The

Resetting Store Strategies

September/October 2023

New Neighborhood Center Focus on Customer-Centricity

Ikea continues push to becoming a climatepositive

new

Trending Stores: Princess Polly, popular online fashion import from Australia, makes U.S. store debut. 18

Autonomous robot takes on additional in-store duties at Stop & Shop.

CSA (USPS 054-410; ISSN 0193-1199), is published bimonthly by EnsembleIQ, 8550 W. Bryn Mawr Ave., Suite 200, Chicago, IL 60631, on a controlled basis to qualified retailer titles and architects. Real estate and shopping center owners and developers $75 per year. All other non-qualified in the United States: $80 one year; $155 two year; $14 single issue copy; Canada and Mexico: $105 one year; $185 two year; $16 single issue copy; Foreign: $115 one year; $215 two year; $16 single issue copy. Digital edition subscription: $55 one year digital; $105 two year digital. Periodicals postage paid at Chicago, IL and additional mailing offices. POSTMASTER: Please send address changes to CSA, Circulation Fulfillment Director, 8550 W. Bryn Mawr Ave, Suite 200, Chicago, IL 60631. Subscription changes may also be emailed to contact@chainstoreage.com, or call 1-877-687-7321. Vol. 98, No. 5, September/October 2023. Copyright ©2023 by EnsembleIQ. All rights reserved. Contents VOL. 98 SEPTEMBER/OCTOBER NO. 5 CHAINSTOREAGE.COM SEPTEMBER/OCTOBER 2023 3 6 from the editor’s desk 31 tech viewpoint: a retail tech column 18 8 TOP 100 U.S. RETAILERS Walmart and Amazon once again take the top spots in Chain Store Age’s annual ranking of the nation’s 100 largest retailers. COVER STORY STORE SPACES

Resetting store strategies for growth

registry Babylist

brick-and-

Commentary:

20 Online

enters

mortar with experiential showroom. 22

business

with

initiatives. 24

21

Contents VOL. 98 SEPTEMBER/OCTOBER NO. 5 4 SEPTEMBER/OCTOBER 2023 CHAINSTOREAGE.COM 37 Home Depot Q&A: How the chain gets store tech up and running after disaster strikes. 26 Neighborhood Centers: Dining, experiences, and events now top customers’ shopping lists. TECH 26 38 A look at how five retailers are enabling customer-centricity for in-store shopping, delivery, warehouse operations, merchandising and promotions. REAL ESTATE 38

zipwall.com info@zipwall.com 800-718-2255 DUST BARRIER SYSTEM Stay Open for Business During a Renovation! ZipWall ¨ –A Temporary Dust Barrier in Minutes Up to 20' high Protects store from dust Conceals messy worksite Easy to set up and take down

All Roads in Retail Lead to the U.S.

Across the globe, American consumers have long been known for their spending power. And now, increasingly, foreign retailers want to get in on the action.

The number of international retailers looking to expand in the U.S. is growing at a fast pace. Some, such as Primark and Uniqlo, have been here for a few years, while others are new on the scene (at least with regard to a brick-and-mortar footprint).

Here’s a look at some of the imports.

•Etam: The century-old French lingerie retailer recently made its U.S. store debut at Simon’s Dadeland Mall in Miami. The storied — and affordable — brand has more than 850 global stores. It now has its eyes set on U.S. expansion, with plans open two more U.S. locations by yearend.

•Intimissimi: With superstar Jennifer Lopez as its global ambassador, the reasonably-priced Italian lingerie and loungewear brand has ambitious expansion plans for the U.S., one of its biggest untapped markets. The company expects to open 27 stores this year, followed by another 30 locations in 2024.

•Mango: The Spanish fast-fashion brand, which has about 10 U.S. stores, is on a mission to open 40 stores here by the end of 2024, after which it will reveal the second phase of its U.S. expansion. While most of its expansion has been in the Northeast, the company plans to further expand into the Southern U.S., including Texas.

•On: The fast-growing Swedish running and performance apparel brand recently opened its fourth U.S. store, in Brooklyn, N.Y. The outpost spans 3,625 sq. ft. across two floors, with the second level

dedicated to community experiences.

The new location underscores On’s investment in the U.S. amid strong (including wholesale) growth. The company plans to open stores in Miami, Chicago, Austin and Portland, Ore.

•Primark: The value-priced family fashions and home goods retailer, a subsidiary of Associated British Foods, is entering new markets as part of its accelerated U.S. expansion. With 22 U.S. stores up and running, Primark is looking to reach 60 U.S. locations by 2026.

•Pop Mart: With nearly 400 stores and 2,000 “Robo Shops” (vending machines) around the world, Chinese collectible toy brand Pop Mart opened its first permanent U.S. store, at American Dream, in East Rutherford, N.J.

Pop Mart specializes in creating “designer” toys in collaboration with international designers and entertainment powerhouses such as Disney and Universal Studios. Its most signature offering is a “blind box,” which features an assortment of items in a sealed box that cannot be opened until the box is purchased.

•Princess Polly: With its affordable offerings, the online Australian fashion brand is a Gen Z fave, particularly in the U.S. where sales make up the majority of its revenue. Polly’s firstever store, at Westfield Century City in Los Angeles, is sleek and stylish — and packed with the brand’s constantly changing assortment of on-trend styles.

•Uniqlo: With some 50 U.S. locations, the Japanese retailer hopes to grow that number by a reported 20 to 30 stores a year.

•Zara: The fashion brand, part of Spanish apparel giant Inditex, is focused on expanding its U.S. fleet. From 2023 to 2025, Zara will open or renovate at least 30 stores in key U.S. cities.

CHANNELS > COMMERCE > CUSTOMERS

BRAND MANAGEMENT

Vice President & Group Publisher, SPECS Chairman Gary Esposito gesposito@ensembleiq.com

EDITORIAL

Editor Marianne Wilson mwilson@ensembleiq.com

Technology Editor Dan Berthiaume dberthiaume@ensembleiq.com

Real Estate Editor Al Urbanski aurbanski@ensembleiq.com

Online Editor Jennifer Mosscrop-Setteducato jmosscrop@ensembleiq.com

ADVERTISING SALES & BUSINESS

Midwest & South Sales Manager Michael Morrissey mmorrissey@ensembleiq.com

East & West Sales Manager Lise Slaviero Groh lgroh@ensembleiq.com

Real Estate Sales Manager Al Urbanski aurbanski@ensembleiq.com

EVENTS/MARKETING

Program Director Deena AmatoMcCoy damccoy@ensembleiq.com

Event Director Melissa Murphy mmurphy@ensembleiq.com

Event Coordinator Rita Ruzalski rruzalski@ensembleiq.com

Marketing & Event Administration Coordinator Farida Batuta fbatuta@ensembleiq.com

ART/PRODUCTION

Art Director Michael Escobedo mescobedo@ensembleiq.com

Production Manager Patricia Wisser pwisser@ensembleiq.com

SUBSCRIPTION SERVICES

List Rental mbriganti@anteriad.com Subscription Questions contact@chainstoreage.com

CORPORATE OFFICERS

Chief Executive Officer Jennifer Litterick

Chief Financial Officer Jane Volland

Chief People Officer Ann Jadown

Chief Strategy Officer Joe Territo

Chief Operating Officer Derek Estey

Marianne Wilson mwilson@chainstoreage.com

CHAIN STORE AGE

FROM THE EDITOR’S DESK 8550 W. Bryn Mawr Ave., Suite 200, Chicago, IL 60631 (773) 992-4450 Fax (773) 992-4455 www.chainstoreage.com 6 SEPTEMBER/OCTOBER 2023 CHAINSTOREAGE.COM

if you want the absolute best in asphalt and concrete services, we are unmatched in terms of expertise, quality, customer service, and execution. With us, you can expect exceptional results and a level of professionalism that surpasses all others. choose Fighting Charlie's Asphalt and Concrete for all your needs! GET

BIG NEWS COMING SOON:

FIGHTING CHARLIE’S ROOFING WARRIORS, LLC.

IN TOUCH TODAY! >>>

Annual ranking of the nation’s largest retailers based on total revenues

By Marianne Wilson

By Marianne Wilson

Amid an uncertain economic environment, shifts in consumer spending, and increased costs and labor problems, the country’s largest retailers continue to demonstrate their resiliency — a fact made clear in Chain Store Age’s annual ranking of the top 100 U.S. retailers.

The CSA Top 100 ranks the industry’s largest players by total revenues in their most recently completed fiscal year, which for most companies is 2022. With few exceptions, mostly owing to mergers/acquisitions or liquidations, the ranking has remained remarkably consistent for some time. This is especially true among the powerhouse retailers that make up the top 10, a group whose operating excellence (in-store and online), omnichannel investments, flexibility and agility help keep them at the top of their game and in sync with customer demand.

On Top: As it has for the past 20-plus years, Walmart once again claimed the No.1 spot on the CSA list. The retail behemoth, which is also the nation’s largest private employer, had another strong year, with its fiscal 2023 revenue (ended 1/31/2023) rising 6.7% to $611.3 billion. In the U.S., comp sales increased 6.6%, and e-commerce sales grew 12%.

Walmart’s ongoing success in today’s uncertain economic environment comes as the chain has worked successfully to keep its prices low. Its focus on low-priced everyday essentials — including groceries — has given it a buffer against the pullback in discretionary spending. The strategy has also brought in new, higher-income shoppers.

“We see people across income cohorts come to us more frequently, looking to save money on everyday needs,” Walmart CEO Doug McMillon said on the company’s second-quarter earnings call in August. “That gives us an opportunity to drive conversion in more discretionary categories.”

