THE NEW GENERATION

TIME FOR BUSINESSES TO DITCH WI-FI AND SWITCH TO 5G

HERE ARE FIVE BAD HABITS IN INSURANCE THE FUTURE OF BANKING COULD LIE IN THE METAVERSE

FINTECH FUNDING SLOWS AS COVID’S DIGITAL HYPE FADES HOW RETAIL STORES CAN REVAMP CUSTOMER EXPERIENCE BY GOING ‘PHYGITAL’

Issue No. 02 Display to June 30, 2023 The Asian Business Review

More insights. More business. Your business trends, on your mobile. Now you know. OCBC Business app. OCBC Business Banking Download the OCBC Business app now. Apple, the Apple logo and App Store are trademarks of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC. ASEAN Best SME Bank, 2022 Asian Banking & Finance Best SME Bank in Southeast Asia, 2022 Alpha Southeast Asia Best SME Bank in Asia-Pacific, 2023 Global Finance Asia-Pacific’s Best SME Bank

The Asian Business Review is a regional magazine serving Asia’s dynamic business community. Essential coverage includes the economy, investment, manufacturing, technology, travel, and trade. It offers fresh perspectives and ideas to guide its readers through the challenges and complexities of their businesses, providing opinion and analysis on all areas of business to improve performance.

PUBLISHER & EDITOR-IN-CHIEF Tim Charlton

PRINT PRODUCTION EDITOR

COPY EDITOR

PRODUCTION TEAM

FROM THE EDITOR

COMMERCIAL TEAM

GRAPHIC ARTIST

Jeline Acabo

Tessa Distor

Noreen Jazul

Djan Magbanua

Frances Gagua

Charmaine Tadalan

Consuelo Marquez

Vann Villegas

Janine Ballesteros

Jenelle Samantila

Simon Engracial

ADVERTISING CONTACT Aileen Cruz aileen@charltonmediamail.com

Reiniela Hernandez reiniela@charltonmediamail.com

ADMINISTRATION ACCOUNTS DEPARTMENT accounts@charltonmediamail.com

ADVERTISING advertising@charltonmediamail.com

EDITORIAL asianbusinessreview@charltonmedia.com

SINGAPORE

Charlton Media Group 101 Cecil St. #17-09 Tong Eng Building Singapore 069533 +65 3158 1386

HONG KONG

Charlton Media Group Hong Kong Ltd Room 1006, 10th Floor, 299QRC, 287-299 Queen’s Road Central, Sheung Wan, Hong Kong www.charltonmedia.com

PRINTING

Asia One Communications Group 13/F, ASIA ONE TOWER, 8 FUNG YIP STREET, CHAI WAN, HONG KONG

TEL: (852) 28892320 | FAX: (852) 28893837

Email: adriantsui@asiaone.com.hk | URL: www.asiaone.com.hk

Can we help?

Editorial Enquiries: If you have a story idea or press release, please email our news editor at asianbusinessreview@charltonmedia.com To send a personal message to the editor, include the word “Tim” in the subject line. Media Partnerships: Please email asianbusinessreview@charltonmedia.com with “partnership” in the subject line.

Subscriptions: Please email subscriptions@charltonmedia.com.

The Asian Business Review is published by Charlton Media Group. All editorial contents are copyrighted and may not be reproduced without consent. Contributions are invited but copies of all work should be kept as The Asian Business Review can accept no responsibility for loss. We will however take the gains.

Sold on newstands in Singapore, Malaysia, Hong Kong, London, and New York. Also out in sbr.com.sg with online readership of 215,000 monthly unique visitors*. *If you’re reading the

The times are indeed changing, and so are the behaviours of consumers and employees and their expectations from business providers. Adopting flexible working conditions is notably slower in APAC than in other regions due to lower levels of managerial trust. Paul Seow, Associate Director at Asia Pacific Total Workplace, explains why now is the perfect time to reconcile that gap between the executors on the ground and the C-suites in an interview on page 12. Meanwhile, ANEXT Bank’s CEO Toh Su Mei talks about the role that digital banks play in staying ahead of SMEs’ financial needs in an interview on page 24.

When businesses rely on Wi-Fi, they are at risk of not being able to make fast and accurate decisions in critical situations given its higher latency. John Lombard, CEO of NTT Ltd (Asia Pacific), explains how this risk can be eliminated by adopting a private 5G connection in an interview on page 30.

Innovation is essential for every business. The Asian Business Review honours outstanding companies that showcased innovation for business development at the recent Asian Technology Excellence Awards, Middle East International Business Awards, Middle East Technology Excellence Awards, the Asian Experience Awards, the Asian Export Awards, and the China International Business Awards. See the full list of the esteemed winners on pages 38, 62, 76, 90, and 92.

Read on and enjoy.

Tim Charlton

The Asian Business Review is a proud media partner and host of the following events and expos:

THE ASIAN BUSINESS REVIEW 1

be missing the big picture

small print you may

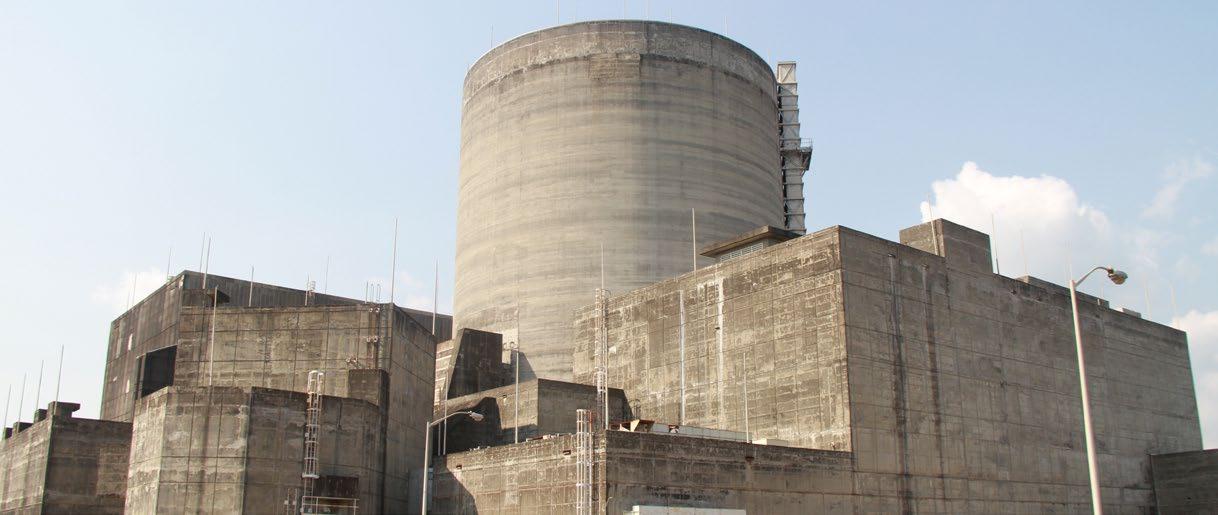

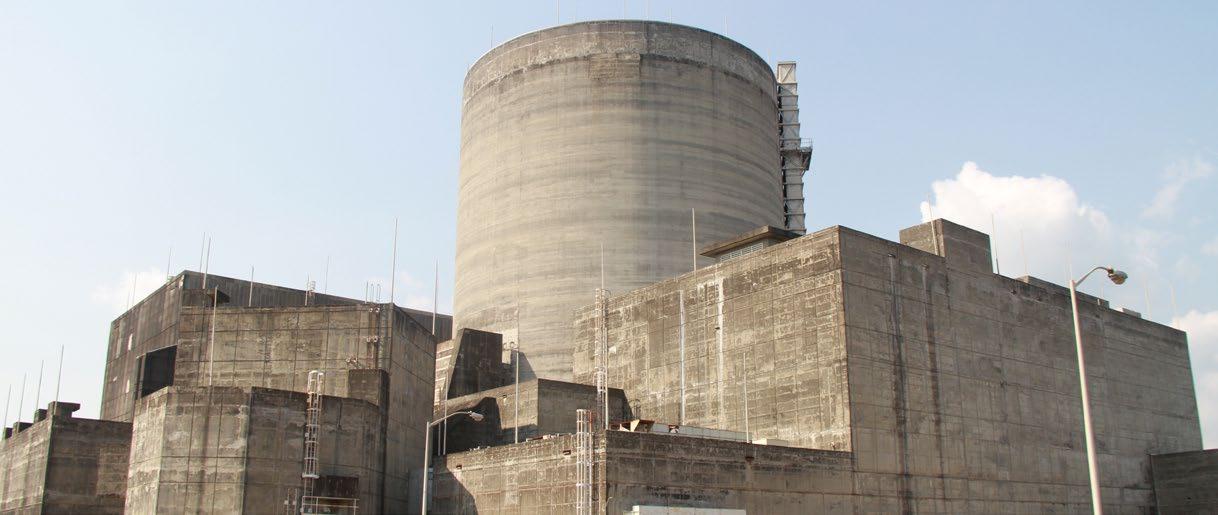

2 THE ASIAN BUSINESS REVIEW SINGAPORE BUSINESS REVIEW | MARCH 2018 CONTENTS Published Biannually by Charlton Media Group 101 Cecil St. #17-09 Tong Eng Building Singapore 069533 For the latest business news from Singapore visit the website asianbusinessreview.com FIRST INTERVIEW FINTECH POWER RETAIL 30 INTERVIEW TIME FOR BUSINESSES TO DITCH WI-FI AND SWITCH TO 5G EVENT 38 Outstanding initiatives recognised at the Asian Technology Excellence Awards 62 Get to know the exceptional winners of the Middle East Awards 2022 76 Innovative, experience-centred initiatives honoured at the Asian Experience Awards 90 Esteemed companies hailed in The Asian Export Awards 2022 92 Take a look at the winners of the China International Business Awards 2022 BANKING & FINANCE THE FUTURE OF BANKING COULD LIE IN THE METAVERSE 16 06 Hospitals launch metaverse clinics as virtual reality healthcare takes off 08 How brands can craft the right ‘Shoppertainment’ 09 SEA consumers see online shopping as ‘integral’ part of life 10 Climate risk-related losses are an increasing challenge for reinsurers 12 Closing gaps between C-suites and workers with flexible workspaces in APAC 24 How to stay ahead of SMEs’ financial needs 26 Tourists now prefer ‘less adventurous’ itineraries 22 Fintech funding slows as COVID’s digital hype fades 28 Southeast Asia’s nuclear energy ambitions dashed by public opinion 20 How brick-and-mortar stores can revamp customer experience by going ‘phygital’ 18 INSURANCE HERE ARE FIVE BAD HABITS IN INSURANCE ACCORDING TO HK’S INSURANCE REGULATOR

Data Center Automa�on

Increase the speed and Agility of Business Services by Automating your data centers networks.

Intent Based Networking automation and orchestration providing all you need to deploy, maintain, and manage your Data Centers networking to act and achieve results faster.

Daily news from Asia

Residential sales to take a hit from banks’ increased fixed-rate home loans

Rising interest rates was amongst factors that led to the crash of home sales in June (-64% MoM). This is why the news of banks in Singapore increasing their fixed-rate home loans—or worse, suspending them— has raised red flags, especially since the market had just gotten out of its “state of pause”.

Conversational commerce levels the playing field for brands online

Fiona Thia, business development director at TMX, was looking for a ring online. She received a message from the brand asking for a photo of her finger to help settle the size and assuring her that if the item did not fit, she can have it exchanged for free. In the end, Thia became one of the brand’s satisfied customers.

Hong Kong’s 10 most influential lawyers under 40 for 2022

Hong Kong’s roster of exceptional lawyers has made the city an irreplaceable legal hub for businesses and high-profile individuals from the Mainland and other parts of the world. Hong Kong Business recognises 10 young lawyers who have raised the bar for legal professionals across all fields in 2022.

‘Mass exchange’ of lawyers push legal firms to review retention strategies

Singapore’s legal industry, similar to those in the US and UK, was hit by the great resignation wave. Many of these lawyers have either moved to other firms or taken in-house positions, resulting in a shortage of mid-level lawyers with four to seven years of Post-Qualified Experience (PQE).

KS Orka’s gradual development model increases geothermal success

When it comes to developing geothermal power plants, the traditional approach can be risky and time-consuming. But Indonesian power plant developer KS Orka has found a solution: the gradual development model. This model enables KS Orka to minimise operational risk and costs.

How Singapore banks are closing the gender gap in hiring

Top Singaporean banks are exceeding projected regional average growth of hiring women in executive positions. Deloitte’s Within Reach series predicted that by 2030, women in senior leadership roles, specifically C-suite, will grow to 20.5%, a moderate increase from 18.5% in 2021.

HUMAN RESOURCES RETAIL BANKING POWER News from asianbusinessreview.com

RESIDENTIAL PROPERTY RETAIL LEGAL MOST READ

Hospitals launch metaverse clinics as virtual reality healthcare takes off

Indian healthcare group Yashoda Hospitals from Hyderabad is the latest healthcare provider to join the metaverse trend by buying virtual land on the platform.

