SPRING 2024 | MEMBER MAGAZINE

Pilgrimage to Rome Announcing Trusted Fraternal Life™

Board of Directors:

John Borgen, Richfield, WI President and CEO

Kristen Mueller, Greenfield, WI Corporate Secretary

Sandra Dempsey, Milwaukee, WI

Mike Giffhorn, New Berlin, WI

Coral Grout, Winchendon, MA

Joe Kopinski, Greenfield, WI

Al Lorge, Cedarburg, WI

Lisa Mick , Fond du Lac, WI

Kari Niedfeldt-Thomas, New Brighton, MN

Susan Obermiller, Green Bay, WI

Bill O’Toole, Pleasant Prairie, WI

Jeff Tilley, Franklin, WI

Spiritual Director:

Archbishop Jerome E. Listecki, Milwaukee, WI

Radiant Life is an official publication of: Trusted Fraternal Life™, 1100 W. Wells Street, P.O. Box 3211, Milwaukee, WI 53201-3211, a fraternal benefit society.

Periodical postage paid at Milwaukee, WI, and additional mailing offices.

POSTMATER: Send

WI 53201-3211 Phone: (800) 927-2547 Copyright 2024 Catholic Financial Life, a Trusted Fraternal Life brand. Insurance products issued by Trusted Fraternal Life™. Not available in all states. All Rights Reserved.

2 RADIANT LIFE MAGAZINE | SPRING 2024

Street,

Box 3211,

address changes to Radiant Life Magazine, Catholic Financial Life, 1100 W. Wells

P.O.

Milwaukee,

Feature In This Issue 3 President and CEO’s Message 5 Spiritual Director’s Message 6 Rome Pilgrimage 10 What’s Happening at Catholic Financial Life Announcing Trusted Fraternal Life™ 14 Governing Documents Updates to Articles of Incorporation and Bylaws 23 Catholic Financial Life Earns an “A” Financial Strength Rating 24 2024 Give Back Contest Winners 25 Joseph E. Gadbois God Bless America Photo Contest 26 Hermelinda’s Journey to Provide for Her Family What’s

Spring 2024 Connect with Us cfl.org/magazine Catholic Financial Life 1100 W. Wells Street Milwaukee, WI 53233 facebook.com/ catholicfinanciallife catholic-financial-life info@cfl.org (800)927-2547 Rome Pilgrimage Once in a Lifetime Opportunity for Members

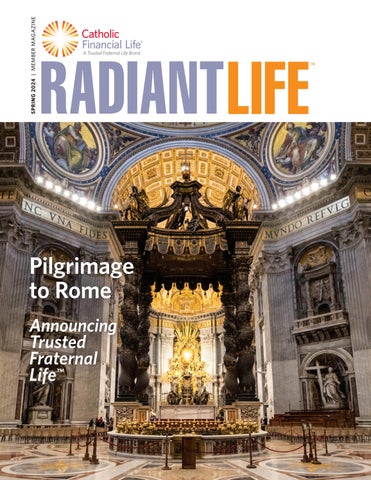

Cover Photo: St. Peter’s Baldacchino, a 60-foot-tall bronze canopy that frames the High Altar in St. Peter’s Basilica. Photo credit: Tim Strauss, Member

Inside

President’s Message

There is an appointed time for everything, and a time for every affair under the heavens. – Ecclesiastes 3:1

Most readers of Radiant Life are familiar with the 1965 hit song, “Turn! Turn! Turn!” written by Pete Seeger and popularized by the Byrds. And I suspect you know the song is based on a poem found in the book of Ecclesiastes 3:1-8. The verses contain 14 pairs of opposites that describe human activities and affirm that God has determined the appropriate time for each of them.

The timelessness of the poem’s wisdom can be applied to our lives and businesses alike. In the case of Catholic Financial Life, we are experiencing a time to give birth, a time to plant, and a time to build.

I am talking about the establishment of Trusted Fraternal Life (described on pages 10-11) which will help Catholic Financial Life fulfill our vision … “to be the innovative leader in fraternal partnerships and consolidation …”

Over the last 30 years, consolidation in the life insurance industry and fraternal sector has been remarkable. In 1990, there were 2,195 life insurance companies; in 2020 there were 737. Similarly, in 1990 there were about 100 fraternals and today there are about 70. I believe consolidation in the fraternal sector will continue as organizations need economies of scale to compete, access to distribution to grow, and a fraternal revival to make a greater community impact. We have chosen to be leaders in this endeavor, shaping our future, because it is in our members’ best interest.

We approach this opportunity from a position of record strength. The Society has never been stronger and I am pleased to share we earned a financial strength rating upgrade to “A” from our rating agency, KBRA (see page 23 for more information).

We move forward ensuring that our faith-based mission and identity will thrive for generations to come. In fact, you can learn more about our first member pilgrimage to Rome, Vatican City and Assisi on pages 6-9. In the Trusted Fraternal Life model, all things that make Catholic Financial Life Catholic continue.

We embark on this journey as people of faith, heeding the words of sacred scripture: Be not afraid. Cast out into the deep. Give birth, plant and build, for behold, I make all things new.

Now is the time!

God Bless,

John T. Borgen President & CEO (414)278-6608

John.Borgen@CatholicFinancialLife.org

John T. Borgen President & CEO (414)278-6608

John.Borgen@CatholicFinancialLife.org

P.S. If I can ever be of assistance to you, please contact me!

We embark on this journey as people of faith, heeding the words of sacred scripture: Be not afraid. Cast out into the deep. Give birth, plant and build, for behold, I make all things new.

CATHOLIC FINANCIAL LIFE | CFL.ORG 3

Mensaje del Presidente

Iniciamos esta jornada como personas de fe, siguiendo las palabras de la sagrada escritura:

No temas. Lleva la barca mar adentro y echa las redes para pescar. Da a luz, planta y construye, porque he aquí, yo todo lo hago nuevo.

Todo tiene su tiempo, y todo lo que se quiere debajo del cielo tiene su hora. – Eclesiastés 3:1

La mayoría de los lectores de Radiant Life sin duda conocen la canción exitosa de 1965 “Turn! Turn! Turn”, escrita por Pete Seeger y popularizada por The Byrds. Y sospecho que saben que la canción se basa en un poema que se encuentra en el libro de Eclesiastés, 3:1-8. Los versos contienen 14 parejas de opuestos que describen actividades humanas y afirma que Dios ha determinado el momento apropiada para cada una de ellas.

La sabiduría del poema es eterna y puede aplicarse a nuestras vidas y a nuestros negocios por igual. En el caso de Catholic Financial Life, nos encontramos en un tiempo de dar a luz, un tiempo de plantar y un tiempo de construir.

Me refiero al establecimiento de Trusted Fraternal Life (que se describe en las páginas 12-13), que ayudará a Catholic Financial Life a hacer realidad nuestra visión de... “ser el líder innovador en sociedades fraternas y en consolidación ...”.

En los últimos 30 años ha ocurrido una consolidación notable en la industria de los seguros de vida y en el sector fraterno. En 1990 había 2,195 compañías de seguros de vida; en 2020 había 737.De manera similar, en 1990 había alrededor de 100 compañías fraternas y hoy hay cerca de 70. Considero que la consolidación del sector fraterno continuará porque las organizaciones necesiten economías de escala para competir, acceso a canales de distribución para crecer, y un renacimiento fraterno para lograr mayores efectos en sus comunidades. Hemos decidido ser líderes en este esfuerzo formando nuestro propio futuro – porque es lo mejor para nuestros miembros.

Emprendemos esta oportunidad con una fortaleza récord. La Sociedad nunca antes había estado tan fuerte y estoy contento de informar que nuestra calificación de fortaleza financiera de nuestra agencia calificadora, KBRA subió a una “A” (mas información en la página 23).

Seguimos adelante, asegurándonos de que nuestra misión e identidad centradas en la fe prosperarán por muchas generaciones. De hecho, puedes ver más información sobre nuestra primera peregrinación de miembros a Roma, Ciudad del Vaticano y Asís en las páginas 6-9. En el modelo de Trusted Fraternal Life, las cosas que hacen católica a Catholic Financial Life continúan.

Iniciamos esta jornada como personas de fe, siguiendo las palabras de la sagrada escritura: No temas. Lleva la barca mar adentro y echa las redes para pescar. Da a luz, planta y construye, porque he aquí, yo todo lo hago nuevo.

¡Este es el momento!

