MARKETCONSOLIDATING, NOTCASCADING

MARKETSIGNALS

BitcoinDeclinesButDownside MomentumSlows

MACROUPDATE

USLabourMarketShowsSignsof StructuralWeakness

BitcoinDeclinesButDownside MomentumSlows

MACROUPDATE

USLabourMarketShowsSignsof StructuralWeakness

Bitcoinwasdownbyasmuchas21.46percentfromitsOctoberall-timehighlast week, briefly dipping below the psychological $100,000 mark to a low of $99,045. Such a fall likely signifies the establishment of a new consolidation base rather than the onset of a cascading sell-off. Historical market and on-chain data suggest that the current price action closely mirrors prior mid-cycle corrections, where structural participants stabilise exposure and capital rotates within the ecosystem before broader uptrend continuation. The failure to hold above the short-term holdersʼ STH) cost basis of $112,500 has led to a controlled decline, bringing BTC back below that key level and confirmingtheanticipatedretestofdeeperstructuralsupports.

Attheselevels,roughly72percentofBTCsupplyremainsinprofit,nearthelower endofthe7090percentequilibriumbandtypicalofmid-cycleslowdowns.This condition indicates that while selling pressure persists, much of the speculative excess has already been flushed out. The $88,500 Active Investorsʼ Realised Pricenowstandsasthenextmajordownsidereference,aligningwithpastcycle support zones where capitulation historically transitioned into re-accumulation. While brief relief rallies toward the STH cost basis remain likely, a sustained recovery will depend on renewed demand inflows from institutional and retail participants. Until then, the market is expected to remain range-bound as volatility compresses and structural positioning resets ahead of the next major cyclemove.

The US economy is flashing mixed signals where corporate borrowing is bouncing back, but hiring is faltering. In the absence of official data, new private-sector data show that the US labour market is weakening faster than expected, with Octoberʼs ADP National Employment Report recording just 42,000 new jobs, almost all from large firms, while small and mid-sized companiesshedworkersforthethirdconsecutivemonth.Consumerconfidence hasalsofallen6percentinNovember,signallingthathouseholdsarestartingto feelthestrainofslowerhiringandpolicyuncertainty.

Thecryptoindustryisenteringanewphaseofmainstreamadoption,drivenby record growth in stablecoins and rising regulatory engagement worldwide. In October 2025, Ethereum-based stablecoins hit an all-time high of $2.82 trillion in monthly volume, up 45 percent from September, as investors rotated into dollar-peggedtokensamidmarketpullbacksandEthereumʼsexpandingLayer-2 ecosystem enabled faster, cheaper transactions. The milestone cements Ethereumʼs role as a foundation of digital finance, powering remittances, DeFi, andinstitutionalsettlements.

Regulators are also accelerating efforts to integrate blockchain into traditional finance. In Japan, the Financial Services Agency approved a stablecoin pilot involving megabanks Mizuho, MUFG, and SMBC, set to begin in November 2025,totestregulateddigitalpaymentsundernewfinanciallaws.Meanwhile,in Australia,theChairoftheAustralianSecurities&InvestmentCommissionASIC Joe Longo urged the nation to embrace tokenisation to modernise its markets, announcing a relaunch of the ASIC Innovation Hub and updated licensing for stablecoinsandtokenisedsecurities.

● BitcoinDeclinesButDownside MomentumSlows

● USLabourMarketShowsSignsof StructuralWeakness

1. MarketSignals 2. GeneralMacroUpdate 3. NewsFromTheCryptosphere

● Ethereum-BasedStablecoinsSurgetoa Record-Setting$2.82TrillionMonthly VolumeinOctober2025

● JapanʼsFinancialWatchdogBacks StablecoinPilotLedbyThreeMajorBanks

● AustraliaʼsFinancialRegulatorPushesfor

Bitcoincontinuedtoextenditsdeclinelastweek-evenbrieflyfallingbelow thepsychological$100,000mark—andputtingitevenlowerthanwhenitfell duringtheOctober10th liquidationevent.

Figure1.BTC/USDDailyChartDrawdownCorrelatestoOtherMid-Cycle Corrections.Source:Bitfinex)

Thismovehoweverisnot,inourview,acontinuationofacascadingsell-off, but more likely marks the establishment of a new consolidation zone. Historicalon-chainandpricedata,combinedwithcurrenttraderpositioning, indicatethatmarketsarenotabouttoseemoreaggressiveselling,butrather thesetupresemblesatypicalmid-cyclecorrection.Thesephasestypically featureprolongedrangeformationandcapitalrotation,ratherthansustained downsidemomentum.Wesee participantsstabilisingtheirpositioningbefore thenextlegofthebroadercyclebegins.

