WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

FROM OPERATIONS TO CUSTOMER ENGAGEMENT, THE CONVENIENCE STORE INDUSTRY IS CONTINUOUSLY ADAPTING AND IMPROVING TO BETTER SERVE COMMUNITIES.

Help responsibly connect & engage with your ATCs 21+ in the digital environment

Establishes a digital foundation to optimize the ATCs 21+ journey

• Enables an integrated marketing approach for your ATCs 21+ • Provides a clear road map for development, integration, and implementation supported by AGDC

Invest in digital infrastructure that responsibly optimizes & enables new channels for ATCs 21+ experiences

Enhance your retail digital capabilities & build a foundation of responsibility to meet the evolving ATCs 21+ expectations & improve their experiences

I AM A HUGE FAN of animated movies, and “Beauty & the Beast” is one of my favorites. In the film, there is a particularly catchy tune called “Be Our Guest.” While dishes and utensils come to life and dance, a candlestick and teapot sing: “Be our guest. Be our guest. Our command is your request. … And we’re obsessed with your meal, with your ease. Yes, indeed, we aim to please.”

Working on this month’s cover story with my fellow editors Melissa Kress and Danielle Romano, I couldn’t help but think of this song (and sing it in my head) as one convenience store retailer after another talked to us about the significance of being guest obsessed.

For bp, this means investing in talent and capabilities to deliver a best-in-class digital experience that gives its guests multiple avenues to transact with its stores digitally.

“A digital transformation will give us the opportunity to provide access points to our brand that are unique and individualized. It allows us to be even more guest obsessed,” Lisa Blalock, vice president of convenience, Americas for Houston-based bp, told us.

For Yesway, it entails leveraging data analytics and artificial intelligence to gain valuable insights into customer behavior, preferences and demand patterns. The Fort Worth, Texas-based convenience store retailer is then able to tailor its product assortments, pricing strategies and marketing efforts to match guest needs,

2021 Jesse H. Neal National Business Journalism Award Finalist, Best Infographics, June 2021

2018 Jesse H. Neal National Business Journalism Award Finalist, Best Editorial Use of Data, June 2017

2023 American Society of Business Press Editors, National Azbee Awards

Silver, Data Journalism, January/April/June 2022

2023 American Society of Business Press Editors, Upper Midwest Regional Azbee Awards Gold, Data Journalism, January/April/June 2022

Bronze, Diversity, Equity and Inclusion, March 2022

2016 American Society of Business Press Editors, National Azbee Awards

Gold, Best How-To Article, March 2015

Bronze, Best Original Research, June 2015

2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015

leveraging data-driven decision making.

For Casey’s, guest service is top of mind. The Ankeny, Iowa-based convenience store chain recently launched its Easy for You initiative, designed to enhance operational efficiency and simplify the store experience for team members. By removing complexity from processes and reducing administrative tasks, team members are given back time that they can use instead to serve Casey’s guests and complete higherimpact work.

These are just a few examples of how c-store companies are adapting, improving and innovating while staying laser-focused on meeting the ever-evolving needs of their guests. There are many more examples like this, which made it difficult to choose which companies to spotlight in this issue of Convenience Store News — our annual “Innovation Issue.”

While they may not have dancing dishes or twirling utensils, c-store retailers across the country are finding new ways to deliver better guest experiences and, most impressive of all, they approach it as a never-ending process, constantly asking how they can further improve.

I’m eager to see what fresh innovations the future holds.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

2022 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single Article, March 2022

Winner, Business to Business, Food & Beverage, Series of Articles, October 2021

Honorable Mention, Business to Business, Retail, Single Article, September 2021

2020 Eddie Award, Folio: magazine

Business to Business, Retail, Series of Articles, September 2019

2018 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Website

Business to Business, Retail, Full Issue, October 2017

Business to Business, Editorial Use of Data, June 2017

2017 Eddie Award, Folio: magazine

Winner, Business to Business, Retail, Single/Series of Articles, May 2017

Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016

2016 Eddie Award Honorable Mention, Folio: magazine

Business to Business, Retail, Full Issue, October 2015

Business to Business, Retail, Single/Series of Articles, August 2015

Laura Aufleger OnCue Express

Billy Colemire Stinker Stores

Robert Falciani ExtraMile Convenience Stores

Jim Hachtel Core-Mark

Chris Hartman Rutter’s

Faheem Jamal CPD Energy Corp./ Chestnut Markets

Ruth Ann Lilly GPM Investments LLC

Vito Maurici McLane Co. Inc.

Jonathan Polonsky Plaid Pantries Inc.

Greg Scriver Kwik Trip Inc.

Tony Sparks Curby’s Express Market

Roy Strasburger StrasGlobal

ELON MUSK has reportedly received approval to proceed with plans to build an all-night diner and drive-in movie theater in Hollywood. The 1950s-style drive-in will feature 32 stalls for all-night charging of electric vehicles (EVs), a restaurant with rooftop seating and two giant movie screens that will show clips from classic movies.

In covering the convenience store industry for the past 17 years, I’ve seen dozens of iterations of the “c-store of the future.” Like Musk’s latest dream, many of those futuristic prototypes featured electric vehicle charging stations to some degree. None showcased as many as the 32 that Musk envisions, but the brilliant entrepreneur has never been known for setting modest goals.

The predictions for EV sales are wildly divergent. One day, you’ll read a report that half of all new car sales by 2035 will be electric. The next day, you’ll read that Ford will lose $3 billion from EV sales to consumers this year. Recently, a former Ford executive told CNBC that EV demand is not keeping up with production.

Regardless of the varying predictions, I think the only thing that will slow EV sales in the near future is the availability of a charging infrastructure. Despite the federal and state government funding for new charging equipment, most experts see a deficit in the number of chargers needed to service the growing EV fleet. There certainly doesn’t appear to be enough charging locations to support the most optimistic predictions for 2035.

The current thinking is that you need at least two charging stations on a site. But is two even enough? Musk certainly doesn’t think so. He’s taking no chances that someone may pull into his facility and not be able to find an unused charger.

One thing that Musk’s new concept appears to understand is the important role foodservice will play as more sites add EV charging units. The whole definition of on-the-go convenience is likely to change as EV owners go inside for a bite to eat while their vehicles’ batteries are recharged. C-store foodservice will progress further from snack bar to fast food to fast casual sit-down restaurants.

I recognize that the obstacles to electrification of the motor vehicle fleet are huge and go beyond the number of charging locations. Who knows if car makers can find sufficient quantities of the minerals needed to make batteries or if the U.S. power grid can handle a massive influx of new electric vehicles. And, as the latest number of severe weather-related events show, the disastrous impact of one major hurricane would be amplified by an overreliance on electricity to power cars, trucks, homes and businesses.

Nevertheless, the momentum — fueled by government spending — appears to be moving the country inexorably toward EVs. The smart business decision is to be ready. Musk’s diner/drive-in/restaurant/charging facility might actually be a glimpse of the future convenience store.

For comments, please contact Don Longo, Editorial Director Emeritus, at dlongo@ensembleiq.com.

Musk’s diner/ drive-in/ restaurant/ charging facility might actually be a glimpse of the future convenience store.

FEATURES

COVER STORY

36 Innovation Abounds

From operations to customer engagement, the convenience store industry is continuously adapting and improving to better serve communities.

FEATURE

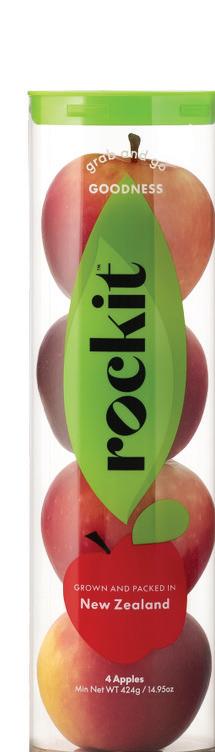

54 An All-Day Affair Products designed for snacking dominate this year’s Best New Products Awards winners.

FEATURE

78 Differentiating Through Private Label

A growing number of convenience stores are boosting their assortments of private brands to offer shoppers unique, high-value products.

DEPARTMENTS

E DITOR’S NOTE

4 Be Our Guest

The drive to wow customers has c-stores innovating in all corners of the business.

