PKW KAIMAHI ANNUAL HUI

$115M INVESTMENT PARTNERSHIP ANNOUNCED

& SURVEYING THE WATERWAYS

MĀORI ARTFORM PROVIDES ANSWERS

31 Whiringa-A-Nuku 2019 issue -

HE

HE

27

TANGATA

2019 COMMITTEE OF MANAGEMENT ELECTIONS Mark the date in your diary 10 GENERATING OPPORTUNITY Wind farm latest addition to portfolio

FARMS EMISSION LEVY PROPOSED Scheme a bid to reduce greenhouse gasses

HE

5

12

WHENUA

WĀHI TAPU PROJECT LAUNCHED Identifying sites of significance

PKW KAIMAHI ANNUAL HUI Conference marks start of farming season

NEW LOOK FOR PKW FARMS TEAM Restructure brings new roles

16

17

19

ORANGA

event

CREATING PATHWAYS TO THE FUTURE PKW sponsor rangatahi tech

SOUTH

PKW

29 CEREMONY RECOGNISES

TARANAKI YOUTH

sponsor awards

Intern and cadetship opportunities 10 17 27

31 LEARNING ON THE JOB

CONTENTS

NGĀ PANUI

Proxies Closure Date 10am Thursday, 7 November 2019 (Proxy Form in supplementary AGM Information Booklet)

PKW AGM Saturday, 9 November 2019 9am at Pariroa Marae, Pātea (full details on page 4)

Order 2019 Annual Report (full details on page 5)

PKW Tertiary Grants 2020

Opens 10 December 2019 (full details on page 33)

COVER Bonita Bigham (Ngāruahine, Te Atiawa), recipient of the 2019 Charles Bailey Scholarship.

| 1 8 $115M INVESTMENT PARTNERSHIP ANNOUNCED PKW expands property portfolio 13 SURVEYING THE WATERWAYS First awa monitoring project begins 22 MĀORI ARTFORM PROVIDES ANSWERS Bonita Bingham discovers a blood legacy FEATURES 22 13

PARININIHI KI WAITOTARA

Postal PO Box 241

New Plymouth 4340

Physical 35 Leach Street

New Plymouth 4310

Tel +64 (6) 769 9373

Fax +64 (6) 757 4206

Email office@pkw.co.nz

www.pkw.co.nz

EDITORIAL

Tēnā

koutou katoa

There is a sense of Spring in the air with daylight savings imminent, temperatures warming up and calving season upon us.

That sense of new beginnings is here in the PKW Whare too, with the announcement of two new investment partnerships and the first environmental monitoring data being collected.

The first partnership agreement, Tai Hekenga, brings together Taranaki iwi to invest in land beneath nine Crown-owned properties in Wellington. This collaboration of Taranaki Māori to enable us all to take advantage of an opportunity is something we as an organisation are continually working towards, so the announcement is very gratifying. Read more about this low-risk, high-return investment on page 8.

Waipipi Wind Farm is an exciting foray into the renewable energy sector for PKW. The turbines are to be built on land purchased generations ago by a future-focused, forward-thinking Committee of Management. The partnership is also new ground for us as we have worked with private landowners to secure the deal. Get the full story on page 10.

Our Kaitiakitianga Strategy has provided us with an operational framework to put into action the responsibilities we hold as guardians of the whenua. The framework includes an environmental monitoring programme so we can know how healthy our awa are, what we can do to improve water quality and the presence of flora and fauna. This is not just an environmental commitment but a cultural one too, and it is great to read about the first field surveys taking place. Find out more on page 13.

Don’t forget to mark Saturday 9 November in your calendars so you don’t miss our AGM – I look forward to meeting you there.

Noho ora mai

Nā, Warwick Tauwhare-George Chief Executive Officer

iSTUDIOS MULTIMEDIA

Postal PO Box 8383

New Plymouth 4340

Physical 77B Devon Street East New Plymouth 4310

Tel +64 (6) 758 1863

Email info@istudios.co.nz

www.istudios.co.nz

WHENUA MAGAZINE

Editor Warwick Tauwhare-George

Deputy Editor Polly Catlin-Maybury

Creative Direction Sheree Anaru

Photography Quentin Bedwell

Graphic Design Dave Pope, Duane Luke

CONTRIBUTORS

Polly Catlin-Maybury

Renee Kiriona-Ritete

Virginia Winder

“Our Kaitiakitianga Strategy has provided us with an operational framework to put into action the responsibilities we hold as guardians of the whenua.”

2 |

My whenua connects me to my past, present and future

It’s not about money. It’s something within that draws me to it. The desire to uphold the respect for our land that our ancestors held, and their values.

We look after nearly 100,000 hectares of Māori land on behalf of over 97,000 owners. But we only have 60% of the contact details that we need for owners. This means that over 30,000 owners are losing a connection to their whenua. We need your help to locate owners so we can invite them to hui, pay them any funds we hold for them, and understand their aspirations for the whenua.

Who is Te Tumu Paeroa

We support Māori land owners to protect and enhance their land – for now and generations to come.

What to do next

Maintain your connection. If you or your whānau have new contact details, please let us know.

0800 WHENUA tetumupaeroa.co.nz

It’s important to keep my ties with the land and in touch with my heritage.

PARININIHI KI WAITOTARA INCORPORATION

ANNUAL GENERAL MEETING

NOTICE IS HEREBY GIVEN THAT the Annual General Meeting of Shareholders will be held at Pariroa Marae, 98 Pariroa Rd, Pātea 4598 on Saturday, 9 November 2019.

9.00am Pōwhiri and registrations

10.00am Meeting commences

BUSINESS:

• Apologies

• Confirmation of Minutes of 2018 Annual General Meeting

• Annual Report and Financial Statements to 30 June 2019

• Approval of Dividend

• Appointment of Auditor

• Appointment of Share Valuer

• General Business

PARININIHI KI WAITOTARA TRUST

ANNUAL GENERAL MEETING

NOTICE IS HEREBY GIVEN THAT the Annual General Meeting of Beneficiaries will be held immediately following the Annual General Meeting of the PKW Incorporation.

BUSINESS:

• Confirmation of Minutes of 2018 Annual General Meeting

• Annual Report and Financial Statements to 30 June 2019

• Appointment of Auditor

• Election of Shareholder Representative for PKW Trust

• General Business

PKW SHAREHOLDER FARM TOUR

Warwick Tauwhare-George SECRETARY

A bus tour of a nearby PKW farm is being organised following the Annual General Meeting. Those shareholders wishing to visit the farm need to book a seat by contacting Aimee at the PKW office by 1 November 2019. The tour is dependent on bookings.

E office@pkw.co.nz

4 | HE TANGATA

P 06 769 9373

2019 Parininihi ki Waitotara Election

Candidate Profiles for the Committee of Management

The Committee of Management are elected by Shareholders and are responsible for setting the strategic direction for the Incorporation. They are also responsible for monitoring performance against the strategy.

In the last issue of Whenua, the annual notice calling for nominations

DON’T MISS OUT!

In order to receive updates and information about PKW, and any dividend payments you may be entitled to, we need to ensure your contact details are up to date.

ORDER YOUR 2019REPORTANNUAL NOW!

What's in the Annual Report?

The report explains how the PKW Incorporation and the PKW Trust performed from 1 July, 2018 to 30 June, 2019. Reports from both Chairs and the CEO along with audited statements are also included. We also discuss key strategic developments and provide

to the PKW Committee of Management was issued.

