MACRODETERMINING BTCPRICE

BitcoinRebounds

MACROUPDATE

TradeShifts,BondMarket Risks,andaCoolingLabor Landscape

BitcoinRebounds

MACROUPDATE

TradeShifts,BondMarket Risks,andaCoolingLabor Landscape

Bitcoin rebounded from the $112,000 lows, reclaiming the $115,800 range floor, afterETFoutflowsearlyinAugustreversedsharplyinto$769millionofnetinflows over three sessions. This recovery, alongside steady accumulation by crypto treasury firms now holding nearly $90 billion in digital assets, has restored short-term confidence, price has broken past range highs near $119,500, but it remainstobeseenifthisbreakoutoverresistancesustains.Thepriceisoscillating aroundtheshort-termholdercostbasisof$106,709,keepingconditions“warmbut not overheatedˮ and consistent with mid-cycle bull phases.

With 70 percent of short-term holder supply still in profit and profit-taking activity cooling to 45 percent, the market is balanced but highly sensitive to macro catalysts,meaningkeyUS inflation data this week coulddecidewhetherBTC pushes for new all-time highsorslipsbacktoward $110,000.

After months of calm in financial markets, a confluence of shifting trade policies, evolvingbondmarketdynamics,andsofteningeconomicdataissettingthestage for a more volatile close to the year. Pending US tariffs threaten to raise costs, disrupt supply chains, and pressure employment, while the bond marketʼs rising term premium — now at 0.65 percent — signals heightened uncertainty over future Fed policy, especially if inflation accelerates post-tariffs. Manufacturing ordersfell4.8percentinJune,underscoringunevendemandandthechallenges businessesfaceinsecuringgoodsaheadofholidayseasondisruptions.

The labour market is also cooling, with job growth slowing, significant downward revisions to prior employment data, and services sector activity stagnating just above contraction levels. Rising service-sector input costs add inflationary pressure, yet improving worker productivity — up 2.4 percent in Q2 — offers a crucialbuffer,suggestingthattechnology-drivenefficiencygainsmayhelpsustain growthinasofterhiringenvironment.

Inthecryptospace,BitMineImmersionTechnologieshasrapidlybuilt theworldʼs largest Ethereum treasury, amassing over 833,000 ETH worth $2.9 billion in just fiveweeks,positioningitselfasamajorinstitutionalplayeralongsidebackerssuch asARK,Pantera,andGalaxyDigital.PolicyshiftsunderPresidentTrumparealso reshapingtheindustryʼslandscape.

Arecentexecutiveorderopensthedoorfor 401(k)andotherretirementplansto include alternative assets, including digital assets, potentially driving mainstream adoption. Another order prohibits politicised debanking, explicitly protecting crypto firmsʼ access to banking services and dismantling barriers erected under previousregulatoryregimes.

Overthepastweek,Bitcoinhasmanagedtoreclaimtherangelowsitbrokeon August 1st, bouncing back, as we forecast last week, from the $112,000 supportlevel. Thesuccessfulrecoveryaftermultiplefailedattemptstomove backabovethe$115,800rangelowsuggeststhatunderlyingmarketstrength towards the upside remains intact. Even though the range highs above $119,500 have been broken on the first attempt,it remains to be seen if the breakout sustains. BTC. continues to trade in a “wait-and-watchˮ zone. Meanwhile, the drop in Bitcoin dominance signals an ongoing rotation of speculative capital towards altcoins, reflecting shifting short-term market focus.

Therecentrecoveryinexchange-tradedfundETF)flowshasbeentheprimary catalyst behind the latest market strength, supported by sustained Bitcoin accumulation from crypto treasury companies and, more recently, by new entrants adopting similar strategies for Ethereum. While ETF flows turned sharply negative at the start of August, the reversal was swift. Whereas between 31 July and 5 August, spot Bitcoin ETFs saw net outflows exceeding 1,500BTC,equivalenttoroughly$1.45billion—thelargestfour-daystretchof selling from these vehicles since April 2025 - that all reversed between 68 August(seeFigure2below).Indeed,historically,suchepisodesofpronounced outflows have been brief, with limited instances of sustained sell-side pressure.

