Being data-driven is complicated. We can

VOL. 36 • NO. 8 • AUGUST 2023 THE AUTHORITY FOR THE DATA-DRIVEN BUSINESS PM40050803 ❱ 8 INTERVIEW with Peter Fader on Customer Valuation ❱ 18 How Data Storytelling Powers Campaigns Today TODAY’S BIGGEST MARKETING CHALLENGES ISTOCK/..SHOCK

help.

We’ll Help You Keep It Clean

Dealing with bad data is a task no marketer needs on their checklist. Inaccurate, outdated, and duplicate records can build up in your database, affecting business decisions, the customer experience, and your bottom line. As the Address Experts, Melissa helps our customers improve their direct marketing efforts with the best Address Veri cation, Identity Veri cation and Data Enrichment solutions available. We validated 30 billion records last year alone, which is why thousands of businesses worldwide have trusted us with their data quality needs for 37+ years.

BAD DATA BUILDUP

Returned Mail & Packages

Missed Opportunities

Decreased Customer Insight

DATA CLEANLINESS

Real-time Address Veri cation

Change of Address/NCOA Processing

Geographic & Demographic Data Appends

Contact us for a Free Proof of Concept and ask about our 120-day ROI Guarantee.

Trust the Address Experts to deliver high-quality address veri cation, identity resolution, and data hygiene solutions.

Melissa.com 800.MELISSA (635-4772)

Vol. 36 | No. 8 | August 2023

PRESIDENT Publisher & Editor-in-Chief

Steve Lloyd - steve@dmn.ca

DESIGN / PRODUCTION

Jennifer O’Neill - jennifer@dmn.ca

ADVERTISING SALES

Steve Lloyd - steve@dmn.ca

CONTRIBUTING WRITERS

Amandine Servain

Stephen Shaw

William Skelly

LLOYDMEDIA INC.

HEAD OFFICE / SUBSCRIPTIONS / PRODUCTION:

302-137 Main Street North

Markham ON L3P 1Y2

Phone: 905.201.6600

Fax: 905.201.6601 • Toll-free: 800.668.1838 home@dmn.ca • www.dmn.ca

EDITORIAL CONTACT:

DM Magazine is published monthly by Lloydmedia Inc. DM Magazine may be obtained through paid subscription. Rates: Canada

U.S.

1 year (12 issues $48)

2 years (24 issues $70)

1 year (12 issues $60)

2 years (24 issues $100)

DM Magazine is an independently-produced publication not affiliated in any way with any association or organized group nor with any publication produced either in Canada or the United States. Unsolicited manuscripts are welcome. However unused manuscripts will not be returned unless accompanied by sufficient postage. Occasionally DM Magazine provides its subscriber mailing list to other companies whose product or service may be of value to readers. If you do not want to receive information this way simply send your subscriber mailing label with this notice to:

Lloydmedia Inc. 302-137 Main Street North Markham ON L3P 1Y2 Canada.

POSTMASTER:

Please send all address changes and return all undeliverable copies to: Lloydmedia Inc.

302-137 Main Street North Markham ON L3P 1Y2 Canada

Canada Post Canadian Publications Mail Sales Product Agreement No. 40050803

Twitter: @DMNewsCanada

// 3 AUGUST 2023 DMN.CA ❰

NEXT ISSUE: A look at Artificial Intelligence in Marketing ❯ 4 Talking Points talkingpoints INTERVIEW

8 Customer Valuation: An Interview with Peter Fader, Professor of Marketing, the Wharton School of the University of Pennsylvania ANALYTICS MARKET RESEARCH

18 Data Storytelling Powers Marketing Campaigns and Business Decisions ❯ 12 2023 CMO State of The Union Survey Today’s Biggest Marketing Challenges ISTOCK/ METAMORWORKS

❯

❯

talkingpoints

the AIR MILES Reward Program and empower Canadians to get the most out of every dollar spent.”

To highlight these and other earning and redeeming opportunities for collectors, AIR MILES recently introduced its AIR EVERYTHING marketing campaign which illustrates the five primary ways to earn Miles across hundreds of top retailers and service providers in Canada. The ways to earn include Online through airmilesshops.ca, In-store, Linked Loyalty, Travel, and Credit Card, encompassing virtually every way that Canadians shop. Through AIR EVERYTHING, Collectors will be better informed on how to never leave a Mile on the table.

new app to find their nearest Firehouse Subs location and place an online order for pick-up through Rapid Rescue To Go.® The app includes features that make it easy to reorder your favourite meals, and robust customization to make sure each hot and hearty sub is just how you like it.

Firehouse Subs is also bringing its loyalty program to Canadian guests for the first time. Firehouse Loyalty members earn points to redeem on future visits, like more free subs, when they order through the app, website and in person, and are the first to learn about new menu items and promotions, including exclusive offers.

AIR MILES reveals new nationwide partnership with Dollarama

On the heels of BMO’s successful acquisition of the AIR MILES Reward Program and the accompanying commitment to reinvigorate Canada’s most recognized loyalty program, AIR MILES today announced the first of several program enhancements including a new partnership with leading Canadian value retailer, Dollarama, and a new innovative way for collectors to earn Bonus Miles through receipt scanning technology.

Faced with rising prices, inflation, and the accompanying cost of living, Canadians are turning to loyalty rewards programs to seek better value for every dollar spent on quality goods. With Dollarama boasting over 1,500 stores across the nation, the partnership, which kicks off on August 7, will provide AIR MILES collectors with an earning experience at a recognized value retailer and is aligned with AIR MILES commitment to continuously add new partners to the vast coalition and invest in new ways for collectors to earn and redeem.

In addition, AIR MILES also announced a new, innovative way for collectors to earn Bonus Miles on everyday products at select major grocers through AIR MILES Receipts. The program, launched in Atlantic Canada with plans to expand nationally, allows collectors to snap a photo of their eligible grocery receipt in the AIR MILES App within 14 days to collect Bonus Miles on qualifying purchases.

“Our promise to Canadians, especially in this tough economy, is to provide the most flexible and expansive ways to earn on everyday purchases,” said Shawn Stewart, President, AIR MILES Reward Program. “These announcements are the first of many in the coming months that are expected to refresh

The Dollarama partnership allows collectors with a linked Canadian issued Mastercard to earn 10 Bonus Miles when they spend $30 or more in a single transaction in-store at Dollarama until November 6, 2023. This includes all items available for purchase across Dollarama’s broad assortment of general merchandise (such as party and office supplies, kitchenware, hardware, toys and apparel), consumables (such as cleaning, health and beauty, pet, snacks and other food products) as well as seasonal items. In addition, BMO will offer BMO AIR MILES credit card holders the opportunity to earn 5x the Miles on purchases at Dollarama, providing enhanced value to its cardmembers until November 6, 2023. More to come on this exciting partnership.

“Our Firehouse Subs guests in Canada welcomed us with open arms when we opened our first restaurant in 2015 in Ontario,” said Elie Javice, Firehouse Subs Chief Digital Officer. “We’re excited to make their experience more convenient and rewarding through exclusive access to new subs and great deals with our new app and loyalty program.”

