BITCOINREBOUNDSAS STAGFLATIONPRESSURESMOUNT

MARKETSIGNALS

MarketRecoversWithBitcoin

ReclaimingKeyLevels

MACROUPDATE

Stag ation

PressuresMount:Fed

FacesPolicyDilemmaasIn ation

StaysHotandJobsCool

MarketRecoversWithBitcoin

ReclaimingKeyLevels

MACROUPDATE

Stag ation

PressuresMount:Fed

FacesPolicyDilemmaasIn ation

StaysHotandJobsCool

Bitcoinclosedtheweek4.2percenthigher,breakingathree-weekdeclineand reclaimingthecritical$112,500supportlevelafterdefendingthe$107,500range lows.Thisreboundfromthelowerendofthegapmarksanimportantstructural recovery, setting the stage for stability into late September and potentially stronger upside momentum in Q4. On-chain data supports this backdrop: the cost-basis distribution heatmap highlights clear dip-buying around $108,000, whilesupplyclustersbetween$110,000and$116,000nowdefinetheshort-term range. A decisive move above $116,000 would confirm renewed momentum; untilthen,consolidationremainsthebasecase.

Cohort behaviour reveals that 36 month holders realised $189 million in daily profits on average, accounting for nearly 80 percent of all short-term holder selling during the rebound. This profit-taking has acted as a near-term headwind,yetoverallmarketstructureremainsconstructive.Totalcryptomarket capitalisation rose 4.8 percent this week to $3.97 trillion, reflecting a cautious but persistent accumulation bias. While volatility persists, both BTC and the broader market appear to be stabilising, with conditions aligning for a recovery phaseonceresistancelevelsarecleared.

USeconomicconditionsareincreasinglydefinedbyadelicatebalancebetween stubborn inflation, weakening labour markets, and resilient—yet fragile—consumer behaviour. Augustʼs Consumer Price Index showed the sharpest increase since January, with broad-based gains in housing, food, and energy costs, much of it driven by tariffs and supply disruptions. At the same time,thelabourmarket hassoftenedconsiderably,withjoblessclaimsclimbing totheirhighestlevelsince2021andpayrollrevisionsrevealingthatemployment growthwasoverstatedbynearlyamillionjobs.

Shiftingtothehouseholdlevel,thesametensionsareplayingoutinsentiment and spending. Consumer confidence fell to its lowest reading since May, reflecting concerns about inflation and job security, while inflation expectationsremainelevated.Yetdespitethisgloom,spendingpatternsreveal resilience, with credit use expanding and households largely keeping up with their financial obligations. Families are drawing on savings and credit to maintainconsumption,sustaininggrowthintheneartermbutraisingquestions aboutsustainabilityifwagegrowthcontinuestolag.Together,thesedynamics highlight a fragile equilibrium: policymakers are caught between inflation controlandemploymentsupport,whilehouseholdsarestretchingtopreserve purchasingpower.

Meanwhile, the digital asset sector is seeing rapid shifts across exchanges, regulators, and corporates. In the US, Cboe plans to launch “Continuous Futuresˮ for Bitcoin and Ether this November, offering long-term exposure within a regulated framework. Hong Kong, meanwhile, is proposing to ease capital rules for banks holding compliant digital assets, aiming to attract institutions while keeping strict buffers for riskier tokens. On the corporate front, Cyprus-based Robin Energy completed a $5 million Bitcoin allocation, briefly sending its stock up more than 90 percent. Together, these moves highlight how crypto is becoming more embedded in global finance, through regulatedmarkets,evolvingpolicy,andcorporateadoption.

