Cremorne Capital Limited – HVT Land Trust

ARSN 154 154 033

Financial Statement for the Year Ended 30 June 2022

THIS ANNEXURE A OF 24 PAGES

REFERRED TO IN FORM 388 COPY OF FINANCIAL STATEMENTS AND REPORTS

MICHAEL RAMSDEN DIRECTOR

DATE: 22 September 2022

1

FOR THE FINANCIAL YEAR ENDED 30 JUNE 2022 Page Number Directors’ Report 2 Auditors Independence Declaration 5 Independent Audit Report 6 Directors’ Declaration 8 Statement of Profit or Loss and Other Comprehensive Income 9 Statement of Financial Position 10 Statement of Changes in Net Assets Attributable to Unitholders 11 Statement of Cash Flows 12 Notes to the Financial Statements 13

FINANCIAL STATEMENT

Directors’ Report

The directors of Cremorne Capital Limited (`the Responsible Entity') submit herewith the financial report for the Cremorne Capital Limited - HVT Land Trust (`the Scheme") for the year ended 30 June 2022. In order to comply with the provisions of the Corporations Act 2001, the directors' report as follows:

Directors

The names of the directors of the Responsible Entity during or since the end of the year are:

• Mr M A Ramsden

• Mr D.A. Carroll

• Mr O.R. Carton

Directors were in office for this entire period unless otherwise stated.

Principal activities

The Scheme is a registered managed investment scheme domiciled in Australia.

The principal activity of the Scheme was to invest funds in accordance with the investment objectives and guidelines communicated to unitholders and in accordance with the provisions of the Constitution.

The Scheme holds investments and manages the land assets obtained and operated by the responsible entity.

The scheme is involved with hay production on part of the land currently not being utilised by trees.

Review of operations Results

The financial results of the operations of the Scheme are disclosed in the statement of profit and loss and other comprehensive income. The total comprehensive income for the Scheme for the year ended 30 June 2022 was a loss of $277,406 (2021: Loss $21,741)

Distributions

No distribution was paid or is payable in respect of the year ended 30 June 2022 (2021: Nil).

Management costs

The Responsible Entity fee for the year ended 30 June 2022 was $207,269 (2021: $205,765).

State of affairs

The Scheme will continue to be managed in accordance with the investment objectives and in accordance with the provisions of its Constitution. Future results will accordingly depend on the performance of the markets to which the Scheme is exposed.

Subsequent events

There has not been any matter or circumstance, other than that referred to in the financial statements or notes thereto, that has arisen since the end of the financial year, that has significantly affected, or may significantly affect, the operations of the Scheme, the results of the Scheme, or the state of affairs of the Scheme in future financial years.

2

Likely developments and expected results of operations

The Scheme will continue to be managed in accordance with the investment objectives and in accordance with the provisions of its Constitution. Future results will depend on a number of factors, some of which are beyond the control of the scheme, such as market factors and environmental factors.

Scheme information in the Directors' Report

There were 6,999 units in the Scheme held by the Responsible Entity as at the end of the financial year (2021: 4,615).

There were no applications in the Scheme issued during the year. No withdrawals from the Scheme during the year.

The value of the Scheme’s assets as at the end of the financial year is disclosed in the Statement of Financial Position.

Options granted

No options were granted over unissued units in the Scheme during or since the end of the year or granted to the Responsible Entity.

No unissued units in the Scheme were under option as at the dat e on which this Report was made. Units were issued in the Scheme during or since the the as a result of a Rights Issue offer carried out in the Scheme.

Indemnification

Under the Scheme's constitution the responsible en tity including its officers and employees is indemnified out of the Scheme's assets for any loss, damage, ex penses or other liability incurred by it in properly performing or exercising any of its powers, duties or rights in relation to the Scheme.

The Scheme has not indemnified any auditor of the Scheme.

Insurance premiums

Insurance premiums are paid out of the Scheme's assets in relation to insurance cover for the Responsible Entity, its officers and employees, the Compliance Committee or the auditors of the Scheme.

3

Independence declaration by auditor

A copy of the auditor's independence declaration as required under section 307C of the Corporations Act 2001 is set out on page 5.

Signed in accordance with a resolution of the directors of the Responsible Entity made pursuant to s.298 (2) of the Corporations Act 2001.