Que Dios los bendiga,

John T. Borgen Presidente y Director Ejecutivo (414)278-6608

John.Borgen@CatholicFinancialLife.org

PD: Si hay algo en lo que te pueda ayudar, ¡no dudes en contactarme!

4 RADIANT LIFE MAGAZINE | SPRING 2024

Our Lenten Journey: A Time to Change

Lent coincides with two other significant events in my life. The first is my birthday. Birthdays lose some of their excitement as we get older but a few weeks ago I turned 75 which means I submitted my retirement letter to Pope Francis. Now we wait; the Pope could accept my retirement in a matter of months or years. Until that time, I continue to serve as Archbishop of Milwaukee.

The second is my annual physical— a routine event with my doctor prescribing predictable advice: eat a little better, exercise a little more, get a little more sleep, etc.

And as I go about working to improve my physical health over the following weeks and months, two phrases synonymous with Ash Wednesday run through my mind, both quite appropriate: 1.Remember you are dust and to dust you will return; and 2.Turn away from sin and be faithful to the Gospel.

You see, Lent is time for an annual spiritual check-up. It is an opportunity to reflect on our words, our deeds and our choices. It is a time to examine our souls, to look at our hearts and ask for God’s grace, mercy and strength to change and be made new.

Because we are human and therefore sinful, transformation into the children of God is the journey of a lifetime. Hence, the wisdom of the liturgical calendar and an annual time set aside for prayer, fasting and almsgiving so that we may be changed.

Speaking of change, I applaud the vision and leadership of Catholic Financial Life’s Board of Directors and President John Borgen. Establishing the Trusted Fraternal Life family of brands will help to ensure Catholic Financial Life’s mission endures for generations. This bold move is quintessentially Catholic in its approach. It builds on the organization’s 155-year tradition while anticipating what is necessary to thrive for the next century—congratulations!

Over the next few weeks, as we move from ashes to the Easter fire, we pray that we may be changed, that we may be transformed. So that when our earthly life is over, we may live eternally with our resurrected Lord.

Change our hearts this time, Your word says it can be.

Change our minds this time, Your life could make us free.

We are the people, Your call set apart,

Lord, this time change our hearts.

A blessed Lent!

Most Reverend Jerome E. Listecki Archbishop of Milwaukee

Catholic Financial Life’s Spiritual Director

Preparación para la Cuaresma: Tiempo de cambios

La Cuaresma coincide con otros dos acontecimientos importantes en mi vida. El primero es mi cumpleaños. Los cumpleaños pierden un poco la emoción a medida que vamos creciendo, pero hace un par de semanas cumplí 75 años lo que significa que envié mi carta de jubilación al Papa Francisco. Ahora, esperar. El Papa podría aceptar mi renuncia en cuestión de meses o años. Por ahora, sigo sirviendo al Arzobispo de Milwaukee.

El segundo acontecimiento es mi examen físico anual; un análisis de rutina con mi médico donde me da indicaciones previsibles: como comer mejor, hacer más ejercicios, dormir más, etc.

Y mientras sigo trabajando en mejorar mi salud física durante las próximas semanas y meses, dos frases sinónimas del Miércoles de Cenizas me vienen a la mente, ambas bastante apropiadas: 1. Recuerda que eres polvo y al polvo volverás; y 2. Aléjate del pecado y sé fiel al Evangelio.

La Cuaresma es un momento para hacerse una revisión anual espiritual. Es una oportunidad para reflexionar sobre nuestras palabras, acciones y decisiones. Es un momento para analizar nuestras almas, mirar nuestros corazones y pedir por la gracia, la misericordia y la fortaleza de Dios para cambiar y convertirse en alguien nuevo. Porque somos seres humanos y, por lo tanto, pecadores; la transformación a ser hijos de Dios es la jornada de toda una vida. De ahí la sabiduría del calendario litúrgico y un tiempo en el año reservado a la oración, con ayuno y limosna para que podamos cambiar.

Hablando de cambios, quiero celebrar la visión y el liderazgo de la Junta Directiva de Catholic Financial Life y del presidente John Borgen. Establecer la familia de marcas de Trusted Fraternal Life ayudará a garantizar que la misión de Catholic Financial Life dure por generaciones. Esta decisión audaz esencialmente presenta el enfoque católico. Se basa en la tradición de la organización de 155 años, mientras que anticipa lo que es necesario para prosperar en el próximo siglo. ¡Felicidades!

En las próximas semanas, a medida que nos trasladamos de las cenizas a la hoguera de Pascua, oramos para poder cambiar, para poder transformarnos. De este modo, cuando nuestra vida terrenal llegue a su fin, podremos vivir en la eternidad con nuestro Señor resucitado.

Cambia nuestros corazones en estos tiempos, Tu palabra dice que es posible.

Cambia nuestras mentes en estos tiempos, Tu vida podría liberarnos.

Somos el pueblo, Tu nos diferencias, Señor, en estos tiempos cambia nuestros corazones. ¡Bendita Cuaresma!

CATHOLIC FINANCIAL LIFE | CFL.ORG 5

Rome Pilgrimage

Once in a Lifetime Opportunity for Members

Rome is a place of ancient history and the birthplace of Western civilization. It’s also the home of the Catholic Church...a fitting destination for Catholic Financial Life’s first pilgrimage for members.

This past November, 83 Catholic Financial Life members traveled with President & CEO John Borgen and Director of Member Engagement Sally Krochalk on a pilgrimage to experience three ancient cities significant to the Catholic faith and Christendom—Rome, Vatican City and Assisi.

The Journey Begins

From day one, members were immersed in history as they stood beside the Roman Colosseum, walked through the Roman Forum, and marveled at other historic structures that have literally stood the test of time—still standing after more than 2,000 years!

The eight-day pilgrimage included visits to some of the most historic and sacred sites of the Catholic Church, including the four major Basilicas of Rome and one in Assisi.

“This pilgrimage was a very powerful experience for our members in attendance,” John said. “It was uniquely different from just being a tourist. Celebrating daily Mass, seeing sacred art, and praying in such holy places created a deeply spiritual, transformative experience. You could feel the Holy Spirit!”

6 RADIANT LIFE MAGAZINE | SPRING 2024

Right: Members of the pilgrimage at the Papal Basilica of Saint Paul Outside the Walls erected during the fourth century and the burial ground of the Apostle Paul.

Above: Catholic Financial Life received an Apostolic Blessing from Pope Francis in recognition of our 155th Anniversary.

Members visited Basilicas beautiful beyond description with magnificent religious art and sculptures, including Michelangelo’s Pieta at St. Peter’s. A highlight for the group was standing beneath the ceiling of the world-renowned Sistine Chapel and viewing Michelangelo’s “The Creation of Adam,” one of the most recognizable and admired works of art in history. It’s also one of the locations in the Vatican where photographs and videos are not allowed.

Walk Through History

A day trip to Assisi included Mass in the Convent of St. Francis at the Basilica. The tomb of St. Francis lies beneath the basilica complex. The group also stopped at the Basilica of Santa Maria degli Angeli, home to the ninth-century church where St. Francis discerned his vocation, chose to live in poverty and serve the poor, and founded three Franciscan Orders. Members saw the actual brown tunic worn by St. Francis, a familiar visual from renderings of this famous saint, and walked in the saint’s footsteps to stand atop the hill overlooking the beautiful valley of Assisi.

“Beyond the history and the beauty of the places we visited was the opportunity to witness the impact it had on the group of pilgrims, drawing them closer to Christ with each stop along the way,” Sally said.

A drive along a portion of the Old Appian Way, an ancient Roman military road, led the group to the Catacombs— a maze of underground tunnels where persecuted Christians would secretly worship, practice their religious rites, and bury their dead. Excavation of the Vatican Necropolis beneath St. Peter’s Basilica led to the discovery of the tombs of many early Popes.

At the Tomb of St. Peter, bone fragments of the Apostle are recessed and illuminated behind protective glass. “It was incredible to see and reflect on the Apostle who had personally walked with Christ and was chosen by Him to be the first leader of the Church!” Sally said.

His Holiness

A pinnacle moment was an audience with the Holy Father, Pope Francis, in St. Peter’s Square. The group was grateful to receive a Papal Blessing and the opportunity to pray with the Holy Father on behalf of all Catholic Financial Life members.

“This trip was a dream for me and exceeded my expectations. What an amazing experience,” said member Barb Gaura. “The entire trip was a blessing in so many ways.”

