8 minute read

Real Estate

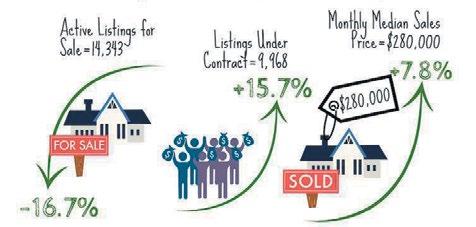

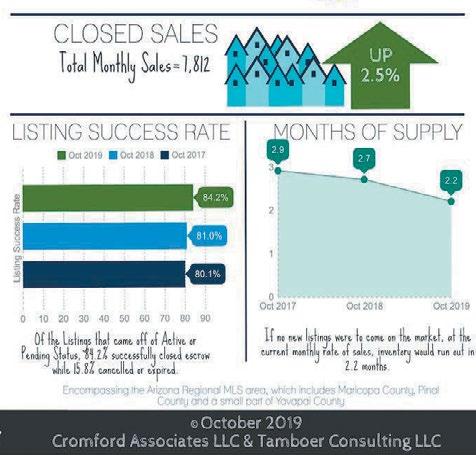

ASKING PRICES UP 9% OVER LAST YEAR, BUT ARE BUYERS PAYING IT? By Chad Arend, Realtor Those between 1,000-2,000sf ap- buyers paying? Actually, many of them the average list per square foot. Things preciated 106%, an average of 5.6% are! In the $200K-$250K range, the change over $500K. Between $500KFOR BUYERS: per year. 2,000-3,000sf appreciated average sales price per square foot is $1M there’s a -6.3% gap between The news media is filled with short- 68% at 3.6% per year. 3,000-4,000sf still 0.8% higher than the average list asking price and sales price, and over term predictions regarding the econo- appreciated 49% at 2.6% per year, and price; and between $250K-$300K the $1M the average sales price is -15.1% my and how it will, or will not, affect homes over 4,000sf appreciated 11% average sales price is 6.8% higher than below the average asking price. real estate prices. It’s understandable at 0.6% per year. for buyers to want their home to appreciate in value after they purchase FOR SELLERS: - who doesn’t? However, there is far Average asking prices per square foot too much attention paid to short-term are up 9% over this time last year and influences and fluctuations these days they’re continuing to rise. However, and not enough attention paid to the not one individual price range has long view. Real estate is a long-term risen 9% or more; confusing, right? investment for many people. Despite That’s because the sharp increase in the euphoria of 2005-2007 and the the average has more to do with a nightmare of 2008-2011, on aver- growing market share of luxury acage, homes are selling 81.6% higher tive listings over $500K as inventory today than they were in the year 2000. has plummeted everywhere else. The That’s an average appreciation rate of highest increase is within the $200K4.3% per year over the course of 19 $250K range, where sellers are asking years. Smaller homes appreciated the 5.6% more than they were last year. most over time while larger homes That’s followed by listings over $1M appreciated the least. Homes under where they’re asking 4.2% more and 1,000sf have appreciated 122% since $500K-$1M at 4.0%. All other price 2000, an average of 6.4% per year. ranges are just 1-3% higher. But are

Chad Arend - Realtor Neighborhood Specialist Chad Arend - Realtor Neighborhood Specialist Chad Arend - Realtor Neighborhood Specialist

We have the experienced team to handle the complicated We have the experienced team to handle the buying process of short sales, lender owned homes and complicated buying process of short sales, lender investor flips. We strive to make sure how clients are happy with our service every step of the way, from initial marketing meeting, to after closing. We promise you won’t be disappointed. • Local market knowledgeable • 14 years full time real estate experience We have the experienced team to handle the complicated buying process of short sales, lender owned homes and investor flips. We strive to make sure how clients are happy with our service every step of the way, from initial marketing meeting, to after closing. We promise you won’t be disappointed. owned homes and investor flips. We strive to make sure how clients are happy with our service every step of the way, from initial marketing meeting, to after closing. We promise you won’t be disappointed. • Local market knowledgeable • 14 years full time real estate experience • Excellent follow up skills Chad Arend Realtor Direct: 602-740-2074 Email: Chad@TheArendTeam.com www.TheArendTeam.com Chad Arend Realtor Direct: 602-740-2074 Email: • Excellent follow up skills • Aggressive negotiation tactics • Extensive marketing campaigns • Local market knowledgeable • 14 years full time real estate experience • Aggressive negotiation tactics • Extensive marketing campaigns • Large client base with multiple referral channels • Community & Neighborhood involvement Office: 21630 N 19th Ave Ste B8 Phoenix, AZ 85027 Chad@TheArendTeam.com www.TheArendTeam.com Chad Arend • • Large client base with multiple referral channelsExcellent follow up skills 14 • November 2019Office 21630 N 19th Ave Ste B8 Phoenix, AZ 85027 Realtor Direct: 602-740-2074 Email: • DEER VALLEY TIMES • Community & Neighborhood involvement• Aggressive negotiation tactics • Extensive marketing campaigns Chad@TheArendTeam.com www.TheArendTeam.com • Large client base with multiple referral channels Community & Neighborhood involvement

