vscpa news

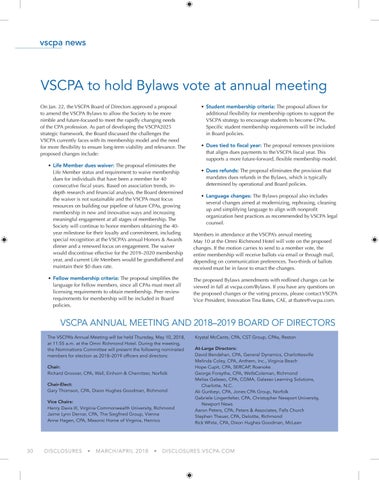

VSCPA to hold Bylaws vote at annual meeting On Jan. 22, the VSCPA Board of Directors approved a proposal to amend the VSCPA Bylaws to allow the Society to be more nimble and future-focused to meet the rapidly changing needs of the CPA profession. As part of developing the VSCPA2025 strategic framework, the Board discussed the challenges the VSCPA currently faces with its membership model and the need for more flexibility to ensure long-term viability and relevance. The proposed changes include: • Life Member dues waiver: The proposal eliminates the Life Member status and requirement to waive membership dues for individuals that have been a member for 40 consecutive fiscal years. Based on association trends, indepth research and financial analysis, the Board determined the waiver is not sustainable and the VSCPA must focus resources on building our pipeline of future CPAs, growing membership in new and innovative ways and increasing meaningful engagement at all stages of membership. The Society will continue to honor members obtaining the 40year milestone for their loyalty and commitment, including special recognition at the VSCPA’s annual Honors & Awards dinner and a renewed focus on engagement. The waiver would discontinue effective for the 2019–2020 membership year, and current Life Members would be grandfathered and maintain their $0 dues rate. • Fellow membership criteria: The proposal simplifies the language for Fellow members, since all CPAs must meet all licensing requirements to obtain membership. Peer review requirements for membership will be included in Board policies.

• Student membership criteria: The proposal allows for additional flexibility for membership options to support the VSCPA strategy to encourage students to become CPAs. Specific student membership requirements will be included in Board policies. • Dues tied to fiscal year: The proposal removes provisions that aligns dues payments to the VSCPA fiscal year. This supports a more future-forward, flexible membership model. • Dues refunds: The proposal eliminates the provision that mandates dues refunds in the Bylaws, which is typically determined by operational and Board policies. • Language changes: The Bylaws proposal also includes several changes aimed at modernizing, rephrasing, cleaning up and simplifying language to align with nonprofit organization best practices as recommended by VSCPA legal counsel. Members in attendance at the VSCPA’s annual meeting May 10 at the Omni Richmond Hotel will vote on the proposed changes. If the motion carries to send to a member vote, the entire membership will receive ballots via email or through mail, depending on communication preferences. Two-thirds of ballots received must be in favor to enact the changes. The proposed Bylaws amendments with redlined changes can be viewed in full at vscpa.com/Bylaws. If you have any questions on the proposed changes or the voting process, please contact VSCPA Vice President, Innovation Tina Bates, CAE, at tbates@vscpa.com.

VSCPA ANNUAL MEETING AND 2018–2019 BOARD OF DIRECTORS The VSCPA’s Annual Meeting will be held Thursday, May 10, 2018, at 11:55 a.m. at the Omni Richmond Hotel. During the meeting, the Nominations Committee will present the following nominated members for election as 2018–2019 officers and directors: Chair: Richard Groover, CPA, Wall, Einhorn & Chernitzer, Norfolk Chair-Elect: Gary Thomson, CPA, Dixon Hughes Goodman, Richmond Vice Chairs: Henry Davis III, Virginia Commonwealth University, Richmond Jaime Lynn Dernar, CPA, The Siegfried Group, Vienna Anne Hagen, CPA, Masonic Home of Virginia, Henrico

30

DISCLOSURES

•

MARCH/APRIL 2018

•

Krystal McCants, CPA, CST Group, CPAs, Reston At-Large Directors: David Bendahan, CPA, General Dynamics, Charlottesville Melinda Coley, CPA, Anthem, Inc., Virginia Beach Hope Cupit, CPA, SERCAP, Roanoke George Forsythe, CPA, WellsColeman, Richmond Melisa Galasso, CPA, CGMA, Galasso Learning Solutions, Charlotte, N.C. Ali Gunbeyi, CPA, Jones CPA Group, Norfolk Gabriele Lingenfelter, CPA, Christopher Newport University, Newport News Aaron Peters, CPA, Peters & Associates, Falls Church Stephen Theuer, CPA, Deloitte, Richmond Rick White, CPA, Dixon Hughes Goodman, McLean

DISCLOSURES.VSCPA.COM