On behalf of the Directors

Michael Ramsden Director

MELBOURNE

DATED: 22 September 2022

4

Registered Audit Company 291969

Level 12 31 Queen Street

Melbourne Victoria 3000

T: +61 3 8613 8888

F: +61 3 8613 8800

nexia.com.au

Auditor's Independence Declaration Cremorne Capital Ltd - HVT Land Trust

As auditor for the audit of Cremorne Capital Ltd - HVT Land Trust for the year ended 30 June 2022, I declare that, to the best of my knowledge and belief, there have been:

• no contraventions of the independence requirements of the Corporations Act 2001 in relation to the audit; and

• no contraventions of any applicable code of professional conduct in relation to the audit.

Richard S. Cen Melbourne Director

Dated this 22nd day of September 2022

Nexia Melbourne Audit Pty Ltd

Nexia Melbourne Audit

Nexia Melbourne Audit Pty Ltd (ABN 86 005 105 975) is a firm of Chartered Accountants. It is affiliated with, but independent from Nexia Australia Pty Ltd. Nexia Australia Pty Ltd is a member of Nexia International, a leading, global network of independent accounting and consulting firms. For more information please see www.nexia.com.au/legal Neither Nexia International nor Nexia Australia Pty Ltd provide services to clients. Liability limited by a scheme approved under Professional Standards Legislation

Level 12 31 Queen Street

Melbourne Victoria 3000

T: +61 3 8613 8888

F: +61 3 8613 8800

nexia.com.au

Independent Auditor’s Report

To the Members of Cremorne Capital Ltd – HVT Land Trust Report on the Audit of the Financial Report Opinion

We have audited the financial report of Cremorne Capital Ltd – HVT Land Trust (the Scheme), which comprises the statement of financial position as at 30 June 2022, the statement of comprehensive income, statement of changes in equity and statement of cash flows for the year then ended, and notes to the financial statements, including a summary of significant accounting policies, and the directors’ declaration.

In our opinion, the accompanying financial report of Cremorne Capital Ltd – HVT Land Trust is in accordance with the Corporations Act 2001, including:

(i) giving a true and fair view of the Scheme’s financial position as at 30 June 2022 and of its financial performance for the year then ended; and

(ii) complying with Australian Accounting Standards and the Corporations Regulations 2001.

Basisfor opinion

We conducted our audit in accordance with Australian Auditing Standards Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Report section of our report We are independent of the Scheme in accordance with the auditor independence requirements of the Corporations Act 2001 and the ethical requirements of the Accounting Professional and Ethical Standards Board’s APES 110 Code of Ethics for Professional Accountants (the Code) that are relevant to our audit of the financial report in Australia. We have also fulfilled our other ethical responsibilities in accordance with the Code

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion

Material Uncertainty RelatedTo Going Concern

We draw attention to Note 15 in the financial report, which indicates that the financial statements of the Scheme have been prepared on the basis of a going concern. The Scheme incurred a net loss of $277,406 during the year ended 30 June 2022 and has a net deficit of working capital of $462,214 These events or conditions, indicate that a material uncertainty exists that may cast significant doubt on the Scheme’s ability to continue as a going concern Our opinion is not modified in respect of this matter.

Oher information

The directors are responsible for the other information The other information comprises the information in the Scheme’s annual report for the year ended 30 June 2022, but does not include the financial report and the auditor’s report thereon.

Nexia Melbourne Audit Registered Audit Company 291969

Nexia Melbourne Audit Pty Ltd (ABN 86 005 105 975) is a firm of Chartered Accountants. It is affiliated with, but independent from Nexia Australia Pty Ltd. Nexia Australia Pty Ltd is a member of Nexia International, a leading, global network of independent accounting and consulting firms. For more information please see www.nexia.com.au/legal Neither Nexia International nor Nexia Australia Pty Ltd provide services to clients. Liability limited by a scheme approved under Professional Standards Legislation

Our opinion on the financial report does not cover the other information and we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial report, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial report or our knowledge obtained in the audit or otherwise appears to be materially misstated

If, based on the work we have performed, we conclude that there is a material misstatement of the other information we are required to report that fact. We have nothing to report in this regard.

Directors’responsibility for the financialreport

The directors of the Scheme are responsible for the preparation of the financial report that gives a true and fair view in accordance with Australian Accounting Standards and the Corporations Act 2001 and for such internal control as the directors determine is necessary to enable the preparation of the financial report that gives a true and fair view and is free from material misstatement, whether due to fraud or error.

In preparing the financial report, the directors are responsible for assessing the Scheme’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the directors either intend to liquidate the Scheme or to cease operations, or have no realistic alternative but to do so.