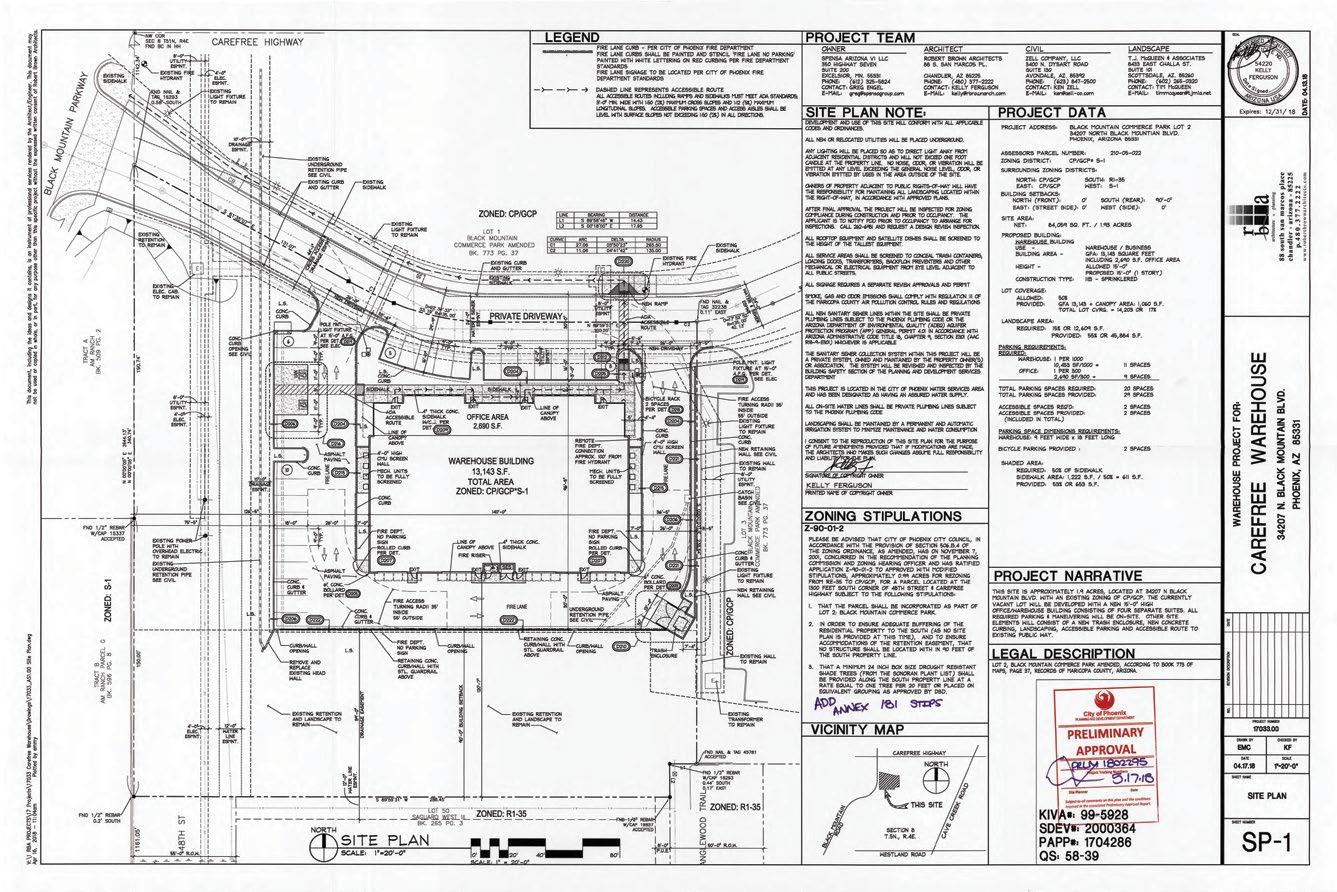

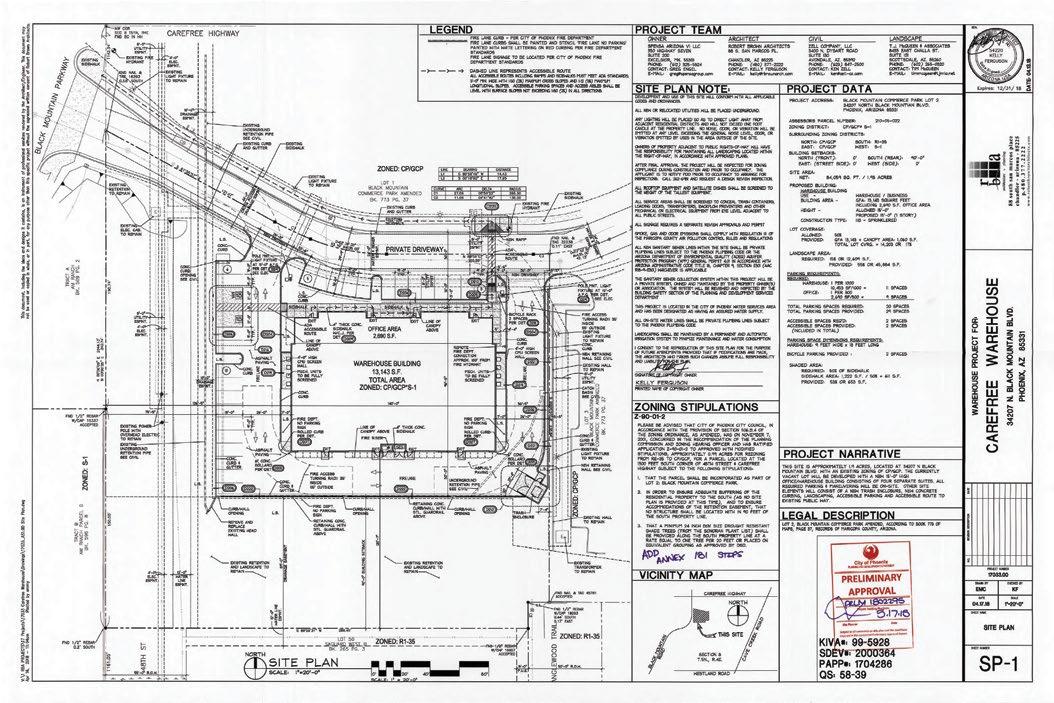

EXCEPTIONAL ECONOMY FOR LEASE - ±3,200 SF EACH (3) Units INDUSTRIAL WAREHOUSE - CAREFREE LOCATION 34207 N. BLACK MOUNTAIN PARKWAY, PHOENIX, AZ 85331 FOR LEASE - ±3,200 SF EACH (3) Units INDUSTRIAL WAREHOUSE - CAREFREE LOCATION 34207 N. BLACK MOUNTAIN PARKWAY, PHOENIX, AZ 85331 REAL ESTATE PROPERTY INFO: New Construction Reception, (1) Office, (1) Bathroom $1.30 PSF /Mo. (IG) PROPERTY INFO: New Construction Reception, (1) Office, (1) Bathroom $1.30 PSF /Mo. (IG)

By Chris Keeley, Phoenix Commercial Brokers

Phoenix Industrial market. We have had approximately 10,000,000 square feet of new construction in the industrial market alone in 2019, and the demand and absorption rates justify the new development. The Deer Valley Airpark could use some of that infusion. We are sitting in a very healthy submarket with lease rates and purchase prices increasing exponentially based on a significant lack of current inventory. There have been 50 industrial buildings sold in the Airpark this year for an average sale price of about $131 per square foot. There are currently only about 18 buildings available for users to purchase between 5,000 and 100,000 square feet, all of which are second generation. The only new buildings under construction are MACS Pinnacle 7 Phase 2 two buildings on Pinnacle Peak and 3rd Street that are for lease, and one 12,000 square foot building under construction in TTR Industrial Park I at Deer Valley and 16th Street. The demand for purchase options is very high in the Deer Valley Airpark but our inventory has not kept up recently. Of course we have reached a Sellers market finally and pricing has reflected that. We are fast approaching the numbers we saw in the heydays of 2005 to 2007. Most quality industrial buildings will cost $140 plus per

Not since 2006 to 2007 have we seen this amount of new construction in the Greater

square foot moving forward. The lease product has kept up with demand, with many new projects built in the last few years in the industrial sector. There are about 800,000 square feet currently available in Deer Valley but minimal small lease spaces. The majority of vacant space is 10,000 square feet up to 150,000. There are only a few projects left that can accommodate 1,000 to 3,000 square foot tenants. And forget it if you are looking for a yard - those properties are few and far between.

