ONCE IN A LIFETIME

A solar eclipse hits next month

TOP 100 C-STORES

A new retailer cracks top 10

ONCE IN A LIFETIME

A solar eclipse hits next month

TOP 100 C-STORES

A new retailer cracks top 10

THE COOKIE BOOM Retailers find success

FOOD PACKAGING Sustainability and stackability

NAVIGATING RECALLS

Being prepared is key

26

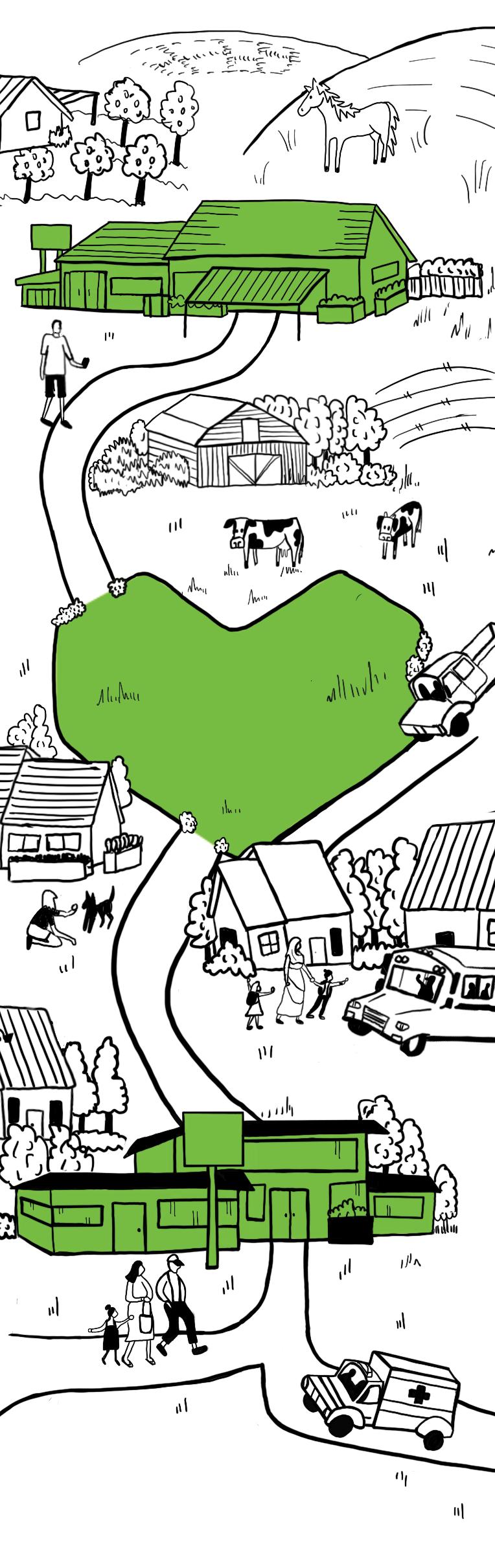

Anatomy of a Food Recall

Convenience retailers need a plan to address food and beverage product recalls.

37

The Top 100 Convenience Retailers

These companies combine to account for nearly 45,000 stores.

44

Lifting the In-Store Experience

This article is brought to you by Cenex.

After $150 million in approved capital loan for in-store renovations, Cenex is not slowing down any time soon.

How

facebook.com/nacsonline

instragram.com/nacs_online linkedin.com/company/nacs

48

Guided by Numbers

Data can drive foodservice success.

56

In the Bag

What does the food packaging industry look like in 2024—and where does it go from here?

70

Get Snack Rich

This Q&A is brought to you by Rich Products.

Rich Products offers retailers high-quality food with minimal labor.

72

Total Eclipse of the Mart Convenience stores are prepping for a wave of eclipse chasers.

62

06 From the Editor

08 The Big Question

10 NACS News

18 Convenience Cares

20 Inside Washington The Biden Administration delays its menthol bans but the threat remains.

24 Ideas 2 Go

The husband-andwife team behind Livi’s Market created a place where they love to shop.

80 Cool New Products

84 Gas Station Gourmet Rock’s Grill & Pizzeria serves everything from quiche to freeze-dried fruit.

86 Category Close-Up Strategic planning and diverse menus spice up foodservice sales figures.

96 By the Numbers

IT’S A FACT

25.57%

The percent of in-store foodservice sales in 2022.

CATEGORY CLOSE-UP PAGE 86

PLEASE RECYCLE THIS MAGAZINE

The presence of an article in our magazine should not be permitted to constitute an expression of the association’s view.

EDITORIAL

Jeff Lenard V.P. Strategic Industry Initiatives (703)518-4272 jlenard@convenience.org

Ben Nussbaum Editor-in-Chief (703) 518-4248 bnussbaum@convenience.org

Lisa King Managing Editor lking@convenience.org

Leah Ash Assistant Editor lash@convenience.org

CONTRIBUTING WRITERS

Terri Allan, Amanda Balthazar, Shannon Carroll, Sara Counihan, Jay L. E. Ellingson Ph.D., Sarah Hamaker, Al Hebert, Pat Pape, Elizabeth Presnell Esq., Shawn K. Stevens Esq., Emma Tainter

DESIGN Imagination www.imaginepub.com

ADVERTISING

Stacey Dodge Advertising Director/ Southeast (703) 518-4211 sdodge@convenience.org

Jennifer Nichols Leidich

National Advertising Manager/Northeast (703) 518-4276

jleidich@convenience.org

Ted Asprooth

National Sales Manager/ Midwest, West (703) 518-4277

tasprooth@convenience.org

PUBLISHING

Stephanie Sikorski

Vice President, Marketing (703) 518-4231

ssikorski@convenience.org

Nancy Pappas Marketing Director (703) 518-4290 npappas@convenience.org

Logan Dion

Digital Media and Ad Trafficker (703) 864-3600 ldion@convenience.org

CHAIR: Victor Paterno, Philippine Seven Corp. dba 7-Eleven Convenience Store

OFFICERS: Lisa Dell’Alba Square One Markets Inc.; Annie Gauthier, St. Romain Oil Company LLC; Chuck Maggelet, Maverik Inc.; Don Rhoads, The Convenience Group LLC; Brian Hannasch, Alimentation Couche-Tard Inc.; Varish Goyal, Loop Neighborhood Markets; Lonnie McQuirter, 36 Lyn Refuel Station; Charlie McIlvaine, Coen Markets Inc.

PAST CHAIRS: Don Rhoads, The Convenience Group LLC; Jared Scheeler, The Hub Convenience Stores Inc.

MEMBERS: Chris Bambury, Bambury Inc.; Tom Brennan, Casey’s; Frederic Chaveyriat, MAPCO Express Inc.; Andrew Clyde, Murphy USA; George Fournier, EG America LLC Terry Gallagher, Gasamat Oil/Smoker Friendly;

CHAIR: David Charles, Cash Depot

CHAIR-ELECT: Vito Maurici, McLane Company Inc.

VICE CHAIRS: Josh Halpern, JRS Hospitality/BCIP dba Big Chicken; Bryan Morrow, PepsiCo Inc.; Kevin LeMoyne, Coca-Cola Company

PAST CHAIRS: Kevin Farley, Impact 21; Brent Cotten, The Hershey Company; Drew Mize, PDI

MEMBERS: Tony Battaglia, Tropicana Brands Group; Patricia Coe, Advantage Solutions; Jerry Cutler, InComm Payments; Jack Dickinson, Dover Corporation; Matt Domingo, Reynolds; Mark Falconi,

Raymond M. Huff, HJB Convenience Corp. dba

Russell’s Convenience; John Jackson, Jackson Food Stores Inc.; Ina (Missy) Matthews Childers Oil Co.; Brian McCarthy, Blarney Castle Oil Co.; Tony Miller, Delek US; Natalie Morhous, RaceTrac Inc.; Jigar Patel, FASTIME; Robert Razowsky, Rmarts LLC; Kristin Seabrook, Pilot Travel Centers LLC; Babir Sultan, FavTrip; Richard Wood III, Wawa Inc.

