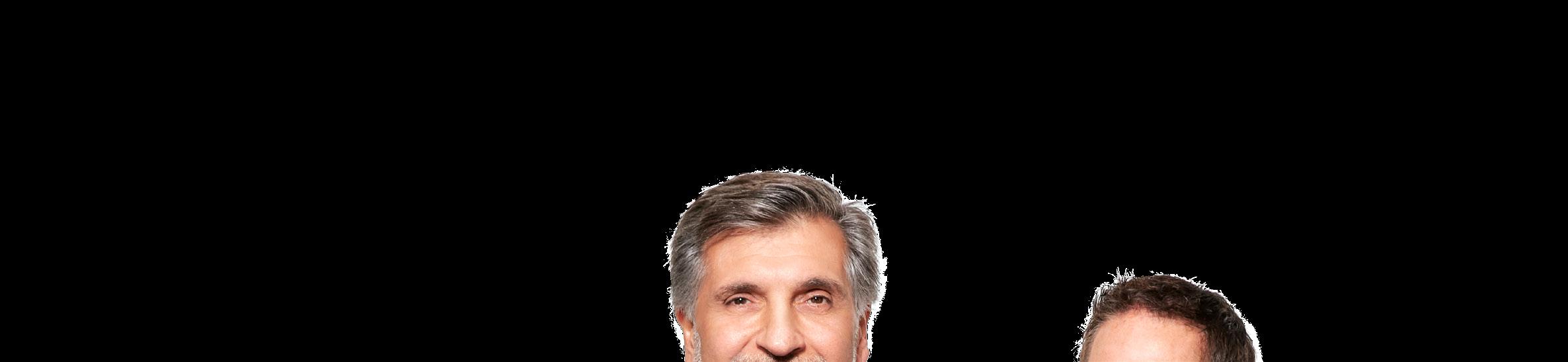

Meet the 2022 Golden Pencil winners: Carmen Fortino & Michel Manseau

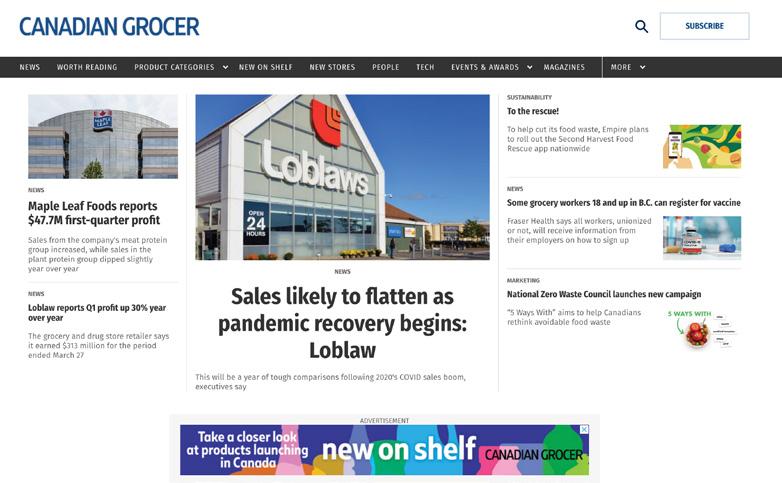

November 2022 || CANADIAN GROCER 3 COVER PHOTO: MIKE FORD, PEOPLE PORTRAIT: CHANTALE LECOURS, ILLUSTRATION: GARY NEILL, BAKED GOODS: GETTY IMAGES/PIDJOE Contents Features Cover Story WHAT RETAIL PAYMENT TRENDS ARE HERE TO STAY? 34 Contactless is in and cash is out, as savvy retailers give shoppers new ways to pay CHECKING IN ON SELF-CHECKOUT 39 As tech improves, shoppers are more willing to do their own checking out at the store GROCERY’S GREATS 29 Meet Carmen Fortino and Michel Manseau, the 2022 Golden Pencil Award winners! 8 Follow us on @CanadianGrocer Canadian Grocer Opinions 5 || Front Desk 21 || Behind the Trends 23 || Eating in Canada People 6 || The Buzz Comings and goings, store openings, awards, events, etc. 8 || The spice of life After taking over his family’s spice business, Ayman Saifi pivoted to create custom blends inspired by his own cooking Ideas 11 || Chop shop The cost saving measures Canadians are adopting to tackle rising food prices 13 || The big question Grocery leaders weigh in on industry hot topics 15 || Mastering the ‘F’ words The Star Women winners panel on the importance of flexibility, feedback and failure 16 || Longo’s teams up with Kitchen Hub The store within a store concept offers restaurant quality meals and convenience 16 || Loblaw, Gatik hit the road with driverless fleet Autonomous delivery service is on the move without a safety driver 17 || Global grocery News and ideas from the world of food retail 24 || Time to shine! See photos from this year’s sold out Star Women in Grocery ceremony, held in Toronto Aisles 49 || Snack of all trades At home or on the go, consumers are experiencing a serious snack attack 53 || Rising to the occasion Why Canadians are willing to indulge in baked goods 54 || Booze-free bevvies: Four things to know Cheers! Your guide to this booming beverage category 55 || New on shelf Shining a spotlight on the latest products hitting shelves Express Lane 56 || Taking Stock CIBC Capital Markets’ Mark Petrie on grocery’s post pandemic opportunities 53 November 2022 || Volume 136 Number 7 34

PUBLISHER

Vanessa Peters vpeters@ensembleiq.com

EDITOR-IN-CHIEF

Shellee Fitzgerald sfitzgerald@ensembleiq.com

MANAGING

Kristin Laird klaird@ensembleiq.com

DIGITAL

Jillian Morgan jmorgan@ensembleiq.com

ART

Josephine Woertman jwoertman@ensembleiq.com

SENIOR

Michael Kimpton mkimpton@ensembleiq.com

SENIOR

Sandra Parente sparente@ensembleiq.com

VICE

Megan Judkins mjudkins@ensembleiq.com

SENIOR

Valerie White vwhite@ensembleiq.com

Katherine Frederick kfrederick@ensembleiq.com

krajani@ensembleiq.com

jchacon@ensembleiq.com

So what lie S ahead? Analysts and industry observers are already specu lating on both big issues—how long will high inflation stick around? (according to The Bank of Canada, awhile yet)—and those a little less weighty; for instance, Whole Foods’ predictions that kelp and something called yaupon, will be ingre dients to watch in 2023.

How the in-store shopping experience will continue to evolve in the future is always a fascinating subject to explore. In this issue, the question was put to CIBC Capital Markets’ Mark Petrie. We asked the equity research analyst what grocery shoppers expect from the in-store experi ence in a post- COVID world. Among other things, Petrie said we’re returning to a time of shopper engagement, and that consumers expect technology to be lay ered into their shop to improve the expe rience (read the full interview, page 58)

Staying on the topic of in-store tech and the shopping experience, in “Checking in on self-checkout” (page 39) writer Rosalind Stefanac looks at the rise, thanks to a pan demic boost, of these self-serve systems, which are projected to grow 11.9% year over year to 2026. Once disparaged, more and more consumers are now embracing the idea of skipping the line and checking themselves out. We also look at the new age of payments (page 34) and how the pressure is on for retailers to stay on top of all the ways shoppers want to pay, and how integrating loyalty and payments can be a big opportunity for grocers.

Finally, in this issue we are also shin ing a light on excellence in the Cana dian grocery industry. Metro’s Carmen Fortino and Michel Manseau of Kruger Products (our cover subjects) are the win ners of the 2022 Golden Pencil Awards, a decades-old award that recognizes out standing contributions to the industry and communities. Turn to page 29 to see why these two impressive leaders are the recipients of the industry’s highest hon our. Fortino and Manseau will receive their awards at a ceremony in Toronto on Nov. 21, as part of Canadian Grocer’s GroceryConnex leadership conference. Visit groceryconnex.com for details. CG

November 2022 || CANADIAN GROCER 5 GETTY IMAGES/WHYFRAMESTUDIO

As another tumultuous year

winds down, inevitably, we look to what’s next

Shellee Fitzgerald Editor-in-Chief sfitzgerald@ensembleiq.com Keep up to date on the latest news by signing up for our e-newsletter. It’s free and we’ll deliver it to your inbox four times a week. Visit canadiangrocer.com to subscribe Front desk Self-checkout is predicted to grow considerably over the next few years LOOKING AHEAD CORPORATE OFFICERS CHIEF EXECUTIVE OFFICER Jennifer Litterick CHIEF FINANCIAL OFFICER Jane Volland CHIEF PEOPLE OFFICER Ann Jadown EXECUTIVE VICE PRESIDENT, OPERATIONS Derek Estey EXECUTIVE VICE PRESIDENT, CONTENT & COMMUNICATION Joe Territo MAIL PREFERENCES: From time to time other organizations may ask Canadian Grocer if they may send information about a product or service to some Canadian Grocer subscribers, by mail or email. If you do not wish to receive these messages, contact us in any of the ways listed above. Contents Copyright © 2022 by EnsembleIQ, may not be reprinted without permission. Canadian Grocer receives unsolicited materials (including letters to the editor, press releases, promotional items and images) from time to time. Canadian Grocer, its affiliates and assignees may use, reproduce, publish, republish, distribute, store and archive such submissions in whole or in part in any form or medium whatsoever, without compensation of any sort. ISSN# 0008 3704 PM 42940023 Canadian Grocer is Published by Stagnito Partners Canada Inc., 20 Eglinton Avenue West, Ste. 1800, Toronto, Ontario, M4R 1K8. Printed in Canada

EDITOR

EDITOR

DIRECTOR

DIRECTOR OF PRODUCTION

VICE PRESIDENT, GROCERY AND CONVENIENCE, CANADA

PRESIDENT, EVENTS

DIRECTOR, DIGITAL CANADA & SPECIAL PROJECTS

SALES NATIONAL ACCOUNT MANAGER

ACCOUNT MANAGER Karishma Rajani

SALES COORDINATOR Juan Chacon

SUBSCRIPTION SERVICES Subscriptions: $85.00 per year, 2 year $136.00, Outside Canada $136.00 per year, 2 year $216 Single Copy $12.00, Groups $61.00, Outside Canada Single Copy $16.00. Digital Subscriptions: $60.00 per year, 2 year $95.00 Category Captain: Single Copy $20.00, Outside Canada Single Copy $30.00 Fresh Report: Single Copy $20.00, Outside Canada Single Copy $30.00 Who’s Who: Single Copy $190.00, Outside Canada Single Copy $230.00 Email: contactus@canadiangrocer.com Phone: 1-877-687-7321 between 9 a.m. to 5 p.m. EST weekdays Fax: 1-888-520-3608 Online: www.canadiangrocer.com/subscription

The

Langley, B.C.’s Walnut Grove neighbourhood is home to a new FRESH ST. MARKET. The store, which opened in late October, is inspired by the executive and culinary team’s tours of public markets and eateries across North America and offers a wide range of local prod ucts. “This destination brings a market-like expe rience to those who live in and around the Fraser Valley who also enjoy supporting local farmers and producers,” said Mark McCurdy, vice-president retail operations and brand strategy at Fresh St. Market, in a release. Among the store’s local offerings are a curry bar featuring family recipes from Spice Mantra Curries, meat sourced from Lepp Farms, coffee beans from Lion’s Bay Coffee Company and cheese from the likes of Golden Ears Cheesecrafters and Creekside Cheese and Creamery. The Langley store is the sev enth Fresh St. Market location in the province.

