NEW POLICIES & PROCEDURES

Impacts of the Anti-Money Laundering and Anti-Terrorist Financing Act p.20

CROSS-COUNTRY CHECK-IN

CMBA directors take the market pulse and discuss the association’s mandate p.10

DATA SECURITY AND PRIVACY BREACHES

How to build a culture of cyber vigilance p.34

FOREIGN BUYERS

Relaxed restrictions on non-Canadians buying residential property p.44

CMBA-ACHC.CA PM No. 41297283

SPRING 2023 $6.95 THE MAGAZINE FOR PROFESSIONAL MORTGAGE BROKERS +

NEW ANTI-MONEY LAUNDERING AND ANTI-TERRORIST FINANCING REQUIREMENTS FOR BROKERS, LENDERS AND ADMINISTRATORS

How

BY RAY BASI

CROSS-COUNTRY CHECK-IN

CMBA’s national directors take the market pulse and discuss the association’s mandate BY CHRIS FREIMOND

AMPLIFYING CMBA’S VOICE

Introducing JP Boutros, newly appointed government relations advisor BY CHRIS FREIMOND

REQUIREMENTS OF A COMPLIANCE PROGRAM FOR A REPORTING ENTITY

Do it and show it’s been done BY RAY BASI

DATA SECURITY AND PRIVACY BREACHES: WHAT MORTGAGE BROKERS NEED TO KNOW

Brokerages advised to build a culture of cyber vigilance

SUBMITTED BY PROLINK-CANADA'S INSURANCE CONNECTION

HOME PRICES APPEAR TO BE STABILIZING BUT SUPPLY IS STILL A CHALLENGE

Professional appraisers use up-to-date and real-time market data to arrive at an opinion of value BY CHRIS FREIMOND

NEW REGISTERED SAVINGS PLAN TO HELP FIRSTTIME HOMEBUYERS

All you need to know about the Tax-Free First Home Savings Account BY MARK

R. SERVELLO

CANADA RELAXES RESTRICTIONS ON NONCANADIANS BUYING RESIDENTIAL PROPERTY

BY GREG UMBACH, JENNY ROSS, PATRICK GORDON AND RASHEED ABOUHASSAN

CMB MAGAZINE CMBA-ACHC.CA SPRING 2023 I 5 VOLUME 8 ISSUE 2 SPRING 2023 departments columns Editorial Advertisers’ Index Off the Clock: Sabeena Bubber channels her time and talents into causes that help those in need BY LISA GORDON Legal Ease: Damages flowing from failing to complete a purchase BY RAY BASI Industry Profile: Nicole George relishes the opportunity to help East Coasters find a place to call home BY LISA GORDON 8 46 28 30 40

24 34 36 42 44

10

20

do the changes impact the mortgage brokering sector?

18 30

features

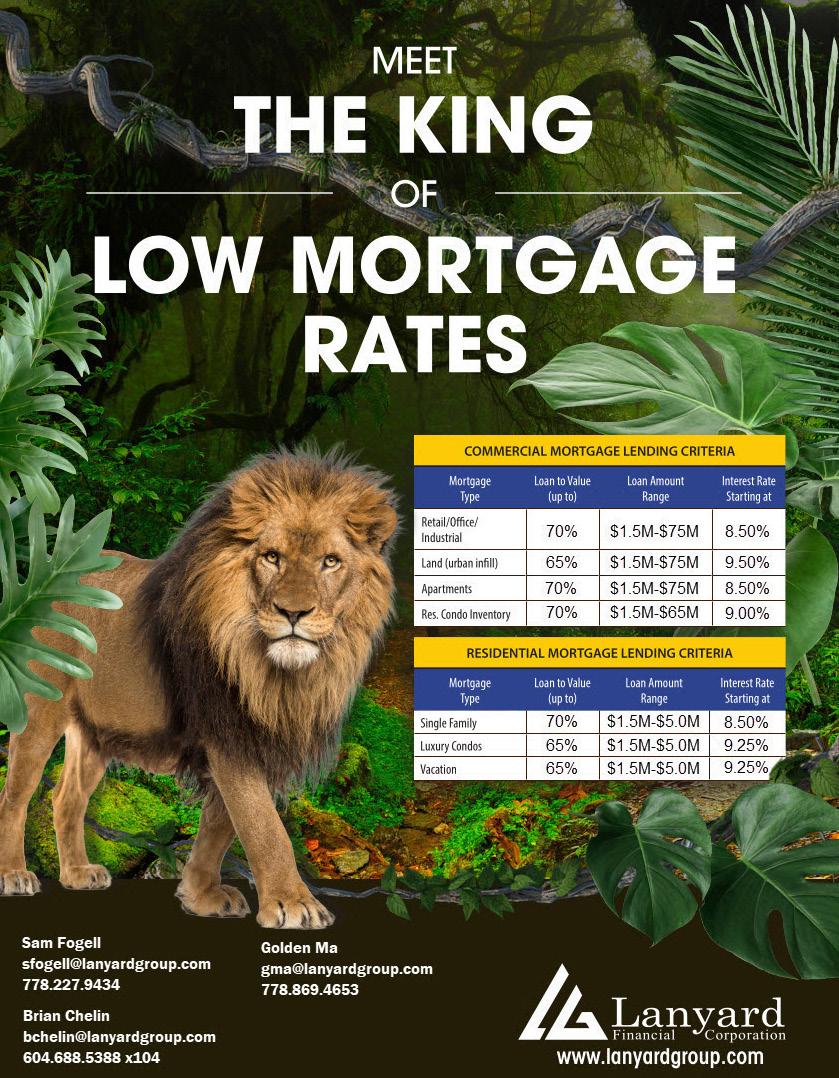

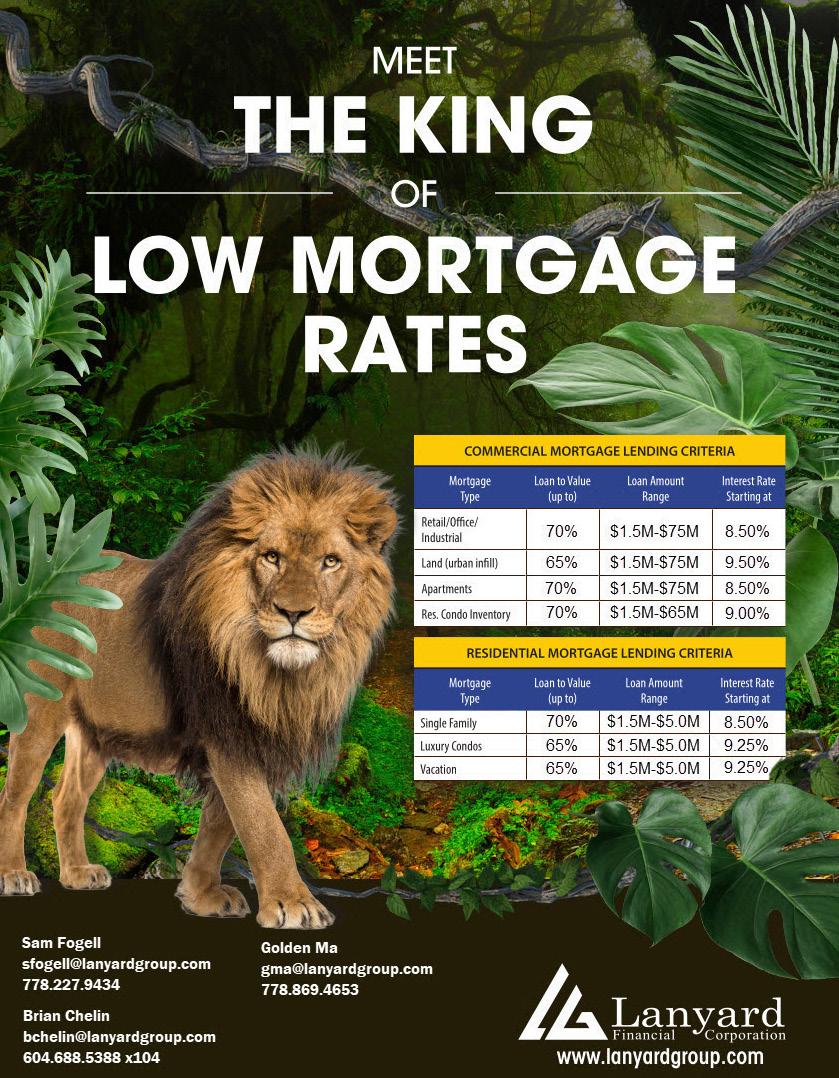

RESIDENTIAL COMMERCIAL CONSTRUCTION DEVELOPMENT LAND

While other lenders rely on automated mortgage approvals, we do things differently. We listen. Because numbers don’t tell the whole story. People do. Talk to us about your client’s needs.

