BTCCONSOLIDATESAHEADOF POTENTIALQ4STRENGTH,AS BONDMARKETSCONTORT

MARKETSIGNALS

ConsolidationContinues

MACROUPDATE

Stag ation,Strains,andStruggles forControl:TheFed’sPrecarious BalancingAct

BTCCONSOLIDATESAHEADOF POTENTIALQ4STRENGTH,AS BONDMARKETSCONTORT

MARKETSIGNALS

ConsolidationContinues

MACROUPDATE

Stag ation,Strains,andStruggles forControl:TheFed’sPrecarious BalancingAct

Bitcoin is holding steady between $108,000 and $112,000, with buyers defending key support zones and filling the air gap left by Julyʼs rapid rally. While a deeper correction remains possible, the more likely outcome is time-based consolidation, especially with September historically acting as a cyclical low point ahead of a historically strong Q4. Short-term holder profitability has normalised, rebounding from 42 percent to now 58 percentofthiscohortremaininginprofit,whileETFinflowshaveslowedsharplyforboth BTC and ETH. This cooling institutional demand highlights the marketʼs dependence on freshcatalysts,thoughweseestrongerspotconvictionforBTC,comparedwiththemixof directionalflowsandarbitrageactivitythatcharacterisesETH.

Seasonality adds weight to the current consolidation narrative.

Augustclosedwitha6.5percent decline, consistent with its historically weak profile, while September is traditionally the softest month with an average 3.3 percent return. That said, the “red Septemberˮ effect has weakened recently, and Q4 seasonality is historically powerful, with October and November averaging outsized gains.

If the Fed confirms a September rate cut, falling real yields and a weaker dollar could amplify BTCʼs seasonal upside, setting the stage for renewed momentum. Until then, consolidationremainsthebasecase,withETFflows,macropolicyshifts,andderivatives positioningactingasthecriticalsignalstowatch.

TheUSeconomyisundermountingpressureasweaklabourdata,bondmarkettension, and political machinations around the Fed converge. The August jobs report on Friday, September 5th, revealed payroll growth of just 22,000 with heavy downward revisions, pushing unemployment to 4.3 percent, its highest in nearly four years. The softness strengthensexpectationsforaFedratecutattheSeptember16th–17thmeeting,though sticky inflation complicates the decision. Bond markets reflect the tension: short-term yields have dropped on expectations of a rate cut, but the 30-year remains near 5 percent, signalling investor concern over deficits and fiscal credibility. This disconnect hassteepenedthecurve,raisinglong-termborrowingcostsandfuellingaflighttogold, which surged to record highs near $3,600 per ounce. Political risks compound the challenge as President Trump moves to dismiss Fed Governor Lisa Cook and threatens newtariffsontheEU,leavinginvestorstoweighnotjusteconomicfundamentalsbutalso growing uncertainty over Fed independence and US policy direction.

Inthemeantime,theglobalcrypto landscapeisshiftingasregulators andmarketsmovetowardclearer frameworks. In the US, the Securities and Exchange Commission and Commodity Futures Trading Commission issued a rare joint pledge on Friday, September 5th, to coordinatemorecloselyondigital asset oversight, targeting clearer rules for spot crypto products, perpetual contracts, portfolio margining,andDeFi.

AjointroundtableonSeptember29thwilladvancethisagenda,andisfurtherbuttressed bytheResponsibleFinancialInnovationActof2025,whichrequiresthecreationofaJoint Advisory Committee on Digital Assets and mandating public responses to its recommendations.Thebillalsointroducesameasureofprotectionandclarificationofthe status of DeFi developers, Decentralised Physical Infrastructure Networks, airdrops and staking rewards. It also directs a study on tokenised real-world assets. Together, these moves show Congress and regulators working in tandem to strengthen US competitivenessindigitalmarkets.

InstitutionalconfidenceinSolanaisalsorising.Lastweekend,SOLStrategiesannounced ithadsecuredapprovaltouplisttotheNasdaqunderthetickerSTKE,amilestoneforthe Solana-focused firm that has surpassed CAD $1 billion in delegated assets and holds a treasuryofnearly400,000SOL.Meanwhile,SouthKoreaʼsFinancialServicesCommission unveiledsweepinglendingrulesonSeptember5th,2025,cappinginterestrates,banning overcollateralised loans, and restricting eligible tokens to top-tier assets, underscoring a proactivepushtosafeguardinvestorsandstabilisedomesticmarkets.

TheFed–BondMarketDisconnect ● Politics,Policy,andPressure:Trumpʼs MovesComplicatetheFedʼsPath

SECandCFTCJoinForcestoEndCryptoʼs Regulatory“NoManʼsLandˮ

SenatorsʼCryptoBillShieldsDeFi,DePIN, andAirdrops

Bitcoin continues to remain range-bound between $108,000 and $112,000, fillingtheairgaphighlightedinlastweekʼsBitfinexAlpha.Suchtradingreflects constructivedip-buying,withlogicalsupportzonesbeingactivelydefended.

Ouroutlookremainsthatwhileafurthercorrectionofafewpercentcannotbe ruledout,themoreprobableoutcomeistime-basedcapitulationratherthana deeper drawdown. Seasonality also supports this view, as September has historicallymarkedcyclicallowsaheadoffourth-quarterrecoveries,whilethe prospectofanimminentratecutprovidesanadditionaltailwind.