VIEWPOINT

6 EV Charging Will Shape the Future of C-store Design Electric vehicles will propel convenience store foodservice to greater heights.

12 CSNews Online

27 New Products SMALL OPERATOR

30 Setting Priorities

While customer-facing technology is important, small operators are also prioritizing the back office to create more efficiency at the store level.

TWIC TALK

106 Challenging the Status Quo Yesway earns the 2023 Top Women in Convenience Corporate Empowerment Award.

INSIDE THE CONSUMER MIND

129 Checking Out

C-store shoppers appreciate and embrace various frictionless offerings.

The NEXT™ 2.0 Tray Merchandising System allows retailers to increase merchandising space and improve product visibility. Each item remains faced and visible to the customer for easy product selection.

By incorporating the NEXT™ 2.0 System into a planogram, retailers can expand the selection of products beyond the limits of peg hooks and put more product in its place. This usually translates to an additional row of merchandise and up to 25-30% more facings in a given section.

Retailers can further reduce labor costs and simplify restocking with the NEXT™ 2.0 pull-out tray option. Customers benefit from a more organized and cohesive layout featuring enhanced product depth and merchandising which, in turn, increases sales.

84

Modern

continues

8550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

SENIOR VICE PRESIDENT-GROUP PUBLISHERUS GROCERY & CONVENIENCE GROUP

Paula Lashinsky (917) 446-4117 - plashinsky@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

ASSOCIATE EDITOR Amanda Koprowski akoprowski@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS

Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR & NORTHEAST

SALES MANAGER Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR & WESTERN SALES MANAGER Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (201) 855-7615 - tkanganis@ensembleiq.com

CLASSIFIED PRODUCTION MANAGER Mary Beth Medley (856) 809-0050 - marybeth@marybethmedley.com

DESIGN/PRODUCTION/MARKETING

90 Distinguished Deliciousness Kum & Go leads the 12th annual class of Foodservice Innovators Awards winners.

ART DIRECTOR Lauren DiMeo ldimeo@ensembleiq.com

PRODUCTION DIRECTOR Pat Wisser pwisser@ensembleiq.com

SENIOR MARKETING MANAGER Krista-Alana Travis ktravis@ensembleiq.com

SUBSCRIPTION SERVICES LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF PEOPLE OFFICER Ann Jadown

CHIEF STRATEGY OFFICER Joe Territo

CHIEF OPERATING OFFICER Derek Estey

Golden Pantry Food Stores teamed up with Juxta to open a portable autonomous, micro retail store at Wire Park in Watkinsville. The integration of a Juxta Nomad store at the mixed-use development will cater to the diverse footfall ranging from local residents to daily visitors.

2

Chevron U.S.A. Inc. is rolling out an initiative to refresh its Texaco-branded gas stations with a new, more modern look. This includes an evolved color scheme; 3-D canopy design; modern pole sign options; noticeable pump flags; and emphasis on the industry-leading Texaco with Techron fuels.

The Wisconsin-based cooperative will downsize to 18 stores in what it called an “important step toward preserving its future success.” All employees who work at a store marked for closure will be offered a position at a remaining Mega Co-op location.

The acquisition of the assets of H.A. Mapes Inc. includes seven company-operated convenience stores under the proprietary Harry’s brand, commission dealer sites and leased wagon dealers, plus a network of open dealers and commercial accounts.

1 3 4 5

Leaning into one of its core strengths — the willingness and desire to learn from one another — members of the convenience channel gathered at McLane Co. Inc.’s national trade show, McLane Engage, to get a taste of where the industry stands and where it is heading from a consumer perspective, operator perspective and product perspective.

At the event, McLane unveiled McLane Fresh, an expanded foodservice at retail program designed for c-stores. As demand for and sales of fresh and higherquality food items increase, c-stores are elevating their foodservice programs and in-store experiences to compete with fast-food and quick-service restaurants.

For more event coverage, visit the Awards & Events section of csnews.com.

MOST VIEWED NEW PRODUCT

Mtn Dew Baja Blast New Flavors

EXPERT VIEWPOINT

The company’s footprint expands to more than 800 c-stores across 20 states

MAVERIK — ADVENTURE’S FIRST STOP has officially doubled in size.

The convenience store retailer completed its acquisition of Kum & Go, operator of 400-plus convenience stores in 13 states, on Aug. 29. The deal also included tank truck carrier and logistics provider Solar Transport from Krause Group, parent company of Kum & Go.

This transaction creates a best-in-class c-store network across the Midwest and Rocky Mountain regions, growing Salt Lake City-based Maverik’s footprint to more than 800 stores in 20 states with approximately 14,000 team members, the company said.

“We are excited to welcome Kum & Go and Solar Transport team members to Maverik,” said Chuck Maggelet, CEO and Chief Adventure Guide of Maverik. “Together, we’ll offer our customers an adventurous and differentiated convenience store experience across fuel, foodservice and inside-store offerings. We look forward to using our combined resources to grow our business and further elevate our product offerings to provide the best service to our customers.”

Maggelet will lead the newly combined organization. Kum & Go’s Tanner Krause is transitioning out of the company following six years of leadership as president and CEO.

Maverik and Kum & Go announced the deal in April, two months after news emerged that Kum & Go was exploring all options for the future, including a potential sale. Financial terms of the acquisition were not disclosed.

“Together over four generations — from my grandfather Tony and my dad Bill to me and my son Tanner — we built these businesses over 64 years through shared vision, collective entrepreneurship and teamwork,” said Krause Group founder and CEO Kyle Krause.

“I’m also incredibly thankful for our associates and their unique contributions that allowed Kum & Go and Solar Transport to reach this level of success. We’ve run the businesses and differentiated ourselves by putting people first and making days better in all we do,” he added.

Starting in January, Kum & Go locations in Utah and the Intermountain West region will rebrand to Maverik stores.

bp, EG America and GetGo see personnel changes at the top

TRAVELCENTERS OF AMERICA INC. (TA) named Debi Boffa as its new CEO effective Sept. 1. She succeeds Jonathan Pertchik, who led TA from 2019 through its May 2023 acquisition by bp and helped position the company for the future of alternative fuels. Boffa was previously named CEO-designate one week after the bp-TA deal closed in May.

A seasoned management executive, Boffa brings more than 25 years of experience with bp to her new role and has worked across many sectors, including engineering, retail, sales, marketing and operations. She recently served as president of both bp’s Retail Operating Organization and Thorntons LLC, where she led the integration of bp’s ampm business with Thorntons while concurrently overseeing the operations of more than 1,200 convenience stores nationwide.

Westborough, Mass.-based EG America, a subsidiary of EG Group, also has a new leader. John Carey was appointed president and CEO of EG America, effective Oct. 1. In his new role, Carey will drive forward the company’s growth strategy in the United States.

Carey brings significant experience operating global businesses and a track record of delivering highquality returns. His past roles include senior executive positions at bp plc and ADNOC Distribution, where as deputy CEO, he led its IPO on the Abu Dhabi stock exchange in 2018.

In Pittsburgh, Giant Eagle Inc. promoted Terri Micklin to executive vice president and president of GetGo convenience stores as part of a wider round of promotions. She brings more than 20 years of retail, fuel and convenience industry expertise to the role.

As president of GetGo, Micklin will lead the chain’s ongoing growth and expansion while prioritizing its food-first approach and guest-obsessed culture, the company said.

Her career includes experience with ExxonMobil Corp. and more than 20 years with Wawa Inc., where she spearheaded multiple construction initiatives, including new stores, remodels and other significant projects. Micklin most recently served as senior vice president of development and strategy for GetGo.

Giant Eagle also appointed Bill Artman as CEO. He was named interim CEO in March.

Wawa also recently launched its first battery-electric truck in partnership with Penske Logistics.

autonomous trucks; serve as a hub for drivers for first- and last-mile deliveries; and support Kodiak’s autonomous deployment network.

Approximately

Approximately 150 convenience stores across Wawa Inc.’s operating footprint now offer electric vehicle (EV) charging. The retailer has hosted more than 6 million charging sessions across its network since 2017.

