WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

THE CONVENIENCE STORE INDUSTRY’S SMALL OPERATORS ARE THE VERY PICTURE OF PERSEVERANCE

ENHANCING THE FUELING EXPERIENCE

Ensure that retail remains the most trusted place to responsibly sell tobacco products.

Did you know the average number of FDA compliance checks per month are approaching pre-COVID-19 levels?

In 2023, as of 9/30/23, the FDA conducted 9,381 compliance checks per month, which was an uptick from previous years.*

*Source: FDA CTP Violation Rate analysis was completed using publicly available raw data posted online at fda.gov.

Calculations of Total Compliance Checks and Violation Rates were computed by AGDC based on Decision Data published. Inspections data FFY 2019 - 2023

Modernize and simplify the ID check process with AVT, helping to reduce the likelihood of selling tobacco products to underage individuals

Improve ID check rates at a store and individual employee level, with We Card™ Training, available for Free via AGDC

State and Federal Law

Summaries and additional resources via the We Card™ resource center

Reinforce your sales associates’ understanding of ID check requirements and policies with Mystery Shop incentives

The convenience store industry’s small operators are rising above adversity

PERSEVERANCE: Continued effort to achieve something despite difficulties, failure or opposition.

The convenience store industry’s small operators (1-20 stores) know a lot about perseverance. It isn’t easy being a small fish in a big pond, especially when the biggest fish in that pond is 12,000 times your size if you’re one of the industry’s 90,000-plus single-store operators.

“Being a single-store operation, many vendors refuse to treat us the same as other stores in the area that are chains, even though we are a very high-volume store for their products. … In some cases, we outsell the chain stores in the area if you just looked at the individual store sales. It is extremely frustrating,” lamented one participant in this year’s fifth-annual Convenience Store News State of the Small Operator Study, which surveys c-store operators with 20 stores or less to better understand the opportunities and challenges they face vs. larger operators (see page 26).

Along with struggling to get equal attention from suppliers and distributors, small operators are also having to work harder than large operators these days to shield themselves from the impact of inflation. Roughly 60% of the small operators we surveyed for this year’s study cited inflation and economic issues as their biggest business challenge for 2024.

Their ranks are also under pressure from rising fuel prices, staffing challenges, supply chain issues (particularly, out-of-stocks) and increasing operational costs. And, as if that’s not enough to contend with, changing

EDITORIAL EXCELLENCE AWARDS (2016-2024)

2021 Jesse H. Neal National Business Journalism Award Finalist, Best Infographics, June 2021

2018 Jesse H. Neal National Business Journalism Award Finalist, Best Editorial Use of Data, June 2017

2023 American Society of Business Press Editors, National Azbee Awards

Silver, Data Journalism, January/April/June 2022

2023 American Society of Business Press Editors, Upper Midwest Regional Azbee Awards Gold, Data Journalism, January/April/June 2022

Bronze, Diversity, Equity and Inclusion, March 2022

2016 American Society of Business Press Editors, National Azbee Awards Gold, Best How-To Article, March 2015 Bronze, Best Original Research, June 2015

2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015

2020 Trade Association Business Publications

Intl. Tabbie Awards

Honorable Mention, Best Single Issue, September 2019

2016 Trade Association Business Publications

Intl. Tabbie Awards Silver, Front Cover Illustration, June 2015

consumer expectations of “convenience” and the ongoing advancement of the c-store business to keep up with those expectations are putting the industry’s small operators in a precarious position: get better or become obsolete.

Many are rising above adversity, finding ways to stand out and persevere. For Double D Market in Defiance, Mo., the focus is on providing that small “mom and pop” feel and personal service. For HOP Shops, operating in Kentucky and Ohio, it’s offering Disco Bathrooms complete with color spotlights, a spinning disco ball and music you can boogie to.

The findings of our 2024 study also uncovered that small operators should:

• Focus on the customer experience to help with customer retention.

• Establish a clear strategy for their foodservice programs to avoid losing momentum.

• Stay aware of new technology trends so that they can adopt the ones that best suit their resources and budgets.

• Investigate solutions for how they can improve their vendor relationships.

Being a small fish in a big pond doesn’t mean you can’t make a big splash!

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

2023 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, September 2022

Business to Business, Retail, Single Article, March 2023

2022 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, March 2022

Winner, Business to Business, Food & Beverage, Series of Articles, October 2021

Honorable Mention, Business to Business, Retail, Single Article, September 2021

2020 Eddie Award, Folio: magazine

Business to Business, Retail, Series of Articles, September 2019

2018 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Website

Business to Business, Retail, Full Issue, October 2017

Business to Business, Editorial Use of Data, June 2017

2017 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single/Series of Articles, May 2017

Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016

2016 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, October 2015

Business to Business, Retail, Single/Series of Articles, August 2015

EDITORIAL ADVISORY BOARD

Laura Aufleger OnCue Express

Richard Cashion Curby’s Express Market

Billy Colemire Stinker Stores

Robert Falciani ExtraMile Convenience Stores

Jim Hachtel Core-Mark

Chris Hartman Rutter’s

Faheem Jamal CPD Energy Corp./ Chestnut Markets

Ruth Ann Lilly GPM Investments LLC

Vito Maurici McLane Co. Inc.

Jonathan Polonsky Plaid Pantries Inc.

Greg Scriver Kwik Trip Inc.

Roy Strasburger StrasGlobal

IN A COUPLE OF MONTHS, the convenience store industry will once again gather in Las Vegas for the 2024 NACS Show. Being held Oct. 7-10, the conference and exhibition is the place for c-store retailers and their suppliers and service providers to get together to review new products, discuss new marketing programs and plan new business initiatives.

For many, it is also the place to participate in education sessions designed to solve challenges and help convenience retailers win the attention of consumers in today’s hypercompetitive marketplace. This year’s convention features 50 education sessions for retailers covering everything from best practices to business strategy to innovative technology. Indeed, there are sessions for every store size, every job responsibility and every type of c-store retailer — from those fresh food forward to those focused on fuel innovation.

Don’t miss the opportunity to take advantage of all the learnings available at the industry’s premier event.

The hard part is deciding which of the 50 sessions you should attend. As a public service, I thought I’d pick out a few sessions you are not going to want to miss. They are broken down into eight broad categories. If you attend one from each category, you’ll leave Las Vegas as a smarter, better-informed and completely energized c-store industry executive.

TECHNOLOGY: There are four technology sessions at the 2024 NACS Show, including one on how barcodes are changing, a session on artificial intelligence and a session outlining the NACS/Connexxus technology roadmap for the industry. Considering the negative ramifications of a security breach and how it can not only bring your business to a standstill but also hurt your reputation in consumers’ eyes, I recommend the session on how to prepare for the inevitable cyberattack.

OPERATIONS: There are six operations sessions. I think the sophistication and complex demands on c-store workers have gotten out of hand, so my recommendation would be the session entitled “Efficiency and Retention Through Operational Sophistication.”

MARKETING: Among the seven marketing sessions, I’d go with the one on “Unlocking Executive and Enterprise Value with Generative AI,” a real hot-button topic.

FUELS: There are four sessions on fuel, but considering that electric vehicles is today’s other hot-button topic, the session to attend is the masterclass on “What’s Ahead for EV Charging.”

PROFESSIONAL DEVELOPMENT: NACS doesn’t neglect the need for professional development, especially for leadership positions. The “Connecting for Success” workshop will help anyone looking to enhance their management skills.

CUSTOMER EXPERIENCE: While all three of these sessions look good, I think to be a truly educated convenience store executive, you should be aware of “Global Innovations from Around the World.”

HUMAN RESOURCES & LABOR: I’ve never heard so many complaints from retailers about younger employees as I’m hearing in recent months. Seems like the session on “Reigniting Passion in Disengaged Employees” is a must-attend.

SMALL OPERATOR: Of the two sessions dedicated to the industry’s small operators, “Understanding Store Economics” is my pick.

You may find other sessions more suited to your specific educational needs and interests. That’s fine. Just don’t miss the opportunity to take advantage of all the learnings available at the industry’s premier event.

For comments, please contact Don Longo, Editorial Director Emeritus, at dlongo@ensembleiq.com.

FEATURES

COVER STORY

26 Overcoming Obstacles

The convenience store industry’s small operators are the very picture of perseverance.

