CHOA LEADS

TIER Changes Raise Cost Avoidance Incentive, but Not for CCUS

Atoms together, At Last: recent Fusion Energy Breakthrough

The View From Gökhan

CHOA Volunteer Profile

GEOTHERMAL ENERGY SERIES

Part 6 Is There Any Money In It? Part 7

Geothermal Development

CHOA

JOURNAL

APril2023

Page 3

CHOA Volunteer Profiles

Page 7

TIER Changes Raise Cost Avoidance Incentive, but Not for CCUS

GEOTHERMAL ENERGY SERIES

Page 25

Part 6 Is There Any Money In It?

Page 42

Part 7 Geothermal Development

Page 65

Atoms together, At Last: recent Fusion Energy Breakthrough

Page 70

The View From Gökhan: CO2 Could Be More Important Than You Think

Publisher: Owen Henshaw

Editor: Andreea Munteanu

Assistant Editor: Gordon D Holden

Editorial Committee: Bruce Carey, Adrian Dodds, Owen Henshaw, Gordon D Holden, Subodh Gupta, Catherine Laureshen, KC Yeung

Layout: Connor McGoran, Seema Patel, Javier Sanmiguel, Julianna Michayluk

CHOA.AB.CA /CANADIAN-HEAVY-OILASSOCIATION @CDN CHOA +1 403 269 1755

Table of Contents

FORE!CHOA Golf Invitational features a golf experience like no other on a fantastic golf course with stunning views. As you enjoy your round, there will be culinary treats and engaging games designed to build connections. This will be a great opportunity to bring out some clients and spend the day.

The game iscappedstroke play, when you‘re at an amazing course like this, you’ll want to play your own ball And you’ll want to use your mulligans

Registration includes all tournament fees, golf carts, a gift souvenir, delectable on course snacks, and tournament prizes. It also includes a full lunch and a post game Social.

REGISTER HERE

CHOA VOLUNTEER PROFILE

CHOA VOLUNTEER SPONSOR, GLJ Ltd., values the talented professionals forming the core of our association: the CHOA Volunteers!

THANK YOU!

Brittany Hale is a Project Coordinator at GLJ Ltd., a Calgary-based global energy consulting company that has been helping clients navigate the evolving energy landscape for over 50 years. Working with a team of engineers, geologists, and business professionals, she helps bring the pieces together for a variety of projects that range from reserves and resources evaluations, strategic planning, reservoir modelling, energy transition advisory, and more

A Calgarian through and through, Brittany was born and raised in Calgary and completed a Bachelor of Commerce at the University of Calgary

Prior to joining GLJ, she spent several years in the fitness industry where she was involved with program development, instructor coordinating, marketing campaigns, inventory management, and leading live fitness classes. She also had the opportunity to participate in multiple workout videos, both behind the scenes and on screen

A few years into her tenure at GLJ, Brittany became involved with the CHOA Project Updates publication where she helps curate content alongside Bruce Carey and fellow GLJer, John Martinez. Together they seek to provide value to CHOA members by summarizing information from a variety of sources that are relevant to all things heavy oil Through these efforts, Brittany has learned a ton about the industry and enjoys continuing to expand her knowledge base.

Outside of work, Brittany is actively re-living her former gymnastics days through her involvement with the CAPTivate Adult Gymnastics Club. When she’s not jumping and flipping, she enjoys travelling and spending time with friends and family.

Brittany Hale

CHOAJOURNAL-APRIL2023I3

CHOA VOLUNTEER PROFILE

John Martinez is a Reservoir and Evaluations Engineer at GLJ Ltd., a Calgary-based global energy consulting company that has been helping clients navigate the evolving energy landscape for over 50 years He has conducted detailed reserves, resources and economic evaluations of oil and gas properties in the Western Canadian Sedimentary Basin and international oil and gas fields used in client corporate evaluations and for regulatory purposes, bank financing and transactions such as mergers, acquisitions, and dispositions

He was born and raised in Colombia, where he completed bachelor’s degrees in both Petroleum and Chemical Engineering In 2017, he decided to go abroad and moved to Canada where he completed a master’s degree in chemical engineering at the University of Calgary Prior to his current role, he worked as a researcher in heavy oil properties and processing and bitumen extraction from oilsands.

A few months after starting his position at GLJ, John became involved with the CHOA Project Updates publication alongside Bruce Carey and fellow GLJer, Brittany Hale. Together they seek to provide value to CHOA members by summarizing information from a variety of sources that are relevant to all things heavy oil Through these efforts, John has kept himself up to date in heavy oil research findings and industry trends into the future.

THANK YOU!

Outside of work, John is an active and avid fencer, and is also always enthusiastic and keen on trying new sports. He enjoys hiking, swimming, travelling year-round to new and unknown places, playing videogames and spending time with friends and family.

We are fortunate to have Brittany, John and Bruce in our team. We appreciate their dedication and their hard work on the monthly Project Updates that all our members enjoy.

John Martinez

John Martinez

CHOAJOURNAL-APRIL2023I4

CHOA VOLUNTEER PROFILE

Dr. Bruce Carey is the Sr. Technical Advisor for Peters & Co, an investment institution specializing in the Canadian energy sector In this role, he provides technical analyses and assessments of resources, projects and technologies to support investment decisions across the upstream and downstream, with particular focus on the in situ thermal sector

He is a Chemical Engineer by training, with degrees from Stanford University and the University of Minnesota. Prior to his current role, he spent his career working for Exxon and Imperial for 32 years in a variety of upstream technical and management assignments.

THANK YOU!

Before moving to Canada in 1988, he worked for 10 years in Exxon Production Research Company’s Chemical EOR section, initially as a laboratory researcher, progressing to the manager role. His career with Imperial included assignments as Reservoir Manager for Cold Lake and all western Canadian conventional O&G properties, Research Manager for heavy oil recovery processes, such as LASER, Cyclic Solvent Process and SA-SAGD and Technical Manager for Drilling, Completions and Formation Evaluation.

He has made two presentations at Slugging It Out conferences on The Impact of SAGD Shut-Ins and The Status and Outlook for Solvent Processes.

He enjoys his volunteerism for CHOA on the Editorial Committee and has been a peer technical reviewer for the SPE for several years. He was the original sponsor and designer of the CHOA Project Updates, developed in the belief that CHOA members would find value in such a monthly “one-stop-shop” of news and

information

Positive feedback from members has supported that belief and made it a worthwhile and satisfying endeavor for him.

In his personal life, he enjoys skiing in the winter, wake surfing at his lake home in Montana in the summer, travelling year-round and being with his family and friends.

Dr. Bruce Carey

CHOAJOURNAL-APRIL2023I5

TIER Changes Raise Cost

Avoidance Incentive, but Not for CCUS

JARED DZIUBA, CFA, ANALYST, RACHEL WALSH, CFA, ANALYST, WILLIAMS AVILA, ASSOCIATE BMO CAPITAL MARKETS

CHOAJOURNAL-APRIL2023I7

Bottom Line:

Higher stringency introduced to Alberta's TIER carbon tax system substantially raises the level of emissions reductions that oil sands producers are obligated to make, more than doubling average compliance costs. This should provide further cost- avoidance incentive, and underscores the need for more disruptive decarbonization options like Carbon Capture, Use and Storage (CCUS) to achieve industry-government targets. That said, we point out that compliance costs are still well below that of CCUS under the existing federal policy framework, meaning TIER alone is unlikely to promote major deployment without further policy support.

Key Points

Amendments to TIER Effective January 2023. Alberta recently passed amendments to its Technology Innovation and Emissions Reduction (TIER) regulation in order to meet rising minimum standards under the federal Greenhouse Gas Pollution Pricing act. At the heart of the changes are a meaningful increase to the rate at which emitters must reduce emissions to avoid penalties Other changes include the creation of separate Sequestration Credits and Capture Recognition Tonnes to aid in administration, adjustments to credit use limits longevity, as well as decreases to the opt-in threshold for smaller emitters Finally, TIER formally adopts federal carbon pricing in which levies rise from $65/T in 2023 to $170/T by 2030.

CHOAJOURNAL-APRIL2023I8

Rising Stringency, Cost-Avoidance

Incentive. While a tightening rate of 1% was previously applied to facility-specific benchmarks only, a 2% annual rate will now apply more broadly, and for oil sands rises 4% in 2029 and 2030 This raises the level of mandated reductions from ~20% to 32%, which is beyond what we expect can be met by process-related improvements of producers. As a result, most are likely to face rising TIER costs without more disruptive solutions, like carbon capture. We estimate average costs increase to $1 52/bbl from $0 68/bbl in our base case, and from a credit to a cost of $0.80/bbl under our 'Advanced Technology' scenario.

Underscores the Need for CCUS, but Not the Incentive. Although stricter rules suggest the need for more disruptive options like CCUS to avoid compliance costs, the resulting costs of TIER ($0.80-1.52/bbl) are still well below that of CCUS development for most projects ($1.66-$2.40/bbl w/carbon credits and federal ITC), implying it is not enough to incentivize large scale CCUS without further policy support

Warding

Off Cap-and-Trade?

It is important to note that a 32% implied reduction by 2030 is nearly aligned with the plans of the Pathways project and federal emissions reduction plan, as well as a long-term net zero trajectory. For this reason, we suspect tighter stringency within TIER may be the Province’s attempt to avoid an additional oil and gas ‘cap-and-trade’ system previously floated by federal policymakers.

The Cost Not Shared Equally. Certain producers are least exposed to the risk of rising TIER obligations (or may generate net credits), while others face higher risk, all else equal, as a function of carbon intensity and mature, legacy assets.

Benefits

to Long-term Carbon Market Stability.

One positive side effect is that rising stringency should, in theory, improve the supply/demand balance of offset credits, translating to more stable carbon markets long-term

CHOAJOURNAL-APRIL2023I9

TIER Changes Raise Cost Avoidance Incentive, but Not CCUS

The Alberta government recently passed amendments to the Technology Innovation and Emissions Reduction (TIER) carbon tax regulation in order to meet rising minimum standards under the federal government’s Greenhouse Gas Pollution Pricing act and avoid the imposition of a backstop program The amendments were announced earlier in 2022, approved in late December, and came into effect January 1, 2023. At the heart of the changes are a meaningful increase to the stringency or tightening rate at which emitters must reduce emissions intensity over time to avoid penalties. While previously a tightening rate of 1% was applied to facility- specific benchmarks only, a proposed 2% annual tightening rate will now apply to both facility-specific benchmarks and high-performance benchmarks (like electricity). What is more, for oil sands production and upgrading specifically, the tightening rate will rachet up by 4% in 2029 and 2030. We believe the tighter stringency within TIER may be the Province’s attempt to avoid an additional oil and gas ‘cap-and-trade’ system (which the federal government has floated).

Other changes include the creation of two separate buckets for credit generation (Sequestration Credits and Capture Recognition Tonnes) to aid in the administration of credit trading, as well as increases to the amount of credits used and their longevity prior to expiry Finally, the amendment formally ratifies TIER’s alignment with the federal carbon price escalation plan, in which levies for non-compliance will be $65/T in 2023 and increase by $15/T increments to $170/T by 2030.

