Asia’s definitive media content and services directory

Index

Who’s who...

Page 4 A+E Global Content Sales

Page 5 ABS-CBN Corporation

Page 6 All3Media International

Page 8 ATV Turkey

Page 9 Banijay Rights

Page 10 BBC Studios

Page 11 BEC World PCL

Page 12 Boat Rocker Studios

Page 13 Fremantle

All programme distribution companies were given the same opportunity to supply information for inclusion in ContentAsia’s The Big List 2023

Who’s who...

Page 30 Deutsche Welle (DW)

Page 31 KC Global Media Asia

Page 32 Paramount Global

Page 33 Rock Entertainment Holdings

Page 34 THEMA Asia Pacific

Page 36 TV5MONDE Asia-Pacific

All channels operating in or for Asia were given the same opportunity to supply information for inclusion in The Big List 2023

Page 38 Cambodia

Page 39 China

Page 42 Hong Kong

Page 44 India

Page 47 Indonesia

Page 51 Japan

Page 54 Korea

Page 14 Cineflix Rights

Page 16 GMA Network

Page 17 Kanal D International

Page 18 Inter Medya

Page 20 NBCUniversal Global Distribution

Page 21 Paramount Global Content Distribution

Page 22 PBS International

Page 23 Red Arrow Studios International

Page 24 Sony Pictures Entertainment (SPE)

Page 25 WildBrain

Page 58 Mongolia

Page 60 Myanmar

Page 61 Pakistan

Page 63 Philippines

Page 65 Singapore

Page 66 Taiwan

Country Profiles 2023

Country Profiles 2023

Page 56 Laos

Page 57 Malaysia

Page 69 Taiwan Creative Content Agency (TAICCA)

Page 70 Thailand

Page 72 Vietnam

A+E Networks Asia

18 Purvis Street

#02-01

Singapore 188597

LifetimeAsia

HISTORYasia

historyasia

lifetimeasia

Who’s Who...

Steve MacDonald President, Global Content Sales & International

Patrick Vien Group Managing Director, International

Saugato Banerjee Managing Director, Asia-Pacific

John Flanagan General Manager, Japan and Regional Head of Programming & Marketing

YoungSun Soh General Manager, Korea & Regional Head of Digital Business Development

Glen Hansen Senior Vice President, Head of International Content

Distribution, Asia Pacific

Amreet Chahal Director, Content Sales, Asia Pacific

Asia focus in 2023

Our biggest strengths are in our appealing, premium quality slate of documentaries, scripted dramas and factual entertainment titles with huge household names like Morgan Freeman, Pierce Brosnan and JayZ attached to the projects. We believe we are in good stead to fill electric content needs across the buying community in Asia.

In addition to the A+E global catalogue, there is a constant stream of incredible content coming out of our Asia business. From premium Korean productions and Japanese documentaries to original unscripted shows in India and brand-new programming in SEA, we are able to leverage on to meet demands across the various genre requirements in Asia, where there is a huge appetite for great storytelling across international and local programming.”

Amreet Chahal, Director, Content Sales, Asia Pacific, A+E NetworkA+E Networks is a global content company comprised of some of the most popular and culturally relevant brands in media, including A&E, Lifetime, The HISTORY Channel, LMN, FYI, and VICE TV, Blaze and Crime+Investigation. A+E Networks’ portfolio extends across platforms and genres with a scripted production division, A+E Studios; unscripted production studios, Six West Media; and Category 6; and film unit, A&E IndieFilms. A+E Digital includes apps, games, FAST channels, AVOD, SVOD, and podcasts. A+E International Includes global branded channels, content distribution and co-productions. A+E Networks’ content reaches more than 335 million households in over 200 territories in 41 languages. A+E Networks is a joint venture of Disney-ABC Television Group and Hearst.

Genres

Scripted, Factual Entertainment, Documentaries, Docu-Dramas, Crime, Lifestyle, Movies and Formats

Top shows are… Miss Scarlet & The Duke

The adventures continue for Victorian London’s first-ever female detective in this full-throttle crime drama. Putting the men around her in their place, Eliza Scarlet has solved the case of who killed her father while her relationship with Inspector William Wellington, aka “the Duke”, continues to slowly simmer. But the harsh challenges still remain for a professional woman in a male-dominated 1880s London. Episodes/length: Season 2a: 6x1 hour; Season 2b: 6x1 hour

Biography: WWE Legends Watch Trailer

Dive into the lives and relationships of the most iconic WWE stars of all time. Learn the stories behind the superstars and major events through archival footage and interviews. The season premiere will explore the infamous stable the New World Order (NWO), while subsequent episodes will examine Jake “The Snake” Roberts, Chyna, Dusty Rhodes, Kane, and Iron Sheik among others. Episodes/length: Season 3: 5x2 hours

WWE Rivals Watch Trailer

In WWE: Rivals, actor and former WWE writer Freddie Prinze Jr. leads a roundtable discussion of WWE stars as they delve into the storylines and dynamic characters behind the epic battles that built the WWE. The season begins with Hulk Hogan vs. Andre The Giant, and will continue with “Stone Cold” Steve Austin vs. Bret Hart, Undertaker vs. Mankind, The Rock vs. John Cena, Triple H vs. Batista, Brock Lesnar vs. Roman Reigns, and “Stone Cold” Steve Austin vs. Shawn Michaels. Episodes/length: Season 2: 8x1 hour

We Need To Talk About Prince

Andrew: The Whole Story

The definitive life story of the Problem Prince and the interview that would take him down and cause the biggest threat to the British monarchy in recent history. With exclusive access to the BBC Newsnight team, this is the inside story that led up to the explosive Prince Andrew interview in 2019. Episodes/length: 2x1½ hour

Alone: Australia Watch Trailer

In Alone: Australia, ten Australian survivalists will be dropped in the remote wilds of Western Tasmania, completely isolated from the world and each other, stripped of modern possessions, contact and comforts, to self-document their experience – the last one standing winning $250,000. Episodes/length: Season 1: 11x1 hour

ABS–CBN Corporation is a Philippine-based media and entertainment company. It is primarily involved in content creation and production for television, online and over-the-top platforms, cable, satellite, cinema, events, and online radio for domestic and international markets.

ABS-CBN Corporation

ABS-CBN Broadcast Center, Sgt. Esguerra Avenue cor Mother Ignacia Street, Diliman, Quezon City 1103 Philippines

T: +63 (02) 3415 2272

E: internationalsales@abs-cbn.com

W: https://www.abs-cbn.com/internationalsales

Who’s who...

Pia Laurel Head, ISD and Partnerships

E: Pia_Bacungan-Laurel@abs-cbn.com

Whatsapp/Viber: +63 917 537 2573

Laarni Yu

Sales Head, Europe, MENA, and Africa | Airlines

E: Laarni_Yu@abs-cbn.com

Whatsapp/Viber: +63 917 569 8531

Wincess Lee

Sales Head, Asia and LatAm

E: Wincess_Lee@abs-cbn.com

Whatsapp/Viber: +63 998 991 5838

Genres

TV Dramas, movies, mini series, drama and movie IPs for adaptation, non-scripted formats, lifestyle, documentaries, music, animation.

Original production/ co-production

We have already started producing for the international market with crime thriller Cattleya Killer which we launched last MIPCOM. This year, we are collaborating with the Philippines’ GMA Network in producing romance series Unbreak My Heart, which will also be streamed by VIU in 15 territories outside the Philippines. This groundbreaking partnership that no one saw coming is a testament to our mission to showcase the best Filipino talent to the world. These projects will help us reach more viewers, both Filipino and foreign.

Top shows are…

Dirty Linen Watch Trailer

Orphan Alexa Salvacion grew up on the streets with one thing in mind – uncover the truth behind her mother’s disappearance. She has always believed that her mother’s employers, the powerful Fiero family, were responsible for her vanishing. Together with others seeking revenge on the Fieros, Alexa infiltrated their lives by working as a maid in their mansion. However, her desire for revenge is challenged when she discovers secrets within the family. As Alexa develops deeper connections with two members of the Fiero family, her plans are put in jeopardy. Genre: Thriller. Episodes/length: approx. 50x45 mins

2 Good 2 Be True Watch Trailer

In addition to our strong romance and family drama lineup, we have been creating bolder storylines in crime and thriller genres that had helped open conversations in markets we aim to set foot in. We’re also bringing stand-up comedy specials and other entertainment content that can surely address the needs of regional Pay TV channels and global OTT players. The goal is to increase the volume in our existing markets while expanding beyond our core clientele.”