E DITOR’S NOTE

4 A Lesson in Perseverance

The convenience store industry’s small operators are rising above adversity.

VIEWPOINT

6 A Plan for Reaping Educational Benefits at NACS Show 2024

A wide range of topics cover all your needs to become a betterinformed c-store exec.

AN EYE ON D&I

57 Pilot Provides a Welcoming Environment for Veterans

The travel center operator’s new partnership with the Department of Defense SkillBridge Program helps service members transition into rewarding careers.

INSIDE THE CONSUMER MIND

74 Convenience vs. Connection

As self-checkout becomes more prevalent, c-store shoppers still prefer human interaction.

Top Women in Convenience awards program will recognize the integral role women play in convenience retailing. Women will be honored from the retailer, wholesaler and supplier communities in four different categories:

• Women of the Year

• Mentors

• Celebrate and network with leaders in the industry at this inspiring event

• Meet with our attendees. Attendees will include the 2024 Top Women in Convenience winners, retail colleagues, manufacturers, distributors, key industry associations, industry luminaries and thought leaders and solution providers

• Establish stronger retailer relationships

• Create a positive impression of your brands among existing and prospective business partners

The annual award honors a convenience retail company that commits to gender equality and promotes female leadership and advancement. The finalists are 7-Eleven Inc., Alimentation CoucheTard Inc./Circle K, GetGo/Giant Eagle Inc., OnCue and The Wills Group/Dash In.

The retailers claimed No. 1 rankings in USA Today’s 10best Readers’ Choice Awards in the Best Gas Station Brands and Best Gas Stations for Food categories, respectively. Nominations were made by a panel of subject matter experts and editors, and the public then voted for winners.

The refresh program began in January with a goal of reaching 250 site conversions by the end of this year. Notable changes include a new logo and signage, with entryways adorned in dark gray paint to contrast against the ExtraMile logo.

Following the success of the promotion’s inaugural rollout in 2023 in Utah, Nevada and Idaho, convenience store chains across the nation were able to join the promo this year, with free Frazils available every Friday in June at participating locations.

1 3 4 5 2

The company held a pair of groundbreaking events to mark the official start of its expansions into Kentucky and Ohio. The first stores in both states are expected to open in spring 2025. To build each new store, Wawa will invest more than $7.5 million.

For the second year in a row, the 2024 National Restaurant Association (NRA) Show focused on the future, offering attendees guidance on how to develop both short- and long-term plans in a rapidly evolving industry. During the event, which took place May 18-21 at Chicago’s McCormick Place, renowned food futurist Liz Moskow explained that future industry trends are being shaped by five elements: craving for convenience, eagerness for experience, appetite for adventure, will for wellness and sincerity toward sustainability. Moskow has more than 25 years of restaurant and food industry experience.

Convenience stores are well-positioned to cater to consumers’ continued desire to dine out while remaining budgetconscious, ARKO Corp. Chairman, President and CEO Arie Kotler told Convenience Store News. The c-store industry has done a good job of breaking the stigma around just selling “gas station food” and is increasingly being considered a viable foodservice destination, he said.

The ideal balance lies in quality and value. “When you provide quality, consumers will come back. Sometimes, consumers’ understanding of quality and value don’t go hand in hand. But, like in our case, if you do the right thing and concentrate on providing high quality at a value, you will win your consumers over and over and over,” Kotler explained.

more exclusive stories, visit the Special Features section of csnews.com.

FreeWire Technologies introduces the Accelerate Program, which enables convenience stores to offer and collect payments from ultrafast electric vehicle charging amenities at their sites while FreeWire owns and operates the equipment. The program provides retail operators with flexibility in branding, allowing them to control the charger’s image, as well as data on charger usage and customer behavior that can help inform business strategies. Each charging station features a 24-inch screen that can be used for promotions and direct customer engagement at the point of charge.

Fiscal year 2024 was the retailer’s second most acquisitive year in its history

By Melissa Kress

CASEY’S GENERAL STORES INC. notched a record year as it made progress on the three-year strategic plan the convenience retail chain laid out one year ago.

Net income for its 2024 fiscal year was $502 million (up 12% vs. the prior year) and EBITDA was $1.06 billion (up 11%), the company reported. It was the first time in Casey’s history that EBITDA topped $1 billion.

“The financial performance is a result of the tireless effort of the team and the dedication to executing our three-year strategic plan,” President and CEO Darren Rebelez said during the company’s fourth quarter fiscal year 2024 earnings call on June 12.

Casey’s presented its current roadmap during the company’s Investor Day in late June 2023. The three primary strategies in this leg of the convenience store operator’s growth plan focus on foodservice, network expansion and increased operational efficiencies.

According to the chief executive, Casey’s continued to innovate in its prepared food program and rolled out a thin crust pizza and a revamped lunch sandwich offering during its latest fiscal year. This innovation coupled with strategic retail

pricing has shown up in Casey’s financial results, Rebelez said, pointing to consistent inside sales growth. “Despite lapping a strong fiscal 2023, we were up 6.8% in samestore sales during the fiscal year,” he pointed out.

Casey’s is also making progress on its commitment to grow its network. During fiscal year 2024, the retailer built 42 new c-stores and acquired 112 stores for a total of 154 new and acquired stores. These moves included the acquisition of 22 Lone Star Food Store locations from W. Douglass Distributing Ltd. in November 2023, which marked Casey’s entry into Texas — expanding its footprint to 17 states.

“We are ahead of our pace for adding at least 350 stores by the end of fiscal 2026. Our two-pronged approach allows us the flexibility to build or buy, and our strong balance sheet gives us the freedom to be opportunistic with acquisitions,” Rebelez said. “That was the case in fiscal 2024 where we had our second most acquisitive year in the company’s history.”

Casey’s continued to make improvements in operating more efficiently in FY2024 as well and, according to Rebelez, its “operational excellence team has done a tremendous job identifying areas to improve store efficiency while simultaneously improving guest satisfaction in team member engagement.” He provided two highlights centered on prepared foods: a digital production planner, and an automated voice assistant that answers the phone and takes orders.

Ankeny, Iowa-based Casey’s General Stores operates more than 2,600 stores.

r Each Performer Is Measured

Reward Points For Motivation I Tr To Ensure Understanding I r s To Guide Quality & Safety I r Training To Qualify Before Execution

Evidencing Actions & Standards oma r s Warning About Issues

27%

More than a quarter of shoppers (27%) say they snack multiple times per day, up from 15% in 2023.

In the last year, 258 new items launched in the energy drink segment, many with unique functional claims and ingredients.

Only 18% of U.S. adults say they would be “very likely” or “likely” to buy a new or used electric vehicle (not a hybrid), down from 23% a year ago.

The future’s looking up for adult tobacco and nicotine consumers looking for spit-free, smoke-free nicotine satisfaction. ZYN makes 23 of the nation’s top 25 selling nicotine pouches which makes your top shelf the most logical place to find it.

Chevron Corp.’s acquisition of Hess Corp. for $53 billion will move forward after receiving the necessary approval of Hess stockholders to close the deal. No approval of Chevron stockholders is required in connection with the merger, which the two companies announced in October 2023.

ConocoPhillips is buying Marathon Oil Corp. in a nearly $17 billion, all-stock transaction. The purchase has an enterprise value of $22.5 billion, inclusive of $5.4 billion of net debt.

Texas Born (TXB) is growing its presence in its home state, bringing the TXB brand to 12 locations in central Texas. Over the past three years, the chain built five stores

and upgraded another five stores in the region. TXB has two additional stores under construction with anticipated openings in the next year.

Anabi Real Estate Development LLC dba Anabi/Rebel is acquiring Land O’Sun Management Corp. dba Fast Track. The deal includes 17 c-stores, 10 colocated quick-service restaurants (QSRs) and two standalone QSRs in northern Florida.

Buc-ee’s unveiled its newest and largest travel center to date in Luling, Texas, home of the retailer’s first family travel center. Occupying more than 75,000 square feet, the updated site beats the size of Buc-ee’s now second-largest location in Tennessee by 1,000 square feet.

CEO signals a return after the convenience retailer abruptly shuttered its locations in late April

DON’T COUNT FOXTROT OUT JUST YET.