Bottom line: the increasing stringency under TIER raises the level of emissions reductions that producers are obligated to make without penalty from ~20% to 32%, in turn increasing average compliance costs to $1.52/bbl from $0.68/bbl in our base case, and from a credit position to a net cost of $0.80/bbl under a scenario of expanded R&D and process-related emissions improvements.

CHOAJOURNAL-APRIL2023I10

“

… increasing stringency under TIER raises the level of emissions reductions that producers are obligated to make without penalty from ~20% to 32%, in turn increasing average compliance costs to $1.52/bbl from $0.68/bbl in our base case, and from a credit position to a net cost of $0.80/bbl under a scenario of expanded R&D and process-related emissions improvements.”

This reinforces the need for more disruptive decarbonization options like Carbon Capture, Use and Storage (CCUS) to achieve collective industrygovernment targets. That said, while the rising pressure and costs provide incremental cost-avoidance incentive to emitters, we do not see the cost as overly burdensome on producers relative to the net cost of CCUS under existing policy, meaning that TIER alone is still unlikely to promote large scale deployment of CCUS. This reinforces our view that incremental policy support is needed for Canadian CCUS to generate investable returns and compete on large scale with other regions

Certain producers are least exposed to the risk of rising TIER obligations (or may generate net credits), while others face higher risk, all else equal, as a function of carbon intensity and mature, legacy assets.

Finally, one possible positive side effect of the TIER amendments is that rising stringency should, in theory, improve the long-term supply/demand balance of offset credits, translating to more stable carbon price markets long-term.

Rising Stringency, Cost-Avoidance Incentive (for some)

One of the early criticisms (including ours) of TIER was that it lacked stringency to incentivize meaningful investment in carbon reduction beyond the routine, particularly for large-scale investments like CCUS. Based on the facility-specific benchmarking process under TIER, and related stringency rules, the original program only called for a reduction of ~20% of emissions by 2030 (vs. 2013-2015 average). Given the historical pace of emissions improvement from the oil sands group, this is a level of reduction that we expected would naturally be met over time by routine R&D programs of producers.

CHOAJOURNAL-APRIL2023I11

"Under the amended regulation, a 32% reduction in oil sands emissions intensity is now expected of facilities by 2030.”

Under the amended regulation, a 32% reduction in oil sands emissions intensity is now expected of facilities by 2030. This means that even under our “Advanced Technology” scenario whereby industry expands R&D investment to meet a ~25% reduction in process- related intensity, most producers are now likely to face TIER compliance costs without more disruptive solutions like carbon capture

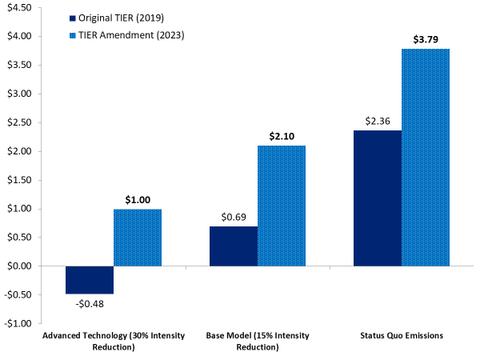

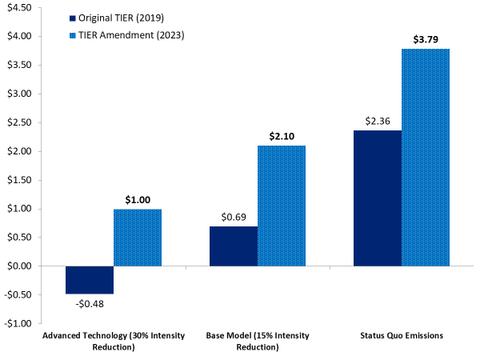

We illustrate this in Exhibit 1, which shows our estimate of average compliance costs under our base model (assumes 15% reduction in sector emissions intensity by 2030) increases from $0.68/bbl to $1.52/bbl with the changes on an NPV10 basis, while compliance costs under an ‘Advanced Technology’ scenario (~25% reduction in sector intensity by 2030 due to expanded process-related R&D) shifts from a credit position, to a $0.80/bbl average cost. In a status quo scenario (no assumed improvement in emissions intensity), we estimate compliance costs increase from $1.66/bbl to $2.48/bbl (and potentially as high as $3.79/bbl in 2030), as illustrated in Exhibit 2.

Exhibit 1: TIER Compliance Cost Scenarios ($/bbl, NPV10)

Exhibit 1: TIER Compliance Cost Scenarios ($/bbl, NPV10)

CHOAJOURNAL-APRIL2023I12

Source: BMO Capital Markets Estimates

Exhibit 2: TIER Compliance Cost Scenarios ($/bbl, 2030E)

Source: BMO Capital Markets Estimates

It is important to note that a 32% implied reduction in oil sands emissions intensity by 2030 is roughly in line with the plans of the Pathways Alliance partners. It is also interesting to note that while it is not clear what tightening rates will apply post-2030, maintaining a 4% clip would align with a net zero trajectory by 2050. For this reason, we believe the tighter stringency of TIER may be an attempt by the Province to ward off an additional oil and gas ‘capand-trade’ system (which the federal government has floated as an option to cap emissions). In our view, the rising stringency under TIER is likely a fair compromise

Underscores the Need for CCUS, but Not the Incentive

Even though the amendments call for an average reduction in emissions intensity of 32%, suggesting need for more disruptive options like CCUS, the resulting costs to producers are not overly burdensome such that it incentivizes investment in CCUS without further policy support to strengthen returns Case in point – as we illustrate in Exhibit 3, the average compliance cost of $0.77/bbl for oil sands producers under an advanced R&D scenario (and $1.52/bbl in our base case) are still well below net zero related CCUS costs of $2.40/bbl net of the federal ITC, and costs of $1.66/bbl including carbon credits valued at $65/T+inflation to 2050.

CHOAJOURNAL-APRIL2023I13

“

… the average compliance cost of $0.77/bbl for oil sands producers under an advanced R&D scenario (and $1.52/bbl in our base case) are still well below net zero related CCUS costs of $2.40/bbl net of the federal ITC, and costs of $1.66/bbl including carbon credits valued at $65/T+inflation to 2050.”

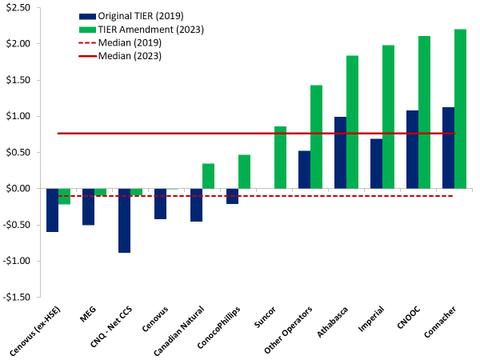

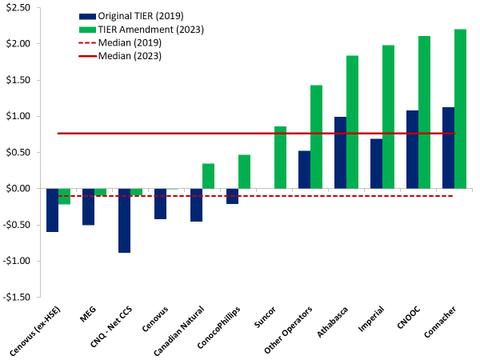

The Cost (Incentive) Is Not Shared Equally

Exhibits 4-5 provide estimates of TIER compliance cost by oil sands company, according to our Base Model (15% reduction in emissions intensity), and our Advanced Technology case (~25% reduction). As demonstrated, some projects are more at risk and therefore potentially more motivated by TIER itself to advance CCUS development.

Exhibit 3: TIER Compliance Costs vs. Net Zero CCUS Costs to 2050 ($/bbl, NPV10)

CHOAJOURNAL-APRIL2023I14

Source: BMO Capital Markets Estimates

Source: BMO Capital Markets Estimates

Source: BMO Capital Markets Estimates

Exhibit 5: TIER Cost by Company ($/bbl, Advanced Tech)

Exhibit 4: TIER Cost by Company ($/bbl, Base Model)

Exhibit 5: TIER Cost by Company ($/bbl, Advanced Tech)

Exhibit 4: TIER Cost by Company ($/bbl, Base Model)

CHOAJOURNAL-APRIL2023I15

We illustrate the impact of implied compliance costs on the oil sands producer group relative to corporate free cash flows by time frame in Exhibit 6 for the sector as a whole. As shown, we estimate that costs consume less than 2-3% of FCF of producers by 2030 under the base case, but increases to 18% by 2050 These percentages decrease to 1% and 8%, respectively, under the scenario of advanced R&D efforts and larger process-related emissions reductions over time.

Source: BMO

Estimates

Possible Benefits to Long-term Carbon Market Stability

Another potentially positive side effect of the TIER amendments is that the increased stringency, in theory, should improve the long-term supply/demand balance of offset credits, translating to more stable carbon price markets long term. That said, a significant challenge facing Canadian CCUS development is the scale at which investment must be made to accommodate 2030 government mandates and widespread net zero commitments, which still stretches well beyond the cost-avoidance scope of TIER We do not believe it fully addresses the issue of future price visibility, particularly under a scenario whereby the federal government somehow restricts trading of credits for oil & gas companies with other industries, (which has been suggested).

Exhibit 6: TIER Compliance Cost vs. Free Cash Flow ($/bbl)

CHOAJOURNAL-APRIL2023I16

Capital Markets

New Credit Terms, Mostly Administrative Noise

In addition to the stringency changes, the government will introduce unique CCUS credits to aid in administration of credit generation and use, and to enable value to flow back to the capturing site more efficiently. The two CCUS credit types include: 1) Sequestration Credits which will enable offsets to be recognized under the Clean Fuel Regulation (CFR), allowing for possible stacking of credits for some emitters These credits will be subject to the same usage limits as performance and offset credits (see below); 2) Capture Recognition Tonnes will allow emitters to deduct sequestered emissions from their total regulated emissions at the capturing facility, with no limit to usage, with the caveat that they cannot be banked and must be used that year. Any excess reductions may be monetized as EPCs after.

Expanding Credit Usage Limits, Accelerating Expiry

The maximum allowable emission offsets (EOCs), emission performance credits (EPCs) or sequestration credits that can be used by a facility in a given year will remain at 60% in 2023, but increase to 90% by 2026 At the same time, the expiry period for EPCs will be reduced to five years (from eight years) for credits with a 2023 or later vintage, limiting the extent to which emitters can bank credits to avoid market manipulation and promote stability. Offset credits will now expire after six years, down from nine. These changes will limit supply and increase with demand, resulting in a stronger market.

Wider Industry Scope

The amendments also decrease the minimum emissions threshold for opt-in facilities in emissions-intensive industries from 10,000 CO2e tonnes/year to 2,000 CO2e tonnes/year enabling smaller emitters to opt into the program and increase demand for offset credits The scope of a “large emitter” also now includes facilities that import >10,000 tonnes of hydrogen starting in 2023.