What began with a group of people who were strangers ended with new friendships. “By the end of the week our group formed a special fraternal, familial bond,” John said. “I was blessed to have shared this experience with our members, joining them in prayer for all Catholic Financial Life members. I can’t wait to do it again!”

Unexpected Blessing

Debbie Moldenauer was eagerly anticipating the pilgrimage to Rome with other Catholic Financial Life members. She and her husband, Curt, had worked through all the details with their employers and were anxiously counting down the days until their departure.

But two weeks before the trip, Debbie suffered an injury that made walking unbearable. “I resigned that I wouldn’t be able to go because of the difficulty I would have on the trip,” Debbie explained.

But that’s when Curt lovingly jumped into action. “I knew how much this trip meant to her and I wanted her to go and see all the amazing sights,” Curt said.

With help from trip guides, Curt arranged for a wheelchair, and devised ways to work around Debbie’s limitation. Rome is filled with cobblestone streets, endless stairs, and steep hills, yet Curt lovingly pushed Debbie in a wheelchair, even in the rain, with a steady determination to make this a trip she would never forget.

On the last day of the pilgrimage, Debbie and Curt were seated in the front row of the Papal Audience. At the end of the audience the Holy Father left the platform and to their great surprise, he stopped and extended his hand to Debbie. “I actually shook the Pope’s hand,” said Debbie. “I don’t remember if I even managed to speak, it was so unexpected. And then he shook Curt’s hand too.”

The Lord took the couple’s adversity and provided a beautiful blessing—the opportunity to meet the Pope with a handshake!

“I’m so thankful to the guides, the other members, everyone was so kind to me and offered help throughout the pilgrimage,“ Debbie said. “And I’m thankful to Curt for making it possible.”

“I was happy to do it,” Curt said.

CATHOLIC FINANCIAL LIFE | CFL.ORG 7

Peregrinación a Roma una oportunidad única en la vida para los miembros

Por la noche, la plaza de San Pedro enciende sentimientos de asombro y reverencia contra el cielo nocturno, azul, profundo y casi tormentoso.

Roma es un lugar con historia antigua y es la cuna de la civilización occidental. También es el hogar de la iglesia católica… un destino apropiado para la primera peregrinación para miembros de Catholic Financial Life.

El pasado noviembre, 83 miembros de Catholic Financial Life embarcaron junto con el presidente y director ejecutivo, John Borgen, y la directora de involucramiento de miembros, Sally Krochalk, en una peregrinación para conocer tres ciudades antiguas que tienen importancia para la fe católica y la cristiandad: Roma, la Ciudad del Vaticano y Asís.

El viaje comienza

Desde el primer momento, los miembros se sumergieron en la historia al pararse junto al Coliseo romano, caminar por el Foro Romano y maravillarse de otras estructuras históricas que literalmente resistieron el paso del tiempo. ¡Aún siguen en pie después de más de 2,000 años!

La peregrinación de ocho días incluyó visitas a algunos de los sitios más históricos y sagrados de la Iglesia católica, incluidas las cuatro basílicas principales de Roma y una en Asís.

“Esta peregrinación fue una experiencia muy fuerte para los miembros que asistieron”, dijo John. “Fue muy diferente a ser solo un turista. Celebrar la misa a diario, ver arte sacro y rezar en lugares tan sagrados generó una experiencia profundamente espiritual y transformadora. ¡Se podía sentir el Espíritu Santo!”.

8 RADIANT LIFE MAGAZINE | SPRING 2024

Saint Peter’s Square at night ignites feelings of awe and reverence against the deep blue and almost stormy-looking night sky.

Photo credit: Tim Strauss, Member

A different view of Saint Peter’s Basilica.

Una vista diferent de la Basílica de San Pedro.

Los miembros visitaron basílicas indescriptiblemente hermosas, con magníficas esculturas y arte religioso, incluida la Piedad del Vaticano de Miguel Ángel en la Basílica de San Pedro. Una de las experiencias más destacadas para el grupo fue pararse debajo del techo de la Capilla Sixtina, famosa en todo el mundo, y observar “La creación de Adán” de Miguel Ángel, una de las obras de arte más reconocidas y admiradas de la historia. También es uno de los lugares del Vaticano donde no se permiten tomar fotos ni videos.

Paseo por la historia

El viaje de un día a Asís incluyó una misa en la basílica del Convento de San Francisco. La tumba de San Francisco se encuentra debajo del complejo de la basílica. El grupo también visitó la basílica de Santa María de los Ángeles, donde se encuentra la iglesia del siglo IX en la que San Francisco discernió su vocación, eligió vivir en la pobreza y servir a los pobres y fundó tres órdenes franciscanas. Los miembros vieron la verdadera túnica marrón que vistió San Francisco, una imagen familiar de este santo famoso, y siguieron los pasos del santo hasta pararse en la cima de la colina desde donde se puede observar el hermoso valle de Asís.

“Más allá de la historia y la belleza de los lugares que visitamos, lo importante fue la oportunidad de presenciar el impacto que tuvo en el grupo de peregrinos, ascercandolos más a Cristo en cada parada del recorrido”, comentó Sally.

El grupo recorrió una parte de la Via Appia Antica, un antiguo camino del ejército romano, y llegó a las catacumbas – un laberinto de túneles a donde los cristianos perseguidos acudian en secreto a rezar, practicar sus ritos religiosos y enterrar a los muertos. Las excavaciones de la necrópolis vaticana, debajo de la Basílica de San Pedro, condujeron al descubrimiento de las tumbas de muchos de los primeros papas.

En la tumba de San Pedro se encuentran los fragmentos óseos del apóstol

“Me siento bendecido de haber compartido esta experiencia con nuestros miembros y de haberme unido a ellos en oración por todos los miembros de Catholic Financial Life.

¡Espero hacerlo de nuevo!”.

empotrados e iluminados detrás de un vidrio protector. “Fue increíble verlo y reflexionar sobre el apóstol que había caminado personalmente al lado de Cristo, y que Él eligió para ser el primer líder de la Iglesia”, afirmó Sally.

Su Santidad

Uno de los momentos culminantes fue participar en una audiencia con el santo padre, el papa Francisco, en la plaza de San Pedro. El grupo estaba agradecido por recibir una bendición papal y tener la oportunidad de rezar con el santo padre en nombre de todos los miembros de Catholic Financial Life.

“Este viaje fue un sueño para mí y superó todas mis expectativas. Fue una experiencia increíble”, expresó la miembro Barb Gaura. “Todo el viaje fue una bendición en muchos sentidos”.

Lo que comenzó con un grupo de extraños finalizó con nuevas amistades. “Hacia el final de la semana, nuestro grupo formó un vínculo familiar y fraternal especial”, dijo John. “Me siento bendecido de haber compartido

The Roman Forum was the center of Roman life.

Photo credit: Tim Strauss, Member El foro Romano era el centro de la vida romana.

esta experiencia con nuestros miembros y de haberme unido a ellos en oración por todos los miembros de Catholic Financial Life. ¡Espero hacerlo de nuevo!”.

CATHOLIC FINANCIAL LIFE | CFL.ORG 9

The Gardens of Vatican City. Photo credit: Tim Strauss, Member El jardín de la Ciudad del Vaticano.

What’s Happening at Catholic Financial Life Achieving Our Vision

In 2017, the Board of Directors adopted the following vision statement:

To be the innovative leader in fraternal partnerships and consolidation, while growing our existing business, and engaging more people to enjoy financially secure, purposeful lives.

For the past two years, the Board has considered several different strategies to achieve this vision. After much careful analysis and deliberation, the Board unanimously voted to establish Trusted Fraternal Life while continuing to market Catholic Financial Life as the Society’s flagship brand.

The Opportunity

The purpose of creating Trusted Fraternal Life is to facilitate consolidation in the fraternal sector, while preserving unique identities and traditions, and achieving additional scale to compete, to be relevant, and to grow. In the process, we will build the NextGen fraternal benefit society.

Consolidation has been happening in the life insurance industry and the fraternal sector for the past 30 years. In fact, Catholic Financial Life is the result of nine different mergers during that time (five Catholic organizations, four non-Catholic.)

Creating Trusted Fraternal Life is an opportunity to leverage our track record of merger success with a unique approach to fraternal consolidation while investing in diverse brands for organic growth.