“A new Foxtrot with some old friends. Coming soon,” said a note posted to the retailer’s Instagram account on June 5. Additionally, a spokesperson told news outlets that Foxtrot cofounder Mike LaVitola plans to open several locations in Chicago, Dallas and Austin, Texas, this summer.

The news came roughly six weeks after Foxtrot suddenly shut down operations in late April. The move followed a merger with Dom’s Kitchen & Market under a new entity, Outfox Hospitality. The closures affected 33 Foxtrot locations and two Dom’s grocery stores in the Chicago; Washington, D.C.; Dallas and Austin markets.

“This decision was not made lightly, and

we understand the impact it will have on you, our loyal customers, as well as our dedicated team members,” the retailer stated on April 23. “We want to express our sincerest gratitude for your support and patronage throughout the years. We understand that this news may come as a shock, and we apologize for any inconvenience it may cause. We genuinely appreciate your understanding during this challenging time.”

Outfox Hospitality filed for bankruptcy in May and assets were put up for auction. According to a spokesperson, the new company retained “Foxtrot’s intellectual property and some locations.”

The exact locations that will reopen had not yet been announced as of press time. However, the spokesperson said the reopened stores “will maintain the same layout and merchandising, focusing on small and local makers.”

Foxtrot was known for combining upscale convenience with a neighborhood feel and was named a brand to watch by data analytics firm Placer.ai earlier this year.

Alimentation Couche-Tard Inc. expanded its partnership with Too Good To Go in North America and Europe to fight food waste. Items nearing expiration are packed in “Too Good To Go Surprise Bags” that customers can purchase at a discount.

RaceTrac Inc. is rolling out an upgraded RaceTrac Rewards app experience for its loyal shoppers. Customer and team member feedback served as the foundation for key improvements, including faster loading times and frictionless use.

EG America is looking to hire nearly 7,500 new team members as the busy summer season gets into full swing.

Positions include full- and part-time guest service associates, foodservice leaders and managers, as well as store support roles and CDL drivers.

True North Energy, in partnership with PDI Technologies Inc. and Rovertown, launched a new truerewards loyalty program and mobile app. Changes include access to exclusive deals, and trackable progress in coffee and fountain drink clubs.

Weigel’s launched the MyWeigel’s Employee Rewards Program. Highlights include weekly discounts on food and gas, regular sweepstakes, and exclusive discounts and offers at select local businesses.

Nouria Energy Corp. is installing bitcoin ATM kiosks at 57 of its locations throughout Massachusetts, Maine and New Hampshire. The Bitcoin Depot BTMs started appearing in the company’s stores in the second quarter of 2024.

The company also resubmitted applications to the agency for its blueberry- and watermelonflavored pods.

NJOY is seeking approval from the U.S. Food and Drug Administration (FDA) for an access-restricted vapor product. The NJOY ACE 2.0 uses technology designed to prevent underage use via Bluetooth connectivity to authenticate the user.

The FDA rescinded the marketing denial orders it issued against the premarket tobacco product applications submitted by JUUL Labs Inc. This move returns the products to pending status with future approval now possible.

The Hershey Co. was named a 2024 honoree of The Civic 50 for its support of community needs, philanthropic giving and advancement of inclusive economic development. The award recognizes the

top community-minded companies in the United States according to an annual survey by Points of Light, a nonprofit organization.

D&S Car Wash Supply, a car wash equipment manufacturer, acquired WashCard Systems Inc. Headquartered in Centerville, Minn., WashCard creates payment hardware and software technology for the car wash sector.

GSTV entered into a partnership with Samba TV. The collaboration will bring forth some of the first research to quantify campaignspecific deduplicated reach across linear TV and a nontraditional national video platform.

Rich Products Corp. began the second phase of its Brownsville, Texas, manufacturing facility expansion. The National New Markets Fund will invest $17.5 million of its New Markets Tax Credit allocation to support the 150,000-square-foot expansion.

PepsiCo Inc. is bringing a new product to its Bubly line, Bubly Burst. The flavor-forward, lightly sweetened sparkling water beverage features fruit flavors, bright colors, zero added sugar and minimal calories. Bubly Burst is available in six flavors: Triple Berry, Peach Mango, Watermelon Lime, Pineapple Tangerine, Cherry Lemonade and Tropical Punch. All varieties are just 10 calories or less and come packaged in 100% recycled PET single-serve 16.9-ounce bottles. PEPSICO INC. • PURCHASE, N.Y. • BUBLY.COM

Pizza Primo

AK Pizza Crust debuts its Pizza Primo line, a comprehensive pizza component program that includes a diverse range of easy-to-use pizza products tailored to operators facing space or staffing concerns. The program offers pizza bases such as thin par-baked crispy crusts, hand-tossed style par-baked crusts, raised edge par-baked crusts, self-rising crusts and versatile dough balls, as well as ready-to-use pizza sauce. Pizza Primo products are currently available through foodservice distributors across the nation.

AK

PIZZA CRUST • GREEN BAY, WIS. • AKCRUST.COM

Dove Milk Chocolate Tiramisu Caramel Promises

Mars Inc.’s Dove Chocolate brand introduces Milk Chocolate Tiramisu Caramel Promises, inspired by the traditional Italian dessert. A new permanent addition to the Promises portfolio, the premium chocolate features a Tiramisu-flavored caramel center surrounded in a silky-smooth milk chocolate, bringing a multitexture experience to consumers. Milk Chocolate Tiramisu Caramel Promises are available now at retailers nationwide in a 6.7-ounce standup pouch. MARS INC. • NEWARK, N.J. • DOVECHOCOLATE.COM

think! Minis Protein Snack Bars Glanbia Performance Nutrition’s think! brand is launching Minis Protein Snack Bars in seven varieties, including Chocolate Chip, Cupcake Batter, Chunky Chocolate Peanut and Chocolate Almond Brownie. The line also includes three exclusive Girl Scout Cookie-inspired options: Girl Scout Adventurefuls, Girl Scout Chocolate Peanut Butter and Girl Scout S’mores. Gluten free and with no artificial flavors or colors, the think! Minis have 6 grams of protein per bar and clock in at only 100 calories. The line will become available starting in summer 2024, with most varieties sold in both single- and eight-count options for $1.19 and $8.49, respectively. The Cupcake Batter, Chunky Chocolate Peanut and Chocolate Almond Brownie flavors will be available exclusively as singles.

GLANBIA PERFORMANCE NUTRITION • DOWNERS GROVE, ILL. • THINKPRODUCTS.COM

Fuel and convenience store pricing solutions provider PriceEasy presents Location IQ. The fuel pricing solution uses external data such as mobility trends and localized consumer buying patterns to provide insights on price elasticity and the volume potential for any site. The program is intended to help retailers improve their investment decisions, site selection process and upgrades. Location IQ can be added to other PriceEasy programs to create an all-in-one enterprise platform for site selection, fuel pricing, in-store pricing and optimal promotions, according to the company. PRICEEASY • HOUSTON • PRICEEASY.COM

el Jimador Spiked Bebidas Variety Pack

Pabst Brewing Co. brings the el Jimador Spiked Bebidas Variety Pack to the cold vault. After a successful test launch in limited states in 2023, the flavored malt beverages are rolling out nationwide through 2024. Consisting of four tequilainspired varieties — Lime Margarita, Grapefruit Paloma, Pina Coconut Margarita and Orange Sunrise — each can has a 5.9% ABV. All four selections will be available in the 12-pack variety pack, while the Lime Margarita and Grapefruit Paloma flavors will be the first available in 16-ounce and 23.5-ounce single-serve cans as well. PABST BREWING CO. • MILWAUKEE • PABST.COM

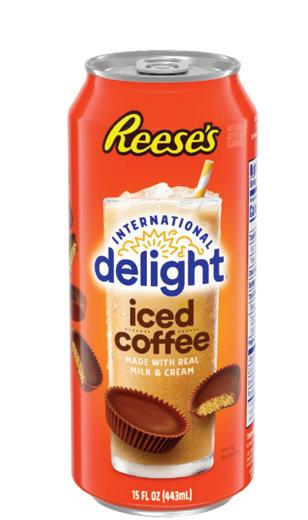

International Delight Reese’s Iced Coffee

International Delight teamed up with The Hershey Co. to create Reese’s Iced Coffee in ready-to-sip cans. Inspired by the iconic candy franchise, International Delight introduced the single-serve offering due to the positive response to its 64-ounce carton. Flavored with a combination of chocolate and peanut butter, the 15-ounce Reese’s Iced Coffee cans are now available at select convenience, grocery and dollar stores nationwide for a suggested retail price of $2.68 each.