CHOAJOURNAL-APRIL2023I17

Alignment With Federal GHG Pricing Plan

With the amendments, Alberta’s carbon pricing program will officially adopt and integrate the federal greenhouse gas pricing plan which escalates from $65/T in 2023 to $170/T by 2030. This rate of price increase was already factored into our emissions compliance cost models. We note that for compliance, regulated facilities can either purchase credits up to the limit described above with the balance being paid into the TIER fund or they can simply pay into the fund entirely. TIER fund payments will reflect the federal price escalation schedule. This dynamic results in a ‘price cap’ on all credit types traded in the market Historically, EPCs and EOCs have traded at a 10% discount to the TIER fund price.

“With the amendments, Alberta’s carbon pricing program will officially adopt and integrate the federal greenhouse gas pricing plan which escalates from $65/T in 2023 to $170/T by 2030.”

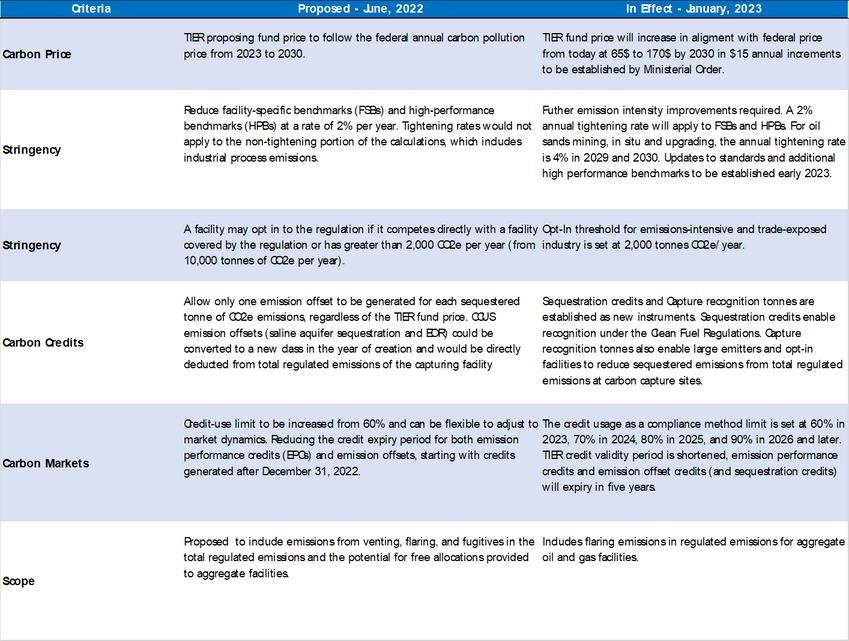

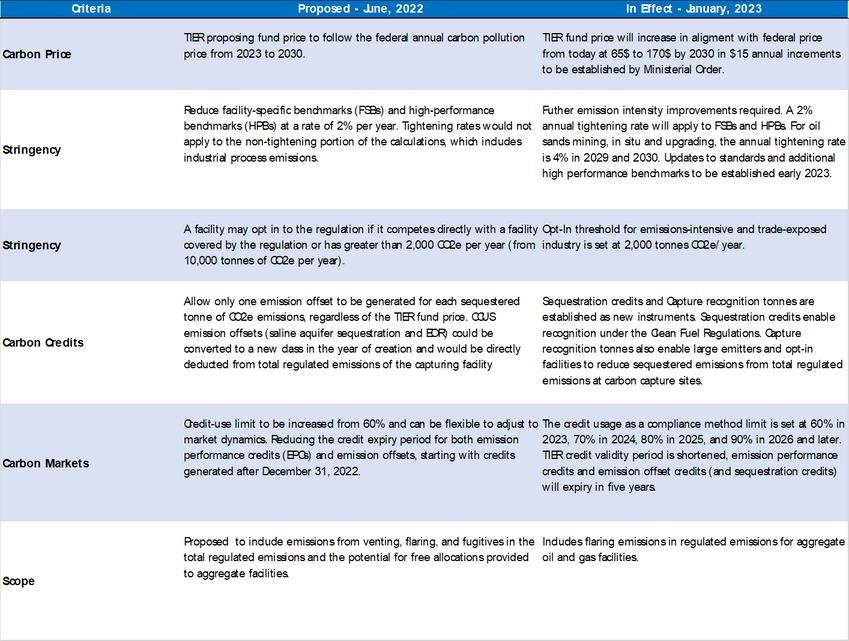

Summary of Amendments

In Exhibit 7, we summarize proposed and enacted changes under the Alberta TIER system for reference.

CHOAJOURNAL-APRIL2023I18

Read BMO Capital Markets Disclaimer HERE

Exhibit 7: Alberta TIER - Proposed vs. Amendments

CHOAJOURNAL-APRIL2023I19

Source: Alberta Government, BMO Capital Markets

Jared Dziuba, CFA, has over 15 years experience as an equity research analyst with BMO Capital Markets, covering a full spectrum of subsectors within the global oil & gas industry In his current role, Jared oversees the execution of industry thematic research, providing insight to BMO’s institutional investor clients on emerging trends that influence the longterm investment prospects of the energy business. Recent areas of focus include in-front perspectives on the Canadian oil & gas sector’s sustainability (Environmental, Social, Governance, or ESG) performance in the global context, as well as the unique decarbonization (CCUS) and energy transition potential of Canada’s oil sands producers Jared graduated from the University of Calgary’s Haskayne School of Business with a B Comm in Finance (with distinction), and is a CFA charter holder

CHOAJOURNAL-APRIL2023I20

Jared Dziuba, CFA, Analyst, Rachel Walsh, CFA, Analyst, Williams Avila, Associate, BMO Capital Markets

ENERGY CHANGEMAKERS IN ACTION

Welcome to CHOA LEARNS: Energy Changemakers!

This year-long series features insightful, interactive talks by technical and business leaders who are shaping the future of Canadian energy. Each event includes dedicated time to network and learn from each other

Let’s get together and learn something new!

16 February 2023

Geothermal

21 March 2023

A Microfluidics-based Approach to Optimizing Heavy Oil Recovery

18 April 2023

Co-Produced Geothermal Power

2 May 2023

I Know my Well is Bent: What Now?

The Energy Changemakers have already delivered four thought-provoking and wellreceived talks The participants have been invited to shape this series by choosing future topics to explore

You can become an Energy Changemaker! Email us topics you are interested in seeing CHOA provide and/or attend one of the upcoming talks of this series.

Potential in the Oil Sands

Potential in the Oil Sands

ENERGY CHANGEMAKERS

CHOA LEARNS: ENERGY CHANGEMAKERS

THE NEW ENERGY MAP FOR CANADIAN OIL

Key Insights from Top Consultancy S&P Global

Join us at this outstanding ENERGY CHANGEMAKERS networking event to hear the latest insights from Raoul LeBlanc and Kevin Birn, (S&P Global) into:

How are “Black Swan” events disrupting the trajectories of oil prices and trade patterns?

What is changing for the North American shale juggernaut?

What are early signals from the decarbonization process?

How are these rapidly evolving themes driving oil production, differentials and profitability?

Connect with thoughtprovoking ideas, meet Industry leaders, engage with each other.

21 May 2023

330 PM - 545 PM

Calgary Petroleum Club

Let's lead the way forward together!

REGISTER HERE

The event includes the Annual General Meeting, a short business meeting for members to vote in our next Board of Directors, and complete yearly procedures for the Canadian Heavy Oil Association.

CHOA PLATINUM SPONSORS

GEOTHERMAL: Is There Any Money in It?

BY TIM MONACHELLO AND PATRICK TANG ATB CAPITAL MARKETS

LEARN MORE ABOUT:

THE ROLE OF CARBON PRICING IN WIDESPREAD GEOTHERMAL DEVELOPMENT

THE TYPES OF CARBON PRICING THAT CAN SUPPORT GEOTHERMAL PROJECTS

STRATEGIC ADVANTAGES OF GEOTHERMAL DEPLOYMENT

CHOAJOURNAL-APRIL2023I25

ECONOMIC, TECHNICAL AND STRATEGIC FACTORS

In this section, we highlight the major economic, technical, and strategic factors impacting the pace of global geothermal development.

Project economics have been a major hurdle for the advancement of geothermal power developments, especially in areas where there is not a known hydrothermal resource In general, the economics of a geothermal project are a function of the revenue capacity of the project, which itself is a function of:

the resource characteristics – most notably the temperature gradient and the flow rates (excluding closed-loop); the project’s revenue streams; the project’s access to carbon credits and government grants; and the market price for power in the region.

… geothermal is a source of renewable, long-life, baseload, dispatchable energy, with new EGS technologies offering the promise of nearly ubiquitous access around the globe over the coming decades.”

“

That said, strategic factors such as energy security and carbon reduction are increasingly playing a role in decisions regarding energy mix. Economics aside, geothermal offers compelling advantages over both renewable and non-renewable energy sources given that geothermal is a source of renewable, long-life, baseload, dispatchable energy, with new EGS technologies offering the promise of nearly ubiquitous access around the globe over the coming decades

GEOTHERMAL ENERGY SERIES

CHOAJOURNAL-APRIL2023I26

O&G Expertise Unlocking the Earth’s Energy Potential

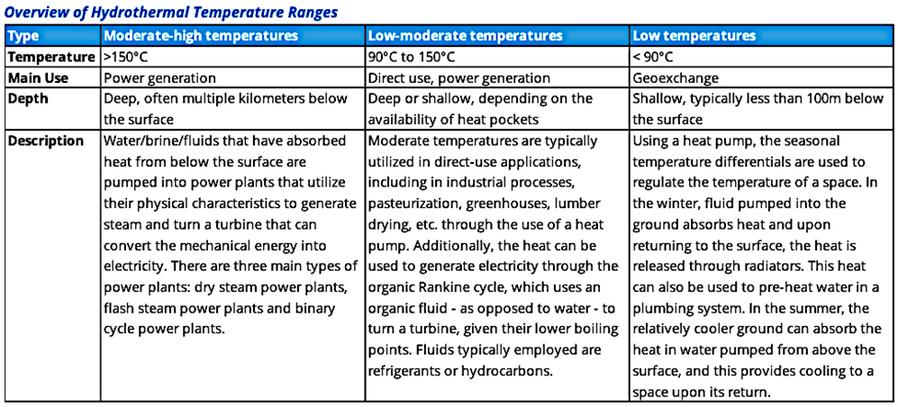

Fundamentally, geothermal power production relies on harvesting the heat of the Earth’s core, and higher temperatures translate to higher power generation capacity. However, temperature is a function of depth, so geothermal developers need to optimize for the highest temperature resources at the lowest depths. Additionally, the ability to harvest this heat and bring it to surface, with the exception of closed-loop systems, relies on the presence of an aquifer at depth, and on sufficient permeability of the formation to allow high volumes of fluid to flow to surface – geothermal wells can often produce fluid volumes >10x that of oil and gas wells. Beyond these two factors, which have historically dictated the location where geothermal developments are feasible, proposed projects are increasingly being modelled with ancillary revenue streams, including direct use heating, mineral production, etc.