VOLUME 8 ISSUE 2 SPRING 2023

THE CANADIAN MORTGAGE BROKERS ASSOCIATION

DIRECTORS

Terry Kilakos (CMBA-Quebec)

Sadiq Boodoo (CMBA-Ontario)

Jim DeCoste (CMBA-Atlantic)

Sachin Varma (CMBA-BC)

EXECUTIVE DIRECTORS

Carla Giles

Petra Keller

CMBA - ATLANTIC

Mortgage Brokers

Association of Atlantic Canada

12 M - 7095 Chebucto Road, Halifax, NS B3L 0A1

CMBA - BC

Mortgage Brokers

Association of British Columbia

2025 Willingdon Ave, Suite 900, Burnaby, BC, V5C 0J3

CMBA - ONTARIO

Independent Mortgage Brokers Association of Ontario

7 - 40 Winges Road, Woodbridge, ON L4L 6B2

CMBA - QUEBEC

L'Association des courtiers hypothecaires du Québec

5855 Taschereau #202, Brossard, QC J4Z 1A5

CANADIAN MORTGAGE BROKER magazine is produced by the Canadian Mortgage Brokers Association (CMBA)

EDITOR

Carla Giles

STAFF WRITER

Ray Basi

MANAGING EDITOR

Kathleen Freimond

ART DIRECTOR

Scott Laing

BILLING AND SALES

Debra Hiller

CONTRIBUTORS

Rasheed Abouhassan

Ray Basi

Chris Freimond

Carla Giles

Lisa Gordon

Patrick Gordon

Jenny Ross

Mark R. Servello

Greg Umbach

IMAGES Adobe iStock

CANADIAN MORTGAGE BROKER © All rights reserved. The views expressed in CANADIAN MORTGAGE BROKER are those of the respective contributors and are not necessarily those of the publisher or staff.

PUBLICATIONS MAIL AGREEMENT 41297283

Please return undeliverable Canadian addresses to 2025 Willingdon Ave, Suite 900, Burnaby, BC V5C 0J3

Printed in Canada by Hemlock Printers Ltd.

6 I SPRING 2023 CMBA-ACHC.CA CMB MAGAZINE

FIRST MORTGAGES, PURCHASES & REFINANCES | RESIDENTIAL & COMMERCIAL 24-HOUR TURNAROUNDS | NO MINIMUM BEACON SCORE | FLEXIBLE FINANCING SOLUTIONS* *Considers income, affordability, LTV, property type and more.

Learn more at www.icmbs.ca

Some call it alternative lending. To us, it’s people-based lending.

30 Years of Experience You Trust Contact Your BDM Today Pratheesan Rathnapala Ontario Business Development Manager 416-629-2219 pratheesan@vwrcapital.com Paula Hutton Prairies Business Development Manager (AB, SK, MB) 780-370-7430 paula@vwrcapital.com Jennifer Peters British Columbia Business Development Manager 604-803-7430 jennifer@vwrcapital.com Earn More Low • Basic • Lender Fee Structure 2nd Mortgage 1 year Closed Fee starting at only $500 1st Mortgage 1 year Closed Fee starting at only $750 • No Income Qualification • No Minimum Beacon Score • 7 75% LTV 1st and 2nd Mortgages • Purchase and Refinance • Residential Financing • Set your OWN broker fee Visit us at vwrcapital.com Submit applications through Filogix, Velocity, Finmo & Lendesk

Housing completions can’t meet supercharged demand

BUDGET DID NOT DO ENOUGH TO ADDRESS MARKET DISTORTIONS

BY CARLA GILES, CHIEF EXECUTIVE OFFICER, CMBA-BC AND MBIBC; CO-EXECUTIVE DIRECTOR CMBA

Home sales in Canada have been rising for two consecutive months, although at a slow pace. Home buyers are adjusting to the current reality of higher interest rates, limited housing supply and home price corrections across the country.

The housing market was one of the sectors most impacted by the Bank of Canada’s aggressive campaign to slow down economic growth and bring the consumer price index (CPI) down. This campaign resulted in a 425 basis points increase to the policy interest rate in less than a year. Despite much uncertainty in the market, these measures were followed by a drop in inflation from a high of 8.1 per cent in June 2022 to 5.2 per cent year over year in February 2023.

The Bank of Canada’s second consecutive hold since March 2022 was a sigh of relief for the housing market, building some confidence in the sector. The Canadian Real Estate Association (CREA) released its March Housing Market forecast indicating that national home sales were up on a month-over-month basis in March 2023 by 1.4 per cent. This is a slight increase, but it comes after three quarters without any significant declines. Overall, CREA seems

optimistic that sales activity will pick up in 2024, resuming a long-term trend as indicated by the figure below.

Supply issues are still a concern. CREA revealed that new listings on the market dropped a further 5.8 per cent in March compared to the previous month. Not surprisingly, the sales to new listings ratio increased to 63.5, higher than the long-term average ratio of 55.1.

March also saw the MLS® Home Price Index up by 0.2 per cent on a month-overmonth basis and, according to CREA, “this trend of prices stabilizing from February 2023 to March 2023 was very broad-based. With few exceptions, prices are no longer falling across most of the country.”

The Bank’s quantitative tightening campaign produced undesired impacts to housing affordability as the costs of owner-

8 I SPRING 2023 CMBA-ACHC.CA CMB MAGAZINE ISTOCK.COM

editorial Source: CREA Housing Market Forecast: https://www.crea.ca/housing-market-stats/canadian-housing-market-stats/quarterly-forecasts/ SALES ACTIVITY 700,000 650,000 600,000 550,000 500,000 450,000 400,000 350,000 300,000 2000 2006 2012 2018 2001 2007 2013 2019 2002 2008 2014 2020 2003 2009 2015 2021 2004 2010 2016 2022 2005 2011 2017 2023F 2024F Historical Forecast 10-year average

ship have increased. Many Canadians will continue to be priced out of the market, further accentuating income disparities across its population.

The 2023 federal budget released in March introduced targeted supports to address inflationary impacts to low- and modestincome Canadians, but these effects will be temporary. The federal budget focused on Canada’s fiscal strength and competitiveness, mostly through supporting a transition to a clean economy through tax breaks aimed at driving up green investment.

By leaving housing affordability off the budget, the federal government appears to believe it has done what it can to steer the housing market onto a more affordable path through its 2022 budget measures.

These efforts included boosting housing supply, curbing speculation and supporting first-time home buyers. One such measure led to the introduction of the First Home Savings Account (FHSA), a new registered plan to help first-time home buyers save towards their first home. The tax-free advantage is available for deposits of up to $8,000 per calendar year with a $40,000 lifetime limit (see p.42).

Analysts tend to agree that these measures won’t be effective for some time and won’t be enough to address market distortions and labour shortages that hinder housing supply.

Recent statistics released by CREA show that new listings are at 20-year lows. Housing

MARCH MARKET SNAPSHOT

supply shortages are nothing new as econo mists and housing market analysts have been vocal about the challenges faced by a combi nation of market factors, including a lack of skilled trades and increased borrowing costs, which are partly due to market factors con tributing to delays in construction projects.

The ever-growing immigration targets the federal government sets are bringing more housing demand to key urban centres. At this pace, immigration will bring added strain on the housing market and further contribute to a deterioration of housing affordability. Ac cording to RBC, “the recent track record for construction has been underwhelming. While home building has picked up in Canada over the past three years – housing completions rose from less than 190,000 units in 2019 to roughly 220,000 units in 2021 and 2022 – it was nowhere near enough to meet supercharged demand.”

How to solve the housing supply crisis is a complex matter. It is best addressed through a systemic approach where multiple stakeholders are brought together to uncover the issues contributing to housing supply shortages. While some solutions can be planned and executed on a broader scale, some will depend on local and regional realities and may require differentiated solutions to address unique situations. For these reasons, a holistic approach that includes multiple stakeholders is necessary.

Stress Test

Your clients need you now, more than ever as the banks are tightening up!

We offer 24 Hour turnaround on commitments – allowing you to present solutions for your clients sooner rather than later.

Source: RBC Thought Leadershipe: https://thoughtleadership.rbc.com/green-shoots-in-canadas-housing-market/

CMB MAGAZINE CMBA-ACHC.CA SPRING 2023 I 9

Canada 1.4 -34.4 -5.8 -27.4 0.2 -15.5 0.63 Toronto 1.6 -37.0 -7.3 -44.2 1.6 -16.2 0.64 Montreal -1.2 -27.8 -0.1 -8.2 -0.3 -6.4 0.58 Vancouver 3.0 -42.5 -6.9 -34.9 0.0 -9.5 0.56 Calgary -2.3 -42.0 -12.7 -39.5 -0.2 1.1 0.85 Edmonton -1.6 -44.1 -12.8 -21.3 -0.2 -7.7 0.60 Ottawa -1.6 -40.5 -2.1 -20.7 -0.7 -14.5 0.61 Home resales New listings MLS Home Price Sales-to(% change) (% change) Index (% change) new listings M/M Y/Y M/M Y/Y M/M Y/Y ratio BRITISH COLUMBIA Greg Kakuno Business Development Manager 604-430-1498 gkakuno@capitaldirect.ca ALBERTA Donna Hunter Business Development Manager 403-874-6348 dhunter@capitaldirect.ca ONTARIO Cheryl Smith Business Development Manager 905-299-1706 csmith@capitaldirect.ca Equity

Purchase

ETO

Special

Lending up to 1,500,000 1st and 2nd Mortgages

/ Refinance,

up to 75% LTV

offers for 600+ Beacon Scores in large urban centres

Still waiting for Bank Approvals?

killing

your deals?