● MarketRecoversWithBitcoin ReclaimingKeyLevels

● RisingInflationandWeakeningJobs MarketPutFedinaTightSpot

● ConsumerSentimentWeakensasJob MarketSoftens,butSpending ResiliencePersists

● CboeSettoLaunch“Continuous FuturesˮforBitcoin&EtheronNovember 10,2025

● HongKongʼsProposaltoEaseCapital RulesforBanksHoldingCryptoAssets

Robin

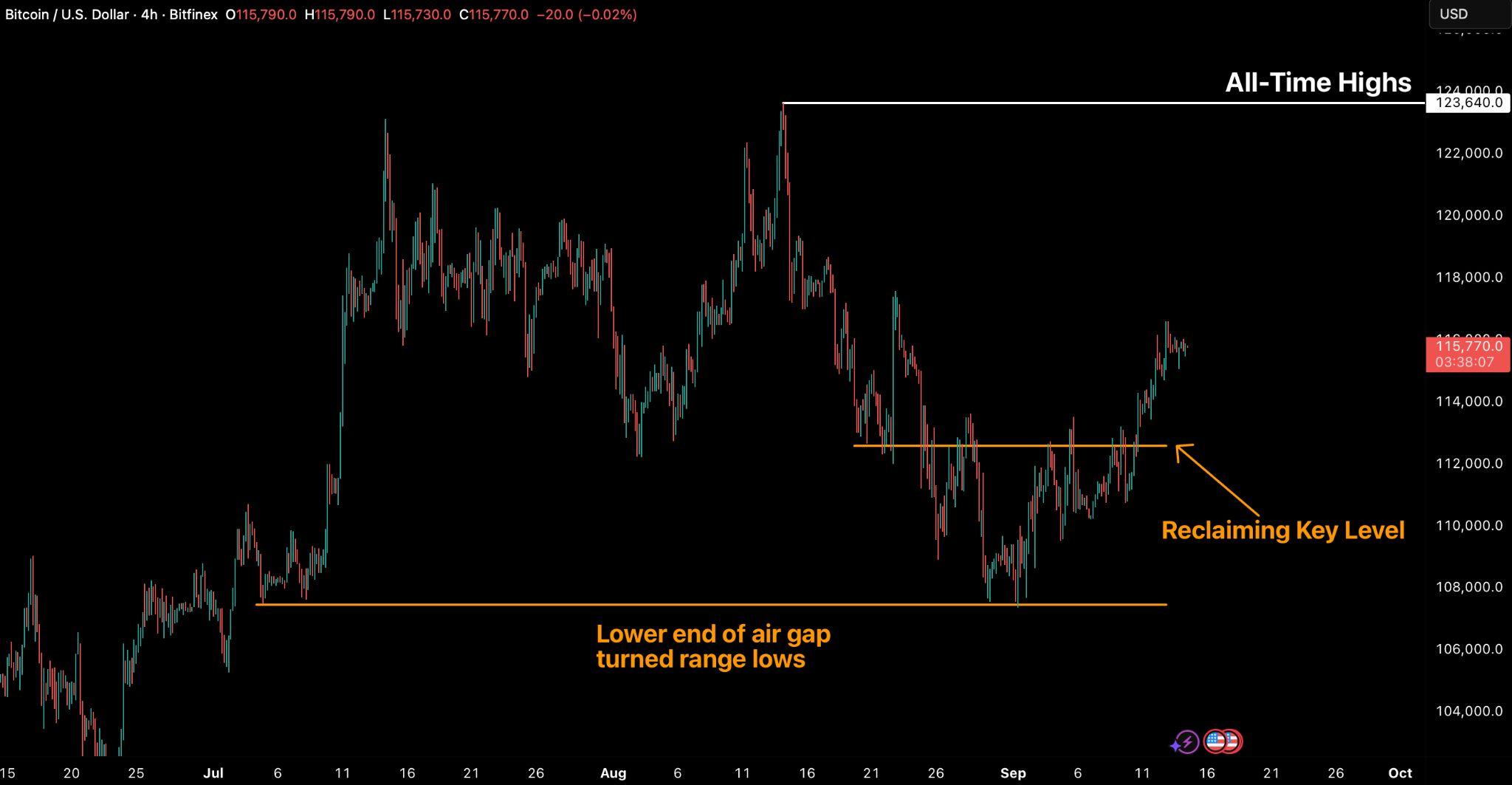

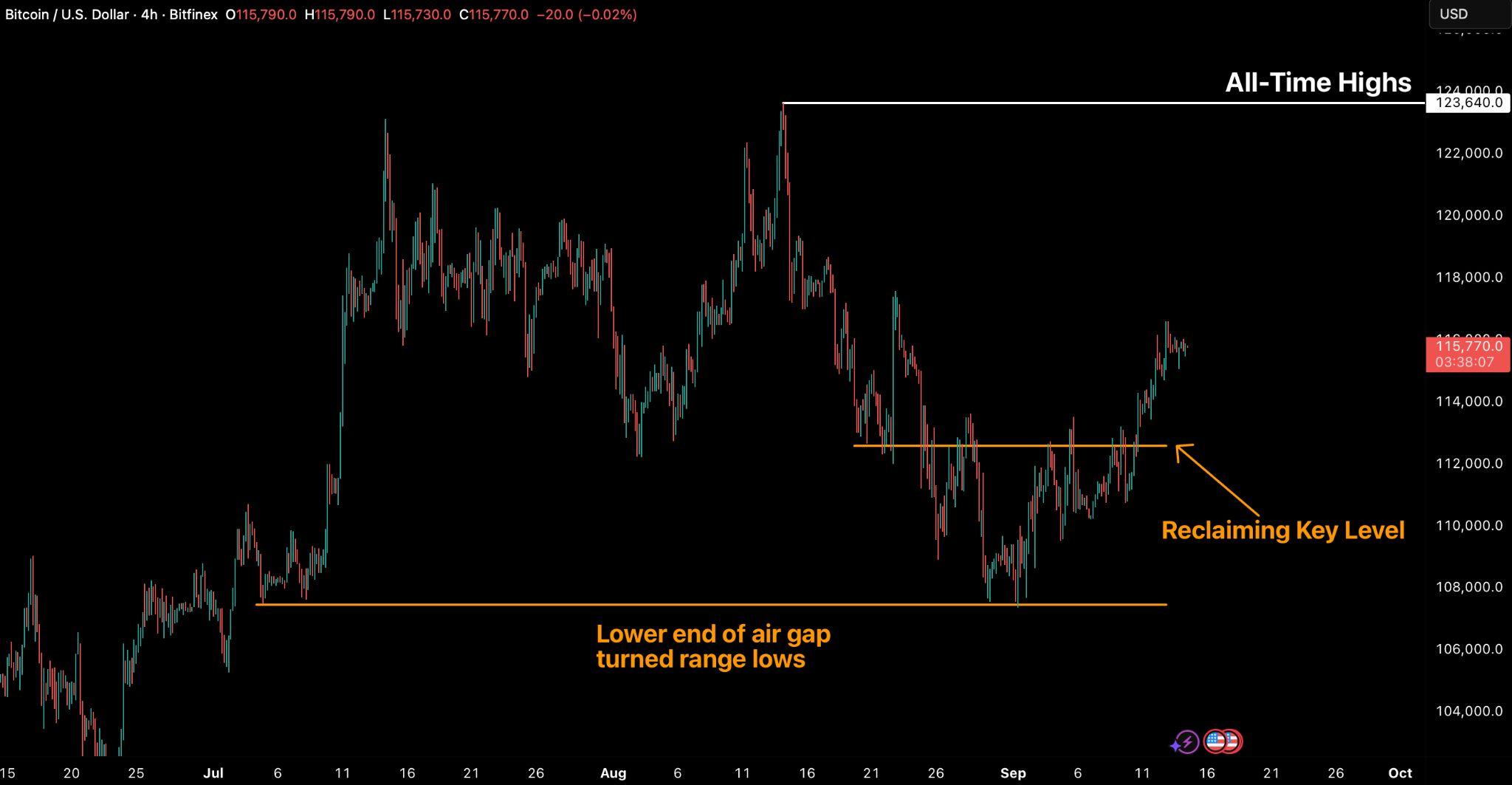

Bitcoinclosedthepastweekup4.2percent,breakingathree-weekdowntrend and a consolidation phase that followed the all-time high.Crucially,BTC has reclaimedthe$112,500levelaftersuccessfullydefendingthelowerendofthe airgap, thekeysupportzonenear$107,500.

Reclaimingandholdingtheselevelsissignificant,astheynowserveasabase ofsupport.Thistechnicalbackdropstrengthensthecaseforrecoveryintolate September and into the fourth quarter, consistent with our thesis that the marketcorrectionisnearingcompletiononlowertimeframes.Withstructural supportinplace,conditionsappearfavourableforarenewedpushhigherinto year-end.

Figure1.BTC/USD4HChart.Source:Bitfinex)

