ACCLAIM

RECOGNISING LEADERS AC ROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY THROUGH THE WealthBriefing AWARDS PROGRAMME

The Thirteenth Annual WealthBriefing European Awards 2025

RECOGNISING LEADERS AC ROSS THE GLOBAL WEALTH MANAGEMENT INDUSTRY THROUGH THE WealthBriefing AWARDS PROGRAMME

The Thirteenth Annual WealthBriefing European Awards 2025

Technology & Operations Trends in Wealth Management 2024

(in partnership with Alpha FMC)

This 12th edition of WealthBriefing’s Technology & Operations Trends in Wealth Management report, created with Alpha FMC, provides a global overview of how digital transformation is reshaping the wealth management sector. Firms across various regions are leveraging technology to enhance operational efficiency and client experience, while navigating evolving client expectations, regulatory changes and a complex economic environment.

Philanthropy Evolved: How High-NetWorth Individuals are Redefining Giving, Ethics and Impact

(in partnership with Jersey Finance)

Philanthropy is undergoing a profound transformation as high-net-worth (HNW) individuals redefine traditional notions of giving, ethics and impact. This report delves into these shifts, offering a comprehensive analysis of emerging trends, generational influences and the evolving dynamics between wealth, altruism and social responsibility.

The Bahamas: A Complete and Compelling Choice (in partnership with The Bahamas Financial Services Board)

The Bahamas stands out as a premier destination for business, blending political stability,

innovative financial structures and an exceptional lifestyle. This report offers an in-depth exploration of its unique advantages as a financial hub, from wealth planning tools to cutting-edge FinTech initiatives, alongside its unparalleled appeal for high-net-worth individuals and global investors.

-

Directions for Rapidly-Expanding Sector (in partnership with UBS)

Our second report examining the growth of Asia’s EAM sector, covering both the powerhouses of Singapore and Hong Kong and emerging markets like Thailand and the Philippines. This study looks at the growth prospects for independent advisors in the round as they seek to tap the region’s booming wealth and growing client acceptance of the EAM model.

Family Office Focus: An Update of the Industry's Efficiency in Accounting and Investment Analysis (in partnership with FundCount)

A deep dive into the key technological and operational challenges facing family offices in their accounting and investment analysis activities. Based on surveys and interviews among family offices managing over $72 billion in assets, this is an invaluable benchmarking tool for the sector which presents fascinating insights into future developments from a range of industry experts.

(in partnership with First Abu Dhabi Bank)

This ground breaking new research examines the growth of female entrepreneurship in the region. More specifically it looks at how women are driving family office strategy as well as the relationship between MENA’s UHNW female clients and the wealth management industry.

Applying Artificial Intelligence in Wealth Management - Compelling Use Cases

Across the Client Life Cycle

(in partnership with Finantix & EY)

This comprehensive report identifies elements of the institution and advisor’s workloads that are ripe for AI amelioration and points the way for firms seeking to maximise the competitive advantages offered by new technologies. AI experts and senior industry executives enrich each chapter, answering crucial questions on risk, KYC/AML, compliance, portfolio management and more.

partnership with EY)

With EY providing the overview, this report draws on the front-line experience of many of the technology sector’s biggest names, in recognition of the fact that they are the ones going in to solve wealth managers’ most pressing problems and have typically seen the ramifications of firms’ choices play out numerous times – not to mention in various contexts globally.

STEPHEN HARRIS CEO, WealthBriefing

I’m delighted to be publishing the thirteenth edition of The European Awards Acclaim Magazine in the twentieth anniversary year of WealthBriefing’s inception.

May I take this opportunity to again applaud this year’s category winners, be they organisations, teams or individuals. Your success is inspirational to colleagues, peers and clients.

In this publication you see how and why, this year’s category winners have triumphed over stiff competition to win the approval of the judges who are also listed within these pages.

Winning a WealthBriefing award is a significant achievement wherever it may be in the world. Doing so in Europe – the flagship programme – is doubly notable and a source of great pride to all those organisations and individuals who came together in London to celebrate their success in March in the splendour of the Marriott Grosvenor Square.

At the heart of each WealthBriefing Awards programme is a rigorous and credible judging process run entirely independently of any commercial considerations of the publishers. This is why a WealthBriefing award is worth winning and is rightly regarded as the premier accolade within our highly discerning industry.

Another distinguishing feature of these awards is their breadth, reflecting the richness of connections that forms the eco-system of the wealth management sector. This also ensures that every WealthBriefing awards ceremony is a networking event like no other and is a firm fixture in the industry’s calendar.

As ever, we are grateful to our commercial partners, I’m sure all of whom are delighted to be associated with such obvious dedication and professionalism.

WEALTHBRIEFING EUROPEAN AWARDS JUDGING PANEL

Europe’s wealth sector has been through ebbs and flows of market pressures, not least the advent of new US tariffs and geopolitical shifts that in some ways have been positive for European investments. It will take time to see the full impact on European wealth management. According to the Capgemini World Wealth Report for 2024, total European high net worth wealth rose 3.9 per cent in 2023 to stand at $18.9 trillion, the second-highest collection of such wealth in the world. Data also showed that the population of HNW people, in millions, rose 4 per cent.

In uncertain times, amid concerns about fracturing alliances and shifting supply chains, Europe retains financial institutions with long experience of navigating instability. Home to several onshore and offshore centres, advisors in Europe can showcase their knowledge and ability to keep clients composed and focused on the long term. The European Union wants to build more integrated investment and capital markets – creating

opportunities over time. The issue will be squaring this goal with national autonomy.

Large banking groups such as BNP Paribas, Deutsche Bank, HSBC, Barclays, Santander, Mediobanca and UniCredit among others, continue to stress benefits of robust balance sheets, resources and geographical reach. Europe is also host to a long tail of medium-sized and boutique firms that can handle varied needs of clients. To give one example, Germany has many single-family offices and banks well versed in how to serve them. European banks cultivate family-owned businesses, understanding their importance in driving growth.

Technology continues to spread its influence across the sector – AI is a hot area in Europe, although some of the older institutions are under pressure to keep pace and invest wisely.

Europe’s wealth and banking market defies easy generalisation. It remains one of the most diversified and important.

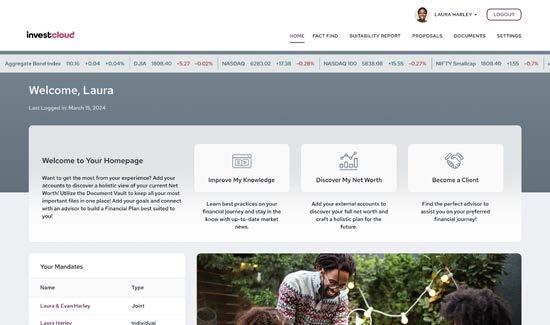

InvestCloud powers connected experiences through human-inspired, technology-forward platforms that enable wealth managers to work smarter, enrich relationships, and elevate financial outcomes.

The WealthBriefing European Awards 2025 programme was focused around three main category groupings: experts (individuals and teams), products and services for wealth managers and clients and institutions of all sizes and types in the European market.

Independence, integrity and genuine insight are the watchwords of the judging process with the judging panels made up of some of the industry’s top trusted advisors and bankers.

AUSAF ABBAS Managing Director Coombe Advisors

MATTHEW DRUMMOND-SMITH Associate Director and Head of Operations JM Finn

PIERRE DUPONT Managing Partner WIZE by TeamWork

ELIZABETH HART CEO & Founder Legacy Wealth Advisors

STEVE DYSON Director Investment & Wealth Management Consultants

MARTIN HEALE Director Schroder US Wealth Management

MARK HUSSEIN UK CEO HSBC Life (UK) Head of UK Insurance HSBC Bank

ANTOINE MEGARBANE Director of Business Development Taranis

ROBERT PAUL Partner & Head of the US Family Office London & Capital

SEAN KIERNAN CEO and Founder Greengage

MATTHEW DUNCAN Partner and Head of the Private Wealth Team Druces

JAMES FLEMING Various

MICHAEL HUNWICK Director - Investment & Wealth Management Deloitte

KEITH MACDONALD Senior Advisor Wealth Management

NAWAZ MUCADAM Chief Revenue Officer Zugo

GLENN MURPHY Director Various

SHEHREEN QUAYYUM Director Barclays Private Bank

BECKY ROBBINS Chief Operating Officer Lincoln Private Investment Office

A shortlist was identified from the hundreds of entries received for these awards and a discussion took place with the judges to agree the winner of each category. The judges were split into three groups, dependent on their industry; a panel of trusted advisors were responsible for judging the private banking categories; a panel of private bankers judges the trusted advisor categories; and new for this year we had a specialist group of tech experts judging the technology categories. This was to ensure that commercially sensitive information was kept confidential and conflicts of interest were avoided.