CROSS-COUNTRY

10 I SPRING 2023 CMBA-ACHC.CA CMB MAGAZINE IN check

directors’ outlook

BY CHRIS FREIMOND

It’s been a tough 12 months for the real estate market. Mortgage rates have risen sharply, inventory in many regions dried up as prices stagnated and sellers took their homes off the market, frustrating buyers and leaving many mortgage brokers wondering how they should respond to changing conditions.

We spoke to CMBA’s four national directors to discuss their mandate and find out what the markets are doing in their regions and asked them to share their views on what mortgage brokers can expect in the coming 12 months. They also provided a few pointers to how brokers can meet the challenges of a changing market and continue providing valuable advice to clients in these difficult times.

SADIQ BOODOO

President and Chair: CMBA; President and Chair: CMBA-Ontario; principal broker and CEO, Approved Financial Services, Whitby, Ontario

CMBA BOARD PRIORITIES

My mandate as CMBA president is to support CMBA members across the country by providing value through education and professional development as well as giving them a voice with industry stakeholders, regulators and government agencies through our government relations and advocacy initiatives. I look forward to continuing to work with our board at CMBA National to promote the best interests of the

CMB MAGAZINE CMBA-ACHC.CA SPRING 2023 I 11 ADOBESTOCK

CMBA’s national directors take the market pulse and discuss the association’s mandate

mortgage brokering industry, mortgage brokers and the clients they work with.

CURRENT MARKET IN ONTARIO AND OUTLOOK FOR THE NEXT 12 MONTHS

The market is, as expected, in constant fluctuation. Regionally there are still bidding wars, whereas in other areas properties are sitting on the market for months. The price points are the major factor impacting this fluctuation.

Over the next 12 months, I would expect that buyers who are sitting on the sidelines will realize that downturns in the market have flat lined and they will come back into the market to purchase. That increased demand will stimulate sellers to re-enter as well. Depending on the speed and degree to which this happens, we could easily see prices start to rise.

MORTGAGE BROKERS’ CONCERNS

Mortgage brokers’ concerns are currently the difficulty they face in helping clients exit shortterm or “bandage” financing that they entered into last year in order to close and, secondly, lower appraisal values leaving clients with few options or only higher interest rate options to consolidate debts to maintain affordability. Both of these concerns would reasonably continue over the next 12 months.

DEALING WITH CHANGING MARKET CONDITIONS

My advice would be the same: focus on giving your clients the best advice and don’t panic. The tougher things get, the more valuable you become.

TERRY KILAKOS

Vice president: CMBA; Director: CMBA-Quebec; founder, North East Real Estate and Mortgage Agency, Saint-Laurent, Quebec

CMBA BOARD PRIORITIES

The Canadian Mortgage Brokers Association truly is the voice of mortgage brokers – it is an association created by mortgage brokers for mortgage brokers. We are mandated to ensure that the mortgage broker’s voice is heard loud and clear and is not diluted by the voice of banks. Banks are not involved in any way, shape or form.

CURRENT MARKET IN QUEBEC AND OUTLOOK FOR THE NEXT 12 MONTHS

We’ve been fairly fortunate and relatively unscathed by interest rate increases because the prices in Quebec in general were not overly inflated to begin with. So we found ourselves in a situation where our prices remained stable while prices in some other parts of the country were correcting downwards.

Up until about the third quarter of last year, there was a serious shortage of inventory. It went up slightly in the fourth quarter, but there was also a slowdown in the number of people buying property, so the one balanced out the other.

It’s interesting to note that sellers in general didn't reduce asking prices.

We’ve started off pretty strong this year. There was a continued increase in

inventory, but that’s come down a bit as interest rates stabilized and buyers came back into the market. We are also seeing a change in buyer behaviour. In many cases, instead of opting for the typical five-year fixed or a five-year variable interest rate that was previously so popular, many buyers are choosing three-year rates or shorter terms because it gives them flexibility, if interest rates drop, to switch without high penalties.

MORTGAGE BROKERS’ CONCERNS

Affordability of mortgages. In general, for people in Quebec with the incomes that we have here, there’s a very sweet spot when it comes to properties they can afford. The stress test has a huge impact on the market.

The other worrying issue is new restrictions being proposed by the Office of the Superintendent of Financial Institutions (OFSI). The CMBA Board is working diligently to lobby the government not to put those changes into effect.

DEALING WITH CHANGING MARKET CONDITIONS

Good planning is in order. Mortgage brokers need to stay proactive and reach out to their clients, particularly clients they feel need their advice on issues such as restructuring debt and improving monthly cash flow. A good mortgage broker is going to do those calculations with their clients and help them understand how much they could actually be saving if they were to rejig that mortgage.

There may also be clients who secured variable rate mortgages when rates were very low and now find themselves with interest rates pushing five and a half to six and a half per cent in some cases. Those clients need to be contacted as well to make sure that what they have is still working for them. If it’s not, it’s a good opportunity for the mortgage broker to help alleviate some of that monthly financial stress.

12 I WINTER 2023 CMBA-ACHC.CA CMBMAGAZINE

directors’ outlook

SACHIN VARMA

Treasurer: CMBA; Past President: CMBA-B.C.; founding partner of Highpoint Capital Solutions, Surrey, British Columbia

CMBA BOARD PRIORITIES

The national board’s mandate is to enhance the industry by promoting

education and professional development among our members and the industry. We aim to provide a platform for members to grow and improve their skills and become leaders in their field. The association also serves as an advocate for its members by giving them a voice in matters that affect the industry and profession.

We are implementing this through a number of different strategies and initiatives, including but not limited to training, publications and government relations.

CURRENT MARKET IN BRITISH COLUMBIA AND OUTLOOK FOR THE NEXT 12 MONTHS

Over the past few weeks, we have noticed an uptick in the real estate market and heard that some properties are again selling for over asking price and in multiple offer situations.

There is still a limited housing supply. The availability of homes for sale has been limited, particularly in urban areas.

Given the increase in mortgage rates over the past year, borrowers are qualifying for lower mortgage amounts. There are many adjustable rate and variable mortgage holders who have seen an increase in their payments, which, for some, has impacted their affordability.

Overall, I would say that the outlook for the next 12 months is cautiously optimistic. While the Bank of Canada paused interest rates recently given the steady decline in inflation and we have seen a slight decline in fixed interest rates, interest rates continue to have a significant impact. If interest rates start to rise again, it could lead to a decrease in demand for mortgages as borrowing becomes more expensive.

CMB MAGAZINE CMBA-ACHC.CA SPRING 2023 I 13 CONTEST CONTEST BMI ADVISORY SERVICES LTD. BMI ADVISORY SERVICES LTD. JAN 1 - DEC 31, 2023 JAN 1 - DEC 31, 2023 Fine Print: Applied insurance applicant is a referral that is converted by a life insurance agent to a submitted life, disability and/or critical illness insurance applicant. Referrals coming from our partners must be their own applicant/client – No pooling There will be no pro-rating of qualification requirements for brokers who join BMI Advisory Services during the contest period. Recipients of incentive must be in good standing with BMI Advisory Services at Dec 31, 2023 to receive the incentive. Incentives will be distributed in January 2024. $2K $2K Cash Cash $1K $1K Cash Cash $4K $4K Cash Cash 5 Draws of 5 Draws of $500 Cash $500 Cash 50 applied insurance applicants or $110K* annualized premium 27 applied insurance applicants or $60K* annualized premium 16 applied insurance applicants or $36K* annualized premium Submit a minimum of 5 applied insurance applicants and starting with the 6th, you will receive a ballot for each applied ins. applicant. Build. Manage. Innovate. * Premium does not include ADO/EDO www.bmiadvisory.ca

The performance of the economy and employment rates can affect the demand for mortgages. If the economy continues to recover and employment rates remain high, it could lead to increased demand for mortgages as more people feel confident in their ability to repay loans.

In B.C., we will notice the impact of the foreign buyers’ ban.

The performance of the housing market can impact the mortgage market. If housing prices continue to rise, it could lead to increased demand for mortgages as people look to buy homes before prices rise even further.

MORTGAGE BROKERS’ CONCERNS

Brokers are concerned about uncertainty with the current interest rate environment and the sensitivity of the real estate market to interest rates. There is also concern about how the market is likely to develop over the next 12 months and whether it will be a year of pause or a robust 12 months.

DEALING WITH CHANGING MARKET CONDITIONS

Mortgage brokers who are finding the current market slower have a great opportunity to refine their business plan. My advice is to revisit your book of clients and implement strategies allowing you to be better connected with existing clients. Reconnect with your centres of influence (COIs) and referral sources. Take this time to build deeper relationships.