When nominations closed on Saturday, 31 August 2019, we had two applications for the one vacancy. The following pages contain the profiles for each candidate and are provided for your consideration.

Voting papers will be sent to you by Electionz.com Ltd, the Independent Returning Officer. Voting closes at 5:00pm on Friday, 8 November 2019.

If you have recently moved, or changed your contact number, email or bank account, let us know by going to pkw.co.nz/contact and sending us any new details.

Alternatively, contact Aimee Morrell at the PKW whare on 06 769 9373 or reception@pkw.co.nz

A reminder that shareholders who would like a hard copy of the 2019 Annual Report must now order a copy by contacting PKW.

information on those who received a scholarship or grant from the PKW Trust.

What makes this report exciting and uniquely Taranaki is that it includes many photos of whānau, mokopuna and events during this period.

The Annual Report is a snapshot of PKW, Shareholders and

Taranaki community in a single document.

copy

The Annual Report can be viewed online from 11 October, 2019 onwards at pkw.co.nz

the

To

Phone: 06 769 9373 or Email: reception@pkw.co.nz

order your

please contact Aimee Morrell on:

HE TANGATA | 5

COMMITTEE OF MANAGEMENT CANDIDATE PROFILE

Ko Taranaki te maunga

Ko Aotea me Kurahaupō ngā waka

Ko Taranaki, Ngāruahine, Tāngahoe, Pakakohi

me Ngāti Ruanui ōku iwi

Ko Ray rāua ko Rauna Edwards ōku mātua.

Will Edwards

Nominated by Raymond William Edwards

Tēnā rā koutou katoa.

I was born and raised in Taranaki where my wife and I have run our Māori development consultancy, Taumata Associates, since 2008. With the support of my whānau, including my sister Hinerangi who is retiring from the PKW Board this year, I offer you my skills, experience, and commitment to serve on the PKW Committee of Management.

I have degrees in horticulture and Māori language, and a PhD about Māori positive ageing. My board roles include the iwi board Te Korowai o Ngāruahine, Te Reo o Taranaki, Tuiora (Māori health and social services provider) and Taranaki Futures. So besides growing up milking cows, I have a technical appreciation of land management and diversification and

understand our Taranaki history and aspirations.

If elected to serve you, I will be guided by PKW’s vision ‘He Tangata, He Whenua, He Oranga: Sustaining and Growing our People through Prosperity’.

He Tangata

PKW must return benefits to its people, in Taranaki and beyond, in dividends and social and cultural returns. Taranaki Māori can lead development in the post-settlement environment in our region. PKW is working with iwi in deals like the Novotel purchase, this type of work should continue.

He Whenua

Increased concern about environmental impact and climate

change highlights the value of PKW’s new Kaitiakitanga Strategy, that reduces heavy reliance on dairying and safeguards our whenua. There is also scope to use new technologies to improve returns and health of the whenua.

He Oranga

PKW must be profitable to sustain and grow people. I see many opportunities to leverage off PKW’s business diversification and networks to build better lives for PKW whānau through work, training and enterprise.

I stand for prosperity through strong business results, as a Māori owned entity, that directly benefits PKW whānau.

6 | HE TANGATA

COMMITTEE OF MANAGEMENT CANDIDATE PROFILE

Ko Taranaki te maunga

Ko Aotea te waka

Ko Waingongoro te awa

Ko Ngaruahine ko Ngati Ruanui nga Iwi

Ko Aotearoa, ko Wharepuni nga Marae

Jayde Rangi Wilkinson

Nominated by William Fox Rangi

Tena koutou katoa.

My name is Jayde Rangi Wilkinson, born Jayde Tamatea Rangi of Hawera in 1977, I am 42 years old.

I am the Son of Thomas Tamatea Rangi, nephew of William Rangi. Grandchild of Amiria (Milly) and Ben Rangi. I am the Great grandchild of Piko and Dorris Tu Potohaka Rangi, Toto Wananga and Hareata Matoe.

I am extremely excited to be applying for a position on your board. My motivation and direct drive for this position come from deep inside me enabling me to help giving back to my Iwi and homeland.

I am married to Chloe Wilkinson and have one son William Tamatea Rangi Wilkinson. I have two university qualifications with a bachelor’s in

Resource and Environmental Planning from Massey University and a Finance diploma from Portsmouth University in the United Kingdom.

I am now able to offer professional experience and guidance through my operational, logistical, Procurement and financial Senior Leadership Background.

I have investigated the core values, Vision and Mission of PKW and I feel that I am more aligned than ever before to deliver the word of the company.

Health and safety, Operational Systemisation, Skill training and development, Succession training, Investment and risk strategy are my core strengths.

I am currently employed in the South Island where I am the South Island

Commercial Manager for ORIX Japanese finance company. I have also held senior operations positions on the Senior Leadership Teams for Interislander/Kiwirail and as the South Island Manager for Hill Laboratories. Overseas I was Senior Business Analyst for Menzies Aviation and Operations Manager at one of the world’s largest airports in the United Kingdom, London’s Gatwick & Heathrow Airport’s.

My ambitions are to transfer my trained skillset learned from senior management positions that I have held from around the world.

HE TANGATA | 7

$115M INVESTMENT PARTNERSHIP ANNOUNCED

A new partnership agreement between Taranaki iwi has given PKW the opportunity to co-invest in an exciting property portfolio in central Wellington.

PETONE CentrePort Wellington Parliament Buildings Beehive Wellington District Court Wellington High Court 2 2 LOWER HUTT HUTT VALLEY HIGH SCHOOL CentrePort Wellington Parliament Buildings Beehive Wellington Girls’ College Wellington District Court Wellington High Court National Library National Archives 2 Westpac Stadium

Wellington Lake Ferry Petone Porirua Wainuiomata Lower Hutt Upper Hutt 8 | HE TANGATA

The investment in the land beneath the nine Crown-owned properties, some of which are high-profile buildings, will be in the vicinity of $115m once all the acquisitions are completed.

Settlement on four properties, Hutt Valley High School, Northland Primary School, Wellington Girls’ College and Te Aro Primary School for $50.35m was completed in early September.

The Tai-Hekenga Limited Partnership (Tai-Hekenga) has been four years in the making after PKW signed a Memorandum of Understanding (MOU) in 2015.

“This investment opportunity is another example of the mahi that has been going on behind the scenes to put our diversification strategy into action,” says Joe Hanita, PKW Chief Financial Officer. “It also shows the leverage Taranaki Māori can generate to take advantage of opportunities that become available by working together.”

Tai-Hekenga has been formed by Te Kāhui Maru Limited Partnership, Te Kīwai Maui o Ngāruahine Limited, Taranaki Iwi Holdings Limited Partnership, Te Atiawa Iwi Holdings Limited Partnership, Te Pou Herenga Pakihi Limited Partnership, Ngāti Mutunga o Wharekauri Asset Holding Company, Ngāti Ruanui Holdings Corporation Limited, Te Pataka o Rauru Limited and PKW with Taranaki Whānui Limited (TWL), the commercial subsidiary of the Port Nicholson Block Settlement Trust (PNBST).

The partnership began when PNBST were offered the chance to acquire the land from the Crown as part of its settlement agreement, but did not have the necessary capital to follow it through on their own.

“This opportunity has brought together a group of Māori investors with members or shareholders who whakapapa back to Taranaki to be part of a low-risk investment that will bring an excellent rate of return with minimal on-going costs,” says Joe. “Built on a foundation of whanaungatanga and kotahitanga, we are looking forward to the partnership going from strength to strength as we work together to deliver sustainable benefits for our Taranaki whānau.”

