WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

WHAT’S NEXT IN CONVENIENCE AND FUEL RETAILING

CONQUERING LABOR CHALLENGES

FEBRUARY 2023 CSNEWS.COM

• Establishes a digital foundation to optimize the ATC 21+ journey

• Enables an integrated marketing approach focused on the ATC 21+

• Provides a clear road map for development, integration, and implementation supported by AGDC

Help responsibly connect and engage with your ATC 21+ in the digital environment

Invest in digital infrastructure that responsibly optimizes and enables new channels for ATC 21+ experiences

Meet the evolving ATCs 21+ expectations to improve consumer experiences by enhancing retail digital capabilities and building a foundation of responsibility

©2023 Altria Group Distribution Company For Trade Purposes Only

Be Your Employees’ Greatest Champion

SEVENTEEN YEARS AGO, I walked into the New York City office of Convenience Store News looking for a job that would buy me some time until I could land a position at a popular consumer magazine, one preferably focused on fashion, fitness or pop culture.

A few months in, I was pleasantly surprised by how much I enjoyed learning about, and reporting on, the happenings of the U.S. convenience store industry. I was also pleasantly surprised by the opportunities available to me for professional development — whether that meant taking on a new category beat, trying my hand at profiles and feature articles rather than just news stories, or being the lead editor for a special section in the magazine.

Because of those opportunities, I was able to advance over the years from my starting position as a staff writer to my current-day position as CSNews’ editor-in-chief. And I never dusted off my resume again to try to get that position at the popular consumer magazine.

Anyone who works in the convenience channel these days knows labor is a major challenge. According to the findings of our 2023 Forecast Study, published last month, c-store operators anticipate that turnover and hiring difficulties will have the greatest impact on their sales and profitability in the year ahead. It was ranked the No. 1 concern for the second straight year.

According to respondents, the labor problem is multifaceted and encompasses difficulty in finding workers with the necessary skillset; increased costs to attract high-quality candidates; high turnover; increased

resources needed to constantly train new employees; poor customer service; inferior site quality; and low team morale.

For this issue, we’ve put together a special feature on “Conquering Labor Challenges” (see page 36). The story discusses how companies are turning to technology to do more with less, while increasing incentives to entice new workers and retain current employees.

A top request among recent job candidates is working for a company that promotes from within and shows proof of that. This is “a huge attraction and selling point,” says Chloe Rosenthal, vice president at Millman Search Group, a Baltimore-based recruiting firm.

At Pilot Co., the Knoxville, Tenn.-based operator of more than 800 travel centers, employees are offered a variety of developmental opportunities, and there’s a blend of in-person, virtual and e-learning, so it’s accessible to all. “One of the most important and effective ways we retain current team members is by supporting their professional development in deliberate and tangible ways,” Jamie Landis, vice president of team member experience at Pilot, tells CSNews

Especially now, ongoing opportunities for growth and advancement are vital not only at the corporate level, but also at the store level. Who knows, that student who joins your team as a customer service associate looking to simply earn some spending money or save for college could very well be your next CEO one day if given the right training, opportunities and encouragement.

For comments, please contact Linda Lisanti, Editor-in-Chief, at llisanti@ensembleiq.com.

LLC

Vito Maurici McLane Co. Inc.

Jonathan Polansky Plaid Pantries Inc.

Greg Scriver Kwik Trip Inc.

Roy Strasburger StrasGlobal

2020 Trade Association Business Publications Intl. Tabbie Awards Honorable Mention, Best Single Issue, September 2019 2016 Trade Association Business Publications Intl. Tabbie Awards Silver, Front Cover Illustration, June 2015 EDITORIAL ADVISORY BOARD EDITORIAL EXCELLENCE AWARDS (2016-2023) 2022 Eddie Award, Folio: magazine Winner, Business to Business, Retail, Single Article, March 2022 Winner, Business to Business, Food & Beverage, Series of Articles, October 2021 Honorable Mention, Business to Business, Retail, Single Article, September 2021 2020 Eddie Award, Folio: magazine Business to Business, Retail, Series of Articles, September 2019 2018 Eddie Award Honorable Mention, Folio: magazine Business to Business, Retail, Website Business to Business, Retail, Full Issue, October 2017 Business to Business, Editorial Use of Data, June 2017 2017 Eddie Award, Folio: magazine Winner, Business to Business, Retail, Single/Series of Articles, May 2017 Honorable Mention, Business to Business, Retail, Single/Series of Articles, June 2016 2016 Eddie Award Honorable Mention, Folio: magazine Business to Business, Retail, Full Issue, October 2015 Business to Business, Retail, Single/Series of Articles, August 2015 2016 American Society of Business Press Editors, National Azbee Awards Gold, Best How-To Article, March 2015 Bronze, Best Original Research, June 2015 2016 American Society of Business Press Editors, Midwest Regional Azbee Awards Gold, Best How-To Article, March 2015 Silver, Best Original Research, June 2015 2021 Jesse H. Neal National Business Journalism Award Finalist, Best Infographics, June 2021 2018 Jesse H. Neal National Business Journalism Award Finalist, Best Editorial Use of Data, June 2017

Chad

Core-Mark Edward

Ed

Associates (7-Eleven

Robert

ExtraMile Convenience

Laura Aufleger OnCue Express

Beck

Davidson

Davidson &

Inc., retired)

Falciani

Stores Jim Hachtel Eby-Brown Co. Chris Hartman Rutter’s Ray Johnson Speedee Mart Ruth Ann Lilly GPM Investments

EDITOR’S NOTE

FEBRUARY 2023 Convenience Store News 3

Today’s job seekers want an employer that invests in their professional development

Making Foodservice Your Center Stage

This is the year to elevate your foodservice program to be the crown jewel of your store

IN THE MOST RECENT Convenience Store News Forecast Study, released last month, convenience store retailers overwhelmingly said foodservice, particularly prepared food, will be the No. 1 category driver for growth and innovation in the channel in 2023.

Seventy percent of retailers surveyed said they expect prepared food to be their highest dollar growth category this year. Another foodservice category, dispensed beverages, was cited by 50 percent of c-store retailers as being their expected highest dollar growth category in 2023.

Even smaller c-store chains (with 20 stores or less) see prepared food as key to their growth this year. Sixty-five percent of small operators surveyed are anticipating an increase in their prepared food dollar sales per store this year. In line with the dollar volume expectations, c-store retailers big and small are projecting they will add more SKUs and more square footage to their foodservice areas in 2023.

All of this comes as little surprise to us. CSNews has been touting the importance of foodservice at convenience stores for years. We are proud to have helped numerous c-store retailers achieve their foodservice growth goals through our reporting on best practices and trends, interactive events like our Convenience Foodservice Exchange, community networking groups like our Convenience Foodservice Alliance, and our one-of-a-kind Foodservice Innovators Awards program that recognizes innovation in convenience foodservice each year.

I think we’ve proven that a distinctive, high-quality foodservice program is a must-have for a successful convenience store. In fact, foodservice should be the centerpiece of the business. It provides your store with an identity and should be the most profitable part of your business.

If you haven’t already made foodservice the crown jewel of your store, or even if you have but want to take your foodservice to the next level, this appears to be the year to do it. Many retailers have already lifted their programs to near best-in-class status. Many of the most advanced convenience foodservice retailers continue to evolve their offerings to meet the more demanding needs of their customers. And, according to the CSNews Forecast Study, the overwhelming majority of c-store retailers will be looking to up their foodservice game in 2023.

You can get a head start on your competition by attending the 2023 Convenience Foodservice Exchange (CFX) event this spring. I invite you to join us in Nashville, Tenn., on May 4-5 for two days of education, collaboration, networking, problemsolving, unique food experiences and store tours as we explore how to elevate your foodservice program to be the centerpiece of your business. Contact me if you’re interested in attending.

For comments, please contact Don Longo, Editorial Director Emeritus, at dlongo@ensembleiq.com.

VIEWPOINT

4 Convenience Store News CSNEWS.com

A distinctive, high-quality foodservice program is a must-have for a successful convenience store.

1. IRI Total C-Store: 52wks ending 12/4/2022. Contact your local Emergen-C representative on how to order or email John.L.Hankins@haleon.com ©2023 Haleon group of companies or its licensor. All rights reserved. Read and follow label directions. DID YOU KNOW? Do you carry these Convenience-sized skus? Emergen-C® is the #1 vitamin C/ immune support brand 1

FEATURES

COVER STORY

28 Changing the Narrative Today’s challenges in the tobacco category can become untapped opportunities.

36 Conquering Labor Challenges

C-store retailers are turning to technology to do more with less, and increasing incentives to entice new workers and retain current staff.

DEPARTMENTS

E DITOR’S NOTE

3 Be Your Employees’ Greatest Champion Today’s job seekers want an employer that invests in their professional development.

VIEWPOINT

4 Making Foodservice Your Center Stage This is the year to elevate your foodservice program to be the crown jewel of your store.

10 CSNews Online

20 New Products

SMALL OPERATOR

24 I Saw the Future & It Is Underground Elon Musk’s Las Vegas Loop offers two lessons for convenience store operators.

AN EYE ON D&I

52 Laying the Foundation

Recruiting and retaining a diverse workforce is not only the right thing to do, but also makes business sense.