Toronto is getting a second EATALY location. The Ital ian food hall has signed a multi-year lease at Cadillac Fairview Sherway Gardens shopping centre, located

The latest news in the grocery biz

in the city’s west end. Eataly opened its first Canadian location in Toronto in November 2019, and it currently has nine food halls in North America with 40 stores worldwide. An opening date has not been announced.

FARM BOY opened its ninth Toronto location in November. The Empire-owned banner continues its expansion across Southwestern Ontario with a new 27,739-sq.-ft. space located at the busy midtown intersection of Yonge and St. Clair. The store will employ 139 staff members and feature a wide variety of fruit and vegetables, butcher-quality meats, arti san cheese, plant-based and vegan options as well as a salad bar and hot bar for grab-and-go options.

CALGARY CO-OP’S North Hill location is being rede veloped into a mixed-use community. The site, purchased in September by Royop Development Corporation, will be transformed to include resi dential apartments, a parkade, two new commercial buildings and a new, full-service Calgary Co-op gro cery store along with a Calgary Co-op Wine Spirits Beer store, a cannabis shop, car wash and gas bar. Construction will begin early next year and the cur rent Calgary Co-op grocery store will continue to operate until the new store opens, at which time the old location will be demolished to make room for other new buildings.

6 CANADIAN GROCER || November 2022 FRESH ST. MARKET, EATALY, CALGARY CO-OP, LOBLAW

Buzz News to share? Tell us about your openings, comings and goings, etc. by dropping a line to sfitzgerald@ensembleiq.com

OPENINGS

(Top left and above) Fresh St. Market opened a new store in Langley, B.C. in late October. (Right)

Eataly announced plans for a second Toronto location at CF Sherway Gardens shopping centre

Calgary Co-op’s North Hill location is being redeveloped. (Below) A new Real Canadian Super store has opened at Calgary’s Bow River Shopping Centre

NATURE’S EMPORIUM continues to expand. The health food market chain has announced plans to open a new location in Oakville, Ont., west of Toronto in 2023. To be located at Dorval Crossing shopping cen tre, the 24,000-sq.-ft. store will specialize in organic produce, plant-based products, healthy meals to go, supplements and natural health and beauty items. Last summer, the retailer announced plans to open its first downtown Toronto store, in the city’s South Core district in 2023. Nature’s Emporium currently has four locations in the Greater Toronto Area: in Newmarket, Burlington, Maple and Woodbridge.

Loblaw has opened a new REAL CANADIAN SUPERSTORE at Calgary’s Bow River Shopping Centre. At 86,200 sq. ft., the store serves as an anchor tenant in the development, which also includes a new Real Cana dian Liquor Store.

WALMART CANADA has announced plans to open its firstever fulfilment centre in Quebec. The new, $100 million high-tech facility will be located in Vaudreuil-Dorion, near Montreal, and will function as a delivery hub for Quebec as well as Atlantic Canada. The retailer says the 457,000-sq.-ft. fulfilment centre will be capable of shipping 20 million items annually to local customers. Walmart Canada is investing $1 billion in infrastructure this year as part of its efforts to “speed up and trans form the business for its customers.”

(Clockwise from top) Walmart is opening its first fulfilment centre in Quebec; Farm Boy announces ninth Toronto store; Nature’s Emporium is expanding to Oakville, Ont.

P&G Canada has made changes to its leadership team. Jennifer Seiler, a 22-year veteran of the company, has been appointed senior vice-president of marketing, Canada. Meanwhile, Melody Wallis, who has racked up 20 years of experience at P&G in Canada and the United Kingdom, has been named vice-president of analytics & insights and technology, Canada. Seiler and Wallis succeed Bethanie Butcher, who has relocated to Panama to take on the role of senior vice-president analytics & insights, Latin America.

Suzanne Dalrymple has joined Gay Lea Foods and will transition to the role of president and chief executive officer of the company next February. The former Mars executive replaces Michael Barrett, who has announced plans to retire at the end of January. Barret has held the top post since 2014.

At Conagra Brands, Sebla Guvener is the company’s new head of supply chain for Canada. Prior to Conagra, Guvener led the supply chain for nutrition at Nestlé Canada and she has also held several roles at P&G Canada.

FHCP AWARD OF DISTINCTION

Food, Health & Consumer Products of Canada (FHCP) has named Margaret Hudson, president and CEO of Burnbrae Farms, and former Tree of Life Canada executive Jamie Moody, as the winners of its 2022 Award of Distinction. The award recognizes “lasting and profound impact on FHCP and Canada’s food, health and the consumer products industry.” Hudson and Moody received their awards at FHCP’s annual CEO and Executive Leadership Conference held in Niagaraon-the-Lake, Ont., in October.

November 2022 || CANADIAN GROCER 7 WALMART CANADA, FARM BOY

Melody Wallis

Jennifer Seiler

Suzanne Dalrymple

Michael Barrett

Sebla Guvener

PEOPLE

AWARDS/RECOGNITION

By Andrea Yu Photography by Chantale Lecours

People Who you need to know THE SPICE OF LIFE After taking over his family’s spice business, Ayman Saifi pivoted to create custom spice blends inspired by his own cooking

Ayman Saifi’S roots in the spice industry go back more than a hundred years. “I’m a fourth-gen eration spice merchant,” Saifi explains. “We’ve been trading spices since my great-grandpa, Husni, started the business in Palestine in the early 1900s.”

From there, Saifi’s grandfather and father expanded the business, shifting from Pales tine to Jordan in the 1970s and 1980s and, ultimately, relocating their operations to Quebec in 1999.

While completing his university studies in the late 2000s, Saifi worked for his father’s business as a sales representative. At the time, the company focused mostly on the distribution of imported finished goods, such as rice and dry legumes, while a third of the business was spices. “Our customer base was mostly regional,” he explains. “Butchers, retail stores, a few restaurants and indepen dent mom-and-pop shops.”

A decade later (in 2013) Saifi’s parents made the decision to retire to Dubai, leaving Saifi to take over operations. “I helped build the business alongside my dad and he had full trust in me,” he says. At the same time, however, Saifi was losing his spark for sales. “I felt like something had to change because we had hit a plateau,” he explains. He wanted to pivot, but he wasn’t sure how to do it.

A few years later, the inspiration for change came from Saifi’s own kitchen, where he often experimented by making different spice blends. “I made tacos one time using my own spice blend,” he recalls. “I invited my neighbours for dinner and they were like, ‘They’re so good’ and wanted to know how I made them. I thought to myself: ‘I need to put this blend together and sell it as a fin ished product’.”

From there, Saifi went on to develop about a dozen spice blends, ranging from a steak spice to Thai-inspired combinations and a za’atar similar to his mother’s. He would test early recipes out on friends (“a lot of my neighbours were my guinea pigs”) and gave samples out to his team of eight employees to test in their home kitchens.

After naming his new company A Spice Affair—“I wanted the brand to represent the love affair that people have with food and their kitchens”—his next task was finding retailers to list his products. Saifi’s first big account, and a validating achievement for the entrepreneur, was getting Winners on board in October 2016, just a few months prior to A Spice Affair’s official launch. “I actually pitched Winners before I had a finished prod uct ready,” Saifi recalls. “I got a few jars and

labels printed out from a regular printer. They looked really bad.” Nevertheless, the Winners buyer believed in Saifi’s product and agreed to stock A Spice Affair in more than 400 stores nationally. “The first time I saw it on the shelves of Winners was through a picture sent to me by a friend who lives in Toronto,” he explains. “It was a very humbling feeling. It gave me a huge sense of pride.”

From there, Saifi continued to seek out more distributors. His next big milestone came in 2018 when HomeGoods, a home decor retailer in the United States, came on board. A year later, A Spice Affair broke into the grocery retail market with Sobeys locations in Quebec. Saifi was just beginning to make further moves in grocery when the pandemic hit.

“It was actually a very scary few weeks,” he recalls. But Saifi persevered and focused efforts on increasing his grocery representa tion, along with pushing direct-to-consumer online orders. “We saw a 2,000% jump in e-commerce sales,” he says. “That was an incredible feat.”

A Spice Affair’s e-commerce growth caught the attention of a distributor in Ontario, who Saifi has since partnered with to gain contracts at Loblaws stores in the province. Saifi also grew his grocery reach in Quebec, working with Metro to develop a French sister brand called Passion d’épices.

And this year, Saifi brought A Spice Affair into more international markets—his former home country of Jordan. There, he secured his first celebrity partnership with renowned Jordanian chef Deema Hajjawi. “She fell in love with the brand,” Saifi says. “We did a collaboration and developed four custom blends that were her recipes.”

Today, A Spice Affair and Passion d’épices can be found in more than 1,000 stores in Canada. And Saifi has no intentions to slow down. Next year, he plans to enter the United Arab Emirates and introduce products such as infused maple syrups—his first venture outside of dry spices. “We’re working on a smoky jalapeño maple syrup and a maple pepper syrup,” he says.

Looking back at his family’s legacy, Saifi thinks his great-grandfather, who used to trade spices and goods by the boatload, might be surprised at the direction that Saifi has taken—but he’d still be proud. “Today, we’re selling [spices] in 100-gram jars, mix ing and matching them,” Saifi says. “I see this as more of an art versus a trade. Their trade was an art in its own form. And today, we’re taking that and turning it into an art that people can enjoy.” CG

30 seconds with …

AYMAN SAIFI

What do you like best about your job?

Getting feedback from customers, like testimonials and reviews. It’s a kind of reassurance and validation in what I’m doing. I think it’s extremely fulfilling and rewarding, especially when people are praising the customer service and the product, the taste, the quality.

If you weren’t in the food business, what would you be doing?

Custom pet supplies. Like many people during the pandemic, I got a pet, which was life changing. My dog, a German Shepherd-Husky named Berlin, is pretty much my other half. But it’s been very difficult to find nice, premium products and gear, like collars and leashes, in customizable colours.

What is the best career advice you’ve received?

Focus, focus, focus. [I received this advice] years ago when I was showing the progress of my business to a mentor and I had a lot of ideas.

What is your favourite product from the lineup?

The Everything Bagel seasoning is something I use almost daily. I put it in my eggs—I can’t have eggs without it—and in labneh, which is a Middle Eastern soft cheese. It’s really good. And the Brazilian barbecue, I use that for every meat, even to make burger patties. I love that flavour.