Road Ranger is launching FeedbackNow by Forrester across its network following a five-store pilot test of the technology. During the initial trial launch, the operator deployed Smiley Boxes with an optional QR code for additional comments, and Check-In & Check-Out Boxes to track cleaning schedules.

Pilot Co. and Kodiak Robotics Inc. are teaming up to open a truckport at Pilot’s travel center in Villa Rica, Ga. It will be used by Kodiak to launch and land

Huck’s partnered with app platform designer Rovertown to launch a revamped mobile app. The redesigned Huck’s Bucks Bigg Rewards app combines the latest in loyalty marketing, scan-and-go payments and customer engagement strategies.

In honor of the 50th anniversary of Allsup’s World Famous Burritos, Yesway is now offering the popular menu item for sale online. The burritos and “Chimi” Chimichangas are available to order in multiple sizes, including six-packs, 12-packs, 24-packs and 48-packs. Allsup’s Beef and Bean Burritos can also be ordered in 72-packs.

A new in-store campaign raises awareness of the common practice used to procure tobacco and vaping products by those under legal age.

It is a frequent scene outside C-stores—underage youths asking legal-age adults to purchase tobacco and/or vaping products for them. Eighty percent of all underage access to those products is from social sources—friends, family and strangers.

This month, We Card is moving the issue to the forefront with an in-store program to address social sourcing—at no cost to retailers.

It builds upon the success We Card has achieved in preventing sales to underage consumers. We Card’s education, training and tools have helped retailers reduce the sales rate of tobacco products to underage consumers from 40% in 1997 to about 10% today. “Compliance education continues and now we are launching a campaign to put social sourcing on everyone’s radar,” said Doug Anderson, president of The We Card Program, Inc.

“We Card’s new in-store campaign complements rather than replaces existing responsible retailing efforts to identify and deny underage purchase attempts of age-restricted products like tobacco and vaping products,” he added.

The campaign is the result of thorough field testing and pilot programs. Through feedback, We Card offers two compelling choices that both produced positive test results. “We tested both campaigns and they both performed equally well. We are letting retailers choose what they want for their stores,” said Anderson.

Be A Real Influencer is one option and it taps into the importance of influencers. The campaign features young adults aged 21+, encouraging them to be “real influencers.” The message is that they can be positive role models by being comfortable saying “no” when asked by someone underage to buy or give them tobacco and vaping products.

The other option is We Card We Care, alerting customers that: If they’re under 21: NO Bumming. NO Borrowing. And NO Buying for Them. “That tagline resonated well with adult customers and retailers,” Anderson said.

Each campaign includes a variety of in-store signage with a QR code call-to-action for customers to scan with their smartphone to learn more and interact with the campaign website.

Distributors and manufacturers are playing an important role in helping raise awareness and alert retailers to the new campaign. “We’ve activated our distributor network and are pleased to be part of this industry-wide effort,” said Kimberly Bolin, president and CEO of the Convenience Distribution Association and a We Card board member.

We Card is supporting retailers to help prevent and discourage adult purchases of tobacco and vaping products on behalf of those underage. These tested materials will help get the message across.

Both campaigns are readily available, and retailers are posting them in-store throughout 2023 and 2024 as it is a long-term, multiple-year campaign. Retailers can order either campaign at wecard.org/Free-Kit

80% of the time, underage youth report getting access to tobacco and vaping products from social sources—friends, family and strangers.

Juul Labs Inc. is restructuring the company to maximize profitability and cash-flow generation while allowing it to continue investing in its core priorities. Plans to reduce operating costs include layoffs and reducing the company’s headcount.

company alleges that certain JUUL products infringe certain patents owned by NJOY.

D&H United, a portfolio company of Wind Point Partners, acquired Tanknology Inc. The acquisition marks D&H’s entry into the Northeast, West Coast and Pacific Northwest markets, and expands its service footprint across the Mountain West, Midwest, Southeast and Southwest.

McLane Co. Inc. unveiled a new fresh food program, McLane Fresh, at its national trade show at the end of August. The program’s brands include CupZa!, a reimagined beverage program; a proprietary pizza program; and an expanded selection of McLane’s existing grab-and-go brand, Central Eats.

Altria Group Inc.’s subsidiary NJOY filed a complaint against Juul Labs Inc. with the International Trade Commission. The

The board of directors of 22nd Century Group Inc. has started to evaluate strategic alternatives for its tobacco assets. The process will include consideration of strategic, operational and financial transactions and alternatives, such as business combinations, asset sales, licensing agreements and alternate financing strategies.

Liquid Barcodes received an equity investment and capital infusion from Norwegian-based Viking Venture, an experienced firm in the business-to-business SaaS space. Liquid Barcodes plans to use part of the capital infusion to increase product development resources to enhance loyalty and subscription solutions.

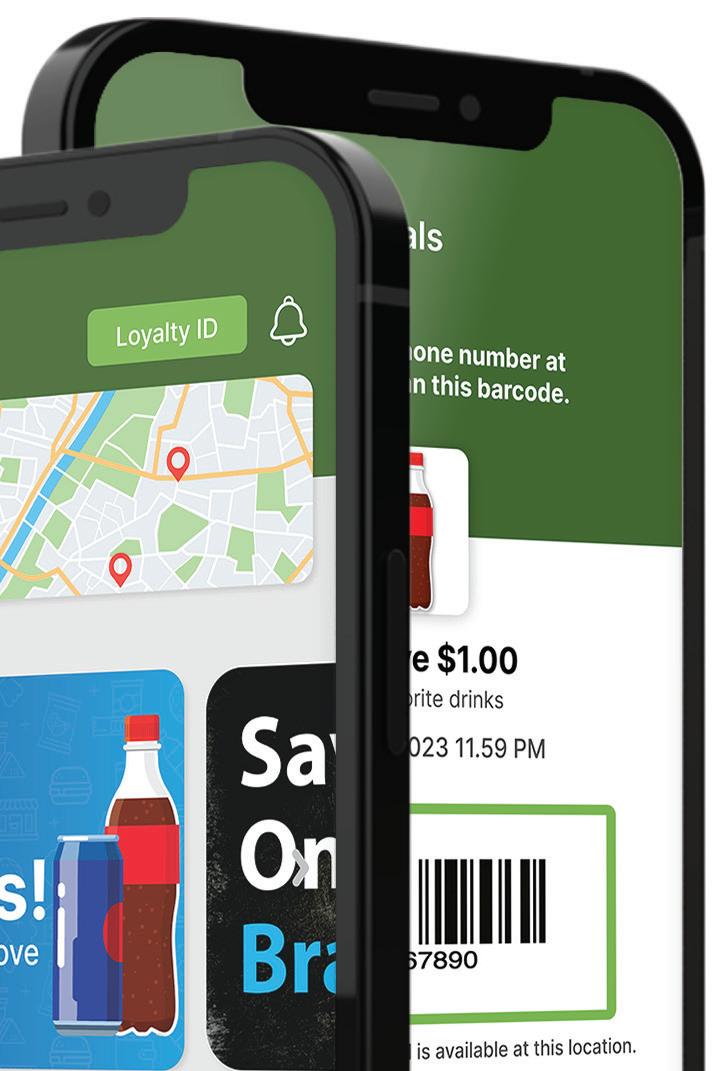

MOBILE INTEGRATION. It is something convenience store operators must focus on as they strive to build a seamless omnichannel shopping experience — one that will engage customers, build brand loyalty and communicate the specific brand message the retailer wants to convey, according to Meghan Wang, strategist for strategy and analytics at Newton, Mass.-based Paytronix, a provider of SaaS customer experience management solutions for c-stores and restaurants.

For Eric Rush, director of marketing for Tri Star Energy, the Nashville, Tenn.-based parent company of Twice Daily convenience stores, an integrated mobile app is more than just an option, it is a necessity — and one that Twice Daily has embraced.

“In order to even be considered as a destination during key times of the day, today’s c-stores need to include some form of alternative ordering, if not all of them,” Rush stressed. “For our loyal guests, our app has essentially taken on the role of the storefront or forecourt. It is the first thing they see when they are considering us as their breakfast, lunch or snack destination.”

Mobile integration, of course, does so much more than just drive foodservice sales.

