WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

A DEI FACT CHECK

MISCONCEPTIONS ARE KEEPING CONVENIENCE STORE INDUSTRY COMPANIES FROM ADVANCING.

2023 CATEGORY

CAPTAINS CREATE SUCCESSFUL SOLUTIONS

MARCH 2023 CSNEWS.COM

• • •

An Industry for All

Convenience Store News introduces The Convenience Inclusion Initiative

TEN YEARS AGO, Convenience Store News launched its Top Women in Convenience (TWIC) program as a way to spotlight the integral role women play in convenience retailing and celebrate individuals across retailer, distributor and supplier businesses for outstanding contributions to their companies and the industry at large.

The inaugural TWIC class consisted of 30 honorees. Last year, the program celebrated its biggest class yet — more than triple the honorees of that inaugural year — and presented the first-ever Top Women in Convenience Corporate Empowerment Award, recognizing an industry company for its commitment to female leadership and advancement.

Building on the success of the TWIC program, CSNews introduced its Future Leaders in Convenience (FLIC) program in 2018 to celebrate and help develop the next generation of c-store industry leaders (aged 35 or under at the time of nomination). Eight up-andcoming convenience retail professionals were honored that first year. Last year, 33 individuals from convenience channel retailer, distributor and supplier companies were recognized.

Never content to rest on its laurels, CSNews saw the opportunity once again to champion the ongoing evolution of the convenience store industry with the 2021 debut of an initiative to facilitate engagement among all stakeholders in the channel around diversity and inclusion (D&I). Launched after more than a year of nationwide protests and serious discussions about race and injustice in America, the platform is designed to be a catalyst for discussion, innovation, engagement and action.

Since its inception, CSNews has established an advisory

board composed of thought leaders from prominent retailer and supplier companies in the channel; published educational columns and special reports on various D&I topics; presented a number of insightful and informational webinars; conducted research on the state of D&I in the industry; and more.

Now, CSNews is introducing The Convenience Inclusion Initiative to bring together these three industry-leading programs under one umbrella for maximum impact.

A survey we fielded found that more than one-third of industry companies do not have a diversity and inclusion program in place and have no immediate plans to develop one (see this issue’s cover story on page 32). The reasons range from not believing it is a corporate responsibility to get involved in D&I issues, to concerns about alienating customers.

The mission of The Convenience Inclusion Initiative is to champion a modern-day convenience store industry where current and emerging leaders foster an inclusive work culture that celebrates differences, allows team members to bring their whole selves to work, and enables companies to benefit from diversity of thought and background — in short, an industry for all.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

Laura Aufleger OnCue Express Chad Beck

Edward Davidson Ed Davidson & Associates (7-Eleven Inc., retired)

Robert Falciani ExtraMile Convenience Stores

Jim Hachtel Eby-Brown Co.

Chris Hartman Rutter’s

Ray Johnson Speedee Mart

Ruth Ann Lilly GPM Investments LLC

Vito Maurici McLane Co. Inc.

Jonathan Polansky Plaid Pantries Inc.

Greg Scriver Kwik Trip Inc.

Roy Strasburger StrasGlobal

2020 Trade Association Business Publications Intl. Tabbie Awards Honorable Mention, Best Single Issue, September 2019 2016 Trade Association Business Publications Intl. Tabbie Awards Silver, Front Cover Illustration, June 2015 EDITORIAL ADVISORY BOARD EDITORIAL EXCELLENCE AWARDS (2016-2023) 2022 Eddie Award, Folio: magazine Winner, Business to Business, Retail, Single Article, March 2022 Winner, Business to Business, Food & Beverage, Series of Articles, October 2021 Honorable Mention, Business to Business, Retail, Single Article, September 2021 2020 Eddie Award, Folio: magazine Business to Business, Retail, Series of Articles, September 2019 2018 Eddie Award Honorable Mention, Folio: magazine Business to Business, Retail, Website Business to Business, Retail, Full Issue, October 2017 Business to Business, Editorial Use of Data, June 2017 2017 Eddie Award, Folio: magazine Winner, Business to Business, Retail, Single/Series of Articles, May 2017 Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016 2016 Eddie Award Honorable Mention, Folio: magazine Business to Business, Retail, Full Issue, October 2015 Business to Business, Retail, Single/Series of Articles, August 2015 2016 American Society of Business Press Editors, National Azbee Awards Gold, Best How-To Article, March 2015 Bronze, Best Original Research, June 2015 2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015 2021 Jesse H. Neal National Business Journalism Award Finalist, Best Infographics, June 2021 2018 Jesse H. Neal National Business Journalism Award Finalist, Best Editorial Use of Data, June 2017

Core-Mark

EDITOR’S NOTE

MARCH 2023 Convenience Store News 3

The Tipping Point

Is there a place for tipping convenience store foodservice workers?

BEFORE THE PANDEMIC, some restaurants — notably Danny Meyer’s Union Square Hospitality Group — began a trend away from tipping. There were several reasons, but I think the main one was that they didn’t think it was fair for front-of-the-house servers to make tips while the kitchen workers were left out. There was also an aspect of class divisiveness that Meyer found distasteful.

Speaking at the Convenience Store News Foodservice Summit in 2016, Meyer told a group of c-store retailers that he found the U.S. culture of tipping unusual. “There’s no tipping in Asia, and much less in Europe. Tipping came about in the U.S. because we wanted to be more like Europe 150 years ago, when really rich people tipped the help. It was a power thing.”

Can you tip on just the service-oriented part of the ticket?

BTW: Smartt, along with speakers from Casey’s and Kwik Trip, will be featured at this year’s Convenience Foodservice Exchange, being held May 4-5 in Nashville, Tenn.

Restaurants were one of the hardest-hit sectors during the pandemic. Many feared that workers wouldn’t return without the lure of being able to supplement their pay with gratuities. Even Meyer reinstituted tipping, though he vowed to find a way to share the proceeds with his entire staff.

Tipping at convenience stores came to my mind while reading the new Vision Report from the recently formed Convenience Leaders Vision Group (CLVG). The CLVG is a think tank composed of convenience retail icons and trailblazers that conduct quarterly virtual meetings to discuss trends, challenges and disruptions in retail.

The first Vision Report came out late last month. It covered such topics as labor (“Applying the Gig Economy to the Labor Equation”), alternative fuels (“New Thinking on How Electric Vehicles Fit into the Future”), and several other so-called “Not So Little Things,” such as eliminating logistics silos, self-checkout, last mile delivery, artificial intelligence and more.

The section on foodservice tipping caught my eye. “Matching the New Foodservice Model for Tips” put forth the notion that convenience foodservice workers are keenly aware that they can work in foodservice somewhere else and receive tips.

Kevin Smartt, CEO of Texas-based TXB Stores, allows tipping in the serviceoriented segments of his stores. “I’m really shocked at the amount of tips that the employees receive. … I definitely see the benefit in doing it,” he said during a CLVG virtual meeting.

I wonder how Kevin handles tipping on non-foodservice items when a customer’s basket includes both food and non-food items. Can you tip on just the service-oriented part of the ticket?

C-stores face the same dilemma as restaurants when it comes to the fairness issue. Just as Meyer grappled with the problem of kitchen workers being left out of the tipping pool, c-store leaders need to confront the issue of allowing tipping in only the foodservice section of the store. I assume some tip-sharing formula would need to be worked out for the entire store.

For comments, please contact Don Longo, Editorial Director Emeritus, at dlongo@ensembleiq.com.

VIEWPOINT

4 Convenience Store News CSNEWS.com

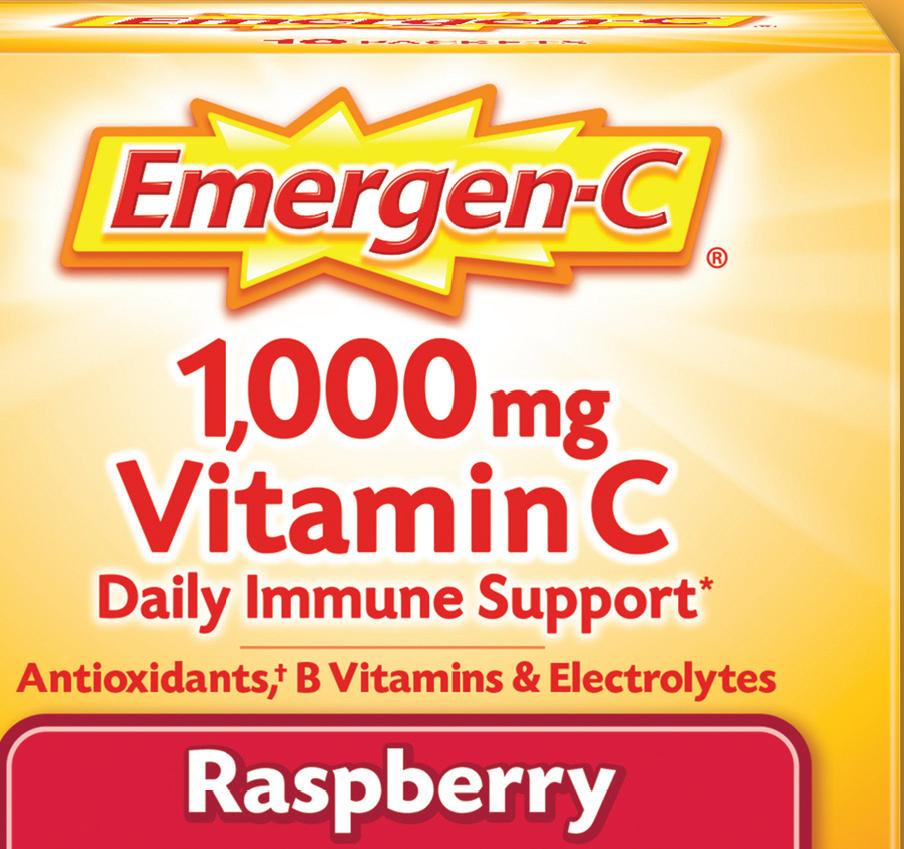

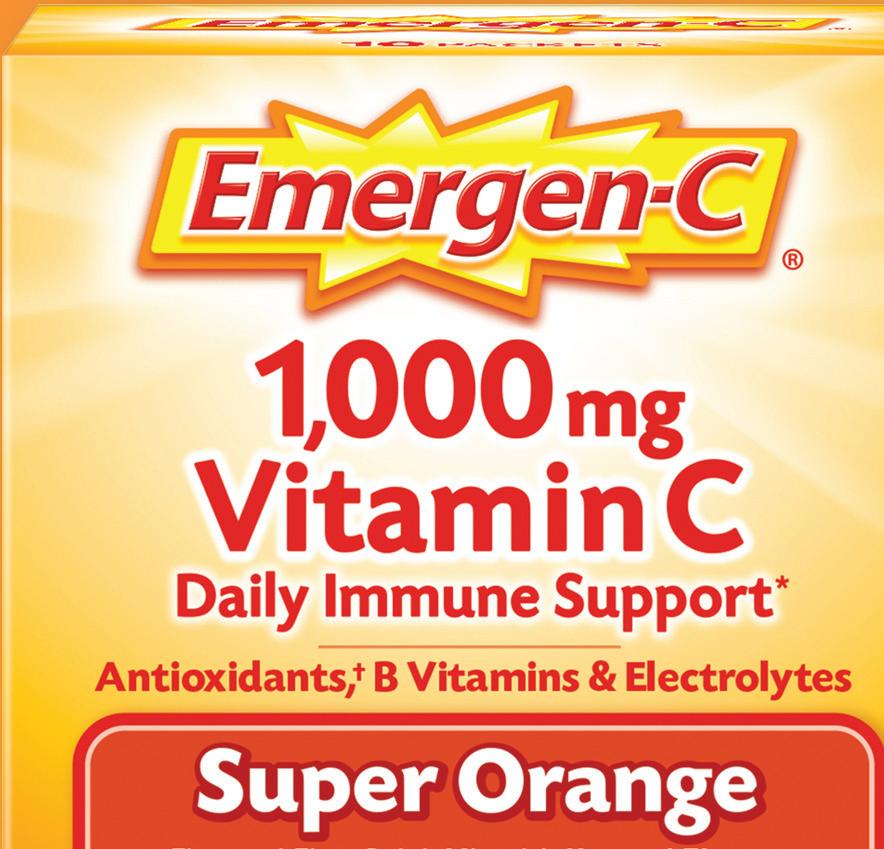

1. IRI Total C-Store: 52wks ending 12/4/2022. Contact your local Emergen-C representative on how to order or email John.L.Hankins@haleon.com ©2023 Haleon group of companies or its licensor. All rights reserved. Read and follow label directions. DID YOU KNOW? Do you carry these Convenience-sized skus? Emergen-C® is the #1 vitamin C/ immune support brand 1

40

This

FEATURES

STORY

A DEI Fact Check

are keeping convenience store industry companies from advancing.

