NRECA EMPLOYEE BENEFITS

n 2026 ANNUAL RENEWAL & ANNUAL ENROLLMENT

4 Get Ready for 2026 Group Benefits Annual Renewal

6 Group Plan Management Replaces Benefit Plan Rating and Renewal Beginning This Annual Renewal

n RETIREMENT BENEFITS

8 Register for the “The Financial Power of Women” PIRC Webinar

n COMPLIANCE

9 Sorting Co-op Pay Into Retirement Plan Compensation

MANAGING EDITOR: Scott Mathias

CONTRIBUTING WRITERS: Jeff Blaszkowski and Judy Mitchell

Benefits Focus is a newsletter published as a member service for NRECA benefit plans, programs and services. In the case of a discrepancy, the plan documents govern. To subscribe to Benefits Focus, call or email Scott Mathias at 703.907.6094 or scott.mathias@nreca.coop © 2025 NRECA. All rights reserved. Let us know what you think of

GET READY FOR 2026 Group Benefits

ANNUAL RENEWAL

l BY SCOTT MATHIAS

Annual renewal, which runs this year from August 14 through September 26, 2025, is your opportunity to elect the NRECA group benefits plans and options your cooperative will offer its employees and their eligible dependents in 2026.

During annual renewal, use the new, improved Group Plan Management feature of the Employee Benefits website, which replaces the Benefit Plan Rating and Renewal feature (see page 6), to:

l VIEW your co-op’s renewal rates.

l COMPARE rates and plans.

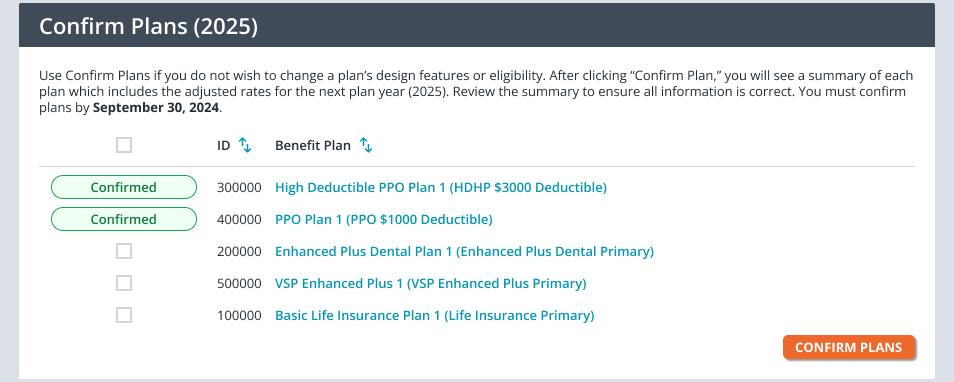

l CONFIRM existing plans without changes.

l MODIFY your co-op’s existing plans.

l BUILD new plans.

Even if you don’t expect to change your co-op’s plans, we need you to review and confirm them and familiarize yourself with the available plan options and enhancements.

2026

Renewal Rates

Emailed August 14

A report with your co-op’s 2026 group benefits renewal rates will be sent by email on August 14, when annual renewal opens. The email also will link to the Annual Renewal section in the BA Guide, where you will find helpful information and resources.

Submit Plan Changes and Confirmations by September 26

You must send changes to, or confirm all of, your co-op’s group benefits plans—medical with prescription drug, vision, dental, disability, life insurance and business travel accident insurance— for each subgroup by the September 26 annual renewal deadline. Your annual benefits renewal isn’t complete until all changes and confirmations for all your co-op’s plans and subgroups are sent online to NRECA. Completing your renewal on time also helps ensure that you receive your summary of benefits and coverage documents in time to distribute them for employee annual enrollment (as required by the Affordable Care Act) and that all screens for online enrollment display the correct benefit information.

If you have any questions about the upcoming annual renewal, speak with your NRECA field representative or contact the Member Contact Center at 866.673.2299 or at contactcenter@nreca.coop BF

Annual Enrollment

Coming This Fall

Annual enrollment for cooperative employees in NRECA group benefits plans will run this year from October 16 to November 21. During that time, your employees will be able to elect their benefits for 2026 through the Employee Benefits website. Benefits administrators will also be able to make and track enrollment changes online.