In a statement, the hospital management said this move will allow the healthcare group to render its treatment on the metaverse and even employ metaversians.

Yashoda Hospitals is also the first healthcare group in India to tap the metaverse for its services. Dr. Abhinav Gorukanti, Head of Yashoda Hospitals, said establishing their presence on decentralised land will ramp up their efforts to accept decentralised technology.

“We will continue to upgrade and invest in making our digital infrastructure futureready,” he added, pointing out that the hospital has since been open to adopting digital technology.

UAE healthcare firm starts virtual hospital Other hospitals in Asia also followed suit in the metaverse hype. Thumbay Hospitals, a United Arab Emirates-based healthcare firm,

had announced its plans to create a virtual hospital on metaverse to talk with patients and improve patient experiences.

In a statement from Thumbay.com, the full-fledged virtual hospital will be built in a multi-phased project on a metaverse platform, which will give patients an immersive experience in healthcare. There will be a patient experience centre, a walkthrough of hospital and services, teleconsultation, multiple doctors consulting a case in a virtual clinic, and avatars in the local language and dress to talk to patients in the medical tourism department.

There will also be the “first AID and preventive health programs using AR/VR and AI programs to educate patients and suggest treatment plans.”

Thumbay Virtual Hospital will also provide health tips on inpatient hospital and room experience for elective surgeries, a surgery

that can be done in advance. Under phase one of the Thumbay patient experience, the application will be developed by visualising the Thumbay Medicity.

“The user will be able to create a base avatar. They could customise their avatar based on hair colour and skin tone, which will have two options each. The receptionist at the hospital would greet the users in their native language,” read the statement.

Commenting on the integration of metaverse in its business, Thumbay President Thumbay Moideen said: “We are very excited to take up these initiatives and be in line with the developments of the future and explore all opportunities to develop our core business in Education, Healthcare, Research and Wellness domains.”

Metaverse research in South Korea

A news report showed that a Medical Metaverse Research Society was rolled out through the joint sponsorship of the Seoul National University Metaverse Lab and the Seoul National University Hospital Innovative Medical Technology Research Center Smart ICT Lab.

This research society seeks to promote academically in the prevention, treatment, and management of medical illnesses and ailments through Metaverse innovations. The research society will also back public and private partnerships and industry-academic cooperation and plan to establish a framework for medical metaverse experts via training projects and global academic exchanges.

SEA hospitals

Two Southeast Asian hospitals previously saw big opportunities in using virtual and augmented reality to enhance telemedicine services, with patients one day potentially tapping the metaverse for recovery.

These hospitals, Malaysia-based IHH Healthcare and Indonesia’s Siloam International Hospitals began using telemedicine in 2020 when the severe respiratory disease crisis started.

They also used technology to reach patients hit by stringent health protocols or those living in remote areas. These hospitals also started exploring AI and data analysis to improve patient treatment.

Now, they think virtual reality (VR), augmented reality (AR), and the metaverse will expand into healthcare.

6 THE ASIAN BUSINESS REVIEW FIRST

Yashoda Hospital joins the metaverse. Photo from Yashoda Hospitals website

We will continue to upgrade and invest in making our digital infrastructure future-ready

ASIA PACIFIC

Immersive

Digital Experiences

can bridge the physical and digital gap for tennis and many other organisations.

Infosys helps our clients accelerate their digital journeys, leveraging these capabilities to hyper-personalise and humanise experiences.

Explore AO Experiences here

THE ASIAN BUSINESS REVIEW 7

© 2021 Infosys Limited, Bengaluru, India.

CONSUMERS ARE WILLING TO PAY MORE FOR 'GREEN'

More than 70% of consumers said they are willing to pay higher for products that have a positive impact on the environment or health, Bain & Company reported.

Shoppers in Asia-Pacific led with 90% of consumers who are willing to pay more, followed by European consumers (74%), and American consumers (71%).

Despite this, Bain & Company found that most consumers are not changing their shopping behaviors.

“Inflation is of course making consumers more sensitive to price – but at the same time it’s also encouraging them to revisit deeply engrained consumption habits,” Luciana Batista, a Partner in Bain’s Retail, Consumer Products and Sustainability practices, said.

“This offers a rare opportunity for retailers to disrupt the status quo and encourage circular models that see consumers returning products or reusing packaging for a discount in the future. Combined with greater choice and clear communication at the point of sale, inflation can be a catalyst for more sustainable behaviour.”

Investments

Moreover, the report found that the higher inflation is also worsening the funding gaps challenge retailers face in investing in sustainability.

“A high-risk environment may reduce investment into sustainability in the short term but there is much retailers can do to decarbonise without making significant financial investments,” Luciana also said.

“Energy and waste saving measures can help to reduce costs and exposure to risk in the short term, while more comprehensive commitments are developed.”

How brands can craft the right ‘Shoppertainment’

ASIA PACIFIC

Retailers need to adopt a video-first approach focusing on education and integrating storytelling and even comedy in order to tap the US$1t "shoppertainment" and capture more consumers, according to a report by Boston Consulting Group and social media platform TikTok.

Brands should tell stories and educate. This could be accomplished by telling a story about a certain brand or product and piquing their interest in a way to educate them and integrating comedy to offer entertainment and engagement.

They should also adopt a “videofirst approach” characterised by short content to retain consumers’ attention, and tap influencers that will help amplify your message.

The report also stated the brands should not force decision-making and that their contents should only contain interests and hobbies the consumers can relate to.

“Target good feelings and nostalgic recollections that rekindle excitement, whilst building stories around uplifting and engaging themes,” the report read. Authenticity in content that will inspire others is also vital for brands to have along with credible reviews and open and engaging community conversations. Brands should also recommend trends by including insights from community experts and enable extended conversations between friends and users, and “build them into a strong and trusted culture and following.”

They should also provide clear information about a product that can be accessed easily and properly communicated, and they should also ensure that there is a “clear and intuitive path to purchase.”

Shoppertainment could open $1t opportunity for APAC brands

Brands in the Asia Pacific region can gain $1t in market value by 2025 due to the rise of “Shoppertainment,” according to a report by Boston Consulting Group and social media platform TikTok.

According to the report, Shoppertainment, a content-driven commerce that targets to entertain and educate first whilst integrating content and community, is expected to grow annually by 63%, across markets included in the report.

Target

good feelings and nostalgic recollections that rekindle excitement

Australia, Indonesia, Japan, South Korea, Thailand, and Vietnam were expected to drive significant value opportunities in shoppertainment.

Sam Singh, Vice President of Global Business Solutions for APAC at Tiktok, said this form of e-commerce is another avenue for businesses to tap as consumer habits continue evolving and “people are looking to be delighted online.”

“This presents an opportunity for businesses to embrace Shoppertainment: a content-first approach where brands educate and entertain audiences. Shoppertainment combines content and culture and commerce in a seamless way, allowing brands to engage with audiences throughout the purchasing journey without overtly selling,” Singh said.

“This allows brands to meet both functional and emotional needs, thereby building stronger and longer relationships,” he added.

8 THE ASIAN BUSINESS REVIEW FIRST

‘Shoppertainment’ should tell a story and be authentic

ASIA PACIFIC

Sam Singh

SEA consumers see online shopping as ‘integral’ part of life

Atotal of 73% of Southeast Asian consumers are now considering shopping online to be “integral to everyday life,” according to a report by Lazada.

In a statement, Lazada said it Regional eCommerce Consumer Study conducted with Milieu Insight also showed that nearly 60% of the consumers welcomed online shopping as part of their daily life only less than two years ago.

“Digital commerce has changed the way people shop in the past decade, especially in the last two years with the pandemic

accelerating the shift towards online retail. Such changes are showing a lasting effect, especially in emerging markets,” James Chang, Chief Business Officer of Lazada Group said.The report also showed that 67% of online shoppers in the region identified eCommerce Mega Campaigns such as 11.11 and 12.12 sales as a key factor in shaping the consumer buying behaviour.

The study also found that low prices and affordable shipping are the top reasons for the consumers’ online purchase, followed by ease of search and convenience, with

55% of consumers from Singapore, 48% from Thailand, and 49% from the Philippines preferring items to be delivered straight to them.

Reviews and rating are also a key factor to a positive shopping experience especially for Singaporean (61%) and Thai (66%) consumers, it said.

Buying authentic products is also a top reason for online shopping in Singapore (54%) and Vietnam (53%), whilst the variety of available payment options are important for Indonesia (54%). Secure payment options, meanwhile, are important for Singapore (53%) and Malaysia (45%).

The Lazada report also showed that consumers in the region are actively choosing items to purchase through digital channels, with 65% saying that they already know where to buy when shopping online.

It also found that 29% of the respondents want an enhanced engagement with the platform through additional browsing for best deals and exploration of the platform for additional items before completing the sale to augment experience.

Due to the pandemic, the priority set on wellness is likely to stay, with 58% of the respondents spending on Health and Beauty categories, it said.

FIRST

Consumers are actively choosing items to purchase through digital channels

SOUTHEAST ASIA

Climate risk-related losses are an increasing challenge for reinsurers

The increased frequency of natural disasters is pushing up the cost of reinsurance as well as the demand for catastrophe protection, according to a report by S&P Global Ratings.

The report highlights that rising catastrophe claims are increasing costs in reinsurance which in turn will inflate the costs for primary insurers, and ultimately, the consumers.

“We expect policymakers in Asia-Pacific will increasingly collaborate with reinsurers, in an attempt to maintain affordability and necessary protection, as well as bolster risk awareness,” WenWen Chen, an Insurance Analyst at S&P Global Ratings.

Climate risk-related losses, especially those caused by weather-related disasters, are a challenge for insurance and reinsurance firms, especially in the pricing mechanism and assessment of pricing adequacy.

In fact, for Asia-Pacific, each year seems to bring outsized natural-disaster claim records to respective jurisdictions related to events such as flooding, drought, and typhoons. Recent examples include the heatwave in China, which interrupted power supply and led to industrial stoppages for some producers, and in Korea, where flooding and typhoon caused record natural disaster costs.

Chen said that surges in claims don't just hit the insurance and reinsurance industry. They have broader social costs.

“Homeowners and businesses face surging insurance premiums--or widening gaps in protection if they can't afford their premiums. Fiscal burdens also rise, as the government foots the bill for social assets and infrastructure losses, clean-up, and other types of remediation. Climate change is also high on the agenda for policymakers,” Chen said. These broader costs are motivating governments to get involved. One recent example is in Australia where heavy flooding in the first quarter of this year caused $3.6b in insured losses, making it one of the costliest natural catastrophes in Asia-Pacific. Natural disasters for three consecutive years have led to surging catastrophe-coverage costs for homeowners in the affected areas.

In July 2022, the Australian government established a reinsurance pool, under the Australian Reinsurance Pool Corp., for cyclone and related flood damage in Northern Australia, backed by a AU$10b government guarantee. This covers residential, strata (or common area) and small business property. Participation is mandatory for property casualty insurers with eligible policies. Large insurers must

participate by 31 December 2023.

“The hope is that the pool will stem some of the inflation in reinsurance cost for primary insurers, and subsequently insurance prices, which will, in turn, will pass on savings to policyholders and prevent coverage gaps from widening,” Chen explained.

Reinsurance in agriculture

Another change that the reinsurance market is facing due to growing natural catastrophes is it has accelerated the agricultural insurance market, especially in emerging Asia. This is further supported by growth prospects in agriculture insurance as well as many policymakers’ initiatives to protect farmers and facilitate such growth.

Many emerging Asian markets have also set up insurance schemes to help build farmers' awareness. These include the National Rice Insurance Scheme established by the Thai government; the rice farming business insurance program in Indonesia; and the public-private partnership on agriculture insurance in the Philippines.

Another example is China which it safeguards farming outputs, by allocating $4.69b (CNY33.4b) to agriculture insurance subsidies in 2021, a 16.8% year-on-year increase. This segment climbed 30% YoY for H1 2022. S&P predicts agriculture insurance in China will continue its rapid growth, likely at 30%-50% over the next two years.

Recent weather events may also motivate farmers to buy more protection. Chen said that policymakers will likely consider widening coverage for agriculture insurance. An intense heatwave and low rainfall in China have led to severe drought in Sichuan and other southwestern locales. Property and casualty (P/C) insurers with large agriculture exposures in these provinces could face swings in their underwriting results. Claims may grow if the drought persists or has more prolonged effects. Sichuan is also in an earthquake zone, compounding its vulnerability.

Long-term solution

According to S&P, technology initiatives will be a must for APAC reinsurers to maintain a home advantage. This is because stakeholders across the value chain will strengthen risk management.

“For primary insurers, this could include using technology to enhance risk assessment, as well as supporting pricing analysis and selection in policy underwriting.