Walmart’s strength in grocery shows no signs of losing momentum. Grocery led the chain’s most recent quarter’s sales growth, with increases in both dollars and units sold.

In the race to stay on top, Walmart continues to make big investments in technology and omnichannel along with supply chain innovations as it sharpens its fulfillment and delivery capabilities.

The company also continues to grow alternative streams of revenue such as its global advertising business, which grew nearly 30% to reach $2.7 billion last year, and its delivery-asa-service platform, Walmart GoLocal, which delivers goods to customers of other businesses.

Amazon ranked No. 2 on the list for the seventh straight year as it continues to inch closer to the top spot. In 2022, the company’s total net sales surpassed the half-trillion-dollar mark — increasing year-over-year to $514.0 billion — becoming the second U.S. company after Walmart to reach that milestone.

The increase came as Amazon focused on cost-cutting efforts that included layoffs, the closure of some its physical store concepts and scaling back its fulfillment center growth. The company continues to to invest in cutting-edge and emerging technologies, including generative AI, which is “core to setting Amazon up to invent in every area of our business for many decades to come,” CEO Andy Jassy wrote in a letter to investors in April.

According to an analysis by Forrester, Amazon’s service sales — which includes everything from third-party seller sales and sales from subscriptions (including Prime) to advertising and cloud computing (Amazon Web Services) — are key to its growth.

Indeed, Amazon Web Services remains Amazon’s most profitable segment. It generated more than $80 billion in revenue in 2022, with an operating profit of 29%. Amazon has also emerged as a key player in the advertising space. It generated $38 billion from advertising services in 2022, up from $31 billion in ad revenue the previous year.

Walmart, Amazon and the other top retailers have shown themselves adept at managing — and staying on top of — the constant change that defines today’s retail landscape. They embrace innovation and know, at the end of the day, they can always do better.

Methodology: Behind the Numbers

Chain Store Age’s Top 100 ranks retail companies by net revenues in the firm’s most recently completed fiscal year (as of press time.) For retailers based in North America, the data reflects the company’s total global store count (except if otherwise noted). For foreign-based companies, such as Ikea, only the figures related to the company’s North American division are provided (except if otherwise noted.)

The ranking contains a number of privately owned companies that do not release annual reports, financial statements or basic details related to their operations. The estimated metrics for these companies, which are highlighted in the listing with an E, are based on public and private reports and independent research. (Research for Top 100 compiled by contributing editor Debra Hazel.)

8 SEPTEMBER/OCTOBER 2023 CHAINSTOREAGE.COM

sales will grow between 4% and 6% in 2023, totaling from $5.13 trillion to $5.23 trillion. Physical stores are expected to account for approximately 70% of total sales.

Source: National Retail Federation For the second consecutive year, Apple ranked as the “most valuable” company in the world, with a brand valuation of $880.45 billion.

Source: Kantar BrandZ’s Most Valuable Global Brands Report 2023 For holiday 2023, 38% of consumers plan to buy half or more of their gifts on sale and 33% will trade down to more affordable brands and retailers.

Source: AlixPartners Holiday Outlook Survey

Source: Company reports unless otherwise noted

E: Estimate, NA: Not applicable, R: Retail operations only.

CHAINSTOREAGE.COM SEPTEMBER/OCTOBER 2023 9 2022 Revenue [000] Fiscal Yearend 2021 Revenue [000] 2022 Store Count 2021 Store Count Core retail

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 Walmart Inc. Bentonville, Ark. 1/31/2023 611,289,000 572,754,000 10,623 10,593 Amazon Seattle 12/31/2022 513,983,000 469,822,000 600 679 CVS Health Corp. Woonsocket, R.I. 12/31/2022 322,467,000 292,111,000 9,674 9,939 Costco Wholesale Corp. Issaquah, Wash. 8/28/2022 222,730,000 192,052,000 838 815 Apple (E), (Americas only) Cupertino, Calif. 9/24/2022 169,658,000 153,306,000 526 512 The Home Depot Atlanta 1/29/2023 157,403,000 151,157,000 2,322 2,317 The Kroger Co. Cincinnati 1/28/2023 148,258,000 137,888,000 2,719 2,726 Walgreens Boots Alliance Deerfield, Ill. 8/31/2022 132,703,000 132,509,000 12,875 13,000 Target Corp. Minneapolis 1/28/2023 107,588,000 104,611,000 1,948 1,926 Lowe’s Cos. Mooresville, N.C. 2/3/2023 97,059,000 96,250,000 1,738 1,971 7-Eleven (E, U.S. and Canada) Dallas 2/28/2023 86,110,000 52,074,450 12,645 9,511 Albertsons Companies Boise, Idaho 2/25/2023 77,649,700 71,887,000 2,271 2,276 Alimentation Couche-Tard Laval, Quebec 4/30/2023 71,856,700 62,809,900 14,468 14,008 Ahold Delhaize (US only) Chantilly, Va. 12/31/2022 55,218,000 53,700,000 2,051 2,048 Publix Lakeland, Fla. 12/31/2022 54,942,000 47,996,551 1,322 1,293 The TJX Cos. Framingham, Mass. 1/28/2023 49,936,000 48,549,982 4,835 4,689 Best Buy Co. Richfield, Minn. 1/28/2023 46,298,000 51,761,000 1,138 1,144 Aldi Inc. (E) Batavia, Ill. 12/31/2022 40,210,000 37,000,000 2,813 2,166 Dollar General Corp. Goodlettsville, Tenn. 2/3/2023 37,844,900 34,220,400 19,104 18,130 H-E-B (E) San Antonio, Texas 10/31/2022 34,790,000 34,000,000 420 420

Patagonia and Costco ranked as the top two most reputable companies among 16 industries surveyed. Trader Joe’s (#4) and Amazon (#8) also cracked the top 10.

Source: 2023 Axios Harris Poll 100

By 2028, U.S. total retail sales are expected to to reach $5.8 trillion, with online retail sales hitting $1.6 trillion. Online retail penetration will grow to 28% by 2028.

Source: Forrester

81% of U.S.-based retailers reported that shrink increased in 2022, with average theft value per case at $846.11, up 17% from 2021.

Source: Jack L. Hayes International 35th Annual Retail Theft Survey

10 SEPTEMBER/OCTOBER 2023 CHAINSTOREAGE.COM

2022 Revenue [000] Fiscal Yearend 2021 Revenue [000] 2022 Store Count 2021 Store Count

Source:

Company reports unless otherwise noted

E: Estimate, NA: Not applicable, R: Retail operations only.

21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Starbucks Corp. Seattle 10/2/2022 32,250,300 29,060,600 34,753 33,833 Dollar Tree Chesapeake, Va. 1/28/2023 28,318,200 26,321,900 16,340 16,077 Macy’s Inc. Cincinnati, Ohio 1/28/2023 24,442,000 24,460,000 783 787 Rite Aid Corp. Harrisburg, Pa. 3/4/2023 24,091,899 24,568,255 2,309 2,450 Verizon Communications Inc. (E,R) Basking Ridge, N.J. 12/31/2022 23,170,000 23,164,000 6,087 6,217 AT&T Inc. (E,R) Dallas 12/31/2022 21,280,000 20,660,000 1,450 1,580 Pilot Co. (E) Knoxville, Tenn. 12/31/2022 21,200,000 26,000,000 655 800 Meijer (E) Grand Rapids, Mich. 2/1/2023 21,180,000 25,457,000 262 258 BJ’s Wholesale Club Holdings Westborough, Mass. 1/28/2023 18,918,435 16,306,365 235 226 Ross Stores Dublin, Calif. 1/28/2023 18,695,829 18,916,244 2,015 1,923 Wakefern Food Corp. Keasbey, N.J. 10/1/2022 18,600,000 17,800,000 371 362 Kohl’s Corp. Menomonee Falls, Wis. 1/28/2023 17,161,000 18,471,000 1,170 1,165 AutoZone inc. Memphis, Tenn. 8/27/2022 16,252,230 14,629,585 6,943 6,767 Gap Inc. San Francisco 1/29/2023 15,616,000 16,670,000 3,352 3,399 Casey’s General Stores Ankeny, Iowa 4/30/2023 15,094,475 12,952,594 2,521 2,452 Nordstrom Seattle 1/28/2023 15,092,000 14,402,000 368 367? Wawa (E) Wawa, Pa. 12/31/2022 14,930,000 11,900,000 1,017 965 O’Reilly Automotive Springfiled, Mo. 12/31/2022 14,409,860 13,327,563 5,971 5,784 Tractor Supply Co. Brentwood, Tenn. 12/31/2022 14,204,717 12,731,105 2,333 2,181 Menards (E) Eau Claire, Wis. 12/31/2022 13,380,000 13,140,000 329 328

ABBY123.COM

Torrid, Lululemon, Madewell, Zara and Free People are the top five most popular resale brands. More than 50% of Gen Z consumers are more likely to shop with a brand that offers secondhand as well as new items.

Source: ThredUp’s 2023 Resale Report

Debit cards are the most popular (78%) point-of-sale payment option, followed by cash (74%) and credit cards (66%).

Source: J.D. Power U.S. Consumer POS Payment Program

Nearly six in 10 retailers plan to adopt AI, machine learning and computer vision technologies during the next year to enhance in-store and online shopping experiences.

