CALMNESS DESCENDSONBTC

MARKETSIGNALS

BitcoinRemainsInConsolidation RangeButDownsideRiskPersists

MACROUPDATE

FedCutsRates;EndsBalanceSheet

Runo asLiquidityTightens

BitcoinRemainsInConsolidation RangeButDownsideRiskPersists

MACROUPDATE

FedCutsRates;EndsBalanceSheet

Runo asLiquidityTightens

Bitcoin has spent the past two weeks confined within a narrow $106,000$116,000range.Despiteabriefreliefrallyto$116,500lastweek,BTC remains weighed down by a short-term resistance cluster, that is seeing continueddistributionfromlong-termholdersandweakinstitutionaldemand.In the options market implied volatility has continued to compress, and investor positioning has shifted to neutral, underscoring a broad lack of directional convictionfollowingtheOctober10thliquidationevent.Thecautioustoneinrisk markets is exacerbated by mixed macro signals from the latest FOMC meeting, andhaskeptspeculativeappetitemutedandpriceactionsubdued.

While structural support still remains intact near $106,000, the balance of evidencepointstofragilitybeneaththesurface.AnalysingtheLong-TermHolder Net Position Change metric reveals that this cohort is deeply negative at 104K BTC per month, signalling persistent profit-taking, while the Short-Term Holder NetUnrealisedProfit/Lossmetricshowswaningconvictionamongrecentbuyers. Unless ETF inflows or new spot demand returns to absorb ongoing distribution, BTC is likely to remain range-bound, with a risk bias toward retesting the $106,000$107,000zone.Asustainedbreakbelowthislevelcouldopenthepath to$100,000perBTC,whereasadecisivereclaimabove$116,000wouldmarkthe firstsignofstructuralrecoveryheadingintoNovember.

UnderpinningthemoodincryptomarketsisaUSeconomythatismovingintoa newstageofpolicyrecalibrationastheFederalReserveshiftsfromtighteningto liquiditymanagementasgrowthslowsandinflationeases.

At its meeting on October 30th, the Federal Open Market Committee ended its balance sheet runoff policy and cut interestratesby25basispoints to a range of 3.754 percent. The move responds to tightening liquidity conditions, as money-market funds pull cash from the Fedʼs reverse repo facility to buy Treasury bills, draining reserves from the bankingsystem.

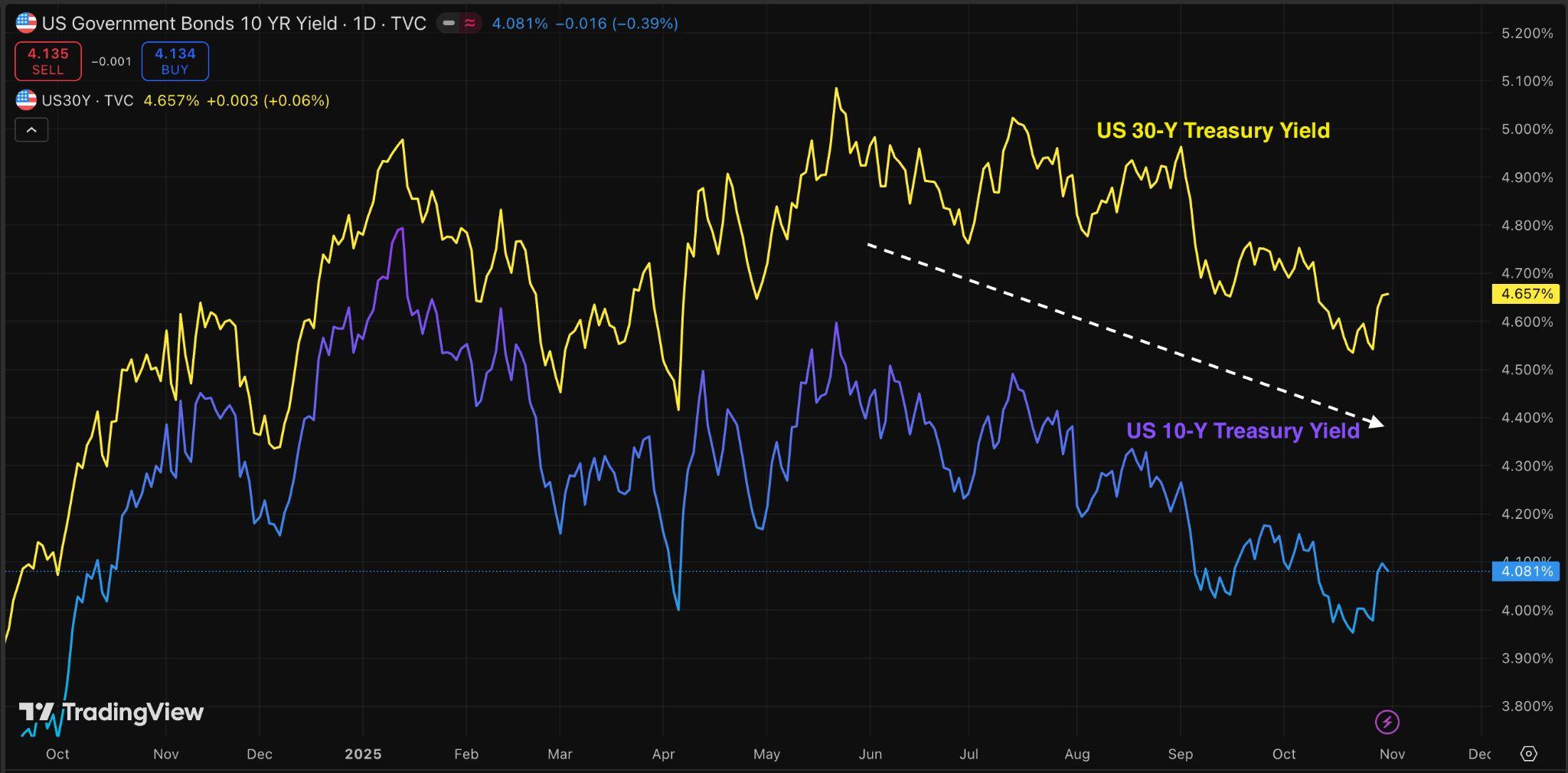

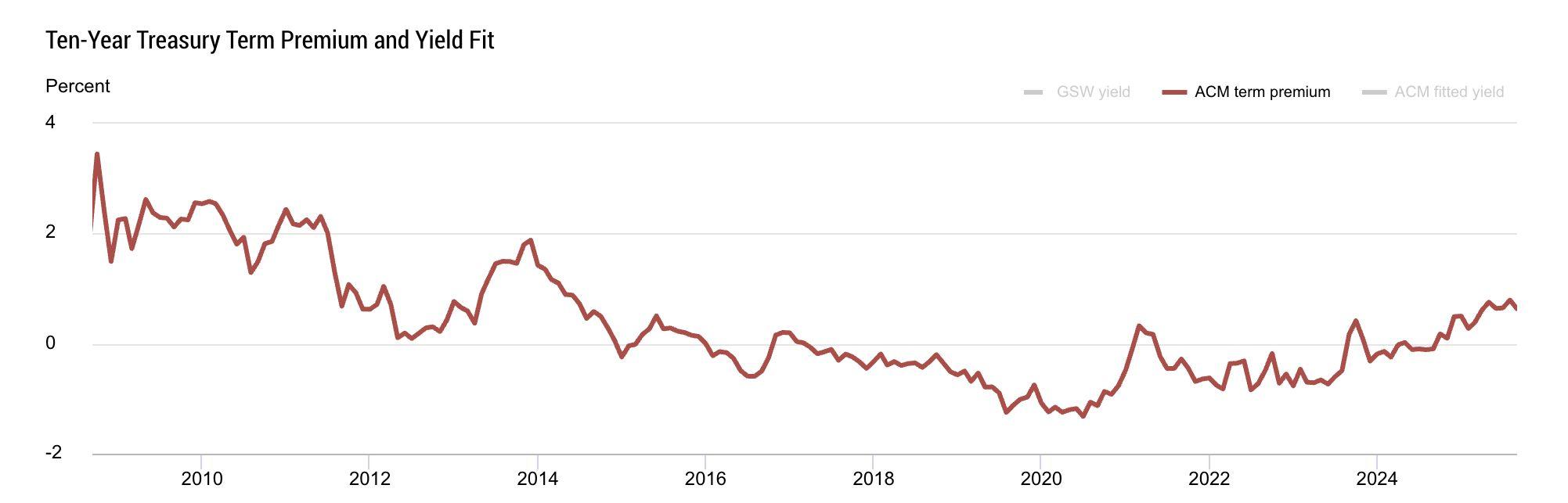

The bond market has been signalling expectations of slower growth and additional rate cuts since the Summer, with 10-year Treasury yields dropping to around 4 percentand30-yearyieldsto4.6percent.Morerecently,however,thetermpremium, which is the extra return demanded by bond investors for taking on risk, has turned positive for the first time in years. It reflects the market view that even though recessionfearsareeasing,concernsoverfiscalandinflationrisksarerising.

