MARKETSCALMAS CONSOLIDATIONCONTINUES

MARKETSIGNALS

DownturnContinuesForCrypto

MACROUPDATE

ResilientSpendingvs.Persistent In ation:Fed’sBalancingActin 2025

DownturnContinuesForCrypto

MACROUPDATE

ResilientSpendingvs.Persistent In ation:Fed’sBalancingActin 2025

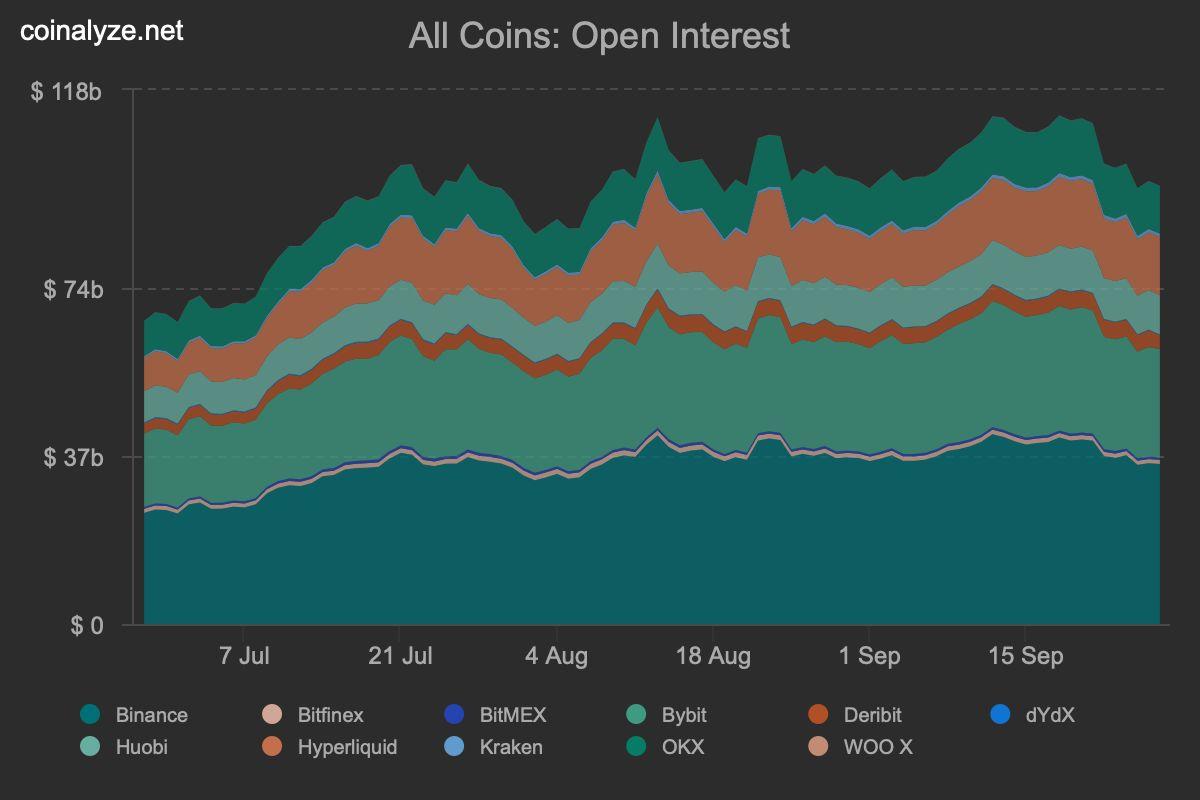

Bitcoinslid5.1percentlastweektocloseat$109,690,breakingbelowkeysupports asthepost-FOMCrallygavewaytorenewedsellingpressure.Etherfell10.1percent andSolanadropped14.3percent,reinforcingthebroadrisk-offtoneacrossmajors. Yet, selective rotation into speculative altcoins persisted, reflecting investorsʼ continued search for higher-beta opportunities even as total market capitalisation contracted 5.9 percent on the week to $3.7 trillion, down 12.6 percent from recent highs.Openinterestalsodeclined13.7percentfromitsSeptemberpeak,signallinga broadreductioninspeculativeleverage.