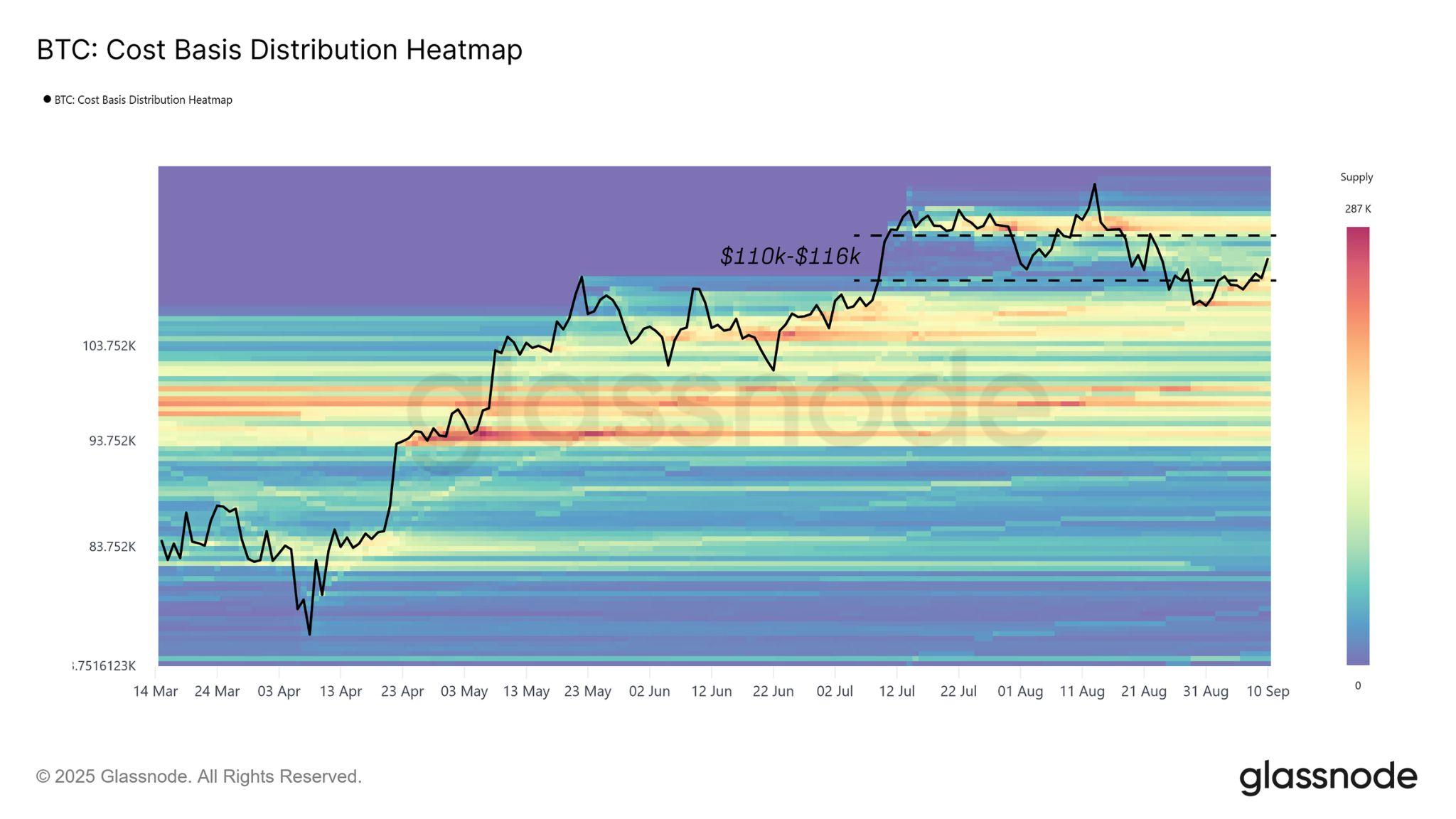

Since the mid-August all-time high, market momentum has steadily faded, pulling BTC back below the cost basis of recent top buyers and into the $108,000$116,000 “air gap.ˮ Price has since fluctuated within this band, gradually filling it as supply redistributes. The key question is whether this activityreflectshealthyconsolidationorthefirststageofadeepercontraction.

2.CostBasisDistributionHeatmap.Source:Glassnode)

The Cost Basis Distribution CBD, which maps supply concentration across acquisitionlevels,showsthatthereboundfrom$108,000wassupportedbyclear on-chain buy pressure, a textbook “buy-the-dipˮ structure that stabilised the market.However,BTCnowtradesattheupperedgeoftherangenear$116,000, whichremainsresistanceuntildecisivelyreclaimed.

Fornow,thebasecaseiscontinuedrange-boundpriceactionwithinthisairgap. Asustainedmoveabove$116,000likelysignalsrenewedmomentum,openingthe doorforamoremeaningfulrecovery.

With immediate supply clusters defining the current range, it is instructive to examinehowdifferentholdercohortsbehavedduringthereboundfrom$108,000 to$114,000.

Whiledip-buyingprovidedastabilisingbid,theprimarysourceofsellingpressure camefromseasonedShort-TermHoldersSTHs.The36monthcohortrealised approximately $189 million per day on a 14-day moving average basis, representingnearly79percentofallSTHprofits.

ThisdynamicsuggeststhatinvestorswhoaccumulatedduringtheFebruary–May correction used the recent bounce as an opportunity to exit profitably, creating meaningfulheadwindsforfurtherupsidemomentum.

3. BitcoinRealisedProfitbyAge.Source:Glassnode)

The total cryptocurrency market capitalisation rose 4.8 percent this week to $3.97trillion,addingnearly$182billioninvalue.Marketcapitalisationpeakedat $3.99 trillion during the week, with the low recorded at $3.77 trillion, a trading bandofroughly$220billion.

4.TotalCryptoMarketCapitalisationAcrossAllAssets. Source:CryptoCap)

This structure reflects ongoing volatility but also underscores the marketʼs underlyingupsidebias.Investorscontinuetopositionwithacautioustilttoward accumulation, suggesting that despite fluctuations, sentiment remains constructiveandsupportiveoffurthergrowth.