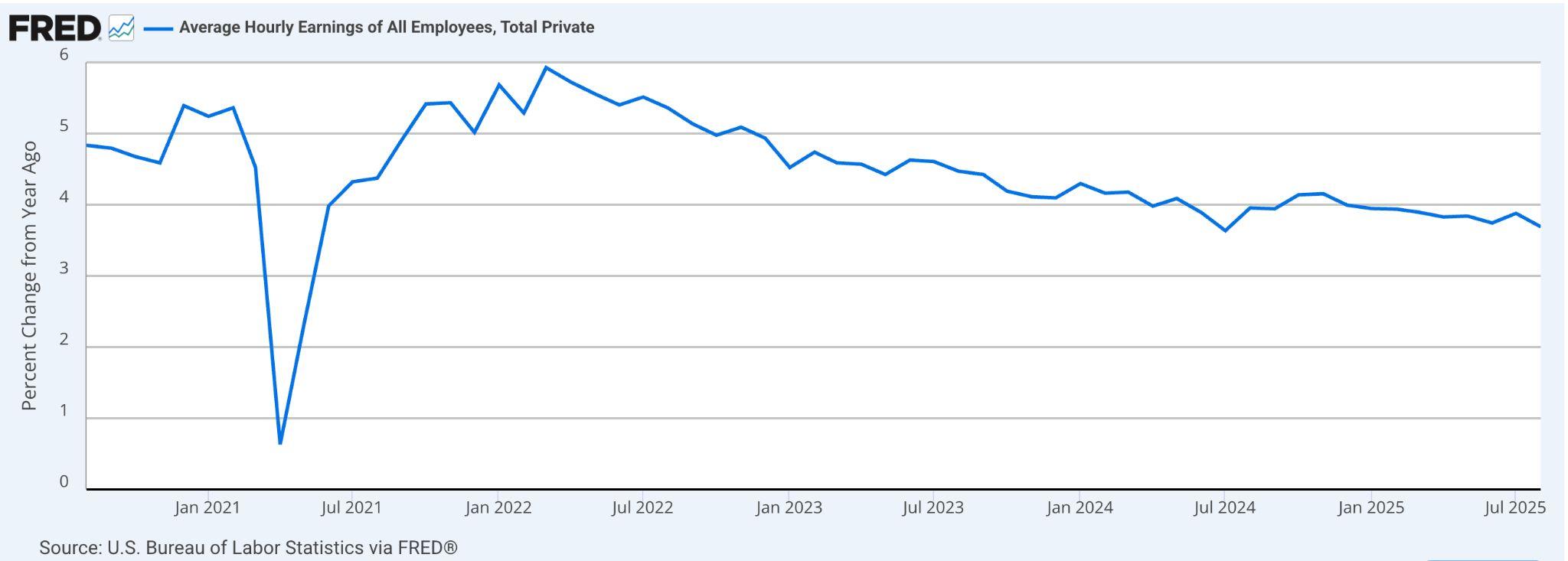

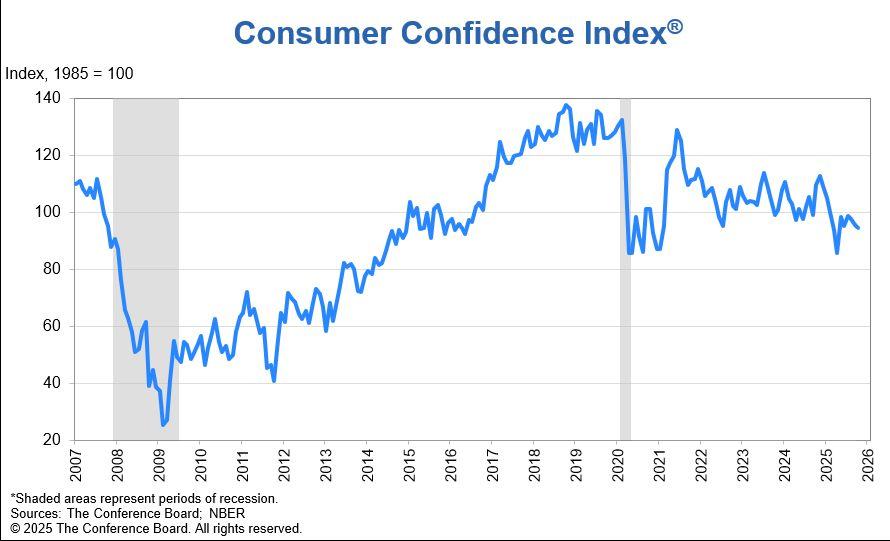

The labour market also shows signs of fatigue. According to the Bureau of Labor Statistics, wage growth slowed to 3.7 percent in August from 4.7 percent last year. Consumerconfidencehasdippedaswell:theConferenceBoardʼsindexfellto94.6in October, reflecting unease among lower- and middle-income households even as equitymarketsremainstrong.

Last Monday, ETHZilla Corporation sold roughly US$40 million in Ether to fund an aggressive share repurchase program, signalling a shift in how crypto-native firms manage treasury assets. By converting part of its ETH holdings into buybacks, ETHZilla aims to narrow the discount between its share price and net asset value, effectivelyturningitscryptoreservesintoacorporatefinancelever.Justadaylater, Western Union entered the crypto arena with the announcement of its US dollar-pegged stablecoin, built on the Solana blockchain in partnership with Anchorage Digital Bank. The launch is indicative of another traditional financial institution modernising cross-border payments by reducing settlement times and costs through blockchain technology. Meanwhile, in Asia, Japan took a bold step towardstate-linkedcryptointegration.MininghardwareproducerCanaan revealeda dealwithamajorJapaneseutilitytodeployhydro-cooledAvalonA1566HAminersfor agrid-stabilityproject.TheinitiativeusesBitcoinminingtobalancerenewableenergy loads, illustrating how blockchain infrastructure can enhance power grid efficiency ratherthanstrainit.

● BitcoinRemainsinConsolidationRange butDownsideRiskPersists

● FedCutsRates;EndsBalanceSheetRunoff asLiquidityTightens

● FallingYieldsandSlowingWagesReveal theUnevenStrengthoftheUSEconomy

● ETHZillaCorporationSellsApproximately US$40MillioninETHtoFundAggressive ShareRepurchaseProgram

● WesternUnionEnters CryptowithUS DollarStablecoinLaunchonSolana

● JapanʼsState-LinkedBitcoinMining ProjectCouldSignalaTurningPointfor

Over the past two weeks, Bitcoin has remained confined within a tight $106,000$116,000 range. Last week began with a relief rally peaking at $116,500 on Monday, 27 October, before the price retraced more than 8.9 percenttorevisitlocalrangelows.

Withvolatilitysubsidinganddirectionaltradingactivitydiminishing,BTChas struggled to regain upward traction or mirror the recovery seen in equity markets.Since the sharp 18.08 percent drawdown on 10 October,following theall-timehighof$126,110setearlierinthemonth,momentumhasremained subdued. This consolidation reflects a period of market recalibration, with reduced speculative activity and lingering uncertainty keeping price action containedwithinadefinedrange.

1. BTC/USD4HChart.Source:Bitfinex)

In the two weeks since the historic 10th October liquidation event, BTC has staged two brief recovery attempts, following its dip to the lower boundary of $106116,000supplycluster.

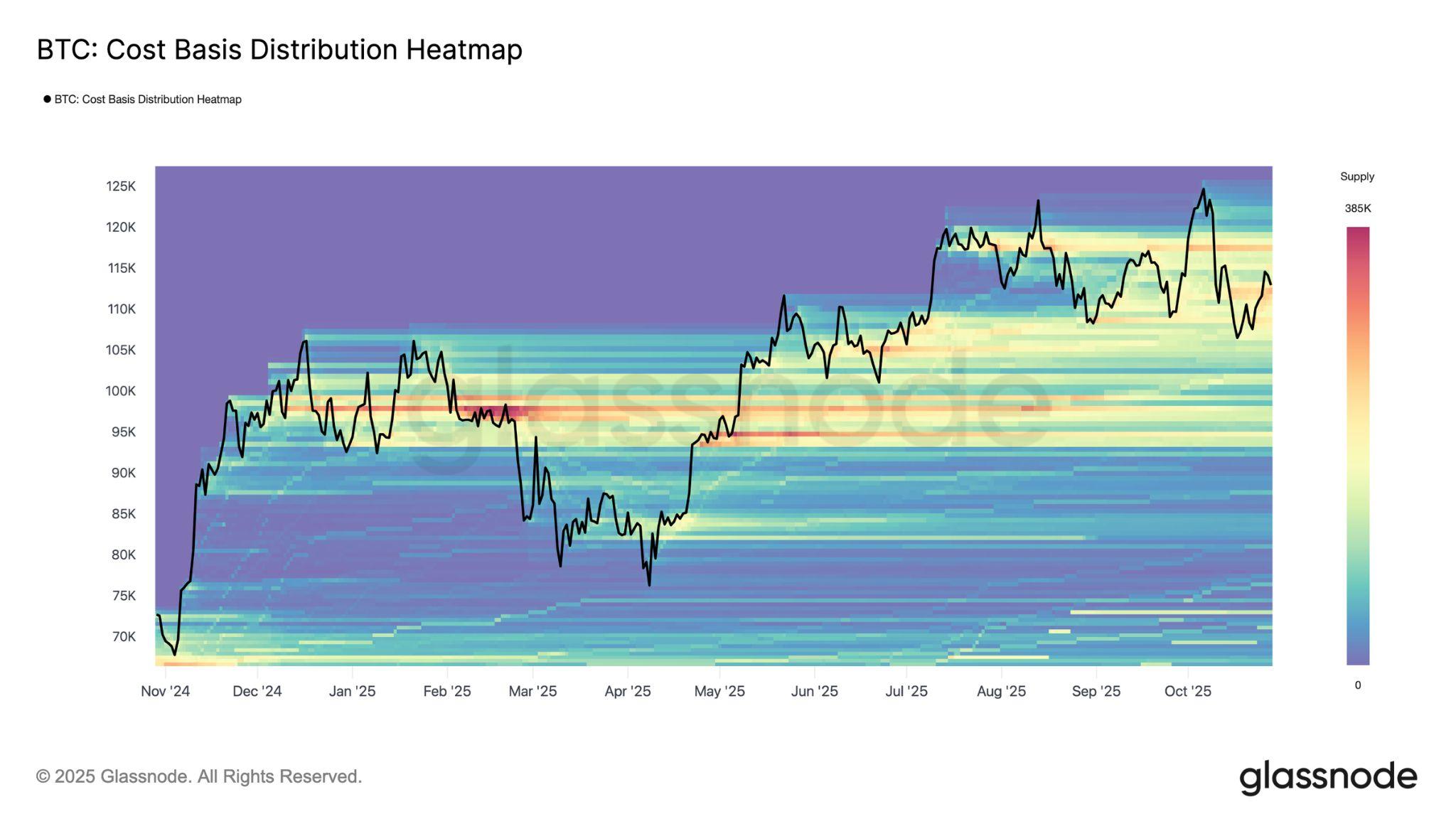

DatafromtheCostBasisDistributionHeatmap(seeFigure2above)showsthat the price twice rebounded from the midline near $116,000 before retracing towardrangelows.

Thispatterncloselyresemblestradingbehaviour observedafterAll-TimeHighs werereachedinQ2Q32024andQ12025,whereshort-livedralliesemergedas buy-side momentum was repeatedly absorbed by overhead supply. In the currentcase,reneweddistributionfromlong-termholdersLTHshasintensified resistance within this supply zone, suggesting that profit-taking continues to suppress upward momentum and limit the marketʼs ability to sustain recovery attempts.