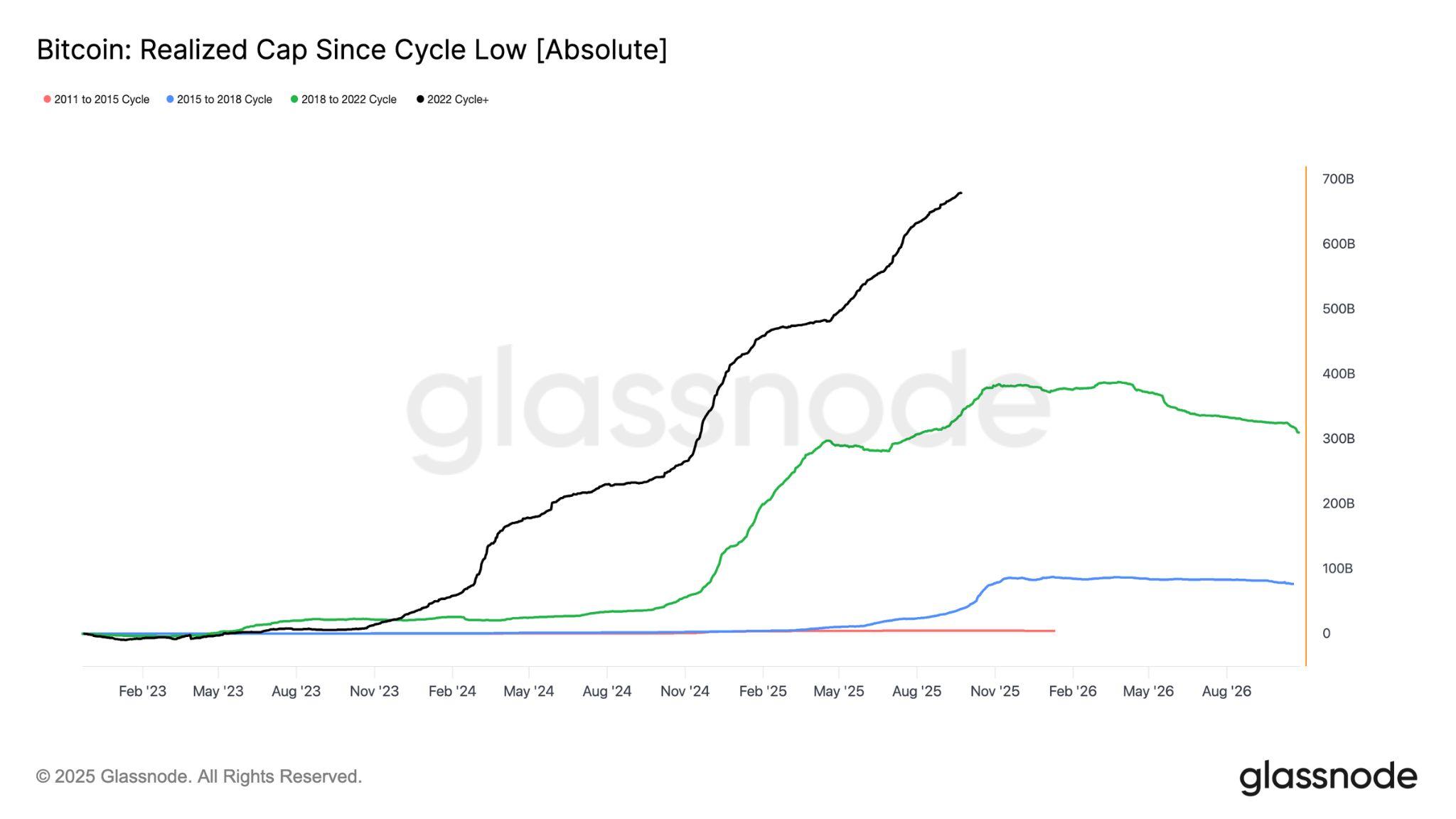

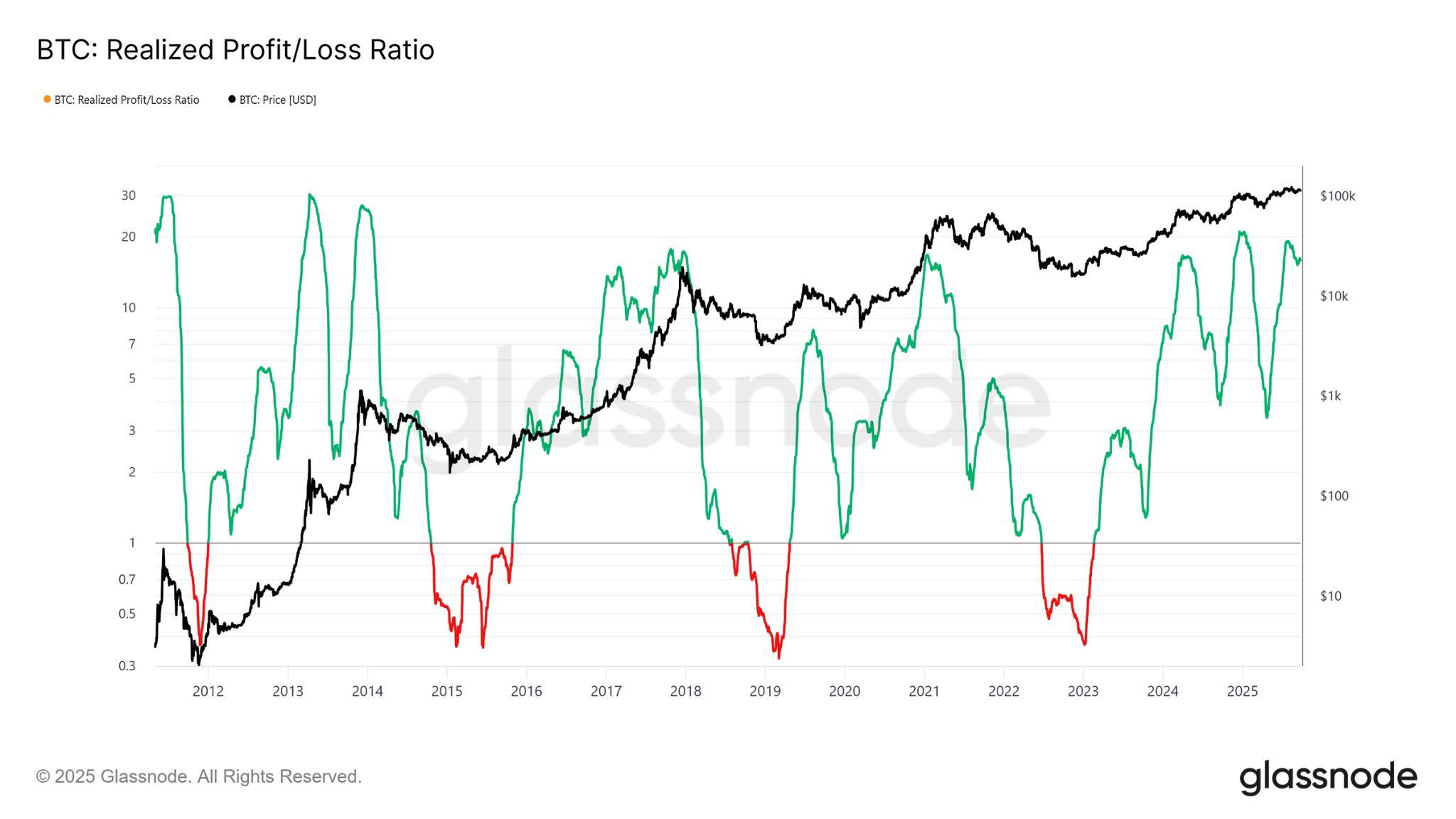

Fromacycleperspective,realisedcapitalinflowshighlightthestructuralscaleofthe current bull market. Since January 2023, Bitcoin has absorbed $678 billion in net inflows,1.8timesthesizeoftheentirepriorcycledrivenbyinstitutionaladoptionand deepening liquidity. Unlike earlier cycles, this one has advanced in three distinct multi-month surges, each punctuated by heavy profit-taking when more than 90 percent of coins moved were transacted in profit. Long-term holders have already realised 3.4 million BTC, surpassing all prior cycles and underscoring the unprecedentedmaturityofthiscohortandthedepthofcapitalrotationunderpinning todayʼs market. With the third wave of distribution now fading, conditions favour a coolingphaseasrealisedgainsaredigestedbeforethenextstructuralleghigher.

The US economy is showing a complex mix of resilience and strain. Consumer spendingremainsstrong,withhouseholdsboostingoutlaysonservices,travel,and goods, helping drive second-quarter GDP growth to its fastest pace in nearly two years and keeping third-quarter projections close to 4 percent. This momentum, however, is unevenly distributed: higher-income households, supported by rising wealth, continue to spend, while lower-income families are increasingly relying on savingsaswagesstagnateandessentialcostslikefoodandenergyclimb.

Inflation remains stubborn, with the Fedʼs preferred measure, the Personal Consumption Expenditures Index, rising 2.7 percent year-over-year in August and core inflation holding at 2.9 percent, driven by persistent service-sector and goods pricepressures.

