5 minute read

12

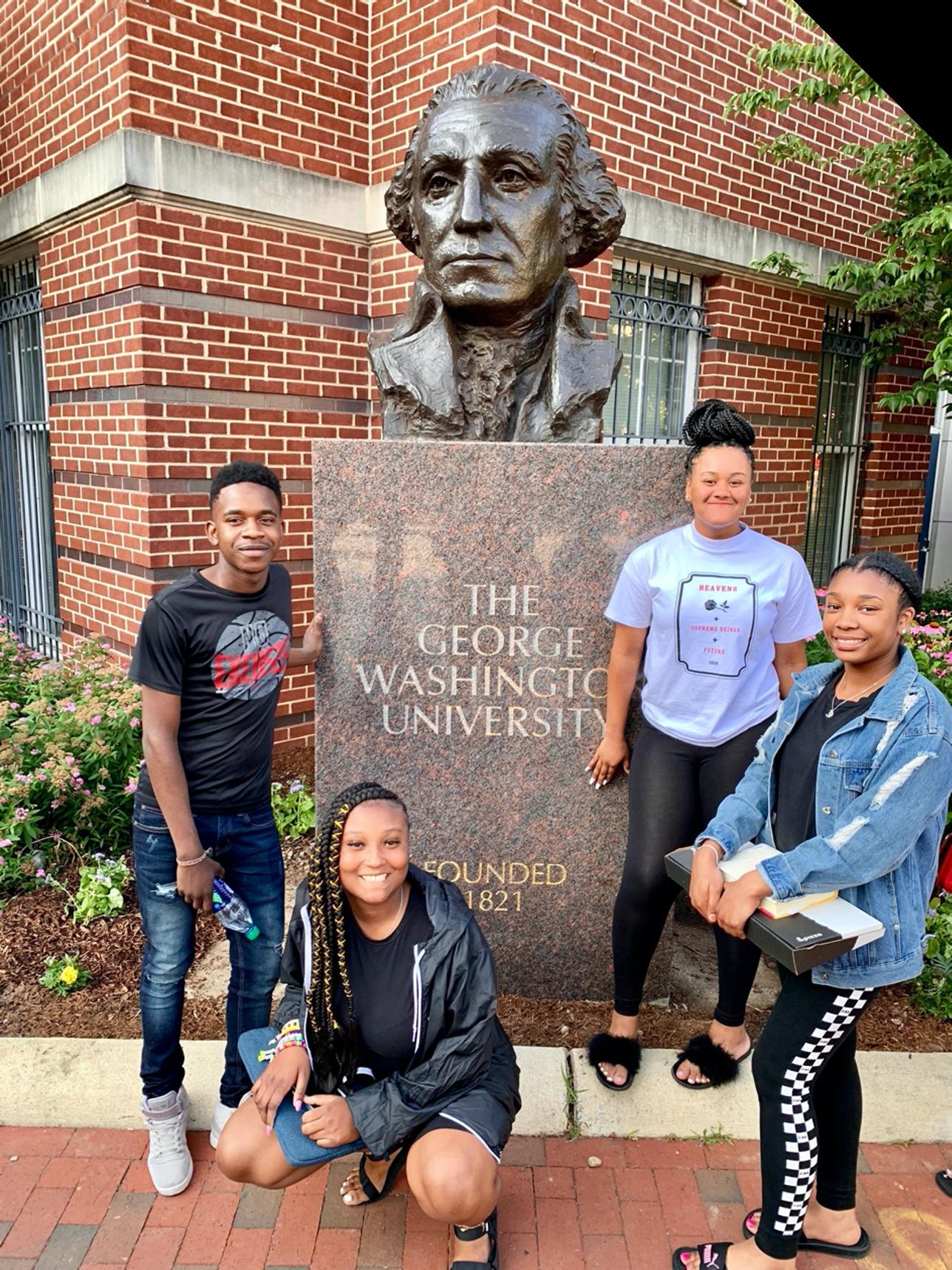

❑ Complete a Financial Analysis with College AIM. (April)

During your financial analysis, you will look at the total cost of attendance, all of your financial aid and how much money is left over for you to pay (your gap). You can complete a financial analysis of several schools so that you know which will really be the most affordable for you. Once you determine your gap, you will develop a plan to fill that gap and pay the remaining amount.