A modern-day Robin Hood falls for his target’s caregiver in this heartwarming series. During an amateur heist meant to aid a family friend, a crafty mechanic named Eloy crosses paths with Ali, a nurse with a nose for trouble. Soon after their encounter, Ali begins working as a secret nurse for Hugo Agcaoili, a real estate tycoon recently diagnosed with Alzheimer’s who Eloy believes has had a hand in the accident which led to his father’s imprisonment and his mother’s death. Eloy starts plotting to use Ali in his mission to discover the truth behind his father’s incarceration despite Ali’s growing suspicions about him. But as they are led back to each other’s paths, they start to fall in love and uncover secrets from the past that should drive them apart. Genre: Light Romance. Episodes/length: 70x45 mins

Flower Of Evil Watch Trailer

Top detective Iris Castillo-Del Rosario and her team reopen the unsolved case of the mysterious serial killings in the town of Corazon after a similar crime happened under their watch. As they dig deeper into the past and piece together new evidence to find the suspect, Iris’ instinct points only to one person – her husband, Jacob del Rosario. How can she face the truth if it will destroy her family? Will she stay faithful to her sworn duty to protect the people? Or will she save her husband from getting caught? Based on the original format Flower of Evil created by Jeong-hui Ryu and produced by Studio Dragon Corporation and CJ ENM Co., Ltd. Genre: Family Drama. Episodes/length: 32x45 mins

All3Media International

Asia Pacific Office

One George Street, 10-01 Singapore 049145

W: www.all3mediainternational.com @all3media_int

Who’s who...

Sabrina Duguet EVP, Asia Pacific (Pan-Asia, Formats for Australia and New Zealand)

E: sabrina.duguet@all3media.com

Jaenani Netra VP Sales (India, Bangladesh, Pakistan, Nepal & Sri Lanka)

E: jaenani.netra@all3media.com

Ziran Tang (Tony) VP Sales (China, Japan, South Korea, Taiwan)

E: ziran.tang@all3media.com

Amanda Pe Sales Executive (Brunei, Cambodia, Hong Kong, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand & Vietnam)

E: amanda.pe@all3media.com

All3Media International is one of the leading independent distributors of television programming and formats in the UK.

All3Media International is the distribution arm of All3Media group and manages a distribution catalogue spanning more than 30,000 hours of content across all genres.

Genres

Our catalogue contains a diverse range of content across a range of genres. Highlights from our 2023 slate include premium scripted series Boat Story from Two Brothers pictures, the award winning team behind Fleabag and The Tourist. We also have a strong pipeline of premium factual titles including Roast Beef’s Spacey Unmasked. On the formats front we are excited to introduce new non scripted formats launching including Picture Slam, a fun, prime-time new quiz show.

Original production/co-production

We have had a fantastic success in the past few years with our scripted formats in Asia, with 10 adaptations, and several more in the pipeline. With regards to nonscripted, the worldwide success of The Traitors is now generating strong interest in the region, as well as some new prime time entertainment shows like idtv’s The Unknown and Studio Lambert’s Rise and Fall.

Asia focus in 2023

We are looking forward to supporting our clients with the requirements, objectives and challenges they are facing, whether this is through adaptations of scripted formats, nonscripted formats or content acquisitions or even in some cases co-pro opportunities thanks to our eclectic catalogue of content as well as All3Media International’s expertise.”

Sabrina Duguet, EVP Asia Pacific

Top shows are…

The Traitors Watch Trailer

Trends & Outlook 2023

• Local, Local and more local content, with local creations and also formats adaptations.

• Diversification of content produced – expanding from the scripted commissions to non scripted commissions

• Diversification of the content acquired – while national and regional content from Asia is crucial for local platforms and channels, to retain the audience there needs to be a diverse catalogue of content offering.”

A highly adaptable format of psychological game play that creates incredibly tense, addictive, must-watch viewing for global audiences. Contestants move into an atmospheric location with the goal to work as a team to complete a series of challenging missions to earn a cash prize. The catch, however, is that some of the contestants are traitors who will attempt to deceive and manipulate their way to the prize instead of sharing it amongst the group. Credit: The Traitors format is devised and developed by IDTV in cooperation with the RTL Creative Unit. The format is distributed by All3Media International.

The Real Crown: Inside The House of Windsor

The series will capture the powerful human drama of Britain’s greatest remaining dynasty, following the story of a family who have lived under intense public scrutiny their entire lives and how the Queen guided them through every predicament until the end of her seven decades reign. Credit: 72 Films in association with All3Media International for ITV, UK

Trigger Point Watch Trailer

A high-octane six-part thriller series recently commissioned for a second season. Set in the high-pressured world of bomb disposal, Trigger Point stars Vicky McClure as Lana (Line of Duty, This is England), a frontline officer who must risk her life during a terrorist campaign in the heart of London. When a terrorist campaign threatens the capital one summer, the Expos are at the forefront of urgent efforts to discover who is behind the bombings before fatalities escalate. Under extreme pressure and searching for answers, Lana becomes suspicious the bomber is premeditatedly targeting her unit – but how does she prove it and discover the bomber’s real identity? Credit: HTM Television for ITV, UK in association with All3Media International

Sabrina Duguet, EVP Asia PacificJaenani Netra Amanda Pe

atv

Turkuvaz Media Group, Guzeltepe mah.

Mareşal Fevzi Cakmak cad. No: 29, 34060 Eyupsultan

Istanbul, Turkiye

T: +90 212 354 37 01 atvdistribution

Who’s who...

Muge Akar

Head of Sales – Europe, Asia, Africa

E: muge.akar@atv.com.tr

Gözde Dinç Ozcan

Sales Deputy Manager

E: gozde.dinc@atv.com.tr

Sena Kul Sales Assistant Specialist

E: sena.kul@atv.com.tr

Our primary goal is to reach audiences all over the world with our powerful series. We want our dramas to work collaboratively with Asia throughout 2023, hoping to get out to everyone with our remarkable and detailed catalog. And, given the high demand and incredibly quickly growing fan base in Asia, we are excited about broadening our catalog. And in upcoming markets, we believe we will achieve this goal and have a significant impact on Asian territories in 2023.”

Muge Akar, Head of Sales – Europe, Asia, Africa

atv is part of Turkey’s largest media group (TMG), which operates in television and radio broadcasting, newspaper and magazine publication and printing. Its flagship TV channel, atv, launched in 1993. atv is the leading TV channel in Turkey and focuses on primetime high-quality drama series that are exported to almost 100 countries worldwide. The channel is renowned for its enthralling dramas, hilarious comedies, action-packed series and engaging programmes – all of which are produced at the highest quality.

Genres

atv’s line-up offers one of the strongest catalogues specialising in Turkish drama. We are happy to provide a variety of genres such as romantic, action, melodrama and historical/period dramas.

Top shows are…

Street Birds Watch Trailer

In this modern journey of friendship and survival, five street kids turn their lives upside down when they rescue a baby abandoned in a trash bin and narrowly escape the gangster Çatal. As they rebuild their lives as a family and run a successful cafe, the past and its secrets come back to prey on them. Who is the baby they are protecting? Who is behind the murder? With survival a constant challenge, the Street Birds become the Ruthless. Against all odds, can this family stay together? Genre: Drama. Length: 45 mins. (In Production)

A Little Sunshine Watch Trailer

When Elif is forced to confront her husband’s secret double life the day he dies, he is presented with his child – a child from the woman. Nevertheless, she raises and loves the little girl dearly. But as time goes by, secrets begin to unravel: who killed her husband, who is the child’s birth mother, and how is everyone related? This female-led drama is the story of motherhood, survival and hope. Genre: Drama. Length: 45 mins (In Production)

The Father Watch Trailer

A secret service assassin who served his country, Cezayir Turk takes revenge on his brother for being sabotaged. For the safety of his beloved family and government, he fakes his own death and moves abroad. Believing he will never return, he meets a woman, falls in love and starts a new family. When he is suddenly exposed and called back to Istanbul, worlds collide – his first family has been praying at his graveside, his second family had no knowledge of his former life, and powerful people still want him dead. Genre: Drama. Length: 45 mins (In Production)

Trends & Outlook 2023

We are delighted to see Turkish dramas’ enormous popularity and fan base throughout Asia. Our family dramas are one of the most popular genres in Asia, with Street Birds having a successful start at the beginning of 2023. Its first episode was a huge success and left an effect on the audience. The series recently aired in Bangladesh and high demand continues. We show strong leading female dramas. One of the new examples, A Little Sunshine, which we launched in September, is about a mother-daughter relationship and surviving in life with all of its challenges. Costume dramas and historical themes have a significant impact in Asia, such as our best drama awarded-series Destan, and The Ottoman which is currently in its 4th season on TV and is always a ratings winner.”

Muge Akar, Head of Sales – Europe, Asia, Africa

Banijay Rights

Lotus Grandeur, 20th Floor

Veera Desai Road Extension

Andheri (West), Mumbai – 400 053 India

W: www.banijayrights.com

Who’s who...

Rashmi Bajpai EVP Asia

E: rashmi.bajpai@banijayrights.com

Trends & Outlook 2023

The rising demand from streaming services for originals is even higher. The need to remain relevant in their local language, which in turn will increase engagement and add viewers.