Figure1.BTC/USD4HChart.Source:Bitfinex)

Thenumberofshort-termholdersSTH)inprofitfellsharplyto42percentduring thesell-offto$107,370lastweek.However,thesubsequentreboundtoapeakof $113,520, restored the number to 58 percent, leaving the market in a neutral position for now. This combination of stabilising profitability, supportive seasonality,andmacrocatalystssuggestsconditionsremainconstructive,albeit withoutacleardirectionalimpulseintheimmediateterm.

WithBTCnowconsolidatingwithinaclearrange,thebehaviourofrecentbuyers has become increasingly important. STH unrealised profit and loss often act as the key psychological driver at local tops and bottoms, with rapid swings betweenprofitandlossshapingreactions.

The share of STH supply in profit provides a clear lens into this dynamic. During the leg lower to $107,370 - a 13.61 percent decline from our ATH of $123,640STH supply in profit collapsed from above 90 percent. For all corrections this cycle, this has been a standard cooling from an overheated state since a large portionoftheSTHshasbeenETFsandBTCtreasurycompanieswhohavebeen buying in a price-agnostic manner. Such reversals typically trigger fear-driven selling from other recent buyers, and futures and options market participants. What then typically follows is exhaustion from the same cohort, resulting in a rebound. This phenomenon underpinned the rebound from $108,000 back to $112,000lastweek.

While morethan58percentofSTHsupplyisbackinprofit,thisrecoveryremains fragile.Asustainedmoveabovethe$114,000$116,000zone,wheremorethan75 percentofSTHsupplywouldbeinprofit,islikelytoinstiltheconfidenceneeded toattractfreshdemandandignitethenextleghigher.

Beyond these on-chain metrics, spot ETF flows also provide one of the clearest measuresofinstitutionaldemandfromtraditionalfinanceTradFi,makingthema criticalgaugeofoff-chainsentiment.

WhatdoETFflowstellus?

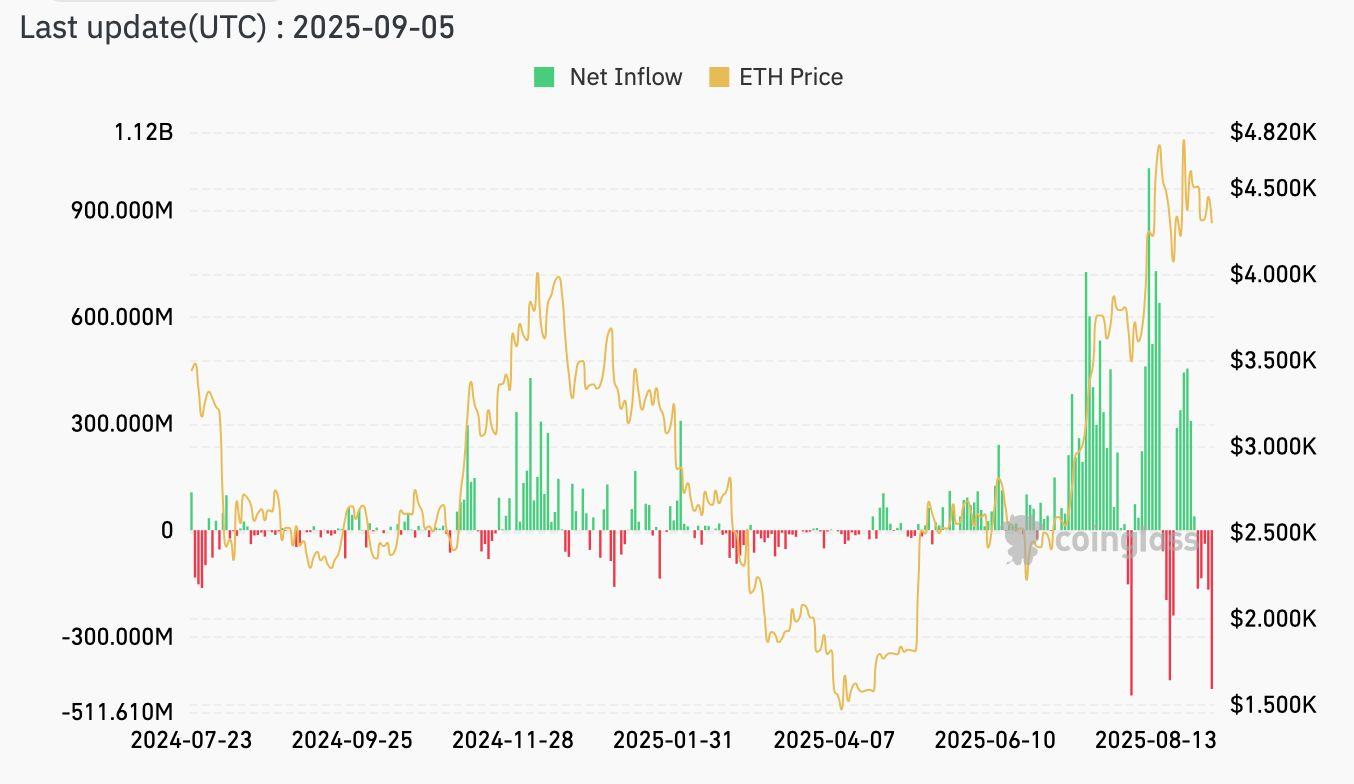

The 14-day average of net inflows into both BTC and Ether ETFs highlights the decisive role these products have played in recent price action.