Temperatures

The bottom-hole temperature of a well, which is a function of the geothermal gradient in a particular part of the world and the characteristics of the well itself (depth), determines how the energy is utilized In general, to generate electricity, the formation must produce fluid (excluding closed-loop systems) sufficiently hot to flash a working fluid efficiently, which is around the 1,100 °C-1,200 °C level, and while higher temperatures offer higher power generation capacity, we understand most flash plants have an optimal efficiency at roughly 1500 °C.

While bottom-hole temperature is generally the focal point when evaluating resource quality, the surface temperature is also important In an ORC power plant, power generation is accomplished by transferring heat from produced fluid to a working fluid.

Resource Characteristics are Core to Project Economics CHOAJOURNAL-APRIL2023I27

The working fluid flashes/evaporates and expands, driving the mechanical action of a turbine. To be reused in the cycle, the working fluid must then be cooled by passing through a condenser that can be either air- or water-cooled. Cooler surface temperatures are more efficient at condensing the working fluid given the higher thermal gradient, which effectively increases the generating capacity of a plant. For these reasons, geothermal power plants are generally more efficient in the winter months, though the seasonal variability in power generation capacity is small compared to the seasonality of other renewables such as solar.

“

… geothermal power plants are generally more efficient in the winter months, though the seasonal variability in power generation capacity is small compared to the seasonality of other renewables such as solar.”

When looking to maximize the value of a project, geothermal power developers must choose a resource that has sufficient downhole temperatures (generally above 1,100 °C) and maximizes geothermal heat gradient (difference from bottom-hole to surface temperature) at the shallowest depth possible to minimize drilling costs Moreover, after passing through a power plant’s heat exchanger, hotter produced water generally has higher residual heat, which may increase the water’s viability in secondary direct-use applications.

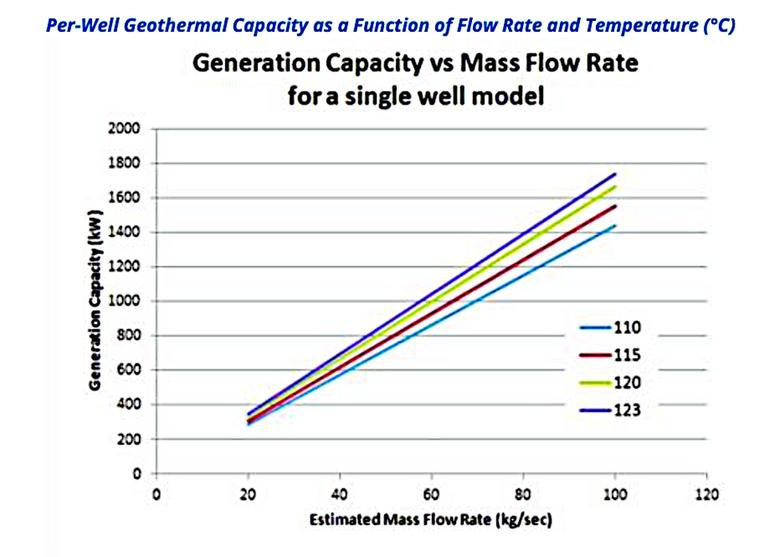

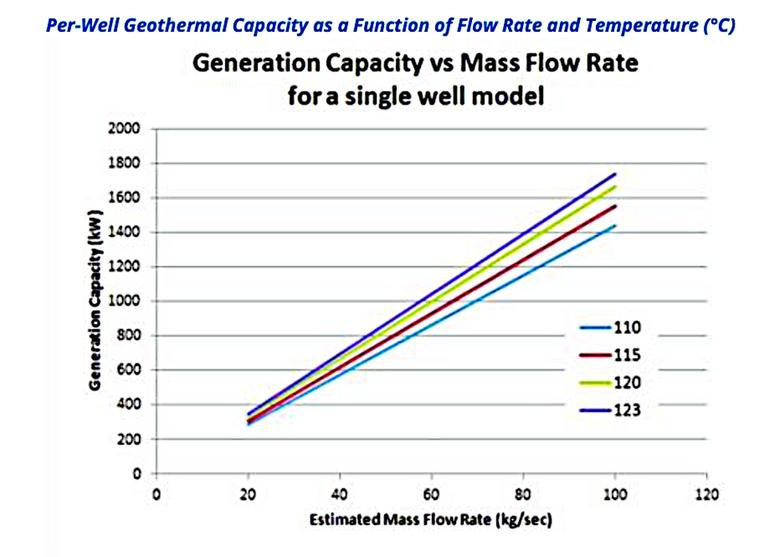

Flow Rates

While higher temperatures determine how the resource is developed, and they and have a positive correlation with the amount of power that can be generated, flow rate is the single largest factor in a conventional geothermal well’s feasibility. Flow rates are ultimately a function of the formation and the porosity and permeability of the rock. To contextualize the typical flow of a geothermal well, at brine temperatures of 120°C, a producing well must flow roughly 300 L/second (~163 mbbl/d) to produce 5 MW using a binary cycle. Figure 27 below illustrates that low flow rates can be a significant bottleneck to power output from a plant, whereas high flowing wells have great potential for economic development. That said, the higher the temperature, the lower the required flow rate.

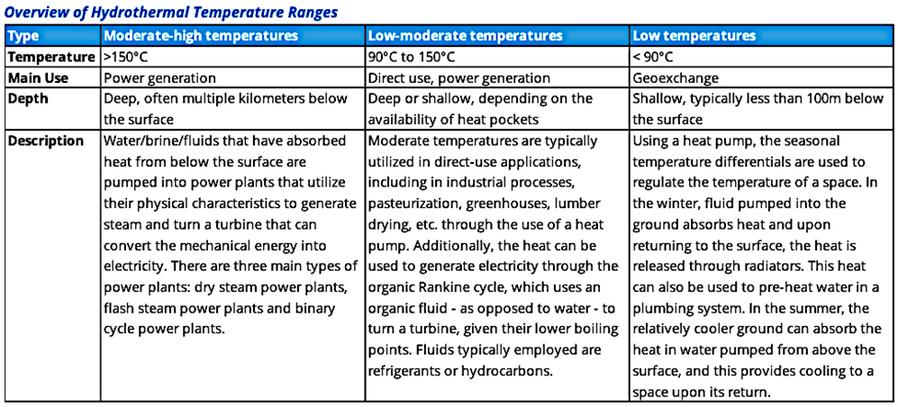

Figure 26 – Overview of Hydrothermal Temperature Ranges

Figure 26 – Overview of Hydrothermal Temperature Ranges

CHOAJOURNAL-APRIL2023I29

Source: ATB Capital Markets Inc.

In areas where the resource is not as prolific, there are certain methods to increase flow rates. The most widely considered is well stimulation – which is similar to hydraulic fracturing in the oil and gas space. When porosity is low, geothermal operators can stimulate the well using hydraulic pressure, which opens fractures in the rock that allow the brine to flow more freely These fractures are often “propped” open by sand or other fine proppants. Beyond stimulation, there has been recent interest in utilizing carbon produced from CCUS projects to pursue enhanced geothermal recovery, similar to enhanced oil recovery in the petroleum industry.

Source: British Columbia Ministry of Energy and Mines

Figure 27 – Per-Well Geothermal Capacity as a Function of Flow Rate and Temperature (°C)

Figure 27 – Per-Well Geothermal Capacity as a Function of Flow Rate and Temperature (°C)

CHOAJOURNAL-APRIL2023I30

Pricing Mechanisms are a Key Source of Economic Value

Carbon Pricing Mechanisms are a Core Consideration for Geothermal Developments: Carbon pricing mechanisms are a key revenue stream for geothermal projects and are a major source of economic value. For many geothermal projects, carbon credits and carbon pricing can compete with power generation in terms of economic value contribution for stakeholders. Given the high economic contribution of carbon pricing mechanisms on the economics of geothermal developments, we believe countries and jurisdictions where carbon pricing mechanisms are most robust and where prices on carbon are expected to increase are the most likely areas for geothermal development growth.

“For many geothermal projects, carbon credits and carbon pricing can compete with power generation in terms of economic value contribution for stakeholders.”

For context, our modeling of the No. 1 Geothermal project proposed in Alberta suggests that carbon offsets could represent roughly 31% of project revenue at the current $50/tCO2 price of carbon, with the project generating roughly a 15% IRR over a 40-year period (see Figure 17 for details and assumptions), while the Canadian Federal government’s proposal to increase carbon prices to $170/tCO2 by 2030 would increase the revenue contribution of carbon pricing to 61% (by 2030) and increase the project’s IRR to roughly 23%, which we believe is sufficient for widescale commercial viability.

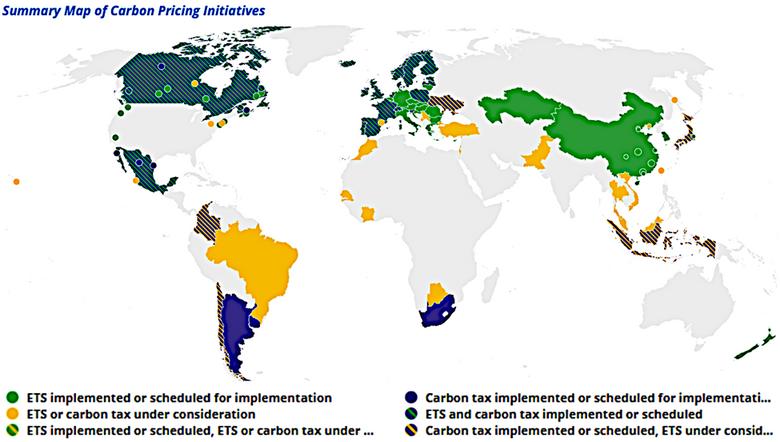

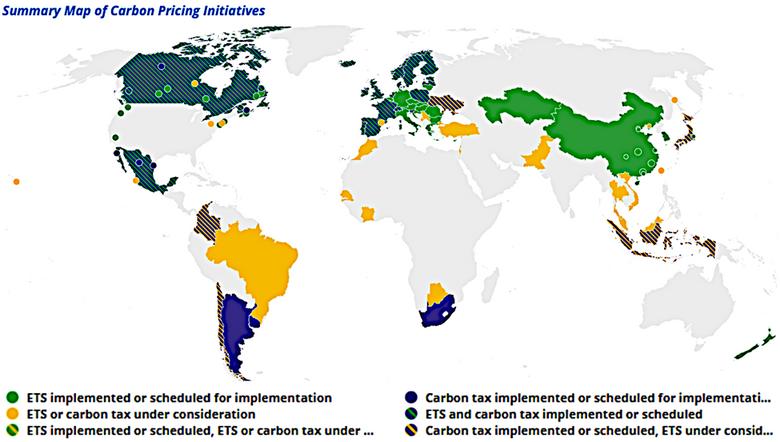

About Carbon Pricing Mechanisms: Carbon pricing schemes either increase the cost of carbon for emitters or economically incentivize emissions reduction – most commonly, these are in the form of an emissions trading system (ETS) or carbon taxes According to the World Bank, 68 carbon pricing initiatives at the national, regional, and subnational levels have been implemented as of 2022. Overall, these initiatives cover roughly 23% of global GHG emissions (see Figure 28).

