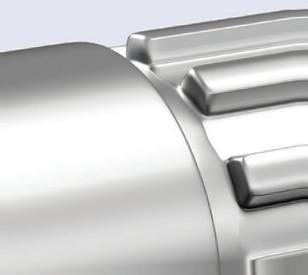

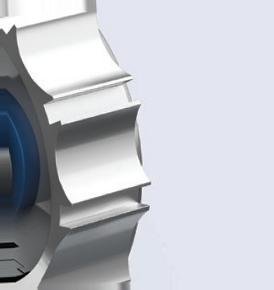

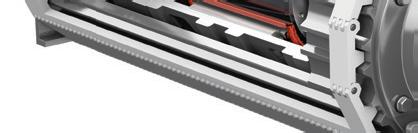

The new SSV-XP Drum Motor features an belt profile is machined onto the drive sleeve which can be easily removed and for another slee the belt required on the conveyor without

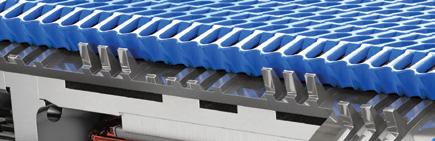

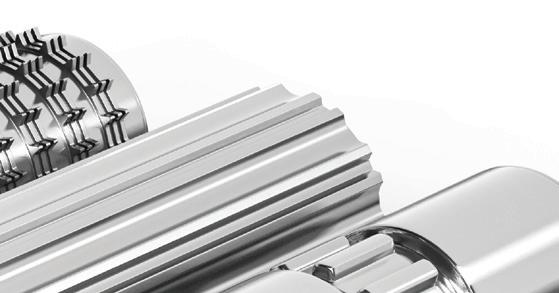

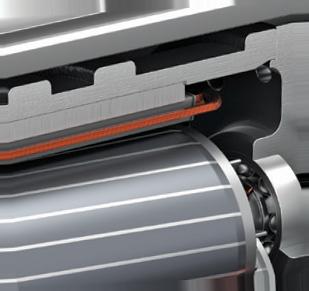

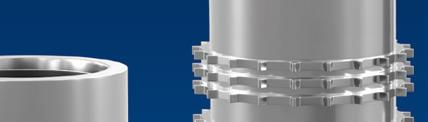

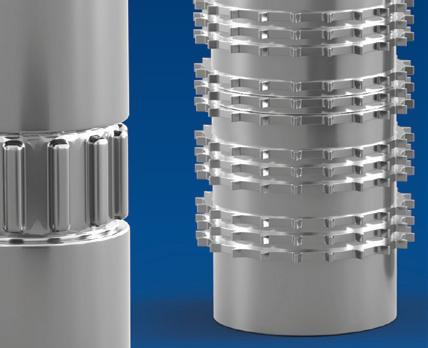

The new SSV-XP Drum Motor features an exchangeable profiled sleeve. The belt profile is machined directly onto the drive sleeve (XP) which can be easily removed and exchanged for another profiled sleeve to match the belt required on the conveyor without changing the drum motor.

ELIMINA D k

ELIMINATE Drive Sprockets

ELIMINA Product Buil

ELIMINATE Product Buildup

ELIMINATE Bacterial Harborage

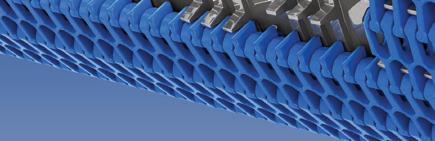

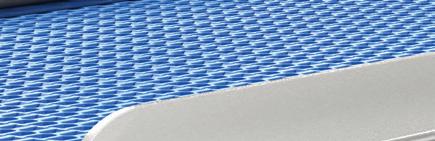

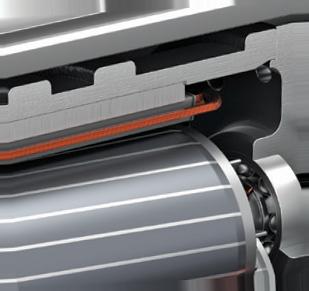

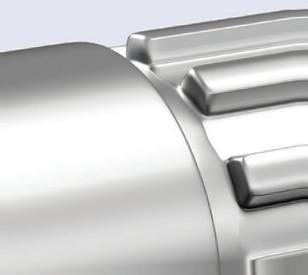

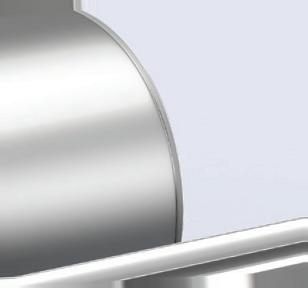

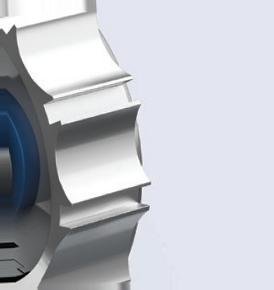

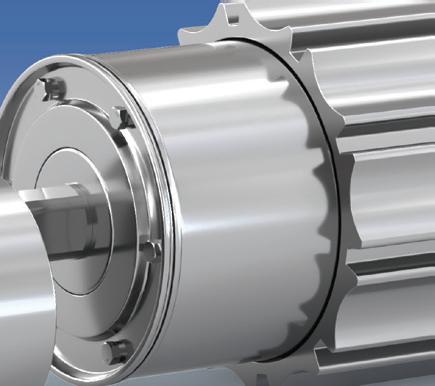

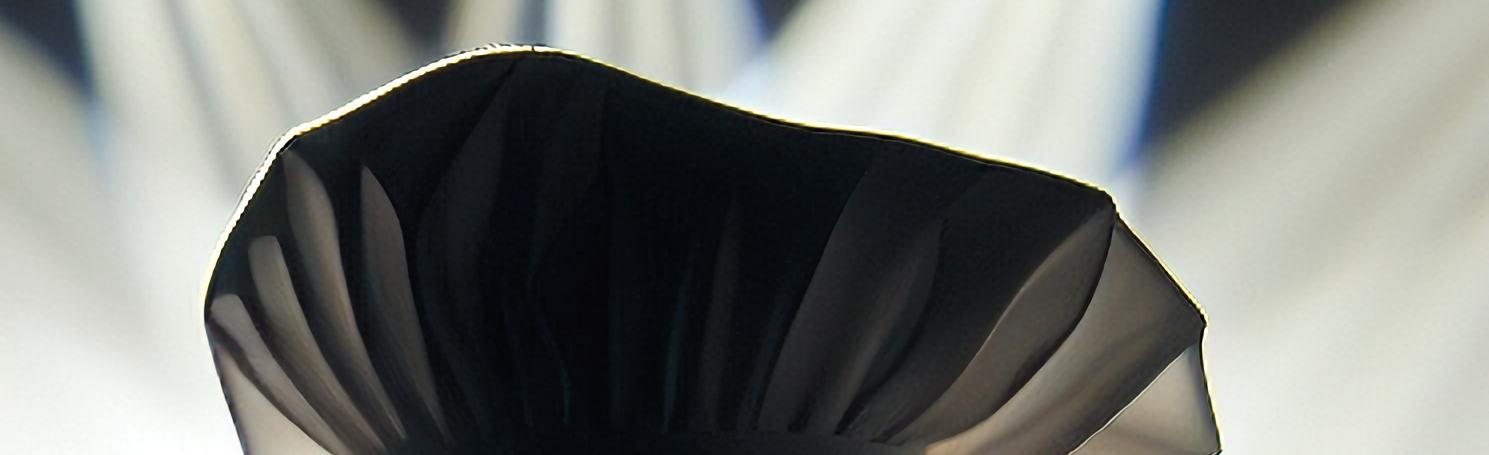

SSV Series Drum Motors, drive modular, wire mesh, and monolithic thermoplastic conveyor belts without using sprockets, eliminate gaps and crevices, and reduce washdown time and water usage by 50%.

ELIMINA Bacterial Ha for 80,000 hours of continuous operation

SSV Series Drum Motors, drive wire and monolithic conveyor belts without using eliminate gaps and crevices, and reduce washdown time and wate b 50%

Designed for 80,000 hours of continuous operation before maintenance, SSV Drum Motors increase throughput and reduce operational costs.

IP69K-rated sealing system

Washdown up to 3,000 psi

Premium-efficiency electric motor

Paul Newman started this trend; Harry Hamlin, Lionel Messi and Jennifer Garner are following. • 16

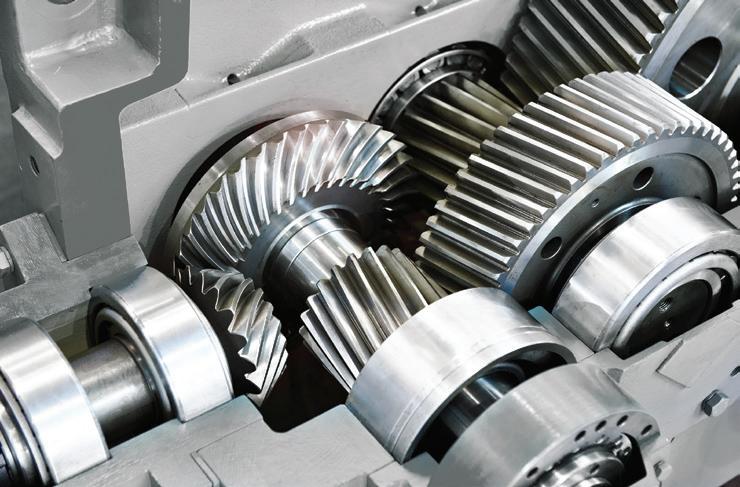

Engineered from the ground up to provide unsurpassed performance in food processing facilities. These high performance, 100% synthetic lubricants provide extended lube intervals, multiple application capability, lubricant inventory consolidation and improved performance. All while maintaining strict H1 safety requirements.

