1 minute read

Industry Insights

With Stuart J Brown

Join

Advertisement

It's hard to believe that we ' re already halfway through 2023. Nonetheless, I hope you ' re eagerly anticipating the upcoming summer holidays and the opportunity to spend quality time with loved ones.

Following the Spring Budget and the start of a new tax year, what can we expect for the future of our economy? In this newsletter, I'll provide an in-depth analysis of market performance from 2022 to the present day, a glimpse into private medical care, and much more.

Stuart J Brown Financial Adviser Eight Wealth Management Ltd

Equities & Rising Inflation

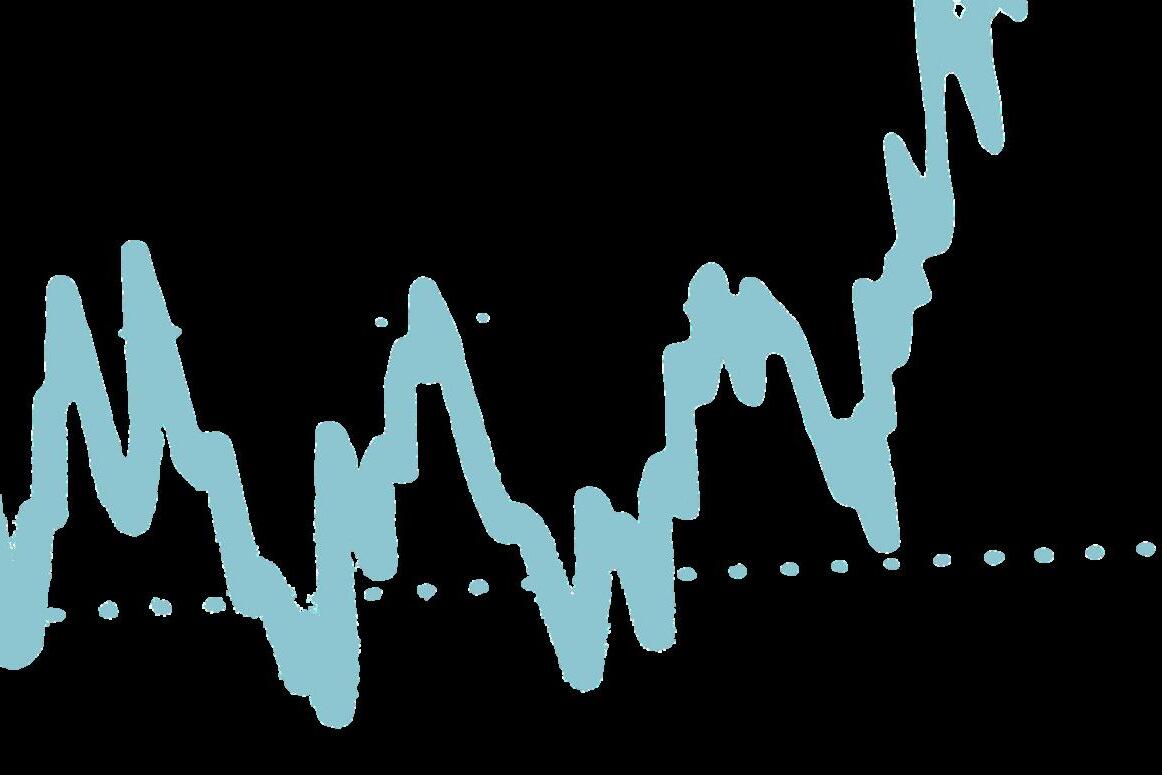

Since the conflict between Russia and Ukraine started, many major equity indices have suffered losses. However, oil and resourceheavy indices like the FTSE 100 have been boosted by rising commodity prices due to a cut-off in Russian supply chains

In response to rising inflation, the Federal Reserve and Bank of England have increased interest rates to curb it. This has disproportionately negatively impacted growth stocks, as fast-growing companies are typically "long duration" This means that while current profits may be low or negative, the value and stock price of "growth" businesses are largely based on future earnings, which are expected to be substantial given their growth trajectory. As interest rates increase, this future growth is discounted at a greater rate, leading to a decline in share prices As a result, Growthoriented funds like Global Growth, Global Quality, Managed Growth and International Equity have underperformed relative to the broader market downturn.

On the other hand, Financials have benefited from the rising rates environment, as have Oil and commodities businesses, which have generated outsized profits due to price increases Value-oriented funds like Global Value and North American, which typically have higher weightings in these sectors, have consequently benefited and delivered strong relative performance.

Past performance is not indicative of future performance.

If there's one thing that 2022 taught us, it's that short-term events are unpredictable. Short-term valuations are subject to numerous variables, and it is difficult to predict them accurately with any frequency. While this may appear daunting, there are reasons to be optimistic. Market performance is largely influenced by sentiment, and history has shown that market declines frequently precede a recession but also begin recovery sooner

In other words, while there is a chance that forthcoming data will indicate a recession, much of the pain may have already been priced in. As a result, it is essential to focus on long-term thinking.