12 minute read

Kathryn Kuehn Story

Story

Kathryn Kuehn, one of our beloved neighbors in Canyon Creek, is in desperate need of help. In March 2014, Kathryn contracted a strep infection that turned septic and resulted in the loss of both of her hands and feet. A loving wife, devoted mom, and active community member, Kathryn is also a certified massage therapist. In true Canyon Creek fashion, the community came together to support one of our own. A goal was set to give Kathryn her independence back by helping her purchase advanced prosthetics. These prosthetics will be life-changing for her and will once again give her the freedom to take care of herself. Things we take for granted, like baking, using a telephone, and opening and closing doors, will be given back to Kathryn.

The prosthetics Kathryn needs run between $60,000 to $80,000 per hand. Insurance may help with some of the cost but will not defer it completely. Unfortunately, that is just for hands and does not include prosthetics for her feet, which she needs as well.

An ambitious goal has been set to raise $200,000, which will go directly to the cost of both Kathryn’s hand and feet prosthetics. A run/walk race was set up on November 15th to help raise additional funds and to rally around Kathryn and show her support. At press time, more than $10,000 had been raised since the October 1st fundraising kick-off. Seeing the neighborhood “Hit the street for Hands and Feet” for Kathryn was truly an amazing sight. Although this issue went to press before pictures of the event could be included, we look forward to sharing the event in our next issue.

If you didn’t have a chance to participate in the walk for Kathryn, you can still give back to our friend and neighbor in need. Tax-deductible donations can be made to HELPING HANDS MINISTIRIES and marked for the Kathryn Kuehn Family Care Project. If you aren’t interested in a tax deduction,

checks and cash are accepted as well. We are a mighty and loving community, and we know that when we put our hearts and minds to a common goal, we can accomplish it together. Thank you to all who have donated to this cause.

The Canyon Creek Homeowners Association (HOA) annual meeting in October was powerpacked with information, awards, announcements, and news. Held at Canyon Creek Country Club, the banquet room was full of our neighbors who had questions, opinions, and ideas.

Hot of the press that day was Governor Rick Perry’sannouncementthat our very own Richardson Methodist Hospital was now the Ebola Crisis Center for Dallas Country. Mayor Laura Maczka addressed the crowd and gave more information on the recent events. Many other announcements were made that night, including the new partnership of Canyon Creek Life and the HOA. Starting in 2015, the Canyon Creek HOA will provide news and announcements within the pages of Canyon Creek Life. Besides the regular communication via e-mails, this will provide our homeowners another source of information on our neighborhood.

Last, the night was topped off with UTD VP of Administration Dr. Calvin Jamison sharing the vision of our neighbors to the west. Most were extremely impressed with the growth and future plans of UTD. Dr. Jamison was very clear that UTD wants to not only communicate with Canyon Creek but wants to make our community a use of the facilities that are being built.

Also, Canyon Creek HOA rewards the PTAs of our three elementary schools (Aldridge, Canyon Creek, and Prairie Creek) for recognition of exceeding the flag lease goals. All three elementary school PTA Presidents were presented checks for their respective schools. This also marked the meeting that was the passing of the baton to new board members, including new president Susan Kassen from Jeremy Thomason. The new board list includes:

President Past President Secretary Treasurer Membership Director Community Relations Director Beautification Crime Watch Director Events Director Communications Director Susan Kassen Jeremy Thomason Nancy Viamonte Bill Ferrell Jay Dalehite Chip Pratt Matt Fulgham Sandhya Seshadri Natalie Swanson Cory Jones

