2 minute read

A Positive Outlook Despite Economic Uncertainty

Despite the challenges we face today, there are reasons to be optimistic about the future. Inflation appears to be on the decline, giving central banks some leeway to ease interest rate hikes If this trend continues, there may be opportunities for high-quality corporate bonds, especially given the current attractive yields. Despite ongoing concerns with COVID-19, there is growing confidence in the recovery of the Chinese economy in the coming year. Additionally, Europe has made progress in reducing its dependence on Russian energy

Advertisement

While the road ahead may be bumpy, there are good-quality companies whose values have been suppressed by broader market forces SJP's fund managers are poised to identify these companies, and take advantage of the more reasonable prices, with the aim to deliver better returns. By making sensible decisions now, we can position ourselves for long-term success, even in the face of ongoing challenges.

The value of an investment with St. James's Place will be directly linked to the performance of the funds selected and may fall as well as rise You may get back less than the amount invested

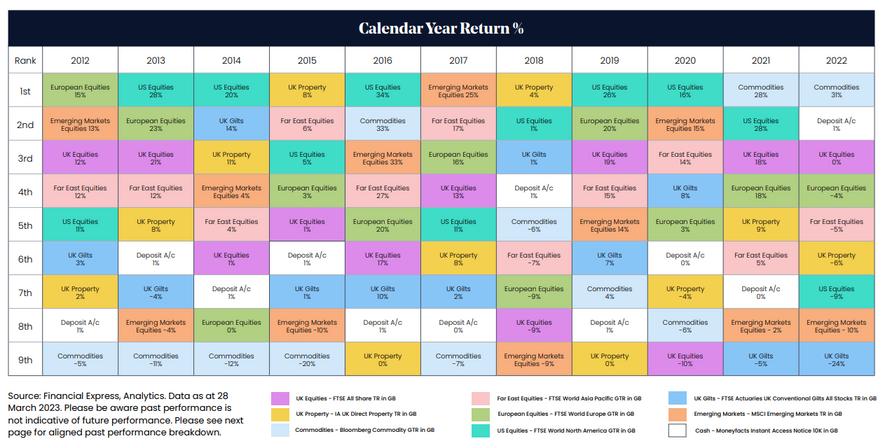

Source: Financial Express, Analytics Data as at 01 January 2023 Please be aware past performance is not indicative of future performance

Source: London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”) © LSE Group 2023 FTSE Russell is a trading name of certain of the LSE Group companies “FTSE Russell®” is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under license All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication No further distribution of data from the LSE Group is permitted without the relevant LSE Group company ’ s express written consent The LSE Group does not promote, sponsor or endorse the content of this communication ” © S&P Dow Jones LLC 2023 All rights reserved

Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products This report is not approved, endorsed, reviewed or produced by MSCI None of the MSCI data is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

Source: FTSE International.

Why Should I Be Treated Privately?

We are lucky enough in the UK to have the NHS, which provides comprehensive healthcare that is free at the point of need. Accessing private healthcare, meanwhile, is far from cheap - for example, the cost of hip or knee replacement surgery is easily likely to cost thousands of pounds*. What's more, the quality of private treatment isn't likely to be better than that you'd receive through the NHS. So why pay?

The main advantage of private healthcare is the greater choice in where and when you receive treatment, as well as the speed and convenience of the process. Private health insurance is, therefore, one means of fast-tracking lengthy waits without needing to have tens of thousands of pounds handy Private health insurance also covers everything from GP appointments to detailed cancer treatments

Should I Consider Private Health Insurance?

Like me, if you love the NHS and all the amazing work they do, but are concerned about wait times, delays in scans or operations after the pandemic, maybe private health care is something for you and your family to consider.