Much like when guests visit their local Firehouse Subs in person, they have the option to donate to Firehouse Subs Public Safety Foundation of Canada when they check out on the app. To date, the Foundation has provided more than $2.8 million in lifesaving equipment, training and funding to first responders and public safety organizations. Guests can also support their local communities through the Foundation when dining in Firehouse Subs restaurants by rounding up at the register, donating spare change and purchasing a recycled pickle bucket for a $3 donation.

Avion Rewards and its first-in-Canada exclusive shopping companion

Sub chain’s new app targets deeper loyalty membership

Firehouse Subs Canada is heating up appetites and making it easier than ever to order hearty and flavorful subs with the launch of its new app. To celebrate, any new Firehouse Loyalty members will get a free medium sub after their first purchase on the app or website for a limited time.

Available for download now in all app stores, Firehouse Subs guests can use the

Avion Rewards ShopPlus (ShopPlus), are now open to all Canadians regardless of where they bank or shop. This brings unparalleled savings and flexibility to everyone and is a fundamental shift in how the rewards program delivers benefits to its members. ShopPlus is an innovative and award-winning shopping companion that eliminates the need to hunt for deals by presenting offers from over 2,400 retailers, more than any other savings platform in Canada.

“RBC has been a leader in loyalty for more than 20 years and by opening up Avion Rewards to all Canadians, we’re shifting from a traditional program to the most comprehensive rewards experience in the

// 4

■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■

■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■

country,” said Neil McLaughlin, group head, Personal & Commercial Banking, RBC. “We’ve made significant investments in modernizing Avion Rewards to transform it into an innovative data-driven platform that delivers unique value to Canadians across their entire shopping journey.”

All eligible Canadians can now access Avion Rewards’ newest membership tier, Avion Rewards Select, for free. Members can find the best deals while they shop, where and when they need them, by enabling ShopPlus through the Avion Rewards Mobile app (for iOS Safari) or web.

“We’re excited to bring ShopPlus to all Canadians,” said Niranjan Vivekanandan, senior vice president & head, Loyalty & Merchant Solutions, RBC. “This is an important part of our transformed program, and with Avion Rewards, our members no longer have to choose between discounts, cash back and points. They can now access all of these benefits in one place and with more merchants and brands than any other loyalty program.”

This is just the beginning of the benefits being offered to all Canadians, with more exciting features and functionality coming for Avion Rewards Select members, including the ability to earn points, book travel and the introduction of in-store offers by linking any payment cards to the platform.

Canadians who hold an eligible RBC product will continue to enjoy even more benefits through the program’s two additional tiers: Avion Rewards Premium and Avion Rewards Elite. To learn more about the Avion Rewards membership program, please visit avionrewards.com/eligibility

“From our market-leading travel value proposition, extensive roster of retail partners, innovative features and payment capabilities, we continue to provide the best and most valuable loyalty experience to our members,” said Vivekanandan. “Opening up Avion Rewards to everyone through our new Select tier is a significant milestone as it helps us achieve our vision of bringing relevant and unparalleled value to all Canadians, and we

look forward to announcing more exciting updates in the months ahead.”

Avion Rewards is an award-winning internationally recognized loyalty and consumer engagement platform that provides Canadians with the flexibility to shop, save, earn and redeem for everyday merchandise, aspirational rewards and experiences.

and Braze makes it that much easier to deliver a best-in-class experience. We’re looking forward to going to market hand-in-hand to deliver a seamless, tightly coordinated solution.”

Braze is a customer engagement platform empowering brands to forge human connections with customers through technology and data. Braze strongly believes in the power of partners and ecosystems, and understands that in order to effectively connect with customers today, a fully integratable customer engagement platform is critical. The Braze Alloys Partner Program was launched in 2018 in an effort to help customers augment

By joining Braze Alloys, Kognitiv becomes part of a curated ecosystem of best-in-breed technology and solutions partners to help integrate, customize, and amplify customer engagement capabilities.

The combined partnership program leverages the Braze technology solution as a fully integratable customer engagement platform, and is designed to create a simple, scalable system for making it easier for Kognitiv customers to use Braze in concert with an ever-wider range of technologies and solutions to support meaningful brand experiences.

Dual partner status also makes it easier for Kognitiv customers to leverage agencies, consultancies, and other partners in concert with Braze and its ecosystem of technology partners to provide users with highly personalized, highly effective brand experiences at scale.

Working together, Kognitiv and Braze can support shared clients to drive increased efficiencies and effectiveness in their customer marketing campaigns through message orchestration, giving them confidence that the right messages will be delivered at the right time to their customers.

“I’m really excited about the benefits this partnership will bring to our business,” said Kognitiv CEO Tim Sullivan. “We know marketers are struggling to provide a consistent customer experience across touchpoints. Offering direct connectivity between our Kognitiv Inspire loyalty platform

and deploy relevant, memorable experiences built on the Braze customer engagement platform. The program has since grown to include more than 128 technology partners, enabling brands to carry out real-time customer experiences with a faster time-todelivery.

Kognitiv also announced the sale of its hospitality technology business, Seekda, to Valsoft Corp. Kognitiv’s loyalty technology platform is helping some of the world’s largest brands stay ahead of customer expectations and build deeper relationships through data-driven personalization. This transaction further streamlines Kognitiv’s operations, allowing the company to focus on its core capabilities and compelling product roadmap of customer data intelligence and activation products powered by AI and machinelearning.

Seekda is an Austrian company that delivers innovative booking technology to the hospitality industry. With this acquisition, Seekda is well-positioned for continued growth and evolution as part of Valsoft’s portfolio of software companies.

In June 2020, Kognitiv and Aimia’s Loyalty Solutions business came together to become a global loyalty solutions leader. Today Kognitiv serves a broad portfolio of global brand customers and has employees in over 20 countries. With decades of loyalty solutions experience, Kognitiv has the history, the technology and the expertise to help marketing professionals stay ahead of the customer expectation curve.

// 6 ❱ DMN.CA AUGUST 2023

■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■

Kognitiv Corporation has joined the Braze Alloys program as an official technology and solutions partner

■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ ■

talkingpoints

Tim Hortons opening its first-ever Boat-Thru for a limited time on Ontario’s Lake Scugog

Buoy, oh buoy, something cool, unique and refreshing came to Ontario’s Lake Scugog this August long weekend — the first-ever Tims Boat-Thru. On Saturday, Aug. 5 and Sunday, Aug. 6, Tim Hortons offered sailors, boaters and paddlers the chance to enjoy a selection of delicious summer beverages from Tims for free — without having to dock — at the Tims Boat-Thru.

“The summertime Tims Run is an iconic Canadian tradition that’s a must-do when you’re gathering with family and friends. Our summers fly by so quickly and Canadians savour every moment of their long weekends — so we thought why not open our first-ever Tims Boat-Thru so our guests on Lake Scugog don’t miss a minute on the water,” says Hope Bagozzi, Chief Marketing Officer for Tim Hortons.

“There’s no better way to beat the heat this long weekend and all summer long than by enjoying one of our refreshing summer beverages.”

Here’s the menu at the Tims Boat-Thru:

❯ Sparkling Quenchers, made with the perfect blend of fruity flavours and sparkling water. These new Quenchers make for a light, bubbly and delicious drink, and are available in two refreshing options: Blackberry Yuzu and Orange Ginger.