November 2022 || CANADIAN GROCER 9

Enterprise IT Services and

When you contact BFG, a dedicated specialist helps you every step of the way. Connect with us today!

Support Economy, Quality & Experience For over 30 years BFG has been Canada’s only nationwide single-source for IT systems, installation, maintenance & support. For Canada’s grocers, retailers, and hospitality, we help you pivot to meet the new realities of ecommerce and the way shoppers interact with your business. Implementation Services Asset Management Field Services Supply Chain Technology Electrical Services End-User Service Customized & Sustained IT Solutions Optimize your store, distribution centre and supply chain performance with the right technology. Maximize uptime with best-in-class technology 90%+ SLA success rate and Asset lifecycle management to stay on top of digital transformation Tailored National IT Solutions First-time-fix support, 7/24/365 bilingual call centre and Coast to coast service from in-house badged technicians. Minimize downtime with a 90%+ first-time-fix rate 170,000+ completed services calls annually Specialized system supporton top of digital transformation bfg.ca

COPING WITH COSTS

aS the coSt of groceries hits eye-watering highs, moneysaving measures are on fire.

That’s a key takeaway from a recent study by the AgriFood Analytics Lab at Dalhousie University, in partnership with Caddle, that examined how Canadian consumers are dealing with higher grocery prices.

The study of 5,000 Canadians found that in the last year, 33.7% of respondents have used more loyalty pro gram points to pay for their groceries, 32.1% read weekly flyers more often, and nearly 24% are using more coupons at the grocery store.

Canadians are cultivating a green thumb to save money on food: 15.5% of consumers have started growing their own food in the last year. Ontario has the highest percent age of budding gardeners (17.4%), followed by B.C. (16.2%), the Atlantic (15.2%), Quebec (13.7%) and the Prairies (13.1%).

“I think the media has done a pretty good job informing the public in terms of how to save money and Canadians

are paying attention,” says Sylvain Charlebois, senior director of the Agri-Food Analytics Lab. “Canadians are also domesticating themselves and doing things at home that are helping.”

The survey also looked at changes in shopping behaviour. While 8% of consumers have changed their primary grocery store where they buy most of their food, 12.9% of Canadians have started to visit more than one store in the last 12 months.

Just over 19% of Canadians have visited discount stores in the last 12 months, and 11.5% have visited dollar stores more often to buy food. Some are going straight to the source: 8% of consumers are visiting farmers markets more often, and 7.1% have visited roadside stands to buy directly from farmers in the last year.

Other money-saving tactics Canadians are using are: trying to waste less food (40.6%) and adding private-label products to their shopping carts (21%).

—Rebecca Harris

November 2022 || CANADIAN GROCER 11 GETTY IMAGES/MONKEYBUSINESSIMAGES

SHOPPER BEHAVIOUR Ideas RETAILERS || SUPPLIERS || SHOPPERS || INSIGHTS

EUROPEAN CHEESES ALWAYS PLEASE THE PALATE

There is something truly special about sampling a fine-quality cheese that tantalizes the tastebuds, and with a bevy of natural, artisan cheeses from Europe now available in Canada, it’s no wonder more Canadians are gravitating towards them.

In Europe, centuries of cheese-making tradition preserved across multiple regions have resulted in the production of delicious, unprocessed, locally made cheeses that are still so authentic their quality is unparalleled to this day.

Austria is among those revered European regions producing high-quality, authentic artisan cheese that work for any occasion. As a central European nation famous for its exceptional landscape, Austria produces more than 450 hard and soft cheese varieties. And in keeping with tradition, these cheeses are primarily produced by small, family-owned businesses guided by generations of cheese-making expertise. In fact, 90% of the milk farms in the region are family-owned and 85% of the land is supported by environment measures. Furthermore, all Austrian milk used to make cheeses is GMO-free, and farmers have been voluntarily producing GMO-free milk for nearly two decades. On average, farms keep only 22 heads of cattle, and most farmers still know their cows by name.

“We know that families have a very close relationship with their land and strive to cultivate it in a sustainable way in order to pass it on to the next generation,” says Margret Zeiler –Export Marketing Manager at Agrarmarkt Austria Marketing. “This kind of caring can’t help but be passed on in the careful crafting of these artisan cheeses.”

THE MAGIC OF THE MOUNTAINS

The Austrian Alps are at the heart of Austrian culture—as well as its cheese-making tradition. These majestic mountains coupled with pure air, soil and water, create the perfect backdrop for producing the nation’s famous mountain cheeses. Far, far away from urban life, pastures in the Alpine region nourish cattle to produce high-quality, GMO-free milk which is processed by small family farms using protected production methods passed down over multiple generations. This milk then plays a starring role in developing Alpine cheeses, the most famous of which is “Bergkase” mountain cheese known for its distinct buttery and nutty flavour.

With more than 500 years of cheesemaking practices passed on from generation to generation, today’s mountain cheeses from Austria offer the authentic taste of the Alps, while complementing Europe’s vast artisan cheese offerings. Consumers can be confident that Austrian mountain cheeses also follow the quality standards set by the European Union, which guarantees the authenticity, quality, place, and cheese-making technique

As more and more Canadians strive to fill their plates with tasty, natural foods—and opt for products that are more environmentally and ethically produced—unprocessed artisan cheeses from Austria fit the bill.

For more information, please contact: export@amainfo.at

The content of this promotion campaign represents the views of the author only and is his/her sole responsibility. The European Commission and the European Research Executive Agency (REA) do not accept any responsibility for any use that may be made of the information it contains.

When it comes to quality and taste, Austrian cheeses are in a league of their own

ADD AUSTRIAN CHEESES TO YOUR IN-STORE OFFERINGS! Special Promotional Feature in Canadian Grocer | November 2022

HOW ARE YOU RESPONDING TO CONSUMER CONCERNS OVER HIGH FOOD PRICES?

Anthony Longo President and CEO LONGO’S

Anthony Longo President and CEO LONGO’S

“We appreciate that many Canadians are concerned about rising day-to-day costs, especially when it comes to necessities like food. To help mitigate the rising cost of food, we are working diligently to increase our Longo’s branded products and provide additional cost-friendly options to help Canadians get the most out of their food budgets. We offer meal solutions and recipes to provide inspiration about how to stretch dollars further. We also have our loyalty program, Thank You Rewards, which provides member pricing on items throughout the store and allows guests to accumulate points towards free groceries.”

Darrell Jones President PATTISON FOOD GROUP

“We understand their concerns as we are all being impacted by record-high inflation rates. Our manufacturers and supplier partners are seeing cost increases in all areas, from transportation and fuel costs to raw materials and packaging. I think it’s fair to say that all of us in the retail food industry are doing everything we can to mitigate passing these cost increases along to our customers. We will continue to work hard to provide options for our guests that are of the highest quality and the fairest prices.”

Jeff Ambrose Senior vice-president, operations & merchandising CALGARY CO-OP

“We understand there are many factors at play from supply chain issues to significant infla tion that are impacting grocery budgets. We encourage our customers to take advantage of our promotional offers including weekly flyer specials, Butcher’s Best savings in the meat department, and our Big Deals offered throughout all departments. We recommend our customers become mem ber-owners by purchasing a one-dollar lifetime membership. They can get even more value with Member Exclusive Pricing throughout our stores, partner discounts and offers, and an

Eric La Flèche

President and CEO METRO

“Inflation affects all departments and categories right now. Metro is well positioned to meet the changes in consumer behaviour and deliver the best value possible to consumers in these inflationary times with our multiple store formats, effective promotional strategies and a strong private-label offering. There’s a shift to value and it’s our job to provide the best value we can.”

Digs Dorfman CEO THE SWEET POTATO

“We’ve done our best to keep prices static during these turbulent times, but in some cases raising prices has been inevitable. To help reduce the strain on customers, we’ve negotiated great everyday low pricing on some key items, which we’ve strongly messaged. But, ultimately, if a customer asks why we had to raise a price on a particular item, we’ve just been direct with them every time: our costs have gone up.”

November 2022 || CANADIAN GROCER 13

THE BIG QUESTION Ideas

Deliver on quality, safety, and compliance, every time.

1

Canadian businesses work hard to ensure the freshness, quality, and safety of their products. Bell is able to help deliver on these commitments with innovative technologies that optimize the distribution process during transport.

On Canada’s best national network,1 Bell Smart Supply Chain allows you to:

Deliver fresh and quality products to customers

Maintain high product quality during transport, with automated near real-time alerts when trailer temperatures rise above or fall below thresholds specific to the cargo being transported.

Drive efficiencies in inventory and fleet management

Track the location of your trailers and allow fleet managers to monitor driver and vehicle performance. Map the location and status of all shipments on a visual dashboard with notification reports, and cross-reference data from multiple operational databases.

Prove compliance with regulations

View and maintain cold chain records with trip temperature graphs that outline events and range limits. Isolate and address quality issues to maintain regulatory compliance and a trustworthy brand image.

To learn more about Bell Smart Supply Chain, visit bell.ca/smartsupplychain

Based on a third party score (Global Wireless Solutions OneScore™) calculated using wireless network testing in Canada against other national wireless networks of combined data, voice, reliability and network coverage. Visit bell.ca/mobilenetwork.

MASTERING THE ‘F’ WORDS

Flexibility, feedback and failure—words that have been traditionally frowned upon or feared in business. But, during a recent panel discussion at Canadian Grocer’s Star Women in Grocery Awards ceremony in Toronto, some of this year’s winners explained how these ‘F’ words (and vulnerability, too) can positively impact company culture, employee engagement and personal success.

“Failure for the longest of times was perceived as a sign of weakness, which is not the case. When you fail, you learn and grow. I think it’s very important for each one of us to be humble and reflect and share those failures.”

—Stephanie Goyette, head of marketing & strategy, Taste Elevation, Kraft Heinz Canada

“It’s funny because people always talk about work-life balance, but for me it’s been about integration and being with a company that helps me do that. I’ve learned not to stretch myself too thin and to leave time for unplanned things. Flexibility has been key for me and exploring the options my company offers.”

—Shilpa Mukhi, VP, sales, P&G Canada

By Kristin Laird

“Early in my career I was running away from feedback. My best advice is to actively pursue feedback. It is a gift. It makes one feel so uncomfortable, but in that discomfort can come really great things.”

—Louisa Furtado, VP human resources Ontario and health & safety, Metro

“Vulnerability is a key aspect of building a strong workplace culture. I didn’t have a traditional career, I was out of the workforce for about eight years and when I [started at] Loblaw it was very difficult to return to work as a woman. I think it’s important to share that story with my teams and with my male colleagues that are hiring—to have that vulnerability of just how tough it is for women or men who are balancing caregiving and family. A big key is showing you’re not perfect. You have days where you forget to pack your kid’s snack.”