Auditor’sresponsibility for the audit of the financialreport

Our objectives are to obtain reasonable assurance about whether the financial report as a whole is free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion Reasonable assurance is a high level of assurance but is not a guarantee that an audit conducted in accordance with the Australian Auditing Standards will always detect a material misstatement when it exists Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of this financial report

A further description of our responsibilities for the audit of the financial report is located at The Australian Auditing and Assurance Standards Board website at: http://www.auasb.gov.au/auditors_responsibilities/ar4.pdf. This description forms part of our auditor’s report

We also provide the directors with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, related safeguards

Nexia

Melbourne Audit Pty Ltd

Richard S. Cen Melbourne Director

Dated this 22nd day of September 2022

DIRECTORS’ DECLARATION

In the opinion of the directors of Cremorne Capital Ltd, the Responsible Entity of Cremorne Capital LimitedHVT Land Trust (the Scheme):

1. The financial statements and notes set out on pages 9 to 24, are in accordance with the Corporations Act 2001, including:

(a) giving a true and fair view of financial position of the Scheme as at 30 June 2022 and of its performance for the financial year ended on that date; and

(b) complying with Australian Accounting Standards (including the Australian Accounting Interpretations), and the Corporations Regulations 2001.

2. The financial report also complies with International Financial Reporting Standards as discussed in Note 1(a).

3. Subject to the achievement of matters described in note 15 there are reasonable grounds to believe that the Scheme will be able to pay its debts as and when they become due and payable.

Signed in accordance with a resolution of the Directors of the Responsible Entity made pursuant to s.295(5) of the Corporations Act 2001.

On behalf of the Directors

Michael Ramsden Director

MELBOURNE

Dated: 22 September 2022

8

STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

For the Financial Year ended 30 June 2022

Statement

be read

9

The above

should

in conjunction with the accompanying notes

Note Year Ended 30 June 2022 $ Year Ended 30 June 2021 $ INCOME Revenue 2 541,259 590,831 Cost of Sales (222,620) (71,477) Gross Profit 318,639 519,354 Total Income 318,639 519,354 EXPENSES Administration Expenses (65,497) (46,580) Management Costs (207,269) (205,765) Consulting Fees (2,200) (1,230) Depreciation (5,655) (5,855) Legal Expenses (36,057) (12,825) Farming and Plantation Expenses (141,847) (146,697) Finance Costs (42,964) (46,965) Auditor’s Remuneration (18,300) (14,431) Other Expenses 3 (76,256) (60,747) Total Expenses (596,045) (541,095) Total Comprehensive Income (277,406) (21,741) Change in Net Assets Attributed to Unitholders (277,406) (21,741)

STATEMENT OF FINANCIAL POSITION

As at 30 June 2022

The above Statement should be read in conjunction with the accompanying notes

10

Note Year Ended 30 June 2022 $ Year Ended 30 June 2021 $ ASSETS Current Assets Cash and Cash Equivalents 13410,461 36,812 Trade and Other Receivables 416,948 13,325 Total Current Assets 427,409 50,137 Non-current assets Biological Assets 63,687,000 3,687,000 Property, Plant & Equipment 74,564,594 4,570,249 Total Non-current Assets 8,251,594 8,257,249 Total Assets 8,679,003 8,307,386 LIABILITIES Current Liabilities Trade and Other Payables5(72,034) (591,105) Borrowings 8(817,589) (1,074,595) Total Current Liabilities (889,623) (1,665,700) Total Liabilities (Excluding Net Assets Attributable to Unitholders) (889,623) (1,665,700) Surplus Attributable to Unitholders 9 7,789,380 6,641,686

STATEMENT OF CHANGES IN NET ASSETS ATTRIBUTABLE TO UNITHOLDERS

For the Financial Year ended 30 June 2022

The above Statement should be read in conjunction with the accompanying notes 11

Net Assets Attributable to Unitholders $ Balance at 30 June 2020 6,817,427 Net loss attributable to unitholders (21,741) Revaluation of assets (154,000) Application for unitsRedemption of unitsBalance at 30 June 2021 6,641,686 Net loss attributable to unitholders (277,406) Revaluation of assetsApplication for units 1,425,100 Redemption of unitsBalance at 30 June 2022 7,789,380