❯ Caramel Toffee Cold Brew. Steeped for 16 hours for a smooth and velvety taste, Tims Cold Brew is paired with Caramel Toffee syrup and topped with espresso-infused

cold foam for the perfect mix of richness, sweetness and creaminess.

❯ Vanilla Iced Latte. Change up your go-to espresso order by adding ice, a hint of vanilla and your choice of milk, cream, or an oat or almond beverage.

The Tims Boat-Thru opened Saturday and Sunday at the Beacon Marina (at 3 Marina Drive) in Caesarea, Ont., just minutes from Port Perry. There was a maximum of six beverages per boat.

In 1964, the first Tim Hortons® restaurant in Hamilton, Ontario opened its doors and Canadians have been ordering Tim Hortons iconic Original Blend coffee, Double-Double™ coffees, Donuts and Timbits® in the years since. Over the last 55 years, Tim Hortons has captured the hearts and taste buds of Canadians and has become synonymous with serving Canada’s favourite coffee.

Do you make decisions about your marketing operations?

Are you responsible for customer acquisition, retention or loyalty? Is your department in charge of fulfilling orders or customer service?

// 7 DMN.CA ❰ AUGUST 2023

Visit our website at www.dmn.ca and learn more about the magazine DM Magazine is a Lloydmedia, Inc publication. Lloydmedia also publishes Foundation magazine and Total Finance magazine. Sign up NOW for a free subscription to DM Magazine.

Customer Valuation: An Interview with

Peter Fader, Professor of Marketing,

the Wharton School of the University of Pennsylvania

BY STEPHEN SHAW

Just about every CMO will tell you their top priority is growing topline revenue. Where they might differ is how they go about achieving that growth. There are two prevailing schools of thought.

The first is that growth comes primarily from attracting as many category buyers as possible, even if most of them are occasional users who buy infrequently. The opposing side argues that the cost of going after everyone in the market is a waste of resources: it makes far more sense to simply encourage existing customers to buy more, more often. Brand loyalty pays off in the long term, they argue, because it is much less costly to retain a customer than to acquire one.

This debate has been going on for years with all the shrillness of an ideological shouting match. On one side you have the Ehrenberg-Bass Institute for Marketing Science led by the iconoclast Byron Sharp whose immensely popular book How Brands Grow debunked a lot of taken-for-granted marketing principles. In a groundbreaking paper he wrote in 2002, he declared, “when brands grow, they can expect most of their sales revenue growth to come from having a larger customer base, rather than from an increased buying rate”. He based his conclusions on the NBD-Dirichlet [deer-ich-lit] mathematical model of brand choice developed in 1984 by his mentor Andrew Ehrenberg.

// 8 ❱ DMN.CA AUGUST 2023

STEPHEN SHAW is the Chief Strategy Officer of Kenna, a marketing solutions provider specializing in delivering a more unified customer experience. Stephen can be reached via e-mail at sshaw@kenna.ca

Sharp’s polarizing views certainly contradict the equally fervent beliefs of loyalty proponents who feel that marketers should apply disproportionate effort to increasing the value of current customers over their lifetime. Probably the best known advocate is Frederick Reichheld of Bain and Company who created the Net Promoter Score. In his classic book The Loyalty Effect published in 1996 he famously wrote that “improving the retention rate by five percentage points doubles the profit margin”. He goes on to conclude that according to Bain’s economic modelling, “Revenues and market share grow as the best customers are swept into the company’s business.” He doubles down on that business case in his latest book Winning on Purpose where he introduces the concept of “Earned Growth Rate” which refers to the revenue growth generated by “Brand Promoters” as a result of increased sales and referrals.

Like most abstract debates in marketing the truth lies somewhere in between. Companies certainly need to spend money acquiring new customers, although that becomes more expensive over time as the pool of potential first-time buyers contracts. But companies also need to invest in maximizing the value of current customers to drive profitable growth. In fact, customers should be thought of as assets whose value appreciates over time. The tricky part, of course, is to find the right balance between acquisition and retention spending.

That’s where Peter Fader comes into the picture. The Wharton School Marketing Professor believes passionately in a “Barbell Marketing Strategy” which involves using acquisition dollars prudently to go after heavy category users while at the same time doing everything possible to please high value customers. The right balance is determined by doing a bottom-up study of behavioural patterns within the existing customer base. This analysis can pinpoint exactly how much untapped revenue potential there is amongst the high value customers who are the most likely candidates to expand their

relationship with the brand. He calls this process a “Customer-Base Audit” which he describes in detail in his latest book of the same name.

Shaw: You were a math major at MIT and then went on to get a doctorate in marketing. Marketers usually have an aversion to numbers. What made you want to pursue marketing as a career?

Fader: I didn’t, is the answer. I was a straight math guy until this professor came up to me while I was in undergrad and said, “You ought to get a Ph.D. in marketing.” And I said to her, “You ought to get your head checked. I’m not going into marketing.” But she was very, very persistent and persuasive, and she just wore me down.

Shaw: What made her suggest marketing as a career choice?

Fader: A couple of things. One is the times. This was the early 1980s, and we were just starting to develop the kind of customer tracking capabilities that we have today. Her pitch to me was, “We are building the electron microscope of the customer. We are going to have the capability to tag, track, predict in a way that we could never imagine.” She was one hundred percent right. At the time I wasn’t sure what I was going to do, but I was spending a lot of time thinking about being an actuary.

Shaw: The exact opposite of marketing.

Fader: You’re right. But her point was we can use the same actuarial models. Instead of asking, “How long is it going to take until you die, it’s going be how long is it going to take until you buy?” This fairy godmother of mine, her name is Leigh McAlister. She’s now a Professor at the University of Texas. She just had incredible foresight about what marketing would become.

Shaw: It is remarkable because database marketing had just crawled out of the crib at that point.

Fader: Absolutely. And that was a big part of it: she looked at some of the things that were going on, database marketing, direct

marketing, late-night infomercials, and saying those kinds of practices should be more rule than exception. And today, so many companies are doing that kind of performance marketing without recognizing the debt they owe to those old-school direct marketers. They think they’ve invented something new.

Shaw: You’re quite right. My father, as an example, worked for 35 years at Reader’s Digest. Those were the days of mainframe computing and yet they were doing predictive modeling way back then.

Fader: And in many ways better than what a lot of companies are doing today. Because back then, they were more scientific about it. They would wonder, “What do these numbers mean? What is our hypothesis? What kind of experiment can we run to test that hypothesis?”. It was just much more thoughtful. Today we talk about data science. There’s just not a lot of science in data science.

Shaw: Let’s talk about your book, “Customer Centricity”, which won you a lot of fame in 2011. What inspired you to write the book at the time? And what accounts for its success? Fader: The book was written out of frustration with companies that weren’t embracing a lot of these methodologies. Like I said, I’m a math guy. I build models. And these models work really well. Our ability to forecast how many customers you’re going to acquire, how long they’re going to stay, how often they’re going to buy from you, they work super well. Twenty years ago, I’d be just yelling at companies, “You’ve got to try this stuff! It works! Just give it a try! Here, I’ll give you videos, and R-code, and technical notes, and spreadsheets. Just try it, will you?”. And most companies would ignore me. They’d say, “We’re busy. We’ve got a job to do”, or “You’re an academic. You’re not in the real world. What do you know?” or “It’s all very technical. There’s a lot of math there.” People would find every reason to either reject my stuff or to push it way down in the organization: “Sure, there’s

someone who works for someone who works for me, and she’ll deal with that stuff, fine.” And so that’s a big reason why I wrote the first book, to say to the C-suite: “The world is changing, and you’re not changing with it”. There was some snark to the book — a willingness to call out specific companies and say, “Here’s why you’re not as good as everyone says you are.”