INSIDE THE CONSUMER MIND

74 Trends to Watch in Beverages

Simplicity and functionality will resonate, according to this year’s predictions.

CONTENTS FEB 23 VOLUME 59 NUMBER 2 6 Convenience Store News CSNEWS.com

20 24 COVER STORY PAGE 28 52

* THE ULTIMATE LIGHTER FOR HARD-TO-REACH PLACES MAXI CLASSIC®, AMERICA’S SAFEST & LONGEST-LASTING LIGHTER1 W ® q TO ORDER, VISIT NEWREQUEST.BIC.COM LIGHT UP YOUR SALES WITH QUALITY AND SAFETY. © 2022 USA S T 06484 22 USA T 06484 1 fix -fl - fi b fix -fl - fi b b z ; *S : R N *S : R N -MULO 52 k 06/05/22

INDUSTRY

8550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 WWW.CSNEWS.COM

BRAND MANAGEMENT

VICE PRESIDENT & GROUP BRAND DIRECTOR Paula Lashinsky (917) 446-4117 - plashinsky@ensembleiq.com

EDITORIAL

EDITOR-IN-CHIEF Linda Lisanti llisanti@ensembleiq.com

EXECUTIVE EDITOR Melissa Kress mkress@ensembleiq.com

SENIOR EDITOR Angela Hanson ahanson@ensembleiq.com

MANAGING EDITOR Danielle Romano dromano@ensembleiq.com

ASSOCIATE EDITOR Amanda Koprowski akoprowski@ensembleiq.com

EDITORIAL DIRECTOR EMERITUS Don Longo dlongo@ensembleiq.com

CONTRIBUTING EDITORS Renée M. Covino, Tammy Mastroberte

ADVERTISING SALES & BUSINESS

ASSOCIATE BRAND DIRECTOR & NORTHEAST

SALES MANAGER Rachel McGaffigan - (774) 212-6455 rmcgaffigan@ensembleiq.com

ASSOCIATE BRAND DIRECTOR & WESTERN SALES MANAGER Ron Lowy - (330) 840-9557 - rlowy@ensembleiq.com

ASSOCIATE PUBLISHER & MIDWEST SALES MANAGER Kelly Fischer - (773) 992-4464 - kfischer@ensembleiq.com

ACCOUNT EXECUTIVE & CLASSIFIED ADVERTISING Terry Kanganis - (201) 855-7615 - tkanganis@ensembleiq.com

CLASSIFIED PRODUCTION MANAGER Mary Beth Medley (856) 809-0050 - marybeth@marybethmedley.com

DESIGN/PRODUCTION/MARKETING

SENIOR CREATIVE DIRECTOR Colette Magliaro cmagliaro@ensembleiq.com

ART DIRECTOR Lauren DiMeo ldimeo@ensembleiq.com

PRODUCTION DIRECTOR Ed Ward edward@ensembleiq.com

MARKETING MANAGER Krista-Alana Travis ktravis@ensembleiq.com

SUBSCRIPTION SERVICES

LIST RENTAL mbriganti@anteriad.com

SUBSCRIPTION QUESTIONS contact@csnews.com

CORPORATE OFFICERS

CHIEF EXECUTIVE OFFICER Jennifer Litterick

CHIEF FINANCIAL OFFICER Jane Volland

CHIEF PEOPLE OFFICER Ann Jadown

EXECUTIVE VICE PRESIDENT, CONTENT & COMMUNICATIONS Joe Territo

CHIEF OPERATING OFFICER Derek Estey

8 Convenience Store News CSNEWS.com CONTENTS FEB 23 VOLUME 59 NUMBER 2

ROUNDUP

Charging

Growth

Fast Facts

Tidbits

Tidbits TECHNOLOGY

12 Shell USA Takes Big Stake in Electric Vehicle

Space 14 Eye on

14

16 Retailer

18 Supplier

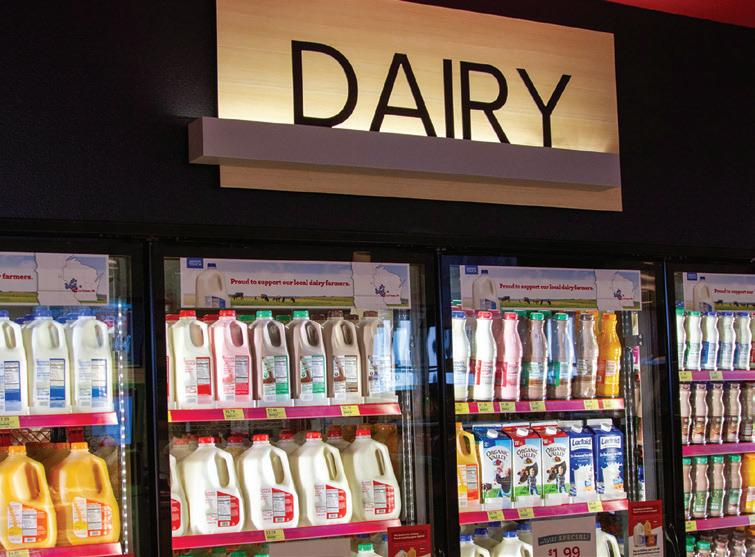

Convenience Store News (ISSN 0194-8733; USPS 515-950) is published 12 times per year, monthly, by EnsembleIQ, 8550 W. Bryn Mawr Ave., Ste. 200, Chicago, IL 60631. Subscription rates: Subscription rate in the United States: $125 one year; $230 two year; $14 single issue copy; Canada and Mexico: $150 one year; $270 two year; $16 single issue copy; Foreign: $170 one year; $325 two year; $16 single issue copy; Digital One year, digital $87; two year, $161. Periodical postage paid at Chicago, IL 60631, and additional mailing addresses. Copyright 2023 by EnsembleIQ. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or information storage and retrieval system, without permission in writing from the publisher. POSTMASTER: send address changes to Convenience Store News, 8550 W. Bryn Mawr Ave. Ste. 200, Chicago, IL 60631. The contents of this publication may not be reproduced in whole or in part without the consent of the publisher. The publisher is not responsible for product claims and representations. CONVENIENCE STORE NEWS AFFILIATIONS Premier Trade Press Exhibitor CATEGORY MANAGEMENT FOODSERVICE 42 How Beverage Programs Can Break Ties Hot, cold and frozen dispensed offerings can make the final difference in customers’ store selections. PACKAGED BEVERAGES 46 Opening the Door to Opportunity in the Cold Vault Retailers can boost basket size by embracing variety and matching selection with their customer base. 46 12

50 Still a Pain in the Chain Using technology and data analytics can help c-store retailers navigate supply chain struggles.

TOP VIEWED STORIES

Wawa Ranks Among Brands to Watch in 2023

The convenience store retailer’s expansion plans, foodservice offerings and loyal customer base set it up for success this year, according to a new whitepaper from Placer.ai. Overall foot traffic to Wawa is on the rise, with average visits per store growing across its network.

2

Applegreen C-stores Coming to New York Thruway

The brand is replacing McDonald’s restaurants as part of a $450 million project to modernize the highway’s 27 service areas. Its offerings include hot meals, grab-and-go food selections, Taste NY program products and merchandise, and more.