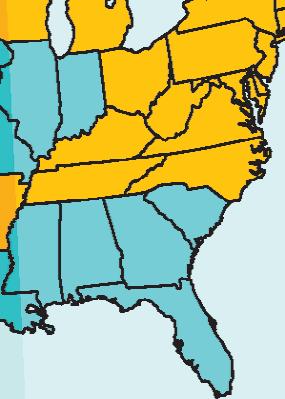

The specific 2026 Annual Enrollment dates will be:

l BA preview period: October 16–17, 2025

l Wave 1 (blue): October 20–November 3, 2025

l Wave 2 (yellow): November 4–November 19, 2025

l BA review period: November 20–21, 2025 28 1 1

Blackout Period June 2–August 14

To prepare for the 2026 annual renewal period, the Benefit Plan Rating and Renewal feature (soon to be Group Plan Management) on the Employee Benefits website will be unavailable from 8 a.m., Eastern time, June 2, through 9 a.m., Eastern time, August 14, 2025.

If you need to model group benefits plans during this period, contact your field representative or the Member Contact Center at 866.673.2299 or contactcenter@nreca.coop for assistance.

The Employee Benefits website is your online portal for administering NRECA benefit plans and programs. It provides information and resources to help benefits administrators do their jobs as well as materials you can share with participants. There are also benefit tools and resources available directly to participants. Here are a few things you or your participants should consider clicking.

Group Plan Management Replaces Benefit Plan Rating

and Renewal

Beginning This Annual Renewal

l BY SCOTT MATHIAS

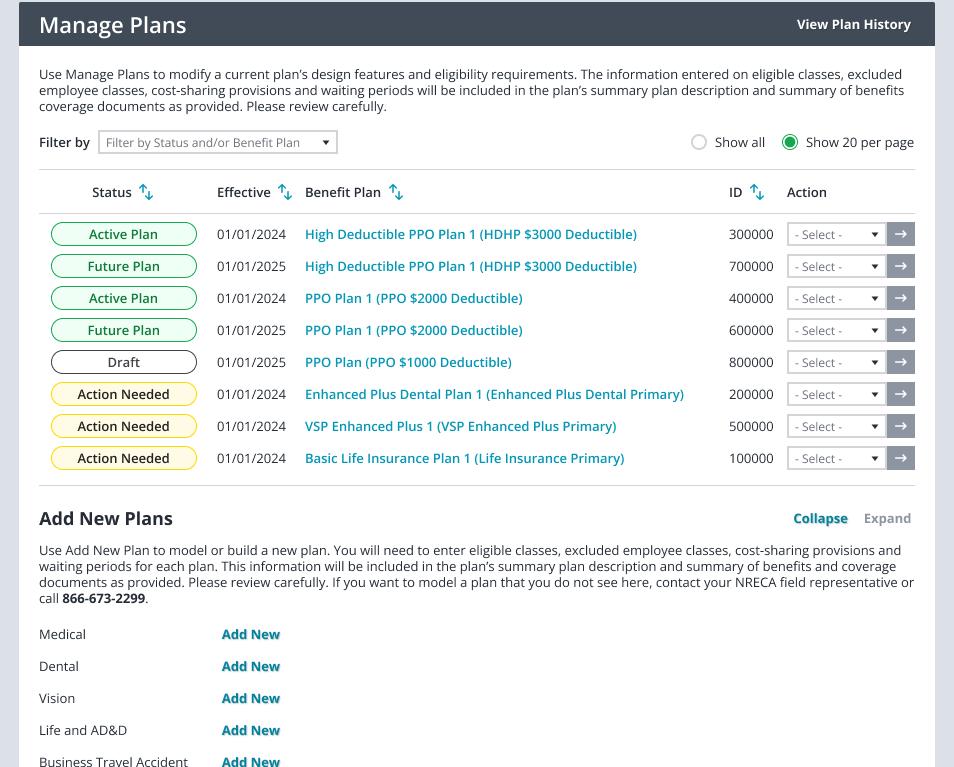

The Benefit Plan Rating and Renewal feature on the Employee Benefits website, which benefits administrators have used to confirm and elect group benefits plans for their cooperatives, is being updated and refreshed as Group Plan Management. The new, enhanced event will open with the 2026 Annual Group Benefits Renewal on August 14, 2025

As with Benefit Plan Rating and Renewal, you will use Group Plan Management to:

l Build group benefits plans.

l Modify existing group benefits plans.

l Confirm existing group benefits plans.

