chicken Sandwich, Chicken Curry Bowls and Everything Breakfast Sandwiches,” he added.

7-Eleven also has a dedicated team of product developers that continually work to identify and create new, on-trend products and recipes to meet customer cravings.

While convenience retailers may view their made-to-order offerings as the most fitting to go head-to-head with the QSRs and fast-casual restaurants, a high-quality, differentiated grab-and-go offering can be a draw — even if it doesn’t offer customization.

Brown noted that 7-Eleven has worked to further cement itself as a leader in immediate consumption by continuously expanding its grab-and-go options and bake-in-store programs to improve the quality of its core items, increasing its ability to compete.

“Our fresh food strategy is all about keeping pace with evolving customer expectations — delivering food that meets customers’ needs for high-quality, fresh, craveable and on-the-go convenient food,” he said.

Getting the Message Across Of course, no competitive advantages will be as effective if they are not marketed well.

“At 7-Eleven, we’re constantly looking for ways to show customers that great value and craveable food can go hand-in-hand — anytime, anywhere,” said Brown. “Our marketing strategy for fresh food, especially with items like pizza, has recently focused on an integrated mix of channels, including social media, connected TV and traditional media. These platforms allow us to reach different audiences where they are, in ways that resonate most with them.”

As an example, he pointed to 7-Eleven’s recent Pi Day promotions, which supported its offer of whole pizzas for just $3.14 on March 14. The retailer activated “a full-tunnel campaign” to build awareness and drive traffic both in-store and through its 7NOW delivery app.

“The response proved that when we show up where it counts with an offer that resonates, customers respond,” Brown shared.

Retailers can gain by getting specific about the benefits their foodservice program offers. For instance, Huck’s ties its Huck’s Kitchen logo to the tagline, “Made Fresh, Right Here.”

“We think it is important that the customers know that we make our subs, salads and wraps in-house. Our Godfather’s Pizza is freshly made, our chicken is freshly made,” said Grimes. “Often, when people think of the convenience environment, they think it is something you put

in the microwave and then transfer to a warming unit! That is definitely not us.”

Marketing plans need to consider how each component contributes to the strength of the overall message. Weigel’s markets its value proposition through a layered approach that meets customers in multiple touchpoints throughout the day, according to Blevins.

“Our most loyal guests typically get the message first through our app — whether it’s a push notification, an in-app reward or a reminder of an offer tied to their behavior,” he said. “From there, we reinforce it in-store with intentional signage, point-ofsale messaging and cashier engagement.”

Outside its stores, Weigel’s utilizes fuel pump video content designed to catch customers’ attention during dwell time, as well as targeted online marketing and streaming platforms to reach customers where they are already spending time. Social media also helps Weigel’s add energy and personality to its brand while building a sense of community.

“The most successful efforts are the ones that connect across all channels,” Blevins said. “When a customer sees the offer on their phone, hears it while fueling up, and walks into the store to see it front and center — that consistency builds trust, drives action and reinforces our value.”

Foodservice sales are the most direct measure of successful marketing, but savvy retailers also pursue more nuanced methods of determining whether they are delivering on their value proposition in a way that resonates with consumers.

“While sales data is one of the ways we measure the success of value proposition — looking at performance by store, geography, product category, etc. — we also put significant emphasis on engaging directly with our customers for feedback,” Brown said.

7-Eleven considers the Brainfreeze Collective, its proprietary customer research panel launched in 2021, as one of the most useful tools in this area. The Brainfreeze Collective includes more than 250,000 engaged members who regularly share ideas, opinions and experiences related to their visits to 7-Eleven, Speedway and Stripes stores.

“The insights we gather from this community are shared across our internal teams and have a direct impact on business decisions, from product innovation to in-store experience,” Brown explained. “A great example of this is the Slurpee rebrand that we unveiled in 2023, where feedback from the Brainfreeze Collective helped inform the brand’s vibrant new look.”

Chains that lack the ability to launch such a largescale initiative can still gain valuable data by connecting with customers in other ways. Whether it’s through the company’s mobile app, in-store comment cards or other channels, the key is listening.