—Janet Rickford, VP, retail and merchandising data products and services, Loblaw Technology/Loblaw

“I am perfectly fine admitting I fail daily. The ‘F’ word is becoming a superpower and we have to embrace it. Nobody will ever put more pressure on me than me, so I get to choose how I accept my failure. If I can turn that around and make it a secret weapon, I’m going to own that all day long.”

—Bonnie Birollo, SVP retail operations, Sobeys

“People want to feel a sense of belonging and to feel understood. Be vulnerable, especially in a leadership position, to show them it’s not easy and create an environment where people feel heard and supported.”

—Jessica Armstrong, VP, eCommerce, Maple Leaf Foods

November 2022 || CANADIAN GROCER 15 GOLDMEDIA.CA

Ideas

LONGO’S TEAMS UP WITH KITCHEN HUB

Grocery S tore S continue their slow but steady evolution from solely selling raw ingredients to being a one-stop shop for both fresh foods and pre-cooked, restaurant-quality meals.

Kitchen Hub, a two-year-old company that brings together “celebrated restau rants” using the ghost kitchen concept, has opened its fourth location, this time inside a Longo’s store in Toronto’s Liberty Village neighbourhood. It is being billed as the first ghost kitchen to open inside a Canadian grocery store.

The store-within-a-store concept fea tures a full menu of items from Thai restaurant PAI, as well as Mandy’s Gour met Salads, fried chicken and burger joint Cabano’s Comfort Food, and the Mexican spot Tecolote. Customers can mix and match items from any of the four restaurants and can also add graband-go offerings from The Cheesecake Factory Bakery and Elle Dee Bakery, as well as ready-to-eat items from Longo’s kitchen, including pizza, sushi, salads and whole roasted chickens. Longo’s and Kitchen Hub say it is the beginning of a longer-term relationship.

“Partnering with Kitchen Hub gives us a very unique opportunity to provide meal solutions, quality food options and convenience to our guests,” says Longo’s vice-president of merchandising, Joey Bernaudo. “We’re continually looking for ways to innovate and meet evolving shop ping needs and are proud to partner with companies that can help us do that.”

Longo’s operates 36 stores in Ontario, but Bernaudo says the Liberty Village location was selected for the Kitchen Hub debut because the neighbourhood’s residents are predisposed to restaurant experiences and “eclectic” food options, “which showed us that store location was a natural fit for Kitchen Hub.” He says Longo’s plans to test the concept and gather feedback from both guests and employees. “We can take those learnings and apply them to potential opportuni ties in the future,” he says.

Bernaudo says having Kitchen Hub operating from the Liberty Village loca tion provides customers with an abun dance of high-quality, ready-to-eat meal options, “which we know the community is looking for.” The diversity of food items available at the store, he explains, means more choices and convenience for shoppers.

While the idea of ghost kitchens in grocery stores is still relatively new, the idea has been adopted by Walmart Canada, which partnered with Toronto’s Ghost Kitchen Brands in 2021. The first Walmart-based Ghost Kitchen opened in St. Catha rines, Ont., followed by Toronto and Woodstock, Ont. Customers can order from a kiosk in the Walmart store or online for pickup or delivery, choosing from more than 20 brands including Quiznos, Canadian Jerk, Saladworks and Taco del Mar.—Chris Powell

Loblaw, Gatik hit the road with driverless delivery fleet

FULLY DRIVERLESS grocery delivery has arrived in Canada.

Loblaw and U.S. autonomous trucking company Gatik have removed the safety driver from behind the wheel of a fleet of multi-temperature box trucks, which will start moving select online orders for the grocer’s PC Express service.

According to the two companies, this marks the first time an autonomous trucking company has removed the safety driver from a daily delivery route in Canada, and enables Loblaw to operate more routes, make more frequent trips, and “establish a supply chain that is safer, more sustainable and more resilient.”

Since partnering in 2020, Loblaw and Gatik have completed 150,000-plus autonomous deliveries (with a safety driver on board) between a Loblaw warehouse and five retail locations throughout the Greater Toronto Area on fixed, predictable routes.

In a press release, David Markwell, chief technology and analytics officer at Loblaw, said being the first company in Canada to deploy a fully driverless solution “illustrates our commitment to making grocery shopping better for customers.”

16 CANADIAN GROCER || November 2022 LEFT: UNBOUND PRODUCTIONS, TOP RIGHT: LOBLAW COS. LTD/GATIK

The store-within-a-store concept is being described as Canada’s first ghost kitchen to open in a grocery store

Ideas

A pop-up freezer shop to fight waste

In September, U.K. grocer Sainsbury’s launched a pop-up in London, aimed at fighting food waste. Described by the retailer as a “first-of-its kind” walk-in freezer store, “Sainsfreeze” was packed with foods customers would normally buy fresh—eggs, herbs, fish, meat, baked goods—but that were all frozen in innovative ways and given away for free. The aim was to show visitors to the pop-up how to freeze foods they usually wouldn’t think to, and avoid waste while also saving money. Sainsbury’s says the items on display at Sainsfreeze were selected based on research revealing the food items most commonly thrown away by Brits. Sainsbury’s has committed to halving food waste across its operations by 2030.

IdeasGLOBAL GROCERY News and ideas from the world of food retail

ASDA EXPRESS

Deliveroo gets physical

ALDI’S NEW ECO STORE

Discount chain Aldi has unveiled what it is calling an eco-concept store in the town of Royal Leamington Spa, in central England. The new store is designed to significantly reduce carbon consumption and cut overall energy demand by 57%, compared to a normal Aldi store. Among the store’s sustainable features: timber fibre insulation, a partial green roof, solar panels, chiller doors to reduce energy consumption and a parking lot with dedicated electric vehicle charging ports with capacity to expand as demand grows. To help its shoppers “reduce, reuse and recycle,” Aldi is piloting several plastic reduction initiatives at the store including a refill fixture dispensing package-free nuts and coffee (consumers can use their own containers or free FSCcertified paper bags). And a “hard to recycle” unit allows customers to recycle items like coffee pods, medicine packets, batteries and cosmetics packaging.

Aldi says the store will be a testing ground for the retailer and if it proves successful, it may roll out the concept to other stores across the United Kingdom.

U.K. rapid delivery giant Deliveroo recently launched its first bricksand-mortar grocery store, in partnership with grocery retailer Morrisons. The Deliveroo HOP store in London offers three ways to shop: customers can walk in and order from a kiosk; order through the Deliveroo app and pick up the order at the store; or have the order delivered “within minutes.” The shop offers more than 1,750 grocery items from Morrisons’ popular product ranges.

Known for its supercentres and supermarkets, U.K. grocer Asda is thinking smaller with its newest format. The retailer has announced plans to open its first two standalone Asda Express convenience stores this year. The smaller-format stores will be in “convenient” residential locations and carry some 3,000 products across groceries and food to go. Asda says it plans to open another 30 Asda Express locations as it “steps up its presence” in the convenience market—a sector forecast to grow by double-digits in the United Kingdom over the next five years.

Lidl’s smart refill station

Lidl is testing a “state-of-art” laundry detergent refill station at three of its U.K. locations. Customers pick up a pouch from the station and follow simple, touchscreen instructions to select their detergent and quickly fill the pouch. Each time a pouch is refilled, Lidl says 59 grams of plastic is saved and each pouch contains a special chip so Lidl and Algramo, the Chilean startup providing the tech for the stations, can track how many times each pouch is refilled and credit customers with 20p (about 30 cents) for refilling. The discount retailer says the compact stations optimize shelf space, taking up space equivalent to 66 single-use bottles, but with the potential to fill 245 pouches, increasing capacity by almost 300%.

November 2022 || CANADIAN GROCER 17 SAINSBURY’S, ALDI, SHUTTERSTOCK/INK DROP, SHUTTERSTOCK/ALEX YEUNG, LIDL, ASDA

CG

100% BIO ORGANIC FIND OUT MORE AT RA.ORG HAND PICKED COFFEE WE STRIVE TO TAKE CARE OF NATURE AND PEOPLE, LEARN MORE ON LAVAZZA.CA N E W ¡ T I ER R A ! O R GA N IC C O FF E E S

Consumers keen on sustainability and health benefits

These last few years have proven that Canada’s love of coffee wasn’t dampened even by a global pandemic. In fact, Canada is the only non-European country listed in this year’s top 10 coffee-consuming countries in the world! According to Nielsen, the Canadian coffee category is worth $1.46 billion, and data from global market research firm Mintel shows that 88% of Canadians shoppers bought retail coffee in the past year. The research also shows that 61% of people say coffee is an important part of their daily routine and 41% would pay more for a higher-quality cup of it too.

Here’s a look at what’s driving all this java love and what coffee trends are gaining favour in the foreseeable future.

Social responsibility/sustainability top of mind Millennials and Gen Zs are especially vocal about their desire for brands to use ethical and sustainable practices—and coffee is no exception. Coffee brands like Lavazza support sustainability projects in coffeeproducing countries, which in turn promotes social and environmental development in these communities. “Through its iTierra Foundation, Lavazza supports 130,000 coffee growers through 31 projects in 19 countries,” says Lauren Laventure, Trade Marketing Manager at Sofina Foods Inc., which distributes Lavazza. “This has been the core of the business for a long time, and these projects are improving living

Product Spotlight

conditions in these communities while also promoting entrepreneurship and economic autonomy.”

Coffee drinkers are getting younger According to the latest US National Coffee Data Trends report issued by the National Coffee Association, a record number of young adults (aged 18-24) are drinking coffee in 2022, with 51% reporting that they’d had some kind of coffee within the past day. Industry experts say the declining popularity of soft drinks in favour of ready to drink coffee is helping drive this trend among the younger set.

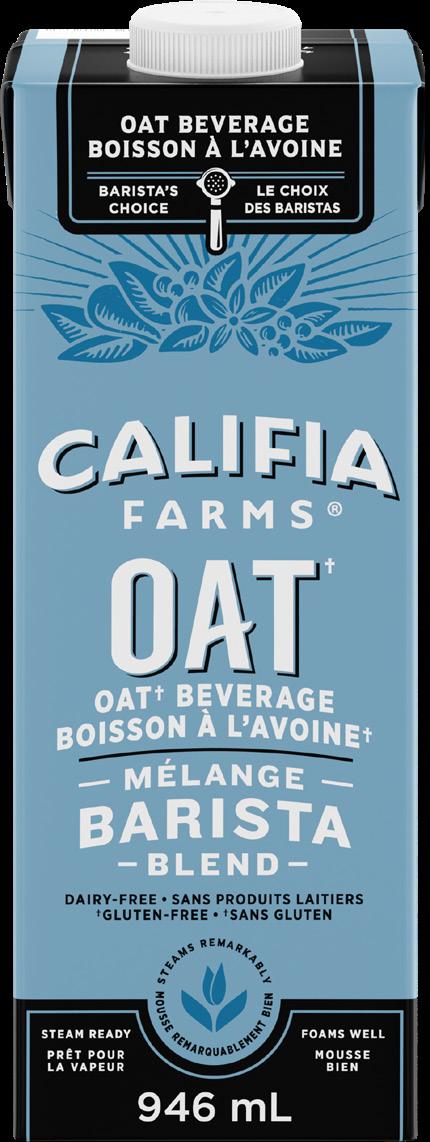

Alternative milks gaining popularity With a growing number of consumers going vegan, or dealing with dietary and health concerns, coffee drinkers are expected to keep turning toward non-dairy milk alternatives. Plant-based milks continuing to gain favour include almond, oat, soy, coconut, hemp and macadamia nut. According to Grand View Research data, the U.S. market-size value for non-dairy milks is expected to more than double in the next three years. Add-ins to boost health and well-being With society’s ongoing focus on better health, more and more coffee drinkers are also looking for healthy additives to their regular cup of joe. Whether its collagen to improve skin complexion and joint pain, or turmeric and cinnamon for their antioxidant properties, coffee is becoming the perfect vessel for additives that can boost metabolism and promote better health.