Since the market reset on October 10th, Bitcoin has struggled to maintain tractionabovetheshort-termholdersʼSTH)costbasisof$112,500.

As we have previously noted, the failure to sustain the price above the crucial $107,000$108,000 region, an area supported by both technical structure and on-chainrelevance,openedthedoortosub-$100,000priceaction.

Historically, such sell-offs have increased the probability of further downside towarddeeperstructuralsupports.

One on-chain level to focus on is the Active Investorsʼ Realised Price, currently around $88,500. This metric tracks the aggregate cost basis of actively circulatingsupplywhileexcludingdormantcoins,andhasconsistentlyactedas acriticalreferencepointduringextendedcorrectivephases.

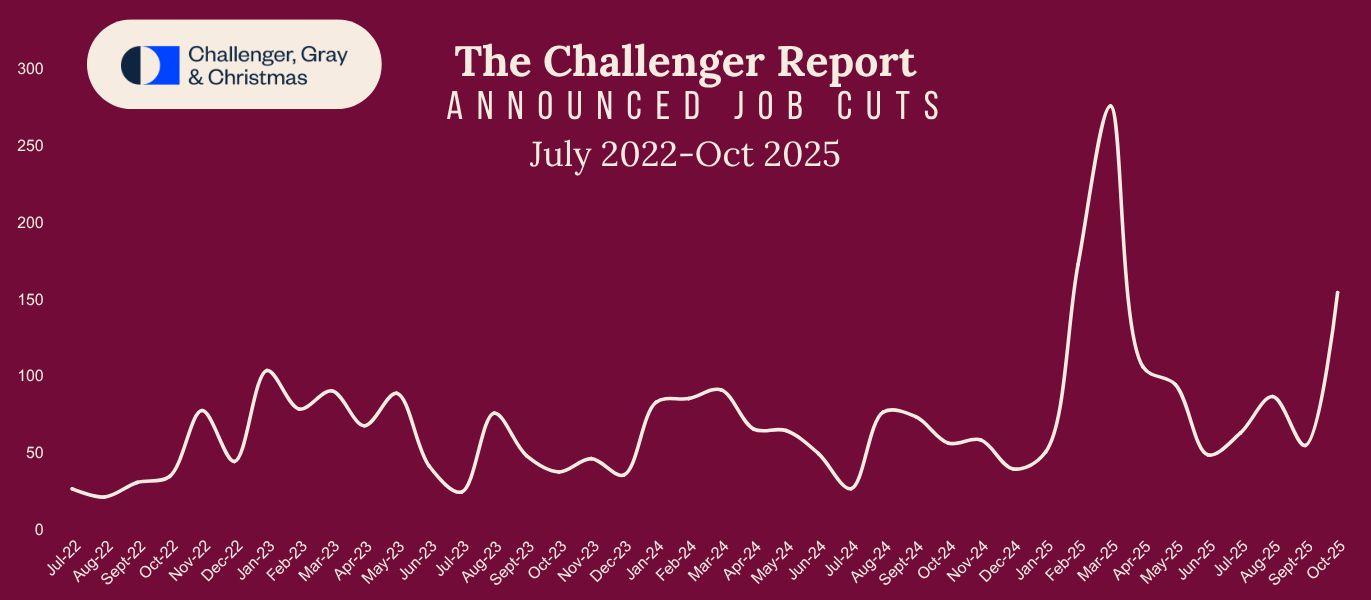

Extending this analysis, the current correction exhibits a structure strikingly similar to those observed in June 2024 and February 2025, both pivotal inflection points where bitcoin balanced between recovery and deeper contraction. Notably, the present drawdown aligns closely with the average magnitudeofpriormid-cycleretracements,witheachcorrectivephasesincethe onsetofthecurrentbullmarketin2023havingreachedroughly22percentfrom theall-timehighbeforereversal.Inthecurrentmarket,sincetheall-timehighin October,bitcoinisdownalmost22percent.

It is important to note too, that even at the $100,000 level, approximately 72 percent of the total BTC supply remains in profit, positioning the market near the lower boundary of the typical 7090 percent equilibrium range historically associated with mid-cycle slowdowns. Phases like these often feature short-livedreliefralliestowardtheSTHcostbasis;however,adurablerecovery typicallyrequiresextendedconsolidationandrenewedinflowsofdemandfrom institutionalandretailparticipantsalike.