“While sales performance is a key indicator, we place significant emphasis on gathering customer and team member feedback. And usually the latter two tell the entire story,” said Blevins. “If the feedback from our customers and our operators is well received, then you can almost count on the sales performance to fall in line.” CSN

“While sales data is one of the ways we measure the success of value proposition — looking at performance by store, geography, product category, etc. — we also put significant emphasis on engaging directly with our customers for feedback.”

— Brandon Brown, 7-Eleven Inc.

Food-forward convenience retailers are taking steps to overcome challenges and enhance their appeal as dining destinations

Cautiously optimistic, convenience store operators are banking on long-term investments in prepared food and dispensed beverages

By Angela Hanson

By Angela Hanson

FOR MANY CONVENIENCE STORE RETAILERS, investing time, effort and money into a foodservice program can be the difference between a good year and a great one during times of prosperity — or the difference between profit and loss during more troubled times.

Increasingly, c-store retailers are expanding their prepared food and dispensed beverage offerings as they fight for foot traffic in a competitive market. The foodservice category is a vital sales and traffic driver within the convenience channel and is only becoming more important as c-stores expand their competitive sphere to include retail foodservice at large and work to establish themselves as top-of-mind dining destinations for those who want convenient yet quality food.

FROM A DISTANCE, the current state of the foodservice category is rosy, and convenience store operators are doing everything right. Sales and profits are up, with most retailers predicting continued increases throughout 2024, and companies are investing in new technology, equipment and menu innovation to ensure success in the years to come.

However, taking a closer look reveals obstacles that even the best-designed food program can’t ignore. Economic difficulties and concerns about the future are prompting consumers to tighten their purse strings, while rising costs have slowed profit growth compared to last year. Meanwhile, employee recruitment and retention remain a struggle despite some easing of the labor crunch.

97% of large operators offer frozen dispensed beverages, up from 77% a year ago.

SPONSORED BY

*New response added in 2025

Iced coffee

66% 54%

Fountain sports drinks/energy drinks 58% 51% 48%

Fountain noncarbonated beverages

Hot tea

Cold brew coffee

Smoothies

Iced cappuccino/latte/espresso

56% 59%

36% 25%

23% 13%

38% 28%

Juices 32% 23% 28%

Soft-serve frozen yogurt/ice cream

20% 15%

Kombucha 7% 12% 7%

Aguas frescas 5% 15% 12%

The good news is that compared to last year, c-store operators across the United States have reason to believe they are on the right track. According to the findings of the 2025 Convenience Store News Foodservice Study, nearly eight out of 10 operators expect their foodservice sales and profits to grow in 2025. At the same time, rising food costs, shifts in consumer behavior and economic uncertainty threaten to upend forecasts, underlining the need for c-store retailers to carefully plan for whatever the future holds.

For now, convenience retailers are backing up their commitment to foodservice by giving the category the space to grow. The average square footage devoted to foodservice rose to 35% of total store size this year, up from 25% last year.

Prepared food remains the primary category driver, offered by 92% of the retailers surveyed and generating, on average, 48% of total foodservice sales. Hot, cold and frozen dispensed beverages vary in availability, but all are offered by a significant majority of retailers. Hot and cold dispensed beverages each account for 24% of total foodservice sales, while frozen beverages account for 16% and are especially popular with the industry’s larger operators.

Many c-stores are embarking on a simple plan to boost their foodservice success: give customers more of what they want. Enhanced menu items, expanded offerings and a focus on quality and freshness are among the reasons retailers express a positive outlook for 2025.

Small operators were more likely than large operators to add cappuccino/ latte/espresso items, milkshakes and smoothies to their dispensed beverage lineup last year.

IMPROVED

DON'T KNOW WORSENED

VERY POSITIVELY STAY THE SAME

SLIGHTLY POSITIVELY

NEUTRAL

SLIGHTLY NEGATIVELY

VERY NEGATIVELY

“Consumers are looking for quick, easy meal solutions, making c-store foodservice a popular choice for on-the-go meals," said one study participant. Another remarked, “We are adding new kitchen equipment and with this, will be able to have a larger offering.”