The current market pattern also aligns closely with macroeconomic developments,whereoptimismhaspersistedacrosstimeframesbuthasrecently begun to moderate. Hopes surrounding a potential USChina trade agreement provided near-term relief across global risk assets, while the Federal Reserveʼs ongoingrate-cuttingcyclehassupportedamoreconstructivelong-termoutlook. However, sentiment cooled following last weekʼs FOMC meeting. While the Fed deliveredtheexpected25basis-pointcut,remarksbyFedChairJeromePowell hinted at uncertainty over whether another cut would follow in December, temperingexpectationsforasustaineddovishtrajectory.

Figure3.BitcoinAt-The-MoneyImpliedVolatilityOverWeeklyandMonthly Expiries.Source:TheBlock)

The initial relief rally across both equities and digital assets faded as investors adopted a more cautious stance. This shift was clearly reflected in Bitcoinʼs derivativesmarkets,particularlyoptions.Impliedvolatility(ameasurementofhow much options market traders expect price to fluctuate in either direction), has continued to decline, signalling a structurally calmer trading environment after theliquidationeventonOctober10th.Evenamidlingeringmacronoiseandpolicy uncertainty,thissustainedcompressioninimpliedvolatilitysuggeststhattraders expect range-bound conditions rather than sharp directional moves in the near term.

Such periods of subdued volatility often accompany phases of accumulation or distribution, where positioning resets and liquidity rebuilds before the next significant move. In this sense, the current macro backdrop easing policy, but mixed communication from the Fed, supports consolidation as a necessary stabilisingphasebeforevolatilitycanexpandagain.

4.BitcoinEuropeanOptionsPut/CallRatioAcrossAllExchanges. Source:Glassnode)

Signs of exhaustion are becoming increasingly evident across derivatives markets, as options positioning continues to revert rapidly toward equilibrium, while BTC oscillates between range highs and lows. This repeated mean reversion underscores a lack of directional conviction, with traders shifting stancesaspricefluctuateswithintheestablished$106,000$116,000corridor.

Earlier this week, the Put/Call volume ratio (see Figure 4 above) reset to its lowestlevelofthemonthastradersaggressivelychasedthebriefupsidemove, driving a sharp increase in call activity, a clear departure from the defensive hedging behaviour that had dominated earlier in the month. However, the optimism proved short-lived. As price momentum faded, the ratio quickly revertedtowardtheupperendofitsrange,signallingareturntomorecautious positioning and reinforcing the broader narrative of indecision and fatigue prevailingacrossthemarket.

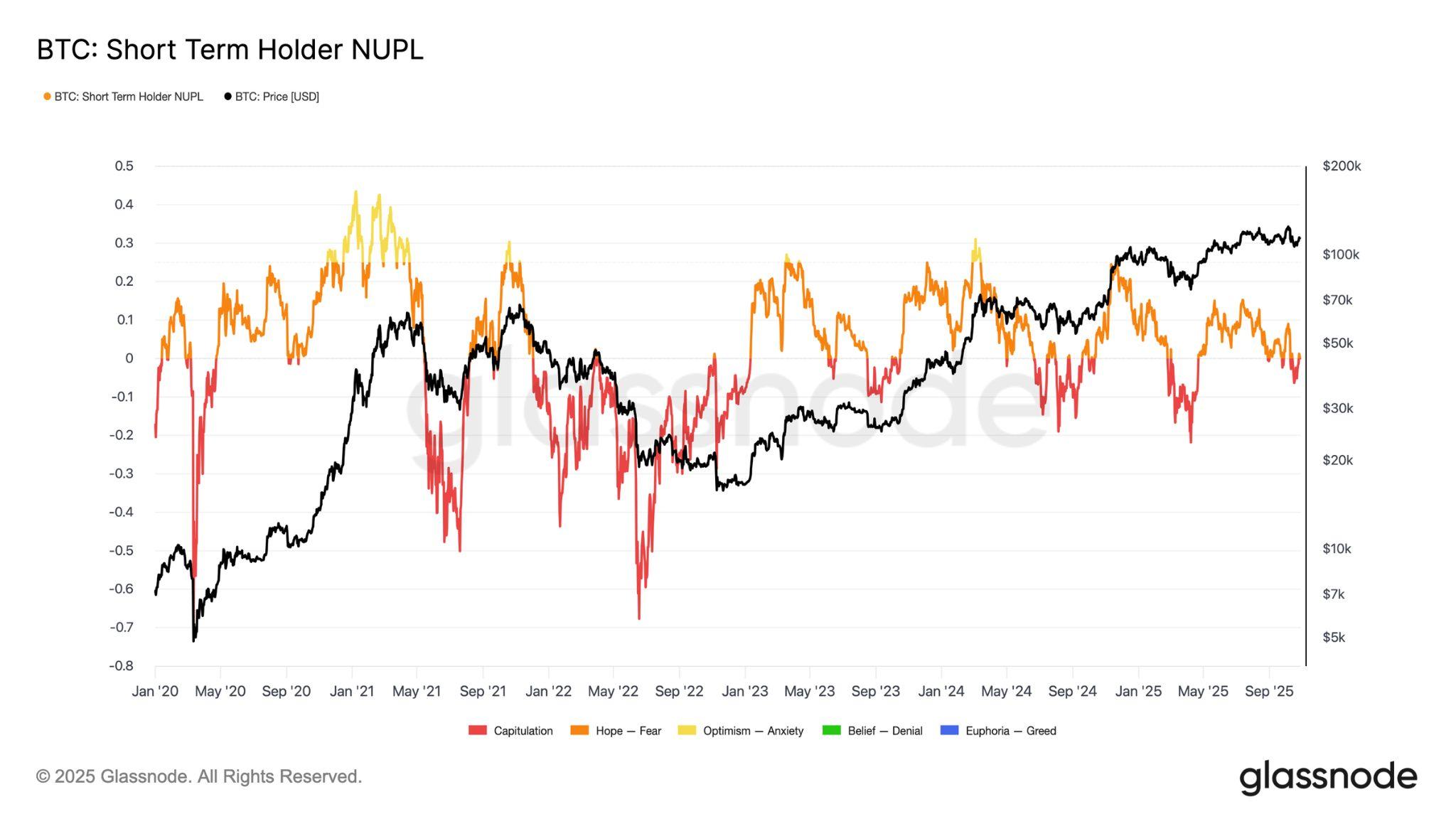

Extending the analysis to investor sentiment, any further weakness across cryptowouldlikelybedrivenbyshort-termholders,thecohortofrecentbuyers now exiting positions at a loss. The Short-Term Holder Net Unrealised Profit/Loss STHNUPL) metric serves as a useful gauge of this dynamic, measuringunrealisedprofitorlossasaproportionoftotalmarketcapitalisation (seeFigure5below).

Historically, deeply negative STHNUPL readings have marked phases of capitulation that tend to precede cyclical market bottoms. The recent decline to $106,000 pushed STHNUPL down to 0.05, indicating mild unrealised losses across this cohort. For comparison, mid-bull market corrections typicallyreachbetween0.1and0.2,whiledeepbearmarketlowshavefallen below0.2.

AsBTCcontinuestotradewithinthe$106,000$116,000top-buyercluster,the marketsitsinafragileequilibrium.Wearenotyetinacapitulationphasefrom these cohorts of investors, but they are showing signs of waning conviction. Unlessthepricerecoversdecisivelyabovethisrange,timebecomesagrowing headwind for bulls, as prolonged stagnation historically erodes sentiment and increasestheriskofforceddistribution.

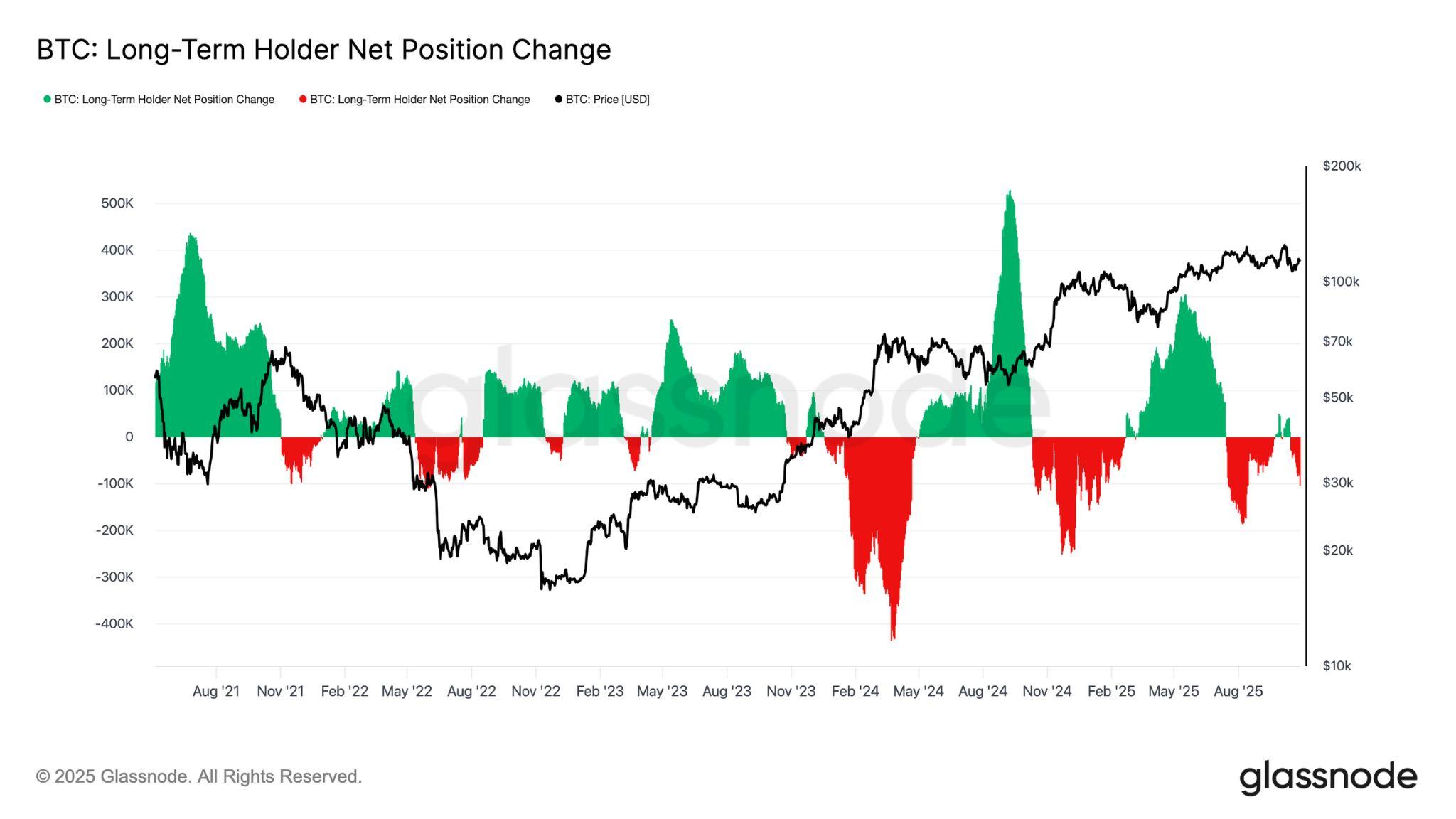

Building on previous observations, persistent distribution from long-term holders LTHs continues to exert structural pressure on the market. The Long-TermHolderNetPositionChangehasfallento104,000BTCpermonth, the sharpest wave of selling since mid-July underscoring the extent of profit realisationamongseasonedinvestors.