Source:FarsideUK

This backdrop explains the mechanical rebound from the $112,000 lows. In the three trading sessions since August 5th, US-listed spot BTC ETFs have attracted $769millioninnetinflows,helpingtorestoreconfidence.Whetherthismomentum continueswilllikelydependonkeyUSmacroeconomicreleases,withCPIandPPI data due this week. Given the close relationship between ETF flows and macroeconomic outcomes in recent months, these figures could be pivotal in determiningwhetherBTCbreaksaboverangehighstowardnewall-timehighs,or insteadretestsrecentlows.

With market sensitivity to macro events running high, traders should prepare for increasedvolatilityandthepossibilityofaretracementtoward$110,000inthenear term.Evenso,thebroaderstructuraloutlookremainsconstructive,underpinnedby sustained institutional accumulation, expanding treasury adoption, and resilient spotdemand.

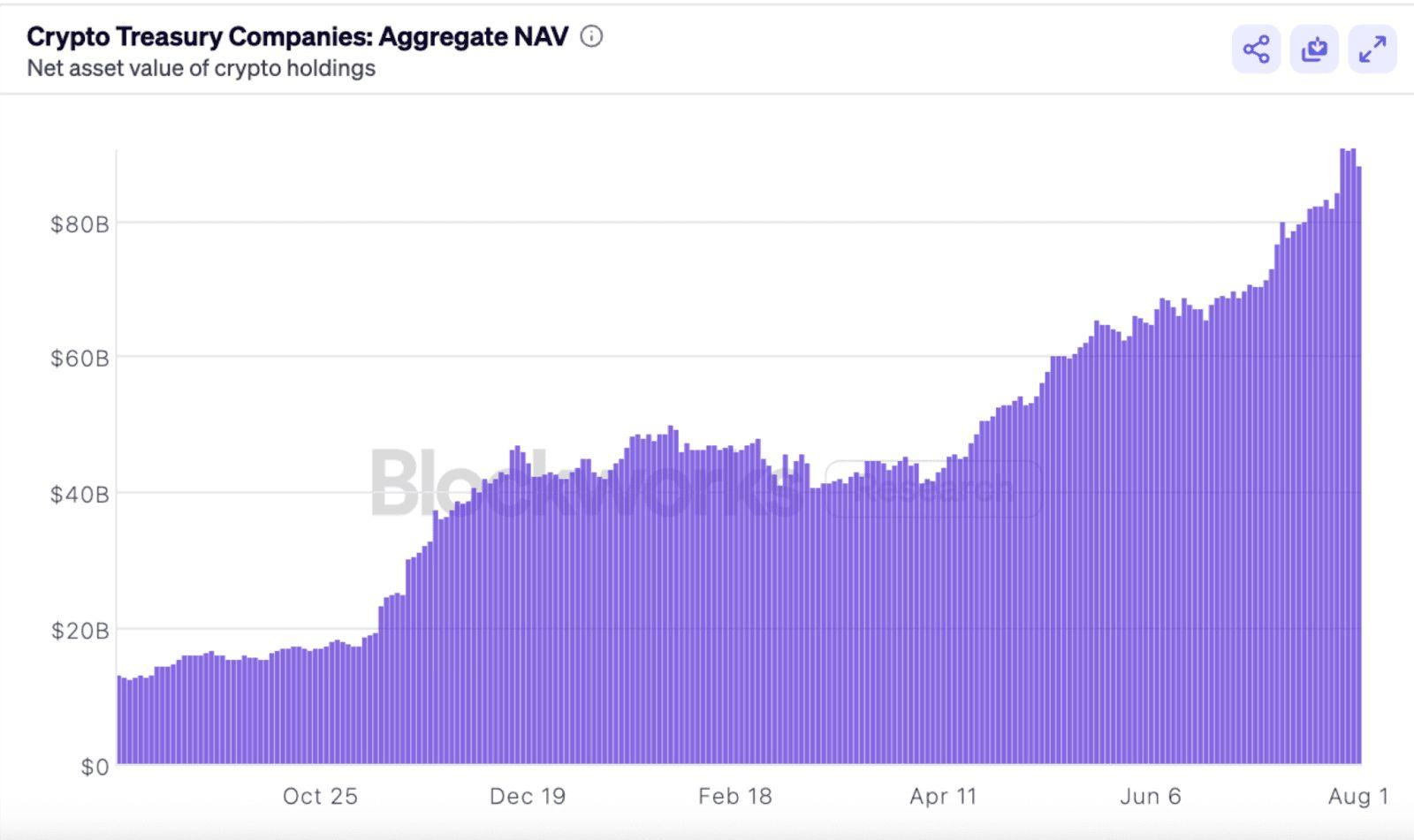

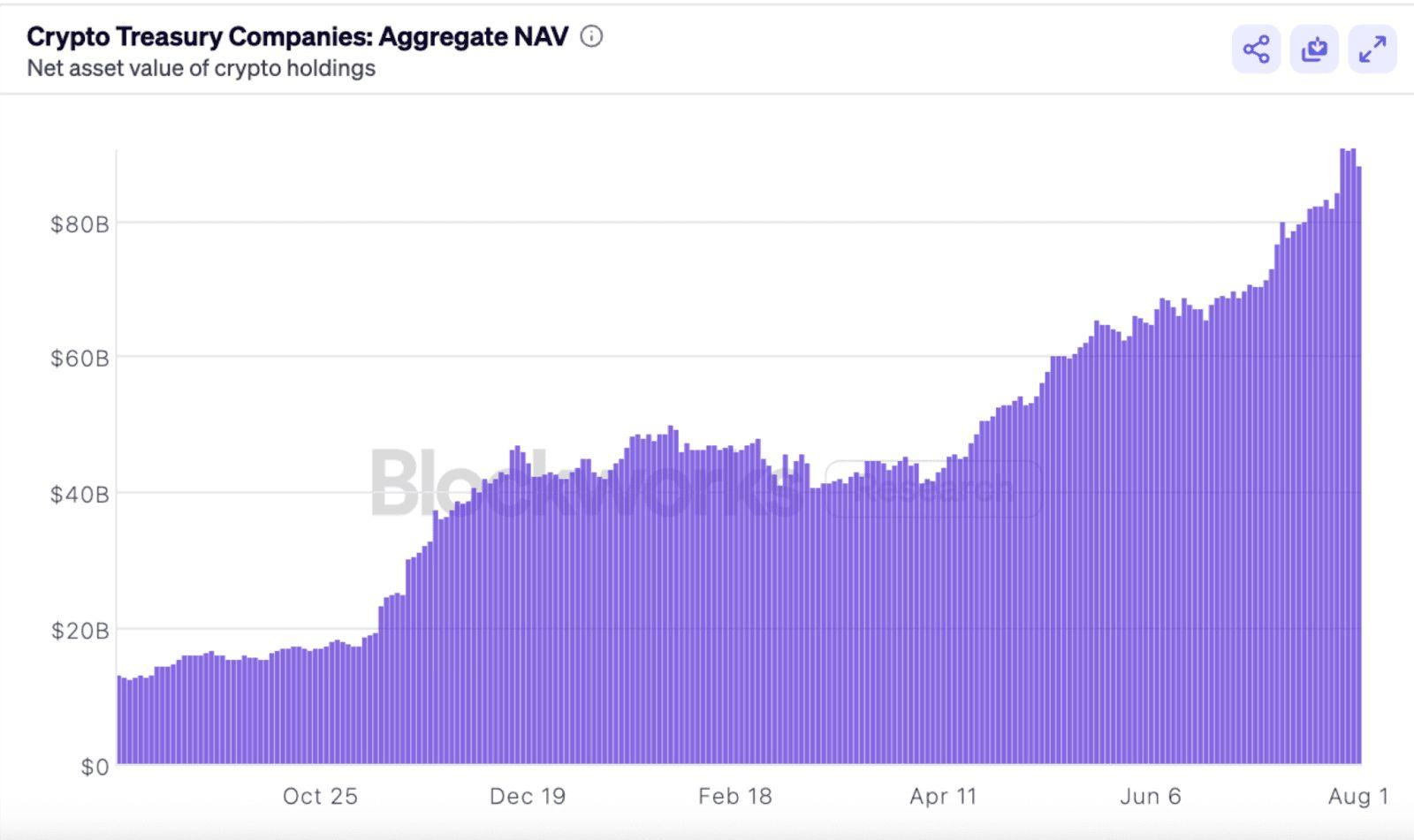

The recent surge in value, supported by steady passive inflows from price-agnostic investors who commit to regular monthly purchases, has been amplified by treasury companies and corporates increasingly following the “MicroStrategyPlaybook.ˮ

Source:Blockworks)

The combined net asset value of crypto treasury companies has continued to strengthen, rising steadily since early April to approach all-time highs above $90 billion.Thissustainedgrowthunderscorestherisingconfidenceamonginstitutions integratingdigitalassetsintotheirbalancesheets,reflectingabroadershifttoward treating these holdings as strategic reserves rather than speculative trades. With momentum showing no signs of slowing, corporate crypto exposure is becoming progressively more entrenched as the market advances deeper into the current cycle.

Despite this buying pressure we believe that the current ranging conditions and oscillatorypriceactionarelikelytopersist,withBTCtradingwithinstatisticalbands derivedfromtheBTCshort-termholderSTH)costbasis—theaverageacquisition priceforallnewholdersoverthepast155days.Thismetricoftenactsasauseful referencepointfornavigatingprevailingmarketstructure.

4. BitcoinShort-Term

Price. Source:BitcoinMagazinePro)

At present, BTC price remains in a “warm but not overheatedˮ zone, holding above the STH cost basis of $106,709. Such positioning is typical in the mid-phaseofaBitcoinbullmarket,withtheSTHcostbasishistoricallyservingas akeythresholdbetweennear-termbullishandbearishregimes.