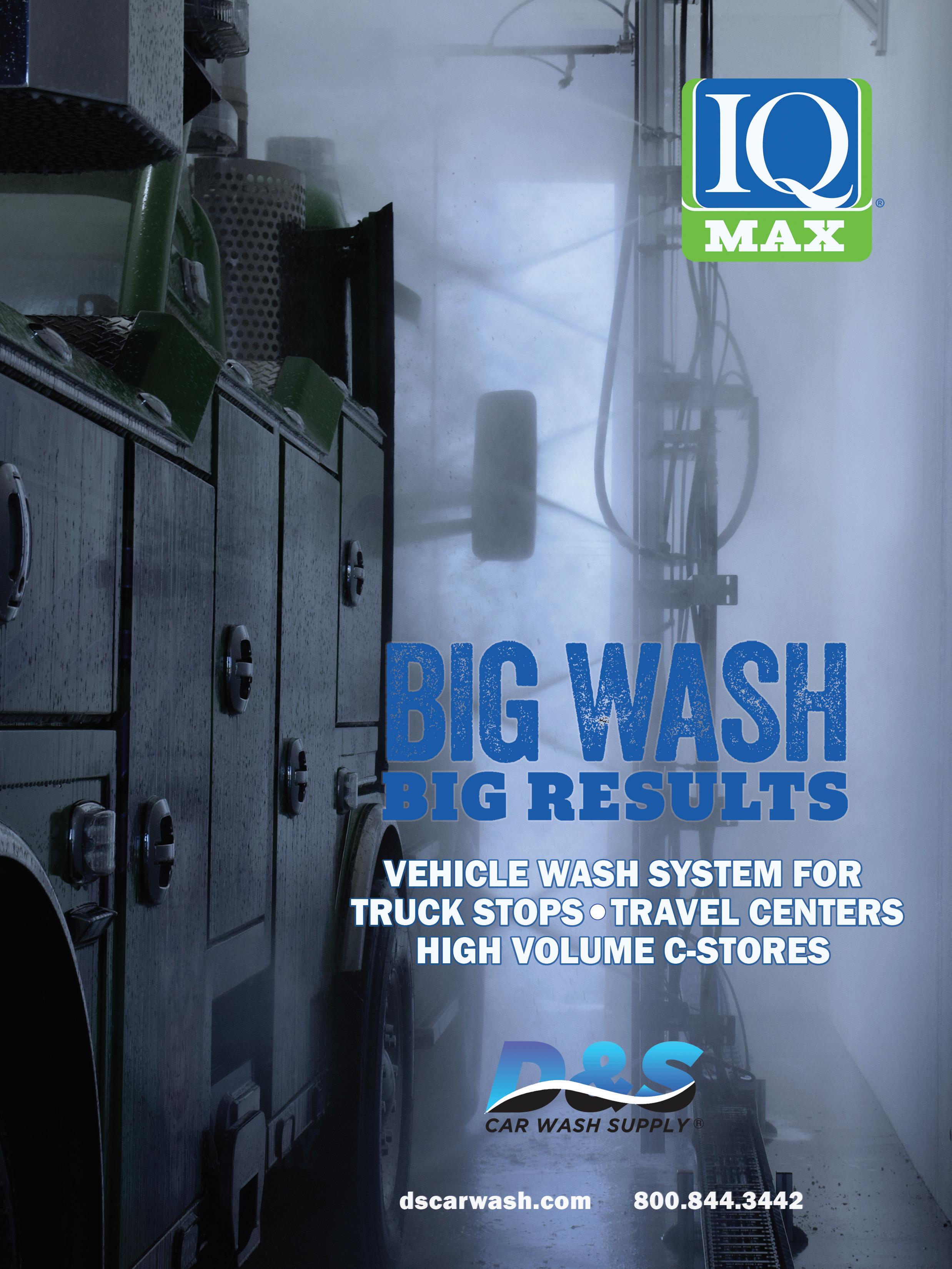

Couche-Tard to Acquire True Blue Car Wash

The deal for the operator of Clean Freak and Rainstorm brands includes 65 car washes located in high-traffic areas in Arizona, Texas, Illinois and Indiana.

RaceTrac Eyes Expansion Into Two New States

The Atlanta-based retailer will enter the Ohio and South Carolina markets with the addition of three new convenience stores. The first location in Ohio is set to open in Delaware, while plans for South Carolina operations will begin in the city of Columbia.

1 3 4 5

Majors Management Acquires Davis Oil

EXPERT VIEWPOINT

How Convenience Store Owners Can Combat Meltflation

The standard 10-pound bag of ice has quietly been reduced to 7 pounds over the last few years. Customers are getting less product but paying the same price, if not more, leading to “meltflation.” This means convenience store owners are paying 30 percent more for the same — or less — amount of product than before, depending on the delivery service, writes Ben Gaskill, co-owner and director of sales and marketing for Ever est Ice and Water Systems. He suggests operators consider a more accessible, cost-effective and environmentally safer alternative that dispenses 10 pounds of ice per purchase, eliminates the need for third-party distribution, restocks automatically and has the poten tial to significantly reduce the use of plastic bags.

Turning Down Turnover

In addition to wages, there are numerous factors that retailers should take into account when considering what employees really want and what will keep them at their current job or send them searching for a new one, according to a recent webinar presented by Convenience Store News and sponsored by Legion Technologies. Sixty-nine percent of managers list staff shortages as a reason to feel stressed. This means it must be a priority to give employees a good experience and not add to their own stresses as part of avoiding turnover. Scheduling is particularly important to employees, who often work multiple jobs but still want to spend time with their families.

For more exclusive webinars, visit the Events & Webcasts section of csnews.com.

MOST VIEWED NEW PRODUCT

Pillsbury Funfetti Popcorn

General Mills Convenience is bringing a new offering to the ready-to-eat popcorn category with Pillsbury Funfetti Popcorn. Coated with Funfetti glaze, the popcorn features tiny rainbow-colored flecks that boost the visual eating experience and fun factor, according to the company. The 2.25-ounce bags will carry a suggested retail price of $2.29 when the product hits store shelves nationwide in May. General Mills also introduced cereal-flavored popcorn, available in Cinnamon Toast Crunch and Cocoa Puffs flavors, earlier this year.

generalmillscf.com

CSNEWS ONLINE ONLINE EXCLUSIVE

The purchase includes 21 c-stores across western Michigan and other assets. First established in 1966 as a small fuel oil delivery service, Davis Oil grew to become one of the largest Marathon jobbers in Michigan. 10 Convenience Store News CSNEWS.com

FRESHLY SQUEEZED

EEZED GAMECIGARS.COM © 2022 SMCI Holding, Inc. AVAILABLE IN 2 FOR 99¢ AND SAVE ON 2 POUCHES FOR MORE INFORMATION, CONTACT YOUR SWEDISH MATCH REPRESENTATIVE. 800-367-3677 • CUSTOMER.SERVICE@SMNA.COM NOW AVAILABLE

SQU

Shell USA Takes Big Stake in Electric Vehicle Charging Space

SHELL USA INC. continues to prepare for the changing mobility landscape with a recent deal to acquire electric vehicle (EV) charging and media company Volta Inc.

The all-cash transaction, valued at approximately $169 million, is expected to close in the first half of 2023 pending regulatory approvals and customary closing conditions.

Volta’s assets include an existing public EV charging network of more than 3,000 charge points at destination sites — such as shopping centers, retail stores and pharmacies — across 31 U.S. states and territories; a development pipeline of more than 3,400 additional charge points; and capabilities to continue developing, operating and monetizing EV charging infrastructure.

Beyond providing a charging service, Volta also specializes in generating advertising revenues from screens embedded into the charge points.

“The shift to e-mobility is unstoppable, and Shell recognizes Volta’s industry-leading

dual charging and media model delivers a public charging offering that is affordable, reliable and accessible,” said Vince Cubbage, interim CEO at Volta. “While the EV infrastructure market opportunity is potentially enormous, Volta’s ability to capture it independently … was limited. This transaction creates value for our shareholders and provides our exceptional employees and other stakeholders a clear path forward.”

The acquisition continues a trend toward renewable resources and cleaner transportation development that Shell’s various subsidiaries have undertaken over the last two years. In 2021, Shell New Energies closed an agreement to acquire energy storage developer Savion from Macquarie’s Green Investment Group. In March 2022, Shell Energy North America joined the Retail Energy Advancement League, an advocacy organization dedicated to energy consumer choice with a special emphasis on green options.

Houston-based Shell USA is an affiliate of Shell plc, a global group of energy and petrochemical companies with operations in 70-plus countries. In the United States, Shell operates more than 14,000 Shell branded stations across all 50 states.

INDUSTRY ROUNDUP 12 Convenience Store News CSNEWS.com

The company reaches an agreement to fully acquire Volta Inc. for $169 million

when a coffee to go becomes an experience that stays.

Despite labor challenges, consumers continue to expect fresh, high-quality coffee whereever they go. Automatic, bean-to-cup coffee machines are the perfect solution for operators wanting to elevate their coffee program without added labor.

The award-winning A400 Fresh Brew is our latest innovation in hot coffee. This fully automatic bean-to-cup coffee machine grinds whole beans fresh for each cup delivering on consumer demand for quality with a simple touch. Creating fresh taste with less waste has never been easier.

Discover more at us.coffee.franke.com

NEW!

A400 Fresh Brew

Eye on Growth

TA also acquired seven existing travel centers and three standalone truck service facilities last year.

TravelCenters of America Inc. (TA) signed 30 new franchise agreements by Dec. 31, 2022, successfully reaching its annual target. The travel center operator plans to open an additional 20 franchised locations in 2023.

As of Dec. 31, Getty Realty Corp. had a committed investment pipeline of more than $100 million for the development and acquisition of convenience stores and car wash properties. In 2022, the real estate investment trust invested approximately $157 million across 52 properties.

FAST FACTS 8%

Consumer spending on foodservice menu items at c-stores was up 8 percent for the combined months of September, October and November 2022 compared to the same period in 2021.

— The NPD Group

68%

Sixty-eight percent of U.S. voters support increasing the availability of E15 to help lower fuel prices and bolster energy independence.

7-Eleven Inc. opened its first convenience store in Israel at the Dizengoff Center Mall in Tel Aviv. Franchisee Electra Consumer Products plans to expand the 7-Eleven footprint throughout the country over the next five years.

R.H. Foster Energy LLC picked up six Leadbetter’s Super Stop locations in Maine. The sites will continue to operate as is while they transition to R.H. Foster’s Freshies c-store brand.

Pops Mart Fuels LLC acquired six convenience stores with fuel from Mallard Oil Co. The transaction brought Pops Mart into eastern North Carolina.

Pump & Pantry plans to build a new travel center on the northeast side of Crete, Neb., at the intersection of Nebraska highways 103 and 33. Construction is expected to begin in the spring.

— Renewable Fuels Association

1,087

The number of single-store operators grew by 1,087 stores in the past year to reach a total of 90,423 stores, or 60.2 percent of all U.S. convenience stores.

— 2023 NACS/NielsenIQ Convenience Industry Store Count

INDUSTRY

14 Convenience Store News CSNEWS.com

ROUNDUP

CELEBRATING ONE BILLION IN RETAIL REVENUE Stock your shelves with proven moneymakers. ZYN is the first and only nicotine pouch to break one billion in retail sales. Increase your bottom line with America’s #1 nicotine pouch. FOR TRADE PURPOSES ONLY. | Source: IRI Total US Multi-Outlet, YTD Ending 11-06-22. | ©2023 Swedish Match North America LLC Call 800-367-3677 or contact your Swedish Match Rep to learn more.

