5 minute read

Financial life lessons stacking up for ākonga at St Joseph’s School

Students at St Joseph’s School in Morrinsville are gaining practical financial literacy skills through Banqer, an interactive programme that helps ākonga learn by making real-life decisions in a safe environment.

St Joseph’s School in Morrinsville is equipping its ākonga with skills for life through the free financial literacy programme, Banqer.

“The most important thing I’ve learned from Banqer is how to save my money and use it wisely,” says Year 5 student Abbie. Her friend, Ruby, adds that saving money makes a better life.

Principal Andrea Devane is a strong advocate for authentic, meaningful learning programmes – and she believes Banqer delivers just that through its transferable, real-world applications. By equipping students with the knowledge and skills needed to make informed financial decisions, and engaging with real-world scenarios in a safe, simulated environment, students can explore concepts like budgeting, saving, and investing – without the risk of real-life consequences. This empowers them to build financial confidence early, so that future decisions are grounded in understanding, not guesswork!

“Our youngest learners start using Banqer at age seven, and they absolutely love it. What’s remarkable is they’re still talking about it years later in Year 8,” says Andrea.

“You know a programme is making an impact when students are having conversations about term deposits, mortgages, and comparing investments – they’re thinking critically about financial decisions.”

She notes that teaching financial literacy was previously optional, taken up mainly by those who saw its value. Now, with a growing emphasis on embedding it into learning, she wholeheartedly welcomes the shift.

Learning by doing

Teacher Kerry Horan has been using Banqer with her St Joseph’s ākonga for the last six years.

“To begin with, I didn’t know much about the programme, but I saw some other people using it and thought I’d give it a go,” she says.

“And then it was just learning as you go along. The programme is set out really well to help teachers, and it’s broken down into different modules so you can focus on one set of learning at a time.”