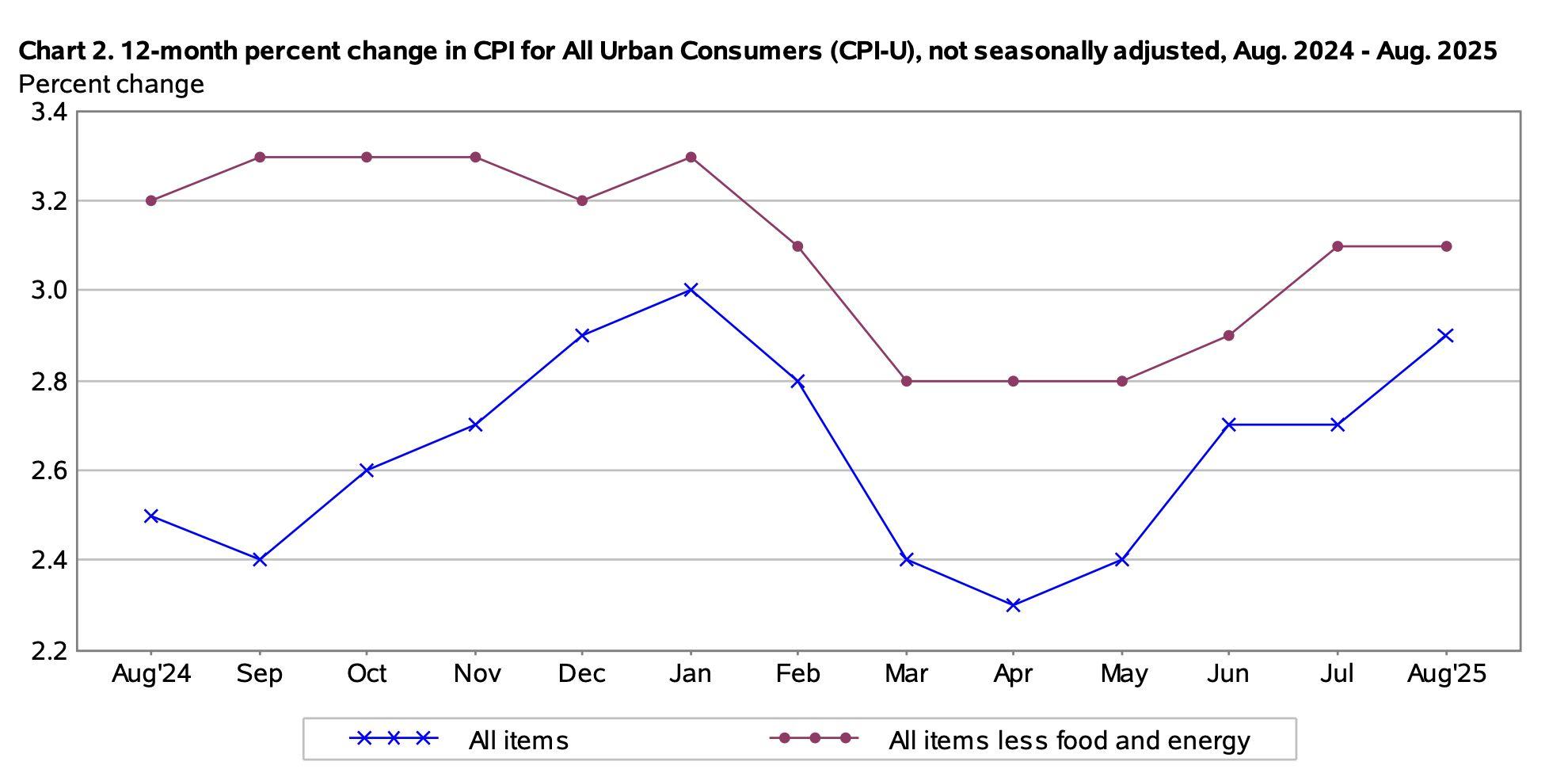

US consumer prices surged in August, adding to concerns that the economy is edging closer to stagflation, even as the labour market shows signs of strain. According to the Bureau of Labor Statisticsʼ Consumer Price Index CPI) report released on Thursday, September 11, headline inflation rose 0.4 percent month-over-monthand2.9percentyear-over-year—thesteepestincreasesince January.

Figure5.MonthlyPercentChangeinConsumerPriceIndex Source:BureauofLaborStatistics)

The jump was broad-based: housing costs advanced 0.4 percent, while food rose 0.5 percent, with supermarket prices climbing 0.6 percent. Fresh produce saw a 1.6 percent increase. Coffee prices also spiked by more than 20 percent compared to a year ago. Much of this was attributed to tariffs, farm labour shortages, and weather disruptions. Energy costs rose 0.7 percent, with gasolineup1.9percent.

Coreinflation,whichstripsoutfoodandenergy,alsoadvancedby0.3percentin Augustand3.1percentannually,showingstickypricepressuresinservicessuch as airline fares, which jumped 5.9 percent, and rents, which rose 0.4 percent. Tariff-related increases extended to goods like motor vehicles, apparel, and furnishings.

Source:BureauofLaborStatistics)

While inflation is running hotter than expected, the labour market is cooling sharply. The Labor Department reported last week that initial jobless claims jumpedby27,000to263,000,thehighestsinceOctober2021.Payrollrevisions showed US job growth may have been overstated by nearly 1 million in the 12 monthsthroughMarch.Recentmonthlyjobgainshaveslowedtojust29,000on average,downfrom150,000inJuly.Unemploymenthasedgedmodestlyhigher, underscoringasofteremploymentbackdrop.