Advertisement

This should be on your college’s web portal. Read over it and make sure that you understand it. If you have questions, ask College AIM for clarification or contact your school’s financial aid office. If your portal says there are any other steps you need to do to apply for financial aid (like verification) get on it ASAP. If you need help, ask College AIM or reach out to your school’s financial aid office. If you want to appeal for additional financial aid, ask College AIM for help.

❑ Review your Financial Aid Award. (April)

❑ Complete Verification (April)

If you were selected for verification, this may be noted on your portal or you might have received an email or letter about it. This means that your school needs to verify that the information you provided in FAFSA is correct. For verification, you school could ask you for some of the following things: • IRS Tax Return Transcript for you or a parent/guardian • W2 forms for you or a parent/guardian • Documentation if you were ever in foster care or homeless • Other documents

Schools might have you submit these things on your portal, on a separate verification portal, or via email. Once you submit the documents, the financial aid office will process them over the next few days or weeks. After processing, you should be able to view your financial aid award.

❑ Complete Loan Counseling and the Master Promissory Note. (May)

If you are taking out federal loans, like the Stafford Loans, you will need to complete online loan counseling, which explains the process of taking out loans, what interest is, how loans are paid back, etc.

If you’re taking out loans, these will also require signing a Master Promissory Note, which is just a fancy word for a document you sign to promise that you’ll pay back your loans. You generally have to start paying them back 6 months after you leave school.

❑ Apply for Work Study Jobs. (Summer)

Start searching and applying for work study jobs over the summer. These jobs are not guaranteed, so the sooner you apply the better. Your school probably has a website for student employment. Find this website and or contact their office for student employment to search for jobs that may be available. Create a list of the jobs you might be interested in and start applying. When you apply, you’ll probably have to submit a resume and cover letter. When you’re trying to get a job, it’s really important to network. Make sure to have a phone conversation or meeting with someone who is in on the hiring process. Having that personal connection will go a long way!

❑ Review and pay your remaining bill, after financial aid. (August)

Most colleges release the bill sometime over the summer and will require that it is paid several days or weeks before you move in or start classes.

The bill should be available through your portal and should show the amount that you owe after financial aid. If you’re unclear about any of the charges, ask the financial aid office or College AIM to explain. Sometimes, there will be some fees we can help you get removed. Some schools will require you to have health insurance and they may automatically put the school’s health insurance on your bill. If you have health insurance that will cover you while you’re in college, you can usually get health insurance costs removed.

If you’re going to college out-of-state, your insurance may not cover you in the new state. In many states though, you can apply for and receive Medicaid for free or low cost, which will save you money. Ask your financial aid office or College AIM if you need help with this process.

❑ Look for additional financial resources on campus. (August)