Lubriplate’s NSF H1 Registered Products Include:

HIGH-PERFORMANCE SYNTHETIC GEAR OILS

SYNTHETIC AIR COMPRESSOR FLUIDS

SYNTHETIC HYDRAULIC FLUIDS

HIGH-PERFORMANCE SYNTHETIC GREASES

HIGH-TEMPERATURE OVEN CHAIN LUBRICANTS

NSF H1 REGISTERED SPRAY LUBRICANTS

The food industry is under constant pressure to meet rising consumer demands. This means increasing production, lowering prices all while offering a greater variety of products. Efficiency must be top of mind to stay competitive.

Regal Rexnord has united engineering expertise and best-in-class brands to provide both standard and customized end-to-end powertrain solutions for the most challenging food applications.

Minimize downtime and maximize throughput with ONE Regal Rexnord powertrain solution.

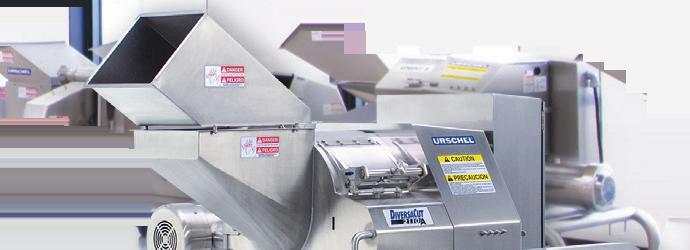

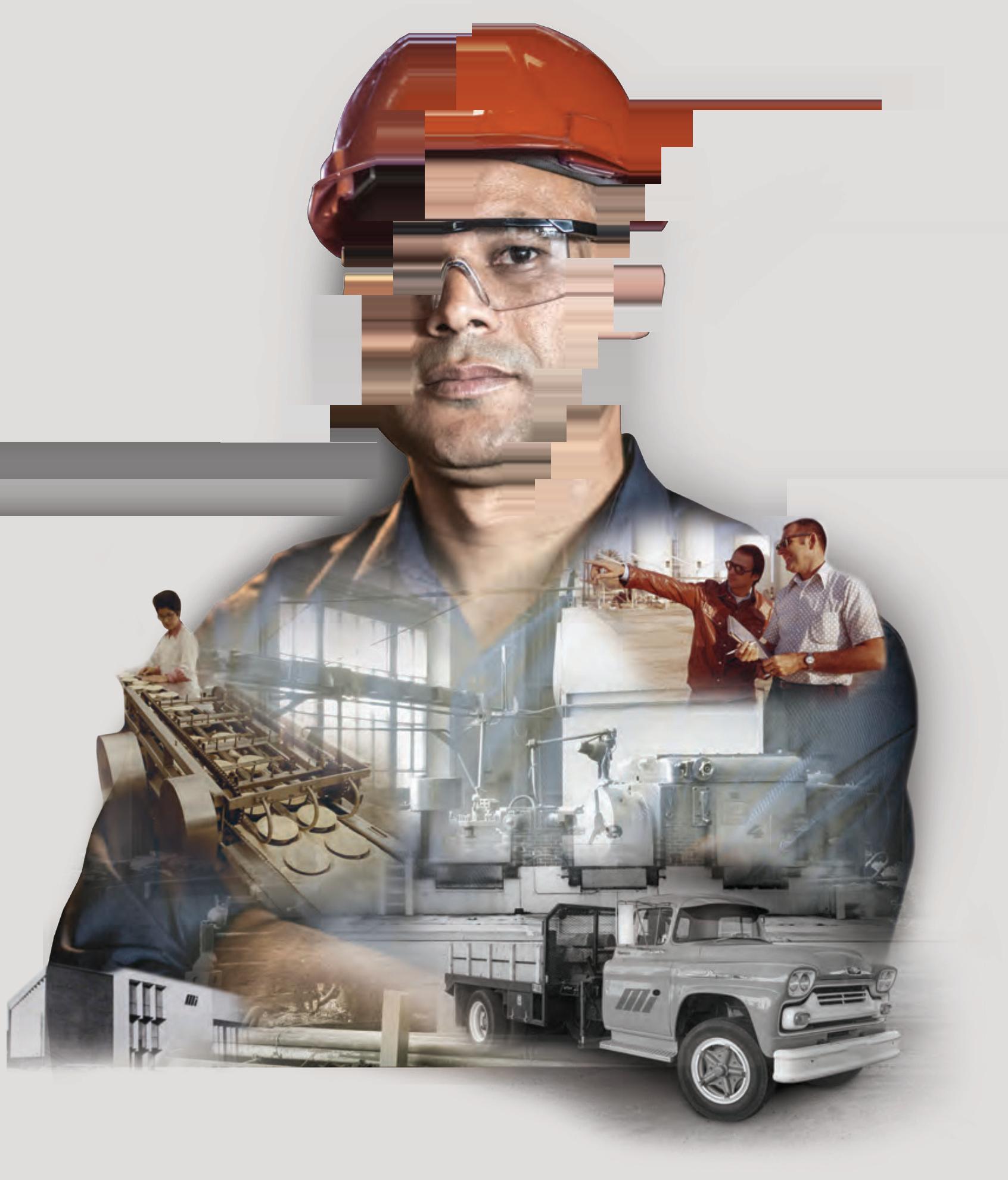

Urschel works with you to share new cutting technology, and discover profitable size reduction solutions that fit your end-goals.

Sanitary, stainless steel design, every machine is crafted to Urschel quality standards; backed by service and support for the life of your machine.

Operation at a push of a button – simplifies time and labor costs. Machines designed for continuous, uninterrupted production to promote the highest outputs. Urschel works with you as your partner in productivity for the long-term with dedicated service and parts when you need them.

Contact Urschel to discover how we can assist you with your operation.

Celebrities Start Food Companies

Why did Paul Newman, Harry Hamlin, Lionel Messi, Jennifer Garner and others get into this crazy business?

for High Cocoa Costs

With the cost of cocoa skyrocketing, suppliers are offering substitutes and solutions.

Ingredients From the IFT Show

The food expo had many interesting sessions, but the focal point always is the ingredients.

Keystone uses landfill-sourced methane and cleaned coal-mine water to reach nearly 100% potato utilization.

Food & beverage processors are sharpening their process control tools.

OCTOBER 2024 | VOLUME 85 NUMBER 9

EDITORIAL TEAM

EDITOR IN CHIEF

Dave Fusaro dfusaro@endeavorb2b.com

SENIOR EDITOR

Andy Hanacek ahanacek@endeavorb2b.com

CONTRIBUTING EDITORS

Ed Avis, Claudia O’Donnell

EDITORIAL ADVISORY BOARD

Mohamed Z. Badaoui Najjar, Ph.D. R&D Senior Director–Strategy & Portfolio Sector Food & Beverage, PepsiCo

Ed Ballina

Principal, Operational Excellence Consulting (retired from PepsiCo)

James Davis

Director-Global Sanitation, OSI Group LLC

Leslie Herzog

Vice President of Operations & Research Services, The Understanding & Insight Group LLC (retired from Unilever)

Steven Hill, Ph.D.

Vice President-R&D, QA, Food Safety, Sustainability, Engineering, Regulatory, T. Marzetti

Leslie Krasny Krasny Law Office

Alvaro Cuba Simons

Operations & Supply Chain Consultant (formerly of Mondelez and Kraft)

Gary M. Stibel

Founder & CEO, The New England Consulting Group

Joel Warady President, Catalina Crunch

DESIGN & PRODUCTION

ART DIRECTOR

Derek Chamberlain dchamberlain@endeavorb2b.com

PRODUCTION MANAGER

Rita Fitzgerald rfitzgerald@endeavorb2b.com

AD SERVICES MANAGER

Jennifer George jgeorge@endeavorb2b.com

EXECUTIVE STAFF

VP/MARKET LEADER - ENGINEERING DESIGN & AUTOMATION GROUP Keith Larson

CIRCULATION REQUESTS Lori Books

ENDEAVOR BUSINESS MEDIA, LLC

CEO Chris Ferrell

PRESIDENT June Griffin

COO

Patrick Rains

CRO

Paul Andrews

CHIEF DIGITAL OFFICER

Jacquie Niemiec

CHIEF ADMINISTRATIVE AND LEGAL OFFICER Tracy Kane

EVP DESIGN & ENGINEERING GROUP

Tracy Smith

Endeavor Business Media, LLC

30 Burton Hills Blvd, Ste. 185, Nashville, TN 37215 800-547-7377

It's only a trickle so far, but Boomers are giving way to Gen Xers in the C-suite; maybe it's due time.

I’ve been doing this job long enough to have seen a steady stream of food & beverage CEOs come and go – sometimes with frightening regularity. Just not lately.

As I near retirement, I wonder if it's time for Generation X, born 1965-1980, to take over. It's not a tidal wave yet, but changes are happening in the C-suite.

At the end of August, Nestle SA, the biggest food company in the world, suddenly replaced Mark Schneider, its CEO of eight years, with Laurent Freixe – who's neither a kid nor a newcomer, having put in 38 years with the company.

A week earlier, Starbucks went outside, hiring Brian Niccol away from Chipotle in a tumultuous turnover at the top of the coffee company. Niccol is a Gen Xer.

Those two news happenings made me realize it's been quite a while since the top dogs changed at the top companies.

Schwan's and Saputo made orderly changes earlier this summer, both installing Gen Xers, but before those there were few turnovers. Which is remarkable when you think about what we've been through in the past couple of years. The pandemic. Then post-pandemic supply chain chaos. Then high inflation coupled with high

interest rates. And the resulting charges of price gouging, even as volumes fell at most food & beverage companies. I don't recall a period where the food industry was so scrutinized by Congress or even a President.

Boomer CEOs must be exhausted! As things settle into a new normal, maybe it is time for a new generation of leaders.