Source: Honeywell AI in Retail survey

12 SEPTEMBER/OCTOBER 2023 CHAINSTOREAGE.COM Source: Company reports unless otherwise noted E: Estimate, NA: Not applicable, R: Retail operations only. 2022 Revenue [000] Fiscal Yearend 2021 Revenue [000] 2022 Store Count 2021 Store Count

41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 Etsy New York City 12/31/2022 13,318,396 13,491,828 NA NA Hy-Vee (E) West Des Moines, Iowa 9/30/2022 12,440,000 12,300,000 306 or 325 285 Dick’s Sporting Goods Coraopolis, Pa. 1/28/2023 12,368,198 12,293,368 853 861 Wayfair Inc. Boston 12/31/2022 12,218,000 13,708,000 3 NA Qurate Retail West Chester, Pa. 12/31/2022 12,106,000 14,044,000 34 25 Wegmans Food Markets Rochester, N.Y. 12/31/22 12,000,000 11,230,000 109 106 Sheetz (E) Altoona, Pa. 9/30/2022 11,700,000 7,200,000 670 630 Advance Auto Parts Roanoke, Va. 12/31/2022 11,154,700 10,998,000 4,770 4,706 Giant Eagle Inc. (E) Pittsburgh 6/30/2023 10,650,000 10,600,000 484 488 Ulta Beauty Bolingbrook, Ill. 1/28/2023 10,208,580 8,630,889 1,355 1,308 EG America Framingham, Mass. 12/31/2022 10,180,000 12,254,000 1,619 1,698 T-Mobile Bellevue, Wash. 12/31/2022 9,857,000 9,733,000 6,480 3,868 WinCo Foods (E) Boise, Idaho 3/31/2023 9,850,000 8,100,000 136 131 eBay Inc. San Jose, Calif. 12/31/2022 9,795,000 10,998,000 NA NA SpartanNash Companies Grand Rapids, Mich. 12/31/2022 9,643,100 8,931,039 139 145 Quik Trip (E) Tulsa, Okla. 4/30/2023 # 9,200,000 11,300,000 992 922 Ace Hardware Oak Brook, IL 12/31/2022 9,170,000 8,600,000 5,700 5,600 Racetrac Petroleum (E) Atlanta 12/31/2022 9,100,000 9,600,000 567 566 Good Neighbor Pharmacy (E) Chesterbrook, PA 9/30/2023 8,840,000 8,660,000 2,350 2,360 Foot Locker New York City 1/28/2023 8,747,000 8,958,000 2,714 2,858

The benefits of generative AI on retail are expected to stem from three primary areas: increased sales (51%), improved gross margins (20%) and lowered selling and administrative (S&A) costs (29%).

Source: IHL Group

Nike is the No. 1 brand for all teens in both apparel (33%) and footwear (61%).

Source: Piper Sandler Spring Generation Z survey

U.S. retailers pay the highest swipe fees in the industrialized world — $126.4 billion in swipe fees were paid by businesses for credit card transactions in 2022, up 20% from the previous year.

Source: National Retail Federation

14 SEPTEMBER/OCTOBER 2023 CHAINSTOREAGE.COM Source: Company reports unless otherwise noted E: Estimate, NA: Not applicable, R: Retail operations only. 2022 Revenue [000] Fiscal Yearend 2021 Revenue [000] 2022 Store Count 2021 Store Count

61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 Burlington Stores Burlington, N.J. 1/28/2023 8,684,545 9,306,549 927 840 Williams-Sonoma San Francisco 1/29/2023 8,674,417 8,245,936 530 544 AAFES Dallas 2/1/2023 8,500,000 8,200,000 4,330 4,330 ODP Corp. (Office Depot) Boca Raton, Fla. 12/31/2022 8,491,000 8,8700,000 980 1,038 PetSmart (E) Phoenix 1/31/2023 7,990,000 7,420,000 1,574 1,566 Staples (E) Framingham, Mass. 1/31/2023 7,950,000 6,400,000 1,005 1,040 Grupo Chedraui (US Only) Mexico City, Mexico 12/31/2022 7,883,696 4,746,245 376 377 Signet Jewelers Ltd. Hamilton, Bermuda 1/28/2023 7,842,100 7,826,000 2,808 2,854 Bass Pro Shops (E) Springfield, Mo. 12/31/2022 7,620,000 6,930,000 154 154 Bath & Body Works Columbus, Ohio 1/28/2023 7,560,000 7,882,000 1,802 1,755 Northeast Grocery (E) Schenectady, NY 12/31/2022 7,200,000 NA 277 NA J.C. Penney Co. (E) Plano, Texas 2/2/2023 7,160,000 8,940,000 661 669 Camping World Lincolnshire, IL 12/31/2022 6,967,013 6,913,754 197 187 Southeastern Grocers (E) Jacksonville, Fla. 12/31/2022 6,940,000 6,764,000 424 419 Sephora Americas (E) New York City 12/31/2022 6,918,000 6,013,000 531 508 Dillard’s Little Rock, Ark. 1/28/2023 6,871,100 6,493,000 277 280 AVB Brandsource (E) Nashville 12/31/2022 6,850,000 6,540,000 4,500 4,500 Hobby Lobby (E) Oklahoma City, Okla. 12/31/2022 6,840,000 6,270,000 1,020 1,001 Tapestry New York City 7/1/2023 6,660,900 6,684,500 1,429 1,443 Sprouts Farmers Market San Bernardino, Calif. 1/1/2023 6,404,223 6,099,869 386 374

Every Tuesday

The premier newsletter showcasing technology and multi-channel, seamless retailing. From

Just

(1)