10 THE ASIAN BUSINESS REVIEW FIRST

Governments will link arms with reinsurers to fortify natural disaster defence

Homeowners and businesses face surging insurance premiums– or widening gaps in protection if they can't afford their premiums

ASIA PACIFIC

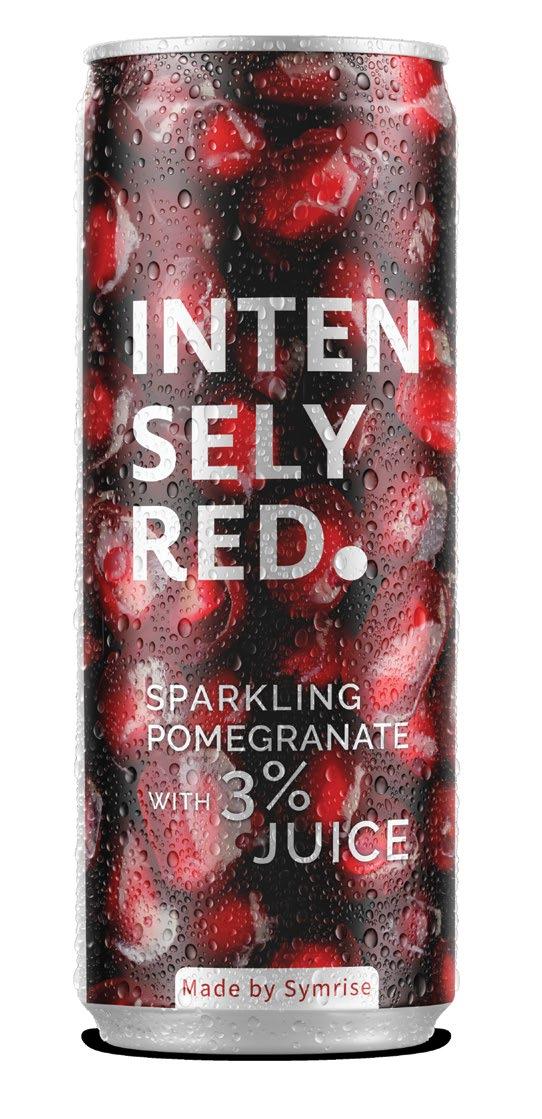

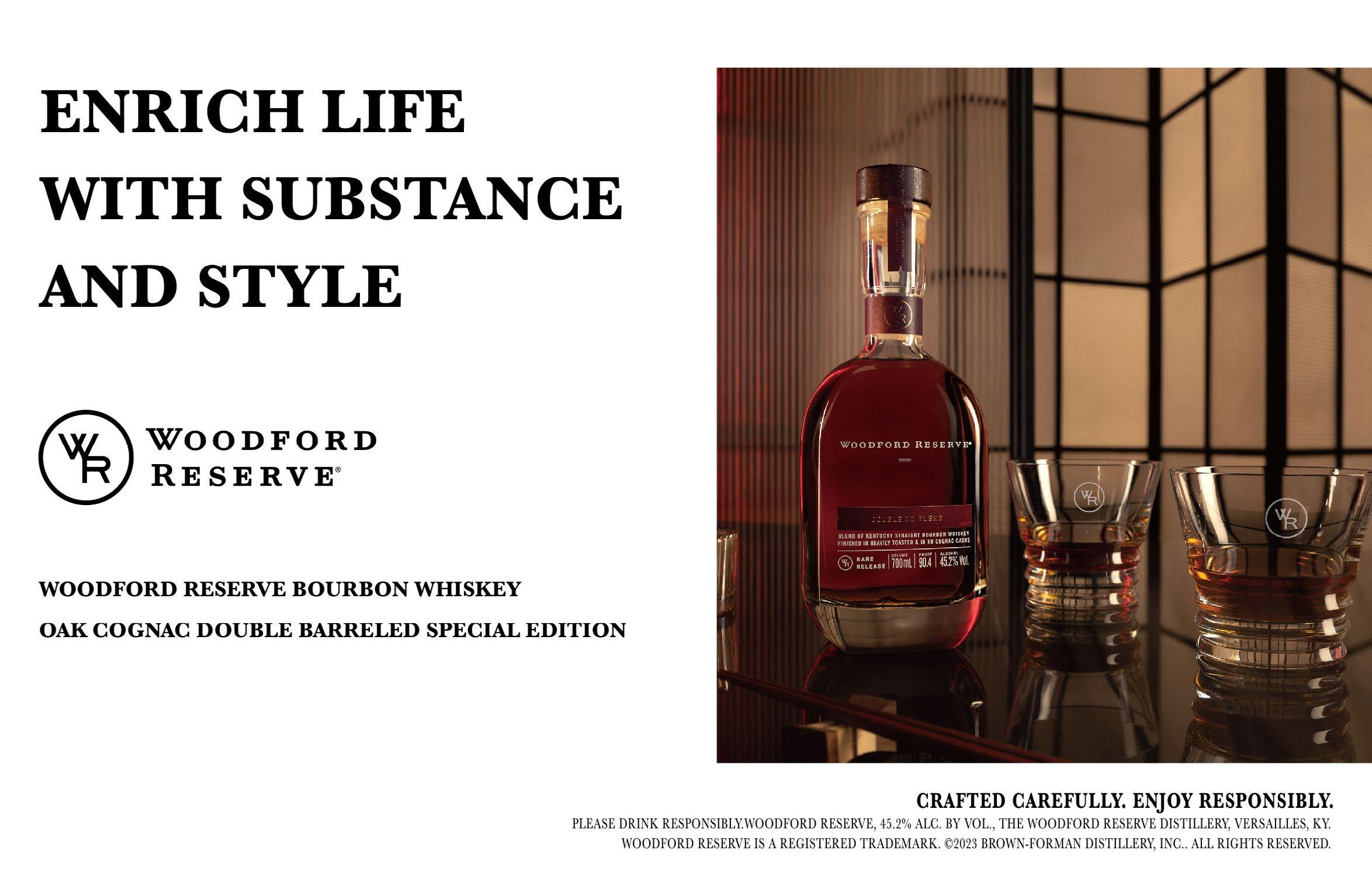

Why Paragon Trading Asia believes the finer

Sustainable and luxury are probably two words that aren’t often seen together but Paragon Trading Asia made it happen by spearheading a different kind of sustainability: one in luxury lifestyle quintessentials.

Established in 2021, Paragon Trading Asia stands on four pillars that most would attribute to wealth: wine, water, whisky, watches, in all of which the company consciously applies sustainability practices.

CEO Christopher Liang, having been an avid collector of the finer things, had the “good opportunity back in 2018, to be part of a corporate finance takeover with an Australian family office to take control of the vineyard which now produces some of the best wines from New Zealand.” This opportunity gave birth to Gladstone Vineyard wines. Established in 1986, the wine label is recognised as a pioneer wine producer in New Zealand and today produces Viognier, PInot Gris, Rose, Pinot Noir, Sauvignon Blanc varieties.

SUSTAINABILITY IN A BOTTLE

The limited production and application of organic principles hugely contribute to the sustainable business.

“We actually produce in boutique volumes every year. And it doesn’t stop us from getting a very good quality rating,” Liang proudly says, after Gladstone Vineyard wines garnered a minimum of 90 points from wine experts Rebecca Gibbs and Robert Parker.

Aside from these, Paragon Trading also boasts to ship wines overseas in 80% recycled, lightweight bottles which reduces the amount of fuel during transport. Across the business, the company also uses recycled office paper, recyclable toners and printer consumables; reuse wine boxes, case dividers, glass, plastic, paper, tins and cardboard in packaging; using environment-friendly cleaning products; and source from local and environment-friendly suppliers where possible. Even the winery’s design maximizes natural lighting as a source of daytime light to reduce energy consumption.

The company is also trying to become a member of as group that supports organic winemaking and organic wine packaging. “We bottle all of our premiere crus with 100% organic cork, and use recyclable or biodegradable glass for a sleek and ESG conscious package” said Liang.

“Regarding the gins and whiskies from Ireland, we are making a move to reduce the use of paper by etching the logos of different

products directly onto the glass of our bottles.” Liang added. Today, Paragon Trading distributes its wine and whiskey through renowned distributors in Asia. including Watson’s wine in Hong Kong, distributors with sector expertise in Europe and the US, and Magnums in Singapore.

PHENOMENAL-BEWATER

Another one of Paragon Trading’s product, an environmentally friendly alternative to plasticbottled water, beWater™, was created to help eliminate single-use plastics and reduce the impact of table water.

a visit to some of these venues every week to talk to them about collecting the used cans, which could be recycled for a nominal sum and benefit from government subsidies,” Liang said.

CIEL WATCHES: THE SKY’S THE LIMIT

Ciel is Liang’s private-label Swiss watch brand and a homage to his passion for the finer and enduring things.

“This is a labour of love and is made up to Swiss horological association standards. I’m trying to promote this amongst a certain segment of the demographic simply because I want to see this memory kept as a collectible,” Liang said.

Ciel, which means ‘sky’ in French, features a moon-shaped second hand, sapphire crystal mechanism with stainless steel case, and highprecision Swiss movement. Only 500 pieces of this limited edition brand circulate worldwide, each uniquely numbered, sold on consignment and upon special dispensation. The natural jewels and authentic Swiss parts are rare even on the high-end market, he claims.

Customers who buy a Ciel watch will receive a “certificate that allows any of our clients who experience technical problems with the watch, to bring it into a Ronda time centre,” two of which are in Switzerland and one in Hong Kong. As the market opens up following COVID-19 restrictions, “We are happy to start promoting select batches of the watch through several multibrand jewelry and watch shops.

BETTER WITH AGE

Catering to an exclusive market will ensure that his products maintain their enduring and high quality, and Liang foresees his products penetrating the upper crust of the Asia Pacific.

“I hope we could improve the connection between different markets so that my stock of very fine wine and spirits could be enjoyed throughout the region.”

“We had created this new concept around 2020, whereby we advocated for the use of aluminium cans rather than plastic bottles as the packaging of choice for the new generation of waters. We managed to get the patent from Ball, a Fortune 500 company that are supportive of our mission and vision. They gave us exclusive rights to package water using aluminium packaging for the next five years in Asia Pacific. This is a big, unique selling point for our waters,” Liang relates.

“Our team of canister collectors would pay

The next phase of marketing involves charitable events and wine tastings in Thailand, Hong Kong, Malaysia, the Philippines, and even Taiwan, supported by a chamber of commerce for wine in Hong Kong, where he sits as chairman.

“It will be nice to host these educational events from time to time as an opportunity for people to mingle and to try our latest vintages, but also to become a loyal member of Paragon Liquors.” Liang said in closing. “The good news is, I’ve got time on my side. I’ve got products that only get better with age.”

THE ASIAN BUSINESS REVIEW 11

Luxury and sustainability meet over a CEO’s passion for the exquisite and drive for change.

things in life should be sustainable

-CL CO-PUBLISHED CORPORATE PROFILE

PASSION, STRENGTH AND HONOUR. TASTEFULLY DISTILLED IN EVERY DROP OF OUR QUALITY CREATIONS.

INTERVIEW

Closing gaps between C-suites and workers with flexible workspaces in APAC

Flexible work adoption is slower in the Asia Pacific due to lower levels of managerial trust.

Adopting flexible working conditions is notably slower in Asia Pacific compared to other regions across the globe. This may cause concerns because it is unlikely that the world will revert to the old ways of doing work, real estate analysts said. In its Asia Pacific Office of the Future Revisited report, Cushman & Wakefield found that the shift to flexible working is much more pronounced in North America with more than 50% wanting to attend the office “3 days a month or less,” as compared to 20% in Asia Pacific, though there is intraregional variance.

“Whether you were ready for it or not, the pandemic has changed the world, more so the corporate real estate, and office culture. [Companies] need to listen to the employees and [employees, in turn, really need to] understand why the office is going to be important in the future,” Paul Seow, Associate Director, Asia Pacific Total Workplace, told the Asian Business Review

“It is the perfect time to reconcile that gap between the executors on the ground and the C-suites.”

Cushman & Wakefield tried its hand at reimagining the office of the future after moving into CapitaSpring, with the destination office exuding the same vibe as the best bars in Singapore, as well as transforming its C&W Services Singapore’s Chai Chee office into a “living lab of technology and innovation”. Seow noted that in treading this path, the company made sure the office was designed with workers at its centre.

“When we were listening to our employees, we used our proprietary workplace strategy tool Experience per Square Foot,” Seow said.

“Together with focus groups and roundtable sessions, our Total Workplace team got to the gist of what was important for our community, both from a business perspective as well as from an employee experience perspective.”

Can you walk us through some of the preliminary findings of the APAC Office of the Future Revisited report?

