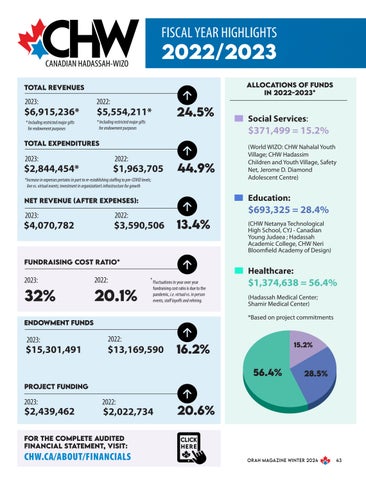

FISCAL YEAR HIGHLIGHTS

2022/2023

Allocations of funds in 2022-2023*

TOTAL REVENUEs

2023:

2022:

* Including restricted major gifts for endowment purposes

* Including restricted major gifts for endowment purposes

$6,915,236*

24.5%

$5,554,211*

$371,499 = 15.2%

TOTAL EXPEnditures

2023:

2022:

$2,844,454*

$1,963,705

44.9%

*Increase in expenses pertains in part to re-establishing staffing to pre-COVID levels; live vs. virtual events; investment in organization’s infrastructure for growth

$693,325 = 28.4%

2022:

$4,070,782

$3,590,506

13.4%

Fundraising COST RATIO*

2023:

32%

$15,301,491

(CHW Netanya Technological High School, CYJ - Canadian Young Judaea ; Hadassah Academic College, CHW Neri Bloomfield Academy of Design)

Healthcare:

2022:

* Fluctuations in year over year

20.1%

fundraising cost ratio is due to the pandemic, i.e. virtual vs. in person events, staff layoffs and rehiring.

$1,374,638 = 56.4% (Hadassah Medical Center; Shamir Medical Center) *Based on project commitments

ENDOWMENT FUNDS

2023:

(World WIZO: CHW Nahalal Youth Village; CHW Hadassim Children and Youth Village, Safety Net, Jerome D. Diamond Adolescent Centre)

Education:

NET REVENUE (AFTER EXPENSES):

2023:

Social Services:

2022:

$13,169,590

15.2%

16.2% 56.4%

28.5%

Project Funding

2023:

$2,439,462

2022:

$2,022,734

20.6%

FOR THE COMPLETE AUDITED FINANCIAL STATEMENT, VISIT:

CHW.CA/ABOUT/FINANCIALS

ORAH Magazine winter 2024

43