STATEMENT OF CASH FLOWS

For the Financial Year ended 30 June 2022

12

The above Statement should be read in conjunction with the accompanying notes

Note Year Ended 30 June 2022 Inflows (Outflows) $ Year Ended 30 June 2021 Inflows (Outflows) $ Cash flows from Operating Activities Receipts from Customers 537,636 585,735 Payments for Expenses (1,289,117) (388,100) Financing Costs (42,964) (46,965) Net Cash (Used In)/Providing Operating Activities 13(b) (794,445) 150,670 Cash flows from Financing Repayments of Borrowings (257,006) (123,004) Proceeds from Rights Issue 1,425,100Net Cash (Used In)/Providing Financing Activities 13(d) 1,168,094 (123,004) Net Increase/(Decrease) in Cash and Cash Equivalents Held 373,649 27,666 Cash and Cash Equivalents at Beginning of the Year 36,812 9,146 Cash and Cash Equivalents at End of the Year 13(a) 410,461 36,812

Notes to and forming part of the Financial Statements for the Financial Year Ended 30 June 2022

1. Summary of Significant Accounting Policies

Basis of preparation

This general purpose financial report for the financial year ended 30 June 2022 has been prepared in accordance with the Corporations Act 2001, Accounting Standards and Interpretations, and complies with other requirements of the law.

The functional currency is in Australian Dollars and the level of rounding is to the nearest dollar.

Statement of compliance

The financial statement complies with Australian Accounting Standards and International Financial Reporting Standards (IFRS). The Scheme is a profit entity.

The financial statements were authorised for issue by the directors. The directors have the ability to amend the financial statements after issue.

In the application of A-IFRS management is required to make judgments, estimates and assumptions about carrying values of assets and liabilities that are not readily apparent from other sources. The estimates and associated assumptions are based on historical experience and various other factors that are believed to be reasonable under the circumstance, the results of which form the basis of making the judgments. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the period in which the estimate is revised if the revision affects only that period or in the period of the revision and future periods if the revision affects both current and future periods.

The accounting policies set out below have been applied in preparing the financial statements for the year ended 30 June 2022 and the comparative information presented in these financial statements.

Adoption of new and revised accounting standards

The Scheme has adopted all standards which became effective for the first time at 30 June 2022, the adoption of these standards has not caused any material adjustments to the reported financial position, performance or cash flow of the Scheme.

Cremorne Capital Limited – HVT Land Trust

13

Notes to and forming part of the Financial Statements for the Financial Year Ended 30 June 2022

Significant Accounting Policies

Accounting policies set out below have been applied consistently to all periods presented in these financial statements and the policies are selected and applied in a manner, which ensures that the resulting financial information satisfies the concepts of relevance and reliability, thereby ensuring that the substance of the underlying transactions and other events is reported.

(a) Financial Instruments Financial Assets

The financial assets of the Scheme have been reclassified into one of the following categories on adoption of AASB 9 based on primarily the business model in which a financial asset is managed and its contractual cash flow characteristics:

• Measured at amortised cost

• Fair value through profit or loss (FVTPL)

• Fair value through other comprehensive income - debt instruments (FVOCI - debt)

• Fair value through other comprehensive income - equity instruments (FVOCI - equity).

Impairment of financial assets

The incurred loss model from AASB 139 has been replaced with an expected credit loss model in AASB 9 for assets measured at amortised cost, contract assets and fair value through other comprehensive income. This has not resulted in the earlier recognition of credit loss (bad debt provisions).

Impairment of non-financial assets

At the end of each reporting period the Scheme determines whether there is an evidence of an impairment indicator for non-financial assets.

Where an indicator exists and regardless for indefinite life intangible assets and intangible assets not yet available for use, the recoverable amount of the asset is estimated.

Where assets do not operate independently of other assets, the recoverable amount of the relevant cash generating unit (CGU) is estimated.

The recoverable amount of an asset or CGU is the higher of the fair value less costs of disposal and the value in use. Value in use is the present value of the future cash flows expected to be derived from an asset or cashgenerating unit.

Where the recoverable amount is less than the carrying amount, an impairment loss is recognised in profit or loss. Reversal indicators are considered in subsequent periods for all assets which have suffered an impairment loss.

(b) Cash and cash equivalents

Cash comprises current deposits with banks Cash equivalents are short-term highly liquid investments readily convertible to known amounts of cash, subject to an insignificant risk of changes in value, and are held for the purpose of meeting short-term cash commitments rather than for investment or any other purposes.