From May to August 2025, daily allocations into ETH ETFs of between 56,000 and 85,000 ETH were instrumental in propelling the asset to new highs, as steadyinstitutionaldemandcreatedapowerfultailwind.

Over the past two weeks, however, this pace has slowed sharply to just 16,600 ETHperdayinthelastweekofAugustandturnedtonegative41,400ETHperday onaverageoverthelastweek,withlastFridaySeptember5thseeing 104,100ETH innetoutflowsalone,markingthesecondlargestsingledayoutflowforETHETFs since launch. ETH is down 15.2 percent from its recent ATH, which is similar to BTC, however the dependency of ETH price action on ETFs and treasury companiesisrelativelyhigher,asBTCbenefitsfromseveraldemandrailsbeyond simplyETFsandtreasuries.Inaddition,theETHpricereflectsalargercomponent of derivatives activity (see page 11. This implies ETH could underperform BTC, particularlyifthegeneralmarketrecoversbutETHETFflowsdonotreverse.

BTC ETFs have followed a similar trajectory. After consistent inflows exceeding 3,000 BTC per day since April, momentum began to fade in July, with the 14-day averagenowsittingatjust540BTCperday.Thedropillustratesaclearcoolingof institutionalcommitmentatelevatedpricelevels.

Source:Coinglass)

Taken together, both BTC and ETH ETF flows reflect a contraction in TradFi buying power, aligning with the broader market pullback of recent weeks. This slowdown highlights the sensitivity of institutional demand to both price and macroeconomic conditions, and reinforces the role of ETF flows as a decisive determinant of whether digital assets can regain upward momentum or remain range-boundinthenearterm.

WhilebothBTCandETHappreciatedalongsidesurgingETFinflows,thestructure of TradFi demand has diverged meaningfully between the two assets. This can be seen by comparing cumulative ETF flows with bi-weekly changes in CME openinterestforBTCandETHfutures.

5.ETFMarket:BitcoinCMEOpenInterest&USETFPositionChange Source:Glassnode)

For BTC, ETF inflows have far exceeded shifts in futures positioning, underscoring that TradFi investors primarily expressed demand through direct spot exposure. By contrast, ETH presents a more complex dynamic: bi-weekly changes in CME open interest have accounted for more than 50 percent of cumulativeETFinflows.ThisindicatesthatasignificantshareofTradFiactivity in ETH combines spot allocations with cash-and-carry strategies, blending outrightdirectionalpositioningwithmarket-neutralarbitrage.

The result is a distinct profile of institutional engagement — while BTC flows reflect clearer directional conviction, ETH flows highlight a balance between speculativedemandandstructuredarbitrage-drivenparticipation.

August closed on a softer note for BTC, in line with its historical tendency to underperform during the month. Augustʼs median return is 7.49 percent (average 1.12 percent), and August 2025 finished with a decline of 6.49 percent. Attention now shifts to September, which has historically been the weakest month for BTC, posting an average return of 3.32 percent and a medianof3.12percent.

That said, the “red Septemberˮ effect has weakened in recent years, with BTC ending the month higher in both 2023 and 2024 3.91 percent and 7.29 percent, respectively), underscoring that seasonality is a tendency, not an iron rule.

The end of summer has always led to a reduction in additional capital entering the market, resulting in a decline in BTC, though not necessarily closing the month red, and sometimes recovering the dip before the monthly close. In contrast, the altcoin market suffers considerably, and despite an ATH for both BTC and ETH last month, total altcoin market cap as measured by the OTHERS index(totalcryptomarketcapnotincludingthetop10assets)hasstillnothitan ATHthiscycle,andisover34percentlowerthanitsDecember2024highs.

The real seasonal opportunityliesinthefourth quarter. October and November have historically beentwoofBTCʼsstrongest months, with October averaging 21.89 percent (median21.20percent)and Novemberaveraging46.02 percent (median 10.82 percent).Takentogether,Q4 averages an impressive 85 percent with a 52 percent median.

Historically, the bulk of this strength arrives in October and November, with Decemberproducingmoremixedresults(average4.75percent,median3.22 percent). Translating this into strategy, the base case is for range-bound conditions with mild downside risk through September, before statistically stronger seasonal tailwinds take hold in October and November, assuming supportivemacroconditions.

Macropolicyhasthepotentialtoeitheramplifyormutetheseseasonaleffects. FollowingaweakAugustlabourreport,futuresmarketsarenowpricinginhigh odds of a September rate cut. Rate relief would typically compress real yields andweakentheUSdollar,conditionsthathavehistoricallysupportedBTCʼsQ4 seasonality.Inaddition,theTreasuryʼsJulyQuarterlyRefundingAnnouncement leaned market-friendly, as it expanded buyback operations in long-duration buckets while keeping coupon sizes steady, a configuration that helps contain term-premium spikes, which is the extra return investors demand for holding longerdurationbonds.Together,thesedynamicssuggestthatiftheFeddelivers acutwithdovishguidanceandTreasurysupplyremainsorderly,thestageisset forseasonalQ4strengthtoexpressitself.