Lease rates have also crept up close to 2007 rates. The average lease rate for quality industrial space is $0.75 to $0.85 psf (NNN). There are a lot of options for larger tenants, so they FOR MORE Joe WelchertFOR MORE Joe WelchertJoe Welchert should still expect to achieve lower Designated BrokerINFORMATION Designated BrokerDesignated BrokerINFORMATION rates if they shop around. With a few more hundred thousand square feet PLEASE CONTACT: 602.432.8532 Mobile joe.welchert@phxcb.com PLEASE CONTACT: 602.432.8532 Mobile joe.welchert@phxcb.com 602.432.8532 Mobile joe.welchert@phxcb.com coming onto the market soon, there may be some discounts to be had today but with the overall lack of new construction in our market, don’t expect that to last long. If there are any of you speculative builders out there looking for new projects, I’d love to sit down with you and discuss what’s worked in the past FOR MORE INFORMATION PLEASE CONTACT: FOR MORE INFORMATION PLEASE CONTACT: Joe Welchert Designated Broker 602.432.8532 Mobile joe.welchert@phxcb.com Joe Welchert Designated Broker 602.432.8532 Mobile joe.welchert@phxcb.com Don’t Let This Fall Deal Get Away! Don’t Let This Fall Deal Get Away! that I expect would work again. Let’s talk. Up to $500 rebate and Chris Keeley is a Deer Valley 0% financing (on qualifying equipment) Commercial Specialist with Phoenix Ends December 31, 2019 Commercial Brokers, an Industrial Real Estate Agency located at 22849 N. 19th Ave. Ste 140 in Phoenix.

FEATURES:

■ 20% Offi ce

FEATURES:

20% Office■ 100% Air Conditioned 100% Air conditioned 16’ x 10’ roll-up doors■ 16' x 10’ Roll-up Doors 10' Clear height Zoned: CP/GCP Phoenix■ 10’ Clear Height ■ Zoned: CP/GCP Phoenix

FEATURES:22849 N. 19th Ave. 22849 N. 19th Ave. 22849 N. 19th Ave. 20% OfficePhoenix, AZ 85027 Phoenix, AZ 85027 Phoenix, AZ 85027 20% Office 100% Air conditioned FEATURES: 100% Air conditioned 16’ x 10’ roll-up doors 10' Clear height 623.516.7744 Office www.PHXCB.com 623.516.7744 Offi ce www.PHXCB.com 623.516.7744 Office www.PHXCB.com 16’ x 10’ roll-up doors Zoned: CP/GCP Phoenix 10' Clear height Zoned: CP/GCP Phoenix

22849 N. 19th Ave.

Phoenix, AZ 85027

22849 N. 19th Ave. 623.516.7744 Office Phoenix, AZ 85027 www.PHXCB.com

623.516.7744 Office

www.PHXCB.com

Call Today! 602-944-9585

*The Wells Fargo Home Projects® credit card is issued by Wells Fargo Bank N.A., an Equal Housing Lender. Special terms apply to qualifying purchases charged with approved credit. The special terms APR will continue to apply until all qualifying purchases are paid in full. The monthly payment for this purchase will be the amount that will pay for the purchase in full in equal payments during the promotional (special terms) period. The APR for Purchases will apply to certain fees such as a late payment fee or if you use the card for other transactions. For new accounts, the APR for Purchases is 28.99%. If you are charged interest in any billing cycle, the minimum interest charge will be $1.00. This information is accurate as of 8/1/2019 and is subject to change. For current information, call us at 1-800-431-5921. Offer expires 12/31/2019. **See your independent Trane Dealer for complete program eligibility, dates, details and restrictions. Special financing offers and rebates up to $500 valid on Qualifying Equipment only. Offers vary by equipment. All sales must be to homeowners in the United States. Void where prohibited. Special financing offer expires 12/31/2019. Instant Rebate offer expires 11/15/2019.