DANONE NORTH AMERICA • BROOMFIELD, COLO. • INTERNATIONALDELIGHT.COM

Chips Ahoy! MMMproved Original Recipe Cookies

Chips Ahoy! unveils an MMMproved recipe for its original chocolate chip cookie — the brand’s biggest update in nearly 10 years. The new recipe features a tastier chocolate chip with a higher cacao content, as well as a higher-concentrate Madagascar vanilla extract to create a more well-rounded chocolate flavor while reducing bitterness, according to the maker. The updated recipe also introduces the implementation of a new mixing process to create a better texture. The MMMproved cookies are on store shelves now featuring an updated logo and new packaging design. MONDELĒZ INTERNATIONAL

18th Street Fresh Zesty Italian Sub

NuVue Foods introduces the 18th Street Fresh Zesty Italian Sub. The sandwich is stuffed with an array of traditional Italian deli meats, including cotto salami, pepperoni and smoked ham. Combined with mild banana peppers and provolone cheese on a sub roll, the product is packaged and ready to go for customers on the move. The 18th Street Fresh Zesty Italian Sub is shipped in a case of a dozen and is available now throughout the United States. NUVUE FOODS • 18THSTREETFRESH.COM • HAMTRAMCK, MICH.

New from Chatmeter, Pulse AI Risk Monitoring is an artificial intelligence (AI) solution that allows multilocation brands to sort through thousands of daily online reviews and social media posts to highlight significant business risks, while accessing qualitative and quantitative metrics in real-time that provide insights into their current risk exposure. Delivered through a user-friendly dashboard, the program uses AI to analyze, flag and classify risky reviews and social media posts into customizable categories such as discrimination, harassment, customer safety, employee safety, unfair business practices, theft and food safety. CHATMETER • SAN DIEGO • CHATMETER.COM

C v S

H K v F j f F S I . f f v v Z! . T C- x f . A $1.3 billion 2023

C v S : W ’ v f ?

K v F j : A o h y h co of o v — c h o fy o oo , k h y, o of oo o y. A c ’ foc o w ov o h y f o c y k o h . B yo oo h c , o h y c ov alternatives to caffeine or nicotine.

CSN: What are you doing to bring aromatherapy benefits C- ?

KF: W ch Z! h , o h h o c c y h ock ywh o joy the benefits of aromatherapy.

Th ’ o h fo v yo w h wo co c o — 100% O F y B .

CS : W f f v ?

KF: Th — h o co or caffeine — so there are no regulatory or age restrictions. Th F y v o fy c v w h h w o of G v , W o , M o and Black Currant. Many of these flavors are familiar to co h o h v fo h c o wh h y — wo k, choo , o c c .

Th k ow o v . Fo x , Boo h c y , , o , o , o y, o vok z f . S , B C o o h co c o .

CS : W Z! f ?

KF: Z! h c o c o h o c ck f o of h co . W ’v c v y of co , , ck y fo y h o ho o .

C o o o c x c ho who purchase multiple flavors based on their mood. They also y o h v oc o ch c , ock ook o wo k c .

W h c of $5, Z! h v c v h 50% .

CS : H ?

KF: Th wh c h k . W o o h of co w h o c y h v .

S c w w o c ch, w k c o o c o B2B B2C co , ch c f oc c . W o o of 20% of the population who are already aware of the benefits of o h o h y o c . W h k o h w v o c w h h o o o v . G v z v Z! . F f v : ://z . A v f v f f . T f A f . A A $625 2022 j 10% 2030 G V R .

THE CONVENIENCE STORE INDUSTRY’S SMALL OPERATORS ARE THE VERY PICTURE OF PERSEVERANCE

BY LINDA LISANTI & DANIELLE ROMANO

SPONSORED BY

THE U.S. CONVENIENCE STORE industry’s small operators (1-20 stores) are under increasing pressure. But instead of buckling under the weight of their challenges, these tenacious and resilient business owners are finding new ways to adapt and persevere.

According to the fifth-annual Convenience Store News State of the Small Operator Study, which looks at how the convenience channel’s small operators are performing vs. their larger chain counterparts, about two-thirds of participants (65%) said their total sales increased in 2023, up slightly from 63% who said the same in last year’s study. Sales growth was driven more by foodservice and in-store merchandise than motor fuels.

Among those who offer each category, more than six in 10 small operators (66%) reported that their foodservice dollar sales rose in 2023, compared to 59% who reported growth in in-store merchandise sales and 49% who reported growth in motor fuel sales. Compared to last year’s study, all three of these percentages were lower than in 2022: a decline of 5 points for in-store merchandise, a decline of 12 points for foodservice and a decline of 14 points for fuels.

65% of participants said their total sales increased in 2023, up slightly from 63% who said the same in last year’s study.

*Including merchandise and foodservice

Motor fuel sales and gallons sold were on par, suggesting that the demand for motor fuels at small operators remains consistent despite fluctuating fuel prices. While 47% of small operators who sell fuel indicated their gallons increased in 2023, 49% said the same for their fuel dollars.

Along these same lines, 2023 motor fuel transactions per week at small operators slightly outpaced the total industry: 1,945 weekly transactions vs. 1,909, respectively. In terms of in-store transactions (including foodservice), however, small operators lagged the total industry: 2,939 weekly in-store transactions vs. 3,255, respectively.

While the total industry’s sales mix still skews more toward motor fuels — 63% for fuels and 37% for in-store — the sales composition for small operators is more evenly distributed. In 2023, the sales ratio for small operators was 51% fuels and 49% in-store.

The profit composition for small operators also deviates from the total industry, leaning more heavily toward the fuel side. Looking at the industry’s gross profit dollar mix in 2023, in-store accounted for 60% while fuel accounted for 40%. Among small operators, though, fuel accounted for 46% of 2023 gross profits while in-store accounted for 54%.

Categories inside the store that performed well for small operators last year included other tobacco products, edible grocery, packaged beverages, beer/malt beverages and salty snacks. On the other end of the spectrum, categories where respondents reported the most sales decreases included cigarettes, wine, nonedible grocery, health and beauty care, and candy.

Foodservice led all other in-store categories in regard to the percentage of small operators who said their sales increased in 2023 vs. 2022. Among those with foodservice, half reported greater prepared food sales year over year, 48% reported higher hot dispensed and cold dispensed beverage sales, and 38% reported improved frozen dispensed beverage sales.

“Our hot deli is a driving force in our store. We make sure to keep it fresh and make sure it’s good quality,” one study participant commented. Another shared: “The new slushie machine is doing great. People love them even when it’s cold outside.”

While nearly all the surveyed operators offer some form of foodservice, more than eight in 10 defined their foodservice offerings as either “limited” or “average.” Only 19% of respondents stated that their foodservice offerings are “robust.”

Inflation & economic issues

Motor fuel prices

Labor turnover & hiring

Supply chain issues/out-of-stocks

Increasing operational costs

Insufficient attention from suppliers that favor larger chains

Changing consumer expectations of “convenience”

Competition from outside the industry

Industry consolidation & competing with larger chains

Declining tobacco sales volume Tobacco regulation

Increasing pressure to invest in foodservice

Keeping up with emerging technologies

Assessing 2024 performance so far, 61% of the small operators surveyed indicated that this year is shaping up to be a better year for overall sales and profits. Only 12% said their sales and profits are currently trending lower than in 2023.

Getting into more specifics, 60% of operators reported that their 2024 foodservice sales are better so far than last year. A slightly lower number (54%) said the same for in-store merchandise sales. In terms of fuel sales, 42% said this year’s performance to date is an improvement.

Still, inflation and economic issues are top of mind and viewed as the biggest threat to small operators’ 2024 sales and profitability. While the channel’s smaller retailers recognize inflation is “the cost of doing business” and “is something that is affecting everyone,” study participants don’t see an end in sight for the persistent economic pressures.

“Customers have less spending money to use. Our costs for products have skyrocketed. Everything is too expensive. No one can afford anything,” one respondent lamented.

and economic issues are top of mind and viewed as the biggest threat to small operators’ 2024 sales and profitability.