COVER

32

Misconceptions

Turning Obstacles

Opportunities

Into

year’s Category Captains awards honor 15 skillful suppliers and distributors. CONTENTS MARCH 23 VOLUME 59 NUMBER 3 6 Convenience Store News CSNEWS.com E DITOR’S NOTE 3 An Industry for All Convenience Store News introduces The Convenience Inclusion Initiative. DEPARTMENTS VIEWPOINT 4 The Tipping Point Is there a place for tipping convenience store foodservice workers? 10 CSNews Online 22 New Products

OPERATOR

Weighing All the Options Small operators need to take multiple factors into consideration when deciding to go or grow.

THE CONSUMER MIND

The Sprouting of Plant-Based Products Deep-rooted values among Gen Zs and millennials are enabling this category to grow. 22 40 COVER STORY PAGE 32 94

SMALL

26

INSIDE

94

*

INDUSTRY ROUNDUP

14 BP & TravelCenters of America Will Join Forces in $1.3B Deal

16 Fast Facts

18 Eye on Growth

20 Retailer Tidbits

20 Supplier Tidbits

74 Prioritizing the Workforce From scheduling and training to task management and communication, workforce management technology helps retain employees, improve efficiency and satisfy customers.

CATEGORY MANAGEMENT

FOODSERVICE

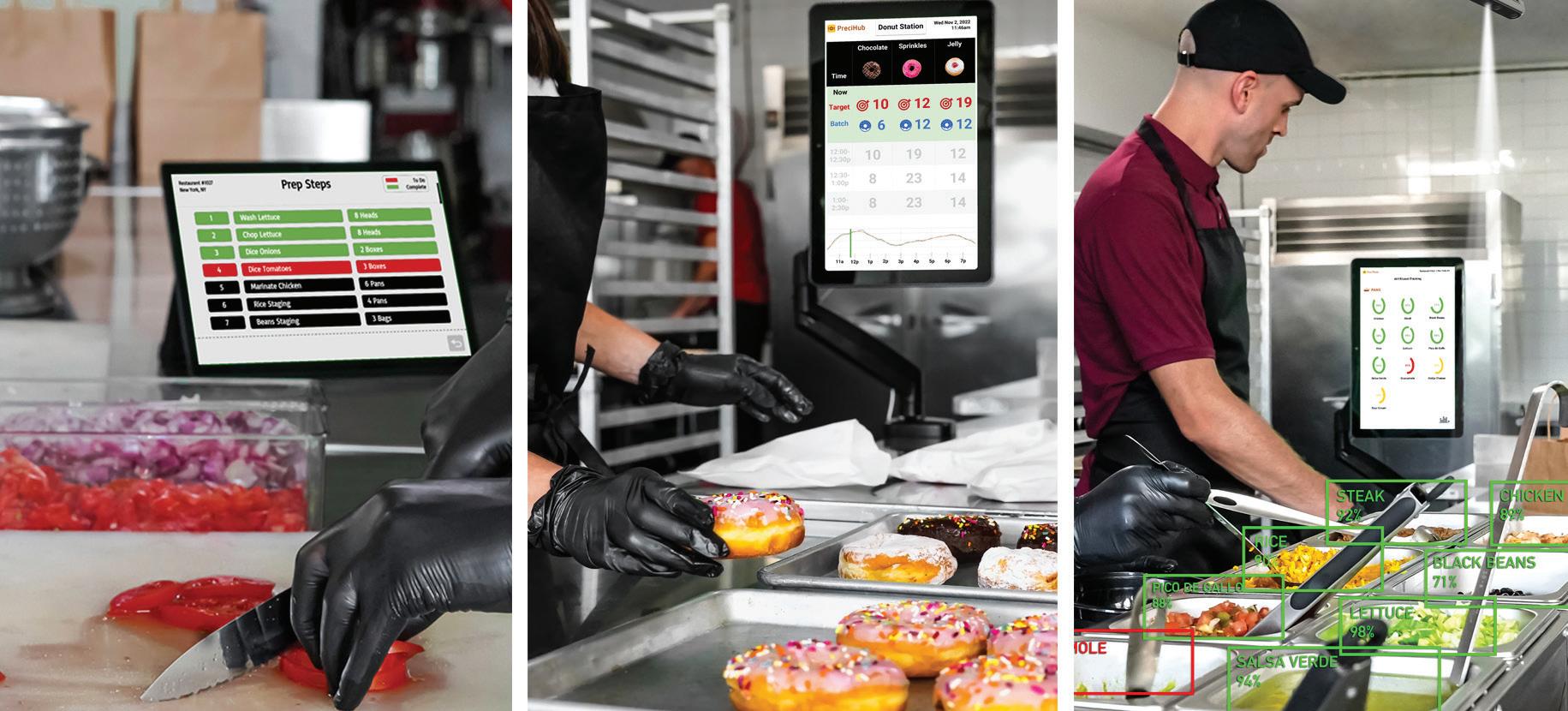

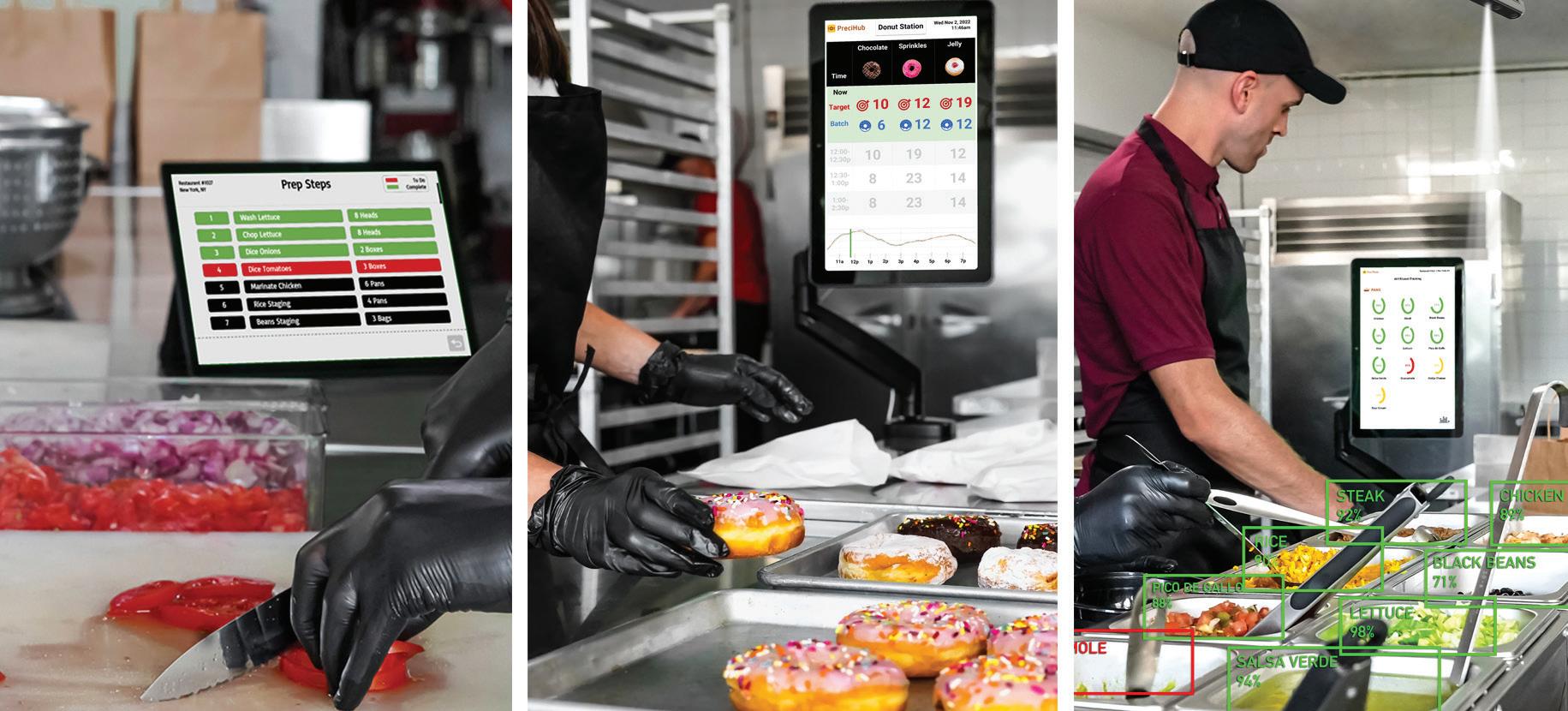

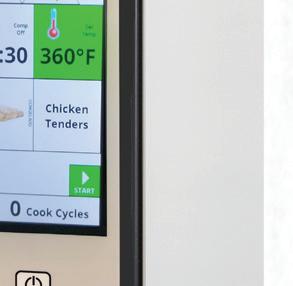

56 Behind the Scenes Innovations in foodservice equipment and technology focus on streamlining the backend.

TOBACCO

62 Pot of Gold? Weighing the viability of cannabis for the convenience channel.

ALCOHOLIC BEVERAGES

66 The Health of Imbibing Wellness trends are shaking up the alcoholic beverages category.

8550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

VICE PRESIDENT & GROUP BRAND DIRECTOR Paula Lashinsky (917) 446-4117 - plashinsky@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

ASSOCIATE EDITOR Amanda Koprowski akoprowski@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR & NORTHEAST SALES MANAGER Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR & WESTERN SALES MANAGER Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

ASSOCIATE PUBLISHER & MIDWEST SALES MANAGER Kelly Fischer - (773) 992-4464 - kfischer@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (201) 855-7615 - tkanganis@ensembleiq.com

CLASSIFIED PRODUCTION MANAGER Mary Beth Medley (856) 809-0050 - marybeth@marybethmedley.com

DESIGN/PRODUCTION/MARKETING

SENIOR CREATIVE DIRECTOR Colette Magliaro cmagliaro@ensembleiq.com

ART DIRECTOR Lauren DiMeo ldimeo@ensembleiq.com

PRODUCTION DIRECTOR Ed Ward edward@ensembleiq.com

MARKETING MANAGER Krista-Alana Travis ktravis@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF PEOPLE OFFICER Ann Jadown

EXECUTIVE VICE PRESIDENT, CONTENT & COMMUNICATIONS Joe Territo

CHIEF OPERATING OFFICER Derek Estey

8 Convenience Store News CSNEWS.com CONTENTS MARCH 23 VOLUME 59 NUMBER 3

TECHNOLOGY

Convenience Store News (ISSN 0194-8733; USPS 515-950) is published 12 times per year, monthly, by EnsembleIQ, 8550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631. Subscription rates: Subscription rate in the United States: $125 one year; $230 two year; $14 single issue copy; Canada and Mexico: $150 one year; $270 two year; $16 single issue copy; Foreign: $170 one year; $325 two year; $16 single issue copy; Digital One year, digital $87; two year, $161. Periodical postage paid at Chicago, IL 60631, and additional mailing addresses. Copyright 2023 by EnsembleIQ. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or information storage and retrieval system, without permission in writing from the publisher. POSTMASTER: send address changes to Convenience Store News, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. The contents of this publication may not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations. CONVENIENCE STORE NEWS AFFILIATIONS Premier Trade Press Exhibitor

14 62

TOP VIEWED STORIES

Investor Renews Call for Seven & i to Spin Off 7-Eleven

ValueAct Capital again called for shareholders to support a spin-off of the convenience store chain. In a letter sent in January, the hedge fund argued that Seven & i Holings Co. could complete a tax-free spin-off through a listing on the Tokyo Stock Exchange in approximately one year.