Admittedly, some of the following goes back quite a bit: In June of 2008, we noted that 14 of the 15 largest companies (as identified by the Food Processing Top 100 list) named new CEOs in the prior three years.

Between November of 2009 and January 2011, we counted six more new CEOs (plus two divisional CEOs, three COOs and three unit presidents) among the 37 largest U.S. and Canadian food & beverage companies.

We've written many stories about how food companies need to look past the Boomers and to develop products for successive generations. Maybe it's starting to happen in the C-suite too. n

Written by Dave Fusaro

EDITOR IN CHIEF DFUSARO@ENDEAVORB2B.COM

A little more seafood consumption could be one answer to food’s biggest sustainability problem.

Our society can overcomplicate things. Even though we have the right intent, many of us can get caught up in details and overlook simple, yet key points. My general rule for success is to keep things simple but always understand the data.

Simplicity is a word that no one would attach to our world’s food supply chain. We know that the environmental impact of growing food can be severe, especially through industrial farming methods.

So when thinking about how to solve these challenges, I tend to revert back to one simple line: “Fish don’t fart!”

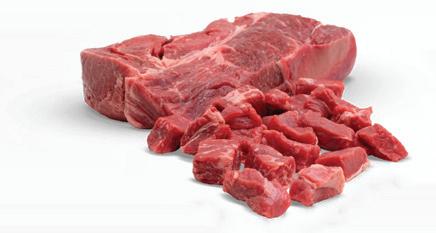

As disgusting as that may seem, it’s true. A significant amount of our greenhouse gas emissions are due to farts, burps and the like from cattle – the traditional go-to protein. These gases generate approximately 15% of global greenhouse gas emissions annually, according to Reuters.

This output happens because digestion and waste from the beef industry produce methane, which then traps heat in the atmosphere for at least 20 years. For perspective, the cattle industry’s emissions are triple the amount of oil sector emissions in recent years – oil typically being the big bad wolf of climate change.

At the end of the day, the emissions from cows are hurting our planet. Beef can be a delicious

protein, but we need to think about diversifying the global food supply so we can sustainably feed the planet.

With the exception of a couple of species like herring and sand sharks, fish don’t pass gas. However, the benefits of fish as a sustainable protein compared to beef go well beyond the smell. As long as we are talking about the right fish.

For example, Alaska pollock sourcing has a fraction of the carbon footprint compared to the farming and distribution of beef. Especially when you take freshwater usage into account.

Fresh water is becoming a scarce resource. At our current consumption rate, by 2025 twothirds of the world’s population is expected to face shortages, according to the World Wildlife Fund. The Alaska pollock industry makes fresh water onboard our boats, which enables us to leave zero impact on this precious resource.

Frozen-at-sea wild Alaska pollock requires zero gallons of fresh water to produce 3.5 oz. of food. In contrast, it takes more than 750 gallons to produce the same amount of beef. Overall, every pound of pollock product accounts for roughly 2.2-2.3 lbs. of CO2-e, while 1 lb. of beef accounts for 130 pounds of CO2-e in the atmosphere. For further perspective, beef burgers produce more than 200 lbs. CO2-e compared to 1.8 lbs. for pollock fish sandwiches.

It’s not just the beef industry that pollock compare favorably to, as chickens are responsible for about four times more CO2-e. Although not as bad as cows, chickens still pass gas. I’d be remiss to not also mention that pollock products even stack up favorably to “fartless foods,” as they contribute less CO2-e than tofu. These are yet more reasons consumers should consider eating more fish.

Now, I’d be lying if I said I think that pollock and fish can replace the entire beef industry, let alone be our only source of protein. Food supply chain diversity is essential. If we halted beef consumption entirely and only ate pollock, there wouldn’t be enough pollock to feed our world. In order to preserve our planet, our global population cannot overconsume one species. But people can and should incorporate more fish into their diets. May I suggest occasionally substituting a delicious, meaty pollock sandwich for that steak? Not only will it be better for your health, but also the planet … and our noses Eat more fish!

Because fish don’t fart! n

Written by Rasmus Soerensen

The food safety agency still hasn’t issued guidelines on any metals except lead.

A2019 study by Healthy Babies Bright Futures found that heavy metals – including arsenic, lead, cadmium and mercury – contaminated 95% of the baby foods tested in the study. The publication was a watershed moment for the industry and parents alike as concerns emerged regarding the safety of these foods for the youngest and most vulnerable population.

These concerns were exacerbated when a followup study by Healthy Babies Bright Futures, which expanded the testing to include homemade baby foods, confirmed that parents of young children could not avoid the risk to their babies by simply making their baby’s food at home. The results were disturbing: Heavy metals contaminated 94% of baby foods tested, suggesting that homemade baby foods did not appear to be any safer than mass produced ones.

The reports brought about a Congressional inquiry into the safety of baby food in the U.S. In 2021, the U.S. House of Representatives Committee on Oversight and Reform published a report aligning with the 2019 study, finding that there are dangerous levels of heavy metals present in several popular baby food brands.

As is often the case, the Congressional report pressured the FDA to take action. Shortly after the Congressional report was

published, the FDA announced the Closer to Zero initiative, which aims to “reduce dietary exposure to contaminants to as low as possible, while maintaining access to nutritious foods.” However, after years of evaluating the science and consulting with industry stakeholders, the Closer to Zero initiative has not yet resulted in final guidance for food manufacturers to follow.

The FDA, however, did issue draft guidance for lead levels in January 2023. This draft guidance set the following proposed action levels for lead in processed food intended for babies and young children:

→ 10 parts per billion (ppb) for fruits, vegetables (excluding single-ingredient root vegetables), mixtures (including grain and meat-based mixtures), yogurts, custards/puddings and single-ingredient meats.

→ 20 ppb for root vegetables (single ingredient).

→ 20 ppb for dry infant cereals.

This draft guidance, while not binding or enforceable, provides context for industry stakeholders as the FDA works on the final guidance, which is expected to be announced this December.

The FDA has not yet issued draft guidance for arsenic, cadmium or mercury levels. It expects to issue draft guidance for arsenic and

cadmium levels this December. It remains unclear whether the FDA will issue any additional guidance regarding mercury levels, because the primary dietary source of this heavy metal is seafood.

The FDA and Environmental Protection Agency previously issued Advice About Eating Fish to encourage consumers, including young children, to be mindful about the types of fish and shellfish they consume and to choose options that are lower in mercury.

A flurry of putative class actions relating to heavy metals in baby foods were filed in the wake of the Congressional report and the FDA’s Closer to Zero initiative. Some courts dismissed these cases in their early stages precisely because the FDA has not issued final guidance setting standards on what levels of heavy metals, if any, may be present in baby food before rendering it unsafe for consumption. Others, however, are continuing to work their way through the court system. The upcoming guidance from the FDA will provide a crucial guidepost for litigants involved in these lawsuits as well as the industry as a whole. n

Written by Courtney Hunter

» Campbell drops Soup from its name

» Kraft Heinz discontinues string cheese

» Mars/Kind gets a new CEO

The U.S. business goes to Lactalis and the Canadian business to Sodiall.

As rumored, General Mills is selling its North American yogurt business but in two parts: the U.S. business going to French dairy products firm Lactalis and the Canadian business to Sodiall – the French dairy cooperative Big G bought it from 47 years ago. Price for both pieces is $2.1 billion.

The divestitures includes such brands as Yoplait, Liberté, Go-Gurt, Oui, Mountain High and :ratio, as well as manufacturing facilities in Murfreesboro, Tenn., Reed City, Mich., and Saint-Hyacinthe, Québec. Collectively, the North American business contributed approximately $1.5 billion to General Mills’ fiscal 2024 sales.

While General Mills never announced the business was for sale, the rumors surfaced in April. Sodiaal, the current name for the group of French dairy farmers who started Yoplait in 1964, sold the North American rights to General Mills in 1977, and in 2021 General Mills acquired a 51% stake in Yoplait from Sodiaal and private equity firm PAI Partners.

Lactalis has been busy building a North American presence. It first established a beachhead with the 2011 purchase of Parmalat’s Canadian business. Since, it has bought Siggi’s and Stonyfield yogurts and, in 2022, Kraft-Heinz’s considerable cheese business. We estimate sales in North America at $9.5 billion and globally at $31 billion.

The proposed transactions are expected to close in calendar 2025, subject to receipt of requisite regulatory approvals and other

customary closing conditions. General Mills expects to use the net proceeds from the transactions for share repurchases.

“Today’s announcement represents another significant step forward for General Mills in advancing our Accelerate strategy and our portfolio reshaping ambitions,” said Chairman and CEO Jeff Harmening. “Upon completion of these divestitures, we will have turned over nearly 30% of our net sales base since fiscal 2018.”

As summer turned to fall, Michigan's Frankenmuth Taffy Kitchen introduced Leinenkugel's Lakewater Taffy, developed in partnership with the Molson Coors beer brand. "Each bite of Leinenkugel’s Lakewater Taffy is infused with Summer Shandy and real lake water straight from the Great Lakes for that perfect last bite of summer."

Boar’s Head Provisions in September announced it was closing indefinitely its Jarratt, Va., processing plant and ending all company production of liverwurst.

This summer, listeria was found in the plant’s liverwurst product, and the resulting outbreak killed 10 people and sickened at least 59 people in 19 states. Boar’s Head started a voluntary recall of the product on July 25.

The company said in September it had identified “the root cause of the contamination as a specific production process that only existed at the Jarratt facility and was used only for liverwurst,” leading to a permanent discontinuation of liverwurst production.

Reports surfaced that USDA inspectors found deplorable conditions at the Jarratt, Va., plant over the past year and even in weeks leading up to the outbreak of listeria. USDA’s Food Safety and Inspection Service found instances of mold, insects, liquid dripping from ceilings and meat and fat residue on walls, floors and equipment.