Thiscombinationofrisinginflationandweakeningemploymenthighlightsarare dilemma for the Federal Reserve. The central bankʼs dual mandate of maximum employment and stable prices is pulling in opposite directions. Cutting rates aggressively risks entrenching tariff-driven inflation, while holding steady could worsenjoblosses.

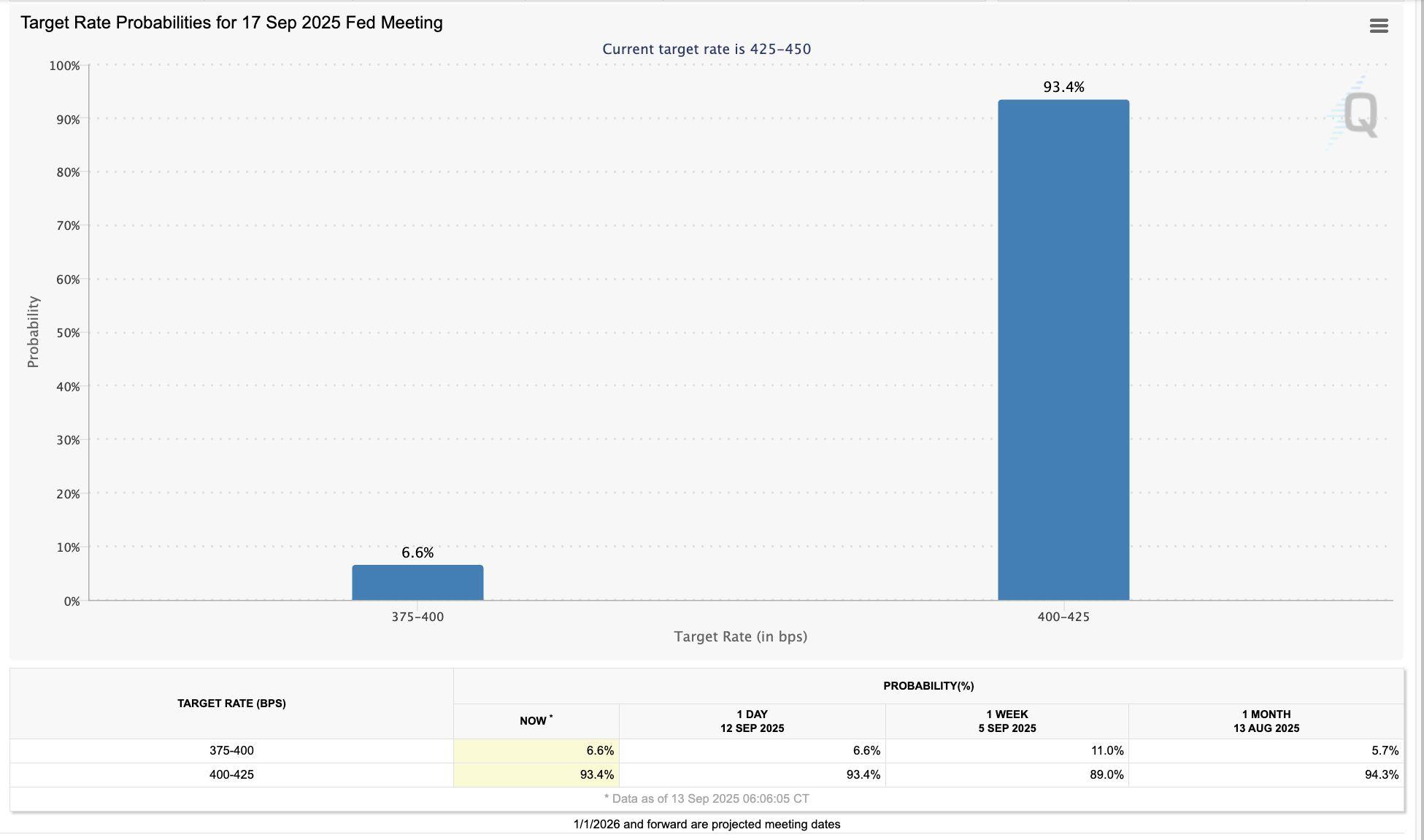

Despitetheserisks,marketshavefullypricedinaratecut.TheCMEFedWatch Tool shows a 93.4 percent probability that the Federal Open Market Committee FOMC)willlowerthefederalfundsrateby25basispointstoarangeof4.00to 4.25 percent at its meeting on Tuesday, September 17. The toolʼs conditional meetingprobabilitiesalsoindicatetwoadditionalcutsinOctoberandDecember, bringing this yearʼs total reductions to 75 basis points. Looking ahead, policymakers are expected to project an additional 75 basis points of easing in 2026, aligning the policy rate with the Fedʼs estimated long-run neutral rate of 3percent.