Source:Glassnode)

This sustained outflow aligns with the broader signs of exhaustion visible across the market, as long-term holders continue to offload into declining demand. Historically, major bull phases have only resumed once this cohort transitionsfromnetdistributiontosustainedaccumulation,signallingrenewed convictionandthere-establishmentofastrongholdingbase.

Untilsuchashiftmaterialises,priceactionislikelytoremainconstrained,with upside rallies repeatedly capped by supply from profit-taking holders. Unless ETF inflows or other marginal buyers step in with sufficient spot demand to absorb this distribution, there remains a tangible risk of Bitcoin retesting the $106,000$107,000supportzoneand,iflost,potentiallyextendingtowardthe $100,000regionorloweroverthecomingweeks.

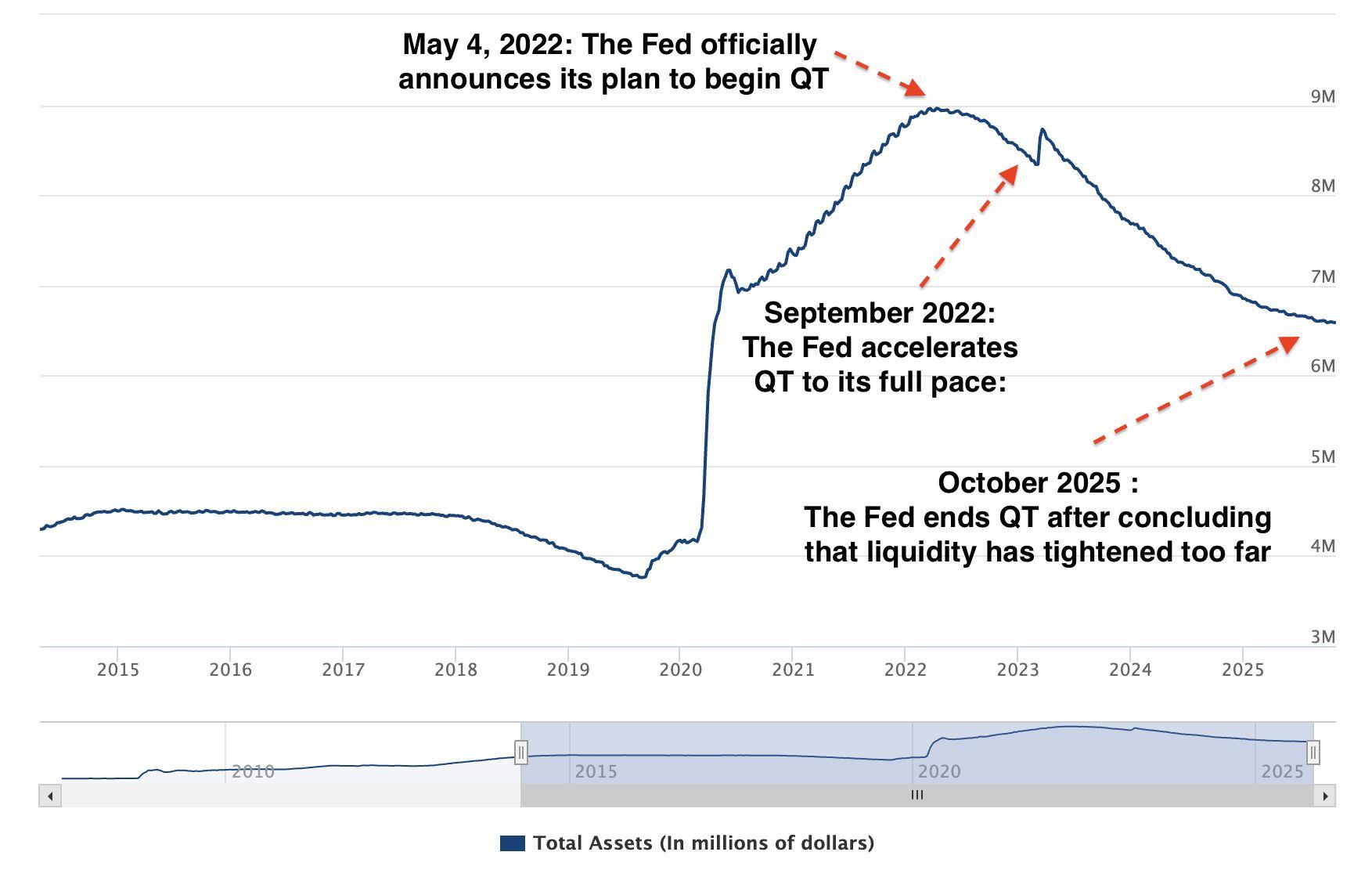

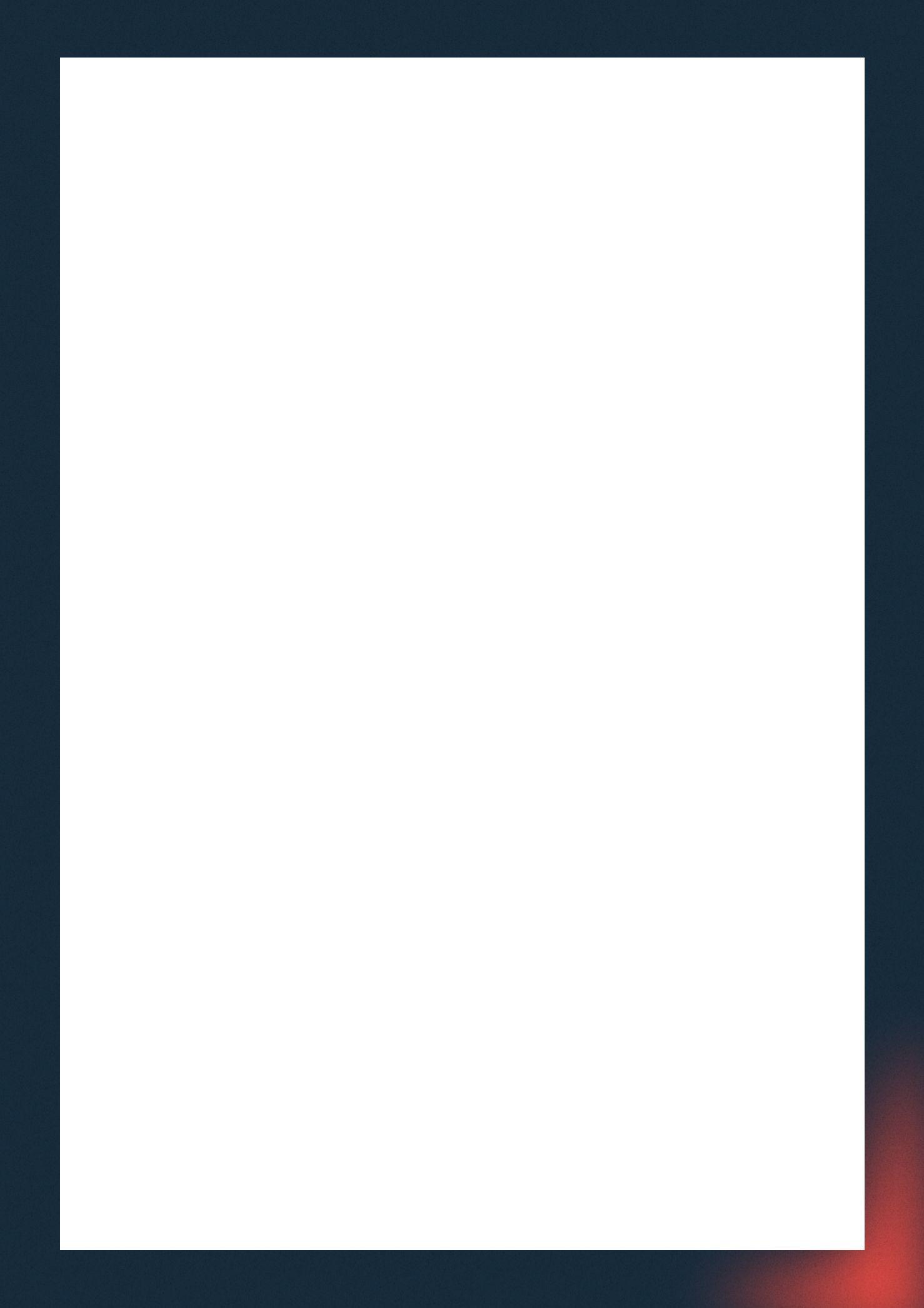

The Federal Reserve has formally ended its balance sheet runoff and trimmed interest rates by 25 basis points, marking a significant policy shift aimed at addressing tightening liquidity conditions in US money markets. The move underscores the central bankʼs concern that financial reserves, once abundant, havenowfallentolevelsthatcoulddestabiliseshort-termfundingmarkets.

ThedecisioncameaftertheFederalOpenMarketCommitteeFOMC)meetinglast Wednesday, October 29th, which lowered the federal funds rate to a range between 3.75 percent and 4 percent, and confirmed that the runoff of its $6.6 trillionbalancesheetwillconcludeonDecember1st.