Government inspectors logged 69 instances of “noncompliance” with federal rules in the past year, according to an Associated Press report, including several in recent weeks. In the earliest inspection report we saw, dated Aug. 8, 2023, an inspector had the cover of a pump removed and “an obvious odor filled the department.” Inside was “heavy, discolored meat build-up.”

That same report noted meat overspray and fat on walls, rusting equipment and standing water. In one of the more recent inspections this July 27 – a day after the first recall – an inspector noted water dripping from a ceiling that was blown by a fan onto uncovered hams. Other inspections noted dead flies floating atop a vat of vinegar, dirty floors and mold.

Americans’ confidence in the federal government’s ability to ensure the safety of the U.S. food supply has reached a record low, according to polling organization Gallup Inc. 57% of U.S. adults say they have a “great deal” or “fair amount” of confidence in the government to keep the food supply safe, but that’s the lowest level since the poll began in 1999, and down 11 percentage points from the prior reading in 2019.

Roughly eight in 10 Americans expressed faith in the government to ensure food safety in Gallup measures from 1999 to 2006. After a massive salmonella outbreak in 2007, that dropped to about seven in 10 and remained at that level in 2008 and 2019 before dropping this year. The data was collected as part of Gallup’s annual Consumption Habits poll, conducted July 1-21.

While 57% express at least a fair amount of confidence in the government to keep food safe, 28% of Americans do not have much confidence and 14% have “none at all.”

A state bill to ban some six food color additives in food served at California public schools was signed into law in September and will go into effect Dec. 31, 2027.

Assembly Bill 2316, the California School Food Safety Act, will prohibit six allegedly harmful food dyes from being used in foods served in the state's public schools: red 40, yellow 5, yellow 6, blue 1, blue 2 and green 3. They impart the vibrant colors in products such as Doritos, Froot Loops and Skittles.

Titanium dioxide originally was in the bill but was dropped –just as it had been in the state’s late-2023 ban of four food ingredients: potassium bromate, propylparaben, brominated vegetable oil and red 3. Those will be banned from all foods manufactured, delivered or sold in the state after Jan. 1, 2027.

Studies suggest that consumption of the six dyes may be linked to hyperactivity and other neurobehavioral problems in some children, especially those who already exhibit signs of ADHD or autism.

The FDA maintains there is not sufficient proof the color additives pose any risk, although the agency hasn’t formally reviewed their safety in decades. However, that review may be coming, as Jim Jones, deputy commissioner of the FDA’s Human Foods Program, has hinted in recent public remarks.

After 155 years, Campbell is dropping the word soup from its name, symbolic of the company’s growth into snacks and other food categories. No worries, it will still make soup. The new name will be The Campbell’s Company, subject to shareholder approval at the annual meeting of shareholders in November. After going through a period of shrinkage, Campbell is now bigger than it’s ever been, we believe. Sales were nearly $8.3 billion in 2014 but shrank in the following three years, but in its fiscal 2024, which ended July 28, increased 3% to $9.6 billion.

Days after settling a long-running lawsuit with Impossible Foods, Motif FoodWorks, a developer of plant-based meat analogues, reportedly is shutting down. Motif was in a costly intellectual property battle with rival Impossible Foods that was resolved in early September with both parties agreeing to cover their own legal costs. And that may have been the last straw – the costs were significant and now unrecoverable, and potential customers appeared fearful of buying ingredients from a company being sued by a major competitor.

Bimbo Canada will close its Quebec City, Que., bakery by the end of this year, idling 141 employees. This is the second bakery Bimbo Canada will close this year, having shut down its facility in Lévis, Quebec, over the summer.

Lifeway Foods, struggling with a family dispute but not financially, has been offered a buyout by France’s Danone SA, which already owns 23%of the kefir company. Danone offered $25 a

share in cash, which would value the Morton Grove, Ill. (suburb of Chicago) company at about $318 million. Lifeway is embroiled in family infighting that has pitted CEO Julie Smolyansky against her mother and brother, who together own a majority of the company.

Kraft Heinz will discontinue production of Kraft and Polly-o string cheese products at its Lowville, N.Y., plant on Nov. 28, the result of conditions placed by the U.S. Justice Dept. on the sale of Kraft Heinz’s natural, grated, cultured and specialty cheese businesses in the U.S. to Lactalis American Group. The agreement to purchase the business for $3.2 billion was initially agreed upon in late 2020, and the Justice Dept.’s ruling came in late 2021.

Mars in September reached inside its own sprawling organization to name Daniel Calderoni CEO of its Kind North America Snacks business. He replaces Russell Stokes Calderoni brings more than 20 years of global experience leading consumer brands, including about 10 in two different stints with Mars, mostly at its pet food business. For this promotion, he comes from Mars Pet Nutrition in Canada, where he’s been general manager since November 2022.

Hershey Co. named Michael Del Pozzo president of its U.S. Confection business. He joins Hershey after 23 years at PepsiCo, most recently leading PepsiCo’s Gatorade business as president and general manager.

Freshpet Inc . introduced Nicki Baty as its new chief operating officer on Sept. 1. Baty joins Freshpet from Colgate-Palmolive , where she most recently was president and general manager of Hill’s Pet Nutrition U.S., a role she had held since 2020.

Tyson Foods named Curt Calaway its chief financial officer, removing the interim tag from his position, and also formally removing John R. Tyson from that role, although John R. will stay with the company in some role. Calaway, who’s been with Tyson Foods since 2006 in financial roles, was named interim CFO in June after the Tyson heir was charged with driving while intoxicated by Fayetteville, Ark., police.

Saputo shuffled its leadership team in support of its new president/ CEO, Carl Colizza. Frank Guido was promoted to COO. Replacing Guido as the president and COO of Dairy Division (USA) is Dominick Bombino, who has been with the company for more than 25 years. Leanne Cutts will fill the newly created chief commercial officer (CCO) role. She’s been with Saputo since 2021. Steve Douglas will take the role of president and COO of Dairy Division (UK).

Egglife Foods Inc., an Indiana maker of egg-based wraps, appointed Brent Gravlee, Clif Bar’s former vice president of sales, as its first chief revenue officer. Gravlee brings more than 20 years of diverse industry experience to Egglife Foods. He was chief commercial officer for start-up brand Munk Pack, spent time at General Mills and Mondelez and had a 17-year career with Clif Bar.

From our beginnings as the Brooklyn Fiber Broom Company in 1924, our founder Matthias J. Kubick Sr. sought to provide innovative cleaning equipment for industries like railroads and firefighting. Continued today by designing tools for hygienic food plants, and mopping systems for clean rooms and critically controlled environments. Now in our fourth generation, Perfex is poised for the next 100 years of making the highest quality cleaning tools available.

Coleman All Natural Meats, an all-natural meat brand since 1875, is rolling out ground pork sausage in five flavors: chorizo, mild sweet Italian, hot Italian, mild breakfast and hot breakfast. Sold in 1-lb. packs, these ground sausage varieties give consumers versatile options for breakfast, lunch and dinner. Packages feature Coleman’s new branding that highlights its claims, including no antibiotics nor added hormones, all vegetarian diet and humanely raised in the U.S. They're made from Heritage Duroc pork, which is known for its abundant marbling. This results in more tender, juicy and flavorful meat. The company surveyed consumers in 2023 and learned that 76% of shoppers may choose a brand of fresh pork if it has Heritage Duroc labeling. The product ships frozen to retailers.

Clean-label beef jerky brand Tillamook Country Smoker has teamed up with Industrias Tajín, a Mexican-owned company, to introduce Tajín Flavored Beef Jerky. Tajín seasoning has an on-trend swicy (sweet and spicy) taste profile. It starts out with some mild heat from chili peppers, which is followed by the tang of lime and a kick of salt. This marks the first time Tajín is available in a beef jerky. A 1-oz. serving contains 80 calories, 1.5g fat and 4g protein. The product comes in 2.2-oz. packs for $5.99 and 6.5-oz. bags for $13.99.

Goodles, which reimagined boxed mac and cheese by developing nutrient-dense pasta and clean-label sauces, is launching deluxe versions that provide a saucier bowlful of pasta. Goodles noodles are made with wheat flour, chickpea protein, wheat protein and nutrients extracted from broccoli, spinach, kale, pumpkin, sweet potato, sunflower seed, cranberry, chlorella, maitake mushroom and shitake mushroom. The deluxe sauces are made with real shredded cheddar cheese — either mild or aged white — and no additional milk or butter is required. One serving of the prepared deluxe varieties provides 16g of protein and 7g of fiber. Earlier this year, the company rolled out two gluten-free varieties of Goodles. There’s a traditional cheddar cheese offering and a vegan variety. The vegan sauce is made from cashew nuts for a savory, cheddar-y flavor. All Goodles products are Clean Label Award Certified, kosher certified and low-glycemic index foods.

Tajín made its first export to the U.S. in 1993 and since has been showing up in all types of applications as a result of co-branding partnerships. Recent rollouts include Hellmann’s Chili Lime Mayonnaise Dressing and G.H. Cretors Kettle Corn with Tajín. The latter is exclusive to Costco club stores in Mexico and the northwest region of the U.S.

Two Rivers Coffee Co. teamed up with the L’Eggo of my Eggo folks at Kellanova to brew up Eggo Coffee. This fusion of two breakfast favorites hopes to redefine the morning routine, giving busy adults the boost they need to get their kids out the door or a moment to savor. A cup of the brewed java combines the taste of freshly toasted, golden Eggo waffles with the rich, aromatic notes of premium coffee. Eggo Coffee comes in five flavors — blueberry, chocolate chip, cinnamon toast, maple syrup and vanilla — and is sold in convenient Keurig-compatible cups.

Kellanova teamed up with Nestlé late last year to offer Nestlé Sensations Eggo Maple Waffle Flavored Milk and Coffee mate Eggo Waffles with Maple Syrup Creamer. The 14-oz. refrigerated milk sells for about $2.59, while the 32-oz. creamer has a suggested retail price of $4.69.