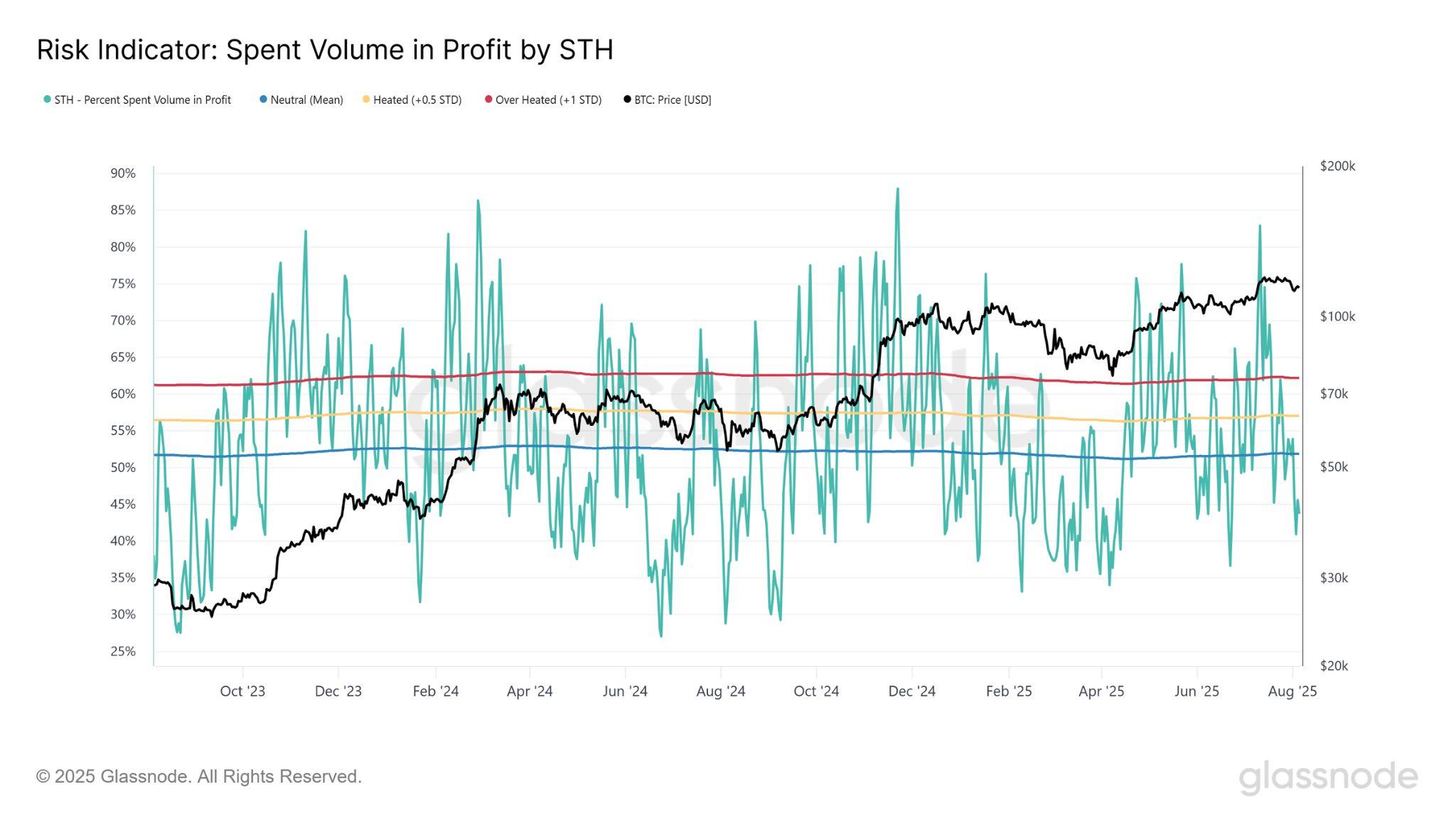

Togaugetheimpactoftherecentpullbackoninvestorbehaviour,itisusefulto examine the percentage of spent volume originating from short-term holders STHsinprofit—ameasureofhowmanyrecentlyacquiredcoinsarebeingsold forgains.

This proportion has eased to 45 percent, falling below the neutral threshold. Overall, the data indicates a relatively balanced market backdrop, witharound70percentof supply still held in profit and an almost even split between profit-taking and loss-realisation among coins currently in motion. This is precisely why we believe that the ranging conditions and oscillation between the range highs and lows will continue, since price is constantly moving above and below the cost-basis of fresh buyers allowing for charged sentiments around key macro datareleases.

Afteracalmstretchinfinancialmarketsmarkedbylowvolatilityandsteady investoroptimism,conditionsareshifting.AcombinationofloomingUStrade policy changes, evolving bond market dynamics, and signs of cooling in manufacturing activity point to a more turbulent second half of the year. Businesses are bracing for higher import taxes, investors are re-evaluating interestraterisks,andeconomicdatarevisionsareraisingconcernsoverthe reliabilityofofficialstatistics.

The summer lull in both equity and bond market volatility—reflected in the relative calm of the VIX and MOVE indices—had created a sense of stability in financial markets. However this has been disrupted by recent substantial revisions to US employment figures, which has rattled confidence in federal economic reporting. Attention has also started turning again to the real-world impact of upcoming tariffs, which could increase costs for businesses and consumers,disruptsupplychains,andinfluenceemploymenttrends.

In the bond market, the 10-year US Treasury yield has remained between 4.154.5 percent since March, but this stability has masked the rising “term premium,ˮ which is the extra return investors demand for holding longer-term bonds because of uncertainty over future monetary policy (see charts above). The current term premium is estimated at 0.65 percent, a notableshiftfrommuchofthepastdecadewhenitwasnegative.Investors appear to be pricing in the risk that the Federal Reserve may raise rates againifinflationacceleratesaftertariffstakeeffect.BylateJuly,the10-year yield of 4.4 percent reflected an expected federal funds rate of about 3.70 percent plus a 0.75 percent term premium—levels more in line with the higher-rateenvironmentofthe1990sandearly2000sthanthepost-financial crisiseraoflowrates.