SUPPLIER BOARD REPRESENTATIVES:

David Charles Sr., Cash Depot; Kevin Farley, Impact 21

STAFF LIAISON:

Henry Armour, NACS

GENERAL COUNSEL:

Doug Kantor, NACS

Oberto Snacks Inc.; Ramona Giderof; Mike Gilroy, Mars Wrigley; Danielle Holloway, Altria Group Distribution Company; Jim Hughes, Krispy Krunchy Foods LLC; Kevin Kraft, Q Mixers; Jay Nelson, Excel Tire Gauge; Nick Paich, GSTV; Sarah Vilim, Keurig Dr Pepper

RETAIL BOARD

REPRESENTATIVES: Scott E. Hartman, Rutter’s; Chuck Maggelet, Maverik Inc.; Tom Brennan, Casey’s

STAFF LIAISON: Bob Hughes NACS

SUPPLIER BOARD

NOMINATING CHAIR: Kevin Martello, Keurig Dr Pepper

NACS Magazine (ISSN 1939-4780) is published monthly by the National Association of Convenience Stores (NACS), Alexandria, Virginia, USA.

Subscriptions are included in the dues paid by NACS member companies. Subscriptions are also available to qualified recipients. The publisher reserves the right to limit the number of free subscriptions and to set related qualifications criteria.

Subscription requests: nacsmagazine@convenience.org

POSTMASTER: Send address changes to NACS Magazine, 1600 Duke Street, Alexandria, VA, 22314-2792 USA.

Contents © 2023 by the National Association of Convenience Stores. Periodicals postage paid at Alexandria VA and additional mailing offices.

1600 Duke Street, Alexandria, VA 22314-2792

Big taste and big savings are two things you get with Wildhorse cigarettes. Our American blend tobacco comes from the finest crops. Enjoy a bold, rich taste and smooth smoking experience. Are you ready to EXPERIENCE THE FREEDOM?

Italked with Beth Hoffer, Weigel’s vice president of operations and foodservice, for The Big Question this issue. After we were done talking about foodservice, she shared an amazing story with me.

During the intense snowstorms that hit Tennessee in mid-January, the Weigel’s corporate team got new jobs: giving rides to team members who were struggling to get to their stores.

I love everything about that. I think it says a lot about Weigel’s culture, but it also speaks to an industry that understands that the hourly workforce is at the absolute heart of any c-store’s success.

With the news that the Kum & Go brand is possibly being retired by new owner Maverik, I’ve been thinking a lot about the six or so months that I was a c-store hourly worker, standing behind the register at a Kum & Go back when I was 19. It was a vibrant store. Foot traffic was high. But foodservice was almost nonexistent. If I got hungry in the middle of a shift, my two options were a microwavable hamburger or a microwavable burrito. I don’t think we even had fountain beverages or a roller grill. With minimal foodservice came minimal staffing requirements: More often than not, I was the only employee in the store.

My guess is that same Kum & Go today has plenty of foodservice options … and more than one person working at a time to help keep all those options viable. As c-stores evolve, the workforce stays front and center.

Officially, this is the foodservice issue, but unofficially we can consider it the labor issue. Behind every foodservice idea, there’s the question of how to execute that idea at the store level.

Not surprisingly, Weigel’s is thinking hard about that, and how to make sure its corporate office is in sync with its team members. After all, they might all share the same ride on a snowy day. Check out The Big Question on page 8. Other highlights from this issue include our annual list of the top 100 retailers (page 37); a story on everyone’s favorite indulgence, cookies (page 62); and a story on navigating food recalls (page 26) … and there’s lots of other great content that you’ll enjoy in this packed issue.

Ben Nussbaum Editor-in-Chief

Behind every foodservice idea, there’s the question of how to execute that idea at the store level.”

Celebrate the annual March classic tip off with iconic brands and easy cocktail solutions. With so many great games to watch, having great-tasting cocktails on hand is the key to winning the season. So make sure your shelves and cooler are filled with a roster full of options – like Smirnoff Smash Vodka Soda and The Cocktail Collection. And watch your bottom line emerge victorious. For additional details, please get in touch with your local Diageo Distributor.

One thing we’ve done in terms of the menu itself is to go after Gen Z and Millennial customers more. They’re very passionate about social issues and so are we. For our chicken program, we chose to partner with a company called Springer Mountain Farms. They’re well-known in our area for high-quality, top-end chicken. They have humanely treated, no antibiotics, no hormones, 100% vegetarian noanimal-byproduct feed, grown-in-theU.S.A. chickens.

It says volumes that a c-store can have that chicken. And we love that we are able to talk about that on our digital menus, that we have got this really good product that nobody else can say they’ve got.

We’ve spent the last year actually paring down our menu. The food team said, instead of trying to be everything for everybody, let’s decide what we want to be really good at. And we decided we want to be really good at pizza and really, really good at chicken.

We pared down our SKUs and went from having around 60 SKUs to now in the 25 range for lunch and dinner. The best part is we saw double-digit growth in sales. And it’s because when you think about innovation, that’s great, but it’s got to be executed. We must think about our operations partner who has to make those things happen. If you can streamline and pick a couple of avenues to innovate within, I think it’s more successful.

How is Weigel’s innovating its foodservice program for success now and in the future?

The worst thing you can do is to have innovation that you cannot execute, and so it fails. We’re constantly figuring out how do you innovate and keep it simple enough to where your team members can execute, but also have enough change and fun to draw in your customers. It is really all about balance.

As we continue to grow we know that training is key to innovation. We wrote SOPs for every product that we make in our store. And now we’re in the process of doing the exact

same thing for all of our equipment and cleaning processes. We are careful to make sure that we keep it as simple as possible so that it’s easily executable, because we want to make sure that no matter which Weigel’s you go into, you get the same pizza, the same chicken tenders.

When you look at a lot of operations, there’s a big disconnect between the food team and the operations team. How do you get the two of them to work successfully together? We actually started a new program for all of our district leaders. Moving forward, anyone who is going to be in the district leader position must first be a food supervisor for a period of time before moving into the district leader position.

Our leadership made the decision to be food first. It is a strategic goal. To make sure that happens, we have even done a few things to change the structure of our organization. In the past, you would have had food rolling up under operations. I am the vice president of food, and recently I took the operations department. This was a strategic move to ensure that food stays top of mind and that we continue to have the mindset that food is first.

Every day, nearly 40 million Americans fill up their gas tanks, and odds are it’s at a convenience store. After all, c-stores sell an estimated 80% of all fuel.

There is arguably no product that consumers think more about on a daily basis (especially the prices!)—but at the same time so misunderstand.

For nearly two decades, NACS has published online Fuels Resource Center updates to help tell the industry’s story and answer common questions that consumers have about the makeup of the industry and how fuel is sold. It also includes plenty of facts and figures and even some fun tangents that tie into the history of fueling. (Look for shout-outs to Col. Sanders, Steve Martin and Sammy Hagar in the fueling history section.)

NACS shares the resources with reporters and public opinion leaders to

help build awareness about the importance of our industry. Feel free to share elements with reporters and customers in your market.

The topic of fueling and gas prices will continue to increase during the annual spring transition to summer-blend fuel, and you can be sure that the presidential candidates will refer to gas prices in their talking points. Be sure to also check out related content on convenience.org that addresses hot-button issues, like the blog post “Does the President Control Gas Prices?”

You can find the Fuels Resource Center at convenience.org/fuels. And look for more fuels insights in the April 2024 issue of NACS Magazine, which will debut findings from the latest NACS Consumer Fuels Survey.

Have a suggestion about topics to feature? Contact Jeff Lenard at jlenard@convenience.org

NACS congratulates the eight 2024 NACS Master of Convenience award recipients. The class was honored at the invitation-only NACS Leadership Forum in February.

“Being able to attend NACS executive education programs has helped me develop skills that have been instrumental in making me a better leader. The skills I learned in a very short time would have taken me months to learn in a standard college setting.,” said Robert Hensman, Love’s Travel Stops. “I am extremely humbled to have been able to be a part of such a great learning opportunity.”

The NACS Master of Convenience designation acknowledges leaders from around the globe who have invested in their personal leadership development and attended three or more NACS Executive Education programs.

“I am thrilled to say that I have earned my Master’s in Convenience. My motives for pursuing were to learn as much as I could about convenience, meet a cross section of my clients and improve my professional acumen,” said Jason Zelinski, NIQ. “[The program] allowed me to hear firsthand from convenience experts how they are tackling their business and create relationships across the globe. My career has grown

from a single-client manager to vice president of our most important c-store clients, and I can honestly say that the NACS Executive Education program contributed to my success.”

Here are 2024 Masters of Convenience who are shaping the future, proactively and powerfully:

• Mr. Darren Comeau, Shell International Petroleum Company Limited

• Mr. Nathaniel Doddridge, Casey’s

• Mr. Drew Graham, Love’s Travel Stops

• Mr. Robert Hensman, Love’s Travel Stops

THRIVR, powered by marketing platform SOCi, is the all-in-one digital marketing platform that simplifies the management of your store’s digital listings, reviews and social media presence.