Big, bold flavors continue to be what consumers are craving, and hot and spicy is leading the way. To meet this growing consumer demand, Idahoan Foods teamed up with the experts in hot sauce at Tapatío to turn up the heat on their Triple Cheese Mashed Potatoes, which come in single-serve microwavable cups and are sold in packs of four.

When it came to expanding the Potato Shreds line, which was launched in August 2023 for consumers’ on-the-go snacking needs, the brand turned to a favorite flavor combo: bacon and cheddar cheese. The shreds come in a two-cup pack.

“We are eager to expand our most popular on-the-go lines with two new flavor-packed options designed for potato fans looking for convenience and great taste,” says Ryan Ellis, vice president of retail marketing and business development at Idahoan Foods. “The launch of these new products showcases our commitment to innovation and listening to consumers.”

Litehouse introduced two new product lines this summer intended to make snacking more delicious. To help get littles to eat more veggies, the company partnered with Paramount Consumer Products and FoodStory Brands to develop Litehouse Kids.

The dips and spreads come in SpinMaster’s Paw Patrol Cheddar Cheesy and Teenage Mutant Ninja Turtles: Mutant Mayhem Pizza Ranch. Each variety is available in 16-oz. squeeze bottles and snack packs sold in boxes of six.

For more mature tastebuds, there’s the new Litehouse Loaded line. The three sauces are packed with out-of-this-world flavor combinations Buffalo, Loaded Fry and Taco.

“Both retail brands will help reinvigorate the category and further showcase our dedication of making meals and snacks more exciting for both returning and new customers,” says Kate Nees, senior brand manager.

Why Paul Newman, Harry Hamlin, Lionel Messi, Jennifer Garner and others get into this crazy business.

Written by Dave Fusaro EDITOR IN CHIEF

Every March, a celebrity or two makes the drive south from Hollywood or thereabouts to appear at Natural Products Expo West in Anaheim, Calif. Over the years, Fabio (remember him?), Marilu Henner, Jessica Alba and Channing Tatum drew crowds as they lent their support to certain food brands.

Celebrity endorsements are nothing new in the food or marketing worlds, but some celebrities start or sincerely embed themselves in food & beverage companies, often to promote some cause near to their hearts.

Paul Newman was the granddaddy of this trend. After a long movie career, he started Newman’s Own in 1982 with author A. E. Hotchner. Over the years, the friends had concocted an Italian salad dressing they bottled and gave as holidays gifts, and that became the initial product in a portfolio that now contains 21 product categories, many of them organic, including pasta sauce, pizza and popcorn. The original olive oil and vinegar salad dressing remains.

Newman and Hotchner were somewhat surprised when their little company turned a $300,000 profit in its first year. What to do with that windfall? “Let’s give it all away,” Newman is quoted as saying. And they have. Since 1982, Newman’s Own Foundation has donated more than $600 million, most of it toward its own mission “To nourish and transform the lives of children who face adversity.”

Charities and children are two of the biggest motivators for celebrities to start food companies, but not all the stars follow that path. For some, it’s creating a

Harry Hamlin and his niece Renee Guilbault are launching The Open Food Company, starting with “Harry’s Famous Rosemary Red Wine Sauce.”

better version of a product they themselves use. Others just like food and cooking it.

Harry Hamlin: ‘People like my cooking’

Some mild contempt of the processed food industry is one of the motivators for actor Harry Hamlin to join his niece in starting The Open Food Company.

“Food Processing?” he asked over the phone when I introduced myself. For a moment, it sounded like he would call off the interview.

“We’re kind of the opposite of that.” But after a slight pause, he went on.

“I never wanted to start a food company. I never wanted to do a cooking show, either,” says Hamlin, who has a long resume of movie and TV roles and currently is the uncle of the main character in AMC network’s “Mayfair Witches.”

“I’m no chef, but I cook for my family and friends, and people seem to like what I make. Everybody asks about the pasta sauce. I kind of had no choice but to bring the sauce out.”

The dish he’s most famous for within that circle of family and friends is a marinara sauce with red wine and rosemary as the key ingredients. He started cooking it when he lived in Italy in the 1980s. He’s refined it over the years and once made it on “Real Housewives of Beverly Hills,” a TV show his wife Lisa Rinna was in.

Hamlin’s niece Renee Guilbault is a chef, author and entrepreneur with more than 20 years of experience in the food industry. When AMC asked Hamlin to do a cooking show in 2023, he insisted Guilbault be his partner. So, together they starred in the AMC series “In the Kitchen with Harry Hamlin.”

Red wine and rosemary are among only eight ingredients in Harry’s Famous Rosemary Red Wine Sauce. Although Hamlin wouldn’t tell us the other

ingredients just yet, he said all will be revealed when The Open Food Company launches this fall.

As the name implies, The Open Food Company will be very open. Not only will the jarred sauce have few ingredients, all of them natural, but the recipe will be available for cooks to make at home. “Customers will be able to scan a QR code to learn about the recipe and cooking method,” Guilbault says.

“We believe that access to nutritious and delicious food is a human right, that people should know what’s in their food,” she continues. “Harry and I agree that food should be made with simple ingredients found in your own kitchen and never [with] synthetic flavoring, preservatives, stabilizers or chemicals.”

Despite that criticism – Hamlin critically used the term “ultraprocessed” a few times in our talk – he said he learned a lot about the food industry and the process of scaling up the recipe from what he made in his kitchen to commercial quantities.

The pair was directed to a contract manufacturer in Texas, experienced in making sauces. Expecting a drawnout effort, Hamlin says he allocated several days to spend with their R&D people, “but within five hours, they had it. It was as good if not better than the original. I was blown away by their R&D people.

Gloucester, Mass., and Project Angel Food in West Hollywood. Those donations will continue as The Open Food Company gets off the ground.

“Charity-partner support is baked into The Open Food Company’s business model to ensure we can spotlight and meaningfully support different social impact missions with every product we release,” says Guilbault.

“No one understands the importance of proper hydration quite like the global soccer icon, Lionel Messi,” starts out a media release about his startup. “He searched for a hydration beverage and found drinks that had healthy ingredients but lacked flavor. Others tasted great but had lots of sugar and calories. He didn't want to choose between the two … So, Messi went to work on a drink of his own.”

Más+ by Messi (mas means more in Spanish), unveiled in June,

International soccer star Lionel Messi couldn't find a hydration drink that pleased him so he developed his own.

is “a next-generation hydration drink created for everyone in every moment that calls for hydration. Because everyone deserves to feel like a champion in every part of their life.”

More than a name on the label, Messi is a founder of Más+ by Messi and The Más+ Next Generation Beverage Co., along with flavor innovators from The Mark Anthony Group – who are largely credited with starting the hard seltzer craze with White Claw.

The drink delivers a balanced blend of electrolytes with natural flavors, no artificial sweeteners or colors, plus vitamins — and is available in four flavors named after milestones in Leo Messi’s career:

→ Miami Punch is named for the city where Messi and his family currently live and he plays soccer.

→ Orange d'Or was inspired by his record eight wins of the Ballon d'Or ("Golden Ball" in French) trophy.

→ Berry Copa Crush harkens to Messi's seven Copa del Rey

“Then I did a blind taste-testing with some of my neighbors, and almost all of them picked the manufactured sauce over what I made in my kitchen.” He feigned being hurt.

As part of their mission, they’ve already donated to The Food Bank for NYC, LA Regional Food Bank, The Open Door Food Pantry in

titles with the Barcelona team and his Copa America win with Argentina.

→ Limón Lime League honors the time he spent playing in the UEFA Champions League, a cup he won three times.

Más+ by Messi is still ramping up to national distribution. The 16.9-oz. bottles have 10 calories and 1g of cane sugar each, and the 12-oz. cans have 7 calories and less than 1g of cane sugar.

"People know the importance of hydration and are seeking better products that help them achieve their goals," says Rishi Daing, executive vice president of Más+ Next Generation Beverage Co. “Our beverage and flavor innovation combined with Messi's expertise as an elite athlete have resulted in a drink unlike anything on the market."

Cassandra Curtis started Once Upon a Farm in 2015 along with co-founder Ari Raz to create more nutritious, convenient and delicious baby food options for her daughter that weren’t available in her local supermarket. After selling her first cold-pressed baby food at retail, in 2017 she brought on Annie’s former CEO John Foraker and actress Jennifer Garner.

For several years now, Jennifer Garner has appeared in the Once Upon a Farm booth at Natural Products Expo West.

In promotional materials, Garner is called a co-founder, and it’s clear she’s been intimately and passionately involved in the development of the company.

“As John, Cassandra and I, along with the entire Once Upon a Farm team, have built this company, we’ve always had big ambitions, chief among them to bring healthy, nutritious food to kids everywhere,” Garner says.

In addition to being an actress, Garner is a philanthropist and mother of three, and she shares Curtis’ commitment to better childhood nutrition – in both the formulation of kids’ foods and in funding charities with a goal of ending childhood hunger.

As part of that latter goal, Once Upon a Farm has committed to funding one million meals for children in food-insecure communities in America by 2025, via charity Save the Children. According to a counter on Once Upon a Farm’s website in mid-September, they had funded 682,382 meals so far.

Once Upon a Farm makes foods for babies, toddlers and young children in formats such as puffs, pouches, bars and dried fruits and vegetables. Profits from all

Where Are Cherlato and Snoop Loopz?

We provided a fair amount of publicity to Snoop Dogg’s late-2022 launch of Broadus Foods (his real name is Calvin Broadus), also to the July 2023 debut of Cherlato by singer Cher. But where are they now? Read www.FoodProcessing.com/55142662 to find out.

contribute toward the company’s charities, plus every Overnight Oats pouch purchased means 25 cents will be donated to Save the Children, with a goal of raising at least $50,000.