MATTHEW SPENCER Advisor Various

PHILIPPE STEFFEN Managing Director REYL & Cie

MIKE TOOLE Owner Director Elterwater Consulting Ltd

DEBBIE WILLS Head of Wealth Management & CMPS, Europe Standard Chartered Private Banking

BRUCE WEATHERILL Chief Executive Weatherill Consulting

BILLY STEPHENSON Chief Executive Stephenson Executive Search

ROSS WHATNALL Founding Partner GSB

IAN WOODHOUSE Board Advisor and Partner Various

Media

Thought

Content

Financial

Rue

info@pulsar-media.ch

www.pulsar-media.ch

At the WealthBriefing European Awards 2025 ceremony in London, ABN AMRO was named 'Overall Best European Private Bank' "A wonderful recognition for all employees of our private banks in the Netherlands, France, Germany and Belgium," says a proud Alen Zeljkovic, Managing Director Wealth Management Clients.

"In these four countries, we have been working to share our expertise and learn from each other in recent years," he continues. "It’s nice to see that this now pays off. This recognition crowns our efforts."

Being and staying relevant

The private bank distinguishes itself with expertise and proactivity. "We are increasingly able to be relevant to our clients at the right time with the right solutions. By knowing what our clients moves, combined with our data, we succeed in serving them ever better." Customer confidence has doubled over the past year. "We also see this reflected in our clients’ appreciation. It is an encouragement for us to continue on the path we have taken."

The private bank serves a wide group of clients: from families to charities, from professionals to entrepreneurs. "The group of entrepreneurial clients is growing," says Alen. "Entrepreneurs face complex issues that affect both private and business assets." Private bankers join forces with their business bank colleagues. "By acting together, we can assist entrepreneurial clients with all wealth issues wherein private and business meet."

Alen Zeljkovic

• Overall European Private Bank

• Private Bank - Private Equity

Offering (Highly Commended) Winner

A special group the private bank is targeting is the next generation. "With Next, we help the younger children of our clients prepare for future wealth management." Connect is for the slightly older children. "The realisation that they will inherit a fortune in the foreseeable future, makes them want to be well prepared. We help them set their own financial course."

Increasingly, major banks are embracing private banking. "It is a stable industry that requires less capital and can be a linchpin for the rest of the bank," says Alen. "Because there are different streams of income, stability is better assured." Alen is determined to extend ABN AMRO Private Banking’s lead. "We look back on a rich history. For 350 years we have managed to distinguish ourselves and we are still doing so today. That doesn’t happen by itself. We have to keep listening to our customers and to each other. By developing innovative solutions and integrating sustainability into all layers of our services, we can strengthen our position."

The private bank also received an award for its private equity services. "Another special recognition for us," Alen points out. "Our Private Equity Advice is a good example of innovation and sustainability. We are able to offer our clients this direct form of investment, which is impossible without volume." The private bank continues to develop in this area. "Last year, we expanded our services to include a private equity fund in unlisted companies with a positive social impact. This meets our clients’ wishes and fits within our sustainable investing policy."

Accuro specialises in trust structures for high net worth individuals and families seeking to responsibly preserve wealth across generations.

Being founder, management and staff owned, Accuro has the freedom to pursue its mission with passion. The way we operate and who we partner with, can only be made possible by our independence.

Accuro offers trustee, corporate administration and private office services to families and entrepreneurs globally and takes responsibility for the implementation and the management of a wide variety of wealth planning structures, with sustainability and purpose at the heart of our strategy and culture.

We are proud to be 100% owned by our founders, management and staff, the latter through an EBT holding 9.4% of the Group. This innovative ownership structure aligns our team with our philosophy and values as a firm.

What was the winning formula of your firm/you that explains why you won?

Our client-base is evolving with a growing emphasis on female and next-generation wealth holders. Our international dialogues around women in wealth (for both clients and intermediaries) and our prominent stance on sustainable wealth are attracting a wider demographic of new clients to us and retaining the loyalty of wealth inheritors.

What are you going to do to remain competitive and stay ahead?

We actively seek feedback from clients and analyse their Accuro experience.

This has helped us to re-design our onboarding process, incorporate regulatory tech to facilitate quicker trust/company establishment, enhance customer experience through polished online interfaces, reduce costs and release resources from traditional labour-intensive compliance processes to be reinvested in client relationships. Over £2m was invested in our technology platform, bringing it to the cutting-edge of technology in readiness for the AI revolution.

Xavier Isaac Co-Founder & CEO Accuro

• Independent Trust or Fiduciar y Team

These developments have resulted in us attracting significant mandates including:

• Establishing a multi-jurisdictional succession planning structure to hold global business assets worth £2bn for a mercantile Middle Eastern family with 15 settlors.

• Structure for Private Equity Principal with assets +£400m holding over 50 lines of PE.

• Structure with contentious dispute between family members where subject assets +£1bn.

• Transfer in of litigation trust (total value +$60m) for multi-branch family structures earning substantial dividends from a multi-jurisdictional operating business.

• Relocation of US family to the UK with assets of +£300m.

• Setting and managing £11m annual lifestyle budget for client with structuring and trusteeship, company administration and private office services from Accuro.

Who inspires you, either inside or outside your organisation?

The NextGen both inside our business and within our client base are a continued source of inspiration.

Where do you see the wealth management industry and your part of it going in the next five years?

One of the pleasures of wealth is convenience and wealth holders will gravitate towards solutions that can maximise this benefit. There is a growing trend towards consolidation of services with singular service providers.

Our existing clients now entrust us with even greater portions of their wealth (AuM increased £2bn year-on-year) such that we are their de facto private office of choice in addition to their trustees.

In recognition of this shift and anticipation of its continued growth, we have enhanced our family office capacities with a unique investment reporting platform that manages private equity capital call cash flows, fund vintages and calculates gains/losses and established 30-minute turnaround payment processes for UHNW lifestyle management capabilities all whilst meeting our regulatory duties.

Feedback from one of these clients was “We only regret why didn’t we have Accuro from the start – your team have been very impressive”.

Please explain why you/your business was able to reach this award-winning level?

Addepar was built to solve a fundamental challenge in wealth management: fragmented data, legacy technology, and inefficient workflows. As portfolios grow more complex across multiple asset classes and currencies, traditional tools have struggled to provide a consolidated, real-time view of wealth. Addepar delivers a seamless, scalable platform that brings clarity and connection to the investment ecosystem, empowering advisors to provide precise, data-driven guidance.

The European market has been massively underserved, and with client expectations ever growing, firms are looking to invest in a platform that can scale with them. Over the past year, our European client base has more than doubled, with firms in the region now collectively managing over $1 trillion. We’ve strengthened our open ecosystem of integrations, expanded portfolio data feeds with top financial institutions, deepened our regional expertise with more than 150 employees across London and Edinburgh, and opened a new office in the UAE with more to come.

Today, more than 1,200 client firms across 50+ countries rely on Addepar to manage over $7 trillion in assets. Winning this award is a testament to our continued innovation, our clients’ success, and our commitment to advancing wealth management in Europe and beyond.

In what ways were you able to deal with challenges and problems this time around. What lessons have you learned?

Our success comes from a simple but powerful principle: putting our clients at the centre of everything we do. By investing over $100 million annually in R&D, we continuously deliver innovations that directly address the evolving needs of our global client base.

One of the most valuable lessons we’ve learned is the importance

Peter O'Brien Global Head of Growth & Strategic Partnerships Addepar

• Innovative WealthTech Solution B2B

of providing local, scalable infrastructure to meet the needs of our European clients. We launched dedicated hosting capabilities in Ireland for faster data processing, enhanced regulatory flexibility, and improved reliability – with more regions to come. Investing in local teams has been equally important to our growth. While the platform itself plays a critical role, in a people-driven industry, we want to ensure our clients receive white glove service to complement the technology.

What will winning this award do for your business and colleagues?

This award recognises Addepar’s momentum in Europe and the trust we’ve built with firms seeking greater transparency and efficiency in wealth management. With this recognition, we are well-positioned to deepen client relationships and continue to expand our presence across Europe. It serves as both validation and motivation to keep enhancing our platform, strengthening our ecosystem, and providing wealth managers with the best tools to drive superior outcomes.