The Design

Fraternal organizations that join the Trusted Fraternal Life family of brands will maintain the essence of their brand identity while achieving economies of scale, pursue growth opportunities in different markets and make an even greater community impact.

“It’s really no different than Coke being part of the Coca-Cola Company,” said John Borgen, President & CEO. The Coca-Cola Company has hundreds of brands throughout the world including Coke, Dasani, Gold Peak Tea, Powerade and Minute Maid, to name a few. Trusted Fraternal Life is similar to the Coca-Cola Company with multiple brands. “Catholic Financial Life is the flagship brand of Trusted Fraternal Life like Coke is the flagship brand of the Coca-Cola Company,” he explained. In time, other organizations will become part of the Trusted Fraternal Life family of brands.

Member Impact

Catholic Financial Life has been protecting members and their families and being a force for good in local parishes and communities for more than 155 years—that does not change. Members are still part of Catholic Financial Life; they are in the same Catholic Financial Life chapter, enjoy the same member benefits, and continue to support local charities as decided by local members just as they always have. All of this will continue in the name of Catholic Financial Life.

For more information, visit cfl.org/answers.

10 RADIANT LIFE MAGAZINE | SPRING 2024

Frequently Asked Questions

What is Catholic Financial Life doing?

We are establishing a family of brands under the name Trusted Fraternal Life with Catholic Financial Life as its flagship brand. This decision was made by the Catholic Financial Life Board of Directors following two years of strategic discussions discerning the best way to achieve our vision—to be the innovative leader in fraternal partnerships and consolidation.

Why is Catholic Financial Life doing this now?

Catholic Financial Life is among the strongest fraternal life insurers in the United States. We have record surplus, capital, and risk-based capital ratio resulting in a financial strength rating of “A” with a stable outlook from the Kroll Bond Rating Agency. By acting now, we are leveraging our financial strength to achieve our vision.

How does this benefit members?

As a life insurance company, we promise to be there for our members and their families when they need us most. By uniting other fraternals as part of the Trusted Fraternal Life family of brands, we will realize additional economies of scale. Those economies will be reinvested in product development, technology, distribution, additional financial strength, and greater charitable impact. In short, it will help us to better fulfill our mission of serving communities, providing financial security, and enhancing quality of life for generations to come.

When is it effective?

We received word from the Wisconsin Office of the Commissioner of Insurance that the changes were effective March 4, 2024.

What changes for Catholic Financial Life members and local chapters?

Nothing changes for members and local chapters. Members will continue to enjoy the benefits of membership as they always have. They are members of the same chapter and may continue to support the same local charities.

Does this change Catholic Financial Life’s mission or support for Catholic causes?

No! Catholic Financial Life’s mission doesn’t change. The things that make Catholic Financial Life who and what we are continue. Our charitable support for Catholic parishes and schools, serving the poor through organizations like St. Vincent de Paul and Catholic Relief Services, and scholarships for members pursuing a Catholic education from grade school through seminary will continue as they have for the past 155 years.

In addition, our sacramental benefits, investment approach, prayer network, Advent and Lenten reflections, having a spiritual director, and quarterly Mass in the All Saints Chapel at the Home Office where we pray for our members’ intentions—they all continue!

Does the name on the Home Office building change?

No, the name on the Home Office building does not change.

Does a member’s agent or advisor change?

No, a member’s agent or advisor does not change.

CATHOLIC FINANCIAL LIFE | CFL.ORG 11

¿Que pasa en Catholic Financial Life?

Lograr nuestra visión

En 2017, la Junta Directiva adoptó la siguiente visión:

Ser el líder innovador en colaboraciones fraternas y en consolidación, mientras crecemos nuestro negocio actual y motivamos más personas a disfrutar una vida significante y con seguridad financiera.

En los últimos dos años, la Junta Directiva consideró varias estrategias para lograr esta visión. Luego de debates y análisis minuciosos, la Junta Directiva votó de forma unánime establecer Trusted Fraternal Life mientras continúamos comercializando Catholic Financial Life como la marca insignia.

La oportunidad

El objetivo de crear Trusted Fraternal Life es facilitar la consolidación en el sector fraterno, y al mismo tiempo preservar tradiciones e identidades únicas y lograr la magnitud necesaria para ser relevantes, competir y crecer. En el proceso, crearemos la sociedad fraternal benéfica NextGen.

En los últimos 30 años ha habido una consolidación en la industria de los seguros de vida y en el sector fraterno. De hecho, Catholic Financial Life es el resultado de nueve diferentes fusiones en ese tiempo (cinco organizaciones católicas y nueve no católicas).

La creación de Trusted Fraternal Life es una oportunidad para aprovechar nuestros antecedentes de fusiones exitosas y un enfoque único para la consolidación fraterna mientras invertimos en diversas marcas para un crecimiento orgánico.

El diseño

Las organizaciones fraternas que se unen a la familia de marcas de Trusted Fraternal Life mantendrán la esencia de su marca y alcanzarán economías de escala, buscarán oportunidades de crecimiento en diferentes mercados y tendrán un impacto aún mayor en la comunidad.

“Es como el caso de Coke, que es parte de The Coca-Cola Company”, dijo John Borgen, presidente y CEO. The CocaCola Company tiene cientos de marcas en todo el mundo, como Coke, Dasani, Gold Peak Tea, Powerade y Minute Maid, entre otras. Trusted Fraternal Life es similar a The Coca-Cola Company sin las múltiples marcas. “Catholic Financial Life es la marca insignia de Trusted Fraternal Life, así como Coke es la marca insignia de The Coca-Cola Company”, explicó. Con el tiempo, otras organizaciones serán parte de la familia de marcas de Trusted Fraternal Life.

Impacto a los miembros

Catholic Financial Life ha protegido a los miembros y a sus familias y ha sido una influencia positiva para las parroquias y comunidades locales durante más de 155 años. Eso no cambia. Los miembros siguen siendo parte de Catholic Financial Life; están en la misma sucursal de Catholic Financial Life, disfrutan los mismos beneficios para miembros y continúan apoyando a las organizaciónes benéficas locales elegidas por los miembros locales, como siempre lo han hecho. Todo esto seguirá ocurriendo en nombre de Catholic Financial Life.

Para obtener más información, ingrese a cfl.org/answers.

12 RADIANT LIFE MAGAZINE | SPRING 2024

Preguntas Frecuentes

¿Qué está haciendo Catholic Financial Life?

Estamos estableciendo una familia de marcas bajo el nombre de Trusted Fraternal Life con Catholic Financial Life como la marca insignia. Esta decisión fue tomada por la Junta Directiva de Catholic Financial Life luego de dos años de discusiones estratégicas para discernir la mejor manera de realizar nuestra visión—ser el líder innovador en asociaciones fraternales y consolidación.

¿Porqué Catholic Financial Life está haciendo esto ahora?

Catholic Financial Life se encuentra entre las compañías de seguros de vida fraternales más sólidas de los Estados Unidos. Tenemos un superávit, capital y ratio de capital basado en riesgo récord, lo que resulta en una calificación de solidez financiera de “A” con una perspectiva estable de la agencia de calificación de bonos Kroll. Al actuar ahora, estamos aprovechando nuestra fortaleza financiera para lograr nuestra visión.

¿Cómo

beneficia esto a los miembros?

Como compañía de seguros de vida, prometemos estar ahí para nuestros miembros y sus familias cuando más nos necesiten. Al unir otros hermanos como parte de la familia de marcas Trusted Fraternal Life, logramos economías de escala adicionales. Esas economías se reinvertirán en desarrollo de productos, tecnología, distribución, fortaleza financiera adicional y mayor impacto caritativo. En resumen, nos ayudará a mejor cumplir nuestra misión de servir a las comunidades, brindar seguridad financiera y mejorar la calidad de vida de las próximas generaciones.

¿Cuándo toma efecto?

Recibimos comunicación de la Oficina del Comisionado de Seguros de Wisconsin que los cambios entraron en efecto el 3 de marzo del 2024.

¿Qué cambia para los miembros y lideres de sucursales de Catholic Financial Life?

Nada cambia para los miembros y lideres de sucursales. Los miembros seguirán disfrutando de los beneficios de la membresía como siempre lo han hecho. Son miembros de la misma sucursal y pueden continuar apoyando a las mismas organizaciones benéficas locales.

¿Esto cambia la misión de Catholic Financial Life o el apoyo a las causas católicas?