Retailer Tidbits

Wawa Inc. is exploring the idea of turning one of its shuttered convenience stores in Philadelphia into a training center for technology workers. The move is part of a greater effort to invest in the region’s technology talent market.

Love’s Travel Stops and Interstate Batteries entered into an exclusive supply agreement for the next five years. Interstate-branded batteries are now available at more than 430 Love’s Truck Care and Speedco locations.

Circle K extended its partnership with Jackpocket to bring the mobile lottery option to the Arizona market. To promote

the expansion, the third-party app is offering Arizona residents their first lottery ticket for free on the app.

Since 2020, the retailer has been awarded more than 25 biodiesel grants to update existing infrastructure to sell biodiesel blends at locations across Iowa.

Kwik Trip Inc. was honored with the Secretary’s Biodiesel Marketing Award during the FUELIowa annual meeting held in Des Moines, Iowa, in January. Iowa Secretary of Agriculture Mike Naig presented the award.

The Army & Air Force Exchange Service plans to roll out 500 self-checkout units across its military department stores. Employees who previously staffed checkout lanes will now focus on customer service.

16 Convenience Store News CSNEWS.com 23_000127_Convenience_Store_News_FEB Mod: December 28, 2022 4:38 PM Print: 01/09/23 page 1 v2.5 CHROME Bright, attractive finish EPOX Coated for superior chemical resistance ORDER B OR SAME DA HIPPING 1-800-295-5510 uline.com π WIRE SHELVING BLAC Decorative, powder-coat finish STAINLESS STEEL Strong, durable and will not rust 23_000127_Convenience_Store_News_FEB.indd 1 1/9/23 10:52 AM INDUSTRY ROUNDUP

AVOID FINES. SAVE LIVES. FOLLOW THE LAW.

IT’S NOW ILLEGAL IN CALIFORNIA TO SELL MOST FLAVORED TOBACCO PRODUCTS, INCLUDING VAPES AND MENTHOL CIGARETTES. FOLLOW THE LAW TO PROTECT KIDS FROM A LIFETIME OF DEADLY ADDICTION.

MAKE SURE YOU’RE FOLLOWING THE LAW AT NOFLAVORS.ORG

© 2023 California Department of Public Health

Supplier Tidbits

Mars Inc. signed an agreement to acquire Trü Frü. The whole-fruit snacking brand is seen as complementary to the health and wellness brands currently in Mars’ portfolio.

Mondelez International Inc. agreed to sell its developed-market gum business in the United States, Canada and Europe to Perfetti Van Melle Group. The deal is set to close for $1.35 billion.

Performance Food Group (PFG) created a Black Inclusion Group as part of its diversity, inclusion and belonging initiatives. It is the second of eight planned associate resource groups that will help direct PFG in future endeavors.

Altria Group Inc. is conducting an equity and civil rights assessment. The audit will evaluate efforts intended to address the harm associated with tobacco use in communities of color and youth.

18 Convenience Store News CSNEWS.com FORECOURT AMENITIES www.forteproducts.com GAS STATIONS, C-STORES, TRUCK STOPS SIDEKICK WASTE/ WINDSHIELD CENTER TRUCKERS WINDSHIELD VALET INDUSTRY ROUNDUP

Trü Frü CEO Brian Neville will continue to lead the brand, which will operate as a separate business within Mars.

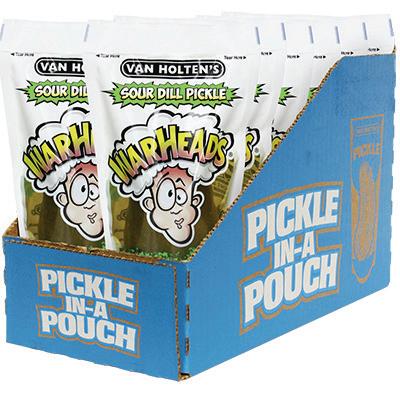

Warheads Pickle-In-A-Pouch

Van Holten’s, maker of the original Pickle-In-A-Pouch, expands its licensed product line with Warheads, the “Extreme Sour” candy brand from Impact Confections. Available for order now, the Warheads Pickle-In-A-Pouch comes in a 12-count display case and has a two-year shelf life. Additionally, the new product offers customers an interactive experience on social media, with the hashtag #sourpicklechallenge intended to engage consumers around the world.

VAN HOLTEN’S • WATERLOO, WIS. • VANHOLTENPICKLES.COM

Old El Paso Fiesta Twists

General Mills is bringing its Old El Paso brand to the salty snacks aisle with the new Old El Paso Fiesta Twists. The crispy and crunchy corn chips with a twist give convenience store retailers a fun snack option to meet demand for savory indulgence anchored in Mexican-inspired flavors, according to the company. Available in Queso, Zesty Ranch and Cinnamon Churro flavors, Old El Paso Fiesta Twists come in 2-ounce bags that are exclusive to c-stores. They are slated to hit store shelves nationwide in June with a suggested retail price of $2.19. GENERAL MILLS CONVENIENCE • MINNEAPOLIS • GENERALMILLSCF.COM

Flick My BIC Special Edition Lighters

The BIC Lighter is “50 and fabulous,” and the company is celebrating this milestone with a special edition Flick My BIC series of lighters. From flower power to virtual reality, the featured imagery encompasses fun, colorful and nostalgic elements from the last five decades. The 50th anniversary series is only available for a limited time. The lighters in this series have a suggested retail price of $2.09 per unit.

BIC USA INC. • SHELTON, CONN. • US.BIC.COM

ADS-TEC Energy ChargePost

ADS-TEC Energy unveiled ChargePost, a compact, battery-based charging system that enables ultra-fast electric vehicle (EV) charging on existing power connections. The system features an all-in-one design that integrates the battery, power electronics, cooling system and charger in a compact package requiring less than 21.5 square feet of ground space. Each ChargePost is equipped with two charging points for ultra-fast EV charging, giving drivers more than 60 miles of range in just a few minutes (up to 300 kW DC power with one charging point or 150 kW with two charging points in use at the same time). The system also offers up to two optional 75-inch digital displays on its exterior surfaces that can be used for advertising space.

ADS-TEC ENERGY PLC • NÜRTINGEN, GERMANY • ADSTEC-ENERGY.COM

Punchh Subscriptions

ParTech Inc.’s loyalty software Punchh is now offering convenience store brands a way to launch and manage a subscription program. The model’s customizable platform drives recurring revenues and incentivizes frequency, leading to lifetime loyalty, the company stated. Punchh Subscriptions integrates seamlessly with mobile apps and online ordering solutions. The new offering provides subscription tracking, renewal processing, automated renewal marketing messaging, customer targeting, and custom analytics that track impact and return on investment.

PARTECH INC. • NEW HARTFORD, N.Y. • PUNCHH.COM

NEW PRODUCTS

20 Convenience Store News CSNEWS.com

Fire Department Coffee Nitro Cold Brew

Veteran-owned Fire Department Coffee enters the ready-to-drink category with the release of Nitro Cold Brew. The line is anchored by Nitro Irish Coffee, a nonalcoholic canned cold brew infused with real whiskey and cream. To achieve the unique flavor, coffee beans were infused with whiskey before the alcohol was roasted out, leaving behind only the spirit’s aroma and natural taste, according to the company. Nitro Irish Coffee is now available alongside three additional varieties: Nitro-Charged Latte, Nitro-Charged Shellback Espresso and Nitro Vanilla Bean Bourbon. All come in 7-ounce single-serve cans.

FIRE DEPARTMENT COFFEE • ROCKFORD, ILL. • FIREDEPTCOFFEE.COM

Rich’s Retail-Ready Merchandiser

Rich’s introduces a retail-ready merchandiser for its gourmet Christie Cookie Co. Triple Chocolate Cookie. Operators simply remove the display from the freezer case, thaw and place it on the counter. Featuring 12 Triple Chocolate Cookies, the classic kraft merchandiser with bright red and navy blue accents emits a homemade vibe that will pop off the shelf, the company stated. The 1.4-ounce cookies come 48 per case with a shelf life of 365 days frozen and seven days ambient.

RICH PRODUCTS CORP. • BUFFALO, N.Y. • RICHSCONVENIENCE.COM

Haribo Berry Clouds

Haribo Berry Clouds are triple-layer foam gummies that come in cloud shapes to highlight their soft and fluffy texture. The mixed assortment features three flavors: blueberry, wildberry and strawberry. This new candy is rooted in innovation and inspired by consumer feedback. Haribo began dreaming up Berry Clouds in 2020 and went through multiple rounds of testing and sample production until the product reached “pillowy perfection,” the company noted.

HARIBO OF AMERICA • PLEASANT PRAIRIE, WIS. • HARIBO.COM/EN-US

MasonWays Compact Outdoor Sign

MasonWays offers a variety of sign solutions to drive consumers from the forecourt into the store. Options include poster sign frames on several different units, such as windshield service centers, locking outdoor cabinets and merchandising bases, which can be changed to reflect current promotions. The new MasonWays Compact Outdoor Sign is designed for areas that require a small footprint. Only 15 inches deep, it fits almost anywhere, both outside and indoors, the company said. Its plastic construction is durable, weather resistant and will not rust. Poster signs slide in easily, and the sturdy base prevents the sign from tipping.