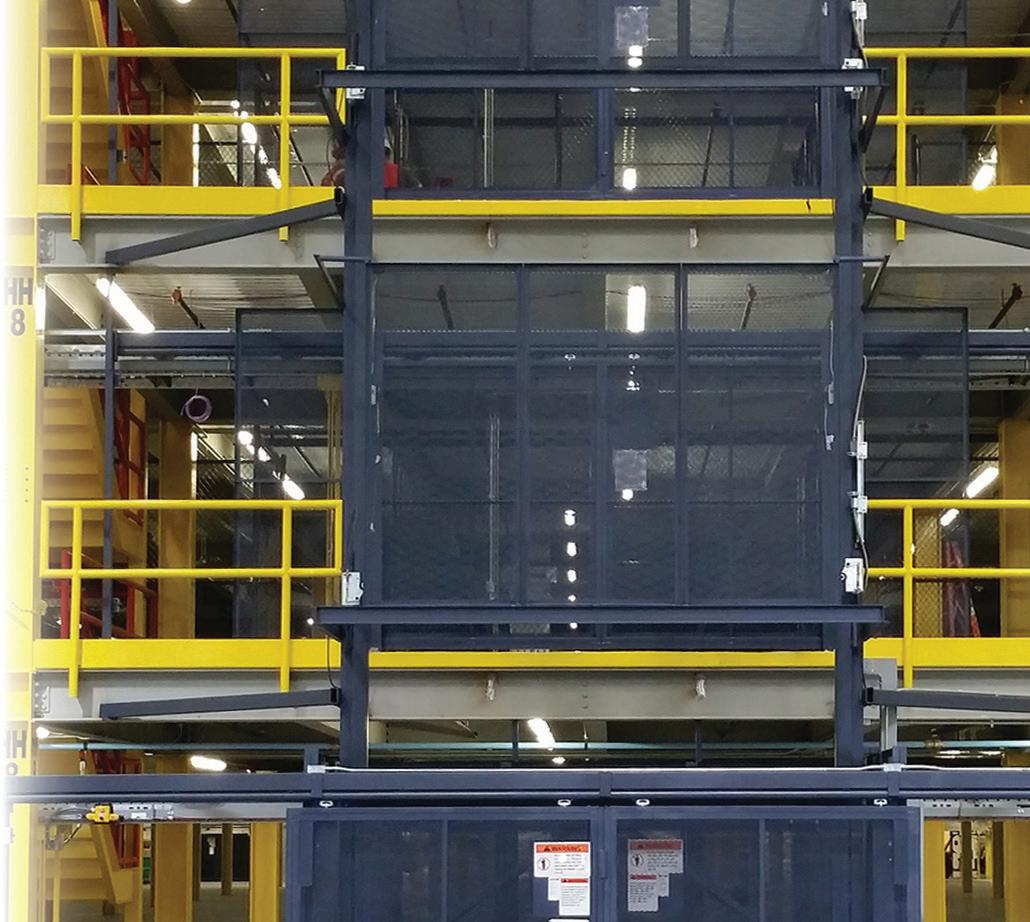

• PROTECT WORKERS • SAVE MONEY • INCREASE EFFICIENCY

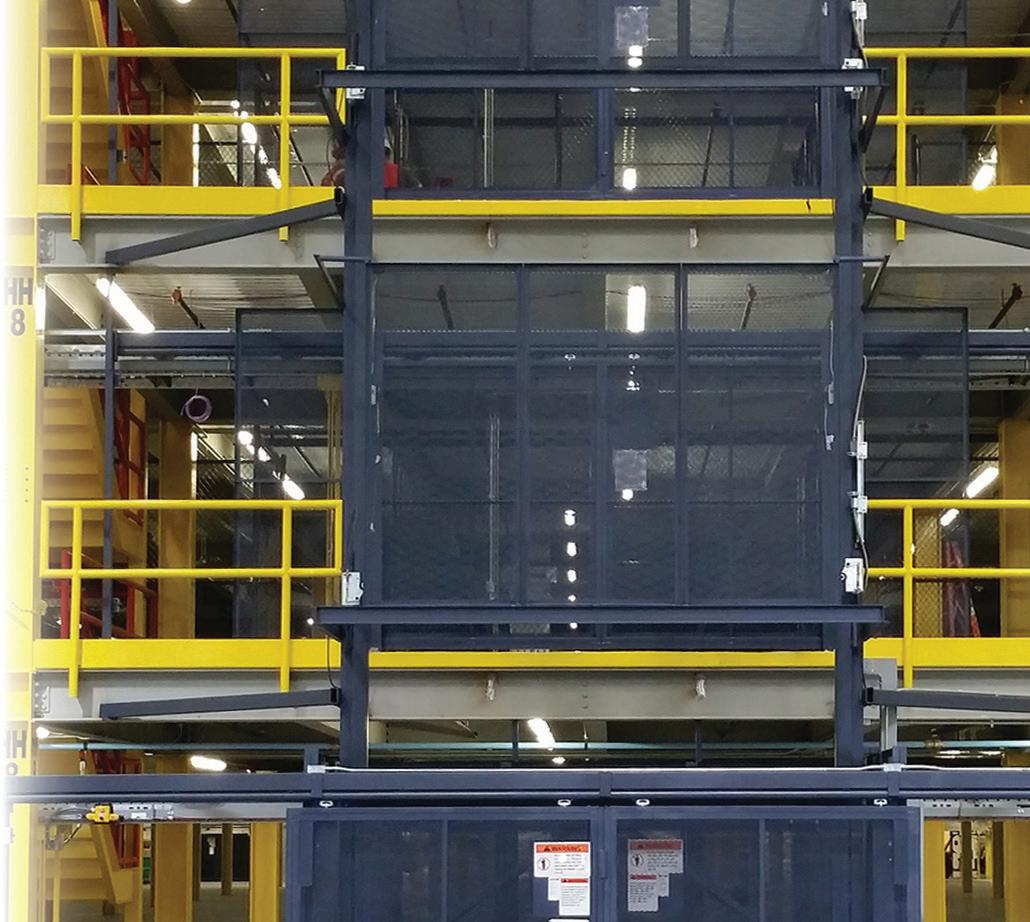

National account programs establish fir m equipment prices with 2 ways to administer them Single point centralized purchasing where all of the dock lifts are purchased and coordinated through a single distributor. Or, dispersed contractor purchasing where the company specifies an Advance dock lift and the actual purchasing is done through contractors or individual locations using local distributors We do both

4 Number one dock lift builder in North America Industr y’s most complete line of dock lifts in both top of ground and recessed units 4 Industr

4 Shortest lead times in the industr y 4 Decades of experience successfully ser ving the nation’s largest retailers

Please call Michael Renken for more infor mation.

COST MORE THAN (1) DOCK LIFT

AN ADVANCE DOCK LIFT

CAN

INSTALL

(1) Lower bAck inJury or

(1) torn rotAtor cuff or

smAshed metAtArsAL

AdvAnce Lifts nAtionAL Accounts ProgrAm

4 Sales, ser vice, & installation arranged anywhere in the US. No location is too remote

y’s best warranty 4 On time production

AdvAnce Lifts AdvAntAges 1-800-THE-DOCK (800-843-3625) a d v a n c e l i f t s . c o m

in-store

Sign up TODAY! www.chainstoreage.com/register

e-commerce and mobility to

technology and social media, Connected Retail keeps retail executives in the know about the fast-paced, ever-evolving world of retail tech.

Click-and-collect sales (includes buy online-pickup- in-store and curbside pickup) will exceed $100 billion in 2023. Sales will double by 2028 to exceed $200 billion.

Source:Forrester

The resale market is expected to grow an estimated 87% to $325 billion by 2031 from $174.1 billion in 2022. Nearly nine in 10 surveyed U.S. consumers plan to shop secondhand in the coming year.

Source: Mercari’s 2023 Reuse Report

37% of respondents consider environmental sustainability and 33% consider social responsibility when making a purchase.

Consumer

16 SEPTEMBER/OCTOBER 2023 CHAINSTOREAGE.COM 2022 Revenue [000] Fiscal Yearend 2021 Revenue [000] 2022 Store Count 2021 Store Count Source: Company reports unless otherwise noted E: Estimate, NA: Not applicable, R: Retail operations only, CS: U.S. convenience store sales only.

Source

Winter

Pulse

81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 Academy Sports + Outdoors Katy, Texas 1/28/2023 6,395,073 6,773,128 268 259 Victoria’s Secret & Co. Reynoldsburg, Ohio 1/28/2023 6,344,000 6,785,000 915 899 Discount Tire (E) Scottsdale, AZ 12/31/2023 6,230,000 5,200,000 1,113 1.087 Petco Health and Wellness Company San Diego 1/28/2023 6,035,967 5,807,149 1,430 1,433 GameStop Corp. Grapevine, Texas 1/28/2023 5,927,200 6,010,700 4,413 4,573 Under Armour, Inc. Baltimore 3/31/2023 5,903,636 5,727,216 439 422 Ikea North America (E) Conshohocken, Pa. 8/31/2022 5,870,000 6,790,000 52 70 Michaels Stores (E) Irving, Texas 1/31/2023 5,870,000 5,010,000 1,142 1,140 Save Mart Supermarkets (E) Modesto, Calif. 6/30/2023 5,700,000 5,600,000 204 204 Ingles Markets Black Mountain N.C. 9/24/2022 5,678,800 4,988,000 198 198 Harbor Freight Tools (E) Calabasas, CA 12/31/2022 5,536,000 4,726,000 1,400 1,280 The Raley’s Companies West Sacramento, Calif. 12/31/2022 5,526,000 3,185,000 253 242 Big Lots Inc. Columbus, Ohio 1/28/2023 5,468,329 6,150,603 1,425 1,431 American Eagle Outfitters, Inc. Pittsburgh, Pa. 1/28/2023 4,989,833 5,010,785 1,175 1,133 Demoulas Supermarkets (E) Tewksbury, Mass. 1/2/2023 4,950,000 6,200,000 91 87 Total Wine & More (E) Bethesda, Md. 12/31/2022 4,940,000 5,000,000 245 233 Temper Sealy Lexington, Ky. 12/31/2022 4,921,200 4,930,800 700 650 Hudson’s Bay Company (E) Toronto, Ontario 2/2/2023 4,860,000 4,500,000 142 141 Stater Bros. Markets (E) San Bernadino, Calif. 9/28/2022 4,850,000 4,700,000 172 170 Shell Oil Company (E, CS) Houston, Texas 12/31/22 4,790,000 4,170,000 4,286 4,157

KPMG

Survey

Retail’s Reinvention

Resetting store strategies to drive growth

By Lori Zumwinkle

During the pandemic, retailers started to wonder what kind of role the physical store still had to play. Many stores closed and there was a higher reliance on online shopping and a resurgence in shopping locally. Overnight, retailers were challenged to rethink and reset their business strategies.

Three years on, stores are back at the top of the agenda in post-pandemic retail and the data speaks for itself. During the holiday period, in-store foot traffic was up, with consumers less inclined to do their seasonal shopping from their couches.

However, the retail landscape has changed, and a new approach is required. To truly capitalize on the growth opportunities, retailers need to be willing to reset their store strategies — and do so as part of a broader reinvention of the business.

Store Locations

While many retailers are rationalizing their footprints, the smart brands are also being more scientific about their store locations. They are leveraging data on foot traffic, sales and customer demographics to gain new insights into where their brand sits within each different catchment area.

We are also seeing retailers optimize the mix of store types and locations. In practice, this will often be about going smaller, more local and more closely tied to the community. Increasingly, for example, we see retail brands focusing on strip centers and freestanding small-format stores rather than underperforming shopping malls.

This is true even for some of the largest and most iconic department store brands. Macy’s, for instance, has opened several new off-mall small-format stores across the United States. This is part of a broader strategy to reposition the brand’s physical store footprint and better serve customer needs with smaller stores focused on immersive discovery and convenience.

Similarly, Nordstrom’s “closer to you” strategy has seen the retailer opening Nordstrom Local outposts, convenient service hubs for online order pickup and returns, express alterations, gift wrapping services as well as offerings tailored to shoppers at each location. It also has partnered with local nonprofits to provide donation drop-off for gently used fashion.

Destination Shopping

Similarly, retailers can better tailor their layouts, in-store services, pricing and product assortments to the local catchment with the right data analytics. It means thinking creatively and innovatively about what the future retail store can be, seeing it as not just a place to purchase products but a multipurpose destination that offers a range of different experiences.

Increasingly, for example, retailers are adding adjacent services like cafes and wine bars for customers to enjoy while they shop.

We’re already seeing this play out.

For instance, LVMH-owned Loewe has opened its first Loewe ReCraft, specializing in repairing and maintaining its leather items. The concept is part of the retailer’s commitment to the long-term viability of the luxury brand’s handcrafted bags.

With a full-time leather artisan on hand for repairs including re-stitching and handle replacement, Loewe ReCraft is a great example of the embodiment of a brand’s value system complimented by excellence in use of retail space.

This reinvention of stores is also about combining online and offline channels into a seamless shopping experience for customers. At one level, that means services like in-store pickups of e-commerce purchases and localized inventory that lets shoppers check the availability of products before the come to the store.

At a more advanced level it can mean a fundamental reorientation of the store

around localized micro-fulfillment, hyper-automation and digitalized in-store shopping. We already see strong moves in this area from retailers such as Target, with its new large-store format giving significant floorspace over to backroom fulfillment to support same-day delivery.

Driving Engagement

The retail store also plays a critical role in building relationships with customers and legitimizing the brand. For instance, a physical presence gives customers a sense of security and reassurance that they’re dealing with a reputable company.

Stores also connect across other retail channels. Retailers have learned, for example, that closing underperforming stores can negatively impact their e-commerce performance in that locality.

Not only that, stores can also be a source of critical insights into local preferences, behaviors and purchase patterns. These insights can then inform everything from forecasting and replenishing to marketing campaigns, to store design.

Ulta Beauty’s major store redesign was partly based on listening to members of its Ultamate Beauty rewards program. This led to improvements in-store navigation and product discovery, making the shopping experience more engaging, welcoming and fun.