2

7-Eleven & Circle K Rank Among Top U.S. Franchises

Two of the top c-store chains in the United States appeared on Entrepreneur’s 44th Franchise 500 list, based on factors such as brand strength, size and growth, and financial stability. 7-Eleven Inc. ranked at No. 18, while Circle K, the global convenience store banner of Alimentation Couche-Tard Inc., was No. 88.

Kum & Go Reportedly Exploring All Options, Including a Sale

Kum & Go LC is reportedly exploring all options for its network of more than 400 convenience stores. A refinancing, real estate leasebacks or other forms of recapitalization are said to be on the table. A sale is also possible, according to sources familiar with the matter, who put the value of the c-store chain at close to $2 billion.

Wawa’s Plans for Southeast Growth Take Shape

Pennsylvania-based Wawa Inc. announced the locations of 12 new stores in south Florida, two stores in the Florida Panhandle, and six in southwest Alabama. The move is part of the retailer’s efforts to double its footprint within the next decade.

1 3 4 5

Two C-store Chains Are Among Top 10 Popular Grocers

Convenience store chains 7-Eleven Inc. and Circle K are among the 10 most popular grocers in America, according to a recent poll from market research and data analytics firm YouGov. 7-Eleven received a popularity score of 60 percent, while Circle K received a popularity score of 51 percent.

What Does the Future Hold for Restaurant Technology?

Technology experts at NRF 2023: Retail’s Big Show discussed the need for operators to think about the role technology can play in improving efficiencies, taking friction out of the jobs of frontline workers, and how technology can empower team members. Innovations include the pilot of a cook-to-needs kitchen management system that uses camera technology to measure things such as ingredients on hand and cooking temperatures, with the intent to always have availability of food and the ability to forecast sales. Meanwhile, technology and customer data can allow brands to both customize the guest experience even more and meet the demands of guests who want more control than ever.

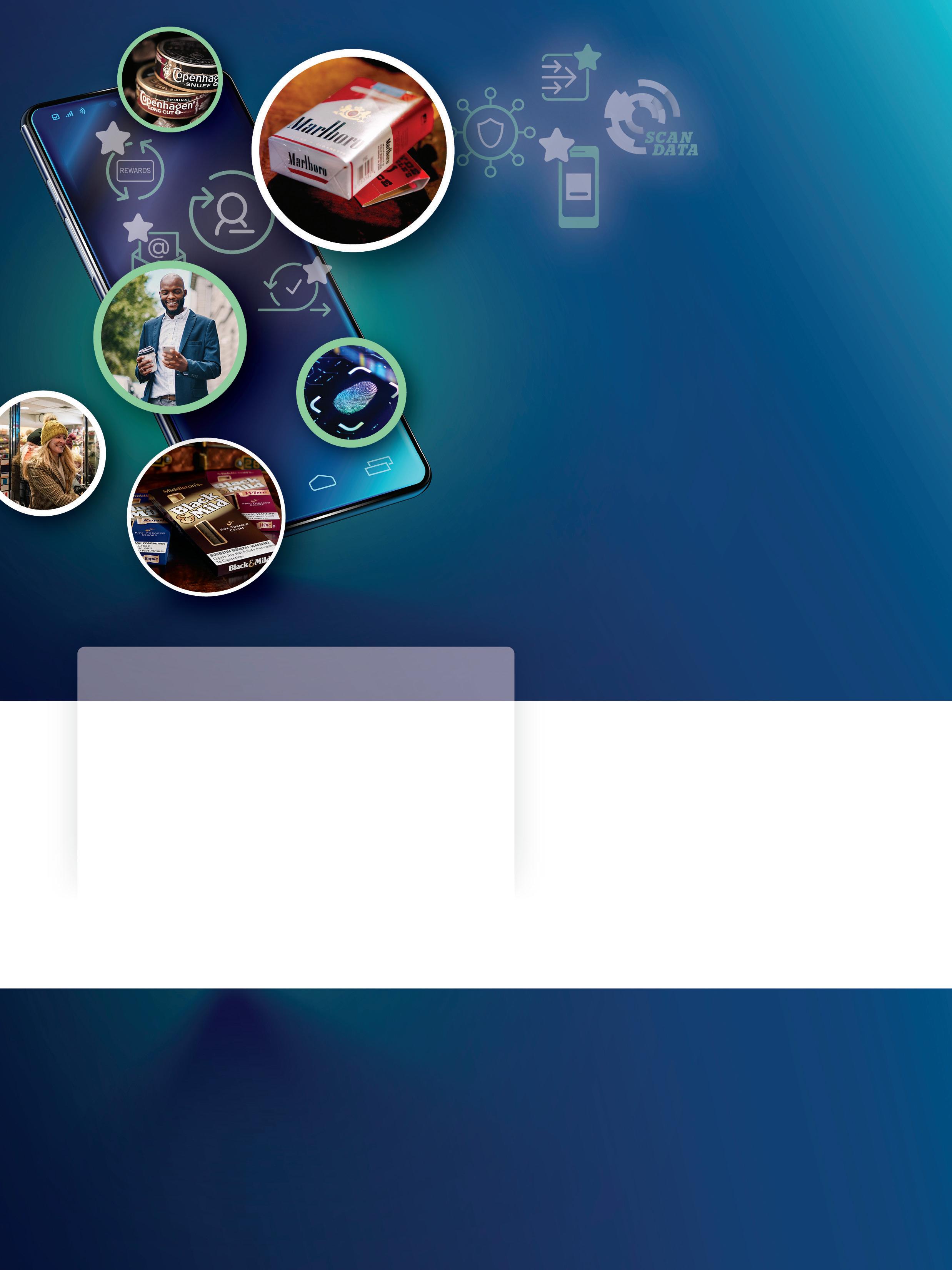

Casey’s Personalizes the Future With Digital Transformation

The retailer tapped Salesforce to consolidate Casey’s customer data in the customer relationship management and customer data platform to serve multiple applications. By unifying this data set, Casey’s can now know more about its customers, what they do in-store, what they do online, and how they respond to messaging. The retailer also has enriched this data with calculated attributes, demographic data and second-party competitive shopping data.

Optimizing this data set, Casey’s can send more relevant content and more personalized texts to customers, yielding higher open rates on messages, higher click-through rates and higher conversion rates. Ultimately, all of this leads to Casey’s Rewards members visiting more often, spending more per transaction and therefore, having a higher lifetime value for the convenience retailer.

For more exclusive stories, visit the Special Features section of csnews.com.

MOST VIEWED NEW PRODUCT

Starry Lemon Lime Soda

PepsiCo is introducing Starry, a soda bursting with lemon lime flavor that delivers a crisp, refreshing bite, to replace its Sierra Mist line. Starry, with the tagline “Starry Hits Different,” launches in both Regular and Zero Sugar versions as a marquee addition to the North America PepsiCo Beverages portfolio. The beverage is caffeine-free and available in a variety of sizes at U.S. retailers and foodservice outlets nationwide. In the coming months, the Starry brand will unveil marketing plans, including a national TV commercial, digital and social content, and large-scale sports, culture and entertainment partnerships.

PepsiCo Inc. Purchase, N.Y. pepsico.com

CSNEWS ONLINE

ONLINE EXCLUSIVE 10 Convenience Store News CSNEWS.com

OUT & ABOUT

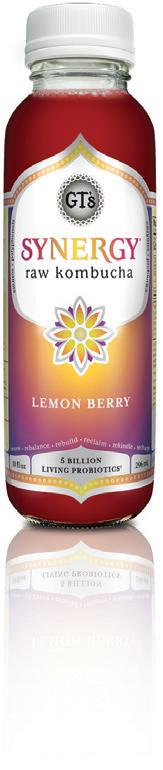

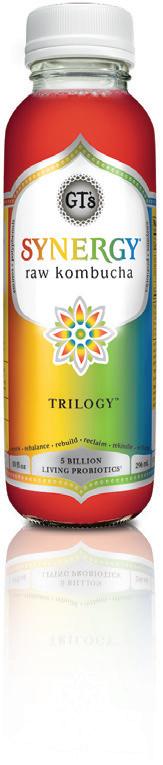

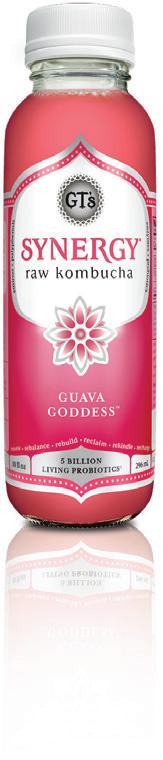

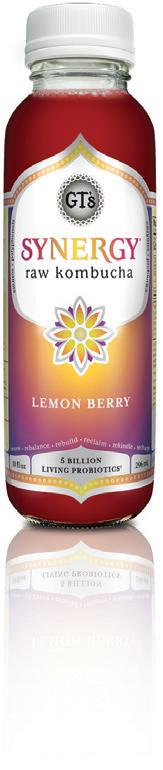

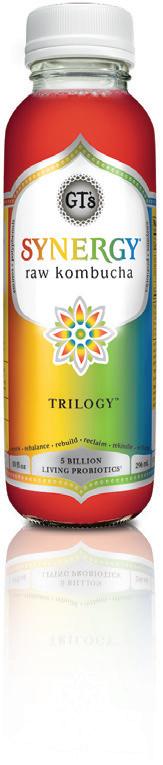

C-Store Exclusive: SYNERGY launches a 10oz bottle

GT Dave founded SYNERGY Raw Kombucha at only 15 years old, back in 1995. Over the last 30 years, GT has become the market leader and SYNERGY has become the most loved, and recognized, Kombucha on the shelves. As any good leader, GT noted the increasing growth in the category and made plans to meet his consumers at their convenience (stores). Celebrating the launch of the new SYNERGY 10oz bottles we sat down with GT to learn all about Kombucha, why C-stores and why now.

Q: For those that don't know, what is Kombucha?

Kombucha is a naturally sparkling, fermented tea that is made with live cultures and contains probiotics, enzymes and natural detoxifiers. Its origin dates back as far as 221 BC and was originally referred to as the "Drink of Immortality" because all those who drank it seemed to live longer and were disease-free.

Q: What are Kombucha's health benefits?