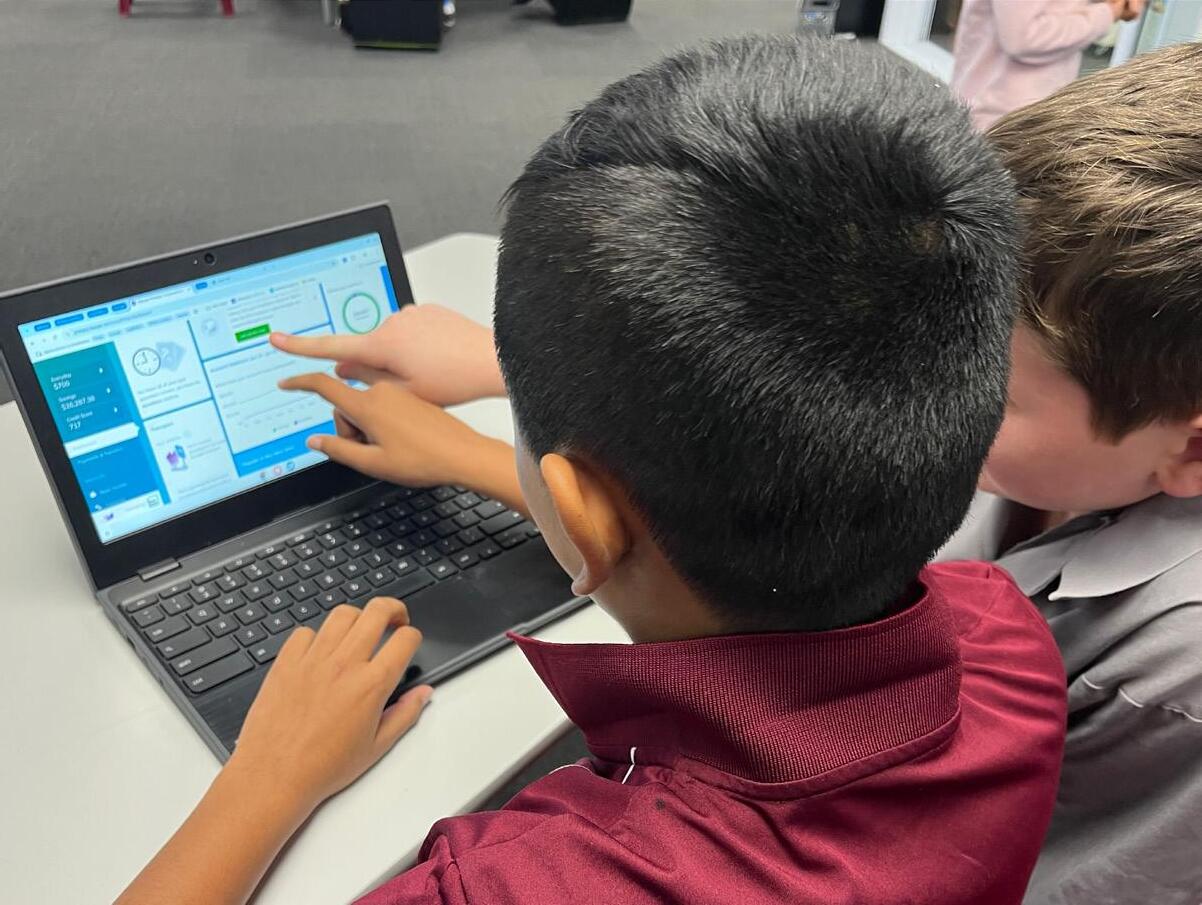

She starts her students with the Income and Expenses module, where they learn about the money coming in and going out of their accounts, and the importance of having enough money to pay for their expenses. Students are paid in Banqer dollars to track as income and to use for spending.

Student Naomi really enjoyed this module. “It was so fun because there was a video where we could pick options to buy stuff,” she says.