Where do you see the wider wealth management sector going in the next five years?

AI and big data will transform wealth management, enabling highly tailored investment strategies, tax optimisation, and financial planning. As expectations shift, clients will increasingly demand more proactive, predictive guidance and real-time insights rather than periodic reviews. At the same time, the Great Wealth Transfer will accelerate the industry’s focus on younger, digital-first investors.

The firms that thrive will be those that invest in technology, adapt to client expectations, and find a balance between human expertise and AI-driven efficiency.

Total Wealth $ 712,825.00

At additiv, we don’t just build technology – we challenge outdated models and rethink how wealth services are delivered. Financial inclusion should be a priority, not an afterthought. Why should people have to visit a branch to invest when they manage everything else – payments, shopping, travel, communication – seamlessly through digital channels?

That’s where we come in. Built on our highly flexible platform, additiv enables financial institutions and consumer brands to scale, personalise and embed wealth services, accessible across multiple channels, effortlessly. Whether it’s banks, insurers, asset managers, or superapps, we empower firms to meet their customers where they already are – expanding access to scalable, compliant and hyper-personalised investment solutions.

Our success isn’t just about technology; it’s about people, culture and expertise. At additiv, we’re problem-solvers. Our team brings deep industry knowledge, ensuring our solutions align with real-world financial needs. We don’t just provide software – we act as strategic partners, working alongside clients to launch and scale wealth services with minimal friction.

We see the impact of our work through our clients. Take DekaBank, for example. Using our API-first platform, they launched Deka-Connect+, a digital wealth solution integrated across 180 partner institutions, managing €1.3 billion in assets. This is embedded wealth in action – at scale.

We never stand still. Our API-first orchestration layer allows institutions to embed not just wealth services, but also credit,

Pierre Dufauret UK Market Head additiv

• Innovative WealthTech Solution B2C

banking and insurance offerings – helping them diversify and monetise new revenue streams.

Scalability is at the heart of everything we do. Our open sourcing model ensures institutions can connect with a global network of regulated financial service providers, allowing them to offer both in-house and third-party investment solutions.

Automation and AI drive efficiency and intelligence. Our platform enables straight-through processing, AI-driven risk assessments, robo-advisory models and compliance automation, reducing operational overhead while ensuring regulatory alignment.

This award recognises our commitment to innovation and financial accessibility. With over 400 financial institutions and consumer brands relying on the additiv platform, we are proud to help drive the next generation of wealth services. But we’re not stopping here. We are committed to ensuring that wealth management is not just for the few but for the many.

The next five years will bring fundamental change to wealth management.

Digital and hybrid advisory models, including robo-advisors, will continue to grow, providing scalable solutions for mass market and mass affluent clients. AI-driven automation will transform how financial institutions scale their advisory capabilities, providing personalised, compliant and cost-effective wealth solutions.

At additiv, we’re not just watching this transformation – we’re leading it. The future of wealth isn’t just digital – it’s embedded, automated and AI-powered. And we’re making it happen.

Best UK Private Bank | Overall

Best UK Private Bank | Client Service

We are a bank for individuals, families, and businesses, focused on supporting you across your banking, borrowing and wealth management needs.

Please explain why your business was able to reach this award-winning level?

Established in 1833, Arbuthnot Latham is a distinguished private and commercial bank, offering private and commercial banking, wealth management and specialist finance services from our offices in London, Manchester, Bristol and Exeter.

We are incredibly proud to have been awarded both the 'Best UK Private Bank - Overall' and 'Best UK Private Bank for Client Service' These accolades reflect our unwavering commitment to delivering exceptional service to our clients.

We believe our personal approach to private banking sets us apart in an increasingly digital-first market. We excel at the fundamentals – we’re approachable, proactive and available for our clients. We listen, understand and then provide prompt assistance and support. We strive to offer a creative and pragmatic approach to client’s needs, always focused on adding value.

Client service is embedded in our DNA. Each client is assigned a dedicated relationship manager, typically a private banker. Depending on their needs, clients may also have an investment manager and a wealth planner. This consistent team ensures continuity and is accessible face-to-face, via email, phone, or video call.

How did your colleagues make a meaningful impact?

With 97% of our clients trusting their dedicated banker and 95% delighted with our service, our high client satisfaction scores highlight the difference our colleagues make. Our relationship managers go above and beyond to understand each client's unique needs and goals, striving to make every client interaction personal and meaningful. We provide a high-touch, personalised experience that clients enjoy and deserve.

Kevin Barrett

Managing Director, Private & Commercial Banking

Arbuthnot Latham

• Overall UK Private Bank

• UK Private Bank - Client Service

This dedication to building meaningful relationships ensures that our clients feel valued and supported, making a significant difference in their financial journey.

How do you intend to remain on the front foot and continue to set a high standard?

It’s true to say we have a passion for client service. We have strong foundations and a client-service culture, but it's essential to keep evolving and making improvements.

We continuously seek and act on client feedback through surveys, qualitative research and direct interactions. Our significant investment in digital transformation is enhancing our ability to provide seamless, efficient services that meet and exceed client expectations.

Our new London headquarters at 20 Finsbury Circus, opened in August 2024, is a prime example of our commitment. It offers the welcome of a five-star hotel, where relationship teams are proud to host clients and it's a modern workspace which fosters greater collaboration between our teams.

These initiatives are just a few examples of how we are setting ourselves up for future success, staying ahead of client expectations and enhancing the colleague experience.

What will winning this award do for your business and colleagues?

Winning these awards will bring an immense sense of pride to all at Arbuthnot Latham, boosting morale and validating their hard work and dedication. Ultimately, these awards enhance our brand, foster confidence and ensure we remain a trusted partner for our clients' financial needs.