Breakfast sandwiches are by far the most widely available prepared food item in the channel (offered by 92% of the retailers surveyed), regaining the lead after seeing a 10-point dip in 2024. Pizza (offered by 80%) surged past chicken (75%) for this year’s No. 2 spot — a shift driven mainly by small operators, 81% of whom report offering it, up from 60% a year ago.

Other top c-store prepared food items in terms of availability are bakery, hamburgers, snacks/appetizers, hot dogs and other roller grill items. Year over year, hot entrées (down 15 points) and wraps (down 11 points) saw the largest declines in availability. This could indicate that some retailers are trimming the size of their menus and focusing on their best-selling items.

The average foodservice department occupies 1,328 square feet.

C-store operators are expanding their number of food preparation locations, with food ready to heat and serve from convenience distributors, company commissaries and direct-store delivery gaining traction over the past year. Overall, prepared food is more frequently being delivered ready to heat and serve (78%) vs. assembled at the store (68%).

Although the convenience channel is building its collective reputation for high-quality proprietary foodservice programs, branded partnerships — particularly with pizza and coffee brands — remain important, with 40% of study participants reporting that they franchise or license a branded restaurant concept. The industry’s small operators are fueling growth in this space, with 41% having a branded partner, up from 21% in last year’s study.

On the beverage side of the category, hot options such as coffee, hot chocolate, cappuccino and lattes lead in availability, but cold and frozen options are growing, particularly frozen drinks like slushies and smoothies, juices and fountain sports/ energy drinks.

“Consumers are looking for quick, easy meal solutions, making c-store foodservice a popular choice for on-the-go meals."

— Study participant

Made-to-order, barista-style beverages saw a big jump over the past year with 28% of study participants saying they now offer them, up from 13% the previous two years.

In recent years, labor hiring and retention have presented a significant challenge to c-store operators. As a result of implementing higher wages, competitive benefits and performance-based bonuses, among other measures, retailers now report better results in this area.

“We are providing not just more pay, but also incentives per month if the food sales increase and there is a decrease in throwaway,” one retailer noted. Another cited “foodservice training classes, state certification and hiring people with QSR [quick-service restaurant] experience” as effective steps they have taken.

The supply chain failed to improve as much as hoped during the last year, but largely did not worsen. Nearly half of operators (48%) reported that supply chain issues stayed the same in 2024 vs. 37% that reported improvement. Nearly six in 10 expect supply chain issues to improve this year.

Convenience retailers are adjusting their menus in response: 45% said they removed at least one food item due to supply chain issues last year. Of these operators, 72% said they plan to bring back some but not all items, while 24% said all items will be brought back.

Inflation was one of the most prevalent challenges in the past year as a majority of the retailers surveyed said inflation and economic issues affected their company either very negatively (19%) or slightly negatively (43%) in 2024. Small operators were especially impacted.

For this year, both large and small operators are split between optimism, neutrality and pessimism regarding how they anticipate inflation and economic issues to affect them in 2025. However, retailers were surveyed prior to the April implementation of tariffs.

To manage whatever inflation and economic-related challenges that do arise, several operators plan to adopt strategies for pricing and cost management (43%) and for better operational efficiency (26%). Local sourcing, limiting menu items that don’t use common ingredients and tightening equipment spending are among the specific steps operators expect to take this year.

Retailers also plan to implement new sales and marketing strategies to help consumers combat inflation. “For 2025, we are looking at doing more combo deals with multiple items in different categories,” one retailer shared. “Customers like to see specials.” CSN

Pricing, personalization and buydown management are just a few of the areas that can benefit

By Renée M. Covino

SELLING TOBACCO and nicotine products is the antithesis of a simple task. Nobody out there is setting the price of a pack and calling it a day. You can’t put a price tag on a cigarette, and advertising is extremely restricted and regulated. What’s more, convenience store operators must juggle manufacturer-imposed pricing rules, complex regulatory requirements, state and local minimums, shifting consumer trends and the need to maintain profitability.