“An integrated e-commerce app will provide guests a simple way to engage with your brand and streamline their purchases. An integrated app optimizes inventory

management through real-time data on stock levels,” Wang explained. “It enhances customer experience through tailored promotions and loyalty programs, and it can provide meaningful data back to the business on customer behavior to help shape more personalized marketing strategies in the future.”

Before a convenience retailer can deliver a brand message, collect data and ultimately build long-term loyalty, they have to be able to reach customers where they are, at any time of day. Today, that “where” is on a mobile device — which means a store’s mobile app should play a critical role in the retailer’s digital guest engagement strategy.

As Wang noted, there are myriad benefits that mobile apps deliver from a customer engagement perspective.

“Apps enable stores to send targeted notifications about promotions, new arrivals or special events directly to customers’ phones. Operationally, they allow for a streamlined experience in which customers may utilize mobile payments and track order fulfillment,” she said. “The app can also collect valuable data on customer behavior, preferences and purchase history, which can then inform more personalized recommendations and tailored offers, making customers feel valued and understood. Finally, stores can incorporate gamification elements within the app, such as quizzes or challenges,

to engage customers and encourage more frequent interaction with the brand.”

Yatco Energy, the Northborough, Mass.-based operator of 20 convenience stores throughout New England, recognized the important role mobile apps play when it was in the early stages of building its digital presence. The company’s mobile app “has been our first step toward having a digital presence,” said Yatco Vice President Hussein Yatim. “It stemmed from the company growing regionally here in New England and really trying to push the Yatco brand and presence to consumers.”

Twice Daily’s app is also key to engaging customers, according to Rush, who said the company “has taken on a significant increase in our digital strategy over the last 12 months.”

How can convenience store operators just getting up to speed with mobile know where to start?

Eric Rush, director of marketing for Tri Star Energy, the Nashville, Tenn.-based parent company of Twice Daily convenience stores, offered the following advice based on his experience:

Find out what your guests want — “What do they want to see, what would make them download your app and become a loyal shopper?” Rush asked. “Your already-loyal guests will not take any convincing, but what is going to turn a casual guest into a loyal one? And what could turn a nonguest into a casual one?”

Consider your business needs and what you hope to get out of the program — These are very important considerations, but if you prioritize them over your guests’ preferences, “the program will not be as successful,” Rush said. “It is a customer loyalty platform first.”

Leverage the big brands and their big pockets and experience — “The CPG brands are ready and willing to provide some amazing offers and contests as long as you can provide some real-time and accurate data back,” Rush pointed out.

Get the buy-in — This means all levels of the organization and must include a strong marketing campaign. “You cannot just roll out an app and let it go on its own,” he concluded.

Upgrading the company’s mobile app experience with the help of the new Mobile Experience Builder from Paytronix was an important step in refining that strategy, which also included “a total redesign of all of our websites and increased organizational focus on the loyalty program and mobile ordering,” he said.

The Mobile Experience Builder is a self-service tool that enables brands of all sizes to publish content in real time to their mobile apps — something that previously had been possible only for companies with the resources to invest heavily in custom mobile app development.

“With this focus on creating a stronger value proposition and finding ways to ensure the guests are aware of that value, we have strengthened our ability to communicate through other channels like SMS, email, social and other digital platforms,” Rush added.

What role does a mobile app play in delivering the specific brand message a c-store wants to convey? According to Wang, it provides a platform for consistent branding, personalized interactions, storytelling and engagement.

A well-designed app — one that is easy to navigate and use — reflects positively on the brand and creates “a strong and lasting impression of the brand” by providing unique value to the customer, she said. “Stores can communicate their message and engage with guests through customized content, push notifications, and in-app surveys or feedback opportunities.”

Yatim shared that Yatco’s mobile app has played “a very significant role in delivering the Yatco brand message,” which has been especially important because the company co-brands its fuel with major oil companies.

“From the consumer perspective, it sometimes isn’t clear what the brand is since our c-store is Yatco and our gas brand is another brand. The app has helped customers know that we are differentiated, and that starts in the store,” Yatim said. “We have used a variety of strategies to communicate our brand and the value it provides to customers. We have run various campaigns that give customers substantial discounts on gas or free items in-store relatively easily. That has helped position Yatco as a brand that is competitive and creative with what we offer. … As more and more consumers sign up on the app and become frequent users, it promotes brand visibility and recognition.”

Since implementing its more robust digital strategy, Twice Daily also has used its app in several ways to communicate its brand promise.

“The biggest change we made was to bring Member Pricing offers into the app through a web view. This has allowed us to display all of the member prices, along with contest information and new items/LTO [limited-time offers] without having to stick to any app limitations,” Rush explained. “It has also allowed us to use that link as a call to action for other digital/social advertising to show potential guests what types of offers and campaigns we run without them first having to download the app.

“When the guests are believers in your brand promise and trust you, they are far more likely to allow your app to take valuable space on their phones,” he observed.

Top loyalty guests overwhelmingly represent the highest spenders and most frequent visitors, according to the “2022 Paytronix Annual Loyalty Report.” As c-store shoppers increasingly demand that loyalty be accessible through easy-to-use mobile apps, it’s not hard to see why giving customers a way to interact with your loyalty program via an app is so important to bottom-line success today.

“Through a combination of convenience, personalization, rewards and engagement, a well-crafted app will keep customers closely connected to the brand,” Wang explained. “By creating an efficient ecosystem, it will not only make shopping easier, but also help foster a deeper emotional bond between the customer and the brand.”

Wang noted that many brands rely on third-party apps to handle things like online ordering, but she cautioned that this isn’t the best way to engender loyalty.

“While the third parties are great for bringing in new customers, they stand between your brand and your customers. Building brand affinity means having your own place on your guest’s phone — then, they come directly to you,” she said. “But you also want to build in incentives to own this real estate, which could mean special offers, discounts or items that aren’t available through the third parties.”

This kind of customization is something Twice Daily anticipates offering in the near future.

“The further we get into the digital transformation, the greater our ability is,” Rush said. “We will be able to create a customized app approach for each guest based on their habits, their likes and what motivates them to continue coming to our stores.” CSN

The benefits of using a mobile app to engage customers, deliver a brand message and build loyalty are many. Northborough, Mass.-based Yatco Energy’s campaign for Memorial Day 2023 is one example of how effective even a simple promotion delivered via an app can be.

The company offered a free 20-ounce Coca-Cola beverage that customers could redeem through the app throughout the holiday weekend.

“We were trying to layer in deals on top of points and rewards,” Hussein Yatim, vice president of Yatco Energy, which operates 20 convenience stores throughout New England, explained during a recent webinar presented by Paytronix and Convenience Store News.

The offer pulled customers who might have only stopped for gas into the store. “There were a couple hundred redemptions of that Coke offer,” Yatim reported.

Even better, a post-promotion report revealed a huge life in incremental sales.

“At least three-quarters of the time, those customers up-bought snacks, sandwiches, tobacco and lottery tickets,” Yatim said, noting that one customer who came for the Coke bought $30 worth of goods in-store.

“That is tremendous upsell and basket size for a c-store.

“You’re prompting customers to come in with the deal and seeing the basket build because you got them in-store,” he continued. “The holy grail of these programs is getting them in and then having your store, your brand, take it from there.”

By Jeff Hoover, Paytronix

By Jeff Hoover, Paytronix

IN TODAY’S DYNAMIC convenience store landscape, staying ahead demands more than just offering quality products and services. It means understanding consumer behavior and delivering personalized experiences. Convenience stores must control their own digital experience through the mobile device to make this work.

Modern consumers have come to expect an effortless shopping experience that transcends physical boundaries. That’s why an integrated e-commerce app has evolved from being a competitive advantage to a fundamental necessity.

By integrating real-time updates, personalized promotions and tailored messaging into their mobile apps, c-stores can deliver a great digital brand experience and gain valuable insights into customer behavior. The competitive edge is in the integration of a complete guest engagement solution through the mobile app.

Beyond wanting it easy, customers want it to be personal, especially from those few apps they choose to keep on their phones. To connect with customers effectively, convenience stores must do more than just offer an app — they need to make sure it works smoothly with their digital guest engagement systems like online ordering, loyalty and CRM.