¡No! La misión de Catholic Financial Life no cambia. Las cosas que hacen de Catholic Financial Life quiénes y qué somos continúan. Nuestro apoyo caritativo a las parroquias y escuelas católicas, sirviendo a los pobres a través de organizaciones como St. Vincent de Paul y Catholic Relief Services, y becas para miembros que buscan una educación católica desde la escuela primaria hasta el seminario continuará como lo ha hecho durante los últimos 155 años.

Además, nuestros beneficios sacramentales, enfoque de inversión, red de oración, reflexiones de adviento y cuaresmales, tener un director espiritual y misa trimestral en la Capilla de Todos los Santos en la oficina central donde oramos por las intenciones de nuestros miembros—¡todos continúan!

¿Cambia el nombre en el edificio de la oficina central?

No, el nombre en el edificio de la oficina central no cambia.

¿Cambia el representante o consejero del miembro?

No, el representante o consejero del miembro no cambia.

CATHOLIC FINANCIAL LIFE | CFL.ORG 13

Governing Documents Updates

Articles of Incorporation and Bylaws

The Catholic Financial Life Board of Directors unanimously voted to amend the Society’s Articles and Bylaws. The amendments will help the Society achieve its vision as the innovative leader in fraternal partnerships and consolidation by creating the Trusted Fraternal Life family of brands structure. This will allow Catholic Financial Life and other fraternal organizations who may join us to maintain unique fraternal traditions, expressions, and charitable work as brands of the Trusted Fraternal Life family.

The amended Articles and Bylaws follow in their entirety.

14 RADIANT LIFE MAGAZINE | SPRING 2024

Pictured in the above photo taken in 2022, left to right, first row: Kari Niedfeldt-Thomas, Coral May Grout, Sandra Dempsey, Kristen Mueller; second row: Lisa Mick, Spiritual Director Archbishop Jerome Listecki, Board Chair Allan Lorge, Joe Kopinski; third row: Susan Obermiller, Jay Mack, President & CEO John Borgen, Jeff Tilley, Bill O’Toole. Director Jay Mack finished his term at the end of 2022. Director Mike Giffhorn (not pictured) began his term in 2023.

ARTICLES OF INCORPORATION OF TRUSTED FRATERNAL LIFE

(As Amended Effective March 4, 2024)

ARTICLE ONE Name

The name of this fraternal benefit Society shall be Trusted Fraternal Life (hereinafter the “Society”). The Society may operate under one or more doing business as names or brands as determined by the Board of Directors.

ARTICLE TWO Location

The location of the principal or home office of the society shall be in the City of Milwaukee, Wisconsin.

ARTICLE THREE Purposes

The objects and purposes of this fraternal benefit Society, which exists solely for the benefit of the members of the Society, and their beneficiaries, shall be:

1. To unite its members fraternally for social, religious, benevolent and intellectual improvement, in accordance with the Bylaws of this Society;

2. To provide assistance to its members;

3. To engage in the insurance business and in any other business reasonably incidental to the insurance business and to form or acquire subsidiaries to the extent permissible under Wisconsin law;

4. To engage in any lawful social, intellectual, educational, charitable, benevolent, moral, fraternal, patriotic or religious activity for the benefit of the members of this Society or the public as the Board of Directors may determine.

ARTICLE FOUR Members

The classes of members and their respective qualifications and rights are as follows:

1. Qualifications of Members

A member is an individual who meets the qualification requirements that the Board of Directors may establish and who has had his or her membership application accepted.

2. Rights of Members . Members who are at least eighteen years old have these rights and benefits:

(A) To have the opportunity to benefit from the insurance, financial and investment products and services produced by the Society and its subsidiaries;

(B) To participate in the social, intellectual, educational, charitable, benevolent, moral, fraternal, patriotic and religious activities of the Society and its local entities as defined in the Bylaws (“Local Entities”); and

(C) To vote for the Board of Directors and to vote and participate in Local Entity affairs. The Board of Directors may grant additional benefits and rights to various members based on the extent of their contribution to carrying out the purposes of the Society.

3. Members Under Eighteen . The Board of Directors shall establish rules and regulations for the conduct of all matters relating to members under the age of eighteen. Such members shall receive such benefits of membership as determined by the Board of Directors.

ARTICLE FIVE

Representative Form of Government

The Supreme Governing Body of this Society shall be the Board of Directors. The Board of Directors shall have the power to make and adopt Bylaws and policies for the governance and management of the Society. The number of directors and the method of election or appointment shall be as set forth in the Bylaws.

ARTICLE SIX Local Entities

The method of formation and powers of the Local Entities shall be as provided in the Bylaws of this Society.

ARTICLE SEVEN Amendments

Any amendments to these Articles of Incorporation shall require approval from not less than two-thirds (2/3) of the votes cast by the Board of Directors at a regular or special meeting of the Board of Directors at which a quorum is present. Any proposed amendments to Article Three (Purposes) must be jointly submitted by the President and Board of Directors to the Judiciary Committee, and require recommendation by the Judiciary Committee prior to approval by the Board of Directors. Any other proposed amendments to these Articles of Incorporation must be jointly recommended by the President and the Committee of the Board that has governance responsibilities prior to consideration by the Board.

CATHOLIC FINANCIAL LIFE | CFL.ORG 15

BYLAWS OF TRUSTED FRATERNAL LIFE

(As Amended Effective March 4, 2024)

CHAPTER ONE

Triennial Fraternal Meeting

SECTION 1. Triennial Fraternal Meeting. Trusted Fraternal Life (the “Society”) shall conduct a triennial fraternal meeting in person or virtually at such date, time and place as the Board of Directors (the “Board”) shall determine. Triennial fraternal meetings will be comprised of local fraternal leaders and guests chosen in accordance with procedures established by the Board.

CHAPTER TWO Member Committees

SECTION 2. Brand Advisory Boards . Brand Advisory Boards consist of members of a Brand appointed by the President who advise the Board and the President on Brand membership matters, unique facets of the Brand, and issues related to the Brand’s specific purpose, identity, expression and experience.

SECTION 3. Fraternal Leaders Advisory Group. The Fraternal Leaders Advisory Group (“FLAG”) consists entirely of chapter officers or members and advises the Board and the President on fraternal and chapter matters. The President appoints nine (9) or more chapter officers or members to serve on the FLAG. The President shall strive to make the FLAG broadly representative of the Society’s membership and Brands. The FLAG shall meet at least two times each year.

SECTION 4. Nominating Committee

(a) The Nominating Committee consists of three (3) members appointed by the FLAG, three (3) members appointed by the President, and three (3) members appointed by the Board of Directors. Members of the Nominating Committee must be adult financial members and may not be employees, agents, directors, or candidates for director election.

(b) The Nominating Committee’s objectives are: (1) to ensure that only persons who meet the Eligibility Requirements for Board election set forth in section 11(a) are presented to the members for election, (2)to assist the members in electing directors who are best able to guide the Society in achieving its business and fraternal missions, and (3) to approve reasonable compensation for the Board.

(c) The Nominating Committee obtains and reviews all completed applications for Board election and other information provided by applicants to the Secretary as needed to determine whether an applicant satisfies the Eligibility Requirements, certifies all applicants who do so, and provides

the membership with a summary of pertinent information about each of the certified applicants.

(d) The Nominating Committee shall also review and consider each candidate’s qualifications relative to any desired attributes that the Board suggests pursuant to section 11(b). To help in this process, the Committee may interview each candidate and seek any additional information it needs to evaluate candidates. The Committee shall recommend to the membership the election of those candidates who the Committee believes are the best suited to meet the current needs of the Society.

(e) The Nominating Committee shall approve compensation for the Board, excluding the positions of President and Secretary, which reasonably reflects industry standards and the Board’s fiduciary and legal responsibilities. This section does not abrogate the authority of the Board to fix compensation for services rendered to the Society by any persons serving on committees of the Board or prevent payment to any persons for special service rendered to the Society by authority of the Board.

SECTION 5. Judiciary Committee

(a) The Judiciary Committee consists of three (3) members appointed by the FLAG, three (3) members appointed by the President, and three (3)members appointed by the Board of Directors. Members of the Judiciary Committee must be adult financial members and may not be employees, agents or directors.

(b) The Judiciary Committee shall receive reports of all proposed amendments to Article Three (Purposes) of the Articles of Incorporation or Bylaw Section 18 (Mergers) of the Society’s Bylaws, jointly recommended by the Board of Directors and President. The Committee shall review and consider such proposals and shall determine whether to recommend them for final approval by the Board.