Game shows are just as popular, but we are receiving more requests from clients to accommodate brand-led ideas since the marketers want more for their buck and their exposure is beyond standard linear or streaming. They are aggressively pushing for more product integrations, customised promotions, meet & greet, contests and quizzes on social media such us YouTube, Facebook, Instagram, etc.

More AVOD deals and the growing popularity of FAST channels. We see this trend continuing in valuedriven and price sensitive territories in Asia. We are confident that the AVOD business will continue to thrive.”

Leading global distributor, Banijay Rights, represents a world-class, multi-genre portfolio of over 150,000 hours of standout programming. Handling the distribution for content powerhouse, Banijay, the division specialises in the exploitation of premium scripted and non-scripted brands to broadcasters worldwide.

Genres

In Asia we are offering a multi-genre portfolio comprising scripted, factual, family, entertainment and reality titles. On the formats front, we also license some of our biggest brands such as MasterChef, Big Brother, Survivor, Fear Factor and Deal or No Deal

Original production/co-production

We are very excited to announce the sixth season of MasterChef Thailand. Recently we launched the seventh season of MasterChef India on Sony. All Together Now Malaysia season two is on-air and performing strongly. We have plenty more deals in the pipeline, which will be announced in due course.

I’m also happy to mention the awards we won in Asia in 2022:

LEGO Masters China was the winner at the Asian Academy Awards 2022 as ‘Best Adaptation of An Existing Format’ (National Winner in China)

LEGO Masters South Korea (Blockbuster: Brick Wars of Geniuses), was the winner at the Asian Academy Awards 2022 as ‘Best Adaptation of An Existing Format’ (National Winner in Korea)

MasterChef Singapore was the winner at the Asian Academy Creative Awards 2022 as ‘Best Adaptation of An Existing Format’ (National Winner in Singapore)

All Together Now Malaysia, nominated at the ContentAsia Awards 2022 as ‘Best TV Format Adaptation (Unscripted)’ in Asia.

Top shows are…

For our finished tapes, our top three programmes for 2023 are The Sixth Commandment, Wild Isles with Sir David Attenborough and the US adaptation of SAS called Special Forces: World’s Toughest Test In terms of formats, we are very excited to represent new titles like Big Interior Battle, Date My Mate and Blow Up

Asia focus in 2023

We must adapt to the changing landscape. The recent mergers and acquisitions amongst major studios have reduced the size of the market. This year will indicate what that means for content distributors as the larger studios will explore their own IP and we will need to re-evaluate our priorities.

Given this consolidation, we need to focus on every opportunity – big or smallto make up the volume. For us this could be territories like South Korea where we licensed Lego Masters or a smaller territory like Mongolia where our format Killer Karaoke will be hitting the floors. We lead the way on local language versions such as Big Brother India which is produced in six languages, Survivor India which was made in Tamil.

With finished tapes suffering at the hands of local original offering, we will concentrate on format sales, especially scripted formats e.g. the third season of Arya will release in India which is an adaptation of our drama, Penoza.”

BBC Studios

18 Robinson Road, #13-01

18 Robinson

Singapore 048547

T: +65 6849 5511

W: https://www.bbcstudios.com/

Who’s who...

Phil Hardman GM, BBC Studios Asia

Cheryl Png VP Distribution BBC Studios Asia, SEA, South Korea and Japan

Asia focus in 2023

We are looking to leverage the power and global scale of BBC Studios to bring more to our audiences. From the most trusted News to ground breaking factual and educational kids shows we bring the best of our creativity to our Channels and Streaming Services with more top titles on BBC Player, continuing and growing new partnerships with streaming partners, and bringing Bluey and BBC Earth to life off screen for our audiences through consumer products and live experiences.”

Phil Hardman GM, BBC Studios Asia

Trends & Outlook 2023

BBC Studios, a global content company with British creativity at its heart, is a commercial subsidiary of the BBC Group. Able to take an idea seamlessly from thought to screen, it spans content financing, development, production, sales, branded services, and ancillaries from both its own productions and programmes and formats made by highquality UK independents. The company, which makes around 2,500 hours of content a year, is a champion for British creativity around the world and a committed partner for the UK’s independent sector. BBC Studios has offices in 20 countries globally, 10 production offices in the UK and a further seven production bases and partnerships in countries outside of the UK.

Genres

We offer a huge range of different genres in Asia from the most trusted international news brand in APAC* to the genre defining Natural History unit, to global smash hits sitting across our lifestyle, comedy, factual, drama and kids categories. With the BBC’s continued mission to inform, educate and entertain we are truly focussed on bringing bold storytelling to audiences across the globe in a wide range of formats, languages and genres. Off screen we are also focussing on bringing our hugely successful Consumer Products and Licensing to Asia.

Original production/co-production

BBC Studios scripted series continue to interest and delight audiences across Asia, with Japan recently joining Indonesia, Thailand, South Korea, the Philippines, and India in commissioning a local version of Doctor Foster with Nippon TV. Local scripted comedy series have also started to grow, as a local version of Uncle aired in South Korea last year, while the team at BBC Studios India Productions is starting work on a local version of Dead Pixels for Disney+Hotstar. As we look ahead into 2023, we’re excited to build on our unscripted format sales, too, as The Great Bake Off’s recent airing in Japan demonstrates the region’s appetite for tasty storytelling.

Top shows are…

Planet Earth III

Premiering later this year this will be the most ambitious natural history landmark ever undertaken by the BBC. Combining the awe and wonder of the original Planet Earth, the new science and discoveries of Blue Planet II and Planet Earth II, and the immersive characterled storytelling of Dynasties, the series will take the ‘Planet Earth’ experience to new heights.

We’re seeing a shift in the way audiences are consuming content and for this year we believe that Asian audiences will become even more discerning in their platform and content choices as barriers to accessibility and affordability move down. The BBC Studios Channels including BBC Earth, BBC Lifestyle, CBeebies, BBC News and ‘BBC Player’, our authenticated SVOD service, will continue to deliver our high quality programming which educates informs and entertains, led by our local teams on the ground in Asia.

Trusted News and Factual programming will lead the way in informing audiences. BBC News continues to report without fear or favour as audiences across the globe are turning increasingly to news channels they can trust. While our factual entertainment will continue to provide content with purpose and a unique focus on sustainability

Lastly we believe the way that people make decisions about workplaces will continue evolving. Creative and commercial talent will want to be part of an organisation with a clear purpose and only with the best people can we serve our audiences, work effectively with our advertising partners and build strong and lasting commercial partnerships.”

Cheryl Png, VP Distribution BBC Studios Asia, SEA, South Korea and Japan

Six Four

An adaptation of Japanese

Novel Six Four by Hideo Yokoyama for the screen by writer, Gregory Burke. A teenage girl runs away from home, exposing lies and political intrigue. This fourpart thriller is set primarily in Glasgow and is a compelling story of corruption, betrayal and an uncompromising search for the truth. When their teenage daughter goes missing, serving Glasgow police detective, Chris O’Neill, and his wife Michelle – a former undercover officer – use their skills to try and track her down.

Supertato

A co-production with Tencent. Meet the world’s greatest potato superhero, Supertato. Inspired by the best-selling book series, Supertato is a new laugh-out-loud comedy adventure for kids. Set in the aisles of an everyday supermarket, good battles against evil as Supertato and his fruit and vegetable pals do everything they can to try and stop the villainous Evil Pea. Each episode brings new challenges and hilarious silliness – from riding an outof-control toy dinosaur to building a baguette rocket and visiting the stinky cheese moon in the deli aisle.

BEC

World (Public) Company Limited

3199 Maleenont Tower, Floor 2, 3, 4, 9, 10, 30-34, Rama 4 Road, Klongton, Klongtoey, Bangkok 10110 Thailand

T: +662 262 3249

W: www.becworld.com

www.ch3plus.com/contentlicensing

E: inter-sales@becworld.com

CH3 Official

CH3 OTT

Ch3thailand

CH3Plus

Asia focus in 2023

BEC World is a content company. We continue to challenge ourselves to be the best storyteller and compete with content from the region for the rest of the world. We produce a wide range of content for different target markets, including tentpoles like “Love Destiny,” which showcases Thailand’s rich history and culture that is widely received internationally, rom-com with BEC’s A-listers, drama, and horror.”

Surin Krittayaphongphun

President of TV Business of BEC World

Who’s who...

Ziraviss Vindhanapisuth (Tum)

VP – Int’l Business

Ratsarin Phaisantanamol (Jeab)

Int’l Business Account Manager

Nantika Nuchpoom (Eve)

Int’l Business Account Manager

Kawalin Chantawatkul (Gift)

Int’l Business Account Manager

BEC World PCL has been at the forefront of Thai media companies in Thai television, feature film production, global distribution and broadcasting for more than 53 years. BEC operates DTTV’s Channel 3 and digital platform CH3Plus, producing original content of various formats, from news to variety shows to more than 1,000 hours of Thai dramas per year starring well-known Thai stars. To further expand its business, the company has established BEC STUDIO to produce its own content for various platforms.