CHOAJOURNAL-APRIL2023I31

Carbon

Beyond these compliance-type schemes, regulators have also implemented systems for buying and selling carbon offsets or renewable energy credits (RECs), which serve to affix economic value to lower-emitting sources of electricity and/or heating – often overlapping ETSs or carbon taxes. Each of these implementations enable market forces to direct investment and expenditures into emissions-reducing projects. Researchers at MIT and the National Renewable Energy Laboratory (NREL) – among others – have suggested that pricing carbon can be an effective way to reduce GHG emissions. Below, we analyze each system and their pertinence to geothermal developers

Source: The World Bank

Figure 28 – Summary Map of Carbon Pricing Initiatives

Figure 28 – Summary Map of Carbon Pricing Initiatives

CHOAJOURNAL-APRIL2023I32

Emissions Trading System (ETS)

ETSs are split into two schemes:

Cap-and-trade: In a cap-and-trade arrangement, regulators set an absolute emissions cap for a group – a set of emitters, an industry, or the whole economy – then distributes allowances through an auction or for free to emitters based on a pre-defined set of criteria In this system, emitters that have excess allowances can generate profits by selling to companies struggling to stay within their quota. In many cap-and-trade schemes, the cap is lowered over time to improve emissions performance.

Baseline-and-credit: Baseline-and-credit schemes set baseline emissions intensity levels for individual emitters, and credits are earned from outperforming the benchmark. When combined with a payment-for-results system, the scheme can provide economic benefits to those that make efforts to reduce emissions intensity, or credits earned can be sold to other companies if compliance regulations are put in place. When contrasted with cap-andtrade, which has a hard limit on emissions, baseline-and-credit systems may not directly impact those failing to outperform their benchmark, and there is no guarantee that total emissions will be lower given the absence of a hard cap

In our view, an ETS in either form incentivizes power producers to develop their lower-emitting sources of electricity, which could spur development in renewables, including geothermal. Those that are able to reduce emissions will ultimately benefit at the expense of those that maintain the status quo One benefit of an ETS is that it is not as burdensome as a carbon tax, which virtually guarantees incremental cash outflows for every emitter.

CHOAJOURNAL-APRIL2023I33

Carbon Taxes

Carbon taxes price emissions directly, and the taxes can be levied on either power producers that generate electricity from carbon-emitting sources (natural gas, coal, etc ), industrial users (i e , users of natural gas in industrial/manufacturing processes), consumers purchasing gasoline or natural gas, or some combination of the three. A main criticism of carbon taxation is that it imposes financial penalties within an economy – regardless of any emissions reductions achieved – which could lead to lower economic activity overall (i.e., deadweight loss), whereas emitters under an ETS may not necessarily be worse off if emissions caps are not exceeded.

“A main criticism of carbon taxation is that it imposes financial penalties within an economy – regardless of any emissions reductions achieved –which could lead to lower economic activity overall (i.e., deadweight loss), whereas emitters under an ETS may not necessarily be worse off if emissions caps are not exceeded.”

Under a carbon tax scheme, power producers are incentivized to shift to renewable sources, which could encourage the development of geothermal power plants Industrial emitters and consumers could also reduce taxes levied against them if natural gas heating is replaced with geothermal district heating. Furthermore, in jurisdictions with carbon taxation, carbon tax revenues are often put to use through subsidization programs for renewables, which could further incentivize geothermal to the extent that geothermal development is eligible for these subsidies.

Carbon Offsets and Renewable Energy Certificates (RECs)

Carbon offsets are commodities that can be bought and sold, with each unit representing a fixed amount of carbon absorbed or prevented from release in some activity. These offsets can be generated through carbon absorption projects (e g , carbon capture and storage) or through the elimination of carbon from a source that normally emits carbon (e.g., renewable energy replacing coal generators).

CHOAJOURNAL-APRIL2023I34

Depending on the jurisdiction, carbon offsetting may be done on a voluntary basis or a compliance basis, with the latter effectively operating as an ETS. In a voluntary system, companies may purchase offsets to show their commitment to sustainable development or to be able to make claims of low- emitting or net zero operations Emitters in a voluntary system may also generate or purchase offsets with the intention to sell to customers or other end-users. For example, airlines may purchase offsets that consumers can opt into to support carbon reduction.

Renewable Energy Certificates (RECs) are a subset of offsets that are specific to generation projects, representing a fixed amount of electricity that is produced from a renewable source. Similar to offsets, RECs are often sold to end-users to allow them to claim that a portion of their electricity usage as renewable.

“For a geothermal developer, the sale of carbon offsets or RECs can represent a stable revenue stream that improves project returns over a given hurdle rate for investments.”

With both carbon offsets and RECs, there is no guarantee that total emissions will be reduced (in a voluntary system), and such schemes often enable heavy polluters to maintain the status quo. That said, there is no undue financial hardship placed upon emitters, and the sale of units can help finance emissions reduction or absorption projects. For a geothermal developer, the sale of carbon offsets or RECs can represent a stable revenue stream that improves project returns over a given hurdle rate for investments

Carbon Offsets Grants and Credits

In many jurisdictions, governments often offer grants and other incentive structures for companies to fund renewable energy projects or projects that incorporate some degree of new technology that may not be commercially viable at its early stage of development. Often these grants are funded by the proceeds of carbon taxes These grant programs can contribute significantly to the economic viability of geothermal projects. We note some of these sources of funding for Canadian and US geothermal projects below:

CHOAJOURNAL-APRIL2023I35

Emerging Renewable Power Program: Applications to the Program are now closed, but the fund was aimed at power technologies that were either already commercially established but not in Canada or demonstrated in Canada but not deployed at scale. Under this Program, Natural Resources Canada made a $25 4 mn investment in Alberta No 1 Geothermal and a $25 6 mn investment in DEEP Earth Energy.

Energy Innovation Program: The Energy Innovation Program is managed by the Office of Energy Research and Development and has an annual budget of $24 mn for grants and contributions. Grants are targeted at advancing clean energy technologies, with a specific focus on research, development, demonstration projects, and other related scientific activities. Under this program, grants have been made to Borealis Geocoder ($1 54 mn) and DEEP ($0.35 mn).

Alberta Innovates: Jointly funded by the Department of Economic Development, Trade and Tourism in Alberta and industry partners, Alberta Innovates funds certain renewable and alternative energy projects. Proposed developments that can demonstrate low-emitting alternative electricity generation are eligible for grants from Alberta Innovates. Grants have been made to Eavor ($1 mn through Emissions Reduction Alberta), Razor/FutEra ($2 mn), and the University of Alberta for their Stirling engine technology (similar to the ORC, but the working fluid remains a gas; $0.2 mn). Funding is sourced from Alberta’s Technology Innovation and Emissions Reduction (TIER) system and from the Low Carbon Economy Leadership Fund (LCELF) at the federal level.

CHOAJOURNAL-APRIL2023I36

Smart Renewables and Electrification Pathways Program: The Smart Renewables and Electrification Pathways Program (SREPs) is funded by Natural Resources Canada and is now closed to new proposals However, with its $922 mn in funding approved for distribution over four years, it aims to facilitate the development of smart renewable energy and electrical grid modernization projects. Through SREPs, Novus Earth has received $5 mn in funding towards its Latitude 53 project.

Renewable Electricity Production Tax Credit (PTC): Established in 1992 and known formally as the Renewable Electricity, Refined Coal, and Indian Coal Production Credit, the PTC is a ten-year, inflation-adjusted US federal tax credit that provides up to $0.025/kWh ($25/MWh) for geothermal power producers, subject to a phaseout after the realized price of electricity exceeds a market- based threshold adjusted upward alongside inflation. We note that other renewable sources (e.g., hydrokinetic, wind, etc.) within the regulation have begun to be phased out altogether, with the applicable credit representing just half or 40% of the base credit. Geothermal – which still earns the full credit – may be subject to phaseout in the future.

Tax Equity Financing Structures:

Available in the US for renewable energy projects, a Tax Equity structure allows tax-laden investors to create partnerships with renewable project proponents whereby tax credits during renewable development flow to the investor, more efficiently offsetting their tax burdens during the early stages of development, and cash flows flow to the project proponent. Later in the life of the project, either after a predetermined time period or after a hurdle rate on investment is achieved, the proportionate allocations change so that the investor receives a smaller share of the tax benefits and a larger share of the cash flows, and often project investors have clauses that whittle down their equity interest in the project over time. These structures allow for more efficient financing options for renewable projects where large tax-laden investors (banks for instance) can invest in renewable projects in efforts to receive the tax benefits, and renewable project proponents can leverage their tax incentives most efficiently to help fund high up-front capital costs.

CHOAJOURNAL-APRIL2023I37

Strategic and Other Considerations

Energy Security

While energy security or independence as a concept has existed for many years, the importance of it was highlighted during the energy crisis of 2021 This crisis saw a massive appreciation in the price of natural gas as various gas importing countries bid up limited gas supplies in advance of heating season, which indirectly led the return of coal as a substitute heating/power input in certain areas. Combined with the desire to be less dependent on energy exporters – namely OPEC and Russia, the latter especially after its invasion of Ukraine – many governments have pushed for greater development of nonfossil fuel power. We believe technological innovations are increasingly driving geothermal to be viewed as a viable source of independent energy that can be developed independently, with limited reliance on global supply chains when compared to other renewables such as wind and solar.

“ … technological innovations are increasingly driving geothermal to be viewed as a viable source of independent energy that can be developed independently, with limited reliance on global supply chains when compared to other renewables such as wind and solar.”

CHOAJOURNAL-APRIL2023I38

Renewable, Long-Life, Baseload, and Dispatchable

While economic returns outside of known hydrothermal resource areas are today relatively weak compared to commercial renewable energy sources, geothermal offers significant strategic advantages over other energy sources; namely, geothermal is a unique source of renewable power that is:

1. Long-Lived: Geothermal projects have a life of 30-50 years, with minimal ongoing capital requirements, and new systems could have essentially unlimited lifespans if properly maintained.

2. Baseload: Geothermal is not subject to intermittency issues that affect wind and solar, so geothermal does not require supplemental peaking power generation (often using fossil fuels) or battery capacity

3. Dispatchable: Closed-loop geothermal technologies can be geared to increase power generation at times of peak demand and scaled back in times when there is limited demand. When power generation is below capacity, heat continues to build in the reservoir, which increases power capacity when scaled back up.

Regulatory Environment

The regulatory environment in which a geothermal project is developed and located can significant impact its feasibility. Most directly, royalties and land rights can reduce the economics of a geothermal project; conversely, supportive regulatory regimes can be conducive to development – this could be in the form of government-subsidized, above-market power pricing or grants. Environmental protection is another facet of legislation that can impact a project. Depending on the rules in place, a geothermal developer can be subject to stringent guidelines, requiring significant investment into liability management.