Shaw: Like Nordstrom. Fader: Nordstrom, Starbucks, Apple, Walmart.

Shaw: Your message 12 years ago was that companies needed to make a greater effort at understanding and serving their most valuable customers. Today the thinking seems to be that brands need to create community around their biggest fans.

Fader: For the high-value customers, we must create community. But at the same time, some people think, “Let’s just build a community and money will come raining down from the sky.” No. You want to make sure you’re measuring it. You want to make sure you’re bringing the right people together. You want to make sure that you’re checking how valuable they are and how much this community investment is increasing their value or helping us to acquire customers who are more valuable than the ones we’d acquire otherwise. So, for me, it’s always going to come back to customer lifetime value.

Shaw: We have made a lot of progress in terms of companies accepting the idea that they need to focus more on the customer. Yet marketers today continue to throw a lot of money at acquisition. What accounts for this mindset?

Fader: Oh, easy, easy, easy. A couple of things. So, number one, we’re very sensitive to costs. Thanks to companies like Google, we know exactly how much it costs when someone clicks on that sponsored search ad. We know exactly what it costs as someone goes through the funnel. And so we’re just really painfully attuned to cost. I’m not saying ignore

// 9 DMN.CA ❰ AUGUST 2023 INTERVIEW

costs. But I want to give equal attention to future value. I want to know that the projected value of a customer should be the same as it’s costing us to acquire them. That if we can make value as visceral, tangible, measurable as cost, that’s going to change the calculus right there. If we can focus a little bit more on quality instead of quantity, it might shift the balance away from just acquisition to the care and feeding of customers after we acquire them.

Shaw: There’s good growth and bad growth for sure. But there seems to be a disconnect between brand marketing and performance marketing with the performance guys winning because they produce immediate sales.

Fader: I have a love-hate relationship with both camps. The performance marketers are very short-term oriented. And the branding people are the antithesis of that: they want to avoid accountability and measurement at all costs: “It’s all about the brand”. And while there’s some truth to that, it doesn’t mean we can’t measure it. So, I love the fact that they have the longterm perspective, as opposed to the short-term performance marketers. I love the fact that the performance marketers have that quantifiable perspective as opposed to the brand people. Well, let’s just create the best of both worlds. And I think lifetime value is the way to unite them.

Shaw: Which I believe was the focus of an analytics company you started called Zodiac and then later sold to Nike. Tell me how that came about.

Fader: What we saw is that we needed to scale the CLV models we were building from academic grade to full commercial scale, as well as add some other bells and whistles. We thought “Don’t trust companies to figure it out on their own: let’s do it for them”. And so that’s what we were doing at Zodiac. We created a means to get the word out in a way that I could never do just sitting in my academic chair. And we created lots of buzz in the industry, lots of testimonials. We had a line-up of companies saying, “Hey, work

with us next.” And ultimately Nike bought the company in March of 2018 — what an incredible testimonial that was: A company that traditionally sold boxes of footwear to Walmart and Foot Locker, saying, “We want to have direct relationships. We want to know who’s buying what and what other things we can surround them with.” Even today, five years later, the fact that companies continue to ask about Zodiac, even though it’s long gone, shows what a great move that was.

Shaw: Certainly proof that Nike is maybe the most progressive marketer in the world.

Fader: I give Nike credit for going that next step beyond being a client to grabbing the whole thing and embracing it, and not just the models but even the philosophical aspects of it. Again, very, very bold move on their part. And I don’t want to overstate cause and effect here, but you look at their performance over the years since they bought the company, every quarter beating investor expectations. Is it because of our thing? Nah. But it’s because of their own mindset, their own willingness to march to their own beat and picking up the skills that they needed along the way.

Shaw: Well, they’ve shifted away from retailers as a primary distribution channel and are pretty much committed now to going direct to consumer.

Fader: Yeah, with their own shops as well. That’s right. And even when they do work with retailers, and they still do, the way they manage those relationships, the way they measure them, it’s just a very different way of operating than it had been. Unfortunately, it’s still more exception than rule, the way that they’re operating. Instead of every company saying,

“We’ve got to do the Nike thing,” a lot of people say, “Well, that’s Nike, they’re different.”

Shaw: Five years ago, you started another company, Theta. That company, as I understand it, is designed to help companies come up with corporate valuations for M&A purposes, in part, using CLV, if I understand that correctly. Fader: So, I’ll tell you the back story. At Zodiac, most of the companies that we were working with wanted to use CLV to enhance and measure the effectiveness of their marketing tactics. But one of our clients was a private equity firm out of LA, and they didn’t care about any of the tactical stuff. They just wanted to know that when they’re thinking about buying that digitally-native women’s accessory company, what are they actually worth? And we can project how many customers they’re going to acquire, how long they’re going to stay, how often they’re going to buy, and how much they’re going to spend. Add that up, that’s the value of the company.

My co-founder and co-author, Dan McCarthy, had worked at a couple of different hedge funds before coming back to Wharton to get his Ph.D. The guy’s super smart. It was Dan who was uniquely positioned to take all the goodness of the models, elevate them even higher, and figure out how to build the bridge to finance in a way that, not only would the models work, but that we could speak about it credibly, speaking their language and addressing their issues, their desires, their limitations, and have our models fit their needs. Dan has done that superbly well. And that just opened up all kinds of opportunities.

Shaw: Concepts like customer equity, brand equity, are usually

buried under goodwill on the balance sheet. Is part of your mission to change how finance reports on CLV?

Fader: The answer is yes. And it made sense until Dan said, “No, no, that’s just not going to happen. We should not be putting forwardlooking projected numbers on accountable financial statements because they’re not accountable.” So, instead, let’s come up with accountable auditable measures that would be very tightly associated with lifetime value and customer equity, but things that we really could measure and report in a standardized way. What kinds of easily observable metrics could we have at our fingertips that would be a strong proxy for them? Let’s do so in a way that’s going to meet the conservative standards of accounting, but at the same time be strong indications of how much gas you have in the tank. And it’s been great. We’re actually getting public companies to start disclosing some of these customer metrics, which can be turned into forward value.

Shaw: On your web site you use the actual example of Warby Parker to suggest that they may be overvalued.

Fader: Yes, that was at the time of their IPO. Fast forward a year and a half, and now they’re grossly undervalued. The whole point to that analysis is let’s not worry about stock prices. Let’s just worry about the unit economics, the value of customers. And if you think about it, the way that people buy glasses is pretty much the same today as it was a year and a half ago. The unit economics of a given customer, or the mix of their customers, is pretty much the same as it was back then. The value of the company hasn’t really changed very much. And so, these estimates that we come up with are not only diagnostic, and interesting, and ultimately accurate, but they also tend to be much more reflective of actual customer behavior, and often much more stable than the whims of Wall Street.