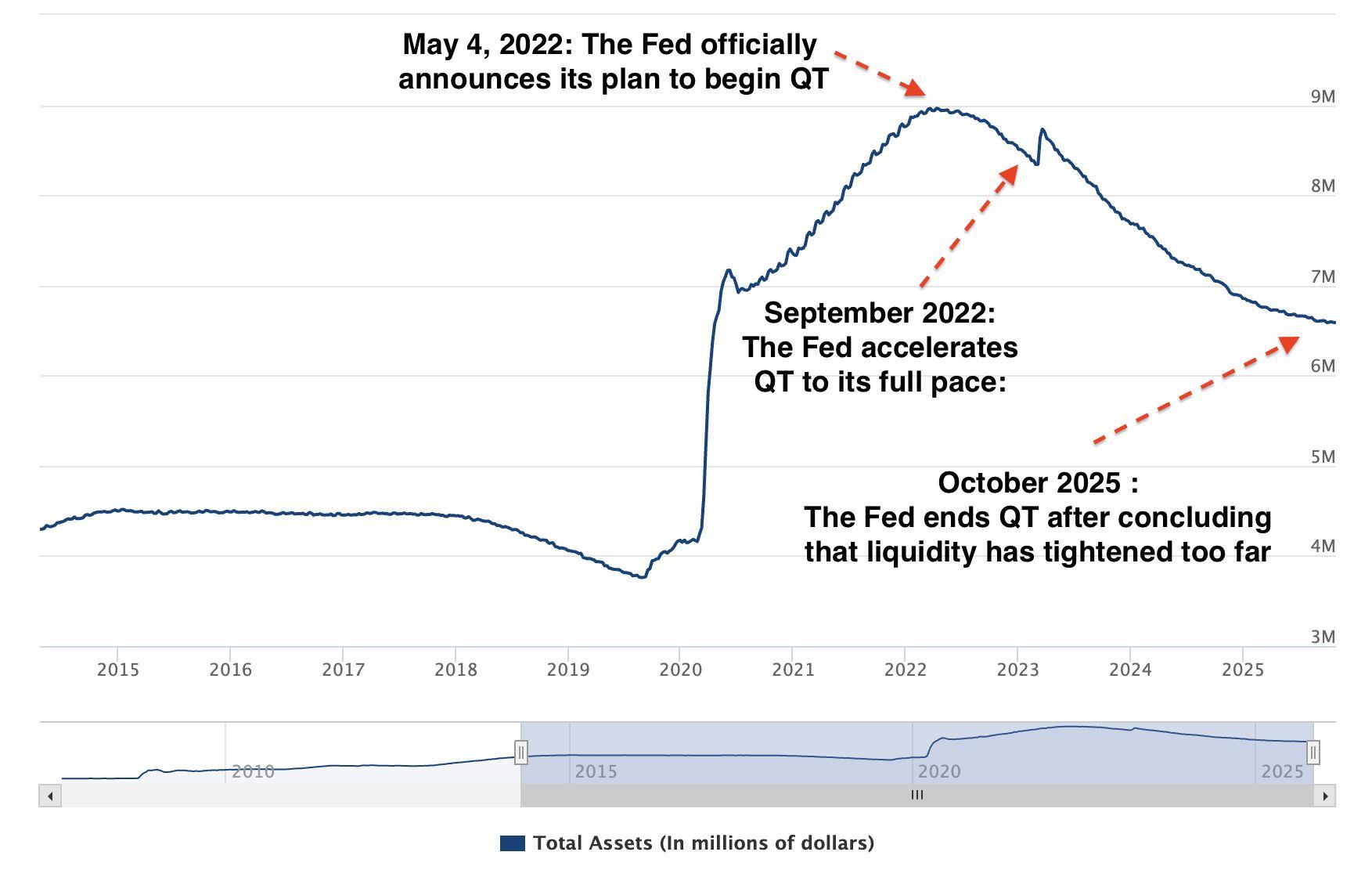

Figure7.TotalAssetsoftheFederalReserveFredCharts)

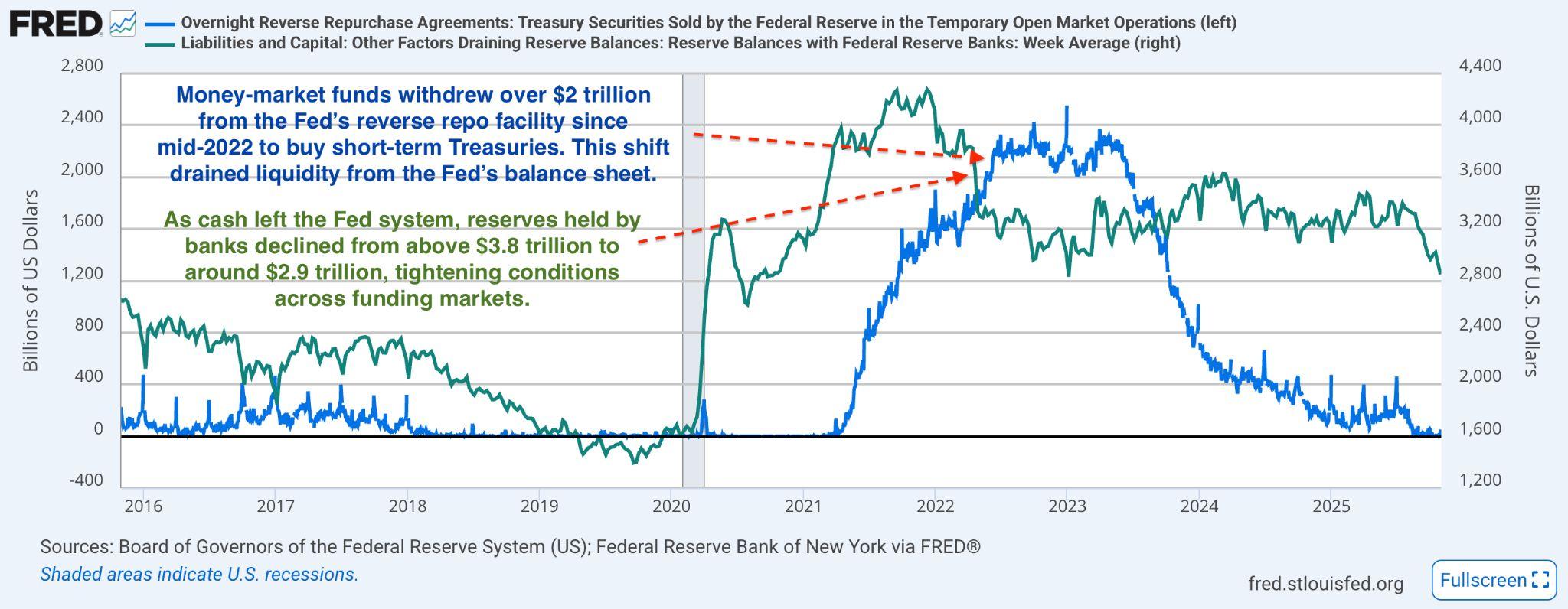

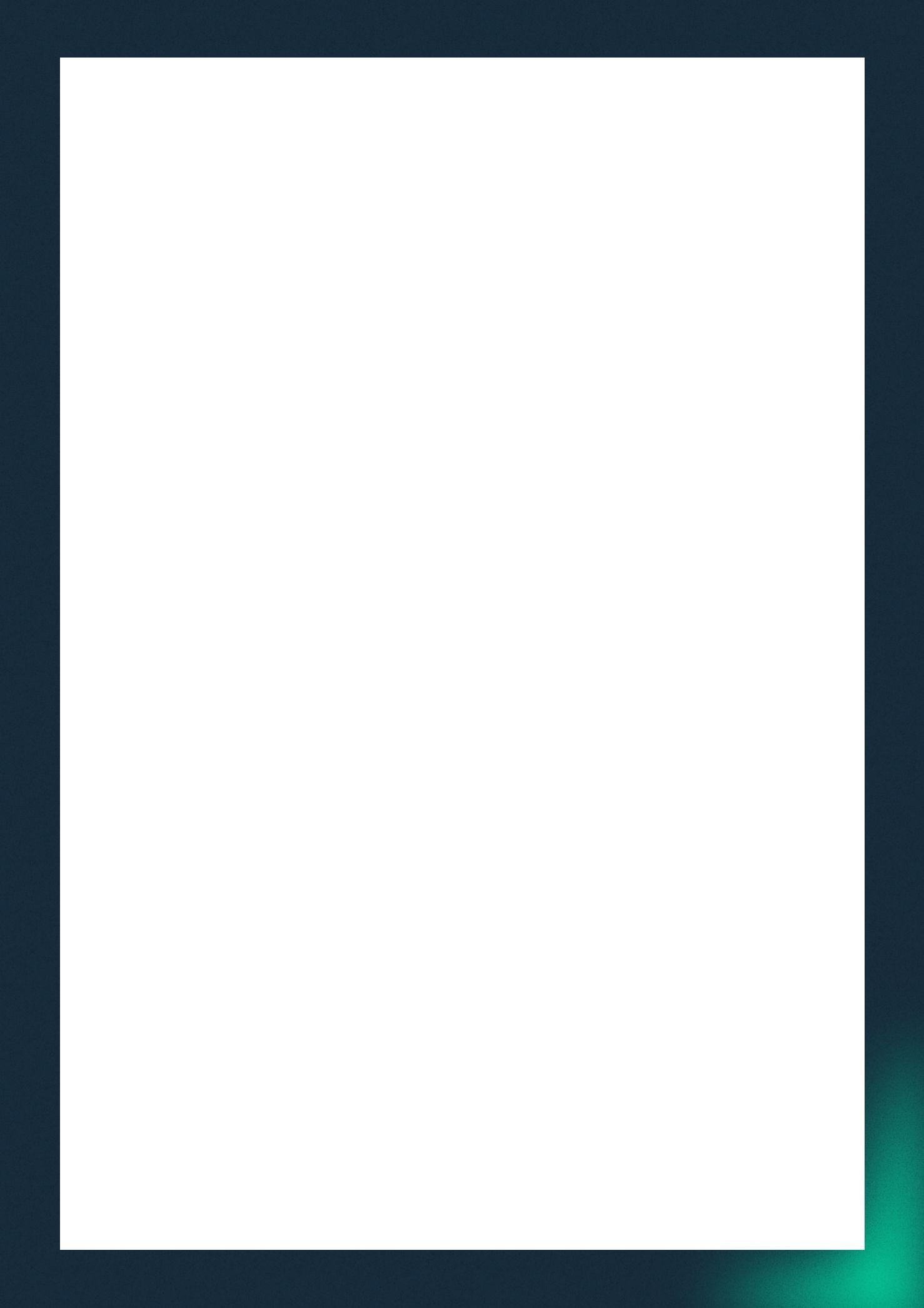

The end of the Fedʼs quantitative tightening QT) program comes amid growing evidence that liquidity in the financial system is starting to dry up. Over the past severalmonths,money-marketfunds,whichholdtrillionsofdollarsinshort-term cash,havebeenpullingmoneyoutoftheFedʼsreverserepofacility,aprogramme where they can safely park cash overnight and earn interest. Instead of leaving theirmoneywiththeFed,thesefundsarenowusingthatcashtobuyshort-term USTreasurybills,whichthegovernmentisissuinginlargeramountstofinanceits wideningbudgetdeficit.