There are three major takeaways from our Asia Pacific Office of the Future Revisited report. First, the demand for office space continues to grow in the Asia Pacific markets and this demand will more than offset the impacts of flexible working resulting in ongoing net positive absorption. The predominant migration flow in the Asia Pacific is from rural areas to urban cities, and Asia’s major cities are expected to remain the dominant economic and employment centres in the region.

Second, hybrid working is here to stay; however, the adoption of flexible work practices is slower as compared to the Americas and EMEA. The desire to work flexibly sits in a bit of a spectrum in the different levels between markets. There are markets that have a very strong presenteeism culture in the office, and they are not as familiar with hybrid working and will need greater assistance with change management. Lastly, the evolving role of the office is a confluence of multiple factors that are redefining the role and

Gen Z are way more interested in the purpose

utility of the modern office. With the pandemic being one, it’s a huge driver of digital transformation in organisations. The rise of Gen Z, the first digitally native generation, who by 2026 will account for 25% of the workforce in APAC, and the rise of DEI (diversity, equity, inclusion), ESG (environmental sustainability and governance), and corporate consciousness. All these three are critical in shaping a destination or purposedriven office. Companies that persist with outdated policies, technology, and infrastructure support will increasingly find themselves on the back foot in the war for talent.

The report found that the Asia Pacific region showed lower levels of flexible working. How can this be remedied? The Asia Pacific is a complex geographical region with diverse cultures. Some markets with an ingrained presenteeism culture generally show a high return to the official rate, but very little flexibility or choice for employees. This is further compounded by domestic companies showing higher attendance rates versus multinationals in the same markets. There are several reasons for these variations, including limited space in residential dwellings and infrastructural issues; but it’s interesting to note that markets in the Asia Pacific scored the lowest on the level of managerial trust – that is being trusted by a manager to execute your job with little oversight – and also tend to score very highly in presenteeism

12 THE ASIAN BUSINESS

REVIEW

It is the perfect time to reconcile that gap between the executors on the ground and the C-suites (Photo: Paul Seow, Associate Director, Cushman & Wakefield)

SINGAPORE

of work

culture. Therefore, there needs to be a re-evaluation of how work is changing in the office, the required skill sets and managers to lead hybrid teams, how we deal with performance management and setting baseline behaviours, and the education of employees in embracing a nonlinear workstyle. There must be a multi-pronged concerted effort by companies to redefine their workplace strategy and corporate culture to balance corporate goals and employee needs to land on a solution that works for them.

What is it about Gen Z that is changing the work setup?

I think they are way more interested in the purpose of work. The world has generally changed from the different generations. We used to work to survive, then we worked for prosperity, and then we worked for our children. Now it’s working for a purpose. The purpose-driven office is key to underline all these issues that Gen Z are concerned about, and this, of course, includes DEI and ESG initiatives of employers.

Another finding you’ve shared is that the influence of both DEI and ESG conditions also are included in the workplace. Can you walk us through how this would influence the workplace?

The rising importance of DEI and ESG is not only to employees, but it also reflects good corporate citizenry. The pandemic has drawn a line in the sand for employees, specifically around wellness, health, and the environment. Many companies tack on DEI and ESG policies as an afterthought to what they are doing, but what you need to do is incorporate it from the ground. Understand that an office is

INTERVIEW

not just a place – it’s a tool to drive human experience. It’s the people and their interactions in the space that matter. Having a holistic workplace strategy starts by seeking out landlords and buildings that have a strong base in environmental best practices, and layering that with an inclusive design that supports and expands on the recruitment and development of talent and people with disabilities. And of course, bringing in the technology and policies that enable people to engage and thrive in the built environment. It’s all about listening, empathising, co-creating, and iterating a workplace strategy and programme that fits your company’s and employees’ needs and ambitions.

Are there also specific requirements that a company should look into before shifting to hybrid setups?

Yes, it is important to make sure that the infrastructure and processes support your employees. There’s nothing worse than getting an employee to work from home, but face legacy processes where they still have to visit the office to execute that task. If they need access to specific servers, is that being taken care of via the company’s VPN and technology pieces?

Having the infrastructure in place with adequate bandwidth and licenses for firewalls is key to making sure that employees can execute their work.

Additionally, it is crucial that your employees are ready to make the change. If there is only one thing that companies do, it is to ensure that they build change management into their programmes.

THE ASIAN BUSINESS REVIEW 13 UOB.pdf 1 26/1/23 4:36 PM

The rising importance of DEI and ESG reflects good corporate citizenry

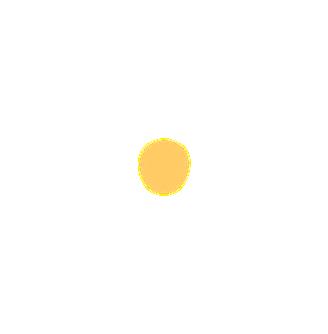

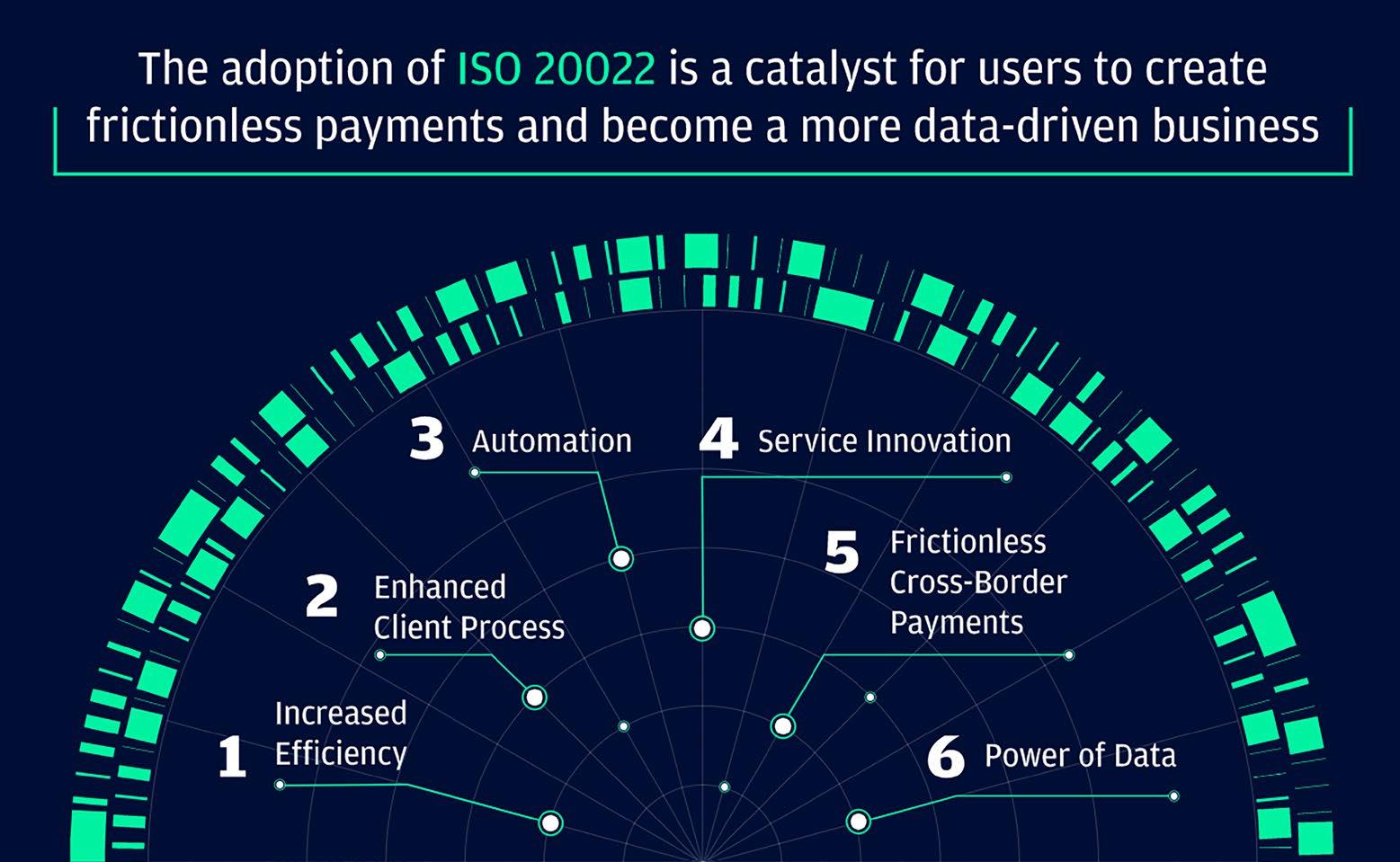

Real-time cross-border payments edges closer to reality with ISO 20022

ISO 20022 is set to become the universal language of payments.

One of the biggest changes in the history of the payments industry is scheduled to set sail in 2023. Come March, banks and financial institutions within the SWIFT ecosystem are mandated to begin steps to fully adopt ISO 20022 guidelines for cross-border payments and cash management messages. The guidelines standardises the language and approach used by financial institutions for real-time payments, whether low or high value, across domestic, regional and international payment flows.

Although it has existed for years, it is only by March 2023 that SWIFT will phase in ISO 20022 as the standard for cross-border payments and cash reporting for all banks and financial institutions under its network. As J.P. Morgan Chase Bank puts it, “ISO 20022 is expected to be the native language of payments by 2025.” Data held by SWIFT supports this sentiment. By 2023, 87% of the total value of high-value payments worldwide are expected to be made up or enabled by ISO 20022-enabled systems; for low-value payments, over half or 65% would be by systems that use ISO 20022, SWIFT’s report estimates.

In terms of volume, almost 8 in 10 high-value transactions worldwide would be making use of the ISO 20022 system, whilst for low value payments, it will be 5 in 10 or 53% of transactions. These figures are just within the year of adoption–which highlight why understanding ISO 20022 is important if relevant players are to consider what the future of payments will look like.

“The key value drivers of ISO 20022 are rich formatting options and the ability to capture structured and unstructured information, which seamlessly gives way to efficient processing and time savings from reduced manual intervention,” said Jennifer Lucas, Consulting Leader for EY Americas Payments; Alla Gancz, EY UK Payments Consulting Leader; and Joanna Forman, Senior

Manager, Financial Services, EY.

“Although migrating infrastructure to be compliant is a major change that can present challenges, banks can use this opportunity to ultimately offer better services and maintain clientcentricity, while corporations and clients can benefit from the data-rich messages,” the trio wrote in a report “Understand key challenges and benefits to ISO 20022 migration.”

All aboard

The most common view is that ISO 20022 should strengthen operational resiliency in payments, enhance straight-through processing, and make the application of sanctions more efficient, according to Accenture’s Sulabh Agarwal, Managing Director for Global Payments, and Ciarán Byrne, Executive Director and Global Head, Clearing Transformation, for

J.P. Morgan Payments. Agarwal and Byrne listed potential use cases for ISO 20022 in their report “5 ways ISO 20022 could rewrite the future of payments.” The first is more accurate reporting and significantly boosted matching rates thanks to the use of automated receivables matching or ARM.

The most obvious impact, of course, is that in the long run, payments, in particular, will be processed and settled more quickly, thanks to reduced errors/failures and investigations throughout the payment lifecycle, EY stated in a separate report.

Automatic reports will also now come to clients when the bank receives their payments. Currently, banks have to use static data tables to build the payment status report, but with ISO 20022, banks will no longer need to maintain these tables, said Accenture’s Agarwal and JP

14 THE ASIAN BUSINESS REVIEW

By 2023, 87% of the total value of high-value payments worldwide are expected to be made up or enabled by ISO 20022-enabled systems (Photo from JPMorgan.com)

BANKING & FINANCE

ISO 20022 is expected to be the native language of payments by 2025

ASIA PACIFIC

Jennifer Lucas

BANKING & FINANCE

long term due to migration effort complexities, banks will need to evaluate their business case to determine when cost savings will take effect and strategically communicate the benefits to program sponsors,” EY said.

Whilst standardisation of messages will be more beneficial for payments processing in the longterm, conversion to one standard will affect the whole cross-border payment processing, especially for clients, who will have to familiarise with a new process.

“Conversion will impact payment initiation, client information, payment channels and payment processing. [It] will require careful consideration and time to reflect the new standard,” EY noted.

Morgan’s Byrne. Instead, clients will receive payment confirmations through their phones or across multiple email addresses.

ISO 20022 also holds the potential to offer real-time data to customers via payment dashboards that banks offer to their customers currently, according to a report by Accenture. The kicker is that the accuracy and quantity of the data offered are expected to radically expand once the guidelines come into effect.

Agarwal and Byrne also believe that the enhanced data available in an ISO 20022 payment instruction will “provide banks an opportunity to better understand every transaction on the standard.”

“The structured name and address details for both sender and beneficiary has the potential to unlock improvements for AML and KYC practices, which should in turn enable more efficient and error-free screening processes,” Agarwal and Byrne wrote in a joint report on ISO 20022 migration.