Meanwhile,thelatestCensusBureaudatashowsthatnewordersfor manufacturedgoodsinJunefellby$30.9billion,or4.8percent,to$611.7 billion,markingdeclinesintwoofthelastthreemonths.Thisfollowedan8.3 percentincreaseinMay.

Withanarrowwindowtosecureholiday-seasongoodsbeforetariffstake effect,businessesmustnavigateacomplexenvironment—balancinghigher costs,slowingordergrowth,andtightersupplytimelines.Theinteractionof tradepolicyshifts,risingbondriskpremiums,andmixedmanufacturing trendssuggestsamorevolatileanduncertainclosetotheyear,with potentialrippleeffectswellinto2026.

TheUSeconomyis delicatelybalancedbetweenresilienceandslowdown. Job creation is losing momentum, services activity is stagnating, and businessesremaincautious,yetlayoffsarestillrestrainedandproductivity hasrebounded.Thismixofsignalssuggeststhelabourmarketisshifting from rapid post-pandemic growth to a more subdued phase, where opportunities are fewer, but the overall system has not tipped into contraction.

Initial unemployment claims rose by 7,000 to 226,000 in the week ending August 2, the highest in a month, according to the US Department of Labor. While this slight uptick indicates some cooling, the figures remain within a stable range seen over the past 10 weeks, pointing to a “no hire, no fireˮ environment. Continued claims—reflecting those still receiving benefits after their first week—climbed to 1.974 million, the highest since November 2021. This signals that workers who lose their jobs are taking longer to find new ones, highlighting the growing mismatch between job seekers and available openings.

TheweaknessbecameclearerafterJulyʼsjobgrowthfellshortofexpectations, and employment data for May and June was revised down by nearly 260,000—oneofthesteepestnon-pandemiceradownwardrevisionsonrecord. The revisions shook confidence in the reliability of labour data and intensified concerns over an already slowing job market. The uncertainty surrounding the Trumpadministrationʼstariffpolicieshasalsokeptbusinesseshesitanttoexpand payrolls,whiletighterimmigrationpolicieshavereducedlaboursupply,keeping theunemploymentrateat4.2percentdespiteslowerhiring.

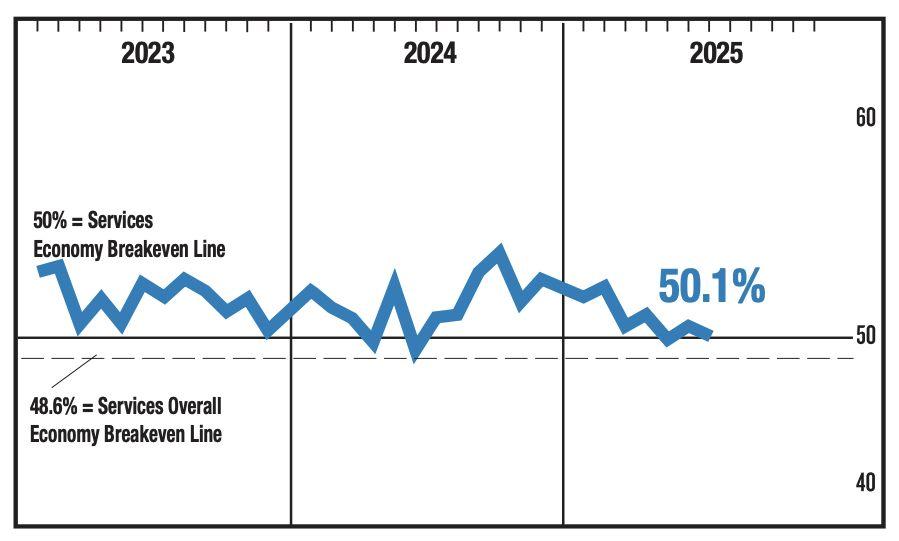

The services sector—which powers over two-thirds of the US economy—echoes the same slowdown. The Institute for Supply Managementʼs non-manufacturing PMIforJuly,slippedto50.1inJuly, barely above the threshold that separates growth from contraction. New orders weakened, export demand contracted for the fourth time in five months, and service-sector employment dropped to its lowest level since March. Employment in this sector has contracted in four of the last five months, reinforcing the picture of a labour market losing steam fromthedemandsideaswell.