The Judiciary Committee shall also submit any amendments to Article Three (Purposes) of the Articles of Incorporation or Bylaw Section 18 (Mergers) of the Society’s Bylaws it determines to be fundamental, to a referendum of adult financial members in accordance with procedures established by the Committee. The Committee shall recommend such amendments for approval by the Board only if approved by a majority of member votes cast.

16 RADIANT LIFE MAGAZINE | SPRING 2024

SECTION 6. Other Committees . The Board may appoint other member committees.

SECTION 7. Other Powers and Duties . In addition to the responsibilities outlined above, each member committee shall have such other powers and responsibilities as may be delegated to it by the Board.

CHAPTER THREE Board of Directors

SECTION 8. Board of Directors . The supreme governing body of the Society shall be the Board of Directors. The affairs of the Society shall be governed by the Board which shall have authority to provide rules and regulations for the extension and development of the Society and all other necessary and incidental powers to carry out the objectives of the Society as provided in the Articles of Incorporation and Bylaws of the Society and the laws of the State of Wisconsin.

SECTION 9. Number of Directors and Term of Office.

(a) Elected Directors. The number of the Society’s elected directors shall not be fewer than nine (9)nor more than twelve (12). By January 1 of the election year, the Board shall set the number, within that range, of the Society’s elected directors to be elected by the members. The Board may also change the number of elected directors at any time pursuant to a merger agreement, including, but not limited to, increasing the number of elected

directors to more than twelve (12), in accordance with such merger agreement, provided that the number of elected directors serving on the Board before the merger constitute at least two-thirds (2/3) of the total number of elected directors serving on the Board after the merger. Elected directors include those elected by the members and those appointed by the Board either to fill a vacancy in an elected director position or to increase the number of elected directors.

(b) Appointed Directors. Subject to confirmation by the Board, the President shall appoint two (2) directors, only one of whom may be an officer or employee of the Society. Each appointed director shall be an adult member with expertise in the business of the Society who owns or participates in a financial service or product as determined by the Board.

(c) Principal Officer Directors . The President and the Secretary of the Society shall also serve as members of the Board.

(d) Voting. All of the foregoing directors have equal voting rights.

SECTION 10. Terms of Directors

(a) Terms . Elected directors serve for a term of three (3) years from the first day of January following their election

and shall serve until their successors are elected and qualified. Appointed directors serve for one (1)year and may be reappointed.

(b) Term Limits. No elected director may serve more than three (3) consecutive threeyear terms or nine (9) consecutive years. If a director is elected or appointed to a partial term, that partial term does not count as part of this consecutive-year sequence. A break in service of at least three (3)years restarts the term-limit period.

SECTION 11. Eligibility Requirements

(a) Required Qualifications. To be a candidate for election as a director, an applicant must:

(1) Submit his or her request to be certified as a candidate to the Secretary by the deadline established by the Nominating Committee;

(2) Own and have continuously owned or participated in a financial service or product as determined by the Board for at least two (2) years prior to January 1 of the election year and have been determined by the Nominating Committee to have demonstrated a significant financial commitment to the Society;

(3) Be an adult member in good standing as determined by the Board;

(4) Submit certification(s) by one or more principal chapter officers or Society officers that the person attended at least six (6) chapter or Society fraternal functions in the three years prior to January 1 of the election year;

(5) Not be a former agent or employee whose service was terminated by the Society in the three years prior to January 1 of the election year;

(6) Not be an agent or employee of the Society when his or her term would begin;

(7) Not be age 75 or older when his or her term would begin, and

(8) Comply with all rules, regulations and requirements that the Nominating Committee establishes.

(b) Desired Attributes

The Board may suggest certain desired attributes of Board members based on the needs of the Society and the Board. These may include, for example, demonstrated sound judgment, prior board or other leadership experience,

CATHOLIC FINANCIAL LIFE | CFL.ORG 17

personality conducive to working in a group, an understanding of fiduciary responsibilities, business experience, fraternal experience, ethical values, ability and willingness to commit the required time and energy, and any specific expertise or qualities needed by the Board. Though these suggested attributes are not part of the Eligibility Requirements, they will be made available to all interested members.

SECTION 12. Board Election Procedures . The Board shall establish the procedures and timelines for election of directors by January 1 of the election year.

(a) Candidates for the Board are required to submit all information required by the Nominating Committee and the Board to the Secretary and complete a screening process and background checks to ensure the candidate meets all Eligibility Requirements within the timeline established by the Board.

(b) The Nominating Committee shall determine whether each nominated candidate meets the Eligibility Requirements to serve as a director. Only candidates who are determined by the Nominating Committee to meet the Eligibility Requirements will be included in the slate of candidates submitted to the adult members for election.

(c) The Nominating Committee will submit the slate of candidates who meet the Eligibility Requirements for election by the adult members. The Nominating Committee will also share with the members, information regarding candidates’ backgrounds and credentials, and recommendations as to the candidates the Nominating Committee has determined to be best suited to meet the current needs of the Society. Only candidate information provided to and approved for publication by the Nominating Committee will be shared with the members. To ensure fairness and consistency for all candidates, the candidates are otherwise prohibited from campaigning or publishing other information to members outside the process established by the Nominating Committee.

(d) A vote shall be taken on candidates by direct written, electronic, or telephonic ballot by the adult members in good standing as of January 1 of the election year, as determined by the Board. The ballot shall specify the deadline for return of the ballot and no ballots received after such time shall be counted. Each adult member who is determined by the Board to be eligible to vote shall have one vote for each elected director position. Cumulative voting or voting by proxy is not permitted.

(e) Directors shall be elected by a plurality of the votes cast by the members i.e., the candidates with the largest number of votes in favor of their election are elected as directors up to the maximum number of directors to be chosen in the election.

SECTION 13. Chair of the Board . The Board shall appoint a Chair to serve a term of one year from among its elected directors. No person shall serve as Chair for more than three years. A selection committee consisting of the President and two directors elected by the vote of a majority of the elected directors present at a meeting at which a quorum is present shall annually nominate a director for Chair. Their nomination must then be confirmed by the vote of a majority of the elected directors present at a meeting at which a quorum is present. The Board shall gather feedback from its members and evaluate the Chair’s performance at the conclusion of a Chair’s tenure, and before any consideration of reappointment by the selection committee. The compensation of the Chair shall be double the standard annual Board member base compensation.

The Chair has a leadership role on the Board and shall call and preside at all meetings of the Board. The Chair shall have the authority to perform such duties as prescribed or delegated by the Board and these Bylaws, including advisory and counseling responsibilities, oversight of the Board’s activities and responsibilities, and facilitating orderly Board

meetings. The Chair shall not assume managerial or executive responsibilities within the Society, usurp or undermine the authority of the President, or assume greater Board voting rights. In the Chair’s absence or vacancy, another director temporarily appointed by the Board may preside.

SECTION 14. Meetings

(a) Regular Meetings. The Board shall meet at least quarterly and at a time and place determined by the Chair and President. Such meetings may be held at the stated time and place without further notice.

(b) Special Meetings. Special meetings of the Board may be held at any time and place for any purpose or purposes, unless otherwise prescribed by statute, on call of the President, Chair of the Board, or Secretary, and shall be called by the Secretary on the written request of any five (5) directors. Notice of any special meeting shall be given to each director not less than 24 hours prior to the meeting.

(c) Electronic Meetings

Regular and special meetings of the Board and any committee or sub-committee of the Board, or any other meeting of the Society, may be conducted by telephone or video conference or other means of communication that allows all participants to simultaneously communicate with each other.

18 RADIANT LIFE MAGAZINE | SPRING 2024

SECTION 15. Quorum and Manner of Acting. A majority of the total number of voting directors in office shall constitute a quorum for the transaction of business at any meeting of the Board. The affirmative vote of a majority of the voting directors present at a meeting at which a quorum is present is the act of the Board unless the Articles of Incorporation, these Bylaws, or applicable law requires the vote of a greater number.

SECTION 16. Vacancy; Removal

(a) Vacancies. Vacancies in the Board occurring by reason of death, resignation or otherwise shall be filled in a timely manner until the next regular election by the affirmative vote of a majority of the directors then in office, even if less than a quorum. A vacancy in the position of President shall be filled within seven (7)days by the Board meeting and naming an “acting president” who shall continue to fulfill the responsibilities of the President until a successor is appointed by the Board.

