4 minute read

10 Business Impacts

7. Requirements Analysis 8. Decision and Management Support Framework 9. Project plan development for a Cross-Border Living Labs Network 10. Cross-border Knowledge Sharing 11. Observation Data Collection and Focus Groups 12. Collaboration and Communication Tools 13. Dedicated Project Meeting 14. Cross-border Application development Framework 15. Community Reporting Tool 16. Platform for Cross-Border Trading of Services 17. Remote Guided Living Labs Tour Using Webcam and Web Conferencing 18. Test Storyline for User Communication 19. Method for Designing Use Transformation Processes 20. Checklist to prepare for product or service introduction 21. Checklist to implement a use case in another environment 22. Customer Review Questionnaire 23. Expertise database

The business profile of an average SME involved in APOLLON is depicted below. Categories Average Number of SMEs 11 Years in operation 18 No. of Employees 90 Autonomicity All Turnover (2009) 6.055.382 € Turnover (2010) 6.492.368 €

Advertisement

Turnover (2011) 7.783.660 € YoY increase (2010) 7% YoY increase (2011) 20% Turnover/Emp (2010) 49.435 € Turnover/Emp (2011) 52.353 €

In order to gauge the cross-border presence and its importance to the SME partners in APOLLON, efforts were made to understand their existing business model and dependence on international businesses and trade. Among the respondents, 64% have presence in international markets. This may seem already advanced, yet upon further research it was revealed that as of 2011 nearly 55% of SMEs are deriving only 0-5% of their annual revenues from international trade and businesses.

SME internationalization and revenues from internationalization activities [Y2011]

In order to investigate the impacts of APOLLON on international revenues generated by the SMEs, data from years 2008, 2011 and 2012 were analyzed for variations. Before APOLLON was initiated in Y2008, 64% of SMEs indicated a meager 0-5% dependence on international business and trade as a source of revenue. A small number of SMEs (9%) indicated 56-60% reliance on international businesses and trade for annual income.

By the peak of their involvement in APOLLON, by Y2011, the original 64% of SMEs that indicated only 0-5% dependence on internationalization shrank to 46%. Also, the number of SMEs heavily exposed to international markets doubled from 9% in Y2008 to 18% in Y2011. From further interviews we learned that this gain can be largely attributed to the cross-border activities carried out the SME partners in APOLLON project.

International Revenue Distribution [Y2008] International Revenue Distribution [Y2011]

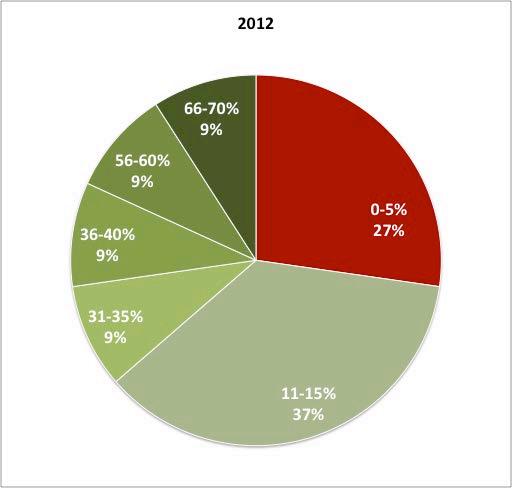

Towards the end of APOLLON, the effect continues to grow significantly, as almost 73% of SME partners indicated their intentions/reliance over the international markets in 2012. The percentage of SMEs still cautious regarding venturing into foreign markets shrank further to 27%, this is one-third of the number recorded in Y2008.

International Revenue Distribution [Y2012]

In order to present an overview of impact on international revenues we cross compared all the individual responses for all the years (Y2008, Y2011, and Y2012). As indicated in Figure 4-4, the red quarter in the figure which represents 0-5% share of international revenues decreases as we move from Y2008 to Y2012. In the same time the green quarter of the figure categorically expands by nearly doubling its original share.

Overall Impact on International Revenues

Every firm adopts one or the other modes to venture into new markets, establish new business contacts etc. APOLLON as a platform provided a fresh start to these SME partners to reinvent their internationalization strategy and consolidate the existing international markets.

Modes of Internationalization

It is clear that the congruence of APOLLON involvement and internationalisation for SMEs was no coincidence, because among several alternatives outlined by us, 45% of stakeholders preferred the APOLLON Network to Distributorship, Franchise and Export type models. APOLLON Network was considered complementary to the successful “business as usual” modes of internationalization like –Parent company presence, JV and International Offices.

As a key metric for assessing impact of APOLLON on SME Partners, each of the partners were required to identify and evaluate the contributions made by APOLLON and its consortium. Among several key contributions made by APOLLON, nearly 70% of respondents valued the Testing and Piloting Experience as most crucial to them. Second most important contribution of APOLLON (59%) was equally attributed to the understanding strategy and improved vision of doing business abroad.

Contributions of APOLLON and Impact

Every partner in APOLLON had ample opportunity to work with local and cross border living labs. Nearly 91% of SMEs indicated their interaction with Living Labs as “satisfactory”. 73% of the partners recognized the importance of Living Labs as a critical component of their internationalization strategy.

APOLLON Living Lab Experience

Besides the SMEs, our evaluation revealed that also for the 4 large enterprises in APOLLON, using a cross-border thematic Living Lab network is a valuable experience.

Modes of Internationalization

As shown below, among several alternatives outlined by us, 50% of large enterprises preferred the APOLLON Network to Distributorship, Franchise and Export type models. APOLLON Network was considered complementary to the successful “business as usual” modes of internationalization like –Parent company presence, JV and International Offices. 50% of the corporate partners have concrete plans to exploit the business contacts, venturing opportunities and lesson learned while working with APOLLON partners across Europe.