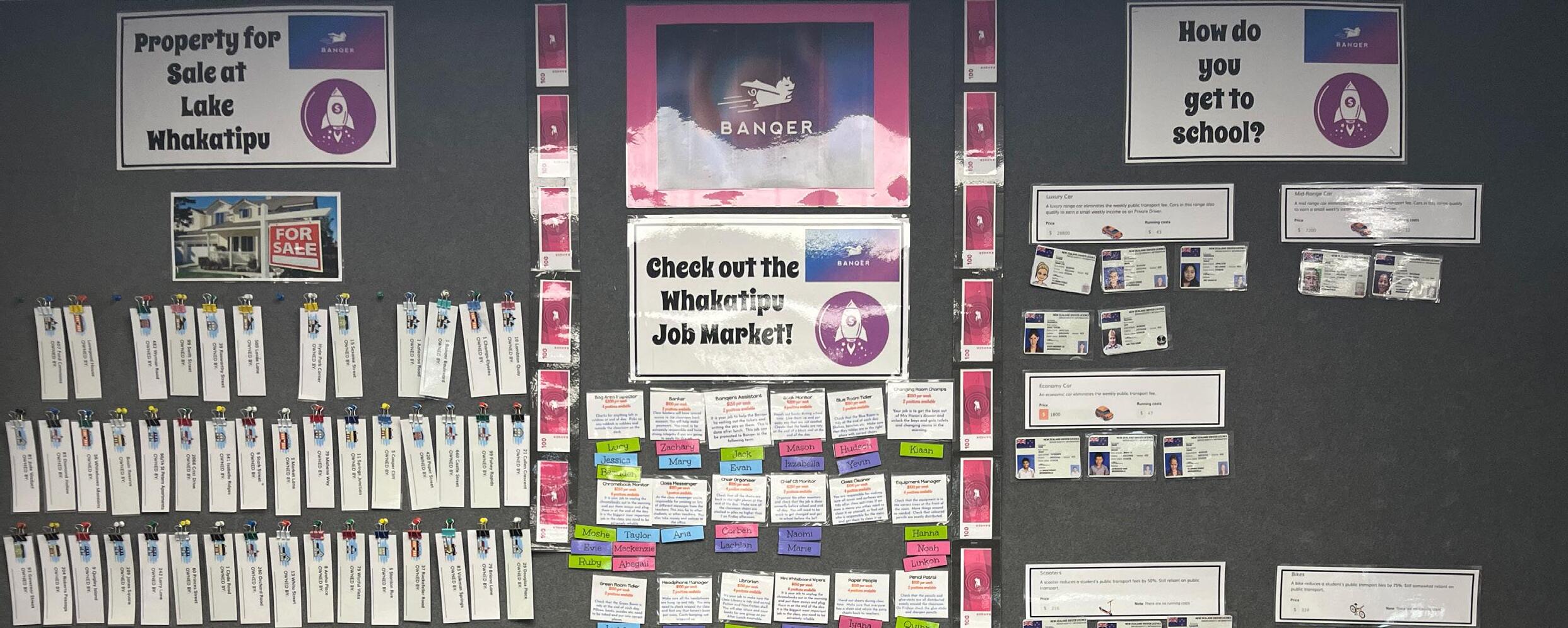

Kerry’s students receive an allowance for attending school and for their classroom jobs, such as bag area inspector, class messenger or Chromebook monitor.

The Banqer dollars are used to pay for classroom expenses such as hiring a Chromebook, renting furniture and paying for Wi-Fi. Banqer is also used as a behaviour management tool, where students are paid for completing their work and can earn bonuses.

“You set those amounts so the students have to start thinking, OK, so I need that much in my account to be able to pay that,’” says Kerry.

Real-life connections

Student Jessica loved the Careers and Employment module where she learned how to write a CV, apply for jobs and understand living costs.

“I have learned about what to do with my money, which has taught me to do good things with it,” she says.

Year 5 student Karsen found the Lending and Debt module challenging. “You can get money from the bank, but not sketchy people. Those people are called scammers,” he explains.

Lunar and Philamena from Year 4 and Marie from Year 5 all enjoyed buying a car in the Transport module, where they discovered the real costs of different car choices.

Kerry says ākonga learn that sometimes a mid-range car costs less in the long run than a cheaper car that requires frequent repairs. The module also teaches the importance of insurance for unexpected car expenses, including accidents.

Year 8 student Kalinda says her favourite module was the Real Estate module where she used money saved from term deposits to purchase her first virtual home. Kerry enhances this with a classroom street map where students can pin their home purchases, bringing a tangible, interactive element to the learning.

“The module is similar to real life, where the housing market goes up and down,” says Kerry. “If they choose to sell early, they’ll often lose money, and that can be a big shock for them.”

Mistakes made safely

Kerry explains that Banqer is all about learning by doing and learning by making mistakes in a safe environment.

“You want them to be making these mistakes now, not in real life when they’re older,” she says.

Year 8 student Patrick reflects “that money is something that can go fast and you have to know how to manage it”.

Students are encouraged to share their learning with their whānau. Karsen says he shares his knowledge with his family and friends, and Marie’s older sister is using Banqer learning to set up a bank account. Hanna shares her new financial knowledge to help her mum with her business.

Naomi says her mum helped her set up a Square One card. “I learned how to walk by stuff I like and not buy it,” she says.

Adapting for all ages

Banqer modules can be adapted to suit different year groups. Kerry tailors the information to make the teaching ageappropriate, whether for eight-year-olds or senior primary students.

At the end of each year, Kerry runs a classroom auction where students use their saved Banqer dollars to bid on preloved items, bringing their learning full circle.

“We’re starting young to sow the seed of financial literacy to go across the school,” says Kerry. “It’s such meaningful learning; they don’t seem to lose it either.”

Her own daughter, a Banqer graduate, is now 15 and starting her first part-time job.

“She said to me, ‘Mum, I’m going to save until the end of the year, and then I think I’ll open a term deposit.’”

For more information, visit www.banqer.co/nz