Cremorne Capital Limited – HVT Land Trust

14

Notes to and forming part of the Financial Statements for the Financial Year Ended 30 June 2022

(c) Revenue

The core principle of AASB 15 is that revenue is recognised on a basis that reflects the transfer of promised goods or services to customers at an amount that reflects the consideration the Scheme expects to receive in exchange for those goods or services. Revenue is recognised by applying a fivestep model as follows:

1. Identify the contract with the customer

2. Identify the performance obligations

3. Determine the transaction price

4. Allocate the transaction price to the performance obligations

5. Recognise revenue as and when control of the performance obligations

(d) Expenses

is transferred

All expenses are recognised in the income statement on an accrual basis. Included in other expenses is insurance, rates and land tax paid by the Scheme.

(e) Income Tax

Deferred taxes have not been recognised in the financial statements in relation to differences between the carrying amounts of assets and liabilities and their respective tax bases, including taxes on capital gains which could arise in the event of a sale of investments for the amount at which they are stated in the financial statements. In the event that taxable gains are realised by the Scheme, these gains would be included in the taxable income that is assessable in the hands of the unit holders as noted above.

Realised capital losses are not distributed to unit holders but are retained within the Scheme to be offset against any realised capital gains. The benefit of any carried forward capital losses are also not recognised in the financial statements. If in any period realised capital gains exceed realised capital losses, including those carried forward from earlier periods and eligible for offset, the excess is included in taxable income that is assessable in the hands of unit holders in that period and is distributed to unit holders in accordance with the requirements of the Scheme Constitution.

(f) Application and Redemptions

Applications received for units in the Scheme are recorded net of any entry fees payable prior to the issue of units in the Scheme. Redemptions from the Scheme are recorded gross of any exit fees payable after the cancellation of units redeemed.

The application and redemption prices are determined as the net assets attributable to unit holders of the Scheme adjusted for the estimated transaction costs, divided by the number of units on issue on the date of the application or redemption.

(g) Redeemable Units

All redeemable units issued by the Scheme provide investors with the right to require redemption for cash and give rise to a financial liability. In accordance with the Constitution, the Scheme is contractually obliged to redeem units at redemption price, which includes an allowance for transaction costs incurred by the Scheme on disposal of its assets required to fund the redemptions.

(h) Unit Prices

The unit price is based on unit price accounting outlined in the Scheme's constitution.

Cremorne Capital Limited – HVT Land Trust

15

Notes to and forming part of the Financial Statements for the Financial Year Ended 30 June 2022

(i) Goods and Services Tax

Revenues, expenses and assets are recognised net of the amount of goods and services tax (GST), recoverable from the Australian Taxation Office (ATO):

i. where the amount of GST incurred is not recoverable from the taxation authority, it is recognised as part of the cost of acquisition of an asset or as part of an item of expense; or

ii. for receivables and payables which are recognised inclusive of GST.

The net amount of GST recoverable from the Australian Taxation Office is included in receivables in the balance sheet.

(j) Payables

Trade payables and other accounts payable are recognised when the Scheme becomes obliged to make future payments resulting from the purchase of goods & services

(k) Receivables

Trade receivables and other receivables are recorded at amortised cost less impairment.

(l) Inventory

Inventories relate to cattle and are valued at the lower of cost and net realisable value. Cost is determined on the average cost basis and comprises the cost of purchase and transport cost.

Net realisable value is the estimated selling price in the ordinary course of business, less estimated costs of completion and the estimated costs necessary to make the sale.

(m) Biological Assets

Biological assets comprise of trees not yet harvested. Biological assets are measured at fair value less costs to sell, with any change recognised in the income statement. Cost to sell includes all costs that would be necessary to sell the assets, including freight and direct selling costs.

The fair value of a biological asset is based on its present location and condition. If an active market or other effective market exists for a biological asset or agricultural produce in its present location and condition, the quoted price in that market is the appropriate basis for determining the fair value of that asset.

(n) Property, Plant and Equipment

Each class of property, plant and equipment is carried at cost or fair value less, where applicable, any accumulated depreciation and impairment of losses. Items of property, plant and equipment acquired for nil or nominal considerations have been recorded at the acquisition date at fair value. Where the cost model is used, the asset is carried at its cost less any accumulated depreciation and any impairment losses. Costs include purchase price, other directly attributable costs and the initial estimate of the costs of dismantling and restoring the asset, where applicable. Assets measured using the revaluation model are carried at fair value at the revaluation date less any subsequent accumulated depreciation and impairment losses. Revaluations are performed whenever there is a material movement in the value of an asset under the revaluation model.

Cremorne Capital Limited – HVT Land Trust

16

Notes to and forming part of the Financial Statements for the Financial Year Ended 30 June 2022

Land

Land is measured using the revaluation model.

Building

Plant and equipment are measured using the cost model.