Technology to enhance the customer experience

Store remodeling

Expand merchandise assortments

Technology to increase efficiency for current operations

Training & retention programs

Add/update order & delivery options

Develop/enhance social media strategy

Supply chain & logistics

Develop/expand fresh prepared food programs

Develop/enhance loyalty program

Streamline merchandise assortments/reduce SKUs

Another pointed out, “It not only affects our customers’ ability to consistently make purchases, but also the amount of money they spend per purchase. Also, prices from our suppliers for certain products as well as gas prices become more expensive for our company.”

Gas price fluctuation is another top concern for small operators, who cited motor fuel prices as their No. 2 business challenge this year. Ongoing conflict in the Middle East and Eastern Europe coupled with motorists driving less is giving retailers reason to worry.

“Higher fuel prices are taking away consumers’ ability to spend on other items and putting price-ceiling pressure on other items,” one study participant commented. “The costs for services go up significantly as well.”

Rounding out the top three business challenges of 2024 is staffing — from finding qualified candidates to retaining store associates. On the labor front, small operators continue to grapple with the same instability they’ve faced since the onset of the COVID-19 pandemic.

Technology to enhance the customer experience and store remodeling are key focal points in small operators’

As one respondent noted, “Frequent hiring strains resources and lowers employee morale.” And another added: “Shortages delay work and impact customer satisfaction and productivity.”

More than one-third of the channel’s small operators are also concerned about supply chain issues/out-ofstocks. Part of the reason for out-of-stocks may be due to insufficient attention from suppliers that favor larger chains (cited by 33% as a business challenge this year).

“It affects our ability to access a diverse range of products and competitive pricing, limiting our ability to meet the evolving needs and preferences of our customers,” one retailer shared.

Despite these obstacles and others, the convenience store industry’s smaller retailers are doubling down and investing in bettering their businesses for today and the future.

When asked to share their top planned investments for 2024, respondents cited technology to enhance the customer experience and store remodeling as key focal points, noting that such improvements will drive long-term growth and help them compete against the larger chains.

“Enhancing the customer experience will have the most positive impact on the business overall.”

— Study participant

As one respondent simply put it, “Enhancing the customer experience will have the most positive impact on the business overall.”

On the technology front, nearly six in 10 small operators currently offer mobile payment in-store and at the pump, while just under a quarter have a mobile app.

When it comes to offering enhanced convenience services, 23% of small operators said adding/updating order and delivery options is one of their top priorities this year. Currently, only 20% of small operators offer third-party delivery, 14% offer in-house delivery, 15% offer curbside pickup, 17% offer online ordering and 12% offer mobile ordering.

The goal, according to one study participant, is to “improve competitiveness by offering a seamless and convenient shopping experience” to consumers.

One other key focal point this year is investing in the employee experience to combat labor challenges. Nearly a quarter of participants in the 2024 State of the Small Operator Study said they are making investments in employee training and retention programs.

“Finding and keeping dependable employees [will] be our focus as the interactions with customer service representatives drive foot traffic in our stores,” said one retailer. CSN

WARNING: Cigar smoking can cause lung cancer and heart disease.

By Renée M. Covino

THE IDEAL 2024 tobacco offering comes down to two words: affordable alternatives. As inflation continues to impact the convenience store tobacco business, retailers would be wise to understand the evolving needs of adult nicotine consumers.

“We remain cautious on the U.S. tobacco/nicotine industry in the near term given continued economic pressures on the tobacco consumer, with many growing increasingly selective in their purchases, turning to more affordable alternatives,” said Bonnie Herzog, managing director and senior consumer analyst at Goldman Sachs.

Citing data from her company’s first quarter 2024 “Nicotine Nuggets” survey of retailer and wholesaler contacts

representing 38,000 retail locations across the United States, she noted: “Continued price increases against a still palpable inflationary backdrop are pushing consumers to the fourth tier or lower-cost alternatives, including nicotine pouches, moist smokeless tobacco or vapor.”

What is the long-term impact of continued inflation on the tobacco category? Looking at the past seven years, Cadent Consulting Group Business Analyst Ethan Harris said the effect has been “significant.”

Citing industry research he’s tracked, there’s been:

• More than a 30% increase in cigarette prices;

• A 27% decrease in the number of cigarette packs sold; and

• A 6% decrease in cigarette dollar sales.

Some retailers report seeing downtrading not only by low-income consumers, but also premium upper-income consumers. On balance, however, most tradedown activity is still coming from secondand third-tier brands, according to Herzog.

Retailers are also growing increasingly concerned that tobacco consumers are both trading down and purchasing fewer items. A number of respondents reported that their overall item count per basket is shrinking as consumers shop around for the best prices. One retailer remarked that traffic has become a struggle even though they are priced competitively and do monthly price surveys to ensure they stay competitive.

Source: Goldman Sachs Investment Research

Tobacco manufacturers are recognizing the need to shift and pivot as well. Looking at what he calls a “dynamic” external environment, Richmond, Va.based Altria Group CEO Billy Gifford said the company is particularly focused this year on monitoring the economy, including the cumulative impact of inflation, as well as adult tobacco consumer dynamics, including purchasing patterns and the adoption of smokefree products.

“Our research and development investments have evolved and shifted from our traditional tobacco businesses to new product platforms and technologies,” he said.

In 2023, the majority of Altria’s pretax research and development (R&D) expense was recorded in the “smokeable products” segment, but beginning Jan. 1 of this year, a substantial amount of its pretax R&D expense is recorded in the “all other” segment, which includes the aforementioned new product platforms and technologies.

As manufacturers shift, so should retailers. Here are some strategies to consider:

Dive deeper into discount

As smokers try to manage rising cigarette prices along with broader inflationary pressures impacting their wallets, they are looking for more value and as a result, retailers and wholesalers are broadly seeing downtrading accelerate.

Altria reported that at retail, its discount

“Continued price increases against a still palpable inflationary backdrop are pushing consumers to the fourth tier or lower-cost alternatives, including nicotine pouches, moist smokeless tobacco or vapor.”

— Bonnie Herzog, Goldman Sachs

segment grew 0.8 share points in the first quarter of this year. “We believe these results were driven, in part, by macroeconomic pressures on adult smokers,” Gifford said. “We continue to see increased competitive activity in the discount segment, including multiple branded discount offerings priced at deep discount levels.”

There are still premium cigarette consumers, however, who continue to stay brand loyal. Thus, it would be wise for c-store operators to cater to high-end and discount customers alike, perhaps making some SKU cuts in the middle tiers.

As one of the top three beneficiaries of downtrading, according to Goldman Sachs research, modern oral nicotine is gaining ground in convenience stores. Several retailers in the latest “Nicotine Nuggets” survey noted that they reset their stores to make more space for this segment, particularly the ZYN, on! and Rogue brands.

“Promotional activity has recently picked up in the oral nicotine pouch category as manufacturers invest to drive conversion and volumes,” Herzog stated. With newer competitors entering the category, modern oral is expected

Source: Goldman Sachs Investment Research

to continue its robust growth this year, gaining share from traditional chewing tobacco.

Some retailers are having success removing nontobacco nicotine and nicotine-free items from behind the counter to free up precious backbar space and establish a better focus on alternatives. Items that fit the bill include nicotine pouches that contain nicotine, but without tobacco leaf, dust or stem. There’s also tobacco-free/nicotine-free pouches such as Black Buffalo ZERO, which is a smokeless line made with edible green leaves.

“We see a small but growing trend toward off-shelf displays of nontobacco nicotine products,” observed Ethan Harris, a business analyst at Cadent Consulting Group, based in Wilton, Conn.

Get the word out about alternatives

Digital advertising should be part of a c-store retailer’s nicotine marketing plan, the way Harris sees it. “Many smokers are still not aware of all the noncombustible, nontobacco product types now available, but digital signage —both inside and out — will better grab their attention. Retailers need to get the word out and start conversations with adult consumers,” he explained.

And while it may not have an immediate effect on business, staying up-to-date on the latest nicotine buzz online and

being able to talk intelligently to alternative-seeking adult customers can be a plus, Harris added. For example, there’s been talk of research showing nicotine has promise as a nootropic, claimed to enhance cognitive function.