The properties will deliver a competitive rental income stream from a low-risk, long-term tenant (the Crown), along with an increase in equity as land values continue to rise.

PKW have committed $4.5m to the partnership, which represents around 2% of the $315m asset base it has under its stewardship.

“This investment aligns with our strategic approach of ensuring we have a balanced and diversified investment portfolio,” says Joe. “In essence, we are ensuring that we own a slice of lots of pies in order to spread investment risk and ensure long-term and sustainable returns for our shareholders.”

“We are continuing to build relationships and work in partnership with others to create opportunities that follow our diversification

kaupapa to ensure we achieve our strategic goals.”

It is expected that the acquisition of the remaining five properties offered by the Crown, namely Archives NZ, National Library, Thorndon Primary school, Wellington District Court and Wellington High Court, will be confirmed by the end of the calendar year.

Cape Palliser

HE TANGATA | 9

“It also shows the leverage Taranaki Māori can generate to take advantage of opportunities that become available by working together.”

Joe Hanita

GENERATING OPPORTUNITY

PKW’s diversification strategy is gaining considerable momentum with the announcement of a wind farm to be built on Incorporation land.

Waipipi Wind Farm will see 31 turbines erected on a 980-hectare site on the Taranaki coast around eight kilometres south-west of the Waverley township.

The project led by Tilt Renewables, who will be responsible for the construction and operation of the renewable energy site, is being supported by five landowners - four private and PKW itself.

“This is a very exciting partnership

for us as it is our first foray into the energy generation sector,” says Joe Hanita, PKW’s Chief Financial Officer. “Strategically, it ticks a great many boxes for us as it represents an alternative, environmentallysustainable use for our ancestral lands that will give us a solid return for minimal outlay for generations to come.”

The agreement ensures PKW a percentage of the revenue generated

by the turbines located on its whenua for the next 50 years. Once the construction period has been completed, the footprint on the farm is relatively small and the land will still be able to be used for grazing, providing a double-income stream for the Incorporation.

“The land currently is not particularly productive as it was mined for iron sand and pasture growth is suboptimal so the wind farm is a real win-

10 | HE TANGATA

win,” says Joe. “This partnership is a very good example of how creating scale creates opportunity and we are delighted that, after nine years in the making, we have reached such a positive outcome.”

The farm will see thirty-one 130-metrehigh turbines on top of 95-metre towers built and connected to a 11 kilometre 110 kiloVolt overhead transmission line to feed the generated electricity into the national grid. Construction is set to begin in October once an upgrade of the site access roads has been completed. It will generate 455 gigawatt hours (GWh) each year, which is enough to power 65,000 homes.

During the planning and approval phase of the project, several

transmission line routes were investigated, with Tilt Renewables undertaking extensive consultation with local iwi, landowners and communities who may be impacted. Environmental and safety considerations were also a priority before the final route and design of the transmission line, which will take 12 months to build, was granted resource consent in 2017.

Tilt Renewables operates renewable energy generation assets across Australia and New Zealand which includes 322 turbines across seven wind farms. They own and operate New Zealand’s largest wind farm, the Tararua Wind Farm in Palmerston North, and the Mahinerangi Wind Farm in Otago.

A Community Consultative Group has been established to facilitate information flow between the community and Tilt Renewables during the construction phase so any issues can be addressed and resolved. A community fund and benefit programme will be set up once the farm begins operating.

“Tilt Renewables asked local iwi Ngaa Rauru Kiitahi to gift a name for the farm which has in turn reconnected the PKW whenua to an identity,” says Joe. “This partnership is bringing so much benefit in so many different areas and PKW is proud to be part of it.”

HE TANGATA | 11

FARM EMISSIONS LEVY PROPOSED

A farm-level levy/rebate scheme that puts a price on emissions has been proposed to the Government as the best way to reduce agricultural methane and nitrous oxide emissions.

The scheme would see dairy farmers paying on average 1 cent per kilogram of milk solids ($ .01/kg MS) in the initial stages, according to the report from the Interim Climate Change Committee (ICCC), impacting the bottom line for all agribusiness, including PKW. But the incorporation is welcoming the recommendation, says Mitchell Ritai, General Manager Shareholder Engagement, as part of its commitment to manage climate change in the Kaitiakitanga Strategy.

“We take our role as kaitiaki of our whenua very seriously and believe that many other farmers do as well” says Mitchell. “While there seems to be a general agreement on the outcome, knowing how it will be achieved will require further debate and discussion with all who will be impacted.”

The ICCC was asked by the Government to find a solution to the issue of agricultural greenhouse emissions (mainly methane and nitrous oxide), which make up around 48% of New Zealand’s total reported greenhouse gas emissions. Reducing greenhouse gases is seen as crucial to achieve the targets set by the Paris Agreement in 2015 to limit global warming to well below 2 degrees above pre-industrial levels. Globally, the world is not on track to achieve this target.

The ICCC has recommended a 5 year period to implement the scheme while also introducing an interim step where emissions will be priced through the

Emissions Trading Scheme (ETS) at processor level by 2020. It is anticipated that a phased-in approach will provide time for farmers to collect and measure the required data to report on their annual emissions. The levy/rebate scheme has been mooted as a simple way of including agriculture in the existing ETS without having to trade units, and farmers will initially receive a 95% free allocation. This will help minimize any social impact from increased costs as well as incentivise farmers to reduce levy costs through reducing on-farm emissions.

While compiling the report, and its recommendation, the ICCC highlighted that any policy must fulfill Te Tiriti o Waitangi principle of partnership and good faith with iwi and hapū and recognise the unique characteristics of Māori land.

The ICCC also recommended that any board or committee established to manage the funds generated by a pricing policy, estimated at between $47 and $95 million per year over the first decade, includes representatives from the agriculture sector and iwi/Māori landowners to ensure effective co-governance.

“It is proposed that the money raised by a pricing policy is put into an Agricultural Emissions Fund for recycling back into programmes that will directly help farmers to transition to farm-level pricing in 2025. A portion of the fund will be used to enable owners of Māori land to equitably engage in this process and access opportunities,” says Mitchell. “While we welcome the Government’s plans, we also acknowledge that there are still some areas that need further attention; we are looking forward to the Government’s response from the consultation round.”

12 | HE TANGATA

SURVEYING THE WATERWAYS

Waterway monitoring surveys have been carried out to give PKW owners a snapshot of the environmental well-being of the awa flowing across their whenua.

HE WHENUA | 13

This is the first water monitoring project to be developed as part of the implementation of the Kaitiakitanga Strategy, with annual surveys planned to take place each year.

“It was great to see this strategic approach to our role as kaitiaki of the land being put into action,” says Mitchell Ritai, General Manager Shareholder Engagement. “Our commitment to enhancing the environmental ecology on our farms has been shown through the extensive fencing and riparian planting work already carried out plus the installation of some major effluent-management systems.

“The results of this survey will help us to see how effective our efforts have been and what more we need to do to ensure the mauri of the waterways is strong and healthy.”

The monitoring work is being carried out across 18 of PKW’s farms with the first three survey sites at Opua Road, Skeet Road and Little Oeo Road.

Surveys will be carried out at these specific points four times this year, so

any changes in water quality can be captured and assessed.