Top shows are…

Love Destiny 2 / พรหมลิขิต (Prom Likit) Watch Trailer

The sequel to Love Destiny picks up where the previous instalment left off, in which an evil, dead Ayutthaya-era noblewoman – Garagade – from the 17th century is revived when the soul of a virtuous woman of today – Gadesurang – enters her dead body. With her playfulness and selflessness, she wins the hearts of everyone, including her fiancé Dej, with whom she has twins. As life continues to weave a tapestry of present-day reality, Love Destiny 2 will finally unravel the mystery of the ancient Krishna Kali manuscript and the identity of its mysterious author. Love Destiny 2 will finally unravel the secret of the ancient Krishna Kali manuscript and the identity of the mysterious author who inscribed the mystical chants. Can their love break the vicious karmic cycle?

Genre: Romance, Drama, Time Travel Episodes/ length: 26x70 mins.

Cast: Ranee Bella Campen, Thanavat Pope Vatthanaputi.

Never Enough / โลกหมุนรอบเธอ (Loke Moon Rob Ter) Watch Trailer

A coming-of-age drama about the friendship, rivalry and love of three best friends: Mana (James), Shin (Ice) and Tawan (Bow), who have spent almost their entire lives growing up together. Tawan, which means “sun” is literally the center of their universe – which both men are in love with. A heartbreaking friendship turn relationship love triangle; Mana and Shin are such good friends that they do not want to hurt each other’s feelings. The bromance is real, as is the romance, but who will capture her heart? Who will she ultimately choose, and at what cost? Genre: Romance Drama. Episodes/length: 22x70 mins.

Cast: Jirayu James Tangsrisuk, Maylada Bow Susri, Paris Ice Intarakomalyasut.

Nobody’s Happy If I’m Not / แค้น (Kaen) Watch

What would you do if your youthful innocence and dreams were stolen by your first love? Betrayed by her first love, who caused the collapse of her parents’ business, young Muanprae is robbed of her promising future. Distraught, she flees abroad to escape her problems. Fourteen years later, she returns to Thailand thinking she can bury the past. But a flashback of her painful memories triggers her inner rage and drives her to seek revenge on the people who caused her family’s downfall. Will Pithan, who sympathizes with Muanprae, succeed in curbing her desperate rage? Genre: Revenge, Psychodrama Episodes/length: 24x70 mins.

Trailer

Nantika

Cast: Natapohn Taew Tameeruks, Naphat Nine Siangsomboon, Taksaorn Aff Paksukcharoen.

Boat Rocker Studios

310 King Street East

Toronto, Ontario

Canada, M5A 1K6

T: +1 416 591 0065

W: www.boatrocker.com

W: www.boatrockercontentsales.com

Asia: 17/F, Millennium City 3

370 Kwun Tong Road

Kwun Tong, Kowloon

Hong Kong

T: +852 3759 1676

Who’s who...

Henry Or SVP, Strategic Partnerships Asia

E: Henry@boatrocker.com

Fabien Ching

Manager, Global Sales & Licensing, Asia

E: Fabien@boatrocker.com

Trends & focus in 2023

While coming to the end of the pandemic, we realised that the world has fundamentally changed. The media industry is no longer the same. Consumer behaviour is being transformed, from the way we work and learn, to shop and entertain. The adoption of digital has accelerated to a point that the SVOD market seems to be saturating, and streamers are now competing in the FAST/AVOD space, and focusing more on programme quality over quantity in their offering. Linear TV will continue to play its traditional, but vital role, during this media revolution in Asia. Since last year, Boat Rocker has expanded our production to include scripted content and feature documentary, adapting to changes in the media industry, and becoming a versatile global content creator and provider. Our primary focus in Asia in 2023 is to extend our reach to broadcasters and streamers beyond our usual factual entertainment and animation segments.”

Henry Or SVP, Strategic Partnerships, AsiaBoat Rocker is the home for creative visionaries. An independent, integrated global entertainment company, Boat Rocker’s purpose is to tell stories and build iconic brands across all genres and mediums. With offices around the world, Boat Rocker’s creative and commercial capabilities include Scripted, Unscripted, and Kids & Family television production, distribution, brand & franchise management, a world-class animation studio, and talent management through Untitled Entertainment. For more information, please visit boatrocker.com.

Genres

Drama, Competition, Crime, Documentary, Factual Entertainment, Food, History & Civilization, Home Renovation, Lifestyle, Reality, Science & Technology, Sports, Travel & Adventure, Wildlife and Kids Live Action & Animation.

Top shows are…

Orphan Black: Echoes

Orphan Black: Echoes is set in the near future and takes a deep dive into the exploration of the scientific manipulation of human existence. The show follows a group of women as they weave their way into each other’s lives and embark on a thrilling journey, unravelling the mystery of their identity and uncovering a wrenching story of love and betrayal. Genre: Scripted, Drama. Episodes/length: 10x60 mins

How I Got Here

Watch Trailer

How I Got Here is a powerfully entertaining and moving series where second-generation children accompany their parents back to their country of origin, to relive the sacrifice, struggle and dramatic circumstances that led their families to immigrate. The series will feature sons asking fathers, daughters asking mothers, grandchildren asking grandparents to travel back together to the homeland that was left behind. Each hour-long episode will introduce us to a second-generation millennial who wants to learn more about their cultural background. Genre: Unscripted, Docuseries/Travel & Adventure. Episodes/length: 10x60 mins

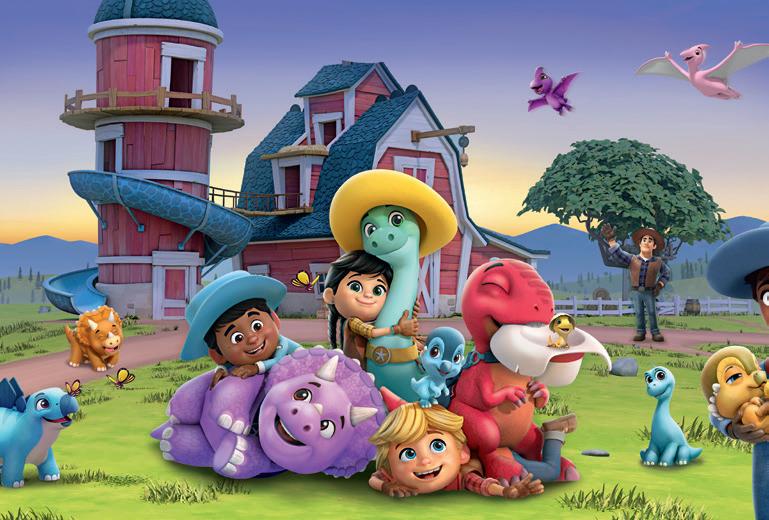

Dino Ranch

Watch Trailer

Dino Ranch follows the action-packed adventures of the Cassidy family as they tackle life in a fantastical, ‘pre-westoric’ setting where dinosaurs still roam. As the young ranchers Jon, Min and Miguel learn the ropes alongside their dinosaur best friends, they discover the exciting adventure involved in ranch life, and tending to the dinosaur sanctuary whilst navigating their ultimate playground – the great outdoors. Genre: Kids & Family, Comedy/Adventure/Pre-school. Episodes/length: S1: 52x11mins; S2: 52x11mins includes 22mins special; S3: 52x11mins includes 22mins special

FremantleMedia Asia Pte Ltd

3 Fusionopolis Way

Symbiosis, #06-21

Singapore 138633

W: www.fremantle.com

fremantle

fremantlehq company/fremantle

Screening Room

https://fremantlescreenings.com/

Who’s Who...

Haryaty Rahman

EVP Distribution, Asia, International

E: Haryaty.Rahman@fremantle.com

T:+65 6307 7226

Trends & Outlook 2023

Productions of format shows will continue to improve and return to pre-Covid volume in some Asian territories. Asian platforms and buyers will also take on more international scripted IP, going beyond traditional sources and embracing those with unique storylines which are relevant and have resonance in Asia. There will also be more distribution avenues for content providers to place their shows including FAST and new creative business models to fund and produce original productions.”

Haryaty Rahman, EVP Distribution, Asia, International

Fremantle is one of the world’s largest and most successful creators, producers and distributors of Entertainment, Drama & Film and Documentaries. Operating in 27 territories we are a proudly independent group of content creators. We produce and deliver highquality multi-genre IP including some of the biggest entertainment formats, most watched international dramas, award winning films and hard-hitting documentaries, amplifying local stories on a global scale.

Genres

Across Asia, Fremantle distributes formats and finished content in all genresEntertainment, Drama, Documentary and Lifestyle.

