Table 24: Clarence Valley population projections by growth scenario and small area Low Small area

2021

2041

Medium Growth 2021

2041

High Growth 2021

2041

Growth

Angourie - Yamba

7,115

7,424

309

7,108

7,994

886

7,051

8,562

1,511

Ashby - Iluka - Woombah & District

3,929

4,013

84

3,935

4,177

242

3,982

4,370

388

Clarenza - South Grafton

6,553

6,703

150

6,556

6,983

427

6,584

7,394

810

Glenreagh - Lanitza - Rural South West & District

2,789

2,855

66

2,790

2,980

190

2,793

3,100

307

10,689

10,799

110 10,697 11,009

312

10,761 11,394

633

Gulmarrad - Townsend

3,592

3,844

252

3,595

4,316

721

3,614

4,839

1,225

Junction Hill - Southgate & District

2,428

2,577

149

2,426

2,854

428

2,412

3,129

717

Lawrence & District

2,105

2,169

64

2,104

2,289

185

2,101

2,396

295

Maclean

2,613

2,696

83

2,614

2,850

236

2,622

3,049

427

Rural North West

2,319

2,365

46

2,318

2,451

133

2,312

2,523

211

Waterview Heights - Seelands & District

4,064

4,116

52

4,064

4,214

150

4,067

4,319

252

Wooli - Tucabia - Ulmarra & District

3,651

3,796

145

3,773

4,185

412

4,811

5,658

847

51,848

53,358

1,510 51,981 56,301

4,320

53,110 60,735

7,625

Grafton

Total Source: HillPDA, Profile.id

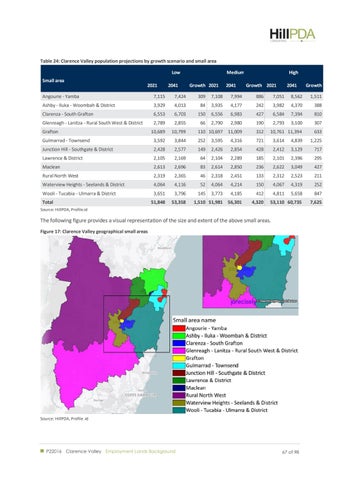

The following figure provides a visual representation of the size and extent of the above small areas. Figure 17: Clarence Valley geographical small areas

Source: HillPDA, Profile .id

P22016 Clarence Valley Employment Lands Background

67 of 98