Mild and fruity with organic Arabica beans hand-picked from Africa, Central and South America, the brand supports the training of coffee producers in agricultural techniques to manage the effects of climate change.

Made from organic coffee beans from Peru and South America, the brand supports reforestation in degraded areas of the Rain Forest.

CATEGORY CLOSE-UP

SPECIAL PROMOTIONAL FEATURE IN CANADIAN GROCER || November 2022

coffee

1. SUBARU STARLINK® Connected Services are offered on an initial three-year free subscription on select trim levels. Customers are required to enroll in the SUBARU STARLINK® Connected Services program. To operate as intended, SUBARU STARLINK® Connected Services require a sufficiently strong cellular network signal and connection. See your local Subaru dealer for complete details. 2. Safety ratings are awarded by the Insurance Institute for Highway Safety (IIHS). Please visit www.iihs.org for testing methods. Visit us at subaru fleet .ca 2023 CROSSTREK 2022 FORESTER 2022 OUTBACK Innovative advance warning safety system that helps you avoid potential danger on the road. Subaru’s eye on safety. Full-time all-wheel drive for full-time confidence in motion. Superior drivability, outstanding control and handling you can count on. IIHS TOP SAFETY PICK+ On-board technology system connecting your Subaru to the world. 24/7 safety and convenience wherever you go.1 From innovative features to expert maintenance, plus leading resale value, Subaru brings safety to your drivers and value to your fleet. 2 welcome to uncommon peace of mind TM WHO’S WHO Annual directory of chains and groups in Canada 2022 Orderyour2022copyonlinetoday!Canadiangrocer.com/reports 2022

The new world of femcare

Comfort tampons, new packaging from U by Kotex that is focused on ComfortFlex design, as well as the rebranding of U.S.-based brand Cora, which has renamed its period items—The Comfort Fit Tampon, The Peace-of-Mind Pad, The Got-You-Covered Liner. Meanwhile, as consumers gravitate towards clean and ethical ingredients that resonate across the physical, emotional and planetary well-being axis, more businesses are introducing recyclable or even biodegradable packaging as well as plant-derived raw materials such as organic cotton, bamboo, sea weed and hemp. This is demonstrated by brands such as NIIMA in Canada, Daye in the United King dom and Rif Care in the United States, whose period products aim to provide not only efficacy but also sustainability that resonates with eco-conscious consumers. In fact, nearly two thirds of global con sumers reported in 2022 that they are worried about climate change and try to have a positive impact on the environment through their everyday actions, according to Euromonitor’s recent International Voice of the Consumer: Lifestyle Survey.

Marketing in femcare has also taken on a different tone, one that brings products’ health and emotional value— particularly comfort—to the forefront

hit by SoarinG inflation and the higher cost of liv ing, global consumers are more motivated than ever to flit between brands in pursuit of value in essen tials. And these days, value encompasses more than just a “nice” price but also quality, convenience, transparency, authenticity, sustainability and holis tic wellness. Such sentiment is increasingly reflected in product innovations, portfolio design and brand communications in feminine care, a category that most commonly refers to disposable sanitary prod ucts such as pads, pantyliners and tampons.

Indeed, consumers today are selective and mind ful about their spending. More than half of profes sionals working in the beauty and personal care space say value for money remains their customers’ most important priority, according to Euromonitor’s most recent Voice of the Industry: Lifestyle Survey. For businesses, this means putting tangible value creation at the forefront of brand positioning, and aligning their offerings and brand narratives with consumers’ priorities and preferences.

Health- and emotion-forward product enhance ments and marketing narratives form a key pillar of value creation in femcare. In fact, with a slew of new products, from tampons by U.S.-based Sequel that feature spiral grooves, which allow for even absorption, to period cramp-soothing tampons with optional CBD coating by U.K.-based Daye, busi nesses, especially insurgents, have been exploring new technologies and format designs to deliver tan gible benefits.

Marketing in femcare has also taken a different tone, one that brings products’ health and emotional value—particularly comfort—to the forefront. This is demonstrated in the Playtex launch of Clean

Lifestyle and regimen support offers another key avenue for value creation. With more female con sumers adopting an active lifestyle, underwear-style period pads—which typically offer mobility-assuring, comfort-enhancing features such as 360 leak protec tion, flexible movement and that are form-fitting— are gaining traction despite their higher prices, which many consider a fair trade for security and conve nience. Though the segment remains relatively small, its further penetration will likely contribute to the growth of overall pads, including slim/thin/ultra-thin pads, the fastest-growing segment within femcare.

Finally, expansion into adjacent categories that encompass skin, body and mind is another dimen sion of the value creation strategy. This has led to, and will likely continue to accelerate, a business drive to redefine femcare through a holistic well ness lens. In North America and Western Europe, for instance, skin care in recent years has become a natural extension of the holistic treatment of men struation, as explored by femcare brands such as Rael in the United States, Blume in Canada and Synk Organic in Australia, and sexual wellness and incon tinence care are the next two logical adjacencies to consider for femcare brands, which are already tack ling women’s below-the-waist taboo.

The elevated expectations of efficacy, convenience and, ultimately, value among consumers includ ing women, coupled with a more deeply entrenched penchant for wellness, will continue to underpin business strategies to further enhance femcare prod ucts in terms of comfort, performance and lifestyle adaptability, as well as to explore adjacent women’s wellness categories in the years to come. CG

November 2022 || CANADIAN GROCER 21

BEHIND THE TRENDS || Liying Qian

Today’s feminine care consumer has elevated expectations when it comes to efficacy, convenience and value

Liying Qian is head of tissue and hygiene at Euromonitor International, an independent provider of strategic market research. Euromonitor.com

Coming soon!

New!

Change is good, especially when it’s this yummy.

To our valued retail partners, I’m Natasha Questel, President of Happy Planet Foods.

We’re making big, bold changes over at Happy Planet and I wanted to personally reach out to share some exciting news.

As you know, we are seeing real shifts in the tastes and shopping habits of Canadians. Consumers are looking for higher nutrition and function in the forms of higher protein, less sugar, more fiber, and powerful ingredients like sustainable grains and superfoods. As a result of this shift, we’ve made the decision to discontinue production of all of our fruit smoothies as of this fall.

We know change can be hard and it’s definitely a bold move –but we’re a brand known for making bold moves that are better for people and the planet.

What does this mean for you? The launch of some exciting new innovations in drinkable snacks under our Mornin’ Oatz and Clean Protein ranges - that are higher in nutrition and better for the planet, made with supergrains and superfoods that are ethically and sustainably sourced.

We are also starting to transition away from plastic bottles to sustainable plant-based cartons.

Our brand new Mornin’ Oatz Breakfast Shake, offers the goodness of a bowl of oatmeal in the convenience of an on the go shake. Launched this spring, it features 10g protein, 10 vitamins and minerals from real oats and fruit, milk, hemp, flaxseed and fonio - a super grain sourced from farmers in Mali, Africa, which thrives in regions struggling with the impacts of climate change.

Plus this fall, we’re bringing new flavours to our indulgent plant-based protein line, Clean Protein Plant-Based Shakes. Each shake contains 10 grams of protein and 70% less sugar than leading brands and will be available in a variety of decadent flavours, including Banana Cashew, Chocolate Coconut and Blueberry Almond Butter.

To the retailers that have been part of our Happy Family over the past 30 years - thank you. We couldn’t have built this brand without you, and we’re so excited to keep

When evaluating distinguishing behaviours among this group, per capita consumption rates of fresh food items are considerably lower among modest income consumers when compared to individuals in higher income households

Cracking the modest income shopper code

• While those in modest income households are more often motivated to save money, they do not show stronger development for buying in bulk or taking advantage of specials or promotions.

• They do shop more often at discount grocery stores, mass and dollar store channels, while sourc ing fewer items at Costco, foodservice and online channels; however, it should be noted that this is not new behaviour.

• They make fewer weekly major grocery trips, while instead making more quick re-stock and emer gency pickup trips.

• They rely more heavily on private-label products, which generally have a lower price. Again, this is not new behaviour.

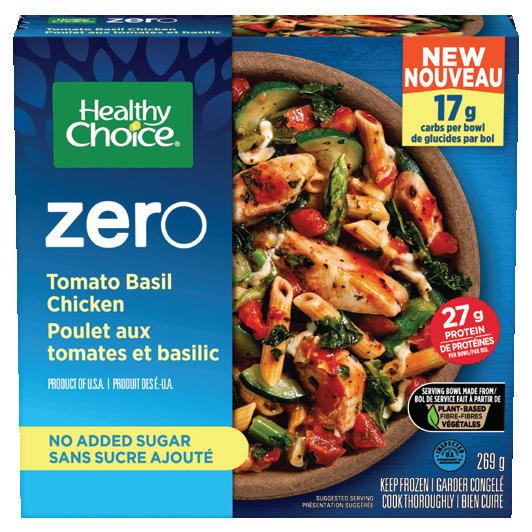

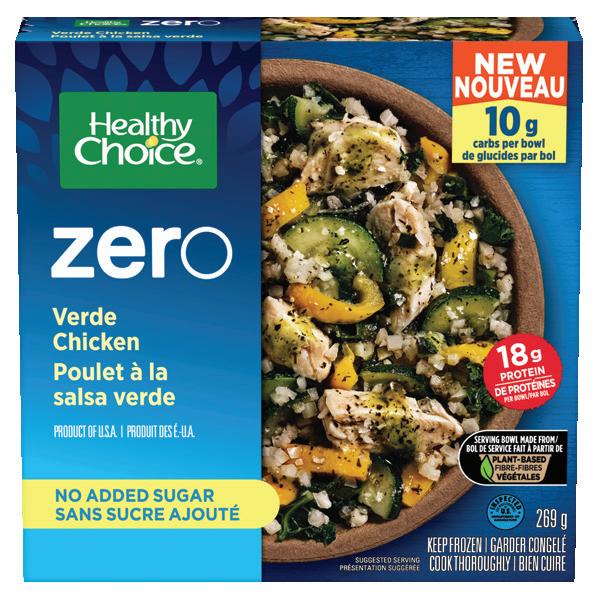

When evaluating distinguishing behaviours among this group, per capita consumption rates of fresh food items are considerably lower among modest income consumers when compared to individuals in higher income households. In fact, they consume less fresh meat and fewer fresh fruits and vegetables, in part, due to the higher cost of these products. Con versely, they do, however, consume more frozen food options and this is driven by value.

the cultural conceptS of thrift, frugality and waste avoidance are engrained among many Canadi ans. In fact, the notion of “a penny saved is a penny earned” is often viewed as exemplary and principled.