“It’s been frequently discussed on social media, especially among younger adult consumers that products like ZYN are being used for the touted nicotine benefits of focus, memory and attention,” he said, adding that it would behoove retailers to at least be aware of this fact if customers come in to make such a purchase.

This oldie-but-goodie category still has merit, especially in the current economic environment. If a retailer is willing to support roll your own (RYO) with space and education, Harris suggests they highlight RYO as space permits and spell out the cost savings compared to traditional name-brand cigarettes being sold in the store.

Perhaps the greatest the greatest takeaway for convenience store operators, though, is that the current economic downturn is not expected to about-face anytime soon. Therefore, they must continue to pivot and go where adult nicotine consumers are going.

“We certainly expect inflation to continue, with current levels nearly two times the Fed’s 2% target. Moreover, tobacco companies have consistently priced cigarettes well in excess of inflation to offset declining unit sales. This will result in less and less cigarette demand,” Harris predicted.

He believes there is a cigarette pack price ceiling, and said states like New York (currently averaging $12 a pack) are reaching it in the minds of today’s consumers. The answer for meeting their needs, he concluded, lies in stocking and promoting other forms of nicotine and reduced-harm alternatives. CSN

Food-forward convenience store operators are looking beyond today’s challenges to determine what will be necessary to best future competition

By Angela Hanson

CONVENIENCE STORE KITCHENS are often small, but succeeding in c-store foodservice requires operators to look at the big picture. As tempting as it may be, retailers can’t just hold on tight and wait for the current challenges of hiring and retention, less disposable income among consumers and rising supply costs to abate — food-focused operators must develop strategies today if they want to be ready to compete tomorrow.

For the most part, participants in the 2024 Convenience Store News Foodservice Study are doing just that. While the details of their plans and priorities differ, convenience foodservice retailers are looking ahead and considering how they can build up their offerings.

“I’m ready to invest in food programs,” one study respondent commented.

Operators are most focused on how to drive traffic, with other major priorities supporting this goal. The No. 1 priority cited by respondents this year is increasing customer counts (43%), followed by using loyalty programs to drive foodservice sales and menu innovation (both at 42%).

restaurants (42%) and fast-casual chains (39%).

The industry’s large operators are significantly more likely than small operators to view quickservice restaurants as their chief competitor — 62% vs. 21%, respectively.

This year’s study results reveal some shifts in how c-store operators are perceiving competitive threats. For instance, the percentage of respondents who cited c-stores as their biggest competitor dropped 14 points year over year. Coffee shops are also viewed as primary competition less these days, with this segment seeing a 25-point decline from last year.

With c-store operators focused on increasing customer counts, it’s not surprising that the most common foodservice amenities currently offered are tied to the onsite experience.

More than half of this year’s respondents

The percentage of respondents who cited c-stores as their biggest foodservice competitor dropped 14 points year over year.

Other c-stores

offer in-store seating (55%). Additionally, just over a third offer outdoor seating and take-home/heat-and-eat dinner solutions. While cook-at-home meal kits remain uncommon, the percentage of retailers offering them jumped 12 points from last year to 19%. Looking ahead, the top foodservice amenities retailers say they plan to add are take-home/heat-and-eat dinner solutions (16%) and catering (15%).

A notable decline in the availability of microwave ovens for customer use — down 19 points from two years ago — likely correlates to the shift toward more hot and fresh food and expanded grab-and-go offerings, rather than customers having to heat up their purchases.

Enhancing the order process for foodservice is also on the drawing board for many operators.

The top foodservice ordering and payment methods currently offered at c-stores are order ahead by phone (cited by 45% of surveyed retailers), in-store selfcheckout (28%) and order ahead via app (25%). Large operators are significantly more likely than small operators to offer both self-checkout (53% vs. 3%, respectively) and order ahead by computer (27% vs. 6%, respectively).

In the future, respondents overall plan to add in-store touchscreen ordering (cited by 21%) and order ahead via app (19%). Small operators are significantly more likely than large operators to have plans to add self-checkout (18% vs. 3%, respectively).

Along with improving the onsite experience as well as the order and payment processes, menu improvements are among the top changes and enhancements retailers have in the queue for the next year. Respondents referred to new, more and higher-quality food items as key aspects of their improvement plans. They also

While cookat-home meal kits remain uncommon, the percentage of retailers o ering them jumped 12 points from last year to 19%.

highlighted ethnic flavors, pizza programs, bakery and regional items as options to help them build and maintain momentum for their programs.

“We are constantly making changes to our menu to accommodate the consumer base,” one study participant noted.

At the same time, operators expressed interest in simplifying and streamlining operations to improve consistency and make things easier on their employees. Planned technology investments to help achieve these goals include in-store ordering kiosks and mobile apps with digital payment.

Promoting

To get the word out about what they offer, c-store retailers expect to boost their marketing efforts, particularly via loyalty programs, targeted deals, bundles and limited-time offers.

Large operators are the primary driver of increased promotions as 56% report having increased the number of promotions at their stores in the past year, compared to just 30% of small operators. Meanwhile, small operators are

Large operators are significantly more likely than small operators to indicate an increased number of foodservice promotions over the past year.

more likely than large operators to say they are offering the same number of promotions as a year ago.

Unsurprisingly, discounts remain popular with consumers as they seek to ease the burden of inflation on their wallets. More than half of surveyed retailers (55%) say price discounts are their most successful promotions. Bundling/meal deals are the next most successful (cited by 40% of respondents), followed by buy-one-getone offers and twofer deals (both at 36%).

In terms of promotional channels, social media remains the most popular. Although its usage has returned to 2022 levels after spiking last year, nearly two-thirds of participants (63%) say they use it for foodservice promotions. Retailers are also focused on loyalty programs (49%) and at-pump signage/signage outside the c-store (48%). Additionally, at least a quarter of respondents use email and proprietary mobile coupons/apps. Large operators are significantly more likely than small operators to use most of the top promotional channels. CSN

The 2024 Sweets & Snacks Expo addressed the obstacles and opportunities around candy and snacks

By Melissa Kress

AFTER 25 YEARS of taking over McCormick Place Convention Center in Chicago, the Sweets & Snacks Expo took Indianapolis by storm this spring.

Featuring a record 1,000 exhibitors — including 300-plus first-time exhibitors — in more than 250,000 square feet of show floor, the 2024 Sweets & Snacks Expo drew 16,000 attendees and kicked off the start of a new multiyear partnership with the city of Indianapolis.

together to debut products, gain insights and create meaningful connections,” said John Downs, president and CEO of the National Confectioners Association, which hosts the annual event. “This year’s show solidified that there is no better place to do so than right here in Indianapolis. You could feel a renewed energy on the show floor from manufacturers, retailers, brokers and suppliers alike — and everyone is buzzing about our bright future.”

“As the top innovation showcase in the confectionery and snack categories, the Sweets & Snacks Expo offers an opportunity for the community to come

As economic pressures continue to bear down on U.S. shoppers, consumers are still treating themselves but have shifted their behaviors. Noting that higher prices are the reality for consumers, Anne-Marie Roerink, president of 210 Analytics, a market research provider, called out candy’s triangle of success: affordability, favorability and permissibility. Notably, 86% of consumers believe it is fine to occasionally have a treat.

As for affordability, candy has always fared well against other categories, but that perception is changing. In 2023, 74% of consumers agreed that chocolate and candy are more expensive but still affordable. That number dropped to 55% this year.

“This is something to keep in mind; consumers are feeling a little bit more pinched when it comes to buying our category and that’s why we see a lot of unit and volume pressure in our category,” Roerink said while presenting a "State of Treating" session at the event. “Over the past year, it also has led to a tremendous amount of change. Forty-one percent of consumers have changed the way they engage with confectionery as they’re shopping.”

The top changes made by consumers are:

• 44% buy chocolate/candy less often

• 30% buy what is on sale

• 26% buy smaller pack sizes

• 26% buy larger pack sizes

• 25% buy only their favorite products

To drive growth, Roerink said retailers can get more consumers to buy; get consumers to buy more often; or get consumers to spend a little bit more per trip. "At the end of the day, there's three levers of growth and depending on where you're sitting and what you want to accomplish, you tend to focus on one of the three or all three," she said.

In the snack aisle, innovation is making a comeback, but there are headwinds — notably, prices that are roughly 30% higher vs. 2019, supply chain hiccups and new diet trends, according to Sally Lyons Wyatt, global executive vice president and chief advisor, consumer goods and foodservice insights at Circana, who presented a "State of Snacking" session at the expo.