Production

In 2022, GMA in the Philippines produced close to 200 episodes of Family Feud Philippines in just its first year of airing the show and is still going strong in 2023. Malaysian media powerhouse Astro acquired multi-language versions of Family Feud, bringing back the format into the territory after more than a decade. Johnson Lee, host of our Family Feud Hong Kong on TVB won “Best Entertainment Host” at the 2022 Asian Academy Creative Awards Project Runway Thailand on JKN18 and Project Runway Mongolia on StarTV Mongolia also crowned their first ever winners in 2022. And Idol Philippines S2 on ABS-CBN and Cambodian Idol S4 on Hang Meas HDTV returned with a bang in 2022, making them the first shiny floor formats to debut post-Covid in their respective territories and both shows saw exceptional viewership performances on social media, on top of linear TV. Our Total Blackout Mongolia and Thank God You’re Here Mongolia which were produced and licensed to Hulegu Pictures, were also big hits in Mongolia on broadcaster EduTV and they have commissioned more episodes in 2023.

Asia focus in 2023

We’re excited to present our latest formats, dramas, documentaries, entertainment and lifestyle shows to clients, bringing them to new buyers and platforms as well as enriching the slate of our existing clients. We foresee scripted formats making a big impact on our business in 2023, more to come on this from us soon! We will also be focused on growing our digital and ancillary businesses through stronger partnerships, new business initiatives and funding models/strategies.”

Haryaty Rahman, EVP Distribution, Asia, International

Top shows are... Whale with Steve Backshall

In this brand-new, blue-chip natural history series, adventurer and conservationist Steve Backshall takes us closer to the lives of whales, dolphins and porpoises than ever before. Follow Steve’s thrilling, firsthand, freediving encounters with mighty Sperm Whales; intelligent, caring Humpback Whales; smart but deadly Orcas; and ingenious Bottlenose Dolphins across the Atlantic, Pacific and Indian oceans. Episodes/length: 4x1 hour

My Brilliant Friend: The Story of the Lost Child

The internationally adored prestige drama – now sold in over 170 territories –brings the immersive storytelling and charm of Elena Ferrante’s books vividly to life, winning the hearts of audiences and critics around the world. The fourth and final instalment of this critically acclaimed masterpiece now follows Elena and Lila’s fortunes through the tumultuous 1980s. Episodes/length: 10x1 hour

Password

The iconic word-guessing gameshow Password returns with The Tonight Show host Jimmy Fallon as one the celebrity players, accompanied by Nope actress Keke Palmer as host. Contestants are partnered with Jimmy and other guest celebrities to face off in the ultimate game of words, competing to win up to $25,000 by guessing a Password from only single-word clues. Episodes/length: 8x1 hour

Cineflix Rights

London Office

First Floor, 275 Grays Inn Road

London WC1X 8QB

United Kingdom

T: +44(0)20 3179 5050

W: www.cineflixrights.com

CineflixRights

CineflixMedia

Cineflix

CineflixRights

Who’s Who...

Chris Bluett SVP, Sales, Asia Pacific and Benelux

E: cbluett@cineflix.com

Tom Misselbrook SVP, Scripted Sales and Development

E: tmisselbrook@cineflix.com

Trends & Outlook 2023

The growth and reach of AVOD platforms continues in Asia, providing lower cost options for consumers alongside subscription services. Buyers in the region are investing in local programming more than ever so having a great new format with Tempting Fortune, which is easily adaptable, is something I’m looking forward to showcasing to clients. Like elsewhere in the world, viewers love compelling scripted content – whether that’s thrillers, crime or young adult. ”

Chris Bluett, SVP Sales, SVP, Sales, Asia Pacific and Benelux

Asia focus in 2023

Cineflix Rights is the UK’s largest, truly independent TV content distributor to broadcasters and streamers worldwide with a catalogue of premium scripted series and movies as well as must-watch, returning factual programming from some of the world’s most creative producers. Established in 2002, Cineflix Rights is based in London, and is part of the Cineflix Media group of companies.

Genres

Our catalogue of long-running factual brands spans a wide range of genres from history and science, wildlife, and true crime, through to lifestyle, property and entertainment formats. Our award-winning scripted lineup features enduring Englishlanguage and international dramas as well as movies.

Top shows are…

Last King of The Cross

Inspired by John Ibrahim’s best-selling autobiography charting his rise from a poverty-stricken immigrant with no education, no money, and no prospects to Australia’s most infamous nightclub mogul, Last King of The Cross is an operatic story of two brothers who organize the street but lose each other in their ascent to power. Produced by HELIUM Pictures for Paramount+, Australia. Episodes/length: 10x60 mins

Tempting Fortune

Twelve strangers are dropped in a remote wilderness where an epic cash prize awaits. It’s theirs to keep. That is, if they can make the grueling 18-day trek across the finish line – without spending it on all the pricey temptations that pop up along the way. Produced by Voltage TV for Channel 4, UK and Roku, North America. Episodes/length: 6x60 mins

History of the Sitcom

Exploring a groundbreaking genre that’s kept us laughing since the dawn of television, History of the Sitcom reunites audiences with their favourite sitcom families, friends, and co-workers – featuring interviews with scores of comedy legends who have graced the small screen over the decades. Produced by Cream Productions for CNN Original Series, U.S. Episodes/ length: 8x60 mins

Patrick Aryee’s Wild World

On Patrick Aryee’s Wild World, the British biologist and explorer travels the globe to explore how nature’s delicate balance can be disrupted – and restored. From the treetops to the unseen world beneath our feet, Patrick reveals the complex web of interactions that link the tiniest of creatures to the mightiest carnivores on the planet. Produced by Curve Media and Cineflix Productions for Sky Nature, U.K. Episodes/length: 4x60 mins

Cineflix Rights has a fantastic slate of strong new and returning scripted series and factual shows. I’m focused on rolling our programmes out to our existing partners as well as new buyers across the region who are looking for fresh content as well as established hits that their viewers already know and love. It feels as though we’re almost back to normal post-Covid, and although we have adapted our ways of working towards more virtual meetings, I’m still looking forward to travelling for face-to-face meetings in individual territories as well as pan-regional markets.”

Chris Bluett, SVP Sales, SVP, Sales, Asia Pacific and Benelux

GMA Network Inc.

GMA Network Center

EDSA corner Timog Avenue

Diliman, Quezon City, 1103 Philippines

T: +632 8333 76 33

E: GWI@gmanetwork.com

W: www.gmanetwork.com

www.gmaworldwide.tv

gmaworldwidediv

Who’s who...

Roxanne J. Barcelona

Consultant/Vice President, Worldwide Division

E: rjbarcelona@gmanetwork.com

Reena G. Garingan Consultant, Business Development and Strategic Content Partnerships

E: rggaringan@gmanetwork.com

Vera G. Tingzon

Sales Specialists, Worldwide Division

E: vgtingzon@gmanetwork.com

GMA Network, the Philippines’ leading and largest media company, is the primary source of Filipino content around the world. Through its Worldwide division, GMA content is distributed to over forty countries in five continents. Its variety of programmes entertains and inspires viewers worldwide. GMA Worldwide has licensed over 100 titles around the globe and continues to reach more viewers around the world via programme syndication and co-production.

GMA offers drama, romantic comedy, fantasy, and action-adventure series. We also have factual content, as well as non-scripted formats. Its variety of programmes entertains and inspires viewers worldwide. GMA’s dramas focus on daring themes and heartwarming love stories , offering viewers a rich array of emotional experiences.

This year, GMA Network and Viu, PCCW’s leading pan-regional over-the-top (OTT) video streaming service, entered into a five year partnership deal. The deal, which marks the first-ever collaboration between GMA and Viu, will make available to Viu Philippines select titles beginning with The Write One and Love Before Sunrise. Both titles are set to premiere in 2023, and will be exclusively available on Viu-ers in the Philippines 48 hours before their free TV broadcast on GMA Network.

Asia in focus 2023

Our focus is on increasing more markets for Filipino content through syndicated multi-title or co-production deals with major content providers in territories such as Africa, eastern Europe, and MENA.”

Roxanne J. Barcelona, Consultant/Vice President, Worldwide Division

Top shows are…

Maria Clara and Ibarra Watch Trailer

Trends

Klay is a young woman who is excited to graduate from the university so she can work abroad. However, she must pass her back subject, Rizal Studies, in order to graduate. Klay wakes up one morning and finds herself in the world of Jose Rizal’s novel, Noli Me Tangere. She desperately tries to return to the present, but she can only do so after she finishes the story and learns her lesson. She meets the lovers in the Novel, Maria Clara, and Crisostomo Ibarra, and they teach her the value of history, empathy, patriotism, and love. Genre: Romance, Fantasy. Episodes/length: 52x45 mins (Approx)

Hearts On Ice Watch Trailer

Despite her disability and lack of dancing skills, Ponggay is determined to fulfill her mother’s childhood dream of becoming a figure skating champion. She realizes that her journey will not be easy, especially when other figure skaters view her as a joke every time she glides on ice with a leg brace. The difficulties she has to overcome makes her realize that in order to succeed, she does not need to dance for her mother but for herself. Genre: Romance, Drama. Episodes/length: 35x45 mins (Approx)

Hands on the Dream Watch Trailer

Analyn is a genius who was born poor and raised by her illiterate and sickly mother. She graduates from high school at the age of 12 and dreams of becoming a doctor in order to help the less privileged. She graduates from med school at 19 years old and becomes the youngest surgical resident in a large hospital. Despite her achievements, she has to deal with bullying and competition from her fellow doctors, who are threatened by her age and intelligence. Genre: Drama. Episodes/length: 87x45 mins (Approx)

& Outlook 2023

First, we expect the further growth in streaming video services to continue in 2023 on both SVOD and AVOD. Second, top SVOD players will continue to invest on development of original content. Finally, we see more partnerships and coproduction deals taking place among key industry players to produce quality content for OTT platforms.”