Adding pressure, service-sector pricegrowthaccelerated.TheISMʼs prices paid index surged to 69.9, the highest since October 2022. Persistent input cost increases could limit profit margins or be passed on to consumers, adding strain to an economy already wrestlingwithinflation.

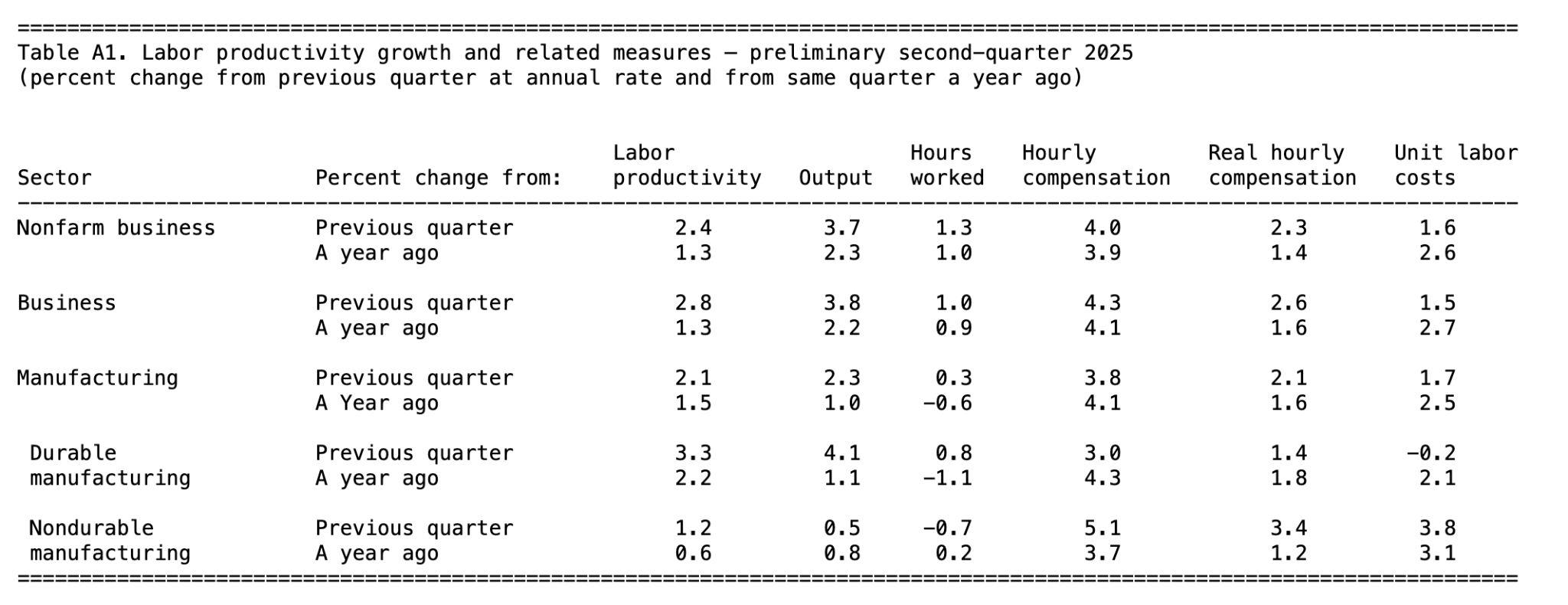

However, one counterweight to this slowdown is improving productivity. In the second quarter, worker productivity rose 2.4 percent—beating expectations—afterasharpdropearlierintheyear.AccordingtotheUSBureau of Labor Statisticsʼ Productivity and Cost report, output per worker grew 3.7 percent, the strongest since late 2023, while growth in labour costs slowed significantly.