Garner still maintains her century-old family farm in Locust Grove, Okla., which grows pumpkins, blueberries, field peas, rye, wildflowers and honeybees, as well as some animals. Garner’s farm supplies the pumpkins for Once Upon a Farm’s “Farmer Jen’s Pumpkins Oatmeal Cookies.”

"Once I started working for Once Upon a Farm, I loved the idea of connecting kids to the farm early on,” says Garner. “And so here we are, connecting kids to the farm and it gets to be my family’s farm that’s been with us since 1936.” ■

Written by Ed Avis

CONTRIBUTING EDITOR

When a food processor’s raw ingredient prices climb, they look for alternatives or ways to reduce the usage of that ingredient. That’s what is happening today with cocoa – prices have been climbing for the past two years, driven by rough weather in Africa and labor and supply chain problems. So processors that use cocoa are scrambling for solutions.

Cocoa prices for decades hovered between $2,000 and $3,000 per metric ton. But beginning in January of 2023, they began a climb that broke $12,000 a ton this April. While they’ve moderated since, at last glance the commodity was still trading above $8,000. Fortunately, there is more than one way to reduce the cost of cocoa in a product.

With the cost of cocoa recently six times the norm, ingredient suppliers are offering a plethora of substitutes and other solutions.

Finally – and probably most common – is a solution that combines various options in some fashion so that the product maintains its chocolatey characteristics with less actual cocoa in the recipe.

Regardless of the solution, food processors that rely on cocoa understand that the solution they develop now should be something that helps them for the long run and won’t be abandoned when, and if, cocoa prices fall.

“We are thinking about this way [beyond] the scenario we’re in right now, where there’s a crisis,” says Justin Demers, director of applications and product development for Prova USA (provaus.com), which develops customized solutions for food processors seeking to reduce cocoa. “For us, this is about long-term solutions and improving products in a lot of different ways.”

Obviously, in an ideal situation, a food processor finds a one-to-one cocoa replacement that works well in a particular recipe. There are several cocoa replacements on the market today, so that’s a real possibility.

Another option is to adjust other ingredients, such as emulsifiers, to permit a reduction of cocoa in a recipe.

Cocoa is complicated

The underlying challenge with reducing or replacing cocoa in a recipe is that it is a complicated ingredient. It contains over 400 volatile compounds, ranging from alcohols and aldehydes to pyroles and pyrazines, so no single ingredient can replace it.

Contrast that to vanilla, another natural product that Prova has deep experience with. “In vanilla, there's a single molecule or compound called vanillin,” Demers says.

“If you had that single compound and you smell that, you would say, 'Oh, this is vanilla.' In the cocoa world, that doesn't exist. So that makes it both complicated but also more flexible on our side.”

Demers explains that different elements within cocoa account for different tastes – pyrazine provides “roasty” nut flavors, while esters provide fruity notes, for example. That means a food scientist attempting to emulate cocoa has lots of options to play with.

The various flavors “can be derived directly from cocoa, but we can also find them derived from other sources,” he explains. “And on a micro level, they're identical. They're the exact same molecules that we then stack and proportion in ways to create custom profiles.”

While that complexity opens the door to multiple options for emulating cocoa, it also means there no simple, one-size-fits-all solution. That situation has led to several companies developing cocoa-similar ingredients.

One company that has developed a cocoa replacement is Planet A Foods (planet-a-foods. com), based in Germany. The company began developing its solution in 2021, before the current cocoa price spikes. And reducing the cost was not the company founders’ intention – they learned that demand for cocoa was causing mass deforestation, exacerbated by climate change, so they set out to create chocolate without cocoa.

Planet A’s cocoa-less solution involves processing oats and sunflower seeds in a way that emulates cocoa flavor.

“Many people don't know that 80% of the taste of chocolate doesn't come from the cocoa bean itself, but from the way the cocoa bean is processed, such as from the fermentation and roasting,” explains Jessica Karch, marketing and public relations manager for Planet A Foods. “So that's what we do with our oats and sunflower seeds as well. They're fermented and roasted, and that's how we get the chocolate taste.”

Planet A Foods launched its chocolate replacer, ChoViva, in 2023. ChoViva currently is an ingredient in chocolate-flavored cookies, peanut butter cups and cereals on German and Austrian grocery store shelves. Karch says they are expanding distribution of ChoViva to other European countries this year and to the U.S. in 2025.

“It’s of course a little bit dependent on the specific case, but in general you can use it just like chocolate,” she says. “It’s very, very similar and you can use it on the same production lines.”

ChoViva was not developed as a lower-cost solution to chocolate, but it may be, depending on the application and the cost of cocoa at any moment, Karch says. In any case, the supply of the product is more certain, she adds, since sunflower seeds are grown close to the company’s plants.

Another replacement product is ChocoUp from Alianza (alianzateam.us/our-solutions-2), based in Colombia but with a U.S. office in Durham, N.C. ChocoUp is a lipid product, made from palm and palm-based fractions, that is designed as a cocoa butter extender. Cost savings vary by application, but food manufacturers are saving money with the product, according to Maria

Angelica Mashali, the company’s chief growth officer.

“When food manufacturers use ChocoUp, they can achieve results that closely match their original cocoa butter-only recipes, both in terms of flavor and functionality,” she says. “It effectively blends with cocoa butter, preserving the crucial tempering properties required for chocolate production while also helping to prevent fat bloom, guaranteeing the chocolate maintains its visual appeal and delightful texture over time.”

Mashali adds that minor adjustments to recipes are required in some cases. “To achieve the same texture, taste, and overall experience as the original cocoa butter recipe, a slight adjustment to the

crystallization curve during tempering might be needed,” she says. “Furthermore, the amount of ChocoUp used can vary based on the type of choco late being made and the specific regulations in each country.”

T. Hasegawa's (www. thasegawa.com) Cocoa Powder Replacer was designed for bev erage applications, and comes in both powder and liquid forms.

“Cocoa Powder Replacer is an alkalized, low-fat cocoa powder flavor that serves as a perfect substitute for traditional cocoa, reducing the amount needed without compromising taste,” the company says on its website.

Reducing cocoa in a recipe does not always require using a cocoa substitute. In some applications, the amount of cocoa needed can be reduced by changing other ingredients.

For example, emulsifiers are commonly used in baked goods and other sweets coated with chocolate to improve the flow of the chocolate. Flow is also improved by an increased amount of cocoa butter, so a manufacturer seeking to reduce cocoa usage could opt to use more emulsifier instead of cocoa butter.

“PGPR [polyglycerol polyricinoleate] is an [emulsifier] product that is commonly used in a lot of chocolate,” says Sheila Rice, key account director/regional marketing for Palsgaard (www.palsgaard. com/en). “And where it can come into play for reduction of cocoa butter usage is when you're trying to set the rheology of your product, or the amount of chocolate that

can achieve the desired flow rate without adding more cocoa butter. “PGPR allows you to get to that level in a more efficient way because the cost per use is minimized with a smaller dosage of PGPR versus using cocoa butter,” she says. “And using additional cocoa butter not only adds cost, but it also adds calories. So it’s all about the complete formulation that a developer decides on.”

Another advantage of using an emulsifier in place of some cocoa butter is that doing so avoids some of the variability found in cocoa butter, Rice adds. A natural product such as cocoa butter may not always have precisely the same characteristics and/or may not perform consistently under different environmental conditions, while an emulsifier such as PGPR or lecithin should perform consistently at all times.

Using a straight substitute for cocoa sometimes works, but in general, processed foods that include cocoa are too complicated for a simple solution. As in any situation, replacing an ingredient –especially one as complex as cocoa – in an existing recipe requires the

Germany’s Planet A Foods ferments and roasts oats, sunflower seeds and other ingredients to create chocolate replacer ChoViva.

processor to consider multiple

Cocoa helps impart a certain mouthfeel to foods, and that cannot be ignored when a replacement is used. And how cocoa interacts with the other ingredients in the food item must be considered.

“Sometimes the reduction in cocoa, depending on the percentage, there are other things that are compromised beyond just the cocoa flavor,” Demers explains. “We have solutions where we can add back in raw materials that add certain mouthfeel qualities or that richness that a fat might be providing.”

Prova specializes in solutions that take all of those factors into account, Demers says. When a client asks for a cocoa replacement for a chocolate chip cookie, for example, Prova looks at the cookie holistically and develops a solution that reduces or replaces the cocoa while maintaining the other characteristics of the cookie. The cocoa may be reduced by using cocoa extracts, different natural flavors or artificial flavors, depending on the situation and the amount of cost savings the food processor is seeking.

How much of a reduction in cocoa is feasible? Demers says a 30% reduction of cocoa typically can be achieved with minimal effect on the rest of the product’s recipe; higher reductions require more adjustments but are still feasible.

Even considering the cost of the other ingredients needed to replace the cocoa, a 30% reduction in cocoa may equate to significant cost savings, especially right now. However, there is more to cost savings than simply reducing the cocoa in a product.

“I like to think of cost in more than just dollars and cents,” Demers says. “There's also production costs. There's opportunity costs, there's storage costs. If you're used to having storage for bags and bags and pounds and pounds of cocoa powder at your facility, and that can now be replaced with a much smaller amount of a flavor that saves space, you save money. Reducing

complications in production also saves time and money.”

The companies offering solutions to high cocoa prices are enjoying a wave of new business in this current environment.

Palsgaard’s Rice, for example, confirms that more companies are looking her company’s emulsifier solutions these days. “We have more people testing it now who had kind of casually looked at it before and said, ‘Oh, I don't know. It seems like it's good,’” Rice says. “The decision to deploy fully is a big decision, but the interest level for sure has gone up.”

What will happen if cocoa prices drop? Some manufacturers will go back to their previous recipes, but

the solutions developed during these high-cost times may have benefits – such as improvements to the product’s shelf life or mouthfeel – that appeal to manufacturers even when they are less concerned about cocoa costs.