However, with food prices today reaching a 41-year high, Ipsos FIVE consumption study’s latest data reveals that saving money is often a necessity rather than a habit practiced out of fiscally minded principles. Today, nearly one in four Canadians (23%) resides in a household with an annual income below $40,000. Further, one in five individuals (20%) resides in a household with an annual income between $40,000 and $60,000. In aggregate, nearly 44% of Canadians live in modest income households.

The data reveals that these consumers, because of economic circumstances, have different habits when it comes to assessing value for money spent and saving money. In fact, these individuals are less likely to participate in couponing activities, perhaps with less time and fewer resources to aggressively hunt for deals. Ongoing tracking reveals that less than half of those living in modest income house holds (42%) used a coupon in the past three months, though usage rates did increase 12% when compared to the previous three-month period.

Beyond the time and effort required to use cou pons successfully, we evaluated whether those in modest income households engage in other promo tional activities. Here’s what we found:

While Canadian grocery retailers continue to strategize how to provide value to all shoppers, it is important to understand how to target those in the modest income tier to grow your customer base. Consider the following strategies:

1 Geo-targeting coupon activities to enable auto matic downloads upon store entry to eliminate the hassle of logging in or loading coupons.

2 Waving delivery fees for those customers living in modest income households based on reasonable minimum trip spends.

3 Reward private-label loyalty based on cumulative purchases over a monthly period.

It’s worth noting that the share of Canadians who now reside in modest income households, and who are required to weigh food and beverage expen ditures against other necessary expenses, may be larger than previously thought. And while these shoppers are price sensitive, their sheer size and loy alty to retailers who can crack the price, convenience and selection code will undoubtedly be rewarded as we continue to wade through inflationary headwinds and rising prices. CG

Kathy Perrotta is a VP of market strategy and understanding with Ipsos Canada and leads the FIVE service, a daily diary tracking of what individuals ate and drank yesterday across all categories/brands, occasions and venues. Kathy.perrotta@ipsos.com

November 2022 || CANADIAN GROCER 23

EATING IN CANADA || Kathy Perrotta

As grocers seek to provide value to all shoppers, it’s important to understand how to target those with modest incomes

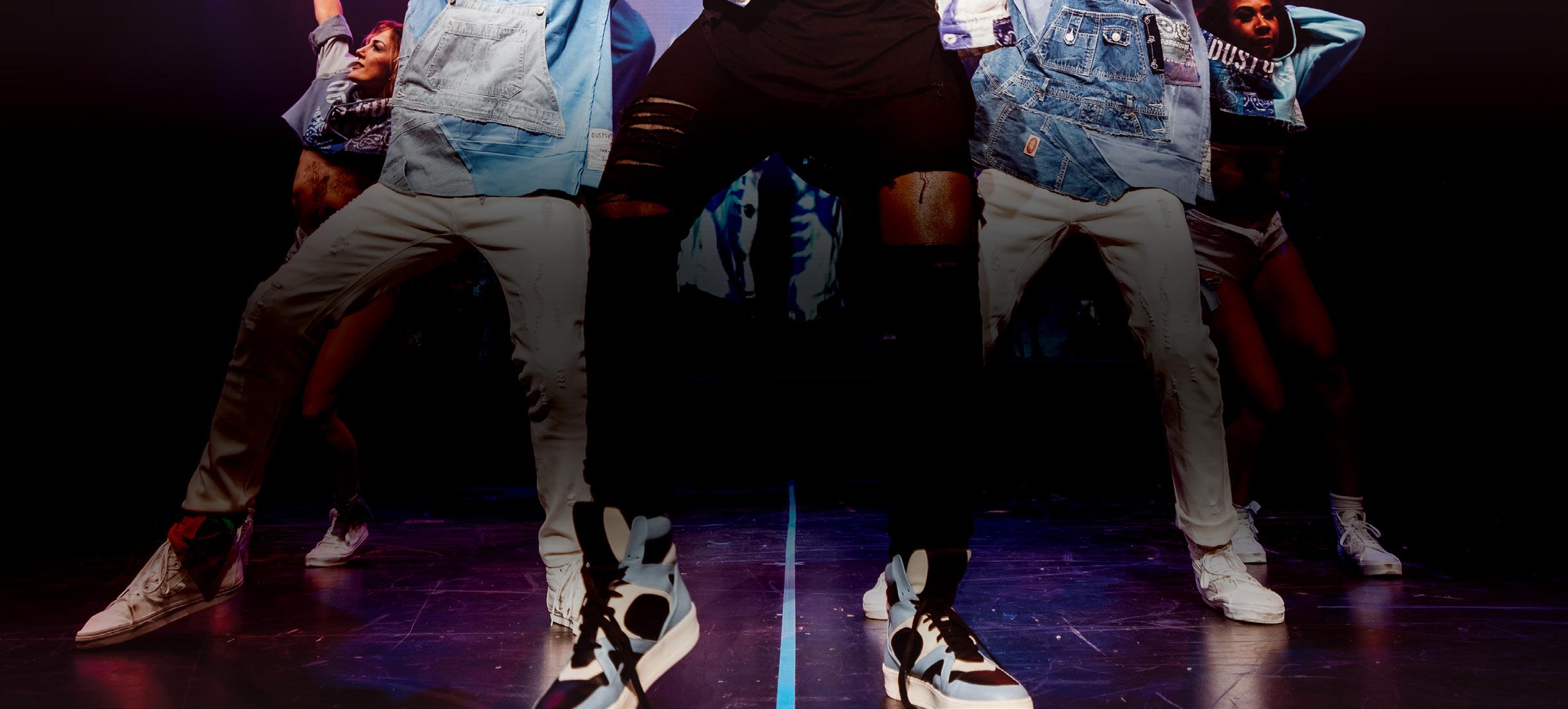

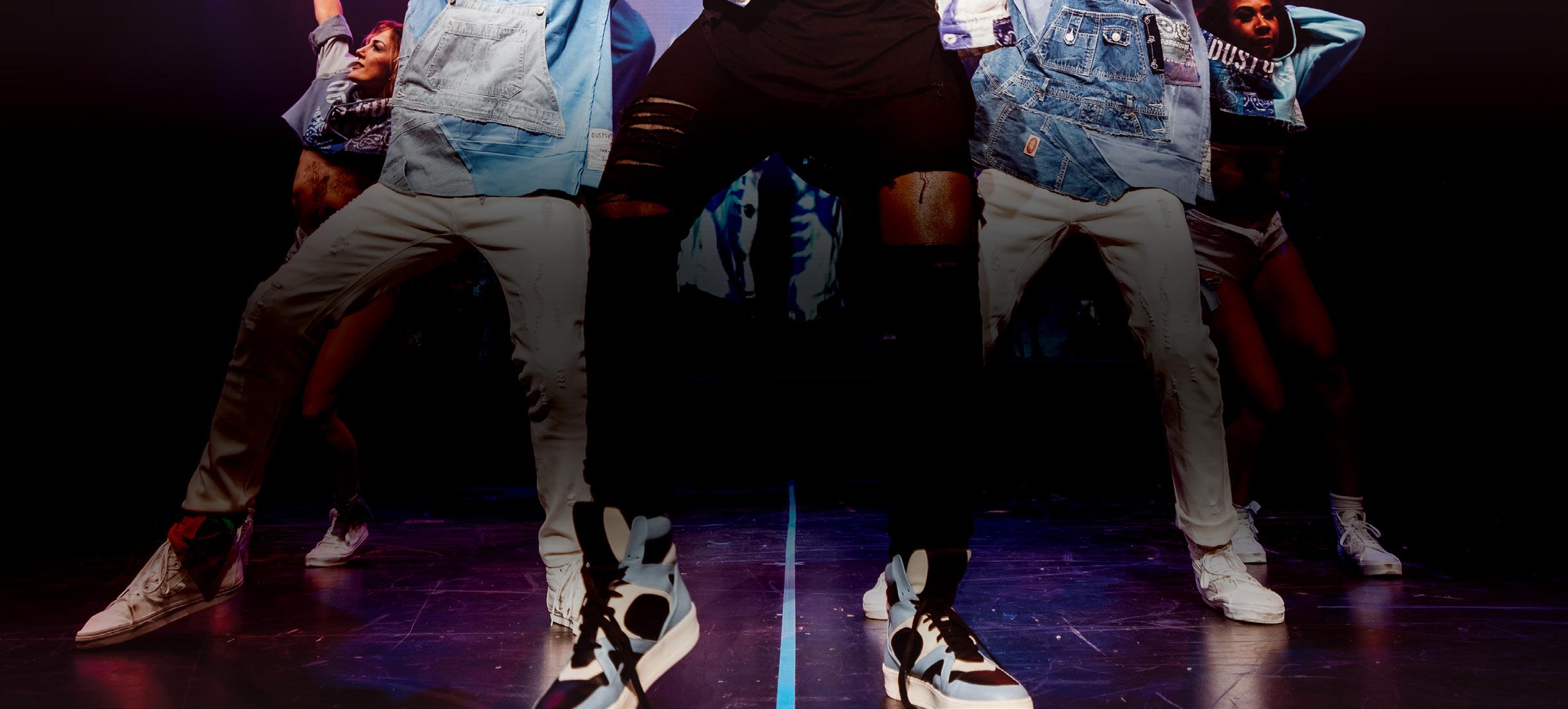

It was a packed house at Mississauga, Ont.’s International Centre on the morning of Sept. 28 as the grocery industry turned up to celebrate Canadian Grocer’s 2022 StAr WOMEN IN GrOCEry winners. “The Star Women in Gro cery Awards is one of the key ways this industry celebrates talent and achievement every year. It is so important that we continue to take the time to recognize those who are doing great things in the grocery industry,” says Vanessa Peters, publisher of Canadian Grocer.