Economists suggest this may reflect companies investing in labour-saving technology, including artificial intelligence, to offset high wages and labour shortages. In the long term, such efficiency gains can help keep inflation in checkandsupporteconomicgrowth,eveninacoolerhiringenvironment.

These trends reveal a transition phase for the US economy: the explosive growth of the recovery period is fading, but underlying stability—helped by restrained layoffs and productivity improvements—remains intact. In this environment,productivitygrowthmaybecomeoneofthemostcriticalbuffers againstbothinflationandrecessionrisk.

In a display of financial agility and strategic ambition, BitMine Immersion Technologies NYSEAmerican: BMNR has amassed over 833,137 ETH, valued at more than $2.9 billion, as of August 3, 2025, establishing itself as the largest Ethereum treasury globally. Remarkably, this accumulation transpired within just five weeks of launching its ETH Treasury initiative on June 30, making BitMine now the third-largest crypto treasury worldwide, behindonlyMicroStrategyandMaraBlockchain.

Thomas Lee, the companyʼs Board Chair, characterised the rapid portfolio expansion as “lightning speed,ˮ underscoring BitMineʼs distinct velocity in elevating its crypto net asset value per share amid robust stock liquidity. Bolstering its institutional credentials, veteran investment figure Bill Miller III has taken a significant stake in the firm, joining a roster of major backers that includes Cathie WoodʼsARK,FoundersFund,Pantera,Kraken, DCG, and Galaxy Digital—all aligned behind BitMineʼs ambitious 5 percent Ethereum acquisitionstrategy.

15.BitMineBoard Chair,ThomasLee

Meanwhile,thecompanyʼsshareshaveemergedasamongthemostactive, trading an average of $1.6 billion daily, ranking it as the 42nd most liquid equity—justbehindUberamongUSlistings

Last Thursday, August 7th, President Donald J. Trump issued a landmark ExecutiveOrderaimedatliberating401(k)anddefined-contributionretirement plans from traditional investment constraints by empowering participants to include alternative assets—such as private equity, real estate, and digital assets—for greater return potential and portfolio flexibility. The Order mandates the Secretary of Labor to reassess fiduciary duty standards under ERISA,mappingaclearerpathfortrusteestoevaluateandauthoriseinclusion ofthesenontraditionalinstrumentswithinassetallocationframeworks.Italso calls for interagency coordination—especially with the Treasury and the SEC—to ensure consistent regulatory alignment, instructing the SEC to adapt its regulations to facilitate lawful adoption of alternative-asset strategies in participant-directedretirementofferings.

Framing the change as a triumphant shift from prior overregulation, the initiative revokes earlier guidance issued under the previous administration governing digital assets, advancing the Trump Administrationʼs broader narrative of democratizing wealth-building tools and reinforcing Americaʼs position as a global crypto leader, while underpinning his domestic “Make America Wealthy Againˮ vision through tax relief and eased regulatory burdens.

President Donald J. Trump has signed an Executive Order prohibiting banks fromdenyingservicesbasedonpoliticalorreligiousbeliefs,orlawfulbusiness activities—amovethatdirectlynamesthedigitalassetsectorasapasttarget ofunfairdebanking.

Theorder:

● Removes “reputational riskˮ as a regulatory justification for account closures.

● Requires banks to reinstate clients previously debanked for political or religiousreasons.

● Orders regulators to review past debanking cases and take corrective action.

● Directs Treasury to develop a long-term strategy to prevent politicised debanking.

Whyitmattersforcrypto:

Cryptofirmshavelongstruggledwithbankingaccessunderwhattheprevious US administration called Operation Chokepoint 2.0. The current White House says this policy has now been dismantled, aiming to give exchanges, payment processors,andserviceprovidersequalaccesstothefinancialsystem.

Theimpactofthisordernowhingesonhowaggressivelyregulatorsenforcethe reinstatement mandate — and whether banks adjust risk policies in favor of broadercryptoaccess.