Figure 7. CME FedWatchTool - Conditional Meeting Probabilities

Figure8.TargetRateProbabilitiesforSeptember17,2025FedMeeting

Even so, Fed officials are likely to tread cautiously. Chair Jerome Powell will face pointed questions at his press conference about how the Fed intends to balance easing financial conditions with preventing an entrenchment of tariff-drivenpricepressures.

Forhouseholds,thepictureisclear:highergrocerybills,risingrents,andmore expensive travel are colliding with slower wage growth. With inflation proving stubborn and labour markets losing momentum, the September rate cut appearsallbutcertain.ButwhethertheFedproceedswithfurtherreductionsin October and December will depend on whether inflationary pressures begin to ease,oriftheUSeconomyslipsfurtherintothestagflationtrap.

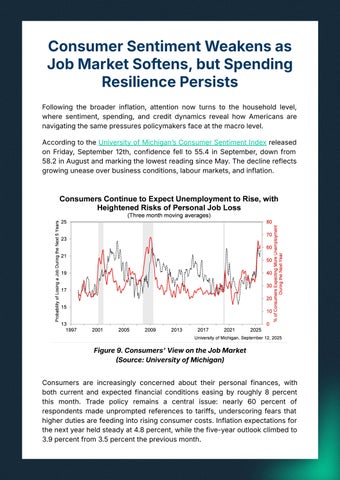

Following the broader inflation, attention now turns to the household level, where sentiment, spending, and credit dynamics reveal how Americans are navigatingthesamepressurespolicymakersfaceatthemacrolevel.

AccordingtotheUniversityofMichiganʼsConsumerSentimentIndexreleased on Friday, September 12th, confidence fell to 55.4 in September, down from 58.2inAugustandmarkingthelowestreadingsinceMay.Thedeclinereflects growinguneaseoverbusinessconditions,labourmarkets,andinflation.

Source:UniversityofMichigan)

Consumers are increasingly concerned about their personal finances, with both current and expected financial conditions easing by roughly 8 percent this month. Trade policy remains a central issue: nearly 60 percent of respondents made unprompted references to tariffs, underscoring fears that higherdutiesarefeedingintorisingconsumercosts.Inflationexpectationsfor thenextyearheldsteadyat4.8percent,whilethefive-yearoutlookclimbedto 3.9percentfrom3.5percentthepreviousmonth.

Fresh government data reinforced concerns about mounting weakness in the labour market. For the week ending September 6th, initial jobless claims climbed to 263,000—well above expectations of 235,000 and marking the sharpest level since late 2021. Alongside this, the Labor Department issued a majorpayrollrevision,revealingthatemploymentgainsoverthepastyearmay havebeenoverstatedbynearly1millionjobs.

Despite these headwinds, consumer spending behaviour continues to show resilience. Data from the Federal Reserveʼs consumer credit report for July, releasedlastMonday,September8,showedoverallcreditgrewata3.8percent annualrate.Revolvingcredit,whichincludescreditcards,rosesharplyata9.7 percent annual pace, while non-revolving credit, such as auto and student loans,advancedatamoremodest1.8percentrate.

Thebroadernarrativerevealsacriticaltension.Inflationremainsuncomfortably high due to tariffs and rising food and energy costs, while the labour market, once the bedrock of resilience, is weakening more rapidly than policymakers anticipated. Consumer sentiment has deteriorated, showing households are aware of these risks, yet spending and credit use suggest that financial cushions, such as accumulated savings and steady bill payments, are still supportingactivity.

This combination implies that the US economy is not collapsing into recession but is instead entering a stagflation-lite environment, where growth slows, inflation lingers, and consumers lean on credit to maintain spending power. Such conditions create a fragile equilibrium: households may sustain consumption in the short term, but prolonged reliance on debt in the face of slowerwagegainscouldquicklyerodestability.

● Cboe Global Markets will launch Bitcoin and Ether Continuous Futures contractsonNovember10,2025,pendingregulatoryapproval,offering US investors long-term, regulated exposure to crypto with contracts lastingupto10years

● TheseproductsmimicoffshoreperpetualfuturesbutoperateunderUS regulation, using cash settlement and transparent funding rates, targeting both institutional and retail traders while supported by educationalinitiatives

Cboe Global Markets announced last Tuesday, September 9, that, pending regulatory approval, it will begin offering Continuous Futures contracts for Bitcoin and Ether on its futures exchange CFE, starting November 10, 2025. ThesenewderivativesareintendedtogiveUSinvestorslong-termexposureto cryptocurrenciesinamorestreamlined,regulatedframework.

Unlike traditional futures contracts, which often expire periodically and require theholderto“rolloverˮpositionsintonewcontracts,CboeʼsContinuousFutures contracts are designed to have a 10-year expiration, meaning that traders can holdpositionsformuchlongerwithoutfrequentcontracttransitions.Theywillbe cash-settled and tied closely to real-time spot market prices via daily cash adjustments,usingatransparentfunding-ratemethodology.