YARD OF THE MONTH

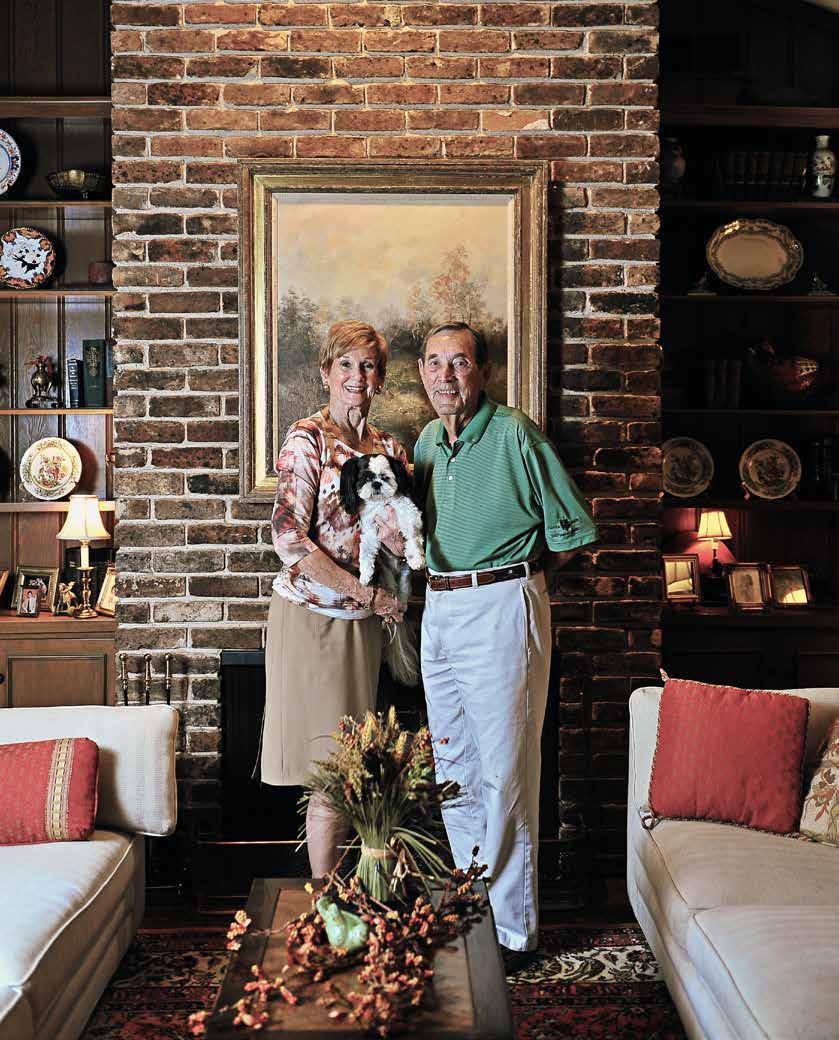

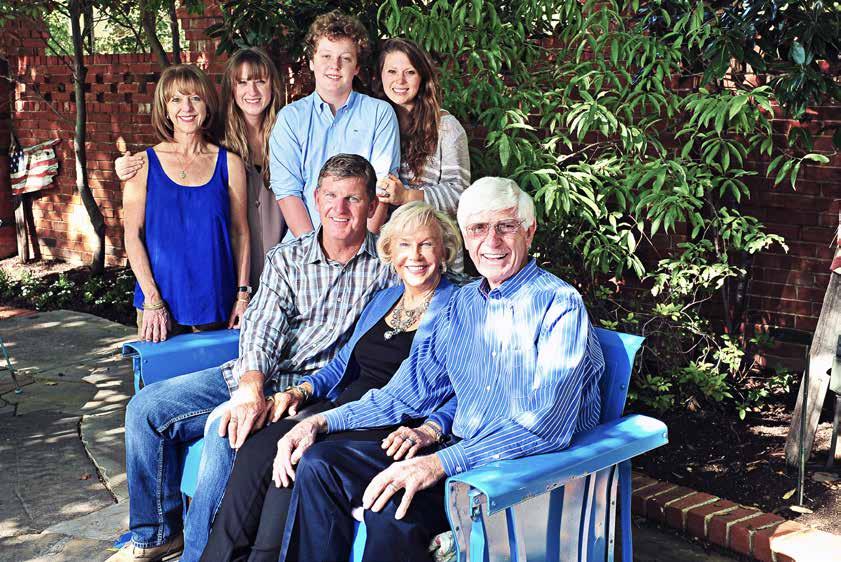

Greg and Shannon Robins 331 Ridgehaven Place

SEPTEMBER

Jim and Jayne Norwood 321 High Brook Dr

OCTOBER

Canyon Creek Life

Our Neighborhood Magazine Checklist: Financial Making a list, checking it twice…

Review your charitable contributions. Do you want to make any more gifts this tax year? Even better, do you have any appreciated stock you’d like to donate directly (and thereby avoid the tax on the gains)? Consult your professional tax advisor. Discuss any steps you can take prior to year end to minimize your taxes. Consider any opportunities you may have to either accelerate deductible expenses by paying them prior to December 31, or deferring taxable income into 2015. Review your 2014 retirement plan contributions: IRAs and Roth IRAs: The limit is $5,500 ($6,500 if you’re over 50). The last day for making contributions is 4/15/15. 401(k) salary deferral - The limit is $17,500 ($23,000 if you’re over 50). The last day for making contributions is 12/31/15. Set up a plan if you don’t have one. If you have an IRA, consider whether a Roth IRA conversion makes sense for you. Meet required IRA distributions. If you have an IRA and are over 70 ½ years old, withdraw your required minimum distribution (RMD) from the account before December 31st to avoid hefty tax penalties. You must also withdraw an annual RMD regardless of your age if you hold an inherited IRA from anyone other than your spouse. Remember, Roth IRAs are exempt from RMDs. Review your taxable portfolio accounts. Check the status of gains and losses and consider selling investments that have declined in value to help offset any realized gains. (Note: If you do realize a loss but want to buy the same position back, make sure you are familiar with the wash sale rule to preserve your capital loss treatment.) Be careful about purchasing mutual funds in taxable accounts near the end of the year. Consider waiting to buy a fund until after its dividend record date for distributing taxable gains to shareholders. Gifts to family and friends: You can give up to $14,000 to as many individuals as you like before December 31st without filing a gifttax return. If you’re married, you and your spouse can give up to $28,000 per recipient. Many college savings plans allow owners to update investments only once per calendar year. If you want to reallocate and haven’t done so yet this year, complete it before December 31st. Review your health insurance and use your renewal period or employer’s “open enrollment” to make changes. If you use a flexible spending account for medical or dependent care expenses, review any “use-itor-lose-it” funds in your account and plan accordingly. Set your budget and savings goals for 2015.

