2 minute read

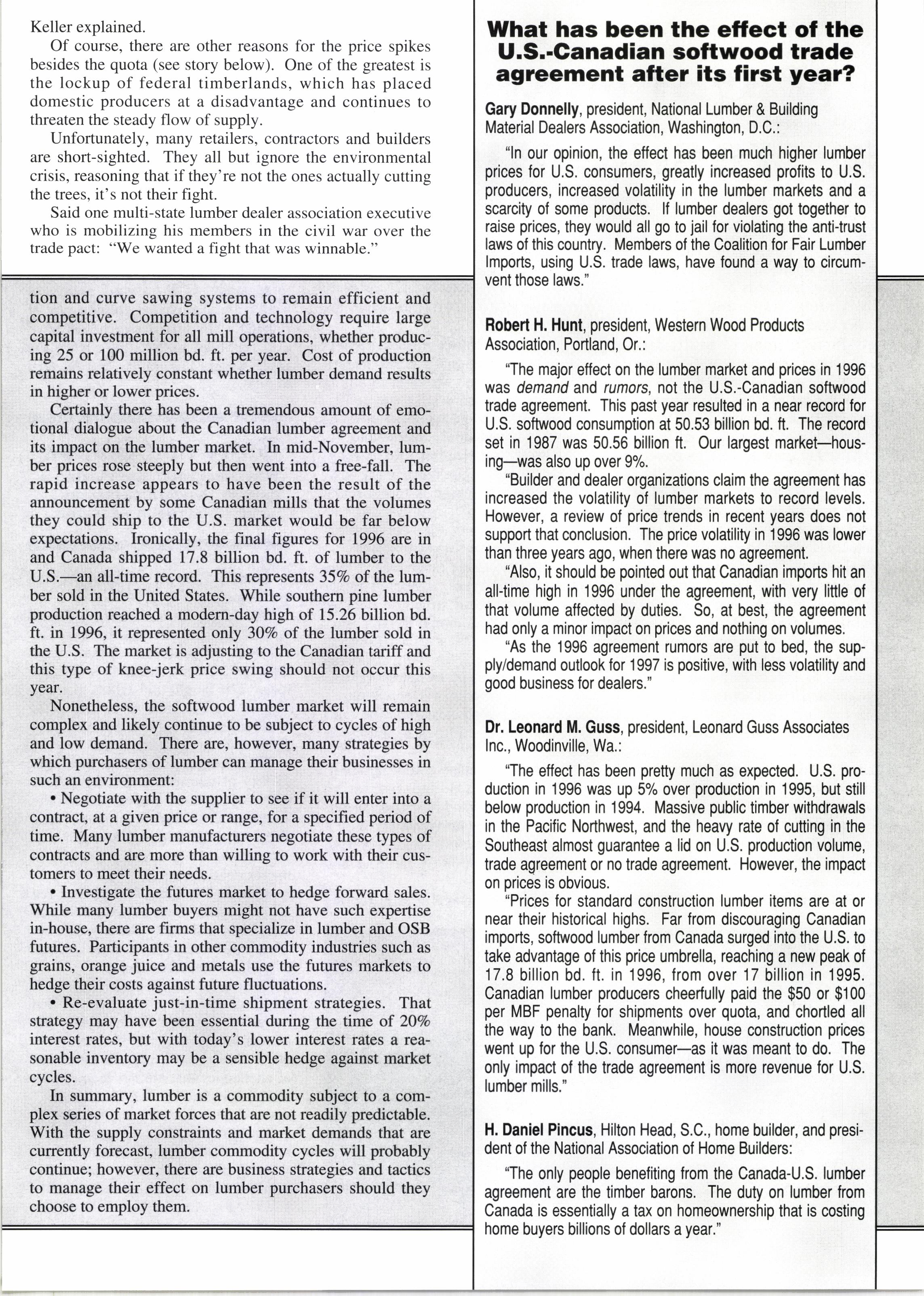

What has been the effect of the U.3,'Canadian softwood trade agreement after its first year?

Gary Donnelly, president, National Lumber & Building Material Dealers Association, Washington, D.C. :

"ln our opinion, the effect has been much higher lumber prices for U.S. consumers, greatly increased profits to U.S. producers, increased volatility in the lumber markets and a scarcity of some products. lf lumber dealers got together to raise prices, they would all go to jail for violating the anti-trust laws of this country. Members of the Coalition for Fair Lumber lmports, using U.S. $ade laws, have fourd a way lo circumvent those laws.'

Robert H. Hunt, president, Western Wood Products Association, Portland, Or, :

'The major effect on the lumber market and prices in 1S6 was demand and rumors, not the U.S.-Canadian sottwood trade agreement. This past year resulled in a near r@td for U.S. soflrood consumption at 50.53 billion bd. ft. The record set in 1987 was 50.56 billion ft. Our largest ma*eFhousing-was also up over 9%

"Builder and dealer organizations claim the agreement has increased the volatility of lumber markets to record levels. However, a review of price trends in recent years does not support that conclusion. The price volatility in 1996 was lower than three years ago, when there was no agreement.

"Also, it should be pointed out that Canadian imprts hit an all-time high in 1996 under the agreemenl, with very litlle of that volume affected by duties. So, at besl, the agreement had only a minor impact on prices and nothing on volumes.

"As the 1996 agreement rumors are put to bed, the supply/demand outlook for'1997 is positive, wilh less volatility and good business for dealers."

Dr. Leonard M. Guss, president, Leonard Guss Associates Inc., Woodinville, Wa.:

'The effect has been pretty much as expected. U.S. production in 1996 was up 5% over production in 1995, but still below production in 1994. Massive public timber wilhdrawals in the Pacific Norlhwest, and the heavy rate of cutting in the Southeast almost guarantee a lid on U.S. production volume, trade agreement or no trade agreement. However, the impact on prices is obvious,

"Prices for standard construction lumber items are at or near their historical highs. Far from discouraging Canadian imports, sottwood lumber frorn Canada surged into lhe U.S. lo take advantage of this price umbrella, reaching a new poak of 17.8 billion bd. ft. in 1996, from over 17 billion in 1995. Canadian lumber producers cheerfully paid the $50 or $100 per MBF penalty for shipments over quota, and chortled all the way lo the bank. Meanwhile, house construction prices went up for the U.S. consumer-as it rilas meanl to do. The only impact of the trade agreement is more revenue for U.S. lumber mills."

"The only people benefiting from the Canada-U.S. lumber agreement are the timber barons. The duty on lumber from Canada is essentially a tax on homeownership that is costing home buyers billions of dollars a year,'