The awards breakfast returned to an in-per son event for the first time since 2019, and more than 500 members of the industry attended the sold-out event honouring this year’s 49 winners for their career achievements and contributions to the industry. The morning kicked-off with an inspirational keynote on courage from UNFI president, and past Star Women winner, Stacey Kravitz. Another highlight was a powerful panel discussion featuring Bonnie Birollo of Sobeys, Janet Rickford of Loblaw Technology/Loblaw, P&G’s Shilpa Mukhi, Jessica Armstrong of Maple Leaf, Metro’s Louisa Furtado and Stephanie Goyette of Kraft Heinz Canada where panelists shared lessons learned and touched on topics such as navigating life as a working parent, building more inclusive workplaces and the power of vulnerability (read more on page 15) CG

24 CANADIAN GROCER || November 2022 GOLDMEDIA.CA

TIME

TO SHINE!

November 2022 || CANADIAN GROCER 25

THIS BLUE COW DRIVES BUSINESS TRUSTWORTHY HIGH QUALITY GREAT TASTING 3-in-4 Canadians associate these statements to products featuring the Blue Cow Logo REQUEST YOUR LICENSE NOW AWARE OF THE BLUE COW LOGO of Canadian consumers are86% ENCOURAGES PURCHASE Canadians say it4 in 5 Based on research provided by IMI, Q1 2022 https://dairyfarmersofcanada.ca/en/blue-cow-logo/producers/apply 100% CANADIAN MILK HIGH CANADIAN BLUE COW LOGO STANDARDS. STANDS FOR. That’s what the

Canadian dairy farmers commit to

net-zero greenhouse gas emissions by 2050

As part of the dairy industry’s ongoing commitments to sustainable milk production, Dairy Farmers of Can ada (DFC) is committing to a goal of net-zero greenhouse gas (GHG) emissions by the year 2050. Reaching ‘net zero’ will be done through emissions reduction and GHG removal off sets. Other strategies will include qualitative targets related to soil and land, water, biodiversity, waste, and energy.

This objective was formally announced in February 2022 and aligns with the Canadian government’s emissions reduction strategy. As Pierre Lampron, president of DFC, explained, “We are bearing witness to the impacts of climate change first-hand, on our farms and at our doorsteps.” It is no longer a question of how our livelihoods will be affected by cli mate change, Lampron said, but rather a question of how we will be affected if we don’t act now.

Fortunately, Canadian dairy farmers are naturally com mitted to environmental sustainability due to the nature of their work: not only do dairy farmers rely on the land to make a living, but many farms are passed down within a family, so being able to keep thriving on that land is imperative for today – and tomorrow. Building on this long history of environmen tal stewardship, DFC’s net-zero goal is an extension of the efforts Canadian dairy farmers are already taking to be part of a global sustainability solution. For example, from 1990 to 2019, Canadian dairy farmers reduced the carbon footprint of milk production by 22 per cent through improved manage ment practices.

“For generations now, Canadian dairy farmers have been stewards of the land, adapting their practices based on sci ence and innovation,” says Pierre Lampron, President, Dairy

Farmers of Canada. “Our leadership in the area of sustainabil ity is already recognized internationally, as we have one of the lowest carbon footprints per litre of milk produced.”

DFC’s net-zero goal aligns with worldwide commitments, as well. The Paris Agreement, for instance, aims to foster climate resilience and lower greenhouse gas development, as well as to make climate flows consistent with a pathway toward a lower carbon future. Last fall, DFC joined 11 of the world’s largest dairy organizations in supporting Pathways to Dairy Net Zero, a Global Dairy Platform-sponsored commit ment towards net-zero GHG emissions.

“A global effort is underway to cut emissions and reduce the direct costs of climate change on our health, our envi ronment and our economy,” says Steven Guilbeault, the federal Minister of Environment and Climate Change. “Every economic sector and every region needs to step up to reduce emissions. The Dairy Farmers of Canada’s com mitment to achieving net-zero shows important leadership and our Government will continue to support our collective efforts to get there.”

This dedicated stewardship has led to the adoption of improved techniques based on research and innovation, which is why it now takes six per cent less water and 11 per cent less land to produce a litre of milk than it did just a decade ago. Dairy farmers also lowered GHG emissions by seven per cent in that same timeframe. Few industries can report that kind of progress and we are incredibly proud of what we have accomplished together.

For more information on DFC’s Net-Zero 2050 announce ment, please visit dairyfarmersofcanada.ca

SPECIAL PROMOTIONAL FEATURE IN CANADIAN GROCER–NOVEMBER 2022

Manseau

from your friends atCongratulations Carmen Fortino and Michel

on your 2022 Golden Pencil Award!

GROCERY’S GREATS THE 2022 GOLDEN PENCIL WINNERS

By Shellee Fitzgerald Photography by Mike Ford

A

November 2022 || CANADIAN GROCER 29

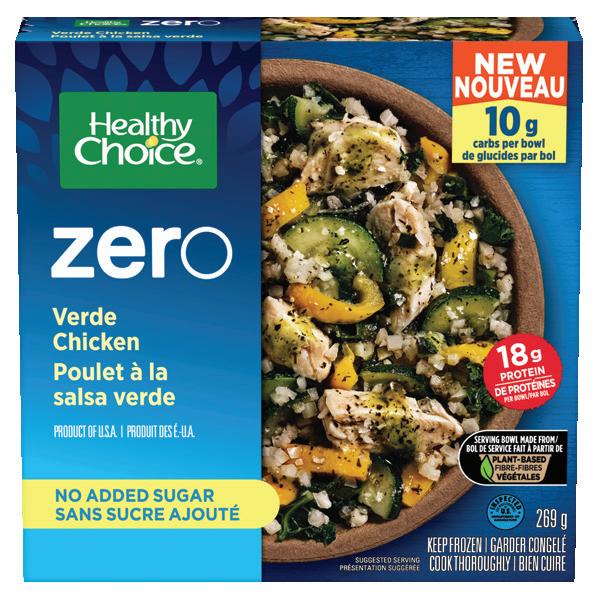

Metro exec with deep family roots in the grocery business and a veteran of one of Canada’s largest tissue product companies are this year’s recipients of the prestigious Golden Pencil Awards. Presented annually by the Food Industry Association of Canada since 1957, the awards recognize an individual’s lifetime contributions to the grocery industry and their communities. Read on to learn more about this year’s outstanding winners Metro’s Carmen Fortino and miChel manseau of Kruger Products.

The Golden Pencil Awards ceremony will take place at Toronto’s Fairmont Royal York Hotel on November 21. For tickets visit groceryconnex.com Golden Pencil

CARMEN FORTINO Executive vice-president, national supply chain and procurement Metro

CARMEN FORTINO’S roots in grocery run deep.

He got his start at age 15, with a part-time job at a Dominion (a chain that Metro would eventually acquire) in Stoney Creek, Ont. Later, he went to work in the family business—Fortinos Supermarkets. He stayed on after the family sold its Ontario grocery stores to Loblaw in 1988 and by the time he parted ways with Loblaw, in 2007, he had ascended to the post of executive vice-president, Loblaw, Ontario region.

After a seven-year stint in the health and wellness sector, Fortino says a “fateful” meeting with Metro CEO Eric La Flèche ultimately wooed him back to gro cery. “Our one-hour meeting turned into four hours and subsequent meetings after that, and it got my juices flowing,” recalls Fortino. “Once grocery is in your blood, it’s there.”

Since joining Metro in 2014, Fortino has success fully led the retailer’s Ontario division and has added national supply chain to his responsibilities. Currently, he is transitioning to the role of executive vice-president national supply chain and procurement.

When asked how he accounts for his success, For tino is quick to say it’s about “being surrounded by great people.” His approach to leadership is to create an environment where making a mistake is not the

end of the world. “I don’t like to live in the safe zone. I like to push the envelope and try things and see what works and what doesn’t,” he says. “A big emphasis for me is creating an environment of trust where people can be themselves and express themselves and where we all learn from each other’s triumphs and mistakes.”

He credits his dad, Luciano, for his work ethic. “My dad was a huge influence on my life,” he says, adding that his father, an immigrant from Italy, helped set his emotional intelligence compass and instilled in him the importance of hard work. “I remember when I started my first job at Dominion, I was nervous, and I remember him telling me like it was yesterday: ‘Just make sure you give them 10% more than what they’re expecting and everything will be fine.’ I learned a lot from my dad.”

In addition to being “extremely” proud of his roots in the Fortinos’ business, Fortino says he’s proud to have joined Metro. “Metro was a relatively young Ontario company at the time. It acquired all A&P, Dominion, Miracle Mart, The Barn, Loeb—there were a bunch of different businesses that it acquired in the Ontario land scape, and I was lucky enough to get involved at a time when I could help weave all those different cultures into one culture, called Metro, which I’m really proud of.”

30 CANADIAN GROCER || November 2022

Golden Pencil

A proven track record of driving results with a customer-first approach.

Carmen Fortino is from a family of grocers, but his passion for his work and his colleagues, has been his own since starting with the family business in 1985. Carmen has long believed that when you love what you do and when people are your passion, then it is impossible to be bored.

The METRO team congratulates Carmen Fortino on his Golden Pencil Award and his lifelong dedication to the Canadian food industry.

Carmen Fortino Executive Vice President, National Supply Chain and Procurement

Carmen Fortino Executive Vice President, National Supply Chain and Procurement

MICHEL MANSEAU

Senior vicepresident and general manager, consumer business Canada

Kruger Products

WHEN MICHEL MANSEAU joined Kruger Products (then Scott Paper) back in 1988, he couldn’t know he’d spend the next three decades with the tissue company.

“You never know when you start with a company how long it’s going to last. I think the honeymoon has been pretty good,” he jokes.

Manseau’s earliest days with the company were as a sales rep in Montreal, calling on retail stores. He quickly moved up the ranks at the organization in various sales roles that took him to the United Kingdom and eventually to Toronto, where he’s been based since 2004. He joined Kruger’s leader ship team in 2006 and was promoted to his current role as senior vice-president and general manager, consumer business Canada in 2018.

Not one who’s comfortable in the spotlight, Man seau is modest about his achievements and gives a lot of credit to his team. “I love people and I’m a firm believer that it’s people that make a difference to the company’s success.” As a leader, Manseau sees his role as an “enabler,” one who gives his team the tools to help them be their best. “And I’m a leader who’s not looking to be right. I listen. I like to chal lenge ideas and I like my ideas to be challenged. If we

always agree and say the same thing, we’re not going to be successful.”

Manseau describes himself as a hard worker who is engaged and disciplined—qualities he says are inherited from his parents. “My dad was super disci plined and had high standards and my mother gave me positivity, curiosity and a never-quit attitude.”

Among his career highlights, Manseau points to the successful transition of the company’s brands after Kruger purchased Scott Paper as something he’s particularly proud of. “I think we did it well and it allowed us to double the size of the company.”

More recently, he’s proud of how the company ral lied during the COVID -19 crisis, efficiently managing supply amid a consumer frenzy around paper prod ucts, especially toilet paper. “We implemented a lot of things to maximize the output of our lines and supply as much as we could in the market.”