MASONWAYS INDESTRUCTIBLE PLASTICS LLC • WEST PALM BEACH, FLA. • MASONWAYS.COM

NexPhase Smart EV Switchgear

Franklin Electric is entering the electric vehicle (EV) charging infrastructure space with the launch of the NexPhase Smart EV Switchgear. NexPhase is a turnkey switchgear solution containing the entire infrastructure required between utility power and up to four 150 kW Level 3 DC fast chargers. The solution comes fully assembled, pre-wired and factory tested, requiring only the utility and EV charger connections for installation. In addition to consolidating switchgear components into a single footprint, NexPhase features advanced intelligence to protect EV charging sites. Features include EV charger crash detection, flammable vapor monitoring, flood detection, pest/rodent mitigation and E-Stop integration capabilities.

FRANKLIN ELECTRIC • MADISON, WIS. • FRANKLINFUELING.COM

NEW PRODUCTS 22 Convenience Store News CSNEWS.com

I Saw the Future & It Is Underground

Elon Musk’s Las Vegas Loop offers two lessons for convenience store operators

By Roy Strasburger,

WHERE ARE THE jet packs, flying cars and robot servants?

The further we get into the 2020s, the more I seem to hear about “the future that never arrived.” People keep talking about how we should be living now, based on the science fiction of the last century. Where are the colonies on the moon and Mars, the cities that are under the seas, and supersonic jets that will get us from New York to Los Angeles in 45 minutes?

I blame a lot of it on the 1968 Stanley Kubrick movie, “2001: A Space Odyssey,” which gave us a fixed date. For those of us of a certain age, this movie formed our expectations of what life would be like this century and we are already almost a quarter of the way through the 2000s.

Oh, I know that the inventions and events I’ve mentioned are “almost here” — including the underwater cities that may be the result of rising sea levels rather than sub-surface settlements. That’s the problem with the future — it is always “almost here.”

But I did get a peek at the future while I was attending the NACS Show in October, except this part of the future wasn’t technically at the NACS Show. When you

stand in the main lobby area of the Las Vegas Convention Center, there is a huge digital sign overhead that is constantly flashing information and advertisements about Las Vegas (this should not surprise anyone who has visited the city). Amongst the advertising about making donations to the local casinos and getting sunburned on desert tours, there was encouragement to travel on “the Loop.” I wasn’t familiar with it and, my curiosity peaked, I decided to investigate.

It was cool. The Loop is a project initiated by Elon Musk’s The Boring Co., a company that specializes in digging tunnels. As it currently stands, the Loop consists of two tunnels that run 1.7 miles from the convention center to the Resorts World mall and hotel complex. The tunnels are 12 feet in diameter and, at their lowest point, 30 feet below ground level. The Loop was opened in 2021 and, if fully completed, will be a total of 29 miles running from the convention center to the airport and around the city of Las Vegas.

Those are the technical specs. The experience is eye-opening. You descend on a long escalator into an enormous cavern under the convention center. Below you is a huge room that looks like something out of a James Bond film. The bright lights

SMALL OPERATOR

24 Convenience Store News CSNEWS.com

CEO, StrasGlobal

Image credit: The Boring Co.

give the area an other-worldly illumination. People move about with purpose. And around the perimeter, cars silently glide by — a continuous parade of sleek sedans. The only thing missing is everyone wearing matching coveralls.

Once you reach the floor, you are directed to a car parking slot to await your ride. In a couple of minutes, a Tesla car rolls up, the occupants get out and you climb in. Our driver greeted us and was very patient as we tried to buckle our seatbelts and “ooh and ahh” at the same time.

The car slowly pulls out of the parking space and joins the convoy of cars circling around the cavern floor. You enter the tunnel, which is lit the entire length with pale blue LED lights. The silence of the car and the smooth concrete floor of the tunnel give you the impression that you are flying in a spaceship. Halfway through the trip, you briefly see the sky as you navigate an interchange that is under construction. The car then dives back below the surface.

At the Resorts World terminal, the car emerges from the tunnel into another enormous room and glides into its designated slot. We jumped out and took the escalator to the surface and into a mall full of glitzy, high-tech glamour and innovative food destinations — in sharp contrast to the drab and functional trade show floor at the beginning of our journey, which confirmed that the Loop had carried us from one world to another!

I found this experience to be fascinating for several reasons. The Loop only uses electric vehicles (EVs). There was no motor noise or exhaust fumes; just the sound of tires rolling over concrete. Although the car had a driver, the plan is for them to be self-driving. It’s the perfect environment for automated cars as there is no other traffic or pedestrians to worry about. Finally, the Loop is all about personal transportation. Imagine that there were 30 stops in the tunnel, and you wanted to get out at stop 25. Your car would travel directly to your stop without pausing at the other 24, unlike a train, subway or bus.

Green transportation that is fast, efficient and automated — what’s not to like?

OK, so this isn’t supposed to be a promotion on behalf of the Las Vegas Tourist Board or Mr. Musk. What does this have to do with retail? I see a couple of lessons here.

Lesson 1: The first has to do with innovation and it is not specifically about EVs. The Boring Co. took two ideas that are fairly common today, tunnels and cars, and combined them to create a new style of public

transportation. I’m not saying it is cheap, but it is innovative. (Speaking of innovation, could the Loop be the initial stage of a hyperloop? Just asking.)

So, how can you innovate at your store? What can you do that creates a new retail experience, especially around foodservice? Instead of just putting a popular food truck on your parking lot, have that chef take over your inside foodservice area. They may already have a following and a destination food offering. Have a local artist do a pop-up shop or provide live entertainment in your store. Collaborate with local trendy restaurants to provide prepackaged take-home meals. Offer free puppuccinos to your customers’ dogs. Innovation does not have to be expensive, it just needs to be innovative. The goal is to surprise and delight your customers.

Lesson 2: The second lesson is that the future is actually “almost here.” Whether it is alternative fuels or a rethinking of the public transportation system, the world is going to continue to change and you need to be ready for it. As with jet packs, it won’t happen overnight or even in the next few years, but change will come.

When EVs become standard, not every retail location will be able to support a charging station. When autonomous cars take to the streets, drivers will not need to stop at your store to refuel. What are you going to do when your fuel pumps become obsolete or uneconomical? Can your store survive without those customers?

Start thinking now about how you are going to evolve your business to accommodate these changes. Can you create a welcoming “dwell” space within your store where customers can comfortably work remotely? If your fuel pumps become unviable, you still have valuable real estate. Can you reclaim some of your parking lot to add a patio, a covered seating area, more sales space, or use the vacant area under the canopy for some other retail function — a coffee trailer, for example.

If you aren’t already in the fuel business, look for public charging stations nearby where you can advertise your store as a place to hang out while a driver charges.

At the end of the day, your future is in your hands. Innovation and evolution are what our industry has been doing for decades and we can still do it. The key will be to understand your customers and become the location that provides them with what they need, now and in the future.

Innovate and evolve. We want to keep your business above ground. CSN

Roy Strasburger is CEO of StrasGlobal, a privately held retail consulting, operations and management provider serving the small-format retail industry nationwide. StrasGlobal operates retail locations for companies that don’t have the desire, expertise or infrastructure to operate them. Learn more at strasglobal.com.

Editor’s note: The opinions expressed in this article are the author’s and do not necessarily reflect the views of Convenience Store News.

FEBRUARY 2023 Convenience Store News 25 CSTORE RESCUE

The Rich, Bold FlavoR oF Our premium quality cigarettes, pipe tobacco, cigarette tubes, and roll-your-own tobacco products are all made from the finest U.S. tobacco. ContaCt us today! www.gopremier.com/contact a customer favorite — now available in enticing NeW PacKaGiNG

THE BOLD CHOICE

Big taste and big savings are two things you get with Wildhorse cigarettes. Our American blend tobacco comes from the finest crops. Enjoy a bold, rich taste and smooth smoking experience. Are you ready to EXPERIENCE THE FREEDOM?

GOPREMIER.COM

28 Convenience Store News CSNEWS.com COVER STORY

CHANGING THE NARRATIVE

TODAY’S CHALLENGES IN THE TOBACCO CATEGORY CAN BECOME UNTAPPED OPPORTUNITIES

BY RENÉE M. COVINO

THE ONLY THING CONSTANT in the tobacco/nicotine business is its ever-evolving nature. For convenience store retailers, whose No. 1 product category in sales per store is cigarettes, this is a blessing and a curse. On the one hand, tobacco restrictions are adding up and tightening. On the other hand, innovation is multiplying and opening.

Convenience Store News recently consulted with industry experts to get their perspectives on the year ahead for the convenience store backbar. Here is what they said:

Economic Squeeze

When it comes to the business of tobacco, the challenges often get mentioned before the opportunities. For instance, analysts and manufacturers were quick to bring up the economic squeeze and its expected effect on the tobacco consumer this year.

“We believe the most pressing challenge for 2023 will be the continuation of consumer pressure on discretionary spending,” said Mike Wilson, vice president of trade strategy and operations for Reynolds Marketing Services Co., based in WinstonSalem, N.C. “Inflation, rising interest rates and a lagging economy in general are impacting how consumers make their purchasing decisions.”