Also, focus on learning. While this should always be top of mind, find opportunities to continue to grow in the field and further develop your knowledge and skills, and implement marketing strategies.

Over the next 12 months as market activity increases, be consistent with your efforts and marketing strategies. Stay connected with existing clients, COIs and referral sources, and your lender partners, and continue to focus on learning and development.

JIM DECOSTE

Secretary: CMBA; President: CMBA-Atlantic; owner, Dominion Lending Centres Maritime Mortgage Group, New Glasgow, Nova Scotia

CMBA BOARD PRIORITIES

The Board is looking at how best to serve the provincial associations and CMBA members as a whole on the national level. We’ve also been working towards developing a strategy for the national association regarding government regulations and policy changes, both on a provincial and federal level. Part of that involved recruiting a government relations advisor, J.P. Boutros (see p.18), to provide support with provincial and federal regulation changes. Education is always an important part of our mandate, so we aim to provide our members with education and advice on best practices as well as advocating on their behalf.

CURRENT MARKET IN ATLANTIC CANADA AND OUTLOOK FOR THE NEXT 12 MONTHS

There have been many changes in the real estate market and the mortgage broker sector over the past 18 months. We’ve gone through both highs and lows. The market overall has dropped in late 2022 and the first quarter of 2023 compared to record-breaking years in 2020 and 2021. However, Atlantic Canada seems to have weathered the storm a little bit better than some of the other provinces due to

the regional market being relatively under-priced, and we are still doing pretty well even though prices have levelled off and sales are down, but not to the same extent as other parts of the country.

Inventory is down in all areas compared to 2021 and 2022. We are hoping for an uptick this spring, but we know there is a shortage of housing stock in Atlantic Canada, and that’s not going to change anytime soon.

The challenge we face is an influx of people into Atlantic Canada because of the property values and affordability issues in some of the other major markets. We are seeing people moving in from Toronto or moving back home from out West. New immigrants to Canada are also coming into Nova Scotia and other parts of Atlantic Canada, and the housing market isn’t able to keep up with the demand even though we are seeing high levels of new construction.

I don’t see a huge change in the next 12 months compared to what’s happened over the past six to 12 months. I think we’re going to be in similar markets. Our numbers are going to be down compared to our highs of 2021 and early 2022, and it’s all down to a supply chain issue. Construction can’t keep up with the demand.

The market will also be impacted by what happens to interest rates. Our fixed rate mortgages are at a 10+-year high. But regardless of what happens to interest rates, we will probably not see a change in sales volumes because there is simply not enough supply to meet market demand. People want to buy homes, but homes have to be available for purchase.

MORTGAGE BROKERS’ CONCERNS

Mortgage brokers’ concerns go hand in hand with the concerns of their clients. When people aren’t buying homes, mortgage brokers need to review their strategies and reconsider how they are assisting their clients.

14 I SPRING 2023 CMBA-ACHC.CA CMB MAGAZINE

directors’ outlook

Probably the biggest concerns for both mortgage brokers and their clients right now are interest rates and lack of housing supply. There is also some concern about possible policy changes the government may implement to help cool inflation.

I doubt we will see a significant dip in property values over the next 12 months because demand is still high. We’re also not going to see huge price increases, although they may rise slightly here in Atlantic Canada.

Mortgage brokers are shifting their mindset from the highs of 2021 and 2022 and are now working with their clients on issues such as debt restructuring. Some clients who have mortgages are looking at ways to reduce their overall monthly costs. Until rates come down, I think this is where many brokers will focus their attention.

DEALING WITH CHANGING MARKET CONDITIONS

We’ve just come off several years of super low interest rates and high demand for property. Everything was gravy, the phone was constantly ringing and there was little time to reach out to our past clients because brokers were so busy. However, there will always be highs and lows in our industry. Things will change, so don’t hit the panic button when that happens.

Sometimes change is good; it opens up other opportunities. In a market where purchases are slowing down, you have the opportunity to reach out to some of your best clients, to work your book of business and look for opportunities to assist clients who may, for example, need help restructuring their debts and reassuring them that inflation will be brought back down to the Bank of Canada’s targets, possibly within the next 12 to 18 months.

Our industry will remain strong. Clients will continue to turn to us for advice, particularly at a time of high interest rates. Those facing mortgage renewals will likely experience sticker shock when they receive their renewal offer from their current bank, so they are likely to shop around for a better rate. That’s where we come in. Reach out to your previous clients and make sure they know you are there to work for them and to find solutions.

THE CANADIAN MORTGAGE BROKERS ASSOCIATION (CMBA) is a national umbrella organization formed in 2015 to enhance already strong regional representation but also promote higher standards and awareness across the country. CMBA’s purpose is to help each of its provincial affiliates to be as strong as possible in serving their local members. CMBA provincial affiliates include: CMBA-BC, CMBA-Ontario, CMBA-Atlantic and CMBA-Quebec.

THE MANDATE of CMBA is to enhance the mortgage brokering industry by promoting education and professional development among our members. We aim to provide a platform for members to grow and improve their skills and become

leaders in their field. The association also serves as an advocate at the provincial and national level for its members by giving them a voice in matters that affect the industry and profession. By doing so, the association is dedicated to advancing the industry and improving the lives and careers of its members.

CMBA promotes a co-operative agenda that empowers each provincial affiliate by supporting activities related to:

n Government relations

n Education

n MB/CH branding

n Consumer awareness

n Industry growth

n Economies of scale

n Member professionalism and ethics

CMB MAGAZINE CMBA-ACHC.CA SPRING 2023 I 15

You envision. We enable.

Ensuring our borrowers see a clear path to success is our unique specialty. We’re one of North America’s leading non-bank commercial mortgage lenders with over $3 billion under administration. We specialize in bespoke lending solutions for commercial real estate financing in amounts from $10M to $100M. We’ll share your vision, and your entrepreneurial mindset, to provide time-sensitive lending and financing solutions. Let’s talk. 800 494 0389 | romspen.com

CMB MAGAZINE CMBA-ACHC.CA SPRING 2023 I 17 All your privates. All the time. Lend Across Ontario 1st & 2nd Mortgages Urban, Small center, Rural Construction, Renovation, Bridge Financing Up to 40 Year Amortization westboromic SPELL CHECK DATE: AD NUMBER: AD / JOB TITLE: PUBLICATION / RUN DATE: LIVE: COLOUR: CLIENT: CREATIVE TEAM: TRIM: BLEED: BENSIMO N PARTNERS TEL.416 597 9700 HELLO@BENSIMON.CA MARCH 8, 2023_2:15PM ROM CMBA 23 02 ENVISION CANADIAN MORTGAGE BROKER / SPRING 2023 8.375” x 10.75” CMYK ROMPSEN BENSIMON/PARKER NA NA ✓

License # 10172 Investment Corporation

AMPLIFYING CMBA’S VOICE

Introducing JP Boutros, newly appointed government relations advisor

BY CHRIS FREIMOND

JPBoutros, Canadian Mortgage Brokers Association’s newly appointed government relations advisor, doesn’t hesitate when asked what value he will bring to CMBA members.

“I look forward to being a conduit between the messages the government and policy-makers want to bring and what mortgage brokers would like to inform the government about on behalf of their clients and themselves. CMBA president Sadiq Boodoo and the board’s goal is to elevate that conversation and ensure that mortgage brokers’ voices are better understood and heard in the wider media sphere and by the government. We want our input to become indispensable to them as a vital stakeholder.”

With 15 years in government relations (GR) under his belt, including four years leading GR for another industry association, Boutros is well placed to ensure CMBA’s voice is heard by the federal and provincial governments.

Boutros, who has a genuine passion for real estate and personal finance, is a strong believer in the value of home ownership and aims to help CMBA convince policy-makers to avoid making buying and owning a home unnecessarily difficult for Canadians.

One of his first priorities is getting decision-makers to understand the socio-economic impacts of Guideline B-20.

In January this year, the Office of the Superintendent of Financial Institutions (OSFI) launched a public consultation regarding changes to Guideline B-20 Residential Mortgage Underwriting Practices and Procedures that would further tighten mortgage underwriting rules and possibly related rules that apply to federally regulated lenders.

Specifically, OSFI is seeking feedback on three measures: (1) possible restrictions on mortgage size (loan-to-income (LTI)) and debt load (debt-to-income (DTI)); (2) debt service coverage restrictions, in relation to a borrower’s gross income and total debt; and (3) interest rate affordability stress tests, to gauge a borrower’s ability to afford higher debt payments in the event of financial shocks.

Boutros personally believes some of the measures exceed the mandate of the regulators whose primary role is to oversee federally regulated financial institutions and big banks rather than individual borrowers, mainly because of effects that lie outside the regulator’s area of expertise.