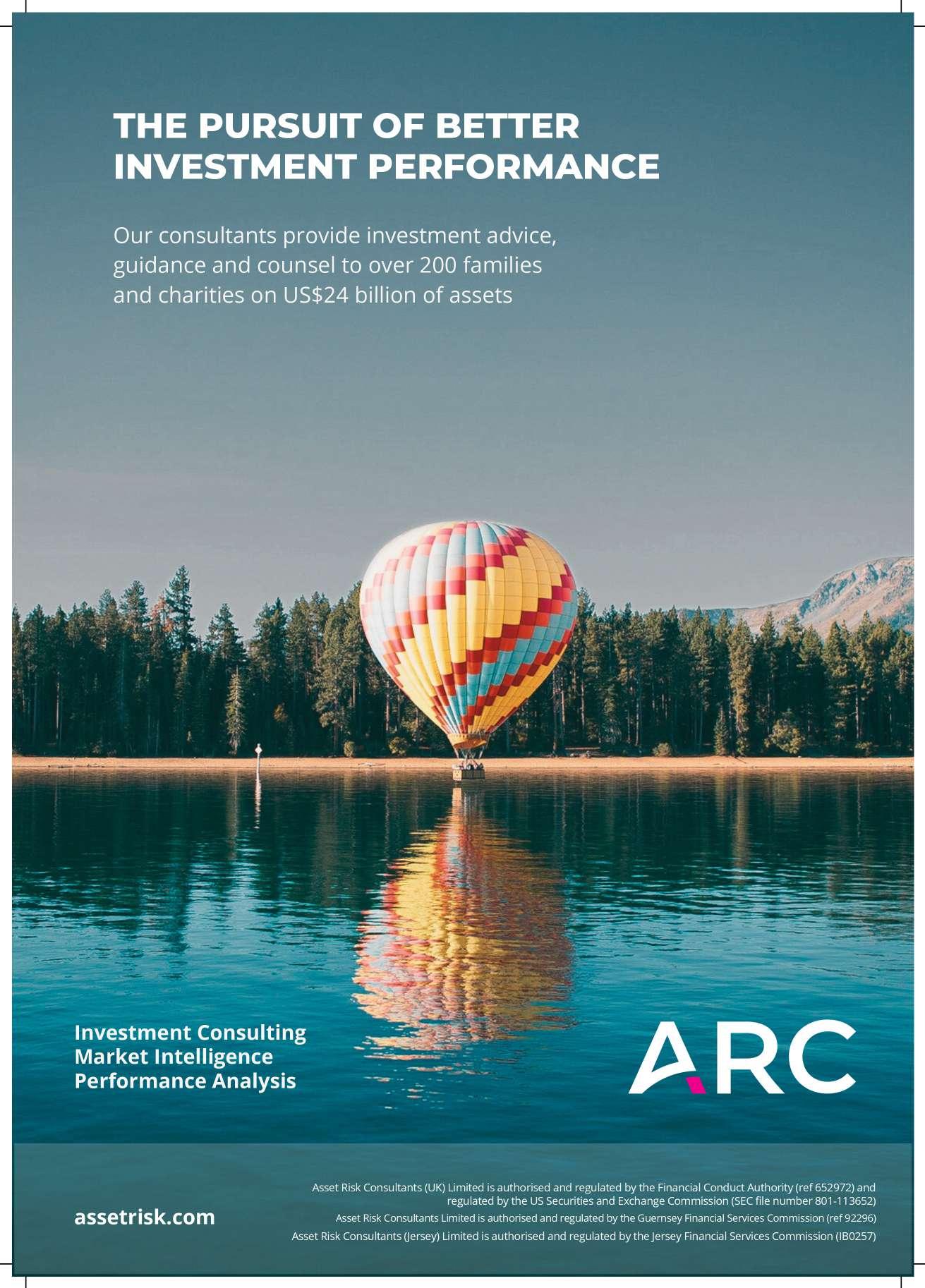

When fiduciaries are tasked with safeguarding intergenerational wealth, certainty is a rare commodity. Our role is to inject just enough, through evidence, clarity and considered counsel to provide peace of mind.

For 30 years, we have quietly served as the investment consultant of choice for fiduciaries, families and their family offices. With assets under advice exceeding USD 24 billion across 200 client groups and regulatory authorisation in five jurisdictions, the our reach is both wide and deep.

The ARC Wealth Indices, built from data on over 525,000 realworld portfolios, are regarded as the definitive benchmarks in private client investing. This dataset powers a consultancy model which places transparency, independence and investor outcomes at the centre. “We are in the unique position of having the data to demonstrate that our consulting clients consistently experience better-than-average investment outcomes,” says Marcus Porter, Client Director.

Please explain why your business was able to reach this award-winning level?

“Our success stems from three decades of insights, innovation and independence,” Porter explains. “We’ve built the ARC Wealth Indices to shine a light on what was once an opaque part of the investment world, private client outcomes. With over 80 professionals, we are uniquely positioned to provide clarity where others offer conjecture.”

“It also helps that we speak the language of fiduciaries,” he adds. “We’re there to enhance oversight and decision-making, not complicate it.”

“A key aspect of achieving successful outcomes is having the insight and confidence to know when portfolio changes are required and more often, when they are not,” says Porter. “That judgement comes not just from data, but from understanding the context that detailed independent analysis provides.”

Porter also credits ARC’s team-based approach. Each client en-

Marcus Porter Client Director ARC

gagement is led by a senior consultant, supported by a dedicated team of analysts and an alternate consultant. Staff turnover is low, with each consultant having been with the firm for 10 years on average. "That continuity means clients receive responsive, joined-up advice, but it also ensures the knowledge isn’t siloed. Crucially, it’s the insights generated by this experienced and stable team, who develop a deep understanding of each client’s strategy and performance, that lead to better investment decision-making.”

How do you intend to remain on the front foot and continue to set a high standard?

With 21 new client engagements in the past year and a 97% retention rate, ARC’s services are valued and gaining wider recognition. But the firm isn’t standing still. It recently expanded a Client Service Review framework to gather structured client experience feedback and enhance the onboarding process. In May 2025, ARC will launch its Managed Platform Solutions Indices, a first-of-itskind benchmark for platform-based portfolios.

“Whether it’s digital reporting or data visualisation, our aim is to give investors and fiduciaries tools that make oversight and decision-making more effective,” says Porter.

Where do you see the wider wealth management sector going in the next five years?

Porter expects a growing demand for demonstrable value. “Clients are typically time-poor, they want advice that’s clear, grounded in evidence and delivered by a team they trust. Fiduciaries increasingly ask: how do we know this manager is good? How do we measure value-for-money? Could our existing arrangements be improved? That’s where ARC fits in. We don’t just report on outcomes; we help define what good looks like.”

In a world where noise often drowns out signal, ARC’s commitment to clarity, context and client-first thinking ensures its insights remain quietly indispensable.

Artorius is a UK based wealth advisory business that provides wealth planning and investment advice for financial services professionals, UK business owners and entrepreneurs, private equity professionals and individuals inheriting wealth. Artorius services ~ £1.8 billion in assets and is owned by management, employees and a small group of individual shareholders.

Please explain why you/your business was able to reach this award-winning level?

The strong long-term nature of the relationships we have with our clients and shareholders is the key reason our business continues to grow. We are always mindful of how long it takes to build trust, which can take longer with some, but we always know when absolute trust exists and it is at the point that a client or shareholder refers us to a friend or colleague. This is our growth engine and the secret to our success, which we guard with all our might.

What was the way your colleagues made a difference?

Businesses are only as good the people they employ and Artorius is no different. We are proud of our team and the fact that everyone is a shareholder. This creates business ownership behaviours and everyone thinks about how we can collectively improve and develop our business. This then naturally brings about change and evolution, which can often challenge how things have been done in the past, but with 100% commitment from everyone, we are able to evolve and reshape the business to meet the future needs of clients and prospective clients.

Paddy Lewis CEO Artorius

• Specialist Investment Manager with AuM up to £2 Billion

• Multi-Family Office Between £ 1 - £3 Billion AuM

What will winning this award do for your business and colleagues?

Organic growth has been challenging to come by in the last 2 years, but we have been able to continue to scale our desire for profitable growth, without compromising on quality. The team at Artorius have worked hard to achieve this and having the hard work validated by receiving this award from our industry peers makes us all proud of our business.

Where do you see the wider wealth management sector going in the next five years?

Every Wealth Management firm needs to grow, evolve and become more efficient. To achieve these things there is still a need for more investment in technology and people. The exam question for everyone is, which technology and what sort of people? The industry faces a cliff edge in terms of people, with many financial planners reaching the Autumn of their careers and not enough new people joining to take on the clients and the children of those clients. This then poses the question of what the client of the future will need and want. The answer to which is a more digitally enabled lower cost solution, with a person to contact if needed. The industry can not apply technology to existing processes, it needs to step back and create better processes before applying technology that meets the future needs of clients and advisors.

For the second year in a row, Atfinity has managed to snag the award for the best on-boarding solution. Thanks to its AI-powered platform, Atfinity helps financial institutions fully automate their on-boarding process, as well as KYC and KYB, focusing on providing the best user experience. Its no-code architecture on the other hand makes it a lot more customisable than similar solutions.

How does it feel to win the WealthBriefing award two years in a row?

Thorben: While we have always been confident in our software, winning the award last year skyrocketed our motivation to keep learning and innovating. Winning the award again felt even better, as it showed us that we’re growing alongside the industry.

Alexander: I think our clients will benefit the most from this victory. Our current clients can continue to be confident that they are working with the best solution on the market and prospective clients can see that they are getting top-notch software when they choose Atfinity.

What makes Atfinity stand out compared to its competitors?

Thorben: Do we really have competitors? I'm not sure about that. I say this because Atfinity does a lot of different things. Yes, we automate the onboarding process. But the way we automate it, relying on an AI-powered rule engine, is quite unique. Plus, our software

Thorben Croisé - CTO (left)

Alexander Balzer - CEO (right) Atfinity AG

• On-Boarding

helps streamline your entire tech stack, helping orchestrate different processes, such as loan origination and lifecycle management.

Alexander: I think more and more businesses are realising the value of best-of-breed solutions. Instead of getting one software solution that does one thing well and three things poorly, businesses are opting for four solutions that are the best in their field. This benefits Atfinity in two major ways; in that we offer the best on-boarding solution and that we can orchestrate these different solutions to form a more comprehensive package.

How do you think the wealth management space will change in the next 5 years?

Alexander: I think we will see a drastic rise in customer expectations. Even now, modern banks are offering fully automated on-boardings that you can do on your phone. Once you’re used to that user experience, you will probably have a lot less patience for in-person on-boardings that require three stacks of paperwork. This will be even more noticeable once AI starts getting implemented in smart ways.

How do you plan to stay competitive moving forward?

Thorben: While I can’t disclose our plans yet, 2025 will be a big year for Atfinity. We plan to significantly improve a cornerstone of our software - our AI rule engine. I think this will make us stand out from the crowd as a truly innovative, modern solution.

Can you meet the 24-hour expectation?