“It’s a balancing act and doing it manually can feel like trying to navigate a maze blindfolded,” said Caitlin Orosz, senior director of marketing at Scottsdale, Ariz.-based ClearDemand, a provider of artificial intelligence (AI) driven price optimization and competitive intelligence solutions. “Tobacco category managers are the unsung heroes. They handle complex tasks while constantly facing the risk of fines and missing manufacturer buydowns. This is where technology can help them.”

By integrating technology, Orosz explained that improvement can be realized in:

Sales Optimization: AI-driven insights can reveal customer buying patterns, helping retailers optimize their pricing and promotions, such as cross-promoting complementary items.

Pricing: Technology ensures that prices align with demand, regulatory requirements and manufacturer buydowns so that retailers don’t leave money on the table. “Instead of scrambling to adjust prices manually, automation ensures retailers hit rebate targets effortlessly,” Orosz noted.

Marketing & Personalization: Data-driven promotions and personalized loyalty programs can influence brand perception and encourage repeat visits by customers.

Regulatory Compliance: Automated compliance tracking helps retailers stay ahead of evolving regulations, avoiding costly fines and ensuring they meet all state and local requirements.

Buydown Management: With technology, retailers can meet manufacturer buydown pricing terms, maximize funding and stay compliant without extra effort.

Automation & Efficiency: Advanced pricing technology can streamline the entire process, integrating manufacturer buydowns all the way to price execution to the store point-of-sale and in some cases, to the digital price tag.

Another top challenge in the tobacco category is the transformation of adult tobacco consumers who are switching from traditional cigarettes to other forms of nicotine.

“As traditional cigarette consumption continues to decline, without data it can appear that the retailer and tobacco companies are losing consumers. However, in many cases, using technology like a loyalty program can help understand and identify if the consumer has quit or just migrated brands or nicotine product types,” explained Margaret Ogren, senior business director for Woodbury, Minn.-based Patron Points, which provides loyalty applications, scan data analytics, mobile app solutions and other customer retention tools.

This information can then be used by a convenience retailer to message a 21-plus consumer with a targeted deal to keep them visiting the location. “Personalized

“We’ve seen through our data that consumers are no longer satisfied with ‘surprise and delight’ discounts. They want to know where to go to receive value and connect with their preferred brand or product.”

— Margaret Ogren, Patron Points

promotions improve the relationship with the retail location and/or brand and reduce the risk of the consumer looking to a competitor for a better price on their new product choice,” Ogren said.

Last September, Patron Points formed an agreement with Laval, Quebec-based Alimentation Couche-Tard Inc. to offer loyalty and scan data services to legacy franchisees of Circle K and Kangaroo Express locations. The partnership offers tobacco loyalty promotions, as well as participation in digital trade programs offered by leading tobacco brands.

Patron Points gives c-store retailers the ability to offer and notify adult tobacco consumers of personalized coupons, discounts and deals, directly communicating to the consumer via email and mobile app notifications when they have discounts waiting for them at a specific retail location.

“We’ve seen through our data that consumers are no longer satisfied with ‘surprise and delight’ discounts,” Ogren told Convenience Store News. “They want to know where to go to receive value and connect with their preferred brand or product.”

Patron Points is also seeing a shift in consumer purchasing habits. For instance, instead of purchasing a carton of cigarettes, consumers are spreading out their purchases to two packs at a time, thus increasing trips. These shifting behaviors open retailers up to risk, but also opportunity, according to Ogren.

“If adult consumers know where they are getting value for their tobacco, it is shown that they will also more than likely purchase additional items during that transaction. In our data, the tobacco consumers who receive personalized offers purchase more items per transaction and visit, which equates to more profits,” she said.

The Near-Future Picture

To create an even stronger customer experience, the near future for c-store retailers is not only about engaging the adult tobacco consumer when they’re at your store, but also engaging them when they are thinking about lunch,

*Savings vs. 2-packs, based on MSRP.