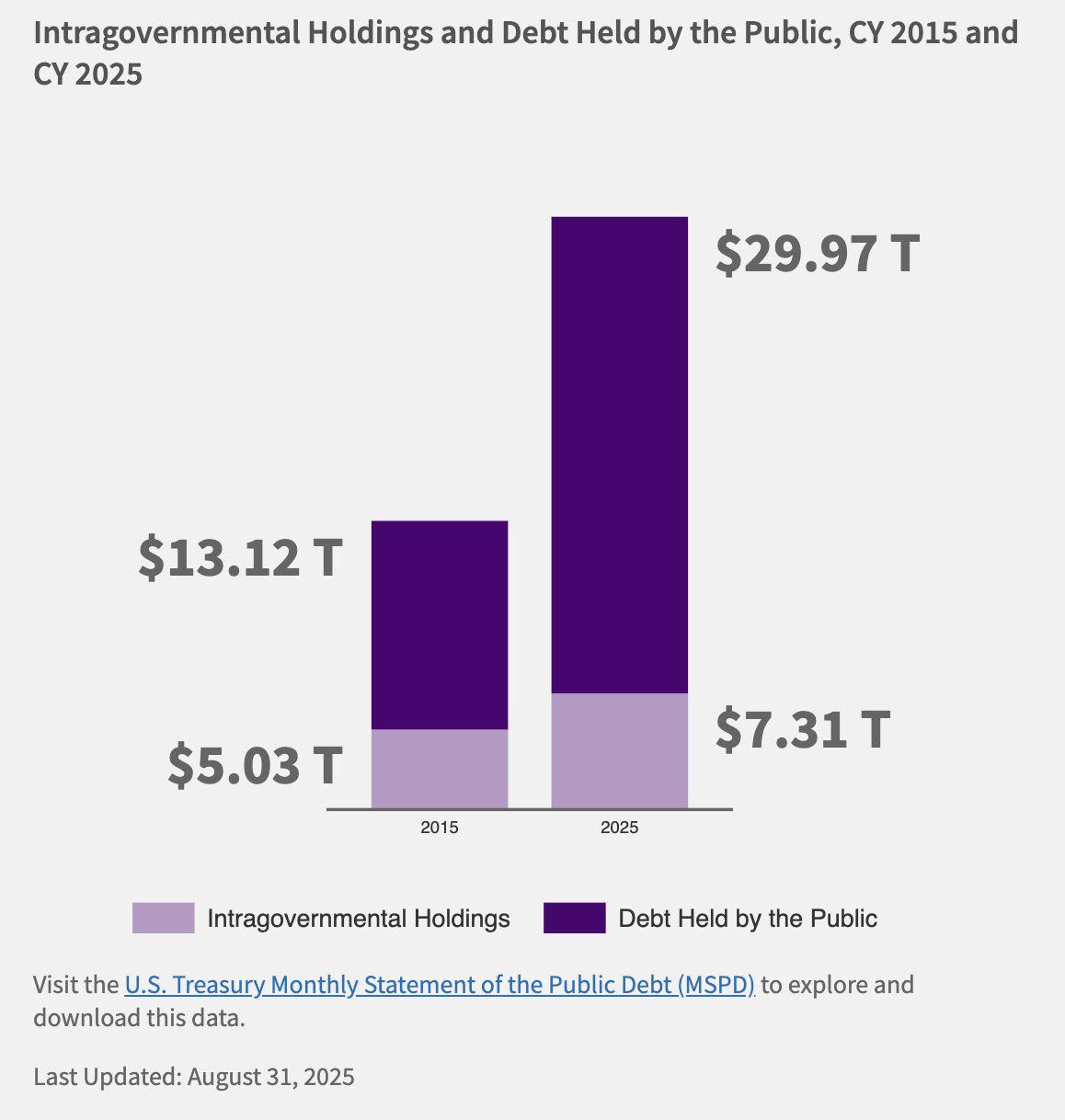

The Federal Reserve cut rates by 25 basis points on September 17th to 44.25 percent, aiming to balance slowing job growth with inflation control. Yet this easing highlightsa delicatetension:whileshort-termyieldshavefallen,long-termTreasury rates remain elevated as investors demand compensation for fiscal risks. National debt has surged to $37.3 trillion, with annual interest costs exceeding $1.1 trillion, making debt service the governmentʼs second-largest expense. This backdrop has steepened the yield curve, leaving mortgage rates stuck near 7 percent and borrowingcostshighforhouseholdsandbusinesses.

The cryptocurrency landscape is being shaped by a mix of political risk, regulatory shifts, and financial innovation across major economies. In the United States, a looming government shutdown on September 30th, the end of the fiscal year, underscores deep political polarisation. While short shutdowns have historically had little impact on markets, todayʼs backdrop of fiscal strain and global fragility could amplify risks. Equities may face pressure from delayed data releases, bond yields couldswingondeficitconcerns,andcryptomaydrawrenewedattentionasinvestors questionWashingtonʼsstability.

Across the Atlantic, the UK is beginning to take a more constructive path to crypto adoption,withleadingbanksincludingBarclays,HSBC,andNatWestlaunchingalive pilotfortokenisedsterlingdeposits.Runningthroughmid-2026,theprogramwilltest use cases such as peer-to-peer payments, faster mortgage processing, and digital assetsettlement,allwithinexistingregulatoryprotections.

Meanwhile, Australia has moved to tighten its regulatory perimeter. Draft legislation released by the Treasury would require crypto exchanges and custody providers to obtain financial services licenses, aligning them with traditional intermediaries under theCorporationsAct.

● DownturnContinuesforCrypto

● AmericansKeepSpending,butInflation PressuresCloudFedʼsNextMove

● Short-TermRelief,Long-TermStrain:Fed CutsClashwithRisingInflationRisks

● LoomingUSGovernmentShutdown RaisesPoliticalTensions,MarketsRemain Cautious ● UKBanksLaunchPilotforTokenised SterlingDeposits ● Australia

Bitcoinextendeditsdeclinelastweek,falling5.1percenttocloseat$109,690 filling . The weakness was broad-based across major assets, with Ether dropping10.1percentand Solanalosing14.3percent,underscoringrenewed sellingpressurefollowingthepost-FOMCrally.

Evenso,themarketshowedsignsofrotation.Selectivecapitalinflowscontinued to find their way into certain altcoins that benefitted from speculative narratives, partially offsetting the broader decline in majors. This rotation reflects investorsʼ ongoingsearchforhigherbetaopportunitiesdespiteheightenedvolatility.

Inaggregate,totalcryptocurrencymarketcapitalisationcontractedby5.9percent fortheweekand12.6percentofftherecenthighsto$3.7trillion,highlightingthe dominance of risk-off flows while still pointing to pockets of resilience further downtheriskcurve.