A: To put it simply, Kombucha cleanses the body and restores its nature balance, so the body performs better and strengthens its natural defenses. Therefore, the actual health benefits range from improved digestion and a stronger immune system to healthier skin and a leaner body.

Q: In 1995, SYNERGY was the first bottled Kombucha to be sold in the U.S. How did you get the idea?

A: I discovered Kombucha through my parents who made it and drank it religiously in our home. I was just a teenager at the time, but I clearly remember my parents raving about its health benefits. Honestly, I did not start drinking it myself until I witnessed how it helped my mom with her breast cancer.

Q: Did Kombucha cure her breast cancer?

A: I would never use the word "cure", but the doctors marveled at how it kept my mom's body resilient throughout her experience and potentially suppressed the growth of the tumor.

Q: Wow, that's an impressive testimonial. Is that why you started your business?

A: Absolutely. I was barely 16 years old when I got started, so my ambition came from being inspired by how kombucha helped my mom and how it could help others.

Q: How has SYNERGY grown over the last 2 decades?

A: It's been a wild ride for sure and SYNERGY is far from an "overnight" success. Truthfully, I prefer the slow and steady build which allows for long-term rewards. SYNERGY is the #1 selling Kombucha in the world despite how competitive the beverage space can be.

Q: You launched in natural foods and grocery, why do you have your eyes set on C-stores?

A: I believe that in the last 5 years, there has been a noticeable shift in consumers seeking out healthier options that are convenient with clean ingredients and legit health benefits.

Q: Is that why you launched SYNERGY in 10oz bottles?

A: Exactly. I wanted to recognize the different use-occasion that the 10oz bottle supports. It’s for the consumer who is "on-the-go" and does not want a full-sized bottle to carry around. Plus, it helps attract curious consumers that feel the smaller bottle is more approachable.

Q: What flavors did you choose to produce in the new 10oz bottles?

A: I wanted to make sure we offered a good range of options to make sure we had something for everyone. We intentionally chose our best sellers: Gingerade, Trilogy, Lemon Berry & Guava Goddess.

Q: Where do you see the future of Kombucha category going from here?

A: I'm convinced that Kombucha is on its way to becoming as large as the soda or energy drink category. For this to happen, it’s critical that the consumer does not get tricked by the "fake" or watered-down Kombuchas that have hit the market in recent years. Of course, I'm biased, but pasteurized or made-from-vinegar concentrate Kombucha products have zero health benefits and lack the delicious taste SYNERGY has become known for.

After conquering grocery, SYNERGY founder GT Dave, tells us why he has big plans with a smaller-sized bottle for the convenience channel.

raw kombucha For wholesale inquiries & to learn more about GT's Living Foods, contact sales@drinkgts.com.

ADVERTORIAL

Now available in 10oz bottles. Growing Healthy Prof its with the #1 Kombucha

BP & TravelCenters of America Will Join Forces in $1.3B Deal

IN THE FIRST BLOCKBUSTER move of the year, BP is acquiring TravelCenters of America Inc. (TA) for approximately $1.3 billion. Subject to shareholder and regulatory approval, the parties are targeting closing the acquisition by mid-year 2023.

BP will purchase the outstanding shares of TA common stock for $86 per share in cash. The sale price represents an 84 percent premium to the average trading price of the 30 days ended Feb. 15 of $46.68, according to TA.

“[The Feb. 16] announcement that BP is acquiring TA for $86 per share is a result of the successful implementation of our turnaround and strategic plans,” said TA CEO Jonathan M. Pertchik. “We have improved our core travel center business, expanded our network, launched eTA to prepare for the future of alternative fuels, and improved our operating and financial results, none of which we could have accomplished without the hard work and dedication of our employees at every level.”

TA’s strategically located network of 281 highway sites complements BP’s existing predominantly off-highway convenience and mobility business, which will enable TA and BP to offer fleets a seamless nationwide service, according to BP.

In addition, BP’s global scale and reach will, over time, bring advantages in fuel and biofuel supply, as well as convenience offers for consumers. It will provide options to expand and develop new mobility offerings, including electric vehicle (EV) charging, biofuels, renewable natural gas (RNG) and later, hydrogen for both passenger vehicles and fleets.

Convenience is one of BP’s five strategic transition growth engines through which it aims to significantly grow investment through this decade. By 2030, the company aims for around half of its annual investment to go into these transition growth engines. From 2023 to 2030, BP aims for around half of its cumulative $55 billion to $65 billion transition growth engine investment to go into convenience, bioenergy and EV charging.

“This is BP’s strategy in action. We are doing exactly what we said we would, leaning into our transition growth engines. This deal will grow our convenience and mobility footprint across the U.S. and grow earnings with attractive returns,” said BP CEO Bernard Looney. “Over time, it will allow us to advance four of our five strategic transition growth engines. By enabling growth in EV charging, biofuels and RNG, and later hydrogen, we can help our customers decarbonize their fleets. It’s a compelling combination.”

INDUSTRY ROUNDUP 14 Convenience Store News CSNEWS.com

TA’s highway locations will complement BP’s off-highway convenience and mobility business

FAST FACTS 71% 1/3 2%

Approximately 71 percent of consumers snack at least twice a day.

— State of Snacking, Mondelez International

More than one-third of consumers say it is “very” or “extremely” important to have plant-based milk options when purchasing hot or cold coffee beverages, smoothies and hot chocolate.

— Datassential

Beer/flavored malt beverage sales growth in c-stores was up a modest 2 percent in Q4 2022, and retailers expect continued modest category growth of roughly 3 percent in 2023.

— Beverage Bytes, Goldman Sachs

16 Convenience Store News CSNEWS.com Products FORECOURT AMENITIES 816-813-3337 www.forteproducts.com GAS STATIONS, C-STORES, TRUCK STOPS SPILL KIT STATION CONTOUR All-in-One Waste/Windshield INDUSTRY ROUNDUP

AVOID FINES. SAVE LIVES. FOLLOW THE LAW.

IT’S NOW ILLEGAL IN CALIFORNIA TO SELL MOST FLAVORED TOBACCO PRODUCTS, INCLUDING VAPES AND MENTHOL CIGARETTES. FOLLOW THE LAW TO PROTECT KIDS FROM A LIFETIME OF DEADLY ADDICTION.

MAKE SURE YOU’RE FOLLOWING THE LAW AT NOFLAVORS.ORG

© 2023 California Department of Public Health

INDUSTRY ROUNDUP

Eye on Growth

BW Gas & Convenience Holdings LLC dba Yesway raised $190 million in new equity to continue its new store construction program. The funds will support Yesway’s plans to build 28 new convenience stores in 2023.

Maverik — Adventure’s First Stop opened its 400th convenience store. Located at 2435 S 8000 W in Magna, Utah, the 5,000-square-foot Maverik store marks the retailer’s 175th location in Utah.

EZ Mart operator Blarney Castle Oil Co. acquired the assets of Michigan-based Alpena Oil Co. The transaction included six Louie’s Fresh Market full-service grocery stores and 14 traditional c-stores, plus a cardlock location.

is extending the reach of its Kwik Star banner with plans to open the first three South Dakota Kwik Star stores in the Sioux Falls area. Two locations are planned for southeast Sioux Falls and one

Colonial Oil Industries Inc. acquired Strickland Oil Co. The 47-year-old company services the Savannah, Ga., area, delivering commercial fuel and lubricants as well as operating a cardlock location in Pooler, Ga.

The company completed the construction of 17 new stores and 21 raze-and-rebuild projects in 2022.

Retailer Tidbits

Tri Star Energy kicked off a three-year initiative to rebrand its Sudden Service and Southern Traders stores to the Twice Daily banner. The conversions started in middle Tennessee and will move into Alabama.

TravelCenters of America Inc. is joining with Electrify America to offer electric vehicle charging at select TA and Petro locations. The goal is to install approximately 1,000 individual chargers at 200 locations over the next five years.

7-Eleven Inc. partnered with food technology startup company Serve Robotics, which is backed by Uber, to pilot delivery by a self-driving robot. Orders for robot deliveries can only be made through the convenience retailer’s 7NOW delivery app.

Supplier Tidbits

Tyson Foods Inc. is adding about 400 new positions as a result of a $180 million expansion that is currently underway at its Caseyville, Ill., prepared food facility. The expansion is expected to be completed in late 2024.

JTM Foods LLC dba JJ’s Bakery is expanding the company’s sweet snacks line with the acquisition of Cookies-n-Milk. The product line includes ready-to-eat edible cookie dough and bake-and-sell cookie dough, as well as cookies, brownies, blondies and doughnuts.

The Food and Drug Administration issued marketing denial orders (MDOs) for R.J. Reynolds Vapor Co.’s Vuse Vibe Tank Menthol 3.0 percent and Vuse Ciro Cartridge Menthol 1.5 percent. The manufacturer plans to challenge the MDOs.

C-StoreMaster opened a 130,000-squarefoot automated warehouse in Huntsville, Ala. The convenience store products

Weigel’s tapped retail solutions provider GSP to deliver point-of-purchase marketing for its 73 locations in East Tennessee. GSP will provide specific kits that reduce wasted print materials, shipping costs and fuel needed in the fulfillment process.

Kwik Stop selected Watchfire to supply digital signs at 27 of its locations in Nebraska and Colorado. To date, 23 locations have placed double-faced, outdoor digital signs, with the remaining sites to be completed by summer.

Coen Markets Inc., in partnership with Grabango, launched checkout-free shopping at two Amoco Coen Markets in Pennsylvania. Customers grab what they need and are billed through the app.

VP Racing Fuels Inc. launched a new identity for the corporation, its products and programs. Over the past decade, the company has been entering into new areas of business and new product categories.

distributor partnered with Geek+ to incorporate three automation technologies in the new warehouse.

Kellogg’s Cheez-It brand inked its firstever name, image and likeness (NIL) deals with four college football athletes. The NIL contracts preceded the Cheez-It Bowl and Cheez-It Citrus Bowl held in January.

Lula Delivery, an e-commerce platform for c-stores that do not have a secondary sales channel, changed its name to Lula Convenience. A new logo and website domain were introduced to coincide with the change.

Relationshop, a digital engagement platform for retail chains, acquired Stor.ai, an e-commerce solution for regional grocers. The purchase will create a unified i-commerce platform, combining operations with data analytics and omnichannel engagement capabilities.

20 Convenience Store News CSNEWS.com INDUSTRY ROUNDUP

Tri Star Energy acquired the Sudden Service brand in 2020 and the Southern Traders banner in 2021. The facility will add seven production lines and 270,000 square feet to increase automated warehousing and robotics.

CELEBRATING ONE BILLION IN RETAIL REVENUE Stock your shelves with proven moneymakers. ZYN is the first and only nicotine pouch to break one billion in retail sales. Increase your bottom line with America’s #1 nicotine pouch. FOR TRADE PURPOSES ONLY. | Source: IRI Total US Multi-Outlet, YTD Ending 11-06-22. | ©2023 Swedish Match North America LLC Call 800-367-3677 or contact your Swedish Match Rep to learn more.

Pepsi Zero Sugar

PepsiCo relaunched Pepsi Zero Sugar with an upgraded recipe that uses a new sweetener system to land a more refreshing and bold taste profile than the previous version. Consumer preference testing found the new Pepsi Zero Sugar outpaced the old formula across the board, including on key metrics such as overall liking and purchase intent. The company coordinated several promotional initiatives in conjunction with the relaunch, including giving away free Pepsi Zero Sugar products throughout the NFL Playoffs and Super Bowl.