This January, THRIVR added TikTok to its platform to help retailers expand their reach to this growing audience. Having a single platform to manage all your social media presence allows for easy content management and distribution.

• Ms. Anna Kruszko, Shell International Petroleum Company Limited

• Mr. Kamol Samiev, Mega Saver

• Mr. Temur Samiev, Mega Saver

• Mr. Jason Zelinski, NIQ

Learn more about the NACS executive education programs at www.convenience.org/education/ NACS-executive-education , or contact Brandi Mauro, NACS education program manager, with questions at bmauro@convenience.org or (703) 518-4223.

THRIVR is taking the guessing out of when, where and how to show up digitally. As AI buzz is ever increasing, retailers today are excited to leverage this technology to simplify the management of their reputation. This allows for a unique, engaging and optimized digital search.

Learn how to simplify the management of your digital presence at www.convenience.org/thrivr, or contact Jen Johnson at jjohnson@ convenience.org

Michael Weston, former NACS board member, passed away in December at age 96. Weston began as a director with Misselbrook and Weston, Plc in 1949, then served as managing director and chairman. He retired from Brookton 2000 Limited in 2012. Weston was the first UK board member of NACS.

Natalie Morhous was promoted to CEO of RaceTrac Inc. by its board of directors. Morhous succeeds Max McBrayer, with whom she partnered on RaceTrac’s business decisions and strategy development since February 2019. Morhous is a third-generation leader in the family-owned business.

BP announced Murray Auchincloss will serve as BP chief executive officer. Auchincloss, who has been interim CEO since September 2023, will continue as a member of the BP board. Before becoming interim CEO in September 2023, Auchincloss had been BP’s chief financial officer since July 2020.

Delek US Holdings Inc. announced that its board of directors appointed Christine Benson Schwartzstein to serve as an independent director effective immediately. Benson will stand for election at the company’s 2024 annual meeting of stockholders. Benson has nearly 20 years of experience in natural resources risk management, capital markets and investing. She is currently a director of Apollo Infrastructure Company LLC as well as Talen Energy Corporation.

GSP announced Tom Custer now serves as vice president of business development. Custer’s background spans more than 30 years in brand development, design services and marketing strategy, a combination that provides him with a vast knowledge of creating unique and relevant brand experiences in retail spaces.

Hoshizaki America Inc. announced the appointment of Allan Dziwoki as the company’s new president. Having joined Hoshizaki in February 2022, Dziwoki brings over two decades of invaluable experience in the HVAC industry to his new role.

Hoshizaki America announced Sandra Raffe as the vice president of refrigeration—a new role for the organization. Raffe will bring foodservice industry experience and over 15 years of experience at organizations such as Franke Systems, Middleby Corporation and H.D. Sheldon & Co.

Paytronix announced that Eric Steele now serves as the company’s chief financial officer. Steele joins Paytronix from Snap One, where he most recently served as senior vice president of finance and corporate development. Prior to Snap One, Steele was a growth equity investor at Catalyst Investors in New York City.

send in your news to news@convenience.org.

NACS welcomes the following companies that joined the Association in December 2023. NACS membership is companywide, so we encourage employees of member companies to create a username by visiting www.convenience.org/createlogin. All members receive access to the NACS Online Membership directory and the latest industry news, information and resources. For more information about NACS membership, visit convenience.org/membership.

HUNTER CLUB MEMBERS

Lil’ Drug Store Products, Inc. Cedar Rapids, IA ww.lildrugstore.com

BeatBox Beverages Austin, TX www.beatboxbeverages.com

Zevia Encino, CA www.zevia.com

RETAILERS

Breeze Thru Markets, LLC Cary, NC www.breezethru.com

JFM Inc. Flowood, MS

Oilfield Outpost LLC Houston, Texas

West Fork Market Inc. Clarksville, TN

Avondale Food Stores Jordan Station, ON, Canada www.avondalestores.com

SUPPLIERS

Aboveo Services Norcross, GA www.aboveo.com

Agriculture Grant Solutions West Des Moines, IA www.agriculturegrantsolutions. com

Alex Co.

AmeriChicken Cape Girardeau, MO www.americhicken.com

Blackhawk Network Pleasanton, CA www.blackhawknetwork.com

Bridor USA Vineland, NJ www.bridor.com

CheckSammy Addison, TX www.checksammy.com

Churchill Container Lenexa, KS www.churchillcontainer.com

Death Wish Coffee Saratoga Springs, NY www.deathwishcoffee.com

Del Real Foods Irvine, CA

Dottie Foods Deerfield Beach, FL

Genomma Lab Houston, TX

Good Boy Vodka Niles, MI www.goodboyvodka.com

Guangzhou Orio Technology Co. Guangzhou, China www.globalorio.com

Jolt Software Lehi, UT www.jolt.com

kpm desserts Davie, FL www.kpmdesserts.com

Leaf Brands LLC Newport Beach, CA www.leafbrands.com

Maintain IQ Inc. West Covina, CA www.maintainiq.com

Mar Company Group Miami, FL

MicroSalt Inc. West Palm Beach, FL www.microsaltinc.com

Shenzhen Cosun Sign SmartTech Co. Shenzhen, Guangdong, China www.cosunsign.com

Sidari Artisan Brands Cleveland, OH www.sidaribrands.com

Simple Inc. Santa Ana, CA www.simplevapeandcbd.com

Skyline USA Sanford, FL

Spangler Candy Company Bryan, OH www.spanglercandy.com

Spunky Pup Orono, MN www.spunkypup.com

Super Scientific Laboratories Hialeah Gardens, FL www.fugginvapor.com

The Ryl Company www.drinkryl.com

Venbrook Insurance Services www.venbrook.com

Virginia Label Co. Richmond, VA

Wow Bao Chicago, IL www.wowbao.com

WSP International Limited Markham, ON, Canada

MARCH

NACS Convenience Summit Asia

March 05-07 | Signiel Seoul Hotel Seoul, Korea

NACS Day on the Hill

March 11-13

Washington, D.C.

NACS Human Resources Forum

March 18-20 | Hyatt Regency

Jackson Riverfront Jacksonville, Florida

APRIL

NACS State of the Industry Summit

April 03-05 | Hyatt Regency O’Hare Chicago Rosemont, Illinois

Conexxus Annual Conference

April 28-May 02 | Live! By Loews Arlington Texas

JUNE

NACS Convenience Summit Europe

June 04-06 | Intercontinental

Barcelona Barcelona, Spain

JULY

NACS Financial Leadership Program at Wharton

July 14-19 | The Wharton School University of Pennsylvania Philadelphia, Pennsylvania

NACS Executive Leadership Program at Cornell

July 28-August 01 | Dyson School, Cornell University Ithaca, New York

OCTOBER

NACS Show

October 07-10 | Las Vegas Convention Center Las Vegas, Nevada

NOVEMBER

NACS Innovation Leadership Program at MIT

November 03-08 | MIT Sloan School of Management Cambridge, Massachusetts

RMike’s Hot Honey® was founded in a Brooklyn pizzeria in 2010, where its first drizzle on pizza sparked a word of mouth sensation. From pizza and chicken to drinks and desserts, it’s the perfect sweet heat topping for any menu item.

Request a sample today: mikeshothoney.com/sample

The company hit a new high mark for its charitable donations.

Rutter’s and Rutter’s Children’s Charities donations reached a new high of $1.8 million in 2023.

“The combined efforts of Rutter’s and Rutter’s Children’s Charities to support our communities is incredible, and we’re hopeful 2024 will be an even bigger year for charitable giving,” said Chris Hartman, vice president of fuels, advertising and development.

The donations went to a variety of organizations. Among the donations was $100,000 to Pennsylvania Wounded Warriors. “We hold immense gratitude for those who have selflessly served to protect our nation,” said Hartman. Pennsylvania Wounded Warriors pro -

vides financial assistance to veterans and their families to help pay for housing, utilities, transportation, medical expenses and other expenses.

Another program was 100k for the Holidays. Rutter’s Children’s Charities donated $25,000 to four groups that have a focus on benefiting children. This year’s recipients were Blair Regional YMCA, Centre County Youth Service Bureau, Chambersburg Fire and Police and York County Children’s Advocacy Center.

At the end of the year, Rutter’s held its annual toy drive. Employees donated a total of 596 toys, which were split between the Salvation Army and the

Mount Alto Fire Department. Rutter’s Children’s Charities matched $10 for each toy that was donated, meaning both organizations received 298 toys and $2,980.