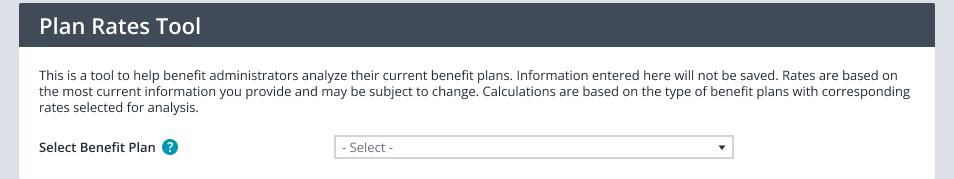

l Model and compare group benefits plans.

l Review group benefits rates.

l Provide information that feeds into group benefits summary plan description and summary of benefits and coverage documents.

We’ve incorporated feedback from benefits administrators to make the process easier and quicker! In addition to a more intuitive and streamlined experience, other enhancements include:

l More information and actions up front to make reviewing plan rates, comparing plans, modeling plans and other tasks easier.

l Step-by-step guidance throughout the processes for building, modifying and confirming plans.

l Inline help—onscreen instructions, tooltips and links to additional resources that replace and significantly reduce the number of pop-ups.

l New notifications showing the status of your plans and any actions you need to take.

l Fewer screens, which means fewer steps to manage your NRECA Group Benefits Program plans.

We will be providing more information about this new feature but see the next page for a sneak peek. BF

So Much Up Front And Even More Inside.

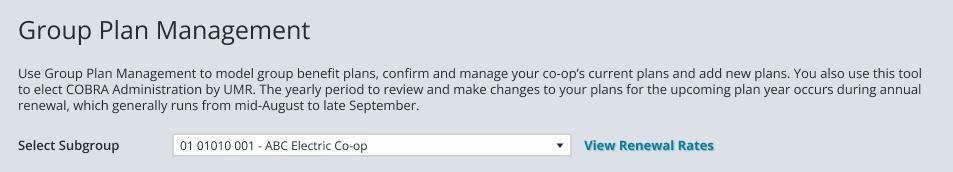

Select the subgroup you wish to manage and view renewal rates.

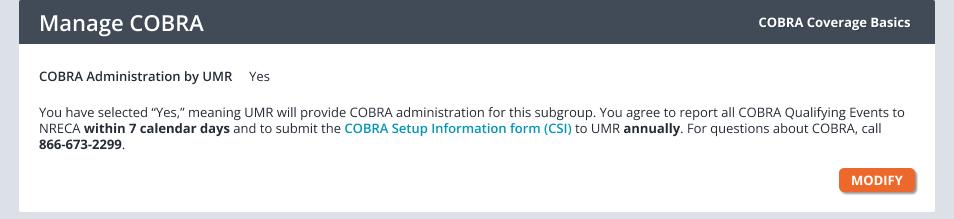

Select and manage your COBRA administration. Your choices— COBRA administration by UMR or self-administered.

Happy with your plans? Confirm all or some of them with no changes.

Modify your existing plans or build new ones.

See and compare rates for various plan designs.

REGISTER FOR THE

“The Financial Power of Women”

l BY JUDY MITCHELL

IPIRC WEBINAR IN JUNE

t’s often been said, “Money is power.” More than two-thirds of female consumers (69%) report being their households’ primary decision-makers regarding financial investment choices. There is still much work to do, however, in translating that fact into better financial outcomes for women.