Flowsremainthemostimmediatetell.LateAugustandearlySeptemberUSspot ETF data showed heavy outflows as mentioned earlier. For traders, three indicators warrant close monitoring: the velocity of daily ETF flows (sustained $150200millionnetinflowstypicallysignalabullishregime),theBTCS&P500 correlation (a decisive SPX breakout on policy easing could pull BTC higher), and derivatives positioning (neutral funding and orderly open interest favour continuation). Our base case is September consolidation transitioning into Q4 strength. The risk case is a hawkish policy surprise or renewed growth concerns, which could revive the “red Septemberˮ profile before seasonal tailwindsfullyassert.

The US labour market showed fresh signs of strain in the latest Employment SituationreportreleasedbytheBureauofLaborStatisticslastFriday,September 5th, with job growth stalling and unemployment climbing to its highest level in nearlyfouryears.Thereportunderscoredbothcyclicalandstructuralpressures weighing on the economy, while also strengthening the case for a Federal ReserveratecutatitsupcomingSeptember16th–17thmeeting.

Figure9.UnemploymentRate,NonFarmPayrollMonth-over-MonthChange

Source:BureauofLaborStatistics)

Nonfarm payrolls increased by just 22,000 jobs in August, far below the consensus forecast of 75,000, while prior months saw heavy downward revisions.Juneʼsdatawasadjustedtoreflectanetlossof13,000jobs,thefirst decline since December 2020, while Julyʼs job gains were revised down by 21,000. When combined, the past three months show a net increase of only about1,000jobsrelativetoearlierestimates.

The unemployment rate rose to 4.3 percent, its highest since October 2021. This increase came even as 436,000 people entered the labour force, suggesting that many new job seekers were unable to find work. Long-term unemployment is also on the rise: the average duration of joblessness lengthenedto24.5weeksinAugust.

The August data revealed broad weakness across the goods-producing economy, with manufacturing, construction, and mining all losing jobs. Manufacturing shed positions for the fourth straight month, reflecting the lingeringdragfromtariffsandsupplychaindisruptions.Constructionandmining also saw declines, underscoring the depth of the slowdown in traditionally resilientsectors.

Government payrolls fell by 16,000 in August, with federal employment down 97,000sinceJanuaryduetobudgetcuts.Losseswerealsoreportedinfinancial services,professionalandbusinessservices,andtheinformationsector.

The services sector provided the only offset, adding 63,000 jobs, driven primarily by healthcare 31,000) and social assistance 16,000, alongside gains in leisure and hospitality. Still, even healthcare hiring came in below its 12-monthaverage,showingthatlabourmarketpillarsarenolongerimmune.

Average hourly earnings rose 0.3 percent in August, bringing year-over-year growth to 3.7 percent. However, total hours worked declined, raising concerns abouttheoverallstrengthofoutputandproductivity.