Similarly, Bonnie Herzog, managing director at Goldman Sachs, pointed out that the macro environment is still uncertain and thus negatively affecting the category. “Gas prices have calmed down, but remain a near-term headwind to adult tobacco/ nicotine consumers,” she noted.

A recent Goldman Sachs survey of retailers and wholesalers projected a “quite cautious” outlook for the nicotine category, thanks to broad-based inflationary pressures, lower discretionary income, lower usage and increased downtrading.

Inflation and rising prices will continue to lead to trade-downs to off-brands, private label and generics/subgenerics in the tobacco/nicotine category, according to Alex Morrison, senior business analyst for Cadent Consulting Group, based in Wilton, Conn.

“The economic pressure facing consumers is real and many are choosing to trade

FEBRUARY 2023 Convenience Store News 29

down to lower-priced brands or products that result in lower register rings at retail,” echoed Becky Roll, chief revenue officer for Glenview, Ill.-based Republic Brands, maker of Top, Premier, Gambler and other roll-your-own (RYO) tobacco products.

Don Burke, senior vice president of Management Science Associates Inc. (MSA), a Pittsburghbased company focused on analytics and informatics, believes the key challenge of managing the 2023 backbar will be for retailers to continue capitalizing on the trend toward value brands in each product segment.

“As inflation and gas prices are expected to remain high this year, being able to offer a strong product selection of value-priced items, while maintaining the right items in the higher-priced segments, will require some retail ingenuity,” he told CSNews.

Regulatory Uncertainty

While economic pressure has been a recent challenge for the category, regulatory uncertainty is a longstanding foe that has been intensifying, especially as it relates to the Food and Drug Administration (FDA) and its painfully slow process for determining which electronic cigarette, vape, modern oral products and more are authorized for sale on the market. Some that were denied authorization are involved in litigation, causing even more industry confusion.

Running parallel with that is the uncertainty around enforcement action “because the FDA has not acted terribly aggressively,” noted Bryan Haynes, a partner with the national law firm Troutman Pepper. He believes the dynamic needs to change to avoid all of the unlawfully marketed products that are on shelves currently.

Of late, the regulatory activity has surrounded electronic cigarette/vape items. There’s been no regulatory action around modern oral products yet, which he said is causing further confusion as to how things might translate from one category to another down the road.

Inventory exposure is top of mind for many retailers, but they are often confused as to the timing of enforcement and when they have to remove product from their shelves, added Agustin Rodriguez, another partner specializing in tobacco at Troutman Pepper.

That’s the conundrum, Haynes explained: “FDA orders speak in immediate terms; there is no sell-through period. So, as a retailer, you basically have two options: rely on the manufacturer to avail itself to stay the action, which has happened a number of times, or you potentially rely on the FDA to delay taking action.”

The Opportunity Outlook

• Modern oral nicotine “looks promising, but is still in the early days,” according to Bonnie Herzog, managing director at Goldman Sachs, which puts the subcategory at around 1.7 percent of the U.S. tobacco market currently, but growing. Perhaps best of all, she noted the segment has attractive demographics: younger, more affluent, better educated, urban consumers.

• “Oral pouches are hot, but we think the unquestionable hottest trend in nicotine this year is disposable e-cigarettes,” stated Alex Morrison, senior business analyst at Cadent Consulting Group, based in Wilton, Conn. “These products have exploded since the FDA’s June ban on non-disposable flavored vapes, unintentionally opening the floodgates for such products to come to market.”

• While most retailers have experienced an increase in sales of flavored vapor disposables and added to their product selection in this segment, Management Science Associates Inc. (MSA), a Pittsburgh-based company focused on analytics and informatics, is beginning to see an increase in tobacco and menthol varieties as well. “This is something to watch during this year — it could be that as more retailers are stocking a wider selection of disposables, more consumers are developing an affinity for this product form and are purchasing it for more than the flavor options,” explained Don Burke, senior vice president of MSA.

• Currently low in volume but starting to grow, Burke views low-nicotine and no-nicotine vapor items as an emerging trend in the industry.

• Make-your-own cigarettes are experiencing somewhat of a resurgence. They provide adult consumers with “a less-expensive alternative to factory-made cigarettes, allow them to build the perfect taste for themselves, and make them feel that they’re crafting something themselves,” according to Becky Roll, chief revenue officer at Glenview, Ill.-based Republic Brands.

• “Retailers are using digital media within their owned channels to drive adult nicotine consumer engagement with c-store loyalty programs. “Those that are leveraging this technology are outpacing their competition,” reported Mike Wilson, vice president of trade strategy and operations for Reynolds Marketing Services Co., based in Winston-Salem, N.C. “Retailers are also leveraging digital content within their owned channels to increase consumer awareness of new product introductions and multiunit sales offers.”

30 Convenience Store News CSNEWS.com COVER STORY

Morrison of Cadent Consulting concurs that there is widespread industry confusion, citing headlines regarding the market removal of certain popular vape items. “By all accounts, these products should no longer be available,” he relayed to CSNews. “With seemingly no enforcement being taken in the last several months, we believe that the biggest backbar challenge in 2023 will be for c-stores to juggle the products offered on-shelf while the regulatory environment is increasingly unclear.”

Haynes offered a prudent way for retailers to deal with the uncertainty in the meantime. “They can take a level of diligence with the companies they deal with,” he said. “This is not rocket science. Deal only with reputable companies that have the resources to undertake compliance. Then, seek to understand at a basic level where they have undertaken regulatory efforts by asking them or consulting some of the publicly available resources on the FDA website.”

Richmond, Va.-based Altria Group Inc., one of the world’s largest producers and marketers of tobacco products, believes more could be done by the FDA to advance harm reduction in the United States.

“The FDA should move more deliberately toward creating a market of authorized smoke-free products

to help accelerate smoker transition away from cigarettes,” CEO Billy Gifford stated during Altria’s third-quarter earnings call. “The fact remains that to date, only a small percentage of e-vapor volume has been authorized, and no oral nicotine pouch products have received market authorization. We believe collaboration and accountability from all stakeholders are required for this market transition to take place.”

An Untapped Dance

On the opposite end of the challenge spectrum lies opportunities, and industry experts are quick to point out that 2023 is robust with potential.

One under-recognized trend MSA is beginning to see this year is “a return to growth in the pipe and roll-your-own tobacco segments,” according to Burke. “While these segments did not particularly fare well during the pandemic, the current ongoing economic conditions of high inflation and higher gas prices are encouraging more consumers to make their own cigarettes.”

Republic Brands is also observing a resurgence in the RYO space. Convenience store retailers can choose to become a top-of-mind destination for these items by carving out dedicated space in their stores for RYO, Roll advised.

COVER STORY 32 Convenience Store News CSNEWS.com

Younger, more affluent, better educated, urban consumers are being drawn to modern oral nicotine.

©2023 Haleon group of companies or its licensor. All rights reserved. CONTACT YOUR LOCAL NICORETTE SALES REPRESENTATIVE ON HOW TO ORDER OR EMAIL SCOTT.X.BREISINGER@HALEON.COM CON C T OU R LOC L N ICOR TO ORDER OR EM A I L DID YOU KNOW... Nicorette 10ct is your answer! Cinnamon Surge, White Ice Mint, & Fruit Chill Gum These retailers are on board, are you? HOLIDAY STATIONSTORES ® WAWA ® CIRCLE K® 7-ELEVEN ® SPEEDWAY® AMPM ® New Jersey passed a law REQUIRING CONVENIENCE STORES that sell tobacco or vapor products TO CARRY FDA APPROVED NRT * NICORETTE IS THE ONLY FDA APPROVED SMOKING CESSATION ITEM† F * Took effect March 18, 2022. Includes Vape shops. Excludes Cigar shops. † Only national branded FDA approved smoking cessation item.

Meanwhile, Burke of MSA has several pieces of advice for c-store operators looking to maximize their tobacco/nicotine business this year. First, stock items with a lower product quantity and/or a lower price point. Second, use window and in-store window signage to make note of your value-priced tobacco items. Also, maintain strong product selection in what Burke identifies as growing categories: value cigarettes, value moist, modern oral and vapor disposables.

On the topic of modern oral, Morrison made note of oral pouch promotions, particularly three-for-one

manufacturer deals that retailers across the country are starting to tap into. These promotions are drawing new adult users into the subcategory.

Reynolds Marketing Services’ Wilson believes consumer choice across segments remains one of the greatest untapped opportunities. “Many adult consumers are looking for potentially lessrisky products and as these consumers continue to navigate away from combustible cigarettes, polyusage continues to rise,” he told CSNews

To meet the demand, c-store retailers need a robust nicotine offering. “The days of backbars entirely dedicated to cigarettes are gone,” Wilson said. “Year after year, we see that adult nicotine consumers are looking for different ways to enjoy the category. Incorporating next-generation products into your backbar provides consumers the option to explore new ways to enjoy nicotine.”

Staying on the forefront of nicotine innovation also means retailers should constantly evolve their programs, the Reynolds executive added, citing digital partnership programs that provide additional resources to retailers.

“Beyond technology, remaining engaged with the category with new-product offerings helps ensure your customers will stay loyal to your location,” Wilson said.