Roxanne J. Barcelona, Consultant/ Vice President, Worldwide Division

Kanal D International

Demirören TV Radyo Yayıncılık Yapımcılık A.Ş. 100 Mahallesi, 2264.

Sokak,Demirören Medya Center Apt. No: 1/21 34218

Bagcilar, Istabul, Turkey

Who’s who...

Selim Türkmen Director of Sales

E: selim.turkmen@kanald.com.tr

Çağla Menderes Sales Manager

E: cagla.menderes@kanald.com.tr

Canan Koca Sales Executive (CEE,CIS and Europe)

E: canan.koca@kanald.com.tr

Ruba Zeytuni Karatepe Senior Sales Executive (Mena and Africa)

E: ruba.karatepe@kanald.com.tr

Sibel Levendoğlu Sales Manager (Latam and North America)

E: sibel.levendoglu@kanald.com.tr

Özen Yenice Çetinaslan Marketing and Operations Manager

E: ozen.cetinaslan@kanald.com.tr

Serena Çoban Marketing and Operation Specialist

E: serena.coban@kanald.com.tr

Kanal D International is the global business arm of Kanal D, the leading TV channel of the Turkish broadcasting world. Operating under Europe’s leading media organization, Demirören Media Group, Kanal D has been creating quality content for the past twenty-eight years. Accompanied by Kanal D International Networks brand, Kanal D International has grown within the content world to reach the end-user since 2018. The distribution arm of the company continues its activities under Kanal D International, and Kanal D International Networks is the business line that holds all linear assets. Kanal D Drama is the first Turkish Drama channel that was established in the LATAM & Europe region and the first channel that entered the US market. Today, it continues to present a never before seen experience of premium Turkish content.

Top shows are… That Girl Watch Trailer

Like any other young girl, Zeynep dreams of being a social media influencer to escape her poor life. But while she is trying to achieve that, she also has to be a “mother” to her father. Because the 45-year-old man has the mind and emotions of a 5-year-old kid. With his toy car, childish jokes, and behaviour, Kadir is like a kid, in an adult costume. Kadir was born as a “test”, both for his parents and his child. At least, that’s what Zeynep’s grandpa says to her. Zeynep dreams big, and she tries to get away from the troubles of her aunt’s house; from her shakedown in a small room in which neither she nor her cousins can fit; from her uncle, who blames them and oppresses her aunt; from her aunt’s enraged exhaustion; from the impossible; and poverty. She works as a cleaner in the house of influencer Ozan, whose way of life is her ultimate goal. One day, in that house, she meets businesswoman Sitare. Sitare owns an agency and is the boss of a number of social media influencers. And also, Ozan’s secret girlfriend…

Love & Hope Watch Trailer

When Zeynep moved from a small town to the big city, for the first time in her life she had to live in a world in which she didn’t belong, where money, power and egos clashed with one another. Staying in a powerful family’s house in Istanbul, Zeynep felt like an outsider, all alone. She didn’t know her father (thought to be dead) was actually alive and living in that house. When Zeynep and Ege met and fell in love, despite all the impossibilities, they didn’t realize that the biggest obstacle would come from their closest. Elif fell in love with Kuzey when she was a little girl. Because of her love, she was terribly humiliated by Handan, the daughter of the house where her mother worked as a maid. On that day, Elif promised to make Kuzey fall in love with her and take revenge on Handan, who stole her childhood. Now grown, Elif built a new life full of lies and secrets, determined to keep her promise and steal Handan’s boyfriend, Kuzey. Once Kuzey learns the lies Elif told and the games she played, it will not be easy for Elif to regain his love.

Three Sisters Watch Trailer

Three Sisters”, adapted from İclal Aydın’s bestseller novel, starring Reha Özcan, İclal Aydın, Berker Güven, Özgü Kaya, Almila Ada and Melisa Berberoğlu; The oldest daughter in the family is Turkan. She is naïve, silent, pure, and romantic.The second-eldest daughter is Dönüş. She goes to high school and studies for the national university exam. She loves reading and writing and eventually, wants to write a novel. Derya, on the other hand, is the youngest daughter. Like her sister Dönüş, she goes to high school and prepares for the national university exam. She is clever and strong. Even though these three sisters have different personalities, they are very close to each other. However, their lives change all of a sudden. A well-known wealthy family (Korman family) asks for Turkan’s hand in marriage with their son Somer (Berker Guven). However, on her wedding day, she learns that her husband Somer has accepted this marriage without his consent. The shadow of their past continues to follow them. Nesrin and Sadik, on the other hand, do their best to protect their daughters.

Inter Medya

Istanbloom Offices, Kore Sehitleri Caddesi 16/1 Zincirlikuyu, 34394 Istanbul, Turkey

T: +90 212 231 01 02

E: info@intermedya.tv

W: www.intermedya.tv inter_medya intermedyatv InterMedya_ company/itv-inter-medya

Who’s who...

Can Okan Founder and CEO

E: Can.okan@intermedya.tv

Ahmet Ziyalar President and COO

E: Ahmet.ziyalar@intermedya.tv

Hasret Ozcan VP and Head Of Legal and Business Affairs

E: Hasret.ozcan@intermedya.tv

Beatriz Cea Okan VP and Head of Sales and Acqusitions

E: Beatriz.cea@intermedya.tv

Pelin Koray Sales Executive –

MENA, APAC, Turkey

E: Pelin.koray@intermedya.tv

Zeynep Balto Sales Executive –

MENA, APAC, Turkey

E: Zeynep.balto@intermedya.tv

Sinem Aliskan Sales Executive –CEE, Europe

E: Sinem.aliskan@intermedya.tv

Ekin Sarpel Sales Executive –CEE, Europe

E: Ekin.sarpel@intermedya.tv

Neset Ersoy Sales Executive – Africa

E: Neset.ersoy@intermedya.tv

Elena Pak Sales Executive – CIS

E: Elena.pak@intermedya.tv

Inter Medya is a leading independent development, co-financing, and distribution company based in Turkey, which is aiming to deliver premium content to viewers across the world. Globally, the company distributes scripted and unscripted formats in over 155 territories and has a powerful portfolio of unique Turkish stories. Encouraged by the increasing global interest in Turkish films and TV series, Inter Medya is always looking forward to achieving success in international markets by co-producing and distributing high-quality Turkish content.

Genres

Drama, Action, Period Drama, Horror, Romantic Comedy

Top shows are…

The Trusted Watch Trailer

Marashli’s life changes when the beautiful Mahur Turel walks into his bookstore. On this journey, Marashli will become Mahur’s closest ally, the person whom she trusts the most, and her lover. That is until she finds out who Marashli really is… Genre: Drama, Action. Production Company: TIMS&B Productions. Cast: Burak Deniz, Alina Boz. Episodes/length: 74x45 mins. Available in HD

The Ambassador’s Daughter Watch Trailer

Always longing for one another, they only saw each other two weeks a year but there were never two minutes they did not think of each other. Fighting for their love, they resisted dragons, talked against pharaohs and swung their swords against heathens. Genre: Drama, Romantic. Production Company: O3 Medya & NGM. Cast: Neslihan Atagül Doğulu, Engin Akyürek, Uraz Kaygılaroğlu. Episodes/length: 180x45 mins. Available in HD

Last Summer Watch Trailer

When Selim suddenly brings Akgun home to live with his family for “justice residence”, everyone’s lives are thrown off balance and changed forever. Genre: Drama. Production Company: O3 Medya. Cast: Ali Atay, Funda Eryiğit, Alperen Duymaz, Hafsanur Sancaktutan. Episodes/length: 93x45 mins. Available in HD

Trends & Outlook 2023

Asia is a new yet continiously growing market for us. We see a big potential for traditional, long running dramas specifically in Southern Asia Countries such as India, Bangladesh, Sri Lanka, Indonesia and Pakistan and we forecast that traditional dramas will draw the broadcasters’ attention even more. We also forecast that the interest for mini series from Asian VOD platforms will increase and these short , fast paced titles are perfectly suitable for us to introduce Turkish content to foreign audiences. Last but not least, there is a huge interest for action, thriller and horror titles from Taiwan, Thailand and Malaysia.”