BTC has entered a corrective phase following its FOMC-driven rally, displaying classic “buy the rumour, sell the newsˮ dynamics. The broader market structure nowreflectsfadingmomentum,withpriceactionsuggestingconsolidationrather thancontinuationintheimmediateterm.

Total global open interest across major exchanges — both centralised CEXs and decentralised DEXs has fallen 13.7 percent from its all-time high on 12 September. This decline highlights broad-based profit-taking following the FOMCmeetingandreflectstheunwindingofspeculativepositioningacrossthe market.

Figure4. BitcoinAbsoluteRealisedCapitalisationSince CycleLowsinJanuary2023Source:Glassnode)

Themarketisnowsignificantlylargerthanithasbeeninpreviouscycles.

This cycle has already absorbed $678 billion in net inflows which is nearly 1.8 timeslargerthantheentirepriorcycle.Thescaleunderscorestheunprecedented magnitude of capital rotation underway, highlighting both the structural depth of institutional participation and the accelerating pace at which digital assets are beingintegratedintoglobalportfolios.

● 20112015$4.2billion

● 20152018$85billion

● 20182022$383billion

● 2022Present:$678billion

Another defining feature of the current cycle is the structure of inflows. Unlike earliercycles,whichtendedtoplayoutinasingleprolongedwaveofcapital,this cycle has unfolded in three distinct multi-month surges. Each has been punctuatedbyheavyprofit-taking,asshownbytheRealisedProfit/LossRatio.At every cyclical peak, more than 90 percent of coins moved were transacted in profit,aclearsignalofwidespreaddistribution.Havingjuststeppedbackfromthe third such extreme, probabilities now tilt towards a cooling phase as the market digestsrealisedgains.

The scale of this process is even more apparent when focusing on long-term holdersLTHs.ThismeasuretrackscumulativeLTHprofitsfromtheformationof anewall-timehightotheeventualcyclepeak,withheavydistributionhistorically markingthetop.Inthecurrentcycle,LTHshavealreadyrealised3.4millionBTC, surpassing the levels seen in all prior cycles. This underscores two critical dynamics: first, the growing maturity of the LTH cohort, whose willingness to distribute has become a defining feature of market structure; and second, the unprecedented magnitude of capital rotation driving this cycle, with far deeper liquidityandinstitutionalparticipationthaneverbefore.

Figure6.DisposablePersonalIncome,OutlaysandSavings

US consumer spending picked up in August, driven by back-to-school shopping, travel, and dining out, even as households leaned on savings to support their outlays. But with inflation proving stubborn, the latest government report highlights a tension between resilient consumption and rising price pressures that could complicate the Federal Reserveʼs path on reducinginterestrates.

The latest Personal Consumption Expenditures PCE) report, issued last Friday, September 26th, showed that overall consumer spending rose 0.6 percent in August after a 0.5 percent gain in July. The increase was broad-based, with households spending more on services such as transportation, restaurants, hotels,andhealthcare,aswellasongoodslikerecreationalitems,clothing,and energyproducts.

Figure7.ChangesinConsumerSpendingforAugust2025Householdsare SpendingMoreonServicesSource:USBureauofEconomicAnalysis)

Source:USBureauofEconomicAnalysis)

At the same time, incomes grew by only 0.4 percent, and wages rose by just 0.3 percentfromthepriormonth,withmuchoftheincreasecomingfromgovernment transfers. As a result, the personal savings rate edged down to 4.6 percent in August from 4.8 percent, signalling that households are increasingly tapping into reservestosustaintheirconsumption.

While upper-income households, buoyed by stock market gains and elevated home values, continue to spend, lower-income families remain under strain, particularly as food and energy prices climb and federal food assistance programsfacecuts.

Inflation remains at the centre of the story. The PCE Price Index, the Fedʼs preferred measure, climbed 2.7 percent year-over-year in August, the largest increase since February. Core PCE, which excludes food and energy, rose 2.9 percent,reflectingpersistentpricegrowthinservices,whichadvancedfrom3.5 percent to 3.6 percent. Goods inflation also accelerated, with beef and veal prices up nearly 14 percent compared with a year earlier, electricity costs were upmorethan6percent,andutilitiesupby7percent.

This backdrop has complicated expectations for monetary policy. The Federal Reserve,whichcutitsbenchmarkinterestrateby25basispointsonSeptember 17th to a range of 44.25 percent, faces a delicate balancing act. Fed Chair Jerome Powell acknowledged the challenge, noting that “near-term risks to inflationaretiltedtotheupsideandriskstoemploymenttothedownside.ˮWhile some investors had anticipated additional cuts in October and December, the strengthofconsumerdemandandpersistenceofinflationargueforcaution.

The broader economy has retained momentum. Consumer spending, which makes up more than two-thirds of US economic activity, contributed to a 3.8 percent annualised GDP growth rate in the second quarter. This is the fastest growth in nearly two years. The Atlanta Fed currently projects third-quarter growth at 3.9 percent. Still, this strength masks underlying cracks. Job creation hasnearlystalledinrecentmonths,andtighterimmigrationrulesarelimitingthe laboursupply.Thatslowdowninhiringsuggeststhatwhileoutputremainsstrong onpaper,thefoundationsmaybeweakening.