CHOAJOURNAL-APRIL2023I39

Other Infrastructure considerations are also key to the economics of a geothermal project. Power station interconnects are a significant one-time upfront cost. However, phased development at a single site – Ormat’s McGinness Hills Geothermal Complex, for example – can effectively amortize this cost over a greater number of plants If grid power can be used, then the parasitic load of a geothermal project can be wholly offset – in effect, trading “grey” grid power for known green energy. Parasitic load can also be offset by the installation of solar panels on facility sites; the Tungsten Mountain Geothermal power plant already utilizes this design. However, this could suffer from the same intermittency problem as solar generation in general. With directuse heating, proximity of a geothermal well to buildings and facilities will reduce the amount of capital needed to build pipelines.

CHOAJOURNAL-APRIL2023I40

THE REGIONAL LANDSCAPE FOR GEOTHERMAL DEVELOPMENT

BY TIM MONACHELLO AND PATRICK TANG ATB CAPITAL MARKETS

BY TIM MONACHELLO AND PATRICK TANG ATB CAPITAL MARKETS

LEARN MORE ABOUT:

THE USA’S GEOTHERMAL CONTEXT

HOW W CANADA IS SET UP FOR GEOTHERMAL POWER DEVELOPMENT

THE SK PROJECT THAT COULD BE CANADA’S BIGGEST GEOTHERMAL DEVELOPMENT

CHOAJOURNAL-APRIL2023I42

GEOTHERMAL ENERGY SERIES

O&G Expertise Unlocking the Earth’s Energy Potential

THE REGIONAL LANDSCAPE FOR GEOTHERMAL DEVELOPMENT

UNITED STATES

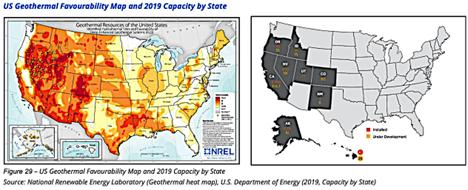

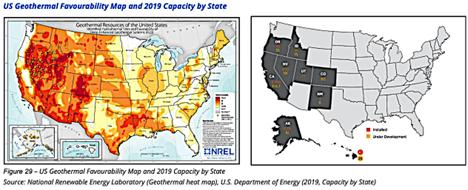

US Geothermal Production Focused on High-Temperature Hydrothermal Resources

The US West region has extremely favourable conditions for the development of geothermal resources (see Figure 29) In the hottest regions, geothermal wells with depths under 1,000 m are capable of producing brine in excess of 1,500 C – providing ample opportunities for commercial power generation.

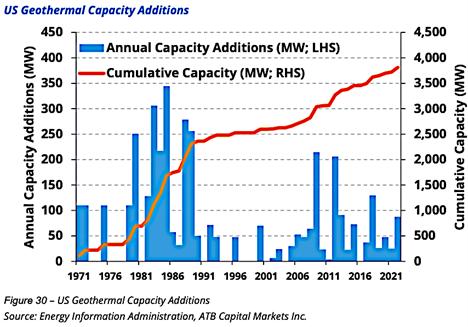

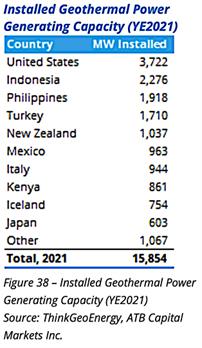

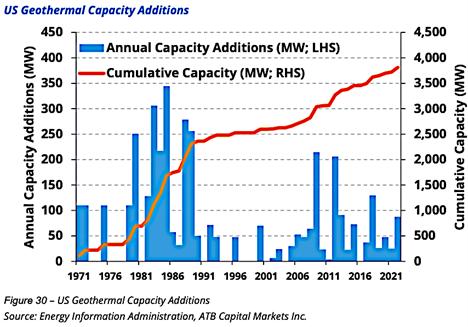

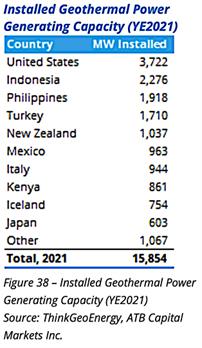

According to ThinkGeoEnergy, the US led all countries in geothermal generation capacity in 2021, at 3,722 MW, or 23% of global installed capacity. Even then, the EIA’s preliminary data indicates that geothermal represented just 0.4% of the country’s utility-scale generation in 2021.

“ … the US led all countries in geothermal generation capacity in 2021, at 3,722 MW, or 23% of global installed capacity.”

CHOAJOURNAL-APRIL2023I43

According to the DOE’s GeoVision analysis, geothermal power generating capacity could be built up to 60 GW by 2050 assuming a streamlined regulatory and permitting process, aggressive technology advancements, and cost reductions (especially for EGS).

Figure 30 illustrates the pace of US geothermal electrical generation capacity additions since 1971. It shows a steep ramp in geothermal capacity in the 1980s which followed the creation of the Geothermal Steam Act of 1970, the Geothermal Loan Guarantee Program in 1974, and the formation of the Department of Energy in 1977

CHOAJOURNAL-APRIL2023I44

The 1980s boom in geothermal capacity was largely related to the development of California’s Imperial Valley and Salton Sea field and the demonstration of binary cycle power generation, which further gave rise to developments in Hawaii, Nevada, and other regions. Geothermal capacity growth slowed significantly in the 1990s until the early 2000s – likely given an era of cheap energy as real power prices (inflation-adjusted) declined from the early 1980s through 2000; per EIA data, the average US retail power price, in real terms, peaked in 1985 at roughly $0 21/kWh (in July 2022 dollar terms) and declined steadily to a low of roughly $0.14/kWh in 2002 before stabilizing. A period of renewed growth began at roughly the same time as the introduction of the 2005 Energy Policy Act, which amended the Geothermal Steam Act of 1970 and set new royalty and lease structures and provided production incentives and research funding for geothermal projects.

US Regulatory Regime

Geothermal Resource: The Geothermal Steam Act of 1970 defined geothermal resources as: 1) all products of geothermal processes – indigenous steam, hot water, and hot brines; 2) steam and other gases, hot water, and hot brines resulting in fluids artificially introduced into geothermal formations; 3) heat or other associated energy found in geothermal formations; and 4) any by-product derived from the aforementioned. Any minerals found in solution with the geothermal resource, which are not economic to produce on their own, are considered by-products under the Act

Resource Ownership and Access: Lands subject to geothermal leasing include: 1) public, withdrawn, and acquired lands; 2) national forests or other lands administered by the Department of Agriculture through the Forest Service; and 3) lands that have been conveyed by the US subject to a reservation to the US of the of the geothermal resources therein – in effect, all land managed by the Bureau of Land Management. In 2019, this represented about 40% of the total US geothermal energy generated

CHOAJOURNAL-APRIL2023I45

The remainder of geothermal capacity is installed on a combination of private land and land that is managed by a state. A developer must agree with the owner of surface rights before development begins, whomever the party Next, if the subsurface rights reside with the landowner, that must also be agreed upon; otherwise, the developer must apply with the appropriate governmental body – federal or state.

Oversight, Licencing and Enforcement: Oversight and licencing is based on the rightsholder. In the exploration/testing stage, a surface owner must give permission if the land is privately owned; otherwise, the respective state or the BLM (for federal land) must grant a lease A developer must also obtain a permit from the state’s water resources administration. When the field undergoes development and moves towards the operational stages, the project proponent must apply with the EPA to obtain a permit for reinjection into a geothermal resource. Additionally, all geothermal projects must have a separate environmental review under the National Environmental Policy Act at the exploratory stage and prior to the utilization of the resource.

Royalties: Royalties are governed by the Geothermal Steam Act of 1970, amended by Sec. 224 of the Energy Policy Act of 2005. During the first 10 years of production, 1.0%-2.5% of gross proceeds from the sale of electricity are due. After that period, this range increases to 2.0%-5.0%. Half of the total royalties collected are paid to the state, 25% to the county, and 25% to the U S Treasury Rents on competitive geothermal leases under the scope of the Geothermal Steam Act of 1970 are calculated at a rate of US$2/acre on the first year of the lease, increasing to US$3/acre for years 2-10 and US$5/acre thereafter. By-products from the production of brine are subject to the Mineral Leasing Act.

CHOAJOURNAL-APRIL2023I46

The remainder of geothermal capacity is installed on a combination of private land and land that is managed by a state. A developer must agree with the owner of surface rights before development begins, whomever the party Next, if the subsurface rights reside with the landowner, that must also be agreed upon; otherwise, the developer must apply with the appropriate governmental body – federal or state.

Oversight, Licencing and Enforcement: Oversight and licencing is based on the rightsholder. In the exploration/testing stage, a surface owner must give permission if the land is privately owned; otherwise, the respective state or the BLM (for federal land) must grant a lease A developer must also obtain a permit from the state’s water resources administration. When the field undergoes development and moves towards the operational stages, the project proponent must apply with the EPA to obtain a permit for reinjection into a geothermal resource. Additionally, all geothermal projects must have a separate environmental review under the National Environmental Policy Act at the exploratory stage and prior to the utilization of the resource.

Royalties: Royalties are governed by the Geothermal Steam Act of 1970, amended by Sec. 224 of the Energy Policy Act of 2005. During the first 10 years of production, 1.0%-2.5% of gross proceeds from the sale of electricity are due. After that period, this range increases to 2.0%-5.0%. Half of the total royalties collected are paid to the state, 25% to the county, and 25% to the U S Treasury Rents on competitive geothermal leases under the scope of the Geothermal Steam Act of 1970 are calculated at a rate of US$2/acre on the first year of the lease, increasing to US$3/acre for years 2-10 and US$5/acre thereafter. By-products from the production of brine are subject to the Mineral Leasing Act.

CHOAJOURNAL-APRIL2023I47

ALBERTA, CANADA

While well-mapped and well-supplied with energy services companies and equipment, Alberta’s potential for geothermal is limited given the current state of geothermal technology. The main issue lies with subsurface temperatures –the temperature gradient is not conducive to the production of hot brine from shallower depths. Second, the price of electricity in the province is very low given the availability of fossil fuels.

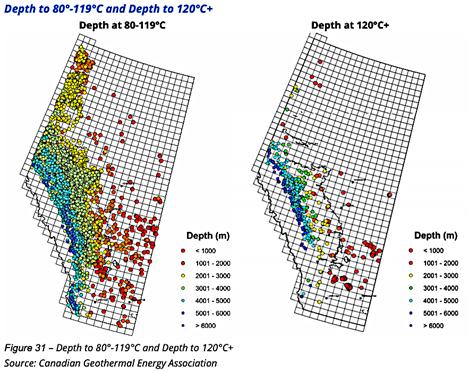

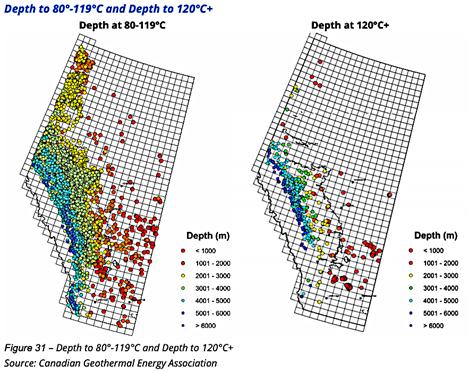

Nonetheless, Alberta could potentially support the use of geothermal for direct use applications, including district heating or in industrial processes, and perhaps low-grade electricity generation. The Canadian Geothermal Energy Association (CanGEA) has published maps that show the depth required to attain certain temperatures (see Figure 31).