Shaw: The sorts of modeling you’re doing relies on fairly granular transactional analysis. What happens with companies

// 10 ❱ DMN.CA AUGUST 2023

INTERVIEW

“The unit economics of a given customer, or the mix of their customers, is pretty much the same as it was back then.”

that aren’t as data rich? Do you have workaround solutions for them?

Fader: Absolutely. I am totally fine using different kinds of proxy measures to get going. NPS can be very useful in that regard.

Shaw: Should share of wallet be a beacon metric?

Fader: Nah. I have nothing against that metric. The problem is, even at the individual level, it’s still lumping together a bunch of different behaviors. If your share of wallet as a whole is leveling off or decreasing, is it because customers aren’t staying as long, not buying as often, not spending as much when they do? I want metrics that help me single out and project one of those behaviors to get a more accurate, more diagnostic revenue projection.

Shaw: Is it your argument that CLV deserves as much attention as other KPIs like market share and share of wallet?

Fader: Actually, no, no, no. So, CLV is the North Star that pulls everything together. Instead let’s report the things that will help us understand the components of CLV like customer retention and repeat buying. What percent of our customers who did something with us last period are still active? The other would be, among active customers, how many purchases on average did they make with us? How often are they buying? And how much are they spending? What’s the average revenue per user? As much as we talk about lifetime value, when we’re doing customer-based corporate valuation, we’re rarely doing that with lifetime value. We’re going to calculate lifetime value and we’ll report that to you — but the main thing that’s driving the valuation will be that next level down related to retention, repeat purchase, and spend.

Shaw: I want to ask you about Byron Sharp’s doctrine that market penetration trumps loyalty. He believes that market growth only comes by attracting as many buyers as possible, no matter whether they’re light or heavy category users. What’s your perspective?

Fader: Well, let me first start by saying I am probably the strongest

advocate for Byron Sharp and the Ehrenberg-Bass Institute down there at the University of South Australia. I’m probably the strongest advocate in the entire Western Hemisphere.

Shaw: You teach it, right?

Fader: I teach it, hours and hours of it. I agree with focusing on penetration, focusing on getting the message out there broadly, focusing on a variety of different benefits instead of owning a niche part of the market. That is, I agree for 80 percent of the customers. Because they’re not going to stay that long, they’re not going to do much, and there’s not much we can do.

Shaw: They may not even be your customers.

Fader: I love that point. And something that we emphasize a lot in the new book. For the so-so customers, which constitute most of your customer base, I’m 100 percent in agreement with Byron. But he’s wrong on the other 20 percent, which is to say he grossly underestimates the value of the high-value customers. And it turns out that the basic model that’s at the heart of what Byron does, which I believe in, too — the NBD-Dirichlet multinomial model — it’s a wonderful model, but it’s missing one component, which is basically how customers change over time. It’s a static model. And when we bring in what we call nonstationarity, allowing customers to evolve over time — something which, by the way, Byron’s mentor, Andrew Ehrenberg, knew full well — that when we bring that one piece into the model, and it’s important, because then those high-value customers actually become even more valuable and more important. And that’s where all this focus on the right customers

we’re doing the Blue-Ribbon Club for those high-value customers, but recognizing there’s very few of them. Incidentally, Byron and I have just a wonderful relationship. Almost all of our exchanges are very, very positive, even if we disagree. But the high-value customers are different and we need to do different things with and for them.

Shaw: A CMO typically gets 10-12 percent of the company’s operational budget to work with and then invariably spends 80 percent of it on acquisition and 20 percent on customer retention. Based on your thinking, shouldn’t it be the other way around?

Fader: Well, yes and no. It all depends on how that acquisition budget is being spent. If it’s being spent, as it is by most companies, on purely performance marketing — let’s go after as many customers as we can, as cheaply as possible — that’s a problem because we’re going to acquire a whole bunch of customers hoping and praying that they become good. They probably won’t. If instead, we’re spending that budget a little bit more on quality instead of quantity, then it might not. Now, if it’s 80 percent on acquisition, 20 percent on retention, that is a little too imbalanced, I’ll agree. But it’s not so much the overall quantity of dollars that companies are spending on acquisition, it’s how they’re spending it. And that tends to be what’s more troublesome, this hunt for low-cost volume as opposed to high-cost quality.

Shaw: The big challenge for marketers is showing the correlation of that spending to the company’s bottom line. It seems that’s where you fit in.

Fader: Exactly. And, for me, it’s going to be these same basic building blocks I keep talking about: acquisition, retention, repeat purchase, spend. Now, it’s not enough just to have metrics around them. We need to understand the reasons why. And that requires more qualitative measures. The problem with many companies is they’ll do the qualitative stuff across the whole customer base. I say let’s do it separately by, say, lifetime value tiers. Let’s look at our top 10 percent of customers and see what they’re saying, what they think, how they feel. What are their needs, desires, frustrations? And how is it different from tier number two, or three, or four, or five? So, let’s figure out the emotional triggers for each type of customer, each value tier of customers, rather than trying to do it on an overall basis.

Shaw: Should customer accounting be an independent department, operating as a bridge between finance and marketing?

Fader: Bless your heart. Such an important question. Too often we either neglect or greatly downplay the role of costs in the equation. Let’s make sure that we have all of the costs accounted for. So, yes. It’s really, really important to do it right, to do it conservatively, to do it in an auditable manner, and to weave it in with all of the revenue and value metrics that we’re coming up with. We’re getting really good on the revenue and value side, but it’s still pretty messy on the cost side.

Shaw: I’m glad to hear that you want to crack the code on that somehow.

Fader: Yes. There should be big, obvious, transparent, agreedon standards. We need to have conversations with some of our accounting colleagues. I think there’s a lot of work that needs to be done. We don’t want the people in accounting or finance to be looking at us as just a bunch of lightweight marketers. We want them to say, “You know what? You really do have something to contribute that’s of value to me.” And I think we’ve been making a lot of good progress in that regard.

// 11 DMN.CA ❰ AUGUST 2023 INTERVIEW

“The unit economics of a given customer, or the mix of their customers, is pretty much the same as it was back then.”

2023 CMO State of The Union Survey

Today’s Biggest Marketing Challenges

BY AMANDINE SERVAIN

BY AMANDINE SERVAIN

This year has proven to be the year of radical change in marketing. Artificial intelligence (AI) is becoming more integrated. Tight margins mean more trips to the Chief Financial Officer to scrutinize the budget. And now, cookies are being phased out. To top it off, traditional paid channels are getting more expensive and aren’t converting as they used to, leaving Chief Marketing Officers wondering where exactly growth will come from this fiscal year and beyond. So, what’s a marketer to do? A year from now, the companies that have hit their KPIs and increased revenue won’t be the ones that

relied solely on an expensive ad strategy or a complex marketing tech stack as in years past. Instead, the businesses that recognized and invested in the untapped potential of their owned channels — the true hidden gem for customer acquisition and retention — will be the ones that finished ahead of the pack. While your website is crucial to this equation, it can’t do all the heavy lifting alone. By establishing a solid interface between owned and paid channels, creating a more efficient and profitable system, brands can build a performance marketing powerhouse. Embracing these adjustments will position marketers for long-term success.