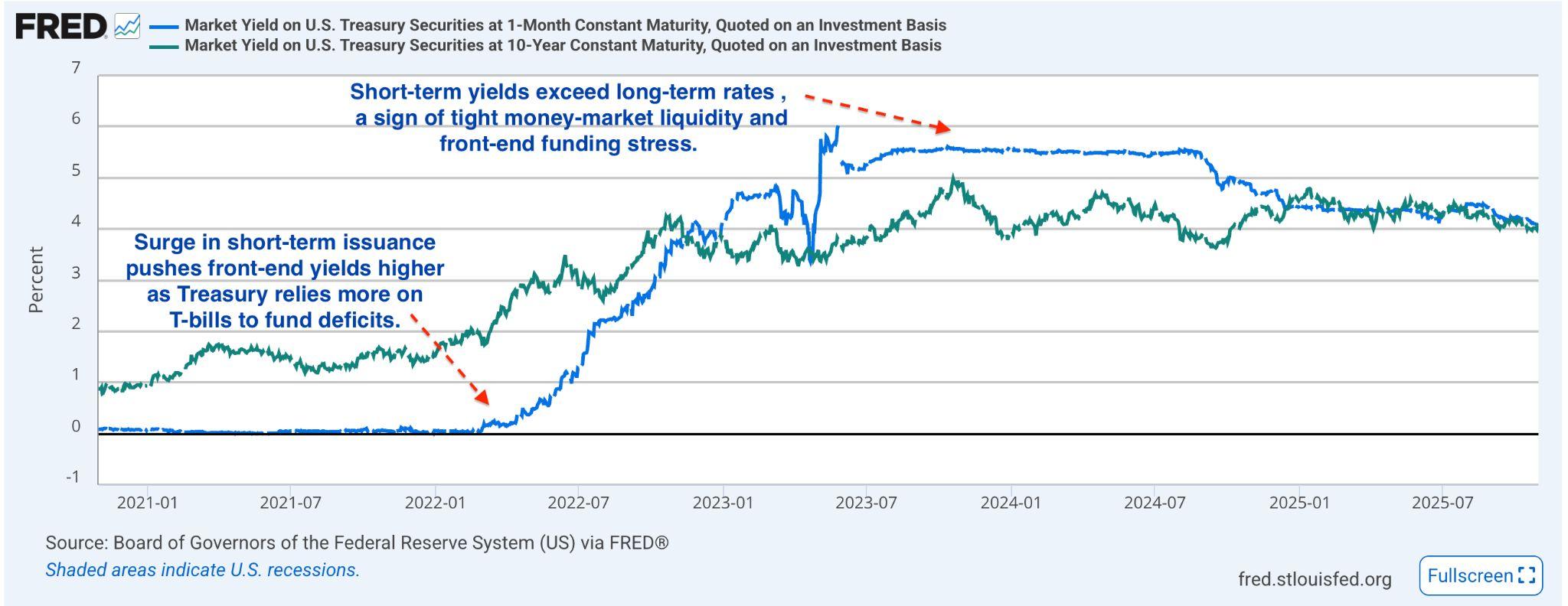

Figure9.Thesurgeinshort-termTreasuryyieldsfrommid-2022onward reflectstheTreasuryʼsheavyrelianceonT-billissuancetofunddeficits. Asmoney-marketdemandstruggledtokeeppace,front-endyieldsrose abovelong-termrates,signalingliquiditystress.

This shift may sound technical, but its effect is real: when these funds move cash out of the Fed and into Treasuries, it reduces the amount of money circulating in the banking system. With fewer reserves available, banks have less cash to lend to one another and to businesses. As a result, short-term borrowing costs, the rates that influence everything from corporate loans to creditcards,havebeguntocreephigher.Itisthis,causedbythetighteningof liquidity, that has prompted the Fed to halt its balance sheet runoff, aiming to keepfinancialmarketsfunctioningsmoothlyand avoidarepeatofthefunding strainsseenin2019.

Fed Chair Jerome Powell acknowledged the shift, saying “signs have clearly emergedthatwehavereachedthatstandardinmoneymarkets,ˮreferringtothe Fedʼs threshold for maintaining “ampleˮ reserves. The central bankʼs goal, he added, is to prevent a recurrence of liquidity disruptions that were experienced duringthe2019fundingsqueeze,whichtemporarilysentovernightlendingrates soaring.

Under the new plan, the Fed will roll over all maturing Treasury securities beginning December 1st , keeping its bond holdings steady. Proceeds from maturing mortgage-backed securities MBS, which the Fed has struggled to unwind, will now be reinvested into Treasury bills. During the period of quantitative tightening, the Fed allowed roughly $60 billion in bonds to mature each month without reinvestment, shrinking reserves from around $4 trillion to $3 trillion See Figure 11 below). According to the Federal Reserveʼs Policy Normalizationframework,theTreasuryrunoffcaphadalreadybeenreducedto $5billionpermonthasofApril2025,whiletheMBScapremainedat$35billion. Now,underthenewplantakingeffectfromDecember1st,theFedwilleffectively halt the monthly balance-sheet decline. Removing these runoff caps could restore roughly $25 to $35 billion in monthly liquidity, easing the reserve depletionthathadbroughtbalancestonear$3trillion.

Meanwhile,theinterestrateonexcessreserveswasloweredfrom4.15percent to3.9percent,andthereversereporatefrom4percentto3.75percent,aiming torelieveupwardpressureonfront-endrates.

The policy shift, while expected, exposed divisions within the Federal Open Market Committee. Two members dissented, one preferring a deeper 50-basis-point cut, another advocating no change, highlighting the ongoing debate over whether the Fed should prioritise employment support or inflation control.

The Fedʼs statement noted that “job gains have slowedˮ but that the unemployment rate has “remained relatively low.ˮ Powell described the cut as “risk managementˮ amid weakening hiring and wages but stressed that future decisionsare“notonapre-setcourse.ˮ