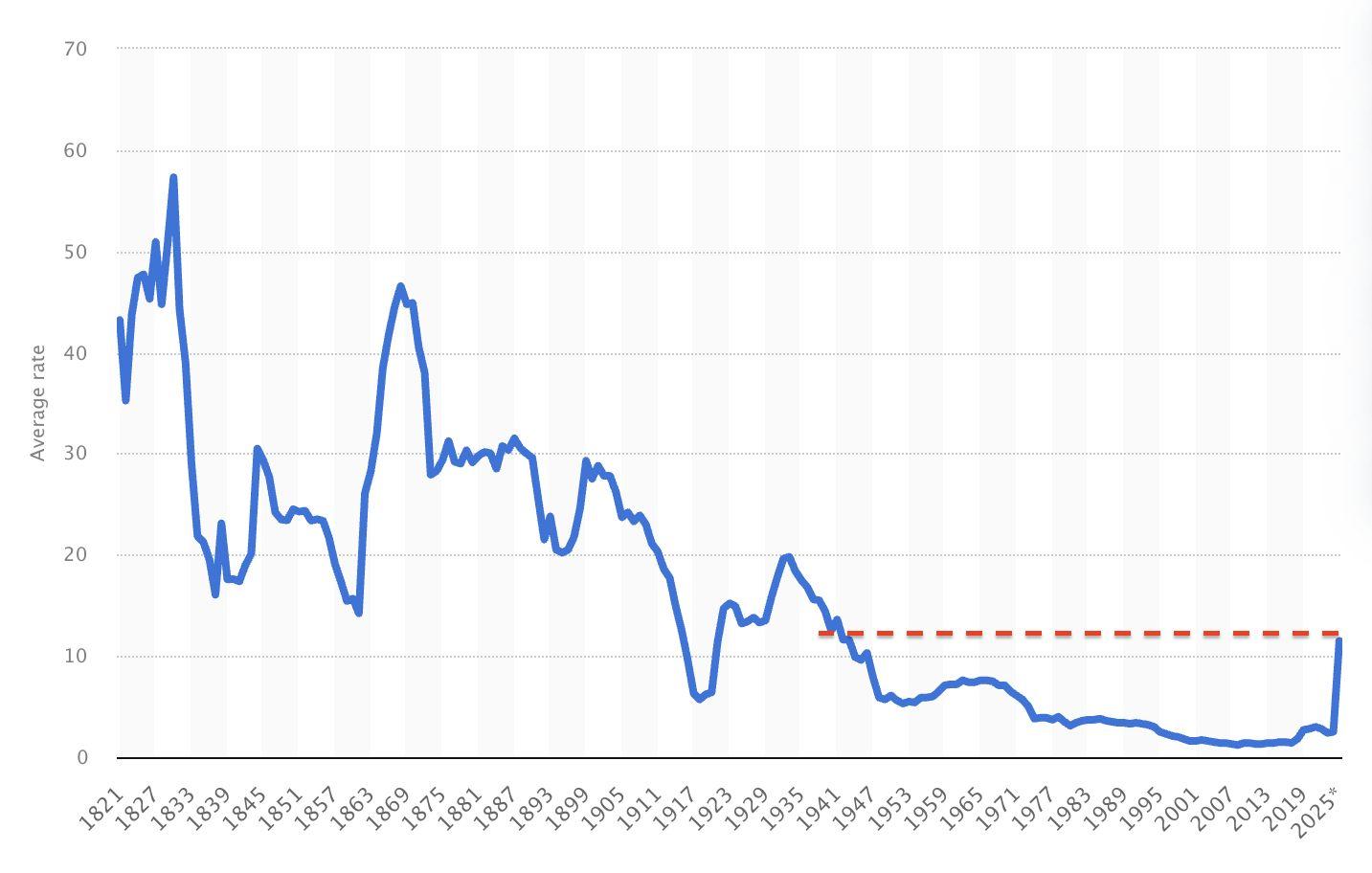

Washingtonʼs economic agenda has become a key force in labour market fragility.TariffshavepushedtheaverageUStariffratetoitshighestlevelsince 1934,fuelingbothcostpressuresandbusinessuncertainty.Insteadofreviving domestic manufacturing, trade restrictions have undermined hiring across the goodssector.

Immigration policies have also constricted labour supply at a time when demographic shifts, particularly the retirement of baby boomers, are already reducingworkforceavailability.Thiscombinationofcyclicalpolicyshocksand structural headwinds has created a “slow hire, slow fireˮ economy where businessesarereluctanttoexpandheadcount.

Withjobgrowthaveragingjust29,000permonthoverthepastthreemonths,a sharp slowdown from last yearʼs pace, the Federal Reserve faces pressure to act.Financialmarketswidelyexpecta25basispointratecutinSeptember.The move would be less about stimulating new growth and more about managing risksfromalabourmarketlosingmomentum.Theemploymentdataopenedthe possibility of a larger 50 basis point cut, but that outcome likely depends on downside surprises in upcoming inflation readings. For now, inflation remains firmduetotariffsandcostpass-through,complicatingtheFedʼsbalancingact betweenstabilisingemploymentandcontainingpricepressures.

Figure 11. Private-Sector Payroll Growth, Three-Month Average, (Source: US Labor Department)

Figure12.TargetRateProbabilitiesforSeptember17thFedMeeting Source:CMEFedWatchTool)

Historically, recessions begin when job growth turns negative for a sustained period.TheUSeconomyisedgingclosetothatline,butcurrentconditionsstill resemble a slow grind rather than a sharp contraction. What makes this slowdown different is the inflation backdrop: tariffs, demographic constraints, and restrictive immigration policies are keeping price pressures firm even as hiringweakens.Thismixpointslesstoacleanrecessionarydownturnandmore to a stagflationary environment, an economy caught between slowing growth andstubborninflation,leavingtheFedwithlittleroomtomaneuver.

With bond yields falling and rate-cut bets rising, investors have turned decisivelytowardtraditionalhedges.Treasuriessawstrongdemandasmarkets pricedinFedeasing,whilegoldsurgedtoarecordhighnear$3,600perounce. The parallel rallies underscore how investors are positioning for two risks at once:near-termmonetaryeasingthatboostsbonds,andlonger-termconcerns over inflation and fiscal stability that favour gold. Together, they highlight deepeninganxietiesabouteconomicdirectionandpolicycoherence.

Outlook

Looking ahead, the combination of Fed rate cuts, potential tax measures, and investment incentives could provide support for hiring into 2025. Still, the path forward remains highly uncertain. Structural constraints like aging demographicsandreducedimmigrationwillcontinuetoweighonlaboursupply, whiletariffskeepinflationelevated.

For now, the US economy is navigating a precarious middle ground: not yet in recession, but with weakening job creation, rising unemployment, and policy uncertainty that erodes business confidence. The September Fed meeting will be a test of whether monetary policy can stabilise conditions, or whether broaderstructuralchallengeswilllimititseffectiveness.

The US is entering a pivotal phase in its fiscal and monetary path. Bond markets are sending conflicting signals: short-term yields are falling as investors bet on Federal Reserve rate cuts, while long-term yields remain elevatednear5percent,reflectingconcernsaboutdeficits,inflation,andfiscal credibility.Thisdisconnecthighlightsthechallengefacingpolicymakers—the FedistryingtoeasefinancialconditionsevenasTreasuryfinancingneedsand investorskepticismkeeplong-termborrowingcostshigh.

The30-yearTreasuryyieldhashoverednearthe5percentthresholdformuch of this year, reflecting investor concern over fiscal deficits and long-term inflation. Yet after the weak August jobs report, shorter maturities dropped sharply:the10-yearyieldfelltoafive-monthlow,whilethe2-yearslidto3.7 percentasmarketspricedinimminentFedratecuts.