We partnered with Retail Dive to survey 100 senior marketing leaders at retail companies to better understand how marketers are adapting to these major changes and taking advantage of their owned channels. The results — detailed in this report — provide a glimpse into how these marketing leaders are prioritizing significant shifts, along with insights on the most momentous struggles they face and how they plan to approach performance marketing moving forward.

Inefficient Tech Stacks

Tech stacks serve as the lifeblood of

companies, forming the bedrock upon which marketing teams build strategies and deploy tactics. Without an efficient tech stack, brands risk financial drain and losing the ability to be agile and adaptive. We asked our survey respondents how satisfied they were with their tech stacks, and the overwhelming sentiment was that current tech stacks are falling short.

So what part of their tech stack specifically isn’t meeting their standards? Respondents said their customer data platforms (63

// 12 ❱ DMN.CA AUGUST 2023

MARKET RESEARCH

percent), customer relationship management software (51 percent), marketing automation platforms (45 percent) and content management systems (43 percent) were the top four elements of their tech stack that weren’t driving results.

When used effectively, customer data platforms (CDPs) can be a huge asset to a marketing organization by centralizing several data points and providing control and ownership over that data to trigger personalization. But there also tends to be inflated expectations of what CDPs are actually capable of. In fact, 63 percent of our survey respondents were dissatisfied with their CDP. So what can we glean from this?

We don’t see CDPs going anywhere or being replaced by something new, as they are still valuable tools in your arsenal. Rather, we predict marketers will pair CDPs with other platforms to enhance their personalization capabilities and compensate for the areas where CDPs fall short. For example, CDPs are great at gathering information about your customers; however, they cannot recognize unidentified visitors. When a company also utilizes an identity solution as part of its infrastructure, they can recognize anonymous site visitors and in turn, make their CDP more intelligent and intuitive.

Ineffective ad campaigns

In the past, digital ads were the most reliable method to gain targeted customers and revenue growth. But they simply don’t have the same effect they once did. More than half (59 percent) of the respondents from our survey said digital advertising was “not improving customer knowledge,” and 50 percent agreed that ads were “not increasing brand loyalty.” To top it off, 44 percent acknowledged that ads weren’t increasing sales.

“I think everybody can agree that efficiency is hard to gain these days, and the cost of digital rent has increased over time,” said Ben Harris, Chief Commercial Officer at rag & bone. “One of the age-old challenges is capturing the right people at the right time with your marketing and ensuring it’s as efficient as possible. It’s all

about making sure you know your customer and putting forward content that’s reflective of your brand and of what your customer values from your brand.”

So why is this happening?

That, combined with the power of artificial intelligence and machine learning to make the right decisions, will set your brand up for long-term success.

Ads, which deliver a user-first ad experience by not interrupting the reader’s content consumption, solves this problem. Once users disengage, ads are delivered in a non-intrusive, impactful way which ultimately drives higher attention quality, more site actions and increased returns.

Deprecation of cookies

Another factor that will have huge ramifications on how marketers operate is the looming deprecation of cookies. Digital ad strategies have long relied on the information provided by cookies, so finding alternative data sources is now essential. We asked our respondents how they were preparing for this seismic change, and 68 percent said they were shifting to new retargeting technology platforms.

Struggles building the right team

Seventy-two percent of respondents reported that employee knowledge and experience had a large or moderate effect on their companies’ paid ad strategies. This highlights the importance of building a team with the proper knowledge and skills to keep up with advancements in marketing (for example, team members who have AI knowledge and experience).

“During COVID-19, everybody invested a ton of money, time and resources into building their technology, especially in the fashion industry, because brickand-mortar came grinding to a halt,” Harris said. “I think the lesson is you need the right talent, skill and experience. You can have the best technology in the world, and you can spend a fortune on it, but if you don’t have a good organization, a good team, and the right skill and experience within your team, all the technology is useless.”

Oftentimes brands invest in technology and then don’t utilize it to its full potential. Having the organizational horsepower and the right talent within your organization allows you to fully unlock the value of the technology. But you don’t have to do it alone. Technology providers that act as a true partner with white glove services can take the pressure off internal teams.

Poor user experience

Another reason for less effective ads is that they can be incredibly intrusive and can ruin a user’s experience, limiting their engagement and costing your brand. Incorporating Adtech solutions such as WunderKIND

In this ever-changing digital landscape, search engines and social platforms are constantly evolving, so having to rely on third-party cookies always keeps companies on the defensive. This transition away from cookies is actually a fantastic opportunity to shift to an offensive approach

// 13 DMN.CA ❰ AUGUST 2023

MARKET RESEARCH

by taking control of your data collection and focusing more heavily on first-party data from your website. Doing this will provide you with rich, robust data that will ultimately drive better customer engagement and ensure better accuracy, quality and security of your data.

Shifting consumer expectations

Nearly three in five marketing executives (57 percent) identified shifting consumer expectations as the most significant challenge for their companies’ marketing leadership. Despite today’s consumers continuing to spend at a high rate, the key lies in persuading

them to spend with your company rather than with the competition, which is only a click away.

As consumer preferences rapidly evolve, marketers must adapt their strategies and focus on gaining a deep understanding of their target audience.

Businesses can establish meaningful connections with both existing and new customers by gathering insights and customizing messaging to meet customers’ needs. This customercentric approach allows marketers to navigate the ever-changing landscape of consumer expectations confidently.

There’s no doubt that today’s customers have become increasingly fickle. So how do you keep your customers loyal and avoid slowdowns in your business? It’s all in the approach you take to learning about and caring about your customers.

“All we think about is, ‘Who are they? What do they want?’” Harris said. “And then ensuring when we

go out into the world with content and messaging, we reflect that back to new, prospective customers and people who have shopped with us before. Using that mentality, you can eliminate much of the noise in the consumer space.”

Tightening budgets

A climate of layoffs and general uncertainty in the market has led many companies to tighten their budgets and focus on profitability rather than growth for the first time in years. Finance departments are exerting more control over the marketing budget and want to ensure that the money spent brings back a good ROI. In fact, 40 percent of marketing leaders surveyed said they are having more meetings than last year with their finance departments. As the cost of ads increases and their effectiveness decreases, marketers are finding it harder to justify the budget needed to run successful ad campaigns.

65 percent of our respondents cite “not enough budget” as having a medium or large effect on their paid ad strategy. To justify their spending, marketing leaders are now responsible for educating their C-suite (especially

// 14 ❱ DMN.CA AUGUST 2023

MARKET RESEARCH

Reach marketers & fi nancial executives

Can you help our readers:

• Create a strong financial structure and healthy economic ecosystem to ensure capital and cash flow keep their engines running?

• Determine who their customers should be, how they can reach them most effectively, and how they can turn data-driven marketing into profitable sales?

• Build efficient and effective financial systems to enhance payments and billings between their companies and their customers and vendors?

• Convert all the data and information they collect from every contact point into tangible benefits that increase revenue and reduce costs?

• Equip their companies with the tools, technology, systems and hardware needed to manage their operations, to create new services or products, and deliver them to their market?

• Manage their customers with smoothly functioning support departments that are properly staffed and equipped to solve problems, foster loyalty and retain customers?

• Make any or every step in that chain better, faster, cheaper, and more profitable?