By using data about what customers like and what they buy, convenience stores can suggest products and deals that truly matter to customers. This not only encourages people to use the app, but also lets stores send them special messages and offers that are just right for that guest. It’s all about making customers feel important and understood.

A mobile app transcends its role as a digital storefront; it becomes an extension of the brand itself. To this end, consistent branding, personalized interactions and storytelling are crucial. A well-designed app that aligns with the brand’s identity reflects positively on the business. Through customized content, push notifications, and in-app surveys or feedback channels, companies can effectively communicate their message, enhancing brand recognition and loyalty.

More than just an e-commerce tool, a mobile app that offers convenience, personalization, rewards and engagement enables c-stores to create an efficient ecosystem that not only simplifies shopping, but also nurtures a deeper emotional bond between customer and brand.

Of course, customers have many choices and a brand’s app may be competing with the third-party aggregators. Those aggregators have a place in the overall marketing ecosystem, often by bringing in new customers, but capturing those guests and offering them additional value through a mobile app is key to increasing customer lifetime value.

Achieving this level of sophistication takes time, energy and planning. And, of course, c-store executives are already stretched thin. That’s why it’s key to balance the different cost options against the needs of the brand. That is, you shouldn’t underinvest to the point of hurting the overall brand experience, but investing heavily before you’re ready can be equally as damaging.

Finding that right balance with the right partner will make the end result fit your needs while still offering room to grow. For example, a technology partner that offers guided processes can expedite app development, enabling a team to design and launch an app efficiently. Further refinements can be made as you grow and gather both data and insights, making the process more manageable and cost-effective.

As c-stores continue to navigate the challenges and opportunities presented by the mobile landscape, it’s evident that the key lies in understanding and adapting to evolving consumer expectations. Whether through personalized experiences, efficient integration or cohesive brand messaging, the power of mobile applications in customer engagement is undeniable. Businesses that embrace this power stand to thrive in a digital-first world.

Built brings to market three new products: Built Bites, Built Balls and Built Krispy. These new varieties combine Built’s protein and balanced macros to provide consumers the nutrients needed to thrive. The Bites and Balls feature a blend of whey and collagen, with the former including a chocolate-dipped exterior and the latter launched with a peanut butter flavor. Built Krispy features a crispy concoction of high-quality protein sources like hydrolyzed collagen and whey protein isolate in two flavors, Peanut Butter Chocolate and Mint Chocolate.

BUILT • AMERICAN FORK, UTAH • BUILT.COM

Electrolit Hydration Beverage introduces its newest flavor, Mango, which joins the global brand’s now 15-drink lineup. Intended as a convenience store take on the company’s traditional formula, each 21-ounce serving of Electrolit Mango contains 326 milligrams of electrolytes, alongside magnesium, sodium, potassium, calcium and real glucose, a natural source of energy that can boost the body’s recovery from dehydration. Electrolit Mango is currently stocked in 1,200 7-Eleven Inc., Stripes and RaceTrac Inc. stores throughout the United States. ELECTROLIT • CERRITOS, CALIF. • ELECTROLIT.COM

Treat Planet LLC releases its first line of pet toys under the Cosmo’s Snack Shack brand. The Fly N’ Float is a frisbee that is lightweight, floatable and tough, yet soft and pliable, and gentle on a dog’s mouth. The Fling N’ Fetch is a bouncing ball attached to a string and acts as an interactive fetch toy that is safer for the dog’s teeth than a tennis ball, according to the company. Both toys are made with BPA-free natural rubber. They are nontoxic and latex-free.

TREAT PLANET LLC • EARTH CITY, MO. • TREATPLANET.COM

BIC debuts a refreshed lineup for its Special Edition Good Vibes Series of lighters. According to the company, the series is aimed at humorloving consumers who don’t want to settle for boring lighters. The designs feature everything from robots to chicken wings to mammoths with attitude. The Good Vibes Series lighters have a suggested retail price of $2.29 per unit and like all BIC Maxi Lighters, are long-lasting, reliable and 100 percent quality inspected.

BIC USA INC. • SHELTON, CONN. • US.BIC.COM

Midway Displays presents its Reusable Shopping Bag Rack for convenience stores. The display rack is designed to be space-efficient, cost-effective, and to support retailers looking to comply with any upcoming plastic bag laws, regulations or ordinances aimed at reducing the number of single-use plastic bags in circulation. The 2-inch-wide wire loop rotors are designed to hold all types of handles on totes, and will evenly present bags no matter the handle style. Additionally, operators can choose from brandable or mobile bases. The racks are selectively made with recyclable materials and knock down and ship compactly, potentially saving both fuel costs and warehousing space.

MIDWAY DISPLAYS • BEDFORD PARK, ILL. • MIDWAYDISPLAYS.COM

Whoa Dough is launching its newest product, Chocolate Chip Cookie Dough. At only 90 calories and 8 grams of sugar per serving, the sweet and salty refrigerated snack can be enjoyed straight from the package or baked into nine cookies within minutes. Allergen-friendly and sensitive for those with dairy restrictions, Whoa Dough Chocolate Chip Cookie Dough is certified gluten-free, vegan, egg-free, nut-free, soy-free and dairy-free. The product is also Non-GMO Project Verified and OU kosher. Whoa Dough Chocolate Chip Cookie Dough became available nationally starting in September 2023.

WHOA DOUGH • HIGHLAND HEIGHTS, OHIO • WHOADOUGH.COM

Children’s snack brand good2grow now offers a larger 10-ounce size of its fan-favorite juice that is compatible with hundreds of its collectible licensed character tops. The Bigger Juice line — its second new product innovation of 2023 — features 65 percent more juice than the brand’s 6-ounce products and comes in two flavors: Raspberry Lemonade and Orange Mango. According to the company, its juices are a good source of vitamin C, zinc and calcium, and contain no added sugar. The Bigger Juice line began hitting shelves this summer at various grocers and convenience store retailers, including Casey’s General Stores Inc.

GOOD2GROW • ATLANTA • GOOD2GROW.COM

Glanbia Performance Nutrition brings to market two new dessert-inspired flavors as part of its think! high protein bars line: Boston Crème Pie and Chocolate Mint. The Boston Crème bars layer crème and chocolate while delivering 15 grams of protein, 4 grams of fiber and 1 gram of sugar. The Chocolate Mint bars combine mint and dark chocolate while providing 20 grams of protein, 2 grams of fiber and zero grams of sugar. Like all think! products, the new varieties are gluten free with no artificial flavors or colors. Both are available as single bars for $2.29 or a five-count box for $9.99 and come in new packaging that aims to improve shelf findability.

GLANBIA PERFORMANCE NUTRITION • DOWNERS GROVE, ILL. • SHOP.THINKPRODUCTS.COM

OPW Vehicle Wash Solutions introduces the LaserWash 360 Plus LaserGlow Arch from PDQ Manufacturing. The arch is intended to provide easy-tounderstand guidance during the loading process that visually communicates to drivers when they should pull forward, back up or stop in the wash bay. The lighting of the arch system has numerous colors and lighting patterns available, allowing operators to use it as a marketing tool to display brand colors or cheer on a local sports team. According to the company, the LaserGlow Arch also has improved arch-rotation navigation that makes it easier to troubleshoot and more resistant to normal mechanical wear, with an improved arch-rotation drivetrain and optimized torque output and control of the spray-arch position.

OPW VEHICLE WASH SOLUTIONS • DEPERE, WIS. • OPWVWS.COM

Foodservice products manufacturer Continental Cup is rolling out a new line of Plastic-Free Cold Cups. The line was created in response to the growing consumer concern over plastic waste and its detrimental impact on the planet, the company stated. The new cups contain no PLA, bio-plastics or other resin or plant-based polymers, providing a sustainable and renewable alternative to plastic. The cups are designed to break down naturally in just 90 days via compost or they can be recycled at a majority of curbside recycling programs. The Plastic-Free Cold Cups are available in various sizes and can be customized to each client’s branding needs.

CONTINENTAL CUP

BETHLEHEM, PA.

