March 2021

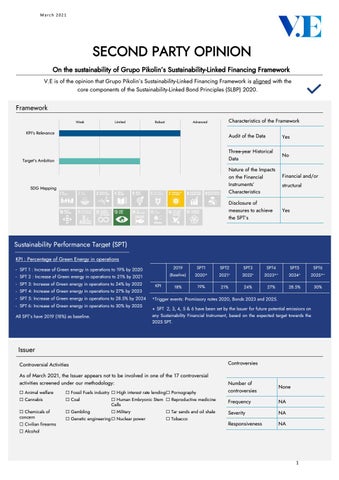

SECOND PARTY OPINION On the sustainability of Grupo Pikolin’s Sustainability-Linked Financing Framework V.E is of the opinion that Grupo Pikolin’s Sustainability-Linked Financing Framework is aligned with the core components of the Sustainability-Linked Bond Principles (SLBP) 2020.

Framework Weak

Limited

Robust

Characteristics of the Framework

Advanced

KPI's Relevance

Target's Ambition

Audit of the Data

Yes

Three-year Historical Data

No

Nature of the Impacts on the Financial Instruments’ Characteristics

SDG Mapping

Financial and/or structural

Disclosure of measures to achieve the SPT’s

Yes

Sustainability Performance Target (SPT) KPI : Percentage of Green Energy in operations - SPT 1 : Increase of Green energy in operations to 19% by 2020 - SPT 2 : Increase of Green energy in operations to 21% by 2021 - SPT 3: Increase of Green energy in operations to 24% by 2022 - SPT 4: Increase of Green energy in operations to 27% by 2023 - SPT 5: Increase of Green energy in operations to 28.5% by 2024 - SPT 6: Increase of Green energy in operations to 30% by 2025 All SPT’s have 2019 (18%) as baseline.

KPI

2019

SPT1

SPT2

SPT3

SPT4

(Baseline)

2020*

2021

2022

18%

19%

21%

24%

+

+

SPT5

SPT6

2023*

2024

2025*+

27%

28.5%

+

*Trigger events: Promissory notes 2020, Bonds 2023 and 2025.

+ SPT 2, 3, 4, 5 & 6 have been set by the Issuer for future potential emissions on any Sustainability Financial Instrument, based on the expected target towards the 2025 SPT.

Issuer Controversies

Controversial Activities As of March 2021, the Issuer appears not to be involved in one of the 17 controversial activities screened under our methodology:

Number of controversies

None

☐ Animal welfare

☐ Fossil Fuels industry ☐ High interest rate lending ☐ Pornography

☐ Cannabis

☐ Coal

☐ Human Embryonic Stem ☐ Reproductive medicine Cells

Frequency

NA

☐ Chemicals of concern

☐ Gambling

☐ Military

Severity

NA

Responsiveness

NA

☐ Civilian firearms

☐ Genetic engineering ☐ Nuclear power

+

☐ Tar sands and oil shale ☐ Tobacco

☐ Alcohol

1

30%