“When things go back to normal, at the very least we hope that your cost can be break even to where it was, but we're offering you a lot of other benefits as well along the way,” Prova’s Demers says. “So whether your product has a longer shelf life, or your product has a better mouth feel or whatever it is, we want it to be more than net zero in the end when the market stabilizes.” n

Eriez offers a wide range of magnetic separators to get metal out

July’s IFT FIRST food expo and annual meeting had sessions on artificial intelligence, feeding the world and emerging proteins. But the focal point of this show always is the ingredients. The overwhelming majority of exhibitors are ingredient suppliers, and many of them save new product introductions for this show. Following are a few of them:

Vitessence Pea 100 HD is Ingredion’s new pea protein optimized for cold-pressed bars. It helps maintain the softness of bars throughout their shelf life, provides other preferred texture and sensory attributes and adds nutritional value to boost consumer preference. It also delivers a minimum of 84% protein on a dry basis, which helps to enable “good” or “excellent” source of protein claims. It functions like whey or soy protein.

In an effort to showcase how color impacts the perception of flavor, GNT allowed visitors to build a snack using five different savory, salty or sweet bases; then add up to six seasonings featuring on-trend flavors, such as African Spice Mix and

Yuzu Aji Amarillo; and finally to add GNT’s Exberry colors made from non-GMO fruits, vegetables and plants. A few weeks after the show, GNT teamed with UK’s Plume Biotechnology to develop colors using fermentation.

Hormel Ingredient Solutions’ samples emphasized the company’s Burke brand of pizza toppings and other fully cooked meats. There were Albondigas Meatballs (made with Burke pork and beef with Albondigas-style seasonings); Roma Fundido (featuring Burke’s Hand-Pinched-style cooked sausage); Three-Meat Breakfast Quiche (with breakfast sausage, bacon pieces and IQF diced ham); and Italian Wedding Pizza (using pork & beef wedding soup-style meatballs as the topping).

Bunge used the show to unveil Beleaf PlantBetter in North America, a plant-based alternative that matches the sensory qualities and versatile functionality of traditional dairy butter and can easily be integrated in current production processes. The company claims it achieves the same aeration, volume and taste required for products such as croissants, cakes and more, which have been challenges for most butter substitutes. The ingredient enjoyed a successful European launch in 2023.

Experts from Ajinomoto Health & Nutrition North America spoke in a scientific session about “Kokumi’s Untapped Potential.” “One of the functions of kokumi compounds is to strengthen the signals between taste receptors and the brain, which ultimately increases the intensity of sweet and umami tastes,” said Elizabeth Morrow, principal food scientist. The company promoted its MSG and a wide variety of other fermentation-derived flavor and texture ingredients.

Who knew that a rich, cheesy, buttery mac & cheese could also have the cleaner label that consumers are looking for? Butter Buds used the classic dish to show off its Cheese Buds Simple Cheddar Cheese Concentrate and Butter Buds Simple Concentrate CL.

ResilientRed BF is the latest in the Lycored coloration collection. The super stable color is heat-resistant, but also vegan and plant-based friendly. Derived naturally from Lycored’s own breed of tomatoes, it is an alternative to artificial and animal-derived color products and is Whole Foodscompliant. The company suggests UHT dairy, plant-based beverages and meats and surimi seafood products for applications.

Sweegen debuted Tastecode Natural Flavor Technologies, taste tools that address specific taste challenges and optimize the sensory experience at the molecular level.

Grande Custom Ingredients created warm, chocolate chunk cookies, made with its new ingredient Durato, which helps keeps sweet baked goods fresh longer. It can replace dairy powders to improve and maintain texture and

provide clean dairy notes in sweet baked goods such as cookies, muffins, bars and cakes. Durato is shear tolerant, freeze-thaw stable and clean label.

Sethness Roquette Caraness Specialty Caramels are crafted for use in dairy, bakery and confectionery applications, and can be customized for your product.

Written by Andy Hanacek

SENIOR EDITOR

The Masser-owned company uses landfill-sourced methane and cleaned coal-mine water to reach nearly 100% potato utilization.

hen it comes to championing sustainability, it’s hard to beat farmers, ranchers and vertically integrated food & beverage companies — especially generational ones. Enter the Masser family, an eighth-generation potato farming family in Sacramento, Pa., which has grown into the Masser Family of Companies, a vertically integrated potato production and processing business — and winner of our 2024 Green Plant of the Year poll.

The Masser family first emigrated to what is now the Reading, Pa., area in 1754, and the next generation began growing potatoes, says David Masser, current CEO of the Masser Family of Companies. In 1970, David’s grandfather started Sterman Masser Inc., and 54 years later, the Masser Family of Companies encompasses four businesses: Sterman Masser, Keystone Potato Products, Masser Logistics Services and Lykens Valley Grain, which provides the cover crops used in rotation on the potato farms.

“The majority of our sales are to retailers across the country,” Masser explains. “Every product that's in the fresh potato category is something that we would provide.”

As company growth really ramped up in the early 2000s (Keystone had yet to be founded), producing potato products while minimizing waste became more complicated than simply planting, picking and packing.

“As our sales and distribution company continued to grow, we found ourselves with a tremendous amount of off-grade potatoes that would not make the specifications for fresh table consumption,” Masser says. “We didn’t have a good use for that off-grade, so we were trying to figure out another way to generate value from that waste.”

That’s where the idea for Keystone Potato Products was born, about 20 years ago. The Keystone plant, in Hegins, Pa., opened in 2005, featuring a dehydration line to turn offgrade potatoes into potato flakes and flour, which has helped Masser garner added value from its potato waste stream.

The 120,000-sq.-ft. facility also produces bulk dices, slices, wedges and fries on a high-capacity french fry line; 30-lb. bags of whole peeled potatoes for foodservice; retail fresh-cut potato products; 3- and 4-potato russet trays for retail sale; and multiple sizes of retail bagged fresh potatoes on two highspeed automated packing lines.

As the number of potatoes needed for these products increased, an uptick in the amount of off-grade spuds followed.

“The [potato] waste that was created prior to Keystone had to go to cattle feed because we didn't have enough outlet for the off-grade,” Masser explains. “That’s really what has helped us in the past 20 years with Keystone: Having value for that off-grade product has really been exceptional.”

Upping the ante on full utilization at Keystone: Central Pennsylvania has a significant chipping potato production stream, given the number of snack food processors in the region. Masser says many companies typically use off-grade or off-size chipping potatoes to supplement bagged, retail, fresh table potato products — but that led to poor consumer experiences.

“If you've ever cooked a chip potato for something other than chips, it's a horrendous cooking experience,” he says. “They don't taste good; they cook away in the water — it just makes for a very bad experience in the kitchen.”

The problem was so prevalent, Masser says, that the company began to see demand for fresh table potatoes slumping because consumers couldn’t be sure that they were getting good, tablestock potatoes in the retail bags. However, chipping potatoes make great processed potato flakes, and those off-grade chipping potatoes

found a new destination in Keystone Potato Products.

“There were no dehydration processing plants east of the Mississippi at that time, so Keystone filled a void,” Masser adds. Additionally, it has offered farmers a type of insurance policy in the event of rough weather.

“We give the growers confidence that if Mother Nature kicks in and doesn’t give us the best growing conditions, we have options for that off-grade potato,” Masser says. “There's always going to be a home for every potato. We're not out there dumping it on the fields or feeding it to cattle; we're making a value-added product from it.”

With water content of about 80%, potatoes require a lot of energy to be properly dehydrated, and Masser sought a low-cost energy source for Keystone that would allow it to be competitive in the market. Various alternative and renewable energy options arose, but ultimately, a nearby landfill was looking to expand and to have the methane it produces used in a sustainable way.

“We were able to partner with the landfill to capture the methane gas, pipe it to our production facility and use that as the fuel source to create the steam to use in our process,” Masser says. Keystone

Keystone won our 14th annual Green Plant of the Year poll, besting very worthy plants from Perdue Farms and West Liberty Foods. Our thanks to the 446 of you who read the essays during the month of August and voted.

Potato Products was built next to the landfill and still uses that methane as its energy source.

Additionally, the Keystone team wanted to be as sustainable as possible with regard to the water it needed for processing. For the first two years of the plant’s life, Keystone tapped into the standard water supply, but that source ended up not meeting the plant’s capacity demands, and the company needed a new water source.

“Underneath the ground the processing plant sits on was an abandoned coal mine pool — basically an underground lake,” explains Masser. “We had all these abandoned mine pools from the anthracite coal industry, and the water in them is contaminated, but there’s plenty of it. So how do we tap into that? Is there a mutually beneficial way to clean that water up and help the environment?”

The technology used to clean the water to potable levels isn't new, and there are multiple ways to reach that goal, says Michael Pechart, executive vice president of strategic development for Masser

Family of Companies, who oversees Keystone Potato Products.

“We were able to remove iron and manganese with our original sand filters, but it was horribly costly,” Pechart says. “In 2014, we expanded our water treatment plant to be able to better remove iron and manganese.”

The water is thoroughly cleaned and decontaminated, and the iron and manganese (the primary metals in the water Keystone uses) precipitate out with the addition of a chemical additive. Keystone uses that clean water in its plant, sends the process wastewater to its on-site treatment plant, and the cleaned water is discharged into the local watershed.

“Ultimately, we clean impaired mining water that would otherwise degrade the environment, use it to process food, then treat it again before discharging it,” Pechart says.

Pushing progress

Keystone believes it has the “greenest” food processing plant in the eastern U.S., but that hasn’t prevented the company from continuing to make the plant even “greener.”

The iron and manganese that Keystone’s process removes from the mine water are caked and currently sent to landfill — but Pechart hints toward future sustainability intiatives for that material.

AUTOMATION DOESN’T HAVE TO BE COMPLICATED.

The COMPASS optical sorter takes food sorting in a new direction by combining the latest intelligent technology with simple, highly intuitive operation.