CONTINENTALCUP.COM

While customer-facing technology is important, small operators are also prioritizing the back office to create more efficiency at the store level

By Tammy MastroberteRETAIL TECHNOLOGY continues to change and evolve, and there are so many new and exciting options for convenience store retailers to utilize in the operation of their stores. However, when it comes to small chains, the budget size is minimal compared to large companies and although many innovative technologies offer lower-priced alternatives for smaller operators, there are far more options available than there are dollars in the budget.

“Technology is still expensive, [so] small operators need to uncover what they are trying to do with it and ask, ‘How can this make me more efficient?’ or ‘How can this save me money?’ when evaluating what to invest in,” Steve Morris, owner and president of St. Paul, Minn.-based Retail Management Inc., operator of 17 stores throughout the United States, told Convenience Store News. “In some cases, they won’t be able to find revenue-generating options, but will improve customer service or employee satisfaction or just become more efficient, which could lead to a cost savings.”

When it comes to technology, retailers are often looking for a return on investment

(ROI), whether that’s an actual dollar amount or measured by improvements in customer satisfaction, labor or efficiency. At Smith Oil Co., based in New Cumberland, W.Va., and operating 12 sites — four with fuel only — the chain requires a hands-on and engaged approach from its entire management team to successfully execute any new initiative, including technology.

“We initially start with a low-tech approach, but if that doesn’t meet expectations, we look to technology to help,” explained Michelle Fluharty, secretary and treasurer for the company. “With each decision, our management team must discuss cost analysis, labor implications, effectiveness and necessity of the technology.”

Smith Oil also evaluates efficiency because that has a direct effect on employee retention and customer satisfaction, including having the right products in stock, accurate pricing and adequate inventory at each location. “All of it combined helps give you a good reputation in the towns you operate, and an efficiently run business will be more profitable,” Fluharty added.

In fact, along with customer-facing technology, administrative and back-office tasks are often a priority for small operators because that is where they see “the actual ROI” through efficiency and labor management, noted Morris.

For example, Smith Oil recently launched a new app for its rewards program while also making investments in the back office, such as suggested ordering software.

“We look at both back and front-facing because both are equally important,” Fluharty said.

Mobile apps, digital signage and selfcheckout are all options available to c-store owners today that can have a positive impact on customer satisfaction and, in some cases, employee satisfaction as well. Chains of all sizes are investing in these technologies, and that includes small operators as more affordable options continue to become available.

“For smaller operators, the elusive self-checkout has become much more affordable,” said Morris. “There are so many more options that can be integrated with a standard point-of-sale (POS).”

Retail Management Inc. installed Gilbarco’s self-checkout system into a high-volume store that struggled with labor and had three POS stations to be staffed. Now, the store only needs two employees and can reallocate labor to stocking shelves, cleaning and other tasks.

“I didn’t see a labor increase or decrease, and not seeing an increase is my return on that investment,” Morris noted. “Also, my in-stock position is improved because I have people stocking more frequently, and the store is cleaner — which are intangibles that are harder to measure.”

Another investment the company made recently was installing digital menuboards, which has allowed the retailer to decrease printing costs and improve efficiency in updating menuboards and food prices, according to Morris.

Loyalty programs and mobile apps are also top of mind for many small operators.

Marshfield, Wis.-based Weiler Convenience Stores, operating three locations, upgraded from a punch card system for coffee and pizza to using an app to track purchases and points that can be redeemed on in-store products and fuel. Customers can use the app to look at their transaction history, the number of points they earned and how far along they are in the coffee or pizza program. Additionally, the loyalty program is based on a customer’s 10-digit phone number, so those who do not want to use the app can give their number at checkout.

“We decided to invest in the technology because it’s really the trend, and we want to keep up with it,” said Kelly Weiler, co-owner of the chain with her husband. “We watch what is out there in the industry and listen to what customers and vendors are telling us as well.”

In fact, it was customers who asked for the ability to use a phone number to track their coffee and pizza program purchases rather than carrying around a punch card. The app also allows the small chain to gather data on its customers, including how many times they visit and what they are buying, and even compare data between stores.

“We try to keep up with what is out there with other chains, and we have a five-year plan on spending whether it’s technology, painting a store or upgrading a bathroom,” Weiler noted. “Every year, we update something. With technology, we pay attention to what is out there, but if you jump on the first new thing and it’s not proven, it can be expensive to be a guinea pig.”

Smith Oil had an app for eight years prior to rolling out its new one. Relaunching with Liquid Barcodes, the new app functions as a loyalty card, while also enabling customers to activate the fuel pump and roll back pricing by 10 cents per gallon. Phase two will integrate its beverage program of buy five, get one free, as well as tailored discounts, said Fluharty.

“We will also be rolling out a subscription service in the app where customers can pay a set amount each month and then come in and get coffee or a fountain drink with it,” she added.

Liquid Barcodes integrates with the company’s POS system. The operator opted to invest in an upgraded app and program because they wanted to offer customers a “wide range of benefits comparable to industry-leading competitors,” Fluharty explained.

Additionally, the chain decided to participate in Skupos for the ability to offer additional product discounts. Skupos brings independent operators together to participate in brand-funded promotions and more. The solution also allows operators to gather data and see who is using the program, while offering customers discounts to stand out amongst competitors.

For small chains with limited staff, freeing up administrative work can be a huge benefit to them, which is why so many are investing in back-office and payroll technology.

Without this type of automation, paperwork can become time-consuming and limit a manager or owner from being able to handle other tasks, Morris pointed out.

“Anything small operators can do to automate or assist them with administrative tasks, such as payroll or vendor reconciliation, is where they are going to find the best ROI,” he said. “That may not be customer-facing, but when I talk to my clients that are single-store or two-store operators, this technology is freeing up their time to focus on something that is more revenue-generating.”

For the 17 sites his company operates, they rolled out payroll technology with a mobile app and electronic onboarding, which reduced paperwork and training documentation for new hires, and improved the ability to interact with employees electronically and individually.

“It saved a ton of paperwork, and saved

both money and time because as the company grows, we can be more efficient and won’t have to hire more administration support,” Morris noted. “It allows for company growth with growth in expenses, and the efficiency and time savings allow us to give employees other things to do.”

Also focusing on back-office technology, Smith Oil implemented suggested ordering software to optimize its inventory levels and resource allocation, and is getting ready to introduce an advanced software for retail site management along with upgraded handheld devices “to enable our managers to dedicate a greater portion of their time to the sales floor, reducing their time on administrative, back-office tasks,” said Fluharty.

The company uses PDI Technologies for back-office software, through which they can run reports to check overstocks and previous sales data to see how much inventory is on hand, how much is overstocked, and identify out-of-stock missed profit opportunities.

“You don’t want to have too much and if you are running out, then you have missed sales, so the technology is allowing us to finetune it to the best of our ability,” said Fluharty. “Monetarily, you can’t put a number on it for savings, but once we move a store to suggested ordering, I compare overstocks and out-of-stocks before and after and you wind up with additional sales when something is not out of stock.”

At Weiler Convenience Stores, the chain has been scanning for years not only at the POS, but also in the back office with vendor invoices.

“It gives you better control over your pricing and making sure your pricing is accurate,” Weiler said. “We have one of our office staff perform audits and being able to scan in the vendors lets her audit cigarettes, tobacco, liquor, lottery tickets and more, so we will know if we have a thief quickly because if you don’t shut it down, the store becomes a target for more.”

Retail Management Inc. is looking into scanning invoices and investing more in back-office technology because moving from scanning one invoice rather than scanning each product will offer a big savings in labor, according to Morris.

“The labor market is tough and I don’t see it changing any time soon,” he said. “Every labor hour is expensive, so if I spend $20 a month on technology and save seven hours of labor, then sign me up.” CSN

“We initially start with a low-tech approach, but if that doesn’t meet expectations, we look to technology to help.”

— Michelle Fluharty, Smith Oil Co.

INTRODUCING THE COOL FLAVOR THAT’S HOT IN SALES

Smirnoff Ice Blue Raspberry Lemonade joins the all-star innovation lineup of successes like Smirnoff Ice Red White & Berry, Smirnoff Ice Pink Lemonade and the Smirnoff Ice Neon Lemonade. Combining the nostalgic taste of blue raspberries over sweet and refreshing-tasting lemonade, its not just for summer but a year round new favorite. A flavor that’s destined to spark taste buds and sales alike. For more information, call your Smirnoff Ice Distributor.