(b) Removals . An elected or appointed director may be removed from office for cause by an affirmative vote of twothirds (2/3) of the full Board at a meeting of the Board called for that purpose. The Board may remove the President or the Secretary from his or her office and thus from the Board at any time, with or without cause, by the vote of two-thirds (2/3) of the total number of elected directors.

SECTION 17. Committees of the Board . The Board Chair may appoint committees, subject to confirmation by the Board, to have such authority as the Board may delegate. Each such committee shall be comprised of three (3) or more directors. The Board Chair may appoint elected members as Committee Chairs.

SECTION 18. Mergers . By the vote of two/thirds (2/3) of all of the directors in office, the Board may initiate and consummate a merger with a fraternal benefit society. Any merger with a fraternal that has assets greater than the Society shall also be approved by a majority vote of the adult members of the Society in accordance member voting procedures established by the Board prior to final Board approval.

CHAPTER FOUR Officers

SECTION 19. Officers

(a) Principal Officers. The principal officers of the Society, who shall be appointed by the Board, shall be the President, the Secretary, and one or more other officers designated as principal.

(b) Vice Presidents and Other Officers . The President may appoint one (1) or more Vice Presidents and other officers, who serve at the discretion of the President.

all of the business and affairs of the Society. In general, the President shall perform all duties incident to that office and such other duties as may be prescribed by the Board from time to time.

SECTION 21. Secretary

The Secretary shall maintain an accurate record of the minutes of all regular and special meetings of the Board, and shall report to the Board on any matters as may be requested. In general, the Secretary shall perform all duties incident to that office and such other duties as may be prescribed by the Board.

SECTION 22. Duties

The Other Principal Officers and the Vice Presidents and Other Officers shall perform such duties as are customarily assigned to their respective office and as may be assigned from time to time by the President.

SECTION 23. Fidelity Bonds

The Board may require that fidelity bonds be maintained on any society officer, chapter officer, employee or agent in such sum and with such sureties as determined by resolution of the Board.

CHAPTER FIVE

Spiritual Guidance

CHAPTER SIX

Indemnification of Officers and Directors

SECTION 25. Indemnification

The Society shall, to the extent permitted by law, indemnify and hold harmless each officer, director or employee now or hereafter serving the Society, or any other corporation, partnership, joint venture, trust or other entity which said officer, director or employee now or hereafter serves as an officer, director, employee, trustee or agent at the request of the Society.

SECTION 26. Liability

Insurance . The Society may maintain insurance on such directors, officers and employees against liability for acts or omissions in the performance of their duties as determined by resolution of the Board.

CHAPTER SEVEN Membership

SECTION 27. Membership

Provisions . The Articles of Incorporation provide for the qualifications, rights and classes of members.

SECTION 20. President

The President shall be the principal executive officer of the Society and, subject to the supervision of the Board, shall supervise and control

SECTION 24. Spiritual Directors and Chaplains. The President may appoint individuals to serve as the Spiritual Directors or Chaplains of Brands or Chapters considering any recommendations provided by a Brand Advisory Board.

SECTION 28. Application for Membership. An applicant for membership in this Society shall sign an application furnished by the Society, stating such information as the Board shall deem necessary to determine their qualification for membership. Applicants for membership who are applying for an insurance contract shall name a beneficiary who has an insurable interest in the insured at the time the certificate is issued.

CATHOLIC FINANCIAL LIFE | CFL.ORG 19

SECTION 29. Insurance Contract. A policy issued by the Society, including any riders or endorsements attached to it, the application, and the Articles of Incorporation and Bylaws constitute the entire contract when it is issued. Any subsequent changes to the Articles of Incorporation or Bylaws shall be binding upon the member, beneficiaries, and other persons affected and shall govern and control in all respects, except that no changes shall destroy or diminish benefits promised in the policy when it was issued. However, in the event of unforeseen circumstances that could threaten the Society’s financial stability or result in an inequitable treatment for certain members, the Board of Directors may adopt policies and procedures that are reasonably needed to protect the overall interest of the Society’s members, including, but not limited to, limiting the amount or frequency of renewal premium deposits that may be made to previously issued contracts. Membership that is based on being an owner, insured, or annuitant shall expire if and when the insurance contract is surrendered or lapses.

SECTION 30. Designation of Beneficiary. An applicant for an insurance contract may designate as beneficiary any person or entity, including the estate of a member or an insured employee, to the extent that the designation is consistent with applicable law. While the insured is alive, the insurance contract owner may change any beneficiary by written notice acceptable to the Society. No change will be binding until it is recorded

by the Society at the Home Office. Once recorded, the change will be effective as of the date the notice was signed. The change will not apply to any payment made by the Society before such change has been recorded. The Society may require that the insurance contract be submitted to make each change.

SECTION 31. Expulsion of Members . Any member may be expelled for just cause by a vote of his or her chapter, with the approval of the President of the Society. If the chapter fails to act on expulsion of a member, the matter may be referred to the President of the Society. If the President determines that there is cause for expulsion, the President shall have the power to expel said member from the membership of the Society, and of said chapter. Provided, however, that no member shall be expelled from the Society without first having had a full and fair opportunity to appear either in person, electronically, or by agent before the chapter or President of the Society, as the case may be, in his or her defense. Provided further that any expelled member shall be entitled to all of the financial and contractual benefits as provided for in the insurance contracts and under these Bylaws.

SECTION 32. Reinstatement of Membership. Any member who has been expelled or has allowed his or her membership to lapse because of nonpayment of premium may, within 60 days after expulsion or lapse, make application for reinstatement on a form prescribed by the Society. After said 60 days, such member may make

application for reinstatement upon such further conditions as determined by the Society.

SECTION 33. Assignment. In such states where permitted by law, assignments of insurance contracts shall be permitted but shall be subject to any claim in favor of this Society and shall not be valid until a copy thereof is filed at the Home Office of the Society. No assignment shall change or deny the elective and social rights of a member.

CHAPTER EIGHT

Maintenance of Solvency

SECTION 34. Maintenance of Solvency. If the Society’s financial position becomes impaired, the Board may, on an equitable basis, apportion the deficiency among the members, the insured employees or the owners of policies, or any combination thereof. A member, insured employee or policy owner may then either (a) pay his, her or its share of the deficiency or accept the imposition of a lien on the insurance policy, to bear interest at the rate charged on policy loans under the policy, compounded annually until paid, or (b) accept a proportionate reduction in benefits under the policy. The Board may specify the manner of election and which alternative is to be presumed if no election is made.

CHAPTER NINE

Funds and Investments

SECTION 35. Funds and Investments . The funds of the Society shall be invested in accordance with investment policies adopted by the Board from time to time. Provided, however, that a reasonable amount of the funds of the

Society shall be set aside for payment of claims and as a special reserve fund as necessary, in accordance with the laws of the State of Wisconsin and of other states in which the Society is licensed to do business.

CHAPTER TEN

Brands and Chapters

SECTION 36. Brands .

The Board of Directors may establish and maintain Brands in accordance with the policies and procedures that the Board may from time to time adoptconsidering any recommendations made by applicable Brand Advisory Boards.

SECTION 37. Chapters . Local chapters may be established, dissolved, and determined to be inactive in accordance with policies and procedures (hereafter referred to as “Chapter Policies”) that the Board may from time to time adopt after soliciting and considering recommendations made by the Fraternal Leaders Advisory Group. If a chapter is dissolved, its members shall be transferred to one or more other chapters in accordance with the Chapter Policies.

SECTION 38. Chapter Purposes . Chapters shall operate to further the object and purposes of the Society pursuant to the Chapter Policies.

SECTION 39. Chapter Operations . At minimum, chapters shall hold meetings and undertake activities as required by applicable law and the Chapter Policies. As subordinate units of the Society, chapters are accountable to the Society for

20 RADIANT LIFE MAGAZINE | SPRING 2024

their activities and finances. Chapters shall maintain accurate records of their activities and finances and shall submit an annual activity and financial report to the Home Office of the Society on a form prescribed for such use. Other procedures relating to operation of the chapters, including without limitation the number, positions and responsibilities of the chapter officers, and chapter meeting quorum, voting and procedures, shall be set forth in the Chapter Policies.

SECTION 40. Transfer. A member may be transferred from one chapter to another upon his or her own request; however, all members living as a family in a single household must be members of one (1) and the same chapter.