Stores: Route to Growth

Today’s retailers are managing constant change. But one thing remains the same. The retail store retains a crucial role in building relationships, understanding customer behaviors, and legitimizing the brand. Remembering that universal truth will be a critical factor as retailers reinvent their businesses for future growth.

Lori Zumwinkle is senior managing director and Accenture’s Retail North America lead.

COMMENTARY 18 SEPTEMBER/OCTOBER 2023 CHAINSTOREAGE.COM

M ER V C G Maximize the use of vertical space in your warehouse and back-of-house retail operations. C C 414 352 9000 .P .C P H H V G M ER Designed for your specific material lifting application, PFlow VRCs make safe, efficient, and easy work of moving heavy loads.

Online Registry Babylist Open Flagship

Showroom lets customers try out baby gear in home-like settings

By Marianne Wilson

An online registry that served more than 9 million new parents and gift-givers in 2022 and drove over $900 million in gross merchandise value has opened its first permanent brick-and-mortar location.

Babylist unveiled its 18,000-sq.-ft. flagship in Beverly Hills, Calif. The opening, which follows successful pop-ups in New York City and Los Angeles, comes as the company is looking to enhance its position in the $88 million baby-products market and as BuyBuy Baby closed its 115 stores following the bankruptcy of parent company Bed Bath & Beyond.

As to why Babylist decided to open a permanent location after more than 12 years in business, founder and CEO Natalie Gordon said that “since people love our experience digitally, we wanted to bring the best of the experience to the physical world.”

The Babylist showroom is designed to reimagine the shopping for baby products experience (and related registry) based on insights from the company’s digital business. It offers an immersive and interactive experience that gives customers the opportunity to test and try out baby gear — and have some fun — in a stylish, upbeat environment.

“Preparing for a baby’s arrival can be overwhelming,” said Gordon. “Babylist Beverly Hills was designed with the user in mind. The showroom journey guides new and expecting families through the home where they can see products in their intended environments and test them and build their digital registry.”

To develop the space, Babylist partnered with Grow, an independent women-owned firm led by mothers, and

Poolside Etiquette, a woman-owned experiential event agency.

As to more showrooms in the future, Gordon said the company is focused on testing in this one site to start.

“While we don’t currently have plans to open more locations, we may open more based on what we learn from this location,” she added.

Vignettes: The showroom houses products from all key baby-related categories

flagship include:

•A stroller trial area that includes a track with cobblestone, brick and other surfaces;

•A life-size “car” where customers can practice removing a car seat and stroller; and

•An “Expectful” lounge where moms can relax, (with nursing, feeding and pumping rooms).

In addition, the space will host community events that include new product launches, local meetups, pop-up festivals and registry parties.

While Babylist Beverly Hills features many national and wellknown brands, it also houses emerging and direct-to-consumer brands that don’t have dedicated physical retail offerings.

across a wide variety of brands. Products are displayed in eight real-life home settings (bathroom, bedroom, kitchen, etc.) where customers can see close-up how the products will fit into their own home.

The majority of the space is for testing and learning about products, which can be added directly to the customer’s registry. An on-site boutique, Babylist Shop, features a curated assortment of baby gifts available for purchase.

The store also has plenty of photo opportunities, including one dedicated for baby announcements. Fun games such as a working carnival “claw” machine are sprinkled throughout the space.

Additional highlights of the Babylist

“Brands understand that consumers wouldn’t visit 15 different baby boutiques to learn about their products,” said Lee Anne Grant, Babylist chief growth officer. “They also don’t want to incur the expense of concepting and building out their own spaces, much less signing a long-term lease. Because we have such deep and long-lasting relationships with brands and a proven expertise in bringing them to life online, they approached us to cocreate this showroom together.”

Babylist describes itself as “the leading vertical marketplace and commerce destination for baby.” Utilizing proprietary data, patented technology and “unbiased” editorial guidance, it recommends expert-tested products to expectant and new parents.

The platform supports revenue streams, including direct purchases from Babylist and partner retailers, and content-driven advertising.

STORE SPACES 20 SEPTEMBER/OCTOBER 2023 CHAINSTOREAGE.COM

PHOTO COURTESY OF BABYLIST

Customers can practice installing and removing a car seat in the showroom’s car replica.

Princess Polly, the Australian online fashion brand that’s a big fave of Gen Z, opened its first U.S. brick-and-mortar location, at Westfield Century City in Los Angeles. Social media and influencers have fueled the brand’s growth in the U.S., where sales now make up the bulk of its revenue. The 3,370-sq.-ft. store features approximately 200 on-trend (and affordable) items at any given time. It also will host special events such as product launches, meetand-greets with influencers, and styling workshops. … A reenergized Abercrombie & Fitch is showing off a more refined, elevated look at its new flagship on Fifth Avenue in Manhattan. The multi-level store is airy and bright, with illuminated walls, sconced columns and unique chandeliers. The updated design will serve as a model for other Abercrombie stores going forward. … Macy’s is expanding its off-mall, small-format store concept with four new locations opening by November. Unlike Macy’s eight previous small-format stores which are called Market by Macy’s, the upcoming ones will bear only the iconic Macy’s nameplate. … Value-priced global fashion and home goods retailer Primark is eying 60 U.S. stores by 2026, up from its current 21. … Nike is opening a network of fitness studios in partnership with FitLab under the Nike Studios banner. The first location will open this year, in West Hollywood, Calif., with additional openings to follow in Los Angles and across the country. The Studios, which will also sell merchandise, will be supported by a digital app for at-home exercise and anchored by a calendar of “fun and motivating” social fitness events. … Popular Asian designer toy and collectibles brand Pop Mart has opened its first U.S. store, at American Dream, the massive three million sq.-ft.-plus entertainment and retail center in East Rutherford, N.J. Founded in 2010 in China, Pop Mart has more than 400 stores, 2,000 “Robo Shops” (toy vending machines) and a vast network of distributors across 84 countries and regions. Pop Mart art specializes in creating

designer toys and collectibles in collaboration with international designers and global entertainment powerhouses such as Disney, Universal Studios and Sanrio. Its assortment includes numerous characters from video games such as World of Warcraft, League of Legends, Clash of Clans and Clash Royale.

Coming Attractions

The 106-year-old Radio Flyer company, maker of the iconic “Original Little Red Wagon,” will open its firstever retail location in November, at Woodfield Mall in Schaumburg, Ill. The store will offer customers the “ultimate Radio Flyer experience,” with attractions that include a test track where kids can get in the driver’s seat for rides and a hands-on experience with products such as go-karts and scooters. An in-store bike shop will offer free test rides for adult electric bikes along with services that include professional assembly, custom bikes, accessory fittings and more. … In its first U.S. initiative, the storied, 150-year-old French department store retailer Printemps will open a two-level, 54,365-sq.-ft. store in New York City, in the 50-story One Wall Street building in Manhattan’s Financial District. The landmark Art Deco building recently underwent an extensive renovation as part of its conversion from a financial headquarters into a mixed-use retail and residential space.

TRENDING STORES CHAINSTOREAGE.COM SEPTEMBER/OCTOBER 2023 21

PHOTO: BUSINESS WIRE

Princess Polly, Westfield Century City, Las Angeles

Ikea U.S. in New Climate-Positive Moves

By Marianne Wilson

Ikea U.S. is doubling down on its commitment to become a climate-positive business. (For Ikea, being climate positive means reducing more greenhouse gas emissions than it emits.)

The retailer is launching two initiatives that will increase on-site renewable energy, increase energy effiency and eliminate the use of fossil fuels from its operations.

The efforts include a solar installation initiative that will add solar car parks, additional rooftop solar panels and battery energy storage systems to six Ikea stores and one fulfillment center.

The project is already underway. Ikea’s store in Paramus, N.J., was the first to have mechanical completion (in July

2023). The location also features the company’s first-ever long-span carpark system, which maximizes the number of solar panels and covers the entire parking deck roof.

When all seven units are operational, they will collectively provide 13,600 megawatt hours of yearly production, the equivalent of offsetting 5,883 tons of carbon that would have entered the atmosphere.

The other project is a large-scale renewable heating and cooling (RHC) project to replace and optimize the existing HVAC equipment with new centralized systems with high energy efficiency and coefficient performance at five locations in 2023.

“We are taking bold steps to reduce our climate footprint in the United States and become a climate positive business by 2030,” said Mardi Ditze, country sustainability manager, Ikea U.S. “The solar project aligns with our goal of being powered by 100% renewable energy, while the renewable heating and cooling project works toward increased energy efficiency and the goal of eliminating fossil fuels from our operations by 80% by 2030.”

Battery Storage: In addition, Ingka Investments (the investment arm of Ingka Group, the largest IKEA retailer) and Apex Clean Energy announced the company’s first-ever battery storage project, Cameron Storage, in Cameron County, Texas.

The standalone lithium-ion battery will support the Texas power grid and increase reliability amid fluctuations in supply and demand. The 16.4 MW project is co-located with Ingka Investments’ Cameron Wind Farm, a 55 turbine, 165 MW project that has been operational since 2015.

STORE SPACES 22 SEPTEMBER/OCTOBER 2023 CHAINSTOREAGE.COM

• Ov W • O H • 3 H F R O R π H O O -8 -295-55 l . O R 7 BOX Z W O

Store Robot Gets Smarter

Stop & Shop rolls out enhanced version of ‘Marty’

By Dan Berthiaume

A 7-ft.-tall autonomous robot nicknamed “Marty” has taken on additional in-store duties at Stop & Shop.

Initially deployed in 2019 at more than 300 Stop & Shop stores throughout the Northeast to detect floor hazards and in-aisle spills, the robot, from Badger Technologies, a product division of Jabil, has been upgraded to further improve the shopping experience.