The project work is being carried out by Emily Bailey and her team from Te Whenua Tōmuri Trust, an organisation that helps inspire and empower people to protect their communities and natural environment through sustainable practices.

“Working with Māori people on Māori land to ensure its well-being for the future is something that we are very honoured to be a part of,” she says. “As a Trust, we are excited to be working with PKW on this project.”

The ecological status of the waterways is being measured using a Stream Health Monitoring and Assessment Kit (SHMAK) developed by the National Institute of Water and Atmospheric Research (NIWA) in collaboration with tangata whenua, farmers and universities. The kit employs scientifically sound methods to gauge stream health through the measurement of water quality, its physical features and the presence and vitality of plants and fish living there.

“This first lot of surveys will provide a baseline of data that subsequent surveys will be compared to so changes – good or bad – can be measured,” says Emily. “The results of those comparisons will enable identification of any areas that need attention and the development of focused, effective programmes to address any issues.”

As well as scientific monitoring, PKW will develop a Cultural Health Index tool that utilises mātauranga Māori to assess a waterway along with its flora and fauna.

14 | HE WHENUA

“The results of this survey will help us to see how effective our efforts have been and what more we need to do to ensure the mauri of the waterways is strong and healthy.”

Mitchell Ritai

Emily Bailey measures temperature in the waterway (above left) and Mitchell Ritai carries out a PH test (above right).

“This tool will be developed inhouse and designed to capture the mātauranga Māori indicators that tell us if a stream is healthy or not, or if a certain plant is flourishing, or that a certain fish population is a stable one,“ says Mitchell.

Initial results of the survey, which includes measurements of water flow rates, pH levels and temperature, suggest that the three test sites are in moderate good health. The next monitoring activity at these three sites

will take place in February and will also seek to assess what species of fish are present and in what quantities.

“Shareholders will be informed of the results of these surveys with regular updates in Whenua,” says Mitchell.

“This project will not only provide us with information about our awa and whenua but will also be a way of establishing and strengthening the connection our people have with the whenua.”

“Working with Māori people on Māori land to ensure its well-being for the future is something that we are very honoured to be a part of.”

HE WHENUA | 15

Emily Bailey

Water conductivity test used to determine water enrichment levels (below left). Identifying macroinverterbrates which is a measure of stream bed life (below right).

WĀHI TAPU PROJECT LAUNCHED

The two-year project will intially identify wāhi tapu on the 3800 hectares of land that the Incorporation manages.

“It is important that we start with the land that we are working on right now, so any sites identified can be given immediate attention. After that is done, we will then move onto the rest of the lands that are currently being leased,” says Mitchell Ritai, PKW General Manager Shareholder Engagement. “Our farmers want to know whether there are wāhi tapu on the land they work on, and if there are, how they can ensure those spaces are cared for.”

The project aligns with the values and aspirations outlined in the Kaitiakitanga Strategy, which puts special focus on environmental matters important to PKW shareholders such as water, flora and fauna and wāhi tapu.

Kōrero with kaumātua to gather historical and oral knowledge about wāhi tapu is an important part of the work which is being carried out. Two previous PKW Trust scholarship recipients are involved in the project.

Rere-No-A-Rangi Pope of Ngāruahine, who completed his Masters Degree in Software Development, has been brought on board to assist with the research element of the project. Aaria Dobson-Waitere of Ngaa Rauru who is the 2016 Charles Bailey scholar and has a Masters Degree in Conservation Science, will be assisting with the GIS mapping element of the project.

“We’re really excited to have both Rere-No-A-Rangi and Aaria on board. They whakapapa to Taranaki, they are smart, they are young and they are passionate about helping their people and the whenua,” says Mitchell.

“Once we have identified the sites, and captured the stories about them from our kaumātua, we will have to visually present the findings, so mapping is going to be a significant part of the project.”

Mitchell says the recent shareholder survey found that many wanted to reconnect with the whenua through visiting wāhi tapu and learning about the history of those sites.

“Walking on the whenua and learning the history of the wāhi tapu is a meaningful way for our whānau to connect to the land, so this project will not only help us identify those sites but also facilitate discussions on the best way to protect these sites of significance,” he added.

16 | HE WHENUA

Reconnecting Taranaki Māori with their whenua is the driving force behind a project to identify wāhi tapu sites on PKW farms.

PKW KAIMAHI ANNUAL HUI

The annual PKW Farms conference brings kaimahi, contract milkers and sharemilkers from across the rohe to celebrate the past year and look forward to the one to come.

<< HE WHENUA | 17

The hui also provides the opportunity to share experiences and ideas, recognise excellence and make sure all staff are up to date with Incorporation strategy and governance decisions.

“The farming calendar is a busy one throughout the year and so the annual conference is a chance for us to pause, reflect and acknowledge the ups and downs of the past season,” says Shane Miles, General Manager Ahuwhenua. “It’s also a chance for people to reconnect with each other.”

Philip Luscombe and Claire Nicholson, members of the PKW Farms Board, spoke about the strategic goal of being a ‘best in class’ Taranaki dairy farming business.

“It was great to have Philip and Claire at the conference so people could talk face to face with them about the future and where the business wants to go,” says Shane.

An integral part of how PKW is measuring its progress as a business is the Kaupapa Evaluation Tool (KET) and there was an opportunity to discuss with Joe Hanita, PKW Chief Financial Officer, how it worked.

“The great thing about KET is that it captures everything going on in the business so our kaimahi can see

clearly that what they do each day has an influence on what happens at group level, “ says Shane.

A benchmarking exercise carried out by independent consultants BakerAg was also discussed, with the initial report suggesting that PKW farms are performing well.

“This positive feedback is indicative of the mahi that has been going on during previous years to get us to where we are now,” says Shane.

Fred McLay, Director of Resource Management at the TRC, also spoke, along with Soraya Ruakere-Forbes and Hoani Eriwata from Te Whenua Tōmuri Trust, who have just begun the awa monitoring project.

A new element to the conference, dubbed the Innovative Think-Tank, hopes to bring the considerable knowledge and experience the Farms team has together to forge new initiatives and share ideas.

“It was a great way of getting those conversations going and sparking

Shane Miles

off each other to find solutions for problems or new ways of doing things,” says Shane.

The 2019 PKW Farms Awards also took place (see side box for the winners), a way of recognising excellence inside the Farms team.

The annual PKW Farms awards are designed to recognise greatness and celebrate achievement.

Congratulations to:

Health & Safety

David (Boof) Wilson

Excellence In Reporting

Matt & Sarah Brittain

Special Achievement (Drystock)

Jon Smyth

Newcomer Award

Nigel Bright

Special Achievement (Dairy)

Lance & Mel Graves

18 | HE WHENUA

Left to right: Award-winners David (Boof) Wilson, Matt Brittain, Jon Smyth, Nigel Bright. (Lance and Mel Graves not present).

“The great thing about KET is that it captures everything going on in the business so our kaimahi can see clearly that what they do each day has an influence on what happens at group level.”

NEW LOOK FOR PKW FARMS TEAM

Changes are on the horizon for the Parininihi ki Waitotara farming team, with a shift in how it is structured.

PKW General Manager Ahuwhenua, Shane Miles, says some of the roles in the team have been reassigned, to provide for increased support of its people and to deliver on health and safety, kaitiakitanga, and animal welfare aspirations.

HE WHENUA | 19 <<

“Making progress in these areas requires more office and administrative support for our people, especially the two business managers, who need to be out on our whenua to be able to talk and engage with our kaimahi,” says Shane.