Thesecontractsaimtoreplicatethepopular“perpetualfuturesˮstyleproducts that have gained widespread use in offshore or unregulated crypto markets. Still, Cboeʼs version will operate within the US regulatory and clearing architecture. Contracts will be cleared through Cboe Clear US, a derivatives clearingorganisationregulatedbytheCommodityFuturesTradingCommission CFTC.

Cboeexpectstheproducttoappealnotjusttoinstitutionalmarketparticipants whoalreadytradefuturesorengageinportfolioriskmanagement,butalsotoa growing segment of retail traders seeking exposure to crypto derivatives withoutsteppingoutsideregulatedmarkets.Toaidadoption,thefirmʼsOptions Institute will host educational sessions in late October and November to help thepublicunderstandtheseContinuousFuturescontracts.

Overall, this move represents a continuation of Cboeʼs product innovation roadmap, expanding its derivatives offerings in digital assets alongside its existingvolatility,equity,andglobalfixed-incomeproducts.

● Hong Kongʼs HKMA proposed new bank capital rules CRP1) to take effectin2026,loweringcapitalrequirementsforcompliantorlicensed cryptoassetslikeregulatedstablecoins,whilekeepinghigherbuffers forriskier,unregulatedtokens

● The framework classifies assets into risk buckets and ties lighter treatment to strong risk controls,aiming to balance financial stability withHongKongʼspushtobecomearegionalhubfordigitalassets

Hong Kongʼs banking regulator, the Hong Kong Monetary Authority HKMA, released a draft consultation paper (module CRP1 in the Supervisory Policy Manual)lastWednesday,September10,outliningproposedadjustmentstothe capital requirements for banks holding exposures to digital assets. Under the new framework, expected to take effect in early 2026, banks may face lower capital buffer requirements for certain crypto assets, especially those that are “compliant,ˮlicensed,orotherwisesubjecttorobustriskcontrols.

Akeyelementoftheproposalistheclassificationofcryptoassetsintodifferent riskbuckets,dependingonfactorslikewhethertheyarestablecoins,tokenised traditionalassets,orunbackedcryptocurrencies(e.g.BitcoinorEthereum).For example,stablecoinsthatmeetregulatory/licensingcriteriaunderHongKongʼs “StablecoinOrdinanceˮmaybenefitfromlightercapitaltreatment.

The draft also tightly ties compliance and risk management to whether banks can earn the lowered risk weights: to qualify, banks must have effective risk controls(e.g.,forvolatility,fraud,andoperationalortechnicalrisks).

This move is part of Hong Kongʼs broader strategy to position itself as a regionalhubfordigitalassets.Byclarifyingandeasingburdensforcompliant, licensed crypto assets, Hong Kong hopes to attract more financial institutions intoregulatedcryptoexposures.

However, riskier assets, those that do not meet licensing or classification criteria,areexpectedtostillcarryrelativelyhighcapitalrequirements.Inother words,HongKongisseekingabalance:easingforsome,strictforothers.

In sum, the HKMAʼs proposed rules CRP1) signal a move toward more nuanced, risk-based crypto regulation for banks, trying to align with forthcoming Basel Committee crypto-asset standardisation, whilst also safeguardingfinancialstability.

Robin Energy Nasdaq: RBNE, a Cyprus-based energy transportation firm, finaliseditsfirst$5millioninvestmentinBitcoinlastWednesday,September10, markingitsentryintodigitalassetsaspartofadiversificationstrategy.

Shares of RBNE spiked more than 90 percent on Wednesday, reaching an intradayhighof$4.27beforetrimminggains.Accordingto GoogleFinance,the stock had been trading steadily around $1.87 throughout August. Earlier this year, on June 13, RBNE briefly touched an all-time high of $14 despite the absence of company announcements, followed by a $5.1 million capital raise throughinstitutionalsharesalesat$5.25persharejustthreedayslater.

The move aligns RBNE with a growing list of publicly traded energy companies exploring cryptocurrency exposure. The energy sector and crypto have long shared synergies: oil and gas producers have historically used flared gas to power Bitcoin mining, while crypto mining firms have increasingly leveraged theirinfrastructuretoprovidebroadercomputingservices.

RobinconfirmedthattheallocationwasexecutedviaAnchorageDigitalBank.

“We are pleased to have completed the allocation of $5 million to Bitcoin in accordance with our board-approved strategy. We believe in Bitcoinʼs unique characteristics as a scarce digital asset and see it as an integral component of our long-term strategy to grow our Company further and drive shareholder value,ˮsaidCEOPetrosPanagiotidis.

Robin Energy specialises in the global transportation of petrochemical gases and refined petroleum products. At the time of reporting, RBNE was trading around$2.78.