And what keeps Manseau passionate about his work after more than 30 years? “The grocery indus try is one of the best industries, from my stand point,” he says. “I’ve met so many great people over the years, and even if the industry has become a little bit more challenging, it’s still a people business that touches consumers’ lives every day.” CG

32 CANADIAN GROCER || November 2022

Golden Pencil

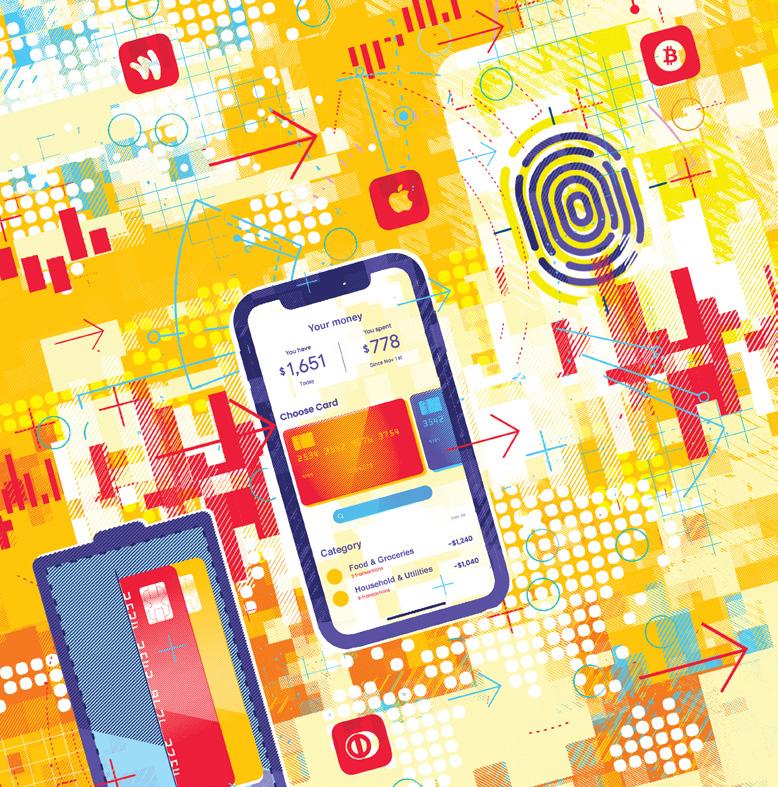

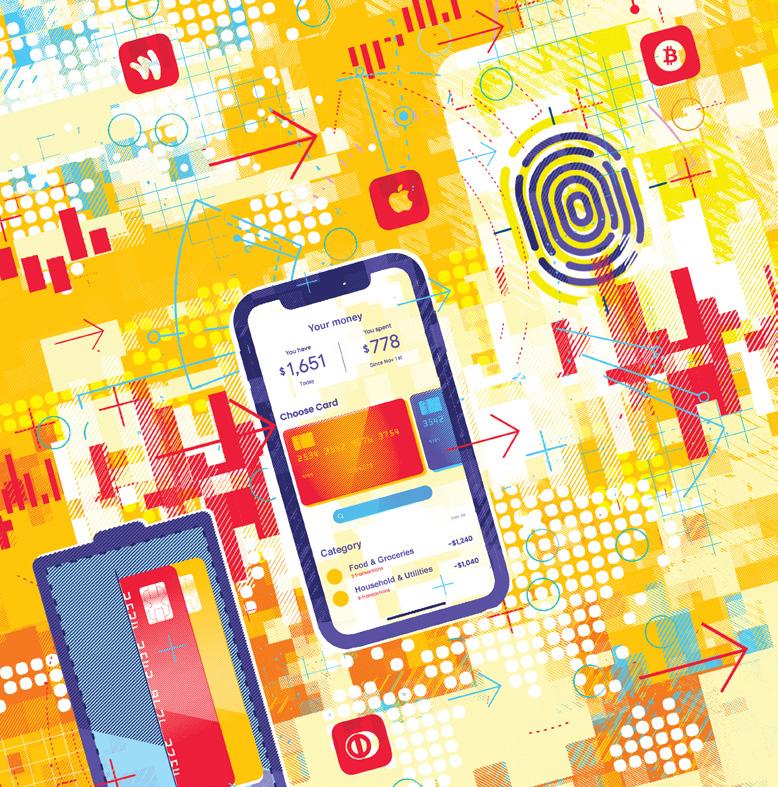

Payment trends

NOT LONG AGO, paying for goods was just a means to an end—the way cus tomers were able to get their items from their carts and into their trunks. Now, payments are no longer an afterthought. They’re an integral part of the shopping experience, as new options beyond the classic “cash or card” are meeting chang ing consumer needs. In this new age of payments, grocery retailers can’t afford to get left behind.

“Adapting the way you run your busi ness and having options for how people can pay is key to both attracting and retaining customers,” says Jon Purther, director of market insights at Payments Canada, a not-for-profit organization that owns and operates Canada’s pay ment clearing and settlement infrastruc ture. “If businesses limit their payment options, they’re going to potentially elim inate or put up an obstacle for customers who may have been interested in making a purchase, but because of the payment option just don’t shop there.”

As the payments landscape evolves, the pressure is on retailers to stay on top of new payment options and respond to consumer shifts. “Retailers need to listen to what their customers are asking for and watch what their competitors are doing, and adapt their business accordingly,” says Purther. “Knowing what new tech nologies are out there and being nimble is important in allowing [retailers] to adapt.”

So, what trends in retail payments should grocers pay close attention to? Here’s a look at what’s here today and here to stay:

No going back from digital payments

During the pandemic, many shoppers discovered the convenience of contact less payments, which kept their hands off potentially germy terminals. The Canadian Payment Methods and Trends 2022 report by Payments Canada found that since the pandemic started, 43% of Canadians tapped their credit card and 42% tapped their debit card when paying at a store. In addition, 43% agreed the pandemic has changed their payment preferences to dig ital and contactless for the long-term.

Mobile payments also continued to increase through 2021 (the latest year tracked by Payments Canada). Mobile payment volume and value each grew by 13% from 2020. Since the pandemic started, 45% of Canadians who used their

WHAT RETAIL PAYMENT TRENDS ARE HERE TO STAY?

the heavy lifting [for retailers]. So, the pandemic and the paytechs really act as a catalyst to create change in Canada for us to become more digital.”

The (almost) end of cash and cheques

As the use of digital payment methods increases, it comes at the expense of good old-fashioned cash and cheques. According to the Canadian Payment Methods and Trends 2022 report, cash transaction volumes decreased by 62% from 2016. More than half of Canadians (53%) report using cash less often since the start of the pandemic and 31% report using cheques less often.

With paper payments going the way of the plastic bag, Canada is inching closer to becoming cashless. “Are we moving towards cashless? Absolutely. But we need to be thoughtful about how to do that,” says EY Canada’s Halder.

By Rebecca Harris Illustration by Gary Neill

Halder points to Rogers’ massive ser vice outage this past summer, which left millions of Canadians without internet and wireless services. “That impacted our debit network,” says Halder. “And so, as we move towards digital payments and digital interactions, we need to put in the right controls from a redundancy standpoint so if there is another outage, our systems will continue to run in a seamless manner.”

mobile wallet to make store purchases said they were using it more than they used to. “We expect that digital payment options like contactless and mobile pay ments is absolutely going to continue,” says Purther. “Canadians who tried it and switched over will not be going back.”

Diana Halder, payments leader at EY Canada, says the pandemic was one of two main factors behind the surge of digital payments. “With everything being shut down, we still had to move forward as a society and be able to make purchases,” she says. “And so, we had this move towards digital payments, online pay ments, mobile payments and even using QR codes to initiate payments,” she says.

The second factor is the rise of fintech and paytech companies, the latter of which focus on payments and transac tions. “Paytechs are making apps turn key for merchants, so they don’t have to spend reams of money,” says Halder. “They create that digital experience, which connects to the payment gate ways, with the paytechs basically doing

Payments Canada’s Purther agrees we’re moving toward becoming cashless, albeit slowly. “It won’t be tomorrow that the world will be cashless,” he says. While Payments Canada data shows 50% of consumers believe stores could become completely cashless in the next 10 years, 42% said not being able to use cash to buy goods would make them anxious. “Even if it’s not their primary or preferred pay ment method, Canadians like knowing they have the option to use cash when need be,” Purther says. “I think for both consumers and businesses, the more pay ment options the better.”

Loyalty programs and payments become one

While the days of fumbling around for punch cards and coins are long gone, it’s still a pain point for customers to have to pull out two pieces of plastic—their loy alty card and bank card—or two separate apps. This is the next battleground in the payments space, as loyalty programs can now integrate payments.

» November 2022 || CANADIAN GROCER 35

Contactless is in and cash is out, as savvy retailers give shoppers new ways to pay

Payment trends

“Retailers are rethinking their loyalty programs and payments is becoming a big weapon in terms of how to improve the loyalty offering,” says Marty Wein traub, partner, national retail leader at Deloitte Canada. “By offering a way for a customer’s payment to be connected to their loyalty card, they’re reducing fric tion and increasing the engagement rate. From a customer perspective, it’s just a cleaner, simpler experience.”

One retail example is loyalty pioneer Starbucks, which gave its members more ways to pay in 2020. Rather than just accept preloaded gift cards as payment, Starbucks Rewards lets members link their credit, debit or select mobile wallet accounts to pay within the app. In the gro cery sector, a first-mover is Germany’s Lidl, which launched a mobile payment option inside its Lidl Plus loyalty app in 2020.

Integrating loyalty and payments can potentially have big bottom-line benefits for grocers. In the global 2022 Retail Report by payments firm Adyen and KPMG, 57% of consumers surveyed said they would be more likely to shop with a retailer if the retailer's loyalty program worked auto matically through their payment card. As Adyen notes in a blog post on its retail report: “Payment-linked loyalty, espe cially when sales channels are connected through a unified commerce solution, can help businesses capture richer data insights, understand shopping prefer ences, assign loyalty points, and better anticipate customers’ needs.”

Ales Novak, a principal director who leads Accenture’s Canadian payments practice, says having a good loyalty pro gram will arguably be the most import ant differentiator in the coming years. Loyalty programs help attract and retain customers, and they allow retailers to understand their customers better through data, he says. “But more impor tantly, your loyalty program sets you ahead for what’s to come in the new and next generation of payments.”

Real-time payments becoming a reality

There may be a lot of exciting tech possi bilities with payments, but the reality is, Canada is still a work in progress. “We’re still evolving when it comes to payments when you compare Canada to other mar kets, such as Asia Pacific, Australia, Saudi Arabia, the United Kingdom and Sweden,

which have very sophisticated payments landscapes,” says EY Canada’s Halder. “However, we’re making investments in modernizing our infrastructure, which is foundational. You can’t necessarily pro vide faster, richer digital payments if you don’t have the foundation in place.”