Finally, banks have the opportunity to identify potential cross-selling opportunities to customers based on data at hand. “For instance, it could give mortgage providers greater insight into originations and refinancing opportunities,” Agarwal and Byrne said. EY’s Lucas, Gancz, and Forman agreed that the significant improvements to the payment procedure and newly added insights

from the ISO 20022 enriched data will provide notable monetisation opportunities for banks. “Robust data provided by ISO 20022 standards enables banks and nonbanks to better identify customer trends and provide improved services to their clients,” the experts said.

Navigating choppy waters

Whilst the standardisation had been a long time coming for the financial industry, the transition would still be a big challenge for banks, who face navigating varying countrymandated timelines.

“Banks need to balance an array of timelines and custom requirements across each market. This is especially challenging, as there is not a one-sizefits-all approach to managing system upgrades across the ecosystem to be compliant,” EY’s Lucas, Gancz, and Forman pointed out in their report.

In particular, EY noted four challenges that its clients faced whilst migrating to ISO 20022 standards: global prioritisation and resourcing; consistent interpretations of data; length of time before benefits are realised; and operational impact.

Migrating to ISO 20022 standards requires banks to invest heavily.

“Prioritising which jurisdictions, products and services should be migrated first will create a competition for global funds and resources to manage the project. Because ISO 20022 return on investment (ROI) tends to be

This lead time will further require internal rework and delay the benefits related to customer journeys. Banks and companies will need to factor in the impact to their internal systems that do not share the same migration priorities as their core processing applications. In particular, EY said that those used for accounting, reconciliation and liquidity management may require legacy tech to be retrofitted.

“To establish a seamless transition to ISO 20022, banks should focus on building interim solutions that support business continuity, while simultaneously focusing on updating legacy systems,” it said.

THE ASIAN BUSINESS REVIEW 15

Alla Gancz

Sulabh Agarwal

Joanna Forman

Ciarán Byrne

Conversion will impact payment initiation, client information, payment channels and payment processing

Migrating to ISO 20022 requires banks to invest heavily

BANKING & FINANCE

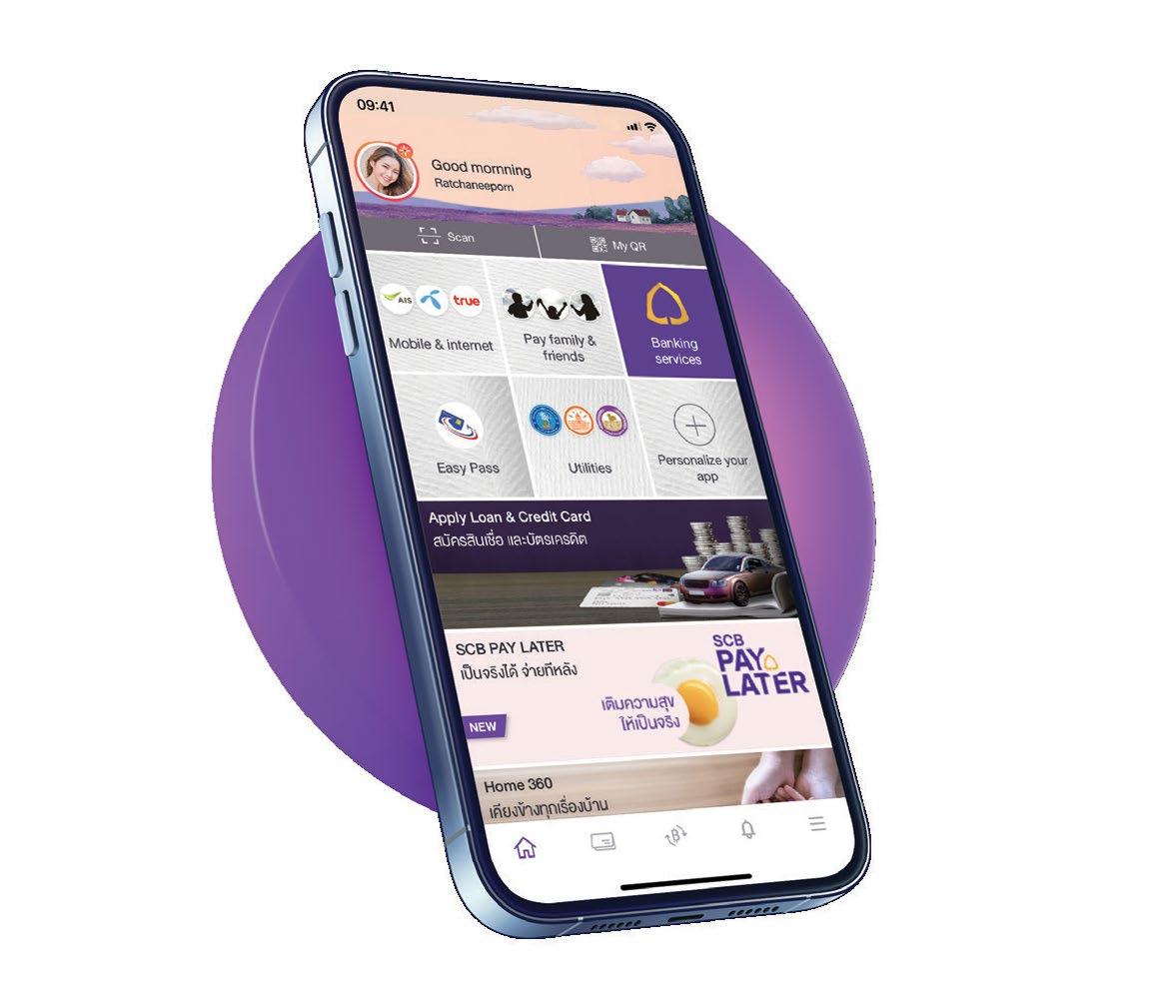

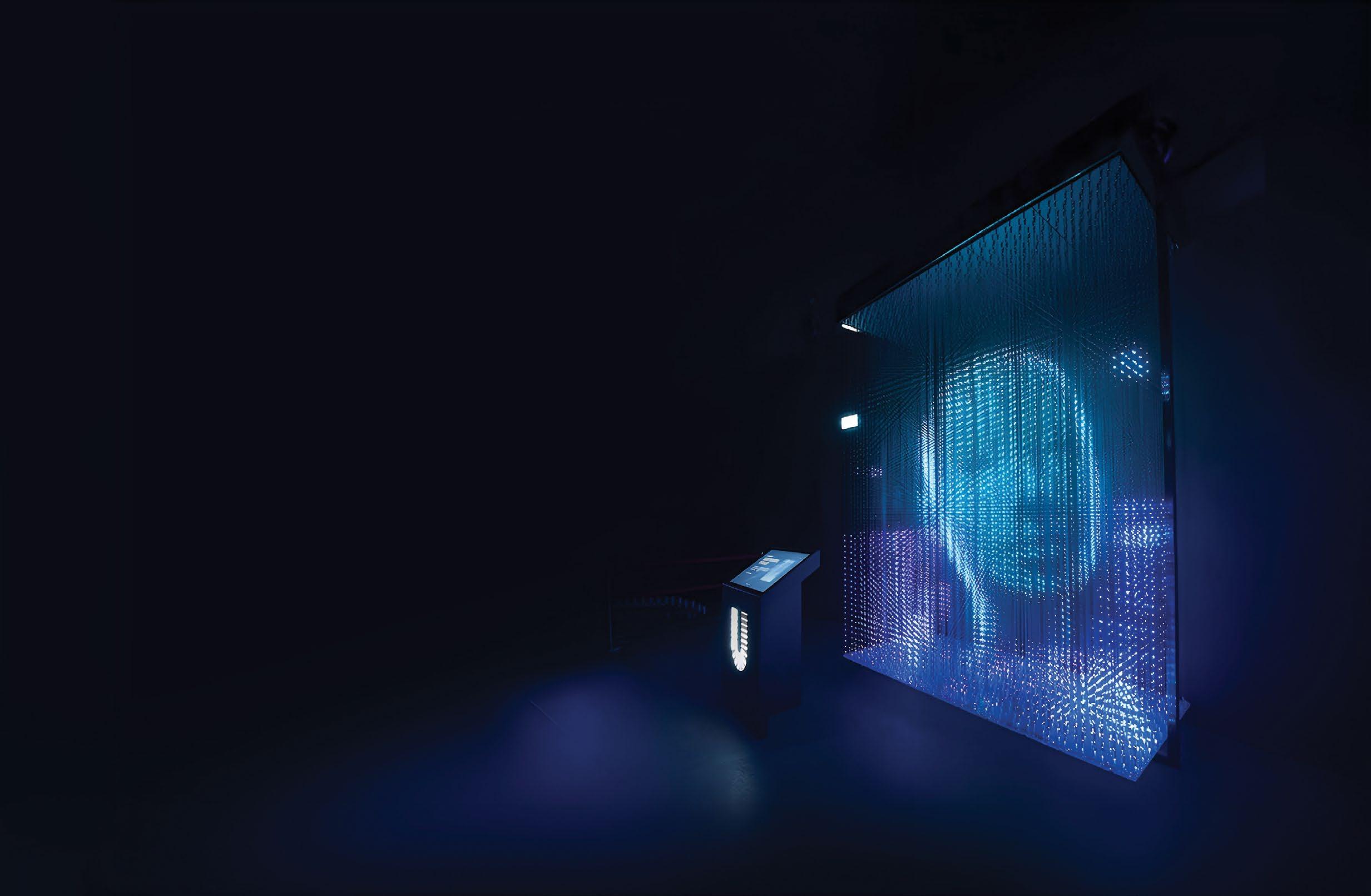

The future of banking could lie in the metaverse

Virtual reality may be the answer to more digitally optimised financial services without having to sacrifice personalisation.

The future of banking may just lie within the comforts of your home whilst you transport yourself into a digital world and your digital self discusses finance with your banking assistant. At least, that’s what banks are betting on as they head into the metaverse.

Global lenders–amongst them big names such as J.P. Morgan and Standard Chartered– have been reportedly snapping up virtual land on which to lay the seeds of their burgeoning digital empires, as they seek to explore how this up-and-coming digital platform may better serve their increasingly tech-savvy customers. “We have seen an uptick in interest amongst banks, primarily driven by their internal innovation incubators,” Capco’s Paul Sommerin, Partner and Digital, Data and Technology Leader; and Leo Leung, Principal Consultant and Head of Innovation APAC, told the Asian Business Review via written

The focus is on how banks can engage with a younger and more tech-savvy consumer

correspondence. “The focus at the moment is on how banks can engage with a younger and more tech-savvy consumer in the future and this is one potential avenue to reach them.”

ventures amongst banks indicates that there is much excitement amongst the lenders in exploring the transformational potential of technology, even when its final form may still be hard to imagine, said Nicole Bodack, Managing Director of Capital Markets, Growth Markets, for Accenture.