Join Ann Blakey, a senior investment and retirement planner on the Personal Investment & Retirement Consulting (PIRC) team, as she leads a discussion on The Financial Power of Women, Tuesday, June 17, at 1 p.m. Central time.

Ann will reflect on the advancement of women’s roles in recent history and how their financial influence and health have evolved. She’ll address the gender pay gap and the impact of career breaks—how they reduce income and retirement savings. She’ll highlight the importance of retirement planning and the financial effects of divorce and widowhood. She’ll also share some strategies for strengthening one’s financial position that both women and men can employ.

“Women have made considerable gains in the workforce, but as a group, we face some unique

PIRC planner Ann Blakey

financial challenges,” said Blakey. “As we prepare for the future, we need to address those challenges,” she added.

Register today to join the webinar or gather your employees and grab lunch or a snack to watch it together.

Submit Your Questions in Advance

If you or your employees have questions for Ann, please send them in advance to employeebenefits@nreca.coop We will try to address your questions during the webinar; otherwise, Ann or another PIRC team member will follow up individually. BF

COMPLIANCE

Get your compliance news and information here. We hope you find this section useful, as we work together to ensure that co-op benefit plans remain in compliance with federal law and plan terms. Keep in mind that NRECA cannot provide legal or tax advice to co-ops. The information presented is our interpretation of the law and regulations. Co-ops should seek the advice of their legal counsel and tax advisor.

Sorting Co-op Pay Into Retirement Plan Compensation

l BY JEFF BLASZKOWSKI

Al Calculating and sending employer and employee contributions throughout the plan year as they’re withheld from payroll (i.e., within five days of withholding).

l Reconciling annual employee deferrals with NRECA’s records.

l Ensuring each participant’s annual employer contributions are correct.

lmost every compliance task requires cooperatives to know and apply their retirement plan’s compensation definition (base or full salary). Here are just a few of those tasks: continued

l Reporting employer contributions when sending year-end W-2 salary data to NRECA.

To perform these tasks properly, it’s important to ensure that your co-op’s pay practices are clear and align with the plan’s compensation definition so that you can properly classify extra sources of compensation.

Finding Your Plan’s Compensation Definition

To find your plan’s compensation definition:

l Review Section 6 of your 401(k) Pension Plan Adoption Agreement. Employer and employee contributions may have different definitions.

l For the Retirement Security (RS) Plan’s traditional benefit formula, see Section II.A.1 of your plan’s adoption agreement. The RS Plan’s cash balance benefit formula, which always uses base salary, is shown in Section II.B.1 of your adoption agreement.

See the following chart for the components that make up each salary definition:

COMPENSATION DEFINITION

RS Plan Full Salary

COMPONENTS

W-2 taxable compensation, which includes bonus and overtime pay, plus:

l Pre-tax 401(k) employee deferrals.

l Pre-tax 457(b) deferrals.

l 125 Plan contributions (health flexible spending accounts and health reimbursement arrangements).

401(k) Plan Full Salary

401(k) Plan Base Salary

RS Plan Base Salary

Classifying Compensation

Knowing how your co-op’s compensation practices flow into retirement plan compensation can be tricky if you use base salary but those compensation practices are not well-defined. This is one reason it’s important to ensure that your co-op’s pay practices are clear and align with the plan’s compensation definition.

Often, the answer to the question “Should I include this pay when calculating plan contributions?” depends on your written practices (see “Sorting it Out” on the next page). The connection between practice and plan compensation is essential for compensation that isn’t clearly either bonus or overtime pay.

The components in the line above (see RS Plan Full Salary) minus taxable fringe benefits.

The components in the line above (see 401(k) Plan Full Salary) minus extra compensation (e.g., bonus and overtime pay).

Prior year’s November 15 compensation multiplied by expected hours to be worked this year.

Let’s use mutual aid or storm restoration pay as an example. If a line worker spends an entire week performing mutual aid service, with every hour paid at time and a half or double time, how much of that pay is considered base salary for purposes of plan contributions, and how much of it is considered extra pay or overtime? If your co-op’s plan uses the base salary definition but does not have a consistent written practice defining whether and how much storm pay is eligible for employee deferrals (and how much is considered extra pay or overtime), then strictly following the plan’s compensation definition could mean that the line worker’s pay for that week would be composed entirely of overtime pay. This in turn means that the line worker could not defer any pay.