Conversely,iffurtherweaknessdrivesalargerportionofsupplyintounrealised loss,theriskoftransitioningfromacontrolledcorrectionintoadeeperbearish phase increases materially. Historically, such transitions have been characterised by capitulation events followed by extended re-accumulation, a processthatestablishesthefoundationforthenextmajoruptrendonceselling pressureisfullyexhausted.

Fresh private-sector data suggests that the US labour market is losing momentum faster than expected, with several indicators pointing to a deeper, morestructuralslowdownratherthanatemporarylull.

According to the ADP National Employment Report released last Wednesday, October 30th, private-sector job growth slowed markedly, adding only 42,000 jobs in October. While large firms contributed most of the hiring, with 73,000 new positions, small and medium-sized companies shed a combined 31,000 jobs, marking the third consecutive month of job losses among smaller businesses.

Thetrendreflectstheendofwhateconomistsdescribeas“labourhoardingˮ,a post-pandemic phenomenon where companies held on to workers despite weaker demand. With firms now investing vast amounts of capital in productivity-enhancing technologies and AI-driven automation, many are restructuring their workforces to improve efficiency, which is leading to layoffs andweakerhiringmomentum.

Over the past three months, ADP data indicate an average monthly gain of just 3,000 jobs, underscoring the sharp deceleration in employment growth. Other private sources, such job posting on Indeed, a popular recruitment site, corroboratethisweakness,showingjobpostingscontinuetodeclineafterrising brieflyinJulySeeFigure4below).

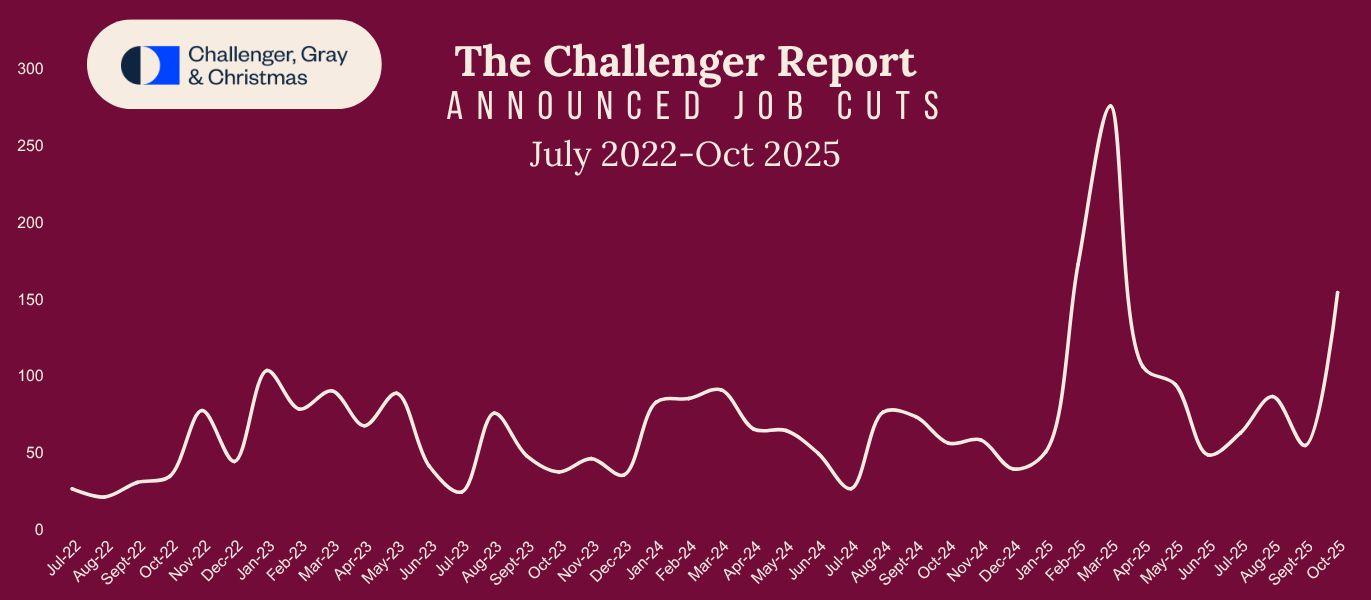

Moreover, data from Challenger, Gray & Christmas, another US recruitment group,showsthatUS-basedemployersannounced153,074jobcutsinOctober, up 175 percent from the 55,597 cuts announced in October 2024. It also represents a 183 percent increase from the 54,064 job cuts announced one monthprior,accordingtoareportreleasedlastThursday.