JUULpod 1-packs lower cost of trial by 40%* for adult nicotine consumers already curious to try JUUL. $ 20** in ving . Exclusively for new independent retailers. Reach out to your Distributor Sales Representative for details.

trying to decide what to make for dinner, looking for a morning pick-me-up and so on, advised Ogren. Using mobile applications, retailers can communicate with consumers through timely notifications, personalized promotions and rewards.

“It will be about creating relationships that drive more repeat visits,” she told CSNews. “Our data shows that retailers who integrate a mobile app into their loyalty program experience an 82% increase in loyalty participation. We believe that this is because with mobile apps, consumers are more aware of the value that is available and therefore, they seek to engage with those retailers who provide them with it.”

The way ClearDemand’s Orosz sees it, manufacturers are already using tobacco scan data to come up with more regional and localized prices and incentives to maximize their sales and margins, and they are expecting c-store retailers to follow suit.

AI and automation are changing everything for the tobacco category manager, and the improvements Orosz believes will stand out the most moving forward are:

• No more analyzing mountains of data to predict sales trends. AI will identify the right price points, best-selling SKUs and emerging product trends before tobacco category managers will think to ask. AI also will help optimize promotions on products that drive repeat purchases and build baskets.

• A competitor down the street that just dropped tobacco prices will be no problem for category

“At the end of the day, retailers who embrace technology aren’t just keeping up, they’re getting ahead. They’re making smarter pricing decisions, building customer loyalty and ensuring compliance without the daily stress.”

— Caitlin Orosz, ClearDemand

managers moving forward. A pricing tool can automatically adjust based on competitor activity, demand fluctuations and compliance requirements.

• Pricing tailored to regional market dynamics, competitive pressures and consumer preferences — down to the individual store level — will become more prevalent soon.

• AI-powered analyses of consumer behaviors will refine loyalty programs and targeted promotions, resulting in relevant offers for the right people. More relevant offers mean stronger customer loyalty and higher overall sales.

• Automated compliance solutions will ensure up-todate pricing and promotional compliance to prevent fines and lost rebates for retailers.

“At the end of the day, retailers who embrace technology aren’t just keeping up, they’re getting ahead,” Orosz said. “They’re making smarter pricing decisions, building customer loyalty and ensuring compliance without the daily stress.” CSN

By Kathleen Furore

WHILE A LITTLE MORE THAN HALF of all confectionery sales are driven by chocolate, nonchocolate candy has grown by nearly $5 billion since 2019, an increase of almost 70%.

In the convenience channel, the nonchocolate segment was a bright spot last year in an otherwise unimpressive year for candy sales, according to Sally Lyons Wyatt, global executive vice president and chief advisor, consumer goods and foodservice insights for Chicago-based Circana.

“In the convenience channel, nonchocolate grew one dollar-share point in 2024 vs. 2023. However, overall sales for confections in the convenience channel were down across dollars, units and volume for the category,” she said. “Part of the sales decline was due to the loss of c-store traffic; however, there were pockets of growth across the U.S.”

Spicewood, Texas-based Texas Born (TXB) Stores is one convenience retailer that has benefitted from the popularity of confections that don’t contain chocolate.

“Nonchocolate experienced strong same-store growth,” reported Benjamin Hoffmeyer, vice president of marketing and merchandising for the chain, which operates 50 locations throughout Texas and Oklahoma. Sweet, sour and infused juice-filled candy were among the best-sellers, according to Hoffmeyer, who expects the infused flavor trend to remain strong this year.

“Flavors are always a hit within the nonchocolate category,” Lyons Wyatt echoed.

Mashups that include combinations of two or more flavors such as grape and strawberry are among today’s

most popular options for candy shoppers, as well as products that boast creative flavor profiles such as tamarind chili, peach chili and lime, honey bun and green apple, she noted. Nonchocolate candy in special shapes and textures is also popular.

“Forms like snakes, unicorns, worms, strips, wedges and rope delight consumers, [and products] with crunchy and chewy type textures grew significantly,” Lyons Wyatt shared.