WHILE THE COVID-19 pandemic undoubtedly brought on an innovation surge, the pace of innovation in the U.S. convenience store industry has not slowed down; in fact, it only keeps accelerating. Industryleading retailers are finding new and better ways to deliver “convenience,” whether it’s streamlining processes for team members or improving the experience for guests.

If asked five or six years ago whether the c-store industry was doing a good job of innovating, Choice Market founder and CEO Mike Fogarty said his answer would have been no. In fact, it is part of the reason Choice Market was started, because he saw a lack of innovation.

With eight locations in the Denver area, the retailer combines quick service and user-friendly technology with fresh, quality food from local vendors and a practical product selection.

Today, Fogarty said his opinion has changed. He thinks most c-store retailers are really starting to “get their arms around the customer and the needs of the customer” and as a result, he’s seeing sizable investments happening around mobility, design, technology, checkout options, etc.

“A lot of these organizations are very large and sometimes it takes a while for that innovation to really take place. But overall, I am impressed personally with where the industry is starting to head,” he told Convenience Store News. “And then, you have younger leaders that are relying on Gen Zs and that are leading these organizations; they get it and they understand it. And I think, ultimately, it’s good for the industry and, ultimately, for the customer.”

Being customer-centric is at the heart of Choice Market. “We really think about that customer as we make decisions around all those different areas that we innovate in,” Fogarty added.

Darrin Samaha, vice president of marketing at Yesway, shares a similar perspective. The role of innovation in today’s convenience store industry, he says, is delivering “wow” moments to customers by reimagining ways to make the shopping experience faster, easier and more enjoyable. This requires cultivating a customer-centric mindset.

It also entails leveraging data analytics and artificial intelligence (AI) to gain valuable insights into customer behavior, preferences and demand patterns. Through data-driven decision making, Yesway can tailor its product assortments, pricing strategies and marketing efforts to match consumer needs, he explained.

Fort Worth, Texas-based Yesway’s c-store portfolio consists of 441 stores in Texas, New Mexico, South Dakota, Iowa, Kansas, Missouri, Wyoming, Oklahoma and Nebraska. Its stores operate primarily under the Yesway and Allsup’s banners.

Of course, a conversation on innovation cannot be had without talking about technology.

“The most important development and advancement in our space is increased use of technology in a variety of ways,” said Kevin Smartt, CEO of Texas Born (TXB). The Spicewood, Texas-based convenience store chain operates 50-plus locations in Texas and Oklahoma.

“From mobile ordering [to] selfcheckout stations, AI technology to quickly identify store needs, customizable mobile apps and loyalty programs, these are all extremely valuable tools to ultimately help our guests get in and out of the store as efficiently and comfortably as possible, while taking some of the pressure off our employees as well,” Smartt noted.

By using SparkCognition’s Visual AI Advisor solution at its Georgetown, Texas, location, he said TXB has been able to gain insight into the demographic mix of shoppers, movement of customers from the forecourt to the store, where and how people are traversing the store and spending time, and service-level measures at the foodservice and checkout counters.

“This is extremely insightful for us as we’re able to identify when shelves are low on product faster, how many times someone has entered the restroom and how often we need to go in and clean, when there is a line at the register and more employees need to be at the counter to help checkout, etc.,” Smartt explained.

Like TXB, Casey’s General Stores Inc. is also deploying digital technology, ranging from AI-enabled voice ordering for its kitchens to data-driven inventory management and fulfillment processes, to an improved digital platform and rewards program.

“Together, this technology optimizes our operations, improves the experience for our team members, and offers more contemporary and personalized ways to engage our guests,” said Ena Williams, chief operating officer for the Ankeny, Iowa-based chain that has more than 2,500 convenience stores serving customers across 16 states.

In an industry focused on meeting the ever-evolving needs of consumers, she shared that Casey’s has realized innovation that comes from “the inside out” is critical to bringing the latest and greatest products and services to its guests.

With this in mind, the company recently launched its Easy for You initiative, designed to enhance operational efficiency and simplify the store experience for team members. So far, the initiative has streamlined a number of internal processes, including:

• Using automated smart safes and outsourcing laundry services to reduce time-intensive tasks;

• Standardizing kitchen processes and equipment to improve food quality and increase capacity; and

• Piloting self-checkout and AI-enabled voice ordering technologies to offer faster service.

“By removing complexity from processes and reducing administrative tasks, these improvements have given back an average of 11 hours per week to each store across our 16-state footprint,” Williams reported. “This is time our team members can use to serve our guests and complete higher-impact work, such as merchandising or food preparation. This is an example of how simple — yet effective — innovation can be when we focus on team success and guest service.”

“Our goal as marketers is to elevate convenience retail customer engagement, loyalty and brand marketing so that it is held in the same regard as the best-in-class channels.”

— Darrin Samaha, Yesway

Using innovation to challenge the status quo is something bp is focused on as well across its two c-store banners, ampm and Thorntons, and its newly acquired TravelCenters of America network.

“We as a brand are constantly iterating and leveraging technology to reach our guests. Consumers are digitally enabled and we’re investing in capabilities to meet their evolving needs,” said Lisa Blalock, vice president of convenience, Americas for Houston-based bp.

The company sees innovation as critical to its ability to engage with the next generation of guests, and is focused on connecting with guests — both present and future — through digital channels to engage them with offers, products and services.

“A digital transformation will give us the opportunity to provide access points to our brand that are unique and individualized. It allows us to be even more guest obsessed,” said Blalock.

Coming back to the question of whether the c-store industry is doing a good job of innovating, Yesway’s Samaha thinks the industry is doing “a very good job” in this area, but nonetheless he believes you should continually be looking to improve. And this may mean looking to other retail channels for inspiration and ideas on how to reimagine the guest experience.

“Our goal as marketers is to elevate convenience retail customer engagement, loyalty and brand marketing so that it is held in the same regard as the best-inclass channels, whether that be hospitality, airlines, entertainment or big-box retail. There are things that these channels do very well that we are looking to emulate,” he said.

The customer-centric mindset, however, will always guide the innovation journey.

“Technology and innovation are cool, yes, and in marketing, we have so many touchpoints with technology, but great retailers apply technology with a customer-centric mindset to drive a better experience,” Samaha stressed. “Innovation to us is not so much revolutionary as it is solving a clear problem, shopping roadblock or consumer need state to make it easier to shop at our stores. At the end of the day, that is our job — to consistently deliver an exceptional value to our customers.”

Innovation means improving convenience for our guests and streamlining processes for our team members. We’re always looking for and testing new technology.

At Casey’s, we’re always growing and evolving to better serve our guests, team and communities. To me, innovation is about looking for new products, concepts and processes that make life easier for our team members and improve the experience for our guests. It can be anything from the launch of ground-breaking technology to simplify operations, to a new menu item exclusive to Casey’s.

— ENA WILLIAMS, CASEY’S GENERAL STORES INC.When we innovate, we’re focused on our ability to connect with our guests through digital channels to engage them with our offers, products and services. Innovation gives us the opportunity to challenge the status quo of our guest experience in a positive way.

— LISA BLALOCK, BPInnovation in convenience retail refers to the continuous improvement and adaptation of processes, technologies and customer experiences to enhance convenience, speed and efficiency in the retail environment. This includes the implementation of cuttingedge technologies like walk in/walk out, mobile payment options and automated inventory management systems. It also involves the development of creative solutions to meet evolving customer needs, such as convenient grab-and-go food options or personalized shopping recommendations through data analysis. Lastly, innovation means embracing digital transformation to offer personalized and frictionless shopping experiences.

— DARRIN SAMAHA, YESWAYThere’s a famous quote that says, ‘Innovate or die.’ Innovation has to not only span product mix and merchandising mix in terms of evolving with that customer, but also things like store design and checkout options and technology. And even small things like lighting and how you incorporate things like art into the store. All these things matter to the customer.