Much of Rutter’s Children’s Charities giving was fueled by its annual golf outing. In 2023, the event raised $900,000.

Rutter’s charitable giving in 2023 also included over $390,000 to the Central PA Food Bank’s Retail Donation Program in the form of prepared subs, sandwiches, bakery items, milk and tea products.

Some of Rutter’s other annual charitable efforts include its charity cannister program and $550,000 in Educational Improvement Tax Credit donations.

Every year, the convenience retail industry dedicates billions of dollars to advancing the futures of individuals and families in our communities. The NACS Foundation unifies and builds on NACS members’ charitable efforts to amplify their work in communities across America and to share these powerful stories.

Learn more at www.conveniencecares.org

1 Tennessee-based Weigel’s held its annual Weigel’s Family Christmas event. The 2023 event was held in collaboration with the Salvation Army and The Boys and Girls Club of East Tennessee. The program enables kids in need to have a jubilant Christmas experience. The kids are chaperoned by volunteers for a day of fun, starting with breakfast, then a shopping spree and ending with a hot lunch. The program started with six children and has expanded to 200 children and over 400 volunteers annually.

2 CF Altitude LLC, operating as Alta Convenience and Petro-Mart, announced it raised more than $300,000 for the Make-A-Wish Foundation. Stores situated across Colorado, New Mexico, Kansas, Nebraska, Wyoming, Missouri and Illinois collectively raised funds. The funds raised in each state directly benefited that state’s Make-A-Wish chapter.

3 The GATE Foundation, the philanthropic affiliate of GATE Petroleum Company, raised $215,000 to benefit Camp Boggy Creek at its annual charity golf tournament. Monies were raised through fundraising activities as well as through sponsorships and registrations for the 300-player event. Funds from the two-day event will support a free summer camp for children with serious illnesses.

4 Maverik raised $323,254 for Feeding America through its annual Round Up Your Change campaign. Maverik’s donations will be distributed to 16 Feeding America partner food banks across the 12 Western states where Maverik operates. The funds are in addition to Maverik’s direct donation of $250,000, which was made in October to kick off the campaign.

5 Nittany MinitMart, with locations throughout central and north-central Pennsylvania, raised over $18,000 for area animal shelters. Shoppers supported animal shelters in their community by rounding up to the nearest dollar at checkout. Funds raised will help support ongoing efforts to provide care, shelter and medical attention to animals in need.

6 NACS participated in a food drive to support New Hope Housing, a local nonprofit dedicated to ending the cycle of homelessness. NACS staff donated food items, stuffed and wrapped baskets, and then delivered them to the local charity. NACS donated $25 gift cards for each basket made.

30% Menthol cigarettes make up this amount of total cigarette sales nationally.

21% Menthols account for this percentage of the cigarette marketplace in California— even after they have been banned.

The Biden Administration delays its bans but the threat remains.BY ANNA READY BLOM

One of the biggest policy threats keeping retailers up at night is the looming ban on menthol cigarettes and flavored cigars. In October, the Food and Drug Administration sent the final rules that would put these bans into effect to the White House for review, the last stop before new rules are implemented. It was expected that the administration would move swiftly to finalize the rules, but at the end of the year, the White House said it needed more time for review. Staunchly opposed to the bans, NACS has pushed the White House to stop the bans alto-

gether, arguing that they would lead to unintended consequences that would be detrimental to communities and dwarf any public health benefit.

Prohibition doesn’t mean products disappear. Just look at the 1920s. With the prohibition of alcohol came an influx of bootlegging and criminals taking advantage of Americans who wanted to continue imbibing. The prohibition of these tobacco products will see similar criminal enterprising. Today, menthol cigarettes account for 30% of cigarette

With an industry as diverse and ever-changing as the convenience retailing industry, new issues pop up every day. That is especially true when it comes to environmental regulations. As part of the Biden Administration’s climate agenda, two agencies have been busy pursuing rulemakings related to energy efficiency standards and reducing hydrofluorocarbons (HFCs)—the EPA and the U.S. Department of Energy (DOE). HFCs are greenhouse gases used in a wide variety of cooling systems, including refrigerators, air conditioning units in buildings and automobiles, building installation and fire extinguishing systems. And a few of those rulemakings and regulatory efforts will have an impact on the convenience industry.

At the end of 2020, Congress passed the AIM Act, which authorizes the EPA to address HFCs by providing EPA new regulatory authority in three main areas:

• Phasing down the production and consumption of listed HFCs.

• Managing these HFCs and their substitutes.

• Assisting in the transition to next-generation technologies through sector-based restrictions.

In addition, the Inflation Reduction Act included increased funding to implement the AIM Act and created incentives for competitive grants for new technologies to address HFCs. Further, in 2022, the United States ratified the Kigali Amendment to the Montreal Protocol on

BY PAIGE ANDERSONSubstances that Deplete the Ozone Layer, which phases down the production and consumption of HFCs by 8085% by 2047.

Along with EPA’s efforts on HFCs, the DOE has been aggressively updating energy efficiency standards for a wide range of technologies and appliances for commercial use and residential use. In 2023 alone, EPA issued 30 proposed or final energy efficiency standards.

While these efforts to improve energy efficiency and the environment are on the whole necessary, as with many well-intentioned policies, it is difficult and complex to implement these proposals. Two key rulemakings from 2023 illustrate this challenge. In mid-2023, EPA announced a rulemaking on the Phasedown of Hydrofluorocarbons: Management of Certain Hydrofluorocarbons. DOE announced its rulemaking on Energy Conservation Standards for Commercial Refrigerators, Freezers, and Refrigerator-Freezers. Both of these regulatory proposals would have an important impact on convenience retailers, as the convenience industry relies on the use of food refrigeration, HVAC and fire-suppression systems. Any changes in requirements, replacement technologies and availability of equipment not only impact the manufacturers and distributors of these technologies, but also the end users, such as convenience store operators.

In EPA’s rulemaking, many retail groups and

manufacturers expressed concerns over the increased costs and feasibility of many of the new requirements, along with concerns over timelines and logistics of some of these requirements, such as new training and certification requirements. NACS also submitted comments during the public comment period over concerns with increased costs and concerns over proposed leak detection requirements.

During the DOE public comment period, NACS joined the Food Industry Association to share concerns with the agency that its proposal on creating more stringent standards on commercial refrigeration units had not demonstrated that these new standards would result in significant conservation of energy, be technologically feasible or be cost effective. Many manufacturers have indicated that in many cases, the proposed standard would require new design elements and technology that is not economically justifiable or feasible. In addition, there were strong concerns shared that the compliance deadlines are unreasonable and do not take into account the efforts underway with EPA’s regulations on implementing the AIM Act.

More rulemakings, standards setting, implementation and compliance efforts are expected in 2024. NACS will continue to closely monitor and engage on these issues. Subscribe to the NACS Daily newsletter for latest news and updates.

sales, while flavored cigars are 50% of cigar sales in convenience stores. With such an established market for these products, many current users will not quit the products or switch to other tobacco products. Instead, they will seek illicit sources for them.

There is a robust illicit tobacco market in the United States, and it is growing. An influx of goods crosses the border from Mexico, with product often made in China. According to some estimates, as much as 21% of the tobacco products sold in America are purchased through the illicit market. In fact, a recent study in California found that more than six months after a state flavor ban took effect, menthol cigarettes continued to make up more than 21% of the marketplace. Of the discarded packs found, 27.6% were non-domestic products. A portion of these were duty-free cigarettes, including the brand Sheriff, purchased with the intent of taking the cigarettes out of the United States—yet evidence shows they are making their way back into the hands of American consumers.

A federal ban on these products will only bolster the illicit market to the detriment of our communities. As legal products today, menthol cigarettes and flavored cigars are sold by legitimate businesses. Convenience retailers check more IDs a day than TSA. These retailers are investing millions to ensure their associates are conducting proper age verification and preventing minors from accessing these products. Illicit sellers don’t take age into consideration, but often prey on those who are underage, meaning more minors would be exposed to these products.

Convenience retailers only sell tobacco products that have undergone intense regulatory scrutiny by the FDA and are permitted to be on the market under the Tobacco Control Act. Counterfeit cigarettes avoid this scrutiny. The Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) states, “While all cigarettes are dangerous and are known to cause disease, counterfeit cigarettes often contain higher levels of tar, nicotine and carbon monoxide than genuine cigarettes, and may contain contaminants such as sand and packaging materials. Counterfeit cigarettes pose a greater health risk to consumers and cost taxpayers millions in lost revenue.” Those people who can no longer purchase these products legally and turn to the illicit market will be exposed to far greater health risks.