Nicole Bodack

Nicole Bodack

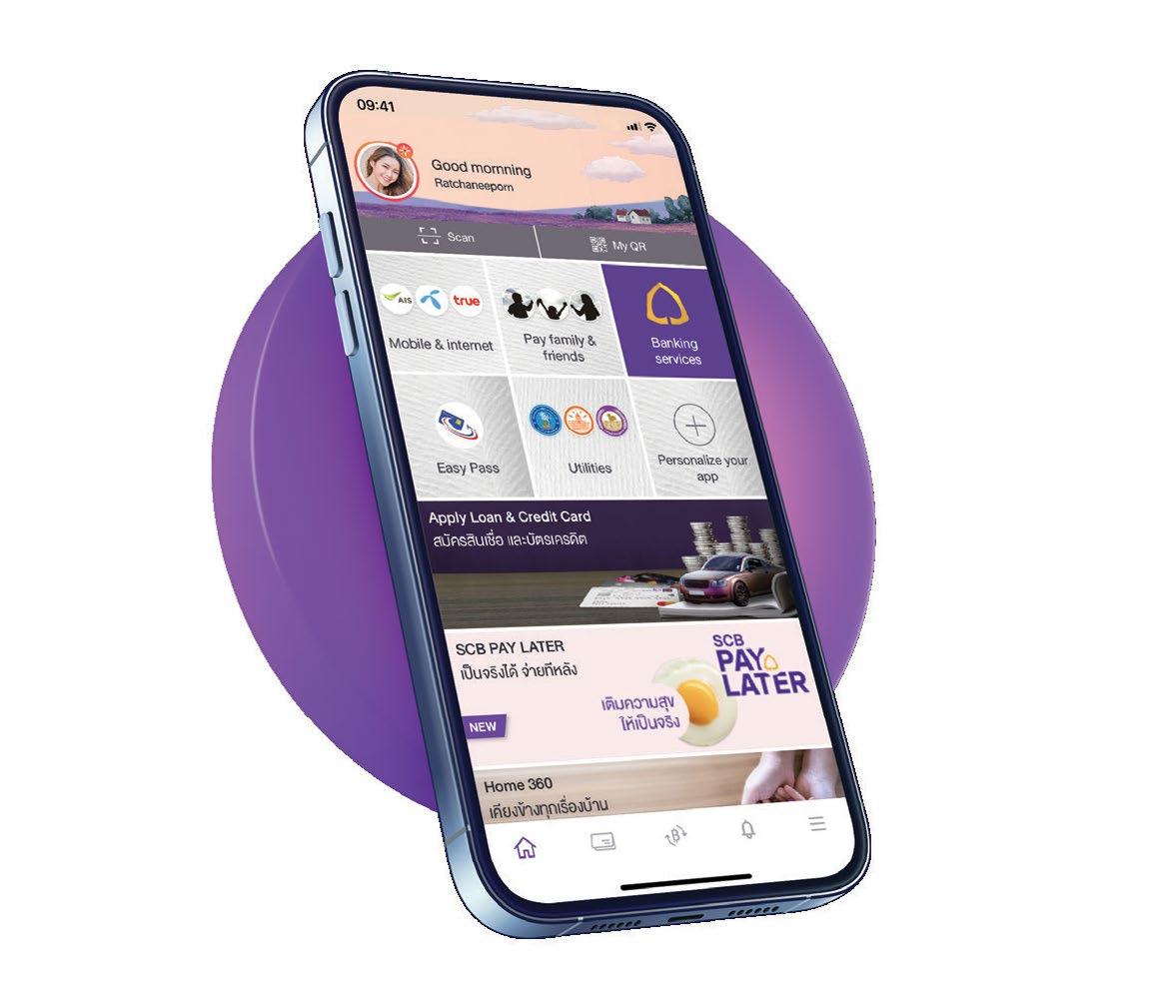

In Asia, banks have already started exploring the metaverse. KB Kookmin Bank, one of the biggest financial institutions in South Korea, has already created a virtual town with a virtual bank where customers can access personalised financial information and interact one-on-one with its financial advisors using virtual reality (VR). In Singapore, J.P. Morgan has unveiled its Onyx lounge in the metaverse, which facilitates cross-border payments, foreign exchange, financial assets creation, trading and safekeeping in the metaverse. DBS also recently bought a 3x3 virtual land in The Sandbox, a decentralised virtual game environment built on Ethereum, for its planned DBS BetterWorld project. The sudden spate of metaverse

“Banks should be prepared to observe a similar trajectory to mobile banking which took five years to fully diffuse into banking. As we go beyond 2D to 3D, we can design an expansive universe with the ability to immerse customers,” Bodack said.

Experience design

The banking world’s progression from 2D and 3D precisely explains how it has arrived to the point where the metaverse is considered a probable banking platform.

“If we think back on banking services up until the 80s, they were analogue-driven. The business model was focused on face-to-face human interaction, building trust and rapport with customers at a physical branch. Fast forward to the present time, the focus has shifted from ATMs to online to digital banking, steered towards increasing distribution and reducing friction,” said Sommerin and Leung. One downside of the shift to digital, however, is that it came at the expense of side-lining human interactions, replacing them instead with services such as chatbots or automatic replies. This impersonalisation is severely affecting an increasingly important factor in delivering a satisfying banking journey: customer experience.

Metaverse could bridge this gap, according to analysts.

“Simply put, metaverse conceptually can be an immersive front-end to the world of web3.0. It offers a unique opportunity for banks to experiment, bringing back the longneglected human interactions. With data analytics and service design, financial institutions should be able to offer immersive hyper-personalisation to rebuild and strengthen customer relationships and lifetime value in this nascent virtual channel,” explained Sommerin and Leung.

Accenture’s Bodack shared the same sentiment. “In the

16 THE ASIAN BUSINESS REVIEW

Metaverse conceptually can be an immersive front-end to the world of web3.0

ASIA PACIFIC

hyperconnected world we live in today, we are still disconnected in many ways. Take banking, for example. Whilst it is functionally complete, most interactions feel transactional,” she noted, adding that a customer could have a more engaging experience with a service representative or advisor represented by a realistic avatar than with a flat screen of a chat application or even a video call.

“Within such a metaverse, banks can bring together people, spaces and objects in both the virtual and real worlds, and evoke a sense of community amongst its customers. Banks can add a third dimension and a sense of human presence to digital banking experiences to bring a more personal touch to remote and virtual customer interactions,” Bodack said.

She added that the metaverse creates an alternative path to embark on the exploratory journey to redefine the financial services experiencespecifically targeting millennial and Gen Z consumers.

“Banks can also introduce new products and services by tapping on the metaverse’s burgeoning economy to extend their brands by insuring and lending against digital assets including cryptocurrency, NFTs and virtual real estate,” she said.

Hurdles

Being still in its infancy stage is what gives the metaverse its potential, but it also means that companies–and in particular, banks–wishing to explore the space have a lot of challenges to contend with. Chief amongst these are banks’ own tech. “To achieve progress in partially or fully institutionalising this realm, and to ensure the safety of banking activities, banks and financial institutions will need to upgrade their current technology platforms or partner with fintech players to prepare for the foreseeable future. Large global financial institutions running on legacy platforms will have the most to lose if they don’t upgrade their core platforms and decide to ignore the potential disruptions these emerging technologies could bring,” Leung and Sommerin warned. Bodack also noted that investors and customers may perceive buying

land in Decentraland as volatile and expensive. Another risk to consider is that of reputation. “For the metaverse, it is quite similar to social media or interactions in the real world. Metaverses may expose brands, including banks, to a range of reputational and legal risks. The nature or extent of these risks might be difficult to anticipate at this early stage as the metaverse is a fairly new concept for banks,” Bodack said.

Bodack advised banks venturing into the space to consider issues that already exist in the real world and how they would handle them in the metaverse. These include issues of abuse and harassment on the internet, money laundering and fraud, and privacy and data risks.

“This is a defining moment for banks. The concerns regulators and consumers already hold today around privacy, bias, fairness, and the human impact of digital platforms will become more acute as the metaverse further blurs the line between people’s physical and digital lives,” the Accenture expert said.

Crypto volatilty

Another factor to consider is that of crypto assets, which is an integral part of most metaverses. The Sandbox, for example, with whom both DBS and Standard Chartered have recently partnered for their first foray into the metaverse, is built on the Ethereum blockchain.

“The widespread adoption of crypto assets in a fully developed

metaverse may pose a systemic risk to financial stability. The larger the volume of crypto transactions happening, the larger the potential impact to real-world financial stability if prices were to collapse,” Bodack said. In an open metaverse, the more the platform grows, the more risks from crypto assets are likely to scale against systemic financial stability, she warned. “Hence, it is critical for regulators to address risks from crypto assets’ use in the metaverse before they reach systemic status.”

Ultimately, it’s up to the banks to balance risk with reward, and take careful steps to ensure stability whilst positioning itself to be at the front once the benefits of the metaverse roll in. “The metaverse is fast approaching with existing and future utilities. Look no further than to the series of metaverse patents and trademark filings, made by some of the world’s leading payment processing providers, as testament to the strategic potential firms now see in “metaverse commerce’, ” Leung and Sommerin said.

And as XR technologies converge with traditional services, and the pace of integration and adoption increases, Capco expects metaverse commerce as a revenue stream for firms will take off and experience exponential growth.

“This all points to why financial institutions need to consider the metaverse in their omnichannel strategies moving forward,” the analysts concluded.

THE ASIAN BUSINESS REVIEW 17 BANKING & FINANCE

Metaverses

may expose banks to reputational and legal risks

The metaverse will significantly impact our commercial and personal lives

Source: McKinsey & Co.