— MIKE FOGARTY, CHOICE MARKET

In early 2020, Casey’s General Stores Inc. outlined three strategic pillars for moving forward: reinvent the guest experience, create capacities through efficiencies, and be where the guest is through unit growth. After successfully wrapping up the three-year agenda this year, the Ankeny, Iowa-based convenience store retailer kicked off the next phase of its strategic journey — one that includes enhancing its operational efficiencies.

“What I want all of you to understand is that we are taking aggressive steps to make our stores more efficient and easier to run. Our goal is not only to lower operating costs, but to improve the guest and team member experience,” Chief Operating Officer Ena Williams said at Casey’s 2023 Investor Day, held June 27. “I see this as a critical part of enabling growth.”

According to Williams, Casey’s store operations have been, historically, too complex — its tools, processes and technologies were not streamlined or very efficient.

The retailer is now working to change that. Notably, leaders in its new centralized Store Support Center “bring a disciplined, data-driven approach to improve operations and hit financial targets,” Williams said. “As a result, we are now measuring almost everything that happens in our stores so that we can understand where we can improve.”

The convenience store chain’s approach to boosting operational efficiencies centers around four strategic steps:

1. Store simplification: removing steps from any process that don’t add value; equipping managers and team members with the right tools and support to make running the stores easier; streamlining communications; and modernizing labor and management.

2. Streamline the kitchen: introducing equipment, technologies and supplies, all intentionally laid out to be at the right places to drive efficiency and cut down the time for preparing and delivering each order.

3. Faster service: rolling out self-checkout and artificial intelligence (AI) solutions like AI-enabled ordering; and improving point-of-sale capabilities.

4. Inventory optimization: simplifying the ordering process; placing the right products in the right places; and establishing store-level inventory management.

These four strategic steps are rooted in two foundational elements: store modernization and a culture of continuous improvement at Casey’s.

While the customer experience is always front of mind, the c-store operator is well aware that customer experience and team member satisfaction go hand in hand. To get to this point, Casey’s began gathering feedback from its stores through surveys and interviews conducted over two years. It also established a store manager advisory board representing various locations across its 2,500-plus-store footprint, according to Williams.

“We asked what their biggest challenges were and how we could help them be more successful. The feedback was clear — managers had too many tasks that took them away from the guest. There were too many steps in each process. They didn’t have the latest tools and technologies. Operations were not designed for efficiency,” she said. “This was the starting point for our strategy. We decided to take the voice of the store seriously.”

The retailer is reimagining its rewards program to increase its share of customer wallets

The convenience store shoppers of today are not who they were yesterday. Over the last several years, the channel has experienced a seismic shift in how shoppers expect a loyalty program to be and how it is delivered to them. What started as card-based programs that evolved to card-and-mobile programs has now evolved into a fully immersive experience across multiple touchpoints.

“Customers across all retail expect loyalty programs to be highly personalized, digitally integrated, accessible across multiple channels, capable of providing instant rewards, and focused on enhancing their overall brand experience. Meeting these evolving expectations is crucial for retailers looking to build and maintain loyal customer relationships in the modern marketplace,” said Darrin Samaha, Yesway’s vice president of marketing. “Those who adapt quickly will ultimately continue to earn their customers’ loyalty.”

Yesway, the Fort Worth, Texas-based operator of 440-plus convenience stores, has always embraced technology, according to Samaha. In doing so, the retailer has had access to more data capture, more learning and more automation underpinning its guest engagement platforms, specifically loyalty.

By levering data analytics centered on criteria such as customers’ buying habits, preferences and demographics, the retailer can offer personalized product recommendations, promotions and communication, strengthening those loyal customer relationships.

“We are moving to an omnichannel experience. It is a buzzword to a certain extent, but it is true. Today’s customers expect a seamless experience across various channels,” Samaha said. “We do our best to ensure that our brand presence is consistent and cohesive across [all] platforms to provide Yesway and Allsup’s customers with a unified and convenient shopping journey.”

To provide its guests with enhanced experiences and a loyalty program that enriches the overall customer experience, Yesway earlier this year tapped solution provider Stuzo to introduce the third iteration of the Yesway Rewards program. The retailer will leverage Stuzo’s Wallet Steering solution to understand the incremental wallet opportunity it has with its customers on both a one-to-one and wallet-by-wallet basis. Yesway will use the new software solution to activate this data in real time in order to increase its share of customer wallets.

“Using Stuzo’s Wallet Steering technology, we will enable an even more robust level of personalization and we hope we will find new wallet share opportunities to help drive more trips from our current members,” Samaha said, adding that Yesway also looked for friction points along its signup process and has removed obstacles.

“We are taking a 360-degree view of our current program and have identified improvements to offer a better customer experience overall,” he explained. “We are shifting from a traditional feature-driven mindset, where we look at what cool or trendy things we can do with our customer segments, and are really flipping the script to understand the opportunities that exist outside of our four walls to drive incremental business outcomes. Those outcomes may be visits, gallons, baskets, or brand affinity overall. It is exciting given this is where the best retailers and lifestyle brands are already operating.”

Convenience stores are the go-to place for U.S. motorists to buy fuel. In fact, according to NACS, the channel sells 80 percent of the gasoline purchased here every year. So, with electric vehicles (EVs) growing in popularity — and government officials taking aim at the sale of gas-powered vehicles — it would make sense for c-store operators to be concerned.

But not bp. The energy giant is putting a focus on EV charging as one of its five strategic transition growth engines, in which it aims to significantly grow investment through this decade. Convenience, bioenergy, renewables and hydrogen are the other four.

According to bp, from 2023 to 2030, roughly half of its cumulative $55 billion to $65 billion transition growth engine investment will go into convenience, bioenergy and EV charging.

“Globally, 550 million people live within 20 minutes of a bp site. We are very well positioned as the world goes through this transition to take advantage of that and provide that service for the guests who would care for it. Across the U.S., we have close to 8,000 sites across different brand platforms — bp, Amoco, Thorntons, and ARCO and ampm on the West Coast. Now, we’ve added TravelCenters of America,” Greg Franks, senior vice president, Mobility & Convenience, Americas at bp, told Convenience Store News

“You look at a network like that, [which] is now on highway [and] off highway, we are very well positioned to invest in things that we believe customers are going to want in the future,” he continued. “Our ability to be in those locations is really interesting and that’s why we’ve announced that by 2030, we intend to put $1 billion into EV charging across the U.S.”

A cornerstone of that investment is bp’s partnership with Hertz to bring fast charging infrastructure to Hertz locations in major cities, including Atlanta; Austin, Texas; Boston; Chicago; Denver; Houston; Miami; New York; Orlando, Fla.; Phoenix; San Francisco; and Washington, D.C.

Several of these fast-charging installations will include gigahub locations. These are large-scale fast charging hubs that will serve rideshare and taxi drivers, car rental customers and the general public at high-demand locations, such as airports. The buildout will be informed by telematics from Hertz’s fleet of connected cars.

Further positioning the company to make sizeable inroads into EV charging is bp’s $1.3 billion acquisition of Westlake, Ohio-based TravelCenters of America (TA) earlier this year.

“TA is going to be very important. We’re very excited to have TA as part of the family. It’s an amazing legacy brand; they have done great work taking care of their guests and their customers and now, they’re well positioned on the highway corridors of the United States,” Franks said.

“Range anxiety is always a thing for an EV consumer, so for us to be able to go along these corridors and be there where the consumer needs to be, and then while they are charging, to be able to offer them the amenities that TA has,” he added. “For professional drivers, you have showers, laundry, business centers, truck scales and fitness facilities. For passenger car vehicles, we’ve got restaurants and convenience, and facilities that they can use. There’s a lot to do at a TA. It’s well positioned, and we believe that it’s very exciting for the future.”

The retailer encourages all eyes to be on its foodservice innovation

At Texas Born (TXB) convenience stores, directing customers’ attention to the brand’s unique, freshmade menu items begins before they ever set foot inside. From the fuel pumps to the building itself, everything serves a purpose.

“We start the messaging outside. You start seeing food at the pump,” said Kevin Smartt, CEO of Spicewood, Texas-based TXB, pointing to the food-centric digital and physical signage that drivers see as they gas up. “You see the outdoor dining facility. When you walk in, you get a very fresh-feeling store. You see a lot of different connotations of food.”