The way Herzog sees it, strong promotional activity and loyalty programs will mitigate downtrading to some extent. Also, a shift to more noncombustible alternatives and more affordable options will continue as cigarette pricing remains high. CSN

COVER STORY 34 Convenience Store News CSNEWS.com

“As inflation and gas prices are expected to remain high this year, being able to o er a strong product selection of value-priced items, while maintaining the right items in the higher-priced segments, will require some retail ingenuity.”

— Don Burke, Management Science Associates Inc.

One under-recognized trend gaining momentum is the roll-your-own tobacco segment.

WHY PAY MORE? Customers know that with Eagle 20’s they don’t have to pay more to get more. That’s why we’ve been America’s favorite value priced cigarette brand for 5 years running.* Visit Us At CDA Marketplace Booth #705 Liggett Vector Brand is the exclusive sales, marketing and distribution agent for Liggett Group and Vector Tobacco. © 2023 Vector Tobacco MSA Participant *Based on 52 weeks MSAi retail shipment data through June 2022. Value price category includes all brands with manufacturing list price of $45 per carton or less. Join more than 80,000 retailers and grow your business today. Call 1-877-415-4100 to order, or contact your LVB rep today.

CONQUERING LABOR CHALLENGES

C-store retailers are turning to technology to do more with less, and increasing incentives to entice new workers and retain current staff

By Tammy Mastroberte

EVER SINCE THE COVID-19 pandemic hit in March 2020, labor has been an issue across all industries, and the convenience store industry is no exception. Whether it’s attracting new workers, fighting turnover or figuring out how to keep the stores open and running with fewer employees, these challenges are expected to continue in 2023.

“We began to see a decline in applications in March of 2020,” recalled Alex Olympidis, president of operations at Valparaiso, Ind.-based Family Express Corp., noting that the 81-store chain is still feeling the effects today. “Family Express is experiencing an increase in turnover this year in the mid-70 percent, compared to 50 percent pre-COVID.”

Although labor issues started to become prevalent at the beginning of the pandemic, things seemed to get worse the following year as the problem hit manufacturers, suppliers and distributors as well — all having a direct impact on the c-store industry.

“The first year of the pandemic was not so bad, but then a year later, at the beginning of the reopening, it just started to unravel,” said Jonathan Polonsky, chairman and CEO of Plaid Pantry Inc., based in Beaverton, Ore., and operating 106 convenience stores. “It was exacerbated by the supply chain because our suppliers didn’t have the labor either. In some cases, they would drop off a delivery and not help our employees, and then our people were unhappy.”

At Pilot Co., the Knoxville, Tenn.-based operator

of more than 800 travel centers, labor shortages were seen in 2020 due to illnesses, quarantines and closures. However, the retailer then began to see the effects of the labor shortage manifest in supply chain issues and product shortages, said Jamie Landis, vice president of team member experience at Pilot.

“We learned a lot through this experience to inform how we’re handling labor shortage now,” he told Convenience Store News. “Overall, we’ve been able to leverage those learnings, lean into our people-first culture, promote our industry-leading benefits and continue to adapt to make sure we’re taking care of our team to equip them to serve our guests.”

Many other c-store industry players are on the same page, offering attractive benefits and salaries to try to bring in new workers and retain the ones they have. They are also turning to technology to enable their stores to run with less staff if necessary.

Making Do With Less

When it comes to finding workarounds, one of the top solutions is technology — whether it’s robotics in the kitchen, self-checkout, or automated inventory and ordering.

“We are definitely lower than we want to be, and historically, as far as staffing levels,” said Polonsky, who noted that computer assisted ordering has been very helpful. “We made an investment with a POS [point-of-sale] a couple of years ago and with PDI Technologies back office, which has the ability for your inventory to be perpetual. It takes a lot of work on the back end, but the advantage is the system will order your replenishment orders for you.”

The first year of the pandemic, Plaid Pantry took

36 Convenience Store News CSNEWS.com FEATURE

#1 Selling Snus Worldwide F GROW PROFITS with THE ORIGINAL Call 800-774-7754

different sections of the store and rolled out computer-assisted ordering. Today, the technology covers 80 percent of the store. While it still requires managers to check orders and monitor the system, it’s a huge time-saver, according to Polonsky.

Pilot is also leveraging technology and logistics to gain insight into best practices across all its travel centers so that the company can maximize supporting its employees and customers, Landis said. One solution has been the introduction of selfcheckout stations at its locations.

“Adding self-service kiosks and other self-service options has been the path of many retailers facing labor shortages,” observed Zach Matook, director of marketing at Sprockets, the Folly Beach, S.C.based provider of an artificial intelligence (AI) powered hiring platform.

Attracting New Employees

When the labor challenges hit, many c-store retailers began looking for ways to attract new workers, while competing with all the other industries also dealing with staff shortages. With so many job openings these days, applicants can be more selective. Retailers must act quickly, especially when an applicant seems like a perfect fit for their business model, Matook advised.

“We tell people to see if a person’s application matches the profile of their top-performing employees, but make sure you get back to them as soon as possible because they are applying to multiple jobs a day and the other c-store or retailer down the street could beat you to it,” he cautioned.

Family Express takes this route at its stores, making sure its application gives the information needed to know whether an applicant is likely a fit. The chain’s “custom industrial assessment” during the application process actually increases the drop-off rate of applicants to help the retailer “get the right applicant, not simply a warm body,” Olympidis said.

The company has also found success hiring “in anticipation of attrition,” meaning Family Express often has more people than needed at any given time. Also, because the chain has highly condensed stores in the geography it operates and a consistent operational system across them, the retailer can swap out employees when one store might be lower staffed.

Plaid Pantry, meanwhile, has made a larger investment in Indeed.com and social media advertising than it has in the past. And Pilot implemented recruitment marketing and advertising technology and services to “strategically place digital job ads to drive applications in tough-to-staff markets,” said Landis. Pilot is using several platforms to make the process more mobile friendly, such as text messaging recruiting, AI recruiting and applicant tracking.

Attracting Corporate Talent

While store-level employees remain a focal point for the convenience store industry during this labor shortage, all segments of the business have been affected, including the corporate level.

Today’s market allows employees to be more selective, forcing retailers to be more competitive.

“It’s a candidate’s market right now,” said Chloe Rosenthal, vice president of Baltimore-based Millman Search Group, which recently filled a director of real estate position in a c-store chain. “He was smart and had a lot of experience, but his big thing is he didn’t want to be in the office every day.”

A year ago, not being in the office wasn’t as big of a deal for candidates, but Rosenthal is seeing this request more and more as people are preferring a hybrid work environment.

Another top request among recent job candidates is working for a company that promotes from within and shows proof of that. This is “a huge attraction and selling point,” she said.

Additionally, any way a company can differentiate itself, such as offering restricted stock and equity options, is yet another plus to attract employees. In some cases, paying a lower base salary but offering equity or a long-term incentive can be attractive to candidates.

“Companies are being pushed to pay higher and higher rates, and I have candidates sitting on five or six offers when it used to be two,” Rosenthal said. “People are applying to so many jobs that they are waiting and sitting on the offers to see who is going to come in the highest.”

Pilot also takes the approach Matook recommends of responding quickly. “We integrated multiple recruitment technology solutions alongside our existing talent acquisition tools and service,” Landis explained. “Doing this has enabled us to prescreen candidates and schedule interviews immediately. This was a key component of enhancing our recruiting efforts [because] candidates sometimes experienced delays waiting for a callback or interview, which left the door open for them to pursue other positions.”

Slowing Turnover

In addition to attracting new employees at a steady pace, c-store retailers are working to keep their current staff happy to avoid turnover. Methods range from pay raises and bonuses, to training and development opportunities.

“We decided to double-down our focus on retaining our quality workforce, rather than on recruitment [at the beginning of the pandemic],” Family Express’ Olympidis said. “Even at that point, our wages were higher than our competitors without offering hazard pay. In June of 2021, we felt compelled to offer a new starting wage of $15

FEATURE 38 Convenience Store News CSNEWS.com

For trade use only. CHARGE AHEAD WITH BLACK BUFFALO. AVG. TRIPS/WEEK TO CONVENIENCE STORES Nicotine-Free ZERO Long Cut & Pouches Wholesale@BlackBuffalo.com NOT Subject to Flavor Bans For MST, Modern Oral + Combustible Users Nicotine Long Cut & Pouches

an hour — not because of any staffing shortage, but because we felt the effort of our frontline workers was heroic and deserving of a wage increase.”

Upon increasing the wage to $15, the company saw a spike in applications for new workers and since then, the daily application total for new employees has remained consistent.

At Plaid Pantry, the company shows appreciation for its employees in some way every quarter. The goal is to slow turnover and reward employees, so they know how much they are appreciated by the company, said Polonsky.

“It’s hard to get people to stay, so when they do, you want to show appreciation,” he added. “Last quarter, we gave them a cash bonus if they were there for the past three months and next quarter, they will get a gift of a hoodie or tumbler.”

Additionally, the retailer adjusted the time for compensation reviews to reward those who are doing well. Compensation reviews used to be at 30 days and 90 days, but the chief executive has given permission to managers to offer a raise sooner to individuals who show promise — even if it’s within the first few days of employment.

“You want to keep that person because turnover is expensive, and it shows our managers that we are doing what we can to slow turnover because they are [on] the frontline and really feel the brunt of the turnover,” Polonsky explained.