These bans would lead to severe economic losses for legal sellers. FDA’s proposals didn’t weigh the true economic impact on businesses selling these products, especially small businesses who aren’t as capable of diversifying. A single convenience store would lose on average an astounding $232,392 in sales annually without these products.

FDA’s proposals didn’t consider losses of sales of non-tobacco products that are purchased along with tobacco products. Retailers stand to lose sales of the entire basket, not just the tobacco products. NACS estimates a convenience store would lose $72,285 a year in non-tobacco sundry sales, representing close to 4% of inside sales, should the bans be implemented.

It is unclear when the White House will finalize these bans, but NACS is making every effort to get the administration to withdraw the rulemakings. NACS continues to vocalize its opposition to the White House, the FDA and Members of Congress. In addition, members of the industry can take action via the NACS Grassroots Portal at convenience.org.

If the administration moves forward with the bans, NACS will explore legal options on behalf of the convenience store industry.

This month, NACS talks to Ron Rutherford, chief operating officer, Apter Industries Inc.

What does NACS political engagement mean to you, and what benefits have you experienced from being politically engaged?

In my former career, I was a social studies teacher in the Washington, D.C., public school system, educating young adults about what it means to be an active participant in our political process. Switching to the convenience store industry and attending my first NACS Day on the Hill allowed me to further my participation in a more meaningful way. I look forward to every opportunity to help our amazing industry.

What federal legislative or regulatory issues keep you up at night (with respect to the convenience store industry)?

Anything that prohibits the industry from continuing to grow successfully—whether it be the ever-increasing swipe fees that gouge retailers or how we are going to rebuild our aging highways, roads and most importantly, because I live in Pittsburgh, bridges.

What c-store product could you not live without?

Any potato that is grated and formed into a cylinder: tater tots, Tater Kegs, tater bombs.

NACSPAC was created in 1979 by NACS as the entity through which the association can legally contribute funds to political candidates supportive of our industry’s issues. For more information about NACSPAC and how political action committees (PACs) work, go to www.convenience.org/nacspac . NACSPAC donors who made contributions in January 2024 are:

Paige Anderson NACS

Arch “Beaver” Aplin Buc-ee’s Ltd.

Henry Armour NACS

Ted Asprooth NACS

Laura Beck NACS

Lyle Beckwith NACS

Chrissy Blasinsky NACS

Anna Ready Blom NACS

Katie Bohny NACS

Jeff Burrell NACS

Sajid Chaudhry NSR Petro Services LLC

Jenna Collard NACS

Gary Dake Stewart’s Shops

Kirk Dickerson Dickerson Petroleum Inc.

Stacey Dodge NACS

John Eichberger Transportation Energy Institute

James Forsyth FKG Oil Company

Rob Gallo Impact 21

Jayme Gough NACS

Robert Griffith Golden Pantry Food Stores, Inc.

Margaret Hardin NACS

Scott Hartman Rutter’s

Jeff Hassman PDI Technologies

Jessica Hayman NACS

Danielle Holloway Altria Group Distribution Company

Bob Hughes NACS

Doug Kantor NACS

Leroy Kelsey NACS

Brian Kimmel NACS

Alicia Landrum NACS

Jay Lee NACS

Jennifer Leidich NACS

Greg Levitan NACS

Michael Lindberg CHS Inc. (Cenex)

Brandi Mauro NACS

Jeff McQuilkin NACS

Jay Nelson Excel Tire Gauge LLC

Nancy Pappas NACS

Anna Paridee RaceTrac Inc.

Chris Rapanick NACS

Carl Rick Kwik Trip, Inc.

Ron Rutherford Apter Industries Inc.

Taha Saleh T. A. Saleh Enterprises Inc.

Brian Sedra Phusion Projects LLC

Ryan Sheetz Sheetz, Inc.

Stephanie Sikorski NACS

Nick Stanley Johnson Junction, Inc.

Lori B. Stillman NACS

Mark Stinde Casey’s General Stores Inc.

Jon Taets NACS

Linda Toth Conexxus

TJ Velasco NACS

Nicole Walbe NACS

Leigh Walls NACS

Don Wasek Buc-ee’s Ltd.

William Weigel

Weigel’s Stores Inc.

Mike Wilson Cubby’s Inc.

Name of company:

Livi’s Market

Year founded: March 2023

# of stores: 1

The husband-and-wife team behind Livi’s Market created a place where they love to shop.BY SARAH HAMAKER

Where do you go for gourmet and niche grocery items in a small town? For Livi and Thomas Harlow, it’s their own convenience store. “We didn’t set out to open a convenience store,” said Livi Harlow. “But when we moved from Richmond, Virginia, to Irvington, we wanted access to the food products we could find in Richmond but not in this more rural area.”

When they spotted a vacant Citgo station, the pair partnered with Thomas’s father to create a store they would like to shop in. “The location is right in the heart of town and we figured we could learn the gas side of things while we focused on setting up

our own gourmet market with classic candies, lottery, soda, snacks, international grocery products, fine wines, beer and fine jewelry,” Livi said.

Because the building had been unused for two years, they updated the exterior and interior with a butcher block checkout counter and stainless steel racks. “I looked to Instagram for inspiration, and decided on a light blue and navy blue color scheme inside and out to reflect the flow of the nearby Rappahannock River,” she said. “We wanted the store to be warm, clean and inviting.”

For the Harlows, stocking the store started out as simply bringing in products they enjoyed. For example, Livi’s Market has a selection of finer wines than would be normal in a convenience store. “Thomas and I have always enjoyed wine, so we have a large wine selection with a chilled wine cooler that has real champagne and rose,” Livi said. The store carries organic and natural wines, which the Harlows choose through tastings with wine distributors.

The personal recommendation is one they carry throughout the store. “We’ve tried everything in the shop, whether it’s probiotic soda or wine,” she said. “If we carry it, we’ve sampled it because we don’t want to carry something we’re not proud of. As we tell our customers, we would serve every product to guests in our own home.”

A few months ago, Livi decided to add fine jewelry. “We describe Livi’s Market as a gift shop for food, so expanding our jewelry seemed like a natural progression,” she said. Originally the store’s jewelry had a “really approachable price point,” but when customers expressed interest in more gift-type items, she brought in gold and pearl necklaces, among other fine jewelry. “Those have been very popular, especially during

We enjoy explaining our mission and what we’re about while helping them pick up what they need.”

the holiday season,” Livi said. “People are always looking for something new and different.”

The Harlows also love supporting small and local artisans and businesses. “We source from all over, and carry local products too,” Livi said. “Our main goal is to carry products that are ethically and sustainably made, as well as supporting women-, black-, and LGBTowned businesses. We feel very strongly about ensuring our retail operations are in line with this mission.”

Since Livi and Thomas work at the store, they spend a lot of time talking to customers. “Our customers are intrigued when they walk in and see higher-end handbags and jewelry, plus our fine wines and gourmet food, so we enjoy explaining our mission and what we’re about while helping them pick up what they need,” Livi said. “The best thing about being in a small town is having regulars. When they walk through the door, we know their names.”

Locals and visitors stop by to buy items for entertaining, such as premade dips, cheese and crackers, and many Asian, Indian, Japanese and Mediterra-

Since the store opened, Livi’s Market owners Livi and Thomas Harlow have invited other vendors to do popups at their store. “Especially when there are town events, like a parade, we get a food truck or other local vendor to come in and stay for the day in our parking lot,” she said.

For example, on the Fourth of July, a gourmet sausage vendor set up shop. “This introduces our customers to niche or unusual items while giving us a chance to try new products,” Livi said. “We also love to bring in the people who make the things we carry so they can meet our customers. It definitely gives those products a nice sales boost in our store afterwards, too.”

nean food brands. “These are the types of foods we enjoyed in Richmond, but aren’t readily available here,” Livi said. While the store doesn’t have its own foodservice yet, the Harlows have partnered with a local chef who prepares grab-and-go dinners for two, sandwiches and dips for carryout at the store.

“We hope those who stop by feel welcomed,” she said. “We want our regulars and visitors to feel like they’re stopping by our house as our guests.”