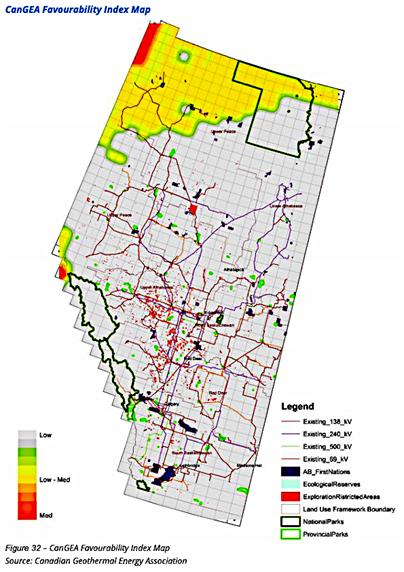

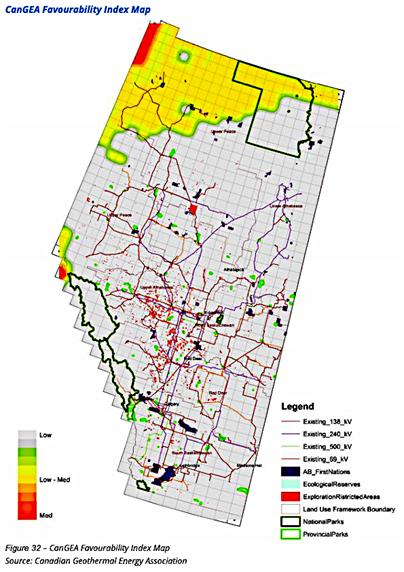

These maps illustrate that there is significant potential for geothermal resource development for ORC binary plants in the western portion of the province, with some clustering around the Greenview/Grande Prairie area – which is the area targeted by Terrapin with its Alberta No.1 project. Eavor also placed its EavorLite demonstration project near Rocky Mountain House in the west. While the east appears attractive based on depth to temperature, these areas are not considered favourable by CanGEA, which we believe is likely due to demonstrated low flow rates. CanGEA’s favourability map shows the areas where development is most likely (see Figure 32).

CHOAJOURNAL-APRIL2023I48

Alberta Regulatory Regime

In October, 2020, Alberta introduced Bill 36: The Geothermal Resource Development Act (GRDA), which came into force in June 2022 and amended certain items within the existing Mines and Minerals Act. The GRDA established a regulatory framework for geothermal developments in Alberta, including provisions related to defining resources and royalties, resource use and ownership, minimum well design features (casing, blowout prevention, etc.) and abandonment, licensing, liability, and oversight Additionally, the GRDA led to the release of AER Directive 089: Requirements for Geothermal Resource Development, which specifically notes that many of the requirements for geothermal development are the same as for oil and gas development

CHOAJOURNAL-APRIL2023I49

CHOAJOURNAL-APRIL2023I50

Geothermal Resource and Royalties: The GRDA defines geothermal resources as natural heat from the Earth that is below the base of groundwater protection. Under the amendment to the Mines and Minerals Act, geothermal royalties are payable to the Crown for reservoirs that are property of the Crown, similar to oil and gas royalties, though we were not able to determine royalty rates at this time.

Resource Ownership and Access: In Alberta, the title to geothermal resources is held through the mineral title as set forth by the Mines and Minerals Act. We understand that roughly 80% of mineral titles in Alberta are held by the Crown, while 20% are held freehold. For freehold titles, some may have parsed mineral rights for different resources, and, as a result, those seeking geothermal development may be required to gain approval from all bearers of mineral rights at a location.

Oversight, Licencing, and Enforcement: Similar to the Oil and Gas Conservation Act (OGCA), the GRDA assigns the Alberta Energy Regulator (AER) as the primary oversight authority in charge of exploration and development activities and gives it authority to make rules regarding licensing, environmental, and operational aspects including operating standards, environmental standards, suspensions, abandonments and reclamations, and monitoring and gives it certain enforcement capabilities In addition to the GRDA, geothermal developments may be subject to environmental laws as prescribed under the Water Act and the Environmental Protection and Enhancement Act, though we understand that the Water Act includes an exemption for saline groundwater, which likely covers the majority of geothermal resources.

CHOAJOURNAL-APRIL2023I51

The One & Only CHOA STAMPEDE FREESTYLIN’ PARTY!

We invite you to enjoy an evening of music, activities, and networking. We organize the party within the party for you and your valued clients

Where: The Hotel Arts – The Freestyle Social Club

When: July 6th, 2023, 3:30 – 6:30 PM, MT

Your ticket includes hot and cold appetizers and access to the cash bar. Drink tickets are available for purchase at the door

Grab your hats and boots and join us on July 6th! REGISTER HERE

CHOAJOURNAL-APRIL2023I52

SASKATCHEWAN, CANADA

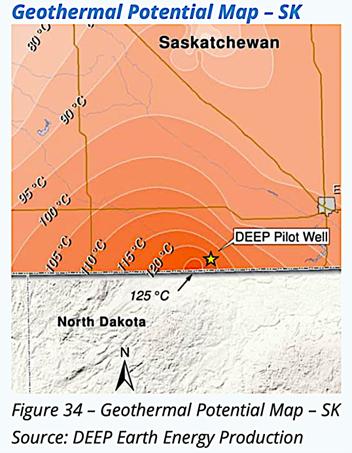

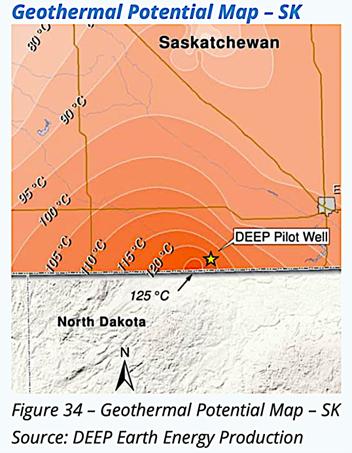

Apart from the south-central region of Saskatchewan, the province has a relatively low-grade geothermal resource. Saskatchewan has no current operational geothermal power generation capacity, though DEEP Earth Energy is pursuing a project to become Canada’s first major geothermal power producer.

CHOAJOURNAL-APRIL2023I53

Saskatchewan Regulatory Regime

Among the jurisdictions we looked into, Saskatchewan has the least-formallydeveloped regulatory regime as it relates to geothermal development. Within the province, there exists no specific geothermal legislation – instead, wells are regulated by a combination of sources, which we believe at least includes the Mineral Resources Act (MRA), the Oil and Gas Conservation Act (OGCA), and the Water Security Agency Act (WSAA). Despite the clarity in legislation, Saskatchewan empirically is further along the development path than Alberta, which may be the result of a better geothermal resource and/or a supportive government Ultimately, applications for geothermal projects are submitted to the Integrated Resource Information System (IRIS) for the Ministry of Energy and Resources to review.

Geothermal Resource: Under all applicable legislation, there is no reference to geothermal resources or development. However, the MRA considers any opening in the ground that obtains water to inject into an underground formation to be a well. Furthermore, given the potential for lithium brine extraction in certain Saskatchewan-based developments, geothermal wells fall under the purview of both the OGCA and the WSAA.

Resource Ownership and Access: To develop a well, surface rights must be obtained from the pertinent freehold landowner. If brine is being extracted for supplemental revenue streams, mineral rights substantially reside with the Crown and are subject to public offerings. Resource developers must participate in a competitive bid process to obtain these rights. Meanwhile, the right to use all groundwater is vested in the Crown – which adds a water licensing requirement for effectively all geothermal developments that use water as a working fluid.

CHOAJOURNAL-APRIL2023I54

Oversight, Licencing and Enforcement: The Ministry of Energy and Resources oversees any mineral extraction activity. Beyond issuing licences, the minister has a wide range of powers that include – but are not limited to – implementing incentive programs for economic development, prescribing fees paid for information or services, or, with the approval of the Lieutenant Governor in Council, entering into agreements to purchase/sell any primary production in Saskatchewan Outside of mineral rights, the Oil and Gas Conservation Board investigates matters pertaining to the OGCA and oversees the protection of the environment. Lastly, the Water Security Agency has the power to issue Water Rights Licences. Each organization listed has the right to investigate any property where rights have been granted and impose penalties and fines in instances of non-compliance

Royalties: There is no royalty framework in Saskatchewan at the moment. However, mineral royalties exist, subject to a 10-year royalty holiday and an exemption until a payer has recovered 150% of its initial costs of exploration and development. The applicable rate is 5% of precious metals sales less than 1,000,000 troy ounces and 10% beyond that threshold.

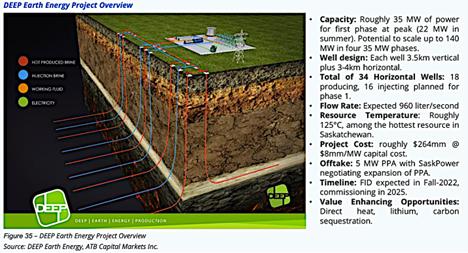

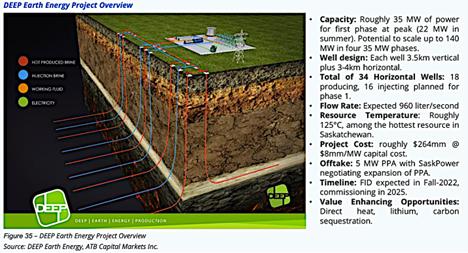

Case Study:

Saskatchewan’s DEEP Earth Energy Likely to be Canada’s First Major Geothermal Producer

DEEP Earth Energy Production aims to become the first major geothermal power producer in Canada. The Company’s vision is to build out 140 MW of geothermal power and direct heating infrastructure in a series of scalable and repeatable 35 MW phases utilizing hot aquifers (roughly 125°C) in SE

Saskatchewan’s Williston Basin, targeting the Deadwood formation.

CHOAJOURNAL-APRIL2023I55

DEEP is currently developing its first 35 MW power plant (minimum 20-25 MW during summer). At roughly $8 mn per MW, we calculate a total capital cost for the initial phase to be roughly $280 mn The initial phase will produce hot brine from 18 purpose-drilled horizontal production wells producing at roughly 960 litres/second, reinjecting cooled water into 16 horizontal injection wells. As currently designed, DEEP will drill long-reach horizontal wells each expected to have a lateral length between 3,0004,000 m and at a vertical depth of roughly 3,500 m – when completed, these wells will be among the deepest wells ever drilled in Saskatchewan. The associated power plant will utilize ORC (binary cycle) technology to generate power.

CHOAJOURNAL-APRIL2023I56

The project was slated for a final investment decision (FID) by the fall of 2022 and it will likely coincide with a pending expansion of DEEP’s current 5 MW Power Purchase Agreement (PPA) with SaskPower (the regional utility) to meet the roughly 35 MW capacity of DEEP’s first phase.