Thisdynamichassteepenedtheyieldcurvetoitswidestinyears.Investorsare betting on near-term monetary easing, but they continue to demand high compensation to hold long-term debt. A steeper curve has dual effects: it boostsbankprofitabilitythroughwidernetinterestmarginsbutraiseslong-term borrowing costs for households and businesses. That pressure is arriving just as inflation-adjusted incomes are slipping and consumer spending is losing momentum, underscoring the fragile balance between financial stability and growth.

TheFedʼspreferredinflationgauge,thePCEPriceIndex,remainsabovethetwo percent target, underscoring that price stability has not been restored. At the same time, fiscal authorities continue to authorise new spending and tax incentives, keeping demand firm and deficits elevated. Structural forces add another layer of pressure. Tariffs are raising input costs, while demographic shifts,suchastheretirementofbabyboomersandslowerlabourforcegrowth, aretighteningsupplyinkeysectors.Restrictiveimmigrationpoliciescompound thisproblem,limitingtheinflowofnewworkers.Together,thesedynamicsmake inflation more stubborn and constrain the Fedʼs ability to engineer a smooth disinflation.

IftheFedcutsratestooaggressivelywhilepersistentdeficitsforcetheTreasury to issue more debt, investors may demand higher yields to absorb the growing USdebtload.Thatwouldweakenthedollar,erodebondvaluations,andfurther pushuplong-termborrowingcosts.Theunderlyingdangerisfiscaldominance — when government financing needs overshadow the central bankʼs ability to manageinflation.

Marketsarehedgingacrosstwofronts.TreasurieshaveralliedonFedcutbets, while gold has surged to record highs as a hedge against fiscal instability and structural inflation. The dual bid reflects skepticism that monetary or fiscal authoritiescanrestorebalancequickly,leavinginvestorstoseeksafetyinboth paperandhardassets.

The Fed–bond market disconnect points to a difficult road ahead. Monetary easingmaysupportgrowthintheshortrun,butfiscalexpansionandstructural forces - tariffs, demographics, and constrained labour supply - are keeping inflation sticky and long-term yields elevated. Unless fiscal and monetary authoritiesactinconcert,theUSrisksslidingdeeperintoastagflationarytrapcaughtbetweenslowinggrowth,persistentinflation,andrisingborrowingcosts.