The rapid rise of freeze-dried candy illustrates the role that texture is playing in nonchocolate candy sales. The #freezedriedcandy hashtag is nearing 5 billion views on TikTok. With a light, airy, crisp texture that’s especially popular with younger consumers, freeze-dried candy is expected to grow at a rate of 8.5% from 2024 to 2030, Grand View Research predicts.

While many factors come into play when evaluating category performance, price is a big one impacting candy sales, or the lack thereof. According to the National Confectioners Association’s (NCA) 2025 “State of Treating” report, 30% of Americans are treating themselves “a little less” these days — many due to concerns about the cost of confections.

“Eighty percent of these consumers said

price was the or a factor for consuming less. Additionally, price is now the No. 1 purchase decision factor, whereas mood has taken the top spot in years past,” the NCA noted in its report.

Consequently, 41% of consumers say they are often/usually looking for sales promotions when buying confectionery for themselves, 44% when buying confectionery to share for holidays such as Halloween and 25% when buying confectionery as a gift for someone else.

What kinds of promotions are candy shoppers hoping to find? In 2024, consumers favored buy one, get one deals and mix-and-match discounts, NCA’s research revealed.

The impact that price is having on candy sales is evident at TXB Stores, where Hoffmeyer said special promotions have helped boost candy sales of the nonchocolate variety.

“Buy 2 Peg, Save $1 has worked extremely well, and the ability to mix and match across multiple brands has done well,” he pointed out. “King-size candy has also experienced strong growth with our Buy Two, Get One Free offers.”

To take advantage of customers’ preferences for these kinds of promotions, TXB added several floor displays to create “additional points of interruption to gain incremental sales” and leveraged “multibuy app digital coupons that stack on top of promotions to help build baskets,” Hoffmeyer said. “We also are seeing an uptick in private label sales adoption as guests look for more value, and higher app digital coupon redemptions as well.”

With economic concerns front and center for today’s consumers, it’s hard to predict how candy sales will fare. “2025 has started out with uncertainty, and we are seeing consumers pulling back from some categories,” Lyons Wyatt cautioned.

Consumers’ love of sweets bodes well for the category. In 2024, 98% of households purchased confectionery at least once, according to NCA’s research. However, that doesn’t mean c-stores will have an easy road considering that last year saw candy

Nonchocolate candy has grown by nearly $5 billion since 2019, an increase of almost 70%.

Source: National Confectioners Association

buyers shift to value-forward channels, particularly club and dollar stores.

“Convenience retailers will have to work hard to get traffic back up and use categories that are a big draw — and nonchocolate is a traffic-building category,” Lyons Wyatt stressed.

She suggests finding ways to promote the candy category in fun and engaging ways.

“Work with CPGs [consumer packaged goods companies] to communicate to ‘co-owned’ consumers — those who buy the category and shop c-stores — and work to increase foot traffic with new consumers,” she advised. “Consumers are looking for ways to reward or treat themselves, to get away from the challenging times. Convenience retailers should find ways to message consumers with inspiration to do just that.”

To that end, Lyons Wyatt advises c-store operators to pay close attention to their candy inventory on hand. “They should make sure they have the right variety/ assortment available, so when consumers do visit their stores, they have what they are looking for, both the loyals and those who may be more transient in the category,” she explained.

Having the right promotion, incentive and/or price point to encourage “just one more” purchases is another strategy Lyons Wyatt recommends. “Leverage innovation to excite consumers on a regular basis, especially with limited-time offers. Additionally, build up seasonal and celebrate the big holidays, but also build up micro-holidays,” she added.

When it comes to exciting consumers, platforms like Facebook, Instagram and TikTok can help. Social media has become a powerful tool in inspiring consumers with new consumption occasions or trial. Young consumers especially are motivated by viral products and trends, according to the NCA, which reported that 27% have found a new brand or item through social media posts and influencers.

Perhaps the best barometer of the future is the way convenience store retailers are feeling as the year progresses. At TXB, a positive mood prevails.