Plant and equipment

Plant and equipment are measured using the cost model.

Depreciation

Property, plant and equipment, excluding freehold land, is depreciated on a straight-line basis over the assets useful life to the Scheme, commencing when the asset is ready for use.

At the end of each annual reporting period, the depreciation method, useful life and residual value of each asset is reviewed. Any revisions are accounted for prospectively as a change in estimate.

(o) Critical Accounting Estimates and Judgments

The directors evaluate estimates and judgments incorporated into the financial statements based on historical knowledge and best available current information Estimates assume a reasonable expectation of future events and are based on current trends and economic data, obtained both externally and within the Scheme.

Sale and cost of agricultural produce and livestock

Revenue from the sale of agricultural produce and livestock is recognised when the goods has been delivered to the customer, the customer has accepted the product and collectability of the related receivable is probable. The cost of wood produced represents the shared cost of all Growers and mainly relates to the wood production, transportation and storage.

Revenue Recognition

Trees in the ground at the reporting date are measured at their fair value less costs to sell. Immediately prior to harvest the fair value is determined on an estimated yield per hectare basis at the commodity’s quoted spot price in the marketplace.

Taxes

The Scheme is subject to income and capital gains taxes in numerous jurisdictions. Significant judgement is required to determine the total provision for current and deferred taxes. The Scheme recognises liabilities for current taxes based on estimates of whether additional taxes will be due. Where the final tax outcome of these matters is different from the amounts that were initially recorded, such differences will impact the income and deferred tax provisions in the period in which the determination is made. Deferred tax assets and liabilities are recognised on a net basis to the extent they relate to the same fiscal unity and fall due in approximately the same period.

Cremorne Capital Limited – HVT Land Trust

17

Notes to and forming part of the Financial Statements for the Financial Year Ended 30 June 2022

The plantation was independently valued as at June 2021 by Margules Groome based on their fair market value.

Cremorne Capital Limited – HVT Land Trust

18 2. Revenue 30 June 2022 $ 30 June 2021 $ Growers Maintenance Contributions 437,353 505,081 Hay Income 77,153 77,971 Agistment Income 26,753 7,779 541,259 590,831 3. Other Expenses Bank Charges 3 55 Compliance 10,543 10,187 Filing Fees 2,731 2,287 Sundry 62,979 48,218 4. Receivables Trade Debtors 1,768 Goods and Service Tax Recoverable 15,180 13,325 16,948 13,325 5. Payables Other Unsecured Payables and Accrued Expenses60,434 582,105 Accrued Audit Fees 11,600 9,000 72,034 591,105 6. Biological Assets Trees 3,687,000 3,687,000 3,687,000 3,687,000

Cremorne Capital Limited – HVT Land Trust

Notes to and forming part of the Financial Statements for the Financial Year Ended 30 June 2022

Movements in carrying amounts of property, plant and equipment

Asset Revaluations

The freehold land was independently valued as at June 2021 by Margules Groome based on their fair market value.

19

Property, Plant & Equipment 30 June 2022 $ 30 June 2021 $ Land Land – At independent valuation 4,400,000 4,400,000 Closing Balance 4,400,000 4,400,000 Building House – At cost 158,414 158,414 Accumulated depreciation (27,052) (23,092) Closing Balance 131,362 135,322 Plant and Equipment Equipment – At cost 57,862 57,862 Accumulated depreciation (24,630) (22,935) Closing Balance 33,232 34,927 Total Property, Plant & Equipment 4,564,594 4,570,249

7.

Land $ Buildings $ Plant & Equipment $ Total $ Year Ended 30 June 2021 Balance at the Beginning of Year 4,400,000135,32234,927 4,570,249 Revaluation ---Depreciation -(3,960)(1,695) (5,655) Balance at the End of the Year 4,400,000131,36233,232 4,564,594

Notes to and forming part of the Financial Statements for the Financial Year Ended 30 June 2022

The operation of the Scheme is solely in Australia and no additional operating segment established in 2021 financial year.