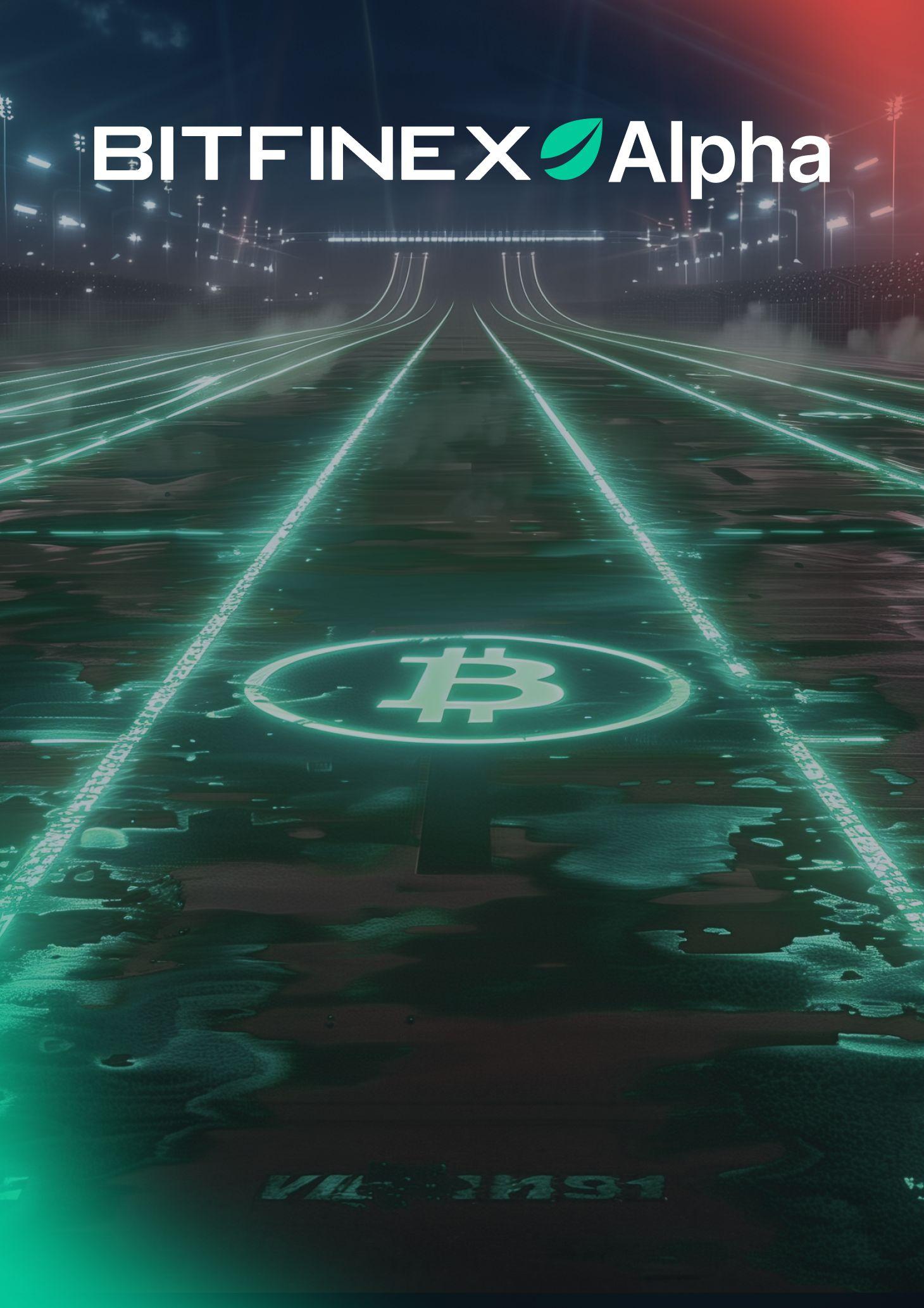

Marketsarealreadygrapplingwithweaklabourdata,stickyinflation,andabond market that resists the Federal Reserveʼs easing signal. But beyond economics, politicaltensionsareintroducinganotherlayerofuncertainty—raisingquestions abouttheFedʼsindependenceandthestabilityofUSpolicydirection.

TheJusticeDepartmenthasopenedacriminalmortgagefraudprobeintoFederal Reserve Governor Lisa Cook, following allegations raised by Federal Housing FinanceAgencyDirectorBillPulte,aTrumpappointee.PresidentTrumpmovedto terminate Cook over those allegations, prompting her to sue and challenge the actionincourt.

Cookʼs legal team argues that the probe is politically motivated and designed to provide cover for Trumpʼs effort to assert influence over the central bank. The case could reach the Supreme Court and carries broader implications: if presidents can dismiss Fed officials at will, the central bankʼs independence — longconsideredcriticaltocontrollinginflation—wouldbeseverelycompromised.

This conflict arrives just as Trump is demanding aggressive rate cuts and criticising Fed Chair Jerome Powellʼs stewardship. The September 16th–17th Fed meeting is now not only an economic event but also a test of the institutionʼs abilitytowithstandpoliticalinterference.

At the same time, Trump is threatening to impose fresh tariffs on the European Union after the European Commission has fined Google €2.95 billion for breaching EU antitrust rules by distorting competition in the advertising technologyindustry.TrumphasframedtheEUʼsactionsasdiscriminatoryagainst US tech giants, suggesting he could invoke Section 301 of the Trade Act to retaliate—amovethatwouldechothetrade-wartacticsofhisfirstterm.

The threats come as his own Justice Department prepares to go to trial with Google in a landmark antitrust case. The juxtaposition highlights the contradictions of current policy: while the administration pursues antitrust remediesathome,itispositioningitselfasthedefenderofUStechabroad.

These developments underscore the politicisation of both monetary and trade policy.TheCookproberaisesdoubtsabouttheFedʼsautonomyjustasitfacesa stagflationary challenge, while tariff threats risk adding new inflationary pressuresthroughhigherimportcosts.

For investors, the message is clear: beyond data and policy fundamentals, politicalagendasareincreasinglyshapingtheeconomicoutlook.

The Securities and Exchange Commission SEC) and the Commodity Futures Trading Commission CFTC announced a rare joint pledge last Friday, September5th,tocoordinatemorecloselyondigitalassetoversight,amovethat couldreshapethelandscapeforUScryptomarkets.

Inajointstatement,SECChairPaulS.AtkinsandCFTCActingChairCarolineD. Phamsaidtheeraoffragmentedoversightthatpushedinnovationoffshoremust end.“ItisanewdayattheSECandtheCFTC,ˮthetwowrote,signalingamore openstancetowardcrypto.

Theregulatorsidentifiedfourpriorityareasforalignment:

● Spotcryptoproducts—clearerrulesforonshoretradingvenues.

● Perpetual contracts — frameworks for a product widely traded outside theUS.

● Portfoliomargining—reducinginefficienciesacrossassetclasses.

● EventcontractsandDeFiprotocols—exploring“innovationexemptionsˮ forresponsibleexperimentation.

A joint roundtable is scheduled for September 29 to begin shaping a harmonised framework. The initiative builds on recommendations from the Presidentʼs Working Group on Digital Asset Markets, which has urged regulatorstomodernise rulestokeepUSmarketscompetitive.

Ifsuccessful,thecollaborationcouldreversearecenttrendthathasbeenseen of crypto entrepreneurs leaving the US, and aims to give investors clearer rulesandanopportunitytotakealeadindigitalfinance.Thetimingisnotable: lawmakersaresimultaneouslyadvancingtheResponsibleFinancialInnovation Actof2025(seenextchapter),abillthatalsocallsforSECCFTCcoordination whileintroducingnewprotectionsforDeFidevelopersandtokenprojects.

● TheResponsibleFinancialInnovationActof2025seekstoharmonise SECandCFTCoversightthroughaJointAdvisoryCommitteeandjoint roundtables

● ThebillstrengthensprotectionsfordevelopersandinnovatorsinDeFi by ensuring activities like coding,validating,or running protocols do nottriggerundueliability

USSenatorsunveiledanewdraftoftheResponsibleFinancialInnovationAct of 2025, aiming to reshape how crypto is regulated while strengthening protectionsfordevelopersandinnovators.