18 I SPRING 2023 CMBA-ACHC.CA CMB MAGAZINE government relations

ISTOCK.COM

“The issue is that a lot of the B-20 messaging talks about the type of homeowner they want, the type of borrower they want on the books at the big banks. I don’t think that’s their mandate and hope they don’t want that as a mandate,” he says. “Their stated mandate is to protect the big banks, deposit holders and shareholders; it’s not to regulate individual Canadians, yet their influence over housing policy is clearly evident.”

Boutros says it is essential for CMBA to be included in conversations with governments and that regulators do not rely on data that quickly becomes outdated.

“Regulators need first-hand, real-time, front-line information that comes from people, especially mortgage brokers. That’s the strong messaging CMBA will take to government; we need to put it out there,” he adds.

In advance of a federal election, Boutros says the board and he will consult members across its four provincial associations to get a better understanding of their government relations and regulatory concerns.

Regulators need first-hand, real-time, frontline information that comes from people, especially mortgage brokers. That’s the strong messaging CMBA will take to government; we need to put it out there.

“We don’t want to be too presumptuous. While B-20 is important, I think there are other local issues that we may be missing and that need our attention,” he says.

For example, says Boutros, on a broader scale, CMBA will also be looking at challenges such as housing supply and will be working with CMBA-BC, CMBA-Ontario, CMBAAtlantic, and CMBA-Quebec on how to accelerate growth through home ownership and construction. The association will also work with philosophically aligned organizations to ensure there are cohesive and coherent messages, with B-20 and fraud prevention high on the list.

“Our overall strategy is definitely to work with government and become an informative and reliable stakeholder so they aren’t listening disproportionately to big entities like the Canadian Bankers Association, with established ways of doing things, because there’s nothing normal anymore during a time of constant change,” he says.

CMB MAGAZINE CMBA-ACHC.CA SPRING 2023 I 19

“

NEW ANTI-MONEY LAUNDERING AND ANTI-TERRORIST FINANCING REQUIREMENTS FOR BROKERS, LENDERS AND ADMINISTRATORS

How do the changes impact the mortgage brokering sector?

BY RAY BASI, J.D., LL.B., DIRECTOR OF EDUCATION FOR CMBA-BC AND MBIBC

Mortgage brokers, lenders and administrators are about to become subject to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (the Act). This will trigger significant new compliance requirements. Why the change now? What is the change? What impact will the change have on mortgage brokers, lenders and administrators?

WHY THE CHANGE?

Money laundering is the process by which proceeds from criminal or illegitimate sources are concealed or disguised (that is ‘cleaned’ or ‘laundered’) to make them appear as if they are from legitimate sources. Terrorist financing is the collecting and providing of funds to fund terrorist activity. It is, of course, in society’s interest to make criminal and illegitimate activity less appealing by making it less profitable. As well, it is in society’s interest to make it financially less feasible for terrorists to carry out their activities in Canada or in other parts of the world.

The federal government in Canada Gazette, Part 1, Volume 157, Number 7: Regulations Amending Certain Regulations Made Under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act expressed its views that:

n Real estate is increasingly being used to launder illegitimate funds and to hold the wealth of criminal and terrorist groups.

n There is a growth in the volume and value of mortgages issued by businesses that are not currently subject to the Act.

n These mortgage lenders, unregulated under the Act, can be highly vulnerable to exploitation for money laundering/terrorist financing (such as by engaging in ordinary matters of helping clients borrow funds, or sending and receiving money).

20 I SPRING 2023 CMBA-ACHC.CA CMB MAGAZINE compliance requirements

ADOBESTOCK

CMBMAGAZINE CMBA-ACHC.CA SPRING 2023 I 21

compliance requirements

The federal government is of the view that by making this sector subject to the Act and its related regulations, this sector will be less vulnerable to being misused in this way. It feels this reduced vulnerability will lead to less crime and terrorist activity in society.

THE CHANGE

The Act targets deterring, detecting, investigating and prosecuting money laundering and terrorist financing. Importantly, it requires “reporting entities” (specified businesses and occupations) to develop and implement compliance programs, including processes to identify clients, monitor business relations, keep records, and report specified types of financial transactions. Significantly, the Act establishes the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) as Canada’s primary anti-money laundering and anti-terrorist financing agency.

FINTRAC is both a regulator and financial intelligence unit. It enforces the requirements imposed on reporting entities and produces data and records to assist national and international agencies to combat money laundering and terrorist financing.

Mortgage brokers, lenders and administrators have to date not been included as reporting entities and so have not been subject to the Act or FINTRAC’s requirements. Others in the financing sector (such as banks, trust companies, loan companies and federal credit unions) have been included as reporting entities for quite some time.

The federal government believes that not including mortgage brokers, lenders and administrators as reporting entities for purposes of the Act makes them more vulnerable to being exploited for money laundering and terrorist financing purposes.

The vulnerability for this group relates particularly to both receiving funds that are proceeds of crime (for example, down payments and

repayments of loans) and lending potential proceeds of crime to clients. The federal government believes including entities of all sizes that are involved in the mortgage lending process (mortgage originators, lenders/ underwriters and administrators) as reporting entities would reduce the vulnerabilities of these entities being misused for money laundering or terrorist financing activities. Accordingly, the published draft regulations would include mortgage brokers, mortgage lenders and mortgage administrators as “reporting entities.” The proposed definitions are sufficiently broad that together they would take in most persons engaging in the mortgage arranging and administering process. Specifically, they provide:

n “mortgage broker”: a person or entity that is authorized under provincial legislation to act as an intermediary between a mortgage lender and a borrower;

n “mortgage lender”: a person or entity, other than a financial entity, that is engaged in providing loans secured by mortgages on real property or hypothecs on immovables; (Note: Financial entities are covered otherwise than by this definition.)

n “mortgage administrator”: a person or entity, other than a financial entity, that is engaged in the business of servicing mortgage agreements on real property or hypothec agreements on immovables on behalf of a lender.

THE IMPACT OF THE CHANGE

If you operate within any of these definitions, you are a reporting entity and will be required to comply with the Act, the regulations and FINTRAC requirements.

So what are the requirements?

Unless the regulations are amended before they are brought into force, you will need to:

n Apply customer due diligence measures;

n Keep appropriate records;

n Report certain types of transactions;

n Have a compliance officer;

n Have a compliance program in place;

n Have a training program in place;

n Have a training plan in place; and

n Review your compliance program at least every two years.

THE TAKEAWAY

Suffice to say that by virtue of being included as a reporting entity for purposes of the Act, the compliance requirements imposed on mortgage brokers, lenders and administrators will increase significantly. For a more detailed discussion of the contents of the compliance program, as it concerns money laundering and terrorist financing, please read the companion article in this magazine (p.24).

This article is not intended as legal advice. You are advised to obtain legal advice in specific instances.

22 I SPRING 2023 CMBA-ACHC.CA CMB MAGAZINE

The federal government believes that not including mortgage brokers, lenders and administrators as reporting entities for purposes of the Act makes them more vulnerable to being exploited for money laundering and terrorist financing purposes.

CMB MAGAZINE CMBA-ACHC.CA SPRING 2023 I 23 LAWRENSONWALKER.COM VANCOUVER · VICTORIA · OKANAGAN PEACE REGION · CALGARY · EDMONTON Guiding You Through The Storm

24 I SPRING 2023 CMBA-ACHC.CA CMBMAGAZINE

REQUIREMENTS OF A COMPLIANCE PROGRAM FOR A REPORTING ENTITY

Do it and show it’s been done

BY RAY BASI, J.D., LL.B., DIRECTOR OF EDUCATION FOR CMBA-BC AND MBIBC

Once mortgage brokers, lenders and administrators are included as “reporting entities,” they will need to comply with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and associated Regulations (for convenience, together referred to as the Act). As such, they will be required to have a compliance program in place that addresses the non-exhaustive topics covered in this article.

The government intends to allow a six-month transition period to allow the new reporting entities to come into compliance, but before then you might want to be familiar with the framework and consider whether you can accommodate the new obligations within your existing resources. Simply put, you might need to add staff to meet the new compliance requirements.

COMPLIANCE OFFICER

A reporting entity must have a compliance officer. The compliance officer of a small business is generally one of its senior managers, owners or operators. For a larger business, it is someone from a senior level who has direct access to senior management and the board of directors. For a sole proprietorship, it is the sole proprietor or someone they appoint.

The compliance officer is responsible for implementing all elements of the compliance program required under the Act and so needs to:

n Have the necessary authority and access to resources in order to implement an effective compliance program and make any desired changes;

n Have knowledge of the business’s functions and structure;

n Have knowledge of the business sector’s money laundering/terrorist financing risks and vulnerabilities as well as money laundering/terrorist financing trends and typologies; and

n Understand the business sector’s requirements under the Act.

WRITTEN COMPLIANCE POLICIES AND PROCEDURES

There must be written compliance policies and procedures that are accessible to those persons who need to follow them. The policies and procedures must be kept up to date and approved by a senior officer of the reporting entity. The level of detail in your compliance policies and procedures will depend on your business size, structure and complexity, and degree of exposure to money laundering/terrorist financing risks.