Following a successful FID, DEEP is targeting a 2025 commissioning for its initial phase development In addition, DEEP is also looking to secure additional funding past the roughly $59 mn currently raised. DEEP has engaged GeothermEx, a Schlumberger company, as a consultant through the feasibility and FEED stages of the project, and GeothermEx will review DEEP’s subsurface engineering work DEEP notes that GeothermEx is a global authority on geothermal due-diligence, and the GeothermEx report is the “gold standard for geothermal investments”, leading to over US$14 bn in cumulative geothermal project investments representing roughly 8.5 GW of power capacity globally.

CHOAJOURNAL-APRIL2023I57

DEEP illustrates the diverse sources of funding available to geothermal projects. While the company is not public and does not file any financial statements, public sources show that the initial plant has received funding from the following sources:

Emerging Renewable Power Program: $27.6 mn grant for delineation work

Energy Innovation Program: $0 35 mn grant for research, development, and other activities

Innovation Saskatchewan: $0.2 mn grant for research and development

SaskPower and Natural Resources Canada: $2.0 mn grant towards prefeasibility studies

PHX Energy Services Corp.: $3 0 mn equity, with provision for $3 5 mn upon warrant exercise

Unnamed private equity investor: $25.4 mn equity over the past two years (as of September 2021)

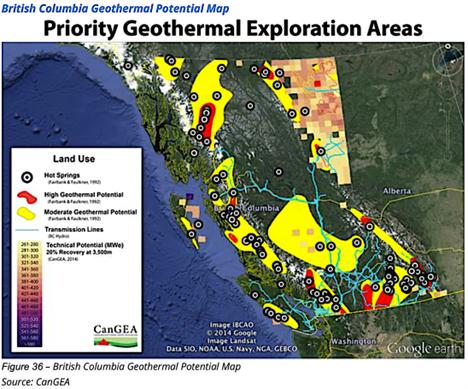

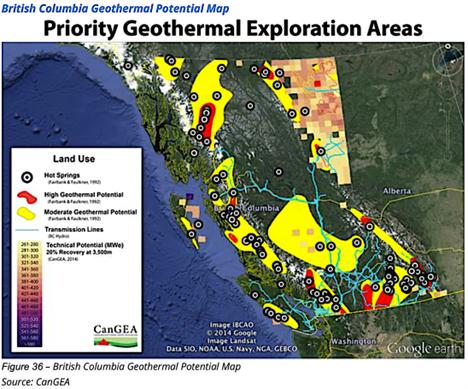

BRITISH COLUMBIA, CANADA

British Columbia has a variety of areas with medium- and high-quality geothermal resource potential. Despite this resource, there are only a few proposed geothermal developments in the province that we are aware of – the most notable of which is the 7-15 MW Tu Deh-Kah Geothermal project (formerly known as the Clark Lake Geothermal project) near Fort Nelson, BC

CHOAJOURNAL-APRIL2023I58

British Columbia Regulatory Regime

BC has a long-standing regulatory framework for geothermal resource development that is administered under the Geothermal Resources Act (GRA), which has been in place since 1996. The GRA addresses issues related to defining resources, resource use and ownership, licensing, liability, and oversight.

CHOAJOURNAL-APRIL2023I59

Geothermal Resource: Unlike Alberta’s GRDA, the GRA casts a wider net when it defines geothermal resources. Essentially, the definition includes any substance that is heated by the natural heat of the Earth regardless of depthdepth as long as it is 80°C or higher, including water, steam, and water vapour, and it includes dissolved substances in any of the aforementioned conduits, but it excludes hydrocarbons As such, lower temperature geothermal resources (below 80°C) would likely fall under the Water Sustainability Act (2014), which does not have a prescribed regulatory framework for geothermal developments.

Resource Ownership and Access: Unlike Alberta, ownership in geothermal resources in BC is held and vested by the provincial government, and they are thus solely allocated by the provincial government – all geothermal resource developments in BC must seek a lease from the provincial government In contrast to Alberta, geothermal resource developments in BC do not need to obtain mineral resource rights. In terms of surface facility and access rights on Crown land, a development may seek authorization through the BC Oil and Gas Commission (BCOGC), and for private lands, developments would be required to make private access agreements or seek a right of entry order from the Surface Rights Board if a private negotiation is not possible.

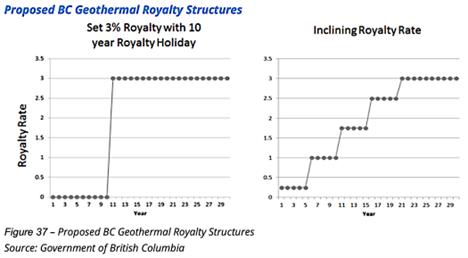

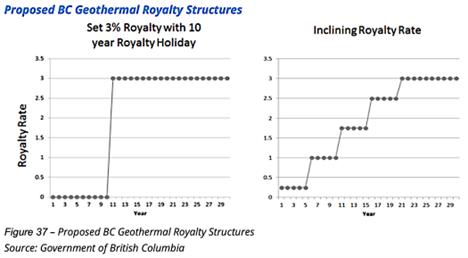

Royalties: The GRA also outlines that royalties and/or unitization will be paid to the provincial government – royalties may be negotiated with the government or, if not negotiated, would default to the prescribed rate. While the royalty framework continues to be developed, the BC government has published a royalty policy proposal which puts forth two potential royalty structures First, a 3% royalty rate following a 10-year royalty “holiday” period, and alternatively, an inclining royalty rate which begins at 0.25% and increases by 0.75% at five-year intervals to a maximum 3% rate (see Figure 37).

CHOAJOURNAL-APRIL2023I60

Oversight, Licencing, and Enforcement: The BCOGC has responsibility for oversight of activities involved in the production and injection of geothermal water, related pipelines, and associated facilities. After participating in a competitive bidding process for subsurface tenure from the Ministry of Energy, Mines and Low Carbon Innovation, project partners must apply to the BCOGC for permission to drill a geothermal well. Additionally, the Ministry of Forests, Lands, Natural Resource Operations and Rural Development has delegated its role in regulating access to land and other protective actions to the BCOGC.

INTERNATIONAL

Global Build-Out Yet to Hit Stride: There are pockets of the world where geothermal makes up a larger share of the power generation mix, but geothermal has not been built out at an appreciable scale globally.

CHOAJOURNAL-APRIL2023I61

At the end of 2021, there was roughly 15 GW installed worldwide, which covered less than one percent of the roughly 22,848 TWh of electricity consumed in 2019 (IEA estimate). Moreover, only 29 countries had any geothermal capacity installed – though ThinkGeoEnergy estimates that number could reach 82 with ongoing and planned development

According to ThinkGeoEnergy and IGA, there is roughly 200,000 MW in potential power generation capacity if low-grade heat and EGS are utilized (see Figure 38), suggesting that there is significant room for further development.

CHOAJOURNAL-APRIL2023I62

This is the final article in a series on how Geothermal Energy can impact the energy industry and net-zero transition. We hope you have enjoyed this comprehensive review of this topic, brought to you by CHOA and ATB Capital Markets Inc.

CHOAJOURNAL-APRIL2023I63

CHOAJOURNAL-APRIL2023I64

Atoms together, At Last: recent Fusion Energy Breakthrough

By CHOA Editorial Committee

By CHOA Editorial Committee

CHOAJOURNAL-APRIL2023I65

NUCLEAR FUSION BREAKTHROUGH

Nuclear Energy and Oil and Gas

Nuclear energy has entered the Canadian oil and gas conversation, as producers look for ways to follow through on their ambitious climate goals. Most of this conversation centers on the Small Modular Reactor (SMR), a design concept that could be used to produce zero-carbon heat and power for oil sands use.

"Absolutely, we are looking at SMRs as a low or no-emission source of the high temperature heat we need," said Martha Hall Findlay, chief climate officer for Suncor Energy Inc.”

Many people have heard of nuclear power but are unsure of how the energy is created There are two main ways to create nuclear energy, both of which use the binding power of protons and neutrons to release a large amount of energy.

Nuclear Fission

The first process, fission, occurs when high speed neutrons collide with a heavy atom, in most cases uranium-235. This causes the heavy atom to split into lighter elements, releasing extra neutrons and a large amount of energy This energy is then typically used to heat water, creating steam which is used to drive a turbine and produce electricity. The heat could also be used directly in an industrial process, like creating steam for SAGD. Elements like uranium are used for fission because atoms are large and split apart relatively easily Fission is responsible for all commercial nuclear power generation today.

Nuclear Fusion

Conversely, fusion occurs when two lighter atoms combine to form a larger atom. Fusion is also accompanied by a large release in energy. Most fusion experiments and technology use hydrogen isotopes (deuterium and tritium) which are combined under extreme heat and pressure to produce the heavier element helium, a single neutron, and energy. This is the same reaction that occurs in the sun.

CHOAJOURNAL-APRIL2023I66

Fusion has some important advantages over fission: it releases several times the energy generated by fission and does not create radioactive by-products. However, the process is extremely complex and is only at a laboratory-stage of readiness Experiments today require large amounts of energy to initiate the fusion reaction, and it’s difficult to control or recreate.

Recent Fusion Breakthrough: a Net Energy Gain

Fusion development marked a major milestone on December 5, 2022, when researchers at the National Ignition Facility (NIF) in California created a nuclear fusion reaction that produced more energy than it consumed, a “net energy gain.” Achieving this was a long-awaited step towards using fusion to produce power.

NIF used a form of nuclear fusion called inertial confinement fusion A cylinder containing a pellet/capsule of hydrogen isotopes is shot with 192 high-energy lasers and heated to 3 million degrees Celsius. This heats the outer layer of the pellet, which explodes outwards generating an inward-moving compression front, or implosion, that compresses and heats the inner layers of the pellet Theoretically, this energy can then create a chain reaction with neighboring pellets. NIF did this experiment with a single pellet.

. CHOAJOURNAL-APRIL2023I67

Implications for the Canadian Oil and Gas Industry?

This is a huge accomplishment, but what does this mean for the Canadian oil and gas industry, and is nuclear fusion now ready to power our facilities? Not quite The “net energy gain” only reflects the amount of energy that entered and left the capsule. The actual amount of energy required to power the lasers was almost 100 times greater than the amount of energy that left the capsule Further, the current facility only fires once per day. It is estimated that to make this a feasible power source, the reaction will need to occur 10 times per second. The first step was achieving the ignition, and now it needs to become more efficient and repeatable. “This was one capsule, one time ”

Overall, this is regarded as a great scientific achievement, but there is still no known date of when fusion will be utilized as a reliable power source The goal of the NIF is to understand how fusion works and behaves but not to make it economically viable

The Fusion Timeline: a Few Decades?

When the director of the NIF was questioned on how long it will be until Inertial Confinement Fusion will be a feasible power solution, her response was “Probably decades not six decades, not five decades, which is what we used to say. I think it’s moving into the foreground and probably, with the concerted effort of investment, a few decades of research on the underlying technologies could put us in a position to build a power plant.”

CHOAJOURNAL-APRIL2023I68

THE VIEW FROM GÖKHAN: CO2