Americaʼs consumers remain a pillar of strength, but at a cost. Spending is being supported by savings drawdowns and wealthier households, while persistent inflation, particularly in services and goods affected by tariffs, is erodingpurchasingpower.Withdeficitsaddingtofiscalpressuresandinflation above target, the Fed is caught in a bind: easing policy to support jobs risks fuellingfurtherpriceincreases,butholdingratessteadycouldslowgrowth.The August PCE report underscores that short-term resilience may come at the expenseoflong-termstrain.

Demand-side strength has helped sustain growth, but it comes with limits. Rising borrowing costs and depleted savings may eventually cool household spending. That risk is already being reflected in financial markets, where investors remain sceptical that near-term rate cuts can fully offset the pressuresofinflationandgovernmentdebt.

TheUSTreasurymarketiscaughtbetweentwoopposingforces:short-term monetaryeasingfromtheFederalReserveandlong-terminvestorscepticism fueledbypersistentinflationandrecordgovernmentborrowing.

Figure10.MarketYieldonUSTreasurySecuritiesat2Yearand5Year ConstantMaturityChartSource:Fred)

US Treasury yields on the short end of the curve have fallen sharply this year. Two-year and five-year Treasury notes dropped about 75 basis points as investors anticipated Fed rate cuts. That expectation materialised when the Federal Reserve delivered its first reduction of the year on September 17th, lowering the federal funds rate by 0.25 percent to a range of 44.25 percent. Fed projections signal two more cuts by year-end, reflecting concerns over slowingjobgrowthandrisingunemployment.

While policymakers see scope for further easing, markets are less convinced. Investorsviewhouseholdspendingasresilientintheshortterm,buttheyworry that persistent inflation and heavy debt issuance will outweigh the benefits of ratecutsovertime.

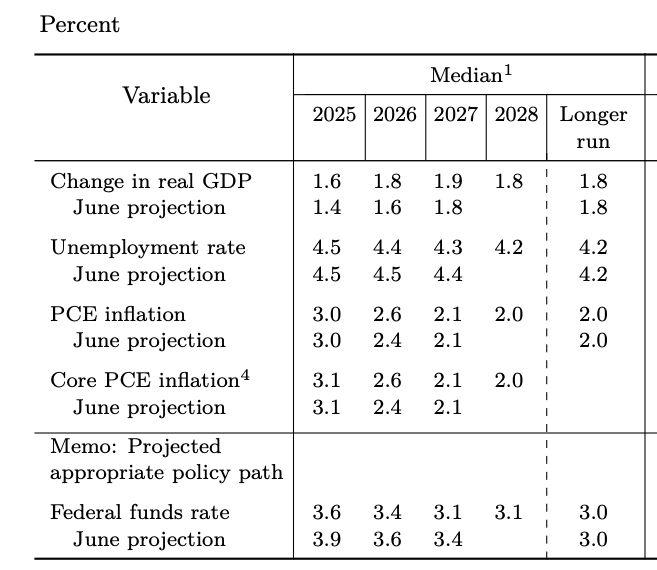

Source:FederalReserveSummaryofEconomicProjections,September2025

Inflation remains stubborn. The Personal Consumption Expenditures PCE Price Index,theFederalReserveʼspreferredgauge,rose2.7percentinAugustfroma yearearlier,whilethecorePCEindex,whichexcludesfoodandenergy,climbed 2.9percent.FederalReserveprojectionsindicateinflationmaynotreturntothe2 percenttargetuntil2027,underscoringthedelicatebalancebetweensupporting employment and containing prices. Chair Jerome Powell emphasised that while policy easing is warranted, it must not become too lax in the face of elevated inflation.“Ifweeasetooaggressively,wecouldleavetheinflationjobunfinished and need to reverse course laterˮ, Powell stated in his speech last Tuesday, September23rd.