CMB MAGAZINE CMBA-ACHC.CA SPRING 2023 I 25 compliance program

ISTOCK.COM

compliance requirements

The compliance policies and procedures should cover, at minimum, requirements concerning the following areas (as applicable):

n Compliance program (such as having an appointed compliance officer, conducting a risk assessment, having an ongoing compliance training program and plan, and conducting a two-year effectiveness review and plan);

n Know your client (such as verifying the identity of clients and the beneficial ownership of property);

n Business relationships (such as keeping a record of the purpose and intended nature of the business relationships with a client and describing your business dealings with them);

n Record keeping (such as documenting how other requirements have been met);

n Reporting (such as regarding suspicious transactions);

n Travel rule (this concerns including or obtaining certain information in relation to an electronic funds transfer or a virtual currency transfer); and

n Ministerial directives or restrictions (the federal Minister of Finance may issue directives or restrictions in dealing with transactions concerning a foreign jurisdiction).

Your compliance policies and procedures should also include the processes and controls put into place to meet your applicable requirements, including the following:

n When an obligation is triggered;

n The information that must be reported, recorded, or considered;

n The procedures created to ensure a requirement is fulfilled; and

n The timelines associated with your requirements and methods of reporting.

RISK ASSESSMENT

The compliance program must include policies and procedures that assess money laundering/terrorist financing risks in the course of the business’s activities.When assessing and

If, at any time, you consider the risk of a money laundering or terrorist financing offence to be high, you must take enhanced measures. Enhanced measures are the additional written controls and processes that you have put in place to be applied to manage and reduce the risks associated with your high-risk clients and business areas.

documenting these risks, you must consider the following:

n Your clients and business relationships, including their activity patterns and geographic locations;

n The products, services and delivery channels you offer;

n The geographic location(s) where you conduct your activities;

n The risks resulting from ‘new developments’ or ‘new technologies’ you intend to carry out or introduce that may have an impact on your clients, business relationships, products, services or delivery channels, or the geographic location of your activities; and

n Any other relevant factors affecting your business (for example, employee turnover, industry rules and regulations).

If, at any time, you consider the risk of a money laundering or terrorist financing offence to be high, you must take enhanced measures. Enhanced measures are the additional written controls and processes that you have put in place to be applied to manage and reduce the risks associated with your high-risk clients and business areas.

Enhanced measures to mitigate risk can include:

n Obtaining additional information on a client (for example, information from public databases and the internet);

n Obtaining information on the client’s source of funds or source of wealth;

n Obtaining information on the reasons for attempted or conducted transactions; or

n Any other measures you deem appropriate.

TRAINING PROGRAM

If you have employees, agents or other persons authorized to act on your behalf, you must develop and maintain a written, ongoing compliance training program. Your training program should explain what your employees, agents or other persons authorized to

act on your behalf need to know and understand, including:

n Your requirements under the Act;

n Background information on money laundering and terrorist financing (such as the definitions of the terms and how to detect such activity);

n How your business or profession could be vulnerable (provide indicators and examples);

n The compliance policies and procedures you have developed to help meet your requirements under the Act for preventing and detecting money laundering and terrorist financing including your reporting, record keeping and know-your-client requirements; and

n Their roles and responsibilities in detecting and deterring money laundering and terrorist financing activities, and when dealing with potentially suspicious activities or transactions.

You must institute and document a plan for your ongoing compliance training program and for delivering the training, including how it will be implemented and delivered. This includes documenting the steps you will take to ensure your employees, agents or other persons authorized to act on your behalf receive an appropriate level of training relevant to their duties and position, on an ongoing basis.

TWO-YEAR COMPLIANCE REVIEW

You must, at least every two years, conduct an effectiveness review to test the effectiveness of the elements of your compliance program (policies and procedures, risk assessment, and ongoing training program and plan).

You must start your effectiveness review no later than 24 months from the start of your previous review. You must also ensure that you have completed your previous review before you start the next review.

The purpose of an effectiveness review is to determine whether your

26 I SPRING 2023 CMBA-ACHC.CA CMB MAGAZINE

compliance program has gaps or weaknesses that may prevent your business from effectively detecting and preventing money laundering and terrorist financing.

Your plan should not only describe the scope of the review, but it should include the rationale that supports the areas of focus, the time period that will be reviewed, the anticipated evaluation methods and sample sizes. The evaluation methods can include, but are not limited to, interviewing staff, sampling records and reviewing documentation. The review must be carried out and the results documented by an internal or external auditor, or by yourself if you do not have an auditor. The auditor should be someone who is knowledgeable of your requirements under the Act.

You must report, in writing, the following to a senior officer no later

than 30 days after the completion of the effectiveness review:

n The findings of the review (for example, deficiencies, recommendations and action plans);

n Any updates made to the policies and procedures during the reporting period (the period covered by the two-year review) that were not made as a result of the review itself; and

n The status of the implementation of the updates made to your policies and procedures.

POSSIBLE CONSEQUENCES FOR NON-COMPLIANCE

Administrative monetary penalties are being contemplated regarding non-compliance. The range of the penalty will depend on the harm done by the violation and the reporting entity’s history of compliance. The penalty for a minor violation would range from $1 to $1,000 per violation,

a serious violation would be from $1 to $100,000 per violation, and a very serious violation would be from $1 to $100,000 per violation for an individual and from $1 to $500,000 per violation for an entity.

TAKEAWAYS

If mortgage brokers, lenders and administrators are included as reporting entities for purposes of the Act, and it is almost certain they will be, compliance efforts and costs are bound to increase. While there is no need to think the weight of compliance will be unbearable, it will certainly be lighter for mortgage brokers who anticipate the future, familiarize themselves with the likely changes, and plan accordingly.

This article is not intended as legal advice. You are advised to obtain legal advice in specific instances.

CMB MAGAZINE CMBA-ACHC.CA SPRING 2023 I 27

INTRODUCING Secured first position up to 75% LTV, variable rate Residential, Ontario Only Purchase, Refinance, Rentals and Condos No Minimum beacon No Income No TDS/GDS ROYALFLEX 1st LINE OF CREDIT Contact one of our BDMs for details: www.royalcanadianmortgage.com/contact-us

While there is no need to think the weight of compliance will be unbearable, it will certainly be lighter for mortgage

FINDING

BY LISA GORDON

Sabeena Bubber has celebrated many successes in her 30-year mortgage industry career. From her early days underwriting for an alternative lender to a position as a bank mortgage specialist, and finally to her current role as a mortgage broker with British Columbia-based Xeva Mortgage, she has no regrets about following the intuition that led her to mortgage brokering.

“I can’t see myself ever doing anything but mortgage brokering,” she said during a recent interview. “I love what I do.”

It was a mortgage broker who told her, when she was underwriting, that she was sitting on the wrong side of the desk. Intrigued, she explored her options and successfully completed the broker’s course while working at a bank.

But, like many other mortgage professionals, Bubber was frustrated at being restricted to the bank’s mortgage products.

“They wanted me to bring all my referral sources from outside and yet, once I completed a mortgage, I could no longer provide advice to that client,” she said. “I wanted to be able to provide long-term advice to my clients. I felt I could provide them with better solutions and more products at a brokerage.”

Today, Bubber handles mostly residential mortgages and specializes in helping clients who are self-employed or those who are going through a divorce.

“When I was going through my own divorce, I gained a whole new perspective,” she recalled. “I started a group called the Divorce Circle in 2019, where we have professionals from different areas come in to educate women about their rights, the processes available to them, and how to get through it. From there, I developed a website, www.divorce.mortgage

28 I SPRING 2023 CMBA-ACHC.CA CMB MAGAZINE

brokers off-the-clock JOY

B.C. mortgage broker Sabeena Bubber channels her time and talents into causes that help those in need

JOY

“This website takes the valuable information from all the professionals I’ve worked with and puts it in one convenient place, with videos and information for people going through divorce.”

Two years before the Divorce Circle was founded, a personal tragedy in her close friend’s life prompted Bubber to start a Go Fund Me campaign to provide financial assistance to her. It was the beginning of what she now calls her “passion project” – Brokers Who Care (www.brokerswhocare.ca).

“About $7,000 of the $30,000 we raised for my friend came from mortgage brokers across Canada, from my network. It gave me an idea,” said Bubber. “What if the broker community could come together to help other families in need?”

Fast forward to 2023, and Brokers Who Care now includes 217 members from across the country.

“Brokers contribute $100 per quarter, or $400 per year, and in addition to the benefits of helping others, they are given marketing materials to promote their involvement to their communities,” explained Bubber. “Then, every three months, the membership has a nomination period. We vote virtually on who we’ll donate to: kids with cancer, people with long-term ailments, parents who are struggling. We help them out. Sometimes it’s actual mortgage brokers or people in the industry, or clients of a broker, or just people we hear about.”

To date, Brokers Who Care has donated an impressive $325,000 to 47 separate causes.