COMPASS reduces maintenance costs and sanitation requirements, while providing access to usable performance data and reports that help you improve your production process.

It’s never been easier to maximize your product quality, yield and line profits. Get started at www.key.net!

“We're in the Chesapeake Bay watershed and regulated by the Susquehanna River Basin Commission, so we're seeing if we can provide that iron/manganese cake to farmers or fertilizer companies to use to bind phosphorus into the soil,” he explains. “One of the leading contributors to Chesapeake Bay issues is phosphorus leaching, so we might have another value-added way for this facility to help the environment.”

Pechart says Keystone is investigating ways to use the methane from its own wastewater facility to generate electricity for the plant, taking it 100% off the grid. Currently, the company flares that methane but would like to put it to a more sustainable use, if possible. On the production side, Masser says, the company is looking for a new outlet for the last little bit of potato peel waste it still sends to cattle feed.

“We're looking at a way … to potentially dehydrate that peel waste, which, again, would be one more feather in the sustainable cap,” he explains. The company also continues to explore ways to expand use of its biodegradable, fresh potato bags, which do not contaminate recycling streams and break down completely, producing peat and methane as they decompose.

The Keystone team sees plenty of growth on the horizon for the facility, which makes the commitment to sustainable solutions that much more important. Masser says Keystone is “the shining star in our family of companies from an innovation perspective,” based on the opportunities and future ahead for the products it creates.

fresh, never frozen, ready-to-cook, ready-to-heat-and-eat potatoes, and that's really where Keystone can shine because it's set up to provide that,” Masser says. “Then,

the methane and water certainly are the Keystone sustainability highlights, but for every single potato to have a use, that's an even better story to tell.” n

“We feel the next innovation in the potato category is going to be Wish

you could do more with less?

You can with CleanWorx™, a new concept in automated washing systems and sanitation solutions from Sani-Matic. Eliminate the inconsistencies of manual cleaning and use your resources more efficiently.

As food & beverage processors look to sharpen their process controls, digitization, artificial intelligence and machine learning offer opportunities.

Written by Andy Hanacek

SENIOR EDITOR TECHNOLOGY

The computer age — and now the digital revolution — has taken human beings to new heights and greater milestones, and food & beverage processing operations have gone along for the ride. Digital connectivity, data collection and data analysis have allowed equipment, lines and facilities to talk to each other, making a world of difference in the ability to predict needs and direct resources and efforts appropriately.

“The advancements in food process control have been tremendous, with many vendors coming out with automated process controls for just about every area of food safety,” explains Takashi Nakamura, vice president of food safety for Fresh Del Monte Inc. (www.freshdelmonte.com). “However, with the proliferation of advancements also comes challenges.”

Indeed, there are hurdles to overcome in this perpetually changing arena, says Mikael Bengtsson, industry & solution strategy director of the food & beverage team for Infor (www.infor.com).

“If you think about the end-to-end process for a processor, there are so many challenges to address and opportunities to capture,” he says. “If you can [set up an optimal process],

the processing will be more efficient, improve the yield and increase food safety.”

Jamey Kirsch, sales & account manager for Vicinity Software (www.vicinitysoftware.com), says product loss during batch production as well as scheduling and quality control stand as challenges for processors that software can help resolve in many instances.

“Software that addresses quality control can provide the best possible outcome with extensive quality control measures,” he says. “Quickly creating a certificate of analysis document, reviewing test results over a period of time, integrating quality control tests and procedures, for example, are all necessary since companies up and down the supply chain request this information.”

Processors also battle the speed at which technology and equipment continues to improve, says Andrew Lorenz, founder and CEO of We R Food Safety! (www.werfoodsafety. com). “Process control is constantly changing. Software — to include controllers and remote monitoring — has made many advancements, allowing processors to monitor their systems in real time and adjust accordingly.”

According to Nakamura, when selecting automated process control solutions, processors must consider the options available to them in several terms: the operational fit of the solution to their processes; cost of the solutions, including ongoing maintenance and training; the education and training

required to maintain proper use of the system, rather than following a “set it and forget it” mentality; and the background of the solution providers themselves to the type of facility the software will serve.

Software innovation has allowed Fresh Del Monte to continue its journey for complete digitization, as well as digitization of food safety, he adds. Digitization refers to transferring analog (paper) documents to digital documents, and having a platform that actively houses electronic documents.

“There are many solution providers that will house these documents,” Nakamura says, “but the one challenge is having an ‘active’ management solution that provides insights into potential areas of issues.”

As Kirsch tells it, processors have so much data readily available today — way more than many of them ever knew they’d have — the question is how to make sense of and then handle it all.

“It’s important to realize that the tools are out there, and they’re not as scary as people might think; you don’t have to invest a huge amount of time or effort to be able to look at data,” he says. “If you’re not taking advantage of all the information available to you as a manufacturer, you are missing out.”

Bengtsson agrees, saying that in order for processors to optimize, they need to know the as-is state, when they are doing well and when they are not, and what levers can make the largest impact. Data provides the foundation to answer those questions.

As digital technology evolves in food and beverage processing, humans will still be needed to provide oversight to the millions of data points and proper analysis by the process control solutions.

“The challenge becomes how to decipher all the data and make it actionable; modern cloud solutions and innovative technologies have provided the tools to do that,” he says. “I believe the future winners within processing will be the ones who are embracing this.”

Lorenz sees the data revolution still in its adolescence when it comes to the food industry in general, but “it’s something that we have to do in order to deal with labor shortages and competition.”

For a large company like Fresh Del Monte, digitization has assisted global operations. “I can see realtime critical process conditions at a facility half a world away on my screen and mobile device,” Nakamura says. “Digitization has also certainly ‘shrunk’ the global food safety ecosystem with this realtime capability.”

He believes digitization has not added complexity to

already-complex hardware and software, but it still requires precision training, maintenance and awareness of the capabilities of the system. He cautions that although technology can enable more multi-tasking, having the right personnel overseeing the system and its operation remains critical.

As technology improves, the next opportunities will evolve from people’s ability to develop better ways to identify and anticipate risk, especially when considering food safety-related software systems.

“The [current] digital platforms are what I consider passive systems, meaning they store data as it is generated. That data, as well as relevant external data (weather, water data, outbreaks, etc.), then needs to be incorporated into an algorithm to determine potential streams of food safety risks,” Nakamura says. “The capability to take potentially millions or more

“Today’s AI capabilities are impressive, and linking these data points and calculate potential ‘hot spots’ before an event is the next evolution of risk assessment.”

One potential evolution that isn’t too far in the future is the incorporation of artificial intelligence (AI) and machine learning (ML) into these process control solutions. Bengtsson calls it “very exciting times right now,” given the paradigm shift that AI and ML have begun to usher into the food & beverage industry by “solving for challenges that were not even possible to address previously.”

Lorenz sees similar results, with AI “already showing benefits in helping predict potential issues and developing fixes or changes to address issues in our production environment.”

Kirsch says AI and ML hold a lot of promise for food & beverage operators, offering the potential to match product formulas with inventory quantities to determine the batch size, or the ability to provide the most efficient parameters for making a product based on historical machine settings, processing times or temperatures.

“Additionally, with machine learning and historical data, maintenance and clean-out activities can be better scheduled to align with the production requirements,” Kirsch adds. “AI/machine learning/Internet of Things technologies and software can lead to improved operational efficiency and cost savings.”

Although AI has evolved quickly, it still has development ahead of it before flooding into process control solutions and driving changes. Currently, Nakamura says, AI works when asked the right question, but it hasn’t evolved to know what to do with data unprompted. The next leap will be systems that

aggregate master data, calculate risks and communicate those risks to the user.

capabilities to process control and other relevant data to calculate risks with more data points will be the next generation of food safety,” he says. n

1.Publication

Fusaro, 1501 E Woodfield

Tower Place, Nashville, TN 37204;Resolute Capital partners Fund IV, LP, 20 Burton

Blvd, Suite 430, Nashville, TN 37215;RCP Endeavor, Inc, 20 Burton Hills Blvd, Suite 430, ,Nashville, TN 37215;Northcreek Mezzanine Fund II, LP,312 Walnut Street, Suite 2310,Cincinnati, OH 45202;Invegarry Holdings, LP,44235 Hillsboro Pike,Nashville, TN 37215;Everside Fund II, LP,155 East 44th St, Suite 2101 - 10 Grand Central,New York, NY 10017Everside Endeavor F1 Blocker, LLC, 155 East 44th St, Suite 2101 - 10 Grand Central, New York, NY 10017;Everside Endeavor International Blocker, LLC, 155 East 44th St, Suite 2101 - 10 Grand Central, New York, NY 10017;Everside Founders Fund, LP, 155

Blocker, LLC,155 East 44th St, Suite 2101 - 10 Grand Central,New York, NY 10017; Known Bondholders, Mortgagees,

written request from recipient, telemarketing and Internet requests from recipient, paid subscriptions including nominal rate subscriptions, employer requests, advertiser’s proof copies, and exchange copies.)

(2)In-County Paid/Requested Mail Subscriptions stated on PS Form 3541. (Include direct written request from recipient, telemarketing and Internet requests from recipient, paid subscriptions including nominal rate subscriptions, employer requests, advertiser’s proof copies, and exchange copies.)

(3) Sales Through Dealers and Carriers, Street Vendors, Counter Sales, and Other

(2) In-County Nonrequested Copies Stated on PS Form 3541 (include Sample copies, Requests Over 3 years old, Requests induced by a Premium, Bulk Sales and Requests including Association Requests, Names obtained from Business Directories, Lists, and other sources) (3) Nonrequested Copies Distributed Through the USPS by Other Classes of Mail (e.g. First-Class Mail, Nonrequestor Copies mailed in excess of 10% Limit mailed

Copies not Distributed Total (Sum of 15f and g) Percent Paid and/or Requested Circulation (15c divided by 15f times 100)