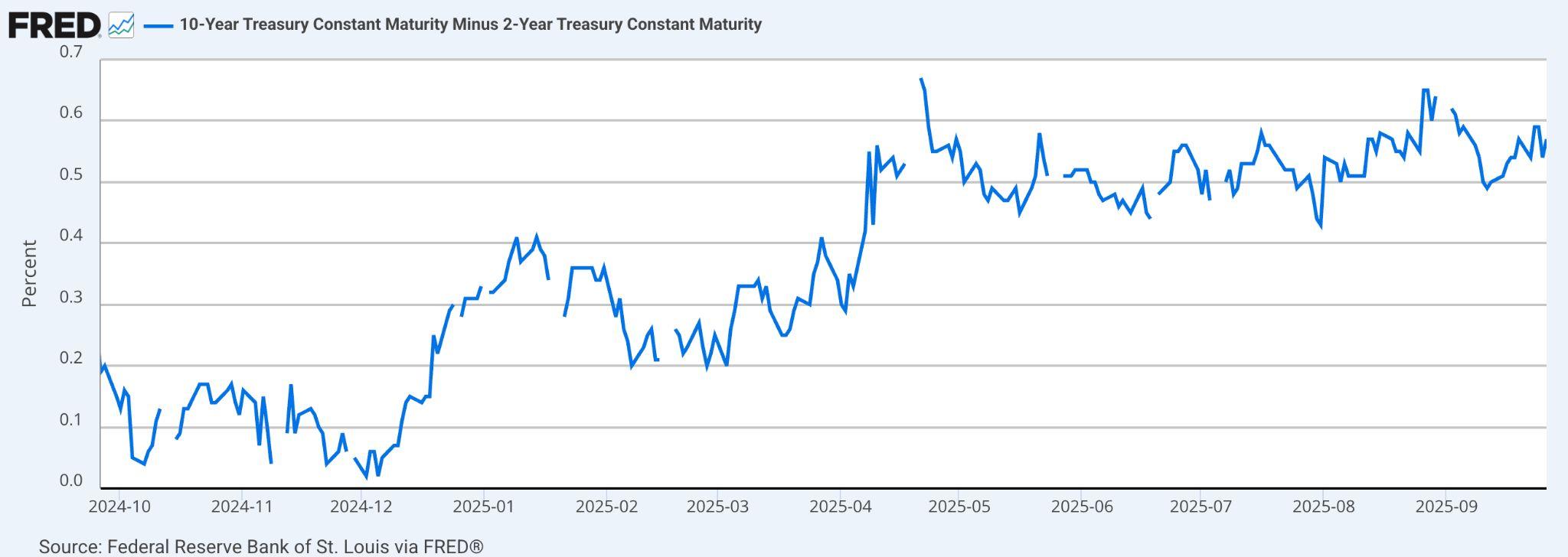

Figure12.MarketYieldonUSTreasurySecuritiesat10Yearand2Year

MaturityChartSource:Fred)

Meanwhile,onthelongendofthecurve,yieldstelladifferentstory.The10-year Treasury has eased only modestly to 4.13 percent, while the 30-year hovers around 4.74.8 percent. Investors are demanding higher risk premia to hold long-term debt, reflecting worries about persistent inflation, rising borrowing costs,andthegovernmentʼsmountingfiscalobligations.

The numbers behind those concerns are stark. US national debt stood at $37.3 trillioninAugust2025,roughly119percentofGDP.Thegovernmentisontrackto post a fiscal year 2025 deficit of about $1.71.8 trillion, or roughly 6 percent of GDP.Interestpaymentsalonehavesurgedpast$1.1trillionannually,makingdebt service the second-largest federal expense after Social Security. While new tariffshaveboostedcustomsrevenues,theyhavealsoaddedtoconsumerprices, furthercomplicatingtheinflationpicture.

This divergence is reshaping the yield curve. Short-term rates have eased following the cut in interest rates, but long-term yields remain elevated, steepening the curve after two years of inversion. Mortgage rates now sit near 6.57percent,keepingconsumerborrowingcostshighdespitefront-endrelief.

Cutting rates while inflation remains above target and government borrowing needs are at historic highs is a delicate operation. On one hand, lowering policy rates provides short-term support to businesses and households through cheaper financing at the front end of the curve. But at the same time, it risks signalling to investors that the Federal Reserve is easing up on its fight against inflation. That perception can push long-term yields higher, as bondholders demandgreatercompensationtooffsettheriskofpersistentpricepressures.

Compounding the challenge, the US Treasury must issue massive amounts of debttofinanceannualdeficits.Ifmonetarypolicybecomesmoreaccommodative while debt issuance stays elevated, markets may question the sustainability of government finances. The result could be a further rise in long-term borrowing costs,effectivelycounteractingtheFedʼsintendedstimulusandaddingpressure onhouseholds,businesses,andthegovernmentitself.

ThiscontrastswithheadlineGDPfigures,whichshowtheeconomyexpandingat one of its fastest paces in nearly two years. The divergence highlights a mixed picture:outputgrowthissolid,butthelabourmarketʼscoolingtrendraisesdoubts abouthowdurablethatmomentumwillbe.

The takeaway is clear: Fed rate cuts may ease financing conditions in the short term, but the bond market is signalling deeper structural concerns. Persistent inflation, trillion-dollar deficits, and historic debt levels are keeping long-term borrowing costs elevated. In this environment, short-term relief is colliding with long-term strain, and investors are demanding discipline before offering lower costsofcapital.

The US federal government is once again on the verge of a shutdown, with funding set to expire at midnight on September 30th, the statutory end of the fiscal year. Unless Congress reaches an agreement, non-essential government functions must cease under the Antideficiency Act , which bars agencies from spendingmoneynotappropriatedbylaw.

The White House has directed agencies not only to prepare for furloughs but alsotoplanforpermanentlayoffsinprogrammesthatfalloutsideadministration priorities.DemocratsandtheRepublican-controlledCongressremainlockedina standoff, with disputes over healthcare subsidies, Medicaid cuts, and public funding provisions blocking passage of a short-term bill. The Senate has rejectedtheHouseʼsproposal,raisingtheriskofafullshutdown.