The business managers are responsible for visiting all 25 farms in the PKW portfolio regularly as the organisation strives to deliver on its farming aspirations.

“At times, there is limited capacity for our business managers to spend time back in the office, and this is where the other two positions – business support manager and farming administrator – come in,” says Shane. “These latter two roles also provide a level of support to our on-farm kaimahi and farming partners involved in the wider farms business.”

“Our business is not just about cows and grass. There are many elements to running a successful agri-business, and ensuring we support our people is just one of them.”

The two new business managers are Roger Landers, who has been with PKW Farms for five years and previously held the Operations Manager role and James Lawn, who has just started work for PKW.

“James was an active farmer in Taranaki before he started here so he knows the realities of working a farm and he knows how important it is that

we make progress on our kaitiaki, animal welfare and health and safety work,” says Shane.

Bex Kelbrick, who was previously the Farms Administrator, and who has also spent time as a 2IC out on-farm, has taken on the new role of Business Support Manager. A new Farms Administrator is currently being recruited.

Another major project the team was preparing for was unpacking a benchmarking report that has been carried out on all farms throughout New Zealand.

PKW Farms is committed to becoming a best-in-class dairy business and there has been a significant amount of mahi done in the past 24 months to find out what changes were needed to deliver on that goal.

With the progress to date and the changes made, PKW Farms is now in a place where benchmarking its farms via external peers will provide the insight needed for further improvements.

“While we have as yet to go through the entire report and associated data, at first glance it looks like we are making the progress we need to be making for the wider benefit of PKW and its owners,” says Shane. “However, there’s always room for improvement so our team is looking forward to seeing the areas we need to concentrate on.”

20 | HE WHENUA

Roger Landers Business Manager

James Lawn Business Manager

Shane Miles General Manager Ahuwhenua

MEET THE TEAM

Bex Kelbrick Business Support Manager

“There are many elements to running a successful agri-business, and ensuring we support our people is just one of them.”

Shane Miles

Let’s talk business

The first He Toronga Pakihi ki Taranaki networking event of te tau hou saw a big turnout of people keen to network and learn how to grow their businesses. The audience heard from event hosts BNZ, as well as guest speakers Wharehoka Wano and Hemi Sundgren, representing Taranaki and Te Atiawa iwi, with the new Ka Uruora initiative, a joint initiative aimed at increasing the financial independence and wellbeing of whanau.

Venture Taranaki is one of the key partners in He Toronga Pakihi ki Taranaki – the Māori Business Network of Taranaki - and has been involved with the revitalisation of the group over the past couple of years. Like the event sponsors, we’re committed to helping Taranaki and its enterprises, communities and individuals grow.

In the twelve months to the end of June this year, we worked with 201 people to help move their new business ideas forward through our free, confidential 1:1 Business Start-Up Clinics. We matched 45 enterprises with business mentors, who offer a valuable sounding board for all those questions and challenges that prevent growth.

To help the region’s managers and directors build their skills, we issued 206 Capability Development Vouchers - worth almost $350,000 – to help with specific on-thejob training courses. We also unlocked research and development grants valued at more than $2.3 million for enterprises in Taranaki.

While this represents part of our mahi, Venture Taranaki is also looking at the long game, and progressing the strategic projects that will ensure our mokopuna share the prosperity we have enjoyed ourselves.

Tapuae Roa is Taranaki’s regional economic development strategy, and this year has guided Venture Taranaki’s work across many areas, including work towards establishing the National New Energy Development Centre, the future potential of hydrogen energy in our region, investigated opportunities to promote inward investments, explore future food opportunities, and much more.

We have worked with thousands of people around the mountain to look beyond Tapuae Roa to develop the Taranaki 2050 Roadmap, a vision of where we all want our region to head in the low-emissions economy of the future. The Roadmap was launched in August, and considers not just how our economy will change, but all aspects of our lives, and provides the opportunity to plan for inclusive growth.

There is much being done to ensure our region and its people can continue to achieve their fullest potential. If you’re looking to grow your enterprise, build capabilities to respond to future challenges, or go boldly where no innovation has gone before, Venture Taranaki has a range of programmes that can help.

To find out how we assist help you and your enterprise get ready for the future and be part of our region’s success, talk to one of our advisors now.

HE WHENUA | 21

Plymouth | T: 06 759 5150 | info@venture.org.nz | www.taranaki.info Venture T ARANAKI Te Puna Umanga

Taranaki’s Regional Development Agency | 9 Robe Street, New

An initiative of the New Plymouth District Council

22 | HE ORANGA

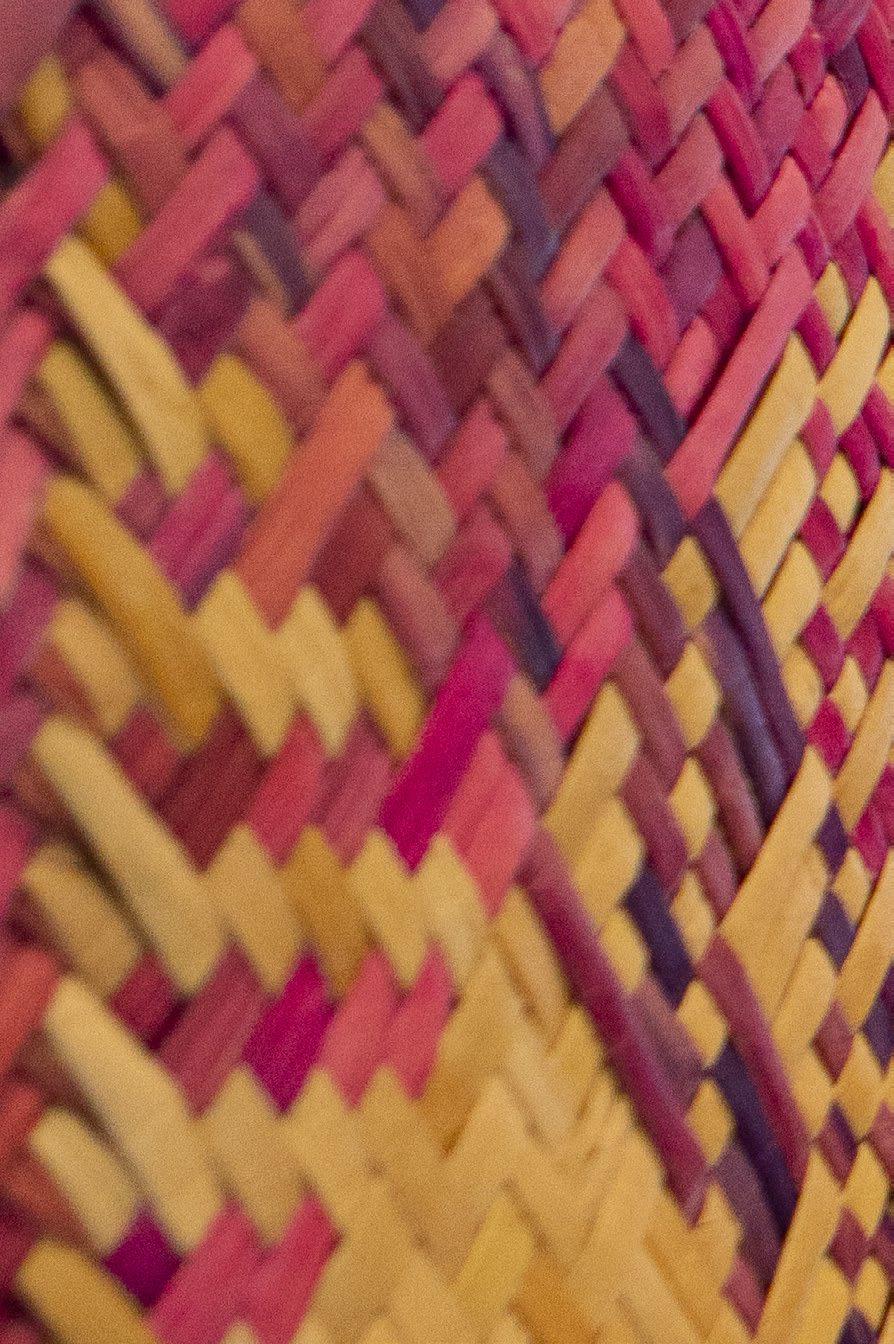

MĀORI ARTFORM PROVIDES ANSWERS

Weaving brought Bonita Bigham back to life after facing a string of challenges that created a perfect storm of despair.