Avaloq wealth insights 2024 report delivers essential learnings from investors and wealth management leaders across Europe, Asia and the Middle East. Discover the

of UK investors expect to hear back from their adviser within a day. 60%

Please explain why your business was able to reach this award-winning level?

Avaloq offers a unified platform integrating core banking, digital banking channels and front office capabilities, with specialised client and investment management software. Our platform supports more than 170 financial institutions worldwide, with over 4 trillion Swiss francs in client assets managed with Avaloq software.

The Avaloq platform’s front office capabilities enable wealth managers to enhance efficiency, compliance and client service. Our solution automates key processes such as investment suitability checks, portfolio construction and risk analytics, while also supporting mass monitoring and rebalancing. Configurable health checks ensure portfolios stay aligned with risk tolerance and automated regulatory checks streamline compliance. Additionally, the platform simplifies client management by offering a centralised interface for daily tasks, transactions and client data. Our lifecycle management tools further support timely onboarding and relationship management, boosting front office productivity.

Our clients benefit from our continuous investment in the platform, combined with our understanding of the wealth management sector. This year, we proudly celebrate 40 years of innovation and client success – including 15 years in the UK – reflecting our long-standing commitment to driving digital transformation in wealth management.

How do you intend to remain on the front foot and continue to set a high standard?

Avaloq invests 25% of annual software revenue in R&D to enhance the platform’s capabilities, ensuring our clients stay at the

Suman Rao Managing Director Avaloq UK

forefront of technology. In addition, we actively monitor regulatory changes across markets and integrate updates directly into our platform, enabling our clients to stay compliant without diverting focus from their core operations.

Our open platform, extensive partner ecosystem and advanced API technology allow our clients to seamlessly roll out new services and integrate third-party applications, harmonised on a single platform with a unified data model for consistency across operations.

Furthermore, our client community benefits from shared insights and joint innovation projects, contributing to the platform’s continuous, long-term development.

Where do you see the wealth management sector going in the next five years?

We expect wealth managers to face increased competition and margin pressure, driving demand for highly efficient, standardised operations. Financial institutions will need to leverage technology to boost operational efficiency and deliver personalised client experiences.

Digitalisation will continue to gain traction in the sector, with a focus on automation, data analytics and artificial intelligence. These technologies will enable wealth managers to provide tailored advice and solutions that meet evolving client expectations at scale. Additionally, wealth managers will have to deal with increasingly complex regulatory requirements, increasing the need for integrated compliance solutions that can adapt to evolving standards.

Our platform’s flexibility and comprehensive capabilities ensure that our clients can confidently navigate these changes, maintaining a competitive edge in a competitive market.

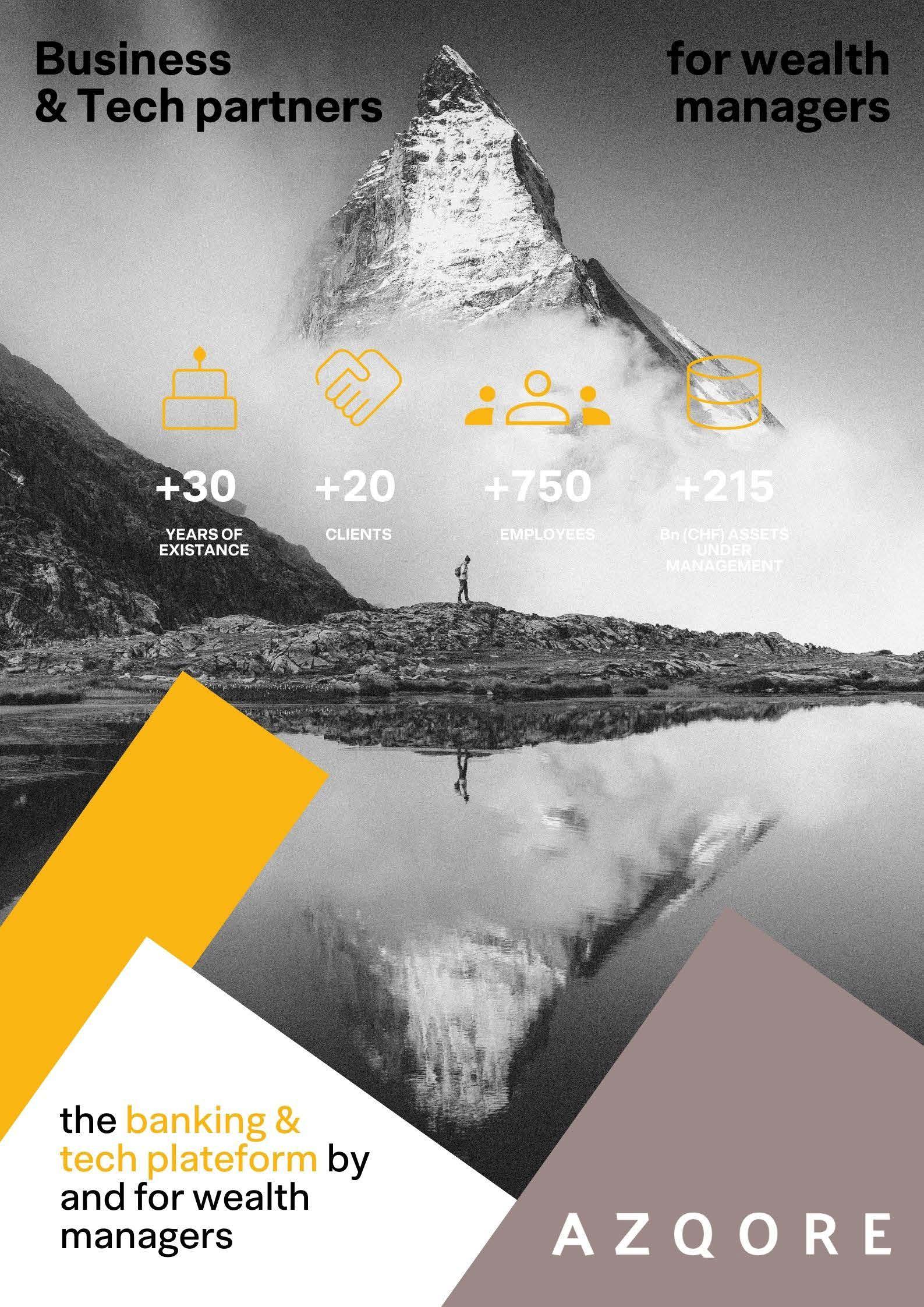

Based in Switzerland, Azqore is a global leader specialising in Business Process Outsourcing (BPO) and Software as a Service (SaaS) for the wealth management sector. For over 30 years, Azqore has supported private banks in their transformation, completing more than 70 successful banking migrations and enhancing their operational efficiency. Beyond providing innovative solutions to transform, digitise and improve the client experience of private banking players, Azqore offers banks the option of fully outsourcing their back office from its hubs in Switzerland and Singapore.

Azqore serves today 25 clients in Europe and Asia totalling more than CHF 215 billion in assets under management with proven experience of numerous migrations. Azqore is a subsidiary of Indosuez Wealth Management (the global wealth management brand of the Crédit Agricole Group and a leader in the field) and Capgemini (a global leader in consulting, technology services and digital transformation). With the support of these two shareholders, Azqore can combine in-depth banking expertise with a leading edge technological approach.

What was the way your colleagues made a difference?

At the heart of Azqore's success lies our extraordinary team. Our BPO solution thrives on the dedication and expertise of our professionals, who relentlessly pursue excellence and innovation. We firmly believe that investing in our people and nurturing their potential is the cornerstone of delivering exceptional services. This commitment is reflected in the following distinctive factors:

• Efficiency: Industrialised processes with a proven track record of handling diverse and complex products and processes, which require continual flexibility.

• High quality combined with thorough Risk Management: Emphasis on quality awareness and long-term thinking, coupled with a strong risk culture

through strict and rigorous quality control. A robust frameworks validated by ISO 9001 / 27001 and ISAE 3000 / 3402 certifications ensures aligned processes across all operational centres.

• Strong Customer-centric mindset: Our commitment to understanding our clients' needs and going the extra mile to support their success makes us a trusted partner in wealth management. We prioritise our clients' unique needs, offering tailored solutions and personalised support. As a subsidiary of Indosuez Wealth Management, this customer-centric approach and deep understanding of Wealth Management are strongly rooted in our DNA.

• Communication and transparency: Direct contact between Azqore's operations team and the client's middle office enables a collaborative and hands-on approach to facilitate business growth.