“I am excited about the candy category this year as there is a lot of great innovation,” Hoffmeyer said. “Typically, great innovation leads to higher impulse, profitable sales.” CSN

Despite a relatively quiet year for deals, a mega-merger looms with the potential to alter store counts, the competitive landscape and consumer perception

By Melissa Kress & Danielle Romano

MERGER AND ACQUISITION (M&A) ACTIVITY in the convenience channel has been relatively quiet over the past 12 months, save for a few notable deals such as Ankeny, Iowa-based Casey's General Stores Inc.'s $1.145 billion acquisition of Temple, Texas-based Fikes Wholesale and its CEFCO Convenience Stores network, and Brentwood, Tenn.-based Delek US Holdings' decision to sell off all its retail assets to a subsidiary of Mexico-based FEMSA, parent company of the OXXO network.

As a result, the U.S. convenience store landscape has remained mostly unchanged, as reflected in this year’s Convenience Store News Top 100 report, compiled in partnership with Nielsen TDLinx using March 2025 data. Same as last year's rankings, the top three chains are Irving, Texas-based 7-Eleven Inc. with 12,369 stores, Laval, Quebec-based Alimentation Couche-Tard Inc. (ACT) with 5,851 stores, and Casey's with 2,899 stores. These three companies account for a combined 21,119 stores of the industry’s 152,192 total locations or 13.87%.

Rounding out the top 10 are Westborough, Mass.-based EG America (1,406 stores), Richmond, Va.-based GPM Investments LLC (1,334 stores), El Dorado, Ark.-based

Murphy USA Inc. (1,173 stores), Tulsa, Okla.-based QuikTrip Corp. (1,142 stores), Media, Pa.-based Wawa Inc. (1,117 stores), La Crosse, Wis.-based Kwik Trip Inc. (879 stores), and Salt Lake City-based Maverik Inc. (852 stores). In all, the top 10 companies account for a combined 29,022 stores or 19.06% of the industry total.

With talks stretching on about a possible tie-up between 7-Eleven's parent company, Tokyo-based Seven & i Holdings Co. Ltd., and ACT, the parent company of the global Circle K banner, it is possible that next year's Top 100 ranking could look very different.

Whether it’s a Circle K and 7-Eleven pairing or another channel-shaking deal, we reached out to industry insiders to get a read on what effect a mega-merger would have on the industry.

While the c-store landscape is made up of more than 152,000 stores, there is not one convenience store company that is a national brand, according to M&A specialist Terry Monroe, president of American Business Brokers & Advisors. Unlike other nationally known businesses such as McDonald’s, Burger King and Holiday Inn that provide a consistent experience throughout the guest journey, the only c-store chain that comes close to being national is 7-Eleven.

If a deal were to close, the combined entity’s brand equity would increase exponentially, Monroe said. “All of a sudden, they can begin marketing on a national basis.

Think of TV, video streaming shows, the internet and social marketing. Think of an app that can be used everywhere, like McDonald’s and other national brands. Think of reduced costs of products and the ability to purchase on a national basis,” he pointed out.

Monroe recounted a conversation he once had as a franchisee with Michael Ilitch, the owner and founder of Little Caesars. During that chat, Ilitch shared that the day the multinational restaurant chain went national on TV, sales rose and catapulted

the company into a business realm they had never experienced before.

“From there, [Little Caesars has] done nothing but grow,” Monroe said.

The creation of a nationally recognized convenience brand would significantly alter the competitive playing field. A company with an excessive controlling market share would dominate, potentially reducing the market share for smaller players while expanding its own reach and efficiencies. This would create a divide of winners and losers, according to Peter Rasmussen, founder and CEO of Convenience and Energy Advisors.

Mart, Loaf

Jiffi Stop, Bread Box, Minit

Winners would include consumers who might benefit from more standardized services, lower prices due to economies of scale and increased convenience through a larger store network. Losers might include smaller, independent c-stores and regional players that would not be able to

with the sheer scale and

of the merged entity.