“It's a good way to show your clients that you’re involved in something that is philanthropic, and you can help people they might know,” she commented. “It feels good to see the people we’re helping. In starting this group, I just wanted to show we are all people, and we have a collective interest in helping our communities.”

Top: Sabeena with her daughter Kavika. Above: Sabeena with her two daughters Kavika (far left) and Anoushka (alongside) and a friend Luci (second from left).

In addition, Bubber participates in The MotherBoard – a network of successful women and mothers that offers support for dealing with everything from babies to boardrooms.

As well, she never misses a “Power Hour” meeting, a biannual gathering of 50 local women in business.

Bubber is also a big proponent of U.S.-based Mindpower Coaching with Steph and Shay. She plans to certify as a Mindpower coach and offer her services in her spare time.

“Since I started in 2016, I know exactly what to do to get myself back up again,” she said. “It gives me the tools to create the life I want from day to day.”

We still have to be there for ourselves and our families. Health is something you can’t overlook –when it’s gone, it’s gone.

The resiliency emphasized by the Mindpower program came into play on Feb. 4, 2022, when Bubber was diagnosed with Stage 2 breast cancer. While she underwent surgery, radiation and chemotherapy treatments, her team stepped up, ensuring her clients were looked after while Bubber focused on getting better.

The life-changing experience taught her many important lessons.

“I think the important thing to say is that I made sure decades ago that I had critical illness insurance and also some personal disability insurance. Thank God I had it.”

And, as much as we all talk about achieving “balance” in our lives, Bubber said there really is no such thing.

“Burnout is real. As brokers, we had such a busy market in 2020/2021 and we give so much of ourselves. We have these cycles in our business where we are so busy, we can’t leave our desks. Then, when things slow down, people aren’t taking breaks because they cannot afford to. It’s so important to take breaks – walk, work out, take your vacations, enjoy your life. We still have to be there for ourselves and our families. Health is something you can’t overlook – when it’s gone, it’s gone.”

She’s achieved many of her bucket list goals since doing the Mindpower program in 2016 and now, since having cancer, that list has evolved even more: growing Brokers Who Care to double her original goal of 100 members; taking memorable vacations with her two daughters, aged 19 and 17; spending more quality time with family; and meeting some personal financial goals.

“There have been significant changes as I prioritize the more important things,” said Bubber. “How do I show up for my family, friends, clients and community? Those are the things that matter most. I am clear on what I want. I focus on that. That’s what helps me get through those tough times.

“I make a point to find some joy in every day – even if just for five minutes.”

This interview with Sabeena Bubber continues our series Brokers off the Clock. In every issue, we ask a mortgage broker to tell us what they like to do when they’re not behind a desk. Be it working with animals, travelling to exotic places or creating an award-worthy garden, we want to know how you unwind. Would you like to be profiled in a future edition – or suggest a fellow mortgage broker? Contact info@cmba-achc.ca

CMB MAGAZINE CMBA-ACHC.CA SPRING 2023 I 29

“

30 I SPRING 2023 CMBA-ACHC.CA CMB MAGAZINE legal ease

DAMAGES FLOWING FROM FAILING TO COMPLETE A PURCHASE

Making the seller whole can leave a buyer full of holes

BY RAY BASI, J.D., LL.B., DIRECTOR OF EDUCATION FOR CMBA-BC AND MBIBC

THE SCENARIO

A buyer and seller entered into a purchase and sale agreement regarding a residential property. By the completion date the contract is unconditional, either because it was from the start or because the parties through the process removed any conditions. The seller’s realtor holds the deposit on the purchase price made by the buyer. Come the completion date, the buyer does not complete the purchase. The seller puts the property back on the market and finds a new buyer, albeit at a lower price. The seller also suffers losses because of having to pay additional mortgage payments, property taxes and property insurance while waiting for the second sale to complete as well as the costs of staging the property a second time.

Is the seller entitled to only the amount received from the second sale? Regarding the first sale, is the seller entitled to only the deposit amount? Is the seller entitled to collect from the initial buyer any amounts lost due to the first sale not completing? The Ontario Supreme Court of Justice on March 20, 2023, in Kisliuk v Algai, 2023 ONSC 1841 (CanLII) provides some guidance.

CMB MAGAZINE CMBA-ACHC.CA SPRING 2023 I 31

ADOBESTOCK

THE DECISION

In Kisliuk, the buyer and seller agreed to the sale of the property for $1,960,000, with the buyer providing the seller’s realtor $75,000 as a deposit toward the purchase price. The initial closing date was extended at the request of the seller, and the seller agreed to pay $1,847 for the extension. The $1,847 was never paid. The seller on the completion date was ready, willing and able to complete, but the buyer failed to complete the purchase.

The seller relisted the property and sold it for $1,800,000. The market had dropped and this was the highest offer received. The seller sued for damages and for release of the $75,000 deposit. The seller claimed a loss of $160,000 on the resale price, the difference between the two sale prices, and carrying costs suffered between the time of the failed sale and the one that completed.

The court granted the seller $160,000 damages arising from the loss of the first sale. It accepted that the price at which the property ultimately sold provided good evidence of the reduced market value. As well, the drop in the market and the reduced sale price was supported by an appraisal. The court concluded that the seller had met the obligation to mitigate by taking reasonable steps to minimize losses.

The court noted that the seller, due to the breach of contract, was entitled to be put in the same position as would have been the case if the first sale had completed. The seller was entitled to additional damages or carrying costs and the court accordingly granted the following as foreseeable and caused by the breach of contract:

n Additional real estate commissions in the amount of $6,554. The greater commission for the second sale as compared to the first sale was needed to attract agents to show the property in the now less attractive market.

n Labour and material costs in the amount of $10,124.49 to paint, plaster, laminate the floors and repair the garage stairs to make the property more marketable.

n Staging and photography expenses in the amount of $597.77. When initially sold, the property was tenanted and sold on an “as is basis.” When the tenant left, cosmetic repairs were needed to attract the best price possible.

n A credit of $700 given by the seller to the new buyer for repairs needed to the basement doors and electrical panels. This credit was beyond what was given to attract the first buyer.

n Appraisal costs of $904 to determine the listing price and/or the market value of the property before it was resold.

n Additional interest on the seller’s mortgage in the amount of $19,223.50 between the time of the failed first sale and the completed sale.

n Penalties and charges in connection with the buyer having to renew the existing mortgage because of the failed sale and having to pay a prepayment charge of $13,088.27 to complete the second sale.

n Property taxes in the amount of $3,287.20 for the period between the time of the failed sale and the second sale.

n Insurance in the amount of $1,812.20 for the period between the time of the failed sale and the second sale.

These amounts totalled $56,291.43 and combined with the $160,000 loss made for a total of $216,291.43. The court added to this the outstanding extension fee of $1,847.50 and ordered that the buyer pay the seller $218,138.93 for damages suffered by the seller for the buyer not completing the purchase, plus $5,747.45 as court costs. In addition, the court ordered that the amount was subject to the addition of interest in accordance with the applicable legislation. The court ordered that the $75,000 deposit held by the realtor be released to the seller as a credit against the ordered amount.

THE TAKEAWAY

A buyer who fails to complete a purchase can be subjected to considerable costs and should be careful in making an agreement unconditional unless they are able to complete. The seller is entitled to be made whole. Particularly in a declining market, the outcome for the would-be buyer can be extremely expensive.

As a bonus takeaway, clients should be encouraged to think things through very thoroughly before making a purchase agreement unconditional. They need to ensure they have everything lined up to complete the transaction.

This article is not intended as legal advice. You are advised to obtain legal advice in specific instances.

legal ease

A buyer who fails to complete a purchase can be subjected to considerable costs and should be careful in making an agreement unconditional unless they are able to complete.

The seller is entitled to be made whole. Particularly in a declining market, the outcome for the would-be buyer can be extremely expensive.

CMB MAGAZINE CMBA-ACHC.CA SPRING 2023 I 33 WITH YOU EVERY STEP OF THE WAY Real Estate Conveyancing - Mortgages - Refinances 604-676-8570 BCNA@bcnotaryassociation.ca www.bcnotaryassociation.ca

DATA SECURITY AND WHAT MORTGAGE

BROKERS NEED TO KNOW

Brokerages advised to build a culture of cyber vigilance

SUBMITTED BY PROLINK CANADA'S INSURANCE CONNECTION

ortgage brokers and administrators are among the most valued members of the financial services industry. That’s the good news. The bad news? Cyber criminals target the financial services industry more than most other sectors. Why? Because of mortgage brokers’ access to confidential personal and financial information, not to mention valuable third-party connections to lenders, credit agencies, investors, law firms and more. Simply put, mortgage brokers either have the type of personal information that cyber criminals seek, or are a potential gateway to it.

According to the 2022 CIRA Cybersecurity Survey, 44 per cent of Canadian businesses indicate their organization has experienced an attempted or successful cyber attack in the last 12 months.