Our magazines are must-reads for key executives in core corporate competencies. DM Magazine, www.dmn.ca Foundation magazine, www.foundationmag.ca Total Finance magazine, www.totalfinance.ca

To advertise or get more information and media kits: Steve Lloyd 905-201-6600 ext 225 | 1-800-668-1838 | steve.lloyd@lloydmedia.ca We can help you tap into the ecosystem at the points that will drive your campaigns.

their CFO) on the importance of increasing their budget to optimize performance and ROI.

“Scaling is important, but scaling marketing spend just to scale marketing spend doesn’t work,” Harris said. “You have to scale the things that are really working. Anybody driving a marketing strategy needs to get into the weeds of what’s performing and not performing within each channel at a more detailed level than before.”

During these uncertain financial times, performance marketing can provide a dependable solution for driving revenue. When marketers leverage data, analytics, and a strong understanding of consumer behavior, they can tailor their performance marketing to ensure they receive the greatest return and make the most out of their tightening budget. Optimizing spend through performance marketing allows marketers to appease their financial teams while also hitting their marketing goals.

Performance marketing and brand marketing are the way forward

Now that we have outlined all the challenges, let’s explore the optimal next steps. Brand marketing typically receives a significant portion of the overall marketing budget, with 26 percent of marketing executives indicating

it as their top investment for 2023. Meanwhile, 23 percent of executives are prioritizing performance marketing, reflecting the growing interest in this area.

Encouragingly, 44 percent of respondents expect to increase their budget specifically for performance marketing, making it the leading area for anticipated budget growth among the options we asked about. These findings highlight the rising support from CMOs and CFOs for allocating more resources toward performance marketing, driven by its potential for measurable results. Businesses can’t rely on just brand or performance marketing; they need both to achieve success. And while they are different practices, when used together they share the same goal: to create individual, tailored experiences that resonate with their target audiences while improving customer loyalty and driving business growth to beat the competition.

Understanding your customer

To truly understand your customer, it’s essential to recognize your site visitors and offer them experiences relevant to their wants and needs. While many marketers said they were taking full advantage of the data available from their websites, there was a large discrepancy in

perception versus reality. Seventythree percent of respondents from our survey said they could identify 50 percent to 74.9 percent of their website visitors, which may sound like a lot, but in reality, that means there’s still a wide gap to close for most CMOs and an opportunity to learn even more about who is on their website.

“You have to really understand who your customer is and what they want, and be crystal clear about what that means in terms of your acquisition strategy and how you’re going to reflect the needs, desires and values of your core customer base,” Harris said. “The efficacy comes down to content, messaging and knowing really well who your audience is.”

While basic analytic tools can help determine a website visitor’s location, how long they stay on your website and what pages they look at, more detail is needed for successful brand and performance campaigns. So how can marketers harness the full potential of data from their websites? Use a platform that empowers brands to leverage their first-party data and gives marketers a competitive edge.

Over the past decade, Wunderkind has developed the foremost identity network in the industry, tailored specifically for permission-based channels. Wunderkind offers a comprehensive, privacy-compliant

performance marketing solution for eCommerce brands, delivering unparalleled revenue generation by leveraging first-party data on a large scale. Wunderkind’s network harnesses actionable consumer insights, AI and machine learning to monetize your traffic and significantly scale your performance marketing.

“Wunderkind is instrumental in helping us identify the traffic coming to our website,” Harris said. “Our approach has been to improve efficiency within our owned channels as much as we can because it’s increasingly hard to identify traffic, and that has an effect on retargeting activities.

“Capturing the organic traffic that is coming to your site is the most efficient thing you can do in terms of ROI. We obsess over that at rag & bone because our owned channels are our most valuable channels.”

Leveraging first-party data through owned channels allows brands to capture, convert and retain customers more efficiently so your brand can confidently tackle these challenges and set your business up for success in the years to come.

// 16 ❱ DMN.CA AUGUST 2023

AMINDINE SERVAIN is CMO of Wunderkind, an agency based in New York with offices in Montreal, Quebec.

MARKET RESEARCH

Wunderkind drives guaranteed revenue for brands, publishers, and advertisers.

Resource Directory // 17 Your Source For Premium Email & Phone Appending Grow & Enhance your Direct Mail Lists with: Data Appending Mailing Lists Email Appends: Grow your list by 40% Phone Appends: Boost telemarketing lists Free Match Test: See how many we can add Consumer & Business Records: U.S. & Canada NCOA Sales Leads 1-800-MELISSA MelissaDirect.com LIST SERVICES LIST SERVICES BETTER DATA FRom CANADA’S LEADER iN CoNTACT DATA SoLu TioNS Ask for a FREE EvALuATioN and pricing! 1-800-454-0223 sales@cleanlist.ca cleanlist.ca ) an interact direct company Date: July 4, 2013 Client: Cleanlist.ca Docket: 3540 Application: Print, 4x4.325", 4C AD: Carter AM: Sinclair Version: F6 Media: Direct Marketing Magazine PLEASE NOTE This file has been optimized for its intended application only. For uses other than intended please contact Seed for alternate formats. Data Cleaning • Address Correction • Mover Update • Deceased Identification Data Enhancement • Phone Append • Demographics Prospect Databases • ResponseCanada • Consumers, Movers and Businesses Custom Solutions CL_ResourceAd_4x4.325_v04.indd 1 DATA ANALYTICS CMY 10-1634-DCM-Resource Directory-OL.pdf 2 2023-05-03 9:06 AM DIRECT MARKETING To advertise in DM Magazine Resource Directory Contact: Steve Lloyd, steve@dmn.ca

Data Storytelling Powers Marketing Campaigns and Business Decisions

BY WILLIAM SKELLY

BY WILLIAM SKELLY

As organizations are getting smarter about measuring performance, from sales revenue and customer interactions to production metrics and costs, there’s more granular data than ever. By 2025, an estimated 181 zettabytes of data will be created, captured, copied and consumed worldwide, according to Statista.1

Most data scientists approach a long column of statistics and analytics with glee. For our colleagues and non-technical executives, their eyes will likely glaze over when faced with a glut of numbers and raw data.

Data can’t speak for itself. For that reason, marketers and organizational leaders are turning to data scientists or outsourcing data management services to uncover the business insights hidden in the spreadsheets and reports.

Two key areas where data consultants can support businesses who may be experiencing information overload, include:

Data Visualization

Business metrics and key performance indicators (KPIs)

come from all areas of the organization, such as sales, marketing, customer service, production facilities, warehouses, logistics, human resources and more. The amount of data is astronomical and often unmanageable.

The critical concern is how to interpret the information. What’s important and vital to understand to make business decisions?

Data visualization gives meaning to facts and stats. Using real-time dashboards, charts and graphs and interactive reports, the visual representations bring the data to life.

Advancements in data visualization tools organize raw information and clarify KPIs. The visual formats spotlight patterns and allow decision makers to connect the dots from root causes to outcomes.

Data visualization can be used to articulate performance, underscore trends, showcase relationships and understand the impact of current strategies. The charts and graphs bring greater value to reports, add context and enhance communication and collaboration.

Data Storytelling

Data storytelling goes a step beyond data visualization. Leveraging reports, dashboards, charts and graphs, data is conveyed as a narrative to inform highlevel decision making. Leading data consultants are harnessing AI to analyze structured and unstructured datasets to assist in data storytelling, creating narratives for guiding strategic planning.