On the other hand, assume your co-op typically splits mutual aid service into two portions: a straight-time 40-hour week (therefore included in base salary) with the rest considered overtime pay (therefore not included in base salary). This practice would not only permit the line worker to make employee contributions for that week, but it would also help participants know how their compensation affects their retirement benefits. Other practices could also be considered reasonable.

Although NRECA’s Retirement Compliance team can’t provide tax or legal advice, we can help you understand the plans’ compensation definitions as you define a written compensation practice for your workforce. We encourage you to consult your co-op’s attorney as you do this.

Sorting It Out

Supplemental insurance (e.g., AFLAC)

Rate of pay

Shift di erential pay

Health savings account contributions

Double-time mutual aid pay OTHER COMPENSATION SOURCES

401(k) deferrals

Safety reward Car allowance Gift cards Commissions

Nov. 15 rate of pay

Remember 401(k) Plan Reconciliation Tasks

The goal in deciding whether pay is part of retirement plan compensation is to ensure that employee and employer 401(k) contributions are accurate for each year. Remember that varying deferral patterns can mean that an individual’s annual employer contribution is different than the

Pre-tax deferrals

A er-tax deferrals

Taxable compensa on

457(b) compensa on

125 Plan premiums

Fringe benefits

Extra compensa on (bonus/over me)

expected amount when calculated annually. Further, your 401(k) Plan may have employer matching or base contributions. Even if not conditioned on employee deferrals, both matching and base contributions must be properly funded annually for plan qualification purposes. For the reasons described in this article and those shown in the BA Guide, it’s a best practice to establish a cyclical review of your compensation definitions and contribution calculations

If you have questions about how the 401(k) Plan defines compensation or about the pay components included in full and base salary, NRECA’s Retirement Compliance team can help. Contact us at 866.673.2299, option 7, or at pension.compliance@nreca.coop BF

WE’RE HERE TO HELP.

CAROL BARNES Director of Retirement Compliance

703.907.6057

JEFF BLASZKOWSKI Retirement Benefits

703.907.6620

HOPESON EHIZELE Group & Retirement Benefits

703.907.6232

MICHELE GARDNER Sr. Director of Benefits Compliance

703.907.5840

Call the Benefits Compliance team at 866.673.2299, option 7. You also can email us at group.compliance@nreca.coop (group benefits) or at pension.compliance@nreca.coop (retirement benefits).

LINDA KEFLE Group & Retirement Benefits

703.907.6683

STEVE KIM Retirement Benefits

703.907.6730

AMANI NDEZE Retirement Benefits

703.907.6108

SUSAN PEARSON Group Benefits

703.907.6442

WHITNEY RADER Retirement Benefits

703.907.6151

JUDEE SCHWARTZMAN Retirement Benefits

703.907.6429

CHRIS SCHWARTZROCK Compliance Communications

703.907.6447

BRIANA SMITH Group Benefits

402.483.9206

SONIA SON Process & Procedures

703.907.6454

JENNIFER SORRELL Sr. Manager of Benefits Compliance

703.907.6384

JEREMY STONE Director of Group Compliance

571.562.4778

SHIMA TABIBI Retirement Benefits

703.907.6435

EUNICE WHITTED HIPAA Privacy Officer

703.907.6601

BENEFIT PLANS, PROGRAMS & SERVICES GUIDE

NRECA offers many group and retirement benefits plans, programs and services to meet cooperatives’ needs. For more information, talk with your field representative or contact the Member Contact Center at 866.673.2299 or contactcenter@nreca.coop.

PLANS

401(K) PENSION PLAN—Offer employees pre-tax as well as Roth contributions. The plan has many investment options, including ready-made portfolios based on employees’ estimated retirement dates. A self-directed brokerage account option is available.

BUSINESS TRAVEL ACCIDENT

Insure employees, directors and one retained attorney during travel on co-op business.