Where do you see the wider wealth management sector going in the next five years and how do you intend to remain on the front foot and continue to set a high standard?

The wealth management industry will continue its significant shift towards digital and data-driven solutions, with the added challenge of efficiently integrating AI into its processes. Concurrently, regulatory evolution will become increasingly complex, driven by factors such as instant payment, cybersecurity and customer protection.

Our mission is clear: to support tomorrow’s private bankers and wealth managers as they navigate this rapidly changing environment. By annually investing over CHF 40 million in technological and functional platform advancements, proactively monitoring and implementing regulatory changes and integrating AI and data analytics into our offerings, Azqore is well-positioned to be the preferred partner for those seeking digital transformation and operational excellence.

Sébastien Buchard Chief Sales & Client Officer, Director & Executive Committee Member Azqore

• Transaction Processing Solution

Please explain why you/your business was able to reach this award-winning level?

We have a very experienced and dedicated team. Our team members have worked together for the last six years and many have been at Barclays for 10-18 years. We tend to work with fewer larger clients than our competitors, which gives each client a more personal service.

The team is complemented by our award-winning Investment team, which manages traditional and sustainable investment strategies for our clients. Our Investment team has worked together for the last 14 years, delivering above-benchmark and topdecile performance versus peers.1 Note that past performance is not a guide to future performance.

What was the way your colleagues made a difference?

We make a difference through our expertise, technical knowledge and passion for client service. We also share knowledge with industry peers and trustees at conferences.

How do you intend to remain on the front foot and continue to set a high standard?

This will be achieved by being plugged into the right organisations – the CFG, ACEVO and CIG, being well read, staying connected to leading lawyers and accountants in the sector and always striving to be consistently excellent.

In what ways were you able to deal with challenges and problems this time around? What lessons have you learned?

As a high-profile organisation, Barclays is often under more scrutiny than other financial institutions in the UK. However, we remain an open and transparent organisation. As a team, we work closely with our Legal, Compliance and Group Communications colleagues to ensure we capture all relevant facts before responding to questions.

Private Bank Charity Team

Barclays Private Bank

In terms of lessons learnt, it is more about understanding the benefits of proactive communication to clients, prospects and stakeholders.

Whom to look for, either inside or outside your business, for ideas and inspiration?

We work very closely with other groups within Barclays, including our Corporate Bank Charities and Higher Education teams, our Investment Bank and our Retail Bank.

We attend meetings with these groups, sharing best practices, learning from each other’s experiences and acquiring new ideas to better serve our clients. We also attend conferences to stay updated on trends and learn about what others are doing well.

What will winning this award do for your business and colleagues?

This award is recognition for all our hard work in serving our clients in a consistently excellent way. It helps to augment our profile and cements our reputation for commitment and excellence.

Where do you see the wider Wealth Management sector going in the next five years?

Wealth Management will continue to grow over the next five years. The needs of our clients will evolve through the increased provision of banking, investment and credit digitally. ESG and Responsible Investing will also continue to grow in importance, especially in the UK and Europe and we expect women of wealth and next generation wealth will become increasingly significant too.

1 Our flagship Sustainable Multi-Asset Endowment Strategy for charity investors has delivered top quartile returns vs. the ARC Steady Growth ACI peer group over 1-, 3-, 5-years and since inception as at end December 2024. Source: Barclays, Asset Risk Consultants www.assetrisk.com. Past performance is not a reliable indicator of future performance, neither capital nor income is guaranteed.

Proud official sponsor of SolarStratos and winner of Discretionary Fund Management (DFM) Offering.

BIan Heap Chief Executive Officer Bordier UK

ordier UK is a private client investment manager, dedicated to providing portfolio management and wealth planning services. We are one of the few private, family-owned private client investment managers of scale operating in the UK today and part of the independent, fifth-generation Bordier Group, established in Geneva in 1844. Built on solid foundations, with a strong Tier 1 capital ratio of 33%, we operate in six countries and manage assets of circa £16bn.

Bordier UK has specialist expertise in private wealth and investment management and is dedicated to managing the wealth of private clients, trustees, personal pensions, charities and others in the UK.

What sets you apart from your peers this year and why?

First and foremost, our focus is always on the end-client. That is arguably easier when dealing directly with private clients, but it is an approach we look to maintain in working with our strategic adviser partners too. We strongly believe that we set the standard when it comes to quality of service. Our clients value a highly personalised approach, a quick and smooth account set up and the ability to speak to experienced individuals in a timely manner. All methods of contact therefore bring our clients and their advisers directly to a member of our team, who look to deliver a same-day response wherever possible. We have no anonymous support systems or chatbots, the adoption of which has become a growing trend within our industry.

Secondly, we are consistent in our delivery of exceptional client outcomes, whilst always maintaining a focus on wealth preservation and offer a wide range of investment solutions, including innovative, industry-leading strategies that underpin our investment management offering. One distinct advantage of our global Group structure is that it enables our clients to access a wide range of international investment management and private banking services. Our investment services also benefit from a robust and repeatable

• Discretionary Fund Management (DFM) Offering

investment process and our deeply experienced centralised Investment Committee who are unconstrained by benchmarks or traditional thinking.

Finally and possibly our key differentiator, is that we are a genuine family business. The absence of external shareholder pressures of any sort means that our interests are genuinely aligned with those of our clients – that is to say, the achievement of objectives over long periods of time, which is exactly how most families view the management of wealth. We believe that this long-term alignment, coupled with unlimited liability at partner level for the Bordier Group, represents a unique proposition in the UK private client investment management sector today.

The Group recognise London as one of the world’s leading hubs for private client investment management and Bordier UK is central to its aspirations for growth.

We have a renewed focus on private clients and, post-Consumer Duty, have identified growing numbers of high-net-worth investors seeking access to an individual investment manager and bespoke service. Many have been invested in purely passive multi-asset or MPS solutions and are coming to realise that they need a forward looking, active manager to guide them through periods of market volatility.

I took over as CEO in January – I am only our third CEO in our 43-year UK history – with Bordier UK established as one of the most highly regarded private client investment managers operating in the UK. Whilst there is a new pair of hands at the helm and 2025 presenting many fresh challenges, we continue to build on a proven and longstanding track record for developing solutions that deliver on the requirement at hand. We look to the year ahead with great optimism.

We’ll guide you through the complex, unusual or the everyday legal world, to achieve your goals and create a positive outcome.

Our Private Client Department provides services to our HNW and UHNW clients that include:

DIVORCE AND FINANCE

PRE AND POST MARITAL AGREEMENTS

LEGAL ADVICE FOR UNMARRIED PARENTS

ONE LAWYER DIVORCE OFFERING (BROADFIELD’S BETTER DIVORCE PRODUCT)

PRIVATE AND LUXURY REAL ESTATE

ESTATE PLANNING (UK AND INTERNATIONAL)

TAX AND TRUSTS

FAMILY OFFICE

PHILANTHROPY

ENTREPRENEURIAL

LITIGATION

EMPLOYMENT

Broadfield is a leading UK law firm with offices in London, Cambridge, Reading and Southampton. Many of our lawyers and advisers are recognised leaders in their practice areas – their knowledge and expertise help us to provide a unique, client-centred approach to law.

Please explain why you/your business was able to reach this award-winning level?

Our work is tailored for ultra-high-net-worth individuals and their families, requiring nuanced expertise across multiple jurisdictions and complex financial arrangements. We pride ourselves on delivering bespoke, discreet and a results-driven service for our clients, leveraging a wide skill set across our team and other practice areas within the firm. As such our main strengths can be summarised as follows:

• Expertise and innovation

• Experience and client-focused approach

• Full service UHNWI providers

What was the way your colleagues made a difference?

Our junior colleagues must be commended for their unwavering dedication, motivation and commitment to our clients in addition to their own professional development. Their enthusiasm and focused approach to their own Business Development means that they are taking an active role in developing the team’s revenue, network and reputation, which is instrumental to our team’s growth.

Alongside this, we have highly experienced and well-respected consultants in our team whose guidance, expertise, reputation and established networks are invaluable in helping to develop the team across our four offices and offer a bridge to established entities and contacts in the private client industry.

How do you intend to remain on the front foot and continue to set a high standard?

Our current focus is primarily two-fold: investing in our technology and resources to provide the best value service for our clients and engaging with external referrers to build stronger connections across various industries both in the UK and internationally.

