1 minute read

Panel demahd, prrces lncrease through 1997

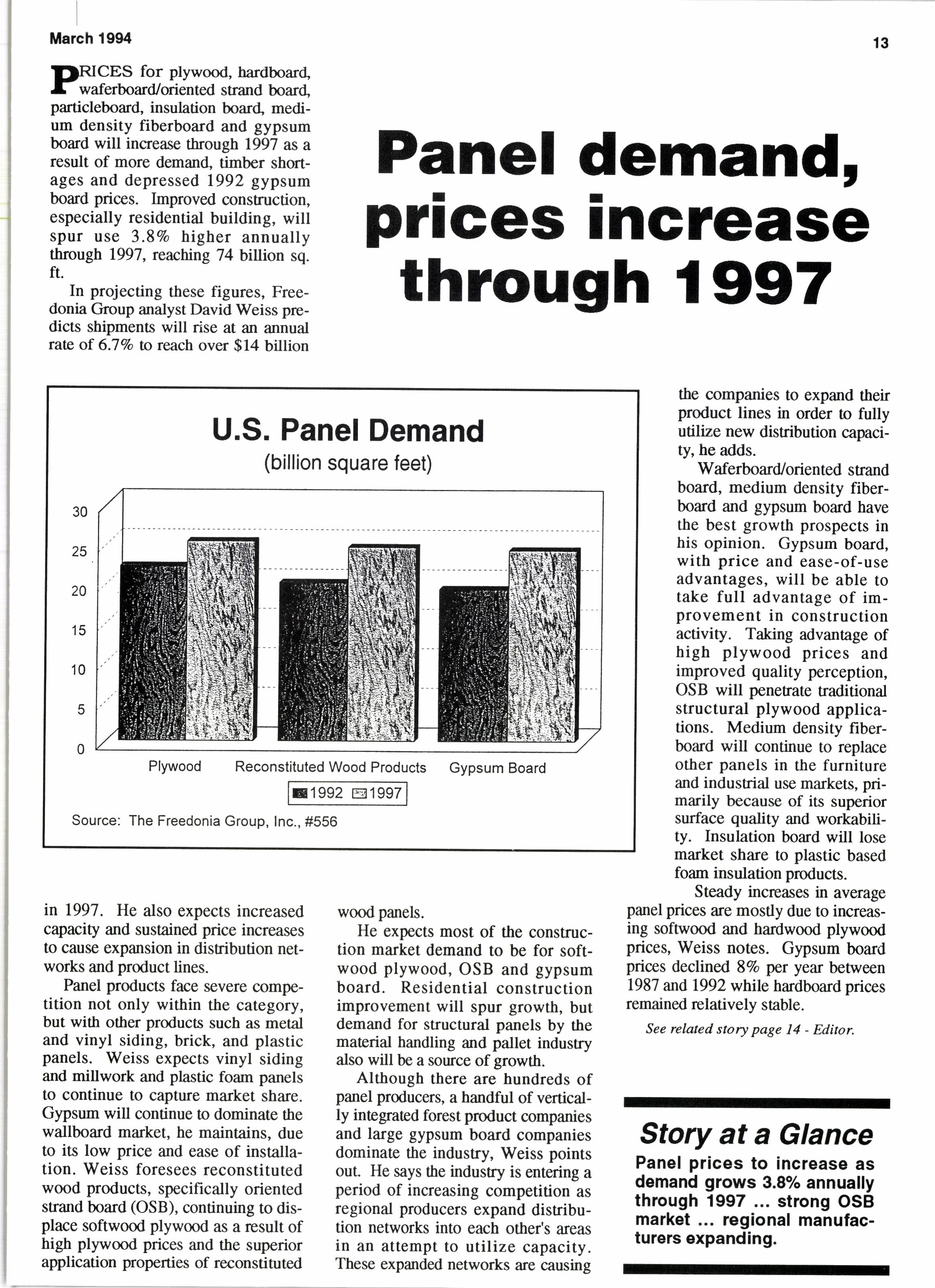

U.S. Panel Demand

the companies to expand their product lines in order to fully utilize new distribution capaci ty, he adds.

Waferboard/oriented strand board, medium density fiberboard and gypsum board have the best growth prospects in his opinion. Gypsum board, with price and ease-of-use advantages, will be able to take full advantage of improvement in construction activity. Taking advantage of high plywood prices and improved quality perception, OSB will penetrate traditional structural plywood applications. Medium density fiberboard will continue to replace other panels in the furniture and industial use markets, primarily because of its superior surface quality and workability. Insulation board will lose market share to plastic based foam insulation products.

Panel products face severe competition not only within the category, but with other produc8 such as metal and vinyl siding, brick, and plastic panels. Weiss expects vinyl siding and millwork and plastic foam panels to continue to capture market share. Gypsum will continue to dominate the wallboard market, he maintains, due to its low price and ease of installation. Weiss foresees reconstituted wood products, specifically oriented strand board (OSB), continuing to displace softwood plywood as a result of high plywood prices and the superior application properties of reconstituted wood panels.

He expects most of the construction market demand to be for softwood plywood, OSB and gypsum board. Residential construction improvement will spur growth, but demand for structural panels by the material handling and pallet industry also will be a source of growth.

Although there are hundreds of panel producers, a handful of vertically integrated forest product companies and large gypsum board companies dominate the industry, Weiss points oul He says the industry is entoing a period of inoeasing competition as regional producers expand distribution networks into each other's areas in an attempt to utilize capacity. These expanded networks are causing

Steady increases in average panel prices are mostly due to increasing sofnvood and hardwood plywood prices, Weiss notes. Gypsum board prices declined 8Vo per year between 1987 and 1992 whlle hardboard prices remained relatively stable.

See related story page 14 - Editor.

Story at a Glance

Panel praces to increase as demand grows 3.8% annually through 1997 ... strong OSB market ... regional manufacturers expanding.

Reck supportod drlvothru warohousos and T' slleds.

Racks lor home cenlors end werehouso stYle retallere.

Cantllevorecks fot lumber and onglnoorod Products.

I Pallst racks lot shoot goods and pelletlzod products.

Rackr lor moldlngs, board8, ind mlllwork