DENTAL—Plans cover 100% of preventive and diagnostic care as well as basic, major and orthodontic services at different levels. A supplemental dental PPO

provides additional discounts in many areas.

DISABILITY—These plans help protect the income of employees who are injured and unable to work. For long-term plans, co-ops choose the benefit level, elimination period and end date. Short-term plans allow co-ops to elect the maximum weekly benefit and benefit period.

LIFE—Co-ops elect basic life and accidental death and dismemberment (AD&D) coverage. This coverage comes with many other benefits, such as will prep, estate resolution, grief counseling and travel assistance. Supplemental life, spouse life, child life and supplemental AD&D are available to employees who have basic life coverage and can

be paid by the employee and/or the co-op. NRECA also offers retired life, director life and AD&D, and director supplemental AD&D.

MEDICAL—NRECA offers nonhigh-deductible medical plans and high-deductible health plans. Co-ops can customize deductibles, coinsurances, copays and out-ofpocket maximums. Preventive care is covered at 100%, not subject to the annual deductible. Network discounts are provided through UnitedHealthcare.

Tiered prescription drug benefit options allow co-ops to choose coverage levels with generic drugs costing the least. High-deductible health plans have their own coverage levels and a preventive drug option.

CVS Caremark™ is our prescription benefit manager. Contact them at 888.796.7322 or visit caremark.com

The hearing aid benefit, which provides a $10,000 lifetime maximum for wearable hearing aids and maintenance, is a standard feature of all medical plans.

NONQUALIFIED DEFERRED

COMPENSATION—Directors fees and highly compensated employee salaries, bonuses and other compensation can be deferred and invested with certain tax benefits. Co-ops are the plan administrators for these plans.

RETIREMENT SECURITY (RS)

PLAN—NRECA manages this defined benefit pension at a very reasonable cost. Co-ops can build a plan that balances benefit goals and plan cost by setting the terms for employee participation and benefit level.

VISION—Vision plans cover eligible eye exams, lenses and frames. Some plans have provider networks and offer discounts on laser vision correction, while others allow participants to see any provider.

BENEFIT PLANS, PROGRAMS AND SERVICES GUIDE

PROGRAMS

CENTERS OF EXCELLENCE

The program offers medical plan participants access to high-quality, specialized medical care at stateof-the art medical facilities as well as personalized nurse support and case management for organ transplants, bariatric (weight loss) surgery, cancer treatment and joint and spine surgery.

FUTUREME—FutureMe, Powered by NRECATM enables co-ops to create a tailored well-being program with the option of a customized rewards program, as it empowers participants to direct their well-being journey.

FUTUREME COACHING

Professional health coaches provided by WebMD help participants set personal health goals, adopt new habits, manage chronic conditions and more. Free, confidential access to a health coach is available seven days a week. 888.321.1521

FUTUREME PORTAL—Connects participants to an interactive, online well-being portal with easyto-use tools powered by WebMD.

HARP—The Health Care Audit Reward Program (HARP) encourages participants to review their health care bills. If a participant reports an error of $100 or more, he or she may receive 10% of the amount of the error, up to a maximum reimbursement of $5,000.

LIFE STRATEGY COUNSELING

Confidential counseling helps participants 18 years and older who are eligible to participate in the NRECA Medical Plan manage personal and emotional issues (e.g., depression, anxiety and substance

abuse). Trained counselors are available by phone 24 hours a day, seven days a week to provide information, resources and referrals. 888.225.4289

FIRST STEPS MATERNITY

PROGRAM—All expectant mothers are encouraged to call this program during their first trimester. A registered maternity nurse provides support and educational materials during pregnancy, labor and delivery. Screening for highrisk pregnancies and specialized case management for pregnancy complications are offered. Preconception counseling also is available. 800.526.7322

PREAUTHORIZATION/SHARE

The Simplified Hospital Admission REview Program provides preauthorization of health services, case management for complex cases and discharge planning to ensure appropriate care. Participants must contact SHARE before certain medical services, such as high-end radiology scans, extended care facility stays and home health care services to avoid a benefit reduction. 800.526.7322