Cremorne Capital Limited – HVT Land Trust

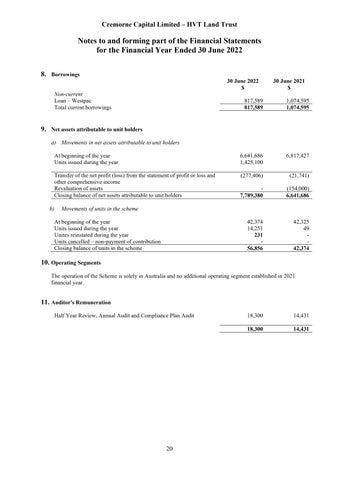

20 8. Borrowings 30 June 2022 $ 30 June 2021 $ Non-current Loan – Westpac 817,589 1,074,595 Total current borrowings 817,589 1,074,595

Net assets attributable to unit holders a) Movements in net assets attributable to unit holders At beginning of the year 6,641,686 6,817,427 Units issued during the year 1,425,100 Transfer of the net profit (loss) from the statement of profit or loss and other comprehensive income (277,406) (21,741) Revaluation of assets - (154,000) Closing balance of net assets attributable to unit holders 7,789,380 6,641,686 b) Movements of units in the scheme At beginning of the year 42,374 42,325 Units issued during the year 14,251 49 Unites reinstated during the year 231Units cancelled – non-payment of contribution -Closing balance of units in the scheme 56,856 42,374

Segments

9.

10. Operating

Auditor's Remuneration Half Year Review, Annual Audit and Compliance Plan Audit 18,300 14,431 18,300 14,431

11.

Notes to and forming part of the Financial Statements for the Financial Year Ended 30 June 2022

12. Related Party Disclosures

The Responsible Entity of Cremorne Capital Limited - HVT Land Trust is Cremorne Capital Limited (ACN 006 844 588).

The Custodian of the Scheme is Perpetual Investment Management Limited. Custody fees of $21,879 were paid during the period. (2021: $29,337)

Transactions with related parties have taken place at arm’s length and in the ordinary course of business.

Investment management fees of $207,269 were paid to the Responsible Entity in accordance with the constitution. (2021: $205,765)

No Custodian fees were paid to the Responsible Entity in accordance with the constitution as no applications were received by the Scheme.

The Responsible Entity has paid $0 (2020: $0) worth of expenses on behalf of the Scheme, which were paid or are payable by the Scheme. At year end the Responsible Entity is owed $33,269 (2021: $180,856).

The Responsible Entity has been paid no commissions for the sale and purchase of assets and debt arrangement fees (2020: $Nil).

Accounting and administration fees of $65,497 were paid or payable to Terrain Capital Ltd. Michael Ramsden is a director of Cremorne Capital Limited and Terrain Capital Limited (2021: $46,580).

Legal fees of $27,375 were paid or payable to Oliver Carton who is a director of Cremorne Capital Limited (2021: $12,825) for legal work associated with the Rights Issue and other matters.

Key Management Personnel

The names of the key management personnel of the Scheme during the financial year were:

• Mr M.A. Ramsden (Director)

• Mr D.A. Carroll (Director)

• Mr O.R. Carton (Director)

The positions noted above for the Scheme's key management personnel are the positions held within the Responsible Entity and not the Scheme itself.

Compensation of Key Management Personnel

No amount was paid by the Scheme directly to the Directors of the Responsible Entity. Consequently, no compensation as defined in AASB 124 "Related Party Disclosures" is paid by the Scheme to the Directors as Key Management Personnel.

Holdings of units by related parties

During or since the end of the financial period, Michael Ramsden who holds 6,967 units in the scheme under the names of Whitehaven Investments Pty Ltd, Pacrim Super Fund, Doverpoint Pty Ltd and Ormley Pty Ltd. Cremorne Capital Ltd holds 6,499 units in the scheme, Don Carroll holds 500 units and Oliver Carton has a beneficial interest in 150 units.

Cremorne Capital Limited – HVT Land Trust

21

Notes to and forming part of the Financial Statements for the Financial Year Ended 30 June 2022

13. Notes to the Statement of Cash flows

(a)

(b) Reconciliation of cash flow from operations with loss from ordinary activities

(c) Non-Cash Financing and Investing Activities

During the period, no distributions were reinvested by unitholders for additional units in the Scheme. During the period, no distributions receivable by the Scheme in respect of its investments were reinvested.

(d) Changes in liabilities arising from financing activities

14. Financial Instruments

(a) Financial risk management objectives

The Scheme does not enter into or trade financial instruments, including derivative financial instruments, for speculative purposes. The use of financial derivatives is governed by the Schemes investment policies, which provide written principles on the use of financial derivatives.

(b)

Significant

accounting policies

Details of the significant accounting policies and methods adopted, including the criteria for recognition, the basis of measurement and the basis on which income and expenses are recognised, in respect of each class of financial asset and financial liability are disclosed in note 1 to the financial statements.