Marty is now conducting product checks to help maintain on-shelf availability by alerting store employees when items need re-stocking. In addition to flagging out-of-stocks, it also detects misplaced items.

At the same time, Marty continues to monitor floor conditions and potentially mitigate the risk of slip-and-fall accidents,

helping to keep stores safe and clean.

The robot is equipped with scanners that allow it to traverse store aisles without bumping into shoppers or displays. The upgraded version uses computervision technology, AI-driven business intelligence and cloud-based analytics to improve the in-store experience for shoppers. Real-time inventory tracking enables Stop & Shop to expedite restocking and price corrections.

“Marty has delivered tremendous value for us already in terms of creating a safer in-store environment, and we’re excited to announce these new automated shelfscanning capabilities, which will deliver even more value for customers and associates,” said Gordon Reid, president of Stop & Shop. “With Marty’s new ability to find

and fix on-shelf product availability and to confirm pricing information, associates can spend even more time with shoppers.”

In addition, Stop & Shop is using Marty to support its “Feed it Forward” community program, with the robot making guest appearances at public events and visiting children in hospitals.

A division of Ahold USA headquartered in Quincy, Mass., Stop & Shop Supermarket operates more than 400 stores throughout Massachusetts, Connecticut, Rhode Island, New York and New Jersey.

BMO is proud to have supported these recent transactions.

• Over $3 billion in retail lending commitments.

• Committed facilities of $15

$300 million with the ability to execute on large, syndicated transactions.

• Top 5 commercial lender in North America with equity and investment banking coverage in the retail space.

STORE SPACES CHAINSTOREAGE.COM SEPTEMBER/OCTOBER 2023 23

Leverage the value of your company’s retail assets.

Marty the Robot has been upgraded at 300-plus Stop & Shop locations. (Photo: Business Wire)

Banking products are subject to approval and are provided in the United States by BMO Bank N.A. Member FDIC. BMO Commercial Bank is a trade name used in the United States by BMO Bank N.A. Member FDIC. Undisclosed Senior Secured Credit Facility Sole Lender Administrative Agent Undisclosed Senior Secured Credit Facility Sole Lender Administrative Agent

BMO Commercial Bank’s asset-based lending provides flexible retail financing solutions that are outside the typical lending criteria of most traditional banks. Our dedicated team of ABL retail specialists will work closely with you to understand your unique business needs and structure flexible financial solutions that help you achieve your vision.

–

commercial.bmo.com/abl

EV Charging Best Practices

By Scott West

By Scott West

Big picture goals are an important first step for any national retailer seeking to be part of the solution on decarbonization. Often, that’s something like, “We’re committed to achieving carbon-neutral operations by 2045.”

The harder part is figuring out exactly what to do next. Retailers could benefit by taking some inspiration from a slogan that has been circulating in the environmental movement since the early 1970s: “Think globally, act locally.”

Here are some locally focused best practices for offering EV charging at sites and stores.

• Factor in the cost of government mandates.

Local and state regulations increasingly require the installation of EV charging

infrastructure in the parking lots of commercial and residential buildings. Retailers need to understand how their portfolios will be affected by these fast-emerging building codes, laws and ordinances.

In cases where the retailer owns its real estate, compliance will be its responsibility. If renewing a lease, the retailer could be asked by the landlord to shell out for some portion of the newly required infrastructure.

For years now, some cities have been requiring commercial properties to make sure a certain percentage of spaces in new or redeveloped parking lots are ready for quick conversion to EV charging. Atlanta, for example, did so back in 2017. These measures require things like surfacemounted or buried conduit, higher

electrical panel capacity, and dedicated branch circuits with spares.

But officials are getting more ambitious with EV charging mandates, especially in more politically progressive states and municipalities. Here, in addition to specs such as those described above, retailers might need to install 240-volt plugs at a higher percentage of spaces, as well as branch circuit cabling and overcurrent protection for safety. In these greener states and districts, they will also be required to offer more parking spaces that have EV-charging equipment fully installed, often labeled EV installed or EV Supply Equipment (EVSE).

Under the California Green Building Standards Code, 30% of parking spaces in so-called Tier 1 municipalities must be

STORE SPACES 24 SEPTEMBER/OCTOBER 2023 CHAINSTOREAGE.COM

Retailers should “think globally, act locally”

EV-capable, with a third of those spaces being fully EVSE installed. More stringent regs in Tier 2 municipalities require 45% of all parking spaces be EV capable, with EVSE installed once again making up at least a third of the total.

Retailers need to stay tuned to what’s happening at their local statehouses and city councils, as these regulations are changing quickly.

• Pay close attention to utility rate structures.

As chains crunch the numbers on their EV charging rollouts, they should also look carefully at the utility rate structures in their top-priority markets.

Under the current federal formula, direct-current, public fast chargers boast capacities of 150 to 350 kilowatts. That is a lot of electricity. If a utility imposes painful, demand-based charges for high consumption during peak hours, those costs will stack up quickly. This could force retailers to pass them to consumers — an important drawback to consider.

• Understand how grid capacities could affect your plans.

Utilities across the country are scrambling to determine how electrification could strain their grids. In some cases, retailers might find that local grid capacities limit the amount of charging they can install at particular stores.

Engineers and energy consultants can communicate with utilities and file the appropriate service applications to help determine those constraints. By bringing technical knowledge to the table, engineers also can help retailers choose their EV-charging equipment manufacturers and develop site plans.

That could include discussing strategies for working within existing limitations, such as installing two chargers for now but roughing in conduit for 10 additional chargers later (thus avoiding the high costs associated with tearing out the pavement). • Consider running locally focused pilot programs.

Another option is to establish locally focused, multidisciplinary subcommittees

to help shape decisions around rollouts of EV charging and other decarbonization technologies. Contributors could include members of the retailer’s real estate, leasing, communications and operations teams, along with specialized attorneys, engineers, energy modelers and other third-party consultants.

In tandem, the company could partner with an engineering firm to run small, locally focused pilot programs centered on EV fast-charging at just a few stores to gauge the interplay of costs, regulations and incentives, and determine how EV charging affects sales and traffic at specific locations.

When it comes to EV charging and decarbonization generally, there’s no need to experience “paralysis by analysis.” By making low-risk, locally focused moves today, retailers can gain insights that allow them to make bigger investments down the line.

CHAINSTOREAGE.COM SEPTEMBER/OCTOBER 2023 25

Scott West is a senior mechanical engineer and commissioning and energy lead at HFA.

THE NEW NEIGHBORHOOD CENTER

By Al Urbanski

GRACELAND SHOPPING CENTER Columbus, Ohio

The age of remote working has changed the tenant menus at neighborhood centers. Restaurants and live events that expand visitor dayparts are now the meat and potatoes of these groceryanchored centers. Here are five properties doing a great job of setting the table.

When it comes to remaking neighborhood centers, Graceland Shopping Center in the Clintonville section of Columbus could serve as a test case.

Columbus-based real estate developer Casto opened the center in 1954, when Clintonville itself was developing into one of the prime neighborhoods in the capital city. Its original anchors were J.C. Penney, Woolworth’s, and Albers Supermarket. Graceland’s latest redevelopment, christened in 2021, is its third.

“Graceland has been a bit of a roller coaster throughout its history,” said Eric Leibowitz, Casto’s VP of leasing and development. “It’s a long and narrow site, 60 acres with only 800 feet of frontage, but the quality of the location and Clintonville’s surrounding density has always sustained the center and helped it reach the thriving mixeduse project it is today.”

About three years ago, Casto took advantage of Clintonville’s popularity and added a 200-unit apartment complex to the project called Graceland Flats. That set off a tenant re-curation at the Target-and-Krogeranchored center that brought in Ulta Beauty, TJ Maxx, HomeGoods, and other national and regional brands.

The center’s former Bob Evans location is being backfilled with a Longhorn Steakhouse, and a newly built Starbucks is set to open soon.

Clintonville is one of Columbus’s most established

and dense neighborhoods, filled with an impressive mix of residential product types. It has a lot of distinctive older homes mixed with tasteful infill projects and attracts a wide range of residents that include young professionals, families, and retirees.

“The lease-up at Graceland Flats, our residential build, was incredibly fast, and the retail demand at Graceland has always been consistently strong,” noted Leibowitz. “One of our issues has been a lack of available space but, because of the strength of the market and surrounding community, tenants have stuck with us, and our team has done a great job at executing when the opportunities have presented themselves.”

REAL ESTATE 26 SEPTEMBER/OCTOBER 2023 CHAINSTOREAGE.COM

Graceland Shopping Center in the 1950s

Casto re-curated Graceland’s tenant mix when a 200-unit apartment complex was added.

VILLAGE AT NEWTOWN Newtown, Pa.

Not long ago, Bucks County, Pa., retailer Jennifer Poe, owner of Rittenhouse Home, moved to the Village at Newtown because she felt its traffic aligned better with her target customer base.

“The merchandise I carry is curated to clients in this community,” she said. “It’s the best move I ever made.”

John Im had served packed houses at his Oishi restaurant at the center for more than 20 years and decided to open another Japanese-themed eatery after a center renovation was carried out by its owner-operator, Brixmor.

“I was turning away so much business that I said, ‘Why not open another restaurant on the other side of the center instead of giving them up to a competitor?’” Im remarked.

Brixmor, which has owned the McCaffrey Foods supermarket-anchored center since the mid-90s, decided to renovate the 219,000-sq.-ft. property to better capitalize on the needs and wants of residents in this Bucks County community whose average household income tops $165,000—73% above the national average.