PEPSICO BEVERAGES NORTH AMERICA • PURCHASE, N.Y. • PEPSICO.COM

Snickers Hi Protein Bar

The Snickers Hi Protein Bar features the same chocolate, caramel and peanut ingredients Snickers is known for, but with the addition of 20 grams of protein. The new performance nutrition bar from Mars Wrigley is aimed at both athletes and exercise beginners who want the benefit of high protein without sacrificing taste, according to the company. The Snickers Hi Protein Bar is currently available at select retailers, with the 2.01-ounce single-size bar set to launch nationwide later this year.

MARS WRIGLEY • NEWARK, N.J. • MARS.COM

Labatt Blue Light Nonalcoholic Strawberry Acai Beer

As the selection of nonalcoholic products expands, Labatt Blue Light brings one of the first fruit-forward offerings to the segment. Labatt Blue Light Non-Alc Strawberry Acai is a nonalcoholic beer that presents notes of strawberry and acai, and contains less than 0.5 percent ABV. Plus, with only 75 calories, it can appeal to the weight conscious, the company noted. The beverage is available year-round in six-packs of 12-ounce cans. Currently for sale in New York and Michigan, a rollout to Pennsylvania, Ohio and Vermont is expected later in 2023.

LABATT USA • BUFFALO, N.Y. • LABATTUSA.COM

Café Delight Line

Sugar Foods introduces its Café Delight line for convenience stores. Products include Flavored Non-Dairy Creamer Sticks, which take up less space, ensure in-stock availability and reduce labor; Flavor Sticks, which allow customers to choose their own DIY flavor, eliminating the need to brew multiple specialtyflavored coffees; Concentrated Cocoa and Cappuccino Blends, which have half the calories and sugar as traditional blends, along with 50 percent more servings per package; and Sweetened Sugar Crystals and Creamier Creamer, which include more servings per container, thus reducing packaging, storage and restockings.

SUGAR FOODS CORP. • WESTLAKE VILLAGE, CALIF. • NJOYCARES.COM

Alto-Shaam Prodigi Combination Oven

Alto-Shaam debuted its latest innovation in the combination oven category, Prodigi, at the recent NAFEM Show. Combining multiple cooking functions in a single appliance, Prodigi enables operators to bake, steam, fry, smoke and more. Prodigi ovens feature advanced controls, are designed to be simple to use — requiring little or no operator training — and can be managed remotely through Alto-Shaam’s ChefLinc cloud-based remote oven management system. With a boilerless design, Prodigi ovens result in 80 percent less water usage and no maintenance, according to the company.

ALTO-SHAAM • ORLANDO, FLA. • ALTO-SHAAM.COM/EN

NEW PRODUCTS

22 Convenience Store News CSNEWS.com

Contact your local Advantage Rep on how to order or email Ed Baker at ed.d.baker@haleon.com ©2023 Haleon group of companies or its licensor. All rights reserved. Read and follow label directions. * Latest 52 Week Pd Ending 1/29/23 Total MULO. Did You Know? TUMS market shareis nearly 20 x bigger than Rolaids* TUMS Chewy Bites sales alone are Innovation is driving our growth! than all of Rolaids*! 4x larger Available in Convenient Rolls & Packs • Chewy Bites Assorted Berries - 8ct Bottle • Ultra Strength Assorted Berries - 12ct Roll • Ultra Strength Peppermint - 12ct Roll • Smoothies Assorted Fruit Extra Strength - 12ct Bottle • Chewy Delights Very Cherry Ultra Strength - 6ct Stick • Extra Strength Assorted Berries - 8ct Roll • Extra Strength Assorted Fruit - 8ct Roll

CandyRific Jurassic World-Themed Fanimation Fan

CandyRific relaunched its Fanimation Fans in the third quarter of 2022 and will continue rolling out the line through 2023. Because of integrated circuit chip shortages over the past several months, CandyRific saw challenges to the entire platform. With the supply coming back, the company is reintroducing its Fanimation Fans, beginning with a new Jurassic World-themed offering inspired by Universal Pictures’ “Jurassic World Dominion.” Each Fanimation Fan comes with candy in the wand.

CANDYRIFIC • LOUISVILLE, KY. • CANDYRIFIC.COM

BIC Ecolutions Lighters

The BIC Ecolutions Lighter is designed to be more eco-friendly while providing the same quality, safety and number of lights as the current BIC Maxi Lighter. BIC Ecolutions Lighters are made with 55 percent recycled metal and have a 30 percent carbon offset by investments in climate projects. Like all BIC pocket lighters, the Ecolutions lighters are made in factories that utilize a mix of renewable energy sources. BIC Ecolutions Lighters are long-lasting, reliable and 100 percent quality inspected.

BIC USA INC. • SHELTON, CONN. • US.BIC.COM

Goya Fontenova Sparkling Spring Water

Goya is bringing refreshing flavors and delicate bubbles to the cold vault with Goya Fontenova Sparkling Spring Water. The new beverage offering has no calories, no caffeine, no carbs, no sodium, no gluten, and no sugars or sweeteners. Goya Fontenova Sparkling Spring Water is available in 12-ounce cans. The sleek cans, featuring a premium design, are convenient for on-the-go consumption as well as social get-togethers, the company noted.

GOYA FOODS INC. • JERSEY CITY, N.J. • TRADE.GOYA.COM

Mantis BBQ Dust & Ghostly Glaze

Mantis BBQ adds two immersive new flavors, Mantis BBQ Dust and Mantis BBQ Ghostly Glaze, to its cause-driven lineup. Mantis BBQ Dust (4 ounces) carries the unmistakable Mantis BBQ flavor in a powdered form. Mantis BBQ Ghostly Glaze (14 ounces) is a versatile, thick reduction glaze that packs a little sweet and finishes with some heat. The new flavors complement its initial collection of Mantis Original, A Whisper of Chile (pepper) and A Haunt of Ghost (pepper). Ten percent of all Mantis BBQ sales go to The Kidney Project.

MANTIS BBQ • SCARSDALE, N.Y. • MANTISBBQ.COM

FS Petroverse

Fiscal Systems Inc., a provider of point-of-sale (POS) integrated systems, introduces FS Petroverse, a universal business solution that manages the entire retail, foodservice and forecourt-fleet business within one POS platform. The new solution offers a set of capabilities that cover all advanced retail processes, from front-end transactions to backend reporting. The platform was developed with the singular goal of unifying all of the various and disparate processes across the retail enterprise.

FISCAL SYSTEMS INC.

• HUNTSVILLE, ALA. • FIS-CAL.COM

NEW PRODUCTS 24 Convenience Store News CSNEWS.com

Weighing All the Options

Small operators need to take multiple factors into consideration when deciding to go or grow

By Melissa Kress

IN THE EARLY 1980S, English punk rock band The Clash famously asked, “Should I stay or should I go?” Lately, many independents and operators of small convenience store chains are asking themselves the same thing. Although the real question may be: Should I grow or should I go?

Looking back on 2022, merger and acquisition (M&A) activity in the convenience channel didn’t drum up as much excitement as in previous years — think headline-grabbing, billion-dollar deals.

That being said, M&A activity did not come to a halt in 2022; it just shifted to midsized and smaller operators. For example, Lawrenceville, Ga.-based Majors Management closed out the year with a flurry of deals, including the acquisition of 13 Maritime Farms stores from Rockland, Maine-based Maritime Energy, as well as the purchase of 10 Chevron-branded

convenience stores, among other assets, from Morgan Oil Co. Inc.

In addition, Brunswick, Maine-based Rusty Lantern Markets picked up the Mallard Mart chain, adding four c-stores to its footprint in Maine when the Mallard Mart owners decided to retire. And moving west, the owners of Dino Stop Convenience Stores in the Green Bay, Wis., area exited the industry through a deal with 7E CO Holdings LLC, a Denver-based chain of 60 convenience stores with locations in Texas, Minnesota and Wisconsin.

More For-Sale Signs Expected

Can we expect the trend toward selling to continue? Absolutely, industry M&A experts say.

“Although operators are now enjoying sustained motor fuel margins at record levels, giving them perhaps less impetus to sell, the cycle can change quickly and without warning,” noted Ken Shriber, managing director and CEO of Petroleum Equity Group (PEG).

PEG has managed seven such transactions in the past 15 months, from single sites to larger double-digit store portfolios. According to Shriber, motor fuel distributors and operators of all sizes — whether they have 30

SMALL OPERATOR

26 Convenience Store News CSNEWS.com

THE BOLD CHOICE

Big taste and big savings are two things you get with Wildhorse cigarettes. Our American blend tobacco comes from the finest crops. Enjoy a bold, rich taste and smooth smoking experience. Are you ready to EXPERIENCE THE FREEDOM?

GOPREMIER.COM

sites or 300-plus sites — are looking to acquire more, “notwithstanding the increase in the cost of capital, so we have the buyers vetted for any size transaction,” he said. “We are seeing multiples paid on deals holding at historically high levels. So, the time is now for small operators to consider a sale.”

Buyer enthusiasm and corresponding deal values are still strong, especially for quality facilities with modern offerings and sufficient real estate, echoed Mark Radosevich, president of PetroActive Real Estate Services LLC.

The retail petroleum space has been constantly evolving from the early 2000s when the oil companies exited and sold their facilities to independent marketers, he explained. Over the years, these marketers have been forced to improve their operational standards or divest sites to independent dealers, while holding branded or unbranded fuel supply agreements.

“This was prompted by entry into numerous geographic areas by quality, highly successful independent store operators — for example, Wawa in Florida or QuikTrip in Atlanta and northern South Carolina — with large and modern facilities,” Radosevich said, adding that market entry by larger players has rendered many of the former oil company sites with small stores on small sites obsolete. “Thus, store operators have been forced to adapt or die.”

The factors at play in an operator’s decision to sell are different for everyone, with Shriber pointing to business structure, geography, competition and asset stack as considerations.

“If an owner already has a very profitable portfolio of stores and a wholesale business, and they can fund additional acquisitions, rebuilds and build large format ground-up big box c-stores with large forecourts and foodservice, they may be advised to remain,” he said. “If, on the flip side, they do not have the significant capital and expertise needed to develop big-box sites with a thriving foodservice business, they are well-advised to sell and monetize what they have, given the record prices being paid. When competition builds their bigger, modern sites nearby and impacts the local operator, it will be too late to achieve that outcome.”

The M&A Outlook for 2023

Considering the higher cost of capital, lower availability of capital, fear of a recession in 2023 and a tight labor market still negatively impacting the inflation outlook, it’s hard to predict how 2023 is going to shake out in terms of M&A — especially until the Federal Reserve settles on an initial terminal federal funds interest rate. Once the Fed pauses on raising short-term rates (which have gone up approximately 4.5 points in the past 12 months), the capital markets should start to settle down, predicts John Sartory, managing director of Petroleum Capital & Real Estate LLC.

“I think the M&A market is going to stay somewhat muted given the Fed’s ongoing monetary actions to raise interest rates and withdraw liquidity from the marketplace,” he said. “In our industry, there is still a desire for companies to acquire and grow, but I do think it is going to be somewhat muted until we get better clarity as to where we are really going with the economy and what’s the cost of capital going to be.”

Another factor Sartory sees impacting the M&A marketplace is that the Federal Trade Commission (FTC) has taken a more aggressive stance in scrutinizing mergers and acquisitions in the convenience store industry and is taking more time to complete its review process.

“Some people were surprised at the level of scrutiny the FTC is giving to what are fairly small acquisitions, less than 50 sites,” he said, citing GPM Investments LLC’s deal for Express Stop stores

28 Convenience Store News CSNEWS.com SMALL OPERATOR

“We are seeing multiples paid on deals holding at historically high levels. So, the time is now for small operators to consider a sale.”