Pelin Koray, Sales Executive

Aziz Watch Trailer

Aziz Payidar, son of the Payidar Family which is biggest and the one and only carpet manufacturer of Antakya, lives his life in prosperity and wealth. Aziz’s fate changes when he kills French delegate Monsieur Pierre’s son Lieutenant Andre. He has to leave behind the lands he was born in and his precious love along with everything he has. Genre: Period Drama. Production Company: O3 Medya. Cast: Murat Yıldırım, Damla Sönmez, Simay Barlas, Ahmet Mümtaz. Episodes/length: 91x45 mins. Available in HD

Mehmed The Conqueror Watch Trailer

In 1451, after receiving the news of his father’s death, Mehmed departs with one dream in his mind…conquering Constantinople. By realizing his biggest dream he puts his stamp on history. After that day, Sultan Mehmed Khan, known as Fatih, broke through a new era and laid the foundations of a great World Empire which would rule the continents for centuries. Genre: Period Drama. Production Company: O3 Medya. Cast: Kenan İmirzalıoğlu. Episodes/length: 93x45 mins. Available in HD

Naked Watch Trailer

Eylül earns her living by escorting. All she wants is to save enough money, and start a new life in Wales. One night, she is invited to a bachelor party of a group of friends. Eylül falls in love with the groom Cem, who is counting the days to marry his classy girlfriend. After that night, Cem and Eylül’s lives begin to collide with one another. Genre: Erotic, Drama. Production Company: TN Yapım. Cast: Müge Bayramoğlu, Mert Ramazan Demir, Ece Ertez, Tarık Emir Tekin. Episodes/length: S1: 8x20 mins; S2: 8x19 mins. Available in HD

Asia focus in 2023

We recently licensed our mini series New Generation

Turkish

Series in East Asia and entered into new territories such as Thailand, Vietnam and Taiwan. We aim to extend our business activities by licensing our long running dramas in those territories. Another target in 2023 is to introduce Turkish content to new regions; we are negotiating with leading broadcasters from Japan and Korea. We believe that within the next 5 years Turkish content will become a good alternative as a foreign content even more.”

Pelin Koray, Sales Executive

Scorpion

Watch Trailer

Ferda was abandoned by her mother at the age of one, and she blames her mother, now successful, for all of her troubles. Determined to take back the life she lost, Ferda accidentally causes the death of her step-sister and launches a family war. Genre: Drama, Family. Production Company: 1441 Productions.

Cast: Demet Akbağ, Evrim Alasya, Yusuf Çim, Aslı Melisa Uzun. Episodes/length: 91x45 mins. Available in HD

Interrupted

Watch Trailer

A young and Idealist journalist Ozan loses his life in an unfortunate traffic accident. But not everything is finished for him just yet. He gets a second chance in life. He’ll come back to life and find answers to the question marks he left behind his mysterious death. But he will not be in his own body. Genre: Drama, Romance. Production Company: TIMS&B Productions. Cast: Dilan Çiçek Deniz, Burak Deniz, Cem Davran, Ezel Akay. Episodes/length: 8x60 mins. Available in HD

NBCUniversal Global Distribution

W: www.nbcuni.com

Singapore (Asia HQ): 10 Collyer Quay, #20-05/10, Ocean Financial Center, Singapore 049315

T: +65 6675 1296

Japan: Atago Greenhills MORI Tower, Atago 2-5-1, Minato-ku, Tokyo 105-6208 Japan

T: +81 3-6860-8967

Korea: 8th Fl., Seoul Finance Tower

136 Sejong-daero, Jung-gu Seoul

04520 Korea

China : Room 1903-1908, ICC Office Building 2, No. 288 South Shaanxi Road, Shanghai, China, 200031

NBCUniversal Global Distribution is responsible for licensing NBCUniversal product to all forms of television and new media platforms in the U.S., Canada and in 200+ territories internationally. This includes a vast portfolio of over 6,500 films and 170,000 television episodes, including current and classic titles, unscripted, kids, sports, news, long-form and shortform programming from Universal Pictures, Focus Features, Universal Television, UCP, Universal International Studios, Sky Studios, NBC Late Night properties, DreamWorks Animation, Telemundo, and more, as well as locally produced content from around the world.

Genres

We license content from all genres (i.e.: drama, comedy, unscripted, talk, kids, sports, film, telenovela/super-series, news, etc.)

Original production/co-production

NBCUniversal Formats is the international division for all scripted and unscripted formats created within the production, broadcast and streaming divisions of NBCUniversal, Telemundo and Sky Studios, as well as select third parties. Part of Universal International Studios, a division of Universal Studio Group, NBCUniversal Formats has continued to expand its slate of productions and formats in Asia, from the sixth season of Hollywood Game Night Thailand and the return of Top Chef Thailand this year to the first international version of Dancing With Myself, which was brought to Vietnamese audiences on VTV3 last year. Additionally, the division recently acquired the Spanish format 20 Little Piggy Banks from Phileas Production to distribute across Asia. 2023 will also see the return of Saturday Night Live Korea on Coupang Play, as well as hit formats Baggage, Top Chef and Singer Auction in Vietnam.

Top shows are…

Ted

An irreverent comedy series based on the live-action/CGI box office hit and sequel from Seth MacFarlane about a cherished teddy bear that comes to life because of a childhood wish. Set in the early ‘90s, after Ted’s moment of fame has passed, the series follows Ted (voiced once again by MacFarlane) and his best friend John Bennett as they try to navigate the highs and lows of high school and teenage life.

Based On A True Story

Who’s who... SALES

Justin Che

Managing Director, Asia PacificDistribution, Networks & DTC

E: Justin.Che@nbcuni.com

Rajiv Dhawn SVP, Sales Liaison, Asia

E: Rajiv.Dhawn@nbcuni.com

Atsushi Miyasaka SVP, Sales Liaison, Japan & Korea

E: Atsushi.Miyasaka@nbcuni.com

Shreya Kapdi VP, Sales Liaison

E: Shreya.Kapdi@nbcuni.com

Barry (Bumsun) Choi VP, Sales Liaison, Japan & Korea

E: Bumsun.Choi@nbcuni.com

Jessy Tse VP, Sales Liaison

E: Jessy.Tse@nbcuni.com

Susan Liu, Director, Sales Liaison China

E: susan.liu@nbcuni.com

Gorden Li, Manager, Sales Liaison

E: Gorden.Li@nbcuni.com

Yuki Yoshida Sales Manager, Japan

E: Yuki.Yoshida@nbcuni.com

Lynn Zhou, Manager, Sales Liaison (China & Mongolia)

E: Lynn.zhou@nbcuni.com

PRODUCTION

Linfield Ng VP, Format Sales Liaison

E: Linfield.Ng@nbcuni.com

Kaley Cuoco and Chris Messina star in this dark comedic thriller inspired by a bizarre true event. This is a gripping tale of a realtor, a plumber and a former tennis star whose lives unexpectedly collide, exposing America’s obsession with true crime, murder and the perfect slow-close toilet seat.

Bupkis

Starring, written and executive produced by Pete Davidson, this live-action comedy series is a heightened, fictionalized version of Davidson’s real life. The series will combine grounded storytelling with absurd elements from the unfiltered and completely original worldview for which Pete is known for.

Asia focus in 2023

Our primary focus will be unscripted content. Unscripted makes it easy for viewers to jump into a programme, any time throughout the series. And with so many subgenres (i.e. true crime, dating, renovation, etc.), people can explore new worlds.

True Crime series are extremely popular now. Regardless of where the crime occurred or previous awareness of the crime, if the story is compelling, the series will have an audience. To feed viewers’ appetite for true crime, we have new series such as Manifesto of a Serial Killer, Sleeping with Death and Living with a Serial Killer to offer.

We’ve also found that audiences have been gravitating towards documentaries that explore the people and events that have shaped history and affected the world. Our upcoming documentaries range from the best F1 racers in Villeneuve and Pironi to the unbelievable story of Pan Am flight 73 in Hijacked and the wildlife documentary turned heist in The Great Rhino Robbery

Other unscripted subgenres we’re focusing on include ballroom dancing in Ballroom Dancing Queens; house cleaning and purging in The Gentle Art of Swedish Death Cleaning; and the newest Below Deck series, Below Deck Adventure, which showcases the lives of the staff and crew working on a superyacht.

Rajiv Dhawn, SVP, Sales Liaison, Asia

Paramount Global Content Distribution

5555 Melrose Ave. Los Angeles CA 90038 U.S.

W: www.paramount.com

E: GDGsales@cbs.com

@ParamountGCD

Who’s who...