CHAPTER ELEVEN Resolution of Disputes

SECTION 41. Resolution of Disputes

(a) Purpose . The purpose of this section is to provide the sole means to present and resolve certain grievances, complaints and disputes between or among members, insureds, certificate owners, or beneficiaries, their heirs, administrators, guardians, representatives, successors and assigns, and the Society or its directors, officers, agents, and employees. The procedures set forth in this section are meant to provide prompt, fair and efficient opportunities for dispute resolution, consistent with the fraternal nature of the Society, without the delay and expense of formal legal proceedings.

(b) Scope . E xcept as expressly limited herein (see subsection e) this section applies to all past, current or future benefit certificates, members, insureds, certificate owners, beneficiaries and their heirs, administrators, successors, guardians, representatives, successors and assigns and the Society. It applies to all claims, actions, disputes and grievances of any kind or nature whatsoever. It includes, but is not limited to, claims based on breach of contract, as well as claims based on fraud, misrepresentation, violation of statute, discrimination, denial of civil rights, conspiracy, defamation, and infliction of distress against the Society or its directors, officers, agents, or employees. To the extent permitted by applicable law, this section applies to all claims, actions, disputes, and grievances brought by the Society against members, insureds, certificate owners, or beneficiaries and their heirs, administrators, guardians, representatives, successors and assigns.

In the event that a court or arbitrator of competent jurisdiction deems any party or claim in a dispute not subject to this section, this section will remain in full force and effect as to any remaining parties or claims involved in such dispute. This section does not apply to any claims or disputes relating to

interpleader actions to determine proper owner, beneficiary or payee.

(c) Procedures. No lawsuits or any other actions may be brought for any claims or disputes covered by this section. All disputes covered by this section will be resolved in accordance with the following procedures, which will occur in the order given in this section:

Step 1. Appeal. Any dispute covered by this section must be submitted to the Secretary at its Home Office at 1100 W. Wells Street, Milwaukee, WI 53233, (800) 927-2547, for resolution by the Society’s internal review process.

Step 2. Mediation. If Step 1 does not result in a mutually satisfactory resolution, either party may have the matter mediated in accordance with the applicable mediation rules of the American Arbitration Association (or other neutral organization as agreed upon by the parties).

Step 3. Arbitration. If Step 2 does not result in a mutually satisfactory resolution, matter will be resolved by binding arbitration in accordance with the applicable arbitration rules as prescribed by the American Arbitration Association (or the rules of another neutral organization mutually agreed upon)

as applicable to the type of matter in dispute. The arbitration shall be administered by a neutral organization agreed upon by the parties. The decision of the arbitrator shall be final and binding, subject only to the right to appeal such decision as provided in the arbitration rules and applicable laws.

The member, insured, certificate owner, beneficiary or other party shall have the right to be represented by legal counsel of his or her choosing at any time at his or her own expense (unless, as provided in subsection (f) below, he or she is awarded attorney’s fees). If an issue in dispute is subject to law that prohibits parties from agreeing to submit future disputes to binding arbitration, arbitration results shall be nonbinding, unless the parties agree to binding arbitration after the claim or dispute has arisen. The Society will take reasonable measures to assure that the dispute resolution process proceeds promptly.

(d) Costs . The administrative costs of any mediation or arbitration (including fees and expenses of mediators and arbitrators, filing fees, reasonable and necessary court reporting fees) will be paid by the Society. Except as awarded under subsection (f) below, each party will bear its own attorney’s fees, expert fees, and discovery costs.

CATHOLIC FINANCIAL LIFE | CFL.ORG 21

(e) Restriction of Joinder of Disputes . The procedures of this section are designed to afford individual members, benefit certificate owners, beneficiaries, other parties and the Society a prompt, fair, and efficient means of resolving individual disputes. Accordingly, no dispute may be brought forward in a representative group or on behalf of or against any “class” of persons, and the disputes of multiple members or benefit certificate owners or beneficiaries (other than immediate family members) may not be joined together for purposes of these procedures without the express written consent of both (i) all members and benefit certificate owners, beneficiaries, and other parties affected thereby and (ii) the Society. The restriction on joinder of disputes contained in this subsection (e) is a condition upon which the agreement to arbitrate contained in subsection (b)and (c) depends. Thus, should a court or arbitrator of competent jurisdiction deem the restriction on joinder of disputes contained in this subsection (e)unenforceable or otherwise void, there shall be no agreement to arbitrate.

(f) Remedies . This section applies to any claim or dispute resolved through binding arbitration as provided in subsection (c)above and to any

action in a court of law in the event that a court or arbitrator of competent jurisdiction deems any party or claim in a dispute not subject to binding arbitration. Except as expressly limited in this section, the parties to a dispute may be awarded any and all damages or other relief allowed for the claim in dispute by applicable federal or state law, including attorney’s fees and expenses if such attorney’s fees and expenses are deemed appropriate under applicable law. Exemplary or punitive damages may be awarded for claims arising under applicable federal or state statutes to the extent permitted under the applicable statutes or, for claims arising under the common law, exemplary or punitive damages may be awarded but may not exceed three times the amount of compensatory damages. In the event that any court or arbitrator of competent jurisdiction deems the foregoing limitation on common law exemplary or punitive damages to be unenforceable or otherwise void under applicable law, the remaining portions of this section will remain in full force and effect.

CHAPTER TWELVE

Communications to Members

SECTION 42. Communications to Members

(a) Means of Communication . The Society shall maintain an official publication

in which it may include any notice, report or statement required by law to be given to the members, including notice of election. If the records of the Society show that two (2) or more members have the same mailing address, an official publication mailed to one (1) member is deemed to be mailed to all members at the same address unless a separate copy is requested. The Society may provide any required notice, report or statement to members by means other than the official publication, including by mail or, to the extent that applicable law allows, by email, website, or other electronic means.

(b) Required Communications

All amendments to the Articles of Incorporation and Bylaws shall be provided to members within four (4) months after the filing of any such amendment with the Office of the Commissioner of Insurance of the State of Wisconsin and shall serve as official notice of such changes. The Society will provide members with an annual report that at minimum shall contain basic financial and operating data, information about important business and corporate developments, and such other information as the Society wishes to include or as the Office of the Commissioner requires it to include in order to keep members adequately informed.

CHAPTER THIRTEEN Amendments of Society Bylaws

SECTION 43. Procedure .

Any amendments to these Bylaws shall require approval from not less than two-thirds (2/3) of the votes cast by the Board of Directors at a regular or special meeting of the Board of Directors at which a quorum is present. Proposed amendments to these Bylaws must be jointly submitted by the President and the Committee of the Board of Directors that has governance responsibilities prior to consideration by the Board of Directors. Any amendments to Bylaw Section 18 (Mergers) of the Society’s Bylaws must be jointly submitted by the President and the Board of Directors to the Judiciary Committee and require recommendation of the Judiciary Committee prior to approval by the Board of Directors.

SECTION 44. Reporting. All amendments duly adopted shall be immediately printed under the supervision of the President and Secretary of the Society and a copy sent forthwith to the Office of the Commissioner of Insurance of the State of Wisconsin. A copy of all amendments shall be provided to members pursuant to section 42 above. The Secretary shall keep a complete record of each amendment.

22 RADIANT LIFE MAGAZINE | SPRING 2024

Catholic Financial Life Earns an “A” Financial Strength Rating

Kroll Bond Rating Agency (KBRA), a global, full-service rating agency, recently upgraded Catholic Financial Life’s Insurance Financial Strength Rating to an “A” with a Stable Outlook.

“Catholic Financial Life has never been stronger,” said President & CEO John Borgen. “Our members trust us to be here for them through every stage of life. This independent rating affirms our ability to make good on the promises we make.”

KBRA highlighted the experienced management team for its forward-looking growth strategy including demonstrated success in acquiring or merging with other fraternal organizations and recognized leadership in the fraternal sector with respect to enhancing/modernizing corporate governance.

The rating upgrade reflects Catholic Financial Life’s continued execution of its business strategy focused

on relatively lower risk life products and the company’s consistent track record in risk-based capital and surplus growth.

Behind the record surplus are consistent earnings, a conservative and diversified investment portfolio, strong financial flexibility, and a thorough Enterprise Risk Management framework.

“Earning an ‘A’ rating is the result of a compelling vision, disciplined execution of strategic plans and conservative financial management,” said John. “Organizations make progress through people. I am honored to lead such a talented team of passionate, authentic, member-focused professionals.”