— Ken Shriber, Petroleum Equity Group

in Michigan in mid-2022 and Global Partners LP’s acquisition of Wheels stores from Consumers Petroleum of Connecticut Inc. earlier in the year.

Still, even with the factors at play in the macro environment, Sartory expects continued strong demand for quality assets in the industry. At the same time, the forces that started big consolidation in the convenience channel — notably, the maturing of the industry and generational issues — will persist. Small operators will be faced with several headwinds, including the increased focus on technology as consumers demand new levels of tech to speed up transactions and enable ordering when they want, how they want.

“Technology like self-checkout is great, but it costs money; it’s not cheap,” Sartory said. “You hope to offset labor costs, but initially you have to have the capital. For a small operator, can you compete with Sheetz, Wawa, 7-Eleven or QuikTrip with all the innovations they are bringing to their stores? I’m not saying you can’t compete, but it’s tougher and you have to have access to capital.”

The ability to raise the capital needed to acquire sites and keep them up to date with the more innovative marketers is probably small operators’ biggest challenge, he continued.

If Exiting Is the Plan…

“I do think you will see smaller players having the opportunity to sell because some of the bigger players with access to capital are looking for nice, smaller fill-in acquisitions — as long as it is small enough not to garner too much FTC scrutiny, or where the assets are attractive in a new market that they planned to enter,” Sartory explained.

However, sellers of sites that are in second-tier or third-tier markets and need improvements will have to be more flexible to get deals done — on terms and pricing. “They are not going to get the price and sale terms they would have gotten a year ago,” he remarked.

Prudent sellers that do not necessarily need to sell right now, and want top dollar, may choose to “hold their powder for this year and see how it rides out. If we end up with a soft landing, history has shown the capital markets will recalibrate,” Sartory pointed out.

Radosevich also noted that interest rates will negatively affect lease cap rates and reduce the value of credit-tenant leases held by investors. “If a small operator is growth-oriented, the key is to keep one’s powder dry, as I believe that the level of available stores will increase in the event that some of the big guys exit,” he said.

“Values will drop, helping to mitigate the rise in interest rates. Lenders will require sufficient amounts of equity to commit loans, and those that are ready to pull the trigger have a better chance of acquisition success,” Radosevich added.

If the plan is to exit, though, now may be best time to do so before interest rates dampen the stable of buyers and deal values drop back down to traditional levels, he cautioned. CSN

SMALL OPERATOR 30 Convenience Store News CSNEWS.com

“If a small operator is growth-oriented, the key is to keep one’s powder dry, as I believe that the level of available stores will increase in the event that some of the big guys exit.”

— Mark Radosevich, PetroActive Real Estate Services LLC

32 Convenience Store News CSNEWS.com COVER STORY

MORE THAN ONE-THIRD of convenience store industry companies do not have a diversity and inclusion (D&I) program in place and have no immediate plans to develop one, according to a survey fielded by Convenience Store News among convenience channel retailers and the distributors and suppliers that serve and partner with c-store retailers.

The reasons range from not believing it is a corporate responsibility to get involved in D&I issues, to concerns about alienating customers, to seeing D&I as only a big company initiative.

Industry players who are leading the charge for change say these are all misconceptions, and sadly they are keeping c-store industry companies from evolving, advancing and realizing the many business benefits that can come from embracing diversity, equity and inclusion (DEI).

Derek Gaskins, chief marketing officer for Fort Worth, Texas-based convenience store chain Yesway, sees a similarity between the transformation companies had to undergo over the past three years due to the COVID-19 pandemic and the transformation he believes companies should be undertaking right now around DEI.

“One thing COVID taught us is that people had to bring their whole selves and be healthy and balanced to bring their best out in a professional setting. Diversity is much the same way. If you have people on your team who are wearing masks, so to speak, and not a mask to protect you from COVID, but a mask that is masking who they are or what they believe; [if they] are uncomfortable speaking up or sharing their thoughts, that is a toxic culture long-term,” he warned.

“Whereas, if you can encourage people to have that open, honest and candid type of culture — where feedback can be given, opinions can be stated and even if you disagree, you have the opportunity to make your voice heard — that is the essence of what diversity and inclusion really are,” he continued. “And if you have that kind of inclusive atmosphere, you’re going to see the value right on your bottom line in terms of better margins and better sales.”

MISCONCEPTION 1:

It is not a corporate responsibility to get involved in D&I issues. D&I leaders in the c-store industry maintain that the onus is really on everyone working in the channel today to recognize that diversity, equity and inclusion are issues in the workplace, and contribute to a culture where everyone feels represented and respected.

The notion that this is not a corporate responsibility is “shortsighted,” according to Steven Kramer, CEO of WorkJam, a Montreal-based company that helps businesses with frontline workers deliver a superior employee experience. “Respect and Inclusivity” is one of WorkJam’s core values and has been since the company’s founding eight years ago.

“I think there’s this fear that is unfounded, and there’s a misunderstanding of what could be done,” Kramer said. “I think organizations need to listen to their employees and understand if there is a perceived issue or a perceived want, and then work a strategy around that.”

MARCH 2023 Convenience Store News 33

People are the lever to achieve better business results, he added, noting that there is a persistent misconception that you can’t achieve higher revenues and better profitability while also investing in people. The way Kramer sees it, however, taking care of the needs of employees only strengthens a company. “And if you look at it through that lens, DEI is an aspect of [investing in] people as the lever to achieve better results,” he said.

Employees have more power today than they’ve ever had given the ongoing labor shortage.

Employers need to understand that employees are looking for a career that supports their personal goals and overall quality of life, and businesses should consider ways to make their employees feel valued, listened to and supported, said Carlton Austin, director of convenience retail strategy and commercialization for The Coca-Cola Co., based in Atlanta.

“For Coca-Cola, creating a culture of respect starts with building diversity, equity and inclusion into our values and our growth strategy,” he explained. “We believe that a diverse, equitable and inclusive workplace makes us stronger as a company, enables us to create a better shared future for employees and communities, empowers access to equal opportunity, and builds belonging in our workplaces and in society.”

At convenience store chain Casey’s General Stores Inc., which is in its first year of a formal DEI journey, Director of Learning & Development Matthew W. Stephenson told CSNews that its DEI

program is just one of many ways the Ankeny, Iowa-based operator of more than 2,400 c-stores in 16 states engages team members through its Casey’s C.A.R.E.S. values: Commitment, Authenticity, Respect, Evolving and Service.

“Casey’s understands that high team-member engagement leads to higher retention, and companies failing to recognize the importance of diversity and inclusion in today’s modern workforce risk losing opportunities that attract and retain talented team members who bring unique ideas and perspectives to the table — helping to solve today’s complex business problems,” he said. “Casey’s believes there is a business case to be made for establishing DEI efforts.”

COVER STORY 34 Convenience Store News CSNEWS.com

High team-member engagement leads to higher retention.

Circle K embraces diversity and inclusion.

Embracing diversity and inclusion not only impacts employees positively, but also customers. It is an important tactic to provide the best experience to customers, team members and the community, according to Colette Matthews, vice president of customer experience, global marketing, at Alimentation Couche-Tard Inc. (ACT)/Circle K. Laval, Quebec-based ACT operates in 24 countries and territories with more than 14,300 stores and approximately 122,000 people are employed throughout its network.

“A company must ask: ‘Are my policies, communications, service model, store layout, outreach and benefits best meeting the needs of everyone?’ This includes the needs of the disabled, women, underrepresented minorities, LGBTQ+, parents, caretakers and people from 20 to 70,” Matthews advised. “Understanding the differences between customer and employee demands, motivations and goals and actively addressing them has the potential to result in fanatical customer support and devoted team support.”

Yesway’s Gaskins acknowledges that there’s a lot of fatigue with this issue, which he understands but also said “is truthfully something that is hard for me to digest and hard to process.”

He challenges those leaders who believe it is not a corporate responsibility to get involved in D&I issues to be more candid with themselves, with their companies and with their team members.

“Recognize that this is an issue and it is something we need to do our collective part to try to fix. … If you surround yourself with people who are different, it will make you have better-quality feedback and that will, [in turn], make you a better leader,” Gaskins said. “We have to push the issue. This dialogue has to be addressed. It is something, I know, I am going to continue to work at to make sure I’m doing my part to champion it and drive meaningful and real change.”

MISCONCEPTION 2: My company isn’t large enough to have a D&I program.

A company’s size is irrelevant. Any organization can implement DEI and integrate it as part of their business, said Kent Montgomery, senior vice president of industry relations and multicultural development for PepsiCo Inc., based in Purchase, N.Y. While larger organizations certainly have more resources to drive change faster and can implement large-scale programs as part of their efforts, smaller organizations can still impact change.

“Any size company can create its own multicultural and equity practices to drive change within and externally in its communities. The key is that DEI is not treated as an extracurricular activity, but integral to achieving goals,” Montgomery advised.

Casey’s Stephenson agrees. DEI can be performed at all organizations, regardless of size, by understanding unconscious bias, pay equity and organizational values, he said. The programs conducted at larger companies can provide the same benefits at scale for smaller companies.

Danielle Holloway, senior director of industry engagement for Richmond, Va.-based Altria Group Distribution Co., pointed out that within the Altria family of companies, she’s seen D&I programs executed within individual teams of just 10 to 15 people.

“Companies and teams of any size can make an impact for themselves, for their stakeholders, and for the communities in which they live and work,” she said. “While a small company may not be in a position to dedicate a full-time role to the work of inclusion, diversity and equity, every organization no matter how small can have it be a part of someone’s responsibilities.”

MARCH 2023 Convenience Store News 35

“Companies failing to recognize the importance of diversity and inclusion in today’s modern workforce risk losing opportunities that attract and retain talented team members who bring unique ideas and perspectives to the table — helping to solve today’s complex business problems.”

— Matthew Stephenson, Casey’s General Stores Inc.

In fact, smaller groups can move quickly and hold more personal programming; there are likely fewer decisionmakers, so quick action can be taken, Holloway added.

WorkJam’s Kramer said it’s “a copout” to use company size as a reason not to get involved in DEI efforts. Programs don’t need to be complex or carry a high price tag.

Since the beginning of WorkJam’s efforts, the company has made it fun, celebratory and social. A DEI Committee made up of eight WorkJammers from different departments and different backgrounds puts together monthly events, which are held in the office but also give remote workers the opportunity to log in and take part. This year’s DEI calendar includes events to celebrate and educate around Black History Month in February, and International Day Against Homophobia, Biphobia, Lesbophobia and Transphobia in May, among others.

“It’s all employee led; we’re allowing the conversation around topics to be initiated by our employees,” Kramer explained. “People don’t realize the power of user-generated content. It doesn’t have to be a massive effort. Just allow people to group together around a common interest and have a conversation.”

The monthly events have been so well received that WorkJam this year doubled the budget for the DEI Committee. “It’s helped our employees feel like they belong,” the CEO said.

Creating conversation and community also can be accomplished by companies through their employee communication app. “Outside of our own organization, we’re going to continue to help our customers understand how technology can unlock their DEI strategies in a low-cost manner, and one where their employees are able to really participate,” said Kramer.

“A lot of organizations don’t know where to start and it feels complicated. But once you get started, it just becomes a part of your culture. This is who we are,” he concluded.

MISCONCEPTION 3: Starting a D&I program is too di cult and complex.