HE ORANGA | 23

<<

Now, after a long personal journey interwoven with healing, creativity and serving her community, the South Taranaki woman wants to help forge a resurgence of art within Māori communities.

Last year, Bonita, from Ngāruahine and Te Atiawa, graduated with a Master’s in Fine Arts from Massey University and this year she began working towards a Master’s in Māori Visual Art, with help from a Charles Bailey Scholarship from Parininihi ki Waitotara.

But back in 2006, times had got tough. “I had a huge emotional breakdown,” she says. “I couldn’t get out of bed; I couldn’t care for my son Te Rei. I didn’t know when I last went out the door.”

Her mother, Hinewaito Bigham, otherwise known as Aunty Josie, cared for Te Rei. But it was the loss of a family member that forced Bonita to get out amongst people again.

“I realised I needed to do something to fill me up because I felt so empty. All I wanted to do was weave.”

She started a Māori Art and Design programme through Te Wānanga o Raukawa at Taiporohēnui Marae in Hāwera. “I wove and I wove and I wove. I fell in love with tāniko, the twisting of threads to make geometric patterns, like on the edges of korowai.”

During this healing time, Bonita learned her mum’s mother, Apihaka Rei (nee Kipa), also did tāniko and was shown work made by her kuia, who died decades before she was born.

“I felt a strong connection with her and still do,” Bonita says.

“That year I didn’t do a single written assignment, so I didn’t pass, but I came back to life. It was wonderful, absolutely cathartic.”

Bonita believes that when faced with tough times it’s critically important that Māori are in touch with their culture.

“There cannot be a sense of wholeness without understanding who you are, where you come from and connecting to those people who got you here. We don’t just arrive; we are here because of them.”

As a child, Bonita loved art, but at high school was channelled into typing and other career-orientated courses, which looking back, she realises she loathed.

In the meantime, she was exposed to “awesome wāhine” doing raranga (weaving). “I was playing around the edges, but never seriously followed it through because I was not an artist –I thought I was an administrator.”

“�I wove and I wove and I wove. I fell in love with tāniko, the twisting of threads to make geometric patterns, like on the edges of korowai.”

24 | HE ORANGA

Bonita Bigham

For many years, Bonita worked in offices, punctuated by a few years in journalism. “But I felt like my soul was being sucked dry and lacked creativity.”

Entwined with her artistic hīkoi, Bonita has been an integral part of the South Taranaki community.

In October, she will retire after nine years as a South Taranaki District Councillor, but is standing for the Taranaki Coastal Community Board and she also chairs Te Maruata, a national collective of Māori in local government.

Earlier this year, she had her first ministerial appointment on to the national Oranga Marae Committee, which considers funding for marae projects around Aotearoa and she recently became Poutakawaenga at Te Korowai o Ngāruahine Trust, the iwi engagement manager for the postsettlement entity.

She’s also sat on school boards of trustees, represented STDC on Sport Taranaki and Dairy Trust Taranaki and supported Te Rei’s sports clubs.

But the creative realignment came in 2014 by studying art at WITT and in 2016 Bonita was accepted to study, via distance, for her Master’s in Fine Arts.

Her thesis was inspired by He Puanga Haeata, the Parihaka-Crown reconciliation ceremony held in 2017 at the historic settlement.

“Woven into that narrative was reference to intergenerational attributes, so I looked at our Kipa whānau and the creativity that flourishes within many of us. I explored the ways we are utilising that in a modern context.”

For her graduating exhibition piece, Mātauranga Interrupted, she worked with cut paper to create a tribute to the nine parāoa (sperm whales) which stranded along the shoreline of her Ngāruahine hapū, Ngāti Tū, in May 2018.

“We had never, in the living memory of our hapū, had anything happen like that,” she says.

The iwi relied heavily on the expertise

of a group from Ngātiwai in Northland, who guided them through the process of hauhake (harvest).

“The learning curve was exponential; it was a very intense time harvesting the resources from these taonga and experiencing the reclamation of that interrupted cultural knowledge.”

The whale stranding led Bonita to a more profound thought process in making art and it was especially transformative for her Pākehā husband, Kevin Huxtable, who was also heavily involved in the event. “It’s brought him to a place of seeking more knowledge in Te Ao Māori, of learning the reo and understanding more about my world view.”

That led the couple to a conversation about Bonita’s lifelong dream of getting moko kauae.

In August this year, renowned tā moko artist and whānau member Rangi Kipa adorned her chin.

“I had not appreciated just how different it would feel to have kauae, especially from Rangi,” she says.

“So, my study for this master’s programme will be looking at moko kauae and the barriers that we, as wāhine Māori, are faced with or put upon ourselves to getting kauae.”

Bonita’s study will take two years, during which time she will receive $7500 each year from PKW’s premiere scholarship.

Far

HE ORANGA | 25

left: Bonita (centre) with her whaene, Hinewaito Josie Bigham (right) and son, Te Rei Bigham-Dudley (left) at Waiokura Marae.

<<

Left: Bonita admires the raranga by Kataraina Houia-Rongonui, created and gifted to her and husband Kevin for their wedding day.

Mitchell Ritai, PKW General Manager Shareholder Engagement, says the scholarship was started in 1980 in recognition of Waitara farmer Charles Bailey.

“He was an instrumental figure in the establishment of the committee of management for PKW Incorporation and became the first chair of the incorporation.”

Mitchell, a proud Charles Bailey Scholar himself, says recipients can be funded for up to three years of their post-graduate studies.

“We look for people who can articulate how their studies can support PKW to balance its business, social and cultural activities, and who have involvement in Taranaki kaupapa,” he says. “Bonita had to overcome a number of challenges to get where

she is. That showed us her resilience, courage and leadership.”

Bonita wants to champion toi Māori, Māori art.

“I have a dream that toi re-finds its place in Te Ao Māori and also in mainstream society as an integral part of our lives, rather than an add-on or

Personally, she’s come a long way. “I’m learning to finally call myself an artist and I’m immensely grateful that PKW sees the value in the arts by honouring me with this scholarship. I may never reach the heights that other artists may, but with PKW’s help, the power of that definition is mine to create for myself.”

26 | HE ORANGA

“�I have a dream that toi re-finds its place in Te Ao Māori and also in mainstream society as an integral part of our lives, rather than an add-on or a hobby.”

Bonita Bigham

Above: Bonita, with the help of her husband Kevin, has re-discovered her spirit.