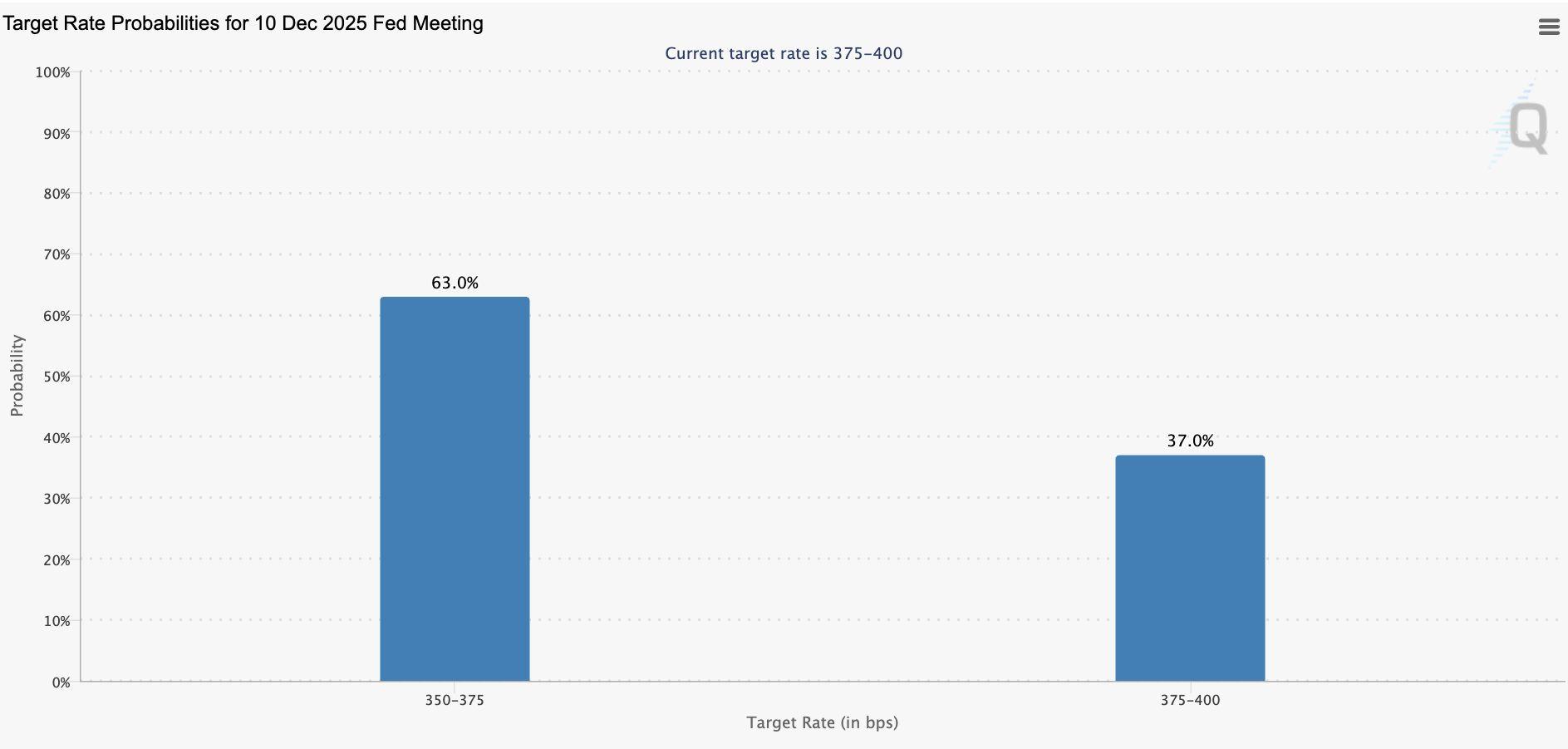

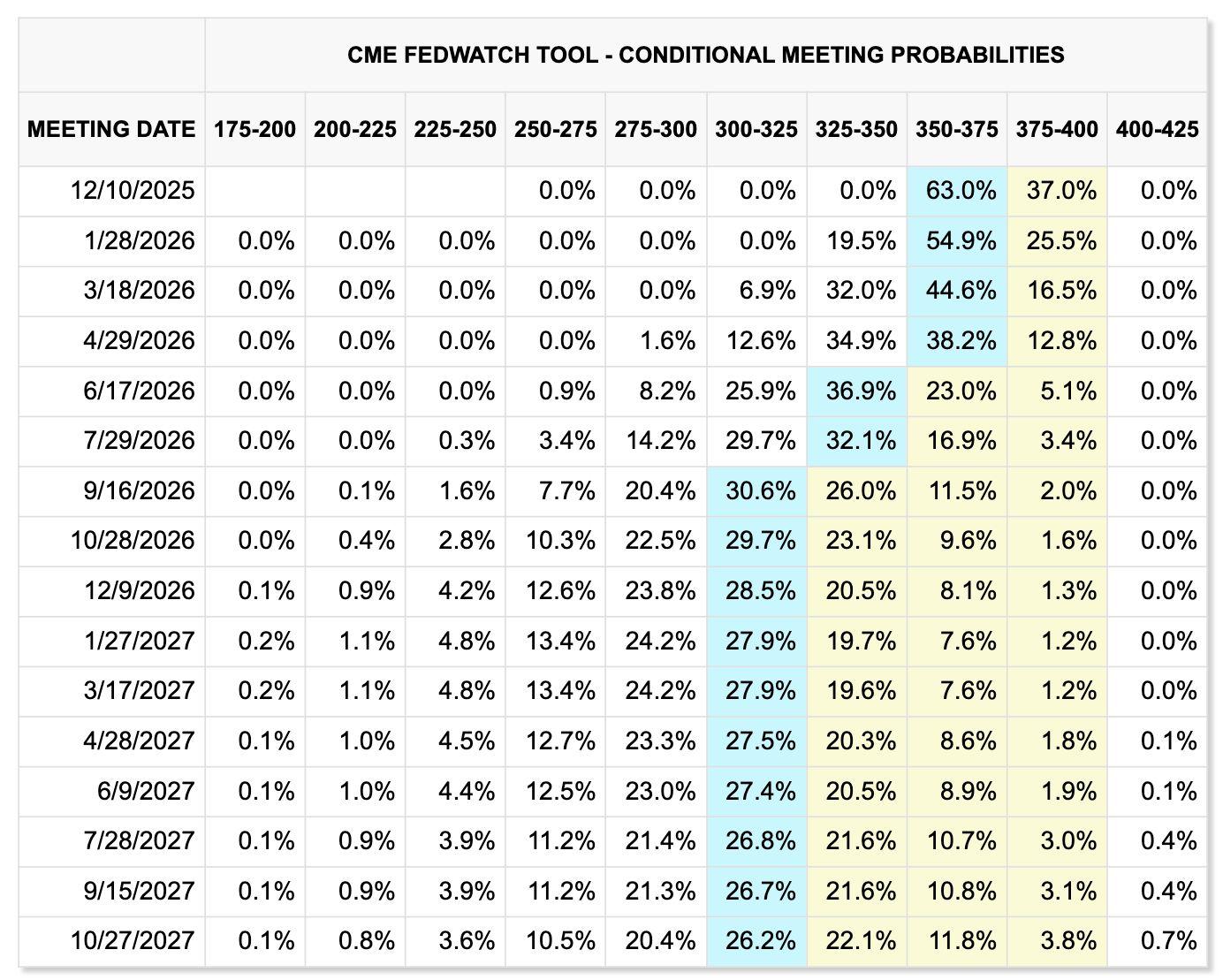

According to the Summary of Economic Projections released in September, officials remain divided on how much further policy should ease. According to CME Fedwatch Tool (see Figure 12 below), there is a 63 percent probability of onemore25-basis-pointratecutinDecember,bringingthepolicyratecloserto theFedʼslong-runneutralestimatenear3percent.

The end of QT marks a turning point in the Fedʼs post-pandemic strategy. After expanding its balance sheet to nearly $9 trillion during the COVID19 crisis, the Fed began reducing its holdings in 2022. That process has now concluded with total assets still well above the $4.2 trillion level seen before thepandemic.

While proceeds from maturing mortgage-backed securities will now be reinvested into Treasuries to maintain current holdings, the Fed may eventually need to resume additional modest bond purchases, beyond these reinvestments, notasaformofnewstimulus,buttopreserveampleliquidity withinthebankingsystem.

MarketReaction

13.EquitiesMarketDippedSlightlyLastWednesdayʼsFOMCDecision

MarketsinitiallycheeredthedecisiontoendQTbutlatershowedmixedsignals as investors digested the implications. The cautious tone in the markets reflected investorsʼ view that while rate cuts support liquidity, the end of QT couldlimitthescopeforfurthereasing.

In fixed income, yields climbed as investors reassessed the balance between easierpolicyandpersistentinflation.The10-yearTreasuryyieldrosetoaround 4 percent, reversing early declines, as the bond market priced in continued volatilityinshort-termfundingrates.

TheUSdollarstrengthenedmodestly,withthedollarindexDXY)upabout0.4 percent,supportedbysafe-havenflowsandexpectationsthatUSinterestrates willremainhigherthanthoseinothermajoreconomies.

In digital assets, Bitcoin briefly rallied before sliding back to the $111,000$113,000 range last Wednesday, reflecting tradersʼ scepticism that ratecutswouldtranslateintoimmediateliquidityinflows,anddroppedfurtheras the week ended. Broader crypto markets remained subdued, as investors weigheddollarstrengthandhigherrealyieldsagainstthelonger-termpotential formonetaryeasing.

MarketsappeartoviewtheFedʼsmoveasarecalibrationratherthanapivotasa combinationofratecutsandtheendofQTsignalsafocusonliquiditycontrol, andnotfull-blownstimulus.

The Fedʼs latest actions highlight the delicate balance between maintaining liquidity and curbing inflation. Ending QT prevents further tightening in money markets, while modest rate cuts aim to cushion the economy from slowing job growth.

Yet,withinflationstillabovetargetandfinancialconditionsremainingfrothy,the Fedʼschallengeistoeasewithoutreignitingpricepressures.Theshiftsignalsa new phase, one defined less by aggressive tightening and more by active liquidity management across both traditional and digital markets, while the absence of fresh data due to the ongoing government shutdown complicates theFedʼsassessmentofreal-timeconditions.

While the Fedʼs moves were aimed at stabilising markets, the broader economic picture reveals growing fragility beneath the surface. Despite a brief uptick after the FOMC decision, yields have trended lower since the summer as investors price in slower growth,despite continued optimism in financial markets. Department of Treasury data show yields on 10-year Treasurynoteshaddroppedby51basispoints,from4.5percentinJuneto4 percentbythethirdweekofOctober,while30-yearbondyieldsslippedby38 basispointsto4.6percent(seeFigure14 below).

Figure14.US10Yearand30YearTreasuryYieldsSource:TradingView)

Thisretreatinyieldsreflectsamixofshiftingexpectations,includingprospects of rate cuts, softer economic growth, and rising safe-haven demand. The forwardmarketisnowpricinginthreeFederalReserveratecutsbyJuly2026. The easing cycle aims to counter liquidity strain and sustain credit conditions amidacoolinglabourmarket.

Thebondmarketʼsrecentmovementssuggestinvestorsarebracingforweaker growthandpersistentimbalancesintheeconomy.TheTreasuryʼspreferencefor issuingshort-termdebtoverlong-termbondshasreinforceddemandforlonger maturities, pushing yields lower. With economic momentum cooling and equity markets looking fully valued, investor preference has tilted toward longer-durationbonds,reflectingasearchforstabilityandportfoliobalance.

The term premium, the extra yield investors demand for holding long-term Treasuries, has recently turned positive after staying mostly negative for much of the past five years. his reversal marks a shift in investor sentiment: markets are no longer solely pricing in recession risks but are also demanding compensationforfiscalandinflationuncertainty.

Figure16. The10YearTreasuryTermPremiumHasTurnedPositive ReflectingHigherFiscalandInflationRisk

Whiletheearliernegativetermpremiumreflectedfearsofeconomicstagnation, todayʼs positive premium underscores renewed long-term risk perceptions, evenasyieldsoverallhavedeclined.Longer-termyieldsremainanchoredeven asthetermpremiumrises,reflectingmixedsentiment,investorsexpectslower growthbutremaincautiousaboutfiscalandinflationrisks.

Whilethebondmarketpointstocaution,USlabourdatapaintsasimilarstory. AccordingtotheBureauofLaborStatistics,year-over-yeargrowthofaverage hourlyearningsforallemployeeshascooledfrom4.7percentinearly2023to 3.7percentbyAugustthisyear,indicatingthatthetightpost-pandemiclabour marketiseasing.

These dynamics underscore that while the labour market remains resilient, its momentumisfading.TheFederalReserveiscloselywatchingthismoderation as it balances price stability with full employment, a tension made more complexbyautomationandtradeuncertainty.

As inflation stabilises around 3 percent, the slowdown in wage growth raises concernthathouseholdpurchasingpowercoulderode.Aweakerlabourmarket couldsuppressconsumption,whichhasbeenthebackboneofUSgrowthsince thepandemicrecovery.

Consumer sentiment has also deteriorated. The Conference Boardʼs Consumer Confidence Index, released last Tuesday, showed a decline to 94.6 in October from 95.6 in September. The drop highlights a growing divide between Main StreetandWallStreet.

Higher-income households, buoyed by surging equity prices and home valuations, continue to spend confidently. In contrast, low- and middle-income households, those more sensitive to inflation and job insecurity, remain wary. Manyare grapplingwithslowerwagegainsandconcernsaboutjobstability.

Theemploymentsubindexofthesurveystayednearafive-yearlow,highlighting thattheoptimismdrivingstockmarketsisnotreflectedinthebroaderworkforce. Thisanxietycanbeattributedpartlytotheriseofartificialintelligence,whichis boosting corporate productivity and profits but also displacing some workers, especiallyinadministrativeandentry-levelroles.

Federal Reserve policymakers face a difficult balancing act. The Fedʼs incrementalratecutsaredesignedtocushionliquiditystrain,notunleashbroad stimulus. The Fedʼs quarter-point reduction in rates last week, to 3.754 percent, is part of its ongoing strategy to support credit conditions amid decelerating demand. The ongoing government shutdown, however, has delayed the release of crucial data, making it more difficult to assess the full impactoftheseadjustments.

