Bond Accountability Commission 2 Recommendations Page 88

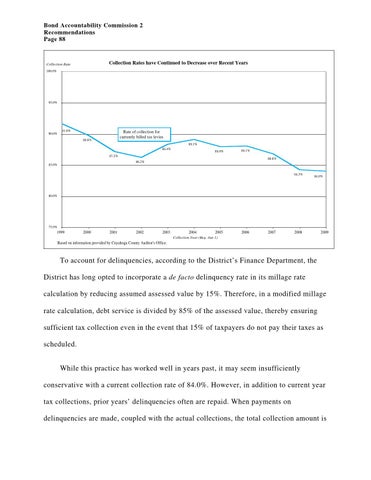

Collection Rates have Continued to Decrease over Recent Years

Collection Rate 100.0%

95.0%

90.0%

91.6%

Rate of collection for currently billed tax levies

89.8%

89.1% 88.4%

88.0%

88.1%

87.2%

86.8% 86.2%

85.0%

84.3%

84.0%

80.0%

75.0%

1999

2000

2001

2002

2003

2004 2005 Collection Year (Beg. Jan 1)

2006

2007

2008

2009

Based on information provided by Cuyahoga County Auditor's Office.

To account for delinquencies, according to the District’s Finance Department, the District has long opted to incorporate a de facto delinquency rate in its millage rate calculation by reducing assumed assessed value by 15%. Therefore, in a modified millage rate calculation, debt service is divided by 85% of the assessed value, thereby ensuring sufficient tax collection even in the event that 15% of taxpayers do not pay their taxes as scheduled. While this practice has worked well in years past, it may seem insufficiently conservative with a current collection rate of 84.0%. However, in addition to current year tax collections, prior years’ delinquencies often are repaid. When payments on delinquencies are made, coupled with the actual collections, the total collection amount is