Right: Two examples of Bonita’s intricate tāniko work.

CREATING PATHWAYS TO THE FUTURE

The event was held to help create pathways for rangatahi Māori to get into careers within the technology and innovation sectors with a foundation based on tikanga Māori.

Mitchell Ritai, General Manager

Shareholder Engagement, says that PKW got behind Ko Māui Hangarau because it saw a chance to engage the leaders of the future in something new.

HE ORANGA | 27 <<

By sponsoring Ko Māui Hangarau, a for rangatahi Māori by Māori tech event, Parininihi ki Waitotara is making sure that young Taranaki Māori are ready for the future.

“We saw an opportunity to expose rangatahi to a topic they might not get in a normal school curriculum. And at PKW we are really aware of the need to embrace technology and innovation,” says Mitchell. The event was led by Morgana Watson of MW Consultancy who hails from Te Atiawa, Taranaki Nui Tonu, Te Atihaunui a Pāpārangi and Ngāpuhi.

A stellar line up of Māori entrepreneurs was brought in to speak to about 100 senior Māori students from high schools around Taranaki at both events held in Waitara and Hāwera in July this year.

“The rangatahi were quiet throughout all the kōrero from the guest speakers which is really unusual, so that’s an indication that the subject really interested them,” says Morgana.

Māori entrepreneurs Vincent Egan and Jordan Tuhura from Māui Studios in Christchurch showed the rangatahi their creation of graphic novels.

“Vincent is a Taranaki whānau from Ngāti Ruanui. He and Jordan blew the rangatahi away with their creation of graphic novels that use augmented reality – books on devices that talk using both sound and visuals. Their creation takes reading and storytelling to a whole new level,” says Morgana.

Lee Timutimu from Arataki Systems in Tauranga presented his creation of the Cultural Trails app which tells stories about a place on location, also using augmented reality.

“Lee has created an amazing app for people who are visiting places and want to find out, on location, the stories about that place. He is

still building up the stories but it is available in Tauranga when visiting Mauao maunga.”

Hiria Te Rangi, who Morgana describes as so intelligent ‘she thinks like a computer’, presented her Whare Hauora creation - sensory devices that measure the health of a home.

Morgana is looking forward to making the 2020 event in Taranaki even better.

“My ultimate utopia is to make this event an annual one. We were so fortunate to get the Māori entrepreneurs that we did speaking at it and I know they are definitely all go for the next Ko Māui Hangarau.”

28 | HE ORANGA

“[Vincent and Jordan’s] creation takes reading and storytelling to a whole new level.”

Morgana Watson

CEREMONY RECOGNISES SOUTH TARANAKI YOUTH

The achievements and success of South Taranaki rangatahi involved in the Youth to Work initiative have been celebrated with a glittering awards evening in Hāwera.

The event also recognised the employers, training providers and educational institutions that supported the scheme, with PKW proud to be sponsor of the Employer’s Award category.

The winner of the award, Everybody’s Theatre Trust in Ōpūnake, fought off stiff competition from four other nominees to earn the accolade.

“As an organisation, we are always keen to recognise the talent of our young people and to support those who do the same,” says Mitchell Ritai, General Manager Shareholder Engagement. “So we are honoured to be sponsoring a category that acknowledges and celebrates South Taranaki employers who make an outstanding contribution to the future of these rangatahi by providing employment, training or apprenticeships.

“The Theatre Trust throughly deserve this award for the commitment and dedication they bring to help their young employees get a great start to

their career, particularly as the Trust is completely run by volunteers.”

While choosing the winner, the judges noted it is often very difficult for young students to gain experience in the arts/creative pathway and it is excellent a Trust is providing this opportunity.

The Youth to Work initiative is one of the projects being carried out by the Mayor’s Taskforce for Jobs, a nationwide organisation that involves every New Zealand mayor to boost employment opportunities in their town or region.

“We are particularly focused on getting young people into work and creating opportunities for them to follow after they leave school,” explains Ross Dunlop, Mayor of South Taranaki. “The annual awards evening is a wonderful way of celebrating the good things that are happening, and for many of those who were nominated it will have been the first time they have been recognised for an achievement.”

“Some of our young people leave school with no real expectations or ambitions in life and this initiative helps them to understand that we believe in them and in helping them find a path to success.”

The awards saw 34 nominees (individuals or organisations) across six award categories.

The winners were;

Employer Award: Everybody’s Theatre Trust, Ōpūnake.

Education, Training and Work Experience Provider Award: Ngāruahine Iwi Health Services, Manaia.

Young Achiever Award 16 - 19 years: Caylin Cozette, nominated by Tairoa Lodge, Hāwera.

Young Achiever Award 20 - 24 years: Tim Preston, nominated by Argyle Performance Workwear, Hāwera.

Learning to Employment Award: Alyssa McCarty, nominated by Ōpūnake High School. <<

HE ORANGA | 29

The Te Pae Tawhiti Award, sponsored by four Taranaki iwi, was won by Heavenlee Ngatai. This category was introduced at the last event to acknowledge and celebrate the achievements of a young Māori person within South Taranaki who has excelled in their chosen career

amongst their peers, community or within marae kaitiakitanga (guardianship), manaakitanga (hospitality), rangatiratanga (self determination) and wairuatanga (spirituality).

Nominations for all categories are invited biannually and Mayor Dunlop

is keen to encourage more employers and young people to take part.

“We are also grateful for the on-going support of our sponsors,” he adds. “I would like to thank PKW personally for being part of the Youth to Work initiative.”

2019 South Taranaki Youth To Work Awards

FULL RESULTS

EMPLOYER AWARD

1st: Everybody’s Theatre, Ōpūnake

2nd: McCurdy’s Trucks, Hāwera

3rd: Tairoa Lodge, Hāwera

EDUCATION, TRAINING AND WORK EXPERIENCE PROVIDERS AWARD

1st: Ngāruahine Iwi Health Services, Manaia

2nd: Tairoa Lodge, Hāwera

3rd: Sandford’s Rural Carriers, Auroa

LEARNING TO EMPLOYMENT AWARD

1st: Alyssa McCarty, nominated by Ōpūnake High School

2nd: Cameron Hasler, nominated by Lunch Shack, Hāwera and Lori Paterson-Beare

3rd: Jared Torrington, nominated by McDonalds, Hāwera

TE PAE TAWHITI AWARD

1st: Heavenlee Ngatai, nominated by Tawhitinui Pa

2nd: Kaile Butcher, nominated by Hāwera High School

3rd: Fern Wilson, nominated by Pātea High School

YOUNG ACHIEVER AWARD, 16-19 YEARS

1st: Caylin Cozette, nominated by Tairoa Lodge

2nd: Liam Whelan, nominated by Hāwera High School

3rd: Michael Back, nominated by Eltham Construction

YOUNG ACHIEVER AWARD, 20-24 YEARS

1st: Tim Preston, nominated by Argyle Performance Workwear

2nd: Katie Adlam, nominated by Pak n Save, Hāwera

3rd: Cody Bibby, nominated by Beccard Motors, Hāwera

Left to right: Mayor Ross Dunlop, Linda Morrison (Tairoa Lodge, 3rd), Ken Whiting (McCurdy Trucks, 2nd) and Thomas Anderson Gardner, Cormach Hughson How, Ruby Gatenby, Maddie Henare and Kim Gatenby (Everybody’s Theatre, Ōpūnake,1st) and Mitchell Ritai.

Image supplied by STDC.