1. INSUFFICIENT CYBERSECURITY

Unencrypted connections, misconfigured servers, unpatched systems and other gaps in network security are clear entry points for opportunistic cyber criminals to infiltrate your network and compromise data. But while larger corporations can afford to strengthen their defences, many small and midsize brokerages lack the funds to invest in proper safeguards or the personnel to maintain their upkeep once implemented. Many also rely on personal devices or free resources, like Gmail, Dropbox or Zoom, to conduct business, which are challenging to adequately secure.

Additionally, with many mortgage brokers – and their clients – now working from home or working on the go, attackers’ digital entry points have increased exponentially, with extra exposure from weak home security or even public Wi-Fi networks.

2. HUMAN ERROR

The typical mortgage brokerage has a fast-paced, entrepreneurial culture. While this environment is conducive to sales,

it can pose a threat to data security. To close a deal quickly, a mortgage brokerage’s employees and subcontractors may bypass security rules by using a personal email to send client information or improperly access data that resides with the company’s cloud services provider. Or they might be so distracted that they misplace a personal device or fail to securely dispose of a client file. These actions could all easily put the brokerage at risk of a breach.

The rise of working remotely has compounded these issues. With many employees working far from the direct oversight of information technology (IT) staff and senior leadership, they might be less vigilant about installing software updates, maintaining password hygiene or using a secure connection. Alternatively, they might simply be unaware of how to handle sensitive data or even recognize the signs of a phishing attack or a breach.

3. THIRD-PARTY COMPROMISE

Many entrepreneurs incorrectly believe that doing business with a major cloud service provider (CSP), such as Amazon or Apple, or even a

34 I SPRING 2023 CMBA-ACHC.CA CMB MAGAZINE data security ADOBESTOCK

WHY ARE MORTGAGE BROKERS VULNERABLE?

PRIVACY BREACHES:

credit agency like Equifax, absolves them of any responsibility in the event of a breach.

However, under Canada’s federal privacy law PIPEDA, as well as various provincial regulations in Alberta, British Columbia and Quebec, your brokerage is legally obligated to protect clients’ data every step of the way, whether it is being stored onsite, in the cloud or running a credit check. Using a third party to collect, store, process or otherwise handle data won’t transfer liability, and the brokerage can still be held accountable and be sued for failing to protect client data.

WHAT ARE THE CONSEQUENCES?

Unfortunately, the repercussions from a cyber incident can be severe, leading to lasting financial, legal and reputational harm. Without proper protections in place, brokers and their staff risk losing permanent access to mission-critical data. As a custodian of personally identifiable information (PII), you could face penalties of up to $100,000 per violation under PIPA if you fail to collect, retain or dispose of personal information in your custody or report a privacy breach.

That’s just the tip of the iceberg.

Then there are indirect costs, such as client notification, investigation, system downtime, business interruption and legal fees from any client legal suits. In fact, IBM Security’s 2022 Cost of a Data Breach Report puts the average cost per lost or stolen record in the financial services industry at $520. Even worse? Diminished goodwill from the breach might even do more harm than remediation costs, especially if you don’t take swift action or notify breach victims right away. Once you’ve lost that trust, it won’t be easy to regain or attract new clients, employees or even investors.

WHAT CAN YOU DO?

According to Derrick Leue, president and CEO of PROLINK-Canada's Insurance Connection, "It is imperative for mortgage brokers and brokerages to take preventative action and work towards a long-term cyber risk management strategy." Leue recommends that mortgage brokers focus on:

n SECURITY: Add extra layers of protection to all networks and devices, such as multi-factor authentication (MFA) and endpoint detection and response (EDR) software. Encrypt data-at-rest and in-transit and routinely backup your information.

The typical mortgage brokerage has a fast-paced, entrepreneurial culture. While this environment is conducive to sales, it can pose a threat to data security.

Keep systems updated with the latest security patches. Develop a tailored incident response plan in case of a breach.

n EDUCATION: Build a culture of cyber vigilance. Provide tailored security awareness training to all employees including how to handle sensitive data, use software safely, and identify, avoid and report potential harmful situations. Keep them aware of threats as they emerge and partner with a cybersecurity firm to offer highquality training and simulations.

n INSURANCE: General liability insurance won’t cover a breach, but a dedicated cyber insurance policy can help you protect digital assets, offset losses and help get your business back online. Plus, depending on your coverage, your policy may provide funds for your legal liability, a legal breach coach, public relations consultants, IT network forensic specialists, client notification and more. For more information, consult with a licensed insurance broker.

PROLINK-Canada’s Insurance Connection is an independent Canadian insurance brokerage that represents more than 30 insurance companies. Information: prolink.insure

CMB MAGAZINE CMBA-ACHC.CA SPRING 2023 I 35

HOME PRICES APPEAR TO BE STABILIZING

BUT SUPPLY IS STILL A CHALLENGE

BY CHRIS FREIMOND

36 I SPRING 2023 CMBA-ACHC.CA CMB MAGAZINE housing values

ISTOCK.COM

HOME

Professional appraisers use up-to-date and real-time market data to arrive at an opinion of value

House prices across Canada seem to be stabilizing with the Aggregate Composite MLS® Home Price Index (HPI) increasing 0.2 per cent in March this year compared to February, but the HPI is still 15.5 per cent below March 2022 levels, according to the latest data from the Canadian Real Estate Association (CREA).

“The trend of prices stabilizing from February 2023 to March 2023 was very broad-based. With few exceptions, prices are no longer falling across most of the country, although they’re not rising meaningfully anywhere either,” says CREA in a news release.

The actual (not seasonally adjusted) national average home price was $686,371 in March 2023, up almost $75,000 from its January 2023 level resulting from outsized sales increases in the Greater Toronto Area (GTA) and B.C. Lower Mainland, two of Canada’s most active and expensive housing markets. Excluding the GTA and Greater Vancouver from the calculation cuts more than $136,000 from the national average price.

The spring market is moving into top gear, but lack of inventory remains a challenge, says CREA senior economist Shaun Cathcart.

“Sales are trending up, markets have tightened considerably, the Bank of Canada is on hold, and the MLS® Home Price Index is stabilizing across the country. That said, the supply issue is still with us. New listings are at 20-year lows,” he says.

CMB MAGAZINE CMBA-ACHC.CA SPRING 2023 I 37

housing values

VALUATION EXPERTISE

While mortgage rates seem to have stabilized for now, many buyers still face stringent stress tests and higher monthly payments than they may be comfortable with to get the home they want. Many are now turning to mortgage brokers to help them find the right mortgage product to suit their budgets.

But navigating between the shortage of housing stock and stabilizing house prices can be difficult. While the market is the final arbiter of value, no buyer wants to be paying more than they should.

Claudio Polito, president-elect of the Appraisal Institute of Canada (AIC), says mortgage professionals should rely on the valuation expertise of professional appraisers to provide independent opinions of value during both the mortgage financing and refinancing process.

One of the ways mortgage brokers can help clients prepare for their purchase is to make sure the home they want is good value for the price and likely to satisfy lenders’ criteria. Getting a professional appraisal could help achieve these objectives.

“Those requests can be tied to many different scenarios in addition to standard buying/selling transactions,” he says. “For example, when prices are rising and a client wants to maximize or leverage more equity in their home; when markets are in flux and a client needs some reassurance on their equity or financing; when homeowners are renovating or investing for future returns.”

Polito says while professional appraisers are sometimes seen as the ‘necessary evil’ or an ‘obstacle’ to making a real estate transaction. it is important to know that their role is to neither stop nor facilitate a transaction.

“Their ultimate objective is to provide an independent opinion of value based on professional appraisal standards so that all parties can make an informed real estate decision that protects the housing market and consumers,” he says.

He points out that during the 200809 financial crash and more recently with international banks requiring bailouts, getting an independent, third-party professional appraiser to provide an opinion of value devoid of emotional aspects or vested interests can be valuable to all parties involved in a transaction because it provides a certain level of risk mitigation for the present and future.

He also notes that financial institutions provide loans based on the appraised value, so it’s important for mortgage professionals to engage a professional appraiser as soon as possible in the process and to provide as much information as possible up front to ensure a seamless process. Obtaining an appraisal early in the process can also avoid any surprises and set proper expectations with potential sellers and buyers, therefore facilitating transactions in the best interest of all involved due to informed decision-making, he adds.

AIC recently updated a tip sheet for mortgage professionals that can be found on the AIC website –alcanada.ca – on what can be done to ensure the appraisal process goes as smoothly as possible.

These tips include:

n Find a local appraiser by using the AIC Find an Appraiser service.

n Share all the relevant details about the property with the appraiser and keep communication channels open between the borrower, lender and appraiser.

n Be clear about the use of the report. Discuss the type of mortgage (conventional, second mortgage, HELOC, private or traditional lender) with the appraiser. Different uses may require different methods.

n Ask for a draft report if you are still looking for a lender. A draft report can provide you or a potential lender with valuable information to help secure financing more quickly. Once you find the right lender, the report can be quickly finalized and sent directly to the lender to help reduce delays.