Addingtothestrain,tradetensionsandhigherimportcosts,sevenmonthsafter sweeping tariffs were announced, continue to ripple through industries, weighing on hiring and investment. These pressures are increasingly structural innature,suggestingthattheslowdownisnotsimplyacyclicaldownturnbuta broadershiftinlabourdemand.

Echoingbroadersignsofsofteningdemand,consumersentimentfellbyabout6 percent in November, according to the latest survey by the University of Michigan.Thedeclinewasledbya17percentdropincurrentpersonalfinances andan11percentfallinexpectationsforbusinessconditionsoverthenextyear. With the extended federal government shutdown, consumers have become increasingly anxious about its potential impact on the economy. The decline in confidence was broad-based across age, income, and political groups, suggestingthathouseholdsarebeginningtofeeltheweightofslowerhiringand policyuncertainty.

The Federal Reserve has implemented two rate cuts over the past two months to cushion the slowdown. However, monetary policy alone may not address structuralforcessuchasAI-drivenjobdisplacement,traderestrictions,andtight immigration policies, all of which contribute to long-term labour market inefficiencies. Although large firms continue to hire cautiously, small and medium-sized businesses are retrenching, signalling that the foundation of job growthisweakening.

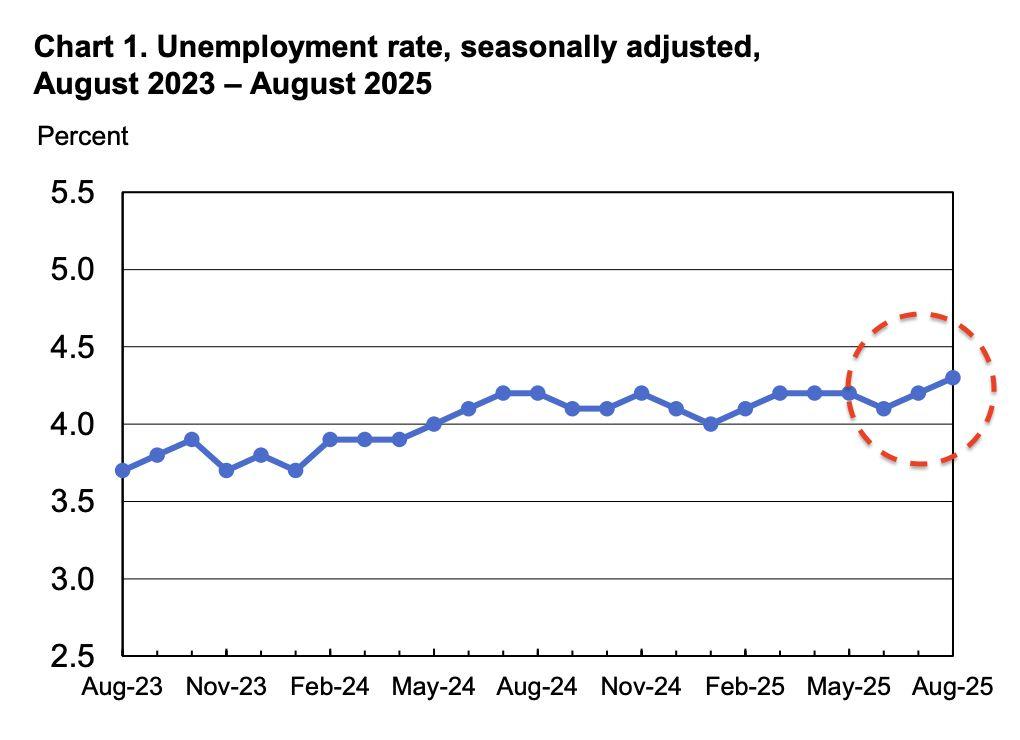

Withinflationhoveringstubbornlyat3percentandunemploymentdriftinghigher (asperlastemploymentdata),thecomingmonthscouldbringafragilebalance of slowing growth and persistent price pressures, a scenario that will test both policymakersandinvestorsastheyeardrawstoaclose.

StablecoinsusingEthereumasatransportlayerachievedanewall-timehighin on-chain transaction volume during October 2025, reaching approximately $2.82 trillion, up roughly 45 percent from the prior monthly record of about $1.94 trillion set in September. This surge underlines Ethereumʼs reaffirmed status as the dominant backbone of the global stablecoin economy, handling the bulk of transfers, settlements, liquidity movements and DeFi-related financinginstruments.

Breakingdownthenumbers,thefrontrunneramongstablecoinswasUSDCoin USDC, which accounted for approximately $1.62 trillion of the volume, followed by Tether tokens USDt at about US $895.5 billion. Meanwhile, Dai DAI)recordedroughlyUS$136billion,aslightdeclinefromthepreviousmonth.

