3 minute read

HMM receives Gold rating by EcoVadis

SEOUL : South Korea’s flagship carrier HMM had been given a gold rating by EcoVadis, a provider of businesssustainabilityratings. HMM achieved better results in the environment and ethics criteria than the year prior with EcoVadis giving a gold classification in 2022, while the ocean carrier received a silver onein2021.

As a result, HMM was ranked in the top 3% of businesses across all sectors by EcoVadis, up from 4%thepreviousyear.

Advertisement

HMM’s accomplishment demonstrates the company’s dedication to the environmental effort, which includes the development of policies and comprehensive plans for decreasing air pollution and waste stream, according to a statement. “This evaluation result will enable us to gain the trust of stakeholders such as customers, shareholders, and communities,” stated Kim, Kyung Bae, President and CEO of HMM, adding, “We will strive to raise our sustainable capability not only in the environment but also in all areas.”

Maersk signs MOU with Shanghai International Port Group on green methanol

COPENHAGEN - A.P. Moller-Maersk (Maersk) announced that the company has signed a Memorandum of Understanding (MOU) with Shanghai International Port Group (SIPG) on strategic cooperation for Shanghai Port methanol marine fuel project. The two parties will join hands to explore green methanol fuel vessel-to-vessel bunkering operation after Maersk’s green methanol container vessels beingdeliveredin2024.

Maersk has set a net-zero emissions target for 2040 across the entire business, and the delivery and operation of its 19 vessels with dualfuel engines able to operate on green methanol will accelerate the evolution of climate neutral shipping. Therefore, establishing port bunkering infrastructure for methanol is imperativeandcriticaltoachievethisgoal.

“Collaborating with ports globally to build green fuel bunkering infrastructuresisnecessarytoservicemethanolvessels.Itisan important step as Maersk strives to lead the decarbonization of end-to-endsupplychainsandmakeameaningfulenvironmental impact in this decade. We are very pleased to form the partnership with SIPG, leveraging its strong capabilities in bunkering service and port operation. Through joint efforts, we can provide low-carbon logistics service for our customers, also contributing to China’s pledge to be carbon neutral by 2060. Meanwhile, we also endeavor to cultivate synergies with SIPG and fuel manufacturers to optimize fuel infrastructure efficiencies, said, Mr. Vincent Clerc,CEOofA.P.Moller-Maersk.

As SIPG, the main operator of the world’s busiest container port, also commits to becoming a leader in developing green and ecological ports, the agreement will also support the aspiration of Shanghai Port to become one of the world’s first commercial green methanol refuelling points, and as a regionalgreenmethanolfuelbunkeringcentre. “We are happy to collaborate with Maersk in support of its mission to decarbonise the shipping industry. As the demand for sustainable fuels increase, establishing the green fuel bunkering service will be another milestone for SIPG, improving port services and enhancing the competitiveness of Shanghai port, in a bid to transform the company into a low-carbon and eco-friendly energy hub in Asia Pacific. SIPG will continue to work with shipping companies to foster Shanghai shipping hub gateway andthegreen,low-carbontransformationofshippingindustryin Shanghai, said, Mr. Gu Jinshan, Chairman, Shanghai InternationalPortGroup.

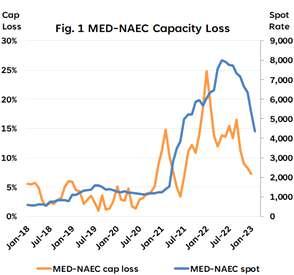

Sea-Intelligence : Capacity loss nearing pre-pandemic normal

COPENHAGEN - While the pandemic challenges were initiated by an exceptionally large growth in demand, the real challenge came as this high demand growth clogged up the hinterlands, which in turn clogged up the ports, which in turn led to unprecedented levels of vessel congestion. When vessels don’t move, they do not contribute to deployed capacity, and the capacity of the non-sailing vessels effectively become a loss of supply. This loss of supply became a greater factor in the supply/demand imbalance, than the demandgrowththatinitiatedit.

On a global level however, we have seen a reversal of capacity loss over the past year as vessel congestion has eased. With the latest measure of 6.2% capacity loss in January2023,wearenowroughly2/3ofthe waybacktoanormalityof2.2%fromthepeakinJanuary2022.In the last two months though, we have seen a reversal i.e., an increase in capacity loss. However, this could very well be a seasonal impact from inclement weather.

What is interesting here is that both the Transpacific and Asia-Europe trades show a strong correlation between capacity loss and spot rates, but the Transatlantic trade does not. At their respective peaks (capacity loss and spot rates), we see a 5-month time lag as shown in Figure 1, which has now increased to 9-10 months. Furthermore, the spot rates are still considerably abovepre-pandemiclevels.Notonly that, the spot rate increase was also delayed compared to on the Transpacific and AsiaEuropetradelanes.Thisisalsotrue fortheotherTransatlantictradei.e., North Europe-North America East Coast. This is a strong indication that there are other drivers than supply and demand impactingfreightratesontheTransatlantictrade.