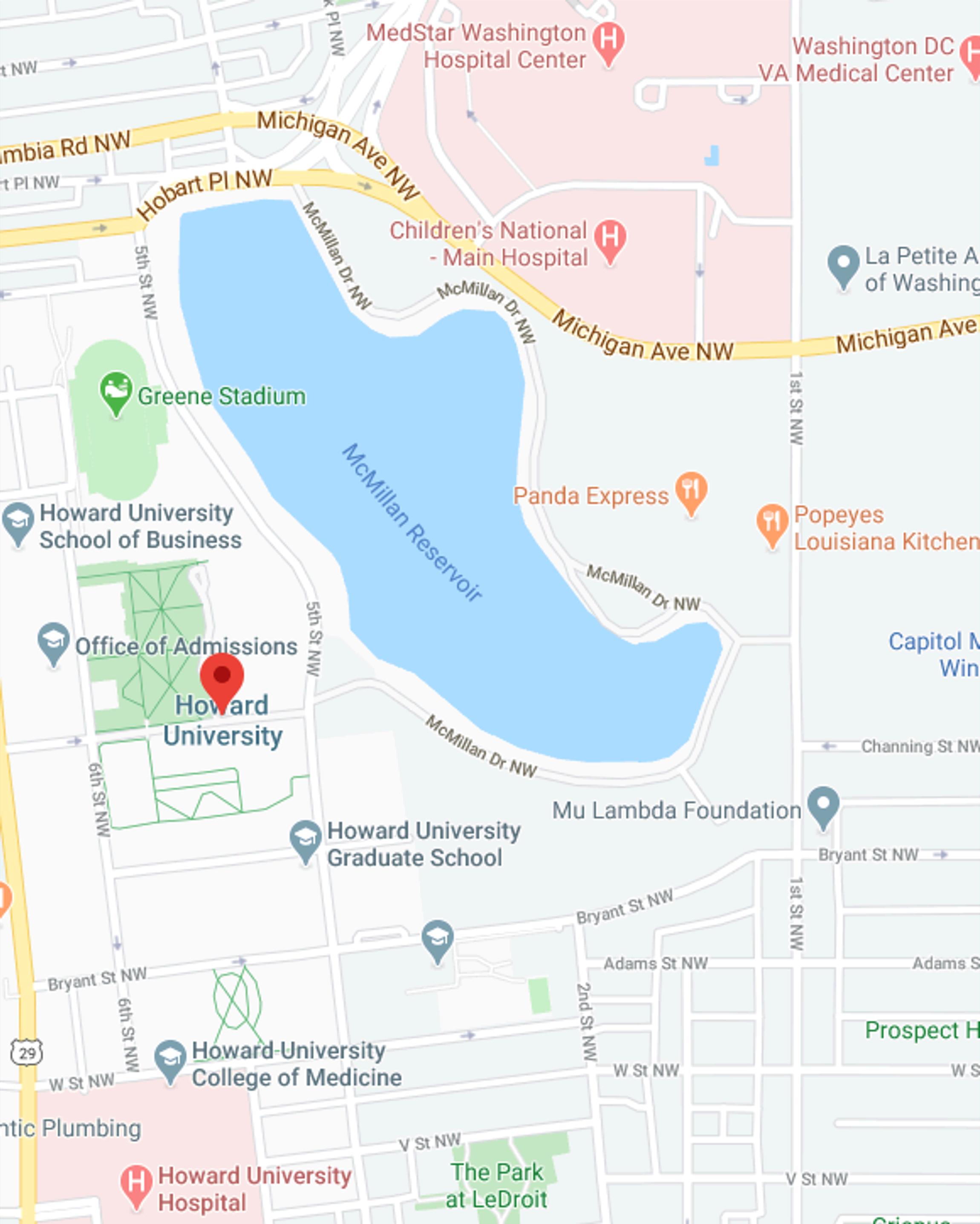

Find out where your financial aid office is on campus, and when you get to school go visit ASAP. Get to know the financial aid team. They are the gatekeepers to the money, so you want to be on their good side! Ask if there are any institutional scholarships that the school offers that they suggest you apply for, especially for your second year. Many scholarships are from specific departments, but you can’t apply until you’re already a student on campus. Often, if you apply during your freshman year, you’ll be able to get these scholarships for your sophomore, junior and senior years. Many schools offer emergency funds, where they can help you out in an emergency. Ask your financial aid office about them now, so you know about the resources before you need them.

❑ Complete housing forms and pay application fee if you are going to be living on campus. (May)

Many colleges have limited housing do this ASAP to reserve space. If you cannot afford the housing fee, ask if your school can waive the fee -- many schools will! When registering for housing, you’ll select your dorm preferences. Often there is a big difference in pricing between dorms, and you can save A LOT of money by choosing the more affordable dorms. Sometimes this means having a roommate, and that’s ok. It’ll save you money. Consider themed/program housing, LGBTQ-safe housing options, housing that will stay open over breaks if you know that you won’t be able to come home, etc. Usually, you’ll take some type of roommate survey or be able to select your roommate. Make sure to answer the questions honestly so they can pair you with someone who will be a good fit for you.