30 | HE ORANGA

LEARNING ON THE JOB

Providing meaningful opportunities for young Taranaki Māori to spend time in a workplace environment and gain experience to help them in their career aspirations is driving a burgeoning cadetship and internship programme at PKW.

HE ORANGA | 31 <<

Cadetships consist of a oneyear fixed-term paid position and internships are shorter term, typically being carried out over the long summer break in the education calendar.

“Internships are a great way of gaining experience in a chosen job or industry, or to find out more about a potential career path,” says Mitchell Ritai, General Manager Shareholder Engagement. “Sometimes getting a foot in the door can present a real obstacle for someone straight out of secondary or tertiary education and an internship can be a way of accessing opportunities.”

This year three new internships have been created with some of our strategic partners as part of the valueadd propositions created by the PKW Procurement Strategy.

Internship roles exist at iStudios, a media and publishing company, for graphic design students and KPMG are offering an opportunity to gain experience in their accountancy business. PKW will also have an internship role with Marsh Insurance that is offered to the successful scholarship recipient and are planning for an internship with BNZ Bank.

“It is exciting to see the increase in opportunities our strategic approach

is starting to generate,” says Mitchell, “An internship not only benefits the individual, but helps to increase the skills and capabilities within our whānau and iwi. The organisation providing the internship also benefits from a new perspective and ideas the intern can bring with them. It’s a winwin all round.”

“We intend to continue building relationships and strengthening partnerships with our suppliers so the number of opportunities for our rangatahi can grow.”

Cadetships provide a longer term insight into a role and the business in which it sits, and can really open an individual’s eyes to what can be achieved.

Mel Williams is a case in point. She was quietly working as a temporary financial assistant at PKW while raising her five children when the question of applying for a cadetship came up.

“I didn’t think I would stand a chance so initially I didn’t apply,” she said. “But then Jacqui King (PKW’s Head of Corporate Services) told me to go for it and I am so glad I did.”

Mel is now studying for a Bachelor’s degree in Business with a major in Accounting, through Massey University. She is also completing the

Mana Ora programme, which will lead to a NZ Certificate in Māori Business.

“PKW are being so supportive, granting me a scholarship towards my fees each year and giving me five hours a week study time, “ says Mel.

“Joe Hanita (PKW’s Chief Financial Officer) is my mentor and he’s so great.”

“It’s given me more of a focus about what I want to achieve in life. Now I am working towards a career, not just turning up to do a job each day.”

“And it’s not just for me, its for my family and for the PKW shareholders too. I owe it to them to do well.”

There are two cadetships being run this year – one farm cadet on PKWmanaged farms for a one year term, and a two-year cadetship in finance support, based at the PKW Whare.

All cadetships are full-time paid employment and open to all Māori, although those who whakapapa to a PKW shareholder or who are uri of a Taranaki iwi will be given special consideration.

Advertising for the cadetships occur as they are available. Keep and eye out on our Facebook and website, or for more information contact Jacqui King on humanresources@pkw.co.nz

“It’s given me more of a focus about what I want to achieve in life. Now I am working towards a career, not just turning up to do a job each day.”

32 | HE ORANGA

Mel Williams

2020 TERTIARY GRANTS AND SCHOLARSHIPS

OPENS 10 DECEMBER 2019

Scholarship Name Overview of Scholarship & Criteria Value Period

Charles Bailey Scholarship

Postgraduate Scholarships

(Edward Tamati, Gloria Kerehoma, Mate ki Tawhiti Carr)

Undergraduate Scholarships

1 x Postgraduate only. Studies must contribute to PKW business activities and recipient must be available to PKW throughout the term of the scholarship. Full or part time students.

3 x Postgraduate only. Studies must contribute to PKW business activities. Full or part time students.

3 x $5,000 per year

5 x Undergraduate only. Can study in any area. Full time students only. 5 x $2,000 per year

Varies per year

years maximum

year

PKW-Victoria University Postgraduate Scholarship

PKW-Ballance Undergraduate Scholarship

PKWRavensdown Undergraduate Scholarship

PKW-Marsh Insurance Undergraduate Scholarship

PKW-Meridian Undergraduate Scholarship

PKW-Nova Energy Undergraduate Scholarship

PKWNgāruahine Scholarship

PKW-BNZ Undergraduate Scholarship

PKWFarmlands Undergraduate Scholarship

Victoria University of Wellington

Ballance Agri-Nutrients

2 x Postgraduate only, co-funded. Must be a student at Victoria University. Studies must contribute to PKW business activities. Full or part time students.

2 x Undergraduate only, funded by Ballance. Studies must contribute to either land sciences or business studies. Full time students only.

Ravensdown 1 x Undergraduate only, funded by Ravensdown. Studies must align to PKW and Ravensdown business activities and recipient has opportunity for internship. Full time students only. Only one recipient at any time.

Marsh Insurance

1 x Undergraduate only, funded by Marsh. Studies must contribute to PKW business activities and recipient has opportunity for internship. Full time students only.

Meridian 1 x Undergraduate only, co-funded. Studies must align to PKW and Merdian Energy activities. Full time students only.

Nova Energy 1 x Undergraduate only, funded by Nova Energy. Studies must align to PKW and Nova Energy business activities and studies must be in the technical or science related fields. Full time students only. Only 1 recipient at any time.

Te Korowai o Ngāruahine Trust

1x Undergraduate only, co-funded. Studies must contribute to PKW and Te Korowai o Ngāruahine Trust business activities. Full time students only.

BNZ Bank 1x Undergraduate only, co-funded. Studies must contribute to PKW and BNZ business activities and studies must be in banking or finance related fields. Full time students only.

Farmlands Up to 3 x Undergraduates only, funded by Farmlands. Studies must contribute to PKW and Farmlands business activities. Full time students only.

PKW-KPMG Internship KPMG Opportunity for a paid Summer Internship for a PKW scholarship recipient in a relevant field of study.

iStudios Internship iStudios Opportunity for a paid Summer Internship for a PKW scholarship recipient in a relevant field of study.

Marsh Insurance Internship

Marsh Insurance Opportunity for a paid Summer Internship for the recipient of the PKW-Marsh Insurance Undergraduate scholarship recipient.

BNZ Bank Internship BNZ Bank Potential opportunity for a paid Summer Internship for the recipient of the PKW-BNZ Undergraduate scholarship recipient.

Go to our website at pkw.co.nz to apply online from 10 December 2019. (Please contact PKW if you are interested in one of the internships).

2 x $5,000 per year

2 x $2,500 per year 1 year

1 x $5,000 per year for only one recipient

3 years maximum

1 x $2,000 per year 1 year

1 x $1,500 per year 1 year

1 x $1,500 per year 3 years

1 x $2,500 per year 1 year

1 x $2,500 per year 1 year

1 x $2,500 per year 1 year

1 x Internship per year 1 year

1 x Internship per year 1 year

1 x Internship per year 1 year

1 x Potential Internship per year 1 year

HE ORANGA | 33

Period

Scholarship Name Partner Organisation Overview of Scholarship & Criteria Value

1 year

3

$7,500 per year

years maximum

3

3

years maximum

Tertiary Grants Can study in any field at any level including trades and apprenticeships. Full or part time students. The value of these grants is variable and dependent on the number of applications received 1

Internships and Joint Scholarships Overview

PKW Tertiary Grants & Scholarships Overview

35 Leach Street | New Plymouth 4310 Taranaki | New Zealand Copyright 2019 Parininihi ki Waitotara