For those who don’t know where to begin, The Hershey Co.’s Chief Diversity Officer Alicia Petross said the Pennsylvania-based candy maker started by understanding its progress on representation compared to industry benchmarks to identify where it had room to improve. From there, she recommends speaking to employees to see how they’re feeling about the existing workplace.

DEI has long been a focus for the Hershey organization. However, in 2020, after the murders of George Floyd and Breonna Taylor and other tragic events, the company started to approach DEI differently. “We held listening sessions with employees to understand how they were feeling and then cocreated our DEI strategy from those conversations,” Petross shared.

Altria’s Holloway advises companies to begin by defining the business case for inclusion, diversity and equity within their organization. “There doesn’t need to be an organizational structure in order to get started, just an expression of the importance of the work and a commitment to being better,” she said. “Also get comfortable with the idea that not everything will be perfect starting out and that’s OK.”

Like Petross, Holloway urges companies to be guided in this effort by their employees.

“Commit to really listening to employees and be guided by their lived experiences and suggestions. This work requires passionate people to volunteer

COVER STORY 36 Convenience Store News CSNEWS.com

“Rather than wondering who may feel alienated with a shift to focus on inclusion and diversity, a better question might be who feels alienated right now and how, as an organization, can you welcome them in?”

— Danielle Holloway, Altria Group Distribution Co.

to lead change, so find those people. Every organization has them,” she continued. “They likely already have a good idea of what to address first.”

“A coalition of the willing” is crucial, echoes Couche-Tard’s Matthews. “That’s where you’re going to get a lot of your momentum and energy, and that’s where you can grow.”

Defining goals and ambitions is also a must, she said, noting that the cascading down of clear expectations and continuous follow-up will make D&I part of a company’s DNA.

Employee resource groups (ERGs) — voluntary, employee-led groups that aim to foster a diverse, inclusive workplace aligned with the organizations they serve — are one of the easiest ways to get started in this space, according to Stephenson of Casey’s. He’s also a proponent of using inexpensive, out-of-the-box training materials when just starting out.

“ERGs generate ideas and identify the organizational blind spots, while training such as unconscious bias will help team members gain a better understanding of their blind spots,” Stephenson said. “Additionally, companies need to define the key metrics to look at to see the company’s hiring practice from an unbiased perspective.”

Building an inclusive and diverse workforce can start with hiring, Coca-Cola’s Austin said.

“Race, gender, ability, cultural and generational representation should reflect the community, which can create an authentic connection that allows employees to feel that they are celebrated

for who they are,” he told CSNews. “We believe that creating an inclusive culture makes us stronger as a business. So, it’s our ambition to not only mirror the markets we serve, but to have women hold 50 percent of senior leadership roles at the company, and in the U.S. to have race and ethnicity representation reflect national census data at all levels by 2030.”

When starting a D&I program, it’s also important to secure full buy-in at the most senior levels of the organization, according to Emile Cantrell, chief marketing officer for Imperial Trading Co., a convenience channel distributor based in Elmwood, La. “The goal is to engage first with your ownership and senior management team to ensure a 100 percent organizational cultural commitment to D&I,” he advised.

Once ownership and senior management have

MARCH 2023 Convenience Store News 37

“People don’t realize the power of user-generated content. It doesn’t have to be a massive e ort. Just allow people to group together around a common interest and have a conversation.”

— Steven Kramer, WorkJam

Embracing D&I impacts the experience of team members, customers and the community.

committed, Cantrell said it is imperative for the project to flow to all levels of management via an organized structure, with assessment and benchmark measurements in place. The human resources department must be committed to the D&I goals as well and willing to change its traditional recruitment methods.

“Best practices indicate the proper incubation systems will allow potential leaders at all levels to rise and take the lead if the culture is inclusive and welcoming,” he said.

MISCONCEPTION 4: Having a D&I program would alienate us from our customers and/or business partners.

Some respondents in the survey fielded by CSNews said they don’t have a D&I program because they believe having one would alienate them from customers and/or business partners.

“Everything that is said or not said can potentially alienate people/customers/business partners given volatile politics across the spectrum,” Imperial Trading’s Cantrell acknowledged, adding that “the risk/reward ratio is a daily component of all business practices.”

He pointed out, however, that the convenience store industry as a whole is already very diverse when it comes to the customers the channel serves day in and day out.

“A truly inclusive environment is where viewpoints are respected in spite of disagreements,” Cantrell said. “We as individuals always have the right to our opinion, but should be aware that progress does not come with the status quo. Change is difficult, but worth it.”

At Altria, the company views its employees’ commitment to inclusion, diversity and equity as an “an enabler” to create and grow some of the biggest brands in the largest tobacco categories, make superior trade relationships even stronger, and drive shareholder value. This

work is embedded into the company’s strategic initiatives because when employees can bring their best selves to work, “our teams work better and we deliver better business results,” Holloway said.

“We believe that maximizing our diversity and inclusion efforts sets us up for success today and far into the future. Rather than wondering who may feel alienated with a shift to focus on inclusion and diversity, a better question might be who feels alienated right now and how, as an organization, can you welcome them in?” she posed.

Some industry companies that are embracing DEI within their own organizations are also looking to partner with businesses that share the same values. Hershey, for instance, is focused on increasing supplier diversity throughout its supply chain and quadrupling its spend with diverse suppliers by 2030, according to Petross.

Similarly, Coca-Cola is committed to spending at least $1 billion annually with diverse suppliers, Austin shared. “Part of building an inclusive culture means that we are also focused on increasing the overall diversity of our suppliers. We aspire to join the Billion Dollar Roundtable — the gold standard of supplier diversity, currently with only 32 member companies,” he said.

DEI efforts require widespread support and action across employees, business partners and communities to make a broader, positive impact, PepsiCo’s Montgomery noted.

“We fully stand by partners and customers who share our values tied to advancing the DEI agenda,” he said. “It’s not a question of if DEI should be part of our company’s ethos, but how we can bring it to life in our day-to-day work and business strategy.” CSN

Convenience Store News has launched an industrywide initiative to facilitate engagement among all stakeholders in the convenience channel around diversity and inclusion, with support from principal underwriters Altria Group Distribution Co., The Coca-Cola Co., The Hershey Co. and WorkJam and supporting underwriter Constellation Brands. This platform is designed to be a catalyst for discussion, innovation, engagement and action.

COVER STORY 38 Convenience Store News CSNEWS.com

PRESENTED BY

The Summit for Exploring Food Trends, Operations, Safety & Technology Through Collaboration & Networking

MAY 4-5, 2023

HILTON NASHVILLE DOWNTOWN

MAKING FOODSERVICE THE CENTERPIECE OF YOUR CONVENIENCE STORE BUSINESS

FOOD TRENDS. OPERATIONS. SAFETY. TECHNOLOGY.

JOIN CSNEWS AND TOP FOODSERVICE C-STORE EXECUTIVES FOR A TWO - DAY EXPERIENTIAL NETWORKING SUMMIT.

PREVIOUS ATTENDEES INCLUDE EXECS FROM DASH IN, ENMARKET, PARKER’S, HIGH’S, KWIKTRIP, CIRCLE K, 7-ELEVEN, MAVERIK & MORE... COMING TOGETHER TO COLLABORATE AT THIS INVITE-ONLY EVENT!

THIS ISN’T YOUR TYPICAL CONFERENCE. ENGAGE WITH PEERS AND PARTNERS VIA THE POWERHOUR - CFX’S UNIQUE 1:1 OPPORTUNITY - AND ENJOY IMMERSIVE FOOD EXPERIENCES AND SITE TOURS

FOR MORE INFORMATION

CONTACT DON LONGO, DLONGO@ENSEMBLEIQ.COM OR SCAN HERE

TURNING OBSTACLES INTO OPPORTUNITIES

This year’s Category Captains awards honor 15 skillful suppliers and distributors

BY SUSAN DURTSCHI, PAST TIMES MARKETING

BY SUSAN DURTSCHI, PAST TIMES MARKETING

THE CONVENIENCE STORE landscape is still proving difficult to navigate as operators grapple with lingering problems such as supply chain issues, labor shortages and higher prices due to record inflation. Changes in consumer shopping habits — from seamless checkout, mobile apps and social media influencers to artificial intelligence and virtual reality — must be optimized to achieve success.

The winners in Convenience Store News’ 2023 Category Captains awards program partnered closely with their c-store customers to create successful solutions for today’s challenging retail environment. They zeroed in on shopper insights to drive decisions within their categories and shared those insights with retailer partners to help them capture consumer attention and grow sales.

Fifteen skillful suppliers and distributors have been chosen as this year’s honorees. Now in

its 10th year, the Category Captains program celebrates outstanding category management by partners to the c-store industry. All entries were judged based on:

• Product innovation;

• Creativity in merchandising, marketing, promotion and advertising;

• Use of consumer insights to drive total category sales;

• Innovative and dynamic category management tools and technologies;

• Demonstrated commitment to meeting the specific needs of retailer customers;

• Efficiently lifting sales for the entire product category; and

• Fact-based evidence of market-specific or account-specific results.

Past Times Marketing, a consumer research and product evaluation firm based in New York, once again judged the entries based on information supplied by participating companies.

FEATURE

40 Convenience Store News CSNEWS.com

Make Your MARK in C-store Foodservice

FIND EVERYTHING YOU NEED FROM ONE TRUSTED PARTNER

Speaking with…

Chris Murray, Core-Mark’s Executive VP of Merchandising and Marketing

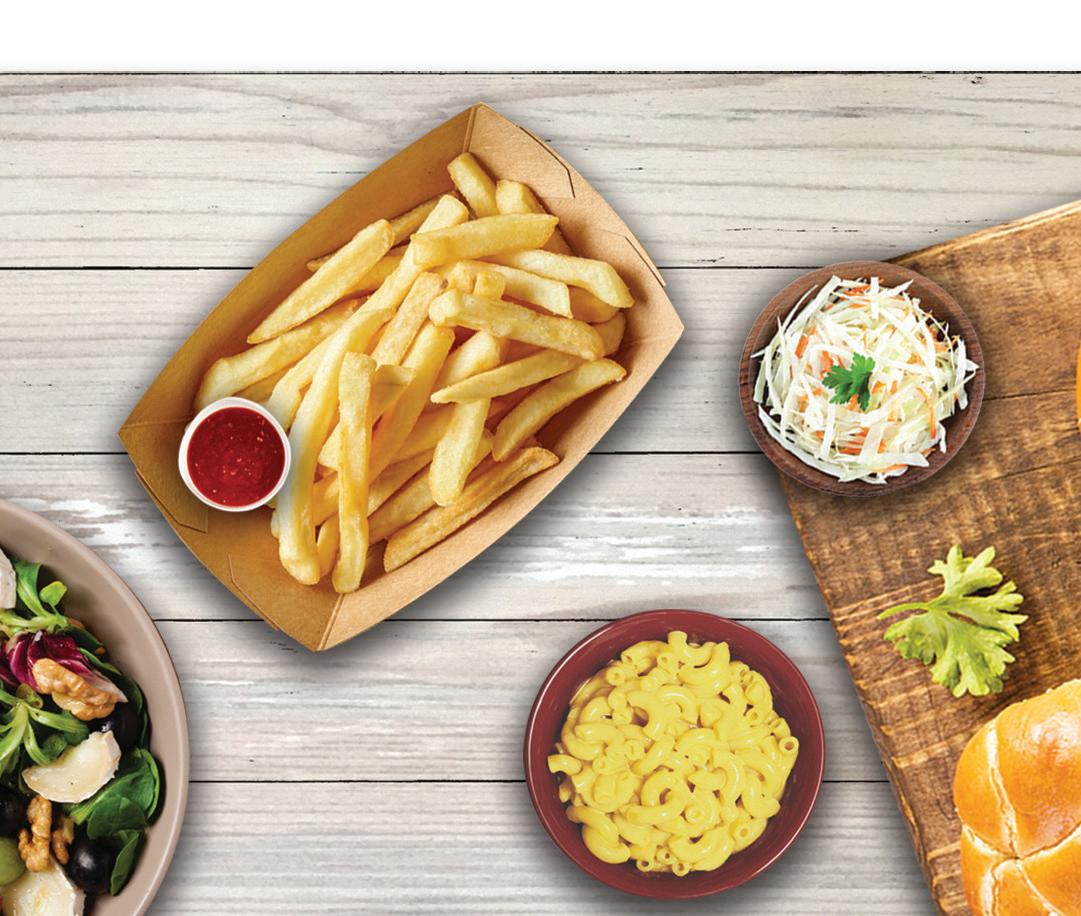

According to a Convenience Store News Forecast Study released in January, foodservice — particularly prepared food — will be the No. 1 category driver for growth and innovation in the channel in 2023. Convenience Store News reached out to Chris Murray, Core-Mark’s Executive VP of Merchandising and Marketing, to learn how the company can help c-stores compete in the foodservice arena.