Jonathan Greenberg EVP Television

Licensing Regional Sales, North Asia

Nicole Sinclair SVP Television Licensing, South Asia (Australia, New Zealand, SEA, India)

June Choi VP Regional Television

Licensing – Korea, Taiwan, Hong Kong and Mongolia

Teng Yong VP Television Licensing and Digital Sales – China and Taiwan

Chris Safford Executive Director

Television Licensing – SEA

Hiromichi Sato Executive Director, Television Licensing – Japan

Alysha Chopra Executive Director

Television Licensing – SEA, India

Trista Chang Director, Television

Licensing and Digital Sales – China

Joyce Smith Director, Television

Licensing – Australia, New Zealand

Makoto Ono Manager, Television

Licensing – Japan, Korea and

Mongolia

Asia focus in 2023

Paramount Global Content Distribution is the leading distributor of premium content across multiple media platforms throughout the global marketplace. The division’s portfolio is comprised of some of the world’s most recognized brands, including feature films and television programmes from Paramount Pictures, Paramount Television Studios, CBS Studios, CBS Media Ventures, CBS News, SHOWTIME Networks, Nickelodeon, MTV Entertainment Studios, Miramax and third-party partners. The division licenses a diverse lineup of scripted and unscripted formats for local production and international coproductions. Paramount Global Content Distribution is a division of Paramount.

Genres

Paramount Global Content Distribution covers all genres from feature films, including non-theatrical releases, to television series covering drama, comedy, non-scripted including late night, daytime and reality competition, kids animation programming, factuals as well as news programming and documentaries.

Original production/co-production

Our partnership with CJ ENM in Korea has helped expand our slate with series such as Bargain, a six-part adaptation of director Lee Chung-hyun’s 2015 short film of the same name, revolving around a group of strangers who gather at a remote motel with ulterior motives – seeking to bargain, with more titles to come in 2023. Additionally, we have European titles including The Sheikh (Der Scheich) from Germany, based on the true story from unskilled worker Volker Eckel and La Red Púrpura for Atresplayer Premium in Spain, where fiction delves into the depths of Internet, and the impossible is bought and sold to satisfy the most depraved instincts of the human being.

Trends & Outlook 2023

Demand for original new series and franchise features will continue to be strong across Asia. Local content in North Asia will continue to dominate but strong Hollywood content will also continue to be in demand. In 2023, demand for Asian content will continue to grow outside of Asia especially on SVOD.”

Jonathan Greenberg, EVP Television Licensing Regional Sales, North Asia

Top shows are…

Mission: ImpossibleDead Reckoning - Part One Watch Trailer

Director and writer Christopher McQuarrie, global superstar Tom Cruise and the IMF team return for the seventh installment of this longlasting, more popular franchise than ever!

Transformers: Rise of the Beasts Watch Trailer

Returning to the action and spectacle that first captured moviegoers around the world 14 years ago with the original Transformers, Transformers: Rise Of The Beasts will introduce the Maximals, Predacons, and Terrorcons to the existing battle on earth between Autobots and Decepticons.

Rabbit Hole

Kiefer Sutherland stars as private espionage operative James Weir, who finds himself in the midst of a battle over the preservation of democracy in a world at odds with misinformation, behavioral manipulation, the surveillance state and the interests that control these extraordinary powers.

Our main focus for 2023 is to continue to provide the best content to the region from our many great Paramount brands. Whilst we will continue to deliver great US content, a key focus will be growing our local and regional content offerings along with our Kids and Factual brands.”Nicole Sinclair SVP Television Licensing, South Asia (Australia, New Zealand, SEA,

India)Rabbit Hole

PBS International

10 Guest St., Boston, MA 02135 USA

W: https://pbsinternational.org/

Who’s Who...

Joe Barrett

Vice President, Sales

E: jfbarrett@pbs.org

Anna Alvord

Director, Sales Operations

E: agalvord@pbs.org

Trends & Outlook 2023

We’re seeing increased demand for short series with relatable characters, whether in natural history, science or world history. Long-running factual series are also getting a fresh look from buyers. Our popular strands such as Nova, Frontline and American Experience continue to resonate with Asian buyers who are looking for factual documentaries on a variety of topics with universal relevance, such as climate and wildlife.”

Anna Alvord Director of Sales Operations

PBS International is the worldwide co-production and distribution arm of PBS Distribution, a leading distributor of public media content around the world, reaching audiences through multiple platforms and formats. PBS International offers the highest quality factual and children’s programming including films from Ken Burns, entertaining and educational PBS KIDS series, and award-winning documentaries from Nova, Frontline, American Experience, and many independent producers.

Genres

We are proud to offer a wide and diverse selection of premium factual content spanning Current Affairs, History, Science, Natural History, Human Interest, Arts & Culture and Lifestyle, as well as Children’s Programming.

Original production/co-production

Our most recent co-production in Asia was with NHK, the Japanese public broadcaster. Together, we co-produced Nazca Desert Mystery, in which discoveries of long-hidden lines and figures etched into the Peruvian desert offer new clues to the origins and purpose behind the Nazca Lines, one of the greatest ancient enigmas.

Asia focus in 2023

We’re looking to expand reach across Asia through partnerships with broadcasters, streamers and other content providers. We’re bringing newly commissioned limited series with the potential to become returning series to the market. Programmes such as Abandoned from Above, World’s Greatest and major projects from award-winning producers Ken Burns and Lynn Novick will be on our slate for 2023.”

Joe Barrett, Vice President of Sales

Top shows are…

Casa Susanna Watch Trailer

In the 1950s and ‘60s, an underground network of transgender women and cross-dressing men found refuge at a modest house in the Catskills region of New York. Known as Casa Susanna, the house provided a safe place for them to express their true selves and live for a few days as they had always dreamed –dressed as women without fear of being incarcerated or institutionalized for their self-expression. Told through the memories of those whose visits to the house would change their lives, the film provides a look back at a secret world where the persecuted and frightened found freedom and acceptance. Episodes/length: 1x97 mins. HD

Baby Animals: The Top Ten

Standing out from the crowd is tough, especially in the Animal Kingdom, with an estimated 8.7 million species vying for attention. There is, however, one group of creatures that has an inexplicable magnetism that few can resist: baby animals. Baby Animals: The Top Ten delivers an amazing assortment of bright-eyed bundles of energy with the power to melt hearts. Each visually stunning episode will countdown the ‘top 10’ baby animals in a particular themed category. Behold an informative, entertaining encounter with the Fastest, the Largest, the Strongest, the Cuddliest and even the most Mysterious Baby Animals that bound, climb and glide the planet. Episodes/length: 12x60 mins. HD

Ancient Builders of the Amazon Watch Promo

Recent stunning discoveries are exploding the myth of the Amazon as a primeval wilderness, revealing traces of ancient civilizations that flourished there for centuries. Dense settlements indicate populations in the millions, supported by sophisticated agricultural systems, while huge geometric earthworks and roadways bear witness to complex religious ideas and social networks. The evidence is now clear that, far from being an untouched wilderness, the Amazon has been shaped by human hands for millennia. Episodes/length: 1x53 mins. HD

Red Arrow Studios International Medienallee 7, 85774 Unterfoehring, Germany

T: +49 89 9507 7303

W: redarrowstudios.com/international E: sales@redarrowstudios.com

Who’s Who...

Joyce Dröse

Sales Manager

(Asia, Africa, Nordics, Inflight)

Trends & focus in 2023

Demand for dating shows is growing, as we see a huge increase in the pick up and production of more daring formats. We are incredibly excited to share our new relationship show Stranded on Honeymoon Island, from the creators of Married at First Sight – an innovative new hybrid take on the relationship and survival genres.

We are seeing more and more high end drama adaptations – as viewers seek out local content with the same high production values of the big global scripted series, such as our high-concept psychological drama Plan B, starring Patrick J Adams, a new adaptation of a successful scripted format.

There is still big demand across Asia for socially conscious factual entertainment content with a heart that looks to make a real impact, for example our compelling social experiment Old People’s Home for Teenagers – which has already sold to both Hong Kong and Korea.”

Red Arrow Studios International is a leading TV distributor of scripted, formats and factual shows from outstanding production companies, third party producers and digital content partners. With offices in Munich and London, Red Arrow Studios International coproduces and finances global entertainment, and distributes hit content to over 200 territories worldwide. Red Arrow Studios International is part of Seven. One Studios, a ProSiebenSat.1 Media SE company.

Genres

Scripted, Formats, Factual

Original production/co-production

Red Arrow Studios International is known as a destination for strong commercial entertainment with broad appeal, spanning premium returning English language dramas, impactful foreign language dramas, and innovative formats. These continue to be our top priorities, along with a selection of premium factual content.

Top shows are…

Plan B Watch Trailer

A high-concept psychological drama about a man on a desperate and relentless quest to save his relationship –using time travel. Genre: Scripted Series/ Drama. Producer/Broadcaster: KOTV for CBC (Canada). Written by JeanFrançois Asselin, Jacques Drolet, Lynne Kamm. Created by Jean-François Asselin, Jacques Drolet. Directed by Aisling Chin-Yee, Maxime Giroux, Jean-François Asselin. Starring Patrick J Adams, Karine Vanasse, François Arnaud, Josh Close. Episodes/length: 6x45 mins