“We added 60,000 sq. ft. of space. Older centers like this one were overparked, so we reclaimed some of that space and densified the center to add some categories that were missing,” said Ryan Duheen, Brixmor’s senior VP of redevelopment, who directed the $40 million makeover.

DUNWOODY VILLAGE Dunwoody, Va.

During its 40-plus-year run, this 121,000-sq.-ft. center in one of Atlanta’s oldest suburbs had maintained the steady, necessitybased daytime traffic expected of grocery-anchored centers. But when Regency Centers, the forward-thinking operator of more than 400 open-air centers nationwide, acquired the property, it had more in mind.

“Dunwoody Village wasn’t anything super exciting,” said its senior leasing agent Leslie Mintz. “It had solid tenants, but it just didn’t have the wow factor.”

The city of Dunwoody lacked a community-centered downtown with dining and entertainment options, something residents would go to find in nearby Alpharetta and Roswell. So Regency and its VP and market officer Nate Smith began to imagine a reenergized Dunwoody Village that might fit that bill.

“You saw great activity with highly visible storefronts facing the parking lot, but the interior struggled. It was more than 50% vacant when we stepped in,” said Smith, who early in his career was general manager of Caruso’s The Americana at Brand in Glendale, Calif., one of the nation’s highest-grossing retail centers.

Turning that interior into a downtown-like community center, the Regency team figured, might be the way to turn Dunwoody Village into “Funwoody,” a nickname Regency has now applied

Brixmor brightened Village at Newtown’s drab brown exteriors with whites and grays, mirroring the palette applied on the barns of the many horse farms in the area. To encourage a better pedestrian flow for more cross-shopping, the sidewalks were wrapped with green spaces and programmed public spaces.

For public performances and events, an amphitheater was constructed that ended up also serving as a comfortable seating area for lunchtime crowds drawn by tenants such as MOD Pizza and Bomba Tacos. Brixmor also expanded its number of sit-down restaurants with brands such as Harvest Seasonal Grill and Iron Hill Brewery.

Brixmor’s most expensive renovation, however, was its remake of a 19th Century toll house at which five-cent tolls were collected for passage on the turnpike. It is now home to Nina’s Waffles & Ice Cream.

“There’s a lot more traffic at lunchtime and across the portfolio,” Duheen said. “The stretched hours create tailwinds for retail leasing.”

to the center.

Façade’s were upgraded on the stores, a courtyard was created, lighting was improved, and soft seating and music were added. But the biggest re-igniter of Dunwoody Village’s relationship with the community came from one of its members.

Local restaurateur David Abes felt that Dunwoody had a severe lack of places where people could hang out. So he approached Regency with a plan to line the new courtyard with up to four food and beverage establishments.

Regency took Abes up on his offer. His first location, Bar(n), serves up fresh oysters, smoked salmon and brisket flatbreads, and puts on wine and whiskey tastings. Folks line up for tables on weekends, and Abes is currently planning a second eatery in the center.

28 SEPTEMBER/OCTOBER 2023 CHAINSTOREAGE.COM REAL ESTATE

Nina’s Waffles & Ice Cream works out of a renovated 19th Century toll booth on the property.

Local restaurateur David Abes’ bar and restaurant now keeps patrons on the property well into the evening.

SAVE THE DATE! MARCH 10-12, 2024 Gaylord Texan Resort & Convention Center | Grapevine, TX Learn more at www.SPECSshow.com Interested in attending this event? Send your request to MMurphy@ChainStoreAge.com Interested in exhibiting at this event? Send your request to RRuzalski@ChainStoreAge.com Exclusively produced by: chainstoreage.com REIMAGINE. INNOVATE. EXECUTE.

CASCADES OVERLOOK

Sterling, Va.

When Phillips Edison & Company (PECO) bought this property nestled in Loudoun County—whose average household income of $150,000 makes it one of the richest counties in America according to the 2020 Census—its residential component made it unlike most of the hundreds of grocery-anchored shopping centers in its portfolio.

“It’s not our typical center. Cascades Overlook includes condos above street retail,” said Erin Majors, PECO’s VP of portfolio management, Mid-Atlantic “This was newer to us and it gave us a different perspective on how we would approach marketing it.”

The 150,841-sq.-ft. center anchored by a Harris Teeter supermarket is just 20 minutes from Washington Dulles International Airport. That makes it a regular stop for high-income locals who take advantage of necessity-based and service-oriented tenants such as Dentists of Sterling, Metro Nail Bar, and InSight Eye Optique.

Its food and beverage lineup is larger and more diverse than most grocery-anchored centers of its size. Among the eleven offerings are Urbano Modern Italian, Choolah Indian BBQ, Burton’s Grill and Bar, Poke Sushi Bowl, and Abbott’s Frozen Custard.

“Because of the condos above the retail, our restaurants do

ANNAPOLIS TOWN CENTER Annapolis, Md.

In growing and thriving markets with diverse populations in the United States, grocery-anchored centers can pull steady customers from five to 10 miles away. Such a one is Annapolis Town Center.

This 2 million-sq.-ft. open-air, mixed-use center anchored by Whole Foods and Target draws business from among 57,000 personnel at Fort Meade and the more than 40,000 people in place at Southwest Airlines, Northwest Grumman, and the U.S. Naval Academy

Since taking over operation of Annapolis Town Center in 2018, the Trademark Property company has doubled the amount of public space and seeded it with tenants like Pottery Barn, Warby Parker, Life Time Fitness, and Williams Sonoma. Whole Foods is the grocery anchor.

“We focused on high-volume users that would resonate with the local community,” said Trademark’s senior VP of leasing Daniel Goldware. “Restaurants are mini anchors these days so curating the right mix is uber-important. Oftentimes, these are local or regional operators who know how to serve the local trade area.”

Among them are Tuscan Prime, True Food Kitchen, Urbano Mexican Fare, and Cooper’s Hawk.

great regular business. One of the big events we do is Restaurant Week,” Majors said.

Monthly activities such as Octoberfest and Cascade’s holiday tree-lighting ceremony are centered in a community space surrounded by the restaurants Bands play there during the summer in the space where kids can romp through interactive fountains.

The Cascades Overlook Event Center is open 365 days a year for weddings, banquets, corporate events, and training sessions. Its Grand Hall, wrapped on two sides by windows, provides views of Loudoun County.

“Cascades Overlook,” said Major, “represents an outstanding mix of fine dining and quick service restaurants to a stop at the grocery store, along with a variety of shops and services with everything from fitness to financial and beauty and care for your pet.”

Trademark also ramped up the events calendar at Annapolis Town Center to a nearly weekly basis. Big quarterly events include Fall Fest, the Fire and Ice Festival, and the Summer Concert Series.

To make the property more walkable and increase cross-shopping and dwell time, Trademark removed a traffic circle inside the property that allowed it to double its public space.

“We had to work with the county and residents in the property to show why this was beneficial to the project,” Goldware said. “I believe that everyone is happy with the results.”

30 SEPTEMBER/OCTOBER 2023 CHAINSTOREAGE.COM REAL

ESTATE

A new restaurant row thrives in its location beneath a condo development at Cascades.

Trademark upscaled tenants at this Whole Foods-anchored center. Life Time replaced 24 Hour Fitness.

Tik-Tok Shakes Up E-Commerce

TikTok now serves as a full-fledged U.S. e-commerce platform, and digital retail will never be quite the same.

Speculation that TikTok, which has been the most downloaded app in the U.S. since late 2018, would take advantage of its vast user base and ability to influence (if not set) popular social trends by venturing into American e-commerce has been going on for some time. The company confirmed those suspicions with the recent U.S. release of its TikTok Shop e-commerce offering.

TikTok has already been serving as an online retail platform in countries including the U.K., Indonesia, Malaysia, the Philippines, Singapore and Thailand. The company has been piloting its TikTok Shop e-commerce offering with select U.S. retailers since November 2022, but the widespread rollout should be a game-changer for domestic e-commerce.

Here are three ways TikTok is already shaking up e-commerce in the U.S.

Video killed the storefront?

TikTok has already become an important player in U.S. e-commerce even though it only just gained the capability to facilitate digital transactions on its platform here. According to recent data from e-commerce platform Jungle Scout, 43% of surveyed Gen Z consumers start their online product searches on TikTok, a higher number than those who start on Google.

And in a blog post announcing its entry to U.S. e-commerce, TikTok said videos with hashtags like #TikTokMadeMeBuyIt had already turned it into a significant purchase influencer, especially among younger shoppers (is there a better kind?). The fact is TikTok has already been an active promoter, along with other video-focused social networks like YouTube and Instagram, of turning videos into e-commerce shops.

Now, with its focus on directly selling to

viewers via shoppable videos and livestreams, TikTok is attempting to move online consumers further away from shopping at web stores and toward engaging with videos. Based on its rapid growth so far, the results of this effort are certainly worth watching.

‘Friendly’ competition

TikTok could be said to have a lot of friends in the U.S. online retail industry. The company has been involved in a variety of e-commerce collaborations with major players including livestream shopping with Walmart, promotional influencer videos with Saks and an initiative to have TikTok influencers teach Sephora beauty brand partners about social content strategies.

Suffice it to say, almost any U.S. retailer seeking to reach Gen Z shoppers has some type of TikTok presence. And as until now TikTok could not directly facilitate any sales, they were a “safe” partner. But with TikTok is engaging in e-commerce in a manner similar to the hosted third-party marketplaces operated by retailers such as Walmart, will business and friendship mix?

The people have spoken

TikTok has been attracting large amounts of governmental attention during the past few years — and not the good kind. The Biden administration has been consistently continuing to express serious regulatory concerns, which began under the Trump administration.