Despite the hurdles, U.S. consumers are still snacking, though

These 13 products were selected out of more than 300 items submitted for judging.

Baked Goods: Strawberry Cake Frosted Cookie, Simply Good Foods Co./Quest

Chocolate: Milk Chocolate PB Minis, Skippy

Gourmet/Premium Candy: Passionfruit Chocolate-Coated Licorice, Lakrids by Bulow

Gum & Mints: Hubba Bubba Mini Gum in Skittles Original Flavors, Mars Wrigley North America

Meat Snacks: Hawaiian Beef Chips Original with Roasted Garlic, Chyler’s

Nonchocolate Candy: Amos Peelerz Gummy Mango, Amos Sweets Inc.

Novelty/Licensed: Amos Peelerz Gummy Banana, Amos Sweets Inc.

Salty Snacks: Ramen Popcorn, Nomad Snacks

Savory Snacks: (tie) Hot Cheddar Fries, Our Home/You Need This and Doritos Dinamita Smoky Chile Queso, PepsiCo Foods

Seasonal: Peanut Brittle, Anderson’s Crazy Candy

Small Business Innovator: Dark Chocolate Covered Strawberry Mochi Gummies, Issei

Sweet Snacks: Banana Cream Pie Peanut Butter Treat, Nerdy Nuts

Best in Show: Avalanche Peanut Butter Treat, Nerdy Nuts

By Tammy Mastroberte

WHEN FUELING THEIR VEHICLE, today’s motorists are looking for a fast, efficient and easy process, from activating the pump to paying for their purchase. Anything that slows this process down or makes it cumbersome could cause them to refuel somewhere else in the future. On the other hand, anything that enhances fueling or makes it more enjoyable can help ensure a return visit, and possibly even get them to make the trip from the forecourt into the store.

“Consumers are time-starved and fueling their vehicles is just a means to an end. When the experience is clunky or slow, and it feels like an inconvenience, it will frustrate them and they will look for somewhere else to go,” Mike Templeton, vice president of digital strategies at NexChapter Inc., a convenience store advisory firm, told Convenience Store News.

The overall site and area should be clean, the experience intuitive, and both the flow speed from the nozzle and the transaction speed should be fast. Technology is available to monitor each pump to ensure it is working properly and performing to expectations.

“If a dispenser is flowing at five gallons

every minute instead of 12 to 13, that will add one to two minutes to a transaction and can be a frustration to a customer,” noted Tony Caputo, director of business development at Fort Myers, Fla.-based Warren Rogers, a fuel management company serving convenience stores and travel centers. “Any time flow rates are below expectation or a dispenser is not operational, it can affect a location’s gallons sold and profitability.”

A speedy transaction on the forecourt also means allowing customers to pay the way they prefer. Contactless payment has become a priority for consumers and since they have this option at other retailers, they expect it at the pump as well.

“If a dispenser is flowing at five gallons every minute instead of 12 to 13, that will add one to two minutes to a transaction and can be a frustration to a customer.”

— Tony Caputo, Warren Rogers

“The migration to EMV paved the way for mobile payments at the pump and following that proliferation of hardware inside the store and consumers being able to pay that way almost everywhere else they go, they have that expectation at the pump,” Templeton explained.

Modern technology at the pump not only aims to deliver an easy experience, but also get motorists from the forecourt into the c-store, where margins are higher on purchases. To drive this transition, operators are utilizing loyalty programs, ordering at the pump or via mobile app, and larger screens featuring media content and advertisements for products in-store.

“Lately, we’ve seen a lot of attention being paid to media and larger screens being inserted into dispensers, and some operators are working on ordering at the pump — both food and in-store items at the dispenser — and enhancing communication through loyalty and rewards programs,” Caputo observed.

C-store retailers must “crack the code” to get customers out of the car and into the store, and loyalty plays a big role in that, along with making it seamless, noted Elie Katz, CEO of NRS Petro, a division of National Retail Solutions, based in Newark, N.J. “All customers are looking for loyalty offers and as the world becomes more seamless, they expect it everywhere.”

Loyalty programs also give the retailer the ability to identify who is at the pump and target promotions based on their past purchases. They’re also able to target customers who are not yet loyalty members and encourage them to join.

“We are launching loyalty this summer and customers can preregister with a phone number on the touchscreen of our Dover Anthem dispensers,” said Kristin Ghere, director of marketing and brand management at Jump Start Stores, a chain of 31 c-stores based in Wichita, Kan. “We can use DX Promote in the system to change our media if someone is already in the program vs. not, so we can encourage them with offers to sign up or let them know what is happening for them as a loyalty member.”

Through a combination of hardware and software at the pump, retailers can show localized content, news or relevant promotions on the screen to offer compelling entertainment to engage consumers for the two minutes or so they are fueling at the pump.

“Activating the fuel pump screens consumers are already interacting with is an easy way to address the entirety of your fueling experience,” Templeton pointed out.

Doing so enables retailers to promote in-store offerings with higher margins, he said, or can be “turned into a revenuegenerating retail media solution that enables CPG [consumer packaged goods] manufacturers to reach the retailers’ customers in a captive moment. Also, when a consumer can identify themselves at the pump as a loyalty member, that opens up even more possibilities to personalize that fueling experience.”

“With audio and video, you will see messaging that is a mix of talking about products we sell, services we provide, and also communicating things about the community such as sponsoring the local basketball team.”

— Kristin Ghere, Jump Start Stores

Two years ago, after starting with test sites, Jump Start Stores transitioned all 31 of its locations to Anthem dispensers from Dover Fueling Systems, which have 27-inch touchscreens.

“We retrofitted our Ovation dispensers to bring in Anthem, and then installed new Anthem dispensers for our new sites,” said Ghere. “This changed the user experience entirely with clean, modern technology they are used to operating with touchscreens on their mobile phone or laptop.”

Scott Negley, senior director of product management at Austin, Texas-based Dover Fueling Systems, explained that these screens and DX Promote software enable retailers to show relevant media, loyalty and overall consumer messaging. There’s a camera at every fueling point able to recognize when a human is there and “wake up the pump and flip to the greeting welcome screen.”

Jump Start Stores is using DX Promote and producing its own media content to communicate specials and other opportunities available to its customers, such as a new breakfast sandwich or the different types of fuel products available, according to Ghere.

“With audio and video, you will see messaging that is a mix of talking about products we sell, services we provide, and also communicating things about the community such as sponsoring the local basketball team or a 30-second spot offering motivational and uplifting messaging through a partnership with a local church,” she added.

As an example of the impact the screens have had, Ghere cited the chain’s partnership with Habitat for Humanity to build a home, matching customer donations. In addition to collecting donations in-store, the retailer took donations at the pump and saw a 25% uplift due to advertising it on the dispenser, Ghere reported. The total amount raised was $60,000.

“When customers come inside, we would ask if they would like to donate one dollar, but you can’t do that outside at the pump unless you use the technology,” she said.

Allowing customers to order foodservice or in-store products while at the pump — either through the pump’s touchscreen or via a mobile app — is another way to enhance the fueling experience. Plus, it can boost the retailer’s bottom line with additional sales.

Jump Start Stores is exploring adding this option to its Anthem dispensers in the future, utilizing DX Market powered by Grubbrr, according to Ghere. This web-hosted application allows customers to order via the touchscreens at the pump, and enables customizable promotions and upsell options with video and static content.

“Kiosk mode takes over the touchscreen and becomes an ordering kiosk,” said Negley.

Even the c-store industry’s small operators and single-store owners are starting to offer ordering at the pump through mobile apps. NRS Petro provides a pumpintegrated point-of-sale system and mobile app to its retailers, which includes loyalty through its Boss Club program.

“For retailers who’ve developed a highly engaged loyalty audience, particularly through the use of digital tools or mobile apps, finding ways to enhance that physical fueling instance with digital interaction can be very impactful.”

— Mike Templeton, NexChapter Inc.

“We started putting QR codes at the pump, so customers can scan it and order within the Boss app from their car and have the order brought out to the pump,” Katz explained.

The combination of enhancing the physical fueling experience and incorporating digital technology to give motorists more is truly offering customers a better and more convenient experience at the pump, according to Templeton.