Drink hot cocoa. Visit Santa’s Village. Sing carols in the car. Loudly. Prepare a family recipe with a child. Tell them about the person who passed the recipe to you. Do a jigsaw puzzle.

Checklist: Fun!

Play a board game. Give a homemade gift. Take a family drive (or carriage ride) to look at lights. Watch a classic movie. Make reindeer chow. Do a family volunteer activity. Make a gingerbread house. Bake holiday treats for neighbors. Tell someone how much they mean to you. Take in a holiday play or musical performance 972.960.1001 | leefin.com

#LFCAdvisor lee-financial-corporation

As we approach the holiday season and prepare to ring in the new year, it’s a great time to review financial goals and tackle year-end opportunities for tax savings. More importantly, it’s also a wonderful time to reflect with gratitude on our many blessings and make some new memories with family and friends. Here are some ideas for enhancing your year-end accomplishments in both categories.

Happy Holidays Canyon Creek! ~ Dusty, Christie, Jaime & Julie ~

DISCLAIMER Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Lee Financial Corporation), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Lee Financial Corporation. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Lee Financial Corporation is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice. A copy of the Lee Financial Corporation’s current written disclosure statement discussing our advisory services and fees is available upon request.

Dusty Wallace, JD, CFP®, Christie Williams, CFP®, Jaime Boyles, CFP® and Julie Toler, CFA, CFP® are residents of Canyon Creek, moms of PCE and CCE students, and financial advisors at Lee Financial Corporation, a registered investment advisor and independent wealth management firm.

Canyon Creek Real Estate

From the Dallas Morning News:

Canyon Creek, Then and Now:

• One Year Ago [8/1/13 - 9/30/13] • Sold: 15 Properties • Range: $186,000 - 499,900 • Average Price: $278,227 • Avg. Sales Price per Sq. Ft.: $ 96.84

For additional & more specific information, please call Joan Lombar 214-770-5947

The following listings are those of many brokers who list Source: NTREIS 2014 Information deemed reliable, but not guaranteed. and sell in Canyon Creek.

Address

820 Firestone Lane 521 Lawnmeadow Drive 2009 Custer Parkway 2802 Tam O Shanter Lane 901 Firestone Lane 319 Forest Grove Drive 421 High Brook Drive 2917 Forest Hills Lane 426 W Lookout Drive 404 Vakkey Cove Drive 315 Woodcrest Drive 11 High Mesa Place 401 Forest Grove Drive 409 Pleasant Valley Lane 2410 Skyview Drive 2901 Canyon Creek Drive 21 Shady Cove

List Price

Sold Date

SqFt

3,950

Gregg’s Famous Sticky Buns

A great recipe to use as a dessert at Thanksgiving or for Christmas morning breakfast. It’s a treat everyone will love!

Ingredients: 1 pkg. Rhodes frozen dinner rolls 1 1/2 sticks melted butter, divided 1 cup brown sugar, divided 1 tsp cinnamon chopped pecans (optional)

Directions: 1. Grease bundt pan and pour 3/4 stick melted butter in bottom of pan. 2. Add 1/2 cup brown sugar and chopped pecans (optional). 3. Mix together 1/2 cup brown sugar and cinnamon. 4. Melt 3/4 stick butter. 5. Dip rolls in butter and then brown sugar with cinnamon. 6. Arrange pin pan on top of first mixture until about 1/2 full (don’t overfill). 7. Cover and let rise in a warm place about an hour or until doubled in size. 8. Bake for 25 minutes at 350 degrees. 9. While hot, carefully invert pan on serving plate. 10. Serve and enjoy!

Hot Pepper Peach Cheeseball

A great appetizer to take to any gathering that that will start the night off right!

Ingredients:

2 8 oz. packages cream cheese 1/3 jar Rothchild's Hot Pepper Peach Preserves 1 T. chopped onion 1 T. jalapeños, cropped Monterrey Jack cheese, grated

Directions: 1. Cream together the first four ingredients and form into a ball. 2. Chill at least one hour. 3. Roll in grated cheese. 4. Serve with bland crackers or toasted bagel chips.

PRSRT STD U.S. POSTAGE PAID RICHARDSON TX PERMIT #215

Roofing & Remodeling

NARI 2014 Local, Regional and National CotY Award For Residential Addition under $100,000

Kitchens Bathrooms Room Additions Design/Build Roof Replacements Windows/ Replacements

NARI 2013 Local and Regional CotY Award For Residential Bath $30,000 - $60,000

NARI 2013 Local and Regional CotY Award for Residential Addition under $100,000