In December 2022, Sen. Marco Rubio (RFL) introduced bipartisan legislation to ban TikTok from operating in the United States. A few months later, Montana Gov. Greg Gianforte signed legislation that will make Montana the first state in the U.S. to completely ban any mobile app store from providing TikTok to users in the state.

However, 150 million users are 150 million users. Clearly, American consumers (and businesses) love TikTok, and the social app, which says it has taken steps to isolate and protect U.S. data, is betting that a popularly elected government won’t risk upsetting that many people and vested interests by banning or restricting it.

Every Wednesday

The only industry newsletter dedicated to store planning & design, construction, and facilities management.

Get the latest news on retailers’ expansion and remodeling programs, new store prototypes, green initiatives, facilities updates and more. Find out who’s opening stores and where. CSA Store Spaces covers retail development and facilities management inside and out.

Dan Berthiaume dberthiaume@chainstoreage.com

Dan Berthiaume dberthiaume@chainstoreage.com

TECH VIEWPOINT CHAINSTOREAGE.COM SEPTEMBER/OCTOBER 2023 31

Sign up TODAY! www.chainstoreage.com/register CSA_StoreSpacesAd_2.375x10_0721.indd 1 7/14/21

The Home Depot applies careful planning and advanced technology to ensure stores can quickly return to business when disaster strikes.

Shelly Scarberry, the company’s technology, senior director- infrastructure delivery and support, has responsibility for a 1,000-person infrastructure delivery and support team. Chain Store Age spoke with Scarberry about how her organization approaches post-disaster recovery of a store’s technology, which is one of her primary responsibilities.

How does your group respond when a Home Depot store is located in a community that has experienced a disaster?

Our goal is to restore normal technology functions at the store location impacted by any event. Whether it’s a natural or manmade disaster, we approach them all very similarly. We act as a single point of contact for technology teams and store locations through our technology command center, which is a grouping of multiple matrix teams within the organization.

My group engages and coordinates all the necessary teams and then communicate the status of what’s happening at a very high level to the business and to all of the technology team members. The number one goal after safety is to try to restore the technology functionality to the store.

Disaster Recovery

How The Home Depot gets store tech up and running after a disaster

By Dan Berthiaume

We work with our disaster captains, field captains and technology deployment centers. The centers are where we hold and ship out all of the hardware that gets our store up and running in the event of any kind of disaster.

What is the role of the disaster captains and the field captains and how the teams work together?

All of the areas where we would need to engage are represented in the technology command center. Using a hurricane as an example, each department, like HR and supply chain, has an IT disaster captain who may have about eight to 13 stores under their responsibility, and they assess if there are store locations that are going to be in a threat zone and if they need to mobilize a response.

The field captains engage with the disaster captain to address very specific technology needs for a store, so they’re looking to see what happened in the location. They work with construction and safety personnel to see if it is safe to go into the store to assess the damage, pull out whatever is defective and ship replacement hardware in to get the store up and running.

What does Home Depot do to get a store that has undergone a disaster reopened?

We want to make sure that we get connectivity up and running as quickly as possible.

The network is in the store with coverage in the parking lot. If there were damage internally to connectivity inside the store, or water damage or any other type of damage that would stop connectivity from happening inside a store,

we use our network connectivity out in the parking lot to set up temporary selling laptops and a tent where we can get out the most critical disaster recovery products, such as generators or plywood.

Can you provide some detail on Home Depot’s proprietary “VISION” disaster response tool?

VISION is a homegrown technology tool that we created within Home Depot. It provides one ‘pane of glass’ anytime we have a disaster. It has mapped out all of our stores and we’re able to see in real time such things as which stores are open, which stores have reduced hours, the impact of the damages, whether stores are connected to the network and what we are doing to help them get up and running.

With the technology, Home Depot is able to see what product we’ve ordered, where it is in shipment and when it’s going to be installed. It also gives us a readout to know how we’re progressing. We have GPS locators on the supply trains and trucks that deliver all of our generators to areas where we need them.

VISION also has a robotic notification system that provides us immediate feedback so that we know where our product is and how the store is functioning. It also helps us with communicating emergency needs and deploying the right technology or the right people to the right sites, as well as logging and registering an event to make notes about what stores are affected and where we need to deploy people and resources.

Editor’s note: Shelley Scarberry was a 2022 recipient of a Chain Store Age Retail’s Top Women in Technology award.

TECH 32 SEPTEMBER/OCTOBER 2023 CHAINSTOREAGE.COM

Customer-Centric Retailing

Aligning the enterprise with your customers

By Dan Berthiaume

Retail is, by definition, a “customercentric” industry. The goal of retail has always been to provide shoppers with the items they want, when and where they want them.

But until the last 20 years or so, retailers were highly limited in their ability to cater to individual customer needs, and consumers mostly accepted a shopping experience with boundaries set by the products retailers had on the shelf, or maybe in a back room or nearby warehouse.

No more. As the evolution of mobile technology has led consumers to lead “constantly connected” lifestyles where handheld devices provide limitless access to everything they want or need, they now expect retailers to provide a custom-tailored shopping experience. This includes quick access to any SKU in their entire assortment, in store, at home or on the go.

In response, the industry is developing a “customer-centric” retail model that ensures workflows across every part of the enterprise are flexible and responsive enough to provide maximum convenience and satisfaction for each individual customer.

Following is a look at how five retailers in disparate sectors — Amazon, Target, Academy Sports, Newegg Commerce and Boohoo — are enabling customercentricity for in-store shopping, delivery, warehouse operations, merchandising and promotions.

Amazon lets store shoppers ‘Just Walk Out’ – with softlines

Amazon is a pioneer in frictionless shopping with its cashierless “Just Walk Out” store model, which debuted at an Amazon Go convenience store location in 2018. Now available at more than 70 Amazon-owned stores and more than 85 third-party retailers across the U.S., U.K.

and Australia, Just Walk Out enables customers to take what they want without having to stop to check out.

The experience is made possible by computer vision, sensor fusion and deep learning technology that detects what customers take from or return to the shelves. Customers identify themselves upon entry, and upon exit payment is automatically deducted from a registered debit or credit account, or customers pay by tapping a credit or debit card or hovering their palm over an Amazon One palm payment terminal.

Primarily, Just Walk Out has been used by grocery and convenience retailers to streamline shopping for food and CPG items. But a new version combines the capability of Just Walk Out with RFID technology to enable frictionless shopping for softlines merchandise, such as apparel and footwear.

With the new system, all the items for sale have a unique RFID tag, designed to look similar to a standard apparel tag. After the customer is done shopping,

they leave the store and pay through a designated exit gate equipped with RFID readers that read the tags and automatically charge their payment card.

Amazon piloted the new system in spring 2023 at select Just Walk Out-enabled concessions stores at Climate Pledge Arena in Seattle (home of the Seattle Kraken NHL franchise). Following positive feedback from the pilot, Amazon launched the RFID-enabled checkout-free system at Lumen Field, home of the NFL’s Seattle Seahawks.

Target sorts out next-day delivery

Target Corp. continues to expand its next-day delivery capabilities with a streamlined sortation center model. The discounter opened its tenth sortation center in August 2023, in Miami.

Since Target launched its sortation center operations in 2021, the facilities have helped to increase the number of orders delivered to customers the next day by more than 150%, according to the retailer.

TECH CHAINSTOREAGE.COM SEPTEMBER/OCTOBER 2023 33

The entrance of a ‘Just Walk Out’-equipped Fresh Market store (Photo: Amazon).

Looking to speed up delivery even further, the retailer in June 2023 opened its first “Target Last Mile Delivery (TLMD)” extension facility, in Smyrna, Ga. The facility receives local, pre-sorted packages from Target’s Atlanta sortation center and stages them for pickup and next-day delivery by drivers on the Target-owned Shipt platform.

Built at a fraction of the cost of a fullsize sortation center, the TLMD extension brings the retailer’s next-day delivery capabilities to more than 500,000 additional customers in the greater Atlanta market. The company has brought Target Last Mile Delivery to all its sortation center facilities.

All merchandising is local at Academy Sports Academy Sports, which plans to open 13 to 15 new stores this year, has a localized merchandising strategy and a value proposition that allows it to connect with a broad range of consumers. The retailer’s product assortment focuses on the categories of outdoor, apparel, footwear, and sports and recreation, and includes national brands and a portfolio of private label brands.

Key to Academy’s localized merchandising strategy is its ability to offer shoppers attractive prices in each

Customer service can make or break brand loyalty

According to the recent third annual “Consumer Insights about Customer Service” survey commissioned by call center platform provider TCN, 73% of surveyed U.S. consumers are likely to abandon a brand after just one poor customer service experience. This is the second year in a row this number has increased, as only 42% of respondents stated this in 2021, but 66% said so in 2022.

Conversely, when asked how likely or unlikely they were to make a repeat purchase with a brand after a positive customer service experience, 81% of respondents said they were either very likely or somewhat likely to do so.

community it serves utilizing Revionics’ Base Price solution. Additionally, with Revionics’ Markdown application, Academy can clear its seasonal inventory quickly and profitably, keeping its on-shelf selection fresh.

Academy is able take a customer-centric and data-driven approach to pricing, using an advanced AI platform to crunch massive amounts of data to help understand how shoppers will react to different combinations of price increases and decreases.

This allows the retailer to price competitively on its most popular goods and be less aggressive on items where demand stays relatively stable even when prices go up.

Newegg picks robots to streamline warehouse operations

Newegg Commerce is leveraging autonomous mobile robots (AMR) to streamline product picking in a California supply chain facility. The California-based technology e-commerce retailer recently deployed a Geek shelf-to-person mobile picking system that uses AMR technology in its Ontario, Calif., warehouse.