Sarah Hamaker is a freelance writer, NACS Magazine contributor, and award-winning romantic suspense author based in Fairfax, Virginia. Visit her online at sarahhamakerfiction.com.

the United States, product recalls happen almost daily. There were about 550 product recalls in 2023, according to the Food Industry Counsel’s Food Recall Reporter, a robust, searchable database of FDA and USDA food product recalls.

In the convenience store space, it’s a good idea to have a plan in place and a team that can take immediate action on recalls. By executing a recall well, retailers can build trust with their customers and show they are looking out for them when it comes to potentially unsafe products.

Food recalls are intended to remove a food or beverage product from the market that may present a food safety risk.

Examples of dangers found in the food include a pathogen (e.g. E. coli, salmonella or listeria); one of the “big nine” undeclared al lergens (milk, eggs, fish, crustacean shellfish, tree nuts, peanuts, wheat, soy, sesame); or a foreign object such as metal or plastic.

Product recalls address safety concerns that could injure consumers, while a product withdrawal is less formal and is used to address product quality concerns.

Product withdrawals are typically used to address product quality concerns such as harmless mold or an off color; rancidity or other off flavor notes; minor labeling errors; and variations in sensory attributes. Product withdrawals are often conducted to the wholesale level and do not affect retailers and consumers.

Just about any food can be subject to a recall—from leafy greens to peanut butter and everything in between. Recalls also have the potential to expand. For example, shelf-stable granola bar products have recently been affected by a recall process due to products potentially contaminated with salmonella, according to the maker and the FDA.

When this recall was first issued, it largely included granola bars and granola cereals but later expanded to include more products, such as additional cereal products and snack mixes. When any recall involves food prod-

The FDA’s New Era of Smarter Food Safety blueprint, announced in July 2020, outlines four core elements that are intended to create a safer and more digital,

• Smarter tools and approaches for prevention and outbreak response

• New business models and retail modernization

• Food safety culture

To download the FDA’s blueprint, go to www.fda.gov/food/new-era-smarter-food-safety

does not cover recall expenses and losses, a company’s recall insurance may provide some coverage.

ucts used for human consumption, it takes a tremendous amount of time, resources and clear communication (including working with both the company and regulatory officials) to resolve these recalls.

As part of greater food safety awareness and national surveillance, more convenience retailers may find themselves a part of product recalls. Recalls and product withdrawals are typically initiated by the manufacturer, following a determination that a safety or quality issue may exist.

However, in some circumstances, the FDA and USDA may require a retailer to initiate a recall if a product manufacturer does not conduct a voluntary recall on its own.

Once it’s determined a recall or withdrawal is appropriate, the manufacturer is typically responsible for identifying who received the recalled product and for providing notice of the recall or withdrawal to those recipients.

Then, those recipients must, in most circumstances, carry the recall or withdrawal further downstream. In most cases, a retailer will learn about the existence of a recall from its distributor or suppliers.

Polar King walk-in coolers and freezers offer stateof-the-art refrigeration solutions for the convenience store industry. Perfectly designed to meet the unique demands of retail environments, these units provide reliable, efficient storage for perishable goods. ach Polar King unit is constructed with a seamless fiberglass design that ensures outstanding insulation and durability, resulting in energy savings and reduced operational costs.

Polar King offers customizable walk-in coolers and freezers, which allows store owners to design a layout that maximizes the use of space according to their specific needs. By efficiently organizing products, stores can improve customer flow and increase sales.

Polar King's innovative approach to walk-in coolers and freezers offers convenient stores a reliable, efficient, and custom-fit solution to their refrigeration needs. With these benefits and features, store owners can not only preserve their inventory but also enhance their daily operations and customer satisfaction.

The company should consider its approach to unaffected but related product.

If you don’t currently have a recall team in place or your recall plan hasn’t been revisited in some time, start by identifying the stakeholders who would need to be involved if a recall were to happen.

Your recall team should be composed of the relevant internal stakeholders and external consultants as necessary (food safety experts and attorneys, for example), to ensure all areas of the business are involved. External stakeholders may also include federal, state and local regulatory officials. If a gap is identified within the recall team, external resources should be vetted and onboarded to ensure all team members are knowledgeable about the company and its recall process.

The recall plan should include the company’s decision-making framework, including what factors are considered when decisions are made and which team members must approve any decisions prior to execution. For example, the company’s executive leadership may not be involved in most actions in advance of a recall but must be consulted for final approval once a decision to recall a product is made.

Some companies may have more sophisticated plans than others, depending on store count and the foodservice program—and that’s OK. Companies will often have different decision-making frameworks and different triggers for involving certain team members.

Ideally, the recall team should meet outside of a recall scenario to develop a framework for managing any potential future recalls and to ensure team members are trained on their individual responsibilities in the event of a recall.

After developing an initial recall plan, which includes all information about how recall decisions are made and executed, the recall team should conduct a realistic mock recall, where the full process is

tested in a fictional scenario. Many companies will work with their food safety lawyers or consultants to develop mock recall crisis scenarios. After completing the mock recall scenario, the recall plan should be updated to include learnings and process updates.

In addition, recall team alternates should be identified to ensure each role is represented if the primary recall team member is unavailable. These recall team alternates should be trained the same as the primary team member and should participate in mock recalls to ensure consistency in the company’s recall response.

Federal, state and local regulators can also be a valuable resource when conducting a product recall. However, these relationships should be developed outside of a recall situation to best allow for collaboration with regulators if a recall becomes necessary.

If you’ve been notified of a product recall affecting product in your control, you should immediately convene your recall team.

Once the recall team has been convened, it should carefully assess the food safety risk (if any) associated with the recall, as well as the status of the product within the company’s supply chain. Often, product that has not yet reached store shelves can be more easily contained and controlled than product that’s been on shelves for consumers to purchase and consume.

Once the food safety risk is understood and the potentially affected product is identified, the recall team should ensure that the product is pulled from distribution and store shelves. In addition, if the recalled product was processed or repackaged by the company, a press release and notification to FDA is typically necessary to communicate the recall to the public.

As product is removed from distribution and store shelves, inventory should be maintained of all actions taken. Specifically, any disposal or destruction of recalled product should be documented comprehensively, as well as the total cost impact of the recall.

In many circumstances, the manufacturer will reimburse affected downstream purchasers of recalled product for costs associated with the recall. This typically requires strong documentation of the company’s actions and losses. If a manufacturer does not cover recall expenses and losses, a company’s recall insurance may provide some coverage.

In addition, regulatory agencies may require documentation confirming that the company took appropriate action after notification of the product recall and destroyed all implicated product. This often is provided to the manufacturer through a recall effectiveness check. If you receive an effectiveness check, ensure that it is carefully and accurately completed and returned to the manufacturer.

Often, a manufacturer will only recall a limited amount of product, such as a single lot or product with a single expiration date. However, in many circumstances, a retailer may have other lots or expiration dates of the recalled product or other products from the same manufacturer.

During a recall, management of these unaffected products should be considered. Typically, this will be a case-by-case determination by the recall team. When considering unaffected related product, the evaluation should consider the risk to the company’s brand from continuing to sell these products, any potential food safety risk associated with the products, the brand’s risk tolerance and the ease or difficulty of pulling only select lots.

It’s a good practice to have the recall team discuss these considerations well in advance of a recall scenario so the brand has a framework for appropriate decision-making when a recall does occur.

In addition to pulling recalled products from distribution and store shelves, when should retailers communicate what’s going on to their customers? There are voluntary communications that the recall team should consider.

First, unless the product is processed or repackaged by the company, a press release issued by the retailer is typically not necessary—that will be generated by the product manufacturer. Second, in-store signage, website communications and/or direct customer notifications (i.e., notices provided to loyalty program members) can help ensure that consumers who may have purchased the product are aware of the recall.

Well in advance of a recall scenario, the recall team should discuss the decision framework for when communications are used. Why? So that when an actual recall occurs, the process is managed seamlessly.

Beyond proactive communications, the company should also be prepared to respond to media questions and customer inquiries and complaints. When addressing inquiries from the media:

• Designate a single point of contact who can field questions.

• Ask for the questions to be submitted via email.

• Work with the recall team to prepare appropriate responses.

Customer contacts might happen through the company’s corporate contact information as well as at the store level when a customer learns a product is not available. Typically, customers can be referred to the product’s manufacturer for questions, but the recall team should determine how in-store associates should respond to any inquiries.

Manufacturers often direct consumers to return recalled product to the point of purchase for a refund. Retailers should therefore ensure that in-store associates are trained and prepared to dispose or return product and issue any recall-related refunds. Further, retailers should consider an appropriate refund method that accurately tracks the refunds so the amount can be recovered from the manufacturer.