Keeping the audience in mind, data storytelling supports proper context and empathy, with the ability to remove possible bias in the data. Rather than simply showing a decline in sales or a surge in customer service calls, data storytelling provides an interpretation to assist with action steps to resolve the issues.

Other ways data storytelling benefits organizations:

1. Clear and memorable –Data storytelling helps the audience understand complex information and remember the key points.

2. Accessible – Simplifying data makes the insights more easily understood by a larger audience, enhancing cooperation and

collaborations across teams.

3. Impactful – Presenting data in a clear, concise manner allows the audience to see the significance of the information and discover the implications for specific actions.

With data storytelling, business decisions can be finalized more quickly and efficiently. In addition, marketing campaigns can more closely align with buyer personas along the customer journey. From product launch and new business strategies to marketing plans and ad campaign management, data storytelling unravels complicated information to assist in reaching sales goals and organizational objectives.

WILLIAM SKELLY is founder and CEO of Causeway Solutions, a leading provider of Acquisition Analytics and innovative data services. Bill serves as advisor with some of the nation’s most influential organizations — from grassroots public affairs efforts to U.S. Presidential campaign strategies. Causeway Solutions empowers clients to make smart, timely, datadriven decisions through real-time consumer insights to better reach target audiences.

1 “Volume of data/information created, captured, copied, and consumed worldwide,” Statista

// 18 ❱ DMN.CA AUGUST 2023

ANALYTICS

ISTOCK/ METAMORWORKS

Harnessing data across your organization to be truly data-driven is not easy. Contact us to learn more about how our PRIZM™ segmentation system helps you connect our data to activation for campaigns that drive real results.

Changing Demographics

EA’s ground-breaking mobile movement and web behaviour databases not only help you keep track of the “clicks versus bricks”, but know which Canadians are driving these trends nationally

Attitudes, Mindsets, Social

Environmental concern, privacy, trust and social connectedness. Psychographic indicators have shifted and Canadians’ social circumstances have changed. It’s never been more important to look at these indicators and map them to different populations.

Finances

Comprehensive, updated financial metrics on Canadians. Understand who is most stretched to make ends meet, who is affected by property market conditions and who has money to donate to their favourite charities.

Media Activation

EA’s ever-growing network of over 50 activation partners includes adtech platforms, media agencies, publishers, broadcasters, list providers and distribution companies to ensure you can use our data for analysis and then reach your target audience.

Looking to achieve the results that data promises? Ask EA. For your free PRIZM consultation, contact us at: https://www.environicsanalytics.com/dm-mag

Print Radio Direct Linear & Connected TV SMS Email Social Media Out of Home Digital OOH Mobile Desktop

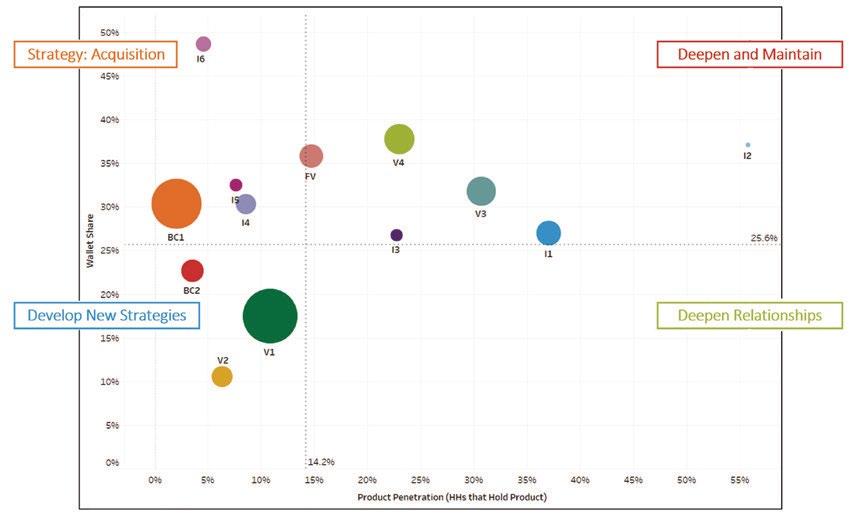

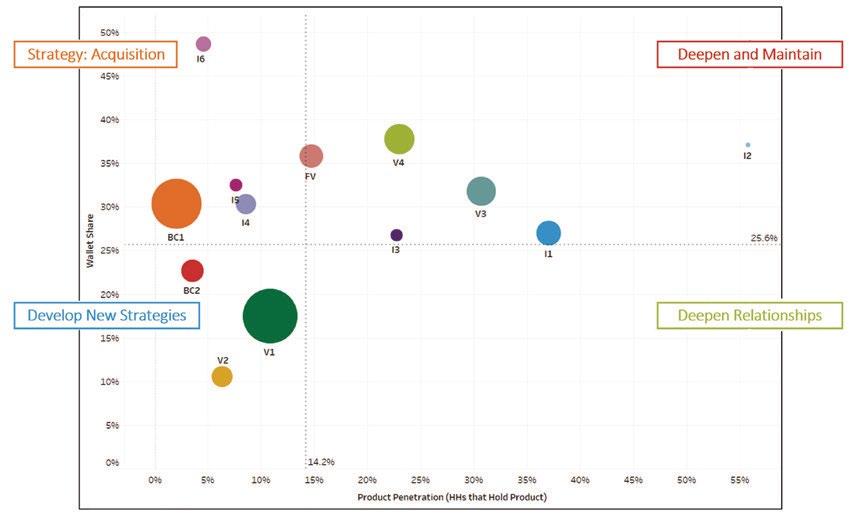

Deposits by Region: Penetration vs. Wallet Share Product Penetration (HHs that Hold Product) Wallet Share Deepen Relationships Deepen and Maintain Strategy: Acquisition Develop New Strategies

Vulnerability Index | Social Vulnerability 124 SOCIAL VULNERABILITY INDEX* 49.1% Index:188 Household Size -1 Person 11.7% Index:117 Unemployment Rate 91 Index Community Involvement 14.9% Index:197 Perceived mental health is fair or poor 51.5% Index:118 "You cannot be too careful in dealing with people" 24.6% Index:235 People know well enough to ask favour (none) 34.7% Index:156 Close relatives (0-2) 47.1% Index:110 Close relatives in same city (0-2) 33.4% Index:124 Close friends (0-2) 29.9% Index:107 Close friends in same city (0-2)

and locally as those behaviours change. Online & Offline Habits March 22 March 21 August 20 Ratio of Website Visitors to In-Store Visits January February March April May June July August September October November December January February March April May June July August September October November December January February March April May June July August September October November December January February March 2019 2020 2021 2022 0.0 1.0 2.0 3.0 4.0 5.0 6.0 1.9 1.0 2.0 4.7 Retailer B Retailer A With an aging population, increased immigration, relocation and changing commuter habits, our suite of demographic products help you stay on top of the changes – nationally, by neighbourhood, and everywhere in between.

Dominant Country of Origin China, People’s Republic of India Nigeria Toronto CSD by Dissemination Area

Being data-driven is complicated. We can help.

BY AMANDINE SERVAIN

BY AMANDINE SERVAIN

BY WILLIAM SKELLY

BY WILLIAM SKELLY