Cremorne Capital Limited – HVT Land Trust

22

Reconciliation of

and

30 June 2022 $ 30 June 2021 $ Cash 410,461 36,812 Total cash and cash equivalent 410,461 36,812

cash

cash equivalent

Net loss attributable to unitholders* (277,406) (21,741) Cash flows

from

operating activities Non-cash flows in loss: Depreciation 5,655 5,855 Changes in assets and liabilities: (Increase)/decrease in receivables (3,623) (5,095) Increase/(decrease) in creditors and accruals(519,071) 171,652 Cash flow from/(used in) operations (794,445) 150,671

excluded

loss attributable to

Non-cash changes 2021 Cash flows Foreign exchange movement Other noncash movements 2022 $ $$$$ Borrowings 1,074,595 (257,006) - - 817,589 Total liabilities from financing activities 1,074,595 (257,006) - - 817,589

Notes to and forming part of the Financial Statements for the Financial Year Ended 30 June 2022

(c) Credit Risk

The maximum exposure to credit risk, excluding the value of any collateral or other security, at balance date to recognised financial assets is the carrying amount of those assets, net of any provisions for doubtful debts, as disclosed in the statement of financial position and notes to the financial statements. The Scheme does not have any material credit risk exposure to any single debtor or group of debtors under financial instruments entered into by the Scheme.

(d) Net Fair Values

The net fair value of financial assets and financial liabilities approximates their carrying values as disclosed in the Statement of Financial Position and notes to the financial statements

(e) Financial liab ility and financial asset maturity analysis

(f) Liquidity Risk

Liquidity risk is the risk that the Scheme will encounter difficulty in meeting obligations associated with financial liabilities. The Scheme manages this risk through the following mechanisms:

- preparing forward-looking cash flow analysis in relation to its operational, investing and financing activities;

- monitoring credit facilities;

- managing credit risk related to financial assets; and

- only investing surplus cash with major financial institutions

Cremorne Capital Limited – HVT Land Trust

23

Within 1 year 1 to 5 Years Over 5 Years Total Financial liabilities due for payment 2022 $ 2021 $ 2022 $ 2021 $ 2022 $ 2021 $ 2022 $ 2021 $ Trade and other payable 72,034591,105 - - - - 72,034 591,105 Loans payable - - 817,589 - - 1,074,595 817,589 1,074,595 Total expected outflow 72,034 591,105 817,589 - - 1,074,595 889,623 1,665,700 Cash and cash equivalents 410,461 36,812 - - - - 410,461 36,812 Trade, term and loan receivable 16,948 13,325 - - - - 16,948 13,325 Total anticipated inflows 427,409 50,137 - - - - 427,409 50,137

Notes to and forming part of the Financial Statements for the Financial Year Ended 30 June 2022

(g) Market Risk

Market risk is the risk that the fair value or future cash flows of financial instruments will fluctuate due to changes in market variables such as interest r ates, foreign exchange rates, and equity prices. Market risk is managed and monitored using sensi tivity analysis and minimised through ensuring that all investment activities are undertaken in accordance with established mandate limits and investment strategies.

15. Going Concern

This report has been prepared on the going concern basis, which contemplates the continuity of normal business activity and the realisation of assets and settlement of liabilities in the normal course of business.

Future operating expenses will either be met through subscriptions received from members of the Scheme, maintenance contributions or from the proceeds of asset and stock sales. Based on sales to date, the Responsible Entity is confident that the Scheme will be successful in achieving its objectives.

Cremorne Capital Limited (A.C.N. 006 844 588) a company incorporated and operating in Australia is the Responsible Entity of the Cremorne Capital Limited - HVT Land Trust.

Registered Office 8 Chapel Street

Cremorne Vic 3121

Cremorne Capital Limited – HVT Land Trust

24

Interest rate risk management 30 June 2022 Weighted Average Int Rate (%p.a.) Variable Int. Rate $ Non-Interest Bearing $ Total $ Financial Assets Cash & Equivalents 0.00%410,461- 410,461 Receivables -16,948 16,948 410,461 16,948 427,409 Financial Liabilities Trade and Other Payables4.81%817,58972,034 889,623 817,589 72,034 889,623 30 June 2021 Weighted Average Int Rate (%p.a.) Variable Int. Rate $ Non-Interest Bearing $ Total $ Financial Assets Cash & Equivalents 0.00%36,812- 36,812 Receivables -13,325 13,325 36,812 13,325 50,137 Financial Liabilities Trade and Other Payables4.81%1,074,595591,105 1,665,700 1,074,595 591,105 1,665,700