RETIREE INSURANCE

SOLUTIONS—Offers Medicare Advantage, Medicare Supplement, Medicare Part D and dental and vision plans for post-65 retirees, their spouses and surviving spouses, as well as Medicaredisabled individuals through Via Benefits. 855.832.0978 or my.viabenefits.com/nreca

TAX-ADVANTAGED ACCOUNTS—

These accounts help participants offset out-of-pocket health care costs, and in some cases, dependent care costs. They include employer-owned health reimbursement arrangement (HRA) accounts, including a retiree HRA, and 125 Plans with flexible spending account options. Co-ops

may offer employee-owned health savings accounts through financial institutions, such as HealthEquity. healthequity.com/nreca

TELADOC HEALTH®—Phone, online and video consultations with board-certified doctors are available 24 hours a day, seven days a week as a convenient alternative to urgent care or emergency room visits for common ailments. Mental health consultations are also available by phone and video appointments with licensed mental health care providers. Certain fees and limitations may apply. 800.835.2362; teladochealth.com/ nreca

SERVICES

COBRA ADMINISTRATION BY UMR—Co-ops in the NRECA Medical Plan can elect to have UMR handle certain COBRA administrative tasks such as billing, collecting premiums, compliance and support for qualified beneficiaries.

CONFERENCES—NRECA hosts the Interact Conference annually at two locations across the country for benefits administrators and HR professionals. An annual Basic Benefits Training Course trains new benefits administrators and refreshes current ones on how to administer NRECA benefits. There are no core conference registration fees.

EMPLOYEE BENEFITS WEBSITE

Using this secure website, benefits administrators can process annual enrollments and employee benefits changes due to life or employment events, submit retirement and salary information, request projections, view and model insurance plans, see invoices

and payments and find forms and other resources to manage NRECA benefits. Participants also can find resources to help them get the most from their benefits, including medical claims information and checking prescription drug prices. Retirement plan participants can view statements, manage their 401(k) Plan investments and view other account information and educational materials. They can also use PLANNING CALCULATORS to calculate savings for retirement, college and more.

FIELD

STAFF—Your field representative and/or regional director is your local consultant on NRECA’s benefit plans. He or she can help you implement and keep up to date on employee benefits programs.

MEMBER CONTACT CENTER

If you have a question or need to speak with someone at NRECA, contact the Member Contact Center. It’s open Monday through Friday from 7 a.m. to 7 p.m. Central time. 866.673.2299 or contactcenter@nreca.coop.

PERSONAL INVESTMENT & RETIREMENT CONSULTING

(PIRC) TEAM—Planners provide RS Plan and 401(k) Plan participants with retirement planning and investment education. Services include telephone consultation and customized, confidential retirement and asset allocation plans. Onsite retirement planning, investment and money management workshops and one-on-one consultations are available. 866.673.2299, option 6, or pirc@nreca.coop

POSTRETIREMENT BENEFITS

VALUATION—The Financial Accounting Standards Board requires that postretirement benefits other than pensions (such as medical, dental, vision and life insurance) be reflected on a company’s financial records as earned during employment rather than when the benefit is paid in retirement. NRECA can perform an annual measurement of a co-op’s future expenses and accumulated liability associated with postretirement benefit payments. There is a fee for this optional service.

PUBLICATIONS

Benefits administrators receive two e-newsletters. BENEFITS FOCUS (monthly) and NRECA EMPLOYEE BENEFITS WEEKLY provide BAs and other co-op decision-makers with the latest information on NRECA benefits.

Medical plan participants receive ENERGIZE, a quarterly newsletter on well-being and prevention and group benefits plans and program topics.

As part of their 401(k) Plan statement, plan participants receive FINANCIAL POWER, a quarterly newsletter that addresses financial strategies and preparation for retirement. Content is customized to three different career stages plus retirees.

RS Plan participants receive FINANCIAL POWER RS with their annual statement. It highlights the unique advantages of a defined benefit pension plan and helps participants develop their retirement strategy.