Paul Sommerin

Here are five bad habits in insurance according to HK’s insurance regulator

These

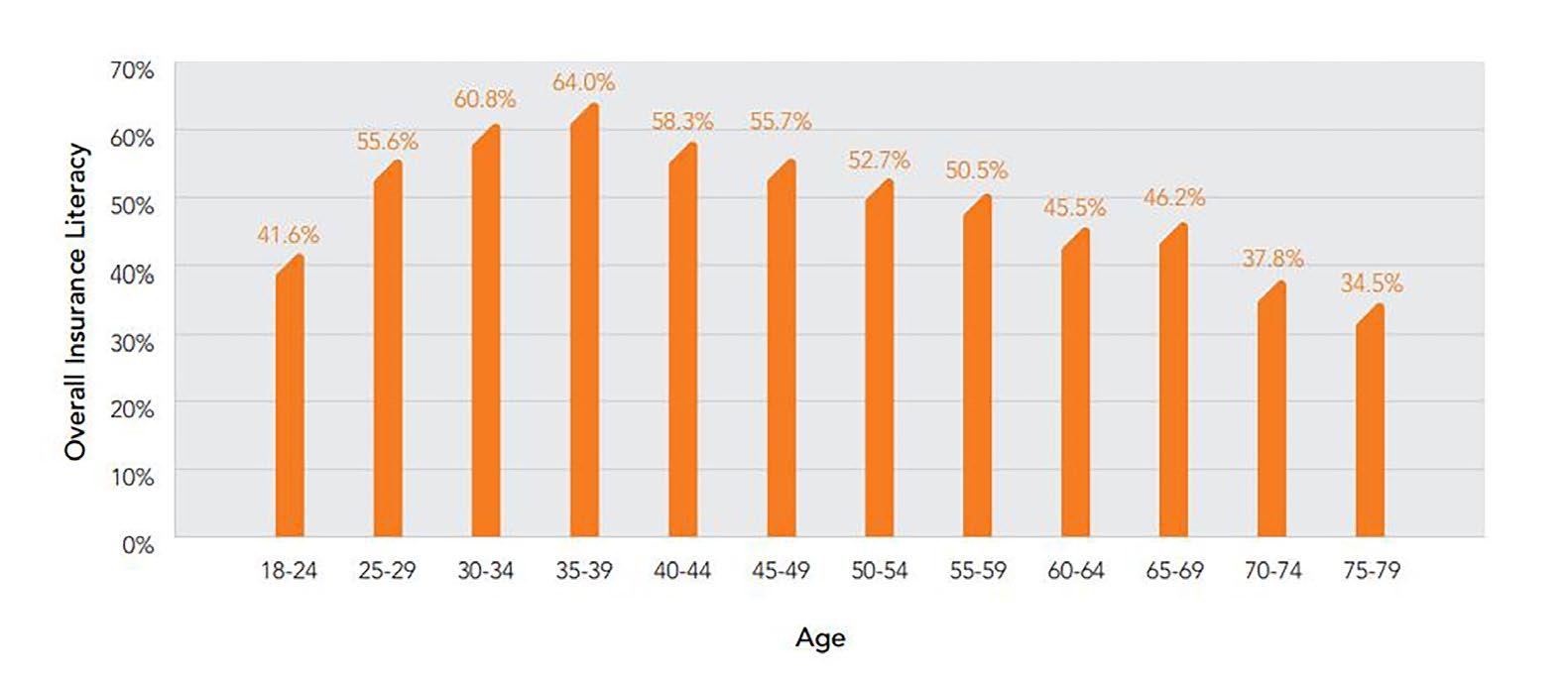

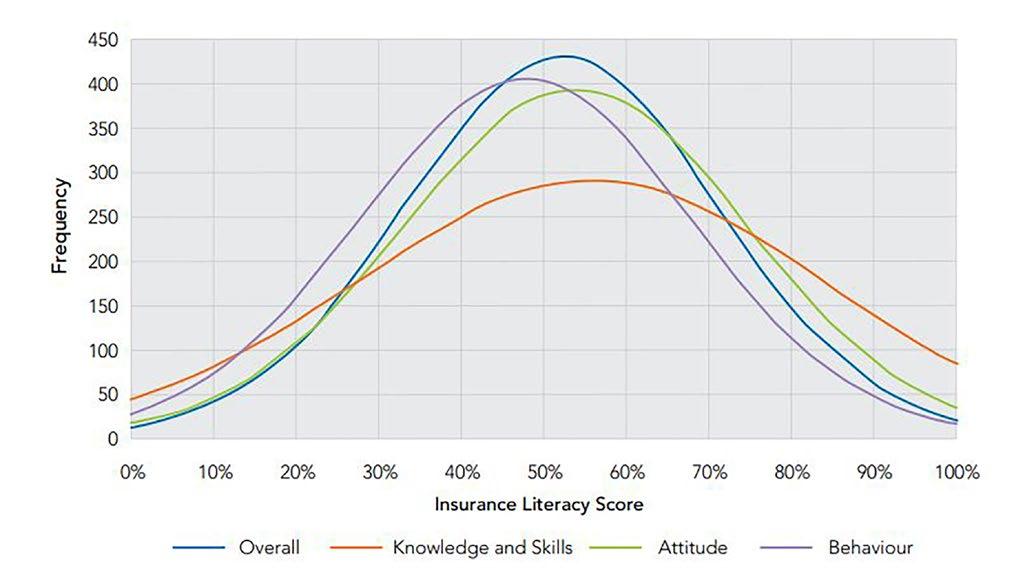

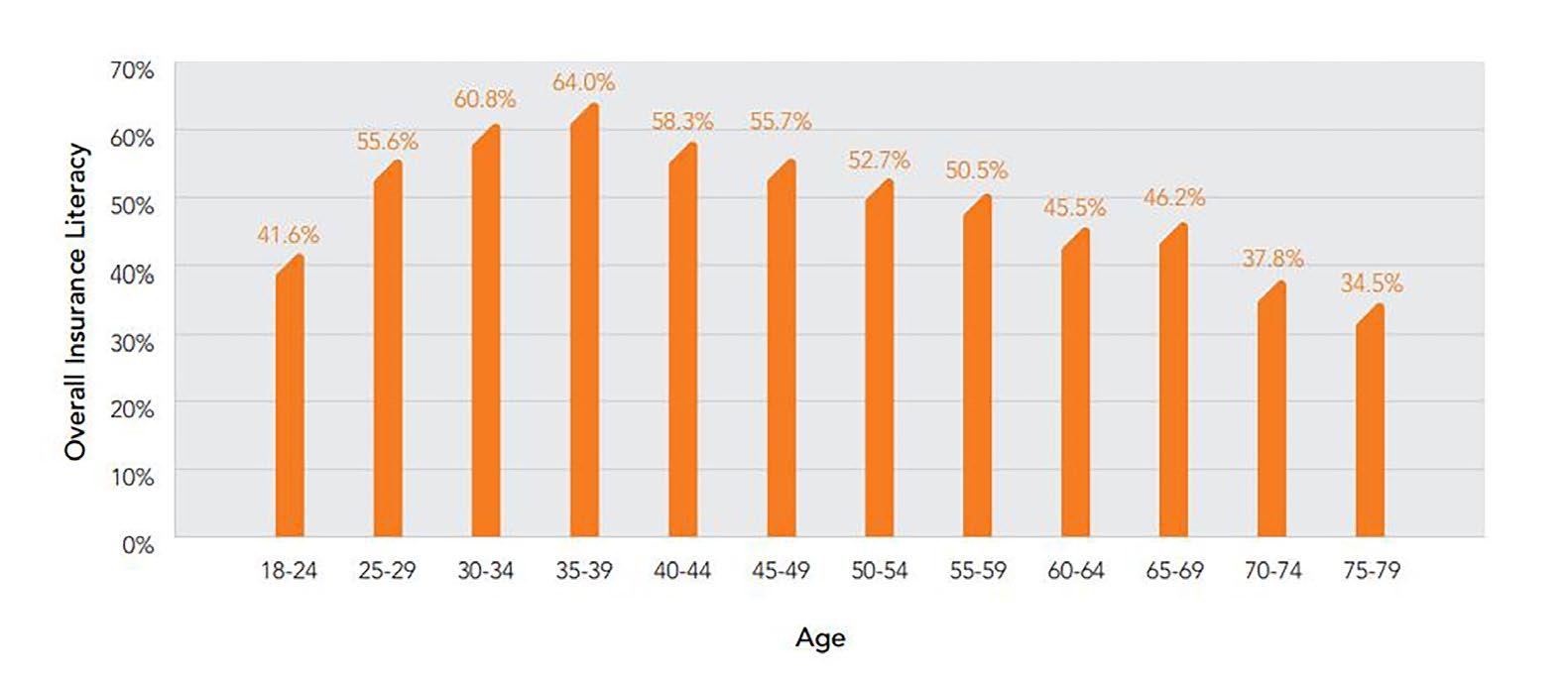

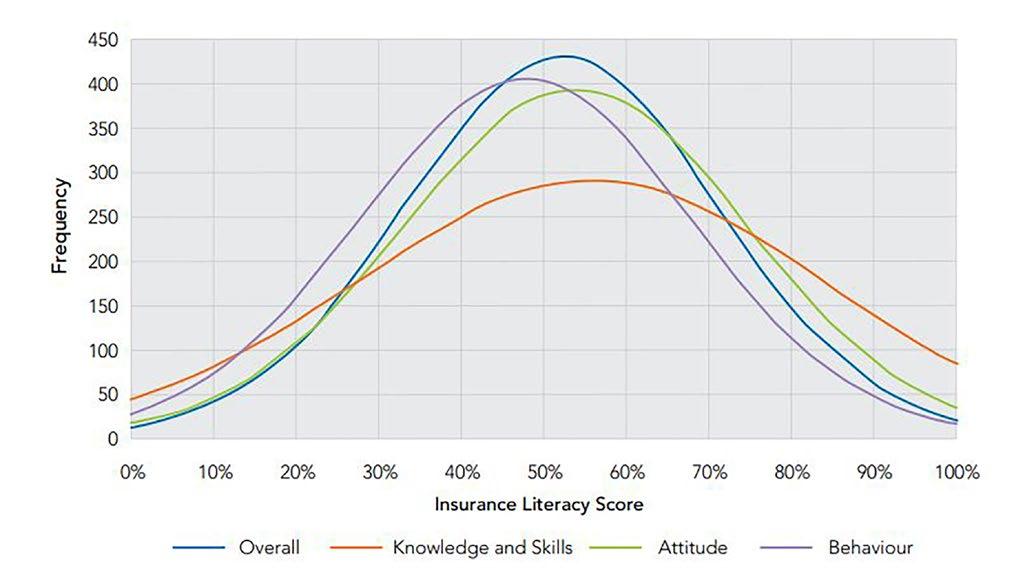

For a market ranking first globally in insurance penetration according to research firm Swiss Re Institute, it is surprising that Hong Kong’s insurance literacy rate stood only at 52%. In the 2022 Report on Insurance Literacy Tracking Survey (ILTS) in Hong Kong 2021 by the Hong Kong Insurance Authority (IA), it was found that most Hong Kongers are moderately literate when it comes to insurance.

“There was a general understanding about policyholders’ rights, insurance principles and product features, but limited knowledge of risk exposure and protection needs,” the IA said.

Respondents of the ILTS were analysed based on the three dimensions of insurance literacy— knowledge and skills, attitude, and behaviour. The results revealed that bad insurance behaviours and habits exhibited by Hong Kongers is the culprit dragging down the insurance literacy rate of the city.

For example, the survey revealed that when it comes to buying insurance, 72% of respondents relied

on the advice and experience drawn from family members or friends instead of insurance or financial professionals. IA identified this as the first behavioural bias—over-reliance on informal information sources.

Consumers who are overly reliant on their family or friends for insurance information and advice is a sign of bandwagon effect. Meaning, that these people do something primarily because others within their circle are doing so, regardless of their own beliefs, IA said.

“People often want to be on the winning side when they make a decision. As a result, they look towards their family or friends to see what is right and then jump on the bandwagon,” the IA explained.

The second behavioural bias is Hong Kongers’ too much focus on promotions. Promotions offered by insurance companies affect consumers’ decisions via price complexity and misdirected attention. The former means consumers find it challenging to calculate true prices when they face multiple prices, such as discounts and add-ons, leading to confusion

and increased possibility of errors. The latter means promotions reduce consumers’ motivation for mental effort, resulting in choices becoming less deliberate but driven by emotions and feelings.

Consumers procrastinate

Most consumers also seldom shop around for better insurance deals when purchasing or renewing insurance. Only 43% of respondents tended to compare different insurance products, whilst nearly half of the policy-holding respondents were influenced by promotion campaigns such as premium discounts, complimentary movie tickets, and healthcare services offered by insurers. On the other hand, a mere 15% of general insurance policy-holding respondents reviewed renewal terms carefully and shopped around when they renewed their policies.

Consumers also tend to procrastinate. This can be caused by different reasons such as too many choices leading to being overwhelmed or people postponing making a decision about insurance as they find it emotionally stressful.

Next is passiveness and inertia. The complexity of terms and conditions makes policy comparison very timeconsuming. Moreover, policyholders often renew their policies with their current insurers due to a perception that switching is risky and with preference for the familiar rather than the best deal.

The last is that most consumers do not take the time to read the terms and conditions of their policies as many find this too long and time-consuming in addition to being written in complex legal languages. The perception most consumers think is that no one reads T&Cs or that they have no choice but to accept them thus there is no point in reading them.

Only 32% of policy-holding

18 THE ASIAN BUSINESS REVIEW

INSURANCE

A

mere 15% of general insurance policy-holding respondents reviewed renewal terms carefully

behaviours drag down Hong Kongers' insurance literacy rate.

People often want to be on the winning side when they make a decision

HONG KONG

INSURANCE

Insurance literacy scores

Source: Hong Kong Insurance Authority

respondents read and study T&Cs before committing to acquire insurance coverage. 20% read neither policy details nor brochures. The rest simply focused on brochure information and verbal advice from agents, brokers, family members, or friends.

Demographical factors

IA also found that insurance literacy can be affected by demographic factors such as age, education, and income. The youngest and the oldest have the lowest literacy scores. Those ages 18 to 24 have a literacy score of around 42% whilst those ages 60 to 79 score below 50%. In contrast, are those people in their 30s who have insurance literacy scores of above 60%.

Income is also positively correlated to insurance literacy as the higher one's income is, the higher the literacy rate. The literacy score of respondents with a monthly income level below HK$10k is 41%, whilst those earning HK$100k or above score 80%. The report also found that insurance literacy is correlated to educational level. For respondents who graduated only from primary schools, their insurance literacy score was below 35% whilst those who graduated from tertiary education or above scored 63%.

Similar results

Talking to the Asian Business Review, Danny Lee, Chief Product Officer at Manulife Hong Kong and Macau said the key findings of the IA’s study mirror a study they did in February

which revealed that most Hong Kong taxpayers do not still do not fully understand the characteristics and benefits of tax-deductible products.

Manulife Hong Kong and Macau's survey asked Hong Kong taxpayers about their knowledge of a trio of tax-deductible solutions: Voluntary Health Insurance Scheme (VHIS), Qualifying Deferred Annuity Policies (QDAP), and Tax Deductible Voluntary Contributions (TVC) under Mandatory Provident Fund (MPF) schemes.

“Respondents on average answered just four out of fifteen questions correctly. With an increasing variety of products in the market, we would advise people to take the time and effort needed to educate themselves on these solutions so they can better understand their options and plan ahead,” Danny said.

Literacy and attitude towards insurance in the next decade Danny also stressed that it is important to seek professional advice from financial advisors who have the knowledge and experience to help customers create a suitable insurance portfolio based on their needs.

This survey by Manulife is also how they, as a major insurer in Hong Kong are striving to educate the public about the risks of being unprepared for future health and financial challenges.

“Hong Kong is one of the most sophisticated insurance markets in the world. IA’s finding means that some Hong Kongers are failing to make good use of the diversified products available in the market to achieve sufficient risk protection planning. Protection planning is an important part of one’s financial planning, particularly in a place like Hong Kong where the cost of living and medical expenses are relatively high. Life and medical insurance can help to close the protection gap. It is crucial to act early and make good use of a wide range of insurance solutions to hedge the risk exposure,” Danny said.

“The pandemic has increased the number of people in Hong Kong adopting healthier lifestyle habits and boosted awareness of health and financial protection, which we believe will raise the level of literacy and overall positive attitude over the next decade,” he added.

THE ASIAN BUSINESS REVIEW 19

The pandemic has boosted awareness of health and financial protection, which will raise the level of literacy

Danny Lee

Overall insurance literacy by age

Source: Hong Kong Insurance Authority

How brick-and-mortar stores can revamp customer experience by going ‘phygital’

Consumers are increasingly demanding more exciting in-store experience.

Dark stores

Another strategy retailers are using is called the dark stores. Despite the name, it can illuminate brick-and-mortar stores’ creativity. Dark stores are like distribution hubs of physical stores, said Sharma. These physical stores turned into dark stores, which are not open to customers but are used as store inventory and for brands to send out orders.

Online grocery store, HappyFresh, increased its dark stores in Singapore to allow an efficient shopping experience, bringing high-quality products to customers.

Since its launch, the online grocery’s users increased by 300%, month-on-month, to address growing demand.

BNPL schemes

To gather and use data analysis and insights, retailers should utilise video-powered retail

When borders reopened and travelling was revived, businesses figured that they needed to revive their physical stores—but they must be different from the pre-pandemic times. In a 2022 Singapore Retail Report study, consumers said that they now demand excitement and pleasure from their instore experience, because if they cannot get that, they would rather buy online.

According to Varun Sharma, Vice President of the unified CX platform , Emplifi, in the Asia Pacific and Japan, one way for retailers to create this excitement is to be “phygital.” They need to mix physical and digital strategies for a unified experience for consumers using digital datadriven customer insights and technologies.

To gather and use data analysis and insights, Sharma suggested utilising video-powered retail that involves video software that uses data to connect callers to an in-store expert to handle their queries.

“Video technology helps humanise digital communication between consumers and brands via their website—leveraging data insights such as how, when, and why customers are interacting,” he explained.