“For retailers who’ve developed a highly engaged loyalty audience, particularly through the use of digital tools or mobile apps, finding ways to enhance that physical fueling instance with digital interaction can be very impactful,” he said. “Creating these ‘phygital’ experiences — the blending of physical and digital — can lead to more memorable moments for the customer.” CSN

The travel center operator’s new partnership with the Department of Defense SkillBridge Program helps service members transition into rewarding careers

By Danielle Romano

FINDING MEANINGFUL employment is one of the challenges veterans face when reintegrating into civilian life. As a veteran-founded company, Pilot Co., which today operates the Pilot and Flying J travel center network of more than 870 locations in 44 states and six Canadian provinces, fosters a welcoming environment for veterans and all team members.

In 2023, Pilot was accepted into the Department of Defense (DOD) SkillBridge Program to offer transitioning service members opportunities for professional development and successful civilian careers. Erin Tanner, recruiting program manager at Pilot and a U.S. Navy veteran, recently spoke with Convenience Store News about the retailer’s involvement with the SkillBridge Program and the company’s commitment to supporting military personnel and veterans.

Pilot is committed to growing the company’s veteran-focused recruiting efforts.

CSN: What is the SkillBridge program, and why did Pilot decide to get involved?

Tanner: We are very excited about our partnership with the Department of Defense’s SkillBridge Program. The program is designed to offer active duty service members who are within the last 180 days, or six months, of service the opportunity to gain civilian job experience before they are transitioned out of the military. It connects service members with different industry partners for realworld experience through training, apprenticeships or internships. At Pilot specifically, we have expanded our program to offer roles across various teams, including operations, logistics, technology, sales and communications, among others in the form of an internship.

As a veteran-founded company, Pilot has had a long history of giving back to veterans’ causes, especially as it relates to bringing meaningful career opportunities to service members and their family members. Over the past year, we have made some great progress in growing our veteran-focused recruiting efforts with the goal of really becoming veteran ready. Some of these initiatives have included our team of recruiters who travel to different military bases and events to speak about opportunities at Pilot. We also have our veteran business resource group, which is dedicated to fostering a welcoming and supporting environment for service members, their families and even advocates that are joining the organization.

[Additionally,] we’ve launched our veteran career page, as well as added military-inclusive language in our job postings. And, of course, SkillBridge gives us an opportunity to meet veterans at a super

pivotal moment in their career journey. The program the DOD has built really brings tremendous value to both the partners and participants involved.

CSN: Once a service member comes onboard through the SkillBridge program, what is their experience like from start to finish?

Tanner: We 100% want to ensure service members are set up for success throughout the program and their transition. The SkillBridge Program established at Pilot should be a transformative experience that empowers service members to confidently and successfully transition into rewarding careers outside of the military.

One of the most important and beneficial things that we are doing as an organization is pairing the service members up with a mentor who will guide them throughout the program. These mentors are going to be veterans or, in some cases, reservists who have gone through the transition process themselves, so they can really relate and understand the challenges that veterans are facing that maybe a civilian wouldn’t quite understand.

On top of that, we spend time with [program participants] by doing skills development work and gaining practical experience through hands-on work assignments and projects. There are also opportunities to have exposure to different areas of the business and different people within the business through meet-and-greets, coffee chats and other networking opportunities.

CSN: How does this program fit into the larger picture of what Pilot is trying to achieve?

Tanner: First and foremost … there are so many benefits to hiring veterans. They have spent years becoming experts in their field, growing through the ranks, and they show up literally on day one with the most valuable skills, which is such a gift to any organization, in my opinion.

“We are dedicated to veteran recruitment. It’s a big part of our identity here at Pilot and it has been since the day we were founded.”

— Erin Tanner, Pilot Co.

Aside from that, from a business perspective, the SkillBridge Program not only allows you early access to service members as an employer, but the DOD actually continues to pay the service member their military salary and benefits while they’re participating in the program. You know, I hear a lot that that seems too good to be true, but it’s actually that awesome and there is no catch. On top of that, there are potential tax credits that organizations can take advantage of.

We are dedicated to veteran recruitment. It’s a big part of our identity here at Pilot and it has been since the day we were founded, so I also think it would be a disservice not to mention that we really feel like this program aligns perfectly with Pilot’s purpose of showing people they matter at every turn. Pilot welcomes dedicated and skilled individuals, fostering a real sense of belonging, which is absolutely critical and crucial for success.

These veterans, known for their reliability and driven nature among other traits, are given the opportunity to really contribute and have an impact on Pilot’s operational excellence as they gain this industry knowledge. And of course, last but not least, the program strengthens Pilot’s teams all around, which is so exciting and rewarding.

CSN

• Three Year Warranty

• Free 25K + UPC Database

• Fast to Operate

• Not Cloud Based

• Easy to use / Friendly Interface PROGRAM REQUIREMENTS: •

As self-checkout becomes more prevalent, c-store shoppers still prefer human interaction

Whether it's at a grocery store, drugstore, fast-food restaurant or convenience store, self-checkout is becoming more and more common, aimed at helping customers move through the purchase process faster and helping retailers improve efficiency and reallocate labor. Nearly two-thirds of convenience store shoppers, however, still prefer to pay at an employee-manned register, according to the 2024 Convenience Store News Realities of the Aisle Study, which surveyed 1,500 consumers who shop a c-store at least once a month. The study also revealed:

More than six in 10 c-store shoppers say they prefer to check out at an employee-manned register.

The percentage of shoppers who favor self-checkout dropped 6 points vs. last year.

Generation Z and millennials, though, do have a higher affinity for self-checkout: 71% of the Gen Z shoppers surveyed and 50% of the millennials surveyed prefer self-checkout.

using an app has the highest satisfaction score with 72% of users saying they are very satisfied/satisfied with the service, compared to 66% saying the same for selfcheckout using a kiosk and 56% for self-checkout using AI sensors.

Conversely, self-checkout using AI sensors has the highest percentage of very unsatisfied/ unsatisfied users at 19%, compared to 13% for selfcheckout using a kiosk and 6% for self-checkout using an app.

Self-checkout using AI sensors

More 42%

Less 2%

About the Same 56%

Self-checkout using kiosk

More 37%

Less 4%

About the Same 58%

Self-checkout using app

More 30%

Less 13%

About the Same 56%

Of the self-checkout options available at convenience stores, self-checkout using AI sensors appears to be gaining the most traction, as 42% of users indicate they are utilizing this option more often today than a year ago. This compares to 37% for self-checkout using a kiosk and 30% for self-checkout using an app.

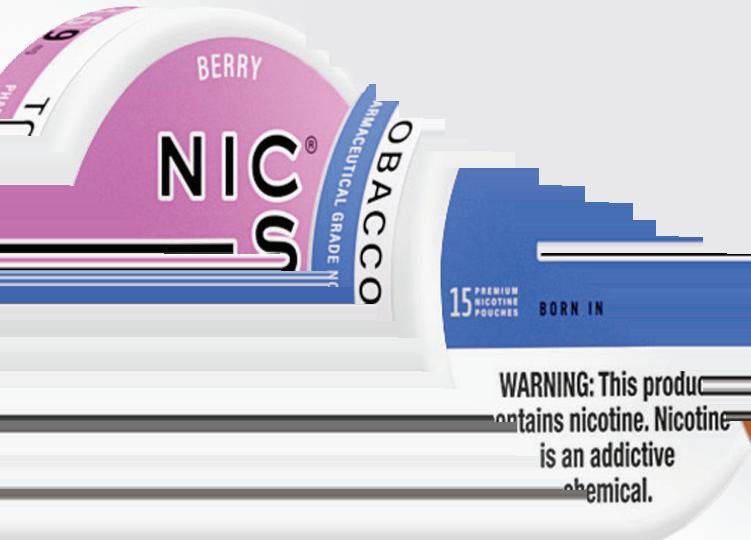

Premier Manufacturing is excited to introduce NIC-S®. Premium tobacco-free nicotine pouches backed by extensive scientific research, made with pharmaceutical grade nicotine, and is setting a higher standard for nicotine pouches.

PHARMACEUTICAL GRADE NICOTINE

6 FLAVOR PROFILES WITH 3 STRENGTHS (3MG, 6MG, AND 9MG) EXTENDED

PREMIUM SOFT POUCHES