If we’re in doubt about a certain product, especially if the recall has the potential to expand, we will pull it.

At Kwik Trip, we strive to always do what is right. Everyone has a role to play in keeping food safe. If you are in the business of production, distribution and/or the sale of food products through foodservice, there are always possibilities of risks within your food system.

How you decide to mitigate those food risks should be part of your company’s mission, culture and leadership strategies. With inherent risks in the food supply chain (especially after Covid) comes the possibilities of either formal recalls or quality withdrawals.

First, formalize a recall team that comprises all aspects of your organization through internal and external resources as necessary, ensuring each business operation is represented: legal, procurement, production, distribution, transportation, customer relations, communications and retail, as applicable.

Second, build strong relationships with your local, state and federal regulatory agencies. These relationships are a critical part of your recall program—if these agencies understand your food system and how you mitigate risk prior to any formal recall or quality withdrawal events, they are in better position to collaborate with your company during times of food emergencies or recalls.

At Kwik Trip Inc., our recall team maintains strong relationships with our local, state and federal regulatory officials and public health teams. Our teamwork approach allows us, through education and collaboration, to maximize opportunities that proactively mitigate risks within our food supply chain. By being proactive, we have strengthened our recall team and our recall and withdrawal plans, especially when events happen in the food supply chain.

We have experienced both recalls and withdrawals in the areas of raw produce, undeclared allergens and foreign materials in food ingredients and finished products. Through these experiences, we have learned the right thing to do when confronted with a recall or withdrawal event. The process that takes place for a recall issued by a vendor to Kwik Trip generally looks like this:

• Upon notification of a recall, the recall team meets, and Kwik Trip begins the process of initiating our internal process using our recall plan.

• The ingredient, raw material or food products involved in the recall notification are removed from retail stores immediately through an alert system. The internal recall alert notice sent to all Kwik Trip retail stores includes key instructions on how to destroy the recalled products, document the destroyed product and confirm the recalled product is removed by all retail stores.

• Product in our distribution center is immediately quarantined, documented and disposed of following both vendor and federal regulatory guidelines. It’s also worth noting that if we’re in doubt about a certain product, especially if the recall has the potential to expand, we will pull it. Customer safety is paramount.

• On the same day of the recall notification, we connect directly with the appropriate federal (FDA/USDA) and state regulatory agencies to coordinate a nationally publicized, detailed press release for consumers who may still have the recalled product. This press release gives all the necessary information and photos to the consumer to identify the affected product.

• The press release is also sent to the local, state and federal agencies and to the appropriate press with the request to release this information to the public immediately. Details of our recall can then be found on the appropriate state and federal websites for the customers to review.

• Customers who return products to Kwik Trip (or Kwik Star, in Iowa) stores are given a full refund, and products are recorded and destroyed according to the vendor and federal guidelines. When it comes to the protection of public health and mitigating risks to your food supply chain and brand, it is best to have a recall team, a tested recall plan and leadership that takes the approach to always do what is right. Open and transparent communication during recall events leads to trust with your regulatory officials and, ultimately, to the customers you serve.

And finally, always doing what is right protects public health, your teams and your brand.

As soon as companies act on a recall, stores can return to normal operations—minus the affected products that have been removed from store shelves.

At this stage, retailers should continue to anticipate questions from customers. The communications work the team has done earlier will still be valuable.

The return to normal inventory of the recalled product can often take several days or weeks, depending on the scope of the initial recall. Often, if a manufacturer recalls only a single lot of products, other lots can be available within days.

On the other hand, if the recall encompasses a large amount of product involving multiple production days, additional replacement inventory may be difficult to obtain, and stores could be without product for several weeks.

As previously discussed, the company should consider its approach to unaffected but related product. The company may decide to avoid selling any lots of the recalled product, even if not directly affected by the recall, for a set period to ensure that the recall will not be further expanded.

Similarly, a company may decide to stop sales of products from the recalling manufacturer, even if unaffected, for a period of time, until a supplier assessment can occur to better understand the cause of the recall and any related food safety risk associated with

Support from regulators and external food safety experts may also be appropriate in determining when to restart any sales of a recalled product.

***

Even though product recalls happen routinely, each product recall creates unique challenges and considerations for a company. To help ensure that your company is prepared to manage any product recall, two immediate steps you can take are to convene a recall team and develop a recall plan.

By consistently revisiting your company’s recall plan, your teams will have a strong and thoughtful approach to any recall that may occur.

Shawn K. Stevens Esq. is the founder of Food Industry Counsel LLC. He can be reached at stevens@ foodindustrycounsel.com

Elizabeth Presnell Esq. is a food industry consultant and lawyer with the Food Industry Counsel LLC. She can be reached at presnell@ foodindustrycounsel.com

Jay L. E. Ellingson Ph.D. is the chief science officer, food protection administration, at Kwik Trip Inc. He can be reached at JEllingson@ kwiktrip.com

There are multiple ways to access timely food and beverage product

The Centers for Disease Control and Prevention offers a recall widget that can be added to your company’s intranet: www.cdc.gov/foodsafety/

The FDA’s recall information:

www.fda.gov/safety/recalls-market-withdrawals-safety-alerts USDA’s Food Safety and Inspection Service recall information: www.fsis.usda.gov/recalls

The Food Industry Counsel’s Food Recall Reporter: www.foodindustrycounsel.com/recalls

From the freezer To The Fryer To The Customer

Hold time of up to 4 hours under heat lamps

FLAVORS:

- Bacon Cheddar & Chive - Crab Feast

- Bacon Jalapeno - The Reuben

- Buffalo Chicken - Chorizo Burrito

- Breakfast Skillet - Cheese Bomb

Request Samples Today!

taterkegs.com

’s y oods is pr v sandw o w om or v

18th Street Fresh

h pr

These companies combine to account for nearly

convenience retailers in the United States accounted for 44,697 locations in 2023. Independents, meanwhile, accounted for 92,301 sites, up from 90,950 in 2022.

Spoiler alert: The top five convenience store retailers of 2023 are the same as in 2022. The difference is that three of the top five added to their store count.

1. The top spot again goes to 7-Eleven Inc. with 12,601 stores. The company ranked No. 1 in 2022 with 12,821 stores.

2. Second is Circle K parent company Alimentation Couche-Tard Inc. with 5,845 stores in the United States in 2023, up from 5,702 stores the year prior.

3. The fifth-largest pizza chain in the United States, Casey’s, is No. 3 in the c-store universe with 2,642 stores, up from 2,470 stores in 2022.

4. Fourth is EG America with 1,572 stores, down from its 2022 store count of 1,696 locations.

5. Rounding out the top five is GPM Investments LLC with 1,517 stores, up from 1,391 stores in 2022.

Regionally, here’s where some of the store count gains and losses among the top five chains transpired:

• 7-Eleven shed stores in all but two regions—Southeast and South Central.

• Couche-Tard gained stores in all regions except the West and Midwest in 2023. The company acquired 112 locations from MAPCO Express Inc., a split deal where Lawrenceville, Georgia-based Majors Management acquired MAPCO Express Inc., including the MAPCO My Reward$ loyalty program and the MAPCO brand. Couche-Tard also plans to open more than 60 new Circle K stores across Wisconsin in 2024 as part of a broader strategy to open 500 new stores, mainly in North America, over the next five years.

• Casey’s continued to not operate stores in the Northeast and West regions but gained 172 stores across the other four regions.

• EG America shed 124 stores in 2023, a decline in store count in every region.

• GPM Investments, owned by Richmond, Virginia-based Arko Corp., gained 126 stores in 2023, with the largest store gain taking place in the South Central region, where the company had 380 stores in 2023, up from 307 in 2022.

Convenience is always evolving, but NACS delivers the insights and innovative tools to help retailers win. Our latest initiatives improve how you serve your customers and communities and keep your business one step ahead.

Revolutionizing age verification at the register and beyond

Optimizing retailers’ digital presence to drive traffic & growth

One significant move came from Utah-based Maverik’s acquisition of Iowa-based Kum & Go—the companies ended 2022 with 399 and 394 stores, respectively. Maverik kicked off 2024 with 821 stores and jumped from the 16th largest convenience retailer to the 10th largest.

Two top 10 c-store chains surpassed 1,000 stores in 2023: Wawa increased its store count from 991 to 1,043 stores, and QuikTrip grew its store count from 972 to 1,039 stores.