Our firm is the founding member of a new international law

Vandana Chitroda Partner Broadfield

• Family Law Legal Team

firm called Broadfield, which was launched in December 2024. As Broadfield, we are supported by SHP Legal Services, which is part of the Alvarez & Marsal family and this has resulted in significant new investment to develop our technology and back-office support with the aim of increasing efficiency in order to provide clients with the best value service across all departments. Within the family team, we are also focused on listening to our clients and the market generally to provide cost-effective options where possible. With this in mind, we have developed a single lawyer divorce product called “Better Divorce” to provide impartial advice to couples jointly and to help them navigate through the divorce process in a neutral and cost-effective manner.

We will continue engaging with external referrers and contacts from different industries to keep up to date with what clients are looking for across various practice areas. Our international network is growing quickly with the development of Broadfield globally and our team will benefit from the collaboration with SHP Legal Services and Alvarez & Marsal to extend the offering we can provide to international clients within what will be a broader web of contacts.

Where do you see the wider wealth management sector going in the next five years?

I anticipate seeing changes within family law in the foreseeable future, following the publication of the recent scoping report on the law governing finances on divorce and the current Government’s comments about cohabitation law reform. Within the wider wealth management sector, I would not be surprised to see further tax and other developments, perhaps to try and make the UK look more attractive in future to UHNWI settlors who wish to stay in the UK. This is a fast-evolving area of law, as my Private Wealth colleagues are well aware, so I would encourage all high-net-worth individuals to ensure that they receive advice from lawyers who are on the ball with any developments”

Brown Shipley is part of Quintet Private Bank, a group of boutique private banks and wealth managers operating across over 33 European cities. Our core offering brings together wealth planning, investment management and lending to create bespoke wealth plans, tailored to each clients’ needs.

Please explain why you/your business was able to reach this award-winning level?

We have created a culture of passion and drive for continual improvement. This can be seen in our lending platform, as well as consistent harmonisation across the business to ensure we put these solutions in front of clients quickly and efficiently. This ultimately allows us to stay competitive, as our clients don’t need to look elsewhere when they have a full suite of solutions at their disposal.

What was the way your colleagues made a difference?

Last year, we ensured there were multiple touchpoints where the team could get together in person with colleagues from across Europe to exchange ideas and create a platform to challenge the business in terms of direction and focus. These discussions focused on what our clients care about. While there was a lot of agreement, we received all important varied thoughts on how we can offer more solutions and how we can further tailor them to clients’ needs. This isn’t only beneficial to clients but ensures that what we plan future-proofs the businesses and prepares us for the growth trajectory we’re looking for. The plans include increasing our loan book and increasing collaboration across the entire business.

Nish Patel Executive Director and Head of Lending Advisory Brown Shipley, a Quintet Private Bank

• Private Bank - Best Credit Provider

How do you intend to remain on the front foot and continue to set a high standard?

We will continue to scrutinise our decisions and push for improvement. Learning from last year, we will ensure to have regular touch points to review our position and adapt accordingly around our product, platform and pricing. This will help us deepen our understanding of clients and their needs and allow us to spend more time with clients, prospects and partners.

In what ways were you able to deal with challenges and problems this time around? What lessons have you learned?

We’ve stayed attractive to our clients by structuring lending solutions which can be partially fixed and partially flexible. This is an example of how we offer more bespoke solutions in response to client needs. It’s not all about pricing and this proves that some clients value speed and flexibility over cost alone.

What will winning this award do for your business and colleagues?

This award would provide well rounded recognition for us. Not just to remind clients, prospects and partners of our capabilities, but also provide recognition to our colleagues who work tirelessly to ensure we provide the service that our clients require.

Where do you see the wider wealth management sector going in the next five years?

Technology, particularly AI, is greatly impacting many sectors and wealth management will be no different. It’s likely we will be using AI in the coming years. However, we will never forget that wealth management done well is a people business. So, we will maintain the face-to-face touchpoints with clients and colleagues, to make sure we maintain a deep understanding of our clients and that we can implement bespoke solutions efficiently.

What was the way your colleagues made a difference?

At Canoe Intelligence (‘Canoe’), we aim to redefine the alternative investment industry with smarter data management powered by cutting-edge technology.

We launched the Canoe Data Innovation Hub and Canoe Asset Data Design Partnership to drive innovation, standardisation and transparency in the alternatives market. These initiatives proactively address industry challenges with scalable, cost-effective solutions. The Hub, comprising strategists, product managers, engineers and growth experts, collaborates with clients to create tailored solutions.

Working with 13 clients, the Hub developed Canoe Asset Data, launched in 2024. This solution extracts, standardises and delivers granular asset-level data from investment funds, enhancing transparency and precision. Clients – including wealth managers, asset servicers and family offices – reported over 99% data accuracy and 80-90% time savings, significantly improving operational efficiency. The collaboration between our team and clients was key in solving the long-standing challenge of accessing asset-level data.

How do you intend to remain on the front foot and continue to set a high standard?

In July 2024, we completed our Series C financing round of $36 million, led by Goldman Sachs Growth Equity, with participation from F-Prime Capital and Eight Roads. This funding validates our market leadership, the strength of our solutions and the trust of our global client base. As we scale, we remain committed to delivering comprehensive front-to-back office solutions while upholding the highest standards of data integrity.

• Change Management Process/ Best Implementation of a Technology Solution

• Chief Executive Officer (CEO)

Mike Muniz Chief Strategy Officer Canoe Intelligence

A key differentiator is our client-centric change management process, ensuring seamless integration of our solutions into existing systems. We conduct in-depth workflow analysis to understand client challenges, design modernised processes and provide comprehensive training – ensuring tangible short- and long-term impact.

Whom to look for, either inside or outside your business, for ideas and inspiration?

Innovation is at the core of Canoe and we seek inspiration both internally and externally.

Internally, we foster cross-department collaboration, blending expertise to challenge conventional approaches and solve complex problems. Our leadership team encourages forward-thinking, helping us anticipate industry shifts and develop truly novel technology solutions.

Externally, we gain valuable insights through partnerships with major global asset servicing firms, investment consultants and wealth managers. Understanding their evolving needs allows us to shape our innovation efforts and deliver impactful solutions.

Where do you see the wider wealth management sector going in the next five years?

The alternative investments space is on the brink of transformation, driven by the urgent need for data standardisation and enhanced transparency. As alternative assets grow in complexity, firms require systematic, unified data solutions to extract insights and drive informed decision-making. Canoe remains dedicated to modernising private markets and fostering a more data-driven, transparent investment landscape.

Communify Fincentric’s MIND™ AI Suite delivers hyper-personalized, precise insights driven by Deterministic AI, ensuring trusted, actionable intelligence in real-time. With seamless integration, scalable solutions, and the innovations advisors need to enhance client relationships, streamline workflows, and accelerate growth, MIND™ AI Plug-In apps set a new industry standard for financial services.

Request a demo at communify.com

Tell us about Communify Fincentric. What do you do and who do you serve?

At Communify Fincentric, we’re focused on one core mission: unifying the digital communication of client and market data to deliver intelligent insights to investors and investment professionals. We serve a wide range of institutions – from online brokerages to private banks, RIAs and asset managers – providing them with the tools they need to better connect with clients, deliver value at scale and build trust in the intelligence era.

Our platform is used across investor, advisor and advised client experiences. Everything we do is designed to help financial professionals deliver relevant, compliant content that resonates – whether that’s an investment summary, a macro update, or a personalised video that shows how market events affect a client’s portfolio.

What differentiates Communify Fincentric from others in the wealth tech space?

One of our biggest differentiators is our Knowledge Base architecture. It’s more than a data warehouse – it’s a living, dynamic system that unifies over 4,000 real-time data feeds across client and market data. This allows us to provide a single source of truth, ensuring consistent, accurate and actionable insights – the kind that power better experiences, smarter decision-making and stronger client relationships.

Our maturity in this space matters too. We’ve been powering many of the largest digital wealth platforms in North America for years – often behind the scenes – and our capabilities are well-proven at massive scale.

Yaela Shamberg Chief Product Officer Communify Fincentric

• Innovative use of Artificial Intelligence

The award recognised your MIND™ AI suite. What makes MIND unique?

MIND™ AI is our suite of plug-and-play AI tools built specifically for financial services. What sets it apart is its use of Deterministic AI (AI-D), not just Probabilistic AI. That means the insights we generate are compliant, consistent and reproducible – a must in a regulated environment.