The economy appears to be settling into a pattern of uneven expansion: wealthier households and corporate sectors tied to technology and capital marketscontinuetobenefitfromlowratesandstrongassetperformance,while middle-income consumers face the strain of rising living costs and weakening jobprospects.

The divergence between markets and households underscores a critical truth ofthecurrentcycle:monetaryeasingcansupportfinancialassets,butitcannot fullyoffsetthestructuralimbalancesweighingonAmericaʼsrealeconomy.

Last Monday, October 27th, ETHZilla Corporation NASDAQ ETHZ announced thatithadsoldroughlyUS$40millionworthofitsEtherETH)holdingstofinance a strategic program of share repurchases. The sale, executed beginning on October 24th, was followed by immediate stock buyback activity: the company repurchased approximately 600,000 shares for around US$12 million to date underitsboard-authorisedrepurchaseprogram.

ETHZilla stated that the share buybacks are being conducted while its stock is trading at a significant discount to its net asset value NAV, and that the ETH sale will continue to fund additional repurchases “until the discount to NAV is normalised.ˮAtthetimeoftheannouncement,thecompanyreporteditstillheld approximatelyUS$400millioninETHonitsbalancesheet,earmarkedforfuture strategicinitiatives.

Management, led by Chairman & CEO McAndrew Rudisill, emphasised that the move reflects leveraging the strength of the companyʼs crypto-treasury to enhanceshareholdervaluebyreducingsharecountandboostingNAVpershare. He noted the dual objectives: using the ETH holdings as a funding source and capturing accretion while the market undervalues the stock relative to its crypto-assetbacking.

ThistransactionsignalsashiftinhowETHZillaismanagingitscorporatetreasury strategy: rather than simply accumulating ETH, the company is selectively monetising part of its crypto holdings to bolster its equity structure and reflect value more directly to shareholders. However, the decision is not without risks; ETHZillaexplicitlyflaggedthevolatilityofEtherprices,thecorrelationofitsstock to crypto valuations, and uncertainties tied to digital-asset regulation and accountingtreatmentofcryptoholdingsunderUSGAAP.

Insum,ETHZillaʼslatestdisclosurehighlightsatacticalrepositioning:turningpart of its digital-asset portfolio into capital-markets manoeuvring, deploying crypto liquiditytoexecuteanaggressiverepurchaseofitsshareswhileitsequitytrades atadiscount,andsignallingtothemarketareadinesstocontinuesellingETHfor buybacksuntilthevaluationgapcloses.

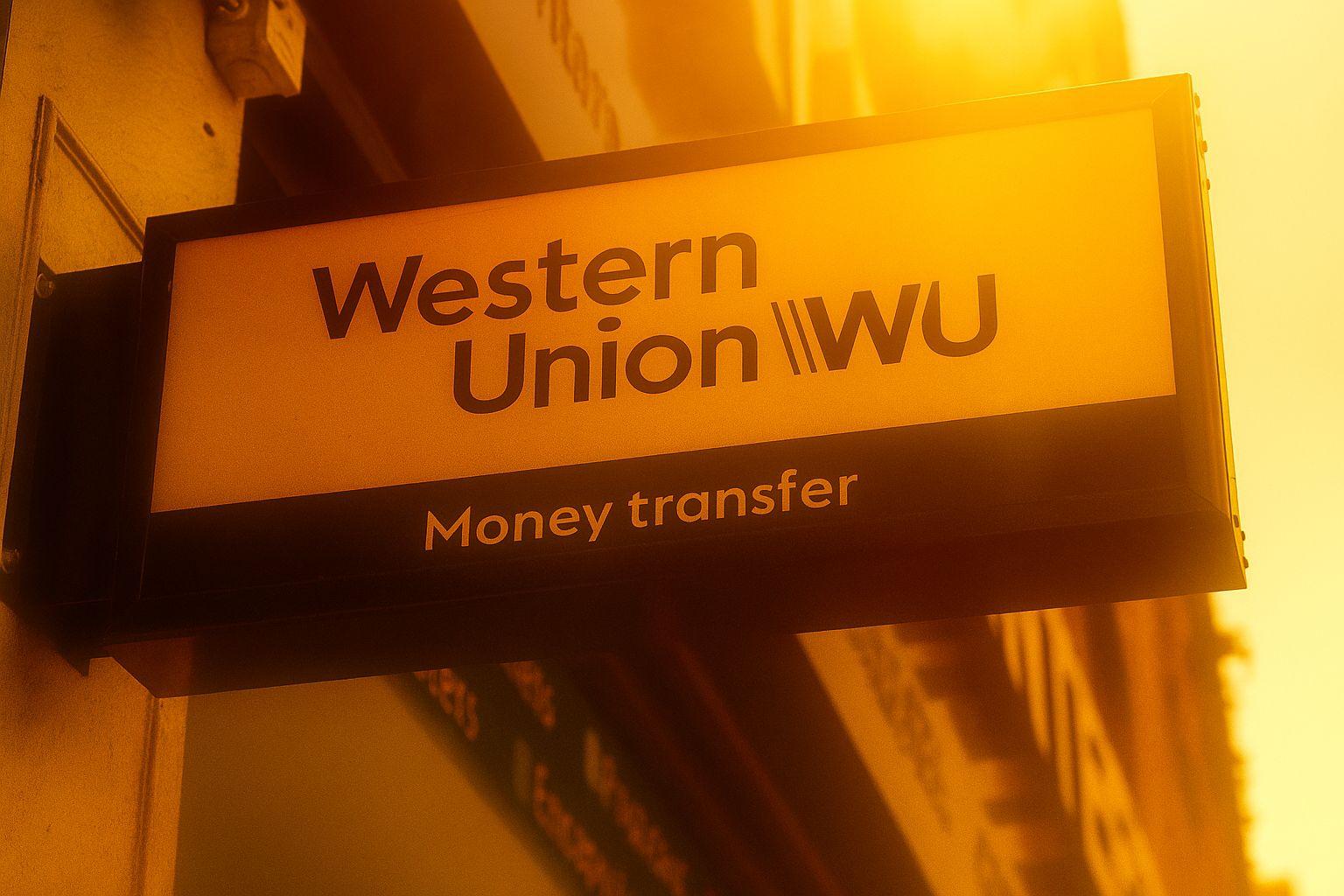

Western Union, the 19th-century telegraph pioneer turned global payments giant, announced plans to launch its own US dollar-pegged stablecoin, the US Dollar Payment Token USDPT, in partnership with Anchorage Digital Bank, a federallycharteredcryptocustodian.Accordingtoapressrelease,thetokenwill operateontheSolanablockchain,achoicemotivatedbyitshighthroughput,low transaction costs, and compatibility with global retail and remittance applications.

ForWesternUnion,whoselegacyisdeeplyrootedinconnectingpeoplethrough financial communication, from the telegraph to international wire transfers, the stablecoin launch represents a pivotal modernisation of its cross-border paymentsinfrastructure.Thecompanyframedthisinitiativeasanevolutionofits mission to “connect people and money,ˮ leveraging blockchain to enhance efficiency,speed,andcost-effectiveness.CEODevinMcGranahandescribedthe move as a “natural next stepˮ in the firmʼs technological lineage, aligning the companyʼs historical expertise in global payments with the emerging architectureofdecentralisedfinance.

The introduction of USDPT comes amid an increasingly competitive environment,asotherfinancialintermediariessuchasPayPal,MoneyGram,and Zelle have begun integrating or testing stablecoin-based solutions. Western Union aims to differentiate itself by embedding blockchain directly into its remittance and agent-network systems, using USDPT to enable near-instant settlements while reducing dependence on traditional correspondent-banking rails. This approach also aligns with the regulatory backdrop of 2025, following the passage of the Genius Act, which provided legal clarity for U.S.-dollar-backedstablecoinsandopenedthedoorformainstreaminstitutions toissuecompliantdigitalassets.

Strategically,WesternUnionʼsstablecoininitiativesignalsabroaderambition:to bridge the gap between legacy finance and blockchain infrastructure at scale. By leveraging its global reach, brand trust, and regulatory expertise, the firm aims to provide a blockchain-based payments ecosystem that maintains compliance and transparency while matching the speed and accessibility of crypto-native systems. However, the undertaking is not without risk. The company will need to ensure that USDPT remains fully collateralised with verifiable reserves, meets rigorous compliance standards across jurisdictions, and achieves meaningful adoption among users accustomed to traditional fiat remittancechannels.

Ultimately, Western Unionʼs foray into stablecoins marks a defining moment in the convergence of traditional finance and digital assets. The move positions the company not merely as an observer of the crypto revolution but as an activeparticipantreshapingglobalvaluetransfer.Ifexecutedsuccessfully,the USDPTcouldserveasabridgebetweendecadesoffinancialinfrastructureand thedecentralisedsystemsshapingthefutureofglobalpayments.

Japan has taken a significant step toward integrating Bitcoin mining into its national energy infrastructure. Last Thursday, Canaan, one of Chinaʼs leading mining rig manufacturers, announced a deal to supply its latest hydro-cooled Avalon A1566HA machines to a major Japanese power utility for a grid-stability researchproject,markingJapanʼsfirstpubliclyconfirmedstate-affiliatedmining initiative.

WhileCanaandidnotdisclosethenameofitspartner,industryobserversbelieve the project likely involves Tokyo Electric Power Company TEPCO) or a comparable regional provider. TEPCO, Japanʼs largest utility, has previously tested Bitcoin mining through its subsidiary, Agile Energy X, by utilising surplus renewable power to convert excess solar and wind energy into Bitcoin, rather thancurtailingproductionduringlow-demandperiods.

The upcoming facility is designed to use Canaanʼs specialised hydro-cooled servers to balance the regional power grid. The machines can dynamically overclock or underclock to adjust energy consumption in real time, acting as a “digital load balancerˮ, an approach Canaan sees as crucial for integrating intermittentrenewableenergysources.Thecompanystatedthatoperationsare expected to commence by late 2025, with plans to expand similar deployments acrossAsia,NorthAmerica,andEuropeby2026.

Japanʼs experiment is significant beyond its borders. If successful, it could demonstrate how Bitcoin mining can stabilise renewable-heavy power grids, turning what was once viewed as an energy liability into a tool for managing supply-demandimbalances.