Another best practice to retain workers is to focus on employee training and development. This is something today’s workforce is looking for, along with a company that promotes from within and shows proof of that, noted Chloe Rosenthal, vice president at Millman Search Group, a recruiting firm based in Baltimore.

“Knowing they can take classes to better themselves and put that on their resume is something employees desire,” she said. “Companies that say they promote from within and actually do it also have a huge selling point in retail.”

At Pilot, employees are offered a variety of developmental opportunities, and there’s a blend of in-person,

virtual and e-learning, so it’s accessible to all employees, according to Landis.

“One of the most important and effective ways we retain current team members is by supporting their professional development in deliberate and tangible ways,” he said, pointing out that the company is so focused on employee experience that it launched an entire department dedicated to it.

“The department works to identify ways we should complement our strong benefits package with ideas and initiatives such as better onboarding programs, new perks, mentorship opportunities, new tools and improved processes.”

Olympidis believes one of the most impactful tactics for store-level retainment, and something that Family Express does, is to give employees access to their schedules and enable them to easily pick up shifts or swap shifts with other employees. The chain makes it a point to publish schedules no less than one month in advance.

The average tenure of store associates at Family Express is three years.

“This gives people a chance to plan their lives,” Olympidis said. “It also grants us some goodwill in the case where a schedule must be adjusted for reasons beyond our control, like the sudden illness of a coworker.”

Any Relief in Sight?

Although the forecast for 2023 and what will happen with labor this year is unclear, many are hopeful there will be positive change. At a minimum, the executives CSNews spoke with are largely not anticipating the situation getting any worse.

Polonsky believes the industry has hit a plateau, but he doesn’t foresee it getting better overnight. “I believe it will get incrementally better as we move through 2023,” he said.

Olympidis agrees, pointing to data he has seen that does seem to reflect an increase in workforce participation across many industries, including the c-store industry.

“As an optimist, I do see clearer skies ahead,” he said. CSN

FEATURE

40 Convenience Store News CSNEWS.com

“As an optimist, I do see clearer skies ahead.”

— Alex Olympidis, Family Express Corp.

How Beverage Programs Can Break Ties

Hot, cold and frozen dispensed offerings can make the final difference in customers’ store selections

By Angela Hanson

By Angela Hanson

WITH THE QUALITY and reputation of convenience store foodservice programs on the rise, prepared food often gets the spotlight. Even when consumers think of a brand as a dining destination, they tend to associate it with signature snack or entrée items. Yet this doesn’t mean retailers can feel free to put little effort into dispensed beverages; on the contrary, this offering can ultimately determine which store a customer chooses.

As competition for share of stomach heats up, it’s more likely that customers will have multiple c-store options they find equally appealing, which only increases the importance of having quality hot, cold and frozen beverages to make the final difference. For example, a morning customer may not have beverages alone in mind, but if two geographically close competitors both offer tasty breakfast

sandwiches, knowing one store has a fantastic cup of coffee can serve as a tie-breaker.

Variety, flavor and a clean and organized beverage area are the main draws, according to retailers.

“I think when it comes to dispensed beverage, it is important to carry as much variety as possible. The goal is to steal guests from your competitors, as well as your cold vault,” said Paul Servais, foodservice director at La Crosse, Wis.-based Kwik Trip Inc., operator of 840 stores across Wisconsin, Minnesota, Iowa and Michigan. “This means playing with all of the latest equipment and drinks.”

In addition to being able to choose from a diverse array of beverage and flavor types — sweet, sour, astringent, herbal and more — customers also value a beverage area’s overall look and feel.

“Things that can get overlooked at the store level can be as essential as cleaning up spills in a timely fashion.

FOODSERVICE 42 Convenience Store News CSNEWS.com

MORE WAYS TO RITA NEW Lone River Ranch Rita Variety Pack is bursting with big flavor and bigger news. Four delicious, premium, margarita-style beverages that feature real lime juice, organic agave nectar, and only 150 calories. Lone River is already the #1 selling agave-flavored seltzer nationally*. With the Ranch Rita Variety pack, we’re putting a new spin on the country’s top cocktail and expanding into new horizons – and new sales opportunities. For more info, contact your local Lone River distributor. *Nielsen Total US xAOC + CONV 52WE 11.19.2022 For more info: loneriverbevco.com Follow us @ranchwater PLEASE DRINK RESPONSIBLY. Far West Spirits LLC, Houston, TX

This along with other pieces to the puzzle would seem to be ‘no-brainers,’ but a guest shouldn’t have to guess where the various dispensed beverages are located within the store or ask for either a cup or the product,” said Ben Lucky, category manager, foodservice, at La Plata, Md.based Dash In Food Stores.

Small, sometimes overlooked, but critical boosts are having machines that function and machines that are intuitive, Lucky noted.

Retailers agree that refillable mug programs are a useful way to encourage frequent flier customers to stay brand loyal, appeal to customers who care about conservation, and promote the company name. However, mugs haven’t fully recovered from the COVID-19 pandemic.

“A mug program is important, but it has declined in the last couple years due to COVID,” Servais told Convenience Store News. “Seems like it is going to take a while to get it back. We are up in new cups, but down in refills all of 2021 and 2022. I am not giving up on refills.”

Hot Dispensed Beverages

Coffee is both a stalwart component of c-store beverage programs and the offering that can tank a program’s reputation if consumers perceive it to be stale, burnt java that’s been sitting on the burner all day. The good news is that c-store customers don’t necessarily require gourmet coffee made from beans with complex flavor profiles to be satisfied.

“A quality cup of coffee. That’s all that matters to our guests,” Servais pointed out. “Problem is, coffee is very personal and every person describes their quality cup of coffee differently.”

Coffee drinkers favor the retailers that they trust to give them what they want, how they want it. At Kwik Trip, customers have begun shifting their preferences toward Colombian and dark roasts over light roast house blends in recent years. In addition to meeting customer tastes, the segment strongly benefits from simple freshness.

“I think if you keep your pots clean and keep brewing fresh coffee all day long, guests recognize this and it pays off,” the foodservice director noted.

Bean-to-cup brewers are another on-trend way to offer the key freshness busy customers seek, according to Ryan Ratcliffe, category manager of dispensed beverages at Maverik — Adventure’s First Stop, the Salt Lake City-based operator of 400 c-stores across 12 states.

“Having bean-to-cup accomplishes that without wasting a bunch of coffee. You can also provide all your customers' favorite blends all day long,” he said. “Also, as cold coffee is trending, bean-to-cup allows customers to enjoy their favorite coffee hot or cold and customize it however they would like.”

The appreciation for customization extends to a well-stocked coffee bar with ample selections of flavors and syrups and enough space to accommodate multiple customers at once. Dash In’s Lucky advises retailers to also consider sensory attributes.

“I think the area should smell like coffee. Having stale water and rags in a sanitizer bucket or other unwelcomed aromas take away from the offer and the brand,” he said. “One small piece I might add is the need for the green sweetener, otherwise known as stevia. The blue, pink and yellow have been around for a while now, but the green is picking up steam.”

Cold Dispensed Beverages

Customization at the soda fountain has gotten a lot of attention in

“I think when it comes to dispensed beverage, it is important to carry as much variety as possible. The goal is to steal guests from your competitors, as well as your cold vault.”

— Paul Servais, Kwik Trip Inc.

44 Convenience Store News CSNEWS.com FOODSERVICE

The Fresh Blends smoothie program added to Kwik Trip's dispensed beverage gross profit.

recent years, but Servais casts doubt on the notion that equipment like Coca-Cola Freestyle and Pepsi Spire units are particularly appealing, despite their proliferation in the last few years.

“This is an old and tired part of dispensed. Soda is dying,” Servais said. “Energy and alternative beverages are taking the fountain heads. The Coke Freestyle is viewed by many as ‘cool to play with,’ but when there’s a line in front of it to get a drink because it takes longer, that is a turnoff.”

Maverik has taken a different approach and found success by going beyond such specialty customization single units. Inspired by the soda shops that are popular around its Salt Lake City headquarters, Maverik’s soda mixology program encourages customers to build their own unique beverages by combining soda with various syrup flavors, sweet creams, fruit wedges and cubed or nugget ice — all for one base price.

The retailer’s larger store format allows multiple customers to take their time and experiment, but for operators that want to offer exciting soda mix-ins in a limited space, Ratcliffe recommends coconut, vanilla, peach and raspberry as some essential musthave flavors.

“The fun of the program is we can recommend and rotate different flavor combinations, but it’s all up to the consumer which is going to be a keeper, or if they’d prefer to keep mixing something fresh and new,” Ratcliffe explained.

Building a fun, experiential program is helpful, but retailers must put effort into smart marketing strategies that ensure consumers remember it and take it into account when they’re deciding on a store visit.

Maverik’s soda mixology program encourages customers to build their own unique beverages.

“Mixology at Maverik has been a hit with Maverik fans on TikTok,” Ratcliffe said, adding that the account uses a variety of content to show off the brand’s mixology options. “Content can include creating existing mixology recipes from Maverik or trying fan creations that were shared on the platform with fans’ personal mixology recipes that match their flavor preferences. Marketing’s goal is to reach customers where they are on their favorite social platforms with engaging and fun content.”