MIND isn’t one product – it’s a family of apps. For example, MINDEvents™ monitors the market for over 140 types of real-time market and portfolio events. MINDStories™ transforms complex financial data into engaging narratives – portfolio, market, or stock-level – delivered in video, podcast, or text formats. SmartText™ and DynamicVideo™ help firms scale communication in a personalised way, without needing an army of content creators.

How does this technology impact advisors and clients?

It helps advisors do more with less, especially as the industry faces a growing advisor shortfall. With MIND AI, they can provide hyper-personalised, real-time insights to clients, without spending hours aggregating and interpreting data. For clients, it means receiving relevant, understandable information – when they need it, in the format they prefer.

Ultimately, we’re enabling firms to move from data overload to intelligent insight – and from generic communications to experiences that truly build trust.

We support the full lifecycle of change from strategic solution design to implementation and delivery, working alongside our clients to deliver enhanced benefit and value to their customers. Find out more about our transformative services.

www.deloitte.co.uk

Deloitte's Wealth Management Consulting team provide transformation services covering all aspects of Wealth Management, including Advised and D2C platform, Life and Pension, DFM and Private Banking propositions, working with market-leading clients across the UK and Europe.

We are proud of the breadth and depth of our capabilities, across market strategy, risk and financial advisory, technology (including digital) and workforce transformation. We provide market leading technical and non-technical implementation capabilities across the system implementation lifecycle and are the only tier 1 consulting firm that can offer proven endto-end wealth platform implementation capability for clients, having successfully delivered core wealth technology change programmes for over £1tn of assets.

Our team of onshore domain experts and near/offshore delivery hubs provide a flexible and responsive resourcing model that enables programmes to scale up and down as required offering a mix that is best aligned to our client's needs, whilst providing cost efficient solutions and market leading capabilities.

How do you ensure effective change implementation?

We focus on taking a tailored approach shaped around three key areas. Firstly, our advisory capabilities allow us to provide unique insights for clients as they prepare for transformational change. Secondly our technical capabilities; our teams have experience delivering a variety of technical change across a range of in-house and leading 3rd party solutions. Lastly our people have market-leading knowledge of effective programme implementations. We work together across these three areas to support our clients in delivering complex change.

How do you ensure continuous improvement?

We have created a culture at Deloitte that encourages our teams to develop their capabilities, focussing on what our clients need and what is happening in the market. We ensure out people have the knowledge and expertise to drive change, within our business and that of our clients.

We benefit from sharing best practices both across our programmes and between clients, this has allowed us to deliver measurable impact and highly effective change for our clients. I see our people constantly learning and pushing boundaries in order to provide the best service for our clients and lead the market with our knowledge and capabilities.

How do you mark yourselves out from others?

What makes us different is the strength of our people and the breadth and depth of our experiences. We have worked hard to cultivate an environment in our team and with our clients that is ambitious and encourages bold ideas. I love that we are constantly solving problems for our clients, innovating and our people are excited about pushing boundaries and trying to do things differently. This carries across to our clients and allows us to provide leading solutions and have fun while we do it!

What does the future of technology in wealth look like?

Clearly AI is going to play a pivotal role in how technology evolves and how services are delivered. Right now, we are helping firms to understand how this innovation can support their businesses and delivering use cases to support Wealth transformation programmes. Wealth management has traditionally been a technology laggard in financial services but I can see that gap closing dramatically going forward with AI playing an ever larger role in orchestration and delivery of services in our clients businesses.

David Chapman Partner Deloitte

At Deloitte, we place diversity and inclusion at the heart of our business and view it as essential for our success. We believe that a diverse and inclusive workplace fosters innovation, drives better decision-making and ultimately leads to better outcomes for our clients and communities.

We take a multifaceted approach, such as providing equal opportunities in hiring and promotions, equalising parental leave, fostering a culture of respect and equipping leaders with the skills and awareness to leverage the strengths of diverse teams. We are proud of the strength of our employee resource groups, providing platforms for networking, mentorship and allyship. Through these ongoing efforts, we aim to create a truly inclusive workplace that everyone can thrive within.

Why is diversity and inclusion so important to Deloitte?

It’s core to our values. At Deloitte, we want everyone to feel they can be themselves in the workplace and thrive at work in everything they do. We want everyone to be their true authentic selves and believe when our people feel like they belong, they’re better able to thrive.

This can only be achieved by providing a workplace culture characterised by inclusive everyday behaviours and built on a foundation of respect and appreciation for diversity in all its forms.

Why does your approach to encouraging women in wealth management make you different?

I believe that our key strength is implementing policies and programmes that aim to make a genuine difference in supporting high-performing women in our workplace. To give you some examples, we have a thriving Gender Balance Network which provides members with access to role models and potential mentors, we run a Future Leaders Programme, providing training and mentorship for women to advance within the firm, our parental and menopause policies are market leading, supporting women, including those with families, in the workplace.

Beyond all of this though I think our greatest strength is how we show gender diversity from the top. This really illustrates our commitment to create a more equitable future. I think the industry has recognised the important role women have. Cultural change has been really important to encouraging more women than ever to seek both a career in wealth and to buy the products and services we produce.

Is there still more to do?

Yes! We have a great environment at Deloitte that values all our people and recognises diversity of opinion however there is still more to be done and we know that our work is not over yet. There are ambitious diversity targets for 2025 and 2030 as we aim to achieve gender balance and a workforce that represents the society we live in.

That change starts with all of us at the firm and I am proud that our people are so committed to driving diversity and inclusion at Deloitte to create a culture of inclusion where diversity is seen as a strength that drives success.

Please explain why you/your business was able to reach this award-winning level?

We excelled at using SEO to build organic visibility by combining high-quality content with a data-driven approach without spending on marketing and PR. By anticipating search trends and user needs, we became a trusted authority on embedded finance without relying on paid PR or advertising.

What was the way your colleagues made a difference?

Our team's expertise in content creation, keyword optimisation and analytics was instrumental. Their focus on quality and relevance ensured that our content not only ranked well, but also resonated with our audience, driving sustainable growth.

How do you intend to remain on the front foot and continue to set a high standard?

We'll use AI to enhance SEO strategies, such as using AI-powered tools to identify trends, personalise content and improve engagement. Investing in AI-powered analytics and content generation will keep us at the forefront of organic marketing.

• Marketing or PR Campaign

Dr. Adriano B. Lucatelli Founder Descartes Finance AG

In what ways were you able to deal with challenges and problems this time around? What lessons have you learned?

Standing out organically in a competitive, rapidly evolving industry has been challenging. We succeeded by adapting quickly to changes, leveraging AI for keyword insights and consistently producing relevant, engaging content.

Whom to look for, either inside or outside your business, for ideas and inspiration?

I like NerdWallet, which specialises in providing expert advice and comparisons on credit cards, loans and other financial products. The company has built a strong online presence by creating high-quality, SEO-optimised content that targets personal finance searches.

What will winning this award do for your business and colleagues?

This award validates our organic-first strategy and reinforces our credibility. It positions us as a leader in using innovative, cost-effective approaches like SEO and AI to drive impact and attract clients overpaying for marketing and PR.

Where do you see the wider wealth management sector going in the next five years?

AI will revolutionise wealth management, making personalised advice, predictive insights and automation accessible to all. SEO will evolve with AI-powered search and we'll lead the way by integrating these advances into our organic marketing strategies to stay visible and relevant in a tech-driven future.

Please explain why you/your business was able to reach this award-winning level?

Years of dedication, strong client relationships and a proactive approach have driven our success. At Druces, we go beyond legal solutions, offering strategic advice that helps clients achieve longterm goals. Our ability to anticipate challenges and structure deals effectively has earned trust and recognition

What was the way your colleagues made a difference?

Success is never achieved alone. My colleagues at Druces bring technical expertise, market insight and a collaborative mindset that drives excellence. Whether tackling complex transactions or sharing knowledge, our culture of support and innovation sets us apart.

How do you intend to remain on the front foot and continue to set a high standard?

Staying ahead means continuous learning and adaptability. We’ll deepen client relationships, track market trends and refine our strategies to keep Druces at the forefront. Expanding our international networks and embracing innovation will help us maintain our high standards.

In what ways were you able to deal with challenges and problems this time around? What lessons have you learned?

Challenges – from market shifts to regulatory changes – require resilience and agility. This year reinforced the need for quick adaptation and transparent communication, pivoting strategies quickly and responding to client needs in real time. Clients seek clarity in uncertain times and our ability to provide it has been invaluable.

Whom to look for, either inside or outside your business, for ideas and inspiration?