Essential services such as Social Security, Medicare, the military, immigration enforcement,airtrafficcontrol,andpostaldeliverywouldcontinue,buthundreds of thousands of federal workers could be sidelined or required to work without pay. Non-essential services, including food safety inspections, national parks, andkeyadministrativehearings,wouldbedisrupted.

The economic drag depends on duration. The Congressional Budget Office estimated the 201819 shutdown, which lasted 35 days, permanently cut roughly $3 billion from GDP. Goldman Sachs has projected that shutdowns reduce growth by about 0.2 percentage points for each week of disruption, thoughoutputtendstorecoveroncefundingresumes.

Historically, markets have treated brief shutdowns as minor events. Since 1950, there have been 21 shutdowns, most lasting only a few days, with little direct impact on corporate earnings. However, prolonged or repeated shutdownscanerodeconfidence.Inanepisodein201819,theS&P500fell13 percent in the lead-up, and 10-year Treasury yields dropped 13bps, as investorssoughtsafety.

This yearʼs standoff may carry greater weight, according to JP Morgan research. Deep political polarisation, rising fiscal deficits, and a fragile global economyleavemarketsmoresensitivetoshocks.Ashutdowncouldhavethe followingeffects,dependingontheassetclass:

● Equities:Pressurevaluationsifinvestorsentimentweakens,particularly ifearningsvisibilityiscloudedbydelayedgovernmentdatareleases.

● Bonds:IntroducevolatilityinTreasuryyields.Whilehistoricalprecedent points to falling yields during shutdowns, political risk and deficit concernscouldpushthemhigherthistime.

● Crypto: Dysfunction in Washington may reinforce the narrative for decentralised assets, but digital markets remain more tethered to liquidityconditionsandFedpolicythantoUSbudgetpolitics.

Another concern is the disruption of federal data collection, including key inflation reports such as CPI. Delays in this data could complicate Federal Reserve policy decisions and ripple through the TIPS market Treasury Inflation-protectedsecurities).Atthesametime,globalinvestorshavealready been trimming US allocations; a drawn-out shutdown could accelerate diversificationintonon-USequities,bonds,andalternativeassets.

Shutdownsarenotthesameasdebt-ceilingcrises,whichdirectlythreatenUS sovereign creditworthiness. But they remain highly disruptive, with significant implications for federal employees and public services. For markets, the immediate risk is confidence erosion and data blind spots, rather than systemicfinancialinstability.

Britainʼs largest lenders, including Barclays, HSBC, Lloyds, NatWest, Nationwide,andSantander,havebegunalivepilottotokenisesterlingdeposits, a step toward moving customer money onto programmable digital rails. The initiativefollowsguidancefromBankofEnglandGovernorAndrewBailey,who has urged banks to focus on tokenisation rather than creating private stablecoins.

Thepilot,announcedbyUKFinance, willrununtilmid-2026.Itwillprocessreal transactions and test three use cases: peer-to-peer payments on online marketplaces with stronger fraud safeguards, faster and more secure remortgaging processes, and settlement of digital assets using tokenised funds.

Built on earlier work from the Regulated Liability Network RLN, the platform aims to ensure interoperability across digital money systems while keeping commercial bank money within the regulated environment. It will also provide tokenisation-as-a-serviceforinstitutionslackingin-housetechnology.Advisory supportisbeingprovidedbyQuant,EY,andLinklaters.

Unlike stablecoins, tokenised deposits are fully integrated within existing bank regulation and deposit protection schemes, making them a safer and more familiar option for customers. The pilot coincides with the UKʼs broader regulatory efforts, with the Financial Conduct Authority expected to finalise stablecoinrulesin2026,whiletheBankofEnglandhassignalledthattokenised depositscanmoveforwardunderthecurrentframework.

Australiaʼs Treasury has released draft legislation that would require crypto exchangesandcustodyproviderstoobtainAustralianfinancialserviceslicenses, bringing them under the same regulatory regime as traditional financial intermediaries.

The proposal, unveiled last Thursday, September 25th, would amend the Corporations Act 2001 to classify digital asset platforms and tokenised custody platforms asfinancialproducts.Thatmeansoperatorssuchastradingplatforms, brokerages, and tokenised asset custodians would be subject to licensing, compliance,andconsumerprotectionrulesoverseenbytheAustralianSecurities andInvestmentsCommission.

TheTreasurysaidtheframeworktargetsbusinessesholdingclientassets,rather than the digital assets themselves, noting that past failures of intermediaries had caused significant consumer losses, including in Australia. Assistant Treasurer Daniel Mulino described the draft as an extension of existing laws applied in a “targetedwayˮtodigitalassets.

The consultation period runs until October 24th, 2025. Currently, crypto exchanges in Australia are only required to follow anti-money laundering and know-your-customer rules. The move comes as ASIC recently allowed licensed intermediaries to distribute stablecoins without additional approvals, signalling a tighteningyetnuancedapproachtocryptooversight.