For example, Marks & Spencer has a “call the expert” video button, enabling their experts to pair with customers for a stronger chance of a sale. This live video service accommodated 28,000 one-on-one consultations of customers browsing furniture, menswear, and lingerie in the store, according to Marks & Spencer’s statement on 28 January 2022.

“This helps brands understand the customer journey better and provide a more personalised experience. With customer data, retailers can give shoppers exactly what they are looking for, boosting their sales potential, and cutting costs, too,” Sharma explained.

The Buy Now, Pay Later (BNPL) schemes also received popularity in Singapore from 2020 to 2021 due to convenience and prudent economic climate, Quan Yao Peh, a Senior Research Analyst at Euromonitor International, said.

Based on Euromonitor’s 2021 data, credit cards account for 61% of personal transactions.

“BNPL has been positioned as increasing the immediate affordability of goods and services, whilst allowing customers greater repayment flexibility compared to one-off spending,” Quan Yao said in an interview with the Asian Business Review

To avoid turning BNPL to buy now, don’t pay later, businesses should consider the profile of their consumers.

“A millennial and Generation Z, someone who has just started working, is perhaps still in university and may not have that much disposable income at this point. The retailer needs to consider whether or not the BNPL implementation will allow them to better reach and capture the wallets of their target consumer,” said Quan Yao.

An example of a brand adopting BNPL is clothing brand, Pomelo’s, partnership with Atome, a BNPL mobile app, to allow customers to pay one-third of the total bill first. After their check out of items, their orders will be shipped and customers will get the items and pay other payments later with zero interest, 30 days apart.

Pomelo is currently operating three physical stores in Singapore which are in Nex, Jem, and 313@Somerset.

Cashier-less checkouts, AR zones

Smart technology can also create seamless experiences for customers when they visit physical stores such as through cashier-less checkouts, voice-activated instore robotic assistants, dynamic merchandising tools, and shelf-monitoring solutions, explained Guillaume Sachet, Partner of Advisory Practice at KPMG, a professional services firm.

He added that these technologies can combat consumers’ frustrations such as long queues, insufficient stock of popular products, and navigating physical stores. A brand that does this is Singapore’s Pick&GO, an AI

20 THE ASIAN BUSINESS REVIEW

RETAIL

Video technology helps humanise digital communication between consumers and brand

SINGAPORE

convenience store, which resorted to AI technology to help customers walk and complete their payments in a matter of seconds.

Quan Yao said these cashier-less options are better suited for grocery retailers, which focus on convenience. It could be different for other retailers such as department stores and beauty specialists that need human expertise to entertain customer concerns.

KPMG expert Sachet also suggested AR zones within stores to elevate customers’ interactivity with products that may be on static display.

In JLL’s 2022 Singapore retail property report, furniture retailer, Castlery, established an AR-enabled store that featured modern living spaces via mobile applications. This helped customers visualise the furniture in their homes and improved customer experience at physical stores.

Since 2019, Castlery’s posted a six-fold increase in its revenue. Further, its modern pieces were sold in 300,000 houses globally.

Mitigating inflationary pressures

Brick-and-mortar stores must also leverage customer experience as Singaporean consumers are bearing the brunt of rising inflation, which changes their way of spending.

These factors should push physical retail stores to “make adjustments” which will attract customers and generate sales, Sachet said.

Retailers can consider introducing or stepping up experiential components for shoppers. For grocery and food and beverage retailers, this could be in the form of sampling stations, self-serve bars, and demonstration stations. For clothing and apparel brands, leveraging AR to enable virtual product trials can refresh the experience whilst decreasing the hassle of physically trying on products, Sachet said.

“More than just a platform for showcasing products, physical stores are a community hub, which allows connections to be built between brand and customer,” the KPMG expert added.

Consumers are bound to spend more consciously with the rising inflation. In fact, a DBS survey showed that 42% of consumers said they will save more and spend less whilst 32% will look for cheaper alternatives.

“Retailers need to make the most of their brick-andmortar assets. One of the ways to do so is by integrating the ‘phygital’ concept as consumers turn into hybrid shoppers,” said Emplifi’s Sharma.

Sharma said businesses should tap omnichannel retailing, which allows customers to receive a unified experience of shopping through a mobile device, computer, or at a physical store.

This is due to the evolving demands of shoppers, who 67% of them in the Asia Pacific seek new products in-store whilst 66% seek new products on their mobile phones, as shown in Meta’s Seasonal Holidays Report.

“Setting up an omnichannel buying journey is no longer a nice to have option for businesses. Customers now want the flexibility to choose which channel suits them at a particular moment and expect to be able to contact businesses via multiple touchpoints,” said Sharma.

Consumers’ flexibility is also shown in Adyen’s 2022 Retail Report which found that 61% of consumers said

they will be more loyal to a business that allows buying things online and returning in-store.

One way to do this omnichannel approach is to elevate the customer experience by speaking to a live customer service agent on social media, logging an order online, and heading to the physical store to get the product.

UK cycle retailer, Ribble Cycles, does this by partnering with Emplifi Shopstream by Go Instore, which is a oneto-many video-streaming service. This service will allow customers access to a Ribble physical store, a Ribble expert, and its range of products online.

When live events were cancelled during the pandemic, Ribble used ShopStream to feature new products. The broadcast on their website, which was also live streamed on Facebook and Youtube, reached 10 times more attendees than launching these new products on a personal event.

One in four engaged visitors add products to their basket during a live stream on Emplifi’s ShopStream, with purchase rates rising to as much as 50% when moving to a one-on-one discussion with an associate.

Locally, an omnichannel approach is being done by Singapore Airlines (SIA) which uses the KrisShop offering, which allows customers to buy from the brand’s website or mobile app.

“Products on sale range from cosmetics to fragrance and electronics, and items can be delivered to the customer’s seat on their next SIA flight or directly to their doorstep in any part of the world,” said Sharma.

Sportswear firm, Decathlon Singapore’s omnichannel approach is Click and Collect, which uses its e-commerce and retail stores.

Through this setup, customers can purchase goods online and collect them at the nearest brick-and-mortar stores within two hours but only for general goods. For items like bikes, they can be collected within seven days.

Using retail technologies is also one of the strategies for brick-and-mortar stores, Quan Yao said.

He cited electrical and furniture retailer, Courts Singapore, as an example of this marketing strategy after the store set up quick response codes that activate a virtual mascot, Bitty the Mascot, which will help in virtual shopping.

“Generally, we see key themes around meeting consumers’ demands for product availability and a positive experience in-store trying the product. Stores should also be strategically located and easily accessible to their target consumer,” said Quan Yao.

THE ASIAN BUSINESS REVIEW 21 RETAIL

Varun Sharma

Quan Yao Peh

Guillaume Sachet

Customers now expect to be able to contact businesses via multiple touchpoints

Fintech funding slows as COVID’s digital hype fades

Valuations of technology stocks, both public and private, are down 60%.

Fintech funding hit a record number of volumes in 2021, with 5,684 fintech deals for a whopping US$210b in total investments garnered during the year–the second highest annual total ever, according to data from KPMG. Yet come a year later and the global fintech investment market is in a downward trend. Global fintech funding fell 33% quarter-overquarter to hit $20.4b — its lowest level since Q4 2020, CB Insights revealed in a report.

The APAC region was not spared, where apart from a few certain markets, the fintech sector saw investments funneled towards them shrink in the first half of 2022.

This is not just a fintech problem, analysts told the Asian Business Review. The volatile stock and investment market situation has pushed investors to take flight to the sidelines and keep their monies close at the moment. Fintechs were not spared from the cautiousness.

“There’s been a consistent declining trend in 2022 across IPOs, SPACs and M&A transactions, not only fintech funding. Investors bearing losses from stock market valuations will become more selective in making new investments,” Tzu-Chung Liang, Southeast Asia Financial Services Strategy and Transaction Leader at EY, told the Asian Business Review in an interview.

In particular, the rising interest rates and renewed fears of a recession encouraged investors to focus first on business fundamentals and exercise more caution on where they sink their funds into, explained Anton Ruddenklau, Partner and Global Head of Fintech, KPMG International.

“Rising interest rates to combat inflation has added to the cost of capital and therefore the required return on that capital. This has sharpened investor resolve to target fintech firms that are more structurally profitable, are at a later

stage in the funding journey or that have demonstrated operational profitability post scaling,” Ruddenklau noted. Ruddenklau noted that the digital hype that rose during the COVID years have faded, which is also currently driving down valuations of technology stocks by up to 60% lower.

“Again, this has resulted in investors looking for differentiated technology business models, investing in the next generation of sectoral change or focusing on firms with a clear path to profitability. Unicorn minting has stilted as investors take a more sanguine rather than speculative view of the business fundamentals of fintech firms,” Ruddenklau explained.

Going up

The good news is that the dismal state of funding will likely not last, according to analysts.

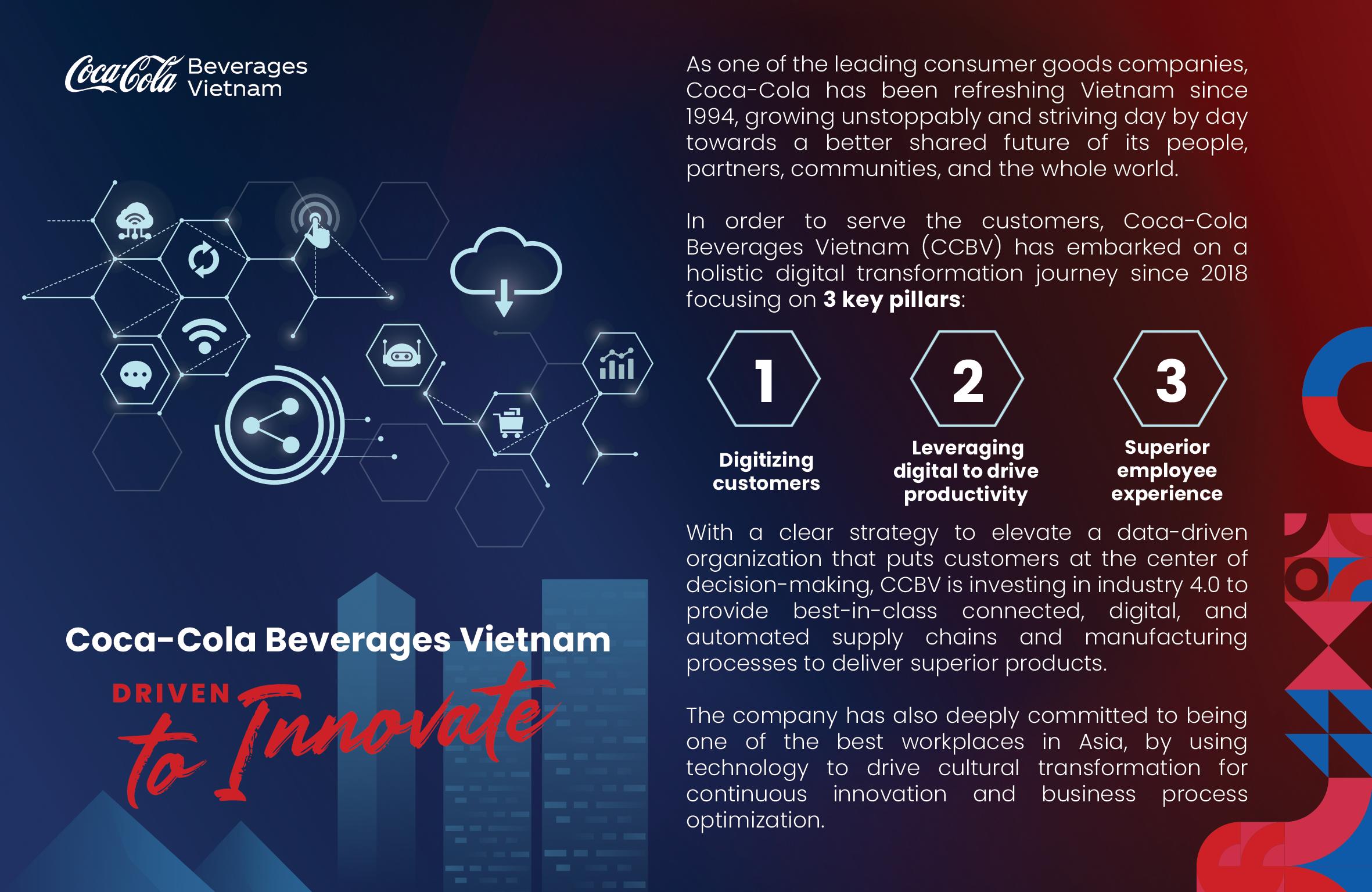

“Interest in fintechs in the APAC region remains strong, especially those targeting growth markets such as China and Southeast Asia,” Liang said. Ruddenklau also forecast that funding will grow as financial technology innovation ramps up over the next 7 years.