Convenience Store News: Why is foodservice such an important component for c-stores today?

Chris Murray: Recent industry data revealed that a robust foodservice offer was the greatest predictor of in-store profit.1 In spite of challenging financial times, we’ve learned that shoppers don’t want to sacrifice quality in exchange for value. They want both — and they want to be able to get that food in a quick and convenient way. Making sure customers enjoy a superior foodservice experience offers the potential for a lucrative payoff for any c-store, large or small.

CSN: What differentiates Core-Mark from other distributors?

CM: Thanks to the recent alignment of Core-Mark and Eby-Brown under the Performance Food Group umbrella, we have a portfolio of programs fit for the convenience channel — one we believe will help define the future of convenience. We offer the culinary expertise from

our 25 corporate chefs, compelling solutions supported by a mix of leading national brands as well as high quality private brands, and a passion to partner with retailers and enhance foodservice offerings in the convenience channel.

CSN: Is there a lot of work involved for stores to get these foodservice programs up and running?

CM: No matter their size, stores don’t have to worry because we offersales and marketing support, and ongoing menu planning. They’ll get restaurant quality recipes and flavor profiles created by culinary experts, with equipment, training, education and distribution, too.

CSN: Have stores that offer your programs had success building their foodservice business?

CM: Absolutely! Hill’s Exxon Convenience Store in Lavonia, Georgia is one example. Here is what the company’s president, Matt Hill, said after the store added our Perfectly Southern Fresh Fried Chicken program: “Our team had no experience doing this… none of us did! And the training Core-Mark was able to provide to us was incredible. We were able to make this work, and work so well.”

Testimonials like Matt’s are exactly what we were aiming for when we created these quality programs with all the resources necessary for successful execution.

1 NACS State of the Industry data, 4/13/22

To learn more about how Core-Mark can help your c-store make its mark in foodservice, visit www.coremark.com.

OUR PORTFOLIO OF FOODSERVICE PROGRAMS

The Red Seal Pizzeria — par-baked crusts to top with sauce and cheese, then bake; pizza dough balls; mix to make crusts in-store; subs, hoagies, pasta, and more

• Contigo Taqueria — authentic Latin-style tacos, burritos, bowls, quesadillas and salads tortilla chips for nachos with guacamole and salsa for dipping churros and flan

• Perfectly Southern Fresh Fried Chicken —our core chicken program with chicken tenders, chicken pieces, biscuits, fries and our exclusive dipping sauces

• Tru-Q BBQ —pulled pork, pulled chicken, beef brisket and smoked sausage

• Deli 55 —made-to-order or graband-go deli foods including signature sandwiches, hearty soups, crisp salads, subs, heroes, hoagies, paninis, burgers and hot dogs

• My Daily Crave — coffee, teas, lemonades, bubbler programs and more!

• Quickeats — full-service programs to fit any space: Quickeats Grill branded roller grill for Meals on the Go, Quickeats Heat & Eat for a Turnkey Branded Look, and Quickeats Hot Takes for Hot & Ready brands to fill every daypart

• Basilio’s Italian Style Pizza — pizzeria style pizzas, frozen to bake in-store to sell by the slice or as whole pies to go

ADVERTORIAL

The 2023 Category Captains are:

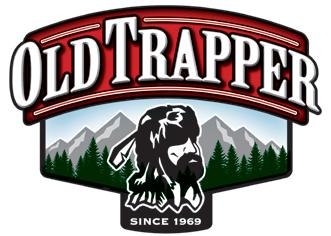

ALTERNATIVE SNACKS: Old Trapper

Shopping and spending habits dramatically changed in 2022 due to inflation and higher fuel costs, leaving c-store operators searching for ways to continue growth. Old Trapper worked closely with its retail partners to build a collaborative relationship to benefit the entire category.

Old Trapper observed that most meat snack sections are vastly under spaced and by evaluating the current selling sets and assortments, the Category Captain found that meat snacks can realize as much as a 50 percent increase by adding an adjacent section to the current category.

Old Trapper focuses on core SKUs to drive sales and uses an unbiased process that places SKUs with the highest average weekly dollars per store to achieve the highest dollar-grossing meat snack sets in every region. Rather than only promoting items within its offering, Old Trapper takes the best from all brands and creates best-in-class planograms based on sales performance. Core items from all brands contribute 88.44 percent of total category sales, whereas only 11.56 percent come from innovation items.

Understanding who its customers are, with a focus on how to bring new users to the category, is important to increasing basket size. Store-level promotions that offer customers value on their meat snack purchases support trip spend and trial. Old Trapper works with retailers to find other items that customers frequently purchase with meat snacks and bundles them in promotions.

Old Trapper also has found success bringing awareness to the meat snacks category with advertising, in-store media partnerships, and app platforms. Its national ad campaign drives consumer awareness to one of the fastest-growing convenience store categories.

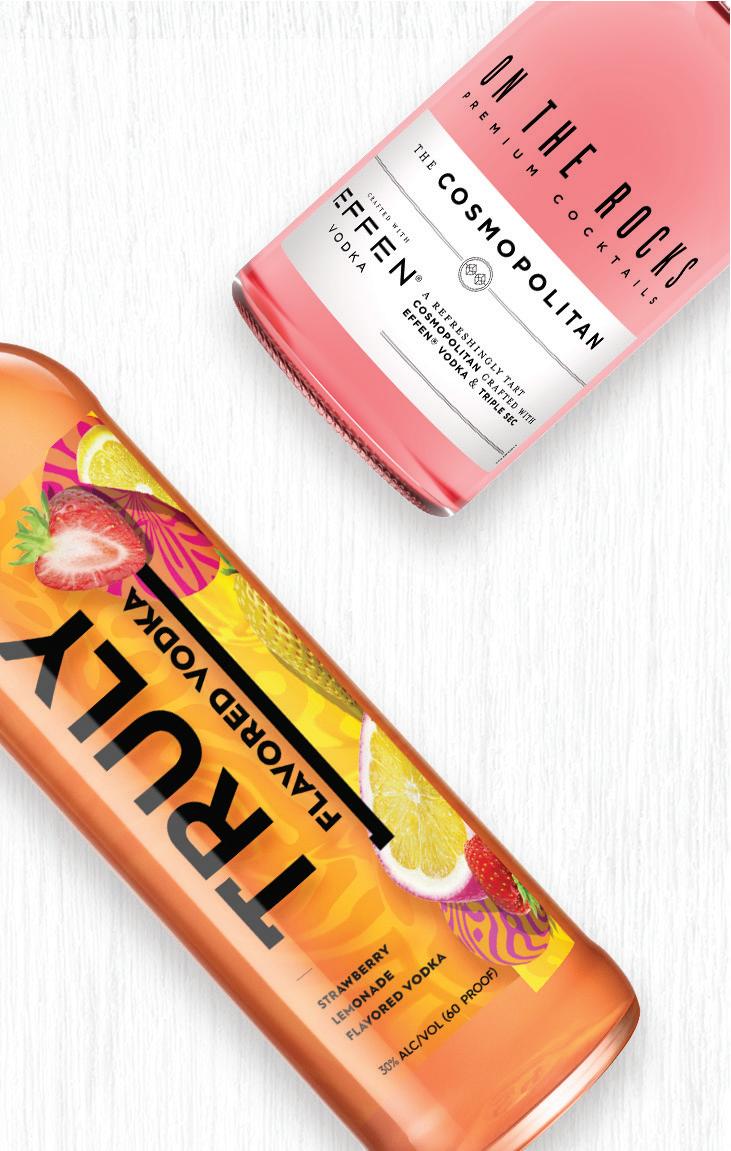

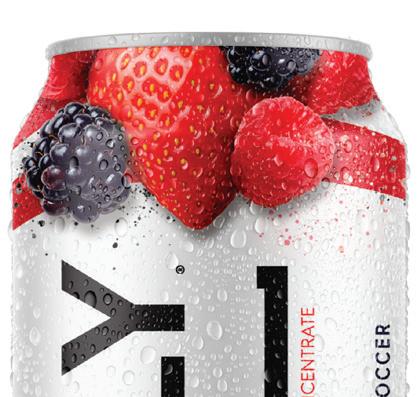

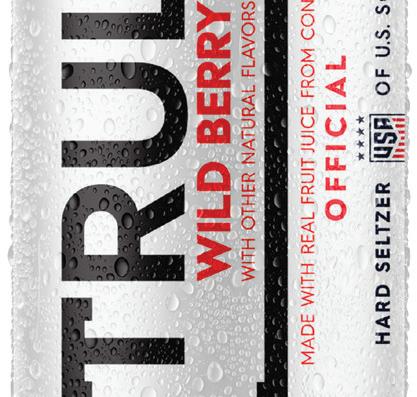

BEER/MALT BEVERAGES: Anheuser-Busch

Anheuser-Busch (AB) has been leading the conversation with the industry in terms of consumer insights, evolving occasions and shopper behaviors. Last year was the first full year for its one-of-a-kind collaboration center The Vault, where category teams are designing the future of total alcohol. This past year, AB hosted 15 retailers, with each visit highlighting trends while identifying opportunities for growth like macro space planning, meals programming, hard beverages and category capabilities. AB continues to integrate these insights and recommendations into IGNITE, its retail category strategy, to continuously provide c-store retailers with suggestions on how to effectively grow the alcoholic beverages category.

AB brought new insights and recommendations to retail to help capture growth with the emergence of a fourth category: hard beverages. After polling consumers to define “hard beverages,” the company created a category expansion framework to analyze and provide insight into growth trends, white space innovation and merchandising recommendations.

AB also worked with small-format retailers to focus on delivering growth through shelf management excellence, concentrating on merchandising guidelines that balance the need for increased days of supply on top SKUs within the core plus, core and value categories. These merchandising guidelines also include shifting the mix in hard beverages to capture the growth of spirit-based seltzers and cocktails, while reducing the over-allocation within malt seltzers and still supporting top SKUs and the trends within bold flavor and high ABV. These efforts have been supported by investments in several technologies and insights partnerships.

CANDY: Mars Inc.

Mars is committed to being a category thought leader and developing solutions to future-proof impulse and confectionery items as the retail environment continues to evolve. Last year, it identified a significant issue jeopardizing the candy category: seamless checkout. The Transaction Zone accounts for 25 percent of confectionery purchases and provides one last opportunity

FEATURE

44 Convenience Store News CSNEWS.com