The bill requires the Securities and Exchange Commission SEC) and Commodity Futures Trading Commission CFTC) to establish a JointAdvisory Committee on Digital Assets, tasked with making recommendations on harmonisation. While nonbinding, each agency must publicly respond to the Committeeʼsfindings—asteptowardgreatertransparency.Theagencieswill alsohostajointroundtableonSeptember29todiscusspriorities.

Beyondregulatorycoordination,thebillintroducesseverallandmarkchanges:

● DeFi developer protections — writing code or running decentralised protocols would not automatically trigger broker-dealer or AML obligations, shielding developers, validators, liquidity providers, and walletbuildersfromundueliability.

● Airdrops and staking rewards — everyday activities such as programmatic distributions, staking outputs, or airdrops would not be classifiedassecuritiesofferings.

● DePIN exemptions — tokens powering Decentralised Physical Infrastructure Networks will not be treated as securities, provided no singleactorholdsmorethan20percentofsupply.

● Tokenised real-world assets RWAs — the bill clarifies that non-securities remain non-securities when tokenized, while directing regulators to study custody, audits, and cross-border enforcement standards.

ThedraftfollowscontroversyovertheconvictionofTornadoCashco-founder RomanStorm,whichraisedalarmsaboutdeveloperliabilityinDeFi.Lawmakers saythebilladdressesindustryfearsofcriminalizinginnovation.

Senator Cynthia Lummis said the Senate aims to deliver the final bill to by year-end. The bill will need to be reconciled with the Clarity Act, which was passedbytheUSHouseofRepresentativesinJuly.Itsintroductionalsocomes just after the SEC and CFTC themselves pledged to end regulatory “no manʼs landsˮ through closer cooperation - signaling that both Congress and regulatorsaremovingintandemtochartaclearerpathforUScryptomarkets.

● SOLStrategies,aSolana-focusedinfrastructurefirmwith$167Mmarket cap,gainedfinalapprovaltouplisttoNasdaqundertickerSTKE,moving beyonditscurrentOTCCYFRD)andCSEHODL)listings

● The company, holding nearly 400k SOL and surpassing CAD $1B in delegatedassets

With institutional interest in Solanaʼs ecosystem continuing to build, SOL Strategies announced last Saturday, September 6th, that it has secured final approval to uplist its common shares to the Nasdaq Capital Market under the tickerSTKE,markingamilestonefortheSolana-focusedinfrastructurefirm.

The company, which currently carries a market capitalisation of about $167 million, has been trading on the OTC exchange under the symbol CYFRD. Until the uplisting takes effect, its shares will also continue to trade on the Canadian SecuritiesExchangeunderthetickerHODL,accordingtoacorporaterelease.

Formerly known as Cypherpunk Holdings, SOL Strategies has built its business around staking and validator operations within the Solana ecosystem. Its validator-driven model recently exceeded CAD $1 billion in delegated assets, while the number of unique wallets staking with the firm hit an all-time high of 7,068.

As of August 25th, the company reported holding 399,907 SOL in its treasury, valuedatroughly$84million.Thatstakerepresentsabout11percentofthetotal assets secured by its validator network, supplemented by large third-party delegations.

“ThisrepresentsmorethanjustanachievementforSOLStrategies,it'svalidation for the entire Solana ecosystem,ˮ said CEO Leah Wald. “Securing Nasdaq approvalisadefiningmomentforSOLStrategies,reflectingbackthetrustweʼve earned from both institutional and retail delegators and the validation of our model that combines a strategic SOL treasury with enterprise-grade validator operations.ˮ

Wald added that the uplisting underscores the “growing legitimacyˮ of Solana andopensthedoortoawiderclassofinvestorswhomaybemoreaccustomed totraditionalmarkets.

To mark the occasion, SOL Strategies said it will host a virtual bell-ringing ceremony,invitingmembersoftheglobalSolanacommunitytoparticipate.

South Koreaʼs Financial Services Commission FSC, in collaboration with the Financial Supervisory Service and the Digital Asset Exchange Alliance DAXA, releasedstringent“VirtualAssetLendingGuidelinesˮonSeptember5th,2025,to enforce broad-ranging reforms aimed at curbing speculative excess and fortifying investor protection. These rules uniformly cap annual interest rates at 20 percent, ban leveraged lending exceeding the borrowerʼs collateral, and prohibit repayment in fiat currency—mandating that exchanges use their own capitaltofundloansanddisallowthird-partyintermediariestopreventregulatory avoidance. Lending eligibility is limited strictly to cryptocurrencies ranked in the top 20 by market capitalisation or those listed on a minimum of three local Won-based exchanges; any asset flagged with a warning status is barred from lendingprograms.

The framework enshrines dynamic, investor-centric precautions: first-time borrowers must complete DAXA-administered online training and suitability assessments; personalized lending limits—ranging between 30 million to 70 million Won—are calibrated to users' trading histories; platforms must deliver timely warnings ahead of forced liquidations and allow clients to add collateral; andtheymustpublishdataonfees,loanvolumes,andliquidationeventsinreal time or monthly. These guidelines, which came after a regulatory-mandated suspensionofcrypto-lendingservicesinAugustpromptedbyriskyofferingson major platforms like Upbit and Bithumb, represent South Koreaʼs pivot toward a proactive, self-regulating architecture—one designed not only to stabilise the domesticdigitalassetmarketbutalsotolaythegroundworkforpotentialfuture codificationintolaw.