The rapid expansion of the stablecoin movement is driven by several converging factors. One is the market environment in October, where core cryptocurrencies such as Ethereum and Bitcoin experienced retracement phases,promptingarotationofcapitalintodollar-peggedtokensasparticipants soughtsafe-harbourliquidityandmodularyieldopportunities.Anotherdriveris the scaling and operational maturation of Ethereumʼs Layer-2 and roll-up ecosystems, which are increasingly enabling high-throughput stablecoin transfers, remittance flows, DeFi stable-pool operations and institutional settlementuse-cases.

The significance of this record volume extends beyond mere nominal figures. ThefactthatasinglenetworkEthereum)processednearlythreetrilliondollars instablecoinflowsinamonthiscomparabletotransactionvolumeshandledby some legacy global payment rails. It reaffirms the fact that stablecoins have gone far beyond their early use case of enabling crypto trading, and are increasingly functioning as digital cash-equivalents, liquidity conduits and settlementprimitivesinbothretailandinstitutionalcontexts.ForEthereum,this reinforces its position as a foundational layer for digital-asset finance, combining smart-contract infrastructure, token settlement, cross-chain composabilityanddecentralisedfinanceDeFiintegration.

Japanʼs Financial Services Agency FSA) has announced its approval of a landmark stablecoin pilot project involving the countryʼs three largest banking institutions,MizuhoBank,MUFG,andSMBC,aspartofJapanʼsongoingpushto modernisedigitalpayments.

InastatementreleasedlastFriday,theFSAconfirmedthattheinitiativewillallow the megabanks to jointly issue a stablecoin designed for payment settlement, marking a significant step toward integrating blockchain-based assets into Japanʼs regulated financial system. The consortium will also include Mitsubishi Corporation, Progmat Inc., and Mitsubishi UFJ Trust and Banking Corporation, bringingtogetherbothfinancialandtechnologicalexpertise.

The pilot will assess how multiple banking groups can collaboratively issue stablecoinsclassifiedas“electronicpaymentinstrumentsˮunderJapanʼsrevised financial laws. The FSA emphasised that the focus will be on ensuring full regulatory compliance, legal soundness, and operational transparency throughoutthetrial.

According to the agency, the programme will begin in November 2025 and continue for an extended period as authorities and participating firms evaluate the projectʼs feasibility. Findings from the pilot, including legal, technical, and complianceassessments,willlaterbepublishedontheFSAʼsofficialwebsite.

TheinitiativehighlightsJapanʼsdeterminationtostayaheadintheglobalracefor secure, regulated digital payment infrastructure, balancing innovation with robustoversightinitsapproachtostablecoinadoption.

Australiaʼstopfinancialregulatorhasurgedthecountrytoembracetokenisation as the next major phase in modernising its financial markets. Speaking last Wednesday,November5th,AustralianSecuritiesandInvestmentsCommission ASICChairJoeLongowarnedthatAustraliamust“seizetheopportunityorbe leftbehindˮasdistributedledgertechnologyreshapesglobalcapitalmarkets.

Longosaidtokenisation“couldfundamentallytransformourcapitalmarketsˮby dividing assets into smaller, tradable units and enabling faster, more efficient settlement. However, he cautioned that Australia risks becoming the “land of missed opportunityˮ as other nations move ahead. Switzerlandʼs digital securities exchange has already surpassed $3.1 billion in tokenised bond issuances since 2021, J.P. Morgan aims to fully tokenize its money market funds within two years, and Nasdaq plans to launch 24-hour tokenized securitiestradingbylatenextyear.

“Once,Australiawasoneoftheearlyadoptersofinnovationinmarkets,ˮLongo said, citing the countryʼs early leadership in electronic trading. “Now, other countriesareoutpacingus.ˮ

To address this, Longo announced plans to review and relaunch the ASIC Innovation Hub, which will take a proactive role in supporting financial market innovation and maintaining an open-door policy for fintech and blockchain developers navigating regulatory challenges. The initiative will also back the governmentʼs review of the Enhanced Regulatory Sandbox, designed to strengthenAustraliaʼsfintechcompetitiveness.

TheannouncementfollowsASICʼsrecentclarificationthatstablecoins,wrapped tokens, and tokenised securities qualify as financial products under existing laws. Firms have been granted until June 2026 to meet new licensing requirements, signalling Australiaʼs intent to catch up with global leaders in digitalassetregulationandmarketmodernisation.