GPM Investments picked up 135 convenience stores with the acquisition of Transit Energy Group’s Corner Mart, Dixie Mart, Flash Market, Market Express and Rose Mart c-stores, which are located throughout Alabama, Arkansas, Louisiana, Mississippi, Missouri, North Carolina, South Carolina and Tennessee.

Casey’s had a busy 2023. The Iowa-based chain acquired 63 of EG America’s Minit Mart and Certified Oil c-stores located in Kentucky and Tennessee. Casey’s also acquired Sherman, Texas-based W. Douglass Distributing’s 22 Lone Star convenience stores, and it also acquired 26 Minit Mart locations in Kansas City in June.

In April 2023, Global Partners and ExxonMobil acquired 64 Houston-area Timewise Food Stores from the Landmark Group.

Love’s Travel Stops, which is celebrating its 60th anniversary this year, is planning to add 20 to 25 new stores, update 35 to 40 legacy stores and rebuild four stores.

In February 2023, BP agreed to acquire TravelCenters of America , a move that accelerated BP’s reentry into the retail landscape, which began in 2021 with its acquisition of Thorntons.

After $150 million in forecourt and in-store improvements through its LIFT initiative, Cenex® is not slowing down any time soon.BY SARA COUNIHAN

All good stories must come to an end … or do they? Cenex® will complete its four-year initiative to renovate the exterior of all Cenex-branded locations this August. While the exterior part of the program ends this year, Cenex is continuing its in-store loan program for the foreseeable future.

The initiative is called LIFT, which stands for lighting, image and facility transformation, and by the program’s completion it will have transformed more than 1,300 c-stores across 19 states.

LIFT is two-pronged. One portion, dubbed Halo, focuses on refreshing and modernizing the forecourt, and the other focuses on improving the in-store experience for consumers. Cenex, which is the energy brand of CHS, partnered with CHS Capital to provide subsidized low-interest loans for eligible in-store improvements.

“When we first launched this program in 2020, the timing wasn’t right for everybody to take on an in-store renovation,” said Akhtar Hussain, director of refined fuels marketing, CHS Inc. “The Cenex brand is committed to continuing to offer the in-store loan program and really help retailers work through these investment decisions.”

Convenience stores are facing stiff competition that’s only increasing. Dollar stores, grocery stores and even Amazon could easily be considered direct competitors to c-stores, and these retailers have forced the industry to rethink how they meet the wants and desires of today’s consumer. But competition within the industry has also increased, as c-store retailers level up to engage with these new competitors.

“In order for us to continue to keep the Cenex brand strong and relevant to consumers, we have to meet our retailers where their competition is, which is offering better in-store amenities, better foodservice programs and brighter, more modern stores,” said Hussain. “That is the flexibility that we are looking to deliver through the in-store loan program.”

The Cenex brand is deeply rooted in the communities it serves, especially rural communities. Oftentimes, a Cenex-branded c-store is the only nearby option to get gas or grab a gallon of milk. When retailers partner with Cenex to revamp their interior, the strategy is to narrow in on exactly what that specific community needs. For example:

• In Merrill, Wisconsin, the River Country Co-Op Cenex location sits along the Wisconsin River and near several lakes, so it added a bait shop as one of its in-store upgrades, so that both minnows and a snack are easy to grab on the way to a fishing trip.

• Offering local food vendors was important to the folks at the Synergy Cooperative Cenex location in Cumberland, Wisconsin, and with the help of LIFT, the retailer incorporated four local meat and cheese vendors in addition to locally made maple syrup and honey products.

• The Northern Star Co-Op management team in Grand Rapids, Minnesota, knew that many residents in the community rely on financial assistance, so they chose to implement the Electronic Benefits Transfer (EBT) program, an electronic system that allows a Supplemental Nutrition Assistance Program (SNAP) member to pay for food using SNAP benefits.

“Cenex-branded stores are different based on geography, size and market, so we really needed to develop a program that allows them the flexibility to improve or add the services, amenities and infrastructure that best suits their community and their purpose,” said Hussain, adding that part of that flexibility is the freedom for retailers to partner with local businesses for the interior renovations. “Our only requirement is that the contractors are bonded and licensed,” he noted.

“We are allowing stores to invest in what the communities need most,” said Hussain. “When you’re hiring local plumbers, electricians and other contractors, that broadens the impact that this investment has made. That’s an investment directly in those communities.”

Akhtar Hussain director of refined fuels marketing CHS Inc.

We offer our retailers the flexibility to choose the store improvements and food service offerings that are best suited to their communities.”

If our store interiors are places that community members want to visit, we will see the benefit of increased fuels sales in the forecourt.”

Throughout the pandemic, dependence on local c-stores increased substantially, so Orton Oil Co. store owner Frank Orton knew it was time to make the changes needed to accommodate customer needs.

The LIFT initiative helped Orton keep pace with evolving consumer behaviors through a series of exterior and interior updates. This included a strong desire for an elevated customer experience and prioritization of safety.

“Within just a few months of finishing our upgrades, we saw a significant increase in traffic and business to our location due to the new Halo image.”

When it came to the interior upgrades, Orton had the freedom and flexibility to make all the updates he deemed necessary to satisfy the needs of his community.

“CHS was a one-stop-shop when undertaking this renovation and really made my

dream store become a reality. CHS and the Cenex® LIFT initiative made the process so much easier knowing we didn’t have to worry and could solely focus on building a premier c-store for our town,” Orton said.

As the convenience store industry continues to evolve, Hussain sees foodservice and fuel as playing complementary roles in the c-store offering.

“People are not going to come to our stores to buy fuel and then go across the street to a convenience competitor to buy their food. They’re going to go to the place that’s going to allow them to do everything in one stop,” he said. “If our store interiors are places that community members want to visit, we will see the benefit of increased fuels sales in the forecourt.”

Cenex offers its partners foodservice equipment and programs, such as Chester’s Chicken and Godfather’s Pizza, but it’s ultimately up to the retailer to decide what its community needs.

“That’s the difference that we were looking to make,” said Hussain. “We offer our retailers the flexibility to choose the store improvements and food service offerings that are best suited to their communities.”

As Hussain looks ahead for the Cenex brand, he doesn’t see a slowdown any time soon. During its four-year run, the LIFT program saw $150 million in approved capital through the in-store program, and there is approximately $70 million in exterior improvements. Easy laurels to rest on, but not for the Cenex brand.

“As nice as it would be for us to take a breath here after our four years of the LIFT initiative and going out there and transforming so many locations, we’re not slowing down,” he said. “We’re going to continue to tell our stories of success as these renovations are completed and take a deeper look at the impact that these investments have made in the communities.”

Hussain noted that the store loan program is open to new marketers as well as existing Cenex fuel marketers.

We know that the true power behind the Cenex® brand comes from our locally-owned retailers – valued partners who are invested in their customers and community. That’s why we’re committed to your success and helping you build your business from the moment you become a Cenex® retailer. From flexible brand conversion and marketing, to convenient payment processing and training programs, we can provide your business with the support it needs to help you grow.

A name your customers trust, a brand you can count on –visit cenex.com/businessopportunities to learn more.

Today’s customers have high expectations. They’re used to shopping in grocery stores and buying food in quick serve and fast casual restaurants that often know everything about them, allowing them to receive personalized offers and experiences that are relevant to their behavior and lifestyle.

“Industry research shows that if we can understand our guests they’re more likely to be loyal to us and if it’s more relevant, they’re more likely to buy it,” said Cheryl Davis, director of digital strategy for Cumberland Farms. “The more we can cater to our customers, the better.”

Retail is powered by data today, said Gary Hawkins, the CEO of Denver-based Center for Advancing Retail & Technology. “Data has become mission critical because of AI and the other tools that can leverage that data,” he said.

“This information can be incredibly valuable to convenience stores because the customer is becoming the battleground,” he added. “If I want to succeed as a retailer, I need to under-

stand [customers] and I need to grow my share of [their] wallet and what [they] spend. Being able to leverage the data is the most important thing to drive business to your store.”

Convenience store loyalty programs are a goldmine of information. They can provide both customer data—who is buying what and when—and data on the performance of foodservice items stores are offering.

Loyalty programs are essential to gather any meaningful amount of customer data, said Hawkins.

Cumberland Farms likes to look at dayparts and know when customers are coming in to buy foodservice products. This helps understand when to boost staffing and when to cut back.

The retailer also likes to use its loyalty program to understand what’s selling in foodservice and which additional items customers are adding on. Dispensed beverages are a popular driver of visits and